预约演示

更新于:2025-08-29

MedStar Health, Inc.

更新于:2025-08-29

概览

关联

2

项与 MedStar Health, Inc. 相关的药物作用机制 CDK2抑制剂 [+9] |

最高研发阶段批准上市 |

首次获批国家/地区- |

首次获批日期- |

靶点 |

作用机制 EWS-FLI1抑制剂 |

非在研适应症- |

最高研发阶段临床前 |

首次获批国家/地区- |

首次获批日期- |

81

项与 MedStar Health, Inc. 相关的临床试验NCT07128927

Assessing the Feasibility of Web-based Insomnia Treatment Among Prostate Cancer Survivors

This pilot study will recruit Black/African American prostate cancer survivors into a clinical trial and will randomize each person to 1 of 2 possible treatments - an internet-based treatment for insomnia called Sleep Healthy Using the Internet (SHUTi) or an educational website. SHUTi provides the treatment - cognitive behavioral therapy for insomnia - across 6 lessons, while the educational website is like an online patient brochure. The study will examine the feasibility of SHUTi to improve sleep and well-being among Black prostate cancer survivors. It will also examine whether SHUTi is acceptable to these survivors and will compare the effect of SHUTi versus the educational website on insomnia and non-insomnia patient-reported outcomes.

开始日期2025-09-02 |

NCT06853925

A Pilot Randomized Controlled Trial of the Use of a Website About Radioactive Iodine Symptom Management in Patients With Thyroid Cancer

The goal of this clinical trial is to learn if adult patients diagnosed with differentiated thyroid cancer can easily use and benefit from an online tool aimed to provide patients with educational resources and symptom management strategies to improve their quality of life after radioactive iodine (RAI) treatment. The main questions it aims to answer are:

1. Can patients easily use and benefit from the RAI Support intervention?

2. Does RAI Support improve health-related quality of life (overall well-being) compared to usual care?

This research will help test better digital tools to support thyroid cancer survivors in managing their health after RAI treatment.

Researchers will compare RAI Support to treatment as usual (a publicly available informational website about thyroid cancer) to see if RAI Support works to improve patients' overall well-being.

Participants will:

1. Receive access to RAI Support or an informational website (treatment as usual) for four weeks.

2. Use the assigned website once a week for up to four weeks.

3. Complete two online questionnaires (an initial questionnaire and a final questionnaire after four weeks of using the assigned website) about symptoms related to RAI treatment, mood, and confidence in managing symptoms.

4. Complete an optional 60 minute virtual interview about your experiencing using the assigned website.

1. Can patients easily use and benefit from the RAI Support intervention?

2. Does RAI Support improve health-related quality of life (overall well-being) compared to usual care?

This research will help test better digital tools to support thyroid cancer survivors in managing their health after RAI treatment.

Researchers will compare RAI Support to treatment as usual (a publicly available informational website about thyroid cancer) to see if RAI Support works to improve patients' overall well-being.

Participants will:

1. Receive access to RAI Support or an informational website (treatment as usual) for four weeks.

2. Use the assigned website once a week for up to four weeks.

3. Complete two online questionnaires (an initial questionnaire and a final questionnaire after four weeks of using the assigned website) about symptoms related to RAI treatment, mood, and confidence in managing symptoms.

4. Complete an optional 60 minute virtual interview about your experiencing using the assigned website.

开始日期2025-09-01 |

NCT07078344

Addressing Diet-Induced Health Disparities With Precision Nutrition and Omega-3 Fatty Acids

The goal of this clinical trial is to learn whether omega-3 fatty acid supplementation can reduce inflammation-related biomarkers and improve cardiovascular health in healthy adult volunteers with different genetic backgrounds. The main questions it aims to answer are: Does the response to omega-3 supplementation differ based on genetic variation in the FADS gene cluster (specifically rs174537)? Are changes in fatty acid ratios and inflammation markers greater among individuals of African ancestry compared to those of European ancestry? Researchers will compare omega-3 supplements to a placebo in a randomized, placebo-controlled crossover study to determine whether the Omega-3 supplementation is more effective in certain genetic and ancestry groups. Participants will take omega-3 supplements or a placebo daily for a defined period, then cross over to the other intervention. They will provide blood samples for analysis of fatty acid levels and inflammatory markers, complete questionnaires, and attend scheduled study visits.

开始日期2025-08-04 |

申办/合作机构 |

100 项与 MedStar Health, Inc. 相关的临床结果

登录后查看更多信息

0 项与 MedStar Health, Inc. 相关的专利(医药)

登录后查看更多信息

9,292

项与 MedStar Health, Inc. 相关的文献(医药)2025-12-31·HIV Research & Clinical Practice

An evaluation of the ambulatory diagnosis and treatment of seborrheic dermatitis in PWH in a regional healthcare system

Article

作者: Kassaye, Seble G. ; Perez, David ; Kini, Aniket ; Ozisik, Deniz ; Visconti, Adam ; Herbert, Carly

BACKGROUND:

Seborrheic dermatitis is a common inflammatory skin condition which disproportionately impacts persons with HIV (PWH). Non-dermatologists, including primary care and HIV clinicians, are often the first providers to diagnose and manage inflammatory dermatoses. Data is lacking regarding the quality of management of such common dermatoses by non-dermatologist compared to dermatologic specialists.

