预约演示

更新于:2025-08-11

Merz Pharmaceuticals GmbH

更新于:2025-08-11

概览

标签

神经系统疾病

其他疾病

口颌疾病

毒素

小分子化药

中药

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 小分子化药 | 4 |

| 中药 | 1 |

| 毒素 | 1 |

关联

6

项与 Merz Pharmaceuticals GmbH 相关的药物靶点- |

作用机制- |

在研适应症 |

非在研适应症- |

最高研发阶段批准上市 |

首次获批国家/地区 中国 |

首次获批日期2020-12-01 |

作用机制 钾离子通道阻滞剂 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2010-01-22 |

靶点 |

作用机制 SNAP25 抑制剂 |

最高研发阶段批准上市 |

首次获批国家/地区 奥地利 [+29] |

首次获批日期2007-10-24 |

102

项与 Merz Pharmaceuticals GmbH 相关的临床试验NCT06995287

Evaluation of the Analgesic Effect of Intramyometrial Botulinum Toxin Injection Via Hysteroscopy in Severe Primary Dysmenorrhea: a Prospective, Multicenter, Randomized, Double-blind, Placebo-controlled Study

The objective of the study is to evaluate the global impression of improvement at 3 months following intramyometrial botulinum toxin injections via hysteroscopy in women with severe primary dysmenorrhea who have failed first-line medical treatment, compared to intramyometrial placebo injections.

开始日期2025-06-01 |

申办/合作机构 |

NCT05623111

Perineural Injections of Incobotulinumtoxin-A for Diabetic Neuropathic Pain of the Lower Extremities: A Double-blind, Randomized, Placebo-controlled Study

The goal of this clinical trial is to test perineural injections (injections around a nerve) of incobotulinumtoxin-A in participants with diabetic nerve pain of the feet and lower legs.

The main questions it aims to answer are:

* Is the treatment safe and effective?

* Does the treatment affect participants quality of life, depression, physical activity, daily life, and sensation?

Participants will be treated every 12 weeks, for a total of 24 weeks, with either incobotulinumtoxin-A or a placebo.

The main questions it aims to answer are:

* Is the treatment safe and effective?

* Does the treatment affect participants quality of life, depression, physical activity, daily life, and sensation?

Participants will be treated every 12 weeks, for a total of 24 weeks, with either incobotulinumtoxin-A or a placebo.

开始日期2023-08-01 |

申办/合作机构  Rigshospitalet Rigshospitalet [+1] |

EUCTR2021-001634-18-LV

A prospective, randomized, double-blind, placebo-controlled, two-stage, multicenter study with an open-label extension period to investigate the efficacy and safety of NT 201 in the treatment of lower limb spasticity in children and adolescents with cerebral palsy. - ELLIE (Evaluation of Lower Limb IncobotulinumtoxinA Efficacy)

开始日期2023-05-18 |

申办/合作机构 |

100 项与 Merz Pharmaceuticals GmbH 相关的临床结果

登录后查看更多信息

0 项与 Merz Pharmaceuticals GmbH 相关的专利(医药)

登录后查看更多信息

144

项与 Merz Pharmaceuticals GmbH 相关的文献(医药)2024-12-31·JOURNAL OF DERMATOLOGICAL TREATMENT

Plain language summary of the pivotal study of calcium hydroxylapatite with lidocaine for improvement of jawline contour

Article

作者: Dakovic, Rada ; Moradi, Amir

2024-04-23·Zhurnal nevrologii i psikhiatrii imeni S.S. Korsakova

Multi-center open comparative randomized study of efficacy and safety of Akatinol Memantine 20 mg (single-doses) vs Akatinol Memantine 10 mg (double-doses) in patients with vascular dementia

Article

作者: Gonik, M.I. ; Frolova, V.I. ; Medvedev, V.E. ; Gushanskaya, E.V. ; Mikhaylova, N.M. ; Lobzin, V.Yu. ; Gavrilova, S.I. ; Tanashyan, M.M. ; Ponomareva, E.V. ; Fedorova, Ya.B. ; Emelin, A.Yu. ; Knyazev, A.V. ; Kolykhalov, I.V. ; Kashin, A.V. ; Kachanova, M.V. ; Litvinenko, I.V.

