预约演示

更新于:2025-05-07

CLDN18.2 x Top I

更新于:2025-05-07

关联

7

项与 CLDN18.2 x Top I 相关的药物作用机制 CLDN18.2抑制剂 [+1] |

原研机构 |

在研适应症 |

非在研适应症- |

最高研发阶段临床3期 |

首次获批国家/地区- |

首次获批日期1800-01-20 |

作用机制 CLDN18.2抑制剂 [+1] |

在研机构 |

非在研适应症- |

最高研发阶段临床1/2期 |

首次获批国家/地区- |

首次获批日期1800-01-20 |

作用机制 CLDN18.2抑制剂 [+1] |

在研机构 |

原研机构 |

非在研适应症- |

最高研发阶段临床1期 |

首次获批国家/地区- |

首次获批日期1800-01-20 |

14

项与 CLDN18.2 x Top I 相关的临床试验NCT06770439

A Phase II Study to Evaluate the Safety, Tolerability, and Efficacy of IBI343 Combined with Chemotherapy in Advanced Pancreatic Cancer

This study is a phase II study to evaluate the safety, tolerability and efficacy of IBI343 combined with chemotherapy in patients with advanced pancreatic cancer, including Part1 (safe lead-in phase) and Part2 (extension phase). In part1, patients with CLDN18.2-positive advanced pancreatic adenocarcinoma who had or had not previously received systemic therapy were treated with chemotherapy in IBI343 with AG regimen (albumin paclitaxel with gemcitabine). In part2, 40 patients with CLDN18.2-positive advanced PDAC will be enrolled, 1:1 randomized to Arm A and Arm B, respectively. In Arm A, patients will receive IBI343 TBD + gemcitabine TBD + albumin-bound paclitaxel TBD; and in Arm B, patients will receive gemcitabine 1000mg / m2 d1, d8 Q3W + albumin-bound paclitaxel 125mg / m2d1, d8 Q3W treatment.

开始日期2025-01-01 |

申办/合作机构 |

100 项与 CLDN18.2 x Top I 相关的临床结果

登录后查看更多信息

100 项与 CLDN18.2 x Top I 相关的转化医学

登录后查看更多信息

0 项与 CLDN18.2 x Top I 相关的专利(医药)

登录后查看更多信息

43

项与 CLDN18.2 x Top I 相关的新闻(医药)2025-04-29

In 2024, the field of cancer therapeutics has witnessed remarkable progress in targeting Claudin 18.2 (CLDN18.2). As a protein highly expressed in several malignancies—particularly gastrointestinal cancers such as gastric and pancreatic cancer—CLDN18.2 has emerged as a highly promising therapeutic target. Antibody-drug conjugates (ADCs) developed against this target, including Zolbetuximab, IBI-343, LM-302, and SHR-A1904, have shown encouraging preclinical and clinical results. These innovations not only improve patient survival but also pave the way for more personalized treatment approaches. By selectively recognizing and attacking tumor cells while minimizing damage to normal tissues, these agents are redefining the landscape of cancer therapy.

CLDN18.2 is an isoform of Claudin-18, which belongs to the Claudin family of proteins. This family comprises transmembrane proteins that play crucial roles in maintaining tight junctions between epithelial and endothelial cells. Tight junctions function as both physical barriers, preventing the free passage of substances through the paracellular space, and as regulators of ion and small molecule permeability.

The depiction of Claudin protein structures1

Structurally, Claudins share common features, including four transmembrane domains, two extracellular loops (ECL1 and ECL2), and intracellular N- and C-termini. CLDN18.2 is predominantly expressed in differentiated epithelial cells of the gastric mucosa, exhibiting highly specific expression under normal physiological conditions. However, during malignant transformation, the disruption of tight junctions caused by uncontrolled tumor proliferation can expose CLDN18.2 epitopes, making them accessible for targeted therapeutic intervention.

Main characteristics of claudins2

From a proliferation perspective, evidence suggests that CLDN18.2 may interfere with intercellular communication and signal transduction pathways, influencing the cell cycle and promoting tumor growth. High expression of CLDN18.2 has been associated with increased tumor cell proliferation in several studies, likely due to its role in maintaining cell polarity and regulating cell growth.

In terms of invasion and metastasis, abnormal activation of the CLDN18.2 gene may alter cell membrane functionality and enhance tissue permeability. This disruption facilitates tumor cells in breaching the basement membrane and invading surrounding tissues, thus promoting both local and distant metastases. Aberrant CLDN18.2 expression also impairs normal cell polarity and structural integrity, further weakening tissue barriers and enabling cancer cell dissemination.

While CLDN18.2 expression is typically confined to gastric mucosal cells under normal conditions, it is significantly upregulated in various cancers, including gastric and pancreatic cancers. This persistent expression even after malignant transformation, combined with exposure of the epitope due to tight junction disruption, makes CLDN18.2 an attractive target for antibody-based therapies, particularly in cancers with limited treatment options.

ADC Therapies Targeting CLDN18.2Zolbetuximab: The First Approved CLDN18.2-Targeted Monoclonal AntibodyZolbetuximab is the first globally approved therapeutic specifically targeting CLDN18.2. It is a chimeric IgG1 monoclonal antibody designed for the treatment of gastric and gastroesophageal junction (GEJ) adenocarcinomas. By binding selectively to CLDN18.2, a transmembrane protein highly expressed on certain gastric cancer cells, Zolbetuximab induces direct cancer cell death. Moreover, it activates two major immune-mediated mechanisms: antibody-dependent cellular cytotoxicity (ADCC) and complement-dependent cytotoxicity (CDC).

