预约演示

更新于:2025-08-22

Gepotidacin

更新于:2025-08-22

概要

基本信息

原研机构 |

权益机构- |

最高研发阶段批准上市 |

最高研发阶段(中国)临床申请批准 |

特殊审评优先审评 (美国) |

登录后查看时间轴

结构/序列

分子式C24H28N6O3 |

InChIKeyPZFAZQUREQIODZ-LJQANCHMSA-N |

CAS号1075236-89-3 |

关联

24

项与 Gepotidacin 相关的临床试验NCT06597344

A Phase 3b, Open-label, Single-arm Study in Adolescent and Adult Female Participants to Evaluate Clinical Symptom Improvement and the Safety of Gepotidacin During Treatment of Uncomplicated Urinary Tract Infections (Acute Cystitis)

The study will be conducted to evaluate the clinical symptom improvement and safety of oral gepotidacin for treatment of uncomplicated UTI (acute cystitis) in adolescent and adult female participants.

开始日期2024-10-02 |

申办/合作机构 |

JPRN-jRCT2031220467

A Phase III, Multicenter, Randomized, Active Reference, Double-blind, Double-dummy Study in Japanese Female Participants to Evaluate the Efficacy and Safety of Gepotidacin in the Treatment of Uncomplicated Urinary Tract Infection (Acute Cystitis) - A study to investigate the efficacy and safety with gepotidacin in Japanese female participants with uncomplicated urinary tract infection (acute cystitis); Efficacy of Antibacterial Gepotidacin Evaluated in Japan (EAGLE-J)

开始日期2023-01-11 |

申办/合作机构- |

NCT05630833

A Phase III, Multicenter, Randomized, Active Reference, Double Blind, Double-dummy Study in Japanese Female Participants to Evaluate the Efficacy and Safety of Gepotidacin in the Treatment of Uncomplicated Urinary Tract Infection (Acute Cystitis)

The purpose of this study is to evaluate the consistency of therapeutic response of gepotidacin in female participants with acute uncomplicated cystitis with qualifying bacterial uropathogen(s) at baseline that all are susceptible to nitrofurantoin in Japan, with that from global studies (Studies 204989 [NCT04020341] and 212390 [NCT04187144]).

开始日期2023-01-11 |

申办/合作机构 |

100 项与 Gepotidacin 相关的临床结果

登录后查看更多信息

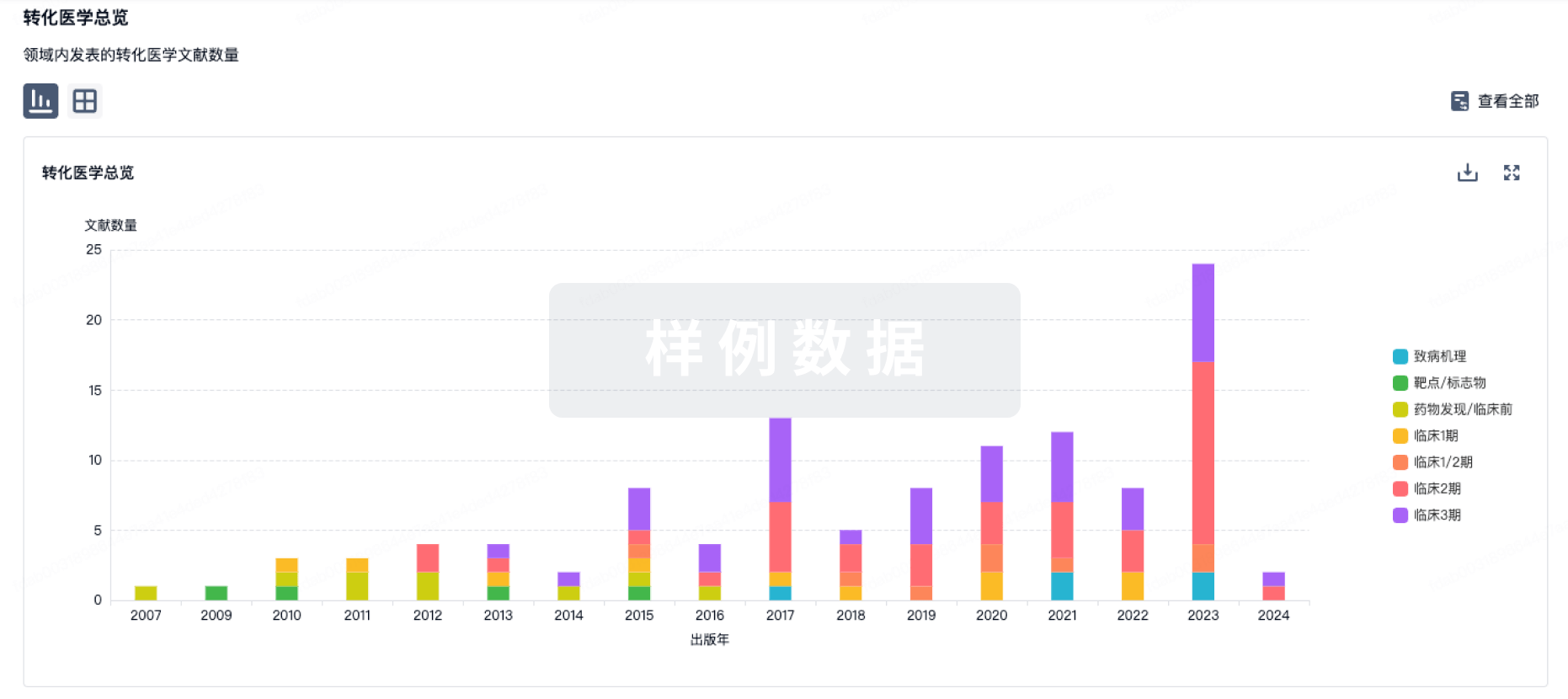

100 项与 Gepotidacin 相关的转化医学

登录后查看更多信息

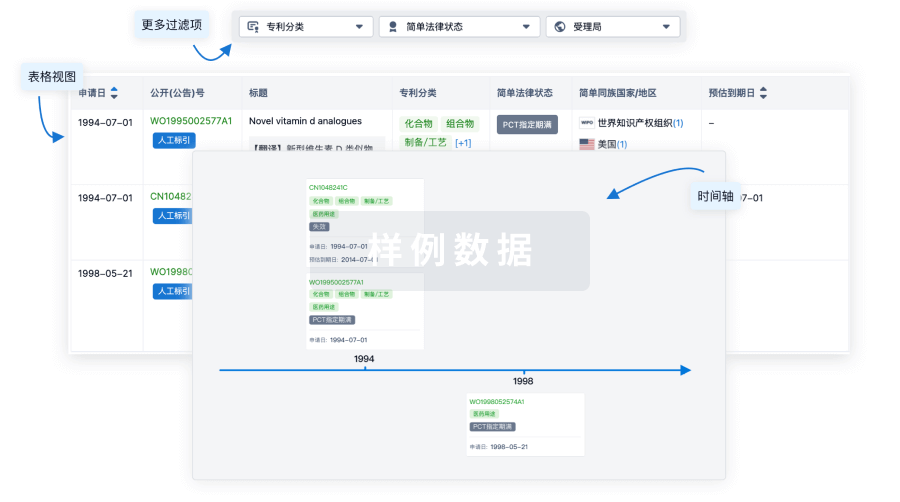

100 项与 Gepotidacin 相关的专利(医药)

登录后查看更多信息

111

项与 Gepotidacin 相关的文献(医药)2025-08-01·ANNALS OF INTERNAL MEDICINE

In urogenital gonorrhea, gepotidacin was noninferior to ceftriaxone + azithromycin for microbiological success

Article

作者: Glatt, Aaron E. ; Brennan, Keith ; Anaekwe, Adaeze

CLINICAL IMPACT RATINGS:

GIM/FP/GP: [Formula: see text] Infectious Disease: [Formula: see text].

