预约演示

更新于:2025-05-07

FGFR2 fusion or rearranged Cholangiocarcinoma

FGFR2融合或重排的胆管癌

更新于:2025-05-07

基本信息

别名- |

简介- |

关联

6

项与 FGFR2融合或重排的胆管癌 相关的药物作用机制 FGFR1拮抗剂 [+2] |

在研机构 |

原研机构 |

在研适应症 |

非在研适应症 |

最高研发阶段批准上市 |

首次获批国家/地区 日本 |

首次获批日期2024-09-24 |

作用机制 FGFR1拮抗剂 [+3] |

在研适应症 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2022-09-30 |

作用机制 FGFR1拮抗剂 [+3] |

在研适应症 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2021-05-28 |

11

项与 FGFR2融合或重排的胆管癌 相关的临床试验NCT06777316

A Phase 1/2 Study of a Selective FGFR2/3 Inhibitor, CGT4859, in Patients With Cholangiocarcinoma and Other Advanced Solid Tumors Harboring FGFR2 and/or FGFR3 Genetic Alterations

This is an open-label, phase 1/2 study evaluating the safety, tolerability, pharmacokinetic (what the body does to the drug), pharmacodynamic (what the drug does to the body), and antitumor activity of CGT4859 in adult participants with intrahepatic cholangiocarcinoma (iCCA) or other advanced solid tumors with FGFR2 and/or FGFR3 genetic alternations.

开始日期2025-01-22 |

申办/合作机构 |

NCT06439485

Phase I/II Trial of Pemigatinib in Combination With Atezolizumab and Bevacizumab for Treatment of Advanced Cholangiocarcinoma With FGFR2 Fusion

To learn if pemigatinib in combination with atezolizumab and bevacizumab can help to control cholangiocarcinoma.

开始日期2024-11-19 |

NCT05727176

Phase 2 Study of Futibatinib 20 mg and 16 mg in Patients With Advanced Cholangiocarcinoma With FGFR2 Fusions or Rearrangements

This is an open-label, multinational, randomized Phase 2 study confirming the clinical benefit of 20 mg futibatinib and evaluating the safety and efficacy of 16 mg futibatinib in previously treated CCA harboring FGFR2 gene fusions and other rearrangements.

开始日期2023-07-05 |

申办/合作机构 |

100 项与 FGFR2融合或重排的胆管癌 相关的临床结果

登录后查看更多信息

100 项与 FGFR2融合或重排的胆管癌 相关的转化医学

登录后查看更多信息

0 项与 FGFR2融合或重排的胆管癌 相关的专利(医药)

登录后查看更多信息

8

项与 FGFR2融合或重排的胆管癌 相关的文献(医药)2025-04-01·Annals of Oncology

Genomic correlates of response and resistance to the irreversible FGFR1-4 inhibitor futibatinib based on biopsy and circulating tumor DNA profiling

Article

作者: Goyal, L ; Okamura, S ; DiToro, D ; Meric-Bernstam, F ; Hollebecque, A ; Bridgewater, J A ; Kano, A ; Silhavy, J L ; Halim, A ; Shimura, M ; Wacheck, V

2023-11-02·The Oncologist

Futibatinib, an Irreversible FGFR1-4 Inhibitor for the Treatment ofFGFR-Aberrant Tumors

Review

作者: Javle, Milind ; King, Gentry ; Spencer, Kristen ; Borad, Mitesh J

2023-09-01·Heliyon

Fibroblast growth factor receptors as targets for anticancer therapy in cholangiocarcinomas and urothelial carcinomas

Review

作者: Joeun Choe, Joanna ; Scartozzi, Mario ; Wekking, Demi ; D'Agata, Alessandra Pia ; Denaro, Nerina ; Solinas, Cinzia ; Martella, Serafina ; Pretta, Andrea

