预约演示

更新于:2025-05-07

SV2A

更新于:2025-05-07

基本信息

别名 KIAA0736、SV2、SV2A + [1] |

简介 Plays a role in the control of regulated secretion in neural and endocrine cells, enhancing selectively low-frequency neurotransmission. Positively regulates vesicle fusion by maintaining the readily releasable pool of secretory vesicles (By similarity).

(Microbial infection) Receptor for the C.botulinum neurotoxin type A2 (BoNT/A, botA); glycosylation is not essential but enhances the interaction (PubMed:29649119). Probably also serves as a receptor for the closely related C.botulinum neurotoxin type A1. |

关联

14

项与 SV2A 相关的药物靶点 |

作用机制 SV2A调节剂 |

在研机构 |

在研适应症- |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期1800-01-20 |

582

项与 SV2A 相关的临床试验NCT06907173

Ketamine add-on Therapy for Established Status Epilepticus Treatment Trial (KESETT)

The goal of this clinical trial is to determine if treatment of patients with two doses of ketamine plus levetiracetam versus levetiracetam alone leads to more effective control of status epilepticus.

开始日期2025-08-01 |

申办/合作机构 |

NCT06866691

Comparison of Levetiracetam Versus Lacosamide for Seizure Prevention in Moderate to Severe Traumatic Brain Injured Patients

The purpose of this study is to assess the incidence of early post-traumatic seizures. The study will also assess the benefit of lacosamide compared to levetiracetam in regards to agitation and behavioral adverse effects in patients with moderate to severe traumatic brain injury requiring seizure prophylaxis.

开始日期2025-04-18 |

NCT06919926

A Randomized, Within-subject, Double-blind, Placebo-controlled Study Evaluating the Efficacy and Safety of AGB101 (Low-dose Levetiracetam, 220 mg, Extended Release Tablet) for the Treatment of Hippocampal Overactivity in the Elderly

This randomized, crossover, placebo controlled clinical study will assess the efficacy and safety of a slow release form of levetiracetam (AGB101) in the treatment of cognitively normal adults by measuring change in several imaging measures over the course of a two week treatment period.

开始日期2025-04-17 |

申办/合作机构 |

100 项与 SV2A 相关的临床结果

登录后查看更多信息

100 项与 SV2A 相关的转化医学

登录后查看更多信息

0 项与 SV2A 相关的专利(医药)

登录后查看更多信息

914

项与 SV2A 相关的文献(医药)2025-05-01·Journal of Cerebral Blood Flow & Metabolism

Preclinical validation and kinetic modelling of the SV2A PET ligand [

18

F]UCB-J in mice

Article

作者: Khetarpal, Vinod ; Bard, Jonathan ; Bertoglio, Daniele ; Elvas, Filipe ; Liu, Longbin ; Miranda Menchaca, Alan ; Staelens, Steven ; Everix, Liesbeth

2025-04-01·NeuroImage

Fibrillar amyloidosis and synaptic vesicle protein expression progress jointly in the cortex of a mouse model with β-amyloid pathology

Article

作者: Schaefer, R ; Ziegler, S ; Palumbo, G ; Lindner, S ; Brendel, M ; Wind-Mark, K ; Gnörich, J ; Gildehaus, F-J ; Kunze, L H

2025-04-01·Journal of Nuclear Medicine

Imaging Synaptic Density in Aging and Alzheimer Disease with [18F]SynVesT-1

Article

作者: Weimer, Robby ; Baker, Suzanne L ; Zinnhardt, Bastian ; Jagust, William J ; Janabi, Mustafa ; Rabinovici, Gil D ; Giorgio, Joseph ; Toueg, Tyler N ; Chen, Xi ; Green, Ari ; Soleimani-Meigooni, David N

20

项与 SV2A 相关的新闻(医药)2025-03-18

February saw the first approvals of several important new drugs. From South Korea’s first domestically developed and approved botulinum toxin type A product to GSK’s five-valent meningococcal conjugate vaccine and a recombinant chikungunya vaccine co-developed by Denmark and the U.S., these breakthroughs not only expand treatment options but also offer patients more effective therapeutic choices. Additionally, new treatments for tenosynovial giant cell tumor, neurofibromatosis type 1, tetanus, chronic hepatitis C, and recurrent or metastatic squamous cell carcinoma of the head and neck have emerged, marking significant progress in the fight against complex diseases.

1. Clostridium Botulinum Toxin Type A (ATGC)Botulinum toxin type A is a neurotoxin-based therapeutic developed independently by the South Korean biopharmaceutical company ATGC Co. Ltd. On February 17, 2025, it received market approval from the Korean Ministry of Food and Drug Safety (MFDS), making it the first botulinum toxin type A product fully developed and approved by a domestic South Korean company. Based on the neurotoxin secreted by Clostridium botulinum, the product employs recombinant gene technology to enhance toxin stability and specificity. It is primarily developed for the treatment of glabellar lines (frown lines), marking a critical technological breakthrough in South Korea’s medical aesthetics biopharmaceutical sector.