METHODS:

We evaluated the treatment of and referral patterns for seborrheic dermatitis relative to accepted standards of care among outpatient dermatologists and non-dermatologists in a regional healthcare system. Using a cross-sectional design, we analyzed a random sample of 100 persons 18 years or older with a diagnosis of HIV and more than one visit to a regional primary care or HIV clinician with an ICD code for treatment of seborrheic dermatitis.

RESULTS:

Seborrheic dermatitis was the most common specific inflammatory dermatosis among PWH in the healthcare system. Non-dermatologists were significantly more likely to prescribe one medication compared to dermatologists (62.2% vs. 50.9%, p = 0.05). 28.9% of persons initially diagnosed by a non-dermatologist were referred to a dermatology specialist. When considering immediate initiation of treatment as optimal management, 33/45 (73.3%) of non-dermatologists had optimal management compared with 53/55 (96.4%) of dermatologists (p < 0.01). However, when considering referral as optimal management, then 86.7% of patients initially diagnosed by non-dermatologists were optimally managed.

DISCUSSION:

Seborrheic dermatitis remains a common issue among PWH in a multispeciality ambulatory setting. Non-dermatologists appear significantly less likely to provide optimal initial management which may affect quality of life given potential for delayed treatment in settings with limited specialists. Additional training should be provided to non-dermatologists to facilitate appropriate treatment of common inflammatory dermatological conditions.

2025-12-01·Current Neurology and Neuroscience Reports

Status Migrainosus – A Narrative Review

Review

作者: Mayers, Michellee ; Wogayehu, Jerusalem ; Ailani, Jessica

PURPOSE OF REVIEW:

In this narrative review, we discuss the current literature on status migrainosus (SM) in the context of the definition, epidemiology, management and prognosis.

RECENT FINDINGS:

SM is associated with a substantial cost burden driven by health care utilization. Individuals with SM have higher rates of ED visits, hospitalizations and progression to chronic migraine. Early treatment and preventative strategies are key aspects of the management of SM. There are a wide variety of medications utilized for the acute treatment of SM. "Bridge strategies" are often employed in an attempt to alleviate refractory pain and prevent a trip to the Emergency Department. It is important that physicians identify patients with SM and prepare them for future attacks, due to the debilitating nature of these episodes and the disease burden. Recent studies highlight the numerous approaches to managing SM. Clinicians should educate their patients about SM as a significant complication of migraine attacks, as well as develop a plan for preventative measures and early treatment of SM.

2025-12-01·AMERICAN JOURNAL OF CARDIOLOGY

Bailout Use of Cangrelor During Percutaneous Coronary Intervention and Associated Outcomes

Article

作者: Hill, Andrew P ; Waksman, Ron ; Ben-Dor, Itsik ; Case, Brian C ; Sawant, Vaishnavi ; Lupu, Lior ; Hashim, Hayder D ; Zhang, Cheng ; Creechan, Patrick ; Haberman, Dan ; Satler, Lowell F ; Chaturvedi, Abhishek ; Abusnina, Waiel ; Rappaport, Hank ; Rogers, Toby

Cangrelor is an intravenous P2Y12 receptor inhibitor. Data on its use as "bailout" therapy for thrombotic complications during percutaneous coronary intervention (PCI) are lacking. We screened patients who received cangrelor as bailout therapy (if not planned upfront, but used for a clinically indicated reason after the first balloon angioplasty or stent deployment) during PCI at our institution from January 2016 through December 2023. Angiographic (thrombolysis in myocardial infarction (TIMI) flow, resolution of thrombus) and in-hospital clinical outcomes - ischemic events (composite of inpatient mortality, target vessel or lesion revascularization, and ischemic stroke), major bleeding (intracranial hemorrhage, blood transfusion for hemoglobin drop >3 g/dL), and length of stay (LOS) - were analyzed. Of 2680 patients receiving cangrelor during PCI, 67 (2.5%) received it as bailout. The mean age was 66.7 years and 73.1% were male. The reasons for cangrelor bailout included slow flow (40.3%), no-reflow (23.9%), stent thrombosis (22.4%), and acute side branch occlusion (16.4%). Cangrelor significantly improved the mean TIMI flow from 1.3 to 2.7 overall and improved flow in all patients with TIMI-0 flow at the time of bailout. In those with stent thrombosis, cangrelor led to complete (86.7%) or partial (13.3%) resolution of the thrombus on the final angiogram. In-hospital ischemic events occurred in 11.9% and major bleeding in 4.5% of patients. The mean LOS was 5.8 days. Among patients undergoing PCI, the use of cangrelor as an ad-hoc bailout strategy is safe, feasible, and may provide an alternative to glycoprotein IIb/IIIa inhibitors.

