预约演示

更新于:2025-05-07

Opella Healthcare Group SAS

更新于:2025-05-07

概览

标签

其他疾病

感染

耳鼻咽喉疾病

小分子化药

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 小分子化药 | 2 |

| 排名前五的靶点 | 数量 |

|---|---|

| H1 receptor(组胺H1受体) | 1 |

关联

2

项与 Opella Healthcare Group SAS 相关的药物作用机制 H1 receptor拮抗剂 |

在研机构 |

原研机构 |

最高研发阶段批准上市 |

首次获批国家/地区 英国 |

首次获批日期1996-03-11 |

6

项与 Opella Healthcare Group SAS 相关的临床试验NCT06386211

Open-label, Randomized, 2-treatment, 2-sequence, 2-period, Crossover Relative Bioavailability Study of Magne-B6 New Formulation Versus Magne-B6 Solution in Healthy Male and Female Subjects in Fasting Conditions.

The purpose of the study is to assess the relative bioavailability of two Magne-B6 preparations, in fasting conditions.

开始日期2024-07-03 |

申办/合作机构 |

NCT06284902

Open-Label, Single-Dose, Randomized, 6-Treatment, 6-Sequence, 6-Period Crossover Relative Bioavailability Study Comparing Fexofenadine HCl New Formulation Tablets (Test Drug) With or Without Water to Fexofenadine HCl Coated Tablets (Reference Drug) With Water in Healthy Male and Female Subjects Under Fasting Conditions

The purpose of the study is to assess the relative bioavailability of a new galenic form of fexofenadine HCl new formulation tablet (test drug) taken with or without water compared to fexofenadine HCl film-coated tablets (reference form) taken with water under fasting conditions.

开始日期2024-02-23 |

申办/合作机构 |

NCT05692154

A Phase IIIb, Single-center, Double-blind, Two-arms, Placebo-controlled, Randomized, Parallel-group Clinical Trial to Evaluate the Efficacy and Safety of 2-day Pre-treatment With Fexofenadine in Patients Suffering From Seasonal Allergic Rhinitis

This study is a proof-of-concept study to demonstrate if a daily dose of a 2-days pre-treatment of Fexofenadine 180mg is effective in alleviating the AR symptoms and to assess the additional benefit to the patient in terms of preventing Allergic Rhinitis (AR) symptoms.

The total study duration per participant is expected at least 4 months, depending on the timing of the screening visit. 5 visits are planned, screening, confirmation inclusion challenge, randomization visit, challenge and end of study visit.

The total study duration per participant is expected at least 4 months, depending on the timing of the screening visit. 5 visits are planned, screening, confirmation inclusion challenge, randomization visit, challenge and end of study visit.

开始日期2023-01-23 |

申办/合作机构 |

100 项与 Opella Healthcare Group SAS 相关的临床结果

登录后查看更多信息

0 项与 Opella Healthcare Group SAS 相关的专利(医药)