2023-11-01·Journal der Deutschen Dermatologischen Gesellschaft = Journal of the German Society of Dermatology : JDDG

Management of psoriatic arthritis by dermatologists – a German nationwide survey

Article

作者: Kaufmann, Roland ; Pinter, Andreas ; König, Anke ; Hofmann, Matthias ; Müller-Stahl, Jutta

16

项与 Merz Pharmaceuticals GmbH 相关的新闻(医药)2025-02-12

— Total Revenues of $1.56 Billion in 2024; Net Sales of Proprietary Products Increased Approximately 18% Year-Over-Year —

— GAAP Net Income from Continuing Operations of $372 Million and Diluted GAAP Earnings per Share from Continuing Operations of $2.20 for 2024 —

— ALKS 2680 Phase 2 Studies in Narcolepsy Type 1 and Type 2 Ongoing With Data Expected in H2 2025 —

DUBLIN, Feb. 12, 2025 /PRNewswire/ -- Alkermes plc (Nasdaq: ALKS) today reported financial results for the quarter and year ended Dec. 31, 2024 and provided financial expectations for 2025.

"2024 marked the completion of a multi-year effort to transition the business into a highly profitable, pure-play neuroscience company. We enter 2025 with a diversified portfolio of proprietary commercial products generating substantial profitability and an advancing development pipeline that represents a significant value creation opportunity in one of the most exciting potential new therapeutic categories in neuroscience," said Richard Pops, Chief Executive Officer of Alkermes. "Looking ahead, we are well positioned to deliver on our financial goals and advance the development programs for our portfolio of orexin 2 receptor agonists. This year, we have clear objectives for our pipeline as we complete the phase 2 studies for ALKS 2680 in narcolepsy, with data expected in the second half of the year, and prepare to initiate the ALKS 2680 phase 2 study in idiopathic hypersomnia and advance ALKS 4510 and ALKS 7290 into planned phase 1 studies in disease areas beyond central disorders of hypersomnolence. Each of these initiatives is an important element of our strategy to unlock what we believe is a multi-billion-dollar market opportunity for this category."

"2024 was Alkermes' strongest year of financial and operational performance to date. Financially, we generated more than $1 billion in revenue from our proprietary commercial product portfolio, delivered EBITDA from continuing operations of approximately $452 million, repurchased $200 million of the company's ordinary shares, retired approximately $290 million of debt and ended the year debt-free with approximately $825 million of cash and investments on the balance sheet. Operationally, we completed the sale of our manufacturing business in Ireland and made significant progress advancing our neuroscience development pipeline," said Blair Jackson, Chief Operating Officer of Alkermes. "We will continue to manage the business with a sharp focus on efficiency and profitability as we invest in the programs that we believe will drive the company's next phase of growth."

Key Financial Highlights

*As a result of the successful resolution of the arbitration with Janssen Pharmaceutica N.V., the twelve months ended December 31, 2023 included approximately $195.4 million of back royalties (and related interest) related to U.S. net sales of long-acting INVEGA® products that would ordinarily have been recognized in prior periods.

Revenue Highlights

LYBALVI

Revenues for the fourth quarter were $77.0 million.

Fourth quarter revenues and total prescriptions grew 37% and 30%, respectively, compared to the fourth quarter of 2023.

During the quarter, the company recorded LYBALVI® revenue of approximately $4 million related to year-end inventory fluctuations.

ARISTADAi

Revenues for the fourth quarter were $96.6 million.

Fourth quarter revenues grew 16% compared to the fourth quarter of 2023.

During the quarter, the company recorded ARISTADA® revenue of approximately $9 million related to year-end inventory fluctuations and gross-to-net favorability, primarily driven by Medicaid utilization adjustments.

VIVITROL

Revenues for the fourth quarter were $134.1 million.

Fourth quarter revenues grew 31% compared to the fourth quarter of 2023.

During the quarter, the company recorded VIVITROL® revenue of approximately $23 million related to year-end inventory fluctuations and gross-to-net favorability, primarily driven by Medicaid utilization adjustments.

Manufacturing & Royalty Revenues

Royalty revenues from XEPLION®, INVEGA TRINZA®/TREVICTA® and INVEGA HAFYERA®/BYANNLI® for the fourth quarter were $36.5 million.

VUMERITY® manufacturing and royalty revenues for the fourth quarter were $35.0 million.

FAMPYRA® manufacturing and royalty revenues for the fourth quarter were $22.9 million. The company does not expect to record any FAMPYRA revenue going forward.

RISPERDAL CONSTA® manufacturing revenues for the fourth quarter were $14.7 million.

Key Operating Expenses

Please see Note 1 below for details regarding discontinued operations.

Balance Sheet

At Dec. 31, 2024, the company recorded cash, cash equivalents and total investments of $824.8 million, compared to $813.4 million at Dec. 31, 2023.

In December 2024, the company prepaid and retired in full all of its outstanding long-term debt in the amount of approximately $290 million.

Financial Expectations for 2025

All line items are according to GAAP, except as otherwise noted.

Notes and Explanations

1. The company determined that upon the separation of its former oncology business, completed on Nov. 15, 2023, the oncology business met the criteria for discontinued operations in accordance with Financial Accounting Standards Board Accounting Standards Codification 205, Discontinued Operations. Accordingly, the accompanying selected financial information has been updated to present the results of the oncology business as discontinued operations for the three and twelve months ended Dec. 31, 2023.

