预约演示

更新于:2025-05-07

Monte Rosa Therapeutics AG

更新于:2025-05-07

概览

标签

肿瘤

免疫系统疾病

血液及淋巴系统疾病

降解型分子胶

分子胶

化学药

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 降解型分子胶 | 8 |

| 分子胶 | 2 |

| 化学药 | 1 |

| 排名前五的靶点 | 数量 |

|---|---|

| NEK7 | 2 |

| CDK2(细胞周期蛋白依赖性激酶2) | 2 |

| VAV1 | 2 |

| GSPT1 | 1 |

| BCL11A(BCL11A蛋白) | 1 |

关联

12

项与 Monte Rosa Therapeutics AG 相关的药物靶点 |

作用机制 GSPT1抑制剂 |

在研适应症 |

非在研适应症- |

最高研发阶段临床1/2期 |

首次获批国家/地区- |

首次获批日期- |

靶点 |

作用机制 VAV1抑制剂 [+1] |

非在研适应症- |

最高研发阶段临床1期 |

首次获批国家/地区- |

首次获批日期- |

靶点 |

作用机制 NEK7抑制剂 [+1] |

在研适应症 |

非在研适应症- |

最高研发阶段临床前 |

首次获批国家/地区- |

首次获批日期- |

2

项与 Monte Rosa Therapeutics AG 相关的临床试验NCT06597799

Phase 1, First-in-Human, Randomized, Double-Blind, Placebo-Controlled, Single Ascending Dose, Multiple Ascending Dose, and Food-Effect Study to Assess Safety, Tolerability, PK and PD of MRT-6160 in Healthy Subjects

The principal aim of this study is to obtain safety and tolerability data when MRT-6160 is administered orally as single and multiple doses to healthy subjects. This information, together with the pharmacokinetic (PK) data, will help establish the doses and dosing regimen suitable for future studies in patients.

The study drug, MRT-6160, is experimental. This is the first study in which MRT-6160 will be given to humans.

Part 1: Subjects will receive a single oral dose of MRT-6160 or placebo on Day 1

Part 2: Subjects will receive multiple oral doses of MRT-6160 or placebo for 7 consecutive days

The study drug, MRT-6160, is experimental. This is the first study in which MRT-6160 will be given to humans.

Part 1: Subjects will receive a single oral dose of MRT-6160 or placebo on Day 1

Part 2: Subjects will receive multiple oral doses of MRT-6160 or placebo for 7 consecutive days

开始日期2024-08-07 |

申办/合作机构 |

NCT05546268

A Phase 1/2 Study of Oral MRT-2359 in Patients With MYC-Driven and Other Selected Solid Tumors Including Lung Cancer and Diffuse B-Cell Lymphoma

This Phase 1/2, open-label, multicenter study is conducted in patients with previously treated selected solid tumors, including non-small cell lung cancer (NSCLC), small cell lung cancer (SCLC), high-grade neuroendocrine cancer of any primary site, diffuse large B-cell lymphoma (DLBCL), and tumors with L-MYC or N-MYC amplification. Patients receive escalating doses of a GSPT1 molecular glue degrader MRT-2359 to determine safety, tolerability, maximum tolerated dose (MTD) and/or recommended Phase 2 dose (RP2D) of MRT-2359. Once the MTD and/or RP2D is identified, additional patients enroll to Phase 2 study, which includes molecular biomarkers stratification or selection, namely expression or amplification of L-MYC and N-MYC genes, hormone receptor positive (HR)-positive, human epidermal growth factor 2 (HER2)-negative breast cancer and prostate cancer.

开始日期2022-10-12 |

申办/合作机构 |

100 项与 Monte Rosa Therapeutics AG 相关的临床结果

登录后查看更多信息

0 项与 Monte Rosa Therapeutics AG 相关的专利(医药)

登录后查看更多信息

8

项与 Monte Rosa Therapeutics AG 相关的文献(医药)2025-04-25·Cancer Research

Abstract LB422: Selective targeting of CDK2 using molecular glue degraders for the treatment of HR-positive/HER2-negative breast cancer

作者: Nguyen, Sophia ; Peck, Dave ; Tiedt, Ralph ; Schillo, Martin ; DeMarco, Bradley ; Narayan, Rajiv ; Quan, Chao ; Gilberto, Samuel ; Townson, Sharon ; Tahaney, William ; Ranieri, Beatrice ; Cheeseman, Liam ; Strande, Vaik ; Pessa, Sarah ; Liu, Yimao ; Janku, Filip ; Alers, Jessica ; Schwander, Laura ; King, Christopher ; Widlund, Nina Ilic ; Moccia, Luca ; Vafeiadou, Vasiliki ; Gkountela, Sofia ; Singh, Ambika ; Castle, John ; Bianda, Christelle ; Diesslin, Anna ; Warmuth, Markus ; Walter, Magnus

