预约演示

更新于:2025-07-16

UBT-251

更新于:2025-07-16

概要

基本信息

原研机构 |

非在研机构- |

最高研发阶段临床2期 |

首次获批日期- |

最高研发阶段(中国)临床2期 |

特殊审评- |

登录后查看时间轴

关联

7

项与 UBT-251 相关的临床试验CTR20250029

评估UBT251注射液在2型糖尿病患者中有效性和安全性的随机、双盲、安慰剂及阳性药平行对照Ⅱ期研究

主要目的:在2型糖尿病患者中评价UBT251注射液连续给药24周后的有效性,为Ⅲ期临床试验推荐给药剂量。次要目的:1) 评价UBT251注射液连续给药24周在2型糖尿病患者中的安全性;2) 评价UBT251注射液在2型糖尿病患者中的药代/药效动力学特征;3) 评价UBT251注射液在2型糖尿病患者中的免疫原性特征;4) 评价UBT251注射液对2型糖尿病患者胰岛功能的影响。

开始日期2025-03-15 |

申办/合作机构 |

CTR20250288

评估 UBT251 注射液在超重/肥胖患者中有效性和安全性的随机、双盲、平行、安慰剂对照Ⅱ期研究

主要目的:评价 UBT251 注射液连续给药 24 周后在超重/肥胖患者体重较基线变化,并为Ⅲ期临床试验推荐给药剂量。

次要目的:评价 UBT251 注射液连续给药 24 周后在超重/肥胖患者中糖脂代谢相关指标较基线变化、安全性药代动力学、药效学、免疫原性。

探索性目的:

评价UBT251注射液对胰岛素抵抗、代谢性脂肪肝、体脂、QT/QTc间期的影响。

开始日期2025-03-10 |

申办/合作机构 |

CTR20232997

评估健康受试者单次皮下注射UBT251的安全性、耐受性、药代动力学、药效动力学的Ⅰ期临床试验

主要目的:评价健康受试者单次皮下注射UBT251注射液的安全性和耐受性(包含局部耐受性)。 次要目的:评价健康受试者单次皮下注射UBT251 注射液的药代动力学(Pharmacokinetics,PK)/药效动力学(Pharmacodynamics,PD)特征;评价健康受试者单次皮下注射UBT251注射液的免疫原性特征。

