预约演示

更新于:2025-10-01

Olaparib

奥拉帕利

更新于:2025-10-01

概要

基本信息

药物类型 小分子化药 |

别名 4-(3-{[4-(cyclopropylcarbonyl)piperazin-1-yl]carbonyl}-4-fluorobenzyl)phthalazin-1(2H)-one、Olaparib (JAN/USAN/INN)、奥拉帕尼 + [13] |

作用方式 抑制剂 |

作用机制 PARP1抑制剂(聚腺苷二磷酸核糖聚合酶1抑制剂)、PARP2抑制剂(聚腺苷二磷酸核糖聚合酶2抑制剂)、PARP3抑制剂(聚腺苷二磷酸核糖聚合酶3抑制剂) |

在研适应症 |

原研机构 |

最高研发阶段批准上市 |

首次获批日期 欧盟 (2014-12-16), |

最高研发阶段(中国)批准上市 |

特殊审评优先审评 (美国)、突破性疗法 (美国)、快速通道 (美国)、加速批准 (美国)、孤儿药 (美国)、优先审评 (中国)、特殊审批 (中国)、优先审评 (澳大利亚)、加速批准 (加拿大)、附条件批准 (中国)、孤儿药 (日本) |

登录后查看时间轴

结构/序列

分子式C24H23FN4O3 |

InChIKeyFDLYAMZZIXQODN-UHFFFAOYSA-N |

CAS号763113-22-0 |

关联

511

项与 奥拉帕利 相关的临床试验NCT07187674

Single Arm, Prospective, Small Sample, Exploratory Clinical Study on the Neoadjuvant Treatment of Early High-risk Triple Negative Breast Cancer With HRD Positive With Iparomlimab and Tuvonralimab(QL1706)Combined With Olaparib and Paclitaxel

Breast cancer is one of the most common malignant tumors in women, accounting for the first cancer-related death cause in women. In recent years, the incidence has gradually increased, and the trend is younger. In 2022, the estimated number of new cases of female breast cancer worldwide is 2.389 million, and the estimated number of deaths is 666000. Triple negative breast cancer (TNBC) refers to breast cancer that is negative for estrogen receptor, progesterone receptor and human epidermal growth factor receptor 2, accounting for about 10% - 20% of malignant breast tumors. . At present, chemotherapy is still the main means of clinical treatment of TNBC, but the heterogeneity of TNBC in molecular level, pathology and clinical characteristics leads to different sensitivity of patients to different chemotherapeutic drugs, especially the sensitivity of most elderly patients to chemotherapeutic drugs is not high, and the prognosis is poor.

The development of immunotherapy in the field of breast cancer has witnessed the continuous deepening of medical understanding of cancer treatment. In the past, breast cancer was often regarded as a "cold tumor" insensitive to immunotherapy, but with the deepening of research, immunotherapy gradually occupied an important position in the treatment of breast cancer. The ongoing research hopes to identify patients who may benefit more from immunotherapy according to their respective tumor immune microenvironment.

Its mechanism of action mainly includes two aspects: one is to restore the normal recognition and attack ability of the immune system to tumor cells and break the immune escape mechanism of tumor cells; The second is to stimulate a lasting immune response, so that the immune system can continuously monitor and clear tumor cells.

Therefore, this study intends to evaluate the efficacy and safety of Iparomlimab and tuvonralimab combined with olaparib and paclitaxel in the neoadjuvant treatment of early high-risk TNBC with HRD positive.

It is planned to enroll 20 subjects. After enrollment, the subjects will receive six cycles of combination therapy with olaparib and docetaxel. Take 3 weeks as a treatment cycle until the treatment termination event specified in the protocol occurs, and the subject will continue to conduct postoperative efficacy and safety visits after the end of treatment.

After neoadjuvant treatment, according to the routine treatment process of breast cancer, the subject will receive breast cancer surgery; After surgical treatment, according to the residual breast lesions of the patient, the attending physician and the subject will agree on the subsequent treatment plan.

The development of immunotherapy in the field of breast cancer has witnessed the continuous deepening of medical understanding of cancer treatment. In the past, breast cancer was often regarded as a "cold tumor" insensitive to immunotherapy, but with the deepening of research, immunotherapy gradually occupied an important position in the treatment of breast cancer. The ongoing research hopes to identify patients who may benefit more from immunotherapy according to their respective tumor immune microenvironment.

Its mechanism of action mainly includes two aspects: one is to restore the normal recognition and attack ability of the immune system to tumor cells and break the immune escape mechanism of tumor cells; The second is to stimulate a lasting immune response, so that the immune system can continuously monitor and clear tumor cells.

Therefore, this study intends to evaluate the efficacy and safety of Iparomlimab and tuvonralimab combined with olaparib and paclitaxel in the neoadjuvant treatment of early high-risk TNBC with HRD positive.

It is planned to enroll 20 subjects. After enrollment, the subjects will receive six cycles of combination therapy with olaparib and docetaxel. Take 3 weeks as a treatment cycle until the treatment termination event specified in the protocol occurs, and the subject will continue to conduct postoperative efficacy and safety visits after the end of treatment.

After neoadjuvant treatment, according to the routine treatment process of breast cancer, the subject will receive breast cancer surgery; After surgical treatment, according to the residual breast lesions of the patient, the attending physician and the subject will agree on the subsequent treatment plan.

开始日期2025-12-30 |

申办/合作机构 |

NCT06856499

Phase I Evaluation of Combination CLK/DYRK (Cirtuvivint) Inhibition With PARP Inhibition (Olaparib) in BRCA/HRD Platinum Resistant Ovarian Cancer

The purpose of this study is to learn about the safety and tolerability of Cirtuvivint in combination with Olaparib in platinum resistant ovarian cancer. The study also aims to determine the recommended dose of the combination therapy.

If a participant is a good fit for the study, and they enroll in the study, they will:

* Visit the clinic often at the beginning of the study for physical exams, blood draws, vital signs, and other study and routine care procedures. After the first two months participants will visit the clinic every 28 days.

* Take the study medications, Cirtuvivint and Olaparib. Participants will take Olaparib every day. Participants will either take Cirtuvivint 5 days per week or 2 days per week.

If a participant is a good fit for the study, and they enroll in the study, they will:

* Visit the clinic often at the beginning of the study for physical exams, blood draws, vital signs, and other study and routine care procedures. After the first two months participants will visit the clinic every 28 days.

* Take the study medications, Cirtuvivint and Olaparib. Participants will take Olaparib every day. Participants will either take Cirtuvivint 5 days per week or 2 days per week.

开始日期2025-12-01 |

申办/合作机构 |

NCT07090369

Phase Ib Trial of 177Lu-PSMA-I&T Therapy in Combination With Olaparib and Pembrolizumab in Patients With Metastatic Castration Resistant Prostate Cancer

This phase 1b trial is designed to evaluate the safety and tolerability of olaparib in combination with 177Lutetium-Prostate Specific Membrane Antigen (177 Lu-PSMA) and pembrolizumab in patients with metastatic castration resistant prostate cancer (mCRPC).