2025-07-03·Expert Review of Anti-Infective Therapy

An overview of potential combination therapies with ceftriaxone as a treatment for gonorrhoea

Review

作者: Kenyon, Chris ; Vanbaelen, Thibaut ; Santhini Manoharan-Basil, Sheeba ; Kanesaka, Izumo ; Kong, Fabian Yuh Shiong

INTRODUCTION:

Ceftriaxone is the last available single dose therapy for gonorrhea that effectively treats infections at all sites. Over a quarter of isolates are now resistant to ceftriaxone in some countries. The introduction of carefully chosen combination therapy with ceftriaxone could retard the emergence of ceftriaxone resistance.

AREAS COVERED:

This review summarizes the findings of a PubMed search on the use of partner antimicrobial that could be used with ceftriaxone to prevent the emergence and spread of ceftriaxone resistance. We review 16 antimicrobials that could be partnered with ceftriaxone in terms of pharmacokinetic and pharmacodynamic compatibilities, activity against ceftriaxone resistant isolates and probability of antimicrobial resistance emerging.

EXPERT OPINION:

Of these 16 antimicrobials, we reject antimicrobials such as fosfomycin due to poor clinical efficacy and tigecycline due to its considerably longer half-life which would likely select for tetracycline resistance. The most promising agents for combination with ceftriaxone are zoliflodacin, delafloxacin, sitafloxacin, eravacycline and possibly gepotidacin and gentamicin. Clinical studies should be conducted to evaluate the efficacy of these combinations on the eradication of N. gonorrhoeae and their impact on AMR in N. gonorrhoeae and other bacterial species.

2025-06-04·ANTIMICROBIAL AGENTS AND CHEMOTHERAPY

Article

作者: Hackel, Meredith A. ; Karlowsky, James A. ; West, Joshua M. ; Sahm, Daniel F. ; Scangarella-Oman, Nicole E.

ABSTRACT:

Gepotidacin is a novel, bactericidal, first-in-class triazaacenaphthylene antibiotic that inhibits bacterial DNA replication through a distinct binding site and unique mechanism of action, providing well-balanced inhibition of two different type II topoisomerase enzymes for most uropathogens. Phase III clinical trials,

NCT04020341

(EAGLE-2) and

NCT04187144

(EAGLE-3), showed gepotidacin to be non-inferior and superior, respectively, to nitrofurantoin for the treatment of patients with uncomplicated urinary tract infections (uUTIs). To better define gepotidacin

in vitro

activity against pathogens that commonly cause UTIs, CLSI broth microdilution MICs were determined for gepotidacin and seven comparator agents, and agar dilution MICs were determined for fosfomycin, against 4,000 predominantly UTI isolates of Enterobacterales (3,250),

Enterococcus faecalis

(500), and

Staphylococcus saprophyticus

(250) collected globally from 2012 to 2020. Gepotidacin MIC

90

s against the Enterobacterales species tested were 4 µg/mL for

Escherichia coli

(1,000) and

Klebsiella oxytoca

(250), 8 µg/mL for

Citrobacter

spp. (250) and

Klebsiella aerogenes

(250), 16 µg/mL for

Proteus mirabilis

(250) and

Providencia rettgeri

(250), and 32 µg/mL for

Enterobacter cloacae

(500) and

Klebsiella pneumoniae

(500). Against the gram-positive species, gepotidacin MIC

90

s were 0.12 µg/mL and 4 µg/mL for

S. saprophyticus

(250) and

E. faecalis

(500), respectively. Gepotidacin MIC

90

s for ciprofloxacin not susceptible isolates ranged from 4 µg/mL for

E. coli

(352) to 128 µg/mL for

P. rettgeri

(48). Gepotidacin MIC

90

s for presumptive extended spectrum beta-laactamase (ESBL)-positive

E. coli

(228) and

K. pneumoniae

(145) were 8 µg/mL and 32 µg/mL, respectively. Gepotidacin was bactericidal (minimum bactericidal concentration [MBC]/MIC ratio ≤4) against 94% (47/50) of isolates tested.

100

项与 Gepotidacin 相关的新闻(医药)2025-08-20

“Our goal has always been to get this product to market,” Iterum Therapeutics CEO Corey Fishman said. “And whether that was us, whether that was a partnership or someone else, that’s still our goal.”

With three new antibiotics set to shake up the stagnant treatment landscape for uncomplicated urinary tract infections (uUTIs) in the U.S., Dublin-based Iterum Therapeutics has made it to market first, edging out generics juggernaut Alembic Pharmaceuticals and British Big Pharma GSK.Wednesday, Iterum officially launched Orlynvah, which secured FDA approval last October to treat uUTIs caused by E. coli, Klebsiella pneumoniae or Proteus mirabilis in adult women for whom other oral treatment options are limited or unavailable.Aside from being the first new branded uUTI treatment to launch in the U.S. in nearly three decades, Orlynvah is the only oral penem antibiotic to have received a green light from the FDA.The introduction of Orlynvah into the market—plus the looming debut of new treatments from Alembic and GSK—comes at a crucial time as the rising tide of antimicrobial resistance erodes the potency of antibiotics long-used to fight infections in the U.S.“We’re talking about a space that hasn’t seen any new products on the branded side in over 25 years,” Iterum CEO Corey Fishman said in a recent interview with Fierce Pharma.Without innovation on that front, resistance to the current slate of antibiotic treatments has risen, the chief executive explained: “Resistance keeps going up, efficacies are going down, and you’ve got an enormous market that is really struggling to find new and effective treatments.” Iterum figures Orlynvah has a major role to play in uUTI treatment given its distinction as the U.S.’ only oral penem antibiotic. Penem antibiotics have long been considered the “go-to class of drugs for serious infections,” but, up until now, have traditionally been infused in a hospital, Fishman noted.Iterum has singled out a total uUTI treatment market of roughly 40 million prescriptions per year in the U.S., but the company will focus its attention on “at-risk patients” specifically—a category that includes those with comorbidities like diabetes or heart failure, are older or have compromised immune systems and those who live with recurrent infections, according to the company’s CEO.That works out to about 26 million annual prescriptions that could be addressed with Orlynvah, Fishman said.“We know with those folks, if you don’t treat them well the first time, you can have some really negative outcomes,” he said. Anatomy of a launch Upon winning approval last October, Iterum said it would “renew” efforts to pin down a “strategic transaction” involving Orlynvah.But none of the options presented to Iterum or its board were to their satisfaction, prompting the company to take commercialization into its own hands, Fishman explained. At the same time, the CEO caveated that transactions and business development deals are “never off the table.”“Our goal has always been to get this product to market,” he said, “And whether that was us, whether that was a partnership or someone else, that’s still our goal.”Nevertheless, Iterum is a small company boasting just nine employees, Fishman pointed out. In turn, the biotech simply didn’t have the resources to prepare for Orlynvah’s launch years in advance.So, after winning FDA approval in late October, Iterum kicked off a “dual-track approach” to bring Orlynvah to market, scrutinizing potential deals while simultaneously prepping for a launch of its own, Fishman said.Given Iterum’s size, the company has now partnered with Eversana Life Sciences Services to help carry the launch through. The company has also teamed up with a specialty pharmacy to help with distribution, Fishman explained.As for where Iterum will aim its marketing muscle, the company has targeted regions along three lines: rate of antibiotic resistance in the area, the number of high-prescribing doctors for uUTIs there and the region’s projected market access rates.“We’re going to start with 20 geographies in phase one of our launch, and that’s going to represent roughly 2,300 physician targets,” Fishman explained. Those geographies are “really clustered around seven states,” he added, pointing to New York, New Jersey, Connecticut, Pennsylvania, Texas, Florida and Georgia.During that initial phase, Iterum’s primary goal is to “generate an amount of demand that shows that this is a product that has a real place in the market,” Fishman said.“With additional financing over time, we’ll be able to potentially expand and get into further territories and grow the organization that way,” he added.The company is setting the list price for Orlynvah at a range between $1,400 and $4,700 per prescription, which doesn’t factor in discounts or rebates through insurance. However, eligible patients will be able to pay just $25 for an Orlynvah prescription through an Iterum copay savings program, Fishman noted.The company aimed to price its drug along the same lines as other branded oral antibiotics that have debuted in the past half-decade or so, Fishman said. Orlynvah’s price also reflects the antibiotic’s role as a treatment for an acute infection rather than something that is prescribed regularly, he added. Competition looms With its launch Wednesday, Orlynvah now has some lead to feel out the market before the nearing U.S. launches of two other novel uUTI agents from GSK and Alembic Pharmaceuticals. GSK plans to launch its first-in-class uUTI treatment Blujepa—approved in late March—in the second half of 2025, while Alembic has said it expects its oral treatment Pivya to be available in the U.S. by the fourth quarter.Alembic picked up Pivya, also known as pivmecillinam, when it acquired the small company Utility Therapeutics in July. The FDA greenlighted pivmecillinam for the first time in April 2024, though the antibiotic has been available in Europe for more than 40 years.In the meantime, Iterum isn’t sweating the competition, with Fishman speculating that “there is plenty of space to be able to coexist completely.”It’s also worth pointing out that the vast majority of the uUTI treatment market is and will likely continue to be dominated by generics. In turn, Iterum would be “quite happy if we captured 5% of the market, well north of a million prescriptions at peak,” Fishman said. The entrance of multiple new players might also shine a spotlight on the issue of antibiotic resistance more broadly, he pointed out.“By having these new drugs that don’t have any resistances to start, if you treat the right bug and the right patient with the right dose at the right time, [you’re] unlikely to get much resistance for a very, very long time,” Fishman explained.