334

项与 MedStar Health, Inc. 相关的新闻(医药)2025-08-20

Sarcoma Foundation of America awards grants to accelerate research on sarcoma, a rare cancer, aiming to improve patient outcomes and therapies.

As the leading private funder of sarcoma research, SFA remains deeply committed to advancing scientific discovery.”

— Brandi Felser, CEO of SFA

DAMASCUS, MD, UNITED STATES, August 20, 2025 /

EINPresswire.com

/ --

Sarcoma Foundation of America

(SFA), the leading private funder of sarcoma

research

in the sarcoma community, has awarded $1.2 million to advance sarcoma research. Fifteen grants were awarded to dedicated scientists committed to studying sarcoma, a group of rare cancers that originate in the body’s soft tissue and bone. Each proposal underwent rigorous peer review by members of SFA’s Medical Advisory Board, who selected the most promising and impactful research projects aimed at advancing toward a cure for sarcoma.

“As the leading private funder of sarcoma research, SFA remains deeply committed to advancing scientific discovery,” said Brandi Felser, Chief Executive Officer of the Sarcoma Foundation of America. “These grants represent a critical investment in research that will deepen our understanding of sarcoma and advance the development of more and better therapies. We are honored to support these exceptional researchers who are at the forefront of this vital work, helping to increase the number of sarcoma survivors.”

Since its inception, SFA has invested more than $27 million in sarcoma research, funding over 240 research grants to more than 200 researchers at 120+ institutions across 13 countries. These investments have contributed to over 300 scientific publications, numerous clinical trials, and a growing number of sarcoma experts advancing the field.

2025 SFA Research Grant Recipients:

Danh Truong, Ph.D. – The University of Texas MD Anderson Cancer Center

2024 Giving Tuesday Donors Research Award – $75,000

“Investigating lineage plasticity and EMT through the ZEB1-GRHL2 axis in DSRCT”

Erica Braverman, M.D. – University of Pittsburgh

Louise Duffy Memorial Research Award – $75,000

“Uncovering mechanisms of adoptive cellular therapy dysfunction in rhabdomyosarcoma”

Fabio Vanoli, Ph.D. – Memorial Sloan Kettering Cancer Center

Todd Baron Memorial Research Award – $75,000

“Establishing in vitro models and discovering novel targets in CIC::DUX4 sarcoma”

George Li, M.D. – Memorial Sloan Kettering Cancer Center

Jay Vernon Jackson Memorial Research Award – $75,000

“Investigating intratumoral heterogeneity in myxoid/round cell liposarcoma”

Janai Carr-Ascher, M.D., Ph.D. – University of California, Davis

Richard and Valerie Aronsohn Memorial Research Award – $75,000

“Identification of YAP-dependent high-grade complex karyotype sarcomas”

Jeffrey Toretsky, M.D. – Georgetown University

Scott Lively Memorial Research Award – $75,000

“Role of biomolecular condensates in EWS::FLI1-driven tumorigenesis”

Jianguo Huang, Ph.D. – Providence Portland Medical Foundation

Marcia Brodsky Memorial Research Award – $75,000

“Siglec15 regulation of the immune suppressive microenvironment in sarcoma”

Mitchell Cairo, M.D. – New York Medical College

John O’Brien Memorial Research Award – $75,000

“Next-generation CAR NK combinatorial immunotherapy against osteosarcoma”

Sandro Pasquali, M.D., Ph.D. – Fondazione IRCCS Istituto Nazionale dei Tumori (Italy)

Technoblade Memorial Research Award – $75,000

“Translational study of the phase III STRASS trial (TRANS-STRASS)”

Rebecca Gladdy, M.D., Ph.D. – Sinai Health System (Canada)

Richard and Valerie Aronsohn Memorial Research Award – $75,000

“Pre-clinical development of synergistic drug combinations for leiomyosarcoma”

Timothy Chan, M.D., Ph.D. – Cleveland Clinic

Chris Langbein Memorial Research Award – $75,000

“Reduced HLA expression in rhabdomyosarcoma: implications for immune recognition”

Tyler McCaw, M.D., Ph.D. – UCLA

John O’Brien Memorial Research Award – $75,000

“Targeting post-operative immune suppression in soft tissue sarcoma”

Wantong Yao, M.D., Ph.D. – MD Anderson Cancer Center

Richard and Valerie Aronsohn Memorial Research Award – $50,000

“Leiomyosarcoma cell line compound screening”

Ajaybabu Pobbati, Ph.D. – Cleveland Clinic

Expanding on a multi-year grant awarded by the EHE Foundation – $70,000

“Evaluation of a Cdk9 inhibitor for aggressive epithelioid hemangioendothelioma”

Last Mile Research Grant

The Last Mile Research Grant is a $150,000 investment in translational science focused on the biology, diagnosis, and treatment of sarcoma. Now in its second year, the grant is named for SFA’s Race to Cure Sarcoma events and helps bridge critical funding gaps while accelerating larger-scale research efforts toward a cure.