ADCC involves the recruitment of immune effector cells, such as natural killer (NK) cells, to the tumor site, leading to targeted destruction of cancer cells.CDC triggers the complement system to form membrane attack complexes (MACs) that lyse tumor cells.The development of Zolbetuximab was underpinned by its successful performance in two pivotal Phase III clinical trials—SPOTLIGHT and GLOW.

In the SPOTLIGHT trial, Zolbetuximab combined with mFOLFOX6 chemotherapy significantly improved progression-free survival (PFS) and overall survival (OS) compared to chemotherapy alone:

Median PFS: 10.61 months vs. 8.67 monthsMedian OS: 18.23 months vs. 15.54 monthsSimilarly, the GLOW trial demonstrated that Zolbetuximab combined with CAPOX chemotherapy also yielded superior outcomes compared to CAPOX alone.

Based on these positive results, Zolbetuximab has received regulatory approval in multiple countries and regions, including Japan, the United States, and the European Union, for the treatment of specific subtypes of gastric cancer. It remains the first and only approved CLDN18.2-targeted therapy to date.

Although initially developed for gastric and GEJ adenocarcinomas, Zolbetuximab’s therapeutic potential could extend to other malignancies, such as pancreatic, biliary tract, esophageal, and lung cancers, where CLDN18.2 expression is also elevated. Expression testing is typically required to identify patients who are most likely to benefit from Zolbetuximab therapy.

As understanding of CLDN18.2 biology deepens, it is anticipated that Zolbetuximab could be explored in combination strategies, such as with immune checkpoint inhibitors or other targeted therapies, to further enhance efficacy and reduce adverse effects. Additionally, the success of Zolbetuximab has catalyzed the development of next-generation CLDN18.2-targeted agents, promising new hope for patients with limited treatment options.

These advances are expected to significantly contribute to the evolution of personalized cancer care, enabling more precise, effective, and individualized therapeutic strategies.

Bispecific Antibody LB-4330LB-4330 is a bispecific antibody developed by L&L Biopharma, designed to leverage its dual-targeting capability to activate CD8+ T cells within the tumor microenvironment, thereby enhancing the body's immune response against cancer. By doing so, LB-4330 not only directly attacks cancer cells but also mobilizes the patient’s immune system for a more effective and sustained anti-tumor response.

The mechanism of action of LB-4330 relies on its unique structural design, which enables simultaneous binding to CLDN18.2 and specific receptors on the surface of CD8+ T cells. This dual specificity allows LB-4330 to accumulate at tumor sites and activate T cells, triggering the release of cytotoxic substances to kill cancer cells. Moreover, LB-4330 may also enhance anti-tumor immunity through additional, less well-characterized mechanisms, such as modifying the tumor microenvironment or improving dendritic cell function. These features position LB-4330 as a promising therapeutic candidate, particularly for patients with advanced or metastatic cancers that are resistant to conventional treatments.

The major CD8+ T cell states in human tumors3

Currently, LB-4330 is in Phase II clinical development, focusing on evaluating its safety and efficacy in patients with advanced or metastatic solid tumors. According to information released by L&L Biopharma, LB-4330 has shown encouraging potential in an open-label, Phase Ib/II dose-escalation and expansion study. This study aims to explore the drug’s effects at various doses to identify an optimal dosing range that maximizes therapeutic benefit while minimizing adverse events. Although detailed clinical results have yet to be fully disclosed, preliminary data indicate that LB-4330 is well-tolerated and has demonstrated meaningful clinical activity in certain patient populations.

Beyond its established indications in gastric cancer, pancreatic cancer, and ovarian cancer, researchers are investigating the potential of LB-4330 in other tumor types. Given the widespread expression of CLDN18.2 across multiple malignancies, LB-4330 could emerge as a broad-spectrum anti-cancer agent. Furthermore, as understanding of CLDN18.2 biology deepens and combination strategies with other therapies (such as chemotherapy, radiotherapy, or immunotherapy) are explored, the application prospects for LB-4330 appear increasingly expansive.

Despite its promising profile, several challenges must be addressed before LB-4330 can be widely adopted. These include the need to accurately identify patients most likely to benefit from the therapy—often requiring precise measurement of CLDN18.2 expression—and the necessity for long-term safety evaluations. Additionally, further mechanistic studies, optimization of dosing strategies, and identification of ideal combination regimens with existing therapies will be critical to fully unlocking LB-4330’s therapeutic potential.

CLDN18.2-Targeting ADCsSeveral antibody-drug conjugates (ADCs) have been developed to target Claudin 18.2 (CLDN18.2), including IBI-343, LM-302, SHR-A1904, ATG-022, Sonestatug vedotin, and SKB-315. These agents utilize a specific antibody to recognize and bind to CLDN18.2 antigens on the surface of cancer cells, delivering a potent cytotoxic payload intracellularly to induce tumor cell death. Developed by companies such as Innovent Biologics, LaNova Medicines, Hengrui Medicine, Antengene Corporation, and Kelun-Biotech, these ADCs span various stages of clinical development (from Phase II to Phase III) and show promise in treating gastric cancer, esophageal cancer, and other CLDN18.2-positive solid tumors.