Conference Call

Alkermes will host a conference call and webcast presentation with accompanying slides at 8:00 a.m. EST (1:00 p.m. GMT) on Wednesday, Feb. 12, 2025, to discuss these financial results and provide an update on the company. The webcast may be accessed on the Investors section of Alkermes' website at . The conference call may be accessed by dialing +1 877 407 2988 for U.S. callers and +1 201 389 0923 for international callers. In addition, a replay of the conference call may be accessed by visiting Alkermes' website.

About Alkermes plc

Alkermes plc is a global biopharmaceutical company that seeks to develop innovative medicines in the field of neuroscience. The company has a portfolio of proprietary commercial products for the treatment of alcohol dependence, opioid dependence, schizophrenia and bipolar I disorder, and a pipeline of clinical and preclinical candidates in development for neurological disorders, including narcolepsy and idiopathic hypersomnia. Headquartered in Ireland, Alkermes also has a corporate office and research and development center in Massachusetts and a manufacturing facility in Ohio. For more information, please visit Alkermes' website at .

Non-GAAP Financial Measures

This press release includes information about certain financial measures that are not prepared in accordance with generally accepted accounting principles in the U.S. (GAAP), including non-GAAP net income, EBITDA and Adjusted EBITDA. These non-GAAP measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similar measures presented by other companies.

Non-GAAP net income adjusts for certain one-time and non-cash charges by excluding from GAAP results: share-based compensation expense; amortization; depreciation; non-cash net interest expense; change in the fair value of contingent consideration; certain other one-time or non-cash items; and the income tax effect of these reconciling items. EBITDA represents earnings before interest, tax, depreciation and amortization. Adjusted EBITDA excludes share-based compensation expense in addition to the components of EBITDA from earnings.

The company's management and board of directors utilize these non-GAAP financial measures to evaluate the company's performance. The company provides these non-GAAP financial measures of the company's performance to investors because management believes that these non-GAAP financial measures, when viewed with the company's results under GAAP and the accompanying reconciliations, are useful in identifying underlying trends in ongoing operations. However, non-GAAP net income, EBITDA and Adjusted EBITDA are not measures of financial performance under GAAP and, accordingly, should not be considered as alternatives to GAAP measures as indicators of operating performance. Further, non-GAAP net income, EBITDA and Adjusted EBITDA should not be considered measures of the company's liquidity.

A reconciliation of GAAP to non-GAAP financial measures has been provided in the tables included in this press release.

Note Regarding Forward-Looking Statements

Certain statements set forth in this press release constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: the company's expectations concerning its future financial and operating performance, business plans or prospects, including expected drivers of growth, value creation and profitability; and the company's expectations regarding development plans, activities and timelines for, and the potential therapeutic and commercial value of, ALKS 2680 and the company's other orexin portfolio candidates. The company cautions that forward-looking statements are inherently uncertain. The forward-looking statements are neither promises nor guarantees and they are necessarily subject to a high degree of uncertainty and risk. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to various risks and uncertainties. These risks and uncertainties include, among others: whether the company is able to achieve its financial expectations, including those related to profitability; clinical development activities may not be completed on time or at all; the results of the company's development activities may not be positive, or predictive of final results from such activities, results of future development activities or real-world results; the unfavorable outcome of arbitration, litigation, or other proceedings or disputes related to the company's products or products using the company's proprietary technologies; the U.S. Food and Drug Administration (FDA) or regulatory authorities outside the U.S. may make adverse decisions regarding the company's products; the company and its licensees may not be able to continue to successfully commercialize their products or support revenue growth from such products; there may be a reduction in payment rate or reimbursement for the company's products or an increase in the company's financial obligations to government payers; the company's products may prove difficult to manufacture, be precluded from commercialization by the proprietary rights of third parties, or have unintended side effects, adverse reactions or incidents of misuse; and those risks and uncertainties described under the heading "Risk Factors" in the company's most recent Annual Report on Form 10-K and in subsequent filings made by the company with the U.S. Securities and Exchange Commission (SEC), which are available on the SEC's website at . Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, the company disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this press release.

VIVITROL® is a registered trademark of Alkermes, Inc.; ARISTADA®, ARISTADA INITIO® and LYBALVI® are registered trademarks of Alkermes Pharma Ireland Limited, used by Alkermes, Inc. under license; BYANNLI®, INVEGA®, INVEGA HAFYERA®, INVEGA TRINZA®, RISPERDAL CONSTA®, TREVICTA® and XEPLION® are registered trademarks of Johnson & Johnson or its affiliated companies; FAMPYRATM is a trademark of Merz Pharmaceuticals, LLC; and VUMERITY® is a registered trademark of Biogen MA Inc., used by Alkermes under license.