This year’s Last Mile Research Grant awardee is:

Matthew Hemming, MD, Ph.D. –University of Massachusetts Medical School

“Regulation of KIT gene expression in gastrointestinal stromal tumor”

To learn more about SFA’s research programs and grantmaking, visit:

https://curesarcoma.org/research/

About the Sarcoma Foundation of America

The Sarcoma Foundation of America (SFA) is a 501(c)(3) nonprofit charitable organization based in the United States. SFA’s mission is to improve outcomes for people diagnosed with sarcoma to increase the number of survivors. We do this by funding and advancing research, educating and providing resources for people diagnosed with sarcoma, advocating on behalf of the community, bringing together the collective sarcoma voice, and growing awareness about the disease. For more information, please visit

www.curesarcoma.org

.

About Sarcoma

Sarcoma is a rare cancer in adults (1 percent of all adult cancers) but rather prevalent in children (about 15% of all childhood cancers). In the U.S., over 17,000 people are diagnosed with sarcoma each year, and more than 7,000 die from the disease. Around 236,000 patients and families are living with sarcoma at any given time. Globally, over 187,000 people are diagnosed each year, and more than 116,000 die from sarcoma.

Danielle Carter

Sarcoma Foundation of America

3012538687 ext.

email us here

Visit us on social media:

LinkedIn

Bluesky

Instagram

Facebook

YouTube

TikTok

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

免疫疗法临床3期

2025-08-19

New research published in the Journal of Head Trauma Rehabilitation could help identify veterans at risk for health problems Research Highlights: More than half of post-9/11 veterans studied had suffered at least one traumatic brain injury (TBI) and showed faster biological aging.TBIs sustained during military deployment showed stronger links to accelerated aging compared to injuries outside military service.Compared to men, women veterans showed significantly stronger links between deployment-related TBIs and accelerated aging. FAIRFAX, Va., Aug. 19, 2025 (GLOBE NEWSWIRE) -- Post 9/11 veterans who sustained one or more traumatic brain injuries show faster biological aging compared to veterans without a TBI, according to new research published today in the Journal of Head Trauma Rehabilitation. In more than 1,000 veterans studied, deployment-related traumatic brain injuries had stronger links to accelerated aging than injuries outside military service, particularly among women. More recent injuries also showed stronger associations with aging than injuries prior to military service. “This is one of the first studies to examine whether traumatic brain injury is associated with biological aging broadly, and the results suggest experiencing a TBI, including a mild concussion, may help identify veterans at risk of faster aging,” says lead author Kyle Bourassa, Ph.D., staff psychologist in Research Service at the Durham Veterans Affairs Health Care System and senior research fellow in the Department of Psychology at Georgetown University. Nearly 5 million Americans have served in the armed forces since September 11, 2001, participating in combat operations in Iraq and Afghanistan. This post-9/11 population faces increased risks for traumatic brain injuries, psychiatric disorders and suicide, compared to earlier generations of veterans. Research has shown that brain injury can evolve into a lifelong health condition that impairs the brain and other organ systems and may persist or progress over a person’s lifetime. Previous research has linked TBI to poor brain health in the form of cognitive decline and dementia risks, but scientists still aim to understand why these problems develop. The new study examined whether accelerated biological aging could help explain these health consequences. Biological aging measures the rate at which a person’s body declines over time, but some people age biologically faster than others. Researchers used blood samples to assess aging markers that predict future health problems, including chronic disease and early death. The findings suggest TBIs, particularly those sustained during deployment, may put veterans at a higher risk for age-related health complications as they grow older. Researchers conducted a cross-sectional study analyzing blood samples from 1,152 post-9/11 veterans with an average age of 37 years enrolled in a long-term study with the Veterans Affairs VISN 6 Mid-Atlantic Mental Illness research, Education and Clinical Center. In this multi-site study, participants underwent clinical interviews about their history of traumatic brain injuries, including when and how the injuries occurred. Scientists used blood samples to measure epigenetic changes – chemical modifications to DNA that respond to environmental factors – to assess biological aging rates. Unlike permanent genetic traits, these epigenetic changes can be influenced by factors like injuries or stress, making them potentially reversible. The aging measure, called DunedinPACE, predicts future health outcomes. Key Findings TBI prevalence: More than half (51.2%) of the 1,152 veterans studied experienced at least one traumatic brain injury, with 299 reporting multiple injuries.Deployment-related injuries: Among the 590 veterans with TBI, more than one in four (27.3%) sustained an injury during military deployment.Co-occurring conditions: Nearly one-third of all participants (31.6%) had received a post-traumatic stress disorder diagnosis, and veterans with multiple TBIs were more likely to have developed PTSD.Deployment vs. non-deployment associations: Deployment-related TBIs were associated with accelerated aging, whereas traumatic brain injuries experienced outside of military service were not.Gender differences: Women veterans showed significantly stronger links between deployment-related TBIs and accelerated aging compared to men. Bourassa believes the findings could help identify approaches to improve health for people with a traumatic brain injury saying, “We know more work is needed, but our findings highlight the importance of integrating TBI screenings and tailored interventions into veteran health care frameworks, which could help address the long-term health consequences associated with military service-related brain injuries.” “This study provides further evidence that TBI can be a risk factor for abnormal aging, but what is important is what we can do about it,” observed John Corrigan, Ph.D., National Research Director for the Brain Injury Association of America (BIAA) and editor-in-chief of the Journal for Head Trauma Rehabilitation. “Having a TBI should be a reason to take better care of your brain through diet, exercise, sleep, stress management and other brain healthy behaviors. BIAA promotes identification of TBI with programs like Concussion Awareness Now, so people can learn the signs and symptoms of a concussion and ways to make healthy choices moving forward.” Scientists noted several important limitations to the research. Because it was a cross-sectional study, the findings cannot prove that TBI caused faster aging, only that the two are linked. Additionally, researchers assessed a participant’s TBI history through self-reported clinical interviews, which can be subject to recall bias. Bourassa noted their study team is conducting a new study using a more detailed method of assessing TBI to attempt to address this limitation. The study also focused on post-9/11 veterans, which may limit how the findings apply to other veteran populations or civilians with traumatic brain injuries. Future studies should examine whether the findings can be replicated in other groups and explore what biological processes lead to accelerated aging following a TBI. Scientists also need to better understand why deployment-related injuries might show stronger associations with aging for women veterans. Co-authors are Sarah L. Martindale, Ph.D.; Melanie E. Garret, M.S.; VA Mid-Atlantic MIRECC Workgroup; Allison E. Ashley-Koch; Jean C. Beckham, Nathan A. Kimbrel, Jared A. Rowland; Ph.D. Financial disclosures or conflicts of interest can be found in the full article. ABOUT THE BRAIN INJURY ASSOCIATION OF AMERICA The Brain Injury Association of America is the country’s oldest and largest nationwide brain injury advocacy organization. BIAA’s mission is to improve the quality of life of people affected by brain injury across their lifespan through advancing prevention, awareness, research, treatment, education, and advocacy. BIAA is dedicated to increasing access to quality health care and raising awareness and understanding of brain injury. Find more information online at our website or follow us on social media. https://www.biausa.org https://www.facebook.com/BrainInjuryAssociationofAmerica/ https://www.instagram.com/bia_usa/ https://x.com/biaamerica https://concussionawarenessnow.org https://www.facebook.com/ConcussionAwarenessNow https://www.instagram.com/concussionawarenessnow/ CONTACT:

Robin Lindner

(336) 926-8000

robin@bluewagongroup.com

2025-08-14

The government has so far prevailed about a dozen times in legal challenges against Medicare’s drug price negotiation program.

But the fight isn’t over.

Since March 2024, federal courts across at least four circuits have rejected drugmakers’ attempts to overturn provisions of the Inflation Reduction Act before new prices take effect in January 2026. But a handful of cases are still undecided and, in the coming weeks, AstraZeneca is

gearing up

to potentially appeal its case to the US Supreme Court.

The government is “winning a lot of battles, but the war is still going on,” said Andrew Twinamatsiko, director of the O’Neill Institute’s Center for Health Policy and the Law at Georgetown University.

During the first negotiation round that began in 2023, the government

secured discounts

of up to 79% from the list price on well-known drugs such as Merck’s diabetes medication Januvia and Bristol Myers Squibb and Pfizer’s blood thinner Eliquis. It’s unclear how much of a discount that is from net prices, which include rebates and discounts. But the Biden administration

previously estimated

that it would save Medicare $6 billion in 2026.

Some pharma companies have argued that the negotiation process

unconstitutionally

restricts their free speech and due process rights. They say it forces them to agree to a price and that the government is essentially taking their property without just compensation. But in cases where courts have ruled on the merits, judges have consistently said the process is voluntary and that drugmakers don’t have to participate.

Despite the industry’s court losses so far, some legal experts say drugmakers like AstraZeneca aren’t likely to drop the fight.

Companies are “always going to have an incentive to fight it, because it produces enormous savings for the program,” said Anna Kaltenboeck, who co-authored the IRA’s drug negotiation section.

HHS declined to comment.

Last week, two appeals courts and a district court in Texas rejected

separate

challenges

from Boehringer Ingelheim, regional chambers of commerce, and PhRMA, respectively.

But with at least a half-dozen cases still undecided, “the litigation is still alive,” Twinamatsiko said. He said that it appears the pharma industry “will not relent until the Supreme Court rules on underlying constitutional challenges.”

The US Court of Appeals for the Third Circuit could decide any day on four challenges brought by Johnson & Johnson’s Janssen, Bristol Myers, Novartis and Novo Nordisk. Merck and Teva are still awaiting rulings in a federal court in DC. And PhRMA appealed its case to the Fifth Circuit on Wednesday.