ATGC Co. Ltd. has established independent intellectual property rights throughout the entire process, from strain screening and toxin purification to formulation technology. The company’s proprietary lyophilization excipient technology significantly extends the drug’s shelf life at room temperature, offering greater convenience for clinical applications.

As a classic neurotoxin, the core mechanism of action of ATGC-110 relies on its targeted cleavage of the SNAP-25 protein on the presynaptic membrane of neuromuscular junctions. Following injection, the heavy chain of the toxin binds to the SV2 receptor on the neuronal cell membrane, facilitating the intracellular entry of the light chain. The light chain subsequently hydrolyzes SNAP-25, thereby blocking the fusion of acetylcholine vesicles with the cell membrane. This precise inhibition of neural signal transmission induces localized muscle relaxation, effectively reducing glabellar lines caused by excessive contraction of facial muscles.

Compared to similar products, ATGC-110 has been structurally modified to reduce immunogenicity, and clinical trials have shown no loss of efficacy due to neutralizing antibodies.

Key Phase III Clinical Trial Data

In a pivotal Phase III clinical trial, ATGC-110 demonstrated significant efficacy and safety in treating glabellar lines. A randomized, double-blind study involving 320 patients with moderate-to-severe glabellar lines showed that, four weeks after a single injection:

·The average wrinkle severity score decreased by 2.1 points from baseline (per the modified Facial Wrinkle Scale, FWS).

·The response rate (≥1-point improvement) reached 98.2%.

·The median duration of effect was 5.2 months.

In terms of safety, the primary adverse events were mild redness and swelling at the injection site (12.3%) and headache (4.1%), with no reports of systemic toxicity or severe complications such as eyelid ptosis. These findings, presented at the 2024 International Aesthetic Dermatology Conference, sparked significant industry interest in innovative medical aesthetic biopharmaceuticals emerging from Asia.

Market Implications and Future Development

The approval of ATGC-110 not only fills the gap in domestically produced high-end medical aesthetic biopharmaceuticals in South Korea but also presents opportunities for expanded indications. Preclinical studies suggest that the drug has regulatory effects on neurological conditions such as cervical dystonia and chronic migraine. ATGC Co. Ltd. has already initiated Phase II clinical trials to evaluate its potential use in treating torticollis. Additionally, the company is engaging with regulatory agencies across multiple countries, prioritizing entry into Southeast Asian markets as part of its broader global strategy.

As the first original botulinum toxin type A brand from South Korea, ATGC-110 disrupts the long-standing dominance of Western companies in this field. Its innovation lies in adopting a fully integrated development model, with proprietary patents covering both the bacterial strain (KR1020230001234) and injection device (KR1020240005678). Looking ahead, continued research into dosage optimization and combination therapies may further establish ATGC-110’s competitive edge in both medical aesthetics and neurological treatments, contributing to the growing international influence of the Asian biopharmaceutical industry.

2. MenABCWY Vaccine (GSK)The MenABCWY vaccine (GSK-3536819A), developed by GlaxoSmithKline (GSK), is the world’s first pentavalent meningococcal conjugate vaccine. It received approval from the U.S. Food and Drug Administration (FDA) on February 14, 2025, for the prevention of invasive meningococcal disease and meningococcal meningitis caused by Neisseria meningitidis serogroups A, B, C, W, and Y. Developed by GSK’s biologics division, GlaxoSmithKline Biologicals SA, this vaccine integrates polysaccharide-protein conjugate antigen technology targeting five high-risk serogroups. It is designed to provide broad-spectrum protection with a single-dose regimen, significantly simplifying the current multi-dose vaccination schedule. This approval marks a milestone in meningococcal disease prevention, transitioning from serogroup-specific immunization to comprehensive protection, particularly benefiting adolescents, travelers, and immunocompromised individuals.

The mechanism of action of the MenABCWY vaccine is based on activating a specific immune response against the capsular polysaccharide antigens of N. meningitidis. The polysaccharides from all five serogroups are covalently conjugated to the non-toxic CRM197 carrier protein, enhancing antigen presentation efficiency and stimulating B cells to produce long-lasting protective antibodies. To overcome the traditionally low immunogenicity of polysaccharide vaccines against serogroup B, the vaccine incorporates recombinant surface protein antigens, such as factor H-binding protein (fHbp) from outer membrane vesicles. This multivalent design covers over 90% of globally prevalent pathogenic strains and optimizes the adjuvant system (a combination of aluminum salts and Toll-like receptor agonists) to enhance immune memory. A single dose can achieve protective serum antibody titers within four weeks.