1) IBI-343IBI-343 is an innovative ADC developed by Innovent Biologics. It combines a highly specific anti-CLDN18.2 antibody with a cytotoxic small-molecule drug. This design enables precise targeting of CLDN18.2-expressing tumor cells, facilitating selective delivery of the cytotoxic agent and minimizing damage to normal tissues, thus improving both safety and efficacy.

In preclinical studies, a single administration of IBI-343 significantly inhibited tumor growth in xenograft models with low antigen expression, maintaining low tumor volumes for up to 21 days. This finding suggests that IBI-343 is not only effective against tumors with high CLDN18.2 expression but also shows robust activity in tumors with lower antigen levels. This bystander effect enhances IBI-343’s appeal as a cancer therapeutic, particularly in tumors with heterogeneous antigen expression within the tumor microenvironment.

IBI-343 has been granted Breakthrough Therapy Designation by China’s National Medical Products Administration (NMPA) for two indications: (1) advanced gastric/gastroesophageal junction adenocarcinoma patients with positive CLDN18.2 expression who have received at least two prior systemic therapies, and (2) advanced pancreatic ductal adenocarcinoma patients with positive CLDN18.2 expression who have received at least one prior systemic therapy. This designation accelerates the development timeline and underscores the potential importance of IBI-343 as a novel treatment option, particularly for patients with difficult-to-treat cancers.

2) LM-302LM-302 is an antibody-drug conjugate (ADC) developed by Lanpu Biopharmaceuticals (also known as Lansion Biotechnology). This investigational therapy combines a highly specific anti-CLDN18.2 monoclonal antibody with a cytotoxic payload, monomethyl auristatin E (MMAE). The design enables the antibody to selectively bind to the CLDN18.2 antigen expressed on tumor cell surfaces and deliver the cytotoxic agent directly into cancer cells, thereby achieving targeted tumor cell killing.

As of the latest updates, LM-302 has been granted three Orphan Drug Designations (ODDs) by the U.S. Food and Drug Administration (FDA) for the treatment of pancreatic cancer, gastric cancer, and gastroesophageal junction (GEJ) cancer. In China, LM-302 has advanced into Phase III clinical trials, indicating that the drug has demonstrated sufficient safety and preliminary efficacy in earlier studies and is now undergoing larger, more diverse patient evaluations to confirm its therapeutic potential.

Moreover, LM-302 has been proposed for inclusion under China’s National Medical Products Administration (NMPA)/Center for Drug Evaluation (CDE) Breakthrough Therapy designation. The targeted indication is for patients with locally advanced or metastatic gastric or GEJ adenocarcinoma who are CLDN18.2-positive and have received at least two prior lines of systemic therapy.

A Phase II clinical trial is also underway to evaluate the efficacy, safety, and tolerability of LM-302 in combination with toripalimab (an anti-PD-1 antibody) in patients with CLDN18.2-positive advanced gastrointestinal tumors. The primary endpoint of this study is to assess the efficacy of the LM-302 and toripalimab combination, with secondary objectives including safety, pharmacokinetics, immunogenicity, and the correlation between CLDN18.2/PD-L1 expression and antitumor activity.

It is worth noting that Lanpu Biopharmaceuticals had previously entered into an exclusive licensing agreement with Turning Point Therapeutics, granting Turning Point rights to develop and commercialize LM-302 outside of Greater China and South Korea. However, following Bristol Myers Squibb’s acquisition of Turning Point, the licensing status of LM-302 has shifted, and the asset is now listed as "global" in ownership.

3) SHR-A1904SHR-A1904 is an ADC independently developed by Hengrui Medicine. It consists of a highly specific anti-CLDN18.2 antibody linked to a cytotoxic payload—a topoisomerase inhibitor (TOPOi). This design enables the ADC to selectively bind to CLDN18.2-expressing tumor cells and deliver its potent payload intracellularly, resulting in targeted cancer cell death.

At the 2024 European Society for Medical Oncology (ESMO) Congress, early clinical data on SHR-A1904 were presented for the treatment of patients with CLDN18.2-positive gastric cancer and gastroesophageal junction adenocarcinoma (GC/GEJC). The results demonstrated manageable safety and promising antitumor activity, with an objective response rate (ORR) of 55.6% and a disease control rate (DCR) of 88.9%.

Beyond gastric cancer, SHR-A1904 is also being investigated for other CLDN18.2-expressing solid tumors, highlighting its broad therapeutic potential.

Notably, Hengrui Medicine entered into a collaboration agreement with Merck KGaA, Darmstadt, Germany, valued at up to €1.4 billion. Under this agreement, Merck has secured global exclusive development, manufacturing, and commercialization rights for SHR-A1904 outside of mainland China. This strategic partnership reflects strong international recognition of SHR-A1904's potential and positions it for global success.

SHR-A1904 has been evaluated across multiple dose levels. The 6.0 mg/kg cohort demonstrated the best efficacy, achieving an ORR of 55.6% and a DCR of 88.9%. The safety profile was considered manageable, although some dose-limiting toxicities (DLTs) were observed at higher doses. With ongoing Phase III clinical trials, SHR-A1904 is poised to become a promising new treatment option for patients with CLDN18.2-positive cancers. Furthermore, through its international collaborations, SHR-A1904 is expected to benefit a broader patient population worldwide.