2024-01-23·Annual Review of Pharmacology and Toxicology

From Thalidomide to Rational Molecular Glue Design for Targeted Protein Degradation

Review

作者: Ryckmans, Thomas ; Fasching, Bernhard ; Thomä, Nicolas H ; Gainza, Pablo ; Oleinikovas, Vladas

2023-12-01·ChemBioChem

A Degron Blocking Strategy Towards Improved CRL4CRBN Recruiting PROTAC Selectivity**

Article

作者: Roumeliotis, Theodoros I ; McAndrew, P Craig ; van Montfort, Rob L M ; Wah Hak, Laura Chan ; Mitsopoulos, Costas ; Collins, Ian ; Sialana, Fernando J ; Warne, Justin ; Chopra, Rajesh ; Hahner, Tamas ; Cabry, Marc P ; Le Bihan, Yann-Vaï ; O'Hanlon, Jack A ; Caldwell, John J ; Pierrat, Olivier A ; Choudhari, Jyoti ; Wang, Hannah Z ; Bouguenina, Habib ; Scarpino, Andrea ; Burke, Rosemary ; Stubbs, Mark ; Sadok, Amine

5

项与 Monte Rosa Therapeutics AG 相关的新闻(医药)2024-10-28

The molecular glue degrader medicines furthest along in development are potential cancer treatments, but Monte Rosa Therapeutics is also researching how this therapeutic modality can treat immunological disorders. Novartis sees promise in a Monte Rosa drug candidate designed to degrade a protein associated with autoimmune disease and the pharmaceutical giant is paying $150 million for global rights to the program.

The sum is an upfront payment for the molecule, named MRT-6160. Boston-based Monte Rosa is still responsible for completing the Phase 1 test underway. Under terms of the deal announced Monday, Novartis will take over development at Phase 2.

Monte Rosa’s R&D is part of a growing field that leverages a cellular system for disposing of old or damaged proteins as a way to eliminate disease-causing proteins. This targeted protein degradation relies on a molecular tag to mark a protein for disposal. For proteins that do not have a defined binding pocket for the molecular tag, a molecular glue can foster the interaction between the tag and the target protein. Monte Rosa addresses such difficult-to-target proteins with drugs called molecular glue degraders.

presented by

Health IT

Accelerating Claim Processing: Strategies to Shorten the Life of a Claim

These strategies and practices can significantly shorten the life cycle of claims, leading to quicker resolutions and improved financial outcomes.

By Greenway Health

MRT-6160 is a molecular glue degrader designed to target VAV1, a protein whose roles include the activation of two types of immune cells, T cells and B cells. Many autoimmune disorders are driven by excessive activity from these cells. By degrading VAV1, the Monte Rosa drug is intended to reduce the aberrant activity of those immune cells. At medical conferences this year, Monte Rosa has presented encouraging preclinical data for the drug in inflammatory bowel disease and rheumatoid arthritis. In August, Monte Rosa began a Phase 1 test of MRT-6160 in healthy volunteers. The company said preliminary data are expected in the first quarter of 2025.

Novartis already has a presence in targeted protein degradation in cancer from an earlier deal. In April, the Swiss pharma giant paid $150 million up front for an Arvinas degrader on track to Phase 3 testing in prostate cancer. Monte Rosa’s drug candidate gives Novartis a way to expand its protein degradation scope to autoimmune disease.

“Novartis has had a long-standing interest in molecular glue degraders, which offer the potential to tackle challenging biological targets,” Fiona Marshall, president of biomedical research at Novartis, said in a prepared statement. “We are excited about their application in immunology and the early progress we have seen by Monte Rosa in this space and with MRT-6160.

Under the terms of the agreement with Novartis, Monte Rosa is eligible to receive up to $2.1 billion in milestone payments tied to the progress of MRT-6160. The deal also calls for the biotech to co-fund Phase 3 testing and share in the profits (or losses) associated with the manufacturing and commercialization of MRT-6160 in the U.S. The biotech would also receive royalties from Novartis’s sales of an approved product outside of the U.S.

