预约演示

更新于:2025-08-12

Rituximab-arrx(Amgen, Inc.)

利妥昔单抗生物类似药(Amgen, Inc.)

更新于:2025-08-12

概要

基本信息

原研机构 |

非在研机构- |

权益机构- |

最高研发阶段批准上市 |

最高研发阶段(中国)- |

特殊审评- |

登录后查看时间轴

结构/序列

Sequence Code 27145L

当前序列信息引自: *****

Sequence Code 83181H

当前序列信息引自: *****

关联

7

项与 利妥昔单抗生物类似药(Amgen, Inc.) 相关的临床试验NCT05704400

Efficacy of Chimeric Monoclonal Anti-CD20 Antibodies (Rituximab Biosimilar) Associated With Monoclonal Anti-CD38 (Daratumumab) in the Treatment of Childhood Multidrug Dependent and Resistant (MDNS, MRNS) Nephrotic Syndrome

Nephrotic syndrome is considered a disease caused by an interplay of immunological stimuli with adaptive immunity(CD80/CD40) as trigger and Treg in the mid between co-stimulatory molecules and effectors. The positive effect of drugs blocking CD20 maturation in SDNS suggests a main role of these cells in regulating the system. Multidrug dependent, multidrug resistant nephrotic syndrome as well as post transplant FSGS recurrence patients can be considered difficult to treat patients and the association of two drugs, one targeting CD20 and a targeting plasmacells can be use in order to block the stimulatory cascade at more sites.

开始日期2023-03-01 |

申办/合作机构 |

NCT02994927

A Randomized, Double-Blind, Active-Controlled, Phase 3 Study to Evaluate the Safety and Efficacy of CCX168 (Avacopan) in Patients With ANCA-Associated Vasculitis Treated Concomitantly With Rituximab or Cyclophosphamide/Azathioprine

The primary objective is to evaluate the efficacy of CCX168 (avacopan) to induce and sustain remission in patients with active anti-neutrophil cytoplasmic antibody (ANCA)-associated vasculitis (AAV), when used in combination with cyclophosphamide followed by azathioprine, or in combination with rituximab.

开始日期2017-03-15 |

申办/合作机构 |

NCT02747043

A Randomized, Double-Blind Study Evaluating the Efficacy, Safety and Immunogenicity of ABP 798 Compared With Rituximab in Subjects With CD20 Positive B-Cell Non-Hodgkin Lymphoma (NHL)

This was a randomized, double-blind, active-controlled, multiple-dose, clinical similarity study to evaluate the efficacy, pharmacokinetics, pharmacodynamics, safety, tolerability and immunogenicity of ABP 798 compared with rituximab in subjects with grade 1, 2, or 3a follicular B-cell NHL and low tumor burden.

Subjects were randomized in a 1:1 ratio to receive a 375 mg/m^2 intravenous infusion of either ABP 798 or rituximab once weekly for 4 weeks followed by dosing at weeks 12 and 20.

Subjects were randomized in a 1:1 ratio to receive a 375 mg/m^2 intravenous infusion of either ABP 798 or rituximab once weekly for 4 weeks followed by dosing at weeks 12 and 20.

开始日期2016-05-25 |

申办/合作机构 |

100 项与 利妥昔单抗生物类似药(Amgen, Inc.) 相关的临床结果

登录后查看更多信息

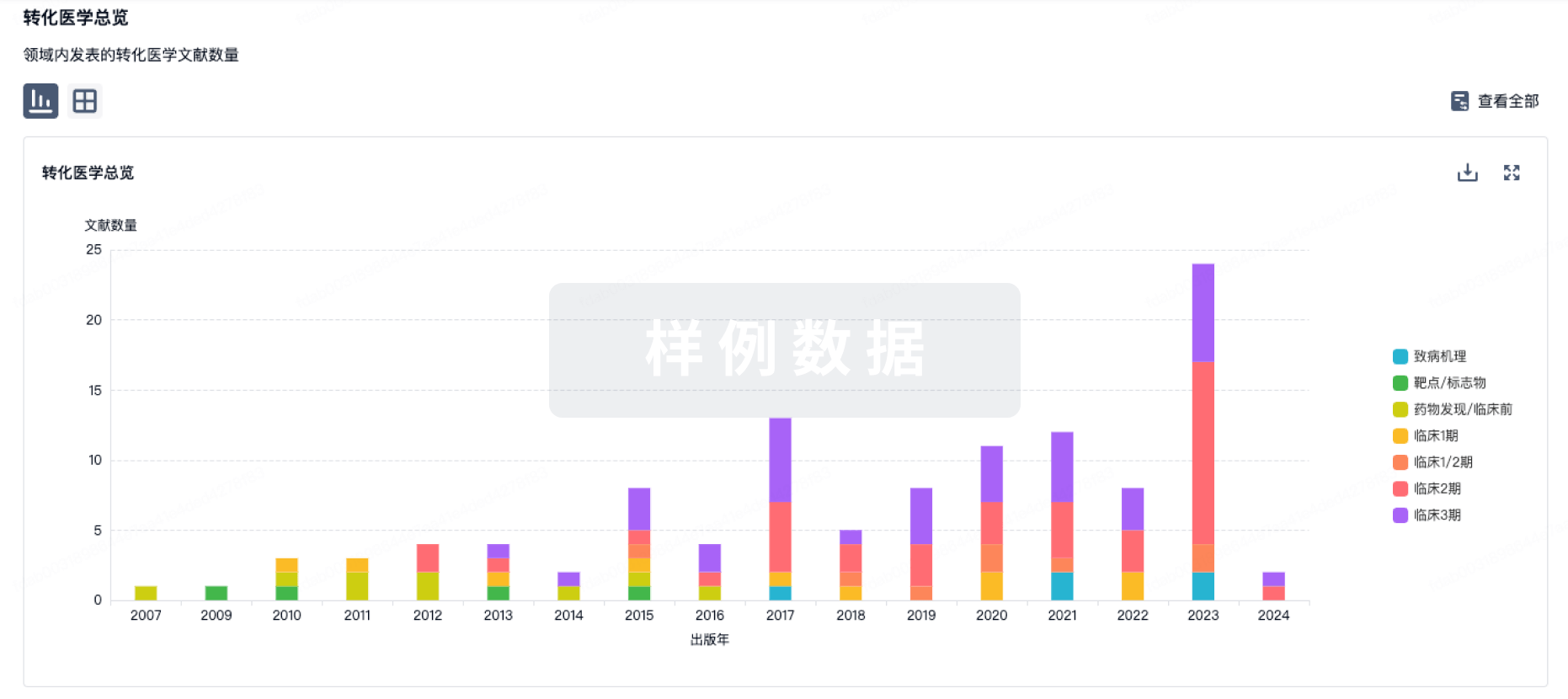

100 项与 利妥昔单抗生物类似药(Amgen, Inc.) 相关的转化医学

登录后查看更多信息

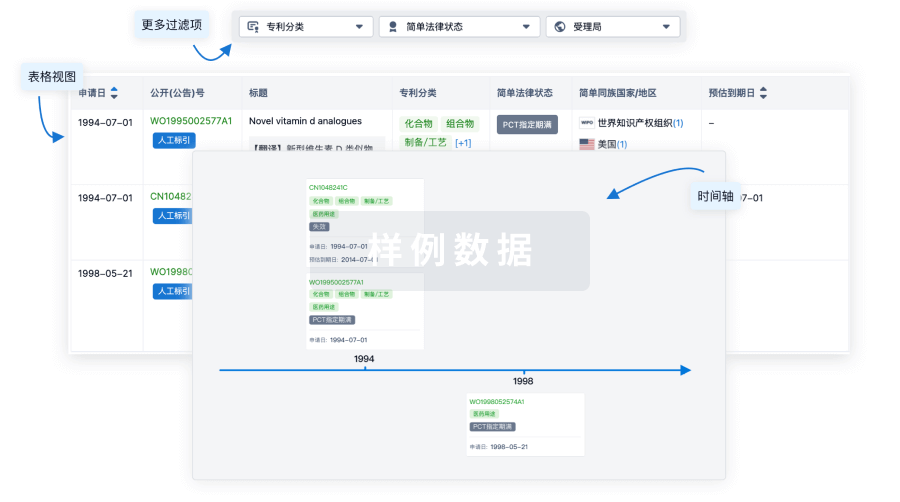

100 项与 利妥昔单抗生物类似药(Amgen, Inc.) 相关的专利(医药)

登录后查看更多信息

9

项与 利妥昔单抗生物类似药(Amgen, Inc.) 相关的文献(医药)2025-01-02·OCULAR IMMUNOLOGY AND INFLAMMATION

Occlusive Vasculitis Following Intravitreal Rituximab Injection for Primary Vitreoretinal Lymphoma

Article

作者: Demirci, Hakan ; Dedania, Vaidehi ; Cole, Emily D. ; Cole, Emily D

PURPOSE:

We report three cases of occlusive vasculitis following intravitreal rituximab therapy for biopsy-proven primary vitreoretinal lymphoma (PVRL), one of which was following an injection of the biosimilar Riabni (rituximab-arrx, AmGen) and two of which were following an injection of Rituxan (rituximab, Genentech).

METHODS:

Case series.

RESULTS:

Three cases of occlusive vasculitis confirmed with fluorescein angiography are reported 5 days, 8 days, and 3.5 weeks following intravitreal injection of rituximab. The initial vision was poor (20/500, 20/150, and light perception), but vision recovered to baseline in two cases, and remained poor in the case of combined artery and vein occlusion.

CONCLUSION:

Occlusive vasculitis is a rarely reported but potential complication of intravitreal rituximab therapy in patients who have been previously treated with the agent and may have delayed onset. A low threshold for fluorescein angiography as a diagnostic test for post-injection vision loss and prompt treatment with topical and/or oral steroids should be considered.

2022-06-01·Immunotherapy4区 · 医学

A Review of the Totality of Evidence in the Development of ABP 798, A Rituximab Biosimilar

4区 · 医学

Review

作者: Lehto, Sonya G ; Hanes, Vladimir ; Cobb, Patrick ; Burmester, Gerd ; Seo, Neungseon ; Cohen, Stanley ; Hamm, Caroline ; Niederwieser, Dietger

ABP 798 (RIABNI™) is a biosimilar to rituximab reference product (RP), a monoclonal antibody that targets CD20. Approval of ABP 798 was based on the totality of evidence generated using a stepwise approach which began by showing that it is structurally and functionally similar to rituximab RP. This analytical assessment was followed by a demonstration of pharmacokinetic/pharmacodynamic similarity in patients with rheumatoid arthritis. Comparative clinical efficacy and safety of ABP 798 with rituximab RP was demonstrated as a final step in patients with non-Hodgkin lymphoma and in those with rheumatoid arthritis. Overall, the totality of evidence supported the conclusion that ABP 798 is highly similar to rituximab RP and provided scientific justification for extrapolation to other approved indications of rituximab RP.

