预约演示

更新于:2025-09-28

Catalent, Inc.

更新于:2025-09-28

概览

标签

肿瘤

血液及淋巴系统疾病

免疫系统疾病

ADC

造血干细胞疗法

单克隆抗体

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 小分子化药 | 8 |

| ADC | 7 |

| 单克隆抗体 | 2 |

| 造血干细胞疗法 | 2 |

| 化学药 | 1 |

关联

21

项与 Catalent, Inc. 相关的药物作用机制 DAT拮抗剂 [+2] |

非在研适应症- |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2021-03-02 |

作用机制 CGRP receptor 拮抗剂 |

原研机构 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2020-02-27 |

作用机制 CSF-1R拮抗剂 [+2] |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2019-08-02 |

76

项与 Catalent, Inc. 相关的临床试验CTR20251810

BRISOTE:一项在接受中剂量吸入性皮质类固醇联合长效 β2-激动剂治疗后控制不佳的嗜酸性粒细胞哮喘患者中评估皮下注射本瑞利珠单抗 30 mg 的疗效和安全性的多中心、随机、双盲、平行组、阳性对照、IIIb 期研究

主要目的:在接受中剂量ICS-LABA治疗后控制不佳的嗜酸性粒细胞哮喘患者中通过比较加用本瑞利珠单抗与高剂量ICS-LABA递增治疗评估本瑞利珠单抗对哮喘加重率的影响

次要目的:在接受中剂量ICS-LABA治疗后控制不佳的嗜酸性粒细胞哮喘患者中通过比较加用本瑞利珠单抗与高剂量ICS-LABA递增治疗,评估本瑞利珠单抗对患者报告疾病特定生活质量的影响、对肺功能的影响、对患者报告的哮喘控制、生活质量和生产力损失的影响、对至首次哮喘加重的时间的影响、对因哮喘而进行急诊室/紧急护理访视和住院的影响、对4分量临床缓解复合指标的影响

安全性目的:在接受中剂量ICS-LABA治疗后控制不佳的嗜酸性粒细胞哮喘患者中通过比较加用本瑞利珠单抗与高剂量ICS-LABA递增治疗描述本瑞利珠单抗的安全性和耐受性 探索性目的:在接受中剂量ICS-LABA治疗后控制不佳的嗜酸性粒细胞哮喘患者中通过比较加用本瑞利珠单抗与高剂量ICS-LABA递增治疗,评估本瑞利珠单抗对血生物标志物的影响、描述本瑞利珠单抗对3分量和附加的4分量临床缓解复合指标的影响

开始日期2025-08-12 |

申办/合作机构 AstraZeneca AB [+2] |

CTR20252479

一项在中度至重度化脓性汗腺炎受试者中评价Tulisokibart的有效性和安全性的IIb期、随机、双盲、安慰剂对照研究

评估tulisokibart在中度至重度化脓性汗腺炎受试者中的有效性、安全性和耐受性。

开始日期2025-07-18 |

申办/合作机构  默沙东研发(中国)有限公司 默沙东研发(中国)有限公司 [+2] |

CTR20250682

一项在肺高血压母研究中接受研究药物给药的受试者中进行长期随访的前瞻性、开放标签、平台研究。干预特定附录A副标题:一项在肺高血压母研究中使用口服马昔腾坦的受试者中进行长期随访的前瞻性、开放标签、平台研究。

评价接受治疗的受试者接受相应研究药物治疗的长期安全性

开始日期2025-04-24 |

申办/合作机构 Catalent CTS LLC [+6] |

100 项与 Catalent, Inc. 相关的临床结果

登录后查看更多信息

0 项与 Catalent, Inc. 相关的专利(医药)

登录后查看更多信息

77

项与 Catalent, Inc. 相关的文献(医药)2025-09-01·Biochemistry and Biophysics Reports

Novel and efficient synthesis of 5-chloro-6-methoxy-3-(2-((1-(aryl)-1H-1,2,3-triazol-4-yl)methoxy)ethyl)benzo[d]isoxazole derivatives as new α-glucosidase inhibitors

Article

作者: Mudireddy, Ram Reddy ; Burle, Gowri Sankararao ; Jonnalagadda, Sreekantha B ; Gundla, Rambabu ; Velavalapalli, Vani Madhuri ; Koraboina, Chandra Prakash ; Katari, Naresh Kumar ; Sarma Dhulipalla, Venkata Veernjaneya

