预约演示

更新于:2025-08-29

Allorion Therapeutics (Guangzhou) Inc.

更新于:2025-08-29

概览

标签

肿瘤

皮肤和肌肉骨骼疾病

呼吸系统疾病

小分子化药

化学药

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 小分子化药 | 6 |

| 化学药 | 1 |

关联

7

项与 安锐生物医药科技(广州)有限公司 相关的药物靶点 |

作用机制 CDK4抑制剂 |

非在研适应症- |

最高研发阶段临床1/2期 |

首次获批国家/地区- |

首次获批日期- |

靶点 |

作用机制 TYK2抑制剂 |

在研机构 |

原研机构 |

非在研适应症- |

最高研发阶段临床1/2期 |

首次获批国家/地区- |

首次获批日期- |

靶点 |

作用机制 CDK2抑制剂 |

原研机构 |

非在研适应症- |

最高研发阶段临床1/2期 |

首次获批国家/地区- |

首次获批日期- |

1

项与 安锐生物医药科技(广州)有限公司 相关的临床试验CTR20250789

评价ARTS-876在局部晚期或转移性非小细胞肺癌(NSCLC)患者中的安全性、耐受性、药代动力学特征和初步抗肿瘤活性的多中心、开放Ia/Ib期临床试验

评估注射用ARTS-876治疗局部晚期或转移性非小细胞肺癌的安全性,耐受性以及初步抗肿瘤效果;探索剂量限制毒性 (DLT)和最大耐受剂量(MTD), 同时确定II期推荐剂量(RP2D)

开始日期2025-04-09 |

申办/合作机构 |

100 项与 安锐生物医药科技(广州)有限公司 相关的临床结果

登录后查看更多信息

0 项与 安锐生物医药科技(广州)有限公司 相关的专利(医药)

登录后查看更多信息

45

项与 安锐生物医药科技(广州)有限公司 相关的新闻(医药)2025-08-17

·信狐药迅

本周药品注册受理数据,分门别类呈现,一目了然。(8.11-8.17)

新药上市申请

药品名称

企业

注册分类

受理号

HY22017胶囊

长春海悦药业股份有限公司

2.3

CXHS2500095

海曲泊帕乙醇胺片

江苏恒瑞医药股份有限公司

2.4

CXHS2500094

海曲泊帕乙醇胺片

江苏恒瑞医药股份有限公司

2.4

CXHS2500093

海曲泊帕乙醇胺片

江苏恒瑞医药股份有限公司

2.4

CXHS2500092

新药临床申请

药品名称

企业

注册分类

受理号

MAX-001胶囊

安炎达医药技术(广州)有限公司

1

CXHL2500859

MAX-001胶囊

安炎达医药技术(广州)有限公司

1

CXHL2500858

HSK39297片

海思科医药集团股份有限公司

1

CXHL2500855

HSK39297片

海思科医药集团股份有限公司

1

CXHL2500854

HSK39297片

海思科医药集团股份有限公司

1

CXHL2500853

HSK39297片

海思科医药集团股份有限公司

1

CXHL2500852

TGRX-678片

深圳市塔吉瑞生物医药有限公司

1

CXHL2500850

D-2570片

益方生物科技(上海)股份有限公司

1

CXHL2500849

HRS-6209胶囊

江苏恒瑞医药股份有限公司

1

CXHL2500848

HRS-6209胶囊

江苏恒瑞医药股份有限公司

1

CXHL2500847

HRS-6209胶囊

江苏恒瑞医药股份有限公司

1

CXHL2500846

HRS-6209胶囊

江苏恒瑞医药股份有限公司

1

CXHL2500845

HRS-2189片

山东盛迪医药有限公司

1

CXHL2500844

HRS-2189片

山东盛迪医药有限公司

1

CXHL2500843

ARTS-023片

安锐生物医药科技(广州)有限公司

1

CXHL2500835

ARTS-023片

安锐生物医药科技(广州)有限公司

1

CXHL2500834

XZ022

山东新时代药业有限公司

2.2

CXHL2500860

紫杉醇软胶囊

美济生物医药(广州)有限公司

2.2

CXHL2500839

HWH217片

湖北生物医药产业技术研究院有限公司

2.3

CXHL2500857

HWH217片

湖北生物医药产业技术研究院有限公司

2.3

CXHL2500856

注射用戈舍瑞林微球

山东绿叶制药有限公司

2.4

CXHL2500851

阿贝西利片

齐鲁制药有限公司

2.4

CXHL2500840

阿贝西利片

齐鲁制药有限公司

2.4

CXHL2500842

阿贝西利片

齐鲁制药有限公司

2.4

CXHL2500841

结合雌激素乳膏

新疆新姿源生物制药有限责任公司

2.4

CXHL2500833

吡非尼酮胶囊

北京康蒂尼药业股份有限公司

2.4

CXHL2500836

PRT-062鼻喷雾剂

四川普锐特药业有限公司

2.4;2.2

CXHL2500838

PRT-062鼻喷雾剂

四川普锐特药业有限公司

2.4;2.2

CXHL2500837

重组呼吸道合胞病毒疫苗(CHO细胞)

北京华诺泰生物医药科技有限公司

1.2

CXSL2500691

吸附无细胞百白破(组分)联合疫苗(成人及青少年用)

