预约演示

更新于:2025-08-29

Endeavor BioMedicines, Inc

更新于:2025-08-29

概览

标签

呼吸系统疾病

其他疾病

肿瘤

小分子化药

ADC

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 疾病领域 | 数量 |

|---|---|

| 肿瘤 | 3 |

| 排名前五的药物类型 | 数量 |

|---|---|

| ADC | 2 |

| 小分子化药 | 1 |

| 排名前五的靶点 | 数量 |

|---|---|

| HER3(受体酪氨酸蛋白激酶erbB-3) | 1 |

| HER3 x Top I | 1 |

| SMO(SMO受体) | 1 |

关联

3

项与 Endeavor BioMedicines, Inc 相关的药物靶点 |

作用机制 SMO拮抗剂 |

原研机构 |

在研适应症 |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

靶点 |

作用机制 HER3调节剂 |

非在研适应症- |

最高研发阶段临床1/2期 |

首次获批国家/地区- |

首次获批日期- |

作用机制 HER3拮抗剂 [+1] |

非在研适应症- |

最高研发阶段临床前 |

首次获批国家/地区- |

首次获批日期- |

5

项与 Endeavor BioMedicines, Inc 相关的临床试验NCT06956690

A First-in-Human, Open-label, Phase 1/2 Clinical Trial to Assess the Safety, Tolerability, Pharmacokinetics and Preliminary Efficacy of ENV-501 in Patients With Advanced-Stage, Relapsed/Refractory HER3-Expressing Solid Tumors

This study is a Phase 1/2, first-in-human, open-label, clinical trial to assess the safety, tolerability, pharmacokinetics and preliminary efficacy of ENV-501 in patients with advanced-stage, relapsed and/or refractory human epidermal growth factor receptor 3 (HER3)-expressing solid tumors. The study consists of 2 phases: a dose escalation phase (Phase 1) and a dose expansion phase (Phase 2).

The primary objectives of Phase 1 are to characterize the overall safety and tolerability profile of increasing doses of ENV-501 in patients with advanced-stage solid tumors and identify the recommended Phase 2 dose (RP2D) of ENV-501. During Phase 1, successive cohorts of patients will receive escalating doses of ENV-501. The results of the dose escalation will determine the RP2D and dosing schedule of ENV-501 to be administered in the Phase 2 part of the study. The primary objective of Phase 2 is to evaluate the preliminary clinical efficacy of ENV-501 in dose expansion cohorts.

The primary objectives of Phase 1 are to characterize the overall safety and tolerability profile of increasing doses of ENV-501 in patients with advanced-stage solid tumors and identify the recommended Phase 2 dose (RP2D) of ENV-501. During Phase 1, successive cohorts of patients will receive escalating doses of ENV-501. The results of the dose escalation will determine the RP2D and dosing schedule of ENV-501 to be administered in the Phase 2 part of the study. The primary objective of Phase 2 is to evaluate the preliminary clinical efficacy of ENV-501 in dose expansion cohorts.

开始日期2025-05-01 |

申办/合作机构 |

NCT06422884

A Phase 2, Multi-Center, Randomized, Double-Blind, Controlled Trial Evaluating the Safety and Efficacy of ENV-101 in Patients With Lung Fibrosis (WHISTLE-PF Trial)

The goal of this clinical trial is to evaluate the impact that ENV-101 has on lung function and key measures of fibrosis in adult patients with idiopathic pulmonary fibrosis (IPF). Another goal of this study is to better understand the safety and tolerability of ENV-101 in this patient population.

开始日期2024-11-15 |

申办/合作机构 |

NCT05817240

A Phase 1, Single-Center, Fixed Sequence, Drug-Drug Interaction Study of ENV-101 (Taladegib) on Nintedanib Pharmacokinetics in Healthy Subjects

The goal of this clinical trial is to learn about the potential effect of ENV-101 (taladegib) on the pharmacokinetics of nintedanib (an approved treatment for idiopathic pulmonary fibrosis) when the two compounds are dosed together in healthy subjects. Participants in this study will receive ENV-101 and/or nintedanib on various days throughout a 10-day period during which they will reside at the clinical trial site.

