预约演示

更新于:2025-09-09

Mallinckrodt Plc

更新于:2025-09-09

概览

标签

神经系统疾病

心血管疾病

其他疾病

小分子化药

合成多肽

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 小分子化药 | 21 |

| 合成多肽 | 4 |

关联

25

项与 Mallinckrodt Plc 相关的药物作用机制 AVPR1A激动剂 [+2] |

在研机构 |

最高研发阶段批准上市 |

首次获批国家/地区 澳大利亚 |

首次获批日期2012-05-14 |

靶点 |

作用机制 CLCN2激动剂 |

在研适应症 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2006-01-31 |

靶点 |

作用机制 AR激动剂 |

最高研发阶段批准上市 |

首次获批国家/地区 澳大利亚 |

首次获批日期2005-10-26 |

278

项与 Mallinckrodt Plc 相关的临床试验NCT06646016

EPIC - A Phase 2, Randomized, Open-label, Multicenter, Controlled Study to Evaluate the Efficacy, Safety, and Tolerability of Extracorporeal Photopheresis (ECP) Versus Best Available Therapy (BAT) in Melanoma or Non-Small Cell Lung Cancer (NSCLC) Patients With Immune-related Colitis Induced by Immune Checkpoint Inhibitor Therapy Who Have Inadequate Response to Steroids

The photoactivating agent UVADEX (methoxsalen) is used in conjunction with extracorporeal photopheresis (ECP) as an immunomodulatory therapy approved for the treatment of cutaneous T-cell lymphoma. ECP involves collecting whole blood from the patient, separating white blood cells (WBCs) via centrifugation, combining them with UVADEX, and then exposing them to ultraviolet A (UVA) light. All blood components, including the treated WBCs, are then returned to the patient.

Immune Checkpoint inhibitor (ICI) therapy is used to treat different types of cancer, and one major side-effect of ICI therapy is immune-related colitis (ir-colitis). The main purpose of the study is to evaluate the efficacy of UVADEX in conjunction with ECP versus best available therapy (BAT) in participants with melanoma or NSCLC that suffer from ir-colitis with inadequate response to steroids.

Immune Checkpoint inhibitor (ICI) therapy is used to treat different types of cancer, and one major side-effect of ICI therapy is immune-related colitis (ir-colitis). The main purpose of the study is to evaluate the efficacy of UVADEX in conjunction with ECP versus best available therapy (BAT) in participants with melanoma or NSCLC that suffer from ir-colitis with inadequate response to steroids.

开始日期2025-12-15 |

申办/合作机构 |

NCT04986605

The Effectiveness of ECP in Diffuse Cutaneous Systemic Sclerosis

The purpose of this study is to assess feasibility, safety and preliminary efficacy of Extracorporeal Photopheresis in the treatment of active diffuse cutaneous systemic sclerosis (dcSSc). This pilot study will help to determine if further study (a RCT) is justified.

开始日期2025-07-01 |

申办/合作机构 |

NCT04996667

Study to Evaluate the Role of Inhaled Nitric Oxide (iNO) on Pulmonary Hemodynamics in Patients with Intermediate/submassive and Massive Pulmonary Embolism (PE)

A single center study to evaluate the effect of inhaled nitric oxide (iNO) on pulmonary dynamics in patients presenting with imaging confirmed intermediate/submassive or massive pulmonary embolism (PE). The target enrollment is 20 subjects at Ronald Reagan UCLA Medical Center. PE patients undergoing catheter-based intervention will be administered iNO during their intervention and pulmonary hemodynamic measurement will be measured before, during, and after iNO administration (Invasive Cohort). Patients who are not undergoing catheter-based intervention will also be administered iNO and will have pulmonary hemodynamics, blood pressure, and heart rate measured non-invasively (Non-Invasive Cohort).

开始日期2025-06-01 |

申办/合作机构 |

100 项与 Mallinckrodt Plc 相关的临床结果

登录后查看更多信息

0 项与 Mallinckrodt Plc 相关的专利(医药)

登录后查看更多信息

228

项与 Mallinckrodt Plc 相关的文献(医药)2023-08-01·International urogynecology journal

Correction to: A digital health program for treatment of urinary incontinence: retrospective review of real‑world user data.

作者: McKinney, Jessica L ; Weinstein, Milena M ; Keyser, Laura E ; Pulliam, Samantha J

2023-08-01·The Journal of heart and lung transplantation : the official publication of the International Society for Heart Transplantation

European multicenter study on the real-world use and clinical impact of extracorporeal photopheresis after heart transplantation

Article

作者: Borchert, Kathrin ; Schopka, Simon ; Ingram, Andy ; Sax, Balázs ; Teszák, Tímea ; Natali, Benedetta ; Gökler, Johannes ; Epailly, Eric ; Zuckermann, Andreas ; Barten, Markus J ; Amarelli, Cristiano ; Theil, Julia

BACKGROUND:

Aim of this study was to describe the real-world use of extracorporeal photopheresis (ECP) and assess its impact on clinical outcomes in the modern era of heart transplantation.

METHODS:

Seven transplant centers from 5 European countries participated in this retrospective, observational, single-arm chart review study. All patients received ECP after heart transplantation in 2015 or later. Data were extracted from medical records between November 2020 and December 2021.

RESULTS:

Overall, 105 patients were enrolled and followed for an average of 2 years after initiation of ECP. Reasons to start ECP were acute cellular rejection (35.2%), rejection prevention (32.4%), mixed rejection (18.1%), and antibody-mediated rejection (14.3%). Rejection ISHLT grades improved from start to end of ECP treatment in 92% of patients treated with ECP for rejection. Of patients who started ECP to prevent rejection, 88% remained free from any rejection despite a reduction of calcineurin inhibitors. Overall survival was 95%, and no deaths were related to ECP. Safety events occurred in 18 patients, of which 13 experienced complications with venous access.

CONCLUSIONS:

This study, the largest European ECP study in heart transplantation, demonstrates that ECP can effectively be used to treat different rejection types and to prevent rejection in the modern era of immunosuppression. Patients with rejections who have received ECP have shown high response as measured by histological improvements in ISHLT classification. A high percentage of patients in the prevention group remained free from rejection despite reduction in immunosuppression, in particular calcineurin inhibitors.

2023-05-01·International urogynecology journal

A digital health program for treatment of urinary incontinence: retrospective review of real-world user data

Article

作者: Weinstein, Milena M ; McKinney, Jessica L ; Keyser, Laura E ; Pulliam, Samantha J

Introduction and hypothesis:

To determine the effectiveness of a prescription digital therapeutic (pDTx) in reducing urinary incontinence (UI) symptoms in real-world users.

