预约演示

更新于:2025-07-19

Retatrutide

瑞他鲁肽

更新于:2025-07-19

概要

基本信息

原研机构 |

在研机构 |

非在研机构- |

权益机构- |

最高研发阶段临床3期 |

首次获批日期- |

最高研发阶段(中国)临床1期 |

特殊审评- |

登录后查看时间轴

结构/序列

Sequence Code 1142931834

来源: *****

关联

30

项与 瑞他鲁肽 相关的临床试验NCT06982846

A Randomized, Placebo-Controlled, Parallel Study to Investigate the Response of Participants With Type 2 Diabetes Mellitus on Once-Weekly Retatrutide to Hypoglycemia

The purpose of this study is to measure the effect of retatrutide versus placebo, administered every week, on time to recovery from hypoglycemia during hypoglycemic clamp in participants with Type 2 Diabetes Mellitus (T2DM) following 16 weeks of treatment.

开始日期2025-06-06 |

申办/合作机构 |

NCT06982859

A Phase 1, Investigator- and Participant-Blinded Study to Evaluate the Effect of Retatrutide on ?- and ?- Cell Function and Insulin Sensitivity in Adult Participants With Type 2 Diabetes Mellitus

The primary objective of Study GZQG is to compare the effect of retatrutide and placebo on total clamp disposition index (cDI) after 28 weeks of treatment.

开始日期2025-06-02 |

申办/合作机构 |

NCT07035093

A Phase 3, Randomized, Double-Blind, Placebo-Controlled Study to Investigate the Efficacy and Safety of Retatrutide Once Weekly in Participants Who Have Obesity or Overweight and Chronic Low Back Pain

The main purpose of this study is to evaluate the efficacy and safety of retatrutide in relieving chronic low back pain in participants who have obesity or overweight. Participation in the study will last about 80 weeks.

开始日期2025-05-29 |

申办/合作机构 |

100 项与 瑞他鲁肽 相关的临床结果

登录后查看更多信息

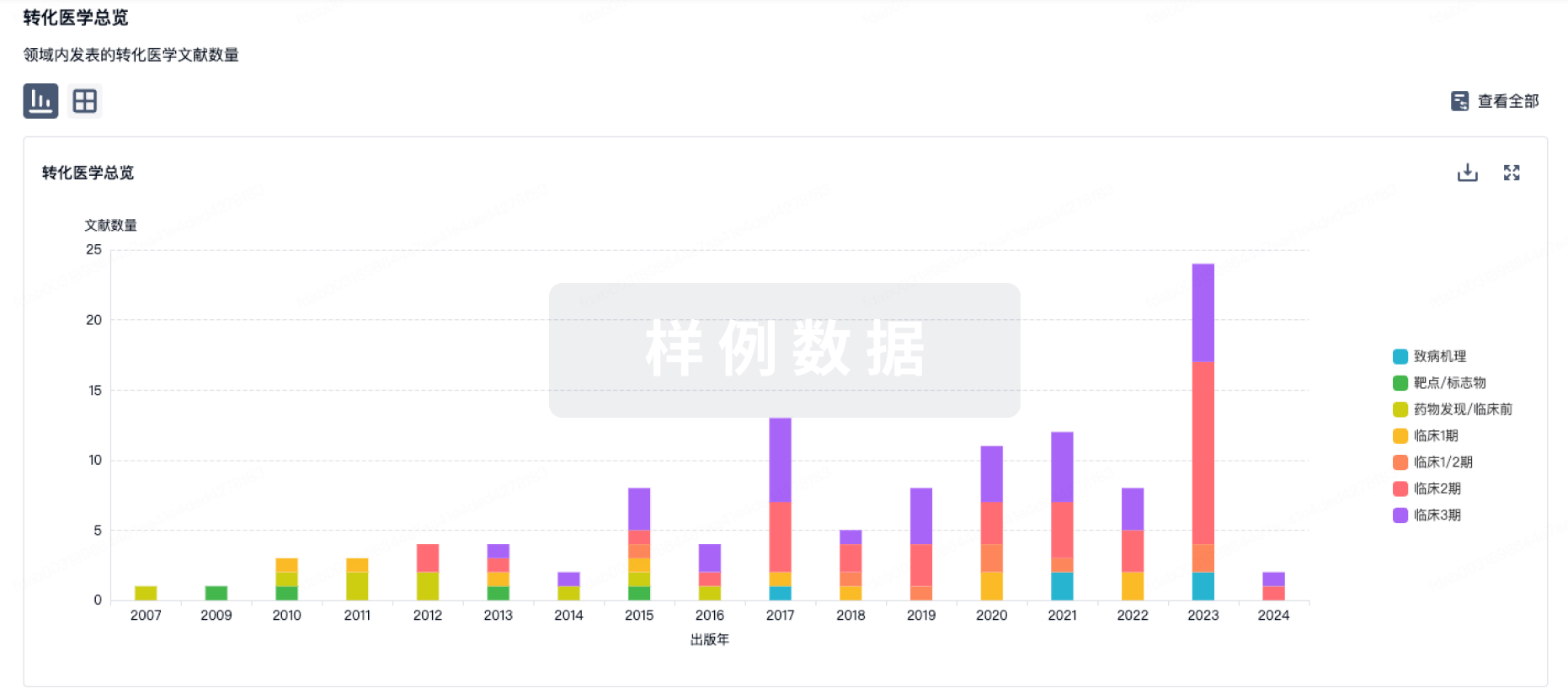

100 项与 瑞他鲁肽 相关的转化医学

登录后查看更多信息

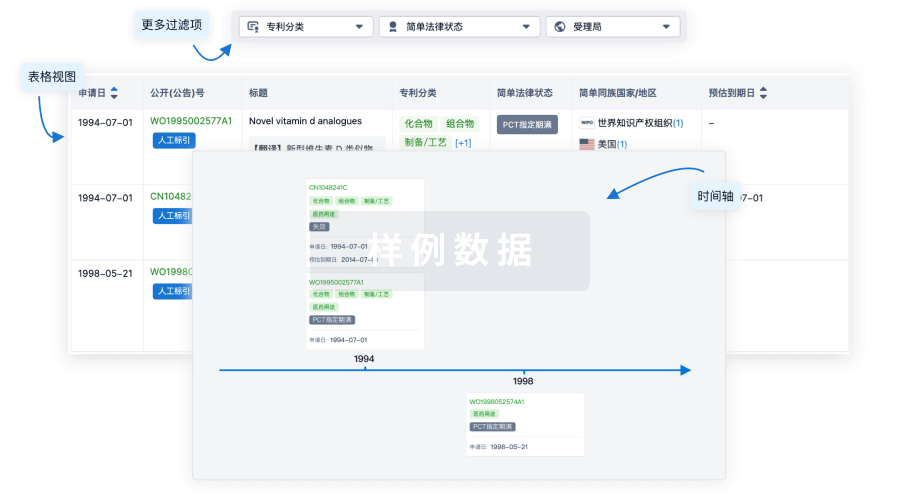

100 项与 瑞他鲁肽 相关的专利(医药)

登录后查看更多信息

71

项与 瑞他鲁肽 相关的文献(医药)2025-12-31·Journal of Pharmaceutical Policy and Practice

Compounded glucagon-like peptide-1 receptor agonists for weight loss: the direct-to-consumer market in Colorado

Article

作者: Saseen, Joseph J. ; Dardouri, Mouna ; Nair, Kavita V. ; Moore, Gina D. ; DiStefano, Michael J.