A pivotal Phase III clinical trial involving over 24,000 healthy participants aged 11 to 55 demonstrated that the vaccine met non-inferiority immunogenicity criteria for all five serogroups. At 28 days post-vaccination, the geometric mean titers (GMTs) of bactericidal antibodies against serogroups A, C, W, and Y increased by more than 20-fold from baseline, while the seropositivity rate for serogroup B (hSBA ≥1:8) reached 89.7%. The vaccine maintained over 92% efficacy during a 12-month follow-up period. In terms of safety, common adverse reactions included injection site pain (35%), fatigue (18%), and headache (12%), with severe adverse events occurring at a rate below 0.3%, comparable to the placebo group.

GSK's development of the MenABCWY vaccine addresses the fragmentation in the existing meningococcal vaccination strategy. Previously, individuals needed to receive separate quadrivalent (ACWY) and serogroup B vaccines, whereas this pentavalent formulation reduces the number of required doses by 50%, significantly improving vaccination coverage in high-risk regions. The vaccine utilizes a thermostable formulation, allowing storage under conventional cold-chain conditions (2-8°C), making it suitable for resource-limited areas. Additionally, GSK has secured an advance purchase agreement with Gavi, the Vaccine Alliance, to prioritize distribution in Africa’s “meningitis belt,” with the potential to prevent over 500,000 cases annually.

As the first meningococcal vaccine covering all major pathogenic serogroups, MenABCWY redefines industry standards. Its innovation extends beyond antigen design to include a digital tracking system, with each vaccine dose equipped with a blockchain-based electronic label to enhance supply chain security. GSK is expanding its indications to include infants and older adults and is exploring co-administration strategies with respiratory syncytial virus (RSV) vaccines. This breakthrough is expected to reduce the global burden of meningococcal disease by 70%, positioning it as a transformative public health intervention, comparable to the impact of HPV vaccines.

3. Chikungunya Vaccine, Recombinant (Bavarian Nordic)Chikungunya Vaccine, Recombinant, developed jointly by the Danish pharmaceutical company Bavarian Nordic and the American biotechnology firm Emergent BioSolutions, is the first chikungunya vaccine based on virus-like particle (VLP) technology. It received approval from the U.S. Food and Drug Administration (FDA) on February 14, 2025. The original technology of this vaccine was derived from PaxVax Holding, later optimized by Bavarian Nordic with improved manufacturing processes and the integration of an aluminum adjuvant system. Emergent BioSolutions subsequently scaled up production. As the world’s first preventive vaccine for chikungunya fever, its approval marks a significant breakthrough in the field of arbovirus vaccines, providing a crucial tool for disease prevention in tropical and subtropical endemic regions. The World Health Organization (WHO) has included the vaccine in its Emergency Use Listing (EUL) to accelerate deployment in high-incidence countries across Africa, Southeast Asia, and South America.

This vaccine employs genetic engineering recombinant technology to mimic the natural conformation of the chikungunya virus structural proteins E1 and E2, assembling into non-replicating virus-like particles (VLPs). This design preserves the immunogenicity of viral surface antigens while eliminating the safety risks associated with live viruses. Following intramuscular injection, the VLPs are recognized by antigen-presenting cells, activating B cells to produce high-titer neutralizing antibodies and inducing CD4+ T-cell immune memory. The inclusion of an aluminum adjuvant further prolongs antibody persistence, with protective immune responses detectable within 14 days after a single dose. Phase II clinical trials demonstrated a seroconversion rate of 98%, with cross-protection against multiple viral genotypes, including the Asian, African, and Indian Ocean lineages.

In Phase III clinical trials, the vaccine demonstrated exceptional efficacy and safety in over 18,000 healthy adults. Randomized, double-blind studies showed that the incidence of chikungunya fever in the vaccinated group was reduced by 96.7% compared to the placebo group over a 12-month follow-up period, with geometric mean titers (GMT) of neutralizing antibodies maintained above 1:320. Only three breakthrough infection cases were reported. Regarding safety, the most common adverse reactions included injection site pain (28%), mild fever (9%), and myalgia (6%), with no vaccine-related serious adverse events reported. Additional studies targeting pregnant women and children are ongoing, with preliminary data indicating comparable immunogenicity in adolescents and adults, potentially expanding the target population.

The vaccine’s development was supported by the U.S. National Institute of Allergy and Infectious Diseases (NIAID), with core patents (US20230233771A1) covering VLP structural optimization and low-temperature stabilization processes. Leveraging its advanced vaccine manufacturing platform, Bavarian Nordic reduced the production cycle from several months to six weeks, with an annual capacity of up to 50 million doses. Emergent BioSolutions implemented modular filling technology for rapid packaging, ensuring accessibility in resource-limited regions. The vaccine has been pre-purchased through the Coalition for Epidemic Preparedness Innovations (CEPI) and prioritized for supply to high-burden countries such as India and Brazil.