开始日期2023-05-03 |

申办/合作机构 |

100 项与 Endeavor BioMedicines, Inc 相关的临床结果

登录后查看更多信息

0 项与 Endeavor BioMedicines, Inc 相关的专利(医药)

登录后查看更多信息

63

项与 Endeavor BioMedicines, Inc 相关的新闻(医药)2025-07-16

SAN DIEGO – July 16, 2025 – Endeavor BioMedicines (“Endeavor”), a clinical-stage biotechnology company developing medicines with the potential to deliver transformational clinical benefits to patients with life-threatening diseases, today announced that both the European Commission (EC) and the U.S. Food and Drug Administration (FDA) have granted Orphan Drug Designation to its investigational therapy, taladegib (ENV-101), for the treatment of idiopathic pulmonary fibrosis (IPF). Endeavor is currently enrolling patients in the Phase 2b WHISTLE-PF (Wound-remodeling Hedgehog-Inhibitor ILD Study Testing Lung Function Endpoints-PF) clinical trial of taladegib in IPF, a chronic, progressive lung disease with limited treatment options. Enrollment in the WHISTLE-PF trial is on track and expected to be completed in 2026.

“Receiving Orphan Drug Designation for taladegib in both the United States and European Union underscores the significant unmet medical need for patients with IPF,” said Lisa Lancaster, M.D., Chief Medical Officer, Endeavor BioMedicines. “We are encouraged by the potential of taladegib to reverse the course of disease across multiple measures of IPF, which is a major step forward from current standard-of-care. I am very proud of our team, which is executing the Phase 2b WHISTLE-PF trial with a remarkable sense of purpose, driven by our mission to push the boundaries of what is possible and restore hope to patients and their families.”

Orphan Drug Designation in the European Union (EU) is granted by the EC based on a positive opinion from the European Medicines Agency’s Committee for Orphan Medicinal Products. It is intended to encourage the development of drugs that may provide significant benefit to patients suffering from rare, life-threatening diseases with a prevalence of not more than five in 10,000 in the EU. The designation provides special incentives for sponsors, including eligibility for protocol assistance and exemptions or reductions in certain regulatory fees, as well as 10 years of marketing exclusivity if the product is approved for the designated use.

The FDA grants Orphan Drug Designation to drugs and biologics intended for the treatment, diagnosis or prevention of rare diseases or conditions affecting fewer than 200,000 people in the U.S. Orphan Drug Designation provides sponsors certain benefits, including financial incentives to support clinical development and the potential for up to seven years of market exclusivity for the drug for the designated orphan indication in the U.S. if the drug is ultimately approved for that use.

About the WHISTLE-PF Trial

The Phase 2b WHISTLE-PF clinical trial is a global, randomized, placebo-controlled study evaluating the therapeutic potential of taladegib in individuals with IPF (NCT06422884). The WHISTLE-PF trial will evaluate the efficacy of a range of taladegib doses through 24 weeks of treatment, characterize the investigational compound’s safety and tolerability, assess its effect on patient reported outcomes and its effects on lung function, lung capacity and lung fibrosis as measured by chest high-resolution computed tomography.

About Taladegib

Endeavor’s investigational drug taladegib is a Hedgehog (Hh) signaling pathway inhibitor. By binding to and inhibiting a key receptor in the Hh pathway, taladegib stops the abnormal accumulation of myofibroblasts that cause fibrosis. This may resolve the excessive wound-healing process seen in pulmonary fibrosis, improving lung volume and function.

About Idiopathic Pulmonary Fibrosis

IPF is a chronic, progressive lung disease that affects more than 150,000 adults in the United States. Although the exact cause of IPF is unknown, various environmental factors can deliver repeated injuries to lung cells that trigger abnormal wound-healing processes and life-threatening lung scarring. IPF is a chronic disease with limited treatment options and a very poor prognosis. The average life expectancy is three to five years after diagnosis.

About Endeavor BioMedicines

Endeavor BioMedicines is a clinical-stage biotechnology company developing medicines with the potential to deliver transformational clinical benefits to patients with life-threatening diseases. Endeavor’s lead candidate, taladegib (ENV-101), is an inhibitor of the Hedgehog signaling pathway in development for fibrotic lung diseases, including idiopathic pulmonary fibrosis (IPF). More information is available at www.endeavorbiomedicines.com and on LinkedIn or X.