17

项与 FGFR2融合或重排的胆管癌 相关的新闻(医药)2024-12-03

Global licensing agreement grants Elevar Therapeutics worldwide rights to develop and commercialize lirafugratinib (RLY-4008) Lirafugratinib is a potential best-in-class FGFR2 inhibitor that has shown differentiated efficacy in FGFR2-driven cholangiocarcinoma and demonstrated durable responses across multiple other types of FGFR2-altered solid tumors Relay Therapeutics has potential to receive up to $500 million in upfront, regulatory and commercial milestone payments, including $75 million in upfront and regulatory milestones, plus up to double digit royalties on global sales CAMBRIDGE, Mass. and FORT LEE, N.J., Dec. 03, 2024 (GLOBE NEWSWIRE) -- Relay Therapeutics, Inc. (Nasdaq: RLAY), a clinical-stage precision medicine company transforming the drug discovery process by combining leading-edge computational and experimental technologies, and Elevar Therapeutics, Inc., a majority-owned subsidiary of HLB Co., Ltd. and fully integrated biopharmaceutical company dedicated to elevating treatment outcomes for patients who have limited or inadequate therapeutic options, today announced an exclusive global licensing agreement for lirafugratinib (RLY-4008). Lirafugratinib is a selective oral small molecule inhibitor of fibroblast growth factor receptor 2 (FGFR2) that is being developed for patients with FGFR2-driven cholangiocarcinoma (CCA) and other FGFR2-altered solid tumors. The announcement of the partnership follows Relay’s recent positive FDA interaction and previously reported differentiated data in cholangiocarcinoma and data across other solid tumors. “Data to-date show that lirafugratinib has the potential to be an important novel medicine for patients with FGFR2-driven cholangiocarcinoma and other FGFR2-altered solid tumors. We are pleased that Elevar will continue its development and leverage their growing commercial capabilities to bring it to patients in need around the world,” said Sanjiv Patel, M.D., President and Chief Executive Officer of Relay Therapeutics. “As a result of this agreement, we are able to remain fully focused on continuing to advance our PI3Kα programs, including initiating the RLY-2608 2L breast cancer pivotal trial and vascular malformations trial next year.” “Lirafugratinib is an NDA-ready therapy that has shown a potential best-in-class profile in both FGFR2-driven cholangiocarcinoma and in other FGFR2-altered solid tumors including in advanced stages where treatment options are limited,” said Saeho Chong, Ph.D., chief executive officer of Elevar Therapeutics. “We are excited to diversify and expand our late-stage oncology pipeline with lirafugratinib, which is a strong strategic fit with our existing oncology portfolio and provides another opportunity to advance our mission of bringing life-changing medicines to cancer patients worldwide.” Lirafugratinib was granted breakthrough therapy designation and orphan drug designation by the FDA. Lirafugratinib is being investigated in the global ReFocus trial in patients with FGFR2-altered tumors. The study includes a pivotal cohort in patients with FGFR2-fusion CCA that was designed to support accelerated approval and is fully enrolled. Interim data from this cohort were presented at the European Society for Medical Oncology Congress in 2022. The study also includes cohorts in patients with other types of solid tumors, including gastric, pancreatic, and head and neck tumors. Interim data from these cohorts were presented at the AACR-NCI-EORTC International Conference on Molecular Targets and Cancer Therapeutics in 2023 and 2024. Earlier in 2024, Relay Therapeutics met with the U.S. Food and Drug Administration (FDA) to discuss data from the ReFocus trial and potential regulatory pathways. The FDA recommended that the company first file an NDA for FGFR2-driven CCA, followed by a supplemental NDA for FGFR2-altered other solid tumors with data from an expanded cohort of patients. Cholangiocarcinoma (CCA) or bile duct cancer is a rare disease in which malignant cells form in the bile ducts. Approximately 8,000 people in the United States are diagnosed with CCA each year. Terms of the Agreement Under the terms of the agreement, Elevar will be granted global development and commercialization rights for lirafugratinib. Elevar will assume full responsibility for all further development activities, including submission of the NDAs, all subsequent clinical development, and global commercialization for FGFR2-driven CCA and FGFR2-altered other solid tumors. Relay Therapeutics is eligible to receive up to $75 million in upfront and regulatory milestones, plus up to $425 million in potential commercial milestone payments, as well as tiered royalties up to the low-teens percentage. Moelis & Company LLC is serving as exclusive financial advisor to Relay Therapeutics in the transaction. Goodwin Procter LLP is serving as exclusive legal advisor to Relay Therapeutics in the transaction. About Lirafugratinib Lirafugratinib (RLY-4008) is a potent, selective and oral small molecule inhibitor of FGFR2, a receptor tyrosine kinase that is frequently altered in certain cancers. FGFR2 is one of four members of the FGFR family, a set of closely related proteins with highly similar protein sequences and properties. Preclinically, lirafugratinib demonstrated FGFR2-dependent killing in cancer cell lines and induced regression in in vivo models with minimal inhibition of other targets, including other members of the FGFR family. In addition, lirafugratinib demonstrated strong activity against known clinical on-target resistance mutations in cellular and in vivo preclinical models. Lirafugratinib is currently being evaluated in a clinical trial in patients with advanced or metastatic FGFR2-altered solid tumors with a single arm, potentially registration-enabling cohort for FGFRi-naïve FGFR2-fusion CCA. To