预约演示

更新于:2025-05-07

FKD Therapies Oy

子公司|Finland

子公司|Finland

更新于:2025-05-07

概览

关联

1

项与 FKD Therapies Oy 相关的药物靶点 |

作用机制 IFNAR激动剂 [+1] |

在研适应症 |

非在研适应症 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2022-12-16 |

3

项与 FKD Therapies Oy 相关的临床试验NCT02773849

A Phase III, Open Label Study to Evaluate the Safety and Efficacy of INSTILADRIN® (rAd-IFN)/Syn3) Administered Intravesically to Patients With High-Grade, BCG Unresponsive Non-Muscle Invasive Bladder Cancer (NMIBC)

Previous multi-dose Phase I and Phase II clinical studies have demonstrated that ADSTILADRIN is a safe and effective treatment for BCG-refractory and recurrent NMIBC. This Phase III study is designed to expand those observations using a high dose of ADSTILADRIN in patients that are "BCG Unresponsive" which refers to patients with high-grade NMIBC who are unlikely to benefit from and should not receive further intravesical BCG.

开始日期2016-09-19 |

申办/合作机构 |

NCT01687244

A Phase 2, Randomized, Open Label, Parallel Arm Study to Evaluate the Safety and Efficacy of rAd-IFN/Syn3 Following Intravesical Administration in Subjects With High Grade, BCG Refractory or Relapsed Superficial Bladder Cancer

This Phase 2 study is designed to assess the efficacy and safety of INSTILADRIN (rAd-IFN with Syn3) when given intravesically to patients with high grade non-muscle invasive bladder cancer who are refractory to or have relapsed from BCG therapy. The pharmacodynamics of INSTILADRIN will also be studied by measuring the interferon (IFNα2b) levels excreted in the urine. rAd-IFN is a non-replicating recombinant adenovirus type 5 (Ad5)-vector encoding the interferon alpha-2b (IFNα2b) gene. Syn 3 is clinical surfactant excipient which enhances the ability of the adenoviral vector to transfect cells in the bladder wall.

开始日期2012-09-01 |

申办/合作机构 |

NCT01162785

Phase 1B Intravesical Administration of SCH 721015 (Ad-IFNa) in Admixture With SCH 209702 (Syn3) for The Treatment of BCG Refractory Superficial Bladder Cancer

The goal of this part (Part 1) of this clinical research study is to learn about the safety of giving 2 doses of SCH 72105 (also known as rAd-IFN) directly into the bladder to patients with bladder cancer that has come back. The goal of Part 2 of this study is to learn about the safety of giving 2 more doses of SCH 72105 directly into the bladder of Part 1 participants who had no sign of bladder cancer after Week 12. The level of effectiveness of SCH 72105 will also be studied by measuring the interferon (IFN) levels in the urine.

开始日期2011-04-01 |

100 项与 FKD Therapies Oy 相关的临床结果

登录后查看更多信息

0 项与 FKD Therapies Oy 相关的专利(医药)