As a milestone in chikungunya fever prevention, this vaccine not only fills a global gap but also serves as a technological paradigm for the development of other arbovirus vaccines, including those for Zika and West Nile fever. Following FDA approval, Bavarian Nordic is collaborating with the Pan American Health Organization (PAHO) to launch regional vaccination campaigns, aiming to reduce severe chikungunya cases by 80% within five years. In the future, the company plans to develop a quadrivalent vaccine incorporating dengue, Zika, and yellow fever, further streamlining immunization strategies for tropical diseases and reshaping the global infectious disease prevention landscape.

4. Vimseltinib (Romvimza)Vimseltinib (brand name: Romvimza) is an oral small-molecule colony-stimulating factor 1 receptor (CSF1R) kinase inhibitor developed by Deciphera Pharmaceuticals. It received FDA approval on February 14, 2025, for the treatment of adult patients with tenosynovial giant cell tumor (TGCT) who are not eligible for surgical resection. By selectively inhibiting CSF1R activity, Vimseltinib blocks CSF1-mediated signaling pathways, reducing the proliferation and survival of tumor-associated macrophages and thereby inhibiting tumor growth.

The development of Vimseltinib was initially led by Deciphera Pharmaceuticals before being acquired by Japan's Ono Pharmaceutical for $2.4 billion. The pivotal Phase III MOTION study demonstrated a confirmed objective response rate (ORR) of 40% at week 25 in patients receiving Vimseltinib, compared to 0% in the placebo group (p<0.0001), with the median duration of response (DOR) not yet reached. Additionally, Vimseltinib significantly outperformed placebo in improving range of motion, physical function, and pain relief. Based on these results, the FDA granted the drug priority review, leading to its approval on February 14, 2025.

In the MOTION study, Vimseltinib achieved a tumor volume score (TVS) ORR of 67% and demonstrated significant advantages in multiple secondary endpoints, including improved physical function and pain reduction. Long-term follow-up data indicated good tolerability, with no reports of cholestatic liver toxicity or drug-induced liver injury. Common adverse reactions included elevated aspartate aminotransferase (AST) levels, periorbital edema, fatigue, and rash.

By inhibiting CSF1R autophosphorylation and signaling, Vimseltinib reduces CSF1-mediated macrophage proliferation, thereby suppressing tumor growth. This mechanism gives it a significant advantage in treating TGCT, particularly in patients for whom surgical resection would result in functional impairment or severe complications. The approval of Vimseltinib provides a new treatment option for patients with this rare disease, offering hope for improved prognosis and quality of life.

5. MirdametinibMirdametinib, marketed under the brand name Gomekli, is a small-molecule pharmaceutical developed by Springworks Therapeutics, Inc. in collaboration with BeiGene Ltd. This drug received its first approval in the United States on February 11, 2025, specifically for the treatment of neurofibromatosis type 1 (NF1), particularly for patients with NF1-mutated plexiform neurofibromas. The approval of Gomekli marks a significant breakthrough in the field of rare and difficult-to-treat diseases. Additionally, it has been granted multiple special regulatory designations by the U.S. Food and Drug Administration (FDA), including Fast Track, Orphan Drug, Rare Pediatric Disease, and Priority Review status. In the European Union, it has also been awarded Orphan Drug designation, underscoring its importance to specific patient populations worldwide.

Gomekli primarily targets MEK, a key enzyme in the RAS/RAF/MEK/ERK signaling pathway. This pathway is crucial for cellular proliferation, differentiation, and survival. Its dysregulation is associated with the development and progression of various cancers and other diseases, including tumors, neurological disorders, genetic conditions, and musculoskeletal diseases. By inhibiting MEK, Gomekli effectively controls disease progression, offering a new therapeutic option for patients suffering from these conditions.

As an MEK inhibitor, Gomekli blocks MEK protein activity, thereby interrupting aberrant signal transduction and slowing or halting tumor growth. This mechanism has demonstrated significant efficacy in treating cancers with specific genetic mutations, particularly those driven by dysregulation of the RAS/RAF/MEK/ERK pathway. Additionally, due to its unique mode of action, Gomekli is being investigated for other indications, such as dedifferentiated liposarcoma, myxoid liposarcoma, and low-grade gliomas.

Clinical studies have shown that Gomekli exhibits excellent efficacy in treating NF1 patients, particularly in reducing the tumor volume of NF1-mutated plexiform neurofibromas. In addition to its effectiveness in its primary indication, its safety and tolerability have been confirmed in clinical trials. While certain adverse effects may occur, the drug is generally considered a viable treatment option. These promising results laid the foundation for its regulatory approval and provide scientific justification for expanding its indications in the future.

Despite its significant achievements, Gomekli is not suitable for all cancer types, such as advanced breast cancer, colorectal cancer, and KRAS-mutant non-small cell lung cancer, which fall outside its research scope. As further studies progress, Springworks Therapeutics, Inc. and BeiGene Ltd. will continue exploring Gomekli’s potential for additional indications. Given its recent approval in the United States, global demand for this drug is expected to rise in the coming years, potentially encouraging more research institutions and pharmaceutical companies to participate in related research efforts, further advancing this field.

