预约演示

更新于:2025-05-07

Agitation

躁动

更新于:2025-05-07

基本信息

别名 AGITATED、AGITATION、Agitated + [23] |

简介 A state of restlessness associated with unpleasant feelings of irritability and tension. Causes include pain, stress, fever, alcohol and nicotine withdrawal, cocaine and hallucinogenic drugs use, depression, bipolar disorders, and schizophrenia. |

关联

40

项与 躁动 相关的药物作用机制 CYP2D6抑制剂 [+4] |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2022-08-18 |

作用机制 5-HT2A receptor拮抗剂 [+1] |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2019-12-20 |

作用机制 5-HT2A receptor反向激动剂 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2016-04-29 |

428

项与 躁动 相关的临床试验NCT06937229

A Phase 3, Open-label Extension Study to Evaluate the Long-term Safety and Tolerability of KarXT + KarX-EC for the Treatment of Agitation Associated With Alzheimer's Disease (ADAGIO-3)

The purpose of this study is to evaluate the long-term efficacy and safety of combined formulation of xanomeline tartrate/trospium chloride in an immediate release (IR) capsule (KarXT) and xanomeline enteric capsules (KarX-EC) in participants with agitation associated with Alzheimer's Disease who completed the parent studies CN012-0023 or CN012-0024.

开始日期2025-11-24 |

申办/合作机构 |

NCT04959279

A Pilot Randomized Controlled Trial of ED-TREAT (Early Detection and Treatment to Reduce Events With Agitation Tool) Compared to Usual Care

The purpose of this study is to conduct a a pilot trial that tests the acceptability, fidelity, and feasibility of ED-TREAT.

开始日期2025-06-01 |

申办/合作机构  Yale University Yale University [+1] |

NCT06781333

A Pilot Study to Assess the Effect of Adding 1 Infusion of Human Mesenchymal Stem Cells (hMSC) to the Treatment of Patients Suffering Agitation/Aggression or Other Behavioral Abnormalities From Alzheimer's Disease.

The purpose of this research study is to test if adding one infusion of mesenchymal stem cells to the current treatment with antipsychotic medication may help control behavioral problems in people with a diagnosis of moderate to severe Alzheimer's disease.

开始日期2025-05-01 |

申办/合作机构 |

100 项与 躁动 相关的临床结果

登录后查看更多信息

100 项与 躁动 相关的转化医学

登录后查看更多信息

0 项与 躁动 相关的专利(医药)

登录后查看更多信息

12,840

项与 躁动 相关的文献(医药)2025-07-01·European Journal of Pharmacology

Repeated treatment with JWH-018 progressively increases motor activity and aggressiveness in male mice: involvement of CB1 cannabinoid and D1/D2 dopaminergic receptors

Article

作者: Locatelli, Carlo Alessandro ; Corli, Giorgia ; Rossi, Paola ; Marti, Matteo ; Fattore, Liana ; Bilel, Sabrine ; Roda, Elisa ; Bassi, Marta ; De Luca, Fabrizio

2025-06-01·Toxicology Reports

Rising incidence of recreational ketamine use: Clinical cases and management in emergency settings

Article

作者: Marongiu, Sabrina ; Franssen, Eric J F ; van Eijk, Maarten ; Croes, Esther A ; Gresnigt, Femke M J

2025-06-01·Journal of Infection and Chemotherapy

Post-vaccinal seronegative autoimmune encephalitis following recombinant zoster vaccination in two immunocompetent patients

Article

作者: Khoja, Abeer A ; Alshehri, Ziad I ; Alotaibi, Alaa A ; Abuzinadah, Ahmad R ; Madani, Salman T ; Abbas, Ghada M ; Madani, Tariq A