登录后查看更多信息

9

项与 FKD Therapies Oy 相关的新闻(医药)2025-04-24

·药融圈

▲8月1-2日 2025生物医药创新博览会 扫码报名注:本文不构成任何投资意见和建议,以官方/公司公告为准;本文仅作医疗健康相关药物介绍,非治疗方案推荐(若涉及),不代表平台立场。任何文章转载需得到授权。近日,Ferring Pharmaceuticals在日本公布了一项3期临床试验的初步结果。结果显示:基因疗法Nadofaragene firadenovec对高危卡介苗(BCG)无应答的非肌层浸润性膀胱癌(NMIBC)伴原位癌(CIS)患者(n=20)的治疗中,三个月完全缓解率为 75%;安全性方面,所有治疗相关不良事件均为 1 级(84.2%)或 2 级(15.8%),未报告 3 级、4 级或 5 级不良事件。之前,妙佑医疗国际(Mayo Clinic)公布数据显示,接受nadofaragene firadenovec治疗的患者完全缓解率高达79%。Nadofaragene firadenovec 是一种基于腺病毒载体的基因疗法,最初由芬兰基因疗法公司 FKD Therapies Oy 于2011年开发。2018年,FKD Therapies Oy将该疗法授权给Ferring。2019 年,Ferring Pharmaceuticals 与黑石生命科学合作,共同筹资 5.7 亿美元成立了专注于基因疗法的子公司 FerGene。FerGene 致力于新型基因疗法 Nadofaragene firadenovec 的全球开发和在美国的商业化。目前,Nadofaragene firadenovec 已获得美国食品药品监督管理局(FDA)的批准,用于治疗患有高危卡介苗(BCG)无反应的非肌层浸润性膀胱癌(NMIBC)并伴有或不伴有乳头状肿瘤的原位癌(CIS)的成年患者。该批准基于157名患者的3期临床试验结果。Nadofaragene firadenovec(商品名为Adstiladrin)是是首个也是唯一一款获美国FDA批准的膀胱内给药非复制型基因疗法。其通过腺病毒载体将人干扰素 α-2b 基因递送至膀胱上皮细胞。其中,所包含的聚酰胺表面活性剂 Syn-3 可促进基因跨尿路上皮转移,并增强病毒转导。人干扰素 α-2b 基因在尿路上皮细胞中表达,产生多效性抗肿瘤作用,包括诱导细胞凋亡、调节免疫反应、抑制肿瘤细胞增殖和血管生成等,从而发挥抗癌功效。Nadofaragene firadenovec使用方法为每 3 个月通过导尿管经膀胱内灌注一次。灌注前推荐使用抗胆碱能药物进行预处理,灌注后将药物留在膀胱中 1 小时。关于Ferring Pharmaceuticals Ferring Pharmaceuticals 是一家全球领先的生物制药公司,成立于1950年,最初名为北欧激素实验室(Nordiska Hormon Laboratoriet)。1954 年,更名为 Ferring。其在全球拥有约 6500 名员工,在近 60 个国家和市场成立分支机构,产品销往 110 个国家。2024 年,公司实现总收入 23 亿欧元,同比增长 7%。版权声明:本文转自生物药大时代,如不希望被转载的媒体或个人可与我们联系,我们将立即删除会议推荐 | 点击查看详情植根上海、辐射全球,药融圈作为生物医药产业级战略平台,以"让智慧与人脉无界流动"为使命,构建覆盖药物研发、生产、流通、商业化的全产业链赋能体系。通过智能化云服务、精准资源链接、产业智库与生态社群四大核心引擎,打造中国医药价值流动的基础设施。在全球化与数字化双重浪潮下,药融圈正重新定义医药资源的流通范式--这里不仅是信息与人脉的枢纽站,更是催生产业变革的化学反应器。我们以中国为原点,编织全球医药智慧网络,让每一次精准链接都成为企业跨越式增长的催化剂。点点赞点分享点推荐

基因疗法临床3期上市批准临床结果

2023-04-11

Ferring Pharma's CSO says the company's commitment to reproductive and maternal health products is unchanged even as R&D priorities shift.

After more than 25 years, Ferring Pharmaceuticals suddenly shuttered a San Diego research institute in March just months after finishing a major renovation. It's all part of the plan, says Chief Scientific Officer Armin Metzger, Ph.D.

The research executive, now in his seventh year with Ferring, said that the company is making a concerted pivot toward external innovation to make the best use of capital following two FDA approvals at the end of 2022. It's a shift that Metzger describes as a "fundamental" change.

"We will still have internal discovery, but [be] much, much more external focused, giving more flexibility of allocating funds," he said in an interview with Fierce Biotech.

The clear-eyed assessment of the company’s priorities set the record straight as to why the Ferring Research Institute, one of the company’s three main R&D hubs, closed after 27 years. The move resulted in nearly 90 staffers being laid off and came after Ferring finished renovations on the institute just last year.