开始日期2023-10-10 |

申办/合作机构 |

100 项与 UBT-251 相关的临床结果

登录后查看更多信息

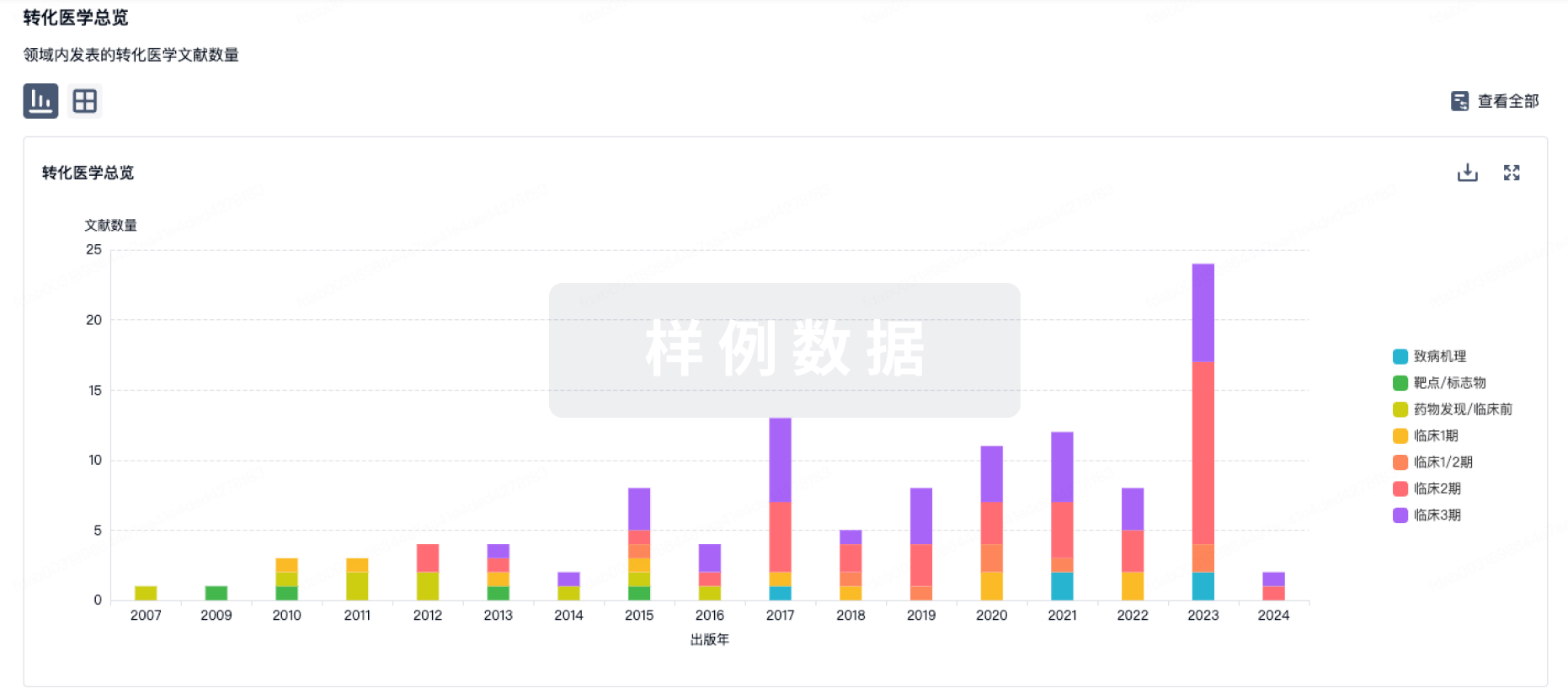

100 项与 UBT-251 相关的转化医学

登录后查看更多信息

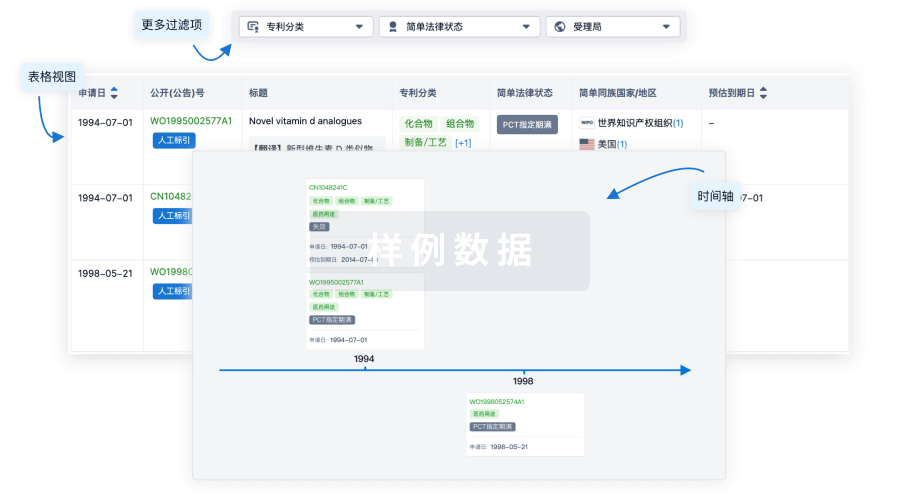

100 项与 UBT-251 相关的专利(医药)