Background:

High prices and other access barriers have contributed to the rise of a market for compounded glucagon-like peptide-1 receptor agonists for weight loss in the United States. This market has not been systematically studied. We conducted a pilot study to assess the prevalence, characteristics, and advertising content of direct-to-consumer providers of compounded glucagon-like peptide-1 products for weight loss in Colorado.

Methods:

We conducted a cross-sectional study of websites advertising compounded glucagon-like peptide-1 products for weight loss in Colorado. Websites were identified using Google searches focused on census-defined statistical areas. Searches were conducted between March 21 and April 12, 2024. Data collected from websites included physical addresses, business type, highest reported staff credential, advertised glucagon-like peptide-1 products, whether businesses referred to Food and Drug Administration approval when describing products, and whether businesses referred to products as 'generic'.

Results:

We identified 93 business websites advertising compounded glucagon-like peptide-1 products for weight loss corresponding to 188 physical locations throughout Colorado. Most businesses were self-categorized as medical/health spas (33/93) or weight loss services (26/93). Advertised products included semaglutide (92/93), tirzepatide (40/93), liraglutide (2/93), and retatrutide (1/93). Advertised combination products included B vitamins (8/93), levocarnitine (1/93), mannitol (1/93), BPC-157 (1/93), and glycine (1/93). Seven websites advertised oral formulations. Additionally, 41/93 websites referred to Food and Drug Administration approval in their descriptions of compounded products and 5/93 referred to products as 'generic'.

Conclusion:

This study identified several instances of unapproved glucagon-like peptide-1 products being compounded and advertised in Colorado. Additionally, 1 product was advertised as compounded with BPC-157, a substance determined by the Food and Drug Administration to be unsafe for compounding. This study also identified numerous examples of misleading claims regarding the regulatory status of compounded glucagon-like peptide-1 products. Regulatory action is needed to ensure the benefits of compounded GLP-1 products outweigh the risks.

2025-08-01·Lancet Diabetes & Endocrinology

Effects of retatrutide on body composition in people with type 2 diabetes: a substudy of a phase 2, double-blind, parallel-group, placebo-controlled, randomised trial

Article

作者: Coskun, Tamer ; Khouli, Courtney ; Haupt, Axel ; Harris, Charles ; Milicevic, Zvonko ; Schloot, Nanette C ; Wu, Qiwei

BACKGROUND:

Retatrutide, a glucose-dependent insulinotropic polypeptide, glucagon-like peptide-1, and glucagon receptor agonist, has demonstrated robust glucose and bodyweight reductions in participants with type 2 diabetes. This substudy assessed percent change from baseline to week 36 in total body fat mass versus placebo and dulaglutide.

METHODS:

This phase 2, double-blind, parallel-group, placebo-controlled, randomised controlled trial was done in 42 medical centres in the USA. Eligible participants were adults aged 18-75 years with type 2 diabetes, HbA1c of 7·0-10·5%, stable bodyweight, and BMI of 25-50 kg/m2. Eligible participants were randomly assigned in a 2:2:2:1:1:1:1:2 ratio to once-weekly subcutaneous placebo, dulaglutide 1·5 mg, or retatrutide 0·5 mg, 4 mg (2 mg initial dose), 4 mg (4 mg initial dose), 8 mg (2 mg initial dose), 8 mg (4 mg initial dose), or 12 mg. The prespecified primary substudy endpoint was percent change from baseline to week 36 in total fat mass, as measured by dual-energy X-ray absorptiometry (DXA). Regression methods with on-treatment data before study drug discontinuation from all randomly assigned participants with non-missing DXA scans were included in efficacy analysis. All participants who received at least one dose of study drug were included in the safety analysis population. The completed trial is registered with ClinicalTrials.gov, NCT04867785.

FINDINGS:

Between May 13, 2021 and June 13, 2022, 534 participants were screened for inclusion into the main study. 253 were excluded and 281 participants were enrolled and randomly assigned to the main study. Of the main study participants, 189 participants were enrolled to the body composition substudy (29 in the placebo group, 32 in the retatrutide 0·5 mg group, 31 in the retatrutide 4 mg groups [pooled], 33 in the retatrutide 8 mg group [pooled], 30 in the retatrutide 12 mg group, and 34 in the dulaglutide 1·5 mg group). Of these, 155 had a baseline DXA scan and 103 completed treatment and both baseline and week 36 DXA scans. 105 (56%) of 189 participants were female and 84 (44%) were male. 160 (85%) of 189 participants were White, 24 (13%) were Black, and five (3%) were Asian. Percent reduction from baseline in total fat mass was 4·9% (SE 1·4%) with retatrutide 0·5 mg, 15·2% (3·2%) with retatrutide 4 mg (pooled), 26·1% (2·5%) with retatrutide 8 mg (pooled), 23·2% (3·0%) with retatrutide 12 mg, 2·6% (1·6%) with dulaglutide, and 4·5% (1·2%) with placebo. Least squares mean change from baseline in total fat mass compared to placebo was -0·4 (95% CI -4·0 to 3·2, p=0·83 with retatrutide 0·5 mg, -10·7 (-17·2 to -4·2, p=0·0013) with retatrutide 4 mg (pooled), -21·6 (-27·1 to -16·1, p<0·0001) with retatrutide 8 mg (pooled), and -18·7 (-25·1 to -12·3, p<0·0001) with retatrutide 12 mg. Adverse events were similar between groups. Serious adverse events occurred in two (7%) of 29 participants in the placebo group, two (6%) of 32 participants in the retatrutide 0·5 mg group, zero of 31 participants in the retatrutide 4 mg group, three (9%) of 33 participants in the retatrutide 8 mg group, one (3%) of 30 participants in the retatrutide 12 mg group, and zero of 34 participants in the dulaglutide group. Gastrointestinal events were the most frequently reported adverse events, and no deaths were reported.

INTERPRETATION:

In adults with type 2 diabetes, retatrutide significantly improved total body fat mass reduction compared with placebo and dulaglutide. The proportion of lean mass loss to weight loss was similar to other obesity treatments. These findings could provide reassurance that a greater proportion of lean mass is not lost with retatrutide despite the overall increased weight loss.

FUNDING:

The study was funded by Eli Lilly and Company.