“[T]he turning point was that we got two FDA approvals of two first-in-class assets in one year,” said Metzger. “And this leads to the adaptation, again of the strategy—how we deliver innovation to the patients—and it is not an easy decision-making process.”

In November 2022, Ferring nabbed FDA approval for the first fecal microbiota product, Rebyota, for adults with C. difficile following antibiotic treatment or recurrent infection. Just a few weeks later, gene therapy Adstiladrin was approved for bladder cancer.

The new strategy is not a complete departure from Ferring’s existing work, as those now-approved assets originated from deals. Ferring acquired Rebiotix in April 2018, tacking on the C. difficile treatments, and then a month later, the Swiss pharma signed a commercialization agreement with FKD Therapies for the bladder cancer treatment.

“I think a company of our size, with the investment needed now on the later stage, we can't entertain technology platforms in-house,” said Metzger, who added that Ferring will instead rely on "partnerships across the globe.”

Ferring’s main therapeutic areas are remaining unchanged, however, including maternal and reproductive health, which Metzger called “the core” of the company. One of the priorities is bringing the infertility treatment Rekovelle to the U.S. after it nabbed approval in Europe and Switzerland. He expects feedback from the FDA in the second half of the year.

In addition to Rekovelle, infertility treatments LutrePulse and Menopur are under development, along with Pabal, a med for postpartum hemorrhage.

But the clinical-stage work is in limbo. A phase 2 trial for a treatment to address inadequate milk production, merotocin, was shuttered earlier this year due to low enrollment and a phase 2 infertility treatment is now absent from the company’s pipeline. A spokesperson for Ferring did not immediately respond to a request for comment on the missing program.

Regardless, Metzger says that in the next year, the company hopes to bolster its portfolio, including potentially boosting the indications for merotocin. This could also mean combination opportunities and female and male infertility assets from Ferring's reproductive medicine pipeline.

上市批准临床2期并购基因疗法引进/卖出

2022-12-19

Bladder cancer can be treated with several types of drugs. Gene therapy is now part of the mix. The FDA has approved a Ferring Pharmaceuticals gene therapy as a treatment for patients whose cancer is at high risk of progressing by invading muscle tissue and spreading throughout the body.

The regulatory decision announced Friday covers the treatment of adults whose bladder cancer does not respond to Bacillus Calmette-Guérin (BCG), an immunotherapy that’s commonly used as a first-line treatment. The Ferring therapy, known in development as nadofaragene firadenovec, is designed to get the body to produce a particular therapeutic protein that fights the cancer.

Engineered versions of the protein Interferon-alfa 2b are already used for indications that include hepatitis B and C infections, hairy cell leukemia, and melanoma. Ferring’s gene therapy, which will be marketed under the brand name Adstiladrin, turns the cells lining a patient’s bladder into tiny factories that churn out high quantities of human interferon-alfa 2b. Delivered via an adenovirus, the therapy brings to bladder wall cells a gene that encodes interferon-alfa 2b. The protein-making machinery of the cells translate the DNA sequence and then express the therapeutic protein, which is intended to provide anti-tumor effects.

The FDA decision for the Ferring gene therapy was based on the results of an open-label, single-arm Phase 3 study that enrolled 157 patients. The gene therapy, which is dosed via a catheter, was administered once every three months for up to 12 months. Results showed that 51% of patients who received Adstiladrin achieved a complete response, meaning the disappearance of all signs of the cancer, at three months. The median duration of that response was 9.7 months; 46% of those responders maintained that response for at least one year. Bladder discharge, fatigue, bladder spasm, urinary urgency, and blood in the urine were among the most common adverse reactions reported from the clinical trial. The results were published by The Lancet Oncology in 2020.

Adstiladrin was initially developed by FKD Therapies. Ferring, a privately held company based in Saint-Prex, Switzerland, licensed global rights to the gene therapy in 2019; the following year, Ferring and Blackstone Life Sciences formed a company called FerGene to continue development and commercialization of the bladder cancer treatment. The partners backed FerGene with a combined $570 million.