北京智飞绿竹生物制药有限公司

2.6

CXSL2500705

SHR-1139注射液

广东恒瑞医药有限公司

1

CXSL2500704

注射用乙型脑炎溶瘤病毒

四川安可康生物医药有限公司

1

CXSL2500709

注射用乙型脑炎溶瘤病毒

四川安可康生物医药有限公司

1

CXSL2500708

注射用乙型脑炎溶瘤病毒

四川安可康生物医药有限公司

1

CXSL2500707

注射用乙型脑炎溶瘤病毒

四川安可康生物医药有限公司

1

CXSL2500706

ZX2021注射液

江苏中新医药有限公司

1

CXSL2500699

ZX2021注射液

江苏中新医药有限公司

1

CXSL2500698

ZX2021注射液

江苏中新医药有限公司

1

CXSL2500697

ZX2021注射液

江苏中新医药有限公司

1

CXSL2500696

ZX2021注射液

江苏中新医药有限公司

1

CXSL2500695

GenSci098注射液

长春金赛药业有限责任公司

1

CXSL2500703

Cizutamig注射液

上海坦蒂生物医药科技有限公司

1

CXSL2500702

注射用YP004

原菩生物技术(武汉)有限责任公司

1

CXSL2500701

VBC101

上海橙帆医药有限公司

1

CXSL2500700

AZD0901

阿斯利康全球研发(中国)有限公司

1

CXSL2500694

注射用QLC5513

齐鲁制药有限公司

1

CXSL2500690

仿制药申请

药品名称

企业

注册分类

受理号

盐酸卡替洛尔滴眼液

成都地奥九泓制药厂

3

CYHS2503016

洛索洛芬钠颗粒

辽宁海一制药有限公司

3

CYHS2503013

联苯苄唑溶液

中山万汉制药有限公司

3

CYHS2503009

盐酸多巴酚丁胺注射液

石家庄四药有限公司

3

CYHS2503006

联苯苄唑溶液

杭州上禾健康科技有限公司

3

CYHS2503005

盐酸西替利嗪口服溶液

海南万玮制药有限公司

3

CYHS2503004

布比卡因脂质体注射液

浙江博崤生物制药有限公司

3

CYHS2503003

布比卡因脂质体注射液

浙江博崤生物制药有限公司

3

CYHS2503002

氨磺必利口服溶液

河北义海医药科技有限公司

3

CYHS2503000

枸橼酸西地那非口溶膜

杭州和泽坤元药业有限公司

3

CYHS2502996

JP-1366片

丽珠医药集团股份有限公司

3

CYHS2502991

聚乙二醇4000散

西安安健药业有限公司

3

CYHS2502988

普瑞巴林口服溶液

江苏贝佳制药有限公司

3

CYHS2502986

普瑞巴林口服溶液

江苏贝佳制药有限公司

3

CYHS2502983

叶酸片

成都通德药业有限公司

3

CYHS2502973

枸橼酸苯海拉明布洛芬片

合肥恩瑞特药业有限公司

3

CYHS2502972

盐酸多西环素片

江苏润恒制药有限公司

3

CYHS2502969

盐酸多西环素片

江苏润恒制药有限公司

3

CYHS2502968

瑞舒伐他汀钙口崩片

广东万泰科创药业有限公司

3

CYHS2502966

瑞舒伐他汀钙口崩片

广东万泰科创药业有限公司

3

CYHS2502965

注射用硫酸多黏菌素B

国药集团国瑞药业有限公司

3

CYHS2502963

叶酸片

建昌帮药业有限公司

3

CYHS2502979

复方聚乙二醇(3350)电解质口服溶液

湖北午时药业股份有限公司

3

CYHS2502957

中性腹膜透析液(碳酸氢盐-G1.5%)

成都青山利康药业股份有限公司

3

CYHS2502955

中性腹膜透析液(碳酸氢盐-G1.5%)

成都青山利康药业股份有限公司

3

CYHS2502954

中性腹膜透析液(碳酸氢盐-G1.5%)

成都青山利康药业股份有限公司

3

CYHS2502953

中性腹膜透析液(碳酸氢盐-G2.5%)

成都青山利康药业股份有限公司

3

CYHS2502952

中性腹膜透析液(碳酸氢盐-G2.5%)

成都青山利康药业股份有限公司

3

CYHS2502951

中性腹膜透析液(碳酸氢盐-G2.5%)

成都青山利康药业股份有限公司

3

CYHS2502950

复方磷酸盐颗粒

江苏润恒制药有限公司

3

CYHS2502947

草酸艾司西酞普兰口服溶液

浙江领创优品药业有限公司

3

CYHS2502944

维生素B12注射液

江苏润恒制药有限公司

3

CYHS2502943

中性低钙腹膜透析液(碳酸氢盐-G2.5%)

成都青山利康药业股份有限公司

3

CYHS2502930

中性低钙腹膜透析液(碳酸氢盐-G2.5%)

成都青山利康药业股份有限公司

3

CYHS2502929

中性低钙腹膜透析液(碳酸氢盐-G2.5%)

成都青山利康药业股份有限公司

3

CYHS2502928

磷/碳酸氢钠血滤置换液(4mmol/L钾、1.25mmol/L钙)

宁波天益药业科技有限公司

3

CYHS2502922

帕拉米韦注射液

哈尔滨三联药业股份有限公司

3

CYHS2502916

色甘酸钠滴眼液

苏州乐珠制药有限公司

3

CYHS2502936

帕拉米韦氯化钠注射液

哈尔滨三联药业股份有限公司

4

CYHS2503015

帕拉米韦氯化钠注射液

哈尔滨三联药业股份有限公司

4

CYHS2503014

注射用磷酸特地唑胺

安徽省先锋制药有限公司

4

CYHS2503008

阿达帕林凝胶

东阳祥昇医药科技有限公司

4

CYHS2503007

盐酸曲唑酮缓释片

合肥力成药业有限公司

4

CYHS2503001

双氯芬酸钠盐酸利多卡因注射液

四川健林药业有限责任公司

4

CYHS2502999

阿法骨化醇滴剂

石家庄科仁医药科技有限公司

4

CYHS2502998

聚乙烯醇滴眼液

北京汇恩兰德制药有限公司

4

CYHS2502981

氧(液态)

准格尔旗鼎承气体有限责任公司

4

CYHS2502980

蒙脱石混悬液

浙江百代医药科技有限公司

4

CYHS2502997

左氧氟沙星氯化钠注射液

四川太平洋药业有限责任公司

4

CYHS2502995

洛索洛芬钠贴剂

苏州弘森药业股份有限公司

4

CYHS2502994

洛索洛芬钠贴剂

苏州弘森药业股份有限公司

4

CYHS2502993

骨化三醇软胶囊

江苏万高药业股份有限公司

4

CYHS2502992

聚乙二醇4000散

西安安健药业有限公司

4

CYHS2502990

瑞舒伐他汀依折麦布片(I)