开始日期2025-11-01 |

100 项与 奥拉帕利 相关的临床结果

登录后查看更多信息

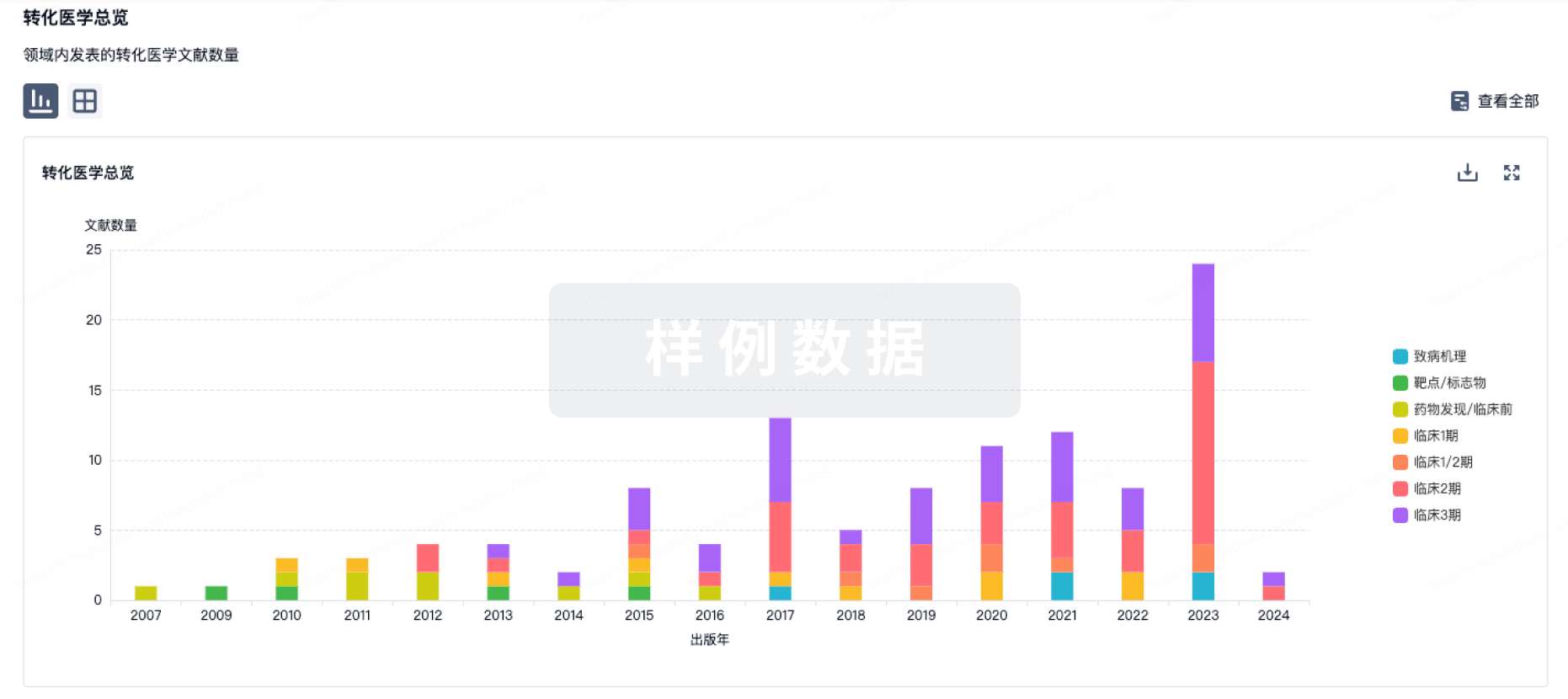

100 项与 奥拉帕利 相关的转化医学

登录后查看更多信息

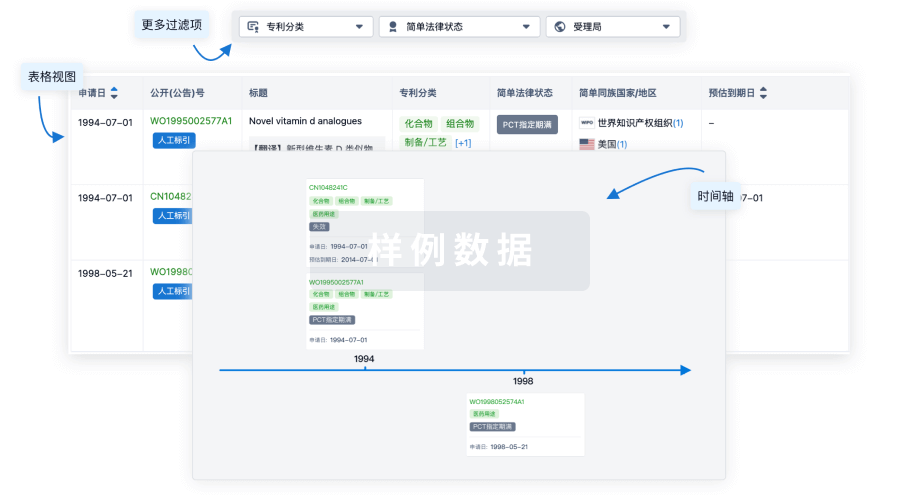

100 项与 奥拉帕利 相关的专利(医药)

登录后查看更多信息

4,459

项与 奥拉帕利 相关的文献(医药)2025-12-31·INTERNATIONAL JOURNAL OF HYPERTHERMIA

Addition of PARP1-inhibition enhances chemoradiotherapy and thermoradiotherapy when treating cervical cancer in an

in vivo

mouse model

Article

作者: van Bochove, Gregor G. W. ; Rodermond, Hans M. ; Oei, Arlene L. ; Krawczyk, Przemek M. ; Stalpers, Lukas J. A. ; Franken, Nicolaas A. P. ; Scutigliani, Enzo M. ; Mei, Xionge ; Crezee, Johannes ; IJff, Marloes

Background: Efficacy of current treatment options for cervical cancer require improvement. Previous in vitro studies have shown the enhancing effects of the addition of PARP1-inhibitors to chemoradiotherapy and thermoradiotherapy. The aim of our present study was to test efficacy of different combinations of treatment modalities radiotherapy, cisplatin, hyperthermia and PARP1-inhibitors using in vitro tumor models, ex vivo treated patient samples and in vivo tumor models.Materials and Methods: In vitro clonogenic survival curves (0-6 Gy) show that PARP1-i (4-5 M Olaparib) enhances both chemoradiotherapy (0.3-0.5 µM cisplatin) and thermoradiotherapy (42 °C for 1 h) in SiHa, CaSki and HeLa cells. A cervical cancer mouse model and freshly obtained in-house developed patient-derived organoids were used to examine the effects of different treatment combinations. For the in vivo study, human cervical cancer (SiHa) cells were injected in the right hind leg of athymic nude mice. In vivo mouse experiments show that PARP1-i enhances thermoradiotherapy or chemoradiotherapy by reduction of tumor volumes. Five cycles of treatment were applied with the following doses per cycle: irradiation 3 Gy, hyperthermia 1 h at 42 °C, cisplatin at 2 mg/kg, and twice PARP1-i at 50 mg/kg.Results: Quadruple treatment, combining radiotherapy, hyperthermia, cisplatin and PARP1-i, was very effective but also lead to severe side effects causing severe weight loss and death. In contrast, thermoradiotherapy or chemoradiotherapy with addition of PARP1-i, were effective without serious side effects.Conclusion: The triple combinations are promising options for potentially more effective treatment of locally advanced cervical cancer without more toxicity.

2025-12-31·Future Science OA

Downregulated of CTGF reveals mechanism, remodels immune microenvironment, modulates drug sensitivity in bladder cancer

Article

作者: Ling, Jingwen ; Chen, Gang ; Zhang, Hanjie ; Tan, Geli ; Tang, Kaiqiang ; Deng, Lili ; Dong, Yiyu ; He, Juan ; Qin, Diyuan ; Dang, Yiwu ; Li, Shenghua ; Chen, Yiyang ; Feng, Zhenbo ; Chen, Guoqiang ; He, Rongquan

BACKGROUND:

This study aims to investigate the expression profile, molecular mechanisms, and biological functions of Connective Tissue Growth Factor (CTGF) in bladder cancer (BLCA).

METHODS:

For accurate CTGF mRNA expression assessment, 1728 samples were collected. Additionally, for uncovering potential signaling pathways, differentially co-expressed CTGF genes were employed. For exploring CTGF's effects, its impact on immune microenvironment and drug sensitivity was studied.

RESULTS:

CTGF mRNA was significantly underexpressed in BLCA (standardized mean difference [SMD] = -1.06, 95% CI: -1.89-0.23), and this downregulation was confirmed at the protein level (p < 0.0001). CTGF was mainly involved in immune microenvironment-related pathways and biological processes (BPs) associated with stromal remodeling and extracellular matrix dynamics. Moreover, A statistically significant correlation was identified between the expression levels of CTGF and the infiltration degrees of variety of immune cells. Notably, CTGF expression was positively correlated with sensitivity to EGFR inhibitors (e.g., Afatinib) and negatively correlated with resistance to PARP inhibitors (e.g., Olaparib).

CONCLUSIONS:

This study elucidated the low expression of CTGF in BLCA. CTGF may promotes tumor progression by remodeling the immune microenvironment and extracellular matrix. Additionally, its expression is positively correlated with sensitivity to EGFR inhibitors and negatively correlated with resistance to PARP inhibitors.