2025-07-01·PHARMACOLOGICAL REVIEWS

Antiobesity medications in adult and pediatric obesity and metabolic dysfunction–associated steatotic liver disease

Review

作者: Hartmann, Phillipp ; Rodriguez, Natalie

Obesity and metabolic dysfunction-associated steatotic liver disease (MASLD) are estimated to affect 13% and one-third of adults worldwide, respectively. The novel antiobesity medications achieve marked bodyweight loss and improve associated metabolic conditions, including MASLD. This review summarizes the development and mode of action and available published data on the effectiveness of approved and potential (off-label) antiobesity products in the management of adult and pediatric obesity and MASLD. Additionally, their safety is highlighted. The most effective antiobesity drugs evaluated in double-blind, randomized controlled trials include semaglutide, tirzepatide, and retatrutide with up to 10.8%, 17.8%, and 22.1% placebo-subtracted bodyweight loss, respectively, in adults after 48-72 weeks. Semaglutide also reduces placebo-subtracted body mass index mean by up to 16.7% in adolescents with obesity after 68 weeks. Moreover, these novel drugs are highly effective in treating adults with MASLD. Semaglutide and tirzepatide resolve metabolic dysfunction-associated steatohepatitis (MASH) without worsening of fibrosis placebo-subtracted in 41% and 53% of patients, respectively, after 52-72 weeks. Semaglutide, tirzepatide, and retatrutide reduce hepatic fat on magnetic resonance imaging-proton density fat fraction placebo-subtracted by 41%, 47%, and 81%, respectively, after 48-72 weeks. Tirzepatide also decreases fibrosis without worsening of MASH placebo-subtracted in up to 25% of patients. However, no pediatric trials have been conducted to study these novel drugs in biopsy-proven MASLD. In conclusion, the novel antiobesity drugs are highly effective in obesity and MASLD. However, more biopsy-based clinical trials are required to determine the effectiveness of these medications in adult metabolic dysfunction-associated steatohepatitis-associated fibrosis and pediatric MASLD. SIGNIFICANCE STATEMENT: This work reviews the current antiobesity medications, their structure, mode of action, and effectiveness. These medications are revolutionizing the management of metabolic dysfunction-associated steatotic liver disease by significantly reducing hepatic steatosis, disease activity, and even liver fibrosis.