learn more about the clinical trial of lirafugratinib, please visit here. About Relay Therapeutics Relay Therapeutics is a clinical-stage precision medicine company transforming the drug discovery process by combining leading-edge computational and experimental technologies with the goal of bringing life-changing therapies to patients. As the first of a new breed of biotech created at the intersection of complementary techniques and technologies, Relay Therapeutics aims to push the boundaries of what’s possible in drug discovery. Its Dynamo® platform integrates an array of leading-edge computational and experimental approaches designed to drug protein targets that have previously been intractable or inadequately addressed. Relay Therapeutics’ initial focus is on enhancing small molecule therapeutic discovery in targeted oncology and genetic disease indications. For more information, please visit www.relaytx.com or follow us on Twitter. About Elevar Therapeutics Elevar Therapeutics, Inc. is a fully integrated biopharmaceutical company built on the promise of elevating treatment outcomes for patients who have limited or inadequate therapeutic options. With expertise rooted in oncology, Elevar is focused on identifying and developing promising medicines for complex yet under-treated health conditions. Elevar’s lead proprietary drug candidate is rivoceranib. The NDA for rivoceranib in combination with camrelizumab as a therapy for advanced or metastatic hepatocellular carcinoma (HCC) is currently under review by the FDA with a PDUFA action date scheduled for March 20, 2025. Additional information is available at www.Elevar Therapeutics.com. About HLB Group The HLB Group is comprised of HLB Inc. (KOSDAQ:028300) and its affiliates with a diverse portfolio across biopharma, lifestyle, marine business, semiconductor and energy, united by the mission of improving all aspects of human life. Members of the HLB Group include HLB Innovation (KOSDAQ: 024850), HLB BioStep (KOSDAQ:278650), HLB Pharmaceutical (KOSDAQ:047920), HLB Life Science (KOSDAQ:067630), HLB Therapeutics (KOSDAQ:115450), HLB Panagene (KOSDAQ:046210) and HLB Global (KOSDAQ:003580). HLB Group’s overseas affiliates include Elevar Therapeutics, Immunomic Therapeutics, a nucleic acid immunotherapy platform company, and Verismo Therapeutics, a CAR T platform oncology company, all of which are based in the United States. Cautionary Note Regarding Forward-Looking Statements This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, without limitation, implied and express statements regarding Relay Therapeutics’ strategy, business plans and focus; the progress and timing of the preclinical and clinical development of the programs across Relay Therapeutics’ portfolio; the expected therapeutic benefits and potential efficacy and tolerability of its programs, including lirafugratinib; the timing and success of interactions with regulatory authorities and any related approvals; the potential market opportunity for lirafugratinib; and the expected strategic benefits under the exclusive global licensing agreement between Relay Therapeutics and Elevar Therapeutics. The words “may,” “might,” “will,” “could,” “would,” “should,” “plan,” “anticipate,” “intend,” “believe,” “expect,” “estimate,” “seek,” “predict,” “future,” “project,” “potential,” “continue,” “target” and similar words or expressions, or the negative thereof, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Any forward-looking statements in this press release are based on management's current expectations and beliefs and are subject to a number of risks, uncertainties and important factors that may cause actual events or results to differ materially from those expressed or implied by any forward-looking statements contained in this press release, including, without limitation, risks associated with: the impact of global economic uncertainty, geopolitical instability and conflicts, or public health epidemics or outbreaks of an infectious disease on countries or regions in which Relay Therapeutics has operations or does business, as well as on the timing and anticipated results of its clinical trials, strategy, future operations and profitability; the delay or pause of any current or planned clinical trials or the development of Relay Therapeutics’ drug candidates; the risk that the preliminary or interim results of its preclinical or clinical trials may not be predictive of future or final results in connection with future clinical trials of its product candidates and that interim and early clinical data may change as more patient data become available and are subject to audit and verification procedures; Relay Therapeutics’ ability to successfully demonstrate the safety and efficacy of its drug candidates; the timing and outcome of its planned interactions with regulatory authorities; and obtaining, maintaining and protecting its intellectual property. These and other risks and uncertainties are described in greater detail in the section entitled “Risk Factors” in Relay Therapeutics’ most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, as well as any subsequent filings with the Securities and Exchange Commission. In addition, any forward-looking statements represent Relay Therapeutics' views only as of today and should not be relied upon as representing its views as of any subsequent date. Relay Therapeutics explicitly disclaims any obligation to update any forward-looking statements. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. Relay Therapeutics:Contact:Megan Goulart617-322-0814mgoulart@relaytx.com Media:Dan Budwick1AB973-271-6085dan@1abmedia.com Elevar Therapeutics:Media Contact: Jeanette BressiHead, Corporate Communications jbressi@elevartherapeutics.com609-439-3997 Investor Relations Contact:Wade Smith Chief Financial & Business Officer wsmith@elevartherapeutics.com

