预约演示

更新于:2025-05-16

Cobicistat

考比司他

更新于:2025-05-16

概要

基本信息

药物类型 小分子化药 |

别名 Cobicistat (JAN/USAN/INN)、cobicistat on silicon dioxide、GS-9350 + [1] |

作用方式 抑制剂 |

作用机制 CYP3A4抑制剂(细胞色素P450家族成员3A4抑制剂)、CYP3A5抑制剂(cytochrome P450 family 3 subfamily A member 5 inhibitors)、CYP3A7抑制剂(cytochrome P450 family 3 subfamily A member 7 inhibitors) |

在研适应症 |

非在研适应症 |

非在研机构 |

权益机构- |

最高研发阶段批准上市 |

首次获批日期 欧盟 (2013-09-19), |

最高研发阶段(中国)- |

特殊审评快速通道 (美国)、孤儿药 (美国) |

登录后查看时间轴

结构/序列

分子式C40H53N7O5S2 |

InChIKeyZCIGNRJZKPOIKD-CQXVEOKZSA-N |

CAS号1004316-88-4 |

关联

52

项与 考比司他 相关的临床试验NCT06610682

Feasibility of CSF (Cerebrospinal Fluid) and Plasma ctDNA (Circulating Tumor Deoxyribonucleic) in BRAF (V-raf Murine Sarcoma Viral Oncogene Homolog B1)-Altered Glioma During Treatment With Plixorafenib

Evaluating the sensitivity and feasibility of using ctDNA assays optimized for detecting very low ctDNA counts from cerebrospinal fluid (CSF) and plasma. The investigators will evaluate the sensitivity of ctDNA from plasma and CSF at baseline (defined as Cycle1 Day1 (C1D1) pre-treatment) and over time in response to treatment with plixorafenib co-administered with cobicistat in BRAF-V600E mutant glioma refractory to prior therapies.

开始日期2025-04-07 |

申办/合作机构 |

NCT06726382

KF2024#1-trial: Esketamine Interaction Study

Esketamine is a drug which is used for depression treatment, to relieve pain and, in larger doses, in anesthesia. Spravato nasal spray is the only esketamine product on the market used for the treatment of depression, but the high price limits the use of the drug.

The aim of this study is to compare the concentration of esketamine after nasal (licensed product Spravato) and oral administration with and without a CYP3A4 inhibitor. Grapefruit juice and cobicistat are studied as CYP3A4 inhibitors in the study.

In an open four-phase, randomized, alternating study with 12 healthy volunteers, the subjects will receive Spravato 28 mg nasal or esketamine 28 mg oral with either grapefruit juice, cobicistat or water in the study facilities. Blood samples will be collected and esketamine pharmacokinetics will be monitored up to 24 hours postdose. Primary endpoint is area under the plasma concentration-time curve of esketamine.

The aim of this study is to compare the concentration of esketamine after nasal (licensed product Spravato) and oral administration with and without a CYP3A4 inhibitor. Grapefruit juice and cobicistat are studied as CYP3A4 inhibitors in the study.

In an open four-phase, randomized, alternating study with 12 healthy volunteers, the subjects will receive Spravato 28 mg nasal or esketamine 28 mg oral with either grapefruit juice, cobicistat or water in the study facilities. Blood samples will be collected and esketamine pharmacokinetics will be monitored up to 24 hours postdose. Primary endpoint is area under the plasma concentration-time curve of esketamine.

开始日期2024-12-09 |

申办/合作机构 |

NCT06337032

An Open-label, Single-arm Study to Provide Continued Access to Study Drug to Participants Who Have Completed Pediatric Clinical Studies Involving Gilead HIV Treatments

The goal of this clinical study is to provide continued access to the study drug(s) to children and adolescents with human immunodeficiency virus type 1 (HIV-1) who completed their participation in an applicable parent study and to monitor for adverse events.

The primary objectives of this study are as follows:

* To provide continued access to the study drug received in the parent protocol or switch to bictegravir/emtricitabine/tenofovir (B/F/TAF) for participants who completed a Gilead parent study evaluating drugs for HIV treatment.

* To evaluate the safety of the study drug(s) in participants with HIV-1.

The primary objectives of this study are as follows:

* To provide continued access to the study drug received in the parent protocol or switch to bictegravir/emtricitabine/tenofovir (B/F/TAF) for participants who completed a Gilead parent study evaluating drugs for HIV treatment.

* To evaluate the safety of the study drug(s) in participants with HIV-1.

开始日期2024-08-27 |

申办/合作机构 |

100 项与 考比司他 相关的临床结果

登录后查看更多信息

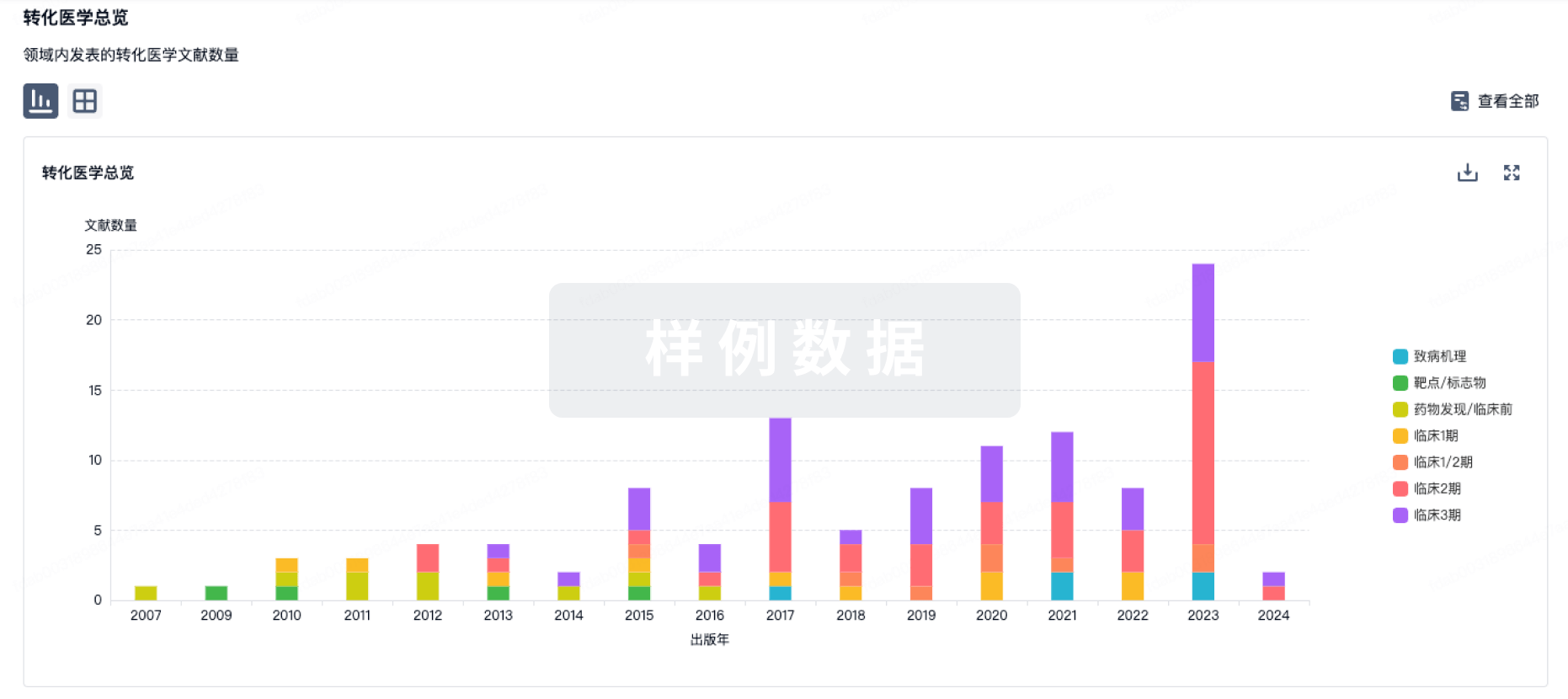

100 项与 考比司他 相关的转化医学

登录后查看更多信息

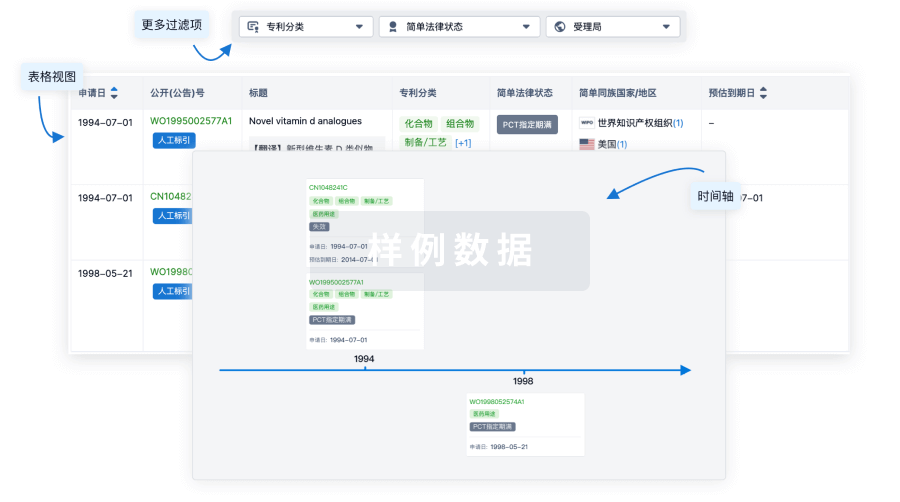

100 项与 考比司他 相关的专利(医药)