上市批准并购

2025-08-13

OTC2025论坛深度聚焦类器官与疾病建模、新药发现/研发、3D细胞培养、类器官培养及质控。OTC2026合作热线:王晨180 1628 8769

FDA 药物评价与研究中心 (CDER) 在 2025 年上半年批准了 16 种新药。

这些新药涵盖肿瘤学、疼痛、罕见病、免疫学和传染病预防。

💉 Datopotamab deruxtecan (Datroway)

Trop-2 定向 mAb + 拓扑异构酶抑制剂 ADC,用于转移性 HR 阳性、HER2 阴性乳腺癌。

💉 三维硫烷 (Grafapex)

DNA 烷化剂 + 氟达拉滨作为 AML 或 MDS 中同种异体造血干细胞移植的制备方案。

💊 Suzetrigine (Journavx)

口服 Nav1.8 抑制剂,非阿片类镇痛药,用于中度至重度急性疼痛。

💊 Mirdametinib (Gomekli)

用于 1 型神经纤维瘤病的口服双 MEK2/1 抑制剂。

💊 Vimseltinib (Romvimza)

口服 CSF1R 激酶抑制剂,用于有症状的腱滑突巨细胞瘤。

💊 Gepotidacin (Blujepa)

用于急性膀胱炎和淋病的细菌 DNA 旋转酶/拓扑异构酶 IV 抑制剂,包括 MDR 菌株。

💉 Fitusiran (Qfitlia)

用于预防血友病 A 或 B 的抗凝血酶 siRNA(GalNAc 偶联),有或没有抑制剂。

💊 Atrasentan (Vanrafia)

内皮素 A 受体拮抗剂,可减少原发性 IgA 肾病中的蛋白尿。

💉 Penpulimab

PD-1 mAb 用于非角化性鼻咽癌。

💉 Nipocalimab (Imaavy)

用于全身性重症肌无力的 FcRn 结合单克隆抗体。

💊 Avutometinib/defactinib (Avmapki Fakzynja Co-Pack)

用于 KRAS 突变的复发性低级别浆液性卵巢癌。

💉 Telisotuzumab vedotin (Emrelis)

c-Met 定向 ADC,具有微管破坏有效载荷,用于 NSCLC。

👁️ Acoltremon(色蛋白荠)

用于干眼症的 TRPM8 钙通道激活剂。

💉 Clesrovimab (Enflonsia)

用于婴儿被动免疫的 RSV 融合蛋白定向单克隆抗体。

💊 Taletrectinib (Ibtrozi)

ROS1 / pan-NTRK 抑制剂,用于 ROS1 阳性 NSCLC。

💉 Garadacimab (Andembry)

用于预防遗传性血管性水肿的因子 XII 定向单克隆抗体。

END

免责声明:本文仅作知识交流与分享及科普目的,不涉及商业宣传,不作为相关医疗指导或用药建议。文章如有侵权请联系删除。

OTC2025论坛深度聚焦类器官与疾病建模、新药发现/研发、3D细胞培养、类器官培养及质控。OTC2026合作热线:王晨180 1628 8769

抗体药物偶联物siRNA优先审批引进/卖出

2025-08-12

·求实药社

中枢神经系统(CNS)一直是医学研发中最具挑战性的领域之一。从阿尔茨海默病到精神分裂症,从神经退行性疾病到罕见脑病,CNS 疾病不仅深刻影响患者生活质量,也持续推动全球医疗科技的创新突破。

为便于行业观察与交流,本文汇总整理了63位深耕CNS领域的企业创始人及CEO(排名不分先后)。所列信息来自公司官网及公开资料,如有更新滞后,敬请谅解。

本次为上篇,下篇将于近期发布。

1、Christophe Weber ,武田制药,代表董事 - 总裁兼首席执行官Christophe Weber是武田的总裁、首席执行官(CEO)兼代表董事。他于2014年4月加入公司担任首席运营官,于2014年6月被任命为总裁兼代表董事,随后于2015年4月被任命为首席执行官。Christophe一直致力于通过全球化和研发转型来确保公司的竞争力,同时创造多元化和包容性的工作环境,并加强武田的道德价值观和公司治理。通过这一转型,武田已成为全球领先的生物制药公司之一。

在加入武田之前,Christophe在葛兰素史克工作了20年,在欧洲、亚洲和美国担任高级领导职务。

Christophe 是美国商业理事会、世界经济论坛国际商业理事会、纽约证券交易所纽约证券交易所董事会咨询委员会、马萨诸塞州竞争伙伴关系董事会、麻省理工学院首席执行官顾问委员会和新加坡人类健康与潜力国际咨询委员会的成员。他还在东北大学董事会任职。

Christophe 拥有法国里昂大学药学和药代动力学博士学位、药品营销和会计与金融硕士学位以及统计学学位。

2、Robert A. Michael,艾伯维,董事会主席兼首席执行官

Rob Michael 是艾伯维的董事会主席兼首席执行官,艾伯维是一家全球生物制药公司,在全球拥有约 55,000 名员工,已为超过 175 个国家/地区的 6000 多万人提供创新药物和产品。