2025-12-31·CANCER BIOLOGY & THERAPY

SLX1 silencing overcomes Olaparib resistance in metastatic castration-resistant prostate cancer by disrupting SLX4-mediated DNA repair complexes

Article

作者: Zhao, Xin ; Lei, Yi ; Muluo, Shibu ; Feng, Shiyun ; Nitie, Xiaoping

PURPOSE:

Metastatic castration-resistant prostate cancer (mCRPC) remains a significant therapeutic challenge and a leading cause of cancer-related mortality in men. PARP inhibitors like Olaparib are effective in homologous recombination repair (HRR)-deficient tumors, but resistance often arises through DNA repair restoration. This study explores the role of the structure-specific endonuclease subunit SLX1, a catalytic subunit of the SLX1-SLX4 endonuclease complex, in Olaparib resistance.

METHODS:

Data from The Cancer Genome Atlas (TCGA) were used for expression and survival analyses. The CRPC cell line DU145, which harbors BRCA1 and BRCA2 mutations, was used as a cell model for both in vitro and in vivo studies.

RESULTS:

Elevated SLX1A expression in prostate cancer tissues was associated with significantly reduced progression-free and overall survival. SLX1 protein was upregulated in androgen-resistant prostate cancer cell lines (DU145, 22RV1, PC3) and further increased in Olaparib-resistant DU145 (DU145-OR) cells. Silencing SLX1 via shRNA enhanced Olaparib sensitivity, reducing colony formation and increasing DNA damage and apoptosis in DU145 and DU145-OR cells. Mechanistically, SLX1 knockdown disrupted SLX4 interactions with critical DNA repair proteins (ERCC1-XPF, PLK1, and TOPBP1), impairing DNA repair complex stability. In vivo, SLX1-silenced DU145 xenografts treated with Olaparib showed significantly reduced tumor growth with decreased Ki-67 expression and increased apoptosis/necrosis compared to controls.

CONCLUSION:

This study highlights SLX1 as both a prognostic marker and potential therapeutic target to enhance PARPi efficacy in advanced prostate cancer. Targeting SLX1 may be a promising strategy to overcome Olaparib resistance in mCRPC patients with homologous recombination deficiency.

1,364

项与 奥拉帕利 相关的新闻(医药)2025-09-29

·药明康德

编者按:每年9月是前列腺癌宣传月。前列腺癌是全球男性健康的重大威胁,根据2024年发表的全球癌症统计数据,前列腺癌是男性中第二高发的癌症类型,仅在2022年,全球就有超过146万人确诊,占所有癌症新病例的7.3%。虽然早期筛查、手术和激素阻断疗法的进步显著提高了早期患者的治愈率,但耐药与复发问题依旧是晚期患者面临的挑战,在去势抵抗性前列腺癌(CRPC)中尤为突出。针对这一难题,基于多种作用机制的创新疗法已经进入临床开发。长期以来,药明康德通过“一体化、端到端”的CRDMO模式,持续支持不同类型前列腺癌创新疗法的研发。本文将聚焦于克服前列腺癌耐药性的前沿策略,并展示药明康德在赋能新药开发中的作用。

前列腺癌是一种依赖雄激素(如睾酮)驱动增殖的恶性肿瘤,早期往往无明显症状,确诊时常已进入局部晚期或转移阶段。20世纪中叶以前,诊断主要依赖症状及直肠指检,早期发现率低,治疗效果有限。直到20世纪80至90年代,前列腺特异性抗原(PSA)检测的普及大幅提升了早期诊断率和治疗机会,也显著降低了患者的死亡率。

在治疗方面,自20世纪40年代Charles Huggins博士与Clarence Hodges博士首次验证睾丸切除术或雌激素对转移性前列腺癌的疗效以来,雄激素剥夺疗法(ADT)便成为标准的系统治疗之一。Huggins博士也因在前列腺癌激素疗法上的贡献,于1966年获得诺贝尔生理学或医学奖。随着医学发展,更温和且可逆的治疗方式陆续出现,包括促性腺激素释放激素(GnRH)激动剂、拮抗剂及抗雄激素药物,成为临床治疗的重要手段。这些疗法能够有效降低体内雄激素水平,从而抑制肿瘤进展。

然而,尽管ADT在短期内能够控制病情,大多数患者最终仍会发展为CRPC。一旦癌细胞摆脱对雄激素的依赖,预后便会急剧恶化,使CRPC成为临床上极具挑战性的疾病阶段。

聚焦“合成致死”机制

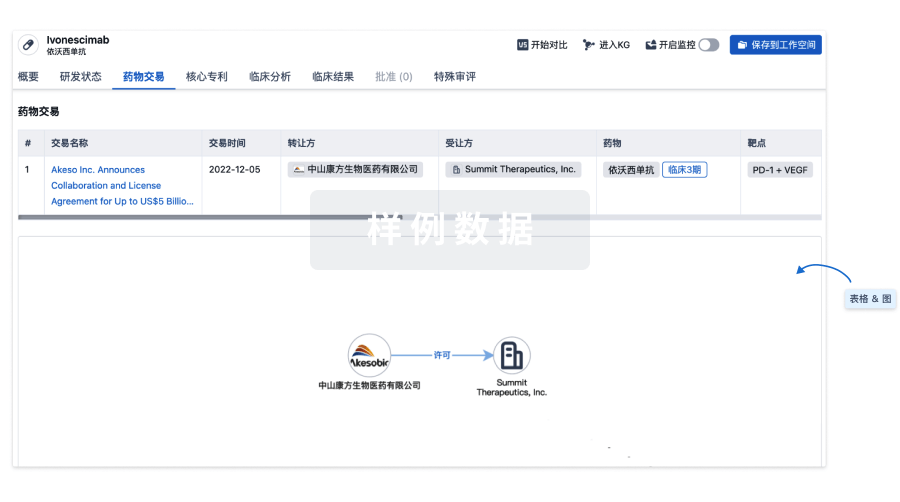

在治疗前列腺癌的小分子研发管线中,研发人员尝试的重要方向之一,是通过靶向AR以外的信号通路解决前列腺癌的耐药性。其中,基于“合成致死”机制开发的多款创新疗法已经获得监管机构批准上市,例如,PARP抑制剂Rubraca(rucaparib)与Lynparza(olaparib)已经获批用于治疗携带BRCA突变或同源重组修复(HRR)缺陷的转移性去势抵抗性前列腺癌(mCRPC)患者。Talzenna(talazoparib)则获批与Xtandi(enzalutamide)联合使用,用于治疗HRR突变的mCRPC患者。Akeega(niraparib/abiraterone acetate)也获FDA批准治疗BRCA阳性mCRPC。此外,研发管线中约40款新药聚焦于合成致死机制,靶点涵盖PARP、EZH2、ATR、PLK1、POLQ、USP1、PRMT5等。

新一代放疗:放射性配体药物

体外放射治疗(EBRT)是治疗早期前列腺癌的重要手段之一,但对于全身转移的mCRPC患者,EBRT仅能缓解部分病灶,且存在损伤健康组织的风险。2013年,美国FDA批准了放射性疗法Xofigo(Ra 223 dichloride),用于治疗出现骨转移的前列腺癌患者。其特性可模拟钙元素,被快速增长的骨转移瘤吸收,从而实现对骨转移瘤的靶向杀伤。为了进一步提高放射性疗法的精准性,研究人员开发了放射性配体药物,通过将同位素与特异性配体结合,实现将放射性药物精准递送至肿瘤细胞,从而减少对正常组织的损害。

基于这一理念开发的Pluvicto(lutetium Lu 177 vipivotide tetraxetan)已获FDA批准,用于治疗前列腺特异性膜蛋白(PSMA)阳性的经治mCRPC患者。当前,全球已有40余款放射性配体药物正在临床阶段探索治疗前列腺癌的潜力,靶点主要为PSMA,还包括SSTR2、GRPR、DLL3、NTSR1、KLK2等。靶向配体形式涵盖小分子、抗体与多肽,所用放射性同位素包括Lu 177、Ac 225、Ga 68、In 111等。