Sponsored Post

The Future of Hospitals and Pharma Companies Will Depend on Strength of Healthcare Analytics Insights

PurpleLab® stands out from others in this sector by providing its data analytics services to several different groups of users across healthcare and pharma companies.

By Stephanie Baum

Monte Rosa’s most advanced program is MRT-2359, a molecular glue degrader in Phase 1/2 testing for cancers driven by MYC, a protein associated with cell proliferation and tumor growth. In Monday’s announcement, Monte Rosa CEO Markus Warmuth said the Novartis agreement provides the financial resources to extend the company’s cash runway and advance its pipeline to potential value-creating milestones and proof-of-concept readouts. More specific details will be provided in the company’s upcoming announcement of third quarter 2024 financial results.

Photo by Flickr user K-State Research and Extension via a Creative Commons license

临床1期引进/卖出蛋白降解靶向嵌合体

2024-03-26

·药明康德

▎药明康德内容团队编辑分子胶的小分子量及其调控蛋白质间相互作用(PPI)的能力,以及更易于成药的特性使其成为近年来产业界密切关注的新型治疗模式。近日,《自然》子刊Nature Biotechnology针对分子胶降解剂在产业界的开发现状发布了报道,药明康德的内容团队将依据该报道以及公开资料,向读者展示分子胶领域的最新产业动态。分子胶概述及其研发挑战分子胶是一类单价小分子(<500 Da),能够改变E3连接酶的表面结构,从而促进新的蛋白质-蛋白质相互作用。与蛋白降解嵌合体(PROTAC)相比,分子胶因其较小的分子量而更易于细胞吸收,并且可以在较低剂量下发挥作用。不同于靶向PROTAC采用灵活连接子(linker)连接两个配体、并允许它们扭曲和转动以形成接触点的方式,分子胶降解剂通过更直接地介入蛋白质界面,加强E3连接酶与靶蛋白之间的复合物形成,从而诱导它们之间的亲和力增加,最终导致靶蛋白的泛素化与降解。目前最广为人知的分子胶降解剂是沙利度胺(thalidomide)及其类似物泊马度胺(pomalidomide)等获批的免疫调节药物(IMiD),它们能与CRL4CRBN E3泛素连接酶中的底物受体蛋白cereblon(CRBN)相结合,通过改变CRBN所靶向底物蛋白的特性,使得CRL4CRBN E3泛素连接酶得以与新的底物蛋白相连并诱导该蛋白后续的降解。▲分子胶作用原理图示(图片你来源:参考资料[1])然而,开发创新的分子胶降解剂面临着不少挑战。首先,分子胶降解剂的初步筛选必须在细胞环境中完成,这不仅提高了成本、增加了时间消耗,还需要大量的后期验证工作。人体内存在600多种E3连接酶,从中挑选出适合降解特定目标蛋白的连接酶颇具挑战性,尤其是考虑到科学家对这些连接酶中的仅20-30种有较深入的生物学理解,这为发现新的分子胶增加了难度。此外,找到能够促使E3连接酶与目标蛋白互动的小分子的几率较低,并且目前对分子胶的一般化学特性的了解尚浅,这些因素均提高了化合物库筛选的复杂性,通常需要依赖大型的化合物库才有可能找到合适分子。分子胶疗法领域的弄潮儿尽管分子胶类药物的开发过程不易,仍有不少公司勇敢地接受了这一挑战,通过不同研发策略来开发潜在的分子胶药物,尤其是针对难以成药的蛋白,像是转录因子这样缺乏可供小分子药物结合口袋结构的蛋白。这些专注于分子胶疗法开发的公司及其策略主要包含:▲专注于分子胶疗法研发的部分公司名单(图片来源:药明康德内容团队根据参考资料[1]制表)Monte Rosa TherapeuticsMonte Rosa Therapeutics专注开发利用cereblon E3连接酶降解特定靶标蛋白的分子胶疗法。