山东新华制药股份有限公司

4

CYHS2502989

氟轻松玻璃体内植入剂

苏州欧康维视生物科技有限公司

4

CYHS2502987

乳果糖口服溶液

浙江震元制药有限公司

4

CYHS2502985

乳果糖口服溶液

浙江震元制药有限公司

4

CYHS2502984

乳果糖口服溶液

浙江震元制药有限公司

4

CYHS2502982

磷酸芦可替尼片

齐鲁制药有限公司

4

CYHS2503012

磷酸芦可替尼片

齐鲁制药有限公司

4

CYHS2503010

磷酸芦可替尼片

齐鲁制药有限公司

4

CYHS2503011

甲磺酸沙非胺片

扬子江药业集团有限公司

4

CYHS2502946

碘佛醇注射液

福安药业集团宁波天衡制药有限公司

4

CYHS2502971

灌注用盐酸氨酮戊酸己酯

江苏联环药业股份有限公司

4

CYHS2502970

伏立康唑干混悬剂

河北嵘霖制药有限公司

4

CYHS2502967

泊那替尼片

成都硕德药业有限公司

4

CYHS2502964

盐酸曲唑酮缓释片

中曦(福建)药业有限公司

4

CYHS2502978

盐酸曲唑酮缓释片

中曦(福建)药业有限公司

4

CYHS2502977

沙库巴曲缬沙坦钠片

江西施美药业股份有限公司

4

CYHS2502976

沙库巴曲缬沙坦钠片

江西施美药业股份有限公司

4

CYHS2502975

沙库巴曲缬沙坦钠片

江西施美药业股份有限公司

4

CYHS2502974

甲磺酸沙非胺片

扬子江药业集团有限公司

4

CYHS2502945

塞来昔布胶囊

吉林亚泰永安堂药业有限公司

4

CYHS2502959

塞来昔布胶囊

吉林亚泰永安堂药业有限公司

4

CYHS2502958

达格列净片

青岛百洋制药有限公司

4

CYHS2502956

美阿沙坦钾片

福建东瑞制药有限公司

4

CYHS2502949

美阿沙坦钾片

福建东瑞制药有限公司

4

CYHS2502948

卡铂注射液

南京泽恒医药技术开发有限公司

4

CYHS2502942

替普瑞酮胶囊

广东迈德珐医药科技有限公司

4

CYHS2502941

巴瑞替尼片

江苏万高药业股份有限公司

4

CYHS2502940

巴瑞替尼片

江苏万高药业股份有限公司

4

CYHS2502939

瑞维那新吸入溶液

复星医药(徐州)有限公司

4

CYHS2502938

瑞维那新吸入溶液

遂成药业股份有限公司

4

CYHS2502937

艾普拉唑肠溶片

广东君康药业有限公司

4

CYHS2502961

沙库巴曲缬沙坦钠片

国药集团致君(深圳)坪山制药有限公司

4

CYHS2502960

巴瑞替尼片

浙江华海药业股份有限公司

4

CYHS2502962

阿达帕林凝胶

河北三禾实创生物科技有限公司

4

CYHS2502934

甲钴胺片

天津柏海药业有限责任公司

4

CYHS2502933

盐酸伐昔洛韦片

浙江浙北药业有限公司

4

CYHS2502932

非奈利酮片

重庆莱美药业股份有限公司

4

CYHS2502931

苯磺酸左氨氯地平片

山西汾河制药有限公司

4

CYHS2502927

苯磺酸左氨氯地平片

山西汾河制药有限公司

4

CYHS2502926

非诺贝特片(III)

深圳格莱恩生物医药科技有限公司

4

CYHS2502925

乙酰半胱氨酸颗粒

武汉远大弘元股份有限公司

4

CYHS2502924

溴芬酸钠滴眼液

盈科瑞(珠海金湾)制药有限公司

4

CYHS2502923

注射用氨苄西林钠舒巴坦钠

山东安信制药有限公司

4

CYHS2502921

注射用氨苄西林钠舒巴坦钠

山东安信制药有限公司

4

CYHS2502920

注射用氨苄西林钠舒巴坦钠

山东安信制药有限公司

4

CYHS2502919

门冬氨酸钾镁注射液

裕松源药业有限公司

4

CYHS2502918

洛索洛芬钠凝胶贴膏

浙江恒研医药科技有限公司

4

CYHS2502917

蒙脱石散

重庆康刻尔制药股份有限公司

4

CYHS2502935

注射用硫酸艾沙康唑

石药集团欧意药业有限公司

4

CYHS2502915

沙库巴曲缬沙坦钠片

苏州第三制药厂有限责任公司

4

CYHS2502914

沙库巴曲缬沙坦钠片

苏州第三制药厂有限责任公司

4

CYHS2502913

奥利司他胶囊

湖南本草制药有限责任公司

4

CYHS2502912

奥利司他胶囊

湖南本草制药有限责任公司

4

CYHS2502911

乙酰半胱氨酸注射液

重庆康刻尔制药股份有限公司

4

CYHS2502910

达格列净二甲双胍缓释片(III)

重庆博腾药业有限公司

4

CYHS2502909

达格列净二甲双胍缓释片(II)

重庆博腾药业有限公司

4

CYHS2502908

达格列净二甲双胍缓释片(I)

重庆博腾药业有限公司

4

CYHS2502907

低钙腹膜透析液(乳酸盐-G4.25%)

辰欣药业股份有限公司

4

CYHS2502906

贝伐珠单抗眼内注射液

珠海亿胜生物制药有限公司

3.2

CXSS2500082

司美格鲁肽注射液

惠升生物制药股份有限公司

3.3

CXSS2500084

司美格鲁肽注射液

惠升生物制药股份有限公司

3.3

CXSS2500083

瑞卢戈利片

山东朗诺制药有限公司

3

CYHL2500147

异硫蓝注射液

康哲(湖南)制药有限公司

3

CYHL2500146

盐酸羟甲唑啉滴眼液

北京汇恩兰德制药有限公司

3

CYHL2500145

甲磺酸酚妥拉明滴眼液

浙江视方极医药科技有限公司

3

CYHL2500143

呫诺美林曲司氯铵胶囊

江苏恩华药业股份有限公司

3

CYHL2500142

呫诺美林曲司氯铵胶囊

江苏恩华药业股份有限公司

3

CYHL2500141

呫诺美林曲司氯铵胶囊

江苏恩华药业股份有限公司

3

CYHL2500140

茚达特罗格隆溴铵吸入粉雾剂

山东京卫制药有限公司

4

CYHL2500144

冻干人用狂犬病疫苗(人二倍体细胞)

成都康华生物制品股份有限公司

3.3

CXSL2500692

QL2302注射液

齐鲁制药有限公司

3.3

CXSL2500693

进口申请

药品名称

企业

注册分类

受理号

塞普替尼片

Eli Lilly Nederland B.V.