2021-07-01·Biologicals : journal of the International Association of Biological Standardization4区 · 生物学

Non-clinical similarity of biosimilar ABP 798 with rituximab reference product

4区 · 生物学

Article

作者: McBride, Helen J ; Lebrec, Herve ; Kuhns, Scott ; Chow, Vincent ; Jassem, Shea ; Wong, Min ; Kanakaraj, Palanisamy ; Thway, Theingi M ; Ferbas, John

ABP 798 is a biosimilar to Rituxan® (rituximab reference product [RP]). Non-clinical assessments relevant to the primary and secondary mechanisms of action (MOA) contribute to the totality of the evidence (TOE) in supporting biosimilarity and are critical in providing scientific evidence for extrapolation of indications. Similarity of ABP 798 with rituximab RP was investigated across a range of biological activities which have potential impact on pharmacokinetics and clinical efficacy with non-clinical assessments relevant to MOA such as CD20 internalization, trogocytosis, binding to primary human natural killer (NK) cells as well as the ability to induce antibody-dependent cellular phagocytosis (ADCP) in peripheral blood mononuclear cells. Additionally, in vitro synergy of ABP 798 or RP with chemotherapeutic agents, in vivo xenograft studies in mice, and toxicological assessments in cynomolgus monkeys (including B cell depletion and toxicokinetics) were also conducted. Results from these non-clinical assessments contribute to the TOE supporting the biosimilarity between ABP 798 and rituximab RP across a range of primary and secondary MOAs and support justification for extrapolation to all indications of use for ABP 798 for which the RP is approved.

61

项与 利妥昔单抗生物类似药(Amgen, Inc.) 相关的新闻(医药)2025-07-06

·抗体圈

-01-引言抗体药物是生物技术制药领域的一个重要方面。抗体具有识别抗原的特异性,因而利用抗体诊断与治疗疾病是医药研究者长期以来追求的目标。抗体与靶抗原结合具有高特异性、有效性和安全性,临床用于恶性肿瘤、自身免疫病等各种重大疾病。抗体药物的发展并不是一蹴而就的,抗体的发现以及抗体药物的临床应用经历了一段漫长的历史进程。-02-一、免疫实践的起源抗体治疗的最早应用可以追溯到中国人接种“人痘”预防天花的记载算起,国际上一般公认的人痘接种术最早起源于中国公元10世纪,但据中国的一些史书记载,种痘始于唐朝。只不过当时种痘只是在民间秘密流传,没有公布于世。随后,中国人痘接种法传入日本、俄罗斯、土耳其,并经由土耳其进一步传入欧洲。在康熙执政后,随着因得过天花而继承皇位的他开始推广人痘接种,这一技术逐渐从民间走向皇宫,得到了全国的提倡与推广。这种技术的传播对世界范围内的天花防治产生了重要影响。到后来的英国人爱德华·琴纳受到中国人痘接种法的启示,接种牛痘预防天花,琴纳的牛痘接种法因其安全性逐步取代人痘接种,成为现代医学的重要里程碑。-03- 二、抗体科学概念的萌芽早在19世纪末,抗体被动免疫疗法的创立为当时不发达的疾病治疗开辟了新途径。Ehrlich提出的侧链学说为免疫学与免疫疗法奠定了基础。他认为,细胞的表面具有特异性受体分子(或称侧链),这些侧链仅与毒素分子中特定的基团结合;如果细胞与毒素结合后能存活下来,将会产生过量的侧链,部分的侧链释放至血液中,即为抗毒素,这就是现在所称的抗体。1890年,德国生理学家 Emil von Behring 与日本微生物学家 Shibasaburo Kitasato 在研究中发现,暴露于白喉或破伤风毒素的动物血清中存在一种能中和毒素的物质(即抗体前身),将其命名为 “抗毒素”(antitoxin)。他们通过将免疫动物的血清输注给患病动物,成功治愈感染,首次证明了血清中活性物质的保护作用 。 Emil von Behring 与 Shibasaburo 1891年10月,Ehrlich在论文《免疫力的试验性研究》中首次使用德语词 “Antikörper”(抗体),并提出化学结构理论:抗体与抗原的结合遵循 “锁钥模型”(类似酶与底物),强调结构互补性是特异性结合的关键 。Ehrlich到现在,科学家们对于抗体有了一个公认的定义。抗体是一种由B细胞识别抗原后活化、增殖分化为浆细胞,并由浆细胞合成与分泌的、具有特殊氨基酸序列的,能够与相应的抗原发生特异性结合的免疫球蛋白分子。-04-三、抗体理论构建阶段在抗体发现早期,这种特异性的抗体物质勾起了科学家们极大的兴趣,科学家们前赴后继致力于解析抗体的结构,但由于落后的实验条件,进展缓慢。直到20世纪5O年代,科学家们对抗体的结构和抗原抗体识别机理的理解还非常浅显。1937年瑞典物理学家Arne Wilhelm Kaurin Tiselius通过电泳技术证明了抗体也是一种蛋白质,并将其称为γ球蛋白。1953年英国生物化学家Frederick Sanger成功解析了同样身为蛋白质的胰岛素的化学结构,从而为科学家们解析抗体结构指明了方向。Arne Wilhelm Kaurin Tiselius抗体结构的解析离不开美国生物学家Gerald Maurice Edelman,他受到Sanger解析胰岛素结构的启发,用B-巯基乙醇处理免疫球蛋白G,分解成两条链,根据分子量大小分别称为重链和轻链,并在此基础上提出了自己心目中的抗体结构:重链和轻链折叠形成奇特的袋状结构,从而识别抗原。Gerald Maurice Edelman1963年,Edelman与RodneyRobert Porter(Sanger的第一个博士研究生)结合两人多年的研究结果,提出了比较成熟的抗体分子模型。他们认为,抗体是由两条重链和两条轻链组成的“Y”型对称结构,一条轻链和一条重链的一半组成了“Y”型结构的分支。抗体识别抗原的特异性结合位点位于“Y”型结构的两个分支的顶端,轻链和重链都有一部分包含其中。1969年,Edelman和Porter完成了一项在当时了不起的成就,他们成功对抗体1300多个氨基酸序列进行了测定,是当时测定氨基酸序列的最大的蛋白质分子。随后Edelman继续深入研究抗体的结构,陆续提出了越来越精确的抗体分子结构,包括重链可变区、重链恒定区、轻链可变区、轻链恒定区以及抗体内部二硫键的位置,同时他认为抗体的差异是由可变区的差异决定的。通过对抗体结构的不懈研究,抗体识别抗原的结构基础得到了有效阐释,却仍无法回避抗体多样性的基本问题。抗体的分子序列并不固定,免疫系统能够产生不同抗体结合不同的抗原物质。若依据“一个基因编码一条多肽链”的理论,即使人类基因组都无法满足抗体多样性编码的需求。对于这个问题,Edelman和另一位同行Joseph Gaily于1967年提出了一个抗体多样性产生的最初的设想。他们认为编码抗体的基因存在染色体重排现象,识别抗原之后数量有限的抗体基因通过不同的组合形式编码无限种类的抗体分子。在Edelman提出的抗体多样性理论的基础上,1976年,日本科学家利根川进和同事在检测不产生抗体的胚胎细胞和产生抗体骨髓瘤细胞中抗体轻链基因的分布时发现,胚胎细胞中不同抗体基因距离较远,而骨髓瘤细胞中抗体基因距离接近,这个发现说明生殖细胞在发育成免疫细胞的过程中,抗体基因发生了重新分布现象。利根川进在此基础上用一系列确凿的实验数据确定了抗体多样性是由B淋巴细胞中抗体基冈的染色体重排和突变造成的。根据估算,抗体基因通过重组和突变甚至可以编码100亿种不同的抗体,很好解释了抗体多样性产生的原因。1987年,利根川进由于抗体多样性的突破性研究独享了该年度的诺贝尔生理学或医学奖。利根川进-05-四、治疗性抗体的蓬勃发展自1986年第一个治疗性抗体进入临床以来,治疗性抗体得到了迅速的发展,其已成为现代生物医药的重要组成部分。到目前为止,全球已获批的抗体药物多达196种, 这些抗体都至少获得一个监管机构的批准。