该公司的联合创始人Raj Chopra先生在Celgene公司工作期间,曾带领团队成功鉴定了首批cereblon降解底物,并展现了通过合理方法发现其新底物的巨大潜力。Monte Rosa公司的核心理念是通过使用不同的分子胶来改变cereblon的表面结构,从而招募并降解多种蛋白质。这些cereblon底物蛋白中,大部分是带有被称作“G环”的降解结构的锌指转录因子。Monte Rosa利用人工智能工具来预测不同小分子如何重新塑造cereblon的表面,使其能够招募并降解含G环的转录因子及其他蛋白质。基于已知的cereblon-分子胶复合体晶体结构,公司合成了这类分子,并在蛋白质和细胞层面进行筛选,通过生化和细胞亲和性测定来鉴定被降解的蛋白质,以验证蛋白间的相互作用,并利用蛋白质组学技术来验证降解事件并确保其特异性。Monte Rosa的首席战略官Owen Wallace博士透露,通过筛选,Monte Rosa已经鉴定出与cereblon结合的新靶点,这些靶点的结合方式与预期不同。公司目前正在研究的两个项目分别针对cdk2和Vav1,这两个靶点都不包含传统的G环结构。这一发现表明,通过引导cereblon识别非传统靶点的方法是可行的,并且其潜在的靶标空间仍在不断扩展。ProxygenProxygen公司开发了一种功能强大的专有技术平台,专注于大规模识别针对难治性或传统手段难以作用的靶点的分子胶降解剂。Proxygen高度通用、专有的发现引擎,支持针对难以成药或不可成药靶点的分子胶降解剂的大规模特异性和无偏倚的筛选。公司的首席执行官Bernd Boidol博士表示,仅依赖结构方法无法揭示所有的作用机制,因此公司旨在深入了解分子胶降解剂和E3连接酶之间的生物学机理,以推动该领域的发展。同时,Proxygen通过结合精准的靶点选择和临床验证来平衡技术与生物学风险。Seed TherapeuticsSeed Therapeutic强调在分子胶药物开发中选择恰当的E3连接酶的重要性。公司的研发流程从评估靶蛋白与E3连接酶之间的互补性开始,利用AlphaFold等计算技术,并考虑E3连接酶在细胞内的位置;然后在细胞模型中研究E3连接酶与靶蛋白的相互作用;验证E3连接酶对靶蛋白的泛素化能力;随后通过高通量筛选来发现合适的降解剂,并进行验证;最终通过药物化学研究来提高药物的效能、特异性和稳定性。Seed Therapeutics的总裁及首席科学官James Tonra博士指出,选择一个能够经受包括高通量筛选和基于细胞的活性测试等所有检验的E3连接酶,是避免在长期研发结束后因需更换E3连接酶而重复研究的关键。A-Alpha BioA-Alpha Bio是一家运用合成生物学和机器学习技术来测量、预测和设计蛋白质之间相互作用的生物技术公司。该公司拥有两个核心技术平台:AlphaSeq能够快速且定量地测量数百万种蛋白质间的结合亲和力;而AlphaBind则是一个计算平台,它使用全球最大型之一的蛋白质相互作用数据库进行训练,能够基于序列预测蛋白质结合强度。A-Alpha Bio公司采用了一种高通量酵母细胞表面展示系统来测试蛋白之间的相互作用。通过将目标蛋白与酵母的锚定蛋白以及参与蛋白质分泌的信号肽序列融合,工程化改造后的酵母细胞能够在其表面表达各种细胞内部蛋白。这些酵母细胞在液体培养中混合并振荡,通过蛋白-蛋白相互作用引导的细胞融合来筛选相互作用的蛋白对。随后对产生的二倍体细胞进行测序,以确定参与相互作用的蛋白质,并通过生物物理验证实验进一步确认。接着,公司会对蛋白-蛋白界面进行突变实验,以探究增强这些相互作用的可能性。A-Alpha Bio的最终目标是通过优先识别和改进现有的蛋白质相互作用,来增加发现有效分子胶的成功率。PlexiumPlexium是一家新一代靶向蛋白降解(TPD)疗法研发公司,致力于开发单价直接降解剂和分子胶,针对治疗癌症中难以攻克的靶点。公司专有的药物发现平台旨在发现新型小分子药物,通过E3连接酶介导的蛋白酶体降解途径,诱导致病蛋白的选择性降解。Plexium的平台将“on-bead”DNA编码文库(DEL)筛选技术与超高通量微型化细胞检测相结合,能够在与疾病相关的细胞环境中直接测量一个或多个目标蛋白的降解情况。Plexium正在利用其平台来鉴定针对致病蛋白的单价降解剂或分子胶降解剂。Plexium旗下多款分子胶研发项目正在积极推进,其中PLX-4545已进入临床开发阶段。▲Plexium公司研发管线(图片来源:Plexium公司官网)诺华(Novartis)诺华公司也在分子胶领域有所布局,专注于开发针对转录因子WIZ的分子胶降解剂。在美国血液学会年会上,该公司报告了两种新型降解剂dWIZ-1和dWIZ-2的研发成果。dWIZ-1是通过针对CRBN的化学库进行表型筛选获得的,筛选标准是寻找能促进胎儿血红蛋白(HbF)表达而不影响红系细胞增殖和分化的化合物。后续的蛋白质组学分析确认了WIZ为其靶点。诺华的dWIZ-2是基于dWIZ-1优化后的分子,因其优良的药物动力学属性而适用于体内WIZ降解和HbF诱导的评估。