PhRMA told

Endpoints News

that it disagrees with the district court’s decision and continues “to believe the IRA’s price setting provisions are unconstitutional.”

Meanwhile, AstraZeneca has until Sept. 20 to file a petition for review with the Supreme Court after the Third Circuit rejected its case in May. The drugmaker had asked the high court to extend its August filing deadline so that it has “sufficient time to fully examine the decision’s consequences” and prepare its petition.

AstraZeneca wrote in its filing last month that the IRA deprives the company of its right to sell its drug at market prices.

The Third Circuit’s decision “gives the government

carte blanche

to set prices without any procedural safeguards — not even judicial review — so long as it acts not only as a price regulator, but also as a market participant,” AstraZeneca wrote.

The company declined to comment on whether it plans to petition the high court.

Repeated court losses have “dampened the hopes” for drugmakers still awaiting decisions, said Mintz partner Theresa Carnegie, who advises clients in the pharma industry supply chain on how to comply with IRA requirements.

While judges are not “beholden” to the conclusions of other circuits, Carnegie said “they’re at least considering how other courts have decided the issue.”

But some claims have not yet been decided on the merits — particularly some claims by drugmakers that multiple products were unfairly tied together and treated as one by the government, improperly expanding the negotiation program.

Twinamatsiko is keeping an eye on Novo Nordisk’s case, which argued that CMS erred by grouping its Novolog and Fiasp insulin products together as one product. Teva made similar arguments over the grouping of its Austedo and Austedo XR products in its lawsuit filed in January. Novo’s blockbuster weight loss drugs Ozempic, Wegovy and Rybelsus were also aggregated for the second round of negotiations.

“We haven’t seen any other court decide that specific claim,” Twinamatsiko said. So far, courts have only rejected the aggregation claims on procedural grounds.

AstraZeneca also challenged CMS’ standard for determining “bona fide” generic competition (which could exempt a drug from negotiations). But the Third Circuit also dismissed that claim on procedural grounds. Teva has also challenged CMS’ “bona fide” marketing standard.

The second round of Medicare negotiations is currently underway, and is expected to conclude this fall.

Law experts say it’s difficult to speculate on what would happen if a court issues a decision against the government after prices take effect in 2026. While it would depend on the judge’s decision and the type of relief granted, Carnegie said it could be “much more complicated to unravel” the law when it’s already gone into effect and is operating in the market.

In parallel to the lawsuits, Carnegie said the pharma industry also appears focused on making “massages” to the IRA, such as lobbying to eliminate the law’s so-called “pill penalty.” Drugmakers have been vocal critics of provisions in the IRA that make small molecule drugs eligible for negotiations four years before more complex biologics. Earlier this year, the bipartisan EPIC Act

was introduced

to amend that part of the law. And a group of pharma companies — Merck, Bristol Myers, AstraZeneca and Eli Lilly — appear to be affiliated with a lobbying coalition focused on “analyzing impact of Medicare Drug Price Negotiation on patients,”

according to a lobbying disclosure filing.

Whether in the courts or before Congress, AstraZeneca’s recent request for more time to petition the Supreme Court is proof that “the manufacturers are not done fighting on this issue,” Carnegie said. “They’re going to take it to whatever next level they can.”