ConclusionAs a member of the Claudin family, Claudin 18.2 (CLDN18.2) plays a vital role in maintaining tight junctions between epithelial and endothelial cells and is aberrantly overexpressed in various cancer types. This unique biological characteristic makes CLDN18.2 an ideal target for cancer therapy.

Several CLDN18.2-targeted antibody-drug conjugates (ADCs)—including Zolbetuximab, IBI-343, LM-302, and SHR-A1904—have demonstrated significant antitumor activity with favorable safety profiles. Particularly, Zolbetuximab has achieved groundbreaking clinical success as the first approved therapy targeting CLDN18.2 for the treatment of gastric and gastroesophageal junction adenocarcinoma. Additionally, bispecific antibodies such as LB-4330, which enhance antitumor immune responses, are further expanding the therapeutic landscape of CLDN18.2 targeting.

Globally, research on CLDN18.2-targeted therapies has become a major area of focus. More than 90 candidate therapies targeting CLDN18.2—including monoclonal antibodies, bispecific antibodies, CAR-T cells, and ADCs—are currently under development. The success of programs such as IBI-343 not only highlights the innovation capacity of Chinese biopharmaceutical companies but also provides valuable models for future drug development.

As clinical trials progress and technologies advance, CLDN18.2-targeted therapies are expected to offer new hope for a broader range of cancer patients, driving forward the era of personalized medicine and precision oncology. These developments mark a deeper understanding of cancer biology and herald the arrival of more CLDN18.2-based therapies, ultimately benefiting patients worldwide.

How to obtain the latest research advancements in the field of biopharmaceuticals?

In the Synapse database, you can keep abreast of the latest research and development advances in drugs, targets, indications, organizations, etc., anywhere and anytime, on a daily or weekly basis. Click on the image below to embark on a brand new journey of drug discovery!

Reference

1. Cao W, Xing H, Li Y, Tian W, Song Y, Jiang Z, Yu J. Claudin18.2 is a novel molecular biomarker for tumor-targeted immunotherapy. Biomark Res. 2022 May 31;10(1):38. doi: 10.1186/s40364-022-00385-1. PMID: 35642043; PMCID: PMC9153115.2. Kubota Y, Shitara K. Zolbetuximab for Claudin18.2-positive gastric or gastroesophageal junction cancer. Ther Adv Med Oncol. 2024 Jan 3;16:17588359231217967. doi: 10.1177/17588359231217967. PMID: 38188462; PMCID: PMC10768589.3. van der Leun AM, Thommen DS, Schumacher TN. CD8+ T cell states in human cancer: insights from single-cell analysis. Nat Rev Cancer. 2020 Apr;20(4):218-232. doi: 10.1038/s41568-019-0235-4. Epub 2020 Feb 5. PMID: 32024970; PMCID: PMC7115982.