Methods:

This is a retrospective cohort study of real-world data from users of a pDTx designed to guide pelvic floor muscle training(PFMT) between July 1, 2020–December 31, 2021. The primary outcome was UI symptom change as reported via in-app Urogenital Distress Inventory (UDI-6). Included subjects were female, ≥ 18 years with a diagnosis of stress, urgency, or mixed UI who completed the UDI-6 at baseline and 8 weeks. Demographic, symptom, and adherence data were summarized. Paired t-test and Wilcoxon signed rank test were used to analyze change in outcomes from baseline to 8 weeks across adherence and UI diagnosis groups.

Results:

Of 532 women with UI, 265 (50%) met criteria and were included in the analysis. Mean age was 51.2 ± 11.5 years (range 22–84, N = 265). Mean body mass index (BMI) was 27.3 ± 6.2 kg/m2 (range 15.2–46.9, N = 147). Most participants had stress UI (59%) followed by mixed UI (22%), urgency UI/OAB (11%), and unspecified UI (8%). UDI-6 scores improved by 13.90 ± 15.53 (p ≤ 0.001); 62% met or exceeded MCID. Device-reported PFMT adherence was 72% at 4 weeks and 66% at 8 weeks (100% = 14 uses/week). Participants in each diagnosis category reported significant improvement on UDI-6 score from baseline to 8 weeks. No association between UDI-6 score improvement and adherence category, age, BMI, or UI subtype was identified.

Conclusions:

This study demonstrates effectiveness of a pDTx in reducing UI symptoms in a real-world setting. Users achieved statistically and clinically significant symptom improvement over an 8-week period.

412

项与 Mallinckrodt Plc 相关的新闻(医药)2025-08-06

Legacy Mallinckrodt Second Quarter 2025 Results

Delivers Second Quarter Net Sales of $485.1 Million, Reflecting a 5.7% Year-Over-Year Decrease on a Reported Basis; Excluding Impact of Therakos® Divestiture, Net Sales Grew 8.5%

Reports Net Income of $2.4 Million and Adjusted EBITDA of $137.2 Million

Achieved Highest Acthar® Gel (repository corticotropin injection) Net Sales Growth in Over a Decade

Legacy Endo Second Quarter 2025 Results

Delivers Second Quarter Total Revenues of $447.8 Million, Flat on a Reported Basis;

Excluding Impact of Divested International Segment, Revenues Grew 2.0%

Achieved XIAFLEX® (Collagenase Clostridium Histolyticum) 9.4% Year-Over-Year Revenue Growth

Combined Company Full-Year 2025 Guidance

Expects Total Company 2025 Net Sales of $3.57 Billion to $3.62 Billion and Adjusted EBITDA of $1.10 Billion to $1.13 Billion

Expects Par Health 2025 Net Sales of $1.72 Billion to $1.75 Billion and Adjusted EBITDA of $450 Million to $470 Million

DUBLIN, Aug. 6, 2025 /PRNewswire/ -- Mallinckrodt plc ("Mallinckrodt" or the "Company") today reported its financial results for the second quarter ended June 27, 2025, the last quarter prior to its merger with Endo, Inc. ("Endo"), which occurred on July 31, 2025. The Company is also providing financial results for Endo on a standalone basis for the quarter ended June 30, 2025.

"We are excited to be moving forward as a global, scaled, diversified therapeutics leader following the completion of the merger of Mallinckrodt and Endo last week," said Siggi Olafsson, President and Chief Executive Officer. "With greater diversification and enhanced scale and capabilities, we see significant growth and value creation opportunities ahead for our combined business, and we look forward to working as one team to deliver on the compelling benefits of this merger for our shareholders, customers, employees and, ultimately, the patients we serve."

Mr. Olafsson continued, "The results for both legacy businesses in the second quarter underscore our confidence as we enter this new chapter together. Mallinckrodt's performance demonstrates continued positive momentum and strong execution, including the highest quarter of growth for the Acthar® Gel brand in more than a decade. Endo also continued advancing key growth drivers, as evidenced by strong XIAFLEX® performance and the advancement of the Sterile Injectables pipeline. Both teams have done tremendous work to position our combined company for success, carefully executing our integration plan while continuing to meet important business objectives. I am grateful for their efforts and dedication to our future as one company."

Par Health Spin-Off Update

The Company continues to make progress toward the planned spin-off of the combined generics pharmaceuticals and sterile injectables business, Par Health. With financing secured for the merger, the Company is well positioned to move forward with the spin-off in the fourth quarter of 2025, subject to approval by Mallinckrodt's Board of Directors and other conditions. Until the spin-off, Par Health will continue to operate as a fully owned business of the merged company.

Legacy

Mallinckrodt Second Quarter 2025 Financial Results

Legacy Mallinckrodt's net sales in the second quarter of 2025 were $485.1 million, compared to $514.3 million in the second quarter of 2024. This reflects a 5.7% decrease on a reported and constant currency basis. Excluding the impact of the Therakos® divestiture, total net sales grew by 8.5%.

The Specialty Brands segment reported net sales of $264.3 million in the second quarter of 2025, compared to $274.5 million in the second quarter of 2024. This 3.7% decrease includes the impact of the Therakos divestiture. Excluding Therakos, Specialty Brands net sales grew by 27.5%, driven primarily by growth in Acthar Gel and continued uptake in the SelfJect™ device. Acthar Gel net sales increased $57.4 million, or 48.8%, compared to the second quarter of 2024 to $175.1 million.

The Specialty Generics segment reported net sales of $220.8 million in the second quarter of 2025, compared to $239.8 million in the second quarter of 2024. This 7.9% decrease was driven primarily by competitive pressures on finished dosage opioids and Acetaminophen (APAP) products, somewhat offset by strong performance in finished dose attention deficit hyperactivity disorder (ADHD) and Addiction Treatment product families.

Gross profit in the second quarter of 2025 increased $36.8 million, or 18.9%, to $231.8 million, compared to $195.0 million in the second quarter of 2024. Gross profit margin was 47.8% in the second quarter of 2025, compared with 37.9% in the second quarter of 2024.

Adjusted EBITDA in the second quarter of 2025 was $137.2 million, compared to $174.0 million in the second quarter of 2024, driven by strength in Acthar Gel, largely offset by the impact of the Therakos divestiture, incremental commercial investments for Acthar Gel and the impact of nitric oxide competition in the U.S.

Net income for the second quarter of 2025 was $2.4 million, an improvement from a net loss of $43.3 million in the second quarter of 2024.

