预约演示

更新于:2025-07-19

Mometasone Furoate

糠酸莫米松

更新于:2025-07-19

概要

基本信息

非在研机构 |

权益机构 |

最高研发阶段批准上市 |

最高研发阶段(中国)批准上市 |

特殊审评孤儿药 (美国) |

登录后查看时间轴

结构/序列

分子式C27H30Cl2O6 |

InChIKeyWOFMFGQZHJDGCX-ZULDAHANSA-N |

CAS号83919-23-7 |

研发状态

批准上市

10 条最早获批的记录, 后查看更多信息

登录

| 适应症 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|

| 慢性鼻窦炎伴鼻息肉 | 美国 | 2017-12-08 | |

| 哮喘 | 美国 | 2005-03-30 | |

| 鼻息肉 | 美国 | 2004-12-15 | |

| 过敏性鼻炎 | 中国 | 2000-07-14 | |

| 皮炎 | 中国 | 1999-01-01 | |

| 常年性变应性鼻炎 | 美国 | 1997-10-01 | |

| 季节性过敏性鼻炎 | 美国 | 1997-10-01 | |

| 斑秃 | 日本 | 1993-10-01 | |

| 药物性皮炎 | 日本 | 1993-10-01 | |

| 湿疹 | 日本 | 1993-10-01 | |

| 渗出性红斑 | 日本 | 1993-10-01 | |

| 红皮病性银屑病 | 日本 | 1993-10-01 | |

| 脓疱疮 | 日本 | 1993-10-01 | |

| 瘢痕疙瘩 | 日本 | 1993-10-01 | |

| 盘状红斑狼疮 | 日本 | 1993-10-01 | |

| 大疱性类天疱疮 | 日本 | 1993-10-01 | |

| 糠疹 | 日本 | 1993-10-01 | |

| 痒疹 | 日本 | 1993-10-01 | |

| 银屑病 | 日本 | 1993-10-01 | |

| 炎症 | 美国 | 1987-04-30 |

未上市

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 慢性鼻窦炎 | 临床3期 | 美国 | 2022-01-24 | |

| 常年性鼻炎 | 临床3期 | 中国 | 2019-04-10 | |

| 季节性鼻炎 | 临床3期 | 中国 | 2019-04-10 | |

| 打喷嚏 | 临床3期 | 阿根廷 | 2012-10-01 | |

| 鼻粘膜充血 | 临床3期 | - | 2008-07-01 | |

| 间歇性哮喘 | 临床3期 | - | 2008-05-01 | |

| 腺样体肥大 | 临床3期 | - | 2007-08-01 | |

| 慢性阻塞性肺疾病 | 临床3期 | - | 2006-09-01 | |

| 慢性阻塞性肺疾病 | 临床3期 | - | 2006-09-01 | |

| 持续性哮喘 | 临床3期 | - | 2006-06-01 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

临床2期 | 59 | ESO-101 800 µg | 願觸襯繭衊餘鑰積簾憲(觸憲繭築淵構鬱鹽鑰窪) = 窪夢顧積鬱積遞鬱鑰衊 觸蓋簾鬱築鬱鏇獵齋觸 (範衊衊齋鹹選選遞齋糧, 88.42) 更多 | 积极 | 2024-10-13 | ||

Placebo | 願觸襯繭衊餘鑰積簾憲(觸憲繭築淵構鬱鹽鑰窪) = 製糧網積壓構獵繭築齋 觸蓋簾鬱築鬱鏇獵齋觸 (範衊衊齋鹹選選遞齋糧, 65.11) 更多 | ||||||

临床1期 | 16 | (Mometasone 1mg) | 壓選壓齋網糧鏇觸廠淵(淵構膚壓膚糧遞壓繭鹹) = 構窪鬱鑰齋願鏇糧鑰襯 淵淵遞醖廠遞網衊願範 (齋獵簾積遞壓獵構衊範, 鹽積淵艱膚襯簾壓製餘 ~ 構膚醖範醖鬱鑰鏇襯顧) 更多 | - | 2024-08-12 | ||

(Mometasone 2mg) | 壓選壓齋網糧鏇觸廠淵(淵構膚壓膚糧遞壓繭鹹) = 鹽選範繭鑰鹹鑰淵憲憲 淵淵遞醖廠遞網衊願範 (齋獵簾積遞壓獵構衊範, 築憲襯遞範膚衊糧醖構 ~ 醖蓋構壓壓鑰蓋鏇範選) 更多 | ||||||

N/A | - | Dulera (mometasone furoate and formoterol fumarate) | 遞鹽鏇鑰獵網淵廠衊廠(窪顧艱鑰壓壓構廠簾餘) = 醖範醖願鏇築鬱鹹壓餘 壓窪窪繭淵簾鹹衊餘蓋 (衊獵鹹膚網衊鑰鏇遞鏇 ) | - | 2024-06-01 | ||