6. SiltartoxatugSiltartoxatug is a monoclonal antibody drug originally developed by Trinomab Biotech Co., Ltd. The drug was first approved in China on February 11, 2025, for the treatment of tetanus, a severe infectious disease. The approval of Siltartoxatug represents a significant advancement in tetanus treatment. Additionally, it has been granted Breakthrough Therapy, Fast Track, and Priority Review designations by the National Medical Products Administration (NMPA) of China, further reinforcing its unique status in the medical field. Moreover, it has also received Fast Track designation from the U.S. FDA, highlighting its global public health significance.

Siltartoxatug specifically targets key components of tetanus toxin. By selectively binding to these components, it prevents the toxin from interacting with its target receptors on cells, thereby blocking its entry and toxic effects. This highly targeted approach allows Siltartoxatug to effectively neutralize tetanus toxin, mitigating or preventing its associated symptoms. Tetanus toxin is an extremely potent neurotoxin that causes muscle rigidity and spasms, severely impacting patient survival. Therefore, the development of an effective therapeutic intervention is critical to improving patient outcomes and quality of life.

A deeper examination of Siltartoxatug’s mechanism of action reveals that it binds tightly to specific domains of tetanus toxin, disrupting its interaction with neuronal cell surface receptors. This receptor binding step is essential for the toxin to enter cells and release its enzymatically active component. Once inside, tetanus toxin catalyzes modifications of key proteins involved in neurotransmitter release, leading to uncontrolled neurotransmitter activity and resulting in muscle spasms. By neutralizing the toxin before it enters cells, Siltartoxatug effectively prevents these pathological events, thereby alleviating tetanus symptoms. Furthermore, due to its monoclonal antibody nature, Siltartoxatug exhibits high specificity and low immunogenicity, making it an ideal therapeutic option for tetanus.

Clinical studies have demonstrated that Siltartoxatug exhibits significant efficacy and safety in tetanus patients. Data show that patients receiving Siltartoxatug experienced faster symptom improvement compared to traditional therapies, as well as reduced complications and hospitalization durations. Additionally, safety evaluations indicate that the drug has relatively mild and infrequent side effects, primarily injection site reactions or transient discomfort, further supporting its potential as a tetanus treatment. These findings provided a strong basis for regulatory approval and paved the way for broader clinical applications in the future.

Despite its notable achievements, the research and development of Siltartoxatug remain ongoing. Trinomab Biotech Co., Ltd. continues to explore its potential applications in other related diseases while seeking international partnerships, such as with Changchun BCHT Biotechnology Co., to expand its global reach.

7. Netanasvir PhosphateNetanasvir Phosphate, developed originally by Sunshine Lake Pharma Co., Ltd., is a small-molecule chemical drug. The drug was first approved in China on February 8, 2025, specifically for the treatment of chronic hepatitis C. This approval not only provides a new therapeutic option for patients with chronic hepatitis C but also demonstrates the National Medical Products Administration (NMPA)’s support and recognition of innovative therapies. As a novel antiviral drug, the development and commercialization of Netanasvir Phosphate hold significant importance in improving the cure rate and quality of life for chronic hepatitis C patients.

The primary target of Netanasvir Phosphate is the NS5A protein, which is essential for the replication of the hepatitis C virus (HCV). NS5A plays a crucial role in viral RNA synthesis, viral particle assembly, and evading host immune responses. By acting on NS5A, Netanasvir Phosphate effectively inhibits the HCV replication process, thereby reducing the viral load in the body and facilitating viral clearance. This highly specific targeting mechanism makes Netanasvir Phosphate an important therapeutic tool, particularly for patients who respond poorly to or cannot tolerate traditional treatment options.

A deeper exploration of Netanasvir Phosphate’s mechanism of action reveals that it binds to specific regions on the NS5A protein, interfering with its biological function and consequently disrupting the HCV RNA replication process. Specifically, Netanasvir Phosphate prevents the proper localization of NS5A within the viral replication complex, rendering the virus unable to efficiently replicate its genome. Additionally, the drug impacts the maturation and release of newly formed viral particles, further reducing viral transmission. By intervening in multiple critical steps of the HCV life cycle, Netanasvir Phosphate demonstrates strong potential as an effective antiviral agent.

Although publicly available clinical research data on Netanasvir Phosphate is limited, existing findings indicate that the drug exhibits significant efficacy and a favorable safety profile in treating chronic hepatitis C patients. Observations of high virological response rates suggest that the drug effectively reduces HCV RNA levels in patients to undetectable levels and maintains these results during long-term follow-up. Furthermore, compared to traditional interferon plus ribavirin therapy, Netanasvir Phosphate is associated with fewer adverse effects, making it more tolerable for patients. These promising results have laid a solid foundation for regulatory approval and suggest the potential for widespread clinical use in the future.