专利侵权

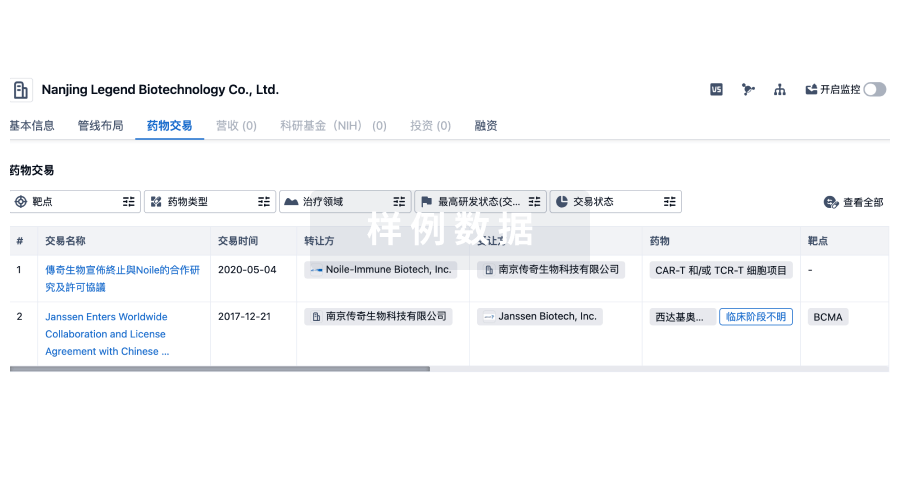

100 项与 MedStar Health, Inc. 相关的药物交易

登录后查看更多信息

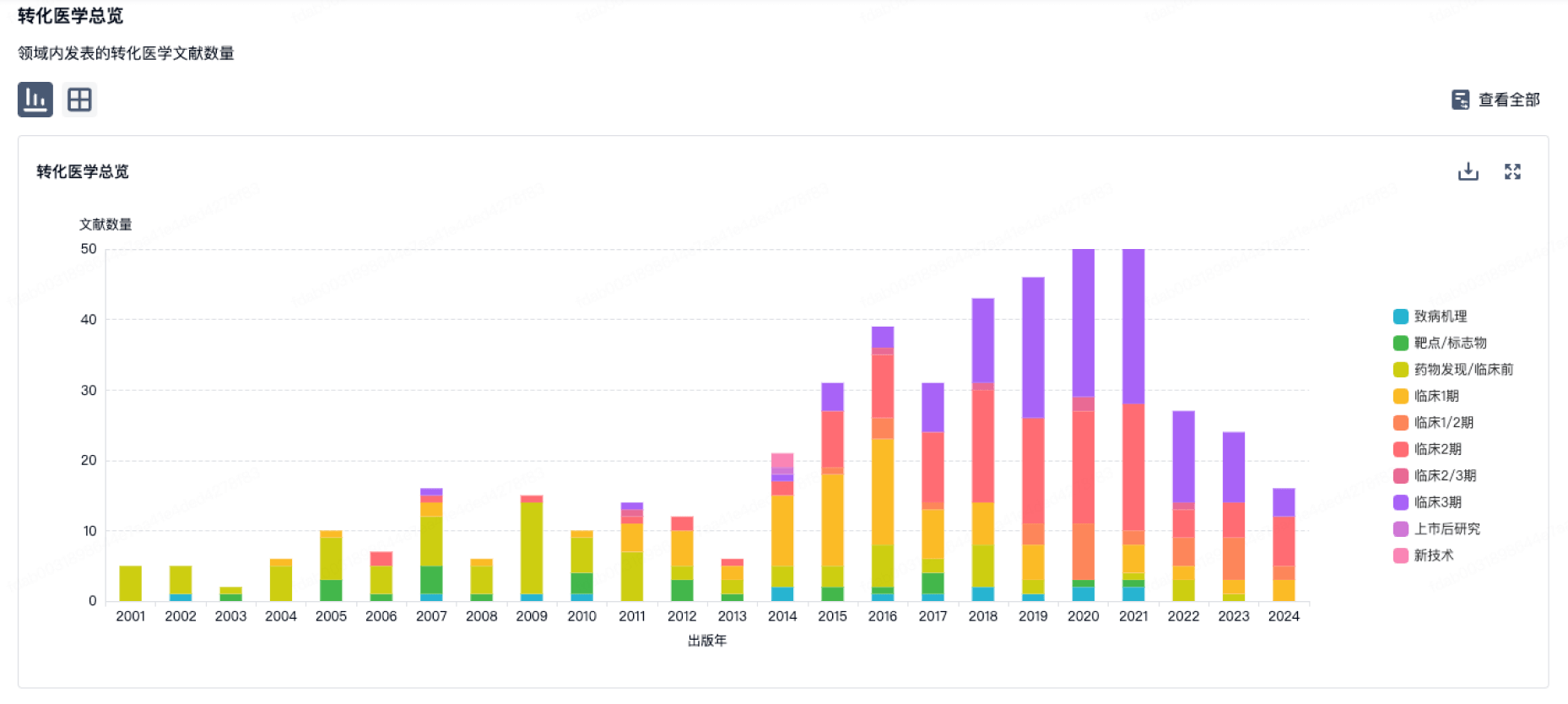

100 项与 MedStar Health, Inc. 相关的转化医学

登录后查看更多信息

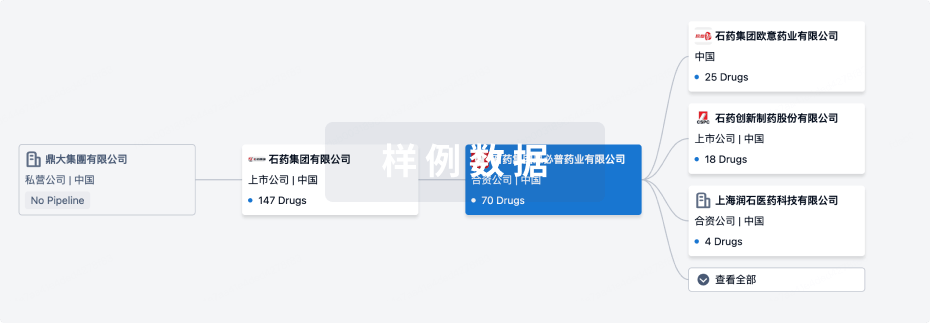

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年09月02日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床前

2

3

其他

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

YK-4-279 ( EWS-FLI1 ) | 尤文肉瘤 更多 | 临床前 |

姜黄素 ( CDK2 x DNMT1 x MDM2 x Nrf2 x PTBP1 x RBM3 x TGF-β x TLR4 x VEGF ) | 黑色素瘤 更多 | 临床前 |

