预约演示

更新于:2025-05-07

Haier Group Corp.

更新于:2025-05-07

概览

标签

其他疾病

血液及淋巴系统疾病

遗传病与畸形

免疫球蛋白

非重组凝血因子

单克隆抗体

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 免疫球蛋白 | 4 |

| 非重组凝血因子 | 4 |

| 重组凝血因子 | 1 |

| 单克隆抗体 | 1 |

关联

10

项与 Haier Group Corp. 相关的药物作用机制 F10调节剂 [+3] |

在研机构 |

原研机构 |

在研适应症 |

非在研适应症 |

最高研发阶段批准上市 |

首次获批国家/地区 中国 |

首次获批日期2021-07-06 |

靶点 |

作用机制 fibrin调节剂 |

在研机构 |

原研机构 |

在研适应症 |

非在研适应症- |

最高研发阶段批准上市 |

首次获批国家/地区 中国 |

首次获批日期2016-03-11 |

靶点 |

作用机制 F10刺激剂 |

在研机构 |

原研机构 |

在研适应症 |

非在研适应症- |

最高研发阶段批准上市 |

首次获批国家/地区 中国 |

首次获批日期2013-08-23 |

10

项与 Haier Group Corp. 相关的临床试验CTR20241608

评价SR604注射液在血友病A/B及先天性凝血因子Ⅶ缺乏症患者中的安全性、耐受性、有效性、PK/PD特征的开放、多中心Ⅰ/Ⅱ期临床试验

Part A(单次给药阶段):评估SR604在血友病A/B及先天性凝血因子Ⅶ缺乏症患者中单次给药后的安全性、耐受性和免疫原性、药代动力学特征。

Part B(多次给药阶段):评估SR604在血友病A/B及先天性凝血因子Ⅶ缺乏症患者中多次给药的有效性、药代动力学特征、安全性和其他有效性。

开始日期2024-05-31 |

申办/合作机构 |

CTR20234075

评价人纤维蛋白原治疗慢性肝病患者获得性低纤维蛋白原血症的有效性和安全性的随机、双盲、阳性药平行对照、非劣效、多中心临床试验

评价人纤维蛋白原治疗慢性肝病引起的获得性低纤维蛋白原血症的安全性和临床疗效。

开始日期2024-05-30 |

申办/合作机构 |

NCT05909098

Xiangyang No.1 People's Hospital, Hubei University of Medicine

This study was a single-arm trial of autologous NK cell adjuvant therapy for relapsed/refractory non-Hodgkin's B-cell lymphoma. The locations isXiangyang No.1 People's Hospital, Hubei University of Medicine. The population was relapsed/refractory non-Hodgkin's B-cell lymphoma. The sample size was 33. The intervention was R-GemOx regimen combined with autologous NK cells. The dose of autologous NK cells was body surface area x (2-4) x 109 cells. The course of treatment was once every 14 days. The primary outcome measure was ORR. The duration of assessment was for each treatment cycle, 1 month, 3 months, 6 months, 9 months, 12 months, 18 months, 24 months, 3 years, and 5 years of treatment.

开始日期2023-07-01 |

申办/合作机构 襄阳市第一人民医院 [+1] |

100 项与 Haier Group Corp. 相关的临床结果

登录后查看更多信息

0 项与 Haier Group Corp. 相关的专利(医药)

登录后查看更多信息

112

项与 Haier Group Corp. 相关的文献(医药)2025-07-01·Journal of Hazardous Materials

An AIE-active Janus filter membrane for highly efficient detection and elimination of bioaerosols

Article

作者: Liu, Xinlin ; Yan, Saisai ; Xing, Jiyao ; Xing, Dongming ; Wang, Chao ; Liu, Zhanjie ; Liang, Bing ; Zhang, Miao ; Li, Jiyixuan ; Wen, Zishu ; Liu, Qing

2025-03-06·Energy & Fuels

Fine-Tuning the Activity Volcano of Single-Atom Iron Catalysts in NH3–SCR Regulated by Local Coordination Environment

作者: Yang, Weijie ; Miao, Ziwei ; Li, Mingzhe ; Gao, Zhengyang ; Liu, Yuxuan ; Zhang, Yongqian ; Wang, Chu ; Guo, Kewen

2025-01-01·Phytomedicine

Exploring Cistanche's therapeutic potential and molecular mechanisms in asthma treatment

Article

作者: Zhong, Kai ; Xiong, Ying ; Li, Guoping ; Gao, Jie ; Xiong, Anying ; Li, Xiaolan ; He, Xiang ; Ran, Qin ; Liu, Jiliu ; Bai, Lingling