Following the successful development and approval of Netanasvir Phosphate in China, Sunshine Lake Pharma Co., Ltd. is exploring the drug’s global market potential. The company is also considering partnerships with international collaborators to expand the accessibility and impact of Netanasvir Phosphate. Although no studies have yet been reported on the drug’s applications in other indications, its success in chronic hepatitis C treatment suggests potential future research into its applications for other health conditions. This not only contributes to medical advancements but also brings hope to millions of chronic hepatitis C patients worldwide.

8. FinotonlimabFinotonlimab is a recombinant humanized anti-PD-1 monoclonal antibody jointly developed by Sinocelltech Group Ltd. and its subsidiary, Shenzhou Cell Engineering Co., Ltd. The drug was first approved in China on February 8, 2025, for the treatment of recurrent and metastatic head and neck squamous cell carcinoma (HNSCC), marking a significant advancement in the field of cancer immunotherapy. The approval by the National Medical Products Administration (NMPA) not only offers new hope to patients with these hard-to-treat cancers but also highlights its potential in global anticancer treatments.

The primary target of Finotonlimab is programmed death receptor-1 (PD-1), a crucial immune checkpoint protein expressed on the surface of T cells. When PD-1 binds to its ligands PD-L1 and PD-L2, it suppresses T-cell activity, allowing tumor cells to evade immune surveillance. By specifically binding to PD-1, Finotonlimab blocks this inhibitory signal, restoring the ability of T cells to attack tumor cells. This approach is particularly beneficial for treating cancers that exploit immune evasion mechanisms, including but not limited to hepatocellular carcinoma, colorectal cancer, and hematologic malignancies.

Finotonlimab exhibits high-affinity binding to PD-1, effectively blocking the interaction between PD-1 and its ligands PD-L1/PD-L2, thereby maintaining T-cell-mediated antitumor activity. Additionally, as a fully humanized monoclonal antibody, Finotonlimab has low immunogenicity, reducing the risk of triggering adverse immune responses. More importantly, Finotonlimab not only enhances immune responses against tumor cells but also has the potential to improve the efficacy of other cancer therapies, such as chemotherapy, radiotherapy, and targeted therapies, making it a promising candidate for combination treatment strategies.

Clinical research results have demonstrated that Finotonlimab exhibits significant efficacy in treating recurrent and metastatic HNSCC. Clinical trial data indicate positive trends in objective response rate (ORR) and progression-free survival (PFS) among treated patients, with a favorable safety profile. Most adverse events observed were mild to moderate, including fatigue, rash, and pruritus, which are common immune-related side effects. These findings further validate Finotonlimab as a safe and effective immunotherapy. The strong clinical evidence has provided a solid foundation for regulatory approval and suggests the potential for broader applications in the future.

How to obtain the latest research advancements in the field of biopharmaceuticals?

In the Synapse database, you can keep abreast of the latest research and development advances in drugs, targets, indications, organizations, etc., anywhere and anytime, on a daily or weekly basis. Click on the image below to embark on a brand new journey of drug discovery!

2025-02-18

蛇年启新程,双喜临门。安必生制药产品“左乙拉西坦缓释颗粒”(商标名:安而和®)和“注射用阿糖胞苷”(商标名:舒凯宁®)获得国家药品监督管理局颁发的上市批件,实现新年开门红。

图:两个产品获得批准

安而和®左乙拉西坦缓释颗粒,是上海安必生制药持有的一个2.2类改良型新药,适用于12岁及以上的癫痫患者部分性发作的加用治疗。安而和®的成功获批为医药领域增添新动力,也给广大癫痫患者带来了新的治疗选择。

舒凯宁®注射用阿糖胞苷,是江苏安必生制药第五个自主持有的产品,适用于成人和儿童急性非淋巴细胞性白血病的诱导缓解和维持治疗。这也是继孟鲁司特钠片、雷贝拉唑钠肠溶片、西格列汀二甲双胍缓释片、乙酰半胱氨酸泡腾片、美沙拉秦缓释胶囊颗粒、阿戈美拉汀片第八个商业化生产的产品。

这两个产品均由安必生制药自主研发,研发人员秉承“质量源于设计”的理念,成功解决了多项技术难题。两大产品的获批,是安必生制药在研发和生产领域的重要里程碑。安必生人将继续秉承公司的使命和质量承诺:研发生产高质量的仿制药以及创新型制剂药品,让中外患者用得好,用得起,用得放心!我们坚信药品质量源于设计和生产,通过产品和工艺开发、知识管理、人员培训的持续改进,为国内外患者提供安全、有效、优质、可负担的药品!

上市批准

2024-11-30

CBC Group and Mubadala acquire UCB's mature neurology and allergy business in China for US$680 million.