Alkermes Contacts:

For Investors: Sandy Coombs +1 781 609 6377

For Media: Katie Joyce +1 781 249 8927

SOURCE Alkermes plc

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

财报临床1期临床2期

2024-01-12

None

Welcome to this week’s Chutes & Ladders, our roundup of hirings, firings and retirings throughout the industry. Please send the good word—or the bad—from your shop to Max Bayer or Gabrielle Masson, and we will feature it here at the end of each week.

TORL taps new CEO

TORL BioTherapeutics

Mark Alles, who’s spent the better part of the last four decades in biopharma leadership roles, has been named chairman and CEO of TORL BioTherapeutics. He’s replacing Dave Licata, who co-founded TORL and helped design its drug development framework. Licata will stick around TORL as a board member and the company’s president, while also taking on a new role as its CFO.

Alles has been a member of TORL’s board for two years and was named its executive chair in late 2022. Before that, he spent more than a decade at Aventis Pharmaceuticals and then another 15 years at Celgene, culminating in a stint as its CEO from 2016 until its acquisition by Bristol Myers Squibb in 2019.

He’s taking the helm as TORL plans to begin a phase 2 trial of its lead antibody-drug conjugate candidate, TORL-1-23, targeting multiple cancers. Meanwhile, the company is actively enrolling patients in phase 1 studies of a handful of other ADCs and monoclonal antibody therapies.

“TORL has rapidly realized significant success in identifying novel cancer targets, developing first-in-class antibody-based therapies directed at these targets, and with the support of our world-class investors, has recently advanced multiple products into Phase 1 studies,” said Dennis Slamon, M.D., Ph.D., TORL’s scientific founder. “We have reached a major inflection point where our opportunity to generate value for patients, our investors and our team made it both possible and important for us to build on the great work Dave has done by adding and appointing Mark Alles as Chairman and CEO.” Release

Insitro installs first CMO

Insitro

As Insitro inches closer to bringing its first artificial intelligence-discovered drug candidates into clinical trials, it has appointed its first-ever chief medical officer.

In the new role, S. Michael Rothenberg, M.D., Ph.D., will take charge of the company’s clinical development work, heading up translational biology and overseeing trial design and medical and regulatory affairs.

Rothenberg hails from Pfizer, where he spent the last four years carrying out similar responsibilities, including, most recently, as VP of early oncology development and clinical research. At the Big Pharma, he led early-phase trials of oncology and hematology therapies, including overseeing the initial first-in-human and proof-of-concept studies of the multiple myeloma drug now approved as Elrexfio. Release

Sanofi’s interim specialty care chief lands permanent role

Sanofi

Brian Foard has temporarily filled the role of chief of Sanofi’s specialty care global business unit since September, when former head Bill Sibold hit the exit to lead Madrigal Pharmaceuticals as CEO. Now, Foard has claimed the title on a permanent basis and will also join Sanofi’s executive committee.

The exec has been with Sanofi since 2017 and was bumped up from his former slot as head of the specialty care business in North America and U.S. country lead. Before that, he bounced from head roles in dermatology and respiratory to immunology, among other positions.

Foard is credited with overseeing launches of Sanofi and Regeneron’s Dupixent across multiple indications and more than 50 countries worldwide, work that will “help to set our roadmap for the first- and best-in-class molecules we are preparing to launch in the coming years,” according to Sanofi CEO Paul Hudson. Release

> FDA commissioner Robert Califf has selected his next chief of staff in Elizabeth “EJ” Jungman, who will leave her current role as the Center for Drug Evaluation and Research’s associate director for policy and director of the Office of Regulatory Policy. Jungman is taking over from Julie Tierney, who recently moved to a deputy director role at the FDA’s Center for Biologics Evaluation and Research. Release

> Rare disease specialist BioMarin has a new CEO in Alexander Hardy and he appears to be shaking up his commercial team as the company announced its lead Jeffrey Ajer will leave the company by July. The disclosure, made via a short SEC filing, said Ajer would "step down" as the company's executive vice president and chief commercial officer in July and that the termination was “without cause." Fierce Pharma

> Longtime Affimed CEO Adi Hoess, M.D., Ph.D., is hanging up the gloves after 13 years at the helm. The company tapped CMO Andreas Harstrick, M.D., to serve as interim CEO while it searches for a successor. Release

> Ginkgo Bioworks selected six executives from across the industry to make up its new Biopharma Advisory Board. The board now includes Kronos Bio CEO Norbert Bischofberger, Ph.D., global head of oncology and hematology at Novartis Jeff Legos, Ph.D., founding Alnylam chief John Maraganore, Ph.D, International Therapeutic Research Centers’ chief scientific officer Paolo Martini, Ph.D., IconOVir Bio head Mark McCamish, M.D., Ph.D., and former Kite Pharma CEO Christi Shaw. Release

