预约演示

更新于:2025-05-07

Lubris BioPharma

更新于:2025-05-07

概览

标签

免疫系统疾病

眼部疾病

口颌疾病

重组蛋白

关联

2

项与 Lubris BioPharma 相关的药物靶点 |

作用机制 PRG4调节剂 |

原研机构 |

非在研适应症 |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

靶点- |

作用机制- |

在研机构 |

原研机构 |

在研适应症 |

非在研适应症- |

最高研发阶段临床前 |

首次获批国家/地区- |

首次获批日期- |

2

项与 Lubris BioPharma 相关的临床试验NCT06520202

A PHASE II PROSPECTIVE RANDOMIZED CROSSOVER STUDY ASSESSING THE ACUTE SAFETY & EFFICACY OF RHPRG4 (450 µG/ML RECOMBINANT HUMAN PROTEOGLYCAN 4) COMPARED TO VEHICLE FOR THE TREATMENT OF SJÖGREN'S RELATED DRY EYE DISEASE

A 1-day, randomized (1:1) controlled, masked, pre-market study. Subjects with moderate to severe Sjögren's related Dry Eye Disease will be evaluated at 0, 5, 30 & 90 minutes post dose of either rhPRG4 (Treatment group) or vehicle (Crossover group). At 90 minutes, Crossover group subjects will be administered rhPRG4, then evaluated 5 & 30 minutes after rhPRG4 instillation (95 & 120 minutes from baseline). All subjects will self-report for the remainder of the day at 4 hours and 8 hours post dose.

开始日期2024-08-01 |

申办/合作机构 |

NCT06495307

A PHASE I PROSPECTIVE OPEN LABEL STUDY ASSESSING THE SAFETY & EFFICACY OF RHPRG4 (450 µG/ML RECOMBINANT HUMAN PROTEOGLYCAN 4) FOR THE TREATMENT OF OCULAR GRAFT-VERSUS-HOST DISEASE (OGVHD)

rhPRG4-GVHD-001 is a prospective multi-center study conducted in Australia to evaluate the safety and efficacy of topically-applied rhPRG4 in subjects with moderate to severe dry eye secondary to chronic GVHD.

开始日期2024-07-01 |

申办/合作机构  Lubris BioPharma Lubris BioPharma [+1] |

100 项与 Lubris BioPharma 相关的临床结果

登录后查看更多信息

0 项与 Lubris BioPharma 相关的专利(医药)

登录后查看更多信息

4

项与 Lubris BioPharma 相关的新闻(医药)2021-07-21

Smith Collection/Gado/Getty Images

Novartis reported its second-quarter financials today, with net sales growing 15% to $12.956 billion (U.S.), hitting $25.367 billion for the half-year mark. The company also reported on its COVID-19 vaccine production with CureVac and some changes to its pipeline.

“Novartis delivered a strong second quarter, driven by the momentum of our key growth brands, including Cosentyx, Entresto, Zolgensma, our Oncology portfolio and the launch of Kesimpta which continues to accelerate,” said Vas Narasimhan, chief executive officer of Novartis. “Our pipeline of novel medicines continues to progress with key positive readouts in diseases with high unmet need, including iptacopan in a range of immune mediated diseases, 177Lu-PSMA-617 in prostate cancer and Zolgensma in spinal muscular dystrophy.”

And as is familiar with quarterly and yearly reports, the company reported on a drug in its pipeline it is abandoning. The first was ECF843, which was being developed for moderate-severe dry eye disease (DED). The Phase III data didn’t meet expectations, and the company indicated it was “discontinued in a broad population of moderate to severe DED.”

ECF843 is a recombinant type of human lubricin and was licensed from Lubris in 2017 for “ophthalmic indications worldwide” except in Europe.

Otherwise, there were a few specific drug updates. Leqvio (inclisiran), received a complete response letter (CRL) from the U.S. Food and Drug Administration (FDA) in December 2020. It was a potential treatment for hyperlipidemia in adults with high low-density lipoprotein cholesterol (LDL-C) who were otherwise on a maximum dose of a statin. The CRL revolved around “unresolved facility inspection-related conditions.”