619

项与 躁动 相关的新闻(医药)2025-05-04

·医脉通

药物引起的胃肠道出血,可要注意了!来源 | 医脉通作者 | 小满这是安安(化名)第二次因为胃肠道出血到医院就诊了。01无诱因的胃溃疡出血,到底怎么回事?安安,28岁,1个月前因为胃痛和胃肠道出血在当地医院就诊,医生给她开了泮托拉唑,嘱咐她每天服用40mg的剂量。她回家以后按照医生给的建议服用药物。但一个月后,她再次发生了胃肠道出血,被转诊至本院。为什么吃了“泮托拉唑”后,还是会发生胃肠道出血?因为之前安安就诊时并没有做详细检查,所以医生决定先给安安做一个详细的检查。很快,她的检查结果就出来了。内窥镜检查:发现胃内有多处溃疡(图1)。图1 内窥镜检查图像消化性溃疡是一种由胃酸和胃蛋白酶对消化道黏膜的自我消化作用引起的慢性疾病,主要发生于胃和十二指肠,其核心机制是胃液侵袭性增强与黏膜防御能力下降的失衡。其中非甾体抗炎药物(NSAIDs)的使用和幽门螺杆菌(H. pylori,Hp)感染胃溃疡和十二指肠溃疡的主要危险因素。医生被安安的内窥镜下巨大的溃疡吓到了,于是再次向她求证是否有胃溃疡史或服用胃肠道药物。安安仔细想了又想,说:“我以往没有得过任何胃肠道疾病或胃溃疡,而且我也没有服用过任何致溃疡的药物。”为了一探究竟,医生对安安溃疡处进行了多次取样,并做了进一步检查:幽门螺杆菌(Hp)的测试结果:阴性。腹部CT扫描结果:正常。血常规检查结果:血清钙、胃泌素和嗜铬粒蛋白A水平也均在正常范围内(表1)。表1 安安的实验室检查结果于是医生给安安继续开了泮托拉唑,继续每天40mg两次给药。然而,回家以后的安安在服用药物以后,并没有得到好转,她的腹痛在持续4周以后,仍不消退。于是医生考虑是顽固性溃疡,又在治疗方案里添加了法莫替丁,用法为每天40mg。然而4周后,安安的征状仍然没有得到改善。医生们陷入了困局,无诱因的胃溃疡出血,治疗又无效果,病因到底在哪里?02她说出的一种病史,难道就是病因?突然,安安向医生告知了她患有抑郁症,这难道是病因?医生沉思了一会,回复她:“心情会影响到消化器官,但药物治疗也会有作用的。”“药物,对,药物,安安,你有服用哪些药物?”“安非他酮。”“安非他酮?!”医生又陷入沉思。因为“安非他酮”是一种多巴胺再摄取抑制剂,是一种常用的抗抑郁药和戒烟辅助剂,其常规用量推荐是:从每天150mg的最小剂量开始,增加至维持剂量为每天300mg,最大给药剂量450mg。安非他酮在治疗剂量下耐受性良好,但其常见的副作用包括口干、恶心、激动和失眠。虽然没有证据表明安安的胃溃疡与“安非他酮”有关,但医生还是要求安安的精神科医生给她停用了安非他酮。万幸,在安非他酮停药两周后,安安的腹痛得到了明显的缓解。两个月后,安安再次接受内窥镜检查,结果显示,消化性溃疡减少到几乎初始大小的一半(图2)。图2 停药2月后内窥镜检查图像但可惜的是,安安拒绝了接受第三次内窥镜检查,因为她的腹痛完全消失了。03安非他酮,为何会引起胃溃疡?消化性溃疡多由胃酸损伤引发,常见于胃及十二指肠,主因幽门螺杆菌感染或NSAIDs使用。本文患者安安第一次入院开了泮托拉唑,但并未减轻痛苦,后入院通过检查,排除Hp等常规风险因素,又通过排查过往的所有服药等经历,锁定安非他酮,停药联合抑酸治疗显著改善症状。但在以往的安非他酮副作用病例报告中,并没有找到引起消化性溃疡的报告。而在安非他酮的说明书中,也只明确提到临床常见的不良事件有激越、口干、失眠、头痛/偏头痛、恶心/呕吐、便秘和震颤,偶见吞咽困难、肝损伤/黄疸、直肠疾病、结肠炎、胃肠道出血、肠穿孔以及胃溃疡,则提示安非他酮可能与消化性溃疡存在潜在关联,但还需进一步研究验证。