> PMV Pharmaceuticals is shaking up its clinical team with the appointment of two new leaders of the clinical program for its lead candidate, PC14586, which is set to begin a phase 2 study this quarter. Deepika Jalota, Pharm.D., and Marc Fellous, M.D.—PMV’s chief development officer and senior VP of clinical development and medical affairs, respectively—are taking the reins from Leila Alland, M.D., who is stepping down to pursue other opportunities but will remain an advisor to PMV. Release

> Athira Pharma is now on the hunt for a new chief medical officer after Hans Moebius, M.D., Ph.D., stepped down to retire, effective Jan. 5. Moebius, who is staying on as a senior scientific advisor to Athira, was appointed CMO in 2019, following a nearly 30-year career in biopharma that included postings at Rodin Therapeutics, Allergan, Merz Pharmaceuticals, Novartis and more. Release

> CRISPR-focused cell therapy developer Caribou Biosciences has named its first chief technology officer: Tim Kelly, who previously served as CEO of Oxford Biomedica Solutions and COO of Homology Medicines and led technical operations at Sarepta, Shire, UCB and Biogen. Release

> Prolific startup starter Flagship Pioneering has promoted from within to name four new origination partners: Kyle Chiang, Ph.D., Molly Gibson, Ph.D., Armen Mkrtchyan, Ph.D., and Jacob Rubens, Ph.D. In their new roles, each will oversee a team tasked with creating and growing new biotech companies. Release

> Capstan Therapeutics tapped Ramin Farzaneh-Far, M.D., to be chief medical officer, following stints at Ra Pharmaceuticals, Akebia Therapeutics, Gilead Sciences and, most recently, RA Capital, where he’s been a venture partner since 2020. Capstan also promoted Miguel Arcinas, the biotech’s VP of corporate development since 2021, to the senior VP level. Release

> Celia Lin, M.D., stepped down from her post as chief medical officer of Vera Therapeutics. Taking over the role is Robert Brenner, M.D., who hails from Orionis Biosciences, while William Turner, formerly of Sierra Oncology, was named Vera’s chief development officer, with both appointments effective immediately. Release

> Maria Törnsén, most recently the chief commercial officer at Passage Bio, has been appointed president of the North America division at Calliditas Therapeutics. Her career also includes stops at Sarepta Therapeutics, Sanofi Genzyme and Shire. Release

> Zura Bio has found a new president and chief operating officer in Robert Lisicki, whose three-decade career in biopharma spans leadership roles at the now-Pfizer-owned Arena Pharmaceuticals, Regeneron, InCarda Therapeutics, Daiichi Sankyo and Amgen. Meanwhile, Kiran Nistala, M.B.B.S., Ph.D., has been tapped as the biotech’s chief medical officer and executive VP of development. Release

> AbbVie’s retired CMO Rob Scott has a new gig as CMO and head of R&D at Abionyx Pharma, where he will lead the team through pivotal trials for its lead sepsis candidate. Back at AbbVie, the medical chief held his role through major approvals including Skyrizi and Rinvoq. Release

> XOMA has selected Owen Hughes as its next CEO. Hughes—who held the top job at the biotech royalty aggregator on an interim basis for all of 2023—was previously CEO of Sail Bio and Cullinan Oncology, and chief business officer at Intarcia Therapeutics. Release

> Probiotics maker Pendulum Therapeutics tapped former Mayo Clinic medical director Adam Perlman, M.D., as chief medical officer. Now-retired CMO Orville Kolterman, M.D., led the selection of Perlman as his successor. Release

> Nutcracker Therapeutics bumped up its executive VP of early R&D, Sam Deutsch, M.D., Ph.D., to the CSO role. Deutsch has been with Nutcracker since its beginnings in 2018 and will now lead the team through trialing its lead mRNA candidate, dubbed NTX-250. Release

> Central nervous system CRO Cognitive Research Corporation appointed Tom Zoda, M.D. Ph.D., as CEO. Zoda came from Apex Innovative Sciences and CenExel clinical research, where he served as chief operating officer. Release

高管变更临床1期上市批准并购

2023-09-05

Martinsried / Munich, Germany, September 5, 2023 - iOmx Therapeutics AG (iOmx), a clinical stage biopharmaceutical company developing cancer therapeutics based on next generation immune checkpoint targets, today announced the appointment of Dr. Nils Peter Debus as Chief Business Officer (CBO) to drive the company’s new stage of growth. Dr. Debus is an accomplished life science leader with 27 years of industry experience and an outstanding track record in Business Development & Licensing.