5.1

JXHS2500087

塞普替尼片

Eli Lilly Nederland B.V.

5.1

JXHS2500086

塞普替尼片

Eli Lilly Nederland B.V.

5.1

JXHS2500085

塞普替尼片

Eli Lilly Nederland B.V.

5.1

JXHS2500084

艾沙妥昔单抗注射液(皮下注射)

Sanofi Winthrop Industrie

2.1

JXSS2500108

乙磺酸LY4066434片

Eli Lilly and Company

1

JXHL2500216

乙磺酸LY4066434片

Eli Lilly and Company

1

JXHL2500215

乙磺酸LY4066434片

Eli Lilly and Company

1

JXHL2500214

Icotrokinra片

Janssen Research & Development, LLC

1

JXHL2500213

Rilzabrutinib片

Sanofi-Aventis Recherche & Developpement

2.4

JXHL2500217

马立巴韦干混悬剂

Takeda Pharmaceuticals U.S.A., Inc.

2.4;2.2

JXHL2500212

马立巴韦干混悬剂

Takeda Pharmaceuticals U.S.A., Inc.

2.4;2.2

JXHL2500211

AZD0486

AstraZeneca AB

1

JXSL2500154

AZD0486

AstraZeneca AB

1

JXSL2500153

AZD0486

AstraZeneca AB

1

JXSL2500152

AZD0486

AstraZeneca AB

1

JXSL2500151

AZD0486

AstraZeneca AB

1

JXSL2500150

BCD-261注射液

SPH-BIOCAD (HK) LIMITED

1

JXSL2500149

MEDI5752

AstraZeneca AB

1

JXSL2500148

Lunsekimig注射液

Sanofi-Aventis Recherche & Developpement

1

JXSL2500146

Lunsekimig注射液

Sanofi-Aventis Recherche & Developpement

1

JXSL2500145

注射用SAR446523

Sanofi-Aventis Recherche & Developpement

1

JXSL2500144

注射用替奈普酶

Boehringer Ingelheim International GmbH

2.2

JXSL2500155

DS-1062a

AstraZeneca AB

2.2

JXSL2500147

中药相关申请

药品名称

企业

注册分类

受理号

小儿胆青双解颗粒

海南葫芦娃药业集团股份有限公司

1.1

CXZL2500065

苏黄止咳胶囊

杨凌科森生物制药有限责任公司

4

CYZS2500009

注:绿色字体部分为潜在首仿品种;

不包含原料药、医用氧、注射用水、氯化钠或葡萄糖注射液等申请,不包含再注册、一次性进口、技术转移、复审申请。

申请上市疫苗

2025-07-29

·医药笔记

▎Armstrong2025年7月29日,阿斯利康发布半年度财报,上年年营收280.45亿美元,同比增长9%。阿斯利康布局多个技术平台,驱动达到2030年800亿美元营收目标。体重管理和相关危险因素领域,小分子PCSK9抑制剂启动3项三期临床,小分子GLP-1正在进行2b期临床试验,胰淀素类似物AZD6234处于二期临床阶段。ADC和RDC系统性地替代化疗和放疗,其中ADC在临床阶段,PSMA核药处于二期临床阶段。PD-1/TIGIT、PD-1/CTLA-4迭代PD-1。细胞治疗和TCE领域扩展布局,BCMA/CD19 CAR-T扩展到自免领域,收购EsoBiotech布局体内CAR-T疗法。基因治疗和基因编辑主要布局罕见病领域。ADC方面,EGFR/cMET双靶点ADC推进到二期临床阶段,这是阿斯利康首款双靶点ADC,也是全球范围内首款EGFR/cMET ADC。阿斯利康终止开发两款实体瘤CAR-T,分别靶向GPC3、Claudin18.2,C5抗体狼疮肾炎适应症放弃。核药领域,阿斯利康除了PSMA RDC之外,还开发了EGFR/cMET双靶点RDC、STEAP2 ADC,后两RDC均处于一期临床阶段。总结2025年上半年,阿斯利康在中国市场的收入为35.15亿美元,同比增长4%。阿斯利康也是最积极从中国引进创新药的MNC之一,包括收购亘喜生物布局新一代CAR-T技术平台,引进康诺亚/乐普生物的Claudin18.2 ADC,引进诚益生物的小分子GLP-1受体激动剂,引进安锐生物的EGFR L858R抑制剂,与和铂医药达成全球战略合作并对其进行1.05亿美元股权投资,与元思生态达成战略合作共同开发口服大环肽药物,引进石药集团Lpa小分子并达成53亿美元AI制药合作等。Armstrong技术全梳理系列GPRC5D靶点全梳理;CD40靶点全梳理;CD47靶点全梳理;补体靶向药物技术全梳理;补体药物:眼科治疗的重要方向;Claudin 6靶点全梳理;Claudin 18.2靶点全梳理;靶点冷暖,行业自知;中国大分子新药研发格局;被炮轰的“me too”;佐剂百年史;胰岛素百年传奇;CUSBEA:风雨四十载;中国新药研发的焦虑;中国生物医药企业的研发竞争;中国双抗竞争格局;中国ADC竞争格局;中国双抗技术全梳理;中国ADC技术全梳理;Ambrx技术全梳理;Vir Biotech技术全梳理;Immune-Onc技术全梳理;亘喜生物技术全梳理;康哲药业技术全梳理;科济药业技术全梳理;恺佧生物技术全梳理;同宜医药技术全梳理;百奥赛图技术全梳理;腾盛博药技术全梳理;创胜集团技术全梳理;永泰生物技术全梳理;中国抗体技术全梳理;德琪医药技术全梳理;德琪医药技术全梳理2.0;和铂医药技术全梳理;荣昌生物技术全梳理;再鼎医药技术全梳理;药明生物技术全梳理;恒瑞医药技术全梳理;豪森药业技术全梳理;正大天晴技术全梳理;吉凯基因技术全梳理;基石药业技术全梳理;百济神州技术全梳理;百济神州技术全梳理第2版;信达生物技术全梳理;信达生物技术全梳理第2版;中山康方技术全梳理;复宏汉霖技术全梳理;先声药业技术全梳理;君实生物技术全梳理;嘉和生物技术全梳理;志道生物技术全梳理;道尔生物技术全梳理;尚健生物技术全梳理;康宁杰瑞技术全梳理;科望医药技术全梳理;岸迈生物技术全梳理;礼进生物技术全梳理;康桥资本技术全梳理;余国良的抗体药布局;荃信生物技术全梳理;安源医药技术全梳理;三生国健技术全梳理;仁会生物技术全梳理;乐普生物技术全梳理;同润生物技术全梳理;宜明昂科技术全梳理;派格生物技术全梳理;迈威生物技术全梳理;Momenta技术全梳理;NGM技术全梳理;普米斯生物技术全梳理;普米斯生物技术全梳理2.0;三叶草生物技术全梳理;贝达药业抗体药全梳理;泽璟制药抗体药全梳理;恒瑞医药抗体药全梳理;齐鲁制药抗体药全梳理;石药集团抗体药全梳理;豪森药业抗体药全梳理;华海药业抗体药全梳理;科伦药业抗体药全梳理;百奥泰技术全梳理;凡恩世技术全梳理。