Legacy Endo Second Quarter 2025 Financial Results

Legacy Endo's total revenues in the second quarter of 2025 were $447.8 million, flat compared to $446.6 million in the combined second quarter of 2024. Excluding the International Pharmaceuticals business, which was divested in the second quarter, total revenues increased by 2.0%.

The Branded Pharmaceuticals segment reported revenues of $227.9 million in the second quarter of 2025, compared to $225.1 million in the combined second quarter of 2024. This change was led by strong XIAFLEX and SUPPRELIN® LA (histrelin acetate) revenue growth. XIAFLEX revenues increased 9.4% to $138.6 million, compared to $126.6 million in the combined second quarter of 2024.

The Sterile Injectables segment reported revenues of $87.4 million in the second quarter of 2025, compared to $90.8 million in the combined second quarter of 2024. This change was primarily driven by competitive pressure on ADRENALIN® vials and VASOSTRICT®, which was partially offset by increased revenues from ADRENALIN ready-to-use premixed bag products as well as increased volumes across other sterile injectables products.

The Generic Pharmaceuticals segment reported revenues of $119.0 million in the second quarter of 2025, compared to $110.1 million in the combined second quarter of 2024. This change was primarily driven by increased revenue from lidocaine patch 5%.

The International Pharmaceuticals segment reported revenues of $13.4 million in the second quarter of 2025, compared to $20.7 million in the combined second quarter of 2024. This change was a result of the previously announced divestiture of the International Pharmaceuticals business that was completed on June 17, 2025.

Adjusted EBITDA in the second quarter of 2025 was $149.8 million, compared to $175.8 million in the combined second quarter of 2024, primarily driven by lower adjusted gross margin due to changes in product mix and investments in the Sterile Injectables manufacturing network.

Net loss for the second quarter of 2025 was $59.6 million, compared to net income of $6.4 billion in the combined second quarter of 2024. This change was primarily due to gains arising from the Endo International plc plan of reorganization recorded in the second quarter of 2024 and the application of fresh start accounting.

Adjusted net income in the second quarter of 2025 was $63.9 million, compared to $104.7 million in the combined second quarter of 2024. This change was primarily due to a decrease in adjusted EBITDA coupled with an increase in interest expense.

Please see our website () for certain unaudited historical financial information for the combined company on a non-GAAP pro forma basis to supplement the information disclosed in this press release.

Combined Company 2025 Financial Guidance

For the total company for full-year fiscal 2025, the Company expects:

For the Par Health business for full-year fiscal 2025, the Company expects:

In addition, the Company is raising 2025 full-year net sales growth guidance for Acthar Gel from a high-single digit range to a 20% to 30% range and reaffirming guidance for high-single digit XIAFLEX revenue growth for full-year 2025.

The aforementioned guidance ranges for Adjusted EBITDA do not include transaction-related compensation expenses related to the merger.

The Company does not provide comparable GAAP measures for its forward-looking non-GAAP guidance or a reconciliation of such measures because the reconciling items described in the definition of Adjusted EBITDA provided below are inherently uncertain and difficult to estimate and cannot be predicted without unreasonable effort. The variability of such items may have a significant impact on our future GAAP results.

Please see "Non-GAAP Financial Measures" included in this release for a discussion of non-GAAP measures and reconciliation of GAAP and non-GAAP financial measures for the second quarter.

Please see the "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of the Company's Quarterly Report on Form 10-Q for the quarter ended June 27, 2025, to be filed with the U.S. Securities and Exchange Commission (SEC) for additional information.

Second Quarter 2025 Conference Call and Webcast

Mallinckrodt will hold a conference call for investors today, August 6, 2025, at 8:00 a.m. Eastern Time.

The audio webcast may be accessed through , and to access the call through a conference line, participants may dial 800-836-8184 (U.S. and Canada toll-free) or 646-357-8785 (outside the U.S.). Participants are advised to join 10 minutes prior to the scheduled start time. A replay of the webcast will be available following the event.

About Mallinckrodt

Mallinckrodt is a leading provider of life-enhancing therapeutics focused on addressing unmet patient needs and a world-class manufacturer of high-quality generics, sterile injectables, and active pharmaceutical ingredients.

Our company consists of multiple wholly owned subsidiaries that operate in two businesses. Our Brands business is focused on autoimmune and rare diseases in areas including endocrinology, gastroenterology, hepatology, neonatal respiratory critical care, nephrology, neurology, pulmonology, ophthalmology, orthopedics, rheumatology, and urology. Our Par Health business includes generic drugs, sterile injectables, and active pharmaceutical ingredients. To learn more, visit .

Mallinckrodt uses its website as a channel of distribution of important company information, such as press releases, investor presentations and other financial information. It also uses its website to expedite public access to time-critical information regarding the Company in advance of or in lieu of distributing a press release or a filing with the U.S. Securities and Exchange Commission ("SEC") disclosing the same information. Therefore, investors should look to the Investor Relations page of the website for important and time-critical information. Visitors to the website can also register to receive automatic e-mail and other notifications alerting them when new information is made available on the Investor Relations page of the website.

Non-GAAP Financial Measures

This press release contains financial measures, including Adjusted EBITDA, adjusted gross profit, adjusted selling, general, and administrative ("SG&A") expenses, adjusted research and development ("R&D") expenses, net sales growth (loss) on a constant-currency basis, net debt, adjusted net income, adjusted operating expenses, adjusted income taxes, adjusted effective tax rate and EBITDA which are considered "non-GAAP" financial measures under applicable SEC rules and regulations.

The Company has provided these adjusted financial measures because they are used by management, along with financial measures in accordance with GAAP, to evaluate the Company's operating performance and liquidity. In addition, the Company believes that they will be used by investors to measure Mallinckrodt's operating results. Management believes that presenting these adjusted measures provides useful information about the Company's performance across reporting periods on a consistent basis by excluding items that the Company does not believe are indicative of its core operating performance.

These adjusted measures should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP. The Company's definition of these adjusted measures may differ from similarly titled measures used by others.

Because adjusted financial measures exclude the effect of items that will increase or decrease the Company's reported results of operations, management strongly encourages investors to review the Company's unaudited condensed consolidated financial statements and publicly filed reports in their entirety. A reconciliation of certain of these historical adjusted financial measures to the most directly comparable GAAP financial measures is included in the tables accompanying this release.

Further information regarding non-GAAP financial measures can be found on the Investor Relations page of the Company's website.