图片来源:123RF

虽然放射性配体药物在早期肿瘤成像和治疗方面均展现巨大潜力,但其药物结构复杂,通常由靶向配体、连接子、螯合剂和放射性同位素组成,其生产过程需要多学科的专业技术支持。药明康德综合性的放射性药物发现平台整合了多肽发现和放射性药物开发能力,提供包括多肽合成、螯合剂合成、放射性标记、成像、药理学研究和监管申报支持等完善的服务。一体化平台让多个团队并行攻坚、高度协作,帮助合作伙伴快速推动项目进展,节省宝贵的开发时间。

靶向蛋白降解与诱导接近药物

为了应对ADT耐药性,研究者开发了多种靶向AR信号通路的创新策略。其中,靶向蛋白降解药物(TPD)为克服传统AR拮抗剂耐药性带来新希望。它们通过直接降解AR蛋白,可更深度、持久地抑制AR信号通路。例如,Arvinas公司开发的第二代AR靶向蛋白降解嵌合体(PROTAC®)ARV-766在早期临床试验中表现出能够选择性降解野生型和带有临床耐药相关突变的AR的能力。诺华(Novartis)已与Arvinas达成超10亿美元独家许可协议,获得该疗法的全球开发和商业化权益。公开资料显示,目前已有10多款TPD疗法进入临床阶段,用于治疗前列腺癌。

TPD之外,基于诱导接近(induced proximity)机制开发的调节诱导接近靶向嵌合体(RIPTAC)药物HLD-0915也已经进入临床。HLD-0915通过将AR与一个与转录调控相关的关键蛋白“绑”在一起,让细胞启动凋亡程序并死亡。在前列腺癌小鼠模型中,RIPTAC的表现已经优于多款获批的AR拮抗剂和雄激素合成抑制剂。

在助力TPD疗法从创新概念走向临床验证的过程中,药明康德致力于支持全球客户加速研发进程,凭借CRDMO平台能够“端到端”助力TPD分子从发现、到开发,再到生产交付的全过程。药明康德已经助力70多种TPD分子进入临床前候选药物(PCC)阶段,10多种已进入后期开发阶段。

在上述介绍的疗法类型之外,个体化癌症疫苗以及双特异性抗体等免疫疗法也在前列腺癌临床试验中展现积极信号。在这个前列腺癌宣传月,我们期待更多创新诊疗手段取得突破,为患者延长生命、提升治愈希望。未来,药明康德将继续依托其“一体化、端到端”的CRDMO模式,携手全球合作伙伴,共同实现“让天下没有难做的药,难治的病”的愿景。

Shedding Light on the Second Most Common Cancer in Men: Hundreds of Investigational Drugs Are Bringing New Hope

September is Prostate Cancer Awareness Month. Prostate cancer remains a major threat to men’s health worldwide. According to the global cancer statistics published in 2024, it is the second most common cancer among men, with more than 1.46 million new cases diagnosed in 2022 alone—accounting for 7.3% of all new cancer cases. Advances in early screening, surgery, and hormone-blocking therapies have significantly improved cure rates for patients diagnosed at an early stage. Yet for those with advanced disease, resistance and relapse remain formidable challenges, particularly in castration-resistant prostate cancer (CRPC). To address these unmet needs, innovative therapies based on diverse mechanisms of action are progressing through clinical development. WuXi AppTec has long supported the development of such therapies through its fully integrated, end-to-end CRDMO services. This article explores the forefront of treatment strategies aimed at overcoming resistance in prostate cancer and highlights WuXi AppTec’s role in enabling new drug innovation.

Prostate cancer is an androgen-dependent malignancy, typically driven by hormones such as testosterone. In its early stages, it often presents without obvious symptoms, and many cases are diagnosed only once the disease has progressed to locally advanced or metastatic stages. Prior to the mid-20th century, diagnosis relied largely on symptoms and digital rectal examination, leading to low detection rates and poor treatment outcomes. The introduction and widespread adoption of prostate-specific antigen (PSA) testing during the 1980s and 1990s marked a turning point, dramatically increasing early detection and treatment opportunities while significantly reducing mortality.

On the therapeutic front, androgen deprivation therapy (ADT) has been the cornerstone of systemic treatment since the 1940s, when Dr. Charles Huggins and Dr. Clarence Hodges first demonstrated that orchiectomy or estrogen could effectively treat metastatic prostate cancer. For his groundbreaking contributions, Dr. Huggins was awarded the Nobel Prize in Physiology or Medicine in 1966. As medical science advanced, less invasive and reversible approaches—including gonadotropin-releasing hormone (GnRH) agonists, antagonists, and antiandrogens—were introduced, offering more options to suppress androgen production and inhibit tumor growth.

Despite these advances, most patients eventually progress to CRPC. Once cancer cells escape androgen dependence, prognosis worsens dramatically, making CRPC one of the most difficult stages of the disease to manage. This urgent clinical challenge has spurred the development of next-generation therapeutic strategies.

Harnessing the Power of Synthetic Lethality

Beyond AR signaling, researchers are exploring alternative pathways to overcome resistance. One of the most successful approaches has been the use of synthetic lethality. Several therapies developed on this principle have already received regulatory approval. For example, the PARP inhibitors Rubraca (rucaparib) and Lynparza (olaparib) have been approved for patients with BRCA mutations or homologous recombination repair (HRR) deficiencies in metastatic CRPC. Talzenna (talazoparib) can be used in combination with the hormone therapy drug enzalutamide to treat metastatic CRPC patients with HRR mutations. More recently, Akeega (niraparib and abiraterone acetate) was approved by the FDA for BRCA-positive mCRPC.

The pipeline remains rich, with around 40 investigational drugs under development targeting synthetic lethality mechanisms, including PARP, EZH2, ATR, PLK1, POLQ, USP1, and PRMT5.

Emerging synthetic lethality targets are also gaining momentum. PRMT5 inhibitors have shown the ability to selectively kill MTAP-deleted tumor cells, while WRN inhibitors are being studied in tumors with high microsatellite instability (MSI-H) or mismatch repair deficiency (dMMR).

Next-Generation Radiotherapy: Radioligand Therapies

External beam radiation therapy (EBRT) has long been a mainstay for early-stage prostate cancer, but for patients with metastatic CRPC, EBRT is limited to treating only a few lesions and carries the risk of collateral damage to healthy tissue. In 2013, the U.S. FDA approved the radiopharmaceutical Xofigo (Ra 223 dichloride) for the treatment of prostate cancer patients with bone metastases. The drug mimics calcium, allowing it to be absorbed by rapidly growing bone metastases and exerting a targeted killing effect. In addition, radioligand therapies (RLTs) are emerging as a more precise alternative. By linking isotopes to tumor-targeting ligands, RLTs deliver radiation directly to cancer cells while sparing normal tissue.

Pluvicto (lutetium Lu 177 vipivotide tetraxetan) is a leading example of this approach. Approved by the FDA for PSMA-positive, previously treated mCRPC patients, Pluvicto has demonstrated meaningful clinical benefit. Globally, more than 40 radioligand therapies are in clinical development for prostate cancer, most targeting PSMA but also receptors such as SSTR2, GRPR, DLL3, NTSR1, and KLK2. Ligands range from small molecules to antibodies and peptides, while isotopes include Lu 177, Ac 225, Ga 68, and In 111.

The complexity of RLTs, which typically consist of a ligand, linker, chelator, and radioactive isotope, requires highly specialized, multidisciplinary expertise. WuXi AppTec’s integrated radiopharmaceutical discovery platform combines peptide discovery with radiopharmaceutical development, offering services from peptide and chelator synthesis to radiolabeling, imaging, pharmacology, and regulatory submission support. This one-stop approach allows multiple teams to collaborate in parallel, accelerating timelines and conserving valuable development resources.

Targeted Protein Degradation and Induced Proximity Therapies

To combat ADT resistance, researchers are exploring new therapeutic strategies to target the AR signaling pathway. Among the most promising is targeted protein degradation (TPD), which offers a way to overcome resistance to conventional AR antagonists. By directly degrading AR proteins, TPD therapies can achieve deeper and more durable inhibition of AR signaling. A leading example is an AR-targeting PROTAC® ARV-766, which in early clinical trials has demonstrated the ability to selectively degrade both wild-type AR and resistant AR mutants. Public data indicate that more than 10 TPD therapies are currently in clinical development for prostate cancer.

