预约演示

更新于:2025-05-07

E39'+GM-CSF vaccine(Galena Biopharma)

更新于:2025-05-07

概要

基本信息

在研机构- |

权益机构- |

最高研发阶段无进展临床1期 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评- |

登录后查看时间轴

结构/序列

Sequence Code 13858242

关联

1

项与 E39'+GM-CSF vaccine(Galena Biopharma) 相关的临床试验NCT02019524

Phase Ib Trial of Two Folate Binding Protein (FBP) Peptide Vaccines (E39 and J65) in Breast and Ovarian Cancer Patients

This is a single-center, randomized, single-blinded, three-arm phase Ib study of the folate binding protein vaccines E39 and J65. The study target population are patients with breast or ovarian cancer diagnosis who have been treated and are without evidence of disease. Disease-free subjects after standard of care multi-modality therapy will be screened and HLA typed. E39 and J65 are cytotoxic T-lymphocyte-eliciting peptide vaccines that are restricted to HLA-A2+ patients (approximately 50% of the U.S. population).

开始日期2013-09-30 |

申办/合作机构 |

100 项与 E39'+GM-CSF vaccine(Galena Biopharma) 相关的临床结果

登录后查看更多信息

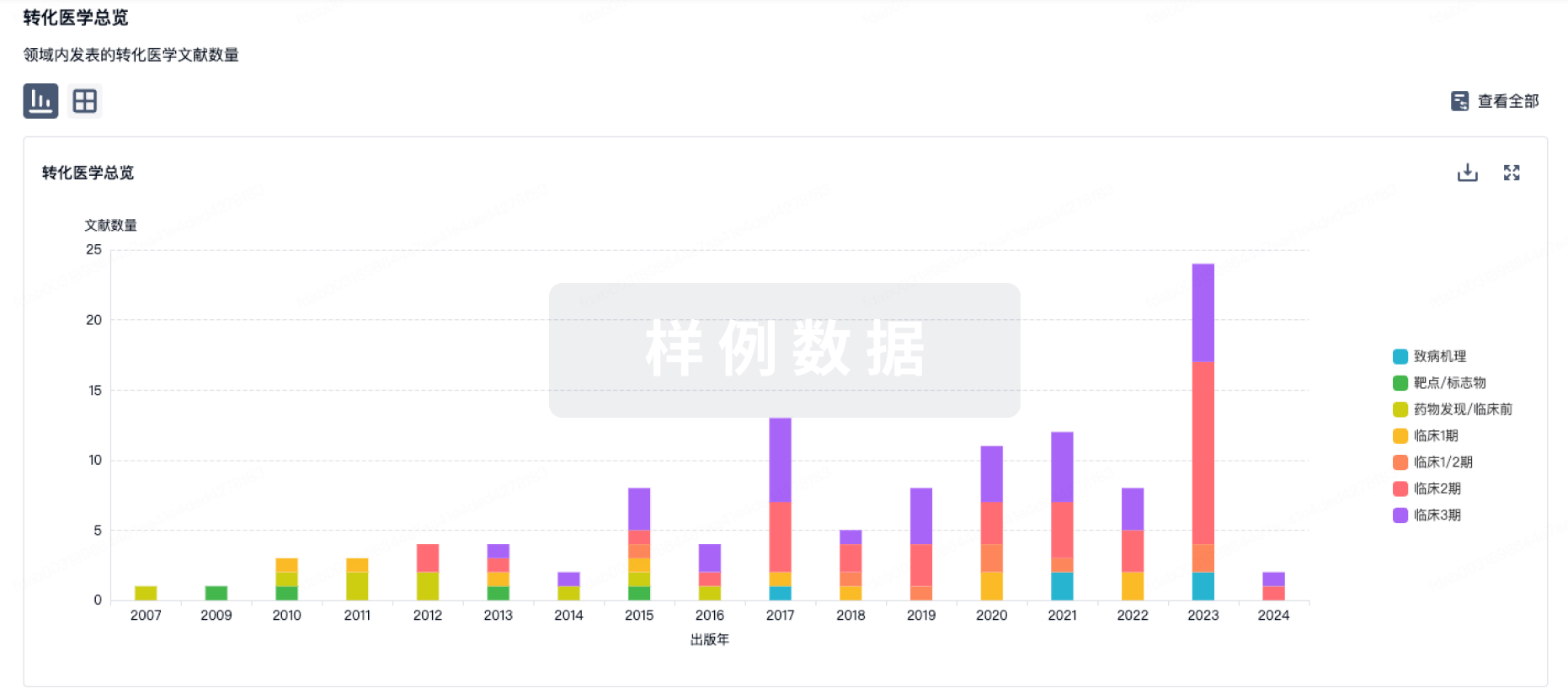

100 项与 E39'+GM-CSF vaccine(Galena Biopharma) 相关的转化医学

登录后查看更多信息

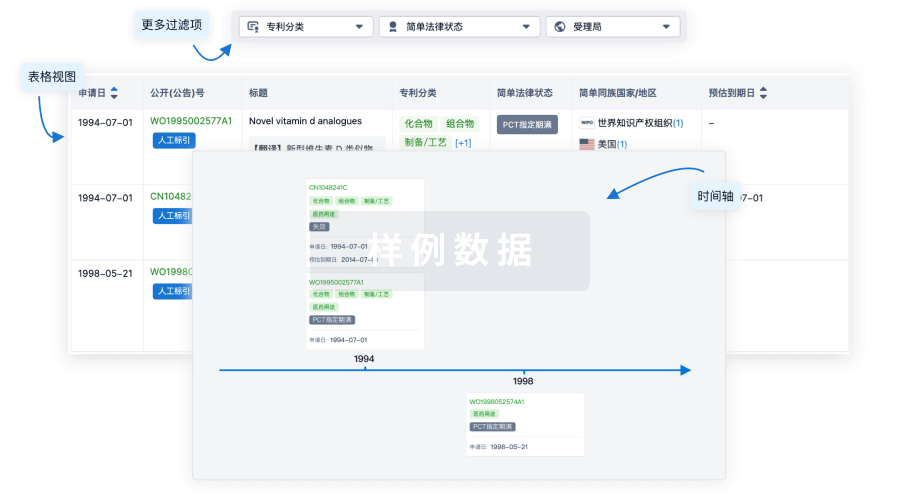

100 项与 E39'+GM-CSF vaccine(Galena Biopharma) 相关的专利(医药)

登录后查看更多信息

3

项与 E39'+GM-CSF vaccine(Galena Biopharma) 相关的文献(医药)2019-08-01·Cancer Medicine3区 · 医学

Final analysis of a phase I/IIa trial of the folate‐binding protein‐derived E39 peptide vaccine to prevent recurrence in ovarian and endometrial cancer patients