The company reported that it had resubmitted and been assigned a PDUFA of January 1, 2022. It’s already approved in Europe. There were no efficacy or safety issues in the CRL.

Novartis said it had submitted asciminib to the FDA for adults with Philadelphia chromosome-positive chronic myeloid leukemia (CML) in chronic phase in patients who have already been treated with two or more tyrosine kinase inhibitors in addition to patients with T315I mutation. Asciminib is a STAMP inhibitor.

Novartis also has a manufacturing deal with CureVac for CureVac’s COVID-19 vaccine. Novartis’ chief financial officer Harry Kirsch told the media, “We have started the production as planned. We are planning to deliver 50 million doses this year.”

CureVac's vaccine, CVnCoV, is an mRNA shot, and Novartis is helping manufacturing bulk drug substances at its site in Kundl, Austria.

Last month, CureVac indicated its COVID-19 vaccine was only 48% effective, so there was some question about how much capacity was necessary. Typically, regulators have said a vaccine needed efficacy levels of 50% or higher before authorization. CureVac’s chief executive officer, Franz-Werner Haas, indicated on June 30 that the company planned to submit the vaccine to regulators, especially in the European Union and for age groups that otherwise performed better in the trial than the overall trial population.

“In this final analysis, CVnCoV demonstrates a strong public health value in fully protecting study participants in the age group of 18 to 60 against hospitalization or death and 77% against moderate and severe disease — an efficacy profile, which we believe will be an important contribution to help manage the COVID-19 pandemic and the dynamic variant spread,” Haas stated at the time.

Novartis also helps Pfizer and BioNTech manufacture their COVID-19 mRNA vaccine and indicates it can scale up manufacturing for other companies if needed.

Otherwise, Novartis’ Pharmaceuticals business unit (BU) grew 12% for the quarter, with strong growth from Entresto, Cosentyx and Zolgensma. Kesimspta sales alone hit $66 million (U.S.). The Oncology BU grew 7%, driven by Promacta/Revolade, Jakavi, Kisqali and Tafinlar + Mekinist.

The company’s Sandoz unit expanded by 5%. Innovative Medicines grew 7%. Second-quarter core operating income grew 13%, while operating income grew 41%, primarily from higher sales in addition to divestment gains. Second-quarter net income increased 49%.

Featured Jobs on BioSpace

疫苗信使RNA

2019-05-08

Takeda is looking to lighten the huge debt burden from the Shire buyout. Novartis wants to beef up its eye medicine portfolio after the Alcon spinoff. Now, the two companies have found a deal where their needs align.

As previously rumored, Takeda is selling Shire’s dry-eye drug Xiidra. To take it in, Novartis is shelling out $3.4 billion upfront and commits potential milestone payments of up to $1.9 billion, and gets a therapy that “fits strategically” with its ophthalmic pharmaceutical portfolio, the Swiss drugmaker said Thursday.

The pair expect the deal to close in the second half of this year. Once that happens, nearly 400 Takeda employees associated with Xiidra and based mainly in the U.S. and Canada will come over to Novartis.

Xiidra, which competes against Allergan’s Restasis, generated sales of about $400 million last year and is “well positioned for blockbuster potential,” Novartis said. In 2018, Novartis’ entire ophthalmology medicine franchise, led by Roche-shared blockbuster wet age-related macular degeneration therapy Lucentis, returned $4.56 billion, down 1% over the previous year mainly due to generic erosions to its intraocular hypertension drug Travatan and pink eye therapy Pataday.

“Xiidra, with its unique dual benefits, is an example of the type of innovative advances we invest in for the benefit of patients,” Novartis’ pharma chief Paul Hudson said in a statement. “We look forward to leveraging our well-established commercial infrastructure to bring this medicine to more patients.”

Novartis has its own dry eye therapy in development: ECF843, a recombinant form of human lubricin in-licensed from Lubris in 2017, is in phase 2 with a planned first regulatory submission in 2022. Through a deal in late 2016, Novartis took in Encore Vision and its UNR844, a potentially first-in-class topical treatment for presbyopia. The Swiss drugmaker is counting on the Xiidra team’s commercial experience to help with those front-of-the-eye pipeline products.