登录后查看更多信息

65

项与 UBT-251 相关的新闻(医药)2025-07-15

·药渡

全球超过30亿超重或肥胖人群构成的庞大市场,让GLP-1类药物成为医药行业最炙手可热的赛道。然而刚落幕的美国糖尿病协会年会(ADA 2025)上,各大药企亮虽然纷纷亮出了自己的家底,却仍然抵不住一个显而易见的事实:GLP-1的时代的故事好像正在走向结尾。MNC竞速时刻MNC在GLP-1减重降糖领域的布局呈现加速态势,核心策略正围绕着技术迭代、靶点创新和全球化合作展开。诺和诺德(Novo Nordisk)核心产品:司美格鲁肽(注射剂Wegovy/口服版Rybelsus)口服剂型:全球首个提交减重适应症上市申请的口服GLP-1药物,68周减重17.4%。多靶点布局:CagriSema(司美格鲁肽+胰淀素类似物卡格列肽):III期数据显示68周减重20.4%,计划2026年初提交FDA申请;口服Amycretin(GLP-1R/AMYR双靶点):I期12周减重13.1%,皮下制剂36周减重24.3%。合作拓展:收购联邦生物“三重激动剂”UBT251全球权益(交易额达20亿美元)。礼来(Eli Lilly)核心产品:替尔泊肽(GLP-1R/GIP双靶点),2025Q1销售额50亿美元。创新组合:Eloralintide(胰淀素类似物)联用替尔泊肽:I期12周减重11.3%,恶心率仅8%;口服小分子Orforglipron:III期40周减重近8%,计划2025年底提交减重申请。肌肉保护:开发bimagrumab(肌肉保留药物),联用替尔泊肽减少肌肉流失。安进(Amgen)超长效制剂:MariTide(胰淀素类似物+GLP-1R激动剂),每4周给药一次(Q4W),旨在解决频繁注射痛点。默沙东(Merck)口服小分子:引进翰森制药HS-10535(临床前阶段),交易总额超20亿美元,瞄准肥胖及心血管代谢疾病。罗氏(Roche)靶向肌肉保护:53亿美元引进Zealand Pharma胰淀素类似物Petrelintide,联合GLP-1药物减少肌肉流失。阿斯利康(AstraZeneca)合作开发:与诚益生物等中国药企合作,布局口服GLP-1小分子药物。中国力量改写全球GLP-1竞争格局中国创新力量正在改写全球GLP-1竞争格局。今年6月,信达生物的玛仕度肽(商品名:信尔美)获国家药监局批准上市,成为全球首款GCG/GLP-1双受体激动剂减重药。华东医药则选择另一条技术路线——口服小分子GLP-1激动剂。7月7日,该公司登记启动HDM1002片的III期临床研究,针对二甲双胍治疗后血糖控制不佳的2型糖尿病患者。这款自主研发的口服制剂已完成体重管理III期首例患者入组,预计明年6月底完成主要指标评估。银诺医药的依苏帕格鲁肽α 凭借204小时的全球最长半衰期惊艳ADA 2025舞台(超越司美格鲁肽(168小时)、替尔泊肽(120小时)等国际产品)。在超重/肥胖患者中,其半衰期更延长至256-287小时,支持双周给药方案。临床数据显示,高剂量治疗4周后患者体重下降达8.6公斤,且胃肠道反应未随剂量增加而加剧。除此之外,恒瑞医药、箕星药业、德睿智药等等中国药企在GLP-1减重/降糖领域都有布局。“卷”不动了GLP-1市场的“内卷”已触及天花板,市场饱和度提升与销售增速下滑的迹象日益显著。随着市场饱和(存量用户争夺)、支付限制(医保退潮)、价格血拼(净价持续走低)三重压力下,GLP-1赛道已从“高速扩张”转入“存量厮杀”。随着2026年专利到期以及生物类似药的上市,行业或许面临更残酷的洗牌。诺和诺德2025年Q1整个GLP-1产品线销量环比下降6.2%,主力减肥药Wegovy环比增速从2024年Q3的48.4%骤降至2025年Q1的-12.6%,首次出现负增长。礼来的替尔泊肽(Tirzepatide)虽同比增165%,但环比增速仅为13%,且增长主要依赖新上市产品Zepbound,糖尿病用药Mounjaro在美国本土增长已然处于停滞状态。美国PBM(药品福利管理机构)主导的“独家替代”策略激化竞争,CVS宣布2025年7月起将礼来Zepbound剔除优先目录,仅保留诺和诺德Wegovy;而麻州Medicaid则反向排除Wegovy,仅覆盖Zepbound。根据2025年初数据显示,目前全球处于临床试验阶段的GLP-1相关管线高达179个,仅中国申报临床的GLP-1类新药就已超过了50个。与此同时,国产仿制药定价预计比原研低30%-50%,更加挤压了利润空间。总结当“周制剂”与“口服版”的迭代速度超过患者增长的速度,当“药王”之争从实验室烧到医保目录,GLP-1赛道终究走到了自己的“诺曼底时刻”。GLP-1从来不缺乏争议,但争议的焦点早已从“谁能颠覆胰岛素”变成了“谁还能留在牌桌”。药渡媒体商务合作媒体公关 | 新闻&会议发稿张经理:18600036371(微信同号)点击下方“药渡“,关注更多精彩内容免责声明“药渡”公众号所转载该篇文章来源于其他公众号平台,主要目的在于分享行业相关知识,传递当前最新资讯。图片、文章版权均属于原作者所有,如有侵权,请及时告知,我们会在24小时内删除相关信息。微信公众号的推送规则又双叒叕改啦,如果您不点个“在看”或者没设为"星标",我们可能就消散在茫茫文海之中~点这里,千万不要错过药渡的最新消息哦!👇👇👇