Audra Friis Sam Brown Healthcare Communications 917-519-9577 audrafriis@sambrown.com

临床2期孤儿药

2025-05-21

·药明康德

肺纤维化小分子抑制剂2期试验积极结果公布日前,Endeavor BioMedicines公布其在研主打疗法ENV-101(taladegib)完成的2a期临床试验的事后分析结果。Endeavor BioMedicines的首席执行官John Hood博士过去接受访问时曾提到,过去20多年来,药明康德始终是值得信赖的合作伙伴。Hood博士强调:“时间经常是最宝贵的资源,我确信药明康德能够按时、高质量地提供我们需要的服务。”此次公布的数据显示,与安慰剂相比,接受ENV-101治疗12周的特发性肺纤维化(IPF)患者表现出肺血管容积显著减少、肺容量显著增加,并且肺纤维化程度有改善趋势等积极疗效。具体关键分析结果如下:肺容量显著增加:ENV-101治疗组患者肺容量显著提升(安慰剂组:−113.07 mL;ENV-101组:142.28 mL;p=0.014)。肺纤维化趋势改善:ENV-101治疗组患者肺纤维化程度改善趋势明显(安慰剂组:1.32 pp;ENV-101组:−1.32 pp;p=0.063)。肺血管容积显著减少:ENV-101治疗组患者的标准化肺血管容积显著降低(安慰剂组:0.07 pp;ENV-101组:−0.25 pp;p=0.0007)。▲Endeavor Biomedicines的首席执行官John Hood博士ENV-101是一款Hedgehog信号通路小分子抑制剂,通过结合并抑制Hedgehog通路中的关键受体,阻止导致纤维化的肌成纤维细胞异常积聚,从而有望逆转肺纤维化中持续性的创伤修复过程,改善肺部容量与功能。罗氏再达超20亿美元抗癌分子胶研发合作Orionis Biosciences今日宣布,已与罗氏(Roche)旗下基因泰克(Genentech)达成第二项多年期合作协议,双方将合作开发用于肿瘤领域的新型小分子单价分子胶药物,这些药物靶向具高挑战性的靶点。此前,Orionis曾于2023年9月与基因泰克开展首项合作,致力于发现适用于肿瘤和神经退行性疾病等重大疾病领域的创新小分子药物。Orionis的Allo-Glue小分子平台整合了多项专有技术,推动用于高挑战性疾病靶点的分子胶药物的发现与设计。该平台融合了先进的化学生物学工具、工程化细胞检测系统、定制构建的高通量自动化设备,以及专门的人工智能(AI)基础架构,能够在细胞内生成并分析数亿次蛋白相互作用事件。其AI驱动的化学引擎整合了预测建模、生成式设计以及化合物筛选系统,涵盖广泛化学空间,从而加速单价分子胶药物在效力、选择性及合成可行性方面的系统性发现与协同优化。根据协议条款,Orionis将负责分子胶的发现与优化工作,而基因泰克将负责后期的临床前与临床开发、监管申报及商业化。Orionis将获得1.05亿美元的预付款,并有资格获得总额可能超过20亿美元的潜在研究、开发、商业化等里程碑款项。潜在首款!强生单抗获FDA咨询委员会支持强生(Johnson & Johnson)公司今日宣布,美国FDA肿瘤药物咨询委员会(ODAC)以6票赞成、2票反对的结果,支持Darzalex faspro(daratumumab & hyaluronidase)单药用于治疗成人高风险冒烟性多发性骨髓瘤(HR-SMM)。根据新闻稿,如果获批,Darzalex faspro将成为首个可能延缓或预防进展为多发性骨髓瘤(MM)的疗法。SMM是多发性骨髓瘤的前期无症状阶段,可能发展为活动性多发性骨髓瘤,目前尚无获批的治疗方案。不过新近研究显示,有高风险进展为MM的患者可能从早期治疗中获益。Darzalex faspro由强生和Genmab联合开发,是首款可以通过皮下注射给药的抗CD38抗体,将患者接受治疗的时间从几个小时缩短到几分钟。Darzalex faspro获得美国FDA批准用于多发性骨髓瘤的9个适应症,其中4个适应症用于符合或不符合移植条件的新确诊多发性骨髓瘤患者的一线治疗。委员会审查了AQUILA研究的数据,这是一项3期、随机、开放标签试验,评估了Darzalex faspro与标准疗法(SoC)积极监测在HR-SMM患者中的疗效和安全性。ODAC基于AQUILA研究中无进展生存期的积极结果和临床获益给出推荐。口服小分子抑制剂获FDA突破性疗法认定Belite Bio今日宣布,美国FDA已授予tinlarebant治疗Stargardt病(STGD1)的突破性疗法认定(BTD)。