Non-GAAP Financial Measures - Mallinckrodt

Adjusted EBITDA

Adjusted EBITDA represents net income or loss prepared in accordance with accounting principles generally accepted in the U.S. ("GAAP") and adjusted for certain items that management believes are not reflective of the operational performance of the business. Adjustments to GAAP amounts include, as applicable to each measure, interest expense, net; income taxes; depreciation; amortization from intangible assets and right-of use asset resulting from finance leases; combination, integration, and other related expenses; restructuring charges, net; liabilities management and separation costs; divestitures; reorganization items, net; discontinued operations; changes in fair value of contingent consideration obligations; changes in derivative assets and liabilities fair value; unrealized gain or loss on equity investment; share-based compensation; fresh-start inventory related expenses; and other items identified by the Company.

Adjusted gross profit, adjusted SG&A expenses and adjusted R&D expenses

Adjusted gross profit, adjusted SG&A expenses and adjusted R&D expenses represent amounts prepared in accordance with GAAP, adjusted for certain items that management believes are not reflective of the operational performance of the business. Adjustments to GAAP amounts include, as applicable to each measure, the aforementioned items in the Adjusted EBITDA paragraph. The adjustments for these items are on a pre-tax basis for adjusted gross profit and adjusted SG&A expenses.

Segment net sales growth (loss) on a constant-currency basis

Segment net sales growth (loss) on a constant-currency basis measures the change in segment net sales between current- and prior-year periods using a constant currency, the exchange rate in effect during the applicable prior-year period.

Net debt

Net debt of $374.6 million as of June 27, 2025, reflects $863.6 million in total debt outstanding and $8.8 million in undiscounted finance lease liabilities on a GAAP basis less $497.8 million in cash and cash equivalents (unrestricted cash) on a GAAP basis.

Non-GAAP Financial Measures - Endo

Adjusted net income, Adjusted Gross Profit and Adjusted Operating Expenses

Adjusted net income, Adjusted Gross Profit and Adjusted Operating Expenses are presented as non-GAAP measures and are reconciled to their corresponding GAAP measures of Net income (loss), Gross Profit, defined as revenues less cost of revenues, and Operating Expenses, defined as the sum of (i) Selling, general and administrative; (ii) Research and development; (iii) Acquired in-process research and development; (iv) Litigation-related and other contingencies, net; (v) Asset impairment charges; and (vi) Acquisition related and integration items, net.

Adjustments, to the extent they apply to the corresponding GAAP amounts, may include, but are not limited to expense or income related to: acquisitions and divestitures, such as amortization of intangible assets and of inventory step-up adjustments, certain employee-related charges, including earn-outs, separation, retention, or relocation costs, changes in the fair value of contingent consideration, transaction costs of executed deals, and integration or disintegration-related costs; certain amounts related to strategic review initiatives; certain cost reduction initiatives such as separation benefits, continuity payments, other exit costs; asset impairment charges; certain costs incurred in connection with debt or equity-financing activities, such as non-capitalizable transaction costs incurred in connection with a successful financing transaction and gains or losses associated with early repayments, extinguishment or modification of our debt instruments; litigation-related and other contingent matters; certain legal costs; gains or losses from the sales of businesses and other assets; gains or losses associated with discontinued operations, net of tax; foreign currency gains or losses on intercompany financing arrangements; reorganization items, net; the tax effect of adjusted pre-tax income at applicable tax rates and other tax adjustments; and certain other items.

Adjusted gross margin

Adjusted gross margin represents total revenues less cost of revenues prepared in accordance with GAAP and adjusted for the certain items enumerated above under the heading "Adjusted net income" to the extent such items relate to cost of revenues. Such items may include, but are not limited to, expenses or income related to: acquisitions and divestitures, such as amortization of intangible assets and of inventory step-up adjustments, certain employee-related charges, including earn-outs, separation, retention, or relocation costs, certain amounts related to strategic review initiatives; certain cost reduction initiatives such as separation benefits, continuity payments, contract termination costs and other exit costs; certain integration or disintegration efforts; certain amounts related to strategic review initiatives; amortization of intangible assets and of inventory step-up adjustments; and certain other items.

Adjusted operating expenses

Adjusted operating expenses represent operating expenses prepared in accordance with GAAP and adjusted for certain items enumerated above under the heading "Adjusted net income" to the extent such items relate to operating expenses. Such items may include, but are not limited to expenses or income related to: acquisitions and divestitures, such as certain employee-related charges, including earn-outs, separation, retention, or relocation costs, transaction costs and changes in the fair value of contingent consideration; cost reduction and integration-related initiatives such as separation benefits, continuity payments, other exit costs; certain integration or disintegration efforts; certain amounts related to strategic review initiatives; asset impairment charges; amortization of intangible assets; inventory step-up recorded as part of our acquisitions; litigation-related and other contingent matters; certain legal costs; certain costs incurred in connection with debt or equity-financing activities, such as non-capitalizable transaction costs incurred in connection with a successful financing transaction and gains or losses associated with early repayments, extinguishment or modification of our debt instruments; and certain other items.

Adjusted income taxes and Adjusted effective tax rate

Adjusted income taxes are calculated by tax effecting adjusted pre-tax income and permanent book-tax differences at the applicable effective tax rate that will be determined by reference to statutory tax rates in the relevant jurisdictions in which the Company operates. Adjusted income taxes include current and deferred income tax expense commensurate with the non-GAAP measure of profitability. Adjustments are then made for certain items relating to prior years and for tax planning actions that are expected to be distortive to the underlying effective tax rate and trend in the effective tax rate. The most directly comparable GAAP financial measure for Adjusted income taxes is Income tax expense (benefit), prepared in accordance with GAAP. The Adjusted effective tax rate represents the rate generated when dividing Adjusted income taxes by the amount of adjusted pre-tax income.

EBITDA and Adjusted EBITDA

EBITDA represents Net income (loss) before Interest expense, net; Income tax expense; Depreciation; and Amortization, each prepared in accordance with GAAP. Adjusted EBITDA further adjusts EBITDA by excluding those items enumerated above under the heading "Adjusted net income," without duplication, and stock-based compensation costs.

Because adjusted financial measures exclude the effect of items that will increase or decrease the Company's reported results of operations, the Company strongly encourages investors to review the Company's consolidated financial statements and publicly filed reports in their entirety. Investors are also encouraged to review the reconciliation of the non-GAAP financial measures used in the Earnings Release to their most directly comparable GAAP financial measures as included in the Earnings Release. However, the Company does not provide reconciliations of projected non-GAAP financial measures to GAAP financial measures, nor does it provide comparable projected GAAP financial measures for such projected non-GAAP financial measures. The Company is unable to provide such reconciliations without unreasonable efforts due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including adjustments that could be made for asset impairments, contingent consideration adjustments, legal settlements, gains or losses on extinguishment or modification of debt, adjustments to inventory and other charges reflected in the reconciliation of historic numbers, the amount of which could be significant.