2025-03-29

·医药笔记

▎Armstrong2025年美国癌症研究协会年会(AACR)即将于4月25-30日在美国芝加哥举行,最近会议摘要已经公开,中国创新密集亮相。以ADC领域为例,绝大部分的报告来自中国药企,创新ADC接近100款,覆盖各种技术路线和靶点上的创新,真正开始引领ADC的创新前沿。双靶点ADC为ADC领域当前最热门的方向之一,百力司康、百奥赛图、博锐生物、橙帆医药、多禧生物、恒瑞医药、基石药业、金赛药业、康宁杰瑞、康源博创、联进生物、启德医药、石药集团、拓济生物、先声药业、信达生物、映恩生物、亲和力生物等多家企业布局。双毒素ADC也开始走到台前,康弘药业、亲和力生物系统布局双毒素ADC,康弘药业的KH815为全球首款进入临床阶段的双毒素ADC新药。两种payload分别为TOP1i和RAN POL2i,同时抑制RNA合成并诱导DNA双链断裂。康宁杰瑞进一步开发了双靶点双毒素ADC,即EGFR/HER3双毒素ADC新药JSKN021。传统ADC的理念是毒素经抗体结合受体介导内吞后释放,DXd-ADC则证明了旁观者效应的重要作用,宜联生物则进一步开发了非内吞ADC,靶向游离靶标VEGF,通过肿瘤微环境特异性酶来释放毒素,进一步打开了ADC药物的应用空间。维立志博开发了首款TCE的ADC,即DLL3/CD3 ADC新药LBL-058,由DLL3/CD3双抗偶联TOP1i而成,T细胞杀伤与payload细胞毒杀伤效应协同。虽然TCE在少数靶点已经开始突破实体瘤,但TCE-ADC的设计无疑为突破实体瘤提供了一种全新强化设计的思路。总结从此次AACR会议来看,中国ADC无论在数量上,还是在差异化设计上,毫无疑问都在真正引领ADC的创新前沿,新靶点ADC、新靶点组合双靶点ADC、双毒素ADC、PDC、TCE-ADC、非内吞ADC等等,以及AACR会议不涉及的自免ADC(映恩生物已经进入临床阶段)等。未来几年,国产ADC的临床突破和出海交易仍然是值得期待的行业焦点所在。Armstrong技术全梳理系列GPRC5D靶点全梳理;CD40靶点全梳理;CD47靶点全梳理;补体靶向药物技术全梳理;补体药物:眼科治疗的重要方向;Claudin 6靶点全梳理;Claudin 18.2靶点全梳理;靶点冷暖,行业自知;中国大分子新药研发格局;被炮轰的“me too”;佐剂百年史;胰岛素百年传奇;CUSBEA:风雨四十载;中国新药研发的焦虑;中国生物医药企业的研发竞争;中国双抗竞争格局;中国ADC竞争格局;中国双抗技术全梳理;中国ADC技术全梳理;Ambrx技术全梳理;Vir Biotech技术全梳理;Immune-Onc技术全梳理;亘喜生物技术全梳理;康哲药业技术全梳理;科济药业技术全梳理;恺佧生物技术全梳理;同宜医药技术全梳理;百奥赛图技术全梳理;腾盛博药技术全梳理;创胜集团技术全梳理;永泰生物技术全梳理;中国抗体技术全梳理;德琪医药技术全梳理;德琪医药技术全梳理2.0;和铂医药技术全梳理;荣昌生物技术全梳理;再鼎医药技术全梳理;药明生物技术全梳理;恒瑞医药技术全梳理;豪森药业技术全梳理;正大天晴技术全梳理;吉凯基因技术全梳理;基石药业技术全梳理;百济神州技术全梳理;百济神州技术全梳理第2版;信达生物技术全梳理;信达生物技术全梳理第2版;中山康方技术全梳理;复宏汉霖技术全梳理;先声药业技术全梳理;君实生物技术全梳理;嘉和生物技术全梳理;志道生物技术全梳理;道尔生物技术全梳理;尚健生物技术全梳理;康宁杰瑞技术全梳理;科望医药技术全梳理;科望医药技术全梳理2.0;岸迈生物技术全梳理;礼进生物技术全梳理;康桥资本技术全梳理;余国良的抗体药布局;荃信生物技术全梳理;安源医药技术全梳理;三生国健技术全梳理;仁会生物技术全梳理;乐普生物技术全梳理;同润生物技术全梳理;宜明昂科技术全梳理;派格生物技术全梳理;迈威生物技术全梳理;Momenta技术全梳理;NGM技术全梳理;普米斯生物技术全梳理;普米斯生物技术全梳理2.0;三叶草生物技术全梳理;贝达药业抗体药全梳理;泽璟制药抗体药全梳理;恒瑞医药抗体药全梳理;齐鲁制药抗体药全梳理;石药集团抗体药全梳理;豪森药业抗体药全梳理;华海药业抗体药全梳理;科伦药业抗体药全梳理;百奥泰技术全梳理;凡恩世技术全梳理。