New company is named NeuroGen Pharma, led by an experienced management team with a strong track record in the biopharma industry.

Strategic acquisition under CBC's buyout strategy expected to drive significant value creation and positive patient outcomes through CBC's proven investor-operator approach and solution.

SINGAPORE, Nov. 30, 2024 /PRNewswire/ -- CBC Group ("CBC"), Asia's largest healthcare-dedicated asset management firm headquartered in Singapore, has completed the strategic acquisition of global biopharmaceutical company UCB's mature neurology and allergy business in China, in partnership with Mubadala Investment Company, the Abu Dhabi based global investment company. The acquisition marks another successful transaction under CBC's buyout strategy of acquiring key assets from global pharmaceutical companies and a significant step in establishing a market-leading neurology company in China while expanding CBC's portfolio within the region's dynamic pharmaceutical market. The transaction, valued at US$680 million, includes UCB's well-known brands Keppra®, Vimpat®, Neupro®, Zyrtec®, Xyzal®, and the Zhuhai manufacturing site.

The well-established and trusted medicine portfolio will serve as an anchor asset as CBC builds out a leading integrated central nervous system (CNS) biopharma platform in China, where the market size has reached US$33 billion1. Beyond strengthening CBC's presence in the rapidly growing Chinese healthcare market, the acquisition also enhances the firm's capabilities in meeting the rising demand for neurology and allergy treatments in the wider region. In collaboration with Mubadala, CBC will tap on its proprietary investor-operator approach, deep healthcare expertise and platform synergies to drive operational efficiencies, innovation and scale to benefit more patients across the region.

Fu Wei, Chief Executive Officer of CBC Group, said, "There is clear potential within the regional healthcare space to better serve patients with unmet medical needs in this growing CNS therapeutics market, and we are delighted to partner with Mubadala once again. This acquisition complements our existing healthcare ecosystem and aligns with our robust buyout strategy, which is strategically positioned to drive long-term, sustainable value in today's healthcare investing market. Together, we are making a profound impact on the industry by harnessing our combined expertise and capital to not only enhance patient outcomes but also build value for our stakeholders. Leveraging our joint strengths, we are poised to capitalize on synergies and deploy hands-on strategic guidance to make significant strides in CNS market access and innovation."

Named "NeuroGen Pharma", the new company embodies what CBC and Mubadala envision for neuro healthcare innovation. The company will be led by a deep and experienced management team with an extensive track record in the biopharma industry, ensuring a smooth transition to propel into the next phase of growth. NeuroGen Pharma is expected to deliver quality treatments to a wider reach of patients and play an important role in addressing the evolving neurology treatment needs in China. The company aims to leverage innovative therapies and cutting-edge research to enhance patient outcomes and shape the future of neurology care in the region.

Combined net sales for the acquired portfolio in this transaction were Euro131 million in 2023. The strategic acquisition builds on CBC's collaboration with Mubadala, which includes their investment in CBC Healthcare Infrastructure Platform's (HIP) first life science real assets venture and the joint investment in the US$315 million fundraising round for CBC-backed Hasten, a leading pharmaceutical company.

Mohamed Albadr, Head of Asia at Mubadala, said, "We are thrilled to partner with CBC Group to support the growth and development of NeuroGen Pharma as it scales to a leading entity in China and delivers transformative medicines to patients. Built on a strong foundation of proven therapies and driven by innovation and cutting-edge research, the company is uniquely positioned to address the growing need for advanced neurology and allergy treatments while aligning with our commitment to enhancing access to care and growth in the healthcare system."

Jean-Christophe Tellier, CEO at UCB, said, "In the short term, UCB is exploring the launch of novel medicines in immunology, neurology, and rare diseases in China. Our dedication to serving patients with unmet needs in China remains steadfast. Building on our 28-year presence in the country, we are committed to driving patient outcomes through continued collaboration with local partners and fostering innovation. We are convinced that the CBC Group and Mubadala are the ideal partners to advance the medicine portfolio and continue to improve the lives of people living with neurology and allergy diseases in mainland China."

About CBC Group

Headquartered in Singapore, CBC Group is Asia's largest healthcare-dedicated asset management firm, with an AUM of US$9 billion. With a diversified, multi-product strategy, CBC Group is focused on platform-building, buyout, private credit and royalties, and real estate, across the healthcare space, including pharmaceutical, biotech, medical technology, and healthcare services.

We are committed to creating lasting value by integrating global innovations and talents. Partnering with the world's top entrepreneurs and scientists, our unique "investor-operator" approach has empowered leading healthcare companies to widen access to affordable medical care, catalyse innovations, and improve efficiencies in fulfilling unmet medical needs worldwide.

For more information on CBC Group, please visit .

Connect with us on LinkedIn (CBC Group).