Dr. Apollon Papadimitriou, CEO of iOmx, said: “Nils brings us significant strategic business expertise with a proven success in building partnerships and executing transformative collaborations and acquisitions. His broad industry experience, will be invaluable as we further grow our global business development activities.”

Dr. Nils Debus, CBO of iOmx, added: “iOmx has made impressive progress in a brief time, leveraging its iOTarg platform to address novel immune checkpoints on myeloid cells and advancing its first novel immune checkpoint inhibitor into the clinic. By identifying novel tumor evasion biology, we will further unlock the immune system's potential to combat cancer and tackle tumors, which currently show resistance to existing immunotherapies. I look forward to working with Apollon and the entire iOmx team to build strong partnerships with pharma to maximize our strategic options. We invite the biopharma community to explore our exciting platform and advanced programs for collaboration opportunities.”

Before joining iOmx Dr. Debus held the CBO position at OSE Immunotherapeutics (Paris, France), a company focusing on innovative treatments for immuno-oncology and autoimmune disorders. At Boehringer Ingelheim (Ingelheim, Germany), he spent nine years in senior BD&L roles with a focus on biosimilars, strategic transactions and alliance management, handling R&D pipeline and commercialization deals, as well as patent negotiations. At Merz Pharmaceuticals (Frankfurt, Germany) he served as VP of BD. He started his BD&L career at Schering AG (now Bayer) in Berlin, Germany. Dr. Debus is a microbiologist by training and holds a PhD in embryonic stem cell research from Humboldt University (Berlin, Germany). In addition, he received training in corporate finance from Duke University (Durham, USA).

About iOmx Therapeutics

iOmx Therapeutics ( ) is a biopharmaceutical company focused on developing first-in-class cancer immuno-therapeutics addressing novel immune checkpoints hijacked by cancer cells. Utilizing its iOTarg™ high-throughput screening platform, iOmx has identified a number of proprietary tumor-associated next-generation immune checkpoints and is advancing a clinical stage pipeline of promising drug candidates that have the potential to address cancers, which are resistant to current immunotherapies. The company’s lead candidate OMX-0407 targets SIK, an immune protective kinase family in multiple solid tumors, and is currently being investigated in Phase I clinical trials. Founded in 2016, based on the work of its scientific founders Philipp Beckhove MD, and Nisit Khandelwal Ph.D., conducted at the German Cancer Research Center, iOmx is today backed by international venture capital investors, such as Wellington Partners, Sofinnova Partners, M Ventures, MIG Capital and Athos Biopharma. iOmx is based in Martinsried/Munich, Germany.