FDA授予tinlarebant该认定主要是基于关键性3期DRAGON临床试验的中期分析结果,数据显示tinlarebant具有良好的疗效和安全性。Tinlarebant是一种每日一次的口服RBP4小分子抑制剂,旨在作为早期干预手段,用于维持STGD1及地图状萎缩(GA)患者视网膜组织的健康和完整性。根据新闻稿,目前FDA尚未批准用于治疗STGD1的药物,也未批准任何口服药物用于治疗GA。因此,如果获批,tinlarebant将成为一款创新的口服疗法,以应对STGD1和GA两种疾病中尚未满足的医疗需求。参考资料:[1] Endeavor BioMedicines Presents New Clinical Findings From Post Hoc Analysis of Phase 2a Clinical Trial Evaluating ENV-101 in Patients with Idiopathic Pulmonary Fibrosis. Retrieved May 21, 2025 from https://www.businesswire.com/news/home/20250520452648/en/Endeavor-BioMedicines-Presents-New-Clinical-Findings-From-Post-Hoc-Analysis-of-Phase-2a-Clinical-Trial-Evaluating-ENV-101-in-Patients-with-Idiopathic-Pulmonary-Fibrosis[2] U.S. FDA Oncologic Drugs Advisory Committee votes in favor of the benefit-risk profile of DARZALEX FASPRO® (daratumumab and hyaluronidase-fihj) for high-risk smoldering multiple myeloma. Retrieved May 21, 2025 from https://www.prnewswire.com/news-releases/us-fda-oncologic-drugs-advisory-committee-votes-in-favor-of-the-benefit-risk-profile-of-darzalex-faspro-daratumumab-and-hyaluronidase-fihj-for-high-risk-smoldering-multiple-myeloma-302461151.html[3] Belite Bio Announces FDA Granting of Breakthrough Therapy Designation for Tinlarebant for the Treatment of Stargardt Disease. Retrieved May 21, 2025 from https://www.globenewswire.com/news-release/2025/05/21/3085441/0/en/Belite-Bio-Announces-FDA-Granting-of-Breakthrough-Therapy-Designation-for-Tinlarebant-for-the-Treatment-of-Stargardt-Disease.html[4] Orionis Biosciences Announces Strategic Partnership with Genentech to Discover and Develop Molecular Glue Class Medicines for Cancer. Retrieved May 21, 2025 from https://www.businesswire.com/news/home/20250521306347/en/Orionis-Biosciences-Announces-Strategic-Partnership-with-Genentech-to-Discover-and-Develop-Molecular-Glue-Class-Medicines-for-Cancer免责声明:本文仅作信息交流之目的,文中观点不代表药明康德立场,亦不代表药明康德支持或反对文中观点。本文也不是治疗方案推荐。如需获得治疗方案指导,请前往正规医院就诊。版权说明:欢迎个人转发至朋友圈,谢绝媒体或机构未经授权以任何形式转载至其他平台。转载授权请在「药明康德」微信公众号回复“转载”,获取转载须知。👇 分享,点赞,在看,聚焦全球生物医药健康创新