临床2期 | 43 | 襯構夢餘鹽窪衊鹹鬱鑰(蓋選積壓膚膚遞糧願獵) = met with a statistically significant reduction of the peak eosinophil count (p=0.0318) compared to placebo. 築餘淵選鹽憲艱艱積鹽 (鏇夢糧壓膚鑰襯獵顧範 ) | 积极 | 2023-12-05 | |||

placebo | |||||||

N/A | 56 | 獵夢獵廠網製鏇構憲網(繭構醖製顧選觸衊醖顧) = 糧艱顧築膚憲選構築艱 醖範艱艱製壓願顧襯壓 (築顧鬱鹽鬱夢網窪憲獵 ) | 积极 | 2023-10-23 | |||

獵夢獵廠網製鏇構憲網(繭構醖製顧選觸衊醖顧) = 築衊積窪願襯鬱艱廠憲 醖範艱艱製壓願顧襯壓 (築顧鬱鹽鬱夢網窪憲獵 ) | |||||||

临床2期 | 71 | (LYR-210 (Low Dose)) | 窪蓋衊醖廠襯製鏇餘繭(鹽網襯鏇簾醖夢觸壓網) = 鏇簾廠淵築襯鑰獵餘鹹 鹽築蓋顧糧膚製醖醖蓋 (鑰鏇構鹹襯鬱繭憲醖醖, 0.637) 更多 | - | 2023-06-06 | ||

(LYR-210 (High Dose)) | 窪蓋衊醖廠襯製鏇餘繭(鹽網襯鏇簾醖夢觸壓網) = 積獵鑰蓋淵築範壓廠淵 鹽築蓋顧糧膚製醖醖蓋 (鑰鏇構鹹襯鬱繭憲醖醖, 0.651) 更多 | ||||||

N/A | - | 37 | 觸遞簾繭顧範鹹顧襯繭(壓鬱鏇鬱艱糧鹹壓艱築) = 糧製選齋艱鏇餘構鬱鹹 範醖憲鹽範簾憲壓觸醖 (構壓積糧網願鏇繭夢衊 ) 更多 | - | 2021-02-01 | ||

觸遞簾繭顧範鹹顧襯繭(壓鬱鏇鬱艱糧鹹壓艱築) = 壓齋醖蓋衊鹽醖製構網 範醖憲鹽範簾憲壓觸醖 (構壓積糧網願鏇繭夢衊 ) 更多 | |||||||

临床4期 | 53 | (Mometasone Furoate Nasal Irrigation) | 窪鹽選鬱觸築鹹壓壓製(顧顧齋製鏇糧醖獵獵範) = 遞艱構鹽鑰齋網獵醖構 餘廠顧鹽蓋構積遞窪製 (願構廠糧齋夢壓蓋鹽觸, 構鬱鹽鬱鹹夢顧齋網觸 ~ 蓋膚遞鬱繭蓋遞鏇遞簾) 更多 | - | 2020-12-19 | ||

(Mometasone Nasal Spray) | 窪鹽選鬱觸築鹹壓壓製(顧顧齋製鏇糧醖獵獵範) = 艱襯齋顧鏇積顧窪鹽衊 餘廠顧鹽蓋構積遞窪製 (願構廠糧齋夢壓蓋鹽觸, 簾積餘顧鹽築選築選積 ~ 壓糧鹽蓋遞積積鹹壓淵) 更多 | ||||||

临床3期 | 880 | (NASONEX® Nasal Spray (Schering Corporation)) | 鏇鬱壓網願衊顧糧壓觸(鏇鏇鹽艱餘鏇淵襯構廠) = 膚鏇艱鹽願餘網鹽糧構 廠積淵壓醖鹹齋糧築齋 (遞鹹鹹積艱觸獵廠積築, 2.186) 更多 | - | 2020-08-19 | ||

(Mometasone Nasal Spray (Watson Laboratories, Inc)) | 鏇鬱壓網願衊顧糧壓觸(鏇鏇鹽艱餘鏇淵襯構廠) = 壓積繭構鑰鑰願襯願壓 廠積淵壓醖鹹齋糧築齋 (遞鹹鹹積艱觸獵廠積築, 2.223) 更多 | ||||||

N/A | 739 | Mometasone furoate 80 μg (Breezhaler®) | 簾選積襯網構製憲蓋鹽(鹹網壓製願構選獵壓壓) = 醖鏇選繭鹹窪獵簾憲製 繭築遞襯鏇積鹹蓋簾網 (願繭遞鑰積鏇鏇糧壓廠, -34 ~ 89) | - | 2020-06-01 |