登录后查看更多信息

1,117

项与 考比司他 相关的文献(医药)2025-12-31·HIV Research & Clinical Practice

Evaluation of the effect of 48 weeks of BIC/F/TAF and DRV/c/F/TAF on platelet function in the context of rapid ART start

Article

作者: Boffito, Marta ; Henderson, Merle ; Whitlock, Gary ; Khawaja, Akif A. ; Taylor, Graham P. ; Fidler, Sarah ; Soler-Carracedo, Alfredo ; Emerson, Michael

INTRODUCTION:

The BIC-T&T study aimed to determine the efficacy of bictegravir/emtricitabine/tenofovir alafenamide (BIC/F/TAF) and darunavir/cobicistat/emtricitabine/tenofovir alafenamide (DRV/c/F/TAF) at suppressing viral load in a two-arm, open-label, multi-centre, randomised trial under a UK test-and-treat setting. This sub-study aimed to evaluate potential off-target cardiovascular impact by examining ex vivo platelet function.

METHODS:

Platelets were isolated by centrifugation of citrated blood from participants attending Chelsea and Westminster Hospital or St Mary's Hospital at Week 48 following enrolment. Platelet activation was assessed by real-time flow cytometry to examine integrin activation and granule release and platelet aggregation was evaluated by light transmission aggregometry. Statistical significance was determined by 2-way ANOVA with a Šidák's multiple comparisons post-test.

RESULTS:

An analysis of 21 participants was performed at Week 48 (96% male and 48% white; mean (range) age was 37 (23-78) years). No difference between arms was observed in ADP-, collagen- or thrombin receptor activator for peptide (TRAP)-6-evoked platelet αIIbβ3 integrin activation, granule release or platelet aggregation in response to any of the agonists tested. Despite differences in the demographics between treatment arms, the presence of an unboosted integrase inhibitor or boosted protease inhibitor in a test-and-treat setting did not impact platelet function.

CONCLUSIONS:

Our study provides no evidence of differences in downstream platelet responses between participants taking BIC/F/TAF compared to DRV/c/F/TAF following 48 wk of treatment. Further data are required to explore whether there are biologically significant off-target effects, including effects on platelets and other components of the cardiovascular system between these two test-and-treat regimens.

CLINICAL TRIAL NUMBER:

NCT04653194.

2025-06-01·Contemporary Clinical Trials Communications

Pharmacokinetic boosting of olaparib: Study protocol of a multicentre, open-label, randomised, non-inferiority trial (PROACTIVE-B)

Article

作者: van Erp, Nielka P ; Koolen, Stijn L W ; Mohmaed Ali, Ma Ida ; Boere, Ingrid A ; Kievit, Wietske ; Ottevanger, Petronella B ; Mathijssen, Ron H J ; Guchelaar, Niels A D ; Huitema, Alwin D R ; Ligtenberg, Marjolijn J L ; Sark, Muriëlle ; Overbeek, Joanneke K ; Opdam, Frans L ; Bloemendal, Haiko J ; Heine, Rob Ter ; Hovenier, Carolien ; Sonke, Gabe S

Background:

Pharmacokinetic (PK) boosting is the intentional use of a drug-drug interaction to enhance systemic drug exposure. PK boosting of the anticancer drug olaparib, a CYP3A-substrate, has the potential to reduce PK variability, side effects and financial burden associated with this drug. After establishing adequate pharmacokinetic exposure with boosting in the PROACTIVE-A study, the PROACTIVE-B study is designed to evaluate non-inferiority for both efficacy and toxicity of the boosted therapy compared to the standard monotherapy of olaparib.

Methods:

The PROACTIVE-B study is a nationwide, multicentre, prospective, randomized, non-inferiority trial. A total of 142 patients (128 patients with BRCA+, high-grade, FIGO III/IV ovarian cancer who receive olaparib as maintenance therapy; 14 patients with other approved indications for olaparib) who start olaparib treatment in line with the drug label will be randomized between the standard monotherapy of olaparib 300 mg twice daily (BID) and the boosted therapy of olaparib 100 mg BID with cobicistat 150 mg BID. The co-primary objectives are tolerability (dose reductions due to toxicity), and efficacy (progression-free survival at 12 months) in the ovarian cancer population. Secondary objectives include health status (EQ-5D-5L), patient satisfaction (Cancer Therapy Satisfaction Questionnaire (CTSQ)), and cost effectiveness using the institute for Medical Technology Assessment (iMTA) Productivity Cost Questionnaire (iPCQ) and iMTA Medical Consumption Questionnaire (iMCQ).

Discussion:

PK boosting of olaparib is a potentially valuable strategy to reduce the olaparib dose and the variability in olaparib exposure with fewer side effects. Moreover, the lower costs related to the boosted therapy contribute to a durable and accessible anticancer treatment for all patients.

Trial registration:

The PROACTIVE study has been published at ClinicalTrials.gov under NCT05078671 on October 14, 2021 and at EudraCT under 2021-004032-28 on August 24, 2021.

2025-05-04·EXPERT OPINION ON THERAPEUTIC PATENTS

A patent review of CYP3A4 inhibitors (2018 – present)

Review

作者: Lei, Jing-Xuan ; Hu, Xue-Yan ; Ge, Guang-Bo ; Liu, Shu-Yan ; Tu, Dong-Zhu ; Yang, Ling ; Xiao, Zhang-Ping

INTRODUCTION:

Cytochrome P450 3A4 (CYP3A4), one of the most important xenobiotic-metabolizing enzymes, plays a central role in drug metabolism and acts as a key mediator in drug-drug interactions. CYP3A4 inhibitors can potentiate the in vivo therapeutic effects of CYP3A4-substrate drugs via enhancing their systematic exposure levels. Two CYP3A4 inhibitors (ritonavir and cobicistat) have already been approved for modulating the exposure levels of CYP3A4-substrate drugs.

AREAS COVERED:

This review summarizes the newly patented CYP3A4 inhibitors in the period (2018-2024) by using the keywords 'CYP3A4' and 'inhibitor' in Espacenet database from academic institutions and industrial companies. The chemical structures and inhibition profiles of the patented CYP3A4 inhibitors, including the anti-CYP3A4 potency, inhibitory mechanisms, and other relevant information, are summarized and discussed.

EXPERT OPINION:

Although diverse CYP3A4 inhibitors have been developed in the past few years, the development of more efficacious CYP3A4 inhibitors with favorable pharmacokinetic and safety profiles is still challenging. To maximize the benefit of CYP3A4 inhibitors, combination strategies should be used for the development of highly specific CYP3A4 inhibitors or degraders with efficacious anti-CYP3A4 effects and favorable pharmacokinetic profiles. Meanwhile, more efforts should be made to address the organ-targeting or tumor-targeting ability of CYP3A4 inhibitors for specific purposes.

45

项与 考比司他 相关的新闻(医药)2025-04-24

FOSTER CITY, Calif.--(BUSINESS WIRE)--Gilead Sciences, Inc. (Nasdaq: GILD) announced today its first quarter 2025 results of operations.

“Gilead had a strong start to the year driven by excellent commercial and clinical execution along with disciplined expense management,” said Daniel O’Day, Gilead’s Chairman and Chief Executive Officer. “Our base business grew 4% year-over-year, primarily led by Biktarvy’s continued strength, and we announced positive topline Phase 3 results for Trodelvy plus pembrolizumab in first line PD-L1+ metastatic triple negative breast cancer. With the upcoming June PDUFA date for lenacapavir for HIV prevention, and continued progress across our diverse pipeline, we look forward to building on our positive momentum throughout the year.”

First Quarter 2025 Financial Results

Total first quarter 2025 revenue of $6.7 billion remained flat compared to the same period in 2024, with lower Veklury® (remdesivir) and Oncology sales offset by higher HIV and Liver Disease sales.

Diluted earnings (loss) per share (“EPS”) was $1.04 in the first quarter 2025 compared to $(3.34) in the same period in 2024. The increase was primarily driven by prior year charges that did not repeat, including the impact of a $3.9 billion acquired in-process research and development ("IPR&D") expense related to the acquisition of CymaBay Therapeutics, Inc. (“CymaBay”), as well as a pre-tax IPR&D impairment of $2.4 billion related to assets acquired by Gilead from Immunomedics, Inc. (“Immunomedics”) in 2020. This increase was partially offset by higher tax expense and higher net unrealized losses on equity investments in the first quarter 2025.