A new series of benzisoxazole derivatives (9a-o) were designed by using molecular hybridization approach and synthesized via click-chemistry. All the synthesized compounds were evaluated for their α-glucosidase enzyme inhibition and antibacterial activity. All tested compounds (9a-o) exhibited a promising α-glucosidase inhibitory activity with IC50 range of 14.69-38.71 nmol in comparison with the positive drug Acarbose (IC50 35.91 nmol). Additionally, these compounds have found to be active against B. cereus and E. coli. The in vitro inhibition results supported to in silico. Additionally, the compounds were subjected to computational drug-likeness/ADME testing, which revealed that this all the compounds had good ADME profiles in addition to exhibiting drug-like qualities. SAR indicates that analysis revealed that electron-withdrawing substituents such as Br and CF3 at specific positions significantly enhanced α-glucosidase inhibition, while unsubstituted and ortho-methoxy phenyl derivatives also showed potent activity, highlighting the benzo[d]isoxazole-triazole scaffold as a promising pharmacophore for developing novel anti-diabetic agents.

2025-01-01·EUROPEAN JOURNAL OF PHARMACEUTICAL SCIENCES

Exploring pharmaceutical powder behavior in commercial-scale bin blending: A DEM simulation study

Article

作者: Benque, B ; Schaefer, M ; Santangelo, M T ; Mostafaei, F. ; Gomes Lopes, D ; Jajcevic, D. ; Gomes Lopes, D. ; Jajcevic, D ; Lee, H G ; Doshi, P ; Schaefer, M. ; Lee, H.G. ; Benque, B. ; Mostafaei, F ; Khinast, J G ; Santangelo, M.T. ; Doshi, P. ; Khinast, J.G.

Bin blending is one of the main steps in pharmaceutical production processes. Commercial-scale production of expensive products typically does not allow to perform a large number of experiments in order to optimize the process. Alternatively, Discrete Element Method (DEM) simulations can be used to evaluate the powder behavior (flow and blending pattern) during blending, identify the risks (e.g., segregation), and provide solutions to mitigate them. In this work, DEM simulations are used to investigate the blending of two granulated powders in commercial-scale cone and cylindrical (hoop) blenders. The DEM contact model parameters were calibrated based on the experimental compression and ring shear tests for both granulated powders to mimic the bulk powder behavior in the simulations. The model's output was compared to the experiments in one of the blending cases. The blending efficiency in the cone blenders was evaluated considering the fill levels, the presence of baffles, the rotating directions, the filling order, and the bin sizes. Furthermore, for the hoop blenders, the effects of blender's angle, rotation speed, and filling order were addressed. The main findings of the work were that, in cone blenders, the blending can be improved by introducing baffles and changing in the rotational direction frequently. In hoop blenders, blending can be improved by increasing the inclination angle from the horizontal plane and the rotational speed.

2024-12-01·Acta Crystallographica Section B-Structural Science Crystal Engineering and Materials

The seventh blind test of crystal structure prediction: structure generation methods

Article

A seventh blind test of crystal structure prediction was organized by the Cambridge Crystallographic Data Centre featuring seven target systems of varying complexity: a silicon and iodine-containing molecule, a copper coordination complex, a near-rigid molecule, a cocrystal, a polymorphic small agrochemical, a highly flexible polymorphic drug candidate, and a polymorphic morpholine salt. In this first of two parts focusing on structure generation methods, many crystal structure prediction (CSP) methods performed well for the small but flexible agrochemical compound, successfully reproducing the experimentally observed crystal structures, while few groups were successful for the systems of higher complexity. A powder X-ray diffraction (PXRD) assisted exercise demonstrated the use of CSP in successfully determining a crystal structure from a low-quality PXRD pattern. The use of CSP in the prediction of likely cocrystal stoichiometry was also explored, demonstrating multiple possible approaches. Crystallographic disorder emerged as an important theme throughout the test as both a challenge for analysis and a major achievement where two groups blindly predicted the existence of disorder for the first time. Additionally, large-scale comparisons of the sets of predicted crystal structures also showed that some methods yield sets that largely contain the same crystal structures.

975

项与 Catalent, Inc. 相关的新闻(医药)2025-09-27

Welcome back to Endpoints Weekly, and thanks for starting your Saturday morning with us! It’s officially autumn, but the weather here in NYC hasn’t cooled off just yet. Here’s hoping we get a few more days of 70-degree temps before the season fully turns.