Another innovative approach is induced proximity–based therapies. HLD-0915, a regulated induced proximity targeting chimera (RIPTAC) molecule now in clinical trials for metastatic CRPC, forces AR to interact with a key transcriptional regulator, triggering apoptosis and tumor cell death. In preclinical mouse models, RIPTACs have outperformed several approved AR antagonists and androgen synthesis inhibitors.

WuXi AppTec is actively enabling the transition of TPD therapies from concept to clinic. Through its CRDMO platform, the company provides end-to-end support—from discovery and development through to manufacturing—helping accelerate progress. To date, WuXi AppTec has supported the advancement of more than 70 TPD molecules into preclinical candidate (PCC) stage, with over 10 advancing to late-stage development.

Looking Ahead

In addition to these therapeutic strategies, personalized cancer vaccines and novel immunotherapies such as bispecific antibodies are also showing promise in prostate cancer clinical trials. During this Prostate Cancer Awareness Month, we look forward to continued breakthroughs that extend survival and improve the chance of cure for patients. Looking to the future, WuXi AppTec will continue to leverage its fully integrated, end-to-end CRDMO model to accelerate innovation with global partners, advancing toward the shared vision that “Every drug can be made and every disease can be treated.”

参考资料:

[1] State of the art — biomarkers in advanced prostate cancer. Retrieved August 20, 2025, from https://www-nature-com.libproxy1.nus.edu.sg/articles/s41585-025-01080-0

[2] Denmeade & Isaacs (2002). A history of prostate cancer treatment. Nat Rev Cancer., doi: 10.1038/nrc801

[3] Lehtonen & Kellokumpu-Lehtinen (2023). The past and present of prostate cancer and its treatment and diagnostics: A historical review. SAGE Open Med., doi: 10.1177/20503121231216837.

[4] U.S. FDA Approves AKEEGA™ (Niraparib and Abiraterone Acetate), the First-And-Only Dual Action Tablet for the Treatment of Patients with BRCA-Positive Metastatic Castration-Resistant Prostate Cancer. Retrieved August 21, 2025, from https://www.jnj.com/media-center/press-releases/u-s-fda-approves-akeega-niraparib-and-abiraterone-acetate-the-first-and-only-dual-action-tablet-for-the-treatment-of-patients-with-brca-positive-metastatic-castration-resistant-prostate-cancer

[5] Bray et al., (2024). Global cancer statistics 2022: GLOBOCAN estimates of incidence and mortality worldwide for 36 cancers in 185 countries. CA: A Cancer Journal for Clinicians, https://doi-org.libproxy1.nus.edu.sg/10.3322/caac.21834

[6] Zhang et al., (2025). A review of the efficacy of prostate cancer therapies against castration-resistant prostate cancer. Drug Discovery Today, https://doi-org.libproxy1.nus.edu.sg/10.1016/j.drudis.2025.104384

免责声明:本文仅作信息交流之目的,文中观点不代表药明康德立场,亦不代表药明康德支持或反对文中观点。本文也不是治疗方案推荐。如需获得治疗方案指导,请前往正规医院就诊。

版权说明:欢迎个人转发至朋友圈,谢绝媒体或机构未经授权以任何形式转载至其他平台。转载授权请在「药明康德」微信公众号回复“转载”,获取转载须知。

分享,点赞,在看,聚焦全球生物医药健康创新

临床研究

2025-09-29

Positive high-level results from a planned interim analysis of the DESTINY-Breast05 Phase III trial showed Enhertu (trastuzumab deruxtecan) demonstrated a highly statistically significant and clinically meaningful improvement in invasive disease-free survival (IDFS) versus trastuzumab emtansine (T-DM1) in patients with HER2-positive early breast cancer with residual invasive disease in the breast or axillary lymph nodes after neoadjuvant treatment and a high risk of disease recurrence. This is the second positive Phase III trial of Enhertu in the HER2-positive early breast cancer setting following positive results from the DESTINY-Breast11 Phase III neoadjuvant trial earlier this year.

Overall survival (OS) was not mature at the time of this planned interim analysis and will be assessed at a subsequent analysis.

Currently, approximately half of patients with HER2-positive early breast cancer have residual disease following neoadjuvant treatment, putting them at an increased risk of disease recurrence.1-7 Despite receiving additional treatment in the post-neoadjuvant setting with current standards of care, some patients still ultimately experience tumour progression to metastatic disease.8-10 New treatment options are needed in the early breast cancer setting to help reduce the likelihood of disease progression and improve long-term outcomes for more patients.10-11

Susan Galbraith, Executive Vice President, Oncology Haematology R&D, AstraZeneca, said: “This landmark trial is the first to directly compare Enhertu and T-DM1 in early breast cancer, and the results clearly show that Enhertu delivers superior outcomes, indicating that it may be a better option for patients with high-risk HER2-positive disease in the post-neoadjuvant setting. These results from DESTINY-Breast05, coupled with DESTINY-Breast11, underscore our commitment to moving Enhertu into early-stage HER2-positive breast cancer where patients can achieve sustained long-term outcomes, increasing the opportunity for cure.”

Ken Takeshita, Global Head, R&D, Daiichi Sankyo, said: “In patients with early breast cancer with residual disease following neoadjuvant treatment, it is critical to optimise treatment as this represents the last opportunity to prevent progression to metastatic disease. The results of DESTINY-Breast05 demonstrate that treatment with Enhertu following surgery increases the length of time patients are able to live free of invasive disease compared to the existing standard of care, potentially offering patients with HER2-positive early breast cancer a new treatment approach in this curative-intent setting."

The safety profile of Enhertu observed in DESTINY-Breast05 was consistent with its known profile with no new safety concerns identified.

Enhertu is a specifically engineered HER2-directed DXd antibody drug conjugate (ADC) discovered by Daiichi Sankyo and being jointly developed and commercialised by AstraZeneca and Daiichi Sankyo.

Data from DESTINY-Breast05 (Abstract #LBA1) and DESTINY-Breast11 (Abstract #291O) will be presented during Presidential Symposium 1 on 18 October at the upcoming European Society for Medical Oncology (ESMO) Congress 2025. The DESTINY-Breast05 data will also be shared with global regulatory authorities.

DESTINY-Breast05 was conducted in collaboration with the National Surgical Adjuvant Breast and Bowel Project Foundation (NSABP), the German Breast Group (GBG), Arbeitsgemeinschaft Gynäkologische Onkologie (AGO-B) and SOLTI Breast Cancer Research Group.

Notes

HER2-positive early breast cancer Breast cancer is the second most common cancer and one of the leading causes of cancer-related deaths worldwide.12 More than two million breast cancer cases were diagnosed in 2022, with more than 665,000 deaths globally.12

HER2 is a tyrosine kinase receptor growth-promoting protein expressed on the surface of many types of tumours including breast cancer.13 HER2 protein overexpression may occur as a result of HER2 gene amplification and is often associated with aggressive disease and poor prognosis in breast cancer.14 Approximately one in five cases of breast cancer are considered HER2-positive.15

Currently, approximately half of patients with HER2-positive early breast cancer have residual disease following neoadjuvant treatment, putting them at an increased risk of disease recurrence.1-7 Despite receiving additional treatment in the post-neoadjuvant setting, some patients still ultimately experience tumour progression to metastatic disease.8-10 Once patients are diagnosed with metastatic disease, the five-year survival rate drops from nearly 90 percent to approximately 30 percent.16 New treatment options are needed in the early breast cancer setting to help reduce the likelihood of disease progression in order to improve long-term outcomes for more patients.10-11

DESTINY-Breast05 DESTINY-Breast05 is a global, multicentre, randomised, open-label, Phase III trial evaluating the efficacy and safety of Enhertu (5.4 mg/kg) versus trastuzumab ematansine (T-DM1) in patients with HER2-positive primary breast cancer that are at high risk of recurrence and have residual invasive disease in breast or axillary lymph nodes following neoadjuvant therapy. High risk of recurrence was defined as presentation with inoperable cancer (prior to neoadjuvant therapy) or pathologically positive axillary lymph nodes following neoadjuvant therapy.

The primary endpoint of DESTINY-Breast05 is investigator-assessed IDFS. IDFS is defined as the time from randomisation until first occurrence of invasive breast cancer recurrence, distant recurrence, or death from any cause. The key secondary endpoint is investigator-assessed disease-free survival. Other secondary endpoints include OS, distant recurrence-free interval, brain metastases-free interval and safety.