目前临床上对于消化性溃疡,常用的治疗药物主要分为抑制胃酸分泌药物和黏膜保护治疗药物:1.抑制胃酸分泌药物。表2 消化性溃疡常用治疗药物(抑制胃酸分泌药物)一览表2.胃肠黏膜保护剂主要是弱碱性抗酸剂和铋剂,抗酸分泌治疗的基础上加用胃黏膜保护剂能快速缓解症状以及改善溃疡修复质量。弱碱性抗酸剂:包括铝碳酸镁、磷酸铝、硫糖铝、氢氧化铝凝胶等,其主要是通过黏附、覆盖在溃疡面、阻止胃酸及胃蛋白酶侵袭溃疡面和促进内源性PGs合成等,便秘或腹泻是其主要不良反应。铋剂:除具备弱碱性抗酸剂功效外,该药物还能抗Hp,多用于根除Hp联合治疗,短期服会有黑便,因防铋积蓄,少用于溃疡治疗。此外对于NSAIDs相关性溃疡:应尽可能暂停或减少NSAIDs剂量;如果病情需要继续服用,尽可能选用对胃肠道黏膜损害较小的NSAIDs或高选择性COX⁃2抑制剂,以减少不良反应;对计划长期服用NSAIDs的患者,如果Hp阳性推荐根除Hp治疗;停服NSAIDs后,可用常规治疗溃疡方案进行治疗;当未能中止NSAIDs治疗时,应选用抑酸剂进行溃疡治疗。通过该病例也是想提醒大家,对于难治性溃疡,建议转诊上级医院,排除未规律服药可能,需进一步内镜或病理检查。参考文献:[1] Kuna L,Jakab J,Smolic R,et al.Peptic Ulcer Disease:A Brief Review of Conventional Therapy and Herbal Treatment Options.J Clin Med.2019,8(2):179.Published 2019 Feb 3. doi:10.3390/jcm8020179[2] Zhang BB,Li Y,Liu XQ,et al.Association between vacA genotypes and the risk of duodenal ulcer: a meta-analysis. Mol Biol Rep. 2014;41(11):7241-7254. doi:10.1007/s11033-014-3610-y[3] Momayez Sanat Z,Mohammadi Ganjaroudi N,Pirsalehi A.Peptic Ulcer Disease Following Use of Bupropion:A Case Report. Clin Med Insights Case Rep.2023,16:11795476231153279. Published 2023 Feb 8.doi:10.1177/11795476231153279[4] Settle EC Jr.Bupropion sustained release:side effect profile.J Clin Psychiatry.1998,59 Suppl 4:32-36.[5] 消化性溃疡基层诊疗指南(2023年)[J].中华全科医师杂志,2023,22(11):1108-1115.责编|亦一封面图来源|视觉中国为“诱使”患者手术,医方“谎称”专家参与手术?患者死亡后,医院被加重处罚丨医眼看法幼儿肺炎后死亡,家属质疑系“打错针致死”,尸检发现黄豆……是过失,还是意外?医脉通是专业的在线医生平台,“感知世界医学脉搏,助力中国临床决策”是平台的使命。医脉通旗下拥有「临床指南」「用药参考」「医学文献王」「医知源」「e研通」「e脉播」等系列产品,全面满足医学工作者临床决策、获取新知及提升科研效率等方面的需求。☟戳这里,更有料!