3区 · 医学

ArticleOA

作者: Clifton, Guy T. ; Hamilton, Chad A. ; Myers, John W. ; Jackson, Doreen O. ; Herbert, Garth S. ; Vreeland, Timothy J. ; Byrd, Kevin ; Brown, Tommy A. ; Berry, John S. ; Elkas, John C. ; Hale, Diane F. ; Peoples, George E. ; Conrads, Thomas P. ; Darcy, Kathleen M. ; Martin, Jonathan ; Greene, Julia M. ; Maxwel, George L.

2018-07-01·Clinical Immunology3区 · 医学

Phase Ib trial of folate binding protein (FBP)-derived peptide vaccines, E39 and an attenuated version, E39’: An analysis of safety and immune response

3区 · 医学

Article

作者: Litton, Jennifer K ; Berry, John S ; Clifton, Guy T ; Vreeland, Timothy J ; Hale, Diane F ; Mittendorf, Elizabeth A ; Jackson, Doreen O ; Greene, Julia M ; Qiao, Na ; Philips, Anne V ; Peace, Kaitlin M ; Alatrash, Gheath ; Peoples, George E

2017-01-01·Journal of Cancer3区 · 医学

Evaluation of Attenuated Tumor Antigens and the Implications for Peptide-Based Cancer Vaccine Development

3区 · 医学

ArticleOA

作者: Peoples, G E ; Jackson, D O ; Vreeland, T J ; Hardin, M O ; Trappey, A F ; Hale, D F ; Berry, J S ; Herbert, G S ; Greene, J M ; Clifton, G T

1

项与 E39'+GM-CSF vaccine(Galena Biopharma) 相关的新闻(医药)2017-03-10

March 10, 2017

By

Mark Terry

, BioSpace.com Breaking News Staff

San Ramon, Calif.-based

Galena Biopharma

announced

that it had hired

Canaccord Genuity

to help it develop a plan to sell the company or its assets.