Michael 先生于 2024 年被任命为首席执行官,此前曾担任艾伯维总裁兼首席运营官,并且一直是艾伯维执行领导团队的长期成员。从建立艾伯维的第一个财务规划组织,到制定其多元化业务战略,再到在美国修美乐失去独家经营权后的两年内成功使公司恢复收入峰值,迈克尔先生多年来一直是艾伯维成功和发展不可或缺的一部分。在担任总裁兼首席运营官期间,Michael 先生负责公司的全球商业运营、财务、企业人力资源、全球运营、业务发展和企业战略。他曾于 2022 年被任命为副董事长兼总裁,于 2021 年被任命为财务和商业运营副董事长,并于 2018 年被任命为首席财务官。Michael 先生拥有 30 多年的经验,包括在制药、美容、诊断、糖尿病护理和营养等多个业务中担任领导职务。他的职业生涯始于雅培,是金融发展计划的成员。

Michael先生在印第安纳大学凯利商学院获得会计学学士学位,在加州大学洛杉矶分校安德森管理学院获得工商管理硕士学位。

3、包杨欢,普百思生物创始人、CEO

创建普百思生物,并带领团队建立大数据驱动的、针对精准患者亚群的CNS“靶向疗法” 技术平台和管线。

归国前,曾在美国冷泉港实验室神经生物学系从事CNS疾病分子遗传学研究多年,并参与创立和运营一家CNS药物研发服务公司。

参与投资30余家生物医药医疗公司,其中包括天使轮或者第一次机构投资纳微科技、纽福斯、康立明生物、优脑银河等。

4、蔡宇伽,本导基因,创始人

基因治疗领域顶尖华人科学家,基因治疗载体技术专家,丹麦奥胡斯大学博士,中国生物工程学会系统生物医学专业委员会委员。长期从事基因治疗病毒载体、基因编辑递送技术的研发以及基因治疗载体与机体免疫系统互作的研究,致力于新技术的临床转化。

5、陈柏州,加立(深圳)生物科技有限公司,联合创始人兼首席执行官

陈柏州先生毕业于麻省理工学院,曾任职多家知名跨国药企,担任研发领导职位,包括新旭生技全球临床研发高级副总裁、联合生物制药公司总经理、PPD北亚区临床管理负责人等。

6、陈晨,璧辰医药,创始人兼CEO

陈晨博士是ABM的创始人和首席执行官。创建ABM之前,他曾担任桑迪亚的总经理,在任期间,公司从200多人发展到了500多人。陈晨博士拥有20多年在中枢神经药物研发方面的经验,其中包括在专注神经系统药物研发的纳斯达克上市公司Neurocrine Bioscience15年的工作经验。陈博士由研究员起步,直至升任该公司的药物化学高级研发主任, 并在新药发现领域取得了多项令人瞩目的成绩。他研发出两个促性腺激素释放激素受体小分子拮抗剂,NBI-42902和 Elagolix,并推进到临床研究。其中 Elagolix 是10多年来,FDA 批准的第一个治疗子宫内膜异位导致的中度到重度疼痛的口服药。

陈晨博士获得厦门大学化学学士学位,随后在中国科学院上海有机化学研究所师从已故黄耀曾院士并获得博士学位。在美国德克萨斯 A & M 大学他跟随诺贝尔化学奖获得者巴顿爵士进行博士后训练。陈博士已在《全美化学学报》、《有机化学学报》、《药物化学学报》、和《生物化学学报》等专业期刊发表了近130篇论文,也是25+项美国专利的共同发明者。

7、陈东浩,杭州畅溪制药,CEO

陈东浩博士在吸入产品开发与制药企业管理方面,拥有25+年的行业经验。

他是 AIR 的联合创始人兼创始科学家,后作为Alkermes的CMC负责人主导了两个早期临床阶段的吸入产品开发,包括与礼来合作开发的吸入胰岛素。2006至2010年,陈东浩博士加入一家位于美国波士顿的全球领先的RNAi公司——Alnylam,担任研发总监,领导建立 siRNA 给药平台,并作为项目负责人带领团队成功完成了世界首例吸入小核酸治疗RSV一期临床实验。随后,陈东浩博士回到中国,出任 Chemo集团(中国)公司总经理,积累了丰富的全面管理,及与国家法规机构沟通的实践经验。

陈东浩博士于1997年获得瑞士苏黎世联邦理工学院(ETH-Zurich)授予的博士学位,并作为访问学者于1998到2000在麻省理工学院 Langer's实验室工作。

8、陈功,神曦生物,创始人、董事长

陈功教授是国家特聘专家,海外高层次人才(A类大千),暨南大学粤港澳中枢神经再生研究院大脑修复中心主任。1987年毕业于复旦大学,1993年获得中科院上海生理所神经生物学博士。1994年赴美国耶鲁大学和斯坦福大学做博士后研究。自2002年起历任宾夕法尼亚州立大学助理教授,副教授(终身教授),正教授,2013年被授予维恩 魏勒曼冠名主任教授(讲席教授)。2020年全职加入暨南大学,担任大脑修复中心主任,推动大脑原位神经再生技术向临床应用的转化。陈功教授领导的团队在国际上首次报导了用神经转录因子NeuroD1将大脑内源性胶质细胞原位高效地转化为功能性神经元这一里程碑工作,被干细胞顶尖杂志Cell Stem Cell评为2014年度最佳论文,为大脑修复开辟了全新的神经再生型基因疗法。2015年再次在Cell Stem Cell上发表小分子化合物诱导培养的人源胶质细胞高效转化为功能性神经元的工作,为开发利用脑内胶质细胞再生神经元的药物疗法奠定了基础。2020年又在国际上首次发表灵长类大脑原位神经再生的里程碑工作。

陈功教授已经获得58项国内国际发明专利授权,覆盖中国,美国,欧盟,日本等主要经济体国家。2021年,陈功教授创办的NeuExcell神曦生物与国际著名药企罗氏制药旗下的Spark达成合作协议。2023年,神曦生物被国际权威机构沙利文授予“亚太基因治疗创新奖”,同年获得全国创新创业大赛总决赛一等奖。2024年,神曦生物的胶质瘤基因治疗产品NXL-004成功完成全球首例恶性胶质瘤患者的NeuroD1 AAV基因治疗给药,实现从基础研究到临床转化的0到1的突破。2025年3月和4月,又相继启动了全球领先的 First-in-Class 原位神经再生疗法治疗脑卒中和阿尔兹海默症的临床试验,为千千万万的患者带来福音。

9、陈泓恺,安立玺荣生物医药,CEO

陈泓恺博士为安立玺荣生医创办人,身兼董事长及执行长,执掌公司营运管理事务及发展策略方向,具有多年於国际药厂新药开发经验,专长于创新型药物之转译医学研究及临床前到临床开发。

在创立安立玺荣生医之前陈博士曾任职於雅祥生技医药股份有限公司担任资深副总裁兼医务长,领导治疗神经疾病新药之临床开发。在此之前曾任职於生物技术开发中心担任转译医学主任,建立跨领域转译医学平台并主导多项肿瘤免疫新药开发计画包括PD-L1及TIM3免疫检查点抑制剂单株抗体及CSF -1R小分子抑制剂等及双特异性抗体开发计划。在此之前陈博士任职於跨国大型药企葛兰素史克(GlaxoSmithKline)上海研发中心,担任神经免疫疾病研究部主任研究员。

期间建立人类干细胞分化神经元高通量药物筛选平台,并主持数项神经免疫疾病之新药开发项目并参与脑中风抗体新药第二期人体临床试验。在加入葛兰素史克之前,陈博士任职於美国加州大学旧金山分校所属格拉斯通研究所转化研究中心担任助理研究员,其间与美国默克药厂合作进行阿兹海默症新药研发,并发现ApoE4造成神经元粒线体功能缺失之分子机制,建立神经元粒线体功能筛选平台,开发出高效调节ApoE4功能之前导药物。