在体外实验中,dWIZ-2显著增加了镰状细胞病患者来源的红系细胞的HbF表达。利用人源化小鼠模型对dWIZ-2的体内效应进行评估时,显示其能剂量依赖性地降解WIZ并提高HbF水平。在动物模型中,连续28天每日口服dWIZ-2治疗后,观察到外周血中γ-珠蛋白mRNA水平和HbF阳性网织红细胞比例显著增加。此外,dWIZ-2具有良好的耐受性,未观察到任何与治疗相关的血液学、凝血或临床化学指标的变化。这些研究成果支持将口服WIZ降解剂作为治疗镰状细胞病的新策略。近年大型药企在分子胶领域的布局分子胶疗法的发展被广泛看好,许多大型药企也在这个领域进行布局,并与许多生物科技公司达成合作协议。例如,Proxygen分别在2020年、2022年、2023年与勃林格殷格翰(Boehringer Ingelheim)、德国默克(Merck KGaA)和默沙东(MSD)达成共同开发分子胶降解剂的协议。而Monte Rosa Therapeutics公司则在去年10月与罗氏(Roche)达成合作,将共同针对此前被认为不可成药的癌症和神经疾病靶点共同开发分子胶药物。此外,Orionis Biosciences也在去年9月宣布与罗氏(Roche)旗下基因泰克(Genentech)达成金额高达20亿美元的多年合作,将共同针对重大疾病领域中的挑战性靶点发现新型分子胶药物,包括肿瘤学和神经退行性疾病。今年2月,百时美施贵宝(Bristol Myers Squibb)与VantAI达成战略合作,将共同针对某些治疗靶点发现新的分子胶。此次合作利用VantAI的几何深度学习能力和百时美施贵宝在靶向蛋白质降解方面的专业知识来发现和开发新的小分子疗法。同月,诺和诺德(Novo Nordisk)也与Neomorph达成14.6亿美元的合作,将共同发现、开发和商业化分子胶蛋白降解剂的合作。尽管在这一创新领域还存在许多挑战,包括需要解析复杂的生物学相互作用和实现精确靶向等,但大型药企的大力投资和生物技术公司的持续关注表明,分子胶疗法具有广阔的发展前景。随着研究人员不断在科学研究上取得新的突破,让我们期待在不久的未来会有更多分子胶降解剂进入临床、造福患者。大家都在看▲欲了解更多前沿技术在生物医药产业中的应用,请长按扫描上方二维码,即可访问“药明直播间”,观看相关话题的直播讨论与精彩回放参考资料:[1] Garber, K. The glue degraders. Nat Biotechnol (2024). https://doi-org.libproxy1.nus.edu.sg/10.1038/s41587-024-02164-9[2] Sasso JM, Tenchov R, Wang D, Johnson LS, Wang X, Zhou QA. Molecular Glues: The Adhesive Connecting Targeted Protein Degradation to the Clinic. Biochemistry. 2023;62(3):601-623. doi:10.1021/acs.biochem.2c00245[3] pipeline,Retrieved March 12, 2024 from https://www.monterosatx.com/queen/[4] Science,Retrieved March 12, 2024 from https://proxygen.com/science/[5] Our Technology,Retrieved March 12, 2024 from https://www.aalphabio.com/technology/[6] A Boundless Platform,Retrieved March 12, 2024 from https://www.plexium.com/platform-plexium-e3-ligase-drugs/[7] Pamela Y Ting, Sneha Borikar, et al; Targeted Degradation of the Wiz Transcription Factor for Gamma Globin De-Repression. Blood 2023; 142 (Supplement 1): 2. doi: https://doi-org.libproxy1.nus.edu.sg/10.1182/blood-2023-179331免责声明:药明康德内容团队专注介绍全球生物医药健康研究进展。本文仅作信息交流之目的,文中观点不代表药明康德立场,亦不代表药明康德支持或反对文中观点。本文也不是治疗方案推荐。如需获得治疗方案指导,请前往正规医院就诊。版权说明:本文来自药明康德内容团队,欢迎个人转发至朋友圈,谢绝媒体或机构未经授权以任何形式转载至其他平台。转载授权请在「药明康德」微信公众号回复“转载”,获取转载须知。分享,点赞,在看,聚焦全球生物医药健康创新