抗体药物偶联物AACR会议

2025-03-28

·抗体圈

ADC药物来到收获期。第一三共德曲妥珠单抗2024年全球销售约38亿美元,有机构预计其2026年有望冲击75亿美金,重磅炸弹威力尽显。国内ADC Biotech离收获期也正在越来越近。3月27日,乐普生物发布2024年业绩公司公告:公司实现了收入3.68亿,同比增长63.2%,其中普特利单抗销售大幅放量,实现3亿销售收入,约为2023年1.01亿的3倍。值得注意的是,过去一年里乐普生物通过产品商业化放量、融资配售等表现,延长了公司的现金流管道,公司的现金及等价物与2023年基本持平(以及MRG007在2025年初出海进一步增厚公司现金流储备);另外,随着PD-1普特利单抗商业化逐渐成熟,公司未来有更多的经验和资源蓄力EGFR ADC产品MRG003商业化。乐普生物业绩数据的渐入佳境只是浅层表象,2025年公司将迎来密集的催化因子,真正的商业化爆发期和新一波的出海浪潮即将到来。01003冲刺商业化:适应症扩容在即在FIC EGFR ADC管线MRG003近期历经了一次申报波折,这仅稍稍拖慢了商业化步伐,不影响这款国内FIC大单品的获批终局;而MRG003更强的催化,也将在今年到来。MRG003在鼻咽癌(NPC)的优势地位正在确立,其已经集齐了FDA关于复发性或转移性鼻咽癌(R/M NPC)的突破性疗法、孤儿药和快速通道资格。目前,MRG003等待CDE审批的适应症为二线及以上鼻咽癌,未来MRG003冲击一线治疗扩大适应症空间也不在话下。乐普生物在2024 ESMO亚洲年会上最新公布的MRG003联合PD-1普特利单抗治疗R/M NPC二期数据显示:在30例接受治疗患者中(29例为PD-(L)1抗体治疗后进展),ORR达到了66.7%,DCR达到了93.3%,6个月PFS率为76.2%,其中2例患者CR、18例患者PR,疗效非常惊艳;当前2024 CSCO指南一线治疗鼻咽癌为PD-1联合吉西他滨联合顺铂的ORR普遍在60-80%不等,≥3级不良反应率超过80%。对比之下,若未来MRG003联合PD-1普特利单抗挑战一线NPC治疗将有着很高的成功率。MRG003更大的预期差在头颈鳞癌(HNSCC)。头颈癌是全球第6大最常见的恶性肿瘤, 据GLOBOCAN估计全球每年新发病例约89万,占所有癌症类型的4.5%。而HNSCC占头颈癌的90%;目前局部晚期的HNSCC主要治疗手段是同步放疗化疗,但超过一半患者接受治疗后3年内复发,复发或转移患者5年生存率不足5%,一线治疗为PD-1联合疗法,二线治疗为EGFR西妥昔单抗联合疗法,再后线缺乏治疗手段。乐普生物在2023 ESMO大会的最新头颈癌二期临床数据显示:PD-1/L1抗体耐药二线头颈癌患者中,接受2.3mg/kg MRG003治疗组ORR为43%、DCR为86%,mPFS为4.2个月,mOS为11.3个月(趋近于一线疗法的OS),相比PD-1/L1抗体在同类病人仅有6-7个月的OS,疗效极具突破性。2024 ASCO乐普生物公布一项MRG003联合普特利单抗治疗鼻咽癌和头颈鳞癌的 I/II 期临床数据,其中5例可评估一线头颈癌患者中,3例PR,1例SD,ORR和DCR分别为60%和80%。尽管样本量不大,但考虑到KEYNOTE-048研究显示K药联合化疗一线治疗头颈癌ORR为36%,MRG003联合普特利单抗初期数据接近将ORR翻倍,颠覆性或迭代性的潜力毋庸置疑。值得期待的是,MRG003 NPC注册性IIb期研究结果入选2025年ASCO大会的LBA(重磅研究摘要)口头汇报,LBA每年的入选概率大概不到0.5%,进一步验证了这个分子的巨大潜力。同时2025年下半年MRG003联合普特利单抗治疗一线头颈癌的三期临床数据也即将读出,若能够延续早期数据优异性,出海潜力拉满。MRG003的商业化前景一片光明。从过往解决未满足临床需求的唯一性或差异化创新药的商业化作为参考,基本上均能实现上市快速放量、至少成为国内或全球潜力重磅炸弹的目标;国内案例看,复宏汉霖的PD-1斯鲁利单抗瞄准小细胞肺癌未满足临床需求,刷新了ES-SCLC免疫治疗患者mOS记录;海外案例看,艾伯维的FRα ADC填补了卵巢癌后线治疗空白,上市首年销售2亿美元。同样,MRG003未来上市之后不仅填补二线及后线鼻咽癌治疗的空白,其同类最佳的疗效潜质有望刷新全线免疫治疗患者的OS获益;头颈癌领域,MRG003提供给二线及后线患者一种全新疗效更优的治疗选择,并且MRG003与PD-1联用有望冲击一线治疗地位,同样有望刷新全线免疫治疗患者的OS获益;未来,MRG003将有望成为二线及后线鼻咽癌、头颈癌治疗的“金标准”。鼻咽癌、头颈癌虽然市场空间不如肺癌、乳腺癌等大适应症,填补临床空白和迭代标准治疗带来的市场潜力不容小觑。由于早期鼻咽癌患5年者生存率极高,数据统计国内存量的一二线鼻咽癌患者至少超过20万人,这均为MRG003潜在治疗患者;2023年国内头颈癌治疗药物市场约45亿元,主要由化疗、PD-1免疫治疗药物占据。海外方面,美林则是对Merus双抗Petosemtamab治疗一线、二线后头颈癌的销售峰值分别给到16亿美元、9.47亿美元;可见,MRG003无论在国内或者海外仅凭鼻咽癌、头颈癌这两个适应症,至少有望冲击15亿美元的市场价值(国内海外二八开)。02手握新型ADC梯队蓄势待发踏入商业化蓄力期的同时,乐普生物新型ADC梯队也开始发力。近年来,乐普生物ADC出海交易不断,2023年乐普生物/康诺亚的CLDN18.2 ADC产品CMG901以总额11.88亿美元授权给阿斯利康,2025年则是将临床前ADC管线MRG007以超12亿美元授权给ArriVent BioPharma,ADC领域创新能力被MNC和海外资本充分认可。为了创造出更多FIC、BIC的创新ADC产品,乐普生物还开发了新一代ADC研发平台Hi-TOPi。Hi-TOPi针对过去和目前这一代ADC产品存在的问题对各个ADC零部件做了全面的“升级”,平台能筛选出亲和力更强、内吞更快的抗体发挥ADC靶向能力,其次则是采用了血液高稳定性并在肿瘤高效释放的Linker,Payload是新型TOP1抑制剂而非Pgp的底物(具有克服耐药性的潜力),未来Hi-TOPi将成为乐普生物新一代ADC孵化池。乐普生物最新进入临床的MRG006A管线便是Hi-TOPi平台的产物,MRG006A是一款全球首创的GPC3 ADC,采用对GPC3亲和力高、内吞快的抗体,同时Payload为新型TOP1抑制剂(非Pgp底物),DAR为8;GPC3是一个超70%肝癌组织高表达的靶点,但在正常组织几乎不表达,是一个非常适合作为ADC开发的靶点。