2025-07-27

·信狐药迅

本周药品注册受理数据,分门别类呈现,一目了然。(7.21-7.27)新药上市申请药品名称企业注册分类受理号注射用GD-11江苏万高药业股份有限公司1CXHS2500085甲磺酸伏美替尼片上海艾力斯医药科技股份有限公司2.4CXHS2500084依沃西单抗注射液康方赛诺医药有限公司2.2CXSS2500077新药临床申请药品名称企业注册分类受理号WJB001胶囊微境生物医药科技(上海)有限公司1CXHL2500756注射用ARTS-876安锐生物医药科技(广州)有限公司1CXHL2500746埃诺格鲁肽片杭州先为达生物科技股份有限公司1CXHL2500745埃诺格鲁肽片杭州先为达生物科技股份有限公司1CXHL2500744埃诺格鲁肽片杭州先为达生物科技股份有限公司1CXHL2500743埃诺格鲁肽片杭州先为达生物科技股份有限公司1CXHL2500742特里豚蝎肽凝胶武汉摩尔生物科技有限公司1CXHL2500755TSL2109胶囊江苏天士力帝益药业有限公司1CXHL2500754TSL2109胶囊江苏天士力帝益药业有限公司1CXHL2500753LBS-007注射溶液北京希而欧生物医药开发有限公司1CXHL2500752HEP-50768片海湃泰克(北京)生物医药科技有限公司1CXHL2500751HEP-50768片海湃泰克(北京)生物医药科技有限公司1CXHL2500750HEP-50768片海湃泰克(北京)生物医药科技有限公司1CXHL2500749HEP-50768片海湃泰克(北京)生物医药科技有限公司1CXHL2500748BPR-6023021注射液成都欣科医药有限公司1CXHL2500747HTMC0435片上海壹典医药科技开发有限公司1CXHL2500739HTMC0435片上海壹典医药科技开发有限公司1CXHL2500738HTMC0435片上海壹典医药科技开发有限公司1CXHL2500737HTMC0435片上海壹典医药科技开发有限公司1CXHL2500736甲磺酸哆希替尼片河南真实生物科技有限公司1CXHL2500732甲磺酸哆希替尼片河南真实生物科技有限公司1CXHL2500731甲磺酸哆希替尼片河南真实生物科技有限公司1CXHL2500730KC1036片北京康辰药业股份有限公司1CXHL2500741KC1036片北京康辰药业股份有限公司1CXHL2500740EGFNASA胶囊宁波艾科索医药科技有限公司1CXHL2500729CMS-D002胶囊深圳市康哲生物科技有限公司1CXHL2500727CMS-D002胶囊深圳市康哲生物科技有限公司1CXHL2500728HL017辉粒药业(苏州)有限公司2.2CXHL2500735注射用紫杉醇阳离子脂质体石药集团中奇制药技术(石家庄)有限公司2.4CXHL2500760盐酸安罗替尼胶囊正大天晴药业集团股份有限公司2.4CXHL2500759盐酸安罗替尼胶囊正大天晴药业集团股份有限公司2.4CXHL2500758盐酸安罗替尼胶囊正大天晴药业集团股份有限公司2.4CXHL2500757GEN-725片河南真实生物科技有限公司2.4CXHL2500734GEN-725片河南真实生物科技有限公司2.4CXHL2500733重组金黄色葡萄球菌四组分疫苗(大肠杆菌)江苏坤力生物制药有限责任公司1.1CXSL2500611三价流感病毒裂解疫苗(BK-01佐剂)长春百克生物科技股份公司3.2CXSL2500608注射用JS207上海君实生物医药科技股份有限公司1CXSL2500617注射用JS107上海君实生物医药科技股份有限公司1CXSL2500623注射用JS207上海君实生物医药科技股份有限公司1CXSL2500621注射用HLX43上海复宏瑞霖生物技术有限公司1CXSL2500619注射用HDM2017杭州中美华东制药有限公司1CXSL2500622重组抗EGFR人源化单抗注射液上海复宏瑞霖生物技术有限公司1CXSL2500620WSK-IM02北京威斯克生物医药有限公司1CXSL2500615SCTB14注射液神州细胞工程有限公司1CXSL2500613SCTB14注射液神州细胞工程有限公司1CXSL2500612脐血单个核细胞注射液广州熙帝生物科技有限公司1CXSL2500614RC148注射液荣昌生物制药(烟台)股份有限公司1CXSL2500610注射用RC118荣昌生物制药(烟台)股份有限公司1CXSL2500609贝莫苏拜单抗注射液正大天晴药业集团南京顺欣制药有限公司2.2CXSL2500624仿制药申请药品名称企业注册分类受理号注射用盐酸头孢替安/氯化钠注射液湖南科伦制药有限公司3CYHS2502693盐酸哌罗匹隆片浙江京