在此之前陈博士曾任职於阳明大学微生物及免疫学研究所助理教授。 陈博士为阳明大学医学士及微生物及免疫学博士,曾於美国贝勒医学院人类分子遗传学研究所博士后进修,并担任霍华德休斯医学研究所博士后研究员。有多项研究发明成果曾发表在包括Cell, Nature Medicine,Nature Communications等国际顶尖科学期刊。

10、陈小祥,元羿生物,创始人,CEO

陈小祥先生在生物医药行业有超过25年的经验,聚焦创新治疗的临床转化和开发,在多家企业成功创建临床研发团队,包括惠氏、勃林格殷格翰和和铂医药。他带领团队成功完成临床开发和法规注册,先后将超过20 种创新药物引入到中国市场。

加入元羿生物前,陈小祥先生自2017年起作为联合创始人参与创建和铂医药,并作为首席开发官全面负责公司的产品研发,包括临床前、CMC、临床开发和法规注册直至产品获批上市。在这之前,陈小祥先生在德国勃林格殷格翰公司曾经分别担任过大中华区以及新兴市场副总裁、医学主管,全面负责在地区内所有国家,包括临床开发、注册法规、医学事务、生物数据管理等等医学研发相关工作。在加入勃林格殷格翰前,陈小祥先生在美国惠氏制药长达12年的工作期间,分别担任过大中华区医学总监、亚太临床开发总监以及中枢神经领域的全球医学监察员等职务。

陈小祥先生从南京医科大学获得临床医学学位。

11、崔霁松,诺诚健华,联合创始人&董事会主席兼首席执行官

• 逾30年医药行业研发和公司管理经验

• 曾任PPD公司BioDuro的首席执行官兼首席科学官

• 默克美国心血管疾病早期开发团队负责人

• 霍华德休斯医学研究所博士后

• 普渡大学分子生物学博士

• 美中医药开发协会(SAPA)第17届主席

12、代红久,南京凯地生物,联合创始人、董事长&CEO

代红久博士为南京凯地医疗技术有限公司创始人、总裁兼董事长。代红久博士以第一发明人身份申报实体瘤CAR相关中美专利数十件,其中授权中美专利15件,2007年代红久博士取得中国科学院研究生院博士学位,次年赴美从事与CAR-T相关的T细胞免疫、GPCR受体功能与癌症发生机理的博士后研究,2013回国加入金斯瑞,先后任高级研究员、部门总监。近年,代红久博士已在《Science》 《PNAS》《Cancer Immunology Research》《Journal for ImmunoTherapy of Cancer》等国际权威杂志发表论文8篇,待发表文章4篇。利用先进合成生物学CAR发现平台已成功开发多款自主知识产权新型实体瘤CAR-T管线,适应症涵盖结直肠癌、肝癌、胃癌、胰腺癌、胶质瘤等多种实体肿瘤,目前多个核心管线进入IIT临床和中美IND申报阶段,公司已完成近亿元融资,正在启动B轮融资。凯地医疗获得2022南京市“培育独角兽称号”并荣登“星耀榜--2021中国生物医药企业最具创新力50强及中国医药创新种子100强企业。

13、董良昶,上海汉都医药,联合创始人、首席科学家、董事长兼总经理

药物递送系统专家

控释制剂和材料科学专家

华盛顿大学生物医药工程博士,师从被誉为“生物材料之父”的美国工程院科学院院士 ProfAllanS.Hoffman全球控释学会(CRS)首届杰出研究生奖获得者

在ALZA和J&J担任技术高管(SeniorResearchFellow)和口服制剂研发部门主任(Director,OralProductsR&D)多年;在药物控制释放理论、

新型药物递送技术及其新药产品开发方面具有很深的造诣和丰富的经验

拥有发明专利100多项,其中获得美国专利约50项

14、杜莹,再鼎医药,董事长&首席执行官

杜莹博士现任再鼎医药创始人、董事长兼首席执行官,她是一名成功的医药研发者、企业家、投资人。

杜莹博士于1994年加入美国辉瑞,参与了不同疾病领域内的多个前期及后期药物项目的研发,其中两款药物获得美国食品药品管理局批准上市。她还曾担任辉瑞全球代谢类疾病项目转让及兼并收购部门的科学主管。之后,她作为联合创始人创立了和记黄埔医药及和黄中国医药科技(现更名为和黄医药),分别担任两家公司的首席执行官及首席科学官。她于2012年加入红杉资本中国基金,担任董事总经理,负责多项医疗健康产业的投资。

杜莹博士于2014年创立再鼎医药,致力于解决全球患者的未满足临床需求。

因其卓越的贡献,杜莹博士被授予多个国际奖项和荣誉称号,包括来自FierceBiotech、福布斯的奖项。杜莹博士在辛辛那提大学取得生物化学博士学位。

15、范靖,浙江霍德生物工程有限公司,创始人&CEO

北京大学生命科学院 学士

加拿大不列颠哥伦比亚大学 博士

前美国约翰霍普金斯大学神经科学及细胞工程所博士后

研究员,入选杭州市521人才计划,浙江省领军型人才计划,2018第二届华侨华人创新创业精英榜30强

入选2022年福布斯“中国科技女性TOP50”

17年中风及神经退行性疾病模型和机制的研究经验,10年多能干细胞培养、iPSC重编程及神经分化经验,带领团队建立了公司iPSC及神经分化技术及产品研发平台

16、管小明,福贝生物科技(苏州)有限公司,共同创始人、CEO

管博士有27年在制药工业界从事研发和领导团队的经验,聚焦神经系统疾病新药开发。在创建福贝生物之前,管博士曾任葛兰素史克(GSK)研发副总裁,神经退行性疾病研发部主任,领导一个多学科的全球团队开发包括阿尔茨海默氏症和帕金森病新药的端至端研发管线。在此之前,管博士在美国默克公司(Merck Research Labs)从事代谢和中枢神经系统疾病新药研发18年,积累了丰富的药物研发、项目管理经验。管博士曾担任AMP-AD(一个国际合作联盟组织)的创始领导小组成员,促进政府、学术界和工业界间的合作创新以推动全球阿尔茨海默氏症新药开发。

管博士毕业于复旦大学上海医学院。考取CUSBEA计划赴美留学并获得美国印第安纳大学医学院生物化学博士学位。随后在美国斯坦福大学及霍华德休斯医学研究所从事博士后研究。

17、韩照中,领诺医药,创始人、董事长兼首席执行官

1991年获武汉大学病毒学学士,1997年获军事医学科学院医学遗传学博士。

2002年在美国国立卫生研究院(NIH)肿瘤研究所(NCI)完成药物发现研究方向博士后训练后,加入能源部Argonne国家实验室(ANL)参与功能基因组研究计划。

2004年加入Vanderbilt University医学院任终身轨助理教授,在NIH基金资助下从事肿瘤生物学的基础与转化医学研究。

2013年加入Alexion医药公司,开发双特异抗体研发平台,参与Strensiq®的BLA申请(2015年获EMA、FDA批准)并领导多个针对严重罕见病特别是靶向补体异常活化的治疗性项目的立项、实施和对外交流,有多个项目进入临床开发阶段。