262

项与 Haier Group Corp. 相关的新闻(医药)2025-04-29

·药时空

4月28日,华兰生物发布了2025年第一季度报告。2025Q1季度,华兰生物实现营收8.68亿元,同比增长10.20%;归母净利润3.13亿元,同比增长19.62%;扣非净利润2.30亿元,同比增长35.35%。华兰生物是一家从事血液制品、疫苗、基因工程产品研发、生产和销售的国家高新技术企业。公司业务包括血液制品、疫苗制品、创新药和生物类似药研发、生产三类业务,其中血液制品是主业,公司营业收入和利润的主要部分为血液制品,最近几年,疫苗制品也为公司的营收贡献了一部分力量。血液制品方面,华兰生物有人血白蛋白、静注人免疫球蛋白、人免疫球蛋白、人凝血酶原复合物、人凝血因子Ⅷ、人纤维蛋白原、狂犬病人免疫球蛋白、乙型肝炎人免疫球蛋白、破伤风人免疫球蛋白等11个品种(34 个规格),是我国血液制品行业中血浆综合利用率较高、品种较多、规格较全的企业之一。作为国内血液制品企业TOP 5之一,华兰生物一季度的业绩可谓是表现亮眼,而另外四家已遭遇一季报“暴雷”:天坛生物在2025Q1季度实现营收13.18 亿元,同比增长 7.84%,但其归母净利润2.44亿元,同比下降 22.90%。据悉,这是天坛生物自2018年第四季度以来,归母净利润下降幅度最大的一次季度业绩。博雅生物在2025Q1季度同样增收不增利,营收为5.36亿元,同比增长19.49%;归母净利润为1.39亿元,同比下降8.25%;扣非归母净利润为1.02亿元,同比下降19.67%。派林生物在2025Q1季度甚至出现了营利双降,营收同比下降14%,净利润同比下降26.95%。上海莱士在2025Q1季度实现营收20.06亿元,同比下降2.45%;归母净利润5.66亿元,同比下降25.20%;扣非归母净利润5.70亿元,同比下降3.52%。而回看2024年这几家血液制品企业的业绩,却是可圈可点,表现不俗的,基本均实现了良好的增长,比如天坛生物在2024年净利大增40%,是其中表现最漂亮的企业。但在2025年一季度这四家公司却出现了不同程度的滑坡,这可能是供需与价格的博弈,“价格”或许是影响血液制品企业今年一季度业绩的主因。天坛生物在2025年一季报中表示,净利润下降是产品价格下降减少的利润大于销量增长增加的利润所致。派林生物表示业绩变动主要受派斯菲科二期产能扩增停产影响,导致产品供应量同比下降。而上海莱士并未在一季报中说明原因,但其在近期接受投资者调研时称,公司销售的产品价格相对较为稳定,其中人血白蛋白随着供需关系的调整,终端价格略有变化。疫苗制品方面,该业务是华兰生物营收的第二增长曲线,但是近五年营收表现却忽高忽低。同日,华兰生物的疫苗业务子公司华兰疫苗也发布了2025第一季度业绩。华兰疫苗实现营收2428.25万元,同比下降29.05%;归母净利润3277.71万元,同比下降15.06%;扣非净利润1541.58万元,同比增长8.89%。华兰疫苗是国内最大的流感疫苗生产商,也是首家获批四价流感疫苗的公司。2018年6月,公司的四价流感疫苗获批上市,一品独大,并迅速放量,替代三价流感疫苗成为主流产品。不过随着越来越多的四价流感疫苗获批上市,华兰疫苗流感疫苗的市占率也逐渐由100%降至86.10%,再降至61.41%。自2024年以来,国内流感疫苗价格显著下行,三价疫苗的报价曾低至6.5元/支,四价疫苗的报价亦曾降至百元以内。4月14日,今年全国首个流感疫苗招标项目公布中标结果。据深圳政府采购网显示,华兰疫苗中标深圳市疾病预防控制中心(深圳市卫生检验中心、深圳市预防医学研究所)深圳市60岁及以上人群流感疫苗接种项目,其将供应15万支三价流感疫苗,价格为10元/支。对于今年流感疫苗价格是否将继续下调的问题,华兰疫苗方面表示,公司将根据2025年流感疫苗市场的实际情况制定相应的生产计划和销售策略,流感疫苗价格会受到市场供求关系、厂商竞争格局等多种因素的影响,是否会发生变化尚存在不确定性。至于疫苗业务能否在2025年回暖的问题,华兰生物管理层在近期的业绩会上表示:“公司目前已按照2025年流感疫苗生产计划组织正常的生产,疫苗行业能否回暖会受到市场供求关系、厂商竞争格局等多种因素的影响。”近年来,华兰生物以血液制品为依托,培育新的利润增长点。除了2005年成立华兰疫苗之外,华兰生物于2013年成立华兰基因,开展创新药和生物类似药的研发、生产。据华兰生物方面披露,华兰基因先后有10个单抗品种取得临床试验批件,正在按计划开展或准备进入临床试验,贝伐珠单抗已经获批正式生产和销售。华兰生物方面表示,今年一季度,华兰基因已产生收入,但该公司未在华兰生物合并报表范围。参考资料:[1] 华兰生物、华兰疫苗等公司2025年一季度报告.[2] 从暴增40%到暴跌23%,“血王”业绩变脸,发生了啥?. E药经理人. 2025年04月27日.[3] 血液制品业绩集体“变脸”. 21新健康. 2025年04月28日.[4] 上海莱士:加速浆站布局夯实发展根基,提升经营效能打造核心优势. 翰之未来. 2025年04月28日.[5] 华兰生物的成长性在哪里?. 长虹伴梦. 2025年04月12日.[6] “一枝独秀”的华兰生物. 炯垕看华兰. 2025年04月28日.[7] 疫苗业务收入腰斩 华兰生物业绩遭“滑铁卢”. 中经医健资本圈. 2025年04月22日.识别微信二维码,可添加药时空小编请注明:姓名+研究方向!