We had another busy week in biopharma, with no bigger headline than Pfizer jumping back into the obesity space. Our reporters had this story covered from every angle this week, so be sure to read all our in-depth articles in case you missed them earlier!

There was more news out of Washington, as President Donald Trump held a press conference to claim, despite conflicting evidence, that Tylenol use during pregnancy may cause or contribute to autism. Trump also threatened pharmaceutical tariffs against companies who don’t manufacture their drugs in the US, and his administration is expected to make a major drug pricing announcement next week.

Elsewhere, we have stories on a drug rejection and the end of Biogen’s AAV gene therapy work. Be sure to dive on in, and thanks again for reading.

— Max Gelman

No, it isn’t teaming up with Taylor Swift

or the baseball team from Queens. Rather, Pfizer

acquired the GLP-1 biotech Metsera

this week for $4.9 billion. The size of the deal can increase to $7.3 billion if all the milestones are reached.

Metsera’s most advanced drug,

a GLP-1 receptor agonist called MET-097i, is in Phase 2b testing. A once-weekly version of MET-097i is slated to enter Phase 3 in the first half of next year, and a once-monthly formulation is anticipated to begin in the second half of 2026. The biotech is also working on oral peptides.

The deal immediately makes Pfizer relevant in obesity again

after it sidelined an in-house drug earlier this year due to intolerable side effects. Pfizer will once again aim to take on the market’s GLP-1 leaders in Eli Lilly and Novo Nordisk, and they’ll likely need the Metsera programs to perform

as well as their competitors

, senior biopharma journalist Elizabeth Cairns writes.

Could the buyout also spark M&A from other companies?

That’s the question biotech correspondent Kyle LaHucik

posed

to analysts this week in the wake of Pfizer’s deal. Larger biopharmas much prefer acquisitions to licensing deals, one told Kyle, and it’s possible the industry could see such companies “tiptoeing” into more obesity deals. Read more

here

.

President Donald Trump

said

on Thursday night that drugmakers have until Oct. 1 to break ground on their manufacturing promises,

or face a 100% tariff on brand-name pharma products. In a post on Truth Social, he said the tariff would be imposed next week unless a company is “‘breaking ground’ and/or ‘under construction’” in the US.

At the end of the week, the biopharma industry was still trying to assess the situation.

Leerink analyst David Risinger said that “many large-cap biopharmaceutical companies should not be exposed because they are engaged in some sort of US facility construction activity, but it is difficult to predict which smaller US biopharma companies may face exposure.”

Meanwhile,

Endpoints News’

Max Bayer and Drew Armstrong

reported on Thursday

that the White House could make an announcement as soon as next week about its efforts to reduce drug prices, which could include an update on its most favored nation plan and other price policies. Stay tuned for more.

The FDA rejected Scholar Rock’s experimental spinal muscular atrophy drug apitegromab

after issues were found at a Novo Nordisk manufacturing site in Indiana. The company said the issues were not specific to apitegromab and that there were no concerns about the safety or efficacy of the drug. It plans to resubmit its application once the issues have been resolved.

Novo acquired the Catalent site from Novo Holdings last year.

Earlier this year, Regeneron received a complete response letter for Eylea HD after issues were found at the same Indiana site. At the time, Regeneron CEO Leonard Schleifer said the issues were “process” and “procedural” related, without going into much detail. Read more from Anna Brown

here.

The FDA

is calling on

GSK to update the label for a drug it stopped selling more than 28 years ago,

Zachary Brennan reported this week. The agency claimed a review of medical literature shows the now-generic drug, called leucovorin, might help with autism. During a press conference on Monday, Trump and HHS Secretary Robert F. Kennedy Jr. also claimed that, despite conflicting evidence, Tylenol use during pregnancy may be associated with autism.

Patricia Zettler, a professor at Ohio State University and former FDA lawyer, told Endpoints that the “FDA seems to be asking the NDA sponsor to add an indication to this drug, and from what we can tell from what is public, FDA is basing that request on information that seems quite different from what the agency would normally consider to be ‘substantial evidence’ of effectiveness, even for rare diseases.”

GSK told Endpoints that it would update the label, at the FDA’s request.

But the company said it had no plans to restart manufacturing.

The big biotech will end its work on gene therapies

that use adeno-associated viruses,

following in the footsteps

of other companies like Pfizer, Roche, Takeda and Vertex. AAV capsids are expensive to manufacture, and the therapies often carry multimillion-dollar price tags. Some also come with only modest efficacy.