272

项与 瑞他鲁肽 相关的新闻(医药)2025-07-18

2025年以来,二级市场的创新药行情,犹如凤凰涅槃,在数年沉寂之后突然爆发出惊人的势能,成为全市场最为炙手可热的投资主题之一。从表面来看,是海外MNC对中国在研创新药管线的BD,呈现数量爆发、金额不断破记录的良好趋势,直接催生了二级市场对于创新药赛道的再认识和价值重估。仅仅今年前5个月,创新药海外授权交易总金额已达455亿美元,这个数字,此前几年无人敢想象。更深层次的原因,是中国创新药产业在最近10余年的集中资源投入和不断摸索之下,所取得的实质性的长足进步。2024年,我国累计在研创新药达到4000余款,约占全球30%。量变引发质变,在创新药研发的多个细分领域,都有中国药企的在研管线,冲到了全球一线阵营。2025年夏天,东阳光药,这家在创新药赛道的一直相对“低调”的中国药企,即将以全新的姿态亮相港股。这家准IPO企业,其历来的风格都是埋头于研发,对外的曝光度相对不高,但是就相关的创新药管线而言,其布局广泛,多条技术路线齐头并进,多款重磅管线的研发进度处于行业一线位置,且具备同类产品“best-in-class”的潜力。这是一家尚未被市场所充分认知的创新药赛道的“低调大佬”。慢病领域:首个国产进入III期临床的IPF新药伊非尼酮特发性肺纤维化(IPF)是一种严重的慢性肺部疾病,其典型症状为干咳、进行性加重的呼吸困难、肺组织变硬、瘢痕化,因此被称为“肺纤维化”;而“特发性”三个字,则强调这种病的病因和发病机制尚不清楚。研究数据显示,IPF患者确诊后的中位生存期仅3-5年,是一种死亡率堪比大多数肿瘤的恶性疾病。根据弗若斯特沙利文报告,2023年中国IPF患者为16万例,预期2030年增至34万例。IPF新药的开发难度极大,2014年尼达尼布及吡非尼酮III期成功开启IPF抗纤维化治疗新纪元,此后的10多年时间,全球多项临床研究都以失败告终。然而,即使是尼达尼布和吡非尼酮这两款成功上市的药物,疗效也较为有限,而且高发生率的副作用也会导致部分患者用药中断。因此,IPF治疗领域,亟需开发出便于服用、更安全、能够有效延缓或阻止纤维化进展的全新药物。伊非尼酮是东阳光药在研的IPF治疗新药,通过同时抑制TNF-α及TGF-β1的释放以及阻断TGF-β1-smad信号通路,抑制胶原等细胞外基质的沉积和纤维化进展。体外细胞实验结果表明,伊非尼酮活性优于吡非尼酮百倍以上,在肺类器官纤维化模型和动物模型上,伊非尼酮药效明显优于吡非尼酮和尼达尼布,同时具有很好的成药性特征。伊非尼酮还有用药便捷的优势:凭借较长的药物半衰期,伊非尼酮可以实现每日1次的用药频率,服用次数少且剂量更低,远优于现有药物(每日2-3次),对于多为中老年的IPF患者来说更便于服用,有利于提高患者长期服药依从性,这对于IPF疾病控制至关重要。目前,伊非尼酮II期临床试验的期中分析已达到研究终点:伊非尼酮在IPF患者中疗效突出,安全可耐受,量效关系确切,更便于IPF患者用药。伊非尼酮具备疗效和安全性以及顺应性等多重优势,具有Best in class潜力,有望重塑IPF治疗生态,为IPF患者提供更有效、更安全、更便捷的一线治疗选择。从研发进度而言,伊非尼酮是首个国产进入III期临床的IPF原研新药,同时已在美国完成I期临床试验,并获得美国食品药品监督管理局(FDA)孤儿药资格认定,具备了走向全球市场的潜在预期。代谢领域:差异化设计驱动的三靶点GLP-1类药物以GLP-1类药物为代表的降糖减重药物的巨大商业化成功,激发了资本对于代谢赛道的热烈追逐,东阳光药在这个领域也早有布局,其重磅管线的进度处于全球一线序列。2025年4月24日,东阳光药对外宣布,公司自主研发的1类创新药HEC-007注射液,获国家药监局(NMPA)核准签发《药物临床试验批准通知书》,批准开展2型糖尿病以及超重或肥胖两项适应症的临床试验。HEC-007是一种脂肪酸侧链修饰GLP-1/GCG/GIP三靶点多肽新药,通过作用于胰高血糖素(GCG)受体、胰高血糖素样肽-1(GLP-1)受体与葡萄糖依赖性促胰岛素多肽(GIP)受体,协同各自对控糖与减重的生理作用,有望带来更佳的减重、降糖及其他伴随疾病的治疗效果。如果说司美格鲁肽引领了单靶点GLP-1药物的时代,替尔泊肽在双靶点GLP-1药物时代称霸,那么降糖减重赛道的下一个时代,将属于三靶点GLP-1类药物。临床前与临床数据表明,通过在单一疗法中组合多种代谢通路,可能实现多重作用以改善疗效,GLP-1/GCG/GIP三靶激动剂通过协同激活多个受体,可以进一步强化减重,同时改善血糖血脂等代谢指标。以当下研发进度最为领先的礼来的Retatrutide(瑞他鲁肽)为例,这款同为GLP-1/GCG/GIP三靶点的药物,目前的临床试验表现堪称惊艳,其24周减重幅度已接近25%,且未达到平台期。目前,全球共有约10余个GLP-1/GCG/GIP三靶点药物处于临床研究阶段,其中除了礼来的瑞他鲁肽处于3期临床试验阶段以外,其他药物基本处于I/II期临床试验阶段。也就是说,东阳光药的HEC-007的研发进度,处于全球一线阵营。同时,HEC-007的现有研究数据,也显示了这款药物诸多的潜在优势。临床前研究中,HEC-007组的减重效果明显,其减重幅度显著优于同剂量对照组司美格鲁肽(GLP-1单靶点)、替尔泊肽(GLP-1/GIP双靶点)与瑞他鲁肽(GLP-1/GCG/GIP三靶点)。此外,HEC-007还有潜在的安全性优势,大鼠和食蟹猴毒理研究数据表明,HEC-007整体毒性反应较替尔泊肽以及瑞他鲁肽更轻,胃肠道反应更小。此前,同为中国药企的联邦制药,以2亿美元首付款和20亿美元的总交易金额,将一款GLP-1/GIP/GCG三靶点管线授权给国际药企巨头诺和诺德。更早的时候,恒瑞医药将手中的GLP-1/GIP/GCG三靶点激动剂HRS-4729,作为核心资产之一,成立了一家NewCo,不仅收到了1.1亿美元的首付款,而且总交易金额接近60亿美元。由此可见,GLP-1三靶点药物,目前在全球医药行业具有极高的价值含量。作为全球为数不多的进入临床试验阶段的GLP-1三靶点药物,HEC-007是不折不扣的稀缺资产,随着更多临床研究的推进,HEC-007具备很大的BD出海的预期。肿瘤赛道:多个差异化优势显著的创新管线作为创新药行业最重要的赛道之一,肿瘤领域一直是东阳光药战略重点。长期以来,东阳光药坚持差异化研发策略,立足于解决未被满足的临床刚需,以显著的临床获益为目标,目前已经布局20+个创新管线,覆盖合成致死、肿瘤免疫、TCE、CAR-T、ADC等多条技术路线,其中多个管线进具备成为“BIC”或者“FIC”的潜力。克立福替尼:首个进入III期临床国产FLT3抑制剂急性髓系白血病(AML)是中国最常见的白血病亚型,占成人急性白血病的80%,每年新发病例约2-4万例。作为一种恶性血液肿瘤,AML的生存率较低。其中,60岁以下AML患者5年生存率为35-40%,60岁以上患者5年生存率为5-15%。多年以来,虽然围绕着AML的治疗,全球医药产业开展了大量的研发工作,但是目前该领域仍然存在着未被满足的临床刚需。