临床2期引进/卖出

2025-05-20

Findings presented at the American Thoracic Society 2025 International Conference corroborate previous findings and provide important new clinical evidence supporting ENV-101

SAN DIEGO – May 20, 2025 – Endeavor BioMedicines (“Endeavor”), a clinical-stage biotechnology company developing medicines with the potential to deliver transformational clinical benefits to patients with life-threatening diseases, today presented a post hoc analysis from the completed Phase 2a clinical trial of its lead investigational therapy, ENV-101 (taladegib). Results demonstrated a significant reduction in pulmonary vessel volume, a significant increase in lung volume, and a trend towards reduced lung fibrosis for idiopathic pulmonary fibrosis (IPF) patients treated with ENV-101 for 12 weeks vs. placebo. The analysis utilized Qureight’s deep learning-based computed tomography (CT) analytics technologies and was presented in a poster presentation at the American Thoracic Society (ATS) 2025 International Conference.

Lung volume, fibrotic tissue volume and pulmonary vessel volume are all volumetric lung measures that can change during IPF disease progression or in response to treatment. Each measure has been established as an independent predictor of mortality. Deep learning-based quantification of lung volume and pulmonary vascular changes may offer valuable insights that corroborate physiological improvement in lung function and measure treatment outcomes with a greater effect size than forced vital capacity (FVC), the current registrational endpoint in IPF. A new finding from this post hoc analysis demonstrated a significant reduction in pulmonary vessel volume for patients in the ENV-101 treatment arm versus placebo. A reduction in pulmonary vessel volume has been correlated with improved mortality and decreased disease burden. To date, ENV-101 is the only therapeutic that has demonstrated a reduction in pulmonary vessel volume in patients with IPF, providing further evidence that ENV-101 has the potential to reverse disease across multiple measures of IPF.

“These findings provide additional evidence of clinical utility of ENV-101 in patients with IPF marking another step forward in our mission to restore hope and improve lives for those facing this otherwise devastating disease,” said Lisa Lancaster, M.D., Chief Medical Officer, Endeavor BioMedicines. “We are grateful to the Qureight team for partnering with us on this important analysis.”

The post hoc analysis of the Phase 2a trial was conducted using novel deep learning-based CT analysis technologies developed by Qureight Ltd (Cambridge, UK). Qureight used three deep learning models developed to quantify lung volume (Lung8), pulmonary vessel volume (Vascul8), and fibrosis extent (Fibr8) on the baseline and follow-up CTs of ENV-101 treated and placebo patients (ENV-101 = 16; placebo = 18).

Key Results from the Post Hoc Analysis Presented at ATS 2025

Significant increase in lung volume (Lung8) for patients in the ENV-101 treatment arm vs placebo (placebo: −113.07 mL vs ENV-101: 142.28 mL; p=0.014; effect size=0.87). Trend towards reduced fibrosis (Fibr8) for ENV-101 treated patients vs placebo (placebo: 1.32pp vs ENV-101: −1.32pp; p=0.063; effect size=−0.64). Significant reduction in normalized pulmonary vessel volume (Vascul8) for patients in the ENV-101 treatment arm vs placebo (placebo: 0.07pp vs ENV-101: -0.25pp; p=0.0007; effect size=-1.28).

“We are excited to share significant findings from the post hoc analysis of the phase 2a clinical trial of ENV-101, highlighting our pulmonary vessel volume quantification model, Vascul8,” said Simon Walsh, M.D., Ph.D., Chief Scientific Officer, Qureight. “Using this model, we quantified a significant treatment effect from ENV-101, with a greater effect size than forced vital capacity. Qureight’s deep learning-based imaging biomarkers offer distinct advantages by capturing treatment signals from each prognostic compartment of the lung separately, optimizing for precision medicine.”

About the ENV-101 Phase 2a Clinical Trial

Data from the post hoc analysis independently validates and builds upon the previously reported results from the Phase 2a randomized, double-blind, multi-center, placebo-controlled clinical trial of ENV-101 (NCT04968574). In the trial, ENV-101 demonstrated significant improvements in lung function and total lung volume, while also showing a reduction in key measures of lung fibrosis versus placebo with a manageable safety profile.

About the WHISTLE-PF Trial

Endeavor continues to study ENV-101 and has initiated the Phase 2b WHISTLE-PF (Wound-remodeling Hedgehog-Inhibitor ILD Study Testing Lung Function Endpoints-PF) clinical trial, a global, randomized, placebo-controlled study evaluating the therapeutic potential of ENV-101 in individuals with IPF (NCT06422884). The WHISTLE-PF trial will evaluate the efficacy of a range of ENV-101 doses through 24 weeks of treatment, characterize the investigational compound’s safety, assess its effect on patient reported outcomes and its effects on lung capacity and lung fibrosis as measured by chest HRCT.

About Idiopathic Pulmonary Fibrosis

IPF is a chronic, progressive lung disease that affects more than 150,000 adults in the United States. Although the exact cause of IPF is unknown, various environmental factors can deliver repeated injuries to lung cells that trigger abnormal wound-healing processes and life-threatening lung scarring. IPF is a chronic disease with limited treatment options and a very poor prognosis: the average life expectancy is only three to five years after diagnosis.

About ENV-101

Endeavor BioMedicines’ investigational medicine ENV-101 (taladegib) is a Hedgehog signaling pathway inhibitor. By binding to and inhibiting a key receptor in the Hedgehog pathway, ENV-101 stops the abnormal accumulation of the myofibroblasts that cause fibrosis. This may resolve the excessive wound-healing process seen in pulmonary fibrosis, improving lung volume and function.