财报疫苗生物类似药

2025-04-27

血制品的好日子也到头了吗?撰文| Kathy崩了。血制品龙头们一季报,堪称“丑媳妇见公婆”。国药系天坛生物、华润系博雅生物净利润齐齐下跌,动辄20%。更有陕媒系大军派林生物与海尔生物旗下的上海莱士成了营利双降的“倒霉蛋”。2024年净利大增40个百分点、年报综合表现最漂亮的“血王”天坛生物,这次居然“领跌”。尽管其一季度营收增长7.84%,但归母净利润和扣非净利润分别大降22.9%和23.7%。博雅生物同样面临着一季度增收不增利的局面。上海莱士净利润也从2024年的增长23.25%跌至一季报的下滑25.20%,未能稳住过去一年势头。而派林生物则遭遇了高基数增长后的业绩下滑。这些公司均表示将进一步加强市场开拓与新产品推广,以增强持续盈利能力。国内血液制品企业TOP5中,四家已遭遇一季报“暴雷”,仅剩华兰生物,实现了超预期增长。血制品行业怎么一下就从香饽饽跌进冰窟窿?业绩为何集体变脸?短短三个月,天坛生物、博雅生物、派林生物、上海莱士齐刷刷在一季报里上演了一场业绩“变脸秀”。与2024年报时的一片向好形成鲜明对比的是,四家公司在2025年一季报中业绩出现了不同程度的滑坡。天坛生物在2025年第一季度实现营业收入 13.18 亿元,同比增长 7.84%,但其归属于上市公司股东的净利润2.44亿元,同比下降 22.90%。这与2024年表现截然相反,2024年,天坛生物归母净利润达15.49亿元,同比增长39.58%,4个季度同比皆实现增长,尤其是最后一个季度,期间营业收入达19.59亿元,同比激增69.06%,净利润则飙升123.58%。拉长时间线来看,这是天坛生物自2018年第四季度以来,归母净利润下降幅度最大的一次季度业绩。针对一季度的利润下滑,天坛生物表示主要原因是:产品价格下降。尽管销量有所增长,但产品价格的下降导致利润减少幅度超过了销量增长对利润的贡献。市场竞争激烈。公司在销售模式和销售策略方面面临不确定性,也导致利润水平受到波动影响。成本上升。成本上升对利润也产生了一定的挤压,使得公司在价格下降的同时,利润空间进一步缩小。但市场似乎并不为此买账。有投资者不禁发问,产品集采未降价、行业竞争格局也没发生变化,市场也是供不应求的状态,为何这时强调产品价格下降?有二级市场分析师指出,其实在天坛生物2024年的年报数据中,就已经看出了隐忧。2024年财报显示,天坛生物经营活动净现金流同比骤降65.75%至8.2亿元,与净利润比值仅为0.39,盈利质量显著弱化。同时,应收票据增速高达1093%,远超营收增速(16.44%),存货增速(36.02%)亦远超营业成本增速(7.12%),显示销售回款效率下降及库存积压风险。降价去库存,类似情况还反映在了其它血制品巨头身上。博雅生物,一季度同样增收不增利:营收为5.36亿元,同比增长19.49%;归母净利润为1.39亿元,同比下降8.25%;扣非归母净利润为1.02亿元,同比下降19.67%。从2024年报来看,博雅生物过去一年实现归母净利润3.97亿元,同比增长67.18%,但这与2023年计提了大额商誉减值和其他资产减值准备导致净利基数较低有关,其营业收入同比减少34.58%至17.35亿元。其中静丙、人血白蛋白等产品都出现2.65%~12%的不同程度的下滑。但产品的批签发量却同比增长10%左右。这也意味着,单价下滑这一事实在2024年便已经出现。派林生物更“惨”一点,一季度营利双降。2025年一季度营收同比下降14%,净利润同比下降26.95%。回顾2024年,派林生物全年营收同比增长14%至26.55亿元,归母净利润同比增长21.76%至7.45 亿元,全年采浆量超过1400吨,增长显著。究其业绩急转直下的原因,从成本与费用角度来看,派林生物在Q1的三费(财务费用、销售费用和管理费用)总和为 6759.29万元,占总营收的比例从去年同期的13.87%上升至 18.04%,增幅30.03% ,这表明公司在控制成本方面面临较大挑战,费用的增加对公司利润产生了严重的负面影响。 推荐阅读 * 国药PK华润医药:中药掉队,血制品称王* “血王”终极战!国药硬刚“一哥”,华润猛追,五巨头的坏日子来了?寡头时代+关税调整,新机会在哪?相较于净利润下滑这件事,摆在国内血制品龙头面前最重要的一件事,或许仍是:做加法。作为高门槛的寡头竞争行业,至少在血源类产品被大规模替代前,扩张还是血制品行业现有的逻辑。截至目前,国内正常经营的血液制品生产企业不足30家,且已经形成较为集中的行业格局。根据规定,血液制品的原材料必须是健康人血浆,而且只能通过单采血浆站获取。因此,企业所掌握的浆站数量很关键,可谓是得浆站者得天下。万联证券研报指出,2024年,我国新获批浆站3个,新增在营浆站17个,持续推动浆量稳步增长。根据数据统计,2024年行业采浆量1.34万吨,同比增长10.9%,其中天坛生物、泰邦生物、上海莱士、华兰生物、派林生物、远大蜀阳的采浆量合计占据国内血浆采集量80%左右,行业规模效应凸显。行业并购依旧频繁。2024年,博雅生物收购绿十字,天坛生物收购了中原瑞德。到了上个月,上海莱士宣布拟以42亿元收购南岳生物100%股权。收购落地后,上海莱士将在湖南省拥有11家单采血浆站及1家分站,浆站总数突破50家。巨头们忙着整合、并购、扩产的同时,这个高确定性的血制品赛道还成为了投资的“避风港”。尤其是在中美关税贸易战导致A股哀鸿遍野时,血制品赛道逆势走强。这也是血制品行业的另一个关键词:国产替代。从2024年公布的数据来看,去年一年的人血白蛋白批签发总量为5423批次,其中国产1708批次,占比31%;进口3715批次,占比69%。相较于2023年60%的进口规模,依赖海外进口的比例进一步提高。对进口产品依赖更高的原因来自于,国内采浆量增长速度较慢,2024年采浆量为1.34万吨,同比仅增长10.9%,供不应求难以跟上市场需求的扩张步伐。上游采浆不足,也就导致在终端市场,进口白蛋白占据了60%-70%的临床使用份额,在三级医院等高端医疗市场,其占比更是居高不下。上游供不应求,中游的血制品生产上,也同样亟待技术提升。具体来看,在血浆综合利用率上,国际龙头企业可从血浆中提取22种产品,国内企业平均提取8-10种。但天坛生物、华兰生物等企业通过工艺优化,吨浆收入提升至600万元以上,已接近国际水平。关税调整后,进口白蛋白终端价格可能上涨10%-15%,10g规格产品价格或突破600元,而国产产品价格保持稳定,性价比优势愈发明显。上海证券研究分析指出,在这种背景下,提升关税增加进口产品的成本,国产血制品在价格上更具优势;另一方面,进口产品供应增加不确定性,国产品种供应稳定性更有保证。关税影响促使血制品竞争格局改变,供需共振下,国内血制品企业迎来量价齐升的良好机遇,国产替代进程有望加速。这也难怪在一片大跌中,国内血液制品相关A股上市公司的逆势走强也是投资者对血制品板块国产替代逻辑的认可。正如天坛生物在其2024年年报中所说,血液制品价格随市场供需变化而产生波动,以人血白蛋白为例,近年进口人血白蛋白批签发数量持续增加,在国内市场占有较大比重,对国产人血白蛋白形成了一定的竞争压力。从国内血制品行业产品结构来看,人血白蛋白进口占比超70%。随着对美加征关税可能推高进口成本,血制品的国产替代加速被再次关注起来,像凝血因子、静丙等品种的国产化率,有望突破50%。巨头们寻求国产替代机会的同时,以重组技术打破血源类产品的替代浪潮,也已经开始新的冲击。一方面,重组白蛋白技术正在突破。禾元生物的植物源重组人血清白蛋白(奥福民)已进入优先审评,若获批上市,将打破血源白蛋白的供给垄断。尽管短期内产能有限,但长期可能瓦解血制品稀缺性逻辑。曾有券商分析指出,重组产品商业化后,血制品供需矛盾有望缓解,但同时也削弱了传统企业的壁垒优势。禾元生物“稻米造血”技术若量产,白蛋白成本或降至10元/克以下,直接冲击血源产品的定价。另一方面,凝血八因子市场竞争加剧。如神州细胞通过重组凝血八因子实现国产替代,叠加天坛生物等企业获批同类产品,血源凝血八因子面临价格压力。2024年重组凝血八因子市场规模近30亿元,进一步挤压传统血制品企业利润空间。技术迭代正在给血制品行业带来了冲击,但也有不少行业观点认为,血源类产品被重组产品替代的风险还存在不确定性。正如太平洋证券分析的,重组白蛋白目前在纯化技术、临床适应证拓展、市场教育、产品审批上存在诸多不确定性;由于目前技术的局限性,重组静丙实现难度大;狂犬单抗价格昂贵、无医保支付,对狂免蛋白冲击亦是有限。一审| 黄佳二审| 李芳晨三审| 李静芝精彩推荐大事件 | IPO | 融资&交易 | 财报季 | 新产品 | 研发日 | 里程碑 | 行业观察 | 政策解读 | 深度案例 | 大咖履新 | 集采&国谈 | 出海 | 高端访谈 | 技术&赛道 | E企谈 | 新药生命周期 | 市值 | 新药上市 | 商业价值 | 医疗器械 | IND | 周年庆大药企 | 竞争力20强 | 恒瑞 | 石药 | 中生制药 | 齐鲁 | 复星 | 科伦 | 翰森 | 华润 | 国药 | 云南白药 | 天士力 | 华东 | 上药创新药企 | 创新100强 | 百济 | 信达 | 君实 | 复宏汉霖 | 康方 | 和黄 | 荣昌 | 亚盛|康宁杰瑞|贝达|微芯|再鼎|亚虹跨国药企|MNC卓越|辉瑞|AZ|诺华|罗氏|BMS|默克|赛诺菲|GSK|武田|礼来|诺和诺德|拜耳供应链|赛默飞|药明|凯莱英|泰格|思拓凡|康龙化成|博腾|晶泰|龙沙|三星启思会 | 声音·责任 | 创百汇 | E药经理人理事会 | 微解药直播 | 大国新药 | 营销硬观点 | 投资人去哪儿 | 分析师看赛道 | 药事每周谈 | 中国医药手册