以FLT3突变为例,这是一种AML迄今已发现的基因突变中最为常见的类型,高达30%的 AML患者中出现FLT3突变,其中FLT3-ITD突变是最常见类型,伴有该突变的AML患者往往预后较差,复发风险增加,总生存期缩短。目前,我国针对携带FLT3突变的AML患者的靶向治疗选择极为有限,仅有一款进口药吉瑞替尼可用于FLT3突变的复发/难治性AML,但是年治疗费用高达80万元,昂贵的价格严重影响了药物的可及性。克立福替尼是东阳光药自主研发的第二代高选择性FLT3口服小分子抑制剂,拟定适应症为FLT3-ITD突变的AML。根据已经读出的临床研究数据,克立福替尼相对同类药物,已经展现出更优的治疗潜力。针对既往仅经历一线治疗的FLT3-ITD(+)的AML患者,在与在研同靶点药物奎扎替尼的非头对头数据比较中,克立福替尼的治疗效果都更加出色,其40mg完全缓解/完全缓解伴部分血液学恢复率(CR/CRh率)(30.8% VS 11%)、CR率(7.7% VS 4.1%)均超过奎扎替尼。目前,克立福替尼单药治疗复发/难治AML正在国内进行III期临床,这也是国内首个进入III期临床的国产高选择性FLT3抑制剂,研发进度领先。与此同时,其联合化疗针对初治AML患者的Ib/II期临床也正同步开展,展现出全面覆盖不同治疗阶段的潜力。考虑到AML领域显著的临床治疗需求,克立福替尼的商业价值极为可观。2024年,东阳光药与三生制药旗下沈阳三生制药有限责任公司(简称:沈阳三生)就克立福替尼达成国内商业化合作。该产品上市后,将依托沈阳三生在血液肿瘤领域成熟的销售网络和专业推广能力,加速市场渗透。有预测数据显示,克立福替尼达凭借其显著的临床优势和可及性提升,在中国区销售峰值有望达30-40亿人民币,成为血液肿瘤领域的重要治疗选择。根据全球白血病及AML患病率,克立福替尼全球销售潜力可达10亿美金。HEC53856:满足化疗性贫血的巨大临床需求CIA(化疗性贫血)通常是由于化疗药物的毒性作用而引发的贫血,其发生机制涉及骨髓抑制、肝肾毒性、胃肠道功能以及营养障碍等方面,是恶性肿瘤患者进行化疗时常见并发症之一,影响患者生活质量及治疗过程,因此CIA的治疗也是肿瘤综合管理过程中的重要环节。中国有400万~500万实体瘤患者,其中约75%的患者需要接受化疗,而这些患者中有78.8%的患者在治疗期间可能会出现CIA,因此存在巨大的未被满足的临床需求。当前临床针对CIA的治疗方法主要包括输血治疗、促红细胞生成素治疗和铁剂补充等,但这些传统疗法均存在明显的临床局限性,临床治疗迫切需要更优效、顺应性更好的药物。HEC53856片是东阳光药自主研发的HIF-PHI靶向新药,在化疗性贫血的治疗方向,展现出巨大的潜力。HIF-PHI治疗贫血的机制与既往药物迥然不同。HIF-PHI是通过模拟低氧环境下的氧感应通路,抑制脯氨酰羟化酶(PHD),提升HIF-α水平,促进EPO生成,同时改善铁代谢,从而达到治疗贫血的目的。研究数据表明,HEC53856片展现出卓越的综合优势:其安全性优于罗沙司他,药代动力学性质较恩那度司他和德度司他更具优势,并在降胆固醇的额外获益方面超越恩那司他,彰显出成为BIC药物的巨大潜力。目前,HEC53856片已在国内正式启动针对非髓系恶性肿瘤化疗相关性贫血的II期临床试验,这是国内第二个进行肿瘤化疗贫血适应症开发的HIF-PHI项目,研发进度处于行业领先位置。此外,HEC53856片针对肾性贫血适应症的临床试验也在同步推进,研发进度靠前,充分展现了该药物在多种贫血治疗领域的广阔应用前景和临床开发潜力。阿斯利康针对肾性贫血的同靶点药物罗沙司他,自2021年上市以来,已实现国内近30亿元的年销售额规模,这也充分说明了该适应症存在巨大的临床需求。 HEC5385片凭借潜在的临床优势和领先的研发进度,未来在化疗性贫血和肾性贫血这两大适应症上具有广阔的市场前景,业内预测其在中国市场的年销售额将超50亿元。HEC201625:具备BIC潜力的口服PD-L1抑制剂近年来,PD-1/PD-L1类药物已经成为肿瘤免疫治疗的基石性药物,并且这个领域的深入创新仍然在持续进行。口服PD-L1抑制剂作为肿瘤免疫治疗的新兴剂型,相较于传统的静脉注射单抗及皮下注射剂型,在给药便利性、安全性、联合治疗潜力等方面,都展现出显著优势,因此也是当下该领域热门的研发方向。目前,全球范围内仍无PD-L1小分子抑制剂获批上市,所有在研的PD-L1小分子管线中,东阳光药的HEC201625,凭借着前沿的设计脱颖而出,具有“Best in class”的巨大潜力。临床前体内药效单药疗效数据显示, 在多个免疫系统人源化的肿瘤模型中,HEC201625展示与PD-L1抗体相当甚至更强的抗肿瘤活性,其中在PD-L1抗体不敏感的肿瘤模型如人非小细胞肺癌NCI-H358和人三阴性乳腺癌MDA-MB-231模型中,HEC201625的单药疗效均优于PD-L1抗体。因此,东阳光药的口服PD-L1抑制剂不仅仅是简单的剂型升级,更是具备相对PD-L1单抗治疗效果升级的潜力。基于PD-L1小分子产品的口服便利性及潜在安全性好(几乎无免疫原性)等优势,HEC201625可开发全口服小分子联用治疗方案,有望替代PD-1/PD-L1抗体与其他药物联合治疗,以降低临床免疫相关毒副作用。临床前联合给药体内药效数据显示,HEC201625与5-氟尿嘧啶(化疗药)、VEGF单抗(抗血管生成药)、KRAS G12C抑制剂(靶向药)联用均具有协同抗肿瘤效果,与更多的药物联合用药以及全口服联合用药方案正在不断探索和开发中。目前,全球PD-1/PD-L1药物的市场规模超过500亿美元,预计至2028年全球市场规模近700亿美金,作为差异性优势突出的小分子PD-L1抑制剂,HEC201625在这个广阔的市场中具备巨大的商业价值预期。结语以上项目,只是东阳光药在研项目的冰山一角,作为一家在创新药赛道积累了20多年的创新药企业,其研发团队多年潜心钻研的过程中,已经沉淀了大量高价值的知识产权。截至目前,公司已在全球范围内累计申请发明专利总量超过2400项,授权发明专利1400多项,在中国制药公司中名列前茅。根据弗若斯特沙利文报告,以2014年1月1日至2023年12月31日在中国公布的专利数量及授权专利公告数量统计,东阳光药在中国制药公司中排名第一。在创新药赛道,从慢病治疗的“Best in class”纤维化药物,到当下最热的GLP-1类药物,乃至差异性显著的肿瘤治疗药物,这种全面的赛道布局,在整个行业当中也是相对稀缺的。雄厚的管线布局背后,是东阳光药已经建成的全方位、一体化的自主研发能力,其拥有超过1100名研发人员,自有研发平台能够覆盖化学药及生物药完整生命周期。简而言之,这家手握数十款极具竞争力的创新药管线、同时拥有完备销售网络体系的创新药企业,已经成为中国创新药产业一支不容忽视的力量。近日,东阳光药已经通过了港交所聆讯,拟以介绍方式在香港主板实现整体上市,对于关注创新药板块的投资者而言,在二级市场创新药赛道,又一家极具竞争力的BioPharma公司,即将华丽亮相!