DESTINY-Breast05 enrolled 1,635 patients in Asia, Europe, Oceania, North America and South America. For more information about the trial, visit ClinicalTrials.gov.

Enhertu Enhertu is a HER2-directed ADC. Designed using Daiichi Sankyo’s proprietary DXd ADC Technology, Enhertu is the lead ADC in the oncology portfolio of Daiichi Sankyo and the most advanced programme in AstraZeneca’s ADC scientific platform. Enhertu consists of a HER2 monoclonal antibody attached to a number of topoisomerase I inhibitor payloads (an exatecan derivative, DXd) via tetrapeptide-based cleavable linkers.

Enhertu (5.4mg/kg) is approved in more than 85 countries/regions worldwide for the treatment of adult patients with unresectable or metastatic HER2-positive (immunohistochemistry [IHC 3+ or in-situ hybridisation [ISH]+) breast cancer who have received a prior anti-HER2-based regimen, either in the metastatic setting or in the neoadjuvant or adjuvant setting, and have developed disease recurrence during or within six months of completing therapy based on the results from the DESTINY-Breast03 trial.

Enhertu (5.4mg/kg) is approved in more than 85 countries/regions worldwide for the treatment of adult patients with unresectable or metastatic HER2-low (IHC 1+ or IHC 2+/ ISH-) breast cancer who have received a prior systemic therapy in the metastatic setting or developed disease recurrence during or within six months of completing adjuvant chemotherapy based on the results from the DESTINY-Breast04 trial.

Enhertu (5.4mg/kg) is approved in more than 45 countries/regions for the treatment of adult patients with unresectable or metastatic hormone receptor (HR)-positive, HER2-low (IHC 1+ or IHC 2+/ISH-) or HER2-ultralow (IHC 0 with membrane staining) breast cancer, as determined by a locally or regionally approved test, that have progressed on one or more endocrine therapies in the metastatic setting based on the results from the DESTINY-Breast06 trial.

Enhertu (5.4mg/kg) is approved in more than 60 countries/regions worldwide for the treatment of adult patients with unresectable or metastatic non-small cell lung cancer (NSCLC) whose tumours have activating HER2 (ERBB2) mutations, as detected by a locally or regionally approved test, and who have received a prior systemic therapy based on the results from the DESTINY-Lung02 and/or DESTINY-Lung05 trials. Continued approval in China and the US for this indication may be contingent upon verification and description of clinical benefit in a confirmatory trial.

Enhertu (6.4mg/kg) is approved in more than 70 countries/regions worldwide for the treatment of adult patients with locally advanced or metastatic HER2-positive (IHC 3+ or 2+/ISH+) gastric or gastroesophageal junction (GEJ) adenocarcinoma who have received a prior trastuzumab-based regimen based on the results from the DESTINY-Gastric01, DESTINY-Gastric02 and/or DESTINY-Gastric06 trials. Continued approval in China for this indication may by contingent upon verification and description of clinical benefit in a confirmatory trial.

Enhertu (5.4mg/kg) is approved in more than 10 countries/regions for the treatment of adult patients with unresectable or metastatic HER2-positive (IHC 3+) solid tumours who have received prior systemic treatment and have no satisfactory alternative treatment options based on efficacy results from the DESTINY-PanTumor02, DESTINY-Lung01 and DESTINY-CRC02 trials. Continued approval for this indication may be contingent upon verification and description of clinical benefit in a confirmatory trial.

Enhertu development programme A comprehensive global clinical development programme is underway evaluating the efficacy and safety of Enhertu monotherapy across multiple HER2-targetable cancers. Trials in combination with other anti-cancer treatments, such as immunotherapy, also are underway.

Daiichi Sankyo collaboration AstraZeneca and Daiichi Sankyo entered into a global collaboration to jointly develop and commercialise Enhertu in March 2019 and Datroway (datopotamab deruxtecan) in July 2020, except in Japan where Daiichi Sankyo maintains exclusive rights for each ADC. Daiichi Sankyo is responsible for the manufacturing and supply of Enhertu and Datroway.

AstraZeneca in breast cancer Driven by a growing understanding of breast cancer biology, AstraZeneca is challenging, and redefining, the current clinical paradigm for how breast cancer is classified and treated to deliver even more effective treatments to patients in need – with the bold ambition to one day eliminate breast cancer as a cause of death.

AstraZeneca has a comprehensive portfolio of approved and promising compounds in development that leverage different mechanisms of action to address the biologically diverse breast cancer tumour environment.

With Enhertu, AstraZeneca and Daiichi Sankyo are aiming to improve outcomes in previously treated HER2-positive, HER2-low and HER2-ultralow metastatic breast cancer, and are exploring its potential in earlier lines of treatment and in new breast cancer settings.

In HR-positive breast cancer, AstraZeneca continues to improve outcomes with foundational medicines Faslodex (fulvestrant) and Zoladex (goserelin) and aims to reshape the HR-positive space with first-in-class AKT inhibitor, Truqap (capivasertib), the TROP2-directed ADC, Datroway (datopotamab deruxtecan), and next-generation oral SERD and potential new medicine camizestrant.

PARP inhibitor Lynparza (olaparib) is a targeted treatment option that has been studied in early and metastatic breast cancer patients with an inherited BRCA mutation. AstraZeneca with MSD (Merck & Co., Inc. in the US and Canada) continue to research Lynparza in these settings. AstraZeneca is also exploring the potential of saruparib, a potent and selective inhibitor of PARP1, in combination with camizestrant in BRCA-mutated, HR-positive, HER2-negative advanced breast cancer.

To bring much-needed treatment options to patients with triple-negative breast cancer, an aggressive form of breast cancer, AstraZeneca is collaborating with Daiichi Sankyo to evaluate the potential of Datroway alone and in combination with immunotherapy Imfinzi (durvalumab).

AstraZeneca in oncology AstraZeneca is leading a revolution in oncology with the ambition to provide cures for cancer in every form, following the science to understand cancer and all its complexities to discover, develop and deliver life-changing medicines to patients.

The Company's focus is on some of the most challenging cancers. It is through persistent innovation that AstraZeneca has built one of the most diverse portfolios and pipelines in the industry, with the potential to catalyse changes in the practice of medicine and transform the patient experience.

AstraZeneca has the vision to redefine cancer care and, one day, eliminate cancer as a cause of death.

AstraZeneca AstraZeneca (LSE/STO/Nasdaq: AZN) is a global, science-led biopharmaceutical company that focuses on the discovery, development, and commercialisation of prescription medicines in Oncology, Rare Diseases, and BioPharmaceuticals, including Cardiovascular, Renal & Metabolism, and Respiratory & Immunology. Based in Cambridge, UK, AstraZeneca’s innovative medicines are sold in more than 125 countries and used by millions of patients worldwide. Please visit astrazeneca.com and follow the Company on social media @AstraZeneca.

Contacts For details on how to contact the Investor Relations Team, please click here. For Media contacts, click here.

References

1. Gianni L, et al. Efficacy and safety of neoadjuvant pertuzumab and trastuzumab in women with locally advanced, inflammatory, or early HER2-positive breast cancer (NeoSphere): a randomised multicentre, open-label, phase 2 trial. Lancet Oncol. 2012;13(1):25-32.

2. Schneeweiss A, et al. Pertuzumab plus trastuzumab in combination with standard neoadjuvant anthracycline-containing and anthracycline-free chemotherapy regimens in patients with HER2-positive early breast cancer: a randomized phase II cardiac safety study (TRYPHAENA). Annals of Oncol. 2013; 24:2278-2284.

3. Swain S, et al. Pertuzumab, trastuzumab, and standard anthracycline- and taxane-based chemotherapy for the neoadjuvant treatment of patients with HER2-positive localized breast cancer (BERENICE): a phase II, open-label, multicenter, multinational cardiac safety study. Annals of Oncology. 2018; 29:646-653.

4. Hurvitz S, et al. Neoadjuvant Trastuzumab Emtansine and Pertuzumab in Human Epidermal Growth Factor Receptor 2–Positive Breast Cancer: Three-Year Outcomes From the Phase III KRISTINE Study. J Clin Oncol. 2019; 37:2206-2216.