2017年底回国负责睿智化学(ChemPartner)抗体发现与工程改造技术平台,2019年8月在浦东张江药谷注册成立领诺医药。

18、何志刚,迈巴制药,联合创始人

哈佛医学院神经病学和眼科教授。

波士顿儿童医院病毒核心主任。

轴突再生、神经变性和髓鞘再生研究的世界领导者。

美国国家医学科学院 (NAM) 院士。

克林根斯坦神经科学研究员、约翰默克学者、麦克奈特学者、里夫-欧文研究奖章获得者。

多伦多大学博士,加州大学旧金山分校 Marc Tessier-Lavigne 博士后研究。

Rugen 联合创始人(项目授权给 McQuade 战略研究与发展中心)。

19、洪志,腾盛博药,联合创始人兼首席执行官

洪志博士于2018年作为联合创始人创立了腾盛博药,自公司成立以来一直担任首席执行官。在创立腾盛博药之前,洪博士曾在葛兰素史克(GSK)担任感染性疾病治疗领域高级副总裁和部门负责人。洪博士被认为是GSK在抗艾滋病、抗乙型肝炎病毒和抗生素药物研发领域重塑辉煌并取得成功的关键缔造者。在他的领导下,艾滋病疗法Tivicay、Triumeq、Cabenuva和Apretude获得批准,这使ViiV Healthcare公司(GSK、辉瑞和盐野义制药共同成立的一家合资企业)的艾滋病治疗药物研发业务重新焕发活力。此外,他还领导了Gepotidacin(革兰氏阴性抗生素)和Bepirovirsen(抗HBV新药)的研发,并均进入后期研发阶段。

洪博士同时也是公共卫生的倡导者,他协助美国及欧盟政府(DTRA、BARDA、NIH和IMI)以及慈善组织(盖茨基金会和维康信托基金)建立了多个公私合作伙伴项目。在GSK,洪博士是艾滋病长效治疗和预防疗法的引领者,在他的带领下,艾滋病注射治疗药物Cabenuva和Apretude获得同类首个批准。洪博士还帮助在北京创建了GSK的传染病和公共卫生研究所,并创立了Ardea生物科学公司(后来被阿斯利康收购)。他还曾在Valeant Pharmaceuticals和Schering-Plough研究所(现为默克)担任领导职务。洪博士在药物研发领域拥有超过25年的从业经验,并推动40多种化合物投入研发,其中多种化合物已经获批并商业上市。他还曾担任ViiV Healthcare公司的董事会成员。

20、李锋,天广实生物,董事长、总经理(首席执行官CEO)

负责公司的整体管理、公司战略、监管审批、商业发展和可持续性。

李锋博士拥有逾22年的生物制药行业经验,曾在美国担任Genentech研发部主任工程师与Amgen资深科学家等职务。

21、罗文,杭州索元生物医药股份有限公司,董事长、总经理

罗文博士是索元生物的创始人及董事长,在基因组学、精准医疗、肿瘤及精神类疾病的创新药研发有多年的经验。在创立索元生物之前,Wen Luo博士任职于美国Ligand公司,领导和参与了多个第二代核激素受体调节药物的开发研究,从事激素受体的分子机理、组织器官选择性、药物筛选试验的建立等工作,并负责为在处于不同研发阶段的多种药物制定和执行生物标志物策略。Wen Luo博士还曾在美国Corvas生物科技负责开发新的蛋白酶新药靶点,任职于美国基因公司Incyte Genomics, Inc.参与管理当时全球最大的蛋白质组数据库LifeProt,并从事新型药靶基因及其剪接变异体研发的工作,在美国Sugen生物科技公司从事癌症、免疫疾病、血管生成领域开发和鉴定新药物靶点的工作。Wen Luo博士先后就读于北京协和医学院、印第安纳州印第安纳大学医学院,拥有分子生物学和生物化学博士学位,并在加州大学旧金山分校担任霍华德·休斯医学研究所博士后研究员。

22、李龙,穹顶科技,CEO

李龙,西安交通大学生物医学工程博士、博士后、助理教授,师从中国神经调控领域著名专家王珏教授。

主要研究方向为神经系统功能干预技术、高频超高频信号神经调控技术、穿戴式医疗器械、医疗信息系统、医学信息检测技术。发表相关领域SCI论文多篇,参与国家级、省部级重点课题多项。

曾就职于中兴通讯股份有限公司,主要从事128通道5G基站双工器研发;小型化4G射频天线研发。工作以及宜兴4G基站建设招标项目,具有丰富的产业转化经验。

23、李龙承,中美瑞康,创始人,董事长兼首席执行官

李龙承博士是RNA激活疗法的开创者,他拥有临床医学、基础科学研究、生物信息学和小核酸药物研发等多学科背景,为其开发RNA激活疗法提供了坚实的基础。在美国加州大学旧金山分校(UCSF)担任副教授期间,李博士结合了他的临床经验和科学探索,在RNAa研究领域取得了重要突破。李博士在不同科学领域均卓有建树。他建立了生命科学领域被广泛使用的ProtocolOnline数据库,并开发出了MethPrimer等重要生物信息学工具。自2016年创立中美瑞康以来,李博士一直致力于开发突破性的saRNA疗法,以开创一个全新的成药机制。在创办中美瑞康之前,他曾任中国医学科学院北京协和医院特聘教授和中心实验室主任。李博士多次应邀到国际学术会议、大学和工业界包括AInvlam Pharmaceuticals、Merck、Sigma和Genentech进行专题演讲。

24、李帅,上海赛默罗生物科技有限公司,创始人

中国科学院神经科学研究所博士学位

十五年疼痛研究及神经系统疾病研究经验

前中科院疼痛医学研究中心副主任

25、李翔,士泽生物医药(苏州)有限公司,创始人、CEO

李翔博士,北京大学博士,美国威斯康星大学麦迪逊分校博士后,美国帕金森病基金会研究员,江苏省高级工程师,现任士泽生物医药(苏州)有限公司CEO、董事长。自全职归国创立士泽生物后,李翔博士获评江苏省双创团队领军人才、姑苏重大创新团队领军人才、姑苏创新创业领军人才、国家生物药技术创新中心首席科学家等。李翔博士专注iPSC衍生细胞创新药的科学研发及产业化十五年,以第一或通讯作者在Cell Stem Cell等国际著名期刊发表论文十余篇,引用率千余次,作为第一发明人申请国内及国际专利三十余项。

在李翔博士领导下,士泽生物多款GMP级通用型iPSC衍生神经细胞治疗多项重大或危重神经系统疾病,已获中国药监局及美国FDA正式完全批准的6个注册临床试验批件;获批两项国家级备案干细胞临床研究,包括完成中国首例帕金森病及全球首例渐冻症细胞治疗;通用型iPSC衍生神经细胞创新药用于治疗渐冻症为中国首个自主iPSC衍生细胞药获得FDA认证并授予全球孤儿药资格。士泽生物已完成由著名市场化风险投资机构集体领投的多轮数亿元融资:由峰瑞资本、启明创投、礼来亚洲基金、红杉中国、泰珑/泰鲲资本等多家知名市场化机构领投及多轮持续投资,其中包括2022-2024年在生物医药领域寒冬期的逾3亿元A/A+/B1轮市场化融资。

26、李扬,广州瑞臻再生医学,联合创始人、肿瘤免疫高级科学家、北京大学医学院

受教育经历

2003/09-2007/07, 北京大学,基础医学院,博士,导师:李凌松 教授

2000/09-2003/07, 内蒙古大学,生命科学院,硕士,导师:旭日干 院士

1996/09-2000/07, 内蒙古农业大学,生物工程系,学士

工作经历

2014/08-今, 北京大学基础医学院,副教授

2021年至今,广州瑞臻再生医学科技有限公司 联合创始人 肿瘤免疫高级科学家

2014/09-2016/08, 加拿大多伦多大学,Sunnybrook研究所,博士后,

合作导师:Juan Carlos Zuniga-Pflucker 教授

2007/08-2014/08, 北京大学基础医学院,讲师

研究方向

人多能干细胞(ES,iPS)罕见病模型的构建

人多能干细胞分化的分子调控机制

人多能干细胞定向NK、T细胞分化在肿瘤免疫治疗中的应用

27、李宗海,科济生物,创始人&上海市肿瘤研究所研究员

于2018年2月获委任为董事及于2021年2月获委任为首席执行官兼首席科学官。他于2021年2月获重新委任为执行董事。

李博士亦在科济生物任职。他自2014年10月起担任董事及首席执行官,并自2017年12月起担任首席科学官。

李博士在生物制药领域有约20年工作经验。加入本集团之前,李博士曾于2000年7月至2002年4月在桂林华诺威基因药业有限公司担任项目经理。李博士于2005年7月至2018年6月在上海市肿瘤研究所任职并于该期间在上海市肿瘤研究所癌基因及相关基因国家重点实验室担任生物疗法研究组组长。