Non-GAAP diluted EPS was $1.81 in the first quarter 2025 compared to $(1.32) in the same period in 2024. The increase was primarily driven by the prior year IPR&D expense related to the CymaBay acquisition.

As of March 31, 2025, Gilead had $7.9 billion of cash and cash equivalents compared to $10.0 billion as of December 31, 2024.

During the first quarter 2025, Gilead generated $1.8 billion in operating cash flow.

During the first quarter 2025, Gilead paid dividends of $1.0 billion and repurchased $730 million of common stock. In addition, Gilead repaid $1.8 billion of Senior Notes in February 2025.

First Quarter 2025 Product Sales

Total first quarter 2025 product sales decreased 1% to $6.6 billion compared to the same period in 2024. Total first quarter 2025 product sales excluding Veklury increased 4% to $6.3 billion compared to the same period in 2024, primarily due to higher HIV and Liver Disease sales, partially offset by lower Oncology sales.

HIV product sales increased 6% to $4.6 billion in the first quarter 2025 compared to the same period in 2024, primarily driven by higher average realized price and demand.

Biktarvy® (bictegravir 50mg/emtricitabine (“FTC”) 200mg/tenofovir alafenamide (“TAF”) 25mg) sales increased 7% to $3.1 billion in the first quarter 2025 compared to the same period in 2024, primarily driven by higher demand.

Descovy® (FTC 200mg/TAF 25mg) sales increased 38% to $586 million in the first quarter 2025 compared to the same period in 2024, primarily driven by higher average realized price and higher demand.

The Liver Disease portfolio sales increased 3% to $758 million in the first quarter 2025 compared to the same period in 2024. This was primarily driven by increased demand in products for primary biliary cholangitis (“PBC”), chronic hepatitis B virus (“HBV”) and chronic hepatitis delta virus (“HDV”), partially offset by lower average realized price for chronic hepatitis C virus (“HCV”) products.

Veklury sales decreased 45% to $302 million in the first quarter 2025 compared to the same period in 2024, primarily driven by lower rates of COVID-19 related hospitalizations across regions.

Cell Therapy product sales decreased 3% to $464 million in the first quarter 2025 compared to the same period in 2024.

Yescarta® (axicabtagene ciloleucel) sales increased 2% to $386 million in the first quarter 2025 compared to the same period in 2024, primarily driven by higher average realized price and increased rest of world demand, partially offset by lower demand in the United States.

Tecartus® (brexucabtagene autoleucel) sales decreased 22% to $78 million in the first quarter 2025 compared to the same period in 2024, primarily reflecting lower demand in the United States.

Trodelvy® (sacituzumab govitecan-hziy) sales decreased 5% to $293 million in the first quarter 2025 compared to the same period in 2024, primarily driven by inventory dynamics and lower average realized price, partially offset by higher demand.

First Quarter 2025 Product Gross Margin, Operating Expenses and Effective Tax Rate

Product gross margin was 76.7% in the first quarter 2025 compared to 76.6% in the same period in 2024. Non-GAAP product gross margin was 85.5% in the first quarter 2025 compared to 85.4% in the same period in 2024.

Research and development (“R&D”) expenses were $1.4 billion in the first quarter 2025 compared to $1.5 billion in the same period in 2024, primarily due to lower clinical manufacturing activities and prior year CymaBay acquisition-related expenses that did not repeat. Non-GAAP R&D expenses were $1.3 billion in the first quarter 2025 compared to $1.4 billion in the same period in 2024, primarily due to lower clinical manufacturing activities.

Acquired IPR&D expenses were $253 million in the first quarter 2025, primarily reflecting expenses related to the strategic partnership with LEO Pharma A/S (“LEO Pharma”) announced in January 2025.

Selling, general and administrative (“SG&A”) expenses were $1.3 billion in the first quarter 2025 compared to $1.4 billion in the same period in 2024, primarily driven by prior year CymaBay acquisition-related expenses that did not repeat as well as lower corporate expenses, partially offset by incremental selling and marketing expenses in the United States. Non-GAAP SG&A expenses were $1.2 billion in the first quarter 2025 compared to $1.3 billion in the same period in 2024. This was primarily driven by lower corporate expenses, partially offset by incremental selling and marketing expenses in the United States.

The effective tax rate (“ETR”) was 20.2% in the first quarter 2025 compared to 7.0% in the same period in 2024, and the non-GAAP ETR was 16.3% in the first quarter 2025 compared to (29.8)% in the same period in 2024. These changes primarily reflect the prior year non-deductible acquired IPR&D charge related to the CymaBay acquisition, and higher tax benefits from stock-based compensation.

Guidance and Outlook

For the full-year, Gilead expects:

(in millions, except per share amounts)

April 24, 2025 Guidance

Low End

High End

Comparison to Prior Guidance

Product sales

$

28,200

$

28,600

Unchanged

Product sales excluding Veklury

$

26,800

$

27,200

Unchanged

Veklury

$

1,400

$

1,400

Unchanged

Diluted EPS

$

5.65

$

6.05

Previously $5.95 to $6.35

Non-GAAP diluted EPS

$

7.70

$

8.10

Unchanged

Additional information and a reconciliation between GAAP and non-GAAP financial information for the 2025 guidance is provided in the accompanying tables. The financial guidance is subject to a number of risks and uncertainties. See the Forward-Looking Statements section below.

Key Updates Since Our Last Quarterly Release

Virology

Announced FDA accepted New Drug Application submissions for twice-yearly lenacapavir for HIV prevention under priority review, with a PDUFA date of June 19, 2025.

Announced the European Medicines Agency validated the Marketing Authorization Application and EU-Medicines for All application for twice-yearly lenacapavir for HIV prevention, which will undergo parallel reviews under an Accelerated Assessment timeline.

Presented initial Phase 1 data evaluating investigational once-yearly lenacapavir for HIV prevention at the Conference on Retroviruses and Opportunistic Infections (“CROI”), and announced plans to launch a Phase 3 study in the second half of 2025.

Presented HIV treatment research data at CROI, including long-term outcomes evaluating the use of Biktarvy in people with HIV/HBV coinfection and the primary results of a Phase 2 study evaluating the investigational combination regimen of lenacapavir and broadly neutralizing antibodies teropavimab and zinlirvimab.

Oncology

Announced Trodelvy plus Keytruda® (pembrolizumab) demonstrated a statistically significant and clinically meaningful improvement in progression free survival in patients with previously untreated PD-L1+ unresectable locally advanced or metastatic triple-negative breast cancer in the Phase 3 ASCENT-04 trial. The use of Trodelvy plus Keytruda is investigational in this setting.

Inflammation

Received conditional marketing authorization from the European Commission for seladelpar for the treatment of PBC in combination with ursodeoxycholic acid (“UDCA”) in adults who have an inadequate response to UDCA alone, or as monotherapy in those unable to tolerate UDCA.

Corporate

The Board declared a quarterly dividend of $0.79 per share of common stock for the second quarter of 2025. The dividend is payable on June 27, 2025, to stockholders of record at the close of business on June 13, 2025. Future dividends will be subject to Board approval.

Certain amounts and percentages in this press release may not sum or recalculate due to rounding.

Conference Call

At 1:30 p.m. Pacific Time today, Gilead will host a conference call to discuss Gilead’s results. A live webcast will be available on http://investors.gilead.com and will be archived on www.gilead.com for one year.

Non-GAAP Financial Information

The information presented in this document has been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), unless otherwise noted as non-GAAP. Management believes non-GAAP information is useful for investors, when considered in conjunction with Gilead’s GAAP financial information, because management uses such information internally for its operating, budgeting and financial planning purposes. Non-GAAP information is not prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of Gilead’s operating results as reported under GAAP. Non-GAAP financial information generally excludes acquisition-related expenses including amortization of acquired intangible assets and other items that are considered unusual or not representative of underlying trends of Gilead’s business, fair value adjustments of equity securities and discrete and related tax charges or benefits associated with such exclusions as well as changes in tax-related laws and guidelines, transfers of intangible assets between certain legal entities, and legal entity restructurings. Although Gilead consistently excludes the amortization of acquired intangible assets from the non-GAAP financial information, management believes that it is important for investors to understand that such intangible assets were recorded as part of acquisitions and contribute to ongoing revenue generation. Non-GAAP measures may be defined and calculated differently by other companies in the same industry. Reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures are provided in the accompanying tables.

About Gilead Sciences

Gilead Sciences, Inc. is a biopharmaceutical company that has pursued and achieved breakthroughs in medicine for more than three decades, with the goal of creating a healthier world for all people. The company is committed to advancing innovative medicines to prevent and treat life-threatening diseases, including HIV, viral hepatitis, COVID-19, cancer and inflammation. Gilead operates in more than 35 countries worldwide, with headquarters in Foster City, California.