伴随现代科技的发展,治疗性抗体经历了鼠源性抗体,嵌合抗体,改性抗体和表面重塑抗体(部分人源化抗体),以及全人源化抗体等不同发展阶段。 第一代:鼠源单抗(momab)第一个单克隆抗体药Orthoclone OKT3来自于小鼠,它的氨基酸序列都是鼠源的。鼠源抗体在给病人服用过程中常常遇到一些问题:1)人体把这些单抗药当作异体蛋白,会产生免疫排斥。2)免疫排斥使单抗药很快从病人体内被清除掉,大大降低了它们应有的疗效。尤其治疗慢性疾病需要长期服用的情况下,鼠源单抗药在后续注射时疗效甚微;3)少数病例中,鼠源抗体会引起严重的过敏反应,甚至导致了个别病人的死亡。因此,早期单抗药的销售始终没有腾飞——Orthoclone OKT3的年销售额仅有1千万美元左右。因此,要想在医学上有更广泛的应用,鼠源抗体必须要转变成人源化抗体或人源抗体。第二代:人鼠嵌合单抗(ximab)和人源化单抗(zumab)人源化抗体一般是以鼠源抗体为基础,通过更换蛋白片断和置换部分氨基酸序列, 使抗体的最终氨基酸序列更接近人源的,其最终目的是既不引起人的免疫排斥,又不降低它对靶抗原的亲和性。抗体人源化又分为两个层次。第一个层次是嵌合抗体(Chimeric antibody): 抗体的恒定区都被置换成人的氨基酸序列。嵌合单抗蛋白约33%的氨基酸序列来自小鼠,其余67%为人源的。第二个层次是人源化抗体(Humanized antibody),即拿到针对某抗原的小鼠抗体后,只取其识别抗原的几段区域(CDR区域),把它们移植到人源抗体中。人源化单抗中人源的序列占90%。人源化单抗显然比嵌合单抗更有优势,引起免疫排斥或超敏的风险更低。但即使这样,由于鼠源序列的存在,人源化单抗还是不能完全避免免疫排斥或超敏的风险。第三代:全人源化单抗(mumab)获得全人源单抗主要有两种途径:噬菌体展示和转基因小鼠。噬菌体展示和转基因小鼠在执行过程中各有千秋。一般来说,噬菌体展示技术“先快后慢”,即找到针对某种靶蛋白的抗体很快,但选出的这个抗体和靶蛋白的亲和性往往不高,需要人工细调,更换个别氨基酸。优化这一步费时费力,而且即使优化的抗体和通过转基因小鼠出来的抗体相比,亲和力可能还是相差一个数量级。另外,在优化的过程中需要替换一些氨基酸,也就引进了被免疫排斥的风险。转基因小鼠技术是“先慢后快”,将抗原注射到小鼠体内、产生特异抗体、制备杂交瘤细胞等前几步需要几个月的时间。但一旦最初的抗体产生,其优化过程在小鼠体内继续完成,又快又好,并且不用担心免疫排斥的问题。-06-五、抗体的筛选技术近年来,随着抗体药的需求越来越大,抗体筛选技术的发展也是日新月异,目前应用较普遍的有杂交瘤技术、抗体文库筛选技术、B细胞克隆技术和转基因小鼠抗体筛选技术。杂交瘤技术杂交瘤技术又称为单克隆抗体技术,是在体细胞融合的技术基础上发展而来的。这项技术将免疫动物的B淋巴细胞与骨髓瘤细胞融合,即可形成在体外长期存活并分泌免疫蛋白的杂交瘤细胞,通过克隆化可得到来自单个杂交瘤细胞的单克隆系,即杂交瘤细胞系,利用杂交瘤细胞可以大量的生产单克隆抗体。 细胞融合技术是杂交瘤技术的基础,通过聚乙二醇(PEG)(最常用)、仙台病毒、电转等方法对细胞进行人工诱导,可使两个细胞通过膜融合形成单个细胞。融合细胞的筛选 HAT培养基筛选技术是杂交瘤技术中另一个关键的技术,在B淋巴细胞与骨髓瘤细胞融合后,会产生多种融合结果(未融合的骨髓瘤细胞、未融合的B淋巴细胞、B淋巴细胞自身融合细胞、骨髓瘤细胞自身融合细胞、正确融合的杂交瘤细胞),为了得到所需的杂交瘤细胞,必须利用 HAT 培养基对融合后的细胞进行筛选。HAT培养基的筛选原理为:DNA合成途径有生物合成途径与应急合成途径两种,HAT培养基中含有次黄嘌呤(H)、氨基喋呤(A)和胸腺嘧啶核苷酸(T)等物质,氨基喋呤可以对 DNA的生物合成途径进行阻断,骨髓瘤细胞会因为生物合成途径被阻断且自身缺乏应急合成途径导致不能增殖进而快速的死亡;而B淋巴细胞因缺乏体外增殖的能力,一般在10天左右死亡;杂交瘤细胞具有体外增殖能力且由于次黄嘌呤与胸腺嘧啶核苷酸的存在,可以通过应急途径合成DNA并在 HAT培养基中正常生长,不会死亡。因此将融合后的细胞放于 HAT 培养基中培养,其他的融合结果会全部死亡,最终筛选出杂交瘤细胞。噬菌体展示技术1985年Smith GP利用基因工程,将外源基因插入丝状噬菌体(Filamentous bacteriophage,fd)的基因组,使目的基因编码的多肽以融合蛋白的形式展示,从而创建了噬菌体展示技术。噬菌体展示技术(phage display)是将外源编码多肽或蛋白质的基因通过基因工程技术插入到噬菌体外壳蛋白结构基因的适当位置,在阅读框能正确表达,使外源多肽或蛋白在噬菌体的衣壳蛋白上形成融合蛋白,随子代噬菌体的重新组装呈现在噬菌体表面,可以保持相对的空间结构和生物活性。然后利用靶分子,采用合适的淘洗方法,洗去未特异性结合的噬菌体。再用酸碱或者竞争的分子洗脱下结合的噬菌体,中和后的噬菌体感染大肠杆菌扩增,经过3-5轮的富集,逐步提高可以特异性识别靶分子的噬菌体比例,最终获得识别靶分子的多肽或者蛋白。除了噬菌体展示技术之外,基于文库展示的技术还包括:酵母展示技术、核糖体展示技术以及细胞展示技术等。B细胞克隆技术人和动物接受了外源性免疫原(如细菌、病毒、非同源蛋白等)的刺激后,获得性免疫(Adaptive Immunity)被激活,并在 T 淋巴细胞、巨噬细胞和树突状细胞等免疫细胞的协同作用下,由 B 淋巴细胞产生针对于该病原体(或免疫原)的抗体分子;B 淋巴细胞经过一系列的成熟和分化之后,最终形成浆细胞(Plasma cell)将大量的 IgG 分泌到血液等循环系统中;而特定的某一个 B 淋巴细胞在经历了 V-D-J 重排、Class Switch 和 Somatic maturation 之后,只含有一对编码 IgG 重链和轻链的基因。因此,经过 B 淋巴细胞表面标记物和抗原特异性筛选,可以获得针对特异性抗原的单个 B 淋巴细胞,然后通过分子生物学手段从中获得编码抗体 IgG 的重链和轻链基因,并在体外重组表达验证,是目前获得单克隆抗体最有效和快速的技术。基于单 B 细胞筛选的抗体发现技术发展,还得益于流式细胞技术、微流控技术(Microfluidic)以及光流体技术(Optofluidic)等相关生物技术的发展和成熟,使其成功的从实验室走向商业化应用,并在单克隆抗体特别是治疗性单克隆抗体的开发方面被广泛应用。基于单 B 细胞分选技术的单克隆抗体开发平台,和传统的单克隆抗体开发平台相比,最突出的优势在于能够从人体内直接筛选获得全人源单克隆抗体;同时,也能够大大缩短研发周期,从获得康复病人的外周血淋巴细胞开始,一般来说在 4-6 周内即可获得全人源单克隆抗体,并完成相应的生物学功能实验(如病毒结合和中和实验、ADCC 实验等);并且由于所获得是全人源单克隆抗体,可以大大简化甚至于不需要抗体人源化改造工程,快速推进至临床试验。 转基因小鼠全人源抗体筛选技术早在1985年,Alt等人就曾提出可以应用转基因技术得到具有人源序列的单克隆抗体。1989年,Bruggemann等人在小鼠中表达了人源重链,从而产生了转基因编码的免疫应答。而在1994年,Lonberg和Jakobovits的团队分别采用了不同的方法构建了能够表达人源抗体的转基因小鼠。Lonberg利用了核内显微注射的方法,而Jakovovits用的是酵母人工染色体(YAC)的方法。重链包含3个重链可变区(VH),16个D,所有的6个JH区。Abgenix的XenoMouse®是第一个同时有大部分人源VH和人源Vκ repertoire的转基因小鼠品系。这些XenoMouse®小鼠有百万碱基对大小的酵母人工染色体,在重链基因座,有34个有功能的VH基因,全部的DH和JH区域,作为Cμ和Cδ功能下游的人源Cγ2基因;κ轻链基因座含有18个Vκ基因,全部五个功能性的Jκ区,和Cκ基因。由于YAC可以整合到小鼠染色体中,这样得到的小鼠具有较好的基因稳定性。2005年,安进以22亿美元收购Abgenix。XenoMouse平台上开发出的第一个单抗药物是Abgenix和安进共同开发的抗EGFR单抗panitumumab(于2006.9被FDA批准),这也是基于转基因小鼠的第一个全人源单抗药物。另一个用于产生全人源抗体的小鼠是GenPharm International, Inc开发的HuMab™或者叫Ultimab®。1997年,Medarex收购了该公司获得这一技术平台。2009年,BMS以24亿美元收购Medarex,将Humab小鼠收入囊中。这一平台可产生高亲和力(纳摩到亚纳摩级别)的人源抗体。Ofatumumab是基于Ultimab平台开发出的抗CD20单抗,它和同为CD20抗体的rituximab靶向的表位不同。Ofatumumab于2009年十月被FDA批准用于治疗慢性淋巴细胞白血病。Ultimab平台还有一系列诸如Canakinumab(抗interleukin-1β的IgG1单抗,用于治疗一种罕见的自身炎症性疾病Cryopyrin蛋白相关周期性综合征), Ustekinumab(靶向IL-12和IL-23所共有的p40亚单位,用于18岁及以上活动性银屑病关节炎患者的治疗)等单抗产生。-07-结语抗体药物从发现到进入临床应用,经历了曲折而又漫长的历程。在这段时间里,人们对于抗体药物的认识发生了巨大的变化。在过去的数十年里,抗体已经成为医药市场上最畅销的药物。随着抗体类药物被批准用于治疗各种包括癌症、自身免疫、代谢和传染病,治疗性抗体药物的市场必会呈现爆炸式增长的态势。识别微信二维码,添加抗体圈小编,符合条件者即可加入抗体圈微信群!请注明:姓名+研究方向!本公众号所有转载文章系出于传递更多信息之目的,且明确注明来源和作者,不希望被转载的媒体或个人可与我们联系(cbplib@163.com),我们将立即进行删除处理。所有文章仅代表作者观点,不代表本站立场。