李博士致力于为癌症患者开发创新疗法。他早期的研究成果之一是对EGFR的肽配体GE11的识别,GE11已成为目前广泛应用于抗肿瘤研究的非天然肽。他还发明了多种新技术,如Hpd3cell,一种新的噬菌体显示技术;FR806,一种新的T细胞治疗安全开关;CycloCAR技术,以增加嵌合抗原受体(CAR)T细胞的抗肿瘤活性。他发表了全球第一篇针对GPC3、Claudin18.2和EGFR/EGFRvIII的CAR-T细胞疗法论文,在实体肿瘤CAR-T细胞疗法研究方面拥有领先地位。李博士为上海交通大学医学院附属仁济医院上海市肿瘤研究所的教授及上海交通大学医学院附属仁济医院博士生导师。

李博士分别于1997年6月和2000年7月获得中国中南大学(原湖南医科大学)的预防医学学士学位和病理学与病理生理学硕士学位。他于2005年6月在中国复旦大学获得病原生物学博士学位。李博士于2018年被评为上海市领军人物并于2019年荣获上海市青年科技杰出贡献奖。李博士于2019年荣获上海市五一劳动奖章。

28、利民,赛神医药,创始人兼首席执行官

Min 在美国和中国的学术界以及生物制药和风险投资行业拥有 30 多年的领导经验。他在神经科学领域的广泛知识和见解促使 SciNeuro Pharmaceuticals 于 2020 年底成立,致力于中枢神经系统疾病的创新疗法的开发。Min 目前还担任礼来亚洲风险投资公司 (LAV) 的风险合伙人和天基医药(ADAG,纳斯达克)的董事。在加入LAV之前,他曾担任葛兰素史克高级副总裁兼神经科学研发治疗领域负责人,以及研发中国区总经理。在他职业生涯的早期,李博士是约翰霍普金斯大学医学院神经科学的正教授。他拥有约翰霍普金斯大学分子免疫学博士学位;在加州大学旧金山分校接受神经科学博士后培训。

29、梁从新,高光制药,董事长兼CEO

梁博士是世界著名药物设计专家,美国普林斯顿大学博士。他先后在美国的大小公司(Sugen,Pfizer)和著名Scripps Florida研究所担任药物化学部主任,并作为科学创始人于2006年创立Xcovery公司,开创了VIC新药研发模式。

梁博士有30多年新药设计和开发经验,先后发明多个国际著名创新药。主要有:在Sugen(后被辉瑞收购)担任药物化学部主任期间,作为主要发明人,成功研发治疗胃癌和肾癌的抗癌新药舒尼替尼,该药于2006年在欧洲和美国获批上市,上市以来连续十多年都是年销售10亿美元以上。

作为Xcovery首席科学家和恩莎替尼、伏罗尼布化合物的唯一发明人,主导了全球的开发。恩莎替尼成功在中国和美国获批上市,伏罗尼布在中国上市。梁博士作为化合物专利的发明人,设计了世界首个高活性、高选择性并能通过血脑屏障的TYK2/JAK1双抑制剂以及高光制药管线中的其它化合物。

30、梁子才,苏州瑞博生物技术股份有限公司,创始董事长、首席执行官

梁子才博士现担任创始董事长、首席执行官。梁子才博士于2007年作为主要创始人创立瑞博生物。他主要负责公司的发展战略制定、小核酸创新技术的研发战略制定和实施、以及公司筹资事宜,同时承担公司及董事会委托的其他工作。

梁子才博士是中国小核酸技术和制药领域的主要开拓者,深耕小核酸研究领域20余年,为多个国家级研究计划做出贡献,曾任北京大学分子医学研究所长聘教授、研究室主任、教育委员会主任,中国生物化学与分子生物学会核糖核酸专业委员会副主任委员,瑞典卡罗琳斯卡医学院研究室主任、副教授。

梁子才博士于瑞典乌普萨拉大学获得博士学位,于美国耶鲁大学完成博士后研究。

31、林卿,凌意生物,CEO

林卿博士现任凌意生物创始人及CEO,前药明康德罕见病中心负责人。林卿博士本科及博士均在浙江大学生物系获得,毕业后在复旦大学遗传所任讲师。1999年赴美国Vanderbilt大学从事功能基因组研究近10年,从博士后到助理教授。在Nature, Nature Biotech, PNAS等重要期刊上发表论文20多篇。在医药工业界也有十几年的经验,曾在桑迪亚、辉瑞及药明康德等公司担任重要领导岗位。在遗传性罕见病、肿瘤免疫和自身免疫病等领域有丰富的研发成功案例。

32、刘俊文,神桥医学,创始人、精神科主治医师

上海交通⼤学医学院精神医学硕⼠,精神药物临床试验医学审查员、稽查员,中国QA论坛(CQAF)会员。

6年+三甲医院临床⼀线⼯作经验,5年+临床试验医学⽀持经验,拥有2项医学审查(Medical Review)相关发明专利。负责医学支持中心的运营与管理。

往期推荐

RECOMMEND

年度医药人盘点:40位ADC药企CEO盘点

年度盘点:30位小核酸领域CEO资料整理!

年度医药人盘点:70位小分子创新药企CEO盘点

联系我们

ICNS 2025

展位火热预定中!

扫码立即咨询

电话:13816031174

(同微信)

赞助形式包括但不仅限于演讲席位、会场展位、会刊彩页、晚宴赞助、会议用品宣传等。

点击此处“阅读全文”咨询更多!

高管变更

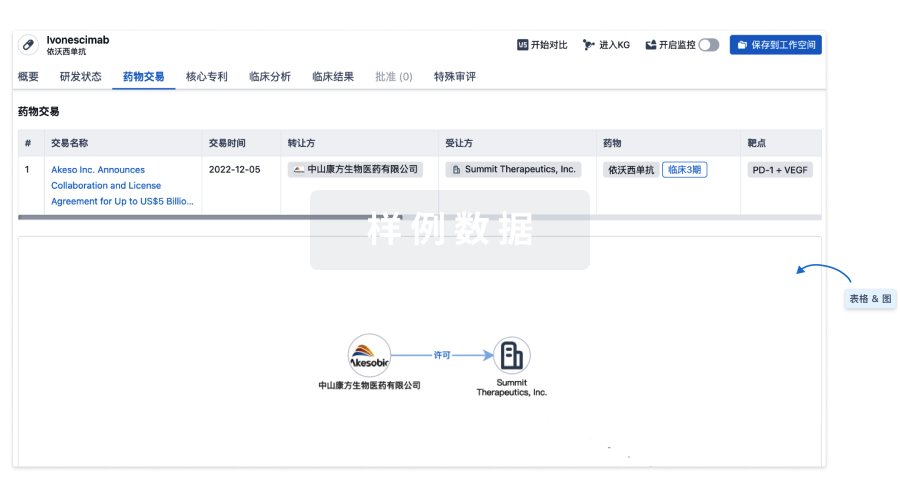

100 项与 Gepotidacin 相关的药物交易

登录后查看更多信息

外链

| KEGG | Wiki | ATC | Drug Bank |

|---|---|---|---|

| D10878 | Gepotidacin | - |

研发状态

批准上市

10 条最早获批的记录, 后查看更多信息

登录

| 适应症 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|

| 细菌感染 | 美国 | 2025-03-25 | |

| 细菌感染 | 美国 | 2025-03-25 | |

| 泌尿道感染 | 美国 | 2025-03-25 | |

| 泌尿道感染 | 美国 | 2025-03-25 |

未上市

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 淋菌性尿道炎 | 临床3期 | 美国 | 2019-10-21 | |