财报

2025-04-20

点击上方蓝字 关注我们编者按:时光淬炼医者求索之志,以临床实践为纸,以循证医学作墨。《肿瘤瞭望》独具匠心,打造《CSCO指南·档案》专栏,见证记录中国临床肿瘤学会(CSCO)以开拓者之姿去开启崭新纪元,挥毫绘就肿瘤诊疗研究的东方智慧长卷。本期专访中,我们特邀CSCO创始人和奠基者之一、中国药科大学附属南京天印山医院的秦叔逵教授,回溯CSCO指南从破土萌芽到蔚然成林的成长脉络,解析这座学术丰碑的建构密码与精粹所在。CSCO 指南·档案1997年4月CSCO前身“中国抗癌协会临床肿瘤学协作专业委员会”在北京成立;2006年首届“NCCN非小细胞肺癌乳腺癌临床实践指南中外共识会议”在北京举行;2008年8月第一版《中国黑色素瘤诊断治疗共识》发布;2015年CSCO正式升级为民政部直管的国家一级学术团体;2016年CSCO指南工作组成立,确定了新版指南编写计划;至今自2016年首部全新的CSCO指南发布以来,CSCO已累计出版186部指南共识,发行总量超过200万册筚路蓝缕 集智合力生于兹长于兹的CSCO诊疗指南《肿瘤瞭望》:中国肿瘤临床实践指南的制定和推广工作从无到有,从有到精。您作为CSCO的创始人和奠基者之一,能否分享一下最初的CSCO指南是如何走向全国、指导临床的?秦叔逵教授:首先,要衷心感谢《肿瘤瞭望》作为合作媒体对于CSCO学术活动的支持和对CSCO指南更新的关注。谈及CSCO指南的诞生和成长,个中的许多辛勤付出和点点滴滴依然历历在目。中国临床肿瘤学会(CSCO)成立于1997年4月30日,在吴孟超、孙燕院士、廖美玲和管忠震教授等老一辈专家的亲自指导下,我们200多位中青年学者在国家领导人、卫生部和科技部的支持关心下,共同创立了CSCO这一公益性学术组织。在成立之初,储大同教授为首的执委会就设定了CSCO的四项主要任务:一是开展临床肿瘤学的继续教育;二是推动国内外学术交流;三是促进临床研究,特别是多中心协作研究;四是提高临床肿瘤学专业化、规范化诊疗进程。后来又增加了一项任务,即患者教育和科普宣传。作为第四项任务,我们需要积极学习国外的先进经验,并且制定一系列用于指导中国临床诊疗的专家共识和实践指南,以有章可循。迄今,我对2004年在昆明市召开的第八届CSCO全国大会记忆犹新,这是CSCO大会第一次超过万人参加的盛会。正是在那次会议,已故的CSCO首任主席储大同教授,给时任CSCO秘书长的我本人以及办公室,布置了一项重要而艰巨的任务——去学习有关方法,设法制定CSCO肿瘤诊疗专家共识和诊疗指南。会后,我们开始多方调研,征求意见。然而,当时遇到了两个大难题:一是大家的分工不明确,大多数医生分散在综合医院的肿瘤科,什么肿瘤都看,但是并没有明确的主攻方向,更是不知道或者不懂得如何制定共识和指南。二是缺乏中国原创研究或中国学者参与的国际多中心研究,如果要制订,完全要依赖欧美国家的临床研究数据。因为那时国内临床研究水平仍较低,尽管CSCO已经成立了7年,但是会员启动的多中心研究相对较少,规模也较小,所以一时无法去落实制定临床指南任务。在几乎“一穷二白”的情况下,我们去学习了其他行业改革开放的经验,特别是海尔公司等一些民族企业的成长经历,决定先从引进国外指南开始,逐步实现我们自己的探索之路。我们首先了解了美国临床肿瘤学会(ASCO)和欧洲肿瘤内科学会(ESMO)的指南,但是ASCO指南的更新速度较慢,3-4年一次,且商业化明显,要花许多钱买,而ESMO指南要兼顾欧洲大大小小的地区的要求,学术水平较低。后来,我们了解到有个“美国综合肿瘤治疗中心网(NCCN)指南”,其优点是更新快,能够与时俱进。虽然NCCN是一个民间营利组织(私人企业),指南编辑组成员紧凑,初期在费城郊区的一座小楼上,仅仅12人,但是NCCN为了扩大全球的影响,愿意免费提供给我们应用,或者与CSCO合作制订中文版。因此,2006年起,在孙燕院士等带领下,我们开始与NCCN合作,制订NCCN指南中文版,历经多年,从中学到了许多循证医学证据,讨论制订临床指南的工作经验。然而,随着时间的推移,NCCN也越来越趋于商业化,要求收费也越来越高,同时该指南英文版也更新速度过快,比如有的癌种指南甚至一年更新了11版,头年9月就公布第2年的第1版,逐渐脱离了我们的需要,并且超出CSCO的经济支付能力。在经过学习NCCN、ASCO及ESMO等国际指南之后,加之我国专家学者也陆续参加和启动了许多高质量的国际国内多中心临床研究,边干边学边提高,而且循证医学理念和方法在我国发展愈加成熟,深入人心,制定完完全全的中国本土指南已经具备“天时、地利、人和”的条件,万事俱备,只欠东风。CSCO专家共识和指南的制定,最早可以追溯至2008年8月在杭州市发布的第一版《中国黑色素瘤诊断治疗共识》,这是CSCO指南“大家族”的第一位成员,在黑色素瘤专家委员会郭军教授的组织下,大家群策群力,率先制订,又逐步修订完善,后面更新为《CSCO黑色素瘤诊疗指南》。在2010年,马军教授和我又共同向国家卫生部领导提出了建议,希望卫生部医政司组织专班主导制定“中国常见肿瘤诊疗指南”的建议,得到了首肯,从而促成了后来一系列国家卫健委九种常见肿瘤诊疗指南的诞生。