蛋白降解靶向嵌合体

2022-06-20

·药明康德

首个蛋白降解药物PROTAC分子的论文发布之后的20年里,这一技术从学术界转化为临床前和临床期新药开发项目,并且在2019年首次在肿瘤学领域获得临床概念验证。靶向蛋白降解是当前新药研发的热点领域,可以用于靶向此前“不可成药”的靶点,通过降解与疾病相关的蛋白治疗多种疾病,解决传统小分子或生物大分子无法解决的难题。

截至今年3月,全球在研蛋白降解药物临床阶段24个,临床前阶段141个(中国地区33个,非中国地区108个),在研疗法针对逾55个靶点,靶向蛋白降解药物领域正在进入一个发展的重要阶段,交易合作事件也快速增加。根据公开信息不完全统计,截至2022年6月7日,2022年全球发生靶向蛋白降解疗法交易(包括研发或授权合作、并购)事件12起,5起公开总交易金额超36亿美元,其中Amphista、Plexium等公司通过独特技术与多家知名药企进行交易合作。相较于去年同期,在这一赛道上,各大药企加速布局。

本文将结合公开信息,按照交易时间顺序对2022年靶向蛋白降解疗法交易事件详细介绍,供读者参阅。

1. Salarius Pharmaceuticals收购DeuteRx的口服蛋白降解药物产品组合

2022年1月13日,抗肿瘤靶向疗法研发公司Salarius Pharmaceuticals宣布收购DeuteRx的一系列口服小分子靶向蛋白降解药物产品组合,以扩展其肿瘤产品管线。此次收购内容包括DeuteRx的主要候选药物DRX-164(Salarius Pharmaceuticals现已将其更名为SP-3164)、相关专利组合以及在靶向蛋白降解领域开发的一系列未公开的抗肿瘤产品。

根据协议条款,交易总金额最高达2.745亿美元。其中DeuteRx将收到来自Salarius Pharmaceuticals的预付款,包括150万美元现金付款和100万美元的限制股投资。作为协议的一部分,Salarius Pharmaceuticals与DeuteRx将合作完成SP-3164开发活动以及未来产品的研究和开发活动,SP-3164成功开发后,DeuteRx还有权获得关于SP-3164最高达5300万美元的未来临床和注册里程碑付款,以及最高达1.35亿美元的销售里程碑付款,并获得净销售额的特许权使用费。此外,DeuteRx有资格获得未来两个产品的临床、注册和销售里程碑付款,以及净销售额的特许权使用费,最高达8400万美元。

2. 新锐与以色列魏茨曼科学研究所达成合作,加速新型共价分子胶降解药物开发

2022年1月25日,肿瘤蛋白降解疗法研发公司Monte Rosa Therapeutics宣布与以色列魏茨曼科学研究所(Weizmann Institute of Science)的商业部门耶达研发有限公司(Yeda Research and Development Company)以及Nir London博士达成合作,利用共价配体定向释放(CoLDR)技术加速新型共价分子胶降解药物的发现和开发。

Monte Rosa Therapeutics是一家总部位于美国马萨诸塞州的肿瘤蛋白降解疗法研发公司。该公司的药物发现平台将专有的小分子蛋白降解药物化合物库与蛋白质组学、结构生物学、基于机器学习的靶点筛选技术以及计算化学相结合,可用于预测和获得蛋白降解药物图谱。

3. 5亿美元助力开发新型分子胶,安进达成研发合作

2022年2月4日,安进(Amgen)和Plexium公司宣布,双方达成一项多年研发合作,针对历史上具有挑战性的药物靶标,发现新型靶向蛋白降解的分子胶疗法。这一合作将聚焦于通过发现以前未知的分子胶或单价降解药物来扩展靶向蛋白降解机会。

此次合作结合了Plexium基于细胞的高通量筛选技术,驱动创新分子胶候选疗法的发现。

根据协议条款,合作最初将集中于两个项目,安进拥有增加额外项目的选择。Plexium有资格获得基于研发、监管和商业进展的里程碑付款,总额可超过5亿美元。安进拥有推进至预定临床前开发阶段的每个项目的商业化许可,并将负责全球开发和商业化。