登录后查看更多信息

27

项与 Opella Healthcare Group SAS 相关的新闻(医药)2025-05-01

在全球生物医药行业面临关税、药价压力等诸多挑战之际,并购市场却悄然回暖。诺华公司的一系列动作,引发了行业对大型药企战略布局和未来走向的广泛关注。并购回暖,诺华打响 “第一枪”近日,Leerink Partners 根据药企财报会议中的信息,大胆预测生物医药行业并购活动即将升温。果不其然,诺华迅速响应,宣布以 17 亿美元收购寡核苷酸生物技术公司 Regulus Therapeutics,为这一预测提供了有力支撑 。而在诺华之前,德国默克(Merck KGaA)已率先出手,本周早些时候以 39 亿美元收购 SpringWorks Therapeutics。这些并购交易标志着行业并购的回归,给饱受宏观经济逆风冲击的生物医药生态系统带来了新的希望。市场波动,并购前景曾不明朗起初,随着特朗普政府上台,市场曾乐观预期并购活动会有所回升,认为新政府对商业交易更为友好 。然而,关税威胁打乱了这一节奏,贸易政策的频繁变动让企业分心,不少公司将重心转向本土制造,Pitchbook 也曾预测并购活动会因此减少 。不过,最新数据显示,行业正逐渐走出阴霾。Pitchbook 报告指出,尽管过去 12 个月生物技术领域的交易数量下降了 26%,但 2025 年第一季度出现反弹,生物技术和制药行业的交易势头上升了 63% 。同时,过去 12 个月估值大幅下降 143%,但在过去三个月回升了 107%,整个医疗保健行业在交易数量和价值上都呈现出缓慢复苏的态势。药企各有打算,积极寻求突破各大药企在并购方面都有着明确的计划和目标。辉瑞计划通过并购来填补关键的业务空白,首席战略和创新官安德鲁・鲍姆表示,公司正在寻找价值 100 亿至 150 亿美元的收购目标,以替代停产的肥胖症药物资产,并充实其心血管代谢产品线 。百时美施贵宝(Bristol Myers Squibb)通过大规模成本调整计划节省了 15 亿美元并削减了员工数量,为开展外部合作和并购创造了有利条件 。公司首席执行官克里斯・博尔纳强调,业务发展是资本配置的首要任务,他们看重项目与公司核心治疗领域的契合度以及对增长的推动作用,尤其关注能填补 2020 年代后期和 2030 年代业务空白的项目,同时也不排除早期项目的可能性。此外,公司认为成本节约计划使其有能力应对关税带来的潜在影响。罗氏首席执行官托马斯・施内克承认关税会阻碍公司的业务发展,但罗氏在并购方面一直较为活跃,去年以 27 亿美元收购了肥胖症药物开发商 Carmot Therapeutics。默克首席执行官罗伯特・戴维斯同样将业务发展视为首要任务,尽管宏观环境带来了不确定性,但他表示不会停止积极推进交易的步伐。葛兰素史克(GSK)首席执行官艾玛・沃尔姆斯利指出,关税影响着交易的进行,公司在推进业务时会保持谨慎和自律 。不过,她对公司的交易潜力仍持乐观态度,并特别提到了中国市场的机遇,GSK 近期就与上海的 DualityBio 达成了一项价值 10 亿美元的 ADC 交易。赛诺菲本周完成了一项长期计划,将其消费者部门 Opella 以 100 亿欧元(约 114 亿美元)出售给私募股权公司 CD&R 。首席财务官弗朗索瓦 - 泽维尔・罗杰表示,这笔资金将用于支持内部增长、研发、人工智能和人才培养,也可能用于新的并购,比如公司 3 月份从 Dren Bio 收购免疫药物 DR - 0201 的交易,最高价值可达 19 亿美元。诺华在完成对 Regulus 的收购后,还计划进行更多的小型并购、业务拓展和授权交易。强生在今年 1 月以 146 亿美元收购 Intra - Cellular Therapeutics,获得了获批的神经精神药物 Caplyta,成为今年以来最大的一笔收购交易 。不过,首席执行官华金・杜阿托表示,公司自 2024 年 1 月以来在研发和 “无机增长机会” 上已投入 150 亿美元,未来短期内的收购规模可能会变小。在复杂的市场环境下,大型药企通过并购来优化资源配置、拓展业务领域、增强竞争力。这些并购活动不仅反映了药企自身的战略调整,也将对整个生物医药行业的格局产生深远影响。未来,行业内的并购趋势究竟如何发展,值得持续关注。参考来源:https://www.biospace.com/business/novartis-strikes-on-m-a-leading-a-line-of-big-pharmas-with-cash-to-spend识别微信二维码,添加生物制品圈小编,符合条件者即可加入生物制品微信群!请注明:姓名+研究方向!版权声明本公众号所有转载文章系出于传递更多信息之目的,且明确注明来源和作者,不希望被转载的媒体或个人可与我们联系(cbplib@163.com),我们将立即进行删除处理。所有文章仅代表作者观不本站。

并购财报

2025-04-30

With Sanofi's sale of consumer health unit Opella for 10 billion euros ($11.4 billion), expect Sanofi to step up its pursuit of "bolt-on" deals, chief financial officer Francois Roger said.