引进/卖出孤儿药突破性疗法

2024-12-03

Global licensing agreement grants Elevar Therapeutics worldwide rights to develop and commercialize lirafugratinib (RLY-4008) Lirafugratinib is a potential best-in-class FGFR2 inhibitor that has shown differentiated efficacy in FGFR2-driven cholangiocarcinoma and demonstrated durable responses across multiple other types of FGFR2-altered solid tumors Relay Therapeutics has potential to receive up to $500 million in upfront, regulatory and commercial milestone payments, including $75 million in upfront and regulatory milestones, plus up to double digit royalties on global sales CAMBRIDGE, Mass. and FORT LEE, N.J., Dec. 03, 2024 (GLOBE NEWSWIRE) -- Relay Therapeutics, Inc. (Nasdaq: RLAY), a clinical-stage precision medicine company transforming the drug discovery process by combining leading-edge computational and experimental technologies, and Elevar Therapeutics, Inc., a majority-owned subsidiary of HLB Co., Ltd. and fully integrated biopharmaceutical company dedicated to elevating treatment outcomes for patients who have limited or inadequate therapeutic options, today announced an exclusive global licensing agreement for lirafugratinib (RLY-4008). Lirafugratinib is a selective oral small molecule inhibitor of fibroblast growth factor receptor 2 (FGFR2) that is being developed for patients with FGFR2-driven cholangiocarcinoma (CCA) and other FGFR2-altered solid tumors. The announcement of the partnership follows Relay’s recent positive FDA interaction and previously reported differentiated data in cholangiocarcinoma and data across other solid tumors. “Data to-date show that lirafugratinib has the potential to be an important novel medicine for patients with FGFR2-driven cholangiocarcinoma and other FGFR2-altered solid tumors. We are pleased that Elevar will continue its development and leverage their growing commercial capabilities to bring it to patients in need around the world,” said Sanjiv Patel, M.D., President and Chief Executive Officer of Relay Therapeutics. “As a result of this agreement, we are able to remain fully focused on continuing to advance our PI3Kα programs, including initiating the RLY-2608 2L breast cancer pivotal trial and vascular malformations trial next year.” “Lirafugratinib is an NDA-ready therapy that has shown a potential best-in-class profile in both FGFR2-driven cholangiocarcinoma and in other FGFR2-altered solid tumors including in advanced stages where treatment options are limited,” said Saeho Chong, Ph.D., chief executive officer of Elevar Therapeutics. “We are excited to diversify and expand our late-stage oncology pipeline with lirafugratinib, which is a strong strategic fit with our existing oncology portfolio and provides another opportunity to advance our mission of bringing life-changing medicines to cancer patients worldwide.” Lirafugratinib was granted breakthrough therapy designation and orphan drug designation by the FDA. Lirafugratinib is being investigated in the global ReFocus trial in patients with FGFR2-altered tumors. The study includes a pivotal cohort in patients with FGFR2-fusion CCA that was designed to support accelerated approval and is fully enrolled. Interim data from this cohort were presented at the European Society for Medical Oncology Congress in 2022. The study also includes cohorts in patients with other types of solid tumors, including gastric, pancreatic, and head and neck tumors. Interim data from these cohorts were presented at the AACR-NCI-EORTC International Conference on Molecular Targets and Cancer Therapeutics in 2023 and 2024. Earlier in 2024, Relay Therapeutics met with the U.S. Food and Drug Administration (FDA) to discuss data from the ReFocus trial and potential regulatory pathways. The FDA recommended that the company first file an NDA for FGFR2-driven CCA, followed by a supplemental NDA for FGFR2-altered other solid tumors with data from an expanded cohort of patients. Cholangiocarcinoma (CCA) or bile duct cancer is a rare disease in which malignant cells form in the bile ducts. Approximately 8,000 people in the United States are diagnosed with CCA each year. Terms of the Agreement Under the terms of the agreement, Elevar will be granted global development and commercialization rights for lirafugratinib. Elevar will assume full responsibility for all further development activities, including submission of the NDAs, all subsequent clinical development, and global commercialization for FGFR2-driven CCA and FGFR2-altered other solid tumors. Relay Therapeutics is eligible to receive up to $75 million in upfront and regulatory milestones, plus up to $425 million in potential commercial milestone payments, as well as tiered royalties up to the low-teens percentage. Moelis & Company LLC is serving as exclusive financial advisor to Relay Therapeutics in the transaction. Goodwin Procter LLP is serving as exclusive legal advisor to Relay Therapeutics in the transaction. About Lirafugratinib Lirafugratinib (RLY-4008) is a potent, selective and oral small molecule inhibitor of FGFR2, a receptor tyrosine kinase that is frequently altered in certain cancers. FGFR2 is one of four members of the FGFR family, a set of closely related proteins with highly similar protein sequences and properties. Preclinically, lirafugratinib demonstrated FGFR2-dependent killing in cancer cell lines and induced regression in in vivo models with minimal inhibition of other targets, including other members of the FGFR family. In addition, lirafugratinib demonstrated strong activity against known clinical on-target resistance mutations in cellular and in vivo preclinical models. Lirafugratinib is currently being evaluated in a clinical trial in patients with advanced or metastatic FGFR2-altered solid tumors with a single arm, potentially registration-enabling cohort for FGFRi-naïve FGFR2-fusion CCA. To learn more