新药业股份有限公司3CYHS2502697盐酸哌罗匹隆片浙江京新药业股份有限公司3CYHS2502696依巴斯汀口服溶液江苏万高药业股份有限公司3CYHS2502684吡格列酮二甲双胍片河南大新药业有限公司3CYHS2502679盐酸溴己新口服溶液合肥远志医药科技开发有限公司3CYHS2502677注射用乳糖酸红霉素海南允鼎医药科技有限公司3CYHS2502675盐酸多沙普仑注射液扬州中宝药业股份有限公司3CYHS2502669盐酸丙卡特罗干糖浆南京海纳制药有限公司3CYHS2502690维生素K1片上海宣泰医药科技股份有限公司3CYHS2502661复方电解质醋酸钠葡萄糖注射液武汉同济中维医药有限责任公司3CYHS2502660复方电解质醋酸钠葡萄糖注射液武汉同济中维医药有限责任公司3CYHS2502659坎地氢噻片宁波科尔康美诺华药业有限公司3CYHS2502656复方聚乙二醇(3350)电解质维C散四川科伦药业股份有限公司3CYHS2502655硝普钠注射液扬州中宝药业股份有限公司3CYHS2502646复方聚乙二醇3350电解质散泓友药业(海南)有限公司3CYHS2502666注射用盐酸多西环素广东金城金素制药有限公司3CYHS2502665注射用盐酸多西环素广东金城金素制药有限公司3CYHS2502663地诺孕素片上海汇伦医药股份有限公司3CYHS2502632多索茶碱片西洲医药科技(浙江)有限公司3CYHS2502629多索茶碱片西洲医药科技(浙江)有限公司3CYHS2502627布美他尼注射液江苏铭远药业有限公司3CYHS2502623辅酶Q10片漯河市汇创医药有限公司3CYHS2502621维生素B6注射液杭州民生药业股份有限公司3CYHS2502619布洛芬片珠海润都制药股份有限公司3CYHS2502645乙酰半胱氨酸注射液海南爱科制药有限公司4CYHS2502692氨甲环酸注射液河南普瑞药业有限公司4CYHS2502700氨甲环酸注射液河南普瑞药业有限公司4CYHS2502699氨甲环酸注射液河南普瑞药业有限公司4CYHS2502698利丙双卡因乳膏河北华晨药业集团有限公司4CYHS2502695利丙双卡因乳膏河北华晨药业集团有限公司4CYHS2502694瑞舒伐他汀依折麦布片(I)云鹏医药集团有限公司4CYHS2502691卡贝缩宫素注射液成都天台山制药股份有限公司4CYHS2502701西洛他唑片石家庄科仁医药科技有限公司4CYHS2502689苯磺酸左氨氯地平片河北宏鑫堂药业有限公司4CYHS2502688苯磺酸左氨氯地平片河北宏鑫堂药业有限公司4CYHS2502687呋喹替尼胶囊南京正大天晴制药有限公司4CYHS2502686呋喹替尼胶囊南京正大天晴制药有限公司4CYHS2502685蒙脱石混悬液浙江远力健药业有限责任公司4CYHS2502683戊酸雌二醇片湖南醇健制药科技有限公司4CYHS2502682盐酸特比萘芬喷雾剂浙江核力欣健药业有限公司4CYHS2502681盐酸莫西沙星滴眼液河北宏鑫堂药业有限公司4CYHS2502680过氧苯甲酰凝胶江苏盈科生物制药有限公司4CYHS2502678硫酸氨基葡萄糖胶囊河南中杰药业有限公司4CYHS2502676艾瑞昔布片仁合益康集团有限公司4CYHS2502674达格列净二甲双胍缓释片(I)河北智恒医药科技股份有限公司4CYHS2502673阿法骨化醇滴剂江西海尔思药业股份有限公司4CYHS2502672双氯芬酸二乙胺乳胶剂青岛百洋制药有限公司4CYHS2502670荧光素钠注射液珠海前列药业有限公司4CYHS2502671达格列净片天津力生制药股份有限公司4CYHS2502658达格列净片天津力生制药股份有限公司4CYHS2502657非奈利酮片中山万汉制药有限公司4CYHS2502654非奈利酮片中山万汉制药有限公司4CYHS2502653丙泊酚中/长链脂肪乳注射液辰欣药业股份有限公司4CYHS2502652丙泊酚中/长链脂肪乳注射液辰欣药业股份有限公司4CYHS2502651苯磺酸美洛加巴林片成都倍特药业股份有限公司4CYHS2502650苯磺酸美洛加巴林片成都倍特药业股份有限公司4CYHS2502649甲磺酸沙非胺片浙江兄弟药业有限公司4CYHS2502648甲磺酸沙非胺片浙江兄弟药业有限公司4CYHS2502647硫酸氨基葡萄糖胶囊江西迪赛诺医药集团有限公司4CYHS2502668艾普拉唑肠溶片浙江皓格药业有限公司4CYHS2502667盐酸达泊西汀片国源国药(广东)制药集团有限公司4CYHS2502664盐酸达泊西汀片国源国药(广东)制药集团有限公司4CYHS2502662蔗糖羟基氧化铁咀嚼片浙江昂利康制药股份有限公司4CYHS2502643吗啉硝唑氯