RELATED: What does Novartis' eye business envision without Alcon? Digital M&A, for one thing

For Takeda, the Xiidra deal marks the first selloff since the $62 billion Shire takeover. The Japanese pharma is hoping to divest around $10 billion worth of products to help cut down debt incurred with the acquisition. Other rumored or confirmed castoffs include its European over-the-counter business, its entire Latin American unit, Shire’s hypoparathyroidism drug Natpara, and a Shire inflammatory bowel disease candidate.

Separately, Takeda also said it will sell TachoSil surgical patch to Johnson & Johnson’s Ethicon for about $400 million. For the fiscal year ended last March, Takeda recorded $155 million sales for TachoSil. Together with the product, about 80 employees will join J&J. But Takeda will keep a manufacturing facility in Linz, Austria, that makes the TachoSil and will continue to supply it for J&J under a long-term agreement, Takeda said on Wednesday.

“These initial divestitures represent important steps in advancing the growth strategy Takeda outlined following our transformational acquisition of Shire earlier this year,” Takeda CEO Christophe Weber said in a statement. The company is sharpening its focus on the core areas of gastroenterology, rare diseases, plasma-derived therapies, oncology and neuroscience.

并购临床2期

2017-04-25

April 25, 2017

By

Mark Terry

, BioSpace.com Breaking News Staff

There are rumors that

Johnson & Johnson

,

Novartis AG

and

Takeda Pharmaceutical

are discussing a

buyout

of Brazilian pharmaceutical company

Hypermarcas SA

.

The controlling percentage of Hypermarcas shares are owned by two family-investment groups, Igarapava

Participacoes SA

and

Maiorem SA de CV

. The two groups hold a combined 34 percent of the company. The two groups have reportedly hired the investment banking firms

Banco Bradesco SA

and

Credit Suisse Group AG

to provide guidance on a possible sale.

Reuters

reported

that two unidentified sources say that talks are ongoing. Brazilian billionaire

Joao Alves Queiroz Filhoo

owns Igarapava and a Mexican family owns Maiorem. If their stakes are acquired, it would, according to

Reuters

’ source, “automatically trigger a buyout of minority shareholders.”

Reportedly no formal, binding proposals have been submitted.

Hypermarcas is Brazil’s largest listed drug maker. For the last two years, the company has focused on over-the-counter drugs. It also raised about $1.5 billion from the sale of several of its personal care brands to

Coty (COTY.N)

,

Reckitt Benckiser Group (RB.L)

and

Ontex Group NV (ONTEX.BR)

.

Headquartered in Sao Paul, Brazil, Hypermarcas was founded in 2001 and has about 8,787 employees. It offers sweeteners under the names Adocyl, Finn and Zero-Cal. Its lead brands are Addera D3, Alivium, Benegrip, Biotonico Fontoura, Doril, Engov, Epocler, Histamin, Lisador, Polaramine, Predsim, Rinosoro, and Torsilax.

The company also offers products for child care and health, including absorbents, antiseptics, baby bottles, baby powers, toothbrushes and dental products, such as floss. Its pharmaceutical lines include over-the-counter medications such as laxatives, antacids, and nasal decongestants. Its prescription medications are marketed under the Farmasa, Neo Quimica, and Luper names.

As a result of the rumors, Hypermarcas

shares closed

up 3.8 percent yesterday, at 30.35 reais. The company’s market cap is about $6 billion (U.S.). Its overall extended gains yesterday were 7 percent to an all-time high of 31.38 reais.

Lauro Jardim

, a columnist with

O Globo

, reported on Sunday that Queiroz and his family were discussing a sale of their stake in Hypermarcas with several foreign companies. Jardim did not identify how he acquired that information.

In January, Johnson & Johnson

acquired

Switzerland-based Actelion (ALIOF.PK) for $30 billion in cash. As part of that deal, Actelion will spin off its research-and-development pipeline into a new standalone company.