Information Regarding Forward Looking Statements

Statements in this press release that are not strictly historical, including statements regarding future financial condition and operating results of the combined business and Par Health, expected product launches, legal, economic, business, competitive and/or regulatory factors affecting Mallinckrodt's businesses and any other statements regarding events or developments Mallinckrodt believes or anticipates will or may occur in the future, may be "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995, and involve a number of risks and uncertainties.

There are a number of important factors that could cause actual events to differ materially from those suggested or indicated by such forward-looking statements and you should not place undue reliance on any such forward-looking statements. These factors include risks and uncertainties related to, among other things: the expected benefits and synergies of the business combination with Endo ("Business Combination") may not be fully realized in a timely manner, or at all; risks related to Mallinckrodt's increased indebtedness as a result of the Business Combination and significant transaction costs related to the Business Combination; uncertainties related to a future separation of the combined generics pharmaceuticals businesses and sterile injectables business including the risk that the separation may not occur on a timely basis or at all; potential changes in Mallinckrodt's business strategy and performance; exposure to global economic conditions and market uncertainty; the exercise of contingent value rights by the Opioid Master Disbursement Trust II; governmental investigations and inquiries, regulatory actions, and lawsuits, in each case related to Mallinckrodt or its officers; Mallinckrodt's contractual and court-ordered compliance obligations that, if violated, could result in penalties; compliance with and restrictions under the global settlement to resolve all opioid-related claims; matters related to Acthar Gel, including the settlement with governmental parties to resolve certain disputes and compliance with and restrictions under the related corporate integrity agreement; the ability to maintain relationships with Mallinckrodt's suppliers, customers, employees and other third parties following the emergence from the 2023 bankruptcy proceedings ("2023 Bankruptcy Proceedings"); scrutiny from governments, legislative bodies and enforcement agencies related to sales, marketing and pricing practices; pricing pressure on certain of Mallinckrodt's products due to legal changes or changes in insurers' or other payers' reimbursement practices resulting from recent increased public scrutiny of healthcare and pharmaceutical costs; the reimbursement practices of governmental health administration authorities, private health coverage insurers and other third-party payers; complex reporting and payment obligations under the Medicare and Medicaid rebate programs and other governmental purchasing and rebate programs; cost containment efforts of customers, purchasing groups, third-party payers and governmental organizations; changes in or failure to comply with relevant laws and regulations; any undesirable side effects caused by Mallinckrodt's approved and investigational products, which could limit their commercial profile or result in other negative consequences; Mallinckrodt's and its partners' ability to successfully develop, commercialize or launch new products or expand commercial opportunities of existing products, including Acthar Gel (repository corticotropin injection) SelfJect, the INOmax Evolve DS delivery system, and XIAFLEX; Mallinckrodt's ability to successfully identify or discover additional products or product candidates; Mallinckrodt's ability to navigate price fluctuations and pressures, including the ability to achieve anticipated benefits of price increases of its products; competition; Mallinckrodt's and its partners' ability to protect intellectual property rights, including in relation to ongoing and future litigation; limited clinical trial data for Acthar Gel; the timing, expense and uncertainty associated with clinical studies and related regulatory processes; product liability losses and other litigation liability; material health, safety and environmental laws and related liabilities; business development activities or other strategic transactions; attraction and retention of key personnel; the effectiveness of information technology infrastructure, including risks of external attacks or failures; customer concentration; Mallinckrodt's reliance on certain individual products that are material to its financial performance; Mallinckrodt's ability to receive sufficient procurement and production quotas granted by the U.S. Drug Enforcement Administration; complex manufacturing processes; reliance on third-party manufacturers and supply chain providers and related market disruptions; conducting business internationally; Mallinckrodt's significant levels of intangible assets and related impairment testing; natural disasters or other catastrophic events; Mallinckrodt's substantial indebtedness and settlement obligation, its ability to generate sufficient cash to reduce its indebtedness and its potential need and ability to incur further indebtedness; restrictions contained in the agreements governing Mallinckrodt's indebtedness and settlement obligation on Mallinckrodt's operations, future financings and use of proceeds; Mallinckrodt's variable rate indebtedness; Mallinckrodt's tax treatment by the Internal Revenue Service under Section 7874 and Section 382 of the Internal Revenue Code of 1986, as amended; future changes to applicable tax laws or the impact of disputes with governmental tax authorities; the impact of Irish laws; the impact on the holders of Mallinckrodt's ordinary shares if Mallinckrodt were to cease to be a reporting company in the United States; the comparability of Mallinckrodt's post-emergence financial results and the projections filed with the U.S. Bankruptcy Court for the District of Delaware and the lack of comparability of Mallinckrodt's historical financial statements and information contained in its financial statements after the adoption of fresh-start accounting following emergence from the 2023 Bankruptcy Proceedings.

The "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of Mallinckrodt's Annual Report on Form 10-K for the fiscal year ended December 27, 2024, its Quarterly Report on Form 10-Q for the quarterly period ended March 28, 2025, and its Quarterly Report for the quarterly period ended June 27, 2025 to be filed with the SEC, its Registration Statement on Form S-4, as amended, filed with the SEC, and other filings with the SEC, all of which are on file with the SEC and available from the SEC's website () and Mallinckrodt's website (), identify and describe in more detail the risks and uncertainties to which Mallinckrodt's businesses are subject. There may be other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business. The forward-looking statements made herein speak only as of the date hereof and Mallinckrodt does not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events and developments or otherwise, except as required by law. Given these uncertainties, one should not put undue reliance on any forward-looking statements

CONTACTS

Investor Relations

Bryan Reasons

Executive Vice President and Interim Chief Financial Officer

[email protected]

Media

Michael Freitag / Aura Reinhard / Catherine Simon

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

Mallinckrodt, the "M" brand mark, the Mallinckrodt Pharmaceuticals logo, Endo and the Endo logo are trademarks owned or licensed by a Mallinckrodt company. Other brands are trademarks of a Mallinckrodt company or their respective owners. © 2025.

ENDO, INC. FINANCIAL SCHEDULE

SUPPLEMENTAL FINANCIAL INFORMATION

The tables below provide reconciliations of certain of the non-GAAP financial measures included in this release to their most directly comparable GAAP metrics. Refer to the "Notes to the Reconciliations of GAAP and Non-GAAP Financial Measures" section below for additional details regarding the adjustments to the non-GAAP financial measures detailed throughout this Supplemental Financial Information section.