4. AI助力蛋白降解药物开发,德国默克达成研发合作

2022年2月9日,CelerisTx宣布与德国默克(Merck KGaA)达成一项研究合作协议,利用CelerisTx基于图形的人工智能(AI)技术平台,发现和设计新型小分子结合剂和双功能蛋白降解药物。

CelerisTx成立于2020年,致力于填补理性设计这些化合物的知识空缺。该公司开发的Celeris One平台是一个能预测生物分子相互作用的闭环发现引擎,可生成符合相关降解药物成功标准的新化学实体,并将这一知识扩展到合成和生化验证。这一发现引擎的应用有望简化强效降解药物的发现方式,同时提高上游研发的生产力。

5. AI助力开发蛋白降解疗法,新锐达成超6亿美元合作

2022年2月28日,Blueprint Medicines宣布与Roivant Sciences旗下的Proteovant Therapeutics达成一项战略性合作,以发现并开发新型靶向蛋白降解疗法,旨在针对癌症和血液学疾病领域的未竟医疗需求。靶向蛋白降解利用人体天然的蛋白处理系统,提供了针对之前“难以成药”的蛋白靶标,开发创新靶向药物的潜力。根据协议条款,Proteovant将获得2000万美元的预付款,并将有资格获得额外高达6.32亿美元的潜在研究、开发、监管和商业化里程碑付款,以及前两个项目未来产品净销售额的分级特许权使用费。

此次合作将结合Proteovant基于AI的靶向蛋白降解(TPD)技术平台,和Blueprint Medicines在精准医疗方面的专业知识,以发现新型靶向蛋白降解药物。两家公司将共同研究重要靶点,并将最多两种新型蛋白降解药物推进到开发候选药物阶段。作为合作的核心部分,Proteovant公司TPD平台的独家合作伙伴VantAI公司将使用高级AI技术,用于生成和优化蛋白降解药物。在确定临床开发候选产品后,Blueprint Medicines拥有开发和商业化合作产品的独家选择权。

6. 与杨森达成研发合作,AI助力开发新型分子胶等药物

2022年4月13日,AI驱动的药物设计公司VantAI宣布,与杨森(Janssen)签订了一项多年合作协议,根据协议,双方将利用VantAI的深度学习平台,开发针对重要疾病靶标的新型分子胶和异源双功能蛋白降解药物。根据协议,合作重点将放在两个靶向蛋白降解药物和一个新型E3泛素连接酶平台的开发上,此外,杨森将获得合作产生的所有产品的商业化独占许可,并负责全球开发和商业化。

VantAI是Roivant Sciences的子公司,致力于使用机器学习,设计和优化诱导接近(induced proximity)药物。该公司的进化评分系统借鉴天然出现的蛋白互作界面,允许生成模型设计分子量更小的分子胶,形成高度合作的三元复合物。VantAI已经与众多生物医药伙伴合作,通过其独特的“Protein-Contact-First”策略,启动令人兴奋的新开发项目,所需时间和成本仅为传统方法的一小部分。

7. 与勃林格殷格翰达成研发合作,AI助力开发创新蛋白降解药物

2022年4月22日,VantAI和勃林格殷格翰(Boehringer Ingelheim)联合宣布,双方达成早期药物发现研究合作,聚焦于发现降解传统“不可成药”靶点的创新降解药物。

这一合作最初将聚焦于一项与多个独特E3连接酶平台结合的降解剂项目。两家公司的科学家将利用VantAI的几何深度学习平台,优化针对每个E3连接酶平台的新分子设计。利用靶点和不同E3连接酶之间的独特互作界面,创建优化药物效力和选择性的新渠道。

8. 分子胶新锐与艾伯维达成研发合作,剑指神经疾病

2022年4月29日,Plexium公司宣布,已经与艾伯维(AbbVie)公司达成研发协议,针对神经疾病,联合开发创新靶向蛋白降解疗法。这一合作将结合艾伯维在神经科学方面的广泛能力和Plexium公司的综合性靶向蛋白降解平台,开发针对历史上具有挑战性靶点的创新疗法。

Plexium公司着重发展单价降解药物。Plexium的靶向蛋白降解平台通过DNA编码化合物库表型筛选,能在疾病相关的细胞背景下,识别细胞活性候选降解药物并进行评估。作为一种药物发现引擎,它旨在识别与E3连接酶结合的新型小分子。这种小分子可以与靶标蛋白或E3连接酶单独结合,导致蛋白构象发生变化,最终降解靶标蛋白。此外,该平台非常适合研究E3连接酶以及调节E3连接酶活性对细胞表型的影响,并可用于鉴定结合E3连接酶的新型小分子,针对特定的活性谱对小分子进行优化。