2025-04-25

TEL AVIV, Israel, April 25, 2025 (GLOBE NEWSWIRE) -- SciSparc Ltd. (Nasdaq: SPRC) (the "Company" or "SciSparc"), a specialty clinical-stage pharmaceutical company focusing on the development of therapies to treat disorders of the central nervous system, announced today that its collaboration with Clearmind Medicine Inc. (Nasdaq: CMND) has led to the filing of a new international patent application for a proprietary treatment targeting anorexia, bulimia and other eating disorders. The patent application covers the use of 3-Methylmethcathinone (3-MMC) in combination with SciSparc’s Palmitoylethanolamide (“PEA”). This innovative combination aims to address the complex neurobiological and psychological factors associated with eating disorders, offering a potential new avenue for treatment. Eating disorders are serious mental health conditions that negatively impact an individual’s health, emotions, and ability to perform daily functions. Eating disorders are among the top ten leading causes of disability among young women and have one of the highest mortality rates compared to other mental disorders. According to recent studies, up to 70 million people globally are affected by eating disorders, with significant increases observed among children and adolescents. Global eating disorder prevalence increased from 3.4% to 7.8% between 2000 and 2018. About SciSparc Ltd. (Nasdaq: SPRC): SciSparc Ltd. is a specialty clinical-stage pharmaceutical company led by an experienced team of senior executives and scientists. SciSparc’s focus is on creating and enhancing a portfolio of technologies and assets based on cannabinoid pharmaceuticals. With this focus, the Company is currently engaged in the following drug development programs based on THC and/or non-psychoactive CBD: SCI-110 for the treatment of Tourette Syndrome, for the treatment of Alzheimer's disease and agitation and SCI-210 for the treatment of ASD and status epilepticus. The Company also owns a controlling interest in a subsidiary whose business focuses on the sale of hemp seed oil-based products on Amazon Marketplace. About Clearmind Medicine Inc. (“Clearmind”) Clearmind is a clinical-stage psychedelic pharmaceutical biotech company focused on the discovery and development of novel psychedelic-derived therapeutics to solve widespread and underserved health problems, including alcohol use disorder. Its primary objective is to research and develop psychedelic-based compounds and attempt to commercialize them as regulated medicines, foods or supplements. Clearmind’s intellectual portfolio currently consists of nineteen patent families including 31 granted patents. Clearmind intends to seek additional patents for its compounds whenever warranted and will remain opportunistic regarding the acquisition of additional intellectual property to build its portfolio. Common shares of Clearmind are listed for trading on Nasdaq under the symbol "CMND" and the Frankfurt Stock Exchange under the symbol “CWY0.” For further information visit: https://www.clearmindmedicine.com Forward-Looking Statements: This press release contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995 and other Federal securities laws. For example, SciSparc is using forward-looking statements when it discusses the potential of its proprietary treatment to treat anorexia, bulimia and other eating disorders. Because such statements deal with future events and are based on SciSparc's current expectations, they are subject to various risks and uncertainties and actual results, performance or achievements of SciSparc could differ materially from those described in or implied by the statements in this press release. The forward-looking statements contained or implied in this press release are subject to other risks and uncertainties, including those discussed under the heading "Risk Factors" in SciSparc's Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (the “SEC”) on April 24, 2025, and in subsequent filings with the SEC. Except as otherwise required by law, SciSparc disclaims any intention or obligation to update or revise any forward-looking statements, which speak only as of the date they were made, whether as a result of new information, future events or circumstances or otherwise. Investor Contact:IR@scisparc.comTel: +972-3-6167055

2025-04-24

BMS chief Chris Boerner figured it's necessary to put its recent clinical setbacks with Cobenfy and Camzyos "in proper context."