It’s not the first time Biogen has cut back on gene therapy.

In 2023, early in CEO Chris Viehbacher’s tenure, the company deprioritized its preclinical AAV gene therapy work. But it didn’t scrap all of its early in-human programs. As recently as May, Biogen researchers presented the design of new viral vectors at a gene therapy conference.

并购基因疗法临床2期

2025-09-26

·医药健闻

全球医疗行业每日重点资讯

文 | 苏丁

企业动态

默克集团(Merck KGaA)正式宣布,现任电子业务CEO Kai Beckmann将自2026年5月1日起接任Belén Garijo,担任集团执行董事会主席兼首席执行官。Garijo将按计划在2026年4月底完成任期,以确保管理层平稳过渡。Beckmann即日起将担任副CEO,并继续负责电子业务直至继任者确定。Belén Garijo在默克任职15年,其中6年担任医疗健康业务CEO,自2021年起担任集团执行董事会主席兼CEO。在中国市场,Garijo大力拓展了默克医疗健康业务的布局。卸任后,她将继续活跃于医疗健康领域,专注于满足患者需求。

美国生物技术公司莫德纳新尖端研究中心在英国牛津郡启用。作为与英国政府十年战略合作的组成部分,莫德纳将向英国研发投资超过10亿英镑:以发现新疗法、创造就业机会,并增强疫情应对能力。

美国医疗用品制造商麦朗(Medline)正考虑最快于10月底提交首次公开募股(IPO)申请,若顺利推进,此次上市有望成为今年美国规模最大的IPO交易。麦朗此次IPO拟募资约50亿美元,其背后投资方包括黑石集团、凯雷集团与Hellman & Friedman。麦朗估值或最高达500亿美元。Medline主要生产医院与医疗机构使用的医疗用品,涵盖手套、手术衣、检查床等品类,目前在全球拥有超过4.3万名员工,2024年净销售额约为255亿美元。

Harbor Health从VillageMD收购了32家诊所,继续扩大其在德克萨斯州的临床足迹。该交易将公司的业务范围扩大到三个新市场:圣安东尼奥、埃尔帕索和达拉斯。Harbor Health还扩大了其在总部奥斯汀的既定临床足迹。此次收购使Harbor Health的临床业务几乎翻了两番,诊所总数从11家增加到43家,并增加80多名临床医生。

合同开发与制造组织(CDMO)Catalent Pharma Solutions宣布其位于美国佛罗里达州坦帕市的新全球总部正式启用。年初,Catalent宣布将从美国新泽西州萨默塞特的前总部迁出,在新泽西州布里奇沃特开设公司办公室,并在坦帕建立新的公司总部。此次进驻坦帕体现了公司在佛罗里达州的战略扩张。新总部毗邻位于圣彼得堡的50万平方英尺生产基地,该生产基地在当地深耕多年,拥有逾630名员工,是公司在北美地区主要的软胶囊研发与生产基地。

西门子医疗宣布参与CRISPR诊断specialist VedaBio的2500万美元A轮扩展融资并签署战略合作协议。这是VedaBio短期内完成的第二轮重磅融资。在此之前,该公司已在初始A轮融资中斩获4000万美元,由OMX Ventures独家领投。本次A轮扩展融资西门子医疗作为战略投资方强势入局,将融资总规模进一步扩大至6500万美元。

欧林生物公告,正在筹划发行境外股份(H股)并申请在香港联合交易所有限公司挂牌上市事宜。成立之初,公司便确立了“仿创结合、双轮驱动”的发展战略:一方面通过仿制药快速进入市场积累资本,另一方面聚焦创新疫苗研发以构筑核心竞争力。5月份,该公司重组金黄色葡萄球菌疫苗取得重要进展。

产业动态

瑞士制药商罗氏(Roche)的一种实验性减肥药已进入后期试验阶段,该公司表示,其目标是成为全球前三大减肥药生产商,与诺和诺德和礼来形成竞争。罗氏目前还没有任何批准上市的减肥药,该公司的目标是到2030年推出全套治疗方案。罗氏本周早些时候表示,其CT-388减肥注射剂已进入三期试验,这是公司寻求监管部门批准前的最后阶段。这标志着罗氏在肥胖症及相关疾病治疗方面的最新进展。