Forward-Looking Statements

Statements included in this press release that are not historical in nature are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Gilead cautions readers that forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include those relating to: Gilead’s ability to achieve its full year 2025 financial guidance, including as a result of the uncertainty of the amount and timing of Veklury revenues, the impact of the Inflation Reduction Act, changes in U.S. regulatory or legislative policies, and changes in U.S. trade policies, including tariffs; Gilead’s ability to make progress on any of its long-term ambitions or priorities laid out in its corporate strategy; Gilead’s ability to accelerate or sustain revenues for its virology, oncology and other programs; Gilead’s ability to realize the potential benefits of acquisitions, collaborations or licensing arrangements, including the acquisitions of CymaBay and Immunomedics, and the arrangement with LEO Pharma; patent protection and estimated loss of exclusivity for our products and product candidates; Gilead’s ability to initiate, progress or complete clinical trials within currently anticipated timeframes or at all, the possibility of unfavorable results from ongoing and additional clinical trials, including those involving Biktarvy, Trodelvy, lenacapavir, teropavimab and zinlirvimab, and the risk that safety and efficacy data from clinical trials may not warrant further development of Gilead’s product candidates or the product candidates of Gilead’s strategic partners; Gilead’s ability to submit new drug applications for new product candidates or expanded indications in the currently anticipated timelines, including for lenacapavir for HIV PrEP; Gilead’s ability to receive or maintain regulatory approvals in a timely manner or at all, including for lenacapavir for PrEP, and the risk that any such approvals, if granted, may be subject to significant limitations on use and may be subject to withdrawal or other adverse actions by the applicable regulatory authority; Gilead’s ability to successfully commercialize its products; the risk of potential disruptions to the manufacturing and supply chain of Gilead’s products; pricing and reimbursement pressures from government agencies and other third parties, including required rebates and other discounts; a larger than anticipated shift in payer mix to more highly discounted payer segments; market share and price erosion caused by the introduction of generic versions of Gilead products; the risk that physicians and patients may not see advantages of Gilead’s products over other therapies and may therefore be reluctant to prescribe the products, including Livdelzi/Lyvdelzi; and other risks identified from time to time in Gilead’s reports filed with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. In addition, Gilead makes estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses and related disclosures. Gilead bases its estimates on historical experience and on various other market specific and other relevant assumptions that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. There may be other factors of which Gilead is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ significantly from these estimates. Further, results for the quarter ended March 31, 2025 are not necessarily indicative of operating results for any future periods. Gilead directs readers to its press releases, annual reports on Form 10-K, quarterly reports on Form 10-Q and other subsequent disclosure documents filed with the SEC. Gilead claims the protection of the Safe Harbor contained in the Private Securities Litigation Reform Act of 1995 for forward-looking statements.

The reader is cautioned that forward-looking statements are not guarantees of future performance and is cautioned not to place undue reliance on these forward-looking statements. All forward-looking statements are based on information currently available to Gilead and Gilead assumes no obligation to update or supplement any such forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statements.

Additional information is available on our Investor Relations website, https://investors.gilead.com. Among other things, an estimate of Acquired IPR&D expenses is expected to be made available on the Quarterly Results page within the first ten (10) days after the end of each quarter.

Gilead owns or has rights to various trademarks, copyrights and trade names used in its business, including the following: GILEAD®, GILEAD SCIENCES®, KITE™, AMBISOME®, ATRIPLA®, BIKTARVY®, CAYSTON®, COMPLERA®, DESCOVY®, DESCOVY FOR PREP®, EMTRIVA®, EPCLUSA®, EVIPLERA®, GENVOYA®, HARVONI®, HEPCLUDEX®, HEPSERA®, JYSELECA®, LIVDELZI®/LYVDELZI®, LETAIRIS®, ODEFSEY®, SOVALDI®, STRIBILD®, SUNLENCA® , TECARTUS®, TRODELVY®, TRUVADA®, TRUVADA FOR PREP®, TYBOST®, VEKLURY®, VEMLIDY®, VIREAD®, VOSEVI®, YESCARTA® and ZYDELIG®.

For more information on Gilead Sciences, Inc., please visit www.gilead.com or call the Gilead Public Affairs Department at 1-800-GILEAD-5 (1-800-445-3235).

GILEAD SCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

Three Months Ended

March 31,

(in millions, except per share amounts)

2025

2024

Revenues:

Product sales

$

6,613

$

6,647

Royalty, contract and other revenues

54

39

Total revenues

6,667

6,686

Costs and expenses:

Cost of goods sold

1,540

1,552

Research and development expenses

1,379

1,520

Acquired in-process research and development expenses

253

4,131

In-process research and development impairments

—

2,430

Selling, general and administrative expenses

1,258

1,375

Total costs and expenses

4,430

11,008

Operating income (loss)

2,237

(4,322

)

Interest expense

260

254

Other (income) expense, net

328

(91

)

Income (loss) before income taxes

1,649

(4,486

)

Income tax expense (benefit)

334

(315

)

Net income (loss)

1,315

(4,170

)

Net income attributable to noncontrolling interest

—

—

Net income (loss) attributable to Gilead

$

1,315

$

(4,170

)

Basic earnings (loss) per share attributable to Gilead

$

1.06

$

(3.34

)

Diluted earnings (loss) per share attributable to Gilead

$

1.04

$

(3.34

)

Shares used in basic earnings (loss) per share attributable to Gilead calculation

1,246

1,247

Shares used in diluted earnings (loss) per share attributable to Gilead calculation

1,259

1,247

Supplemental Information:

Cash dividends declared per share

$

0.79

$

0.77

Product gross margin

76.7

%

76.6

%

Research and development expenses as a % of revenues

20.7

%

22.7

%

Selling, general and administrative expenses as a % of revenues

18.9

%

20.6

%

Operating margin

33.6

%

(64.6

)%

Effective tax rate

20.2

%

7.0

%

GILEAD SCIENCES, INC.

TOTAL REVENUE SUMMARY

(unaudited)

Three Months Ended

March 31,

(in millions, except percentages)

2025

2024

Change

Product sales:

HIV

$

4,587

$

4,342

6%

Liver Disease

758

737

3%

Oncology

757

789

(4)%

Other

209

224

(7)%

Total product sales excluding Veklury

6,311

6,092

4%

Veklury

302

555

(45)%

Total product sales

6,613

6,647

(1)%

Royalty, contract and other revenues

54

39

37%

Total revenues

$

6,667

$

6,686

—%

GILEAD SCIENCES, INC.

NON-GAAP FINANCIAL INFORMATION(1)

(unaudited)

Three Months Ended

March 31,

(in millions, except percentages)

2025

2024

Change

Non-GAAP:

Cost of goods sold

$

961

$

974

(1)%

Research and development expenses

$

1,338

$

1,403

(5)%

Acquired IPR&D expenses(2)

$

253

$

4,131

(94)%

Selling, general and administrative expenses

$

1,222

$

1,295

(6)%

Other (income) expense, net

$

(98

)

$

(104

)

(6)%

Diluted earnings (loss) per share attributable to Gilead

$

1.81

$

(1.32

)

NM

Shares used in non-GAAP diluted earnings (loss) per share attributable to Gilead calculation

1,259

1,247

1%

Product gross margin

85.5

%

85.4

%

12 bps

Research and development expenses as a % of revenues

20.1

%

21.0

%

-91 bps

Selling, general and administrative expenses as a % of revenues

18.3

%

19.4

%

-104 bps

Operating margin

43.4

%

(16.7

)%

NM

Effective tax rate

16.3

%

(29.8

)%

NM

(1)

Refer to Non-GAAP Financial Information section above for further disclosures on non-GAAP financial measures. A reconciliation between GAAP and non-GAAP financial information is provided in the tables below.

(2)

Equal to GAAP financial information.