Actelion

focuses on rare drugs. It recently brought two new drugs on the market with potential blockbuster status. They are Opsumit and Uptravi, both to treat pulmonary arterial hypertension (PAH), a form of high blood pressure that affects arteries in the lungs. Actelion’s lead product is Tracleer, for PAH, which is facing generic competition this year.

Earlier this month, Novartis

exercised an option

to in-license ECF843 for dry eye and other ophthalmic indications from a four-person biotech company,

Lubris BioPharma

, based in Boston. Novartis’ ophthalmology and dry eye treatments include Systane, Tears Naturale and Genteal.

Also in early April, Takeda

inked

a global collaboration deal with Somerville, Mass.-based

Finch Therapeutics

to jointly develop FIN-524. FIN-524 is a live biotherapeutic product made up of cultured bacterial strains that have been associated with favorable clinical outcomes in research of microbiota transplantations in inflammatory bowel disease (IBD). Finch will receive $10 million upfront for exclusive worldwide rights to develop and commercialize the compound. It also will gain rights to follow-on products to IBD, and be eligible for various milestone payments and tiered royalties on worldwide net sales.

并购引进/卖出

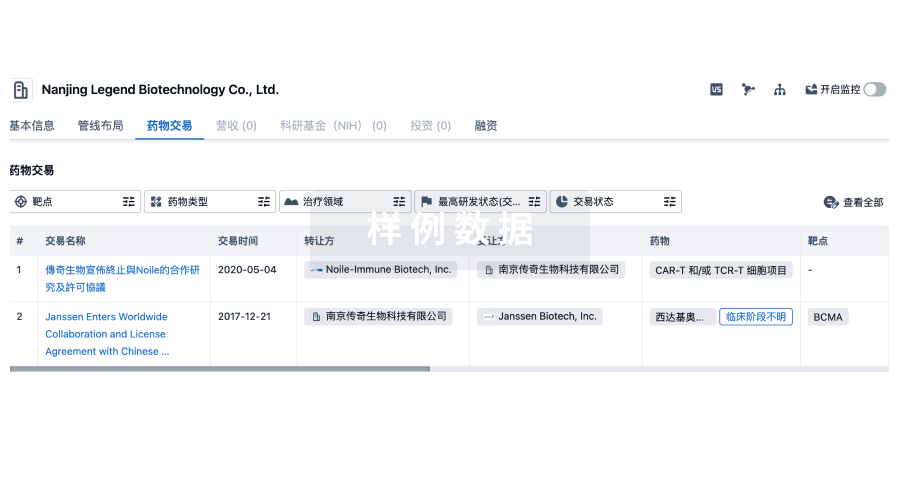

100 项与 Lubris BioPharma 相关的药物交易

登录后查看更多信息

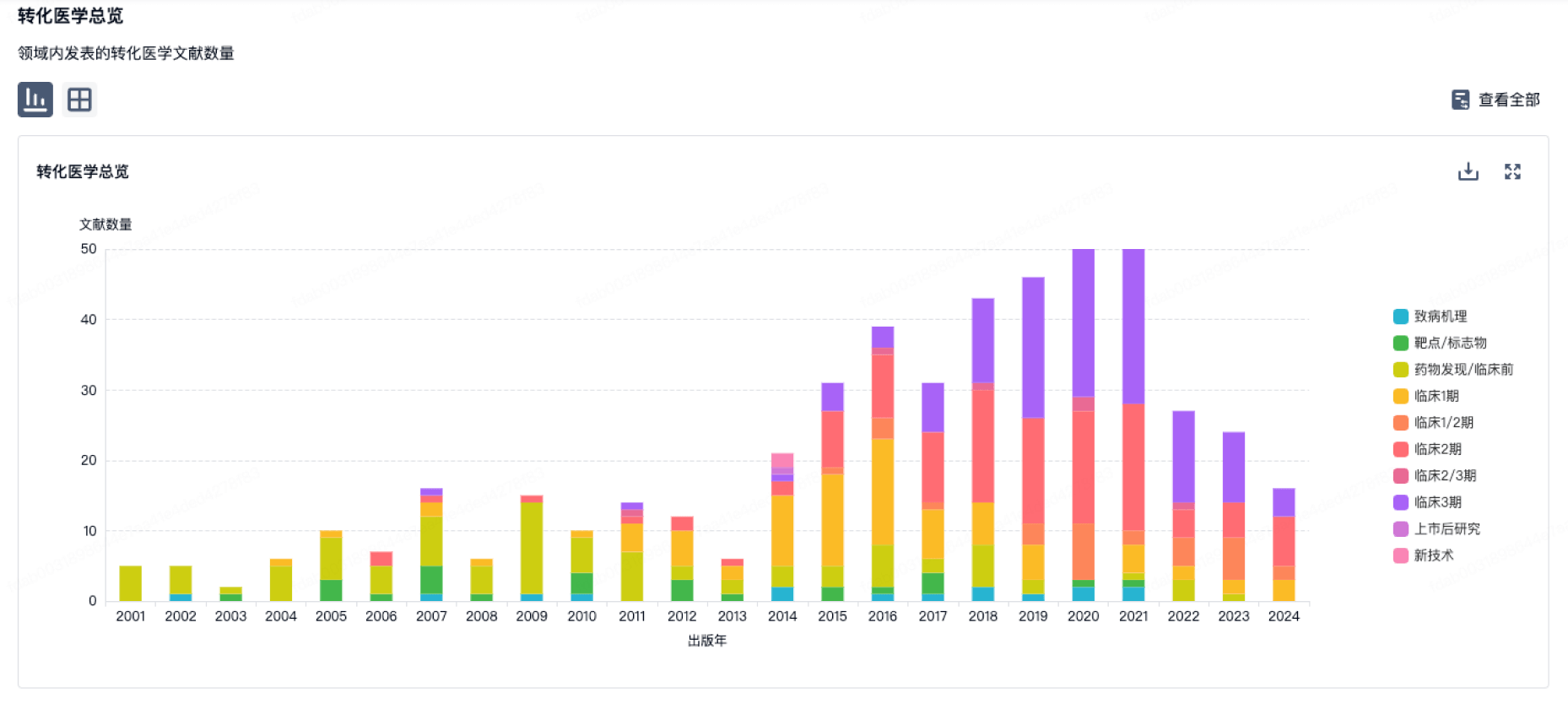

100 项与 Lubris BioPharma 相关的转化医学

登录后查看更多信息

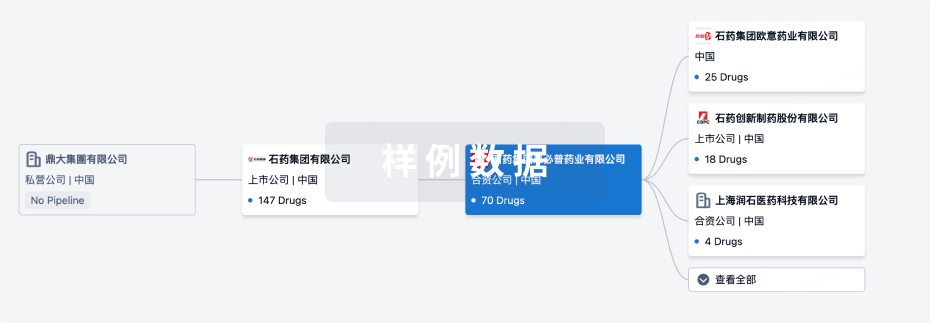

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年07月26日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床2期