An application seeking FDA approval of Adstiladrin was turned down in 2020 due to manufacturing issues. Two months ago, Ferring and Blackstone restructured their alliance to give Ferring full control of FerGene and its bladder cancer gene therapy. In a news release announcing regarding the FDA approval, Ferring said it expects Adstiladrin will become commercially available in the second half of 2023 after the company expands its manufacturing capacity.

Approval of Adstiladrin is the second affirmative FDA decision for Ferring in the past month. In late November, the agency approved Ferring’s Rebyota, the first microbiota-based live biotherapeutic for preventing recurrence of Clostridioides difficile infection in adults.

Image: Getty Images, magicmine

基因疗法临床3期临床结果上市批准免疫疗法

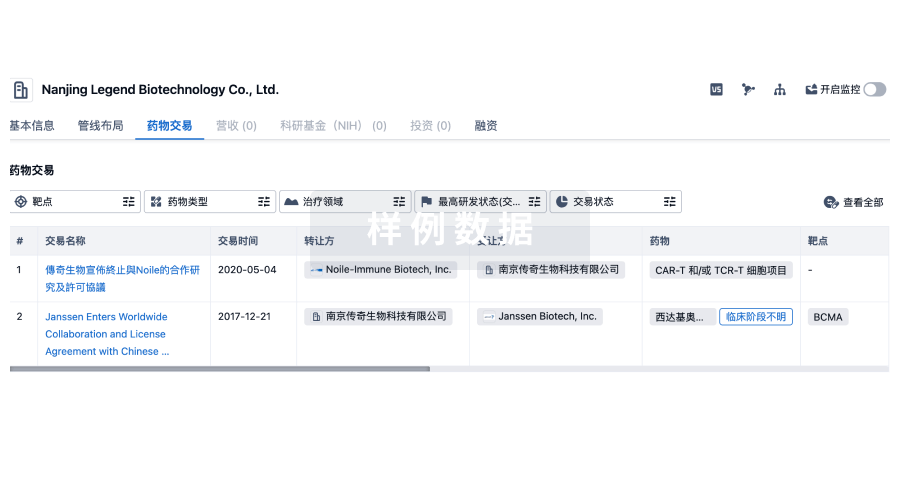

100 项与 FKD Therapies Oy 相关的药物交易

登录后查看更多信息

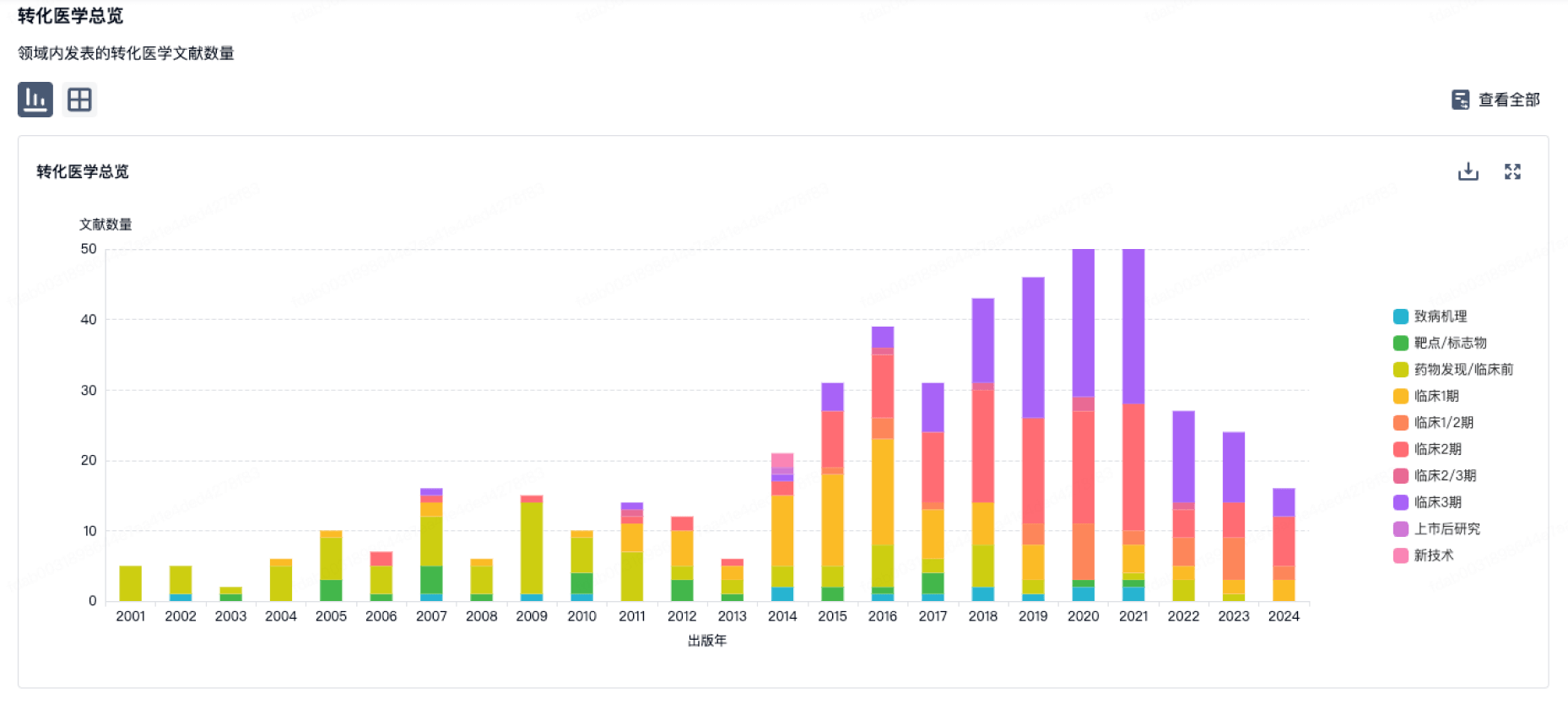

100 项与 FKD Therapies Oy 相关的转化医学

登录后查看更多信息

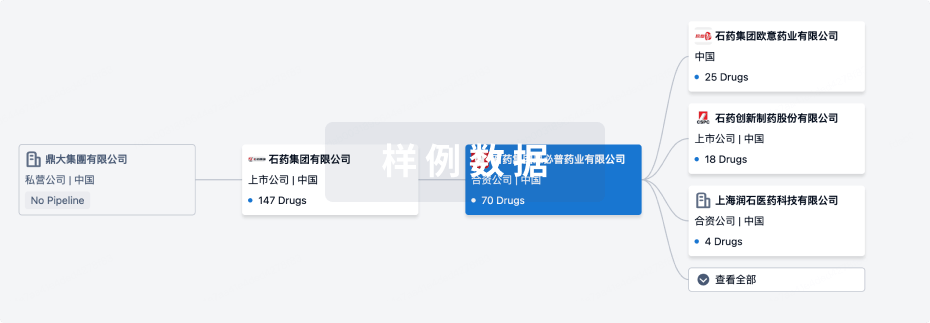

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年11月02日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

其他

1

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

Nadofaragene firadenovec-vncg ( IFNAR ) | 复发性膀胱癌 更多 | 无进展 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