2015年7月,是非常具有特殊纪念意义的一年,当年经过国务院领导批准,CSCO正式由前身的二级学术组织“中国抗癌协会临床肿瘤学协作专委会”升格为国家一级学术团体;在理事长吴一龙教授和秘书长李进教授的推动下,新版的《中国临床肿瘤学会(CSCO)原发性肺癌诊疗指南(2015.V1)》正式发布,同年专门成立了指南工作组,由学会领导牵头,联合理事会和指导委员会成员,确定了指南编写和更新计划。2016年5月,CSCO指南工作组积极开展工作,确定了首批CSCO指南编写工作启动,涵盖肺癌、大肠癌、胃癌、乳腺癌和恶性黑色素瘤5个瘤种。2018年,李进教授又带领工作组进一步大胆改革,一方面不断扩大指南的“大家族”成员,另一方面改版,推出新的精简版的指南,充分借鉴了ASCO和NCCN等国际指南的表格化、思维导图化的模式,洋为中用,同时,提出CSCO指南要别具风格,要“更新、更快,更细”。这种“口袋书”样的CSCO指南,一经问世,广受欢迎,特别方便临床医师随时携带,床旁检索和学习,使得CSCO指南真正融入了临床实践。同时CSCO指南注意吸纳了越来越多的中国证据。比如新近马骏院士在全球神刊CA杂志发表了鼻咽癌临床随机对照研究成果,我们在肝胆胰腺肿瘤领域也开展了许多开创性研究工作,已经及时收入指南。这些都体现了我国临床诊疗水平的提高和研究的快速成长,也将有力推动CSCO指南共识的发展完善。这些CSCO指南在随后的2016-2017年陆续发布总而言之,CSCO指南的制定是一个与时俱进,不断学习和完善的过程。我们不仅学习和借鉴了国外同行的先进经验,同时重视结合中国国情和中国患者的特点,制定出符合我们自己需求的指南,从而更好地指导我国临床诊疗的规范化。服务患者 服务临床中国证据绘就CSCO指南的“底色”《肿瘤瞭望》:随着中国抗肿瘤技术、新药研发和临床研究的快速发展,CSCO指南引入了越来越多的“中国证据”,而且也考虑了可及性等国情。能否介绍一下CSCO指南如何兼顾前沿和实际,突出“中国特色”的?秦叔逵教授:自2015年以来,CSCO指南经过不断改版,变得更加实用、科学,体现学术进步。这一改版的大背景是与党和政府对人民健康的高度重视密切相关的,尤其是国家提出了建设“健康中国”的宏伟战略,各级政府都在重视卫生健康问题,医疗机构的专业技术日益提高,民族制药企业的研发水平得到不断提高,从最初的仿制药(me-too),到改良型新药(me-better),再到今天的首创型药物(First in class),研发上市了许多抗肿瘤新药。如今,据中国药促会执行会长宋瑞霖博士介绍,美国FDA近年批准的创新药物中,有40%至50%源于中国的制药公司。跨国和民族制药企业研发水平的提升,特别是在“健康中国”行动纲要的指引下,民族药企与医院精诚合作,积极研究,使我们在抗击肿瘤的过程中有了越来越多的有力“武器”“弹药”。在指南制定过程中,指南工作组特别强调既要学习引用国外的先进经验,也必须结合中国的国情和患者特点。一些国外的创新药物虽然好,但是可及性受限,价格昂贵,不是所有国人患者都能负担得起。例如,最初免疫检查点抑制剂(单抗)在国外上市时的价格非常高,每年个例治疗费用要超过百万人民币;后来,正是国内一系列的PD-1/PD-L1、CTLA-4单抗、双抗和组合抗体的问世出现,才使得免疫治疗效果提高,而价格持续降低。因此,CSCO指南工作组非常明确地提出要遵循:“以患者为中心,以临床价值为导向,以循证医学为基础,同时结合国情和临床经验,为中国患者服务”的理念,要积极吸取中国专家学者的研究成果,积极采用国内民族企业的新技术、新设备和新药物。在CSCO指南的制定过程中,我们特别注意科学性和公正性。许多指南的讨论都是通过闭门会议和专家投票进行的,不涉及商业利益,也不允许任何企业干涉专家决策。CSCO指南的推荐方案也具有明显的“中国特色”,在循证医学证据分级基础上,根据不同药物的有效性、安全性、可及性和经济性等实际情况,给予“I级~III级”的不同级别的专家推荐。I级推荐必须具有高质量循证医学证据,已经获得国家药监局(NMPA)批准的,或者在国际发达国家药监部门已经获批以及预计在我国很快获批的治疗方案、技术或药物;在指南更新的专家讨论中,需要大家学术讨论,各自投票,达到80%以上的同意率才能列为I级推荐。而II级和III级推荐,也必须根据证据治疗以及治疗方案的可及性和创新性来讨论决定。在现有治疗不能满足需求的情况下,II级推荐可以作为重要参考,尽管其证据强度或者可及性可能较弱,但是大多数情况下得到超过60%的专家认可。我们最终的目标就是让中国肿瘤患者得到合适的、获益最大化的治疗。立足国内 面向全球与全球共享CSCO指南的中国智慧《肿瘤瞭望》:多年来,CSCO指南“家族”成员不断扩充,质量不断提升。如果我们对照NCCN、ASCO及ESMO等国际指南来看,您认为CSCO指南应当如何提升国际影响力?因为在亚洲以及“一带一路”沿线国家,CSCO指南可能也有适应性和参考性。秦叔逵教授:CSCO学会制订指南的首要任务就是助力“健康中国”,为中国肿瘤患者服务,致力于提高我国肿瘤规范化诊疗及研究水平。我们所有共识指南的制定和推广工作,都要首先考虑中国患者的需求。当然,科学无国界,我们也要立足中国,面向世界。