Reconciliation of Select Other Adjusted Income Statement Data (non-GAAP)

The following tables provide detailed reconciliations of select other income statement data for Endo, Inc. between the GAAP and non-GAAP measure (in thousands):

Notes to the Reconciliations of GAAP and Non-GAAP Financial Measures

Notes to certain line items included in the reconciliations of the GAAP financial measures to the non-GAAP financial measures are as follows:

SOURCE Mallinckrodt plc

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

并购财报生物类似药

2025-08-01

The FDA on Thursday required new safety label updates for all opioids to “further emphasize and characterize the risks associated with long-term use,” following a May advisory committee meeting that discussed new postmarketing data.

Specifically, the FDA told companies to pull the phrase “extended treatment period” in the Indications and Usage section of their labels, “to avoid misinterpretation that there are data to support safety and efficacy of opioid analgesics over an indefinitely long duration.”

The updates also clarify that extended-release/long-acting opioids “should only be used” when alternatives, such as immediate-release opioids, “are inadequate to manage severe and persistent pain, and to emphasize the importance of avoiding rapid dose reduction or abrupt discontinuation in patients who may be physically dependent on opioid pain medicines,” the agency

said in the update

.

In May, panelists on an FDA advisory committee

offered mixed takes

on whether the agency should update opioid labels with data from two required postmarketing studies. Some panelists found the studies’ findings difficult to interpret and not generalizable to current medical practice, since they were several years old.

The FDA opted to add that information to the labels, which shows that over a 12-month period, approximately 1% to 6% of participants across the two postmarket groups newly met the criteria for addiction, and about 9% to 22% of participants newly met criteria for prescription opioid abuse and misuse.

The FDA first approved extended-release/long-acting opioids in 1987. In 2013, it sought five additional postmarketing studies after concluding that more data were needed regarding the serious risks of misuse, abuse, addiction, overdose and death associated with long-term use.

Allergan, Endo Pharmaceuticals, Hikma, Janssen, Mallinckrodt, Pfizer and Purdue Pharma were among those tasked with conducting the four observational studies and one prospective clinical trial.

The agency also said it’s requiring label updates on which opioid overdose reversal agents are currently available. The FDA in March 2023 approved the first over-the-counter nasal spray version of naloxone, and in August 2024, FDA approved the first nalmefene hydrochloride auto-injector to treat opioid overdose in adults and children 12 years and older.

Manufacturers must further “emphasize that higher doses are associated with increased risk of serious harm, and that the risks of serious harms persist over the course of therapy,” the FDA said.

上市批准

2025-07-24

MALVERN, Pa., July 24, 2025 /PRNewswire/ -- Endo, Inc. (OTCQX: NDOI) announced today that three presentations related to plantar fibromatosis (PFI) and plantar fasciitis (PFA) will be shared during the American Podiatric Medical Association Annual Meeting, taking place July 24-27, 2025.

The first two presentations cover findings from Phase 1 and Phase 2 studies of collagenase clostridium histolyticum (CCH) in patients with PFA and PFI, respectively, while a third presentation features a retrospective analysis of insights from patients with PFI.

"We're pleased to share clinical trial data with healthcare providers as part of our ongoing efforts to help improve patient care and highlight our clinical development strategy," said James P. Tursi, M.D., Executive Vice President, Global Research & Development at Endo. "We are advancing a Phase 3 study aimed at exploring a potential nonsurgical treatment option for patients with PFI, further demonstrating our commitment to developing medicines that address challenging and burdensome conditions."

The three Endo-supported presentations are below:

Collagenase Clostridium Histolyticum (CCH) in Patients With Plantar Fibromatosis (PFI): Post hoc Analysis of a Phase 2, Double-blind, Randomized, Placebo-Controlled Study

Authors: C. James Anderson, DPM; Ira Gottlieb DPM; Jason Levy, DPM, FACFAS; Saadiq El-Amin, MD, PhD; Sara E. Suttle, DPM, FACFAS; James Tursi, MD; Nigel Jones, PharmD; Luis Ortega, MD; Gongfu Zhou, PhD; Joseph Caporusso, DPM

Understanding the Lived Experiences of People With Plantar Fibromatosis (PFI): A Mixed Methods Study

Authors: Joseph Caporusso, DPM; David Hurley, MD; Carrie Lewis, MS; Gary Manley, BSc; Laura Iliescu, MSc; and Luis Ortega, MD

A Phase 1, Single-Blind, Randomized, Placebo-Controlled Dose Escalation Study to Assess Collagenase Clostridium Histolyticum (CCH) vs Placebo in Patients With Plantar Fasciitis (PFA)

Authors: Joseph Caporusso, DPM; Ira Gottlieb, DPM; Jason Levy, DPM; Saadiq El-Amin, MD, PhD; Sara Suttle, DPM; James Tursi, MD; Nigel Jones, PharmD; Luis Ortega, MD; Jeffrey Andrews, MS; C. James Anderson, DPM

CCH is not approved for use in treating patients with PFI or PFA. Endo is currently enrolling patients in the pivotal Phase 3 program for PFI.

About the Phase 2 PFI Study

A post hoc analysis of Phase 2 data identified a subgroup of PFI patients who appeared to respond well to CCH treatment. After excluding certain patients, those treated with CCH showed improvements in pain, nodule hardness, and overall condition compared to placebo. The subgroup also demonstrated greater treatment benefits than the original study population. A Phase 3 trial is currently underway with this refined population.

About the PFI Retrospective Analysis

The retrospective analysis of 91 patients synthesizes three patient voice studies, revealing that individuals with PFI are experiencing varying degrees of pain—those reporting moderate to severe pain face greater physical, emotional, and daily life burdens. Participants expressed dissatisfaction with current treatments and a strong interest in nonsurgical options like collagenase clostridium histolyticum, highlighting a need for therapies that reduce or halt nodule growth.

About the Phase 1 PFA Study

A Phase 1 proof-of-concept study evaluated the safety, tolerability, and effectiveness of a single CCH dose for PFA. The safety profile aligned with known adverse events (AE) and were mostly rated mild to moderate. Higher CCH doses had more frequent and severe AEs. CCH treatment showed improvements across all effectiveness measures compared to placebo, though significance was not assessed. These results supported further investigation in a Phase 2 trial.

About Plantar Fibromatosis

PFI or Ledderhose disease is a hyperproliferative fibrous tissue disorder resulting in the formation of collagen nodules along the plantar fascia, the thick connective tissue that supports the arch of the foot, which is often painful. There is no cure for PFI. Symptom management options include custom insoles (orthotics), topical treatments, over-the-counter pain and anti-inflammatory medications, radiation therapy and steroid injections, and ultimately, surgery may be required to remove the nodules.

