Amgen dives deeper into rare disease drugs with $27.8 bln Horizon deal

2022-12-12

并购孤儿药

Preview

来源: Reuters

Dec 12 (Reuters) - Amgen Inc (AMGN.O) on Monday agreed to buy Horizon Therapeutics Plc (HZNP.O) in a deal valued at $27.8 billion, fortifying its rare diseases portfolio in the biggest buyout in the sector this year.

The company will pay $116.50 in cash, a premium of nearly 20% to the stock's last close, for each Horizon share.

Horizon shares closed up 15% on Monday at $112.36. They had climbed 23.5% through Friday since the company disclosed in late November it was in preliminary talks with Amgen, Sanofi (SASY.PA) and Johnson & Johnson (JNJ.N) for potential offers. Amgen shares dipped less than 1% to close at $276.78.

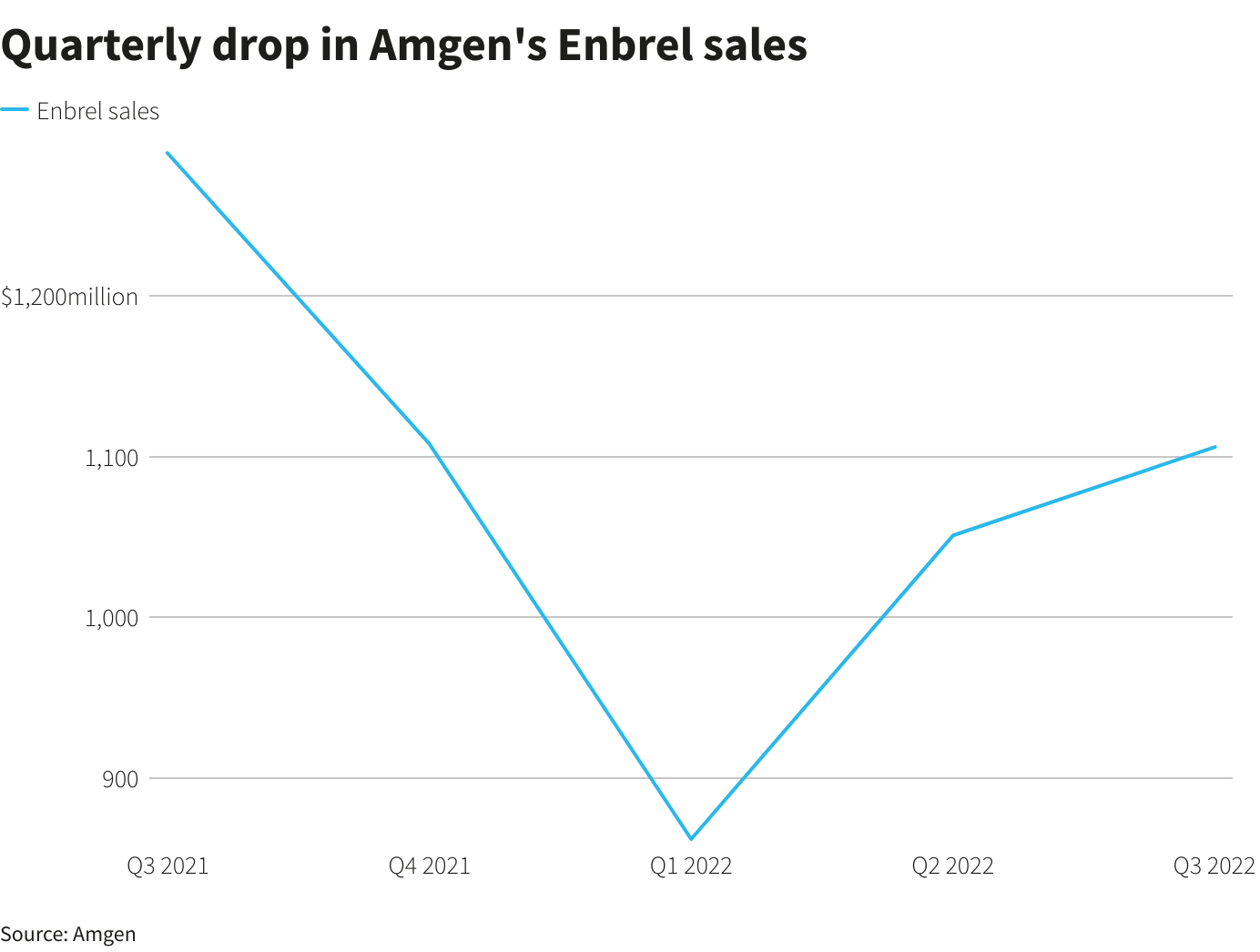

With the deal, Amgen gains two fast-growing drugs, the thyroid eye disease treatment Tepezza and gout treatment Krystexxa. Amgen hopes they can act as a bulwark against rising competition for its blockbuster arthritis drug Enbrel and as other key drugs in its portfolio, such as psoriasis therapy Otezla, face loss of patents over the next few years.

Both Horizon medicines have an orphan drug designation, a status granted by the U.S. Food and Drug Administration to encourage development of drugs for rare conditions that comes with a market exclusivity period if the drug is approved.

Orphan status also means they would likely not be among the drugs for which the U.S. government's Medicare program can negotiate lower drug prices under the Biden Administration's Inflation Reduction Act (IRA).

"We liked this company, even before the IRA," Murdo Gordon, Amgen's head of global commercial operations, said in an interview.

"Given the IRA, the strategic importance of being in these kinds of disease areas with biologics primarily, and with products that have low Medicare exposure and orphan designation, makes it even more attractive," he added.

Amgen plans to finance the deal through debt and cash, and has entered into a $28.5 billion credit agreement with Citibank (C.N) and Bank of America (BAC.N)

Amgen said it expects the deal to close in the first half of next year and add to earnings from 2024. It does not anticipate any "overlaps of concern to regulators."

Sales of Amgen's Enbrel tumbled 14% in the latest reported quarter to $1.1 billion.

Preview

来源: Reuters

"The offer clearly brings in a number of growing assets for Amgen," said William Blair analyst Matt Phipps.

The Horizon bid follows Amgen's $3.7 billion deal in August for rare blood vessel inflammation treatment maker ChemoCentryx Inc .

Our Standards: The Thomson Reuters Trust Principles.

更多内容,请访问原始网站

文中所述内容并不反映新药情报库及其所属公司任何意见及观点,如有版权侵扰或错误之处,请及时联系我们,我们会在24小时内配合处理。

靶点

-来和芽仔聊天吧

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。