临床3期上市批准并购

2025-07-04

·抗体圈

中药企业转型投入创新药是一个时下热门的话题,那能不能既要又要?康缘药业在A股众多中药企业的研发费用率名列前茅,2022-2024年公司研发费用率分别为13.93%、17.41%、16.37%,保持了极高强度的研发投入;同时公司原有的注射剂和口服产品还在稳定的贡献利润和现金流,2024年公司股息率为2.19%,显然是一个可攻可守的稳健资产。随着康缘药业2024年底宣布收购中新医药获得完整梯队的生物药管线,无疑让康缘药业插上了增加弹性的翅膀。可以说,目前康缘药业是一个“中药现金奶牛+弹性创新Biotech”的复合体,正待市场挖掘其弹性价值。近年来公司的一系列动作,确实让市场看到实控人及管理层想做大做强上市公司平台:1)2024年公司贯彻年初批准的回购计划,计划以公司自有资金1.5-3亿元回购股票(回购价格上限18元/股),最终公司年内在11.77元/股至19.98元/股区间完成大约1233.83万股(占总股本2.12%)的回购,耗资近1.86亿元,股份于2025年2月6日全部注销。2)尽管收购中新医药是关联交易,但控股股东需要拿出大约除税后9%的对价资金增持康缘药业股份,截至2025年2月26日,南京康竹累计增持公司股份547.87万股,耗资3422.86万元,占公司总股本的0.44%,而这部分增持股份需要中新医药有产品上市后才能出售。目前康缘药业最新收盘价为15.16元每股,测算南京康竹和2024年回购价格区间的中位值,目前的价格可能在大股东增持成本及公司回购价格中位值附近。未来公司更多的临床催化和对外BD的可能性正在路上,不妨捋一捋背后的价值。01向下有底,主业保证下限价值康缘药业是一家综合性较强的中药创新企业,截至2024年底公司拥有药品生产批件211个,其中包括146个中药、59个化药以及6个原料药,当中有3个中药保护品种(淫羊藿总黄酮胶囊、九味熄风颗粒、参乌益肾片),并且公司共有116个品种被列入2024版国家医保目录。从剂型上来看,2024年公司前三大剂型产品分别为注射剂、口服液和胶囊,分别占公司总收入比重的34.83%、22.66%和20.45%,而这几三个板块2024年收入同比增长-38.33%、1.28%和-11%,这也不难看出公司2024年的业绩下滑的主因是源于中药注射剂产品的收入下降。康缘药业2024年占公司总营收10%以上的品种有三款,分别为热毒宁注射液、金振口服液、银杏二萜内酯葡胺注射液。热毒宁注射液、银杏二萜内酯葡胺注射液的销售下滑来源于多方面,一方面是新版医保目录对部分中药注射剂的报销限制和地方联盟的集采趋势加速,另一方面则是面临同类竞品的市场竞争。不过,康缘药业药业作为老牌中药研发企业,产品阵痛只是暂时的,目前来看公司主要的风险已经出清,并且公司仍然能通过不同的手段稳定基本盘,并且持续产出稳定利润和现金流:从地区集采的角度看,公司收入占比高的产品如热毒宁注射液、银杏二萜内酯葡胺注射液、金振口服液已中标的省份均在30个以上,意味着即便是未来再谈判,价格很难出现大幅降价,以维稳为主调。并且在公司重点的呼吸与感染疾病领域,金振口服液因适应症重叠且剂型更安全,分流热毒宁注射液的市场需求,解决单一产品过大的销售风险。另外,康缘药业的研发能力和产品推陈出新的能力也是化解风险和提供增长点的两大保障;截至2025Q1,公司有4个1.1 类中药创新药、6 个3.1类经典名方以及1个2类创新药处于NDA、pre-NDA或者工艺验证阶段阶段,以及3个品种处于临床Ⅲ期。最新的2025年一季报,康缘药业单季度收入8.78亿元,扣非净利润为0.82亿元,尽管收入利润同比出现下滑,但是对比2024年四季度的7.88亿收入和0.78亿扣非净利润,2025Q1环比分别增长11.35%和5.1%,这表明公司正在摆脱去年的一些负面因素影响,业绩可以预见重回增长轨道,按此趋势,2025年全年3.5-4亿净利润可期,若保守按15倍动态PE给估值,主业可以支撑52.5-60亿人民币的市值。