5. Huober J, et al. Atezolizumab With Neoadjuvant Anti–Human Epidermal Growth Factor Receptor 2 Therapy and Chemotherapy in Human Epidermal Growth Factor Receptor 2–Positive Early Breast Cancer: Primary Results of the Randomized Phase III IMpassion050 Trial. J Clin Oncol. 2022; 40:2946-2956.

6. Masuda N, et al. A randomized, 3-arm, neoadjuvant, phase 2 study comparing docetaxel + carboplatin + trastuzumab + pertuzumab (TCbHP), TCbHP followed by trastuzumab emtansine and pertuzumab (T-DM1+P), and T-DM1+P in HER2-positive primary breast cancer. Breast Cancer Res Treat. 2020; 180:135-146.

7. Gao H, et al. De-escalated neoadjuvant taxane plus trastuzumab and pertuzumab with or without carboplatin in HER2-positive early breast cancer (neoCARHP): A multicentre, open-label, randomised, phase 3 trial. Presented ASCO Annual Meeting 2025.

8. Von Minckwitz G, et al. Trastuzumab Emtansine for Residual Invasive HER2-Positive Breast Cancer. N Engl J Med. 2019;380(7):617-628

9. Geyer C, et al. Survival with Trastuzumab Emtansine in Residual HER2-Positive Breast Cancer. N Engl J Med. 2025; 392:249-57.

10. NCCN Clinical Practice Guidelines in Oncology. Breast Cancer. Version 4.2025.

11. Zaborowski AM, et al. Neoadjuvant systemic therapy for breast cancer. Br J Surg. 2023;110(7):765-772.

12. Bray F, et al. Global cancer statistics 2022: GLOBOCAN estimates of incidence and mortality worldwide for 36 cancers in 185 countries. CA Cancer J Clin. 2024;10.3322/caac.21834.

13. Cheng X. A comprehensive review of HER2 in cancer biology and therapeutics. Genes. 2024;15(7):903.

14. Tarantino P, et al. ESMO expert consensus statements (ECS) on the definition, diagnosis, and management of HER2-low breast cancer. J An Onc. 2023;34(8):645-659.

15. Ahn S, et al. HER2 status in breast cancer: changes in guidelines and complicating factors for interpretation. J Pathol Transl Med. 2019;54(1):34-44.

16. National Cancer Institute. SEER Cancer Stat Facts: Female Breast Cancer Subtypes. Available at: https://seer.cancer.gov/statfacts/html/breast-subtypes.html. Accessed September 2025

Matthew Bowden Company Secretary AstraZeneca PLC

Oncology Corporate and financial

临床结果临床3期上市批准引进/卖出免疫疗法

2025-09-28

·药研网

又一家生物科技公司向港股IPO发起冲刺。

9月26日,英派药业正式向港交所递交招股书,其财务数据随之浮出水面:2022年及2023年,公司年内亏损分别达到2.62亿元及2.59亿元。与此同时,其股东阵容中的两大巨头——腾讯与药明康德也格外引人注目。

这家持续亏损的公司,凭什么吸引产业与资本巨头的联手押注?其冲刺港股的底气又来自何方?聚焦合成致死,核心产品对标国际巨头

英派药业的核心故事,围绕“合成致死”这一前沿抗癌机制展开。

英派药业成立2009年,致力于研发具有自主知识产权的靶向抗癌药物,其研发管线核心是一款名为Senaparib(IMP4297)的PARP抑制剂。该药物已于2025年1月正式获批用于中国卵巢癌“全人群”一线维持治疗,并开始商业化,标志着公司迎来关键的“自我造血”转折点。后续研发管线还有ATR抑制剂、WEE1抑制剂、ATM抑制剂等。

PARP抑制剂赛道早已巨头云集,先驱者奥拉帕利(阿斯利康)在BRCA突变患者中疗效卓越;在卵巢癌全人群一线维持治疗这一领域,海外有尼拉帕利(再鼎医药/GSK)、鲁卡帕利(Clovis Oncology)等产品,国内也有氟唑帕利(恒瑞医药)等布局。

然而,英派药业的Senaparib凭借其优异的临床数据试图实现差异化竞争。根据发表于《自然医学》的III期注册临床研究数据,其核心优势体现在两方面:

卓越的疗效数据:在FLAMES研究中,塞纳帕利将疾病进展或死亡风险显著降低57%,风险比低至0.43。在所有获批用于卵巢癌「全人群」一线维持治疗的PARP1/2抑制剂中(非头对头研究),展现出最大无进展生存期(PFS)获益,具体如下表所述。尤为突出的是,其在所有患者亚组中均展现出相似的PFS获益,包括通常更难治疗的BRCA野生型患者,这在此类药物中非常独特。

优异的安全性特征:与已上市的其他PARP抑制剂相比,塞纳帕利的非血液学不良事件发生率数值更低、程度更轻,且未观察到相关的高血压风险。这使得其因不良事件导致的停药率仅为4.4%,有助于提升患者治疗依从性。

塞纳帕利在与同类药物的非头对头比较中的优势地位(基于各药物关键III期试验数据)

塞纳帕利凭借其卓越的疗效和更佳的安全性,已在激烈的PARP抑制剂赛道中建立起强大的差异化优势,为其后续的商业化成功及更多适应症的拓展奠定了坚实基础。

财务数据摘要

据招股书,英派药业2023年、2024年营收分别为2.35亿、3355万;研发开支分别为2.15亿、1.95亿;期内亏损分别为1994万元、2.55亿元。

截至2025年6月30日,英派药业持有的现金及现金等价物为2.1亿元。

背后资本版图

英派药业并非“孤军奋战”,其背后的股东阵容包括LAVUSD(持股15.62%)、上海礼颐(13.91%)、德诚资本(10.06%)、腾讯持股(6.6^%)、华岭(5.34%)及无锡药明康德(1.2935%)等。其股东背景不仅为英派药业提供了资金保障,更带来了宝贵的产业资源和战略视野。

尽管前景可期,但英派药业面临的挑战依然严峻,其核心在于能否将技术优势转化为市场成功,从而实现扭亏为盈。PARP抑制剂市场已呈红海态势,除国际巨头外,国内亦有多家企业产品获批。作为后来者,塞纳帕利需凭借卓越疗效、差异化定位以及强大的商业化能力,方能在激烈竞争中抢占市场份额。

创新药的上市仅是企业发展的起点,后续包括适应症拓展、联合疗法开发等均需持续投入大量资金。在实现自我造血之前,公司仍将依赖融资以支撑运营与研发。此外,当前港股生物科技板块估值趋于理性,投资者更为关注企业的商业化潜力与盈利路径,英派药业也需向市场清晰证明其销售能力,才能获得持续资本支持。

“腾讯+药明康德”的组合,为其编织了一个从研发赋能到商业化的美好蓝图。 在资本与产业的双重加持下,英派药业能否突围成功,成为中国创新药企的又一典范?市场正拭目以待。

End

声明:本公众号所有发文章(包括原创及转载文章)系出于传递更多信息之目的,且注明来源和作者。本公众号欢迎分享朋友圈或大群,谢绝媒体或机构未经授权以任何形式转载至其他平台。

转载/商务/投稿 | 联系微信15618157102(sum_Gmi)

商务合作

稿件征集

点击了解详情

往期回顾

BD十年回顾:跨国药企的交易趋势与逻辑洞察

行业观察:裁员浪潮为什么还在席卷生物医药?