Media contact

MC Services AG

Katja Arnold, Julia von Hummel, Shaun Brown

T: +49(0)89 2102280

iomx@mc-services.eu

临床1期高管变更免疫疗法

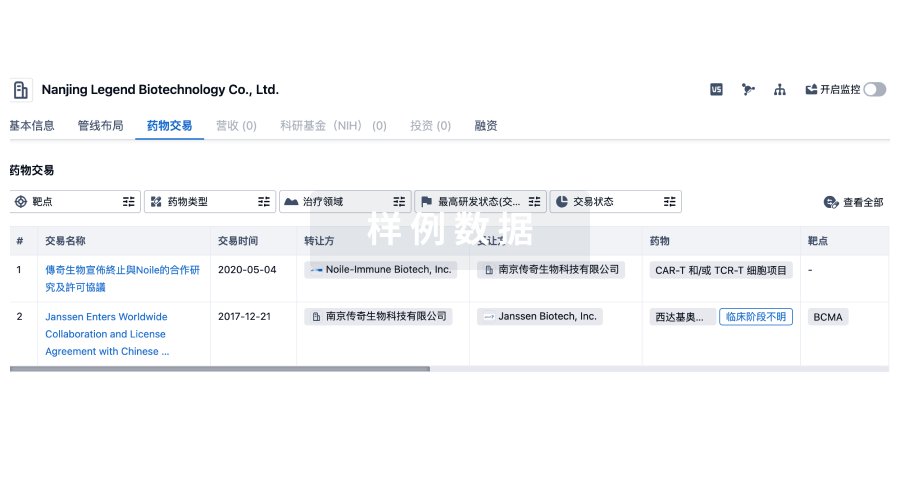

100 项与 Merz Pharmaceuticals GmbH 相关的药物交易

登录后查看更多信息

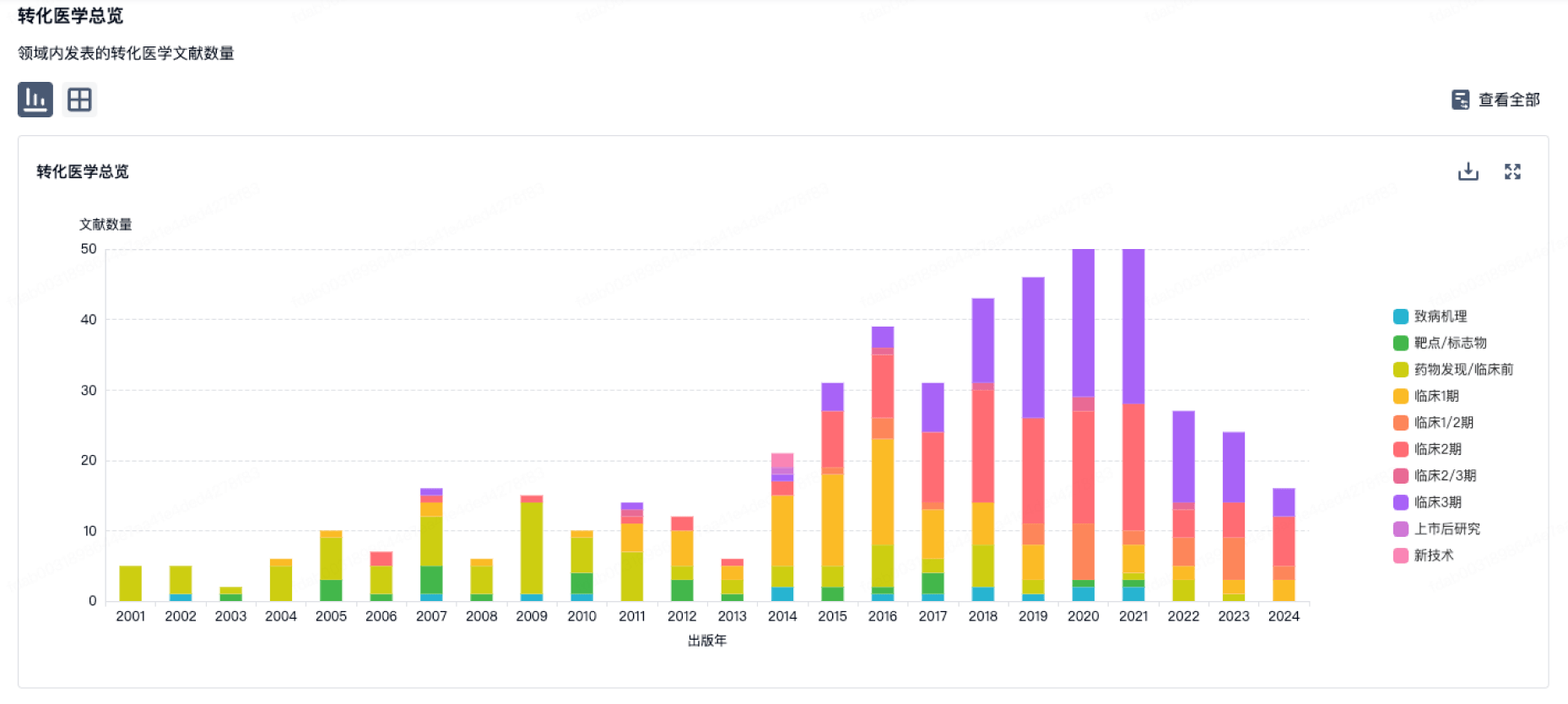

100 项与 Merz Pharmaceuticals GmbH 相关的转化医学

登录后查看更多信息

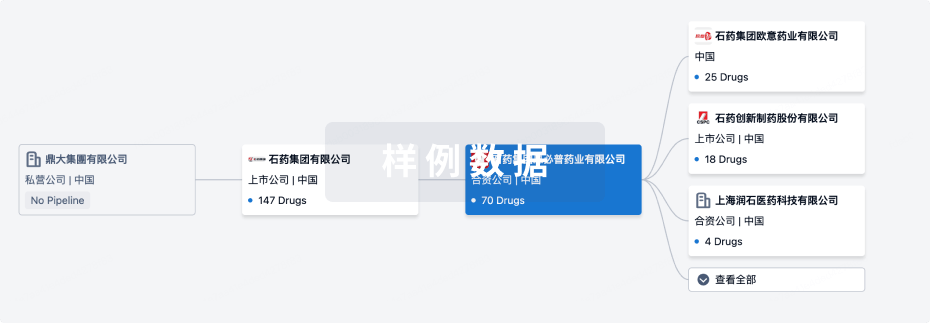

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年10月11日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

批准上市

6

4

其他

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

A型肉毒毒素 (Biotecon) ( SNAP25 ) | 流涎 更多 | 批准上市 |

盐酸美金刚 ( NMDA receptor ) | 阿尔茨海默症 更多 | 批准上市 |

达伐吡啶 ( Potassium channel ) | 多发性硬化症 更多 | 批准上市 |

格隆溴铵 ( mAChRs ) | 流涎 更多 | 批准上市 |

左旋多巴 ( D1 receptor x DRDs ) | 帕金森病 更多 | 批准上市 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