阿替利珠单抗 ( PDL1 ) | 广泛期小细胞肺癌 更多 | 终止 |

Sazetidine-A ( α4β2 receptor ) | 记忆障碍 更多 | 无进展 |

10074-G5 ( c-Myc ) | 肿瘤 更多 | 无进展 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

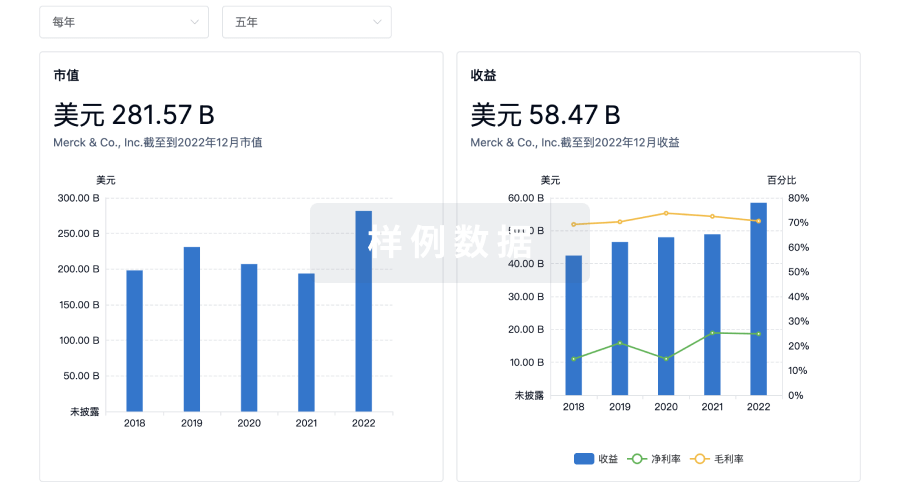

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

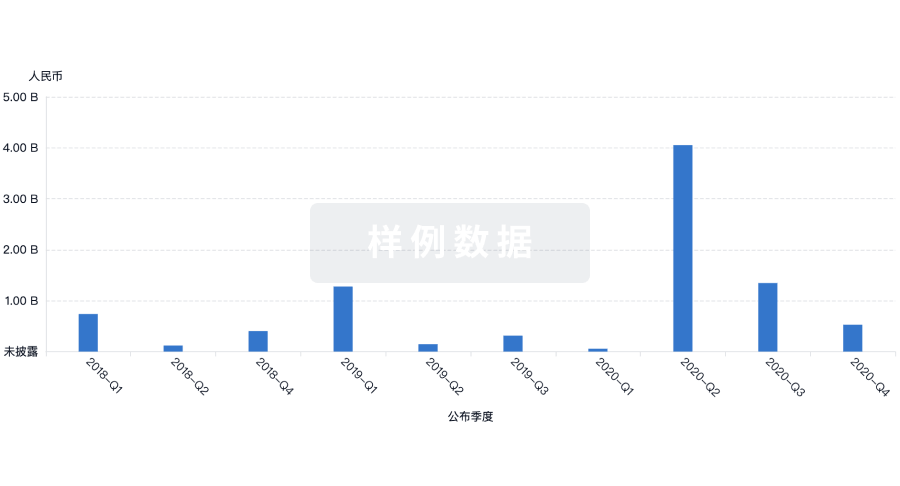

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

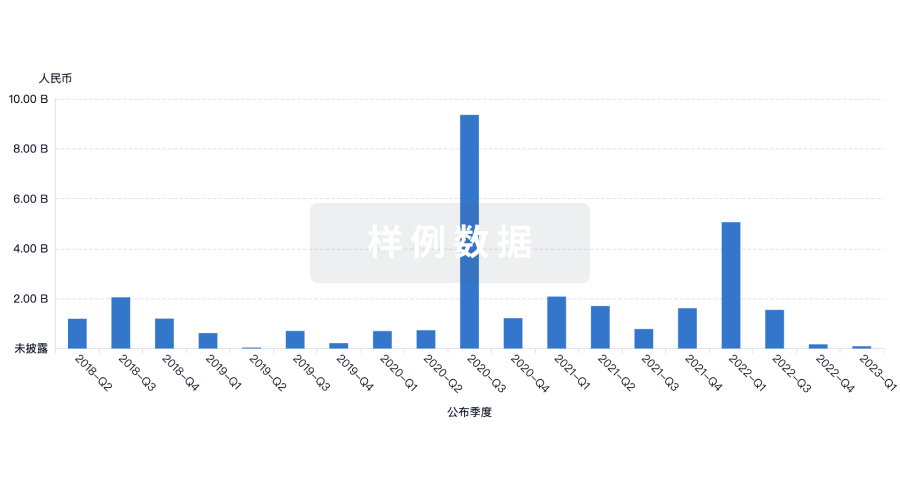

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用