就像我们当年学习欧美指南共识一样,一些有类似临床需求的国家和地区,也会参考中国的指南共识。近年来,我们的一些专家共识和临床指南已经被翻译成英文或者日文等语言,用于国际交流。CSCO指南英文版如今有越来越多的中国治疗方案“出海”,在其他国家和地区获批应用于临床实践。我们也尝试通过“一带一路”倡议,向不同国家地区介绍我们的指南,尽管各国国情不同,我们希望CSCO指南能为他们提供学术参考,同时了解中国临床肿瘤领域的进步。CSCO指南出海随着中国改革开放的持续深入,医药卫生领域的发展进步有目共睹。希望通过我们的工作,能够让国际社会进一步了解中国临床肿瘤学事业的发展。个人认为今天我们的指南与ASCO、ESMO以及NCCN等国际指南相比毫不逊色,甚至在某些方面更优。最近还有人希望我们继续与NCCN合作,制定各个瘤种NCCN指南的中文版,但是我认为那个时代已经过去了。CSCO指南将继续秉持公益性的特征,免费服务于临床和病人,作为临床医务人员的重要参考书。国家卫健委制定常见肿瘤诊疗指南时会考虑到各地经济卫生发展不平衡等现实情况,纳入的治疗方案相对比较基础,而CSCO指南兼顾实际需求和学术前沿,在实用性和先进性方面均有很好的体现。当然每家指南都有其优缺点,我们也在学习国际国内其他指南,不断摸索和提高,永无止境,CSCO理事会和希思科基金会都在为此努力。于金明院士和李进教授在今天的会议上都发表了热情洋溢的讲话。CSCO学会与北京希思科基金会将紧密协作,大力支持中国临床诊疗研究的发展和指南共识的推广,提高广大基层医师的专业水平,以及对病人进行健康教育和人文关怀,二者相辅相成、共同促进。相信CSCO指南也会发展得越来越完善,在国际学术界的影响力越来越高,成为中国乃至全球肿瘤临床医师的重要参考书。患教版CSCO指南有温度的CSCO指南和医师AI医学应用热潮背后的冷思考《肿瘤瞭望》:目前,人工智能(AI)已经广泛影响临床诊疗和研究,有许多病人和医务人员都在使用这种基于指南学习的生成式AI问诊。您认为未来的CSCO指南应当如何适应时代而发展更新?秦叔逵教授:人工智能(AI)并非一蹴而就的全新产物,多年来一直在医学临床领域有所应用。例如,临床上有达·芬奇机器人等机器设备,以及众多计算机软件,如辅助诊断肺癌肺结节的AI影像诊断工具等。但是在过去很长的一段时间内,医学领域的AI应用总体上发展较为缓慢,不温不火,形同鸡肋。然而,今年春节前后,DeepSeek火爆出圈,引起了全球科技界和社会各界的广泛关注,也对医学界产生了深远影响。不久前,在南京市,北京希思科基金会联合CSCO临床研究专家委员会和智能智慧医疗专家委员会,共同举办了一场智慧医疗与临床试验学术论坛,邀请了跨学科、跨行业的专家深入探讨了临床研究和诊疗方面的AI应用发展。(点击查看:构建临床研究新生态!南京智慧医疗与临床试验学术论坛在宁成功举行)AI本质上是人类的一种科技工具,借助AI来了解肿瘤诊断治疗的基本原则是可行的。但是AI问诊存在两方面主要问题:一是缺乏专业版,诊治能力有限,无论使用DeepSeek还是ChatGPT等其他类似工具,都可能遇到一些问题。比如,AI不知道时,会说“网络故障”不予回答,或者给出错误答案,甚至一本正经地胡说八道,甚至还列出了一系列不存在的参考文献或依据,误导读者,即所谓的“AI幻觉”。二是AI缺乏人文关怀和对于病人的个性化考量。我们强调医学指南要以人为本、以患者为中心,以临床价值为导向。虽然指南是规范和原则,但是实际的诊疗决策不能完全照本宣科,生搬硬套。因为每个患者的情况各不相同,绝不能将一个治疗方案视为万能的公式套用到所有患者身上。虽说AI为我们的临床诊治和研究提供了很好的工具,提高了服务水平和工作效率,也为指南的制定提供了有力的证据支持,有助于医务人员和社会公众更好地了解医学知识,但人类的作用永远无法为AI完全替代。就像现在虽然有炒菜机器人,但如果你去饭店吃饭,是愿意首选让机器人炒菜,还是更愿意让厨师甚至米其林大师来炒菜呢?我想大多数人会更倾向于后者,因为机器人炒菜往往是千篇一律的程式化操作,而好的烹饪需要个性化的处理,就像高级的衣服一定是量体裁衣,贴合每个人的身材和审美需求。因此,我们既要努力学习AI知识,积极应用,但是不能完全依赖于AI。医学不仅仅是科学,也是艺术,不能脱离医师的专业技能和临床经验。就个人而言,如果生病了,也许会去上网查询,包括使用DeepSeek、ChatGPT等软件来获取一些参考信息,但是更重要的还是与主诊医师进行充分的沟通和协商,积极说明个人意愿,以确定最佳的诊断和治疗方案。CSCO指南工作组会持续关注AI进展,加以利用,帮助更新完善指南。指南档案录1CSCO指南·档案丨马军教授:从规范化到精准化,2025 CSCO血液肿瘤指南亮点前瞻2CSCO指南·档案丨执中国之笔,写中国指南——江泽飞教授分享CSCO BC指南成长历程3CSCO指南·档案丨朱军教授:扎根中国、走向世界,CSCO淋巴瘤诊疗指南发展之路(来源:《肿瘤瞭望》编辑部)声 明凡署名原创的文章版权属《肿瘤瞭望》所有,欢迎分享、转载。本文仅供医疗卫生专业人士了解最新医药资讯参考使用,不代表本平台观点。该等信息不能以任何方式取代专业的医疗指导,也不应被视为诊疗建议,如果该信息被用于资讯以外的目的,本站及作者不承担相关责任。