化钠注射液海南丰恺思制药有限公司4CYHS2502642注射用阿莫西林钠克拉维酸钾/氯化钠注射液山东二叶制药有限公司4CYHS2502641注射用阿莫西林钠克拉维酸钾/氯化钠注射液山东二叶制药有限公司4CYHS2502640吸入用乙酰半胱氨酸溶液成都市海通药业有限公司4CYHS2502639小儿法罗培南钠颗粒博智安健(河北)药业有限公司4CYHS2502638玻璃酸钠滴眼液山东诺明康药物研究院有限公司4CYHS2502637瑞维那新吸入溶液海南美康达药业有限公司4CYHS2502636注射用氟氧头孢钠海南海灵化学制药有限公司4CYHS2502635聚乙烯醇滴眼液四川好医生攀西药业有限责任公司4CYHS2502634克立硼罗软膏武汉益博元医药科技有限公司4CYHS2502633盐酸达泊西汀片海南赛立克药业有限公司4CYHS2502631盐酸达泊西汀片海南赛立克药业有限公司4CYHS2502630磷酸芦可替尼片青岛国信制药有限公司4CYHS2502628磷酸芦可替尼片青岛国信制药有限公司4CYHS2502626磷酸芦可替尼片青岛国信制药有限公司4CYHS2502625酮洛芬凝胶湖南派格兰药业有限公司4CYHS2502624酮洛芬凝胶湖南派格兰药业有限公司4CYHS2502622美沙拉秦栓华东医药(西安)博华制药有限公司4CYHS2502620替米沙坦氨氯地平片吉林省德商药业股份有限公司4CYHS2502644盐酸奈必洛尔片浙江花园药业有限公司3CYHL2500131冻干b型流感嗜血杆菌结合疫苗北京百晖生物科技有限公司3.3CXSL2500616罗莫佐单抗注射液珠海联邦生物医药有限公司3.3CXSL2500618进口申请药品名称企业注册分类受理号BAY 2927088片Bayer HealthCare Pharmaceuticals Inc.1JXHS2500077麦考酚钠肠溶片Aurobindo Pharma Limited5.2JYHS2500029麦考酚钠肠溶片Aurobindo Pharma Limited5.2JYHS2500028Orforglipron片Eli Lilly and Company1JXHL2500199Orforglipron片Eli Lilly and Company1JXHL2500198Orforglipron片Eli Lilly and Company1JXHL2500197Orforglipron片Eli Lilly and Company1JXHL2500196Orforglipron片Eli Lilly and Company1JXHL2500195Orforglipron片Eli Lilly and Company1JXHL2500194PKN605片Novartis Pharma AG1JXHL2500191ASP5541注射液Astellas Pharma Global Development, Inc.2.1JXHL2500200LNP023胶囊Novartis Pharma AG2.4JXHL2500192维A酸过氧苯甲酰乳膏SOL-GEL TECHNOLOGIES LTD5.1JXHL2500193MK-7240注射液Merck Sharp & Dahme LLC1JXSL2500132PF-08046054 (注射用冻干粉针)Pfizer Inc.1JXSL2500125Depemokimab注射液GlaxoSmithKline Research & Development Limited1JXSL2500126BMS-986340注射液Bristol-Myers Squibb Company1JXSL2500124Risankizumab注射液AbbVie Inc.2.2JXSL2500131Risankizumab注射液AbbVie Inc.2.2JXSL2500130Risankizumab注射液AbbVie Inc.2.2JXSL2500129Risankizumab注射液AbbVie Inc.2.2JXSL2500128Risankizumab注射液AbbVie Inc.2.2JXSL2500127特泽利尤单抗注射液AstraZeneca AB2.2JXSL2500123中药相关申请药品名称企业注册分类受理号芍药甘草颗粒国药集团广东环球制药有限公司3.1CXZS2500031猴枣除痰散WAI YUEN TONG MEDICINE CO LTD.其他情形JYZS2500002欣力康胶囊贵阳新天药业股份有限公司2.3CXZL2500054注:绿色字体部分为潜在首仿品种;不包含原料药、医用氧、注射用水、氯化钠或葡萄糖注射液等申请,不包含再注册、一次性进口、技术转移、复审申请。