about the clinical trial of lirafugratinib, please visit here. About Relay Therapeutics Relay Therapeutics is a clinical-stage precision medicine company transforming the drug discovery process by combining leading-edge computational and experimental technologies with the goal of bringing life-changing therapies to patients. As the first of a new breed of biotech created at the intersection of complementary techniques and technologies, Relay Therapeutics aims to push the boundaries of what’s possible in drug discovery. Its Dynamo® platform integrates an array of leading-edge computational and experimental approaches designed to drug protein targets that have previously been intractable or inadequately addressed. Relay Therapeutics’ initial focus is on enhancing small molecule therapeutic discovery in targeted oncology and genetic disease indications. For more information, please visit www.relaytx.com or follow us on Twitter. About Elevar Therapeutics Elevar Therapeutics, Inc. is a fully integrated biopharmaceutical company built on the promise of elevating treatment outcomes for patients who have limited or inadequate therapeutic options. With expertise rooted in oncology, Elevar is focused on identifying and developing promising medicines for complex yet under-treated health conditions. Elevar’s lead proprietary drug candidate is rivoceranib. The NDA for rivoceranib in combination with camrelizumab as a therapy for advanced or metastatic hepatocellular carcinoma (HCC) is currently under review by the FDA with a PDUFA action date scheduled for March 20, 2025. Additional information is available at Press Releases - Elevar Therapeutics. About HLB Group The HLB Group is comprised of HLB Inc. (KOSDAQ:028300) and its affiliates with a diverse portfolio across biopharma, lifestyle, marine business, semiconductor and energy, united by the mission of improving all aspects of human life. Members of the HLB Group include HLB Innovation (KOSDAQ: 024850), HLB BioStep (KOSDAQ:278650), HLB Pharmaceutical (KOSDAQ:047920), HLB Life Science (KOSDAQ:067630), HLB Therapeutics (KOSDAQ:115450), HLB Panagene (KOSDAQ:046210) and HLB Global (KOSDAQ:003580). HLB Group’s overseas affiliates include Elevar Therapeutics, Immunomic Therapeutics, a nucleic acid immunotherapy platform company, and Verismo Therapeutics, a CAR T platform oncology company, all of which are based in the United States. Cautionary Note Regarding Forward-Looking Statements This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, without limitation, implied and express statements regarding Relay Therapeutics’ strategy, business plans and focus; the progress and timing of the preclinical and clinical development of the programs across Relay Therapeutics’ portfolio; the expected therapeutic benefits and potential efficacy and tolerability of its programs, including lirafugratinib; the timing and success of interactions with regulatory authorities and any related approvals; the potential market opportunity for lirafugratinib; and the expected strategic benefits under the exclusive global licensing agreement between Relay Therapeutics and Elevar Therapeutics. The words “may,” “might,” “will,” “could,” “would,” “should,” “plan,” “anticipate,” “intend,” “believe,” “expect,” “estimate,” “seek,” “predict,” “future,” “project,” “potential,” “continue,” “target” and similar words or expressions, or the negative thereof, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Any forward-looking statements in this press release are based on management's current expectations and beliefs and are subject to a number of risks, uncertainties and important factors that may cause actual events or results to differ materially from those expressed or implied by any forward-looking statements contained in this press release, including, without limitation, risks associated with: the impact of global economic uncertainty, geopolitical instability and conflicts, or public health epidemics or outbreaks of an infectious disease on countries or regions in which Relay Therapeutics has operations or does business, as well as on the timing and anticipated results of its clinical trials, strategy, future operations and profitability; the delay or pause of any current or planned clinical trials or the development of Relay Therapeutics’ drug candidates; the risk that the preliminary or interim results of its preclinical or clinical trials may not be predictive of future or final results in connection with future clinical trials of its product candidates and that interim and early clinical data may change as more patient data become available and are subject to audit and verification procedures; Relay Therapeutics’ ability to successfully demonstrate the safety and efficacy of its drug candidates; the timing and outcome of its planned interactions with regulatory authorities; and obtaining, maintaining and protecting its intellectual property. These and other risks and uncertainties are described in greater detail in the section entitled “Risk Factors” in Relay Therapeutics’ most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, as well as any subsequent filings with the Securities and Exchange Commission. In addition, any forward-looking statements represent Relay Therapeutics' views only as of today and should not be relied upon as representing its views as of any subsequent date. Relay Therapeutics explicitly disclaims any obligation to update any forward-looking statements. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. Relay Therapeutics:Contact:Megan Goulart617-322-0814mgoulart@relaytx.com Media:Dan Budwick1AB973-271-6085dan@1abmedia.com Elevar Therapeutics:Media Contact: Jeanette BressiHead, Corporate Communications jbressi@elevartherapeutics.com609-439-3997 Investor Relations Contact:Wade Smith Chief Financial & Business Officer wsmith@elevartherapeutics.com