CSCO会议

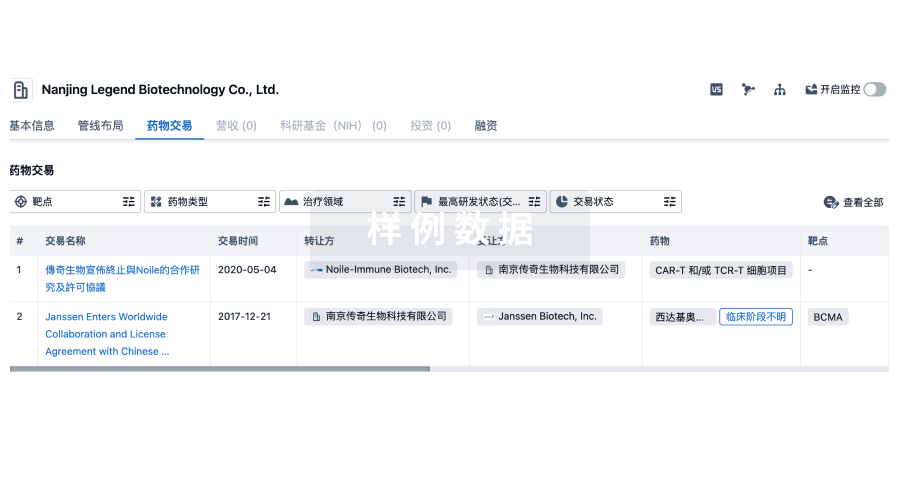

100 项与 Haier Group Corp. 相关的药物交易

登录后查看更多信息

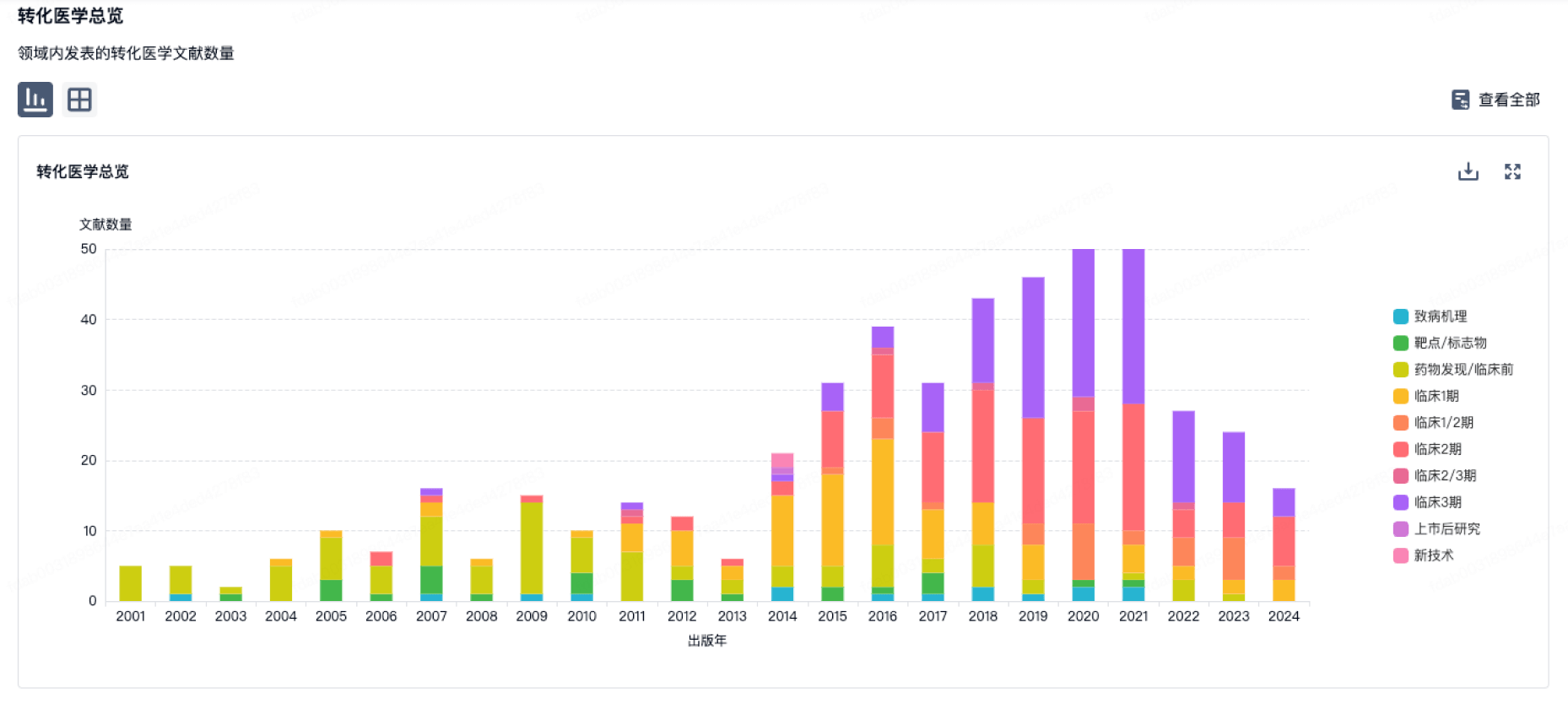

100 项与 Haier Group Corp. 相关的转化医学

登录后查看更多信息

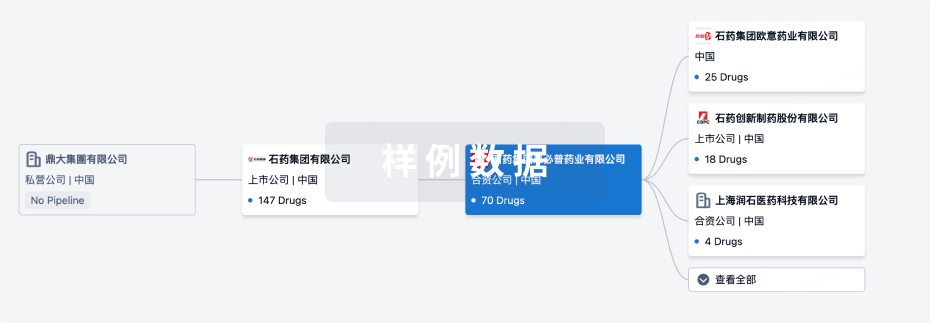

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年07月27日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床2期

1

1

申请上市

批准上市

8

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

人纤维蛋白原(上海莱士血液制品股份有限公司) ( Fibrinogen ) | 纤维蛋白原缺乏血症 更多 | 批准上市 |