MRG006A临床前研究显示:其在多个不同GPC3表达水平的肝癌CDX模型和PDX模型中均表现出强大且剂量依赖的抗肿瘤功能。将视角拉回来,乐普生物在研管线中进度靠前且有望接下来兑现出海潜力的ADC莫过于靶向TF的MRG004A。组织因子(TF)靶点本身便是一个潜在市场空间较大的ADC开发靶点,其在多种实体瘤中存在阳性表达,包括宫颈癌(阳性率100%)、非小细胞肺癌、卵巢癌、前列腺癌、胰腺癌等,这定位了其开发上限;目前,全球TF靶点进入临床药物屈指可数,唯一获批的是辉瑞的TF ADC产品Tivdak,2024年销售1.31亿美元,乐普生物MRG004A目前进度全球第二,处于I/II期临床的数据整理阶段,未来一年有望进入注册三期临床。目前MRG004A处于I/II期临床探索在TF阳性实体瘤的潜力(涵盖胰腺癌、三阴性乳腺癌、宫颈癌等),其中MRG004A在被称为“癌王”胰腺癌适应症上展现了超强的潜力。MRG004A在ASCO大会公布的I/II期数据显示,在2.0mg/kg剂量组的12名可评估胰腺癌患者中,ORR为33.3%,DCR为83.3%;在TF高表达(TF≥50%)且前线治疗线数2线以内的胰腺癌患者中,ORR为80%,DCR为100%。要知道,胰腺癌的5年生存率极低,并且以二线标准治疗化疗为例其有效率在6-17%,PFS只有2-3.5个,缺乏有效的治疗方案。MRG004A无疑提供了一个全新的治疗方案,并且尤其在胰腺癌TF高表达的部分人群中拥有巨大的潜力,由此MRG004A也获得FDA授予在胰腺癌治疗上的孤儿药认定。对于胰腺癌这种全球性难题,填补临床空白的创新有宽广的定价区间和巨大的市场潜力,例如Revolution公司RMC-6236仅在PDAC适应症早期临床展现出初步潜力,市值便一度突破百亿美元,Jefferies预计RMC-6236仅在PDAC适应症就有约50亿美元的市场机会。而对于MRG004A,除了胰腺癌适应症外其在三阴乳腺癌、宫颈癌小样本临床数据均展现不俗潜力,未来市场空间广阔,有望在读出早期数据后放大出海价值。与阿斯利康合作的CMG901早在2024年4月启动了全球胃癌三期临床,公司有望在未来三期读出数据后收获源源不断的临床监管里程碑及后续销售分成;另外,CD20 ADC产品MRG001在血液瘤中大适应症复发难治型DLBCL的早期临床中也展现出不俗潜力,有望解决后线DLBCL患者的未满足临床需求。不难看出,乐普生物正手握一大批拥有出海潜力的ADC管线,能够在未来为公司提供源源不断的现金流和持续拓展公司的价值上限。03手握最佳联用组合下一个免疫治疗时代离不开IO、ADC等迭代创新分子,同样也离不开联合用药。随着更多“PD-1+ADC”组合开始冲击实体瘤一线治疗,有“PD-1+溶瘤病毒”组合在实体瘤全球三期展现迭代性疗效,可以确认未来实体瘤免疫治疗的一线疗法离不开抗体、ADC或溶瘤病毒等的联用,目前已经有不少企业尝试双抗+ADC的组合。据Hanson Wade 数据库显示,2022年启动的ADC临床研究达到244项,联合用药有126项超过临床数量的一般,其中ADC+IO的联用达到58项,联合用药显然是一个大趋势。乐普生物显然深谙下个时代的趋势,公司在每一个关键“部件”领域都有布局,涵盖PD-1、TCE多抗、ADC、溶瘤病毒,尽显公司布局前瞻性。在联用布局上,乐普生物区别于其他Biotech的一大差异化优势在于,公司拥有稀缺的溶瘤病毒资产CG0070权益,拥有潜在BIC的潜力。CG0070是一种基因修饰的5型腺病毒(Ad5)溶瘤病毒,溶瘤病毒最大优点在于“百搭性”,其能够作为免疫激活和药物递送的工具。从乐普生物合作伙伴CG Oncology公布最新临床BOND-003数据显示,单药治疗110例高危卡介苗(BCG)无反应的非肌层浸润性膀胱癌(NMIBC)患者中,110名患者中有82例患者实现了完全缓解(CR率74.5%),1年完全缓解率为46%;而在阶段更早的CG0070联合K药二期临床CORE-001数据显示,35名患者中29名实现了完全缓解(CR率82.9%),12个月时的CR率为57.1%。CG0070的海外数据,一方面证实了该疗法潜在同类最佳的潜力(与强生TAR- 200 疗效相近),CG0070有望凭借BOND-003的数据支持获得美国FDA的批准,另一方面也证明溶瘤病毒联用IO疗法有着优越的潜在价值。。乐普生物从引进CG0070以来一直在等待其注册临床的进展,随着今年CG0070海外顺利成药验证和申报上市,乐普生物即可在国内实现简洁快速的桥接临床和推动药物上市,亦能占到国内PD-1联合溶瘤病毒治疗NMIBC的先机,在国内联合治疗史上又是浓墨重彩的一笔。另外,乐普生物早早的开展了普特利单抗分别联用MRG003和MRG002分别探索EGFR阳性实体瘤、HER2阳性实体瘤的二期临床,EGFR、HER2两个靶点均为在多种实体瘤上高表达的热门靶点,这样的联用布局不仅能进一步探索组合在各类适应症上的广泛潜力,同时能够帮助过去单药ADC治疗突破后线治疗的桎梏推进前线治疗,可谓一箭双雕;普特利单抗和MRG003的联用布局已经前述2024 ESMO的鼻咽癌二期临床确证了“1+1>2”的显著疗效,而2025H2头颈癌三期数据验证将进一步打开该联用疗法的市场空间。从联用方向角度来看,乐普生物的上限走在国内Biotech的前列,公司不仅有已商业化的PD-1单抗,同时手握多个实体瘤高表达广谱靶点的ADC管线,以及稀缺的溶瘤病毒产品权益,公司有望通过合理创新的药物组合机制,在更多如乳腺癌、膀胱癌、头颈癌等大适应症或差异化未满足临床需求去挑战早线治疗,若挑战成功将收获巨大市场份额,这里甚至还没有考虑到公司早研新型TCE分子的组合。结语:乐普生物正处于一个准备加速的蓄力期,MRG003的头颈癌三期数据或国内的商业化审批都能将公司带上一个全新的高度,这是深耕未满足临床需求和同类首创分子的正向馈赠;同时,公司前瞻性布局的一众新型ADC分子和联合用药组合将在未来随时迸发出超预期的临床及出海价值,这家低调的Biotech正在向市场展示强大研发能力和其蕴含磅礴的出海价值;至于价值突破,也只是时间问题。识别微信二维码,添加抗体圈小编,符合条件者即可加入抗体圈微信群!请注明:姓名+研究方向!本公众号所有转载文章系出于传递更多信息之目的,且明确注明来源和作者,不希望被转载的媒体或个人可与我们联系(cbplib@163.com),我们将立即进行删除处理。所有文章仅代表作者观点,不代表本站立场。