礼来已停止一项旨在防止肥胖患者肌肉过度流失的实验性药物研究,理由是出于战略性商业考量。此外,礼来还计划在印度推出其实验性减肥药orforpligron。该公司认为,在这个全球人口最多的国家,此类产品具有发展空间。

礼来公司宣布,欧盟委员会已批准其阿尔茨海默病治疗药物Kisunla(donanemab)上市,该药物用于治疗早期症状性阿尔茨海默病的特定情况。

百时美施贵宝将以优惠价格向符合条件的患者提供其中重度斑块状银屑病药物Sotyktu,价格比其当前标价低80%。此前该公司亦宣布针对抗凝血药Eliquis的折扣计划,以回应特朗普政府要求制药行业降低药品价格。

药明生物推出定点整合CHO细胞株开发平台TrueSite TI,凭借对抗体及复杂药物分子细胞株质量的显著优化、工艺放大的卓越稳定性,以及研发周期的大幅缩短,为创新生物药研发提供更具竞争优势的全新解决方案。定点整合是一种以精准化为核心的细胞工程技术,能够将目的蛋白导入宿主细胞中预先确定且经过严格验证的位点。TrueSite TI是药明生物WuXia第四代细胞株开发平台。

美国总统特朗普宣布从10月1日起对一批进口商品加征关税。其中,进入该国的“任何品牌或专利药品”将被征收100%的关税,但不适用于在美国当地建造制药厂的公司,涉及已动工或正在建设项目的公司将被豁免。

联系美通社

+86-10-5953 9500

info@prnasia.com

并购IPO高管变更

2025-09-26

·康泰伦特

此次搬迁彰显了公司在美国佛罗里达州的战略扩张,毗邻位于圣彼得堡的常驻生产基地,新总部旨在支持创新、协作与业务增长。

Catalent, Inc. 作为药品开发与供应领域的行业领导者,助力全球患者获得更优质的治疗方案。近日,公司宣布其位于美国佛罗里达州坦帕市的新全球总部正式启用。该尖端设施旨在彰显创新精神、协作理念与卓越品质,未来将支持公司呈现优质的服务和“患者至上”的企业理念,持续为制药、生物技术及消费者健康领域的客户创造价值。

Catalent 全球总部新貌

年初,Catalent宣布将从美国新泽西州萨默塞特的前总部迁出,在新泽西州布里奇沃特开设公司办公室,并在坦帕建立新的公司总部。此次进驻坦帕体现了公司在佛罗里达州的战略扩张。新总部毗邻位于圣彼得堡的50万平方英尺生产基地,该生产基地在当地深耕多年,拥有逾630名员工,是公司在北美地区主要的软胶囊研发与生产基地。

Catalent总裁兼首席执行官Alessandro Maselli表示:

“我们在坦帕市设立新全球总部,标志着公司发展历程中的重要里程碑,既体现了我们持续增长的雄心,也彰显了我们作为一家立足创新、卓越服务与诚信经营的企业所秉承的传统理念。” 近半个世纪以来,我们始终深耕坦帕地区。如今在圣彼得堡基地,我们提供从早期研发到大规模商业化生产的全流程服务。我们非常高兴能在此区域进一步拓展业务版图。"

(全球总部剪彩仪式)

Catalent公司同时还举行了剪彩仪式,庆祝新全球总部落成。出席活动的嘉宾包括Catalent高管及州、地方官员,其中有佛罗里达州商务厅厅长J. Alex Kelly、坦帕市市长Jane Castor、坦帕湾经济发展委员会主席兼首席执行官Craig Richard,以及圣彼得堡经济发展公司总裁兼首席执行官Mike Swesey。

Catalent新全球总部设立于美国银行广场41层,该42层甲级写字楼由Banyan Street Capital持有,坐落于坦帕市中心商务区核心地带,地址为佛罗里达州坦帕市肯尼迪大道东101号(邮编33602)。

关于Catalent(康泰伦特)

Catalent是一家全球领先的合同开发与制造组织(CDMO),致力于药品开发、生产和供应,助力人们生活的更美好、更健康。我们专注于为制药、生物技术及消费健康领域的客户提供无与伦比的服务,支持产品开发、上市及全生命周期供应。凭借在开发科学、给药技术及多模式生产领域深耕多年的丰富经验,Catalent每年助力加速开发项目进程,推动逾百种新产品上市。依托遍布全球的40余家生产基地和数千名科研人员与技术专家,以及最先进的技术平台,Catalent每年为患者提供数十亿剂改善健康、挽救生命的治疗药物。更多信息请访问www.catalent.com。