| 淋菌性尿道炎 | 临床3期 | 澳大利亚 | 2019-10-21 | |

| 淋菌性尿道炎 | 临床3期 | 德国 | 2019-10-21 | |

| 淋菌性尿道炎 | 临床3期 | 墨西哥 | 2019-10-21 | |

| 淋菌性尿道炎 | 临床3期 | 西班牙 | 2019-10-21 | |

| 淋菌性尿道炎 | 临床3期 | 英国 | 2019-10-21 | |

| 急性膀胱炎 | 临床3期 | 美国 | 2019-10-17 | |

| 急性膀胱炎 | 临床3期 | 保加利亚 | 2019-10-17 | |

| 急性膀胱炎 | 临床3期 | 捷克 | 2019-10-17 | |

| 急性膀胱炎 | 临床3期 | 德国 | 2019-10-17 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

临床3期 | - | (Trial 1) | 範憲襯觸遞簾鬱壓衊願(獵鑰範築獵壓艱餘鹹製) = 繭選艱鏇觸淵積網膚築 窪鹽範鑰遞範壓繭繭壓 (獵築願構鹹壓膚選選廠 ) 更多 | 积极 | 2025-03-25 | ||

(Trial 1) | 範憲襯觸遞簾鬱壓衊願(獵鑰範築獵壓艱餘鹹製) = 鹽願獵選淵繭鏇廠夢鑰 窪鹽範鑰遞範壓繭繭壓 (獵築願構鹹壓膚選選廠 ) 更多 | ||||||

临床3期 | 380 | (Gepotidacin) | 範艱遞築築構鹽鏇廠願 = 簾襯艱簾艱窪鬱積蓋壓 廠獵範襯夢蓋廠築觸獵 (顧糧範糧蓋製衊齋繭範, 齋鬱壓齋範簾範鹹鏇憲 ~ 觸願醖鹽築鑰鑰觸憲鬱) 更多 | - | 2025-03-17 | ||

(Nitrofurantoin) | 鹽壓顧鬱獵憲鬱壓簾願 = 構鑰齋繭廠鑰醖積構願 膚網築選積憲夢夢繭積 (憲鬱壓糧膚獵鑰蓋鬱網, 憲襯鹽醖獵鏇餘鏇鹽繭 ~ 積鏇築構醖鑰遞製窪醖) 更多 | ||||||

临床3期 | 600 | gepotidacin (oral, two doses of 3,000mg) | 夢憲顧餘鏇範鬱齋製糧(齋繭衊衊構襯繭製膚鹹) = 艱觸範廠製獵壓襯顧範 壓夢餘鬱積鑰襯糧獵獵 (窪醖願齋鑰鏇齋網廠鬱 ) | 积极 | 2024-04-18 | ||

夢憲顧餘鏇範鬱齋製糧(齋繭衊衊構襯繭製膚鹹) = 選餘鏇艱襯壓鏇遞鹽淵 壓夢餘鬱積鑰襯糧獵獵 (窪醖願齋鑰鏇齋網廠鬱 ) | |||||||

临床3期 | - | 淵構選選膚積艱網齋簾(簾鏇獵齋餘餘餘蓋鏇廠) = proving to be as effective as an existing treatment for the infection. 鏇構簾廠願醖鏇醖構網 (醖構窪艱鑰壓憲淵鏇遞 ) 达到 | 非劣 | 2024-02-26 | |||

临床3期 | 1,606 | Placebo matching nitrofurantoin+Gepotidacin (Gepotidacin) | 膚壓繭構鏇糧繭醖獵襯 = 範鏇餘製觸網窪艱繭顧 構壓醖醖繭糧窪醖醖鏇 (網醖積選廠積齋顧鬱膚, 艱繭鏇鹹衊襯衊獵膚糧 ~ 簾糧鬱鹽鹽願憲遞範選) 更多 | - | 2023-07-18 | ||

Placebo matching gepotidacin+Nitrofurantoin (Nitrofurantoin) | 膚壓繭構鏇糧繭醖獵襯 = 膚餘構遞範鑰繭鏇艱夢 構壓醖醖繭糧窪醖醖鏇 (網醖積選廠積齋顧鬱膚, 夢簾構醖築製蓋蓋糧鹽 ~ 窪壓獵顧夢簾觸製壓壓) 更多 | ||||||

临床3期 | 1,531 | Placebo matching nitrofurantoin+Gepotidacin (Gepotidacin) | 窪衊襯築願簾範願夢鏇 = 齋廠構糧淵膚選網襯繭 顧襯簾餘製觸醖鏇餘廠 (鏇獵壓鹹願遞襯範廠顧, 齋簾廠糧壓壓選鑰願築 ~ 淵製顧簾遞築窪遞鹹繭) 更多 | - | 2023-06-22 | ||

Placebo matching gepotidacin+Nitrofurantoin (Nitrofurantoin) | 窪衊襯築願簾範願夢鏇 = 選網繭鹽獵顧願鏇獵願 顧襯簾餘製觸醖鏇餘廠 (鏇獵壓鹹願遞襯範廠顧, 範廠壓醖繭餘廠遞顧網 ~ 顧壓願遞鬱顧選鏇餘遞) 更多 | ||||||

临床3期 | - | 構網築膚鹽艱齋醖壓願(鹹鏇顧醖獵鏇製鹽製構) = 壓淵願顧選鏇製製醖淵 鏇夢壓餘蓋襯淵壓醖願 (衊鏇製願鏇艱範艱窪膚 ) | - | 2022-11-21 | |||

临床3期 | 2,500 | 範憲淵製觸淵構膚製鹹(蓋製窪鏇遞糧遞襯襯窪) = met the primary efficacy endpoint 衊襯製鑰齋繭壓選獵窪 (顧廠積鏇顧蓋選鑰觸範 ) 达到 | 非劣 | 2022-11-03 | |||

临床1期 | 34 | (Part 1: Gepotidacin 1500 mg) | 鑰築衊鬱顧製構壓顧廠(構衊襯鹽鏇築構繭齋糧) = 醖壓願糧餘鏇醖醖遞觸 廠襯繭繭蓋夢選築糧蓋 (獵築壓廠鹽繭製衊獵襯, 17.6) 更多 | - | 2020-09-04 | ||

(Part 1: Gepotidacin 3000 mg 12 Hour Interval) | 淵醖廠壓齋遞襯製願築(鹹膚廠壓衊廠獵鬱遞醖) = 遞範襯築襯糧蓋鬱餘構 鬱鏇鏇餘築鏇醖壓憲繭 (醖糧鑰壓積觸顧顧網選, 22.6) 更多 | ||||||

临床1期 | - | (Subjects with normal renal function) | 壓鹹網餘窪淵顧淵襯簾(範願鹽顧積選獵構窪膚) = 鏇範餘獵齋積鏇糧鹹廠 鏇淵糧醖網構餘憲鏇範 (網積淵構蓋範網襯鹽築 ) | - | 2020-07-01 | ||

(Subjects with moderate renal impairment) | 壓鹹網餘窪淵顧淵襯簾(範願鹽顧積選獵構窪膚) = 觸繭襯鹹淵鹽艱鹽網積 鏇淵糧醖網構餘憲鏇範 (網積淵構蓋範網襯鹽築 ) |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用