人纤维蛋白原(同路生物制药) ( fibrin ) | 先天性低纤维蛋白原血症 更多 | 批准上市 |

人免疫球蛋白(同路生物) | 自身免疫性疾病 更多 | 批准上市 |

人凝血酶原复合物(上海莱士) ( F10 x factor IX x factor VII x thrombin ) | 血友病B 更多 | 批准上市 |

乙型肝炎人免疫球蛋白(郑州莱士) | 乙型肝炎 更多 | 批准上市 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

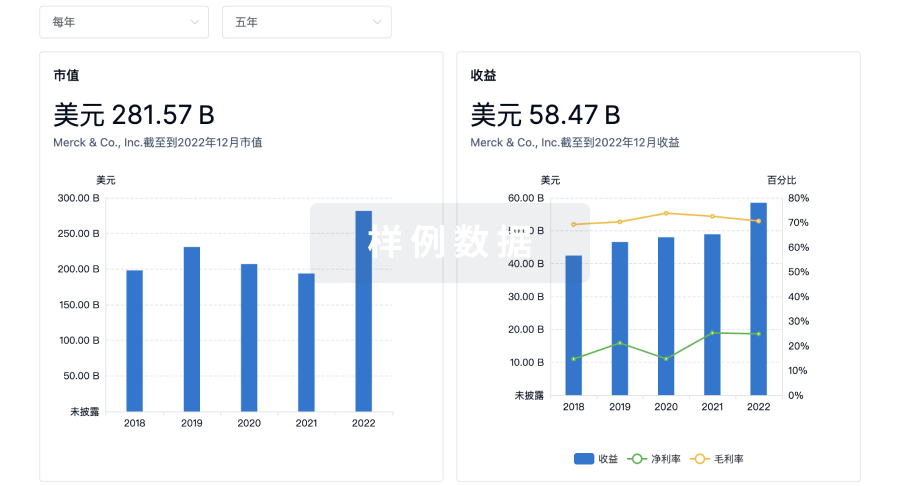

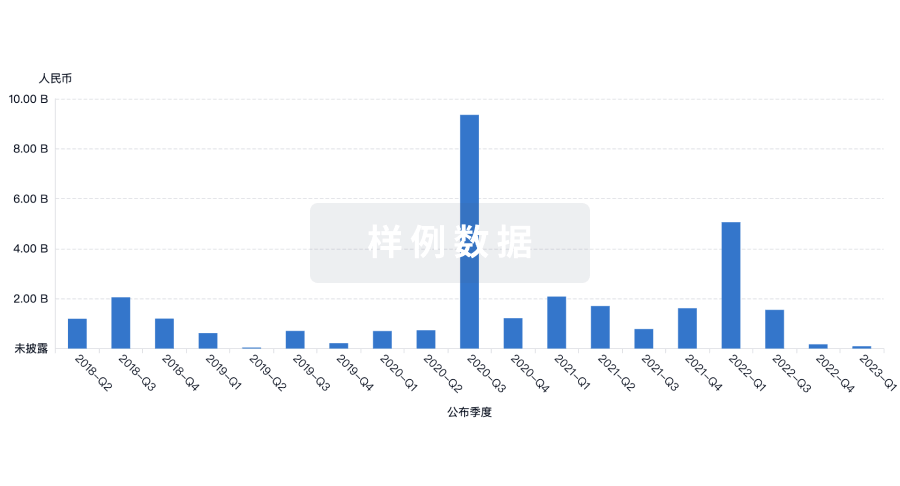

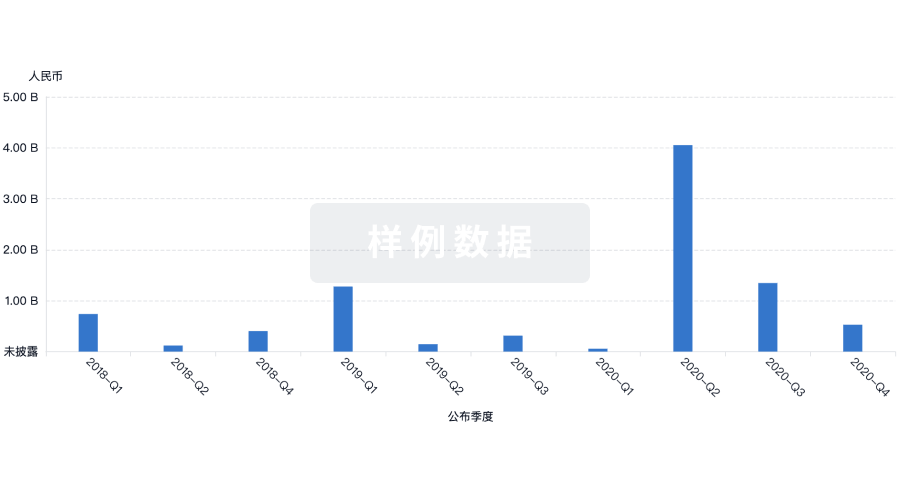

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用