抗体药物偶联物孤儿药CSCO会议临床2期引进/卖出

分析

对领域进行一次全面的分析。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

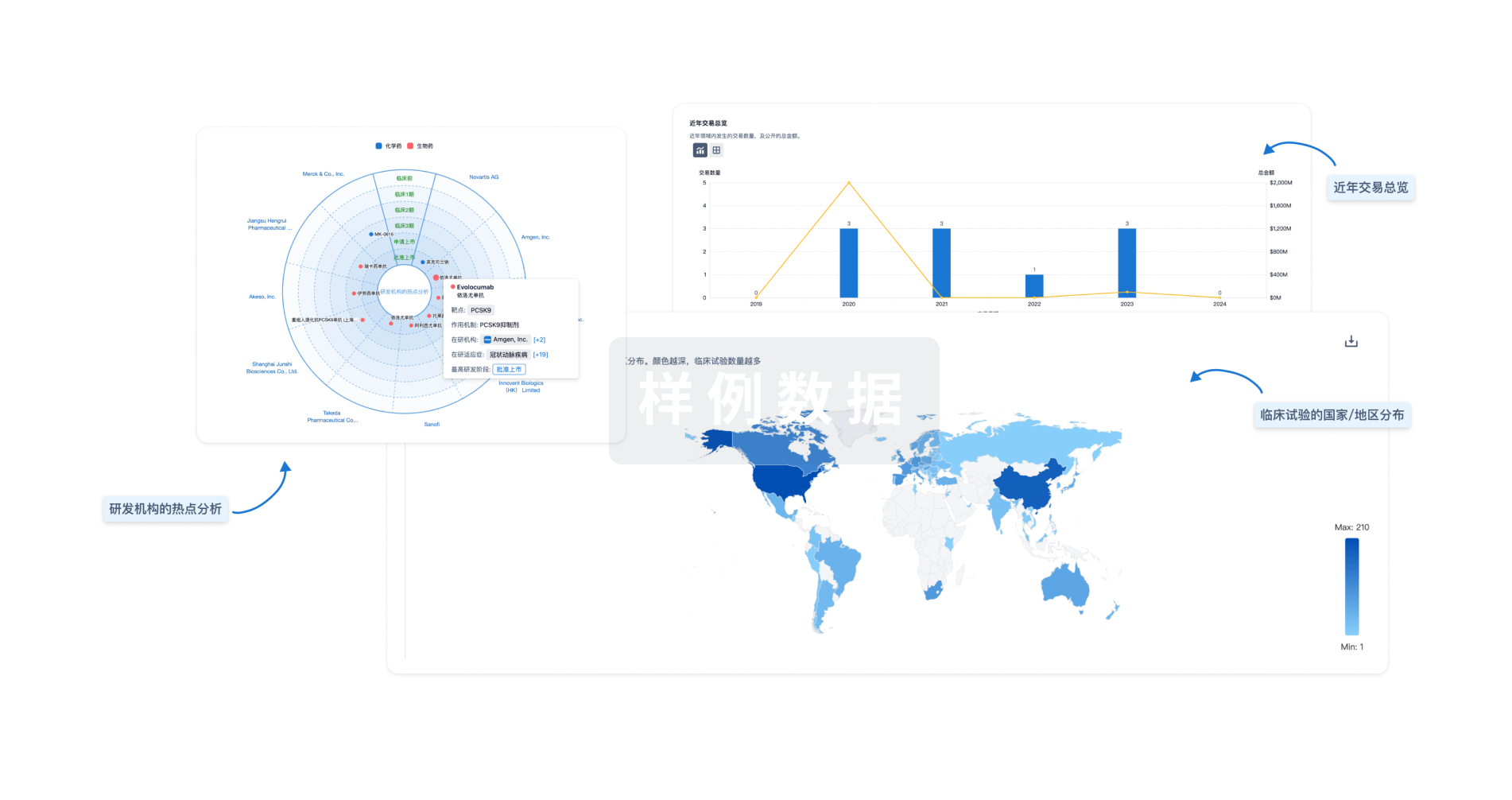

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用