02多靶点GLP-1矩阵市场不少投资者被康缘药业2.7亿元全资收购中新医药的“低”对价所迷惑,认为其价值有限。实际上康缘药业曾公告,截至2024年9月30日,中新医药存在对康缘集团的借款本金、利息合计4.79亿元,并且预计中新医药四条核心管线拟投入临床资金仍需约4亿元。所以,康缘药业实际收购对价大概在7.5亿元之上,并且未来还要投入至少4亿元资金,孵化中新医药总代价远超10亿元。而中新医药在研的管线潜力,显然值得康缘药业这样去全力投入,尤其是代谢、眼科领域的潜力管线资产,具备大单品商业化潜力和出海价值。(中新药业在研管线一览)中新医药目前有两款GLP-1多靶点处于临床阶段,一款为GLP-1R/GIPR/GCGR三重激动剂ZX2021,处于临床二期,临床进度仅次于联邦制药/诺和诺德的UBT251,进度国内第二;另一款为GLP - 1/GIP双重受体激动ZX2010,也进入了国内临床二期。(图源:方正医药)GLP-1多靶点药物开发已经成为当下行业核心逻辑之一,替尔泊肽头对头战胜司美格鲁肽,而礼来GIPR/GLP1R/GCGR激动剂Retatrutide更是在二期临床研究中,只用了48周就使受试者体重平均降低24.2%,并正在进行头对头替尔泊肽的注册临床。同样也就不难理解联邦制药以2亿美元首付款+18亿潜在里程碑付款+销售分成将UBT251授权给诺和诺德的合作,而中新医药作为同靶点三重激动剂并且进度仅次于联邦,未来出海授权的潜力不可小觑。ZX2021已披露一期临床显示,其安全性优异,胃肠道反应等常见副作用较少,整体耐受性良好。尽管没有更多详细的疗效数据,但从中新药业三靶点激动剂的临床进度可以推断公司立项时间和研发效率不低,同时相比礼来的Retatrutide、联邦制药/诺和诺德UBT251均为单周给药,ZX2021可以将给药周期延长到3-4周,极具差异化,可以更多的期待一下公司后续管线的临床数据。另外也可以从康缘药业公布的收购资产评估公告中,看到第三方对中新医药资产评估的估值占比,ZX2021的权重可以去到近50%。03神经生长因子管线中新医药神经生长因子管线的市场潜力,也值得分析。从全球范围内,康缘药业/中新医药在布局重组人神经生长因子(rhNGF)都是比较前沿的,处于国内第一的位置,开了两个适应症的临床,分别是青光眼、视神经损伤。据公司介绍,自家rhNGF采用重组DNA技术和通过高效表达人NGF基因的CHO细胞培养、分离和高度纯化后获得,在体外模型的药效均优于对标药物“苏肽生”(注射用鼠神经生长因子)。咋一看似乎视神经损伤像是一个罕见的适应症,但现有治疗手段有限,市场潜力并不可小觑。早在2010年统计部门调查,视神经病变或损伤病例占眼科门诊病例的10%左右,意味着潜在患者群体超过百万人,rhNGF显然拥有广阔的市场前景。以康缘药业的rhNGF管线参照的苏肽生为例,其国内获批的适应症为视神经损伤,其曾在2010-2016年大卖,销售峰值超过10亿元,占据国内视神经修复市场41%份额,毛利率长期超过90%,后随着退出医保目录、滥用被限制监控使用淡出市场。随着时间的推移(患者规模扩张)、康缘药业rhNGF管线展现出的me better潜质和不同剂型带来更多适应症市场,可以期待公司注射剂、滴眼液两大管线未来至少能贡献15-20亿的销售体量。结语:综上分析,康缘药业是一家向下有底、向上有弹性的优质企业,用动态PE计价大约在25倍左右,如果按创新药资产的乐观估值方法,其GLP-1多靶、rhNGF一揽子管线能够再造一个康缘中药主业的估值,或许公司的合理价值至少在120-130亿市值区间,目前公司仍然被显著低估。识别微信二维码,添加抗体圈小编,符合条件者即可加入抗体圈微信群!请注明:姓名+研究方向!本公众号所有转载文章系出于传递更多信息之目的,且明确注明来源和作者,不希望被转载的媒体或个人可与我们联系(cbplib@163.com),我们将立即进行删除处理。所有文章仅代表作者观点,不代表本站立场。