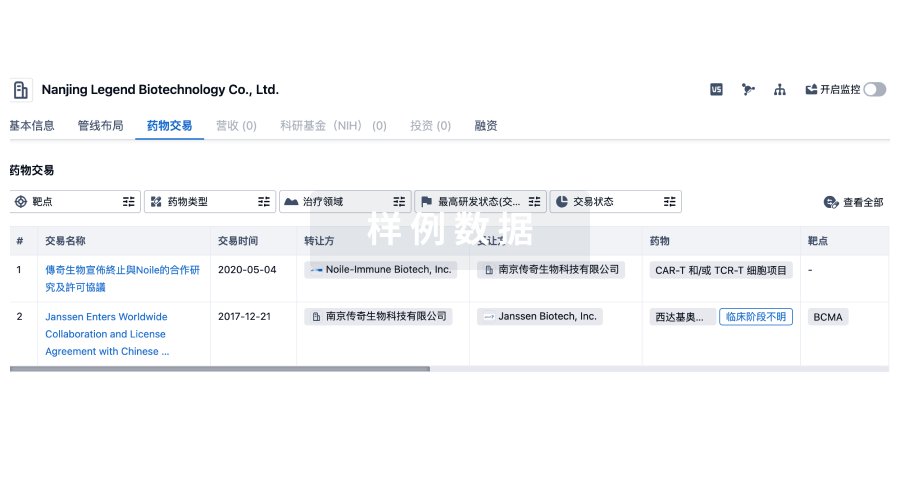

引进/卖出

100 项与 Catalent, Inc. 相关的药物交易

登录后查看更多信息

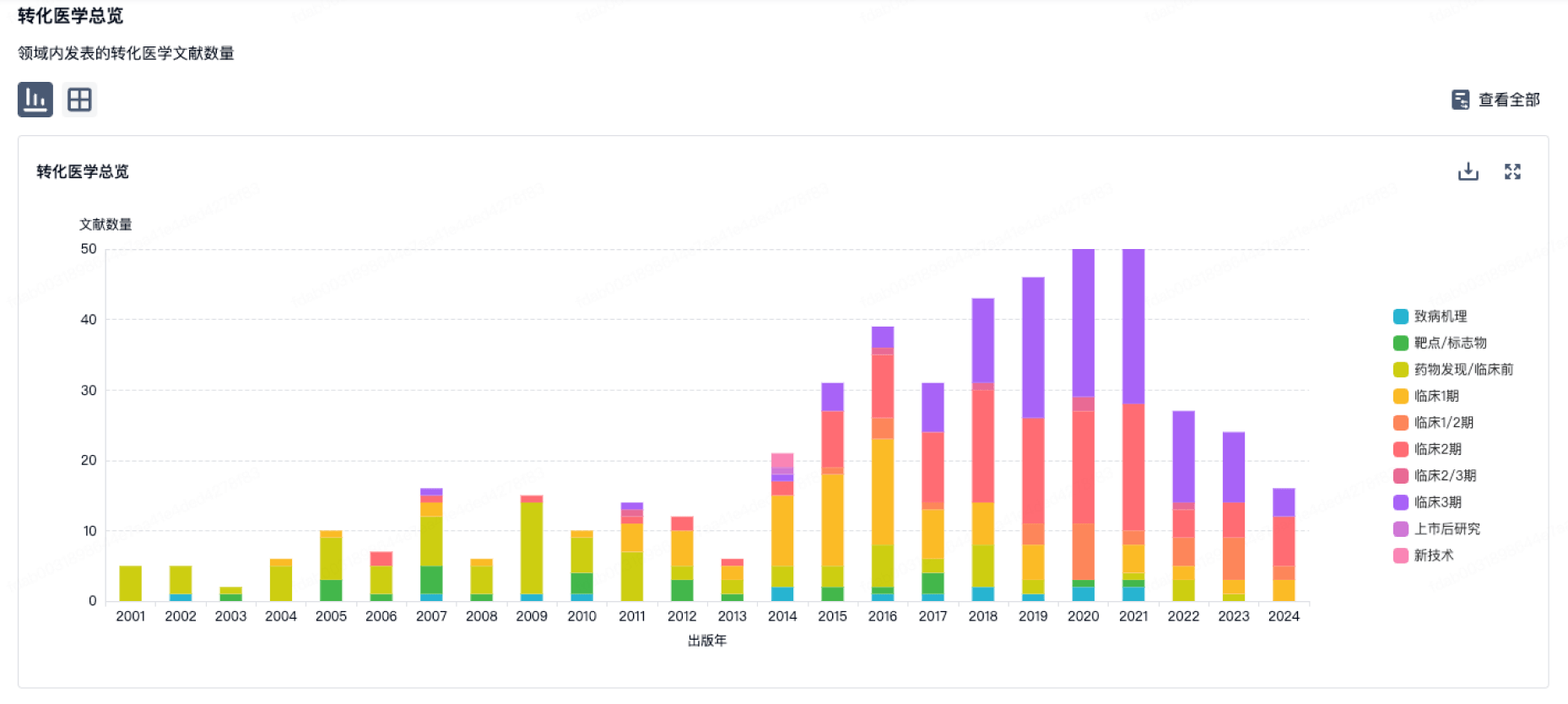

100 项与 Catalent, Inc. 相关的转化医学

登录后查看更多信息

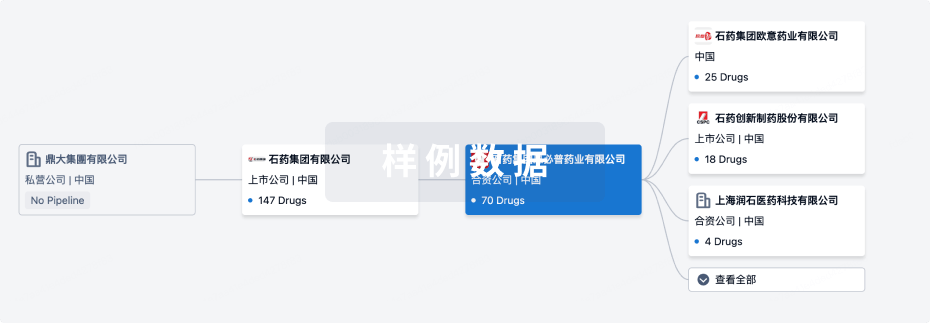

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年09月29日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

药物发现

2

8

临床前

临床2期

1

8

申请上市

批准上市

2

14

其他