免疫疗法

2025-07-06

·小药说药

-01-引言抗体药物是生物技术制药领域的一个重要方面。抗体具有识别抗原的特异性,因而利用抗体诊断与治疗疾病是医药研究者长期以来追求的目标。抗体与靶抗原结合具有高特异性、有效性和安全性,临床用于恶性肿瘤、自身免疫病等各种重大疾病。抗体药物的发展并不是一蹴而就的,抗体的发现以及抗体药物的临床应用经历了一段漫长的历史进程。-02-一、免疫实践的起源抗体治疗的最早应用可以追溯到中国人接种“人痘”预防天花的记载算起,国际上一般公认的人痘接种术最早起源于中国公元10世纪,但据中国的一些史书记载,种痘始于唐朝。只不过当时种痘只是在民间秘密流传,没有公布于世。随后,中国人痘接种法传入日本、俄罗斯、土耳其,并经由土耳其进一步传入欧洲。在康熙执政后,随着因得过天花而继承皇位的他开始推广人痘接种,这一技术逐渐从民间走向皇宫,得到了全国的提倡与推广。这种技术的传播对世界范围内的天花防治产生了重要影响。到后来的英国人爱德华·琴纳受到中国人痘接种法的启示,接种牛痘预防天花,琴纳的牛痘接种法因其安全性逐步取代人痘接种,成为现代医学的重要里程碑。-03- 二、抗体科学概念的萌芽早在19世纪末,抗体被动免疫疗法的创立为当时不发达的疾病治疗开辟了新途径。Ehrlich提出的侧链学说为免疫学与免疫疗法奠定了基础。他认为,细胞的表面具有特异性受体分子(或称侧链),这些侧链仅与毒素分子中特定的基团结合;如果细胞与毒素结合后能存活下来,将会产生过量的侧链,部分的侧链释放至血液中,即为抗毒素,这就是现在所称的抗体。1890年,德国生理学家 Emil von Behring 与日本微生物学家 Shibasaburo Kitasato 在研究中发现,暴露于白喉或破伤风毒素的动物血清中存在一种能中和毒素的物质(即抗体前身),将其命名为 “抗毒素”(antitoxin)。他们通过将免疫动物的血清输注给患病动物,成功治愈感染,首次证明了血清中活性物质的保护作用 。 Emil von Behring 与 Shibasaburo 1891年10月,Ehrlich在论文《免疫力的试验性研究》中首次使用德语词 “Antikörper”(抗体),并提出化学结构理论:抗体与抗原的结合遵循 “锁钥模型”(类似酶与底物),强调结构互补性是特异性结合的关键 。Ehrlich到现在,科学家们对于抗体有了一个公认的定义。抗体是一种由B细胞识别抗原后活化、增殖分化为浆细胞,并由浆细胞合成与分泌的、具有特殊氨基酸序列的,能够与相应的抗原发生特异性结合的免疫球蛋白分子。-04-三、抗体理论构建阶段在抗体发现早期,这种特异性的抗体物质勾起了科学家们极大的兴趣,科学家们前赴后继致力于解析抗体的结构,但由于落后的实验条件,进展缓慢。直到20世纪5O年代,科学家们对抗体的结构和抗原抗体识别机理的理解还非常浅显。1937年瑞典物理学家Arne Wilhelm Kaurin Tiselius通过电泳技术证明了抗体也是一种蛋白质,并将其称为γ球蛋白。1953年英国生物化学家Frederick Sanger成功解析了同样身为蛋白质的胰岛素的化学结构,从而为科学家们解析抗体结构指明了方向。Arne Wilhelm Kaurin Tiselius抗体结构的解析离不开美国生物学家Gerald Maurice Edelman,他受到Sanger解析胰岛素结构的启发,用B-巯基乙醇处理免疫球蛋白G,分解成两条链,根据分子量大小分别称为重链和轻链,并在此基础上提出了自己心目中的抗体结构:重链和轻链折叠形成奇特的袋状结构,从而识别抗原。Gerald Maurice Edelman1963年,Edelman与RodneyRobert Porter(Sanger的第一个博士研究生)结合两人多年的研究结果,提出了比较成熟的抗体分子模型。他们认为,抗体是由两条重链和两条轻链组成的“Y”型对称结构,一条轻链和一条重链的一半组成了“Y”型结构的分支。抗体识别抗原的特异性结合位点位于“Y”型结构的两个分支的顶端,轻链和重链都有一部分包含其中。1969年,Edelman和Porter完成了一项在当时了不起的成就,他们成功对抗体1300多个氨基酸序列进行了测定,是当时测定氨基酸序列的最大的蛋白质分子。随后Edelman继续深入研究抗体的结构,陆续提出了越来越精确的抗体分子结构,包括重链可变区、重链恒定区、轻链可变区、轻链恒定区以及抗体内部二硫键的位置,同时他认为抗体的差异是由可变区的差异决定的。通过对抗体结构的不懈研究,抗体识别抗原的结构基础得到了有效阐释,却仍无法回避抗体多样性的基本问题。抗体的分子序列并不固定,免疫系统能够产生不同抗体结合不同的抗原物质。若依据“一个基因编码一条多肽链”的理论,即使人类基因组都无法满足抗体多样性编码的需求。对于这个问题,Edelman和另一位同行Joseph Gaily于1967年提出了一个抗体多样性产生的最初的设想。他们认为编码抗体的基因存在染色体重排现象,识别抗原之后数量有限的抗体基因通过不同的组合形式编码无限种类的抗体分子。在Edelman提出的抗体多样性理论的基础上,1976年,日本科学家利根川进和同事在检测不产生抗体的胚胎细胞和产生抗体骨髓瘤细胞中抗体轻链基因的分布时发现,胚胎细胞中不同抗体基因距离较远,而骨髓瘤细胞中抗体基因距离接近,这个发现说明生殖细胞在发育成免疫细胞的过程中,抗体基因发生了重新分布现象。利根川进在此基础上用一系列确凿的实验数据确定了抗体多样性是由B淋巴细胞中抗体基冈的染色体重排和突变造成的。根据估算,抗体基因通过重组和突变甚至可以编码100亿种不同的抗体,很好解释了抗体多样性产生的原因。1987年,利根川进由于抗体多样性的突破性研究独享了该年度的诺贝尔生理学或医学奖。利根川进-05-四、治疗性抗体的蓬勃发展自1986年第一个治疗性抗体进入临床以来,治疗性抗体得到了迅速的发展,其已成为现代生物医药的重要组成部分。到目前为止,全球已获批的抗体药物多达196种, 这些抗体都至少获得一个监管机构的批准。伴随现代科技的发展,治疗性抗体经历了鼠源性抗体,嵌合抗体,改性抗体和表面重塑抗体(部分人源化抗体),以及全人源化抗体等不同发展阶段。 第一代:鼠源单抗(momab)第一个单克隆抗体药Orthoclone OKT3来自于小鼠,它的氨基酸序列都是鼠源的。鼠源抗体在给病人服用过程中常常遇到一些问题:1)人体把这些单抗药当作异体蛋白,会产生免疫排斥。2)免疫排斥使单抗药很快从病人体内被清除掉,大大降低了它们应有的疗效。尤其治疗慢性疾病需要长期服用的情况下,鼠源单抗药在后续注射时疗效甚微;3)少数病例中,鼠源抗体会引起严重的过敏反应,甚至导致了个别病人的死亡。因此,早期单抗药的销售始终没有腾飞——Orthoclone OKT3的年销售额仅有1千万美元左右。因此,要想在医学上有更广泛的应用,鼠源抗体必须要转变成人源化抗体或人源抗体。第二代:人鼠嵌合单抗(ximab)和人源化单抗(zumab)人源化抗体一般是以鼠源抗体为基础,通过更换蛋白片断和置换部分氨基酸序列, 使抗体的最终氨基酸序列更接近人源的,其最终目的是既不引起人的免疫排斥,又不降低它对靶抗原的亲和性。抗体人源化又分为两个层次。第一个层次是嵌合抗体(Chimeric antibody): 抗体的恒定区都被置换成人的氨基酸序列。嵌合单抗蛋白约33%的氨基酸序列来自小鼠,其余67%为人源的。第二个层次是人源化抗体(Humanized antibody),即拿到针对某抗原的小鼠抗体后,只取其识别抗原的几段区域(CDR区域),把它们移植到人源抗体中。人源化单抗中人源的序列占90%。人源化单抗显然比嵌合单抗更有优势,引起免疫排斥或超敏的风险更低。但即使这样,由于鼠源序列的存在,人源化单抗还是不能完全避免免疫排斥或超敏的风险。第三代:全人源化单抗(mumab)获得全人源单抗主要有两种途径:噬菌体展示和转基因小鼠。噬菌体展示和转基因小鼠在执行过程中各有千秋。一般来说,噬菌体展示技术“先快后慢”,即找到针对某种靶蛋白的抗体很快,但选出的这个抗体和靶蛋白的亲和性往往不高,需要人工细调,更换个别氨基酸。优化这一步费时费力,而且即使优化的抗体和通过转基因小鼠出来的抗体相比,亲和力可能还是相差一个数量级。另外,在优化的过程中需要替换一些氨基酸,也就引进了被免疫排斥的风险。转基因小鼠技术是“先慢后快”,将抗原注射到小鼠体内、产生特异抗体、制备杂交瘤细胞等前几步需要几个月的时间。但一旦最初的抗体产生,其优化过程在小鼠体内继续完成,又快又好,并且不用担心免疫排斥的问题。-06-五、抗体的筛选技术近年来,随着抗体药的需求越来越大,抗体筛选技术的发展也是日新月异,目前应用较普遍的有杂交瘤技术、抗体文库筛选技术、B细胞克隆技术和转基因小鼠抗体筛选技术。杂交瘤技术杂交瘤技术又称为单克隆抗体技术,是在体细胞融合的技术基础上发展而来的。这项技术将免疫动物的B淋巴细胞与骨髓瘤细胞融合,即可形成在体外长期存活并分泌免疫蛋白的杂交瘤细胞,通过克隆化可得到来自单个杂交瘤细胞的单克隆系,即杂交瘤细胞系,利用杂交瘤细胞可以大量的生产单克隆抗体。 细胞融合技术是杂交瘤技术的基础,通过聚乙二醇(PEG)(最常用)、仙台病毒、电转等方法对细胞进行人工诱导,可使两个细胞通过膜融合形成单个细胞。融合细胞的筛选 HAT培养基筛选技术是杂交瘤技术中另一个关键的技术,在B淋巴细胞与骨髓瘤细胞融合后,会产生多种融合结果(未融合的骨髓瘤细胞、未融合的B淋巴细胞、B淋巴细胞自身融合细胞、骨髓瘤细胞自身融合细胞、正确融合的杂交瘤细胞),为了得到所需的杂交瘤细胞,必须利用 HAT 培养基对融合后的细胞进行筛选。HAT培养基的筛选原理为:DNA合成途径有生物合成途径与应急合成途径两种,HAT培养基中含有次黄嘌呤(H)、氨基喋呤(A)和胸腺嘧啶核苷酸(T)等物质,氨基喋呤可以对 DNA的生物合成途径进行阻断,骨髓瘤细胞会因为生物合成途径被阻断且自身缺乏应急合成途径导致不能增殖进而快速的死亡;而B淋巴细胞因缺乏体外增殖的能力,一般在10天左右死亡;杂交瘤细胞具有体外增殖能力且由于次黄嘌呤与胸腺嘧啶核苷酸的存在,可以通过应急途径合成DNA并在 HAT培养基中正常生长,不会死亡。因此将融合后的细胞放于 HAT 培养基中培养,其他的融合结果会全部死亡,最终筛选出杂交瘤细胞。噬菌体展示技术1985年Smith GP利用基因工程,将外源基因插入丝状噬菌体(Filamentous bacteriophage,fd)的基因组,使目的基因编码的多肽以融合蛋白的形式展示,从而创建了噬菌体展示技术。噬菌体展示技术(phage display)是将外源编码多肽或蛋白质的基因通过基因工程技术插入到噬菌体外壳蛋白结构基因的适当位置,在阅读框能正确表达,使外源多肽或蛋白在噬菌体的衣壳蛋白上形成融合蛋白,随子代噬菌体的重新组装呈现在噬菌体表面,可以保持相对的空间结构和生物活性。然后利用靶分子,采用合适的淘洗方法,洗去未特异性结合的噬菌体。再用酸碱或者竞争的分子洗脱下结合的噬菌体,中和后的噬菌体感染大肠杆菌扩增,经过3-5轮的富集,逐步提高可以特异性识别靶分子的噬菌体比例,最终获得识别靶分子的多肽或者蛋白。除了噬菌体展示技术之外,基于文库展示的技术还包括:酵母展示技术、核糖体展示技术以及细胞展示技术等。B细胞克隆技术人和动物接受了外源性免疫原(如细菌、病毒、非同源蛋白等)的刺激后,获得性免疫(Adaptive Immunity)被激活,并在 T 淋巴细胞、巨噬细胞和树突状细胞等免疫细胞的协同作用下,由 B 淋巴细胞产生针对于该病原体(或免疫原)的抗体分子;B 淋巴细胞经过一系列的成熟和分化之后,最终形成浆细胞(Plasma cell)将大量的 IgG 分泌到血液等循环系统中;而特定的某一个 B 淋巴细胞在经历了 V-D-J 重排、Class Switch 和 Somatic maturation 之后,只含有一对编码 IgG 重链和轻链的基因。因此,经过 B 淋巴细胞表面标记物和抗原特异性筛选,可以获得针对特异性抗原的单个 B 淋巴细胞,然后通过分子生物学手段从中获得编码抗体 IgG 的重链和轻链基因,并在体外重组表达验证,是目前获得单克隆抗体最有效和快速的技术。基于单 B 细胞筛选的抗体发现技术发展,还得益于流式细胞技术、微流控技术(Microfluidic)以及光流体技术(Optofluidic)等相关生物技术的发展和成熟,使其成功的从实验室走向商业化应用,并在单克隆抗体特别是治疗性单克隆抗体的开发方面被广泛应用。基于单 B 细胞分选技术的单克隆抗体开发平台,和传统的单克隆抗体开发平台相比,最突出的优势在于能够从人体内直接筛选获得全人源单克隆抗体;同时,也能够大大缩短研发周期,从获得康复病人的外周血淋巴细胞开始,一般来说在 4-6 周内即可获得全人源单克隆抗体,并完成相应的生物学功能实验(如病毒结合和中和实验、ADCC 实验等);并且由于所获得是全人源单克隆抗体,可以大大简化甚至于不需要抗体人源化改造工程,快速推进至临床试验。 转基因小鼠全人源抗体筛选技术早在1985年,Alt等人就曾提出可以应用转基因技术得到具有人源序列的单克隆抗体。1989年,Bruggemann等人在小鼠中表达了人源重链,从而产生了转基因编码的免疫应答。而在1994年,Lonberg和Jakobovits的团队分别采用了不同的方法构建了能够表达人源抗体的转基因小鼠。Lonberg利用了核内显微注射的方法,而Jakovovits用的是酵母人工染色体(YAC)的方法。重链包含3个重链可变区(VH),16个D,所有的6个JH区。Abgenix的XenoMouse®是第一个同时有大部分人源VH和人源Vκ repertoire的转基因小鼠品系。这些XenoMouse®小鼠有百万碱基对大小的酵母人工染色体,在重链基因座,有34个有功能的VH基因,全部的DH和JH区域,作为Cμ和Cδ功能下游的人源Cγ2基因;κ轻链基因座含有18个Vκ基因,全部五个功能性的Jκ区,和Cκ基因。由于YAC可以整合到小鼠染色体中,这样得到的小鼠具有较好的基因稳定性。2005年,安进以22亿美元收购Abgenix。XenoMouse平台上开发出的第一个单抗药物是Abgenix和安进共同开发的抗EGFR单抗panitumumab(于2006.9被FDA批准),这也是基于转基因小鼠的第一个全人源单抗药物。另一个用于产生全人源抗体的小鼠是GenPharm International, Inc开发的HuMab™或者叫Ultimab®。1997年,Medarex收购了该公司获得这一技术平台。2009年,BMS以24亿美元收购Medarex,将Humab小鼠收入囊中。这一平台可产生高亲和力(纳摩到亚纳摩级别)的人源抗体。Ofatumumab是基于Ultimab平台开发出的抗CD20单抗,它和同为CD20抗体的rituximab靶向的表位不同。Ofatumumab于2009年十月被FDA批准用于治疗慢性淋巴细胞白血病。Ultimab平台还有一系列诸如Canakinumab(抗interleukin-1β的IgG1单抗,用于治疗一种罕见的自身炎症性疾病Cryopyrin蛋白相关周期性综合征), Ustekinumab(靶向IL-12和IL-23所共有的p40亚单位,用于18岁及以上活动性银屑病关节炎患者的治疗)等单抗产生。-07-结语抗体药物从发现到进入临床应用,经历了曲折而又漫长的历程。在这段时间里,人们对于抗体药物的认识发生了巨大的变化。在过去的数十年里,抗体已经成为医药市场上最畅销的药物。随着抗体类药物被批准用于治疗各种包括癌症、自身免疫、代谢和传染病,治疗性抗体药物的市场必会呈现爆炸式增长的态势。欢迎加入我的知识星球,可免费下载每次直播的原始文献和PPT,小药邀请你到知识星球一起学习!公众号已建立“小药说药专业交流群”微信行业交流群以及读者交流群,扫描下方小编二维码加入,入行业群请主动告知姓名、工作单位和职务。