This comes about five weeks after its chief executive officer,

Mark Schwartz

,

stepped down

over a civil and criminal investigation into the company’s marketing of Abstral (fentanyl). The company was under investigation by the U.S. Department of Justice, looking into several employees, as well as two high-prescribing physicians, over a rebate deal between the company and the two doctors.

Schwartz took over the job in 2014. At that time, the company was headquartered in Lake Oswego, Ore. Its then-CEO

Mark Ahn

resigned after Galena was,

according to

Xconomy

,“accused of tricking potential investors by allegedly paying a publicity firm to inflate its stock. Galena settled a lawsuit for $20 million in 2015 (most of it was paid by insurance).”

The company indicates that it is reviewing options, including “a sale of the company, a business combination, a merger or reverse merger with another party, continuing to advance the clinical programs as a stand-alone entity, and a license or other disposition of corporate assets of the Company.”

The company’s assets include GALE-401, currently in a Phase III-ready program for essential thrombocythemia, and an immune-oncology franchise for prevention of recurrence in breast and ovarian cancer, that includes NeuVax (nelipepimut-S), which has three Phase II clinical trials, a Phase IIb trial that expects to complete enrollment in the second quarter, and GALE-301 and GALE-302, which completed early-stage trials in ovarian cancer.

The Phase III trial of NeuVax didn’t go well. The drug didn’t perform as well as placebo, which caused independent data monitors to recommend halting the trial, which was then officially closed on August 10, 2016.

“Although the Phase III PRESENT trial of the HER2 vaccine was terminated early, after unblinding the data, it appears that the trial failed due to a design flaw in the study and not due to lack of activity of the vaccine (data to be published soon),” wrote

George Peoples

to

Xconomy

. Peoples is the San Antonio-based scientist who developed NeuVax.

Galena, which was then known as

RXi Pharmaceuticals

and headquartered in Worcester, Mass., acquired the Arizona biotech company,

Apthera

, in 2011 that held the license for NeuVax. Apthera had licensed NeuVax from the

MD Anderson Cancer Center

in Houston and the

Henry Jackson Foundation

in 2006.

Not surprisingly, Galena has tanked recently. Shares are currently trading for $0.59. Shares traded at $45.40 on June 22, 2016, before they plunged to $7 on June 29, 2016.

The stock has a

one-year high

of $49.80 and a one-year low of $0.21. Its 50-day moving average is $1.09 and its 200-day moving average is $1.21. On February 6, FBR analyst

Vernon Bernardino

downgraded the stock to “Hold,” with a price target of $4. On February 2,

Jason McCarthy

, an analyst with

Maxim

, downgraded the stock to “Hold.”

临床2期并购临床3期疫苗高管变更

100 项与 E39'+GM-CSF vaccine(Galena Biopharma) 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 乳腺癌 | 临床1期 | 美国 | 2013-09-30 | |

| 卵巢癌 | 临床1期 | 美国 | 2013-09-30 |

登录后查看更多信息

临床结果

临床结果

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

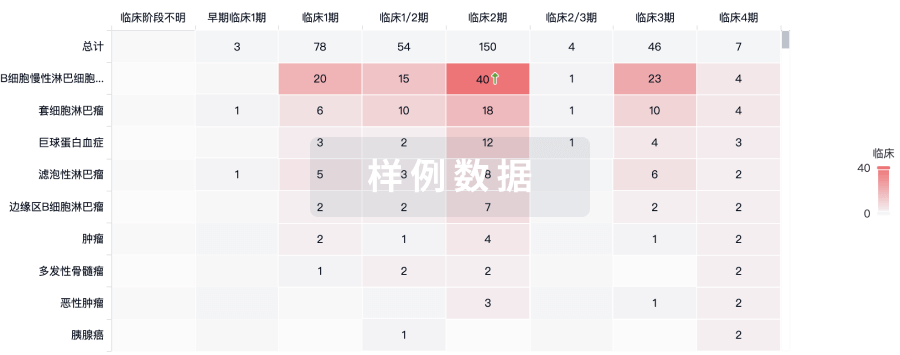

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用