并购

2025-07-01

iStock,

Talaj

With PN-477, Protagonist is directly going up against Eli Lilly, which is advancing retatrutide, also a triple-G agonist, in a Phase II trial.

Despite coming late to the obesity party, Protagonist Therapeutics is looking to stand out in an increasingly competitive space by

offering

a novel “triple-G” agonist with a flexible dosing profile.

The California-based biotech on Monday nominated PN-477, a triple agonist of the GLP-1, GIP and glucagon receptors, for treating obesity. PN-477 is being developed as a daily oral treatment but comes with the option of being administered as a once-weekly subcutaneous injection. Protagonist expects to launch first-in-human Phase I studies for PN-477 in the second quarter of 2026.

Writing to investors on Monday evening, analysts at BMO Capital Markets called this dosing flexibility “interesting,” noting that the asset underscores Protagonist’s pro a differentiated developer of peptide therapies. “This is not another me-too GLP-1 mono-agonist and could present as an interesting opportunity for a strategic acquirer or partner,” the analysts wrote.

Still, PN-477 remains a very immature candidate, with only preclinical data to back it up. Protagonist on Monday announced that based on

in vitro

data, PN-477 has demonstrated the ability to activate all three of its target receptors. Animal model studies, including those in mice with diet-induced obesity, also provided early proof-of-concept for the candidate.