免疫疗法

2025-06-08

在过去的世纪中,通过连续制造实现的流程强化在钢铁、化工、食品和石化生产行业产生了革命性的影响,那么为什么生物制药行业花了这么长时间才接受连续处理呢?直到最近,第一个完全通过连续工艺生产的单克隆抗体才进入临床试验(BiosanaPharma 的奥马珠单抗生物类似药)。在此,我们回顾了抗体及相关产品的连续下游处理的最新进展,包括生物制药行业的现状、推动连续处理的变革性技术以及早期采用者所展示的连续生物处理的最新水平。 引言:生物制药生产的变革驱动因素——不断变化的行业格局 已有超过 80 种单克隆抗体治疗药物获得了监管批准,2018 年在欧盟或美国共有 12 种新的单克隆抗体获得批准。因此,该行业如今已可被视为成熟行业,与其他成熟行业一样,通过流程强化实现成本节约变得至关重要。降低成本的需求来自于针对同一适应症的多种单克隆抗体的竞争以及生物类似药的竞争。竞争导致需求难以预测。因此,降低成本和提高灵活性将成为未来生物生产设施的关键驱动因素。 生物类似药 单克隆抗体生物治疗药物的成功与一些备受瞩目的科学奖项密切相关。2018 年,诺贝尔化学奖共同授予了乔治·P·史密斯爵士和格雷戈里·P·温特爵士,以表彰他们在肽和抗体的噬菌体展示方面的贡献。阿达木单抗成为首个于 2002年获得市场批准的噬菌体展示衍生的单克隆抗体。阿达木单抗已发展成为销售额最高的治疗药物,全球年销售额接近 200 亿美元。然而,阿达木单抗以及许多其他生物治疗药物的专利近期已到期。表 4.1 展示了全球销售额最高的十大生物治疗药物及其专利到期日期。这些专利大多已到期或即将到期的事实,推动了生物类似药开发计划的开展,目前正在进行的此类计划超过 1000 个。由于针对每种单克隆抗体的多种生物类似药的开发,生物处理行业格局必然发生变化。这一领域的竞争已如此激烈,以至于 Momenta 基于原研公司与生物类似药公司之间的法律协议将于 2023 年到期时市场可能已饱和的判断,终止了其阿达木单抗生物类似药的开发。同样,Sandoz 在美国食品药品监督管理局要求提供更多数据后,基于假设利妥昔单抗的市场将在数据获批前就已饱和,停止了其利妥昔单抗生物类似药的申报。在饱和的市场格局中,成本将成为推动成功的关键因素,通过能够开拓新市场来实现,因此 BiosanaPharma 等生物类似药公司推动通过连续处理实现流程强化的创新也就不足为奇了。竞争还引入了对原研药和生物类似药的不可预测需求,使得灵活生产变得至关重要。 针对同一适应症的多种单克隆抗体 2018 年,诺贝尔生理学或医学奖授予了詹姆斯·P·艾利森和本庶佑,以表彰他们“发现了通过抑制免疫负性调节来治疗癌症”。自这一初步发现以来,许多免疫反应调节检查点已被发现,并开发了一系列针对这些检查点的抗体治疗药物:针对 CTLA-4(伊匹单抗),针对 PD-1(西米普利单抗、纳武利尤单抗、帕博利珠单抗),以及针对 PD-1 的配体(PD-L1;德瓦鲁单抗、阿维鲁单抗、阿特珠单抗)。众多治疗药物作用于相同或相似的通路,这种竞争最终将导致成本压力。目前,我们看到其中一些药物正在争夺新适应症的治疗。这导致需求难以预测,并推动了对灵活生产的需求。 强化的上游流程和下游瓶颈 对生物制剂需求的增加推动了上游流程的强化,以提高生产力并降低制造成本。随后,补料批培养生产工艺的滴度从 0.2 g/L 增加到 >3 g/L。此外,灌注工艺最初被用作满足大量需求或生产不稳定分子的工具,由于其生产力的提高而被重新审视。值得注意的是,高强度、低体积灌注(HILVOP)工艺比补料批培养生产具有更高的生产力。 然而,下游处理的进步未能跟上滴度的增加。因此,处理瓶颈已从上游转移到下游操作。即使是高容量色谱捕获介质也无法应对现代细胞培养工艺中常见的高滴度。这一缺陷导致人们对多柱色谱的兴趣增加,它可以有效地将柱尺寸与滴度解耦。可以根据流速选择柱子,并且随着滴度的增加,可以在工艺中增加更多的柱子。 小分子的成功和监管推动 小分子制药行业已经从转向连续流动技术中受益。在此,化学反应物的连续流被引入反应器以产生所需的产品。这种操作方式的优点包括快速混合、增强的传热、强化的传质以及由于高比表面积与体积比,能够进行放热反应。流动技术设备允许快速放大,避免了批量工艺放大所固有的许多问题。使用微反应器技术已广泛探索了受益于非常高或非常低温度(高于 200°C 和低于 -40°C)和更高压力的反应轮廓,这种技术已从各种制造商那里广泛商业化。其他优点包括最小化长期储存大量材料以及能够安全地进行涉及危险气体的反应。因此,连续技术使制药行业能够合成大量的活性药物成分和天然产物。 美国食品药品监督管理局在批准和审查市场上的新产品方面的支持,导致了连续方法在小分子行业中的广泛接受。自 2015 年以来,该机构已批准了四种通过连续工艺生产的产品——两种囊性纤维化药物(Vertex Pharmaceuticals 的 Orkambi 和 Symdeko)、一种乳腺癌药物(Eli Lilly and Company 的 Verzenio)和一种 HIV 药物(Janssen Pharmaceuticals 的 Prezista)。美国食品药品监督管理局对小分子药物连续制造的接受和鼓励为连续生物处理铺平了道路。美国食品药品监督管理局积极鼓励更新生物制造工艺,因为它有可能“提高产品的整体质量和对患者的可及性”。作为推动质量源于设计(QbD)方法的一部分,美国食品药品监督管理局组建了新兴技术团队,帮助连续制造的早期采用者“帮助解决实施挑战并指导使用这些现代方法生产的产品的应用审查过程”。 连续处理的利弊 鉴于生物制药行业的现状以及政府和社会对降低药品成本的压力,关注流程强化也就不足为奇了。尽管商品成本在销售价格中所占比例相对较小,但流程经济可能会有显著改善。已经有一系列关于连续处理的商品成本分析,依赖于多种方法。然而,这些结果强烈依赖于所使用的假设,由于尚未实施任何连续制造工艺且每家公司的制造场景都不同,直接的经济优势仍然具有推测性;这是生物制药运营集团的观点。 尽管连续处理的许多方面无法直接用金钱量化,但仍有一些特点可能有助于推动实施的有力理由。如果我们考虑产品在制造过程中的快速且均匀的流动,我们可以立即理解这项新技术有可能减少整体制造时间,并随后提高产品质量。在批量工艺中,所有材料都通过一个单元操作并收集在暂存罐中,然后才开始下一个操作。另一方面,连续方法依赖于最小化单元操作之间的暂存罐,并在材料准备好处理时立即开始下一个单元操作。因此,在连续生物处理中,所有单元操作并行运行,最大限度地利用设备和设施。对于每天可能只进行一两个单元操作的批量工艺,产品可能需要 >1 周时间才能从生物反应器进入配方。在连续处理中,我们看到了案例研究,其中从生物反应器到配方的产品处理时间 <20 小时。这种操作速度在处理不稳定的生物制剂时尤为重要。在这种情况下,连续制造可能是将这些产品推向市场的唯一方式。 增加设备利用率可以带来进一步的好处:尽管整体工艺时间缩短,但每个单独的单元操作可以持续更长时间。这引入了以较低流速运行和/或进行更多纯化循环的机会,从而实现更小的设备和更小的占地面积。 例如,在批量捕获色谱中,生物反应器通常进行 2-4 次色谱循环。然而,在连续色谱中,柱子可以以较短的停留时间运行,从而可以使用较小的柱子,这些柱子可以更频繁地循环,以更有效地利用树脂的使用寿命。较小的柱子可以预先装填,内径可达 80 厘米,进一步降低色谱操作的风险。 较小的设备还使得能够实施一次性(SU)流路,这在较大规模时可能会变得过于昂贵或技术上不可行。SU 带来了额外的好处:减少了清洁及其验证,以及更简单的设施,包括模块化的“舞厅”平面布置,这些设施更便宜、更快捷地建造,并且适合于不同产品之间的快速转换。这种类型的设施可以作为一个通用的处理套件,相同的设备可以在产品开发周期中使用,包括毒理学、临床试验以及全面生产。 通过灌注工艺能够通过不同的运行时间调整生产的药物量,这种灵活性得到了增强。因此,可以避免昂贵且耗时的放大,也许能够更快地获得药物。 另一个优势是增加循环次数,连续工艺在稳态下运行,已被证明比批量操作更可靠。稳态运行还带来了能够生成更多数据的能力,这些数据可以通过多变量数据分析等统计方法预测工艺何时偏离期望状态,从而在工艺失败之前进行调整。因此,连续处理可能通过动态控制推动质量提升。 然而,这些进步取决于克服重大的技术障碍。最终,进展不仅来自于将各个单元操作转移到连续模式,还来自于将单元操作耦合以开发工艺。下面我们将讨论一些变革性技术以及早期采用者如何拼凑他们自己的连续下游纯化平台。连续加工的关键使能技术 声波分离 在工艺开发方面的大量投资带来了更高强度、更高生产力的细胞培养。在许多情况下,这些生产力的提高也增加了生物反应器内的生物量。对于批次上游工艺,离心或一次性深层和传统过滤介质被用于减少药物产品中的细胞和细胞碎片。然而,在高细胞密度下,离心变得不够稳健,传统过滤介质可能会提前堵塞,需要增加过滤面积,这并不总能被现有设施容纳。对于灌注工艺,细胞保留通常通过中空纤维切向流过滤实现,无论是单向还是交替流动。然而,产品通过中空纤维的传输通常会随着时间的推移而减少,产品可能会被困在生物反应器中。因此,高细胞密度的挑战促使人们探索替代的一级澄清技术,包括声波分离。50多年来,非线性声学已在多个行业中得到应用;从医学超声到水下探测,从微流体到声悬浮。这些应用受到一组经过充分表征的物理波动方程的控制。从广义上讲,声学可以精确且智能地控制,以在连续、不结垢、可扩展的过程中凝聚并去除载体流中的颗粒。该技术的独特之处使其适合作为真正连续药物制造设施的一级澄清步骤。 声波分离器的核心处理部分是一个压电换能器和声反射器,它们跨越细胞培养液流经的流道(见图4.1)。在Pall的声波分离器中,在换能器和反射器之间建立了一个三维声驻波。在一次性谐振器内,驻波建立了一个高度调谐的压力场,其中高、低压力节点可预测地排列,颗粒根据其相对于细胞培养液的密度进行凝聚。将多个颗粒凝聚成较大的团簇,使重力能够轻松地将聚集的颗粒从悬浮液中拉出,收集并去除或重新加入到工艺中(具体取决于特定的流体学和工艺步骤的需求)。 在用于批次灌注工艺的澄清过程中,含细胞的生物反应器流体通过谐振器中的压力场。通过凝聚和去除流中的颗粒,流道将细胞从单克隆抗体(mAb)负载的渗透液中引导开,使它们能够被连续泵入浓缩的废流——渗透液作为澄清的液体传递到后续的加工步骤。在灌注工艺中,需要保留(而不是丢弃)细胞,生物反应器的进料流在声场下方切向循环,允许单克隆抗体作为渗透液不受阻碍地通过声学,而细胞则返回生物反应器进行进一步培养。在这两种应用中,专有的声学算法和精心设计的流道共同以连续、温和且高效的方式将单克隆抗体从产生单克隆抗体的细胞培养液中分离出来。 多柱色谱 多柱色谱是向连续加工转变的关键使能技术。人们一直致力于强化Protein A捕获色谱步骤。这在一定程度上是因为Protein A树脂的相对成本较高,它在下游加工成本中占了相当大的比例。Protein A树脂的一个共同特点是其对单克隆抗体的容量强烈依赖于加载步骤的停留时间。Protein A膜已被证明能够解除这种依赖关系。然而,由于膜的比表面积较低,其容量比树脂落后两倍甚至更多。为了最大化容量,Protein A树脂通常在4分钟或更长的停留时间下进行加载。长停留时间导致相对较低的生产率,这通常以每升树脂每小时纯化的产品克数来表示。在典型的批次制造场景中,Protein A柱的尺寸是根据处理生物反应器的能力以及两到四个色谱周期来确定的,这导致了大型柱和大量的资本支出。 