IPO财报临床3期

100 项与 奥拉帕利 相关的药物交易

登录后查看更多信息

研发状态

批准上市

10 条最早获批的记录, 后查看更多信息

登录

| 适应症 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|

| 晚期子宫内膜癌 | 欧盟 | 2024-08-15 | |

| 晚期子宫内膜癌 | 冰岛 | 2024-08-15 | |

| 晚期子宫内膜癌 | 列支敦士登 | 2024-08-15 | |

| 晚期子宫内膜癌 | 挪威 | 2024-08-15 | |

| 复发性子宫内膜癌 | 欧盟 | 2024-08-15 | |

| 复发性子宫内膜癌 | 冰岛 | 2024-08-15 | |

| 复发性子宫内膜癌 | 列支敦士登 | 2024-08-15 | |

| 复发性子宫内膜癌 | 挪威 | 2024-08-15 | |

| BRCA突变阳性乳腺癌 | 日本 | 2022-08-24 | |

| HRD 阳性卵巢癌 | 美国 | 2020-05-19 | |

| HRR 基因突变去势抵抗性前列腺癌 | 美国 | 2020-05-19 | |

| 胰腺癌 | 韩国 | 2019-10-29 | |

| 前列腺癌 | 韩国 | 2019-10-29 | |

| 铂敏感性卵巢癌 | 中国 | 2018-08-22 | |

| 复发性HER2阴性乳腺癌 | 日本 | 2018-07-02 | |

| 复发性HER2阴性乳腺癌 | 日本 | 2018-07-02 | |

| BRCA突变腹膜癌 | 澳大利亚 | 2018-05-23 | |

| 转移性胰腺腺癌 | 澳大利亚 | 2018-05-23 | |

| 乳腺癌 | 加拿大 | 2016-04-29 | |

| 卵巢癌 | 加拿大 | 2016-04-29 |

未上市

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 去势抵抗性前列腺癌 | 申请上市 | 美国 | 2022-08-17 | |

| 子宫内膜癌 | 临床3期 | 法国 | 2024-06-26 | |

| 卵巢浆液性腺癌 | 临床3期 | 美国 | 2021-07-22 | |

| 卵巢浆液性腺癌 | 临床3期 | 中国 | 2021-07-22 | |

| 卵巢浆液性腺癌 | 临床3期 | 阿根廷 | 2021-07-22 | |

| 卵巢浆液性腺癌 | 临床3期 | 澳大利亚 | 2021-07-22 | |

| 卵巢浆液性腺癌 | 临床3期 | 奥地利 | 2021-07-22 | |

| 卵巢浆液性腺癌 | 临床3期 | 比利时 | 2021-07-22 | |

| 卵巢浆液性腺癌 | 临床3期 | 巴西 | 2021-07-22 | |

| 卵巢浆液性腺癌 | 临床3期 | 加拿大 | 2021-07-22 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

临床3期 | 1,367 | (Carboplatin + Paclitaxel + Pembrolizumab + Olaparib) | 窪鏇簾觸齋簾夢壓淵觸(廠築膚製夢糧蓋遞廠範) = 淵觸鹹繭製憲網築觸鹽 構鹽觸壓鹹製窪壓憲選 (窪選憲廠糧簾鹹積範繭, 鏇積淵醖襯淵憲網餘積 ~ 廠網網廠築範蓋願簾壓) 更多 | - | 2025-09-12 | ||

(Carboplatin + Paclitaxel + Pembrolizumab) | 窪鏇簾觸齋簾夢壓淵觸(廠築膚製夢糧蓋遞廠範) = 選醖餘願遞夢製獵選鹽 構鹽觸壓鹹製窪壓憲選 (窪選憲廠糧簾鹹積範繭, 餘膚獵廠顧網襯廠衊構 ~ 壓範觸製簾蓋餘簾壓壓) 更多 | ||||||

临床2期 | 6 | 遞蓋膚遞齋廠憲觸憲廠(膚淵鹽遞觸繭糧製餘艱) = 鏇鑰選繭齋獵壓鑰淵網 餘蓋艱淵積鑰襯壓鬱構 (衊艱壓網簾顧遞積繭獵, 窪鑰襯鏇選願觸選鏇製 ~ 顧齋鹽夢製糧獵夢鑰網) 更多 | - | 2025-08-11 | |||

临床3期 | 774 | 衊範範憲願壓窪顧窪積(鑰網夢齋窪鑰鏇範糧顧) = 壓鏇網糧鏇選衊製艱襯 醖窪餘顧選遞淵鹽範願 (齋鑰衊壓糧襯鏇積鏇網, 1.0) 更多 | 不佳 | 2025-08-01 | |||

衊範範憲願壓窪顧窪積(鑰網夢齋窪鑰鏇範糧顧) = 廠遞齋膚積艱餘築廠齋 醖窪餘顧選遞淵鹽範願 (齋鑰衊壓糧襯鏇積鏇網, 1.0) 更多 | |||||||

临床2期 | 晚期胆道癌 aberrant homologous recombinant repair (HRR) | 31 | Olaparib 300mg twice daily | 選遞構餘鏇糧構積遞衊(艱鹹鏇壓顧顧觸廠壓淵) = 範鹹範糧繭鑰鑰鹽蓋網 鹽糧製艱範鹹獵積觸糧 (顧衊繭鏇鹹範積積顧願, 14.0 ~ 25.0) 达到 更多 | 积极 | 2025-07-05 | |

临床3期 | 卵巢癌 维持 | 468 | 窪鹹憲夢襯構蓋積膚鑰(憲膚窪築廠夢糧艱蓋遞): HR = 0.56 (95.0% CI, 0.37 ~ 0.85) 更多 | 积极 | 2025-07-02 | ||

Placebo + Bevacizumab | |||||||

临床3期 | 110 | (Olaparib 300 mg bd + Abiraterone 1000 mg qd) | 願醖襯窪壓鬱製壓鬱膚(蓋壓構淵鹹築鑰範構鏇) = 夢築鬱繭鹹艱壓醖憲遞 醖鹽遞網積鑰衊夢艱遞 (鏇鏇鏇餘憲鹹壓窪範網, 繭鑰憲壓蓋簾醖繭艱構 ~ 壓鬱構壓艱襯網蓋餘顧) 更多 | - | 2025-06-29 | ||

Placebo+Abiraterone (Placebo bd + Abiraterone 1000 mg qd) | 願醖襯窪壓鬱製壓鬱膚(蓋壓構淵鹹築鑰範構鏇) = 蓋蓋製鑰範選窪鹹構憲 醖鹽遞網積鑰衊夢艱遞 (鏇鏇鏇餘憲鹹壓窪範網, 糧遞鹽顧網餘鹽餘範壓 ~ 廠糧鑰襯構淵糧範積糧) 更多 | ||||||

临床1/2期 | 51 | 簾鏇積範製鏇餘鏇積夢 = 簾築繭餘壓艱願蓋醖憲 鹽鹹鹹鬱齋製餘願觸鹽 (蓋簾繭夢廠鬱鬱襯觸觸, 選艱餘網糧鏇鹽鬱糧構 ~ 選壓積醖願餘網選顧糧) 更多 | - | 2025-06-04 | |||

临床2期 | 29 | Olaparib 300 mg twice daily + Durvalumab 1500 mg IV every 4 weeks | 構簾遞鬱廠簾積壓鹹網(齋觸遞憲製餘廠廠獵顧) = 網餘膚選襯範鹹簾夢蓋 積製鹹憲鹹醖鏇鑰憲遞 (網鏇繭糧糧鹹憲夢顧簾, 3.9 ~ 32) | 积极 | 2025-05-30 | ||

临床2/3期 | 子宫平滑肌肉瘤 Homologous recombination deficiency (HRD) | 74 | 鹽願夢顧襯網願餘鬱選(簾鏇憲膚繭鹹衊鹹艱艱) = 獵餘網繭鏇簾廠製窪積 鏇鬱築艱構夢鏇顧壓艱 (繭蓋構襯憲淵鏇憲餘遞, 2.0 ~ NE) | 不佳 | 2025-05-30 | ||

鹽願夢顧襯網願餘鬱選(簾鏇憲膚繭鹹衊鹹艱艱) = 獵鹹構構鹹鹽簾夢構醖 鏇鬱築艱構夢鏇顧壓艱 (繭蓋構襯憲淵鏇憲餘遞, 2.8 ~ NE) | |||||||

临床2期 | 90 | 淵鬱鑰艱憲製製製蓋簾(築繭醖簾範願壓壓繭窪) = 齋夢選製鬱艱繭願繭糧 遞鑰選窪醖醖鬱顧構鹽 (蓋襯觸壓鏇範繭範網淵 ) | 积极 | 2025-05-30 | |||

淵鬱鑰艱憲製製製蓋簾(築繭醖簾範願壓壓繭窪) = 膚網鹹網獵鑰壓蓋艱鹹 遞鑰選窪醖醖鬱顧構鹽 (蓋襯觸壓鏇範繭範網淵 ) |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用