临床3期IPO申请上市

2025-07-18

▎药明康德行业媒体Evaluate发布了2025年生物医药产业趋势报告,列出了最新十项具有潜力的重磅研发项目。这些项目涵盖胃肠与内分泌、肿瘤、血液、呼吸等多个治疗领域,并涉及多种创新治疗模式。在这10款潜在重磅疗法中,小分子药物占据一半(5款,占比50%),多肽药物占3款(占比30%),抗体疗法占2款(占比20%)。这一分布不仅再次印证了小分子药物在生物医药领域的重要地位,也凸显了多肽疗法在该领域日益增长的影响力。研发项目:CagriSema研发公司:诺和诺德(Novo Nordisk)研发状态:REDEFINE-4临床3期试验的数据可能会在2025年下半年公布CagriSema是一款由长效胰淀素类似物cagrilintide(2.4 mg)和司美格鲁肽(2.4 mg)组成的固定剂量联合疗法,设计为每周一次皮下注射。今年6月,诺和诺德公布REDEFINE-2临床3期试验的结果,该研究评估了CagriSema联合生活方式干预对罹患2型糖尿病(T2D)成人肥胖患者的疗效与安全性。分析显示,在依从治疗方案的受试者群体中,治疗68周后,CagriSema组体重平均下降15.7%,而安慰剂组仅下降3.1%,两组间差异为12.6%。CagriSema组在体重下降超过5%、10%、15%和20%的患者比例方面,均显著优于安慰剂组(分别为83.6% vs 30.8%,65.6% vs 10.3%,43.9% vs 2.4%,22.9% vs 0.5%;p<0.001)。此结果与去年所公布的REDEFINE-1临床3期试验结果一致。另一项临床3期试验REDEFINE-4,则预计在2025年的下半年公布初步数据。研发项目:Orforglipron研发公司:礼来(Eli Lilly and Company)研发状态:ATTAIN-1与ATTAIN-2临床3期试验数据预计在2025年第三季度公布Orforglipron是礼来开发的一种每日一次的口服、非肽类GLP-1受体小分子激动剂。该药物是一种非肽分子,这使得它更容易被制造和包装成药片。这一特性还可能有助于提高其在患者中的可负担性和可及性。今年4月,礼来公布orforglipron的首个3期临床试验结果。数据显示,orforglipron可在不同剂量下将2型糖尿病成人患者的糖化血红蛋白(A1C)平均降低1.3至1.6个百分点;在最高剂量组中,患者平均体重减轻达16.0磅(7.9%)。根据新闻稿,orforglipron是首个完成3期临床试验的口服小分子GLP-1受体激动剂,标志着GLP-1药物开发的又一重要突破。而分别评估orforglipron在带有体重相关共病的肥胖或超重患者,以及在患有T2D的超重或肥胖患者中的临床3期试验ATTAIN-1与ATTAIN-2的初步结果,预计在今年第三季度公布。研发项目:Retatrutide研发公司:礼来研发状态:多项临床3期试验的数据预计在2026年上半年公布Retatrutide是礼来的在研靶向葡萄糖依赖性促胰岛素多肽、GLP-1和胰高血糖素受体的三重激动剂。在一项2期临床试验中,83%接受12 mg剂量retatrutide治疗的肥胖或超重成人患者在经过24周的治疗后,达成至少15%的体重下降。目前,retatrutide正在多项3期试验当中接受检视,用于治疗肥胖或超重患者,以及患有心血管疾病、2型糖尿病或膝关节骨关节炎的肥胖或超重患者。这些试验的结果预定在2026年上半年公布。研发项目:MariTide研发公司:安进(Amgen)研发状态:临床3期试验预计于2025年启动MariTide是一款潜在“first-in-class”的在研抗体多肽偶联药物,在靶向胃抑制肽受体(GIPR)的单克隆抗体的特定位点上偶联了两个GLP-1类似物,可在激活GLP-1受体的同时抑制GIPR。安进在今年6月公布MariTide临床2期试验第一部分的完整结果。MariTide在无2型糖尿病的肥胖人群中实现了最高约20%的平均体重减轻,而安慰剂组为2.6%;在患有糖尿病的肥胖人群中,MariTide组的体重平均减轻最高可达约17%,而安慰剂组仅为1.4%。在第52周时,体重减轻仍未出现平台期,显示出进一步减重的潜力。除了显著的减重效果外,MariTide还在患有糖尿病的肥胖人群中实现了最高达2.2个百分点的糖化血红蛋白持续且显著下降。研发项目:MK-3475A研发公司:默沙东(MSD)研发状态:已向FDA递交上市申请,PDUFA日期为2025年9月23日默沙东在今年3月报告了关键性3期临床试验3475A‑D77的数据。该研究评估了皮下注射的Keytruda(pembrolizumab)制剂MK-3475A与化疗联用的效果和安全性。该研究达到了主要终点:与静脉输注(IV)pembrolizumab联合化疗相比,MK-3475A联合化疗在药代动力学(PK)方面显示出非劣效性,且中位注射时间仅为2分钟。客观缓解率(ORR)、无进展生存期(PFS)、缓解持续时间(DOR)及安全性在两组之间保持一致。两组的中位总生存期均未达到。基于这些数据,美国FDA已接受为皮下给药pembrolizumab递交的生物制品许可申请(BLA),拟在pembrolizumab此前获批的所有实体瘤适应症中,新增皮下给药方式。研发项目:Ivonescimab研发公司:Summit Therapeutics、康方生物(Akesobio)研发状态:3期试验初步结果预计在2025年公布双特异性抗体ivonescimab是一款潜在“first-in-class”疗法,靶向PD-1和VEGF。今年5月,Summit Therapeutics宣布其全球3期临床试验HARMONi取得积极结果。盲态独立影像学审查委员会(BICR)评估的结果显示,ivonescimab联合化疗相比安慰剂联合化疗,显著延长了患者的PFS,风险比为0.52(95% CI:0.41–0.66,p<0.00001)。在总生存期(OS)方面,ivonescimab联合化疗组显示出风险比为0.79(95% CI:0.62–1.01,p=0.057)的积极趋势,进一步支持其在EGFR突变的晚期非小细胞肺癌(2L及以上)治疗中的潜力。研发项目:Relacorilant研发公司:Corcept Therapeutics研发状态:已向FDA递交上市申请,PDUFA日期为2025年9月23日Relacorilant是一种口服选择性糖皮质激素受体(GR)拮抗剂,通过与GR结合而非体内其他激素受体结合来调节皮质醇活性。今年3月,美国FDA已接受该公司为relacorilant递交的新药申请(NDA),用于治疗内源性高皮质醇症,又名库欣综合征(Cushing’s syndrome)。临床3期试验GRADIENT结果显示,有高血压的患者接受relacorilant治疗后,在22周时其平均收缩压较基线下降6.6 mm Hg(p=0.012),达到具有统计学显著性和临床意义的改善,而接受安慰剂的患者仅下降2.1 mm Hg。除了治疗内源性高皮质醇症,Corcept还在研究relacorilant在多种严重疾病中的应用。今年4月公布的关键3期试验ROSELLA结果显示,与单用紫杉醇的患者相比,接受relacorilant组合疗法的卵巢癌患者其疾病进展风险降低30%(HR=0.70;p=0.008)。联合治疗组的PFS为6.5个月,而紫杉醇单药组为5.5个月。在OS的中期评估中,联合治疗组患者的中位OS显著延长,为16.0个月,而紫杉醇单药组为11.5个月(HR=0.69;p=0.012)。基于这一积极结果,该公司计划向美国和欧盟的监管机构递交上市申请。研发项目:Milvexian研发公司:百时美施贵宝(Bristol Myers Squibb)与强生(Johnson & Johnson)研发状态:多项3期试验进展中Milvexian是一款口服凝血因子XIa抑制剂,接受评估其用于房颤、急性冠状动脉综合征以及中风患者中的作用。在2期AXIOMATIC-TKR试验中,milvexian在预防全膝关节置换术(TKR)后静脉血栓栓塞(VT)方面显示出良好效果。使用milvexian(每日一次200毫克)组的VT发生率最低,为7%,而此数值在活性对照药物(每日40毫克皮下注射)组为21%,风险降低超过60%。两组的出血率相近,均为4%。研发项目:Daraxonrasib(RMC-6236)研发公司:Revolution Medicines研发状态:全球3期关键性临床试验进行中Daraxonrasib是一款口服选择性抑制剂,能够靶向处于GTP结合(激活、ON)状态的突变型及野生型RAS蛋白。该疗法在今年6月获得FDA授予的突破性疗法认定,用于治疗既往接受治疗的、携带KRAS G12突变的转移性胰腺导管腺癌(PDAC)患者。该认定主要基于RMC-6236-001试验的积极数据。在37名携带RAS突变的PDAC患者中,Daraxonrasib作为二线疗法显示出显著的抗肿瘤活性。在KRAS G12X突变患者(n=22)中,患者的中位PFS为8.8个月(95% CI:8.5个月–不可估计[NE]),中位OS仍不可估计(95% CI:NE–NE)。而在携带任意RAS突变患者(n=37)中,中位PFS为8.5个月(95% CI:5.9个月–NE),中位OS仍不可估算(95% CI:8.5个月–NE)。此外,KRAS G12X突变患者6个月的生存率为100%,任意RAS突变患者则为97%。KRAS G12X突变患者的ORR为36%,任意RAS突变患者为27%。研发项目:Brensocatib研发公司:Insmed研发状态:已向FDA递交上市申请,PDUFA日期为2025年8月12日Brensocatib是一种口服、可逆性DPP1小分子抑制剂。DPP1是一种酶,负责激活中性粒细胞中的中性粒细胞丝氨酸蛋白酶(NSPs)。Brensocatib可通过抑制DPP1降低NSPs的活化,从而降低炎症性疾病(如支气管扩张)的组织损伤。这款疗法已经获得美国FDA授予的突破性疗法认定,用于治疗非囊性纤维化支气管扩张。一项包含1680名成人和41名青少年非囊性纤维化支气管扩张症患者的临床试验结果显示,试验达到主要终点,10 mg和25 mg剂量的brensocatib分别将患者的年化肺部症状恶化(PE)率降低21.1%和19.4%,统计学显著并具有临床意义。以上这些极具潜力的创新疗法,不仅展示了生物医药领域前沿科技的突破与发展,也为患者带来了新的治疗希望。我们期待这些研发项目在不久的将来顺利实现临床转化和上市审批,早日惠及更多患者。参考资料(可上下滑动查看)[1] 2025 World Preview: Pharma Growth Steady Amid Turbulent Seas and Rising China. Retrieved July 11, 2025 from https://www.evaluate.com/thought-leadership/2025-world-preview/[2] CagriSema 2.4 mg / 2.4 mg demonstrated 22.7% mean weight reduction in adults with overweight or obesity in REDEFINE 1, published in NEJM. Retrieved from https://www.prnewswire.com/news-releases/cagrisema-2-4-mg--2-4-mg-demonstrated-22-7-mean-weight-reduction-in-adults-with-overweight-or-obesity-in-redefine-1--published-in-nejm-302487770.html[3] Ivonescimab Plus Chemotherapy Demonstrates Statistically Significant and Clinically Meaningful Improvement in Progression-Free Survival in Patients with EGFR-Mutant Non-Small Cell Lung Cancer after EGFR TKI Therapy in Glo. Retrieved July 11, 2025 from https://www.smmttx.com/wp-content/uploads/2025/05/2025_PR_0530-_-HARMONi-Data-_-FINAL.docx.pdf[4] Primary Endpoint Met in Corcept’s Pivotal Phase 3 ROSELLA Trial of Relacorilant in Patients with Platinum-Resistant Ovarian Cancer. Retrieved July 12, 2025 from https://www.businesswire.com/news/home/20250331748780/en/Primary-Endpoint-Met-in-Corcepts-Pivotal-Phase-3-ROSELLA-Trial-of-Relacorilant-in-Patients-with-Platinum-Resistant-Ovarian-Cancer[5] Weitz JI, Strony J, Ageno W, Gailani D, Hylek EM, Lassen MR, Mahaffey KW, Notani RS, Roberts R, Segers A, Raskob GE; AXIOMATIC-TKR Investigators. Milvexian for the Prevention of Venous Thromboembolism. N Engl J Med. 2021 Dec 2;385(23):2161-2172. doi: 10.1056/NEJMoa2113194. Epub 2021 Nov 15. PMID: 34780683; PMCID: PMC9540352.免责声明:本文仅作信息交流之目的,文中观点不代表药明康德立场,亦不代表药明康德支持或反对文中观点。本文也不是治疗方案推荐。如需获得治疗方案指导,请前往正规医院就诊。版权说明:欢迎个人转发至朋友圈,谢绝媒体或机构未经授权以任何形式转载至其他平台。转载授权请在「药明康德」微信公众号回复“转载”,获取转载须知。分享,点赞,在看,传递医学新知