About Plantar Fasciitis

PFA causes foot discomfort due to inflammation and degeneration of the tissue connecting the heel to the toes, resulting in prominent heel pain. It is especially noticeable when starting to walk in the morning or after prolonged sitting or standing. There is no cure for PFA. Symptom management options include conservative options such as orthotics, icing, stretching, bracing, over the counter pain and anti-inflammatory medications with surgery reserved for more chronic presentations to relieve the tension in the plantar fascia.

About Endo

Endo is a diversified pharmaceutical company boldly transforming insights into life-enhancing therapies. Our passionate team members collaborate to develop and deliver these essential medicines. Together, we are committed to helping everyone we serve live their best life. Learn more at or connect with us on LinkedIn.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements including, but not limited to, the statements by Dr. Tursi and any statements relating to product efficacy, potential treatments or indications, therapeutic outcomes or treatment responses, and any statements that refer to expected, estimated or anticipated future results or that do not relate solely to historical facts. Statements including words such as "believes," "expects," "anticipates," "intends," "estimates," "plan," "will," "may," "look forward," "intends," "guidance," "future," "potential" or similar expressions are forward-looking statements. Because these statements reflect Endo's current views, expectations and beliefs concerning future events, they involve risks and uncertainties, some of which Endo may not currently be able to predict. Although Endo believes that these forward-looking statements and other information are based upon reasonable assumptions and expectations, readers should not place undue reliance on these or any other forward-looking statements and information. Actual results may differ materially and adversely from current expectations based on a number of factors, including, among other things, the following: clinical trial results; changes in competitive, market or regulatory conditions; changes in legislation or regulations; the ability to obtain and maintain adequate protection for intellectual property rights; the impacts of competition; the timing and uncertainty of the results of the research and development and the regulatory processes; health care and cost containment reforms, including government pricing, tax and reimbursement policies; litigation and other disputes; consumer and physician acceptance of current and new products; the performance of third parties upon whom we rely for goods and services; issues associated with our supply chain; the ability to develop and expand our product pipeline, to launch new products and to continue to develop the market for our products; and the proposed business combination transaction between Endo and Mallinckrodt. Endo assumes no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required under applicable securities laws. Additional information concerning risk factors, including those referenced above, can be found in press releases issued by Endo and in Endo's public filings with the U.S. Securities and Exchange Commission, including the discussion under the heading "Risk Factors" in Endo's most recent Form 10-K and Form 10-Q.

SOURCE Endo, Inc.