Six months after entering talks with U.S. private equity firm Clayton, Dubilier & Rice (CD&R), Sanofi has closed a deal to sell a 50% controlling stake of its consumer health business Opella for 10 billion euros ($11.4 billion), the French biopharma powerhouse said on Wednesday.As for Sanofi’s next move with its fresh injection of funds, don’t expect a mega-merger any time soon.In its quarterly earnings presentation last week, in addressing the company’s plan after the sale of Opella, Sanofi Chief Financial Officer Francois Roger said that it will “explore external growth opportunities for bolt-on acquisitions.”With that, Roger cited the company’s deal last month for Dren Bio’s clinical-stage bispecific antibody, DR-0201. Sanofi paid $600 million upfront for the asset and pledged another $1.3 billion attached to launch and development milestones.“We have always been very active in the M&A space,” Roger said during the company’s quarterly call in January. “We may be a bit more in the near future due to the fact that we have a strong balance sheet.”Roger said last week that Sanofi’s “primary focus” with the added funding is to drive organic growth through R&D and other internal investments. Roger said it will bolster its “dividend policy” and enhance its share repurchase program.With the Opella deal, Sanofi will retain a 48.2% stake in the consumer healthcare outfit. Public sector investor bank Bpifrance will own a 1.8% stake in Opella and gain a seat on the board. CD&R gains a company that employs more than 11,000 people in 100 countries and operates 13 manufacturing sites and four innovation development centers. Opella is the third-largest over-the-counter business in the world, selling products such as Allegra, Doliprane and Dulcolax.With the move, Sanofi becomes a “pure-play biopharma,” it said, joining other companies in its sphere that have divested to focus on developing and marketing prescription drugs.Other drugmakers have made similar moves over the last several years, including Novartis, GSK, Johnson & Johnson and Pfizer. Sanofi’s largest acquisitions over the last few decades were a 2011 purchase of rare disease specialist Genzyme for $20.1 billion and an $11.6 billion buyout of Biogen spinout Bioverativ in 2018, which bolstered the company’s presence in hemophilia.In recent years, Sanofi has settled for smaller deals such as a $3.2 billion acquisition of Translate Bio in 2021, a $2.9 billion buyout of Provention Bio in 2023 and a $1.7 billion deal for Inhibrx in January to gain a rare disease drug.

并购

2025-04-30

Narmeen Arshad/Getty Images

Many companies have foreshadowed deals to come during earnings calls in recent days. The return of M&A would be a welcome sign for the biopharma ecosystem, which has been battered by macro headwinds such as tariffs and the possibility of new drug pricing pressures.

Early Wednesday morning Leerink Partners boldly predicted that M&A was about to pop off, based on comments from the past few weeks’ earnings calls. The prescient prediction came true hours later when Novartis announced a

$1.7 billion offer

to buy oligonucleotide biotech Regulus Therapeutics.

But, as Leerink pointed out, Novartis is one of many companies that had foreshadowed a deal to come during earnings calls in recent days. The Swiss pharma was also following German peer Merck KGaA, which sealed a deal to

buy SpringWorks Therapeutics

earlier this week for $3.9 billion. The return of M&A would be a welcome sign for the biopharma ecosystem, which has been battered by macro headwinds

such as tariffs

and the possibility of new drug pricing pressures.

These headwinds were not fully anticipated. In fact, the year started off with optimism that deals would return, particularly as the new Trump administration was perceived to be

more deal-friendly

than the outgoing Biden administration. But the threat of tariffs has turned that on its head, with companies across the economy distracted by the

whiplashing trade policies

. Pitchbook also recently predicted

reduced M&A activity

in the face of such tariffs as onshoring manufacturing becomes a key focus.

Now, the deal-making environment is once again feeling more positive according to Leerink and, now, Pitchbook, too. A

new report from Pitchbook

on global M&A trends found that while deal count momentum in biotech had fallen 26% over the past 12 months, the first quarter of 2025 saw a return, with momentum rising 63% in the biotech and pharma sectors. Valuations fell precipitously by 143% over 12 months, but the last three months have seen a recovery of 107%, according to the report. Pitchbook said the healthcare sector as a whole seems to be slowly recovering with improvements in deal count and deal value.