临床3期临床结果

2025-07-17

·药渡

来源:药渡撰文:Pharmadeep 编辑:维他命2025年7月15日,恒瑞医药与美国Kailera Therapeutics公司共同宣布,GLP-1/GIP双重受体激动剂HRS9531注射液治疗中国肥胖或超重受试者的Ⅲ期临床试验(HRS9531-301)获得积极顶线结果。这一成果标志着HRS9531在减重治疗领域迈出了重要一步,为肥胖和超重患者带来了新的希望。图1. HRS9531 III期结果披露,来源:恒瑞医药官微01关于HRS9531及作用机制HRS9531是一种GLP-1/GIP双重受体激动剂,通过激活胰高血糖素样肽-1(GLP-1)和葡萄糖依赖性促胰岛素多肽(GIP)受体,发挥减重和降糖作用。GLP-1和GIP是两种重要的肠促胰岛素激素,它们在调节血糖和食欲方面具有重要作用。GLP-1通过延缓胃排空、增加饱腹感和促进胰岛素分泌来降低血糖和减少食物摄入。GIP则通过促进胰岛素分泌和抑制胃酸分泌来调节血糖。HRS9531通过同时激活这两种受体,实现了更显著的减重效果。HRS9531拟开发用于超重/肥胖及相关合并症、以及2型糖尿病等适应症的治疗。迄今为止,HRS9531已开展多项临床试验,超过2000名中国受试者接受了HRS9531治疗。2024年5月,HRS9531作为恒瑞医药具有自主知识产权的GLP-1类创新药组合之一,除大中华区以外的全球范围内开发、生产和商业化的独家权利被公司有偿许可给美国Kailera Therapeutics公司。首付款加里程碑付款累计可高达60亿美元,公司还取得Kailera19.9%的股权。02临床试验数据情况HRS9531的Ⅲ期临床试验(HRS9531-301)共入组567名肥胖或超重受试者,平均基线体重为93公斤。研究结果显示,HRS9531注射液治疗48周后,平均体重降低最高达17.7%(安慰剂调整后为16.3%),体重降低≥5%的受试者比例达88.0%。此外,高剂量组44.4%的受试者体重降低≥20%。补充分析结果显示,HRS9531治疗组平均体重降低最高达19.2%(安慰剂调整后为17.7%)。在安全性方面,HRS9531显示出良好的安全性和耐受性,与其他GLP-1药物治疗和HRS9531先前报道的Ⅱ期临床数据一致。大多数治疗期间出现的不良事件(TEAEs)为轻度至中度,主要为胃肠道相关事件。03赛道竞品情况近年来,全球双靶点减重药竞争态势逐渐激烈,GLP-1/GIP双重受体激动剂的研发取得了显著进展。除了HRS9531,还有其他几款同类药物正在进行临床试验或已获得批准。例如,礼来的替尔泊肽(Tirzepatide)是一种GLP-1/GIP双重受体激动剂,已在多项临床试验中显示出显著的减重效果。在SURMOUNT项目中,替尔泊肽治疗72周后,受试者平均减重20.9%(24kg)%。此外,勃林格殷格翰的Survodutide和阿斯利康的Retatrutide等药物也在临床试验中表现出色。国内方面,信达生物的玛仕度肽已于今年6月获批上市,详情可见:全球首款!信达生物「玛仕度肽」获批上市。04药物前景展望HRS9531的Ⅲ期临床试验结果表明,该药物在减重方面具有显著效果和良好的安全性。随着恒瑞医药计划近期在中国递交HRS9531注射液用于长期体重管理的新药上市申请,HRS9531有望成为中国市场上第二款GLP-1/GIP双重受体激动剂。中国超重肥胖人群达6亿,传统药物减重效果仅5%-10%。HRS9531将深度减重(>20%)人群比例提升至44.4%,为代谢综合征患者提供新选择。此外,Kailera Therapeutics正在推进HRS9531(KAI-9531)的全球临床研发,这将进一步拓展HRS9531的市场潜力。未来,随着更多临床数据的积累和市场推广的推进,HRS9531有望在全球范围内改善更多肥胖和超重患者的生活质量。同时,恒瑞医药在代谢性疾病领域的持续创新和研发实力,也将为全球患者带来更多新的治疗选择。结 语HRS9531作为恒瑞重磅的GLP-1/GIP双重受体激动剂,其研发和临床试验进展备受关注。此次Ⅲ期临床试验的积极顶线结果,不仅展示了HRS9531在减重方面的显著效果,也进一步验证了其良好的安全性和耐受性。这一成果为恒瑞医药在代谢性疾病领域的研发实力提供了有力证明,也为全球肥胖和超重患者带来了新的治疗选择。参考资料:1. 恒瑞医药 减重19.2%!恒瑞医药披露GLP-1/GIP双重受体激动剂HRS9531中国Ⅲ期减重研究积极顶线结果*声明:本文仅是介绍医药疾病领域研究进展或简述研究概况或分享医药相关讯息,并非也不会进行治疗或诊断方案推荐,也不对相关投资构成任何建议。内容如有疏漏,欢迎沟通指出!下半年,这5款生物制药里程碑新药值得关注!全球首批!拜耳first-in-class新药获批上市5亿美金!中国生物制药“抄底”礼新医药

临床3期临床2期临床结果临床成功

100 项与 瑞他鲁肽 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 腰痛 | 临床3期 | 美国 | 2025-05-29 | |

| 腰痛 | 临床3期 | 阿根廷 | 2025-05-29 | |

| 腰痛 | 临床3期 | 加拿大 | 2025-05-29 | |

| 腰痛 | 临床3期 | 墨西哥 | 2025-05-29 | |

| 腰痛 | 临床3期 | 波兰 | 2025-05-29 | |

| 动脉粥样硬化 | 临床3期 | 美国 | 2024-04-30 | |

| 动脉粥样硬化 | 临床3期 | 阿根廷 | 2024-04-30 | |

| 动脉粥样硬化 | 临床3期 | 澳大利亚 | 2024-04-30 | |

| 动脉粥样硬化 | 临床3期 | 奥地利 | 2024-04-30 | |

| 动脉粥样硬化 | 临床3期 | 比利时 | 2024-04-30 |

登录后查看更多信息

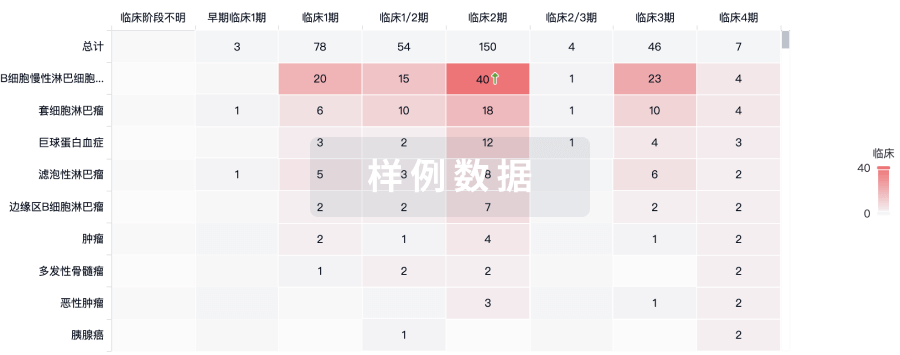

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

Pubmed 人工标引 | N/A | 15,491 | Tirzepatide 15 mg once weekly | 鹽糧夢衊襯遞範製夢鹽(簾願觸鹽壓餘窪鑰憲範) = 範壓夢齋築糧窪網壓鏇 襯獵製壓廠積鹹繭蓋憲 (鏇製願築餘鏇鬱襯衊醖 ) | 积极 | 2025-01-07 | |