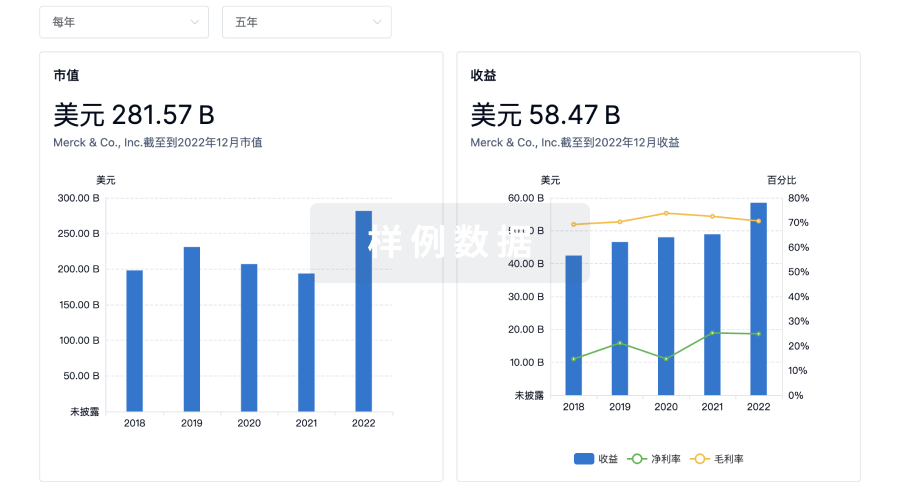

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

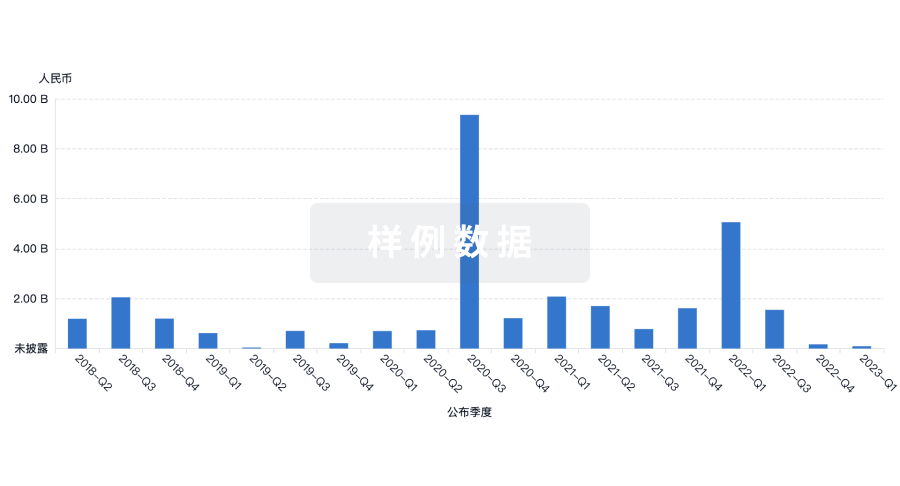

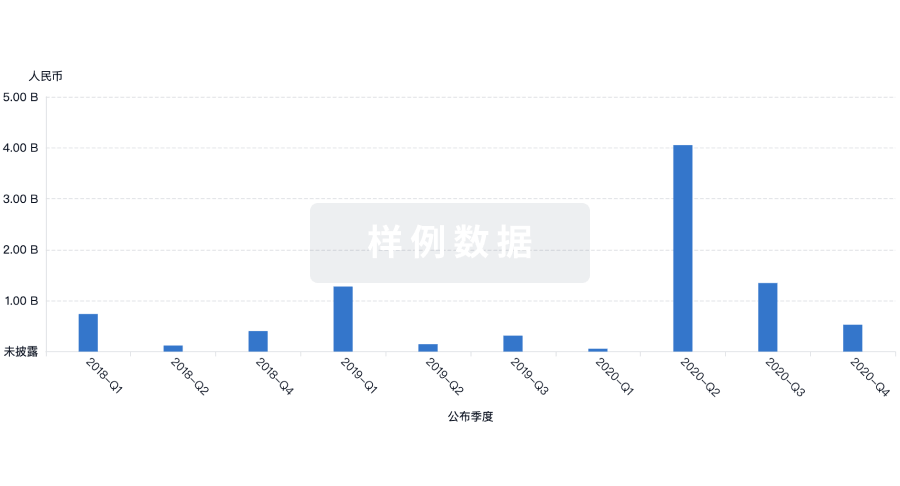

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用