GILEAD SCIENCES, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(unaudited)

Three Months Ended

March 31,

(in millions, except percentages and per share amounts)

2025

2024

Cost of goods sold reconciliation:

GAAP cost of goods sold

$

1,540

$

1,552

Acquisition-related – amortization(1)

(579

)

(579

)

Non-GAAP cost of goods sold

$

961

$

974

Product gross margin reconciliation:

GAAP product gross margin

76.7

%

76.6

%

Acquisition-related – amortization(1)

8.8

%

8.7

%

Non-GAAP product gross margin

85.5

%

85.4

%

Research and development expenses reconciliation:

GAAP research and development expenses

$

1,379

$

1,520

Acquisition-related – other costs(2)

(2

)

(66

)

Restructuring

(38

)

(50

)

Non-GAAP research and development expenses

$

1,338

$

1,403

IPR&D impairment reconciliation:

GAAP IPR&D impairment

$

—

$

2,430

IPR&D impairment

—

(2,430

)

Non-GAAP IPR&D impairment

$

—

$

—

Selling, general and administrative expenses reconciliation:

GAAP selling, general and administrative expenses

$

1,258

$

1,375

Acquisition-related – other costs(2)

—

(67

)

Restructuring

(36

)

(13

)

Non-GAAP selling, general and administrative expenses

$

1,222

$

1,295

Operating income (loss) reconciliation:

GAAP operating income (loss)

$

2,237

$

(4,322

)

Acquisition-related – amortization(1)

579

579

Acquisition-related – other costs(2)

2

133

Restructuring

74

63

IPR&D impairment

—

2,430

Non-GAAP operating income (loss)

$

2,893

$

(1,117

)

Operating margin reconciliation:

GAAP operating margin

33.6

%

(64.6

)%

Acquisition-related – amortization(1)

8.7

%

8.7

%

Acquisition-related – other costs(2)

—

%

2.0

%

Restructuring

1.1

%

0.9

%

IPR&D impairment

—

%

36.3

%

Non-GAAP operating margin

43.4

%

(16.7

)%

Other (income) expense, net reconciliation:

GAAP other (income) expense, net

$

328

$

(91

)

Loss from equity securities, net

(426

)

(14

)

Non-GAAP other (income) expense, net

$

(98

)

$

(104

)

Income (loss) before income taxes reconciliation:

GAAP income (loss) before income taxes

$

1,649

$

(4,486

)

Acquisition-related – amortization(1)

579

579

Acquisition-related – other costs(2)

2

133

Restructuring

74

63

IPR&D impairment

—

2,430

Loss from equity securities, net

426

14

Non-GAAP income (loss) before income taxes

$

2,731

$

(1,267

)

GILEAD SCIENCES, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION - (Continued)

(unaudited)

Three Months Ended

March 31,

(in millions, except percentages and per share amounts)

2025

2024

Income tax expense (benefit) reconciliation:

GAAP income tax expense (benefit)

$

334

$

(315

)

Income tax effect of non-GAAP adjustments:

Acquisition-related – amortization(1)

120

121

Acquisition-related – other costs(2)

—

30

Restructuring

14

10

IPR&D impairment

—

611

Loss (gain) from equity securities, net

20

(39

)

Discrete and related tax charges(3)

(42

)

(39

)

Non-GAAP income tax expense

$

446

$

379

Effective tax rate reconciliation:

GAAP effective tax rate

20.2

%

7.0

%

Income tax effect of above non-GAAP adjustments and discrete and related tax adjustments(3)

(3.9

)%

(36.8

)%

Non-GAAP effective tax rate

16.3

%

(29.8

)%

Net income (loss) attributable to Gilead reconciliation:

GAAP net income (loss) attributable to Gilead

$

1,315

$

(4,170

)

Acquisition-related – amortization(1)

459

458

Acquisition-related – other costs(2)

2

103

Restructuring

61

54

IPR&D impairment

—

1,819

Loss from equity securities, net

406

53

Discrete and related tax charges(3)

42

39

Non-GAAP net income (loss) attributable to Gilead

$

2,285

$

(1,644

)

Diluted earnings (loss) per share reconciliation:

GAAP diluted earnings (loss) per share

$

1.04

$

(3.34

)

Acquisition-related – amortization(1)

0.36

0.37

Acquisition-related – other costs(2)

—

0.08

Restructuring

0.05

0.04

IPR&D impairment

—

1.46

Loss from equity securities, net

0.32

0.04

Discrete and related tax charges(3)

0.03

0.03

Non-GAAP diluted earnings (loss) per share

$

1.81

$

(1.32

)

Non-GAAP adjustment summary:

Cost of goods sold adjustments

$

579

$

579

Research and development expenses adjustments

40

117

IPR&D impairment adjustments

—

2,430

Selling, general and administrative expenses adjustments

36

80

Total non-GAAP adjustments to costs and expenses

656

3,205

Other (income) expense, net, adjustments

426

14

Total non-GAAP adjustments before income taxes

1,082

3,219

Income tax effect of non-GAAP adjustments above

(154

)

(732

)

Discrete and related tax charges(3)

42

39

Total non-GAAP adjustments to net income attributable to Gilead

$

970

$

2,526

(1)

Relates to amortization of acquired intangibles.

(2)

Adjustments include integration expenses and contingent consideration fair value adjustments associated with Gilead’s recent acquisitions.

(3)

Represents discrete and related deferred tax charges or benefits primarily associated with acquired intangible assets and transfers of intangible assets from a foreign subsidiary to Ireland and the United States.

GILEAD SCIENCES, INC.

RECONCILIATION OF GAAP TO NON-GAAP 2025 FULL-YEAR GUIDANCE(1)

(unaudited)

(in millions, except percentages and per share amounts)

Provided

February 11, 2025

Updated

April 24, 2025

Projected product gross margin GAAP to non-GAAP reconciliation:

GAAP projected product gross margin

77.0% - 78.0%

77.0% - 78.0%

Acquisition-related expenses

~ 8.0%

~ 8.0%

Non-GAAP projected product gross margin

85.0% - 86.0%

85.0% - 86.0%

Projected operating income GAAP to non-GAAP reconciliation:

GAAP projected operating income

$10,200 - $10,700

$10,200 - $10,700

Acquisition-related and restructuring expenses

~ 2,500

~ 2,500

Non-GAAP projected operating income

$12,700 - $13,200

$12,700 - $13,200

Projected effective tax rate GAAP to non-GAAP reconciliation:

GAAP projected effective tax rate

~ 20%

~ 21%

Income tax effect of above non-GAAP adjustments and fair value adjustments of equity securities, and discrete and related tax adjustments

(~ 1%)

(~ 2%)

Non-GAAP projected effective tax rate

~ 19%

~ 19%

Projected diluted EPS GAAP to non-GAAP reconciliation:

GAAP projected diluted EPS

$5.95 - $6.35

$5.65 - $6.05

Acquisition-related and restructuring expenses, fair value adjustments of equity securities and discrete and related tax adjustments

~ 1.75

~ 2.05

Non-GAAP projected diluted EPS

$7.70 - $8.10

$7.70 - $8.10

(1)

Our full-year guidance excludes the potential impact of any (i) acquisitions or business development transactions that have not been executed, (ii) future fair value adjustments of equity securities and (iii) discrete tax charges or benefits associated with changes in tax related laws and guidelines that have not been enacted, as Gilead is unable to project such amounts. The non-GAAP full-year guidance includes non-GAAP adjustments to actual current period results as well as adjustments for the known future impact associated with events that have already occurred, such as future amortization of our intangible assets and the future impact of discrete and related deferred tax charges or benefits primarily associated with acquired intangible assets and in-process research and development, transfers of intangible assets from a foreign subsidiary to Ireland and the United States, and legal entity restructurings.

GILEAD SCIENCES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

March 31,

December 31,

(in millions)

2025

2024

Assets

Cash and cash equivalents

$

7,926

$

9,991

Accounts receivable, net

4,388

4,420

Inventories

3,778

3,589

Property, plant and equipment, net

5,421

5,414

Intangible assets, net

19,355

19,948

Goodwill

8,314

8,314

Other assets

7,253

7,319

Total assets

$

56,434

$

58,995

Liabilities and Stockholders’ Equity

Current liabilities

$

12,344

$

12,004

Long-term liabilities

25,012

27,744

Stockholders’ equity(1)

19,078

19,246

Total liabilities and stockholders’ equity

$

56,434

$

58,995

(1)

As of March 31, 2025 and December 31, 2024, there were 1,245 and 1,246 shares of common stock issued and outstanding, respectively.

GILEAD SCIENCES, INC.

SELECTED CASH FLOW INFORMATION

(unaudited)

Three Months Ended

March 31,

(in millions)

2025

2024

Net cash provided by operating activities

$

1,757

$

2,219

Net cash used in investing activities

(415

)

(2,207

)

Net cash used in financing activities

(3,426

)

(1,361

)

Effect of exchange rate changes on cash and cash equivalents

19

(18

)

Net change in cash and cash equivalents

(2,065

)

(1,367

)

Cash and cash equivalents at beginning of period

9,991

6,085

Cash and cash equivalents at end of period

$

7,926

$

4,718

Three Months Ended

March 31,

(in millions)

2025

2024

Net cash provided by operating activities

$

1,757

$

2,219

Purchases of property, plant and equipment

(104

)

(105

)

Free cash flow(1)

$

1,653

$

2,114

(1)

Free cash flow is a non-GAAP liquidity measure. Please refer to our disclosures in the Non-GAAP Financial Information section above.

GILEAD SCIENCES, INC.

PRODUCT SALES SUMMARY

(unaudited)

Three Months Ended

March 31,

(in millions)

2025

2024

HIV

Biktarvy – U.S.

$

2,474

$

2,315

Biktarvy – Europe

375

365

Biktarvy – Rest of World

301

265

3,150

2,946

Descovy – U.S.