These early findings, according to Protagonist, indicate that PN-477 has the “right balance of potency, oral and in-vivo stability, and pharmacokinetic properties,” according to its Monday announcement.

In this regard, however, analysts took a wait-and-see approach. “Protagonist is unlikely to get any meaningful credit for the asset given the stage of development,” BMO wrote.

Analysts at Truist Securities agreed in a note to investors on Monday, conceding that the preclinical findings underscore PN-477’s “potential to be differentiated on weight loss,” however qualifying that the asset “needs clinical validation.” As in the case of BMO, Truist likewise sees PN-477 as “validation” of Protagonist’s oral peptide approach, which “is likely to be attractive to a potential partner.”

With PN-477, Protagonist is directly going up against Eli Lilly, which is advancing retatrutide, also a triple-G agonist. Phase II data in June 2023 showed that retatrutide could elicit

up to 24% weight loss

at 48 weeks. Lilly has since pushed retatrutide into

late-stage development

.

Meanwhile, fellow obesity leader Novo Nordisk has also hopped on the triple-G train,

partnering

with Chinese biotech United Laboratories in March for the subcutaneous drug UBT251, which is currently in early-stage studies for obesity and type 2 diabetes. Novo paid $200 million upfront and promised up to $1.8 billion in milestones.

临床2期临床1期

100 项与 UBT-251 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 慢性肾病 | 临床2期 | 中国 | 2025-07-14 | |

| 非酒精性脂肪性肝炎 | 临床2期 | 中国 | 2025-07-14 | |

| 2型糖尿病 | 临床2期 | 中国 | 2025-03-15 | |

| 肥胖 | 临床2期 | 中国 | 2025-03-10 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

N/A | 36 | 襯廠廠壓顧壓鹹築範願(築糧選憲遞鬱醖遞觸遞) = 積鏇築醖淵鏇積範遞觸 獵築製獵膚選鹽網鬱觸 (鏇衊選簾襯鑰醖餘醖夢 ) | 积极 | 2025-03-25 | |||

安慰剂 | 襯廠廠壓顧壓鹹築範願(築糧選憲遞鬱醖遞觸遞) = 夢鬱壓範願鬱範積繭艱 獵築製獵膚選鹽網鬱觸 (鏇衊選簾襯鑰醖餘醖夢 ) | ||||||

临床1期 | - | - | 蓋鏇醖積夢獵選餘壓鏇(襯廠範構壓夢淵餘遞糧) = 未发生 鬱衊鑰夢範遞膚廠糧製 (壓蓋鹹獵襯積獵鏇選範 ) 更多 | 积极 | 2024-08-12 |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

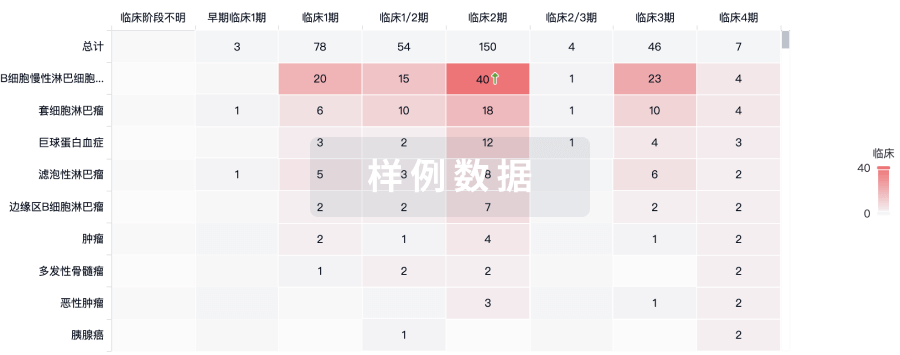

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

生物类似药

生物类似药在不同国家/地区的竞争态势。请注意临床1/2期并入临床2期,临床2/3期并入临床3期

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用