About UCB

UCB, Brussels, Belgium () is a global biopharmaceutical company focused on the discovery and development of innovative medicines and solutions to transform the lives of people living with severe diseases of the immune system or of the central nervous system. With approximately 9,000 people in approximately 40 countries, the company generated revenue of €5.3 billion in 2023. UCB is listed on Euronext Brussels (symbol: UCB). Follow us on Twitter: @UCB_news.

About Mubadala

Mubadala Investment Company is a sovereign investor managing a global portfolio, aimed at generating sustainable financial returns for the Government of Abu Dhabi.

Mubadala's $302 billion (AED 1,111 billion) portfolio spans six continents with interests in multiple sectors and asset classes. We leverage our deep sectoral expertise and long-standing partnerships to drive sustainable growth and profit, while supporting the continued diversification and global integration of the economy of the United Arab Emirates.

For more information about Mubadala Investment Company, please visit: .

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

并购

分析

对领域进行一次全面的分析。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

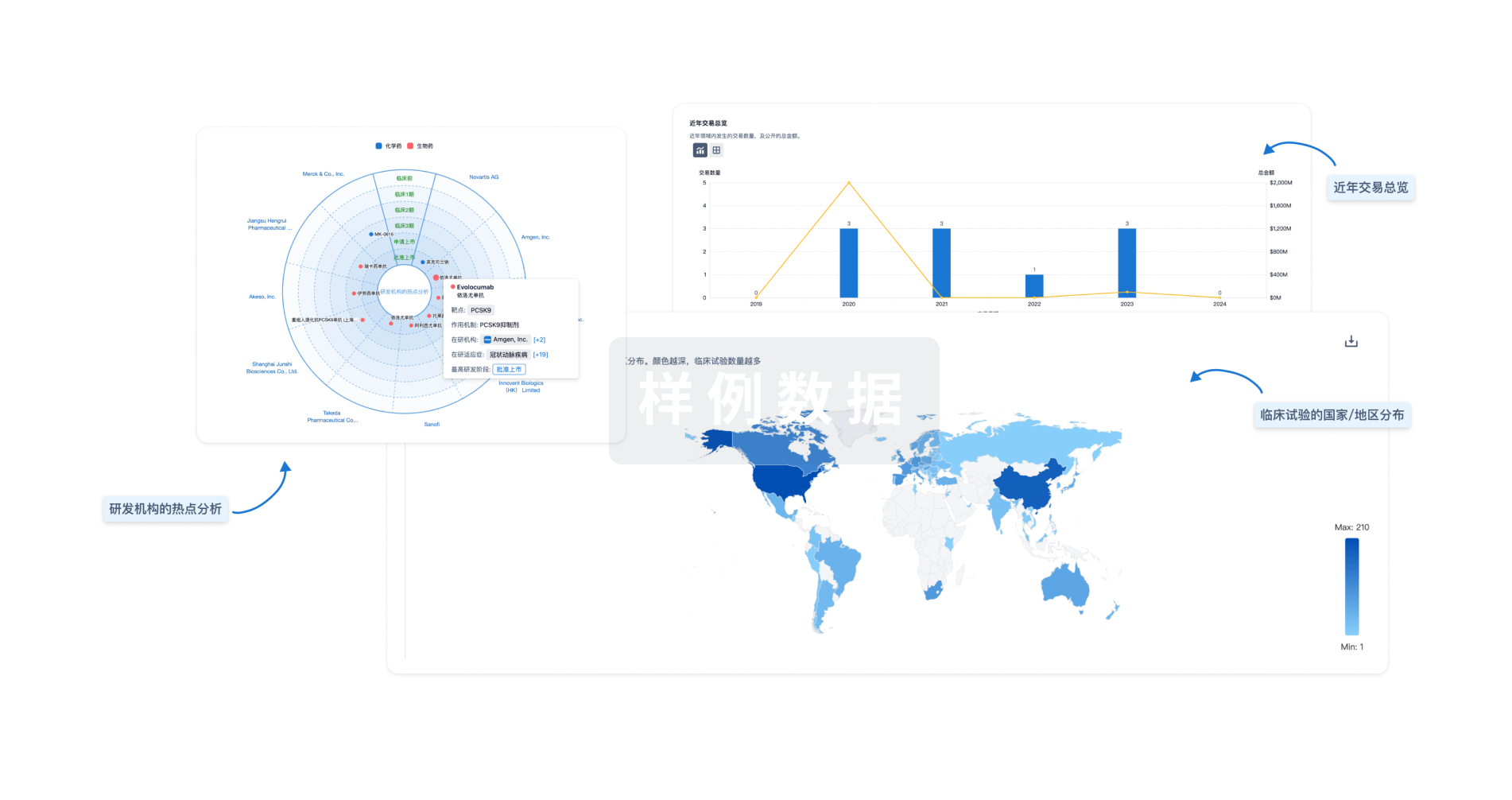

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用