“What I tell my team constantly is never let a good crisis go to waste. And with crisis, there are risks, but also there are tremendous opportunities because things are changing,” Pfizer CEO Albert Bourla said during his company’s

earnings call

. “They [should] start to exploit the change. So you need to be strategic. You need to be smart, you to be disciplined. But you need [to] sell when prices are high and buy when prices are low.”

Ready To Deal

Pfizer, on Tuesday, specifically detailed a plan to replace a key discontinued obesity asset with a deal and fill out its depleted cardiometabolic pipeline. Chief Strategy and Innovation Officer Andrew Baum said that the company is looking in the $10 billion to $15 billion for its next buy.

Over at Bristol Myers Squibb, a massive

cost realignment program

has slimmed down the organization with $1.5 billion in cost savings and headcount reduction, smoothing the path to take on external opportunities, CEO Chris Boerner said

last week

.

“Business development is our top capital allocation priority,” Boerner stated, flagging both partnership and acquisition opportunities. He also pointed to innovation coming out of

China as a source

for new therapies.

“What’s important is that we like the science, and we feel we’re the rightful owners,” Boerner said.

Pushed further on what attributes BMS might be examining for a potential deal, Boerner said there isn’t a specific size. Instead, the business development team evaluates a program’s fit within BMS’ core therapeutic areas and considers whether a given deal will boost growth. BMS is particularly looking to fill gaps in the back end of the decade and into the 2030s, Boerner said. Earlier-stage opportunities are also a possibility, but Boerner said the focus is on more near-term growth.

As for tariff pressures, Boerner said the company’s cost savings program is putting them in a strong position to be able to absorb any potential impact.

“By continuing to focus on making the company more efficient and more agile, that enables us to pull cost out of the system and puts us in a stronger position,” Boerner said. “That financial flexibility gives us the ability to be much more engaged on business development.”

But Roche CEO Thomas Schinecker admitted that tariffs could get in the way of business development at the Swiss pharma. The company has been fairly active with M&A, buying obesity drug developer

Carmot Therapeutics last year

for $2.7 billion.

Merck CEO Robert Davis called business development a “top priority” during his company’s April 24 call. The macro environment has not changed that goal, he added.

“Clearly, what’s happening does make it more complex to get things done, because of the uncertainty everyone is wrestling with,” Davis told investors. “But it’s not stopping us from being aggressive and wanting to move forward and do deals.”GSK CEO Emma Walmsley agreed with her peers that potential

tariffs are impacting dealmaking

and promised that the company will be “cautious and disciplined” as it proceeds. But she too spoke optimistically of the company’s deal-making potential, specifically noting the opportunities in China, where GSK recently struck a $1 billion ADC deal with

Shanghai-based DualityBio

.

“We want to engage, we seek to move agilely, we are always focused on returns—and obviously you have to take a cautious and disciplined view in the current environment, but we still see opportunity here,” Walmsley said.

For its part, Sanofi finally executed on a

long planned deal

to offload its

consumer division

Opella this week, wrapping up a deal with private equity firm CD&R worth €10 billion ($11.4 billion). With that out of the way, Sanofi plans to funnel the money towards internal growth, R&D, AI and talent. But the cash could also help fuel some new deals, according to CFO François-Xavier Roger. Specifically, Roger said the company is on the hunt for bolt-on acquisitions, pointing to Sanofi’s March deal to buy immunology drug

DR-0201 from Dren Bio

for up to $1.9 billion.

Novartis is also eyeing bolt-on M&A, business development and licensing deals, executives noted during the company’s Tuesday call, with today’s purchase of Regulus fitting nicely into that strategy.

When it comes to bigger buys, Johnson & Johnson’s $14.6 billion acquisition of

Intra-Cellular Therapeutics

in January still stands as this year’s largest. The deal, which gave J&J the approved neuropsychiatric asset Caplyta, reinvigorated excitement in the space and kicked off the J.P. Morgan Healthcare Conference

with a bang

. But after the big play, the company warned that future near-term

deals would smaller

.

Indeed, in its first quarter earnings call on April 15, CEO Joaquin Duato Noted that J&J has already spent $150 billion in R&D and “inorganic growth opportunities” since January 2024, including acquisitions in the medtech group as well as Ambrx and Proteologix, in addition to Intra-Cellular.