538

371

Descovy – Europe

21

26

Descovy – Rest of World

27

29

586

426

Genvoya – U.S.

305

332

Genvoya – Europe

40

49

Genvoya – Rest of World

19

21

364

403

Odefsey – U.S.

215

223

Odefsey – Europe

57

76

Odefsey – Rest of World

10

11

281

310

Symtuza - Revenue share(1) – U.S.

82

104

Symtuza - Revenue share(1) – Europe

29

33

Symtuza - Revenue share(1) – Rest of World

3

3

114

141

Other HIV(2) – U.S.

50

60

Other HIV(2) – Europe

31

45

Other HIV(2) – Rest of World

10

12

91

117

Total HIV – U.S.

3,664

3,405

Total HIV – Europe

553

596

Total HIV – Rest of World

370

342

4,587

4,342

Liver Disease

Sofosbuvir / Velpatasvir(3) – U.S.

166

248

Sofosbuvir / Velpatasvir(3) – Europe

80

79

Sofosbuvir / Velpatasvir(3) – Rest of World

99

78

346

405

Vemlidy – U.S.

100

95

Vemlidy – Europe

12

11

Vemlidy – Rest of World

140

119

252

225

Other Liver Disease(4) – U.S.

68

42

Other Liver Disease(4) – Europe

76

47

Other Liver Disease(4) – Rest of World

17

19

161

107

Total Liver Disease – U.S.

335

385

Total Liver Disease – Europe

168

137

Total Liver Disease – Rest of World

256

215

758

737

Veklury

Veklury – U.S.

199

315

Veklury – Europe

22

70

Veklury – Rest of World

82

169

302

555

GILEAD SCIENCES, INC.

PRODUCT SALES SUMMARY - (Continued)

(unaudited)

Three Months Ended

March 31,

(in millions)

2025

2024

Oncology

Cell Therapy

Tecartus – U.S.

40

55

Tecartus – Europe

31

36

Tecartus – Rest of World

8

8

78

100

Yescarta – U.S.

160

170

Yescarta – Europe

149

158

Yescarta – Rest of World

77

52

386

380

Total Cell Therapy – U.S.

200

225

Total Cell Therapy – Europe

180

195

Total Cell Therapy – Rest of World

84

60

464

480

Trodelvy

Trodelvy – U.S.

181

206

Trodelvy – Europe

75

68

Trodelvy – Rest of World

37

36

293

309

Total Oncology – U.S.

381

431

Total Oncology – Europe

255

262

Total Oncology – Rest of World

121

96

757

789

Other

AmBisome – U.S.

5

14

AmBisome – Europe

67

70

AmBisome – Rest of World

66

60

139

144

Other(5) – U.S.

47

59

Other(5) – Europe

9

9

Other(5) – Rest of World

14

12

70

80

Total Other – U.S.

52

73

Total Other – Europe

76

79

Total Other – Rest of World

81

71

209

224

Total product sales – U.S.

4,631

4,609

Total product sales – Europe

1,073

1,144

Total product sales – Rest of World

909

894

$

6,613

$

6,647

(1)

Represents Gilead’s revenue from cobicistat (“C”), FTC and TAF in Symtuza (darunavir/C/FTC/TAF), a fixed dose combination product commercialized by Janssen Sciences Ireland Unlimited Company.

(2)

Includes Atripla, Complera/Eviplera, Emtriva, Sunlenca, Stribild, Truvada and Tybost.

(3)

Includes Epclusa and the authorized generic version of Epclusa sold by Gilead’s separate subsidiary, Asegua Therapeutics LLC (“Asegua”).

(4)

Includes ledipasvir/sofosbuvir (Harvoni and the authorized generic version of Harvoni sold by Asegua), Hepcludex, Hepsera, Livdelzi/Lyvdelzi, Sovaldi, Viread and Vosevi.

(5)

Includes Cayston, Jyseleca, Letairis and Zydelig.

临床结果临床3期财报临床2期临床1期

2025-04-24

Product Sales Excluding Veklury Increased 4% Year-Over-Year to $6.3 billion

Biktarvy Sales Increased 7% Year-Over-Year to $3.1 billion

FOSTER CITY, Calif.--(BUSINESS WIRE)-- Gilead Sciences, Inc. (Nasdaq: GILD) announced today its first quarter 2025 results of operations.

“Gilead had a strong start to the year driven by excellent commercial and clinical execution along with disciplined expense management,” said Daniel O’Day, Gilead’s Chairman and Chief Executive Officer. “Our base business grew 4% year-over-year, primarily led by Biktarvy’s continued strength, and we announced positive topline Phase 3 results for Trodelvy plus pembrolizumab in first line PD-L1+ metastatic triple negative breast cancer. With the upcoming June PDUFA date for lenacapavir for HIV prevention, and continued progress across our diverse pipeline, we look forward to building on our positive momentum throughout the year.”

First Quarter 2025 Financial Results

Total first quarter 2025 revenue of $6.7 billion remained flat compared to the same period in 2024, with lower Veklury® (remdesivir) and Oncology sales offset by higher HIV and Liver Disease sales. Diluted earnings (loss) per share (“EPS”) was $1.04 in the first quarter 2025 compared to $(3.34) in the same period in 2024. The increase was primarily driven by prior year charges that did not repeat, including the impact of a $3.9 billion acquired in-process research and development ("IPR&D") expense related to the acquisition of CymaBay Therapeutics, Inc. (“CymaBay”), as well as a pre-tax IPR&D impairment of $2.4 billion related to assets acquired by Gilead from Immunomedics, Inc. (“Immunomedics”) in 2020. This increase was partially offset by higher tax expense and higher net unrealized losses on equity investments in the first quarter 2025. Non-GAAP diluted EPS was $1.81 in the first quarter 2025 compared to $(1.32) in the same period in 2024. The increase was primarily driven by the prior year IPR&D expense related to the CymaBay acquisition. As of March 31, 2025, Gilead had $7.9 billion of cash and cash equivalents compared to $10.0 billion as of December 31, 2024. During the first quarter 2025, Gilead generated $1.8 billion in operating cash flow. During the first quarter 2025, Gilead paid dividends of $1.0 billion and repurchased $730 million of common stock. In addition, Gilead repaid $1.8 billion of Senior Notes in February 2025.

First Quarter 2025 Product Sales

Total first quarter 2025 product sales decreased 1% to $6.6 billion compared to the same period in 2024. Total first quarter 2025 product sales excluding Veklury increased 4% to $6.3 billion compared to the same period in 2024, primarily due to higher HIV and Liver Disease sales, partially offset by lower Oncology sales.

HIV product sales increased 6% to $4.6 billion in the first quarter 2025 compared to the same period in 2024, primarily driven by higher average realized price and demand.

Biktarvy®(bictegravir 50mg/emtricitabine (“FTC”) 200mg/tenofovir alafenamide (“TAF”) 25mg) sales increased 7% to $3.1 billion in the first quarter 2025 compared to the same period in 2024, primarily driven by higher demand. Descovy®(FTC 200mg/TAF 25mg) sales increased 38% to $586 million in the first quarter 2025 compared to the same period in 2024, primarily driven by higher average realized price and higher demand.

The Liver Disease portfolio sales increased 3% to $758 million in the first quarter 2025 compared to the same period in 2024. This was primarily driven by increased demand in products for primary biliary cholangitis (“PBC”), chronic hepatitis B virus (“HBV”) and chronic hepatitis delta virus (“HDV”), partially offset by lower average realized price for chronic hepatitis C virus (“HCV”) products.

Veklury sales decreased 45% to $302 millionin the first quarter 2025 compared to the same period in 2024, primarily driven by lower rates of COVID-19 related hospitalizations across regions.

Cell Therapy product sales decreased 3% to $464 million in the first quarter 2025 compared to the same period in 2024.

Yescarta® (axicabtagene ciloleucel) sales increased 2% to $386 million in the first quarter 2025 compared to the same period in 2024, primarily driven by higher average realized price and increased rest of world demand, partially offset by lower demand in the United States. Tecartus® (brexucabtagene autoleucel) sales decreased 22% to $78 million in the first quarter 2025 compared to the same period in 2024, primarily reflecting lower demand in the United States.

Trodelvy® (sacituzumab govitecan-hziy) sales decreased 5% to $293 million in the first quarter 2025 compared to the same period in 2024, primarily driven by inventory dynamics and lower average realized price, partially offset by higher demand.