申请上市临床申请

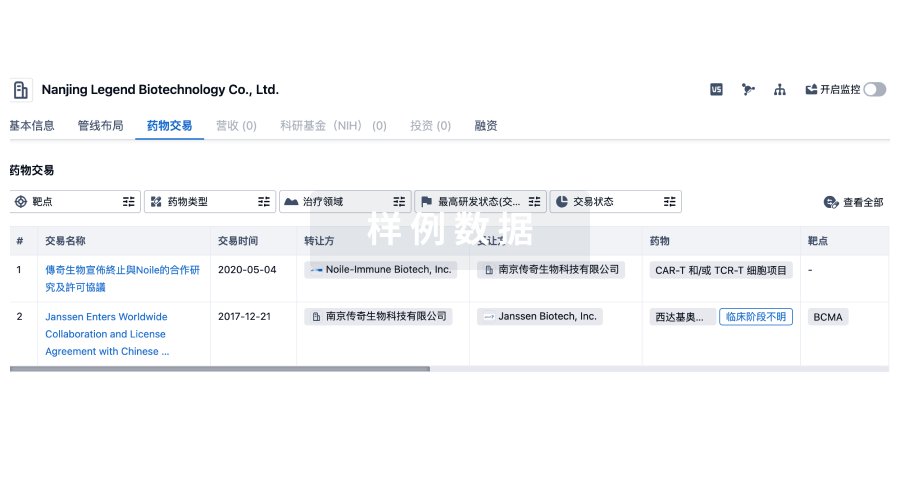

100 项与 安锐生物医药科技(广州)有限公司 相关的药物交易

登录后查看更多信息

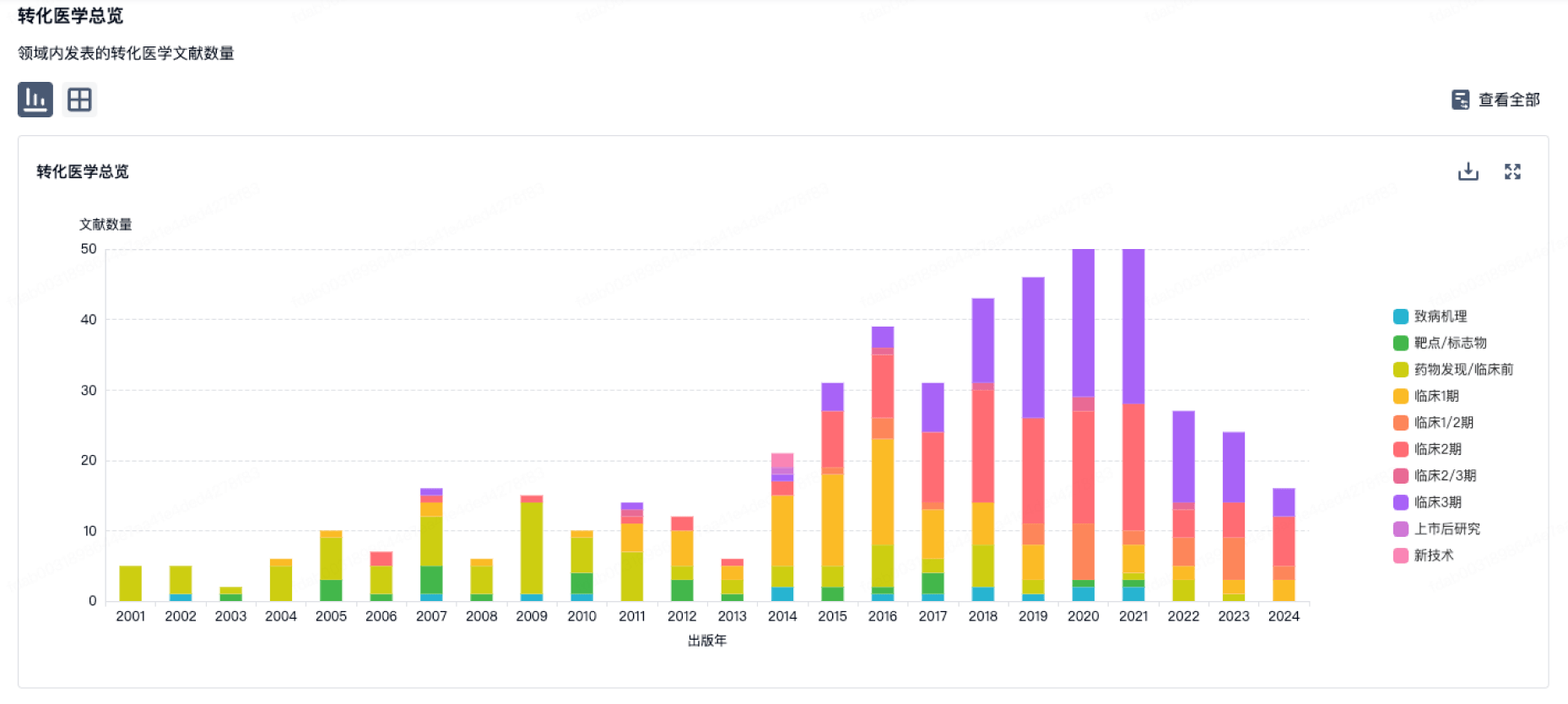

100 项与 安锐生物医药科技(广州)有限公司 相关的转化医学

登录后查看更多信息

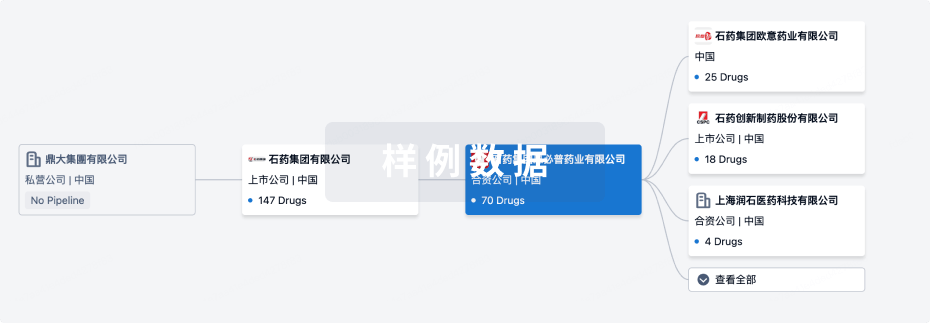

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年09月15日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

药物发现

1

2

临床前

临床申请

1

2

临床1期

临床2期

1

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

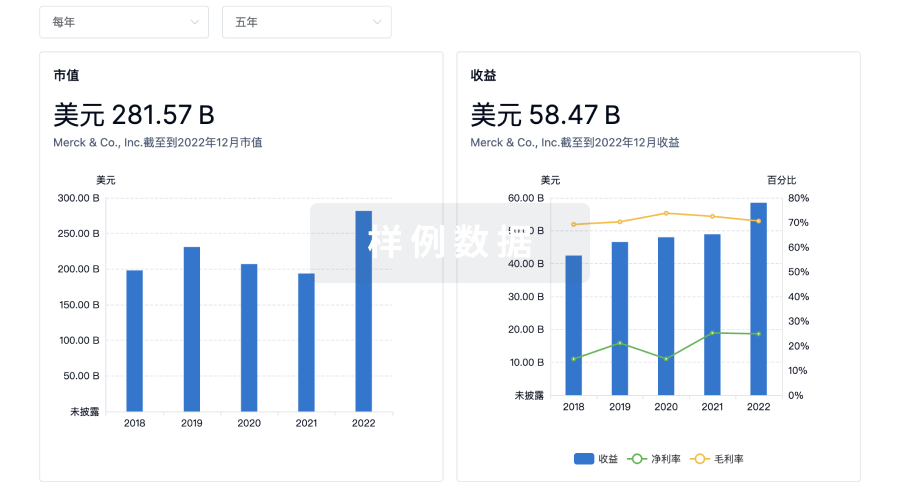

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用