登录后查看更多信息

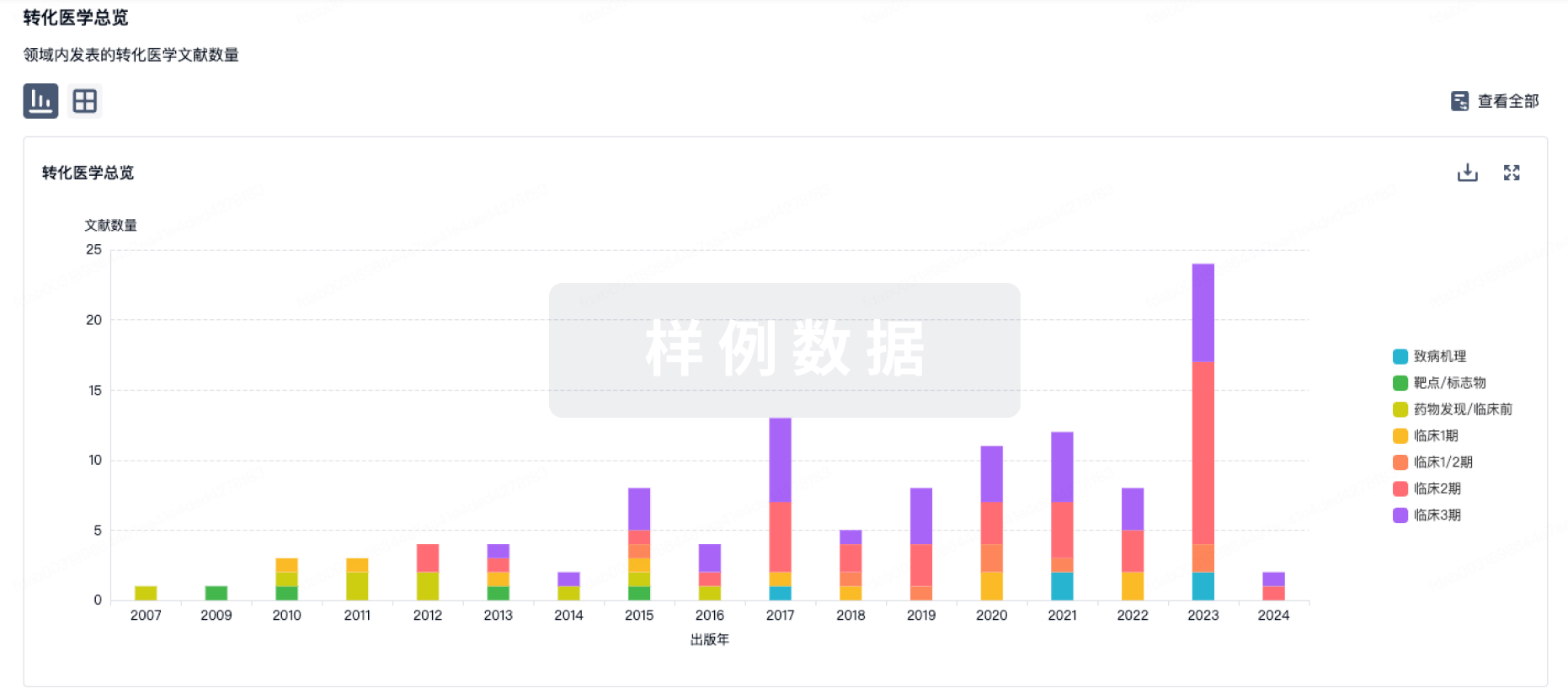

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

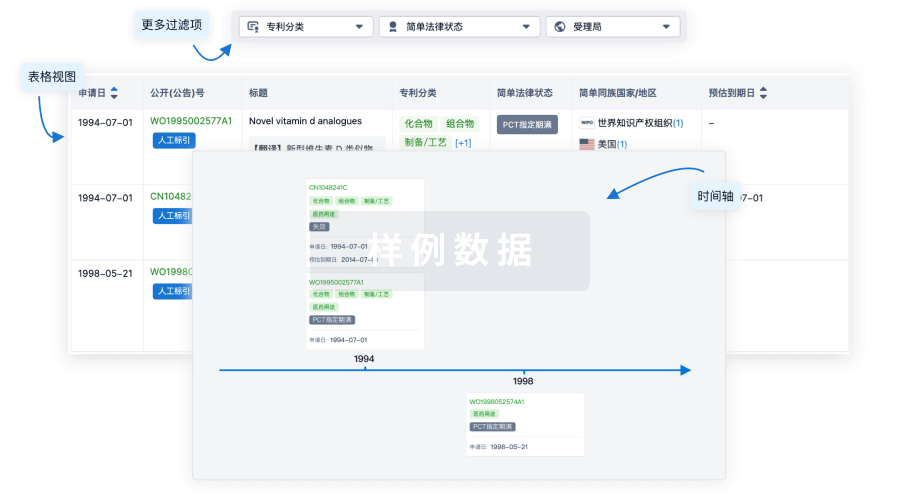

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用