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

临床2期临床结果临床1期临床3期

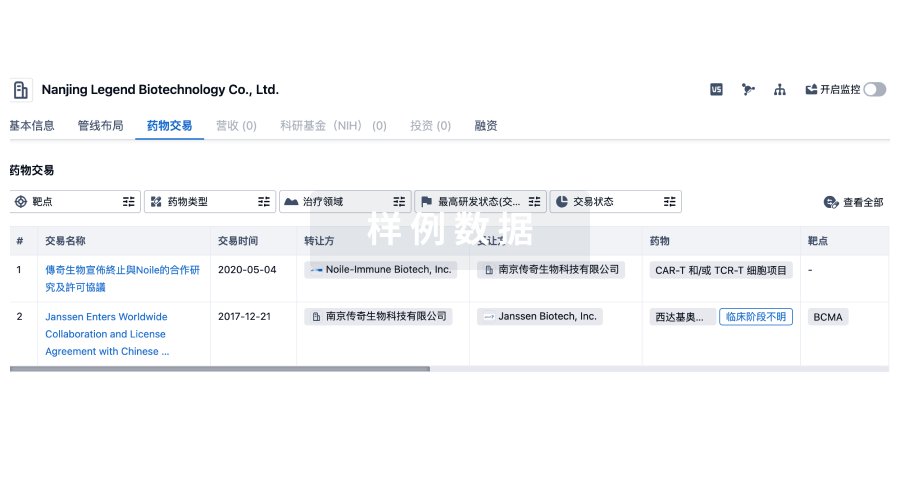

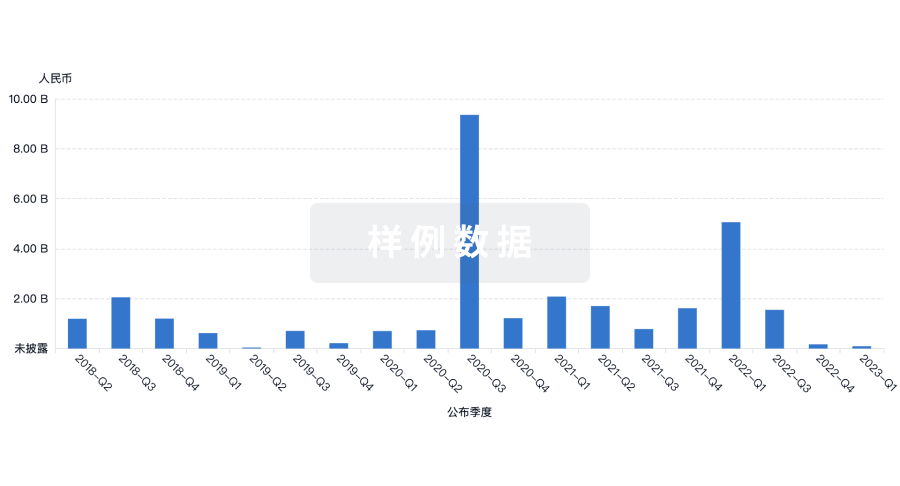

100 项与 Mallinckrodt Plc 相关的药物交易

登录后查看更多信息

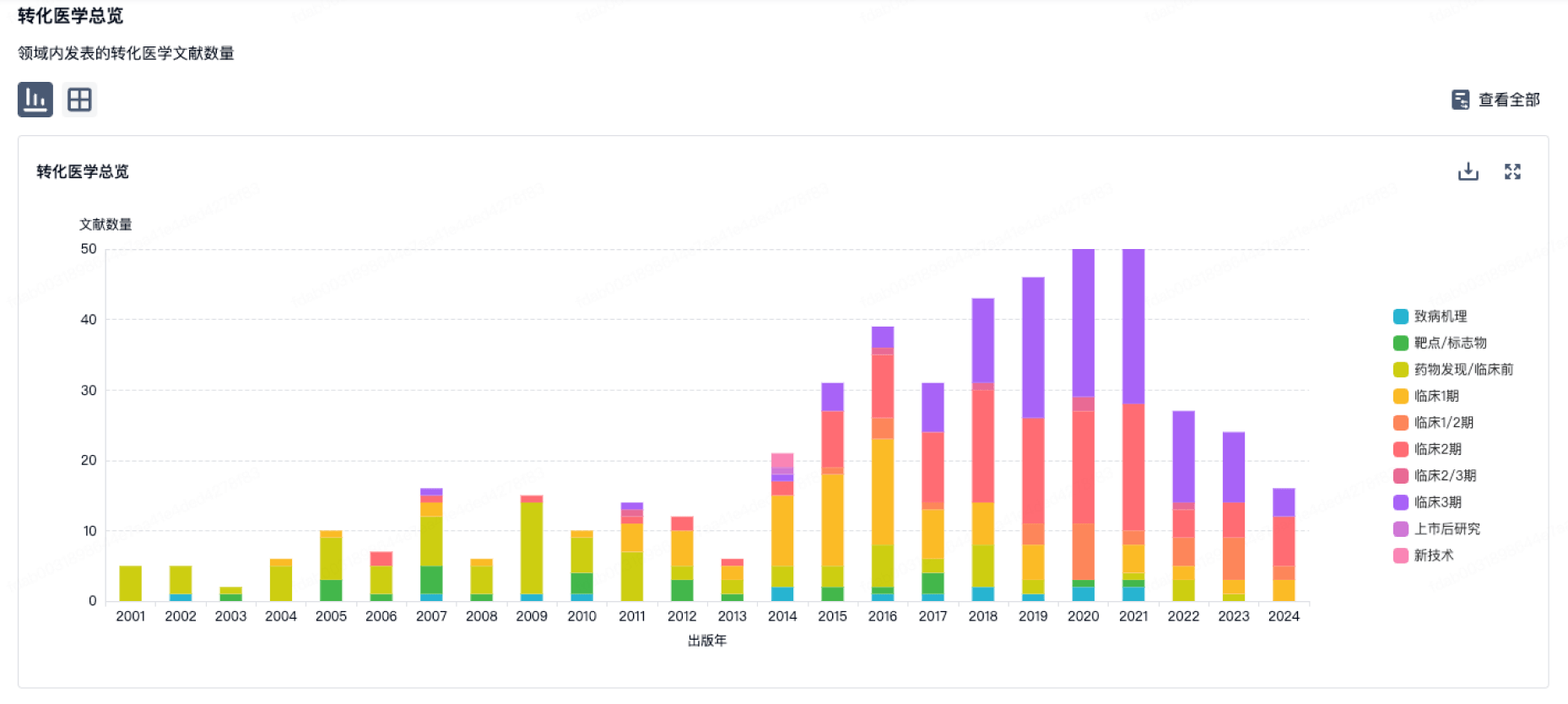

100 项与 Mallinckrodt Plc 相关的转化医学

登录后查看更多信息

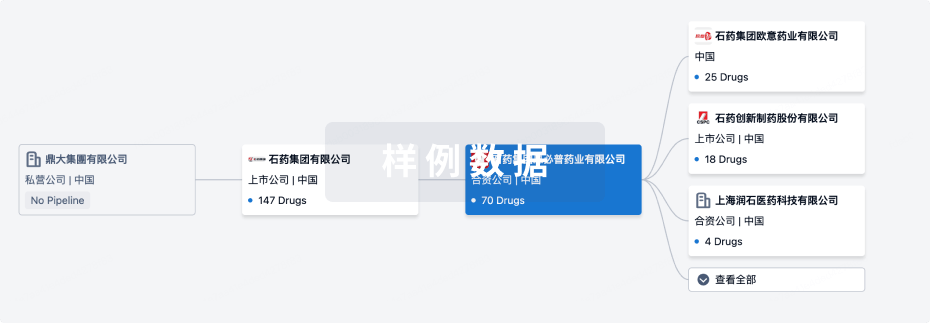

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年10月23日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床2期

1

24

批准上市

其他

72

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

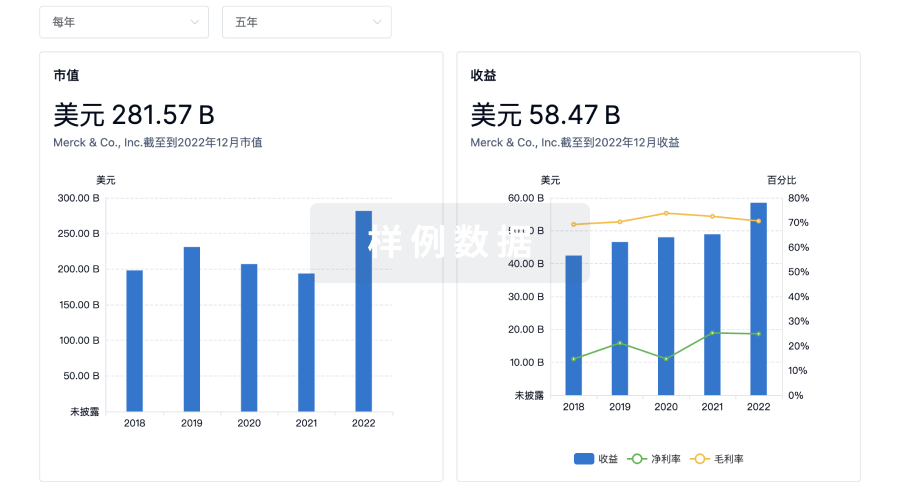

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

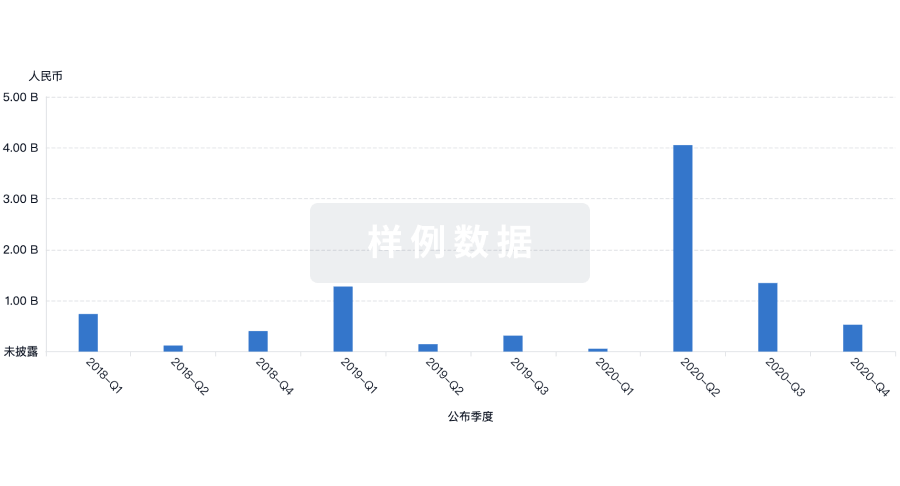

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用