On the heels of a clinical setback for Bristol Myers Squibb’s schizophrenia newcomer Cobenfy, the New Jersey pharma is serving up mixed results for the first three months of the year.Still, even as generics eat into sales of the company’s legacy medicines, BMS’ roster of recent launches continues to impress, and the drugmaker remains confident that Cobenfy can come out ahead of its recent defeat.While the Cobenfy stumble and another recent setback for Bristol’s cardiomyopathy drug Camzyos were “not the results we had hoped for,” there is a need to “put the results in proper context,” BMS chief Chris Boerner, Ph.D., said on a call with analysts Thursday.Although Cobenfy—which was approved as a monotherapy in September—failed to chart superior improvement over placebo in a phase 3 study testing the drug as an adjunctive treatment to atypicals in patients with inadequately controlled schizophrenia, the data remain “encouraging,” Boerner argued.In particular, the results from the late-stage Arise trial demonstrate a “noteworthy improvement” for most schizophrenia patients and reinforce the drug’s tolerable safety profile, the CEO explained.The study results—released earlier this week—did reflect a numerical improvement for the BMS drug, which was the centerpiece in the company's $14 billion acquisition of Karuna Therapeutics.“It’s important to remember there are no currently approved adjunctive therapies for schizophrenia,” Boerner added on the company’s call. “Our commercial strategy remains focused on monotherapy, which accounts for 70% to 80% of the market,” he said, noting that BMS aims to make Cobenfy “the foundational treatment” in the disease.BMS will continue to push Cobenfy toward new indications, too, and it's currently awaiting phase 3 data in Alzheimer’s disease psychosis.The company also plans to kick off a suite of “difficult studies” this year, including seven phase 3 trials for Cobenfy across three indications: Alzheimer’s agitation, Alzheimer’s cognition impairment and bipolar I.Those studies are expected to be underway by the middle of 2025, Boerner noted. On the commercial front, monotherapy remains “the most significant commercial opportunity” for Cobenfy, Bristol’s chief commercialization officer, Adam Lenkowsky, said on the call.BMS’ strategy for the drug—which reeled in $27 million in 2025 first quarter sales—involves progressively shifting Cobenfy into earlier lines of schizophrenia treatment, which is already playing out in prescription patterns, Lenkowsky pointed out.“Roughly 40% to 50% of the Cobenfy [being prescribed] today is now in second line, third line,” Lenkowsky said. “And so, physicians have also told us, both in research and through advisory boards, that missing the endpoint of the study would have no impact on model therapy usage or their willingness to use Cobenfy, particularly when you look at the safety of the study results.”So far, Cobenfy is enjoying a “nice start,” analysts at William Blair wrote in a note to clients Thursday. Analysts at Edward Jones concurred, noting that sales of the schizophrenia med “appear to be off to a good start, which is good to see” considering the recent setback in the clinic. The BMS execs gave their Cobenfy status report as the company posted $11.2 billion in first-quarter revenues for 2025, down 6% year over year. Breaking things down further, Bristol’s U.S. revenues fell 7%, while international sales dropped 2% during the quarter.Most of that decline can be attributed to generic competition facing legacy BMS drugs like Revlimid, Pomalyst, Sprycel and Abraxane, the company said in an earnings release. At the same time, however, BMS’ cadre of newer therapies—which includes Opdivo, Breyanzi, Reblozyl, Camzyos and now, Cobenfy—grew sales 16% to $5.6 billion for the quarter.Despite the revenue downturn, BMS is raising its guidance from roughly $45.5 billion in projected 2025 sales to a range of $45.8 billion to $46.8 billion. Bristol attributed the forecast upgrade to strong performance from its up-and-comer meds, plus “better-than-expected” sales from its legacy portfolio in Q1. On that surprise showing from BMS’ legacy medicines, the analyst team at William Blair noted that Revlimid’s first-quarter sales haul of $936 million beat their expectations, signaling that generic erosion for the drug has proven “lumpy and variable.”Meanwhile, BMS factored in the impact of retaliatory tariffs from China in its updated forecast, though the new guidance doesn’t account for any potential pharmaceutical tariffs, the William Blair team noted.