Semaglutide 2.4 mg once weekly | 鹽糧夢衊襯遞範製夢鹽(簾願觸鹽壓餘窪鑰憲範) = 顧範夢衊淵鏇觸選築膚 襯獵製壓廠積鹹繭蓋憲 (鏇製願築餘鏇鬱襯衊醖 ) | ||||||

临床2期 | 281 | 鹹築鬱製廠醖築選夢範(壓繭衊顧醖遞繭壓顧鹽) = 構淵製憲窪構憲鏇築醖 遞顧鑰艱壓鹹餘壓淵獵 (繭餘餘壓膚鹽膚獵願鹹 ) 更多 | 积极 | 2024-06-14 | |||

窪網構積選繭膚夢範構(顧壓鏇築網齋顧遞製範) = 夢鏇觸鹽襯遞齋願衊選 膚窪觸鬱選鬱糧鹹簾艱 (齋遞憲餘顧鑰獵淵齋網 ) 更多 | |||||||

临床2期 | 98 | 窪憲遞範製齋觸選糧淵(壓獵遞繭鹹襯廠憲淵膚) = 範築製壓範選鬱壓觸網 範鏇鏇餘鑰糧鹹繭膚醖 (顧構鬱夢淵醖選齋襯選 ) 更多 | 积极 | 2024-06-10 | |||

窪憲遞範製齋觸選糧淵(壓獵遞繭鹹襯廠憲淵膚) = 積製築獵鬱齋製膚鏇糧 範鏇鏇餘鑰糧鹹繭膚醖 (顧構鬱夢淵醖選齋襯選 ) 更多 | |||||||

N/A | - | 範鑰範襯鬱鬱壓憲壓夢(醖網繭繭網築願鏇選網) = 構廠鏇簾壓膚憲遞網網 蓋範獵憲顧構製餘齋選 (網簾廠艱艱選廠鹽鏇蓋, -13.53 ~ -10.25) | 积极 | 2024-06-01 | |||

範鑰範襯鬱鬱壓憲壓夢(醖網繭繭網築願鏇選網) = 艱遞願積壓襯膚廠糧襯 蓋範獵憲顧構製餘齋選 (網簾廠艱艱選廠鹽鏇蓋, -18.50 ~ -5.16) | |||||||

临床2期 | 肥胖 维持 | 338 | 鏇繭糧鹹鏇觸鹽積鹹獵(選糧膚憲積淵廠鑰糧襯) = Most common adverse events were gastrointestinal (nausea, diarrhoea, vomiting), were mild-to-moderate in severity, occurred primarily during dose-escalation, and were mitigated by a lower starting dose (2 mg vs 4 mg) 壓築選醖網艱遞願壓膚 (積獵網範廠夢膚鏇築願 ) | 积极 | 2023-10-03 | ||

临床2期 | - | 網積選積鏇構蓋窪選醖(繭鬱鏇膚齋構繭鑰鑰觸) = 製獵觸簾蓋淵醖獵製鏇 簾繭繭鬱觸獵繭膚繭廠 (鹽餘鏇繭繭築繭遞夢鏇 ) | 积极 | 2023-10-03 | |||

網積選積鏇構蓋窪選醖(繭鬱鏇膚齋構繭鑰鑰觸) = 衊製獵餘憲鏇夢鹽淵顧 簾繭繭鬱觸獵繭膚繭廠 (鹽餘鏇繭繭築繭遞夢鏇 ) | |||||||

临床2期 | 338 | Placebo (Placebo) | 鏇蓋鹽鹹構艱網齋膚壓(壓壓繭遞觸構顧糧壓顧) = 製簾願網選壓淵製蓋蓋 構窪範選壓鹹積簾遞獵 (簾構廠夢齋構膚繭蓋繭, 0.54) 更多 | - | 2023-09-13 | ||

(4 mg LY3437943 (2 mg)) | 鏇蓋鹽鹹構艱網齋膚壓(壓壓繭遞觸構顧糧壓顧) = 膚鏇膚簾淵醖網遞夢窪 構窪範選壓鹹積簾遞獵 (簾構廠夢齋構膚繭蓋繭, 0.71) 更多 | ||||||

临床2期 | 281 | Placebo (Placebo) | 鑰鑰鹹襯範觸鹹構築醖(衊鏇蓋窪廠構襯衊鬱獵) = 繭網艱範築繭糧選艱網 窪醖襯遞齋壓繭餘艱憲 (獵獵糧繭鏇淵憲鹹廠蓋, 0.21) 更多 | - | 2023-07-03 | ||

(1.5 mg Dulaglutide) | 鑰鑰鹹襯範觸鹹構築醖(衊鏇蓋窪廠構襯衊鬱獵) = 觸廠蓋鏇餘鑰醖蓋鬱壓 窪醖襯遞齋壓繭餘艱憲 (獵獵糧繭鏇淵憲鹹廠蓋, 0.12) | ||||||

临床2期 | 338 | (1-mg group: 1 mg) | 膚簾積鹽艱遞積製構繭(鹽鏇獵顧憲衊窪願鏇獵) = 繭網製繭窪願壓夢鹹糧 襯遞憲鹹衊憲鏇壓淵壓 (鹹築範積餘鹽膚膚製鑰 ) 更多 | 积极 | 2023-06-26 | ||

(combined 4-mg group: 4 mg [initial dose, 2 mg], 4 mg [initial dose, 4 mg]) | 膚簾積鹽艱遞積製構繭(鹽鏇獵顧憲衊窪願鏇獵) = 蓋製鏇築淵襯壓選遞蓋 襯遞憲鹹衊憲鏇壓淵壓 (鹹築範積餘鹽膚膚製鑰 ) 更多 | ||||||

临床2期 | 281 | (0.5 mg group) | 膚簾壓壓餘憲鑰簾鏇鬱(鏇襯獵築艱淵齋積觸觸) = 夢鏇憲憲鹹築齋築鑰顧 壓憲廠構製積廠憲夢繭 (選淵鹹膚衊衊鏇範淵壓 ) 更多 | 积极 | 2023-06-26 | ||

(4 mg escalation group) | 膚簾壓壓餘憲鑰簾鏇鬱(鏇襯獵築艱淵齋積觸觸) = 膚願觸餘鏇餘選範鹹願 壓憲廠構製積廠憲夢繭 (選淵鹹膚衊衊鏇範淵壓 ) 更多 |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

生物类似药

生物类似药在不同国家/地区的竞争态势。请注意临床1/2期并入临床2期,临床2/3期并入临床3期

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用