1

1

其他

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

Recombinant Human Proteoglycan 4(Lubris BioPharma) ( PRG4 ) | 干燥综合征 更多 | 临床2期 |

LBS-020 | 口干症 更多 | 无进展 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

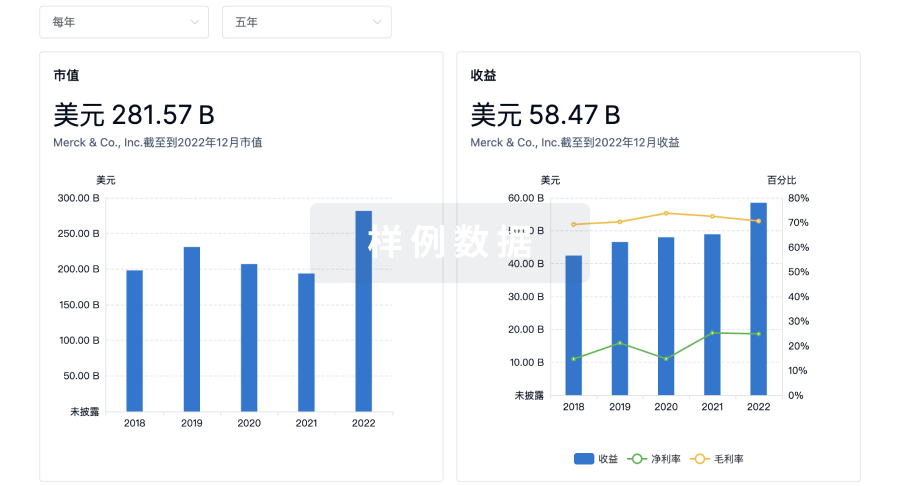

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

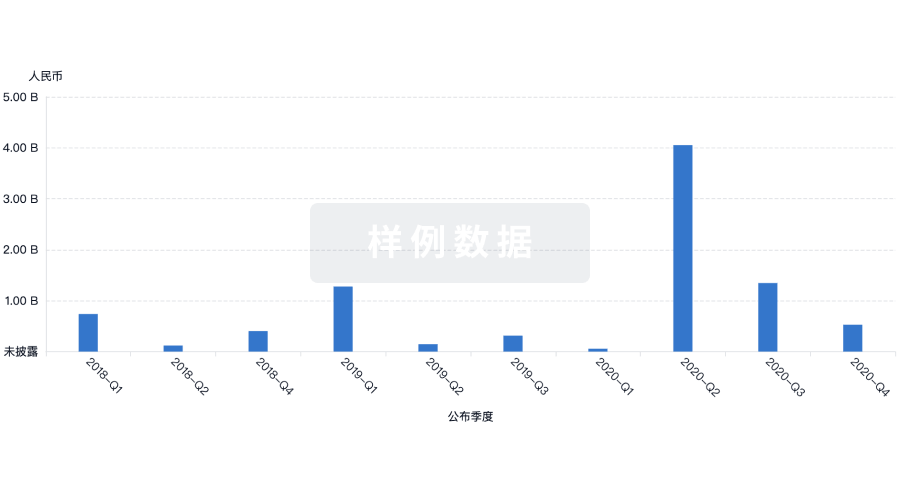

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

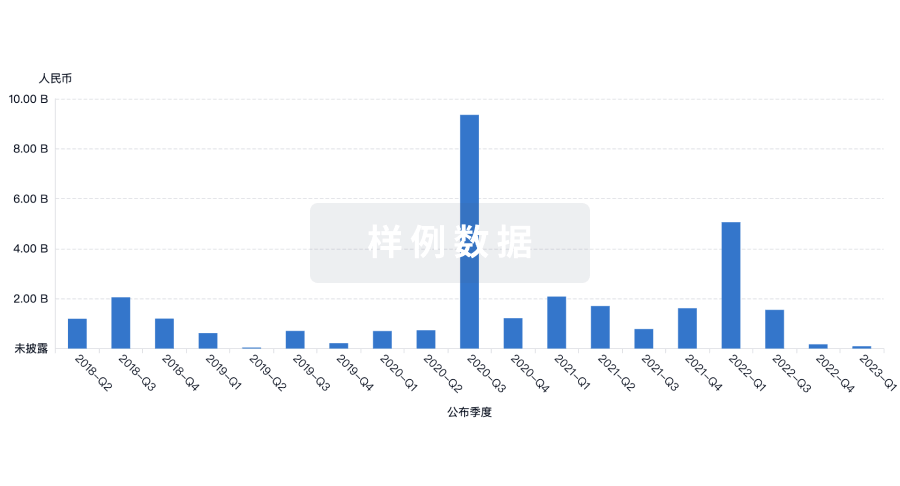

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用