引进/卖出孤儿药突破性疗法申请上市

2024-03-12

·精准药物

前言成纤维细胞生长因子(FGF)通过FGF受体(FGFR1-4)发出信号,协调胎儿发育,有助于组织和全身稳态,但FGFR基因的融合、重排或突变也可能促进肿瘤发生。FGFR融合可分为I型(非受体型,由融合伴侣的N端置换引起,如BCR-FGFR1和ZYM2-FGFR1)、IIa型(受体型,也由融合伴侣N端置换产生;如FN1-FGFR1、KLK2-FGFR2)或IIb型(受体型,由融合伴侣C端置换产生;如FGFR2-BICC1、FGFR3-TACC3)。在实体瘤中检测到的FGFR变化包括非小细胞肺癌中的FGFR1扩增(20%)、乳腺癌中的FGFR

1/2扩增(7-23%)、尿路上皮癌中的FGFR3突变(10-60%)或FGFR3融合(6%)、肝内胆管癌中的FGFR2融合(10-20%)、子宫内膜癌中的FGFR2突变(12%)和胃癌中FGFR2的扩增(5-10%)。在约7.0%的未经选择的癌症患者中可以检测到FGFR基因的改变。目前,已经开发出了多种FGFR靶向药物,包括泛FGFR抑制剂(erdafitinib和futibatinib)、FGFR1/2/3抑制剂(infigratinib和pemigatinib),以及一系列更具特异性的药物,其中一些已进入临床使用。Erdafitinib已被批准用于携带FGFR2/3突变的尿路上皮癌患者,futibatinib和pemigatinib被批准治疗携带FGFR2融合或重排的胆管癌患者。这些药物的临床益处在一定程度上受到高磷血症的限制,这是由于FGFR1的脱靶抑制以及FGFR基因中耐药性突变的出现。下一代小分子抑制剂,如lirafugratinib和LOXO-435,以及FGFR2特异性抗体bemarituzumab,有望降低高磷血症的风险,并有能力克服某些耐药性突变。FGFR的结构和信号通路FGFs由具有球状或非典型β三叶结构的保守核心结构域组成,可分为典型FGFs(FGF1-10、FGF16-18、FGF20和FGF22)、内分泌型FGF(FGF19/FGF15、FGF21和FGF23)以及FGF同源因子(FGF11-14)。全长FGF受体(FGFR1-4)是I型跨膜蛋白,具有三个细胞外免疫球蛋白样结构域和一个胞内酪氨酸激酶结构域。典型的FGF与硫酸乙酰肝素辅因子一起通过FGFR传递信号,而内分泌型FGF与klotho共受体(KLA和KLB)和硫酸乙酰肝素辅助因子一起通过FGFR传递信号。FGF–FGFR信号传导参与细胞存活、增殖、代谢、迁移和分化,包括生理作用,如协调胎儿发育和维持组织和/或全身稳态。这些受体也可以驱动肿瘤的发展。FGFR中配体依赖性二聚化或病理改变通过自身抑制机制释放而导致内源性激酶激活。FGFR激活导致FRS2依赖性激活PI3K–AKT、RAS–ERK和磷脂酶Cγ(PLCγ)依赖性二酰基甘油(DAG)–PKC和IP3–Ca2+信号。癌症患者的FGFR改变通过异常的FGFR信号传导促进肿瘤发生:FGFR扩增导致FGFR过度表达和下游信号通路过度激活;FGFR融合或重排导致融合伴侣介导的FGFR二聚化、磷酸化改变和异常的下游信号传导;细胞外区或跨膜结构域中的FGFR突变通过改变对FGF配体的特异性或亲和力,以及配体非依赖性二聚化来激活FGFR;酪氨酸激酶结构域中的FGFR突变由于自身抑制机制的破坏而结构性性地激活FGFR。小分子FGFR抑制剂几种小分子FGFR抑制剂已被开发用于治疗具有FGFR改变的癌症患者,如尿路上皮癌、乳腺癌、胃癌、肝癌、肺癌、卵巢癌和宫颈癌。能够与酪氨酸激酶结构域的ATP结合位点结合的FGFR抑制剂通常分为多激酶FGFR抑制剂或选择性FGFR抑制剂。Derazatinib、dovitinib、tasurgratinib、lenvatinib、lucitanib、nintedanib和ponatinib都是多激酶FGFR抑制剂,对FGFR以外的多种RTK具有活性。然而,由于其广泛的活性,与选择性FGFR抑制剂相比,多激酶FGFR抑制剂的作用机制和不良反应都很复杂。选择性FGFR抑制剂包括泛FGFR、FGFR1/2/3和FGFR2/3抑制剂以及选择性FGFR2、FGFR3或FGFR4抑制剂。泛FGFR抑制剂包括 erdafitinib,

futibatinib, rogaratinib和resigratinib;FGFR1/2/3抑制剂包括pemigatinib,

infigratinib, fexagratinib和zoligratinib;Lirafugratinib是一种选择性FGFR2抑制剂,LOXO-435是一种选择FGFR3抑制剂,roblitinib和fissotioninib是选择性FGFR4抑制剂。目前,根据在II期试验中观察到的疗效和耐受性,美国食品药品监督管理局(FDA)在这些适应症的二线或更后线的治疗中加速批准erdafitinib、futibatinib、infigratinib和pemiginib。在erdafitinib的临床研究(BLC2001)中,根据FGFR3或FGFR2/FGFR3融合物中至少一种突变的存在,选择局部晚期和/或不可切除的尿路上皮癌患者。整体队列的ORR为40%,中位无进展生存期(mPFS)和中位总生存期(mOS)分别为5.5个月和13.8个月。46%的患者出现≥3级不良事件,在初步分析中包括低钠血症(11%)、口腔炎(10%)和乏力(7%),以及长期随访的指甲(15%)、口炎(14%)和皮肤事件(8%)。在FIGHT-203的II期研究中,在携带I型FGFR1融合(如ZMYM2–FGFR1或BCR–FGFR2)的MLN患者中测试了pemiginib的药效和安全性。其中77%(24/31)的患者对pemiginib有完全响应。常见的≥3级不良事件包括贫血(18%)、口腔炎和四肢疼痛(均为12%)。2022年8月,FDA批准了pemiginib用于携带FGFR1融合的复发性和/或难治性MLN患者。任何级别的高磷血症都发生在大多数接受泛FGFR抑制剂或FGFR1/2/3抑制剂的患者中。这种不良反应很可能反映了泛FGFR或FGFR1/2/3抑制剂对FGF23信号传导的抑制,因为这种分泌蛋白依赖于与近端小管上皮细胞膜上的FGFR1和klotho的结合。该复合物通过抑制磷酸钠协同转运蛋白(NPT2a/c)调节肾脏中的磷酸盐吸收。FGFR1在这一过程中的作用得到证实,因此,开发FGFR2特异性和FGFR3特异性抑制剂有望避免或降低这种不良反应的发生率。FGFR抑制性单克隆抗体在靶向FGF/FGFR信号的生物制剂中,bemarituzumab是目前正在III期试验中评估的唯一药物。bemarituzumab是一种人源化抗FGFR2b抗体,其抑制FGF7、FGF10和FGF22的结合,从而抑制癌细胞中配体诱导的FGFR2b信号传导,并且由于修饰的Fc结构域对自然杀伤细胞上的人FcγRIIIA受体的亲和力增加,因此具有诱导抗体依赖性细胞介导的细胞毒性(ADCC)的能力。在一项涉及晚期FGFR2b过表达胃和胃食管交界腺癌(GEA)患者的I期试验中,bemarituzumab单药治疗显示出可接受的耐受性,ORR为18%(5/28)。随后,在携带FGFR2扩增或FGFR2过表达的GEA患者的II期FIGHT试验中,将bemarituzumab与mFOLFOX6(包括氟嘧啶、亚叶酸和奥沙利铂)联合测试。bemarituzumab联合化疗组和安慰剂联合化疗组患者的ORR分别为53%和40%,mPFS分别为9.5个月和7.4个月(P=0.073)。bemarituzumab的其他几项试验,包括评估bemarituzumab联合mFOLFOX6加(NCT0511626) 或不加(NCT050252801)