First Quarter 2025 Product Gross Margin, Operating Expenses and Effective Tax Rate

Product gross margin was 76.7% in the first quarter 2025 compared to 76.6% in the same period in 2024. Non-GAAP product gross margin was 85.5% in the first quarter 2025 compared to 85.4% in the same period in 2024. Research and development (“R&D”) expenses were $1.4 billion in the first quarter 2025 compared to $1.5 billion in the same period in 2024, primarily due to lower clinical manufacturing activities and prior year CymaBay acquisition-related expenses that did not repeat. Non-GAAP R&D expenses were $1.3 billion in the first quarter 2025 compared to $1.4 billion in the same period in 2024, primarily due to lower clinical manufacturing activities. Acquired IPR&D expenses were $253 million in the first quarter 2025, primarily reflecting expenses related to the strategic partnership with LEO Pharma A/S (“LEO Pharma”) announced in January 2025. Selling, general and administrative (“SG&A”) expenses were $1.3 billion in the first quarter 2025 compared to $1.4 billion in the same period in 2024, primarily driven by prior year CymaBay acquisition-related expenses that did not repeat as well as lower corporate expenses, partially offset by incremental selling and marketing expenses in the United States. Non-GAAP SG&A expenses were $1.2 billion in the first quarter 2025 compared to $1.3 billion in the same period in 2024. This was primarily driven by lower corporate expenses, partially offset by incremental selling and marketing expenses in the United States. The effective tax rate (“ETR”) was 20.2% in the first quarter 2025 compared to 7.0% in the same period in 2024, and the non-GAAP ETR was 16.3% in the first quarter 2025 compared to (29.8)% in the same period in 2024. These changes primarily reflect the prior year non-deductible acquired IPR&D charge related to the CymaBay acquisition, and higher tax benefits from stock-based compensation.

Guidance and Outlook

For the full-year, Gilead expects:

(in millions, except per share amounts)

April 24, 2025 Guidance

Low End

High End

Comparison to Prior Guidance

Product sales

$

28,200

$

28,600

Unchanged

Product sales excluding Veklury

$

26,800

$

27,200

Unchanged

Veklury

$

1,400

$

1,400

Unchanged

Diluted EPS

$

5.65

$

6.05

Previously $5.95 to $6.35

Non-GAAP diluted EPS

$

7.70

$

8.10

Unchanged

Additional information and a reconciliation between GAAP and non-GAAP financial information for the 2025 guidance is provided in the accompanying tables. The financial guidance is subject to a number of risks and uncertainties. See the Forward-Looking Statements section below.

Key Updates Since Our Last Quarterly Release

Virology

Announced FDA accepted New Drug Application submissions for twice-yearly lenacapavir for HIV prevention under priority review, with a PDUFA date of June 19, 2025. Announced the European Medicines Agency validated the Marketing Authorization Application and EU-Medicines for All application for twice-yearly lenacapavir for HIV prevention, which will undergo parallel reviews under an Accelerated Assessment timeline. Presented initial Phase 1 data evaluating investigational once-yearly lenacapavir for HIV prevention at the Conference on Retroviruses and Opportunistic Infections (“CROI”), and announced plans to launch a Phase 3 study in the second half of 2025. Presented HIV treatment research data at CROI, including long-term outcomes evaluating the use of Biktarvy in people with HIV/HBV coinfection and the primary results of a Phase 2 study evaluating the investigational combination regimen of lenacapavir and broadly neutralizing antibodies teropavimab and zinlirvimab.

Oncology

Announced Trodelvy plus Keytruda® (pembrolizumab) demonstrated a statistically significant and clinically meaningful improvement in progression free survival in patients with previously untreated PD-L1+ unresectable locally advanced or metastatic triple-negative breast cancer in the Phase 3 ASCENT-04 trial. The use of Trodelvy plus Keytruda is investigational in this setting.

Inflammation

Received conditional marketing authorization from the European Commission for seladelpar for the treatment of PBC in combination with ursodeoxycholic acid (“UDCA”) in adults who have an inadequate response to UDCA alone, or as monotherapy in those unable to tolerate UDCA.

Corporate

The Board declared a quarterly dividend of $0.79 per share of common stock for the second quarter of 2025. The dividend is payable on June 27, 2025, to stockholders of record at the close of business on June 13, 2025. Future dividends will be subject to Board approval.

Certain amounts and percentages in this press release may not sum or recalculate due to rounding.

Conference Call

At 1:30 p.m. Pacific Time today, Gilead will host a conference call to discuss Gilead’s results. A live webcast will be available on http://investors.gilead.com and will be archived on www.gilead.com for one year.

Non-GAAP Financial Information

The information presented in this document has been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), unless otherwise noted as non-GAAP. Management believes non-GAAP information is useful for investors, when considered in conjunction with Gilead’s GAAP financial information, because management uses such information internally for its operating, budgeting and financial planning purposes. Non-GAAP information is not prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of Gilead’s operating results as reported under GAAP. Non-GAAP financial information generally excludes acquisition-related expenses including amortization of acquired intangible assets and other items that are considered unusual or not representative of underlying trends of Gilead’s business, fair value adjustments of equity securities and discrete and related tax charges or benefits associated with such exclusions as well as changes in tax-related laws and guidelines, transfers of intangible assets between certain legal entities, and legal entity restructurings. Although Gilead consistently excludes the amortization of acquired intangible assets from the non-GAAP financial information, management believes that it is important for investors to understand that such intangible assets were recorded as part of acquisitions and contribute to ongoing revenue generation.Non-GAAP measures may be defined and calculated differently by other companies in the same industry. Reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures are provided in the accompanying tables.

About Gilead Sciences

Gilead Sciences, Inc. is a biopharmaceutical company that has pursued and achieved breakthroughs in medicine for more than three decades, with the goal of creating a healthier world for all people. The company is committed to advancing innovative medicines to prevent and treat life-threatening diseases, including HIV, viral hepatitis, COVID-19, cancer and inflammation. Gilead operates in more than 35 countries worldwide, with headquarters in Foster City, California.

Forward-Looking Statements

Statements included in this press release that are not historical in nature are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Gilead cautions readers that forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include those relating to: Gilead’s ability to achieve its full year 2025 financial guidance, including as a result of the uncertainty of the amount and timing of Veklury revenues, the impact of the Inflation Reduction Act, changes in U.S. regulatory or legislative policies, and changes in U.S. trade policies, including tariffs; Gilead’s ability to make progress on any of its long-term ambitions or priorities laid out in its corporate strategy; Gilead’s ability to accelerate or sustain revenues for its virology, oncology and other programs; Gilead’s ability to realize the potential benefits of acquisitions, collaborations or licensing arrangements, including the acquisitions of CymaBay and Immunomedics, and the arrangement with LEO Pharma; patent protection and estimated loss of exclusivity for our products and product candidates; Gilead’s ability to initiate, progress or complete clinical trials within currently anticipated timeframes or at all, the possibility of unfavorable results from ongoing and additional clinical trials, including those involving Biktarvy, Trodelvy, lenacapavir, teropavimab and zinlirvimab, and the risk that safety and efficacy data from clinical trials may not warrant further development of Gilead’s product candidates or the product candidates of Gilead’s strategic partners; Gilead’s ability to submit new drug applications for new product candidates or expanded indications in the currently anticipated timelines, including for lenacapavir for HIV PrEP; Gilead’s ability to receive or maintain regulatory approvals in a timely manner or at all, including for lenacapavir for PrEP, and the risk that any such approvals, if granted, may be subject to significant limitations on use and may be subject to withdrawal or other adverse actions by the applicable regulatory authority; Gilead’s ability to successfully commercialize its products; the risk of potential disruptions to the manufacturing and supply chain of Gilead’s products; pricing and reimbursement pressures from government agencies and other third parties, including required rebates and other discounts; a larger than anticipated shift in payer mix to more highly discounted payer segments; market share and price erosion caused by the introduction of generic versions of Gilead products; the risk that physicians and patients may not see advantages of Gilead’s products over other therapies and may therefore be reluctant to prescribe the products, including Livdelzi/Lyvdelzi; and other risks identified from time to time in Gilead’s reports filed with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. In addition, Gilead makes estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses and related disclosures. Gilead bases its estimates on historical experience and on various other market specific and other relevant assumptions that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. There may be other factors of which Gilead is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ significantly from these estimates. Further, results for the quarter ended March 31, 2025 are not necessarily indicative of operating results for any future periods. Gilead directs readers to its press releases, annual reports on Form 10-K, quarterly reports on Form 10-Q and other subsequent disclosure documents filed with the SEC. Gilead claims the protection of the Safe Harbor contained in the Private Securities Litigation Reform Act of 1995 for forward-looking statements.

The reader is cautioned that forward-looking statements are not guarantees of future performance and is cautioned not to place undue reliance on these forward-looking statements. All forward-looking statements are based on information currently available to Gilead and Gilead assumes no obligation to update or supplement any such forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statements.

Additional information is available on our Investor Relations website, https://investors.gilead.com. Among other things, an estimate of Acquired IPR&D expenses is expected to be made available on the Quarterly Results page within the first ten (10) days after the end of each quarter.