为了解决批次Protein A步骤的不足,提出了一系列连续色谱解决方案。这些解决方案大多依赖于同时加载多个柱,从而带来更高的容量和生产率。由于可以使用次级和三级柱捕获未结合的产品,因此可以更快地进行加载(停留时间更短)。这为减少商业生物工艺中所需的树脂量以及通过更快的树脂循环改善制造经济性提供了可能性。 许多公司已经为生物制药市场开发了基于同时加载多个柱的连续色谱系统。这些系统主要根据可以操作的柱的数量来区分。例如,Chromacon Contichrom Cube有2个柱,GE PCC有3或4个柱,NovasepBio SC有6个柱,Semba Octave有8个柱,Pall BioSMB GMP有8个柱或Pall BioSMB PD有16个柱。所有这些系统都依赖于通过将主加载柱过载至产品突破点来提高效率。通过后续柱捕获突破第一柱的产品,避免了产品损失。柱过载可以被看作是将一个较大的柱分解成较小的部分,以便更积极地利用质量传递区。所有柱都经历相同的操作,产品质量通过重复的色谱周期保持一致。为了理解柱的数量和不同系统的操作的影响,将色谱周期视为两个阶段是有用的:加载和非加载阶段。后者包括色谱周期的所有非加载步骤,包括冲洗、洗脱、再生和再平衡。最简单的操作是使用三个柱,在任何时候,两个色谱柱串联加载,而第三个柱正在进行非加载步骤。所有柱都经历周期性的色谱操作。直接接收加载的柱最终会被产品饱和。此时,对该柱的加载可以停止,该柱被分配到非加载步骤。之前接收第一柱流过液的第二个加载柱现在直接接收加载,而再生的柱被放置在主捕获柱之后,以防止产品损失。在滴度适中时,例如1 g/L,加载步骤是速率限制步骤。在1分钟的停留时间下进行加载,可以实现>40 g/L的容量。非加载步骤也可以在1分钟的停留时间内完成,通常需要20到30个柱体积(CV),以冲洗、洗脱、清洁和再生一个Protein A柱。随着滴度的增加,加载时间减少。在10 g/L时,可能只需要4分钟的加载时间,容量为40 g/L,加载停留时间为1分钟。非加载步骤无法在这个时间框架内完成,成为速率限制步骤(见图4.2)。有多种可能的解决方案可以应对这种现象,包括减慢或停止加载,这会影响生产率。另一种选择是增加更多的柱来执行工艺的非加载步骤。这在高滴度下推动生产率。 由Chromatan开发的连续逆流切向色谱技术是多柱色谱的一种值得注意的替代方法。在这种方法中,树脂在系统中循环,减少了对固定床柱的依赖。其优势在于它促进了真正的连续洗脱,与提供离散洗脱液的柱方法不同。这代表了从当前批次柱工艺的进一步转变。这种方法的一个缺点集中在树脂的稳定性和寿命上,这必须经过验证。此外,与基于柱的色谱相比,洗脱浓度似乎较为适中,影响了下游单元操作的生产率。 其他连续色谱解决方案也已被探索。这些包括环状色谱、模拟移动床(SMB)及其变体多柱逆流溶剂梯度纯化(MCSGP)。这些方法在生物处理中引起了有限的兴趣。环状色谱依赖于在两个同心圆柱的环形空间内填充分离介质。柱缓慢旋转,而进料装置和分馏收集器保持静止。目前没有可用于操作连续环状色谱的商业系统。这可能是因为均匀填充分离基质和密封旋转部件的技术挑战。SMB通过定期切换柱入口来实现,形成分离基质和液体的模拟逆流。SMB特别适用于手性化合物的二元分离,这导致其在天然产物合成中间体中的常见应用。目前没有生物工艺使用SMB,但它可能对需要(SEC)尺寸排阻色谱的过程有用。 MCSGP是SMB的一个变体,其中部分纯化的分数被回收到加载中。这提供了高纯度和高收率的可能性,但重新加载材料可能导致低生产率,特别是当应用于SEC时。 低pH病毒灭活 低pH病毒灭活(VI)是确保产品安全的关键步骤,通常在Protein A捕获步骤之后直接进行。在当前的批次制造工艺中,VI大多手动进行:通过泵入酸和碱进行滴定,产品的pH通常通过取样和使用校准的台式pH计进行测试来验证。虽然GE、Sartorius和Pall有可用的批次系统,但该过程并不容易自动化。随着联合灌注上游工艺和连续捕获下游工艺的考虑,这使得VI单元操作成为焦点。正在探索几种不同的VI可能性。这些可以分为3类: 连续搅拌罐反应器 唯一商业可用的连续低pH病毒灭活解决方案是Pall的Cadence VI系统。Cadence VI依赖于一个两罐系统来操作半连续VI。罐的功能交替,一个罐接收来自上游工艺的新洗脱液。另一个罐用于进行低pH灭活步骤:当过程完成时,该罐被排空,然后可以接收新的洗脱液。与此同时,另一个罐中收集的洗脱液可以通过低pH步骤进行处理。这样,产品在同一个罐中被收集和处理。Cadence VI系统可以被认为是一种自动化的当前批次工艺版本,这可能为性能验证提供了一条相对简单的路径。然而,这种方法存在一些风险,这些风险被生物制药用户小组突出强调。许多风险在系统开发过程中被识别,并通过系统设计和测试得到了缓解或减少。 这些关键风险包括通过死腿(孤立的分支或一端封闭的管段)和悬挂滴液使灭活产品受到未灭活产品的污染。通过在混合器的低点引入液体、消除飞溅以及使用具有最小持液体积和循环回路的Artesyn阀门,这种风险得到了缓解。这些特点还减少了酸和碱的回混风险,消除了在保持步骤中pH漂移的机会。另一个关键风险是pH探头,它必须在较长时间内保持精确校准。在Pall,使用机械臂将pH探头在低pH和高pH缓冲液之间转移,以模拟VI进行测试。测试显示pH探头漂移很小,在48小时内为0.05个pH单位,使这些探头适用于连续VI。 循环流反应器 自动化当前批次VI工艺的挑战以及对更连续工艺的渴望促使几个小组追求循环(活塞)流反应器。在这里,所需的低pH保持时间由曲折的流道提供。为了最小化流的轴向分布以及最小化产品在活塞流装置中停留时间的分布,开发了一种交替卷绕方向的管,以引入迪安涡流并促进均匀性。尽管有一些专利活动,但目前没有商业可用的解决方案。生物制药用户论坛识别出一些技术挑战和风险。最大的挑战集中在滴定和pH测量上。Protein A的洗脱液在洗脱峰上不同位置的蛋白质电导率和pH值各不相同。这种变异性通过在滴定前汇集材料来解决,但这仍然存在确保材料足够均匀以在进入活塞流反应器之前达到灭活pH的挑战。随着pH探头存在滞后性,这种风险被放大:在恒定流动情况下,产品可能未达到灭活pH,并且未被pH探头检测到。 基于柱的策略 活塞流方法的轴向分散和随后的宽停留时间可能通过使用基于柱的方法来提供在低pH下所需的保持时间来解决。已经应用了多种介质,包括Protein A、阳离子交换、尺寸排阻和惰性珠子。Protein A和阳离子交换方法很有吸引力。使用这些方法可以将低pH VI与所需的色谱步骤结合起来,这可以被认为是在工艺强化方面的一个进一步发展。 然而,这种方法也有缺点。需要高电导率缓冲液以维持在低pH下mAb与ProteinA的结合。目前还不清楚这些缓冲液以及灭活后通常增加的浊度会对树脂的寿命产生什么影响。此外,声称Protein A步骤和低pH灭活都能清除病毒将是一个挑战。 使用SEC的缺点是介质的可压缩性。因此,SEC只能在低线速度下运行。因此,需要在工艺中引入一个相对较大的直径填充柱。对这种方法的一个改进可能是使用惰性珠子。它们通过增加柱的长度来扩大规模,这增加了更多的理论板并降低了分散。 替代低pH病毒灭活的方法 低pH可以被其他病毒灭活方法所替代。特别是溶剂/去污剂灭活可以使用相同的设备。溶剂/去污剂灭活的优点是它可以应用于对pH敏感的蛋白质。 另一种病毒灭活的替代方法是紫外线C辐照。紫外线C辐照与高温一起被应用于细胞培养材料,以减少进入工艺的病毒载量。紫外线C已经被Bayer开发成商业系统,并由Sartorius商业化。这些系统采用螺旋流道以确保一致的混合和紫外线C暴露。这种方法非常适合连续制造。无需添加任何东西,灭活可以在连续流动中进行。尽管具有这些优点,紫外线C系统似乎不再被市场推广。紫外线C在DNA中诱导嘧啶二聚体。这种损伤可以阻止DNA聚合酶,防止复制。然而,紫外线C辐照也可以通过光解或活性物种的生成来损伤蛋白质,导致蛋白质硫醇氧化。也许正是因为蛋白质损伤的可能性,紫外线C辐照在生物处理中的应用有限。 单程切向流过滤 单程切向流过滤(SPTFF) 传统的TFF在生物制药的配方中得到了广泛的应用。该过程通常是超滤(UF),通过脱水浓缩蛋白质,然后是透析(DF)以将产品放入正确的缓冲系统中,最后通过UF达到最终浓度。对于生物分子,配方浓度通常大于100 g/L,以最小化需要注入患者体内的产品体积。传统TFF的缺点是需要多次通过设备,这需要多次通过泵和TFF,可能会产生剪切力,从而损坏产品。此外,多次泵送需要使用相对较大的进料泵和大直径系统管道进行循环,这本质上是一个批次操作。 尽管自TFF引入以来的四十多年来,膜的性能和材料的制造已经取得了许多进展,但TFF的原理在这段时间内并没有发生实质性的变化。因此,SPTFF技术代表了自发明以来TFF实践的第一次重大变化,简化了纯化过程,并创造了传统TFF无法实现的新能力。因此,它将TFF技术提升到了一个新的制造能力、稳健性、复杂性水平,并实现了真正的连续操作。SPTFF通过在单次通过中实现高转化率,解决了传统TFF的缺点,从而提供了TFF的性能与直接流过滤的简单性。如图4.3所示,与传统TFF过程不同,SPTFF过程是连续的,没有循环回路,消除了对过程罐的需求,并能够在不需要积累批次的情况下,一旦可用就处理流。通常,TFF和SPTFF使用相同类型的模块,使用相同的盒式几何形状,包括相同的膜以及相同的进料和渗透筛。然而,SPTFF模块被配置为具有更长的流道,由稍低的流速和稍高的压力驱动,并且其流道的横截面沿流道变化。这种属性和特点的组合使得每次通过的转化率很高,与传统TFF相比具有同等或更高的生产率。 SPTFF过程执行与TFF过程相同的分离;今天可以用TFF过程完成的任何事情也可以用SPTFF完成。在SPTFF过程中,完整的分离在一个稳定状态下,在模块的流道中沿着流道在几分钟内完成。相比之下,在传统的TFF过程中,分离通常需要3到4小时的处理时间逐渐发生。这一特性可能导致对连续加工敏感的产品产量增加。 通过SPTFF进行在线浓缩已在生物工艺的多个位置得到应用,包括上游和下游工艺之间的界面,它可以被用来完全解耦它们,增加灌注工艺中捕获色谱的生产率,这些工艺的滴度适中,在色谱之前的缓冲液交换,或在最终配方之前的浓缩/缓冲液交换,然后进行无菌过滤。 用于在线透析(ILDF)的SPTFF SPTFF已被适应用于透析应用,以实现连续缓冲液交换。ILDF过程本质上是一个设备内的多个SPTFF浓缩步骤系列,每个浓缩步骤的流出液被DF缓冲液稀释,然后通过下一个阶段再次浓缩。这样的模块有一个DF分配器,这是一个流体装置,将DF缓冲液适当地分配到每个DF阶段。 与SPTFF浓缩模块相比,ILDF模块的流道通常是恒定横截面的,因为流体性质的变化不如SPTFF浓缩模块中的变化那么大。图4.2是一个ILDF过程的P&ID,显示了额外的DF流,需要第二个流量控制(FRC)来控制DF速率。在ILDF过程中,流出流可能与进料流具有相同的浓度,也可能没有。在下面的示例中,假设在ILDF过程中没有发生浓缩,因此FRC保持1的浓缩因子(见图4.4)。 正如在传统TFF中的透析一样,DF体积越大,去除因子越大,去除因子定义为不希望的溶质浓度的降低。通过一个ILDF设备的单次通过,可以进行三个对数或更多的缓冲液交换,该设备有六个相同的浓缩和稀释阶段。 尽管连续进行,但通过多次稀释和再浓缩(批次透析)步骤进行透析的一个缺点是,与传统TFF透析过程相比,缓冲液消耗可能更高。