About Endeavor BioMedicines

Endeavor BioMedicines is a clinical-stage biotechnology company developing medicines with the potential to deliver transformational clinical benefits to patients with life-threatening diseases. Endeavor’s lead candidate, ENV-101 (taladegib), is an inhibitor of the Hedgehog signaling pathway in development for fibrotic lung diseases, including idiopathic pulmonary fibrosis (IPF). The company’s second candidate, ENV-501, is a HER3 antibody-drug conjugate (ADC) in development for the treatment of HER3-positive solid tumors. More information is available at www.endeavorbiomedicines.com and on LinkedIn or X.

Audra Friis Sam Brown, Inc. 917-519-9577 audrafriis@sambrown.com

临床2期临床结果

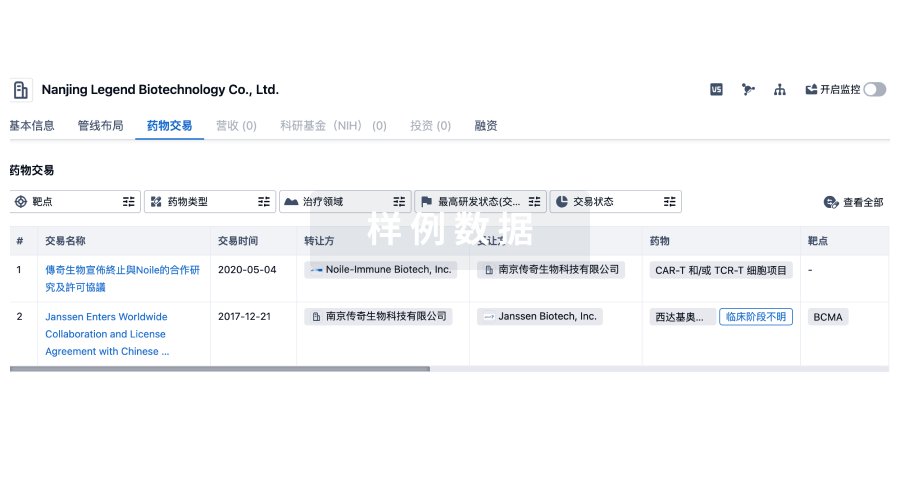

100 项与 Endeavor BioMedicines, Inc 相关的药物交易

登录后查看更多信息

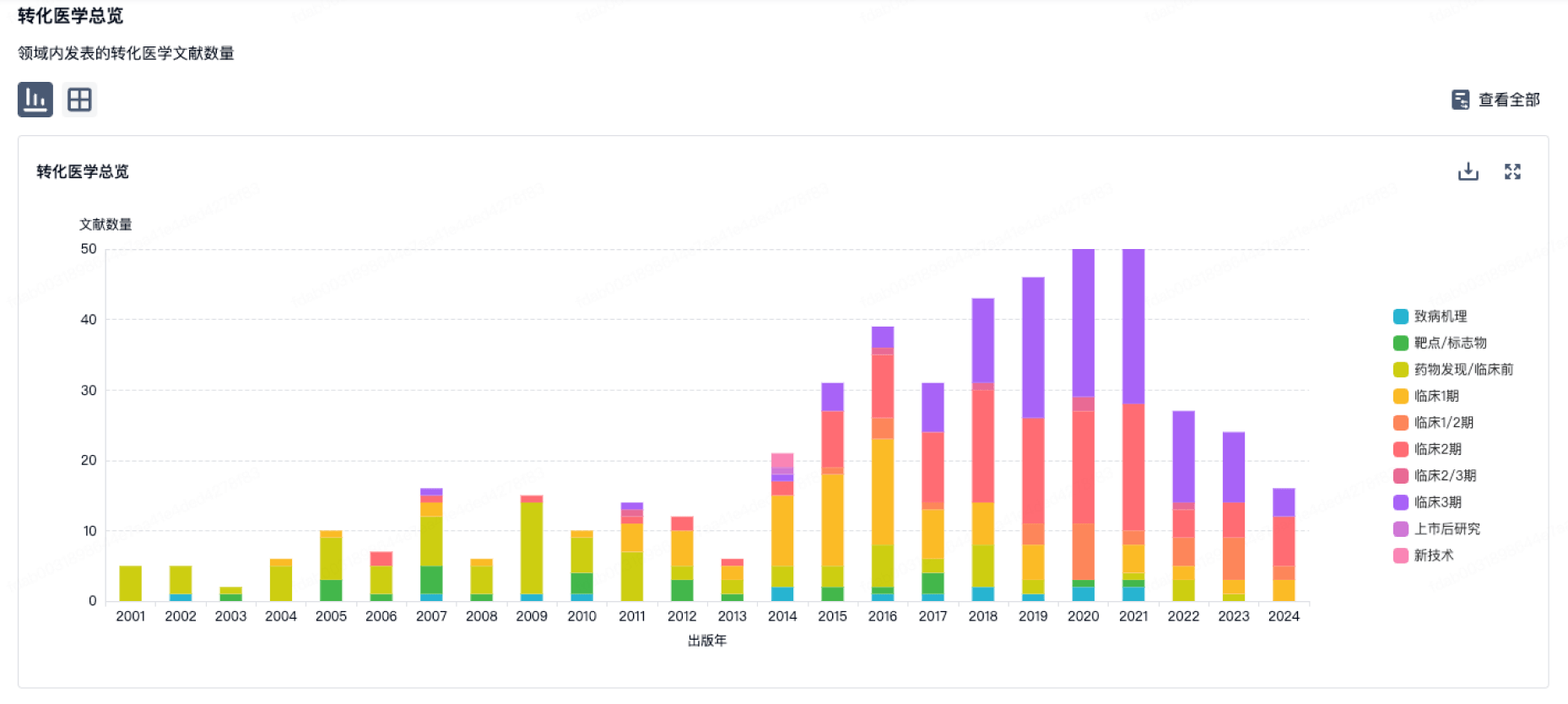

100 项与 Endeavor BioMedicines, Inc 相关的转化医学

登录后查看更多信息

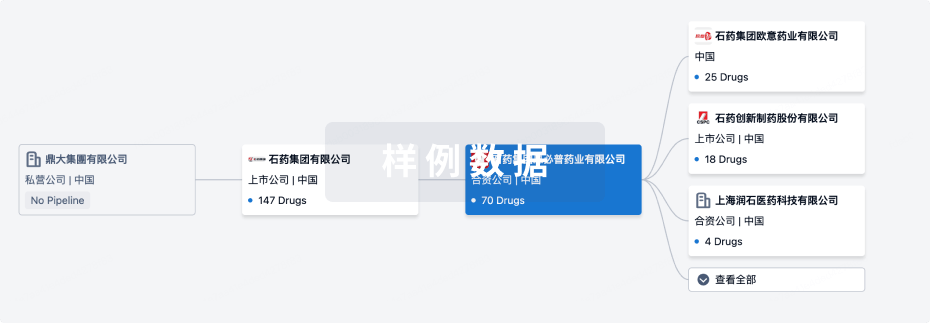

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年09月16日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床前

1

2

临床2期

其他

1

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

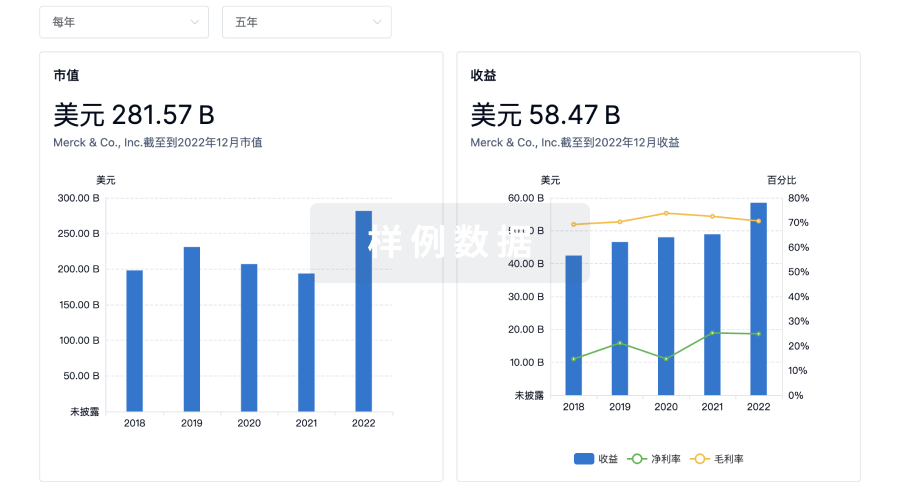

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用