并购

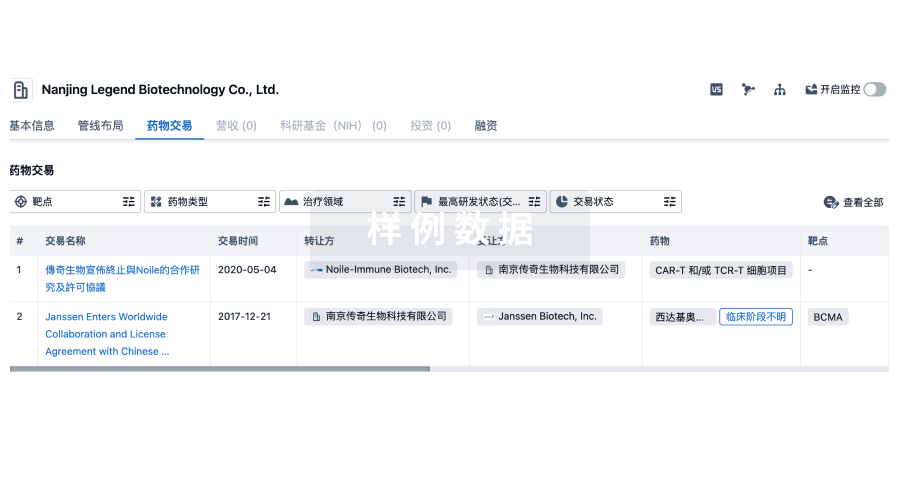

100 项与 Opella Healthcare Group SAS 相关的药物交易

登录后查看更多信息

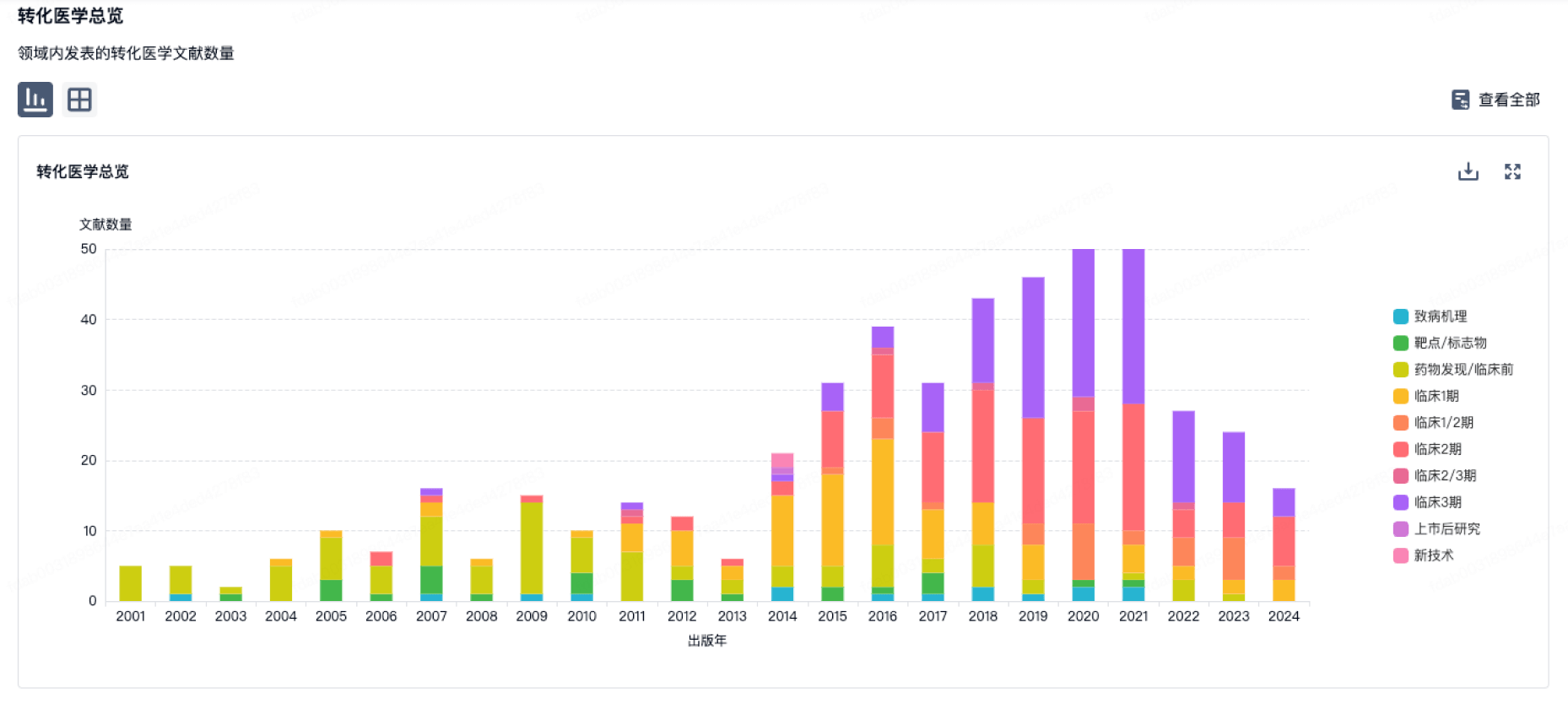

100 项与 Opella Healthcare Group SAS 相关的转化医学

登录后查看更多信息

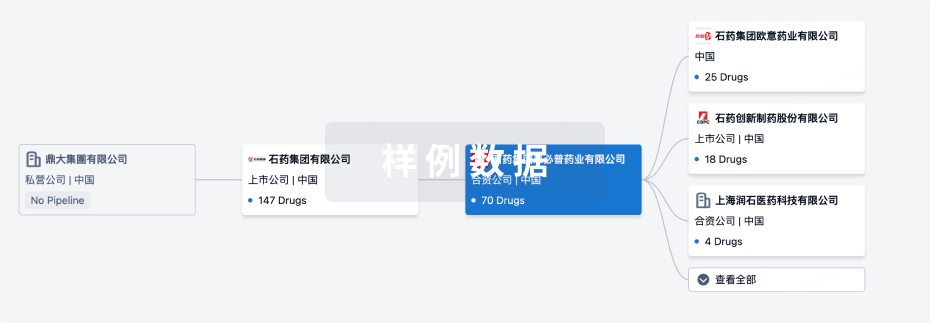

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年07月16日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