nivolumab在先前未经治疗的晚期GEA患者中的研究正在进行中。新型FGFR靶向疗法蛋白水解靶向嵌合体(PROTAC)、嵌合抗原受体(CAR)T细胞、抗体偶联药物(ADC)、放射免疫偶联物(RICs)和可溶性受体是能够靶向FGF–FGFR信号级联的潜在新治疗模式,其中一些已经或正在临床试验中进行测试。PROTACPROTAC具有双重部分,使其能够与靶蛋白和E3泛素连接酶相互作用,从而诱导靶蛋白的泛素化介导的蛋白酶体降解。LC-MB12是一种基于infigratinib的PROTAC,能够优先降解FGFR2,并抑制表达TEL–FGFR2融合的Ba/F3细胞和FGFR2扩增的SNU16癌细胞的增殖。相比之下,DGY-09-192是另一种基于 infigratinib的PROTAC,旨在募集von Hippel–Lindau蛋白(VHL),从而优先降解FGFR1和FGFR2。这些药物目前仍处于临床前开发阶段。CAR-T细胞由于PAX3–FOXO1的下游作用,FGFR4在儿科横纹肌肉瘤中普遍过表达。然而,N535K和V550L等耐药性突变通常在治疗前出现,这可能会限制小分子抑制剂的有效性。因此,研究人员开发了靶向FGFR4的CAR-T细胞,如RJ154-HL和3A11,具有不同的靶向FGFR4的scFv。目前,靶向FGFR的CAR-T细胞也仍处于临床前开发阶段。基于抗体的药物Aprutumab是一种全人源抗FGFR2抗体,它识别FGFR2b和FGFR2c亚型共同N末端区域P23、L27和E29周围的表位,并已被证明能诱导这些变体的内化和运输至溶酶体降解。Aprutumab和bemarituzumab在I期临床试验中均显示出良好的安全性和耐受性。目前,bemarituzumab已作为联合疗法进行II期和III期临床试验,而Aprutumab用于开发ADCs和RICs。Aprutumab ixadotin(前身为BAY-1187982)是具有不可裂解连接子的抗FGFR2 ADC,LY3076226是具有可裂解连接子的抗FGFR3 ADC。然而,测试这两种药物的第一阶段试验(nct22368951)由于耐受性差和活性有限而终止。此外,Aprutumab和抗FGFR3抗体vofatamab分别用于FGFR2靶向的RIC(227Th-Aprutumab,BAY 2304058)和FGFR3靶向的RIC,225Ac-vofatamab(FPI-1966)和111In vofatamab(FPI-1967)。BAY 2304058仍处于临床前开发阶段,而FPI-1966(用于放射免疫疗法)和FPI-1967(用于放射成像)目前正在I/II期试验(NCT05363605)中进行测试,用于表达FGFR3的晚期实体瘤患者。可溶性FGFR受体可溶性FGFR受体,如衍生自FGFR1c的细胞外结构域的FP-1039和衍生自FGFR 3c的细胞外区域的Recifecept,是另一类通过充当诱饵受体来捕获FGFR配体的重组蛋白药物。FP-1039已显示对促有丝分裂FGF配体具有高亲和力,并且在FGFR1扩增的肺癌和FGFR2突变的子宫内膜癌的小鼠异种移植模型中具有抗肿瘤作用。FP-1039在一期试验中具有可接受的耐受性。测试FP-1039与各种化疗联合用药的Ib期试验(NCT01868022) 显示同时接受紫杉醇和卡铂治疗的鳞状非小细胞肺癌患者的ORR为47%,同时接受培美曲塞和顺铂治疗的恶性胸膜间皮瘤患者的ORR为39%。小结目前,小分子FGFR抑制剂和FGFR靶向抗体药物已在临床后期试验中进行开发和测试,其中几种小分子FGFR抑制剂已被批准用于FGFR改变的癌症患者。尽管如此,某些不良事件,如FGFR1脱靶抑制引起的高磷血症和获得性耐药性,仍然限制了这些药物的临床益处。选择性第三代抑制剂,如特异性靶向FGFR2或FGFR3的抑制剂,正在临床开发中,这些药物可能避免或显著降低高磷血症的风险,并可能克服突变介导的耐药性。参考文献:1.FGFR-targeted