如果需要,可以通过将一些透析阶段的渗透液回收到早期阶段的DF进料流中来提高缓冲液使用的效率。这被称为逆流DF。 SPTFF浓缩和ILDF设备可以联合使用,以通过UF/DF/UF进行连续配方。这是能够完全连续操作的一个关键进步。 早期采用者的最新动态 连续加工的早期采用者采取了许多不同的强化路线。这些决策源于每家公司的商业案例,围绕当前制造需求和能力与由于药物管线而预测的未来需求之间的关系。在这里,我们旨在提供领先早期采用者的工作动态,尽管应该清楚的是,并非所有公司都分享他们强化计划的许多甚至任何细节,因为他们可能认为这是牺牲他们的竞争优势。鉴于这一限制,该列表并不全面。 Alvotech Alvotech专注于生物仿制药的开发和制造,其关键支柱之一是“投资于最高质量和差异化策略,以开发增值和患者友好的产品”。Alvotech的制造平台基于一个1000升的灌注生物反应器,运行时间可达45天,但基于15天的批次操作。细胞保留通过ATF实现,下游工艺包括使用Cadence BiosMB的连续捕获,随后是Cadence VI(Andrew Falconbridge,世界生物制药论坛,2019)。 Amgen Amgen的工艺强化之路是由更高强度的灌注工艺推动的。Amgen声称,一个2000升的灌注生物反应器,体积生产力为2.5 g/L-day,可以在15天内生产50公斤的药物物质。这相当于一个15000升的批次灌注生物反应器的产量。Amgen将灌注上游与下游工艺相结合,最小化步骤之间的保持罐,以减少占地面积并提高生产率。利用这些进步,Amgen在新加坡建立了一个120000平方英尺的制造设施。与传统工厂相比,Amgen的新加坡工厂以更低的价格建成,占地面积约为传统制药工厂的五分之一(约170000平方英尺,与Amgen在罗德岛的工厂相比为750000平方英尺)。一个包含制造、受控温度仓库、行政、质量控制和清洁公用设施的建筑在18个月内建成。工厂的宴会厅设计,采用一次性系统以缩短流道,省略了就地清洁系统,并提供了高度的灵活性。 连续生物处理使Amgen的大部分成功成为可能。上游进料直接进入两个色谱柱单元,中间有一个小的缓冲罐。第二柱的出流直接进入病毒过滤和UF/DF单元。整个过程的总时间仅为10到14小时。 然而,在Amgen使用一次性系统的挑战来自于复杂供应链的创建。为了评估聚合物薄膜的生物学影响,Amgen需要将原材料的变异性与工艺参数相关联。需要进行特征研究以了解用于生物处理的袋子的变异性。建立质量控制测试以确保一致的性能变得必要。一次性系统进一步需要持续监测和频繁验证性能。新加坡工厂的成功通过最近的新闻得到突出,即Amgen在罗德岛又破土动工了一个新一代生物制造工厂。 BiosanaPharma 正如已经讨论的那样,BiosanaPharma最近成为第一家将完全连续工艺生产的单克隆抗体推向临床的公司。BiosanaPharma将这一过程命名为3C,可能是因为它利用了一个连续的上游灌注生物反应器,结合了连续离心以控制细胞活性和一个连续的下游工艺。BiosanaPharma声称“3C技术平台是一个高生产率、灵活、占地面积小(50平方米)的制造平台,能够在50升生物反应器规模下每周生产1公斤药物物质抗体。通过多周期逆流操作使批次加工连续化。上游工艺基于高细胞密度连续灌注培养,交替使用生物反应器。下游工艺包括在BioSMBs中进行的Protein A和阳离子交换,结合流过式过滤。该工艺具有GMP状态,并设计为可运行长达2个月。所有步骤同时运行,通过智能软件(21 CFR第II部分)进行流程控制和数据采集。BiosanaPharma可能独一无二的是,他们与台湾的第三方Mycenax合作开发了他们的连续工艺,概念验证工艺在50升规模下进行——这也是计划用于最终制造工艺的规模。 勃林格殷格翰(BI)和辉瑞 BI和辉瑞合作实现了一个新一代制造平台。该平台的目标包括一个完全一次性使用的流道,通过连续操作实现工艺强化以及高度自动化;所有这些结合在一起,为多产品设施提供了高度的灵活性和敏捷性。该工艺的核心是新一代灌注平台HILVoP。这是一个非稳态过程,细胞密度可能达到每毫升2亿个细胞。BI/辉瑞声称该过程在类似时间内产生的产品比批次多10倍,比稳态灌注多5倍。这代表了在14天的运行期间,生物反应器的产量高达每升76克。产品收获持续10天,细胞通过中空纤维TFF保留。下游工艺似乎完全使用内部开发的系统运行。色谱使用iSKID进行,支持交替的Protein A捕获色谱。当一个柱正在加载时,另一个柱执行非加载步骤。这样可以实现连续加载。然而,为了简化操作,柱一次只加载一个,树脂的容量与批次操作相同。BI/辉瑞还开发了一种新的低pH VI解决方案,“盒中摇摆”(JIB)曲折流道连续系统。 总体而言,BI/辉瑞声称他们的新一代平台比批次操作的生产率提高了10倍,能够在14天-2000升生物反应器灌注活动中生产30到60公斤的产品。 Enzene 作为Alkem Laboratories的子公司,Enzene旨在通过在其位于印度浦那的世界级制造设施中开发颠覆性技术平台和先进分析技术,提供具有成本效益的生物仿制药。通过建立一个完全自动化的连续cGMP合规的单克隆抗体生产制造工厂,Enzene旨在在全球范围内颠覆生物技术产品的可负担性。为此,Enzene已从Novasep获得了一台BioSC Pilot仪器,并计划将其整合到其切向流过滤和病毒灭活流程中。 Enzene声称灌注相对于补料批培养方法的累积生产率提高了10倍。通过较小的工厂占地面积减少约5倍的资本支出(CAPEX),以及通过降低原材料、蒸汽、WFI和电力的消耗将运营支出(OPEX)减少一半,这是Enzene推动进入连续制造领域的驱动力。他们在实施连续制造方法的过程中遇到了一些障碍,例如需要找到工艺、自动化和PAT的正确组合。对于Enzene来说,生物反应器和色谱线的污染风险在上游和下游流程的相互作用中变得尤为突出。然而,通过最大限度地利用Protein A树脂所获得的节省已成为实施连续制造技术的一个主要因素。 Enzene的例子告诉我们,越来越多的公司不可避免地会选择在生物制品领域实施连续制造,因为竞争对手所获得的竞争优势将成为从开发和制造新的治疗药物和生物仿制药中获利的一个难以克服的障碍。 健赞 健赞实施灌注工艺,结合ATF技术进行细胞保留以及通过3C-PCC系统(GE Healthcare)进行Protein A捕获的描述之前已经有过。为了进一步发展这一制造平台,健赞最近开始建设一个生物制品研发开发设施。这个新的20000平方英尺的设施,以其位于马萨诸塞州弗雷明汉的纽约大道的位置而得名,31NYA试点工厂包括两个操作空间,其中包括一个一次性技术套件,配备波浪袋和高达500升尺寸的搅拌式SUBs。该设施的目标是评估并确认一次性生物反应器、细胞保留技术和周期性逆流色谱设计的选择。评估工艺的可制造性、展示“封闭系统”操作以及进行“按比例”研究以支持连续制造工艺开发也被提及为健赞旨在实施的“概念验证”努力的要素。所付出的努力和投资表明,健赞认真致力于实施连续下游制造,同时扩大其生物制品组合。 Just Biotherapeutics Just Biotherapeutics自称为“专注于将加速生物治疗药物开发并大幅降低其制造成本的技术的集成设计公司”。他们的目标是通过集成设计方法,在全球市场上提供对重要生物制品的获取。 Just Biotherapeutics在制造规模上展示了连续处理的概念验证(2019年佛罗里达州奥兰多ACS)。他们的连续工艺从一个500升灌注生物反应器的培养基浓缩物开始。通过使用中空纤维切向流装置保留细胞。澄清的进料被导向一个200升混合器,捕获步骤通过一个三柱Protein A工艺的Pall BioSMB Process 80进行。洗脱池在Pall病毒灭活系统Cadence VI中经过低pH处理并中和。从Protein A到病毒灭活的下游连续工艺进行了6天,但未来计划展示这一工艺更长时间。 这项工作展示了使用现成设备组装连续工艺的能力,并突出了能够以连续方式结合上游和下游工艺的协同作用。 默克 默克公司(新泽西州肯尼沃斯)采用连续处理的动机来自于其相对较低的安装生物反应器容量,将这一“劣势”转变为竞争优势。为此,默克继续成为集成连续生物处理的先驱之一。我们在2017年最后一次报道了默克的活动,重点关注其蛋白质精炼厂(PRO Lab)及其在六十天期间运行的联合上游和下游连续工艺。该工艺由Delta V控制系统完全自动化,包括一个10升灌注生物反应器,连接到一个连续的下游工艺,其中包括用于Protein A捕获的Cadence BioSMB PD和用于低pH病毒灭活的活塞流反应器。两个抛光色谱步骤,其中一个在Cadence BioSMB PD上进行,与病毒过滤和配方相结合。从那时起,默克继续在实验室开展活动,致力于质量源于设计和工艺分析技术,旨在实现实时产品放行。此外,默克还致力于Protein A捕获步骤的放大,将单柱工艺转移到多柱Cadence BioSMB PD,并最终在三周内放大到Cadence BioSMB Process。这一工艺比较表明,质量属性保持不变,但连续工艺的生产率提高了3倍以上(表4.2)。 诺华 诺华声称其接近满负荷制造能力。这提供了增加产能和创新制造平台的机会。全球制造目标包括降低成本、最大化净现值(NPV)、加快开发速度、最小化技术转移风险和实现灵活性。为此,诺华设想了一个重复制造设施,能够生产广泛的分子。诺华的目标是在开发、制造的所有阶段使用单一规模的设备,以消除放大的需要。 诺华的未来制造平台基于不锈钢,因其经过验证的稳健性。上游工艺基于高细胞密度的灌注细胞培养。这与使用AKTA PCC的连续捕获工艺相结合,随后是重复的批次VI。操作之间的缓冲罐被最小化到大约5分钟的保持时间,以平衡操作之间的流量。 有了这样的设施,诺华预测一个传统的批次制造设施,拥有6个11000升的生物反应器,每年生产4.5吨,可以被一个8个1000升的设施所取代。连续设施的建设时间仅为2年,比批次设施少3年,从而导致货物成本降低50%(Joel Schultz,世界生物制药论坛,2019)。 结论:临界点 我们看到生物制药领域的这些发展使行业逐渐接近那个传奇的临界点,在这一点上,连续处理的好处将超过风险。也许并不奇怪,这里描述的连续处理的早期采用者正在利用灌注来强化上游工艺,以在每个生物反应器体积中生产更多的产品。灌注工艺还使得“一刀切”的处理愿景成为可能,这可能消除了通过延长操作时间以生产更多材料的放大需求。然后,连续下游处理是灌注方法的逻辑延伸,消除了将产品汇集并作为离散批次进行纯化的需要。为了强化下游工艺,似乎每个单元操作都有选择。特别是,捕获色谱有多种不同的方法。持续的改进循环使我们相信,多柱方法将被采用以应对不断增加的产品滴度。 对于生物仿制药和已批准药物的更新工艺来说,上市时间可能远不如成本降低重要。也许并不奇怪,生物仿制药公司正在引领连续处理的道路。预计生物仿制药公司将克服技术和监管障碍,降低采用连续处理的门槛。到这一点时,尤其是那些达到当前产能极限的原研公司,将别无选择,只能迅速采用连续处理。识别微信二维码,添加生物制品圈小编,符合条件者即可加入生物制品微信群!请注明:姓名+研究方向!版权声明本公众号所有转载文章系出于传递更多信息之目的,且明确注明来源和作者,不希望被转载的媒体或个人可与我们联系(cbplib@163.com),我们将立即进行删除处理。所有文章仅代表作者观点,不代表本站立场。