Gilead owns or has rights to various trademarks, copyrights and trade names used in its business, including the following: GILEAD®, GILEAD SCIENCES®, KITE™, AMBISOME®, ATRIPLA®, BIKTARVY®, CAYSTON®, COMPLERA®, DESCOVY®, DESCOVY FOR PREP®, EMTRIVA®, EPCLUSA®, EVIPLERA®, GENVOYA®, HARVONI®, HEPCLUDEX®, HEPSERA®, JYSELECA®, LIVDELZI®/LYVDELZI®, LETAIRIS®, ODEFSEY®, SOVALDI®, STRIBILD®, SUNLENCA® , TECARTUS®, TRODELVY®, TRUVADA®, TRUVADA FOR PREP®, TYBOST®, VEKLURY®, VEMLIDY®, VIREAD®, VOSEVI®, YESCARTA® and ZYDELIG®.

For more information on Gilead Sciences, Inc., please visit www.gilead.com or call the Gilead Public Affairs Department at 1-800-GILEAD-5 (1-800-445-3235).

GILEAD SCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

Three Months Ended

March 31,

(in millions, except per share amounts)

2025

2024

Revenues:

Product sales

$

6,613

$

6,647

Royalty, contract and other revenues

54

39

Total revenues

6,667

6,686

Costs and expenses:

Cost of goods sold

1,540

1,552

Research and development expenses

1,379

1,520

Acquired in-process research and development expenses

253

4,131

In-process research and development impairments

—

2,430

Selling, general and administrative expenses

1,258

1,375

Total costs and expenses

4,430

11,008

Operating income (loss)

2,237

(4,322

)

Interest expense

260

254

Other (income) expense, net

328

(91

)

Income (loss) before income taxes

1,649

(4,486

)

Income tax expense (benefit)

334

(315

)

Net income (loss)

1,315

(4,170

)

Net income attributable to noncontrolling interest

—

—

Net income (loss) attributable to Gilead

$

1,315

$

(4,170

)

Basic earnings (loss) per share attributable to Gilead

$

1.06

$

(3.34

)

Diluted earnings (loss) per share attributable to Gilead

$

1.04

$

(3.34

)

Shares used in basic earnings (loss) per share attributable to Gilead calculation

1,246

1,247

Shares used in diluted earnings (loss) per share attributable to Gilead calculation

1,259

1,247

Supplemental Information:

Cash dividends declared per share

$

0.79

$

0.77

Product gross margin

76.7

%

76.6

%

Research and development expenses as a % of revenues

20.7

%

22.7

%

Selling, general and administrative expenses as a % of revenues

18.9

%

20.6

%

Operating margin

33.6

%

(64.6

)%

Effective tax rate

20.2

%

7.0

%

GILEAD SCIENCES, INC.

TOTAL REVENUE SUMMARY

(unaudited)

Three Months Ended

March 31,

(in millions, except percentages)

2025

2024

Change

Product sales:

HIV

$

4,587

$

4,342

6%

Liver Disease

758

737

3%

Oncology

757

789

(4)%

Other

209

224

(7)%

Total product sales excluding Veklury

6,311

6,092

4%

Veklury

302

555

(45)%

Total product sales

6,613

6,647

(1)%

Royalty, contract and other revenues

54

39

37%

Total revenues

$

6,667

$

6,686

—%

GILEAD SCIENCES, INC.

NON-GAAP FINANCIAL INFORMATION(1)

(unaudited)

Three Months Ended

March 31,

(in millions, except percentages)

2025

2024

Change

Non-GAAP:

Cost of goods sold

$

961

$

974

(1)%

Research and development expenses

$

1,338

$

1,403

(5)%

Acquired IPR&D expenses(2)

$

253

$

4,131

(94)%

Selling, general and administrative expenses

$

1,222

$

1,295

(6)%

Other (income) expense, net

$

(98

)

$

(104

)

(6)%

Diluted earnings (loss) per share attributable to Gilead

$

1.81

$

(1.32

)

NM

Shares used in non-GAAP diluted earnings (loss) per share attributable to Gilead calculation

1,259

1,247

1%

Product gross margin

85.5

%

85.4

%

12 bps

Research and development expenses as a % of revenues

20.1

%

21.0

%

-91 bps

Selling, general and administrative expenses as a % of revenues

18.3

%

19.4

%

-104 bps

Operating margin

43.4

%

(16.7

)%

NM

Effective tax rate

16.3

%

(29.8

)%

NM

(1)

Refer to Non-GAAP Financial Information section above for further disclosures on non-GAAP financial measures. A reconciliation between GAAP and non-GAAP financial information is provided in the tables below.

(2)

Equal to GAAP financial information.

GILEAD SCIENCES, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(unaudited)

Three Months Ended

March 31,

(in millions, except percentages and per share amounts)

2025

2024

Cost of goods sold reconciliation:

GAAP cost of goods sold

$

1,540

$

1,552

Acquisition-related – amortization(1)

(579

)

(579

)

Non-GAAP cost of goods sold

$

961

$

974

Product gross margin reconciliation:

GAAP product gross margin

76.7

%

76.6

%

Acquisition-related – amortization(1)

8.8

%

8.7

%

Non-GAAP product gross margin

85.5

%

85.4

%

Research and development expenses reconciliation:

GAAP research and development expenses

$

1,379

$

1,520

Acquisition-related – other costs(2)

(2

)

(66

)

Restructuring

(38

)

(50

)

Non-GAAP research and development expenses

$

1,338

$

1,403

IPR&D impairment reconciliation:

GAAP IPR&D impairment

$

—

$

2,430

IPR&D impairment

—

(2,430

)

Non-GAAP IPR&D impairment

$

—

$

—

Selling, general and administrative expenses reconciliation:

GAAP selling, general and administrative expenses

$

1,258

$

1,375

Acquisition-related – other costs(2)

—

(67

)

Restructuring

(36

)

(13

)

Non-GAAP selling, general and administrative expenses

$

1,222

$

1,295

Operating income (loss) reconciliation:

GAAP operating income (loss)

$

2,237

$

(4,322

)

Acquisition-related – amortization(1)

579

579

Acquisition-related – other costs(2)

2

133

Restructuring

74

63

IPR&D impairment

—

2,430

Non-GAAP operating income (loss)

$

2,893

$

(1,117

)

Operating margin reconciliation:

GAAP operating margin

33.6

%

(64.6

)%

Acquisition-related – amortization(1)

8.7

%

8.7

%

Acquisition-related – other costs(2)

—

%

2.0

%

Restructuring

1.1

%

0.9

%

IPR&D impairment

—

%

36.3

%

Non-GAAP operating margin

43.4

%

(16.7

)%

Other (income) expense, net reconciliation:

GAAP other (income) expense, net

$

328

$

(91

)

Loss from equity securities, net

(426

)

(14

)

Non-GAAP other (income) expense, net

$

(98

)

$

(104

)

Income (loss) before income taxes reconciliation:

GAAP income (loss) before income taxes

$

1,649

$

(4,486

)

Acquisition-related – amortization(1)

579

579

Acquisition-related – other costs(2)

2

133

Restructuring

74

63

IPR&D impairment

—

2,430

Loss from equity securities, net

426

14

Non-GAAP income (loss) before income taxes

$

2,731

$

(1,267

)

GILEAD SCIENCES, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION - (Continued)

(unaudited)

Three Months Ended

March 31,

(in millions, except percentages and per share amounts)

2025

2024

Income tax expense (benefit) reconciliation:

GAAP income tax expense (benefit)

$

334

$

(315

)

Income tax effect of non-GAAP adjustments:

Acquisition-related – amortization(1)

120

121

Acquisition-related – other costs(2)

—

30

Restructuring

14

10

IPR&D impairment

—

611

Loss (gain) from equity securities, net

20

(39

)

Discrete and related tax charges(3)

(42

)

(39

)

Non-GAAP income tax expense

$

446

$

379

Effective tax rate reconciliation:

GAAP effective tax rate

20.2

%

7.0

%

Income tax effect of above non-GAAP adjustments and discrete and related tax adjustments(3)

(3.9

)%

(36.8

)%

Non-GAAP effective tax rate

16.3

%

(29.8

)%

Net income (loss) attributable to Gilead reconciliation:

GAAP net income (loss) attributable to Gilead

$

1,315

$

(4,170

)

Acquisition-related – amortization(1)

459

458

Acquisition-related – other costs(2)

2

103

Restructuring

61

54

IPR&D impairment

—

1,819

Loss from equity securities, net

406

53

Discrete and related tax charges(3)

42

39

Non-GAAP net income (loss) attributable to Gilead

$

2,285

$

(1,644

)

Diluted earnings (loss) per share reconciliation:

GAAP diluted earnings (loss) per share

$

1.04

$

(3.34

)

Acquisition-related – amortization(1)

0.36

0.37

Acquisition-related – other costs(2)

—

0.08

Restructuring

0.05

0.04

IPR&D impairment

—

1.46

Loss from equity securities, net

0.32

0.04

Discrete and related tax charges(3)

0.03

0.03

Non-GAAP diluted earnings (loss) per share

$

1.81

$