therapeutics: clinical activity, mechanisms of resistance and new directions. Nat

Rev Clin Oncol.2024 Feb 29声明:发表/转载本文仅仅是出于传播信息的需要,并不意味着代表本公众号观点或证实其内容的真实性。据此内容作出的任何判断,后果自负。若有侵权,告知必删!长按关注本公众号 粉丝群/投稿/授权/广告等请联系公众号助手 觉得本文好看,请点这里↓

放射疗法

分析

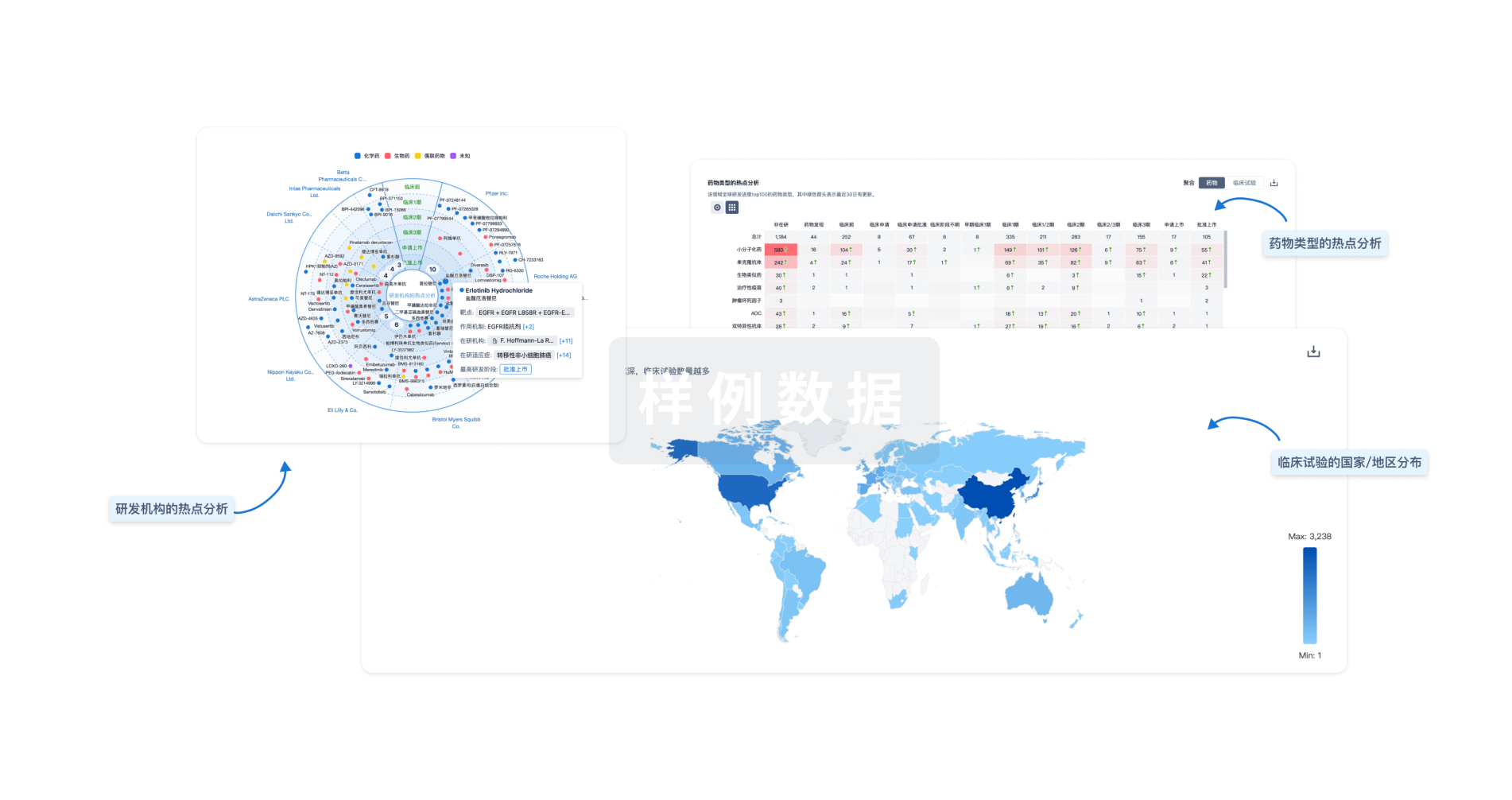

对领域进行一次全面的分析。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用