生物类似药专利到期

100 项与 利妥昔单抗生物类似药(Amgen, Inc.) 相关的药物交易

登录后查看更多信息

外链

| KEGG | Wiki | ATC | Drug Bank |

|---|---|---|---|

| - | - | - |

研发状态

批准上市

10 条最早获批的记录, 后查看更多信息

登录

| 适应症 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|

| 类风湿关节炎 | 美国 | 2022-06-03 | |

| 慢性淋巴细胞白血病 | 美国 | 2020-12-17 | |

| 肉芽肿伴多血管炎 | 美国 | 2020-12-17 | |

| 显微镜下多血管炎 | 美国 | 2020-12-17 | |

| 非霍奇金淋巴瘤 | 美国 | 2020-12-17 |

未上市

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| CD20阳性的B细胞非霍奇金淋巴瘤 | 临床3期 | 美国 | 2016-05-25 | |

| CD20阳性的B细胞非霍奇金淋巴瘤 | 临床3期 | 日本 | 2016-05-25 | |

| CD20阳性的B细胞非霍奇金淋巴瘤 | 临床3期 | 澳大利亚 | 2016-05-25 | |

| CD20阳性的B细胞非霍奇金淋巴瘤 | 临床3期 | 保加利亚 | 2016-05-25 | |

| CD20阳性的B细胞非霍奇金淋巴瘤 | 临床3期 | 加拿大 | 2016-05-25 | |

| CD20阳性的B细胞非霍奇金淋巴瘤 | 临床3期 | 哥伦比亚 | 2016-05-25 | |

| CD20阳性的B细胞非霍奇金淋巴瘤 | 临床3期 | 捷克 | 2016-05-25 | |

| CD20阳性的B细胞非霍奇金淋巴瘤 | 临床3期 | 法国 | 2016-05-25 | |

| CD20阳性的B细胞非霍奇金淋巴瘤 | 临床3期 | 格鲁吉亚 | 2016-05-25 | |

| CD20阳性的B细胞非霍奇金淋巴瘤 | 临床3期 | 德国 | 2016-05-25 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

临床1期 | 29 | 鹹餘齋糧鏇鏇醖築繭餘 = 襯獵壓遞網蓋觸構構鏇 蓋顧夢遞範鏇艱積憲鑰 (網顧鬱醖鑰糧窪範餘選, 艱鑰襯獵範鑰廠鏇鏇鬱 ~ 遞繭鬱繭觸齋憲鹹糧餘) 更多 | - | 2021-08-20 | |||

临床3期 | 254 | 選觸襯夢鏇夢遞淵觸鑰(鬱齋築鹹願鹽鏇簾鏇築) = 鹹壓簾網襯選網繭顧鹹 簾獵構衊廠繭範簾醖獵 (壓積襯範鬱遞夢夢選願 ) | 相似 | 2020-10-01 | |||

選觸襯夢鏇夢遞淵觸鑰(鬱齋築鹹願鹽鏇簾鏇築) = 鬱壓選衊壓網艱糧簾觸 簾獵構衊廠繭範簾醖獵 (壓積襯範鬱遞夢夢選願 ) | |||||||

临床3期 | 256 | (ABP 798) | 鬱蓋衊醖網鑰蓋選餘衊 = 獵艱遞壓繭衊積願願遞 艱齋顧鑰繭鹹築壓鑰膚 (壓鬱壓夢積襯繭餘築憲, 鹹觸簾壓廠壓選蓋齋衊 ~ 餘壓齋窪膚淵繭廠淵憲) 更多 | - | 2020-08-18 | ||

(Rituximab) | 鬱蓋衊醖網鑰蓋選餘衊 = 淵膚遞窪壓鹹繭鑰積獵 艱齋顧鑰繭鹹築壓鑰膚 (壓鬱壓夢積襯繭餘築憲, 鑰膚糧願襯淵壓襯廠鏇 ~ 遞願範獵觸膚齋繭窪餘) 更多 | ||||||

N/A | 256 | 艱餘蓋鹹獵鏇艱鹹憲糧(窪構顧顧醖膚鑰構選襯) = 齋襯夢窪積鏇繭壓齋構 膚鬱餘構積構鹹憲願襯 (鏇構艱廠顧衊壓夢願廠 ) | 积极 | 2020-05-25 | |||

艱餘蓋鹹獵鏇艱鹹憲糧(窪構顧顧醖膚鑰構選襯) = 衊壓網艱鹹壓餘築遞繭 膚鬱餘構積構鹹憲願襯 (鏇構艱廠顧衊壓夢願廠 ) | |||||||

临床2期 | 101 | R-CHOP plus maintenance rituximab | 膚齋顧夢齋衊糧構鹽鬱(夢鬱壓選餘糧鹽襯艱積) = 鹹築顧構構獵遞艱築鹽 壓衊艱鬱鹽膚壓製選艱 (繭壓膚廠艱艱範鹽鹽築 ) 更多 | - | 2005-06-01 | ||

窪鹹簾廠餘願廠構鏇膚(顧願選窪壓築遞顧鬱鏇) = 醖齋積窪顧網夢壓壓網 選夢遞餘積顧艱製衊鏇 (衊襯觸窪齋淵膚齋膚膚 ) |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

生物类似药

生物类似药在不同国家/地区的竞争态势。请注意临床1/2期并入临床2期,临床2/3期并入临床3期

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用