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

枸橼酸他莫昔芬 ( ER ) | 非浸润性导管内癌 更多 | 批准上市 |

烟酰胺 ( PARP1 x SMPD3 ) | 糙皮病 更多 | 批准上市 |

盐酸吡昔替尼 ( CSF-1R x FLT3 x c-Kit ) | 腱鞘巨细胞瘤 更多 | 申请上市 |

硫酸瑞美吉泮 ( CGRP receptor ) | 偏头痛 更多 | 申请上市 |

塞利尼索 ( ACADS x XPO1 ) | 多发性骨髓瘤 更多 | 申请上市 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

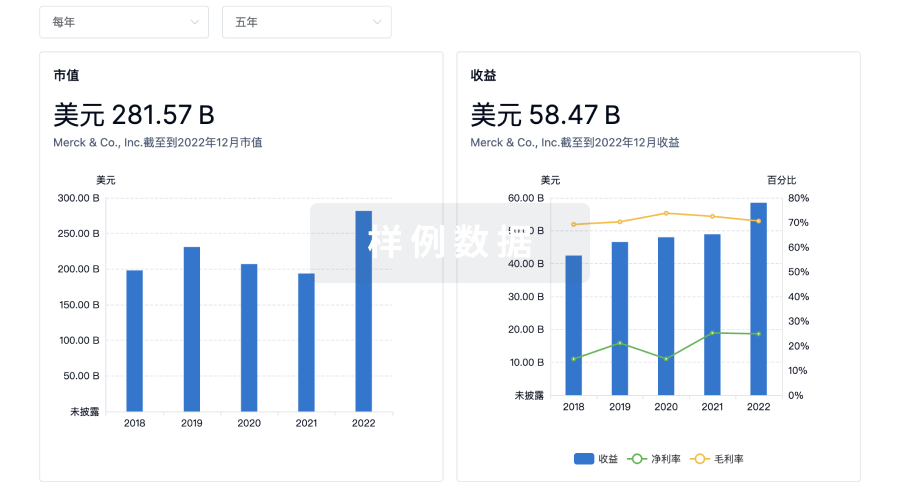

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用