申请上市

1

1

批准上市

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

盐酸非索非那定 ( H1 receptor ) | 季节性过敏性鼻炎 更多 | 批准上市 |

多烯磷脂酰胆碱 | - | 申请上市 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

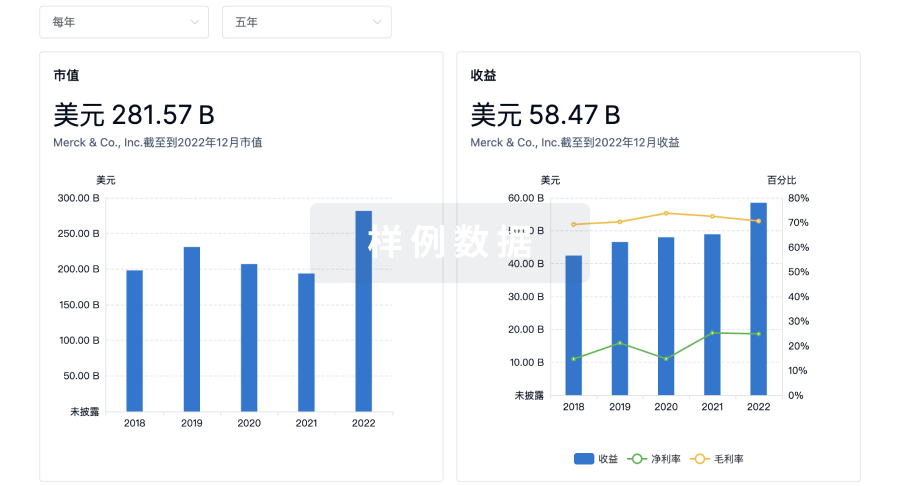

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用