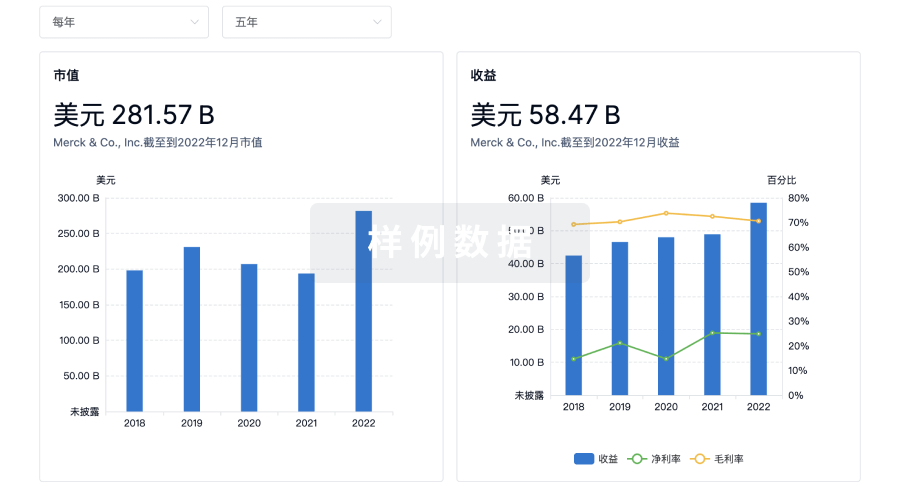

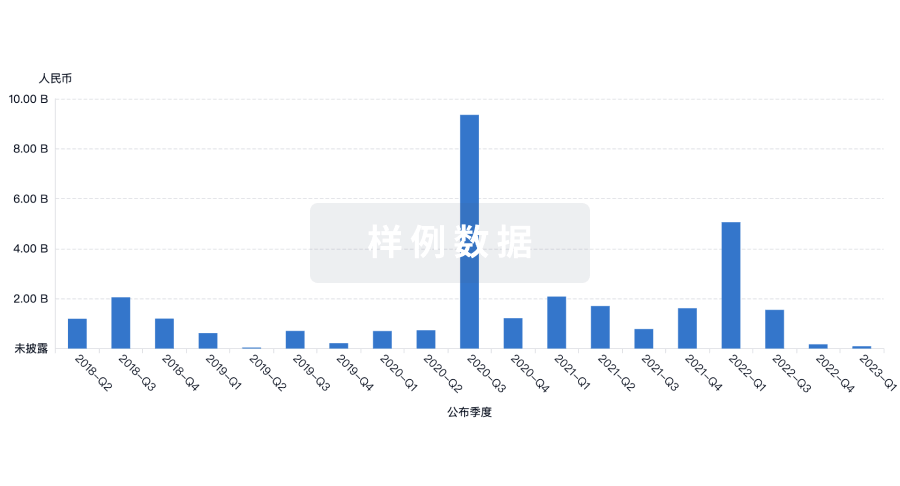

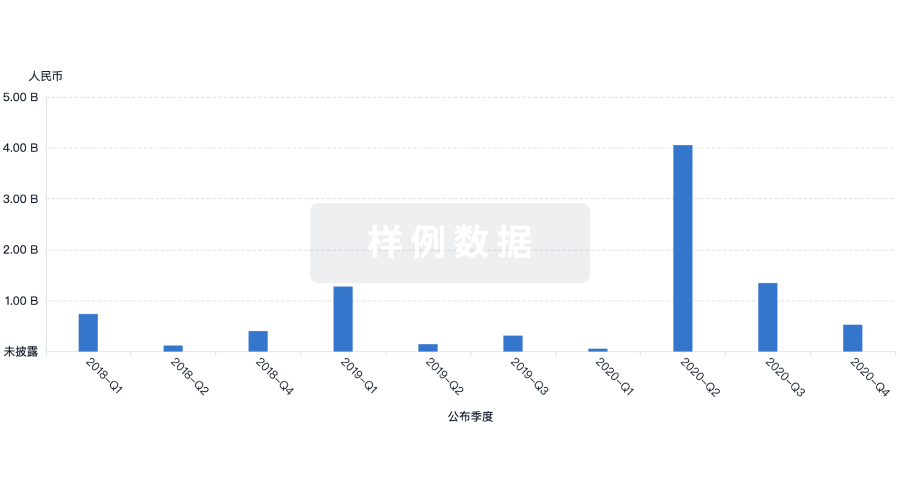

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用