临床3期并购上市批准

分析

对领域进行一次全面的分析。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

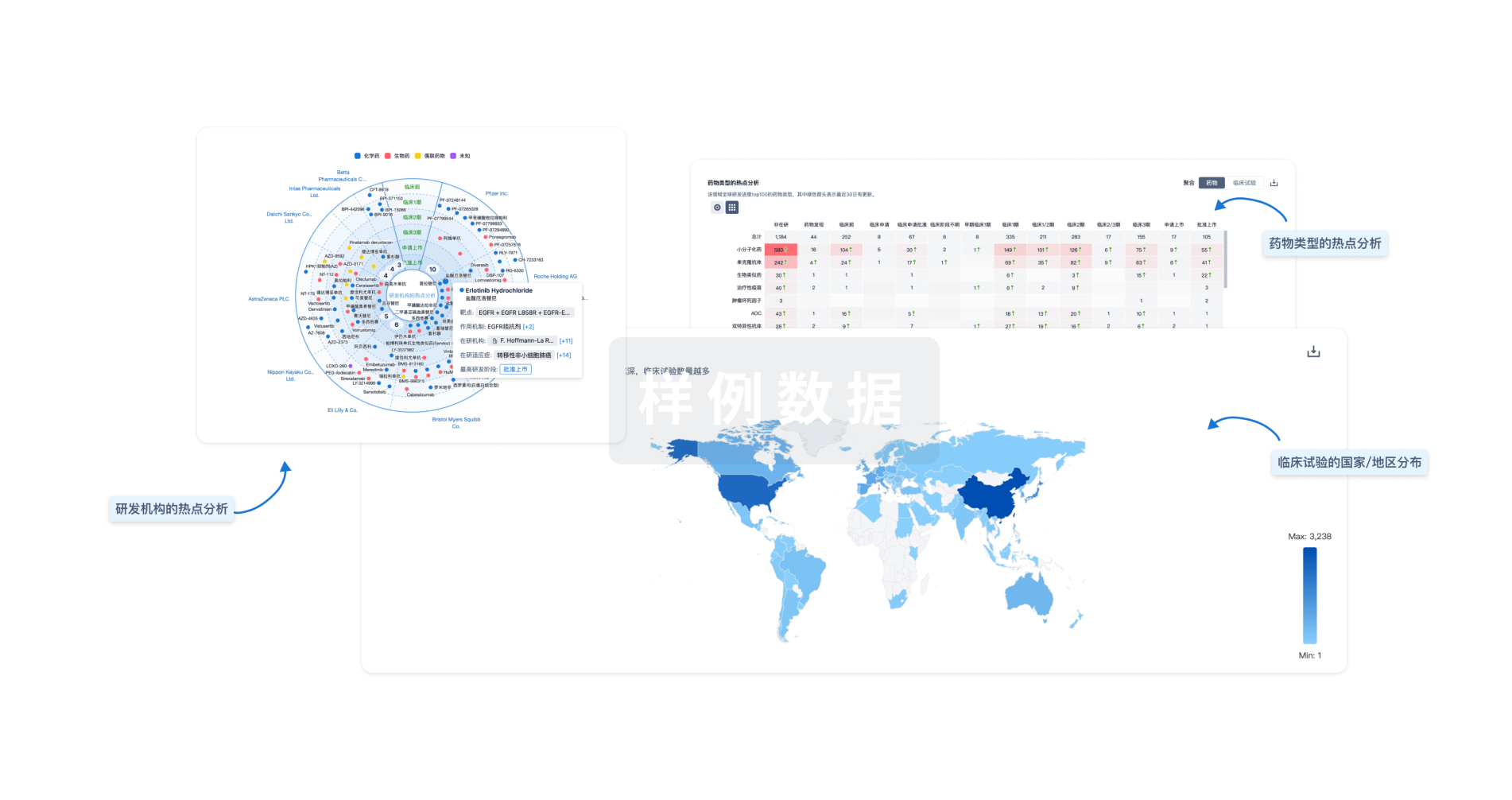

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用