9. 新锐与德国默克达成8.935亿欧元合作,推进新一代靶向蛋白降解疗法开发2022年5月4日,肿瘤蛋白降解疗法研发公司Amphista Therapeutics与德国默克(Merck KGaA)的子公司Merck Healthcare达成合作,两家公司将基于Amphista Therapeutics独有的蛋白降解药物发现平台Eclipsys,针对肿瘤学和免疫学领域的3个靶点开发小分子蛋白降解药物,推进新一代靶向蛋白降解疗法开发。根据协议条款,Amphista Therapeutics将获得预付款、研发资金和里程碑付款,总计最高达8.935亿欧元。

Amphista Therapeutics是一家总部位于苏格兰的肿瘤蛋白降解疗法研发公司,由Advent Life Sciences创立,正在推进一系列候选药物的开发,这些候选药物最初专注于肿瘤学,以解决许多难以治疗的肿瘤类型。该公司利用机体的自然过程选择性地、高效地降解和清除致病蛋白,基于新型靶向蛋白降解平台的产品线主要集中在包括癌症在内的疾病上。

10. 新锐与百时美施贵宝达成12.8亿美元合作,推进新型靶向蛋白降解疗法研发

2022年5月5日,肿瘤蛋白降解疗法研发公司Amphista Therapeutics与百时美施贵宝(Bristol Myers Squibb)达成合作,利用Amphista Therapeutics专有的蛋白降解药物发现平台Eclipsys开发新型靶向蛋白降解疗法。

根据协议条款,双方将合作发现和开发小分子蛋白降解剂,百时美施贵宝将获得所开发降解剂的全球独占许可,并负责进一步开发和商业化活动;Amphista Therapeutics将获得3000万美元预付款,并有资格获得潜在最高达12.5亿美元的付款,包括里程碑付款、有限的扩展合作付款,以及基于全球产品净销售额的特许权使用费。

11. “靶向蛋白降解+蛋白质组学”达成战略合作,共同开发靶向蛋白降解药物2022年5月7日,蛋白稳态调控药物研发公司和正医药与蛋白质组学技术应用开发公司景杰生物达成战略合作,双方将在靶向蛋白降解领域就靶点发现、药物研发等方面建立长期全面的战略伙伴关系。此次合作,和正医药与景杰生物将充分利用各自特有的小分子DaMLib库、DaTProD平台和“整合蛋白质组学平台”,共同引领靶向蛋白降解技术的突破。

和正医药拥有自主开发的DaMLib类药性片段库和蛋白降解/拯救药物DaTProD及DaTProSTM技术平台,支持高效输出新药候选分子。公司已建成拥有10余个1类新药的项目管线,其中3个分子进入临床研究,2个蛋白降解分子进入临床前研究。

景杰生物致力于蛋白质组学技术应用与开发,以“蛋白质组学--精准医学”前沿研究领域为科学背景,已形成集研发、生产、服务于一体的商业模式,现已建成“整合蛋白质组学平台”,内含蛋白质组学技术平台、表观遗传学技术平台、生物标志物发现平台、高质量抗体开发平台、诊断试剂盒平台和大数据分析平台。

12. AI助力开发蛋白降解疗法,针对“不可靶向”药物靶点

2022年5月10日,专注于开发“不可靶向”药物靶点领域的奕拓医药(ETERN Therapeutics)与由端到端AI驱动的临床阶段药物研发公司英矽智能(Insilico Medicine)宣布达成合作协议,双方将针对数个未公开靶点,发现和设计潜在的全新机制药物。

本次合作旨在将英矽智能端到端人工智能驱动的药物发现平台Pharma.AI,与奕拓医药蛋白动态结构技术平台(Dynamic Structure Platform)相结合,开发针对选定靶点的小分子药物。根据合作协议,双方将利用英矽智能独有的生成式人工智能技术平台及计算机模拟等分子设计手段,与奕拓医药的蛋白动态结构技术平台及生物筛选平台体系,共同发现、设计和筛选针对肿瘤靶点的PROTAC小分子候选药物,推动创新药物的开发和后续的转化。

期待这些蛋白降解疗法的交易合作后续研究顺利进行,为患者带来更多、更好的治疗选择。

内容来源于网络,如有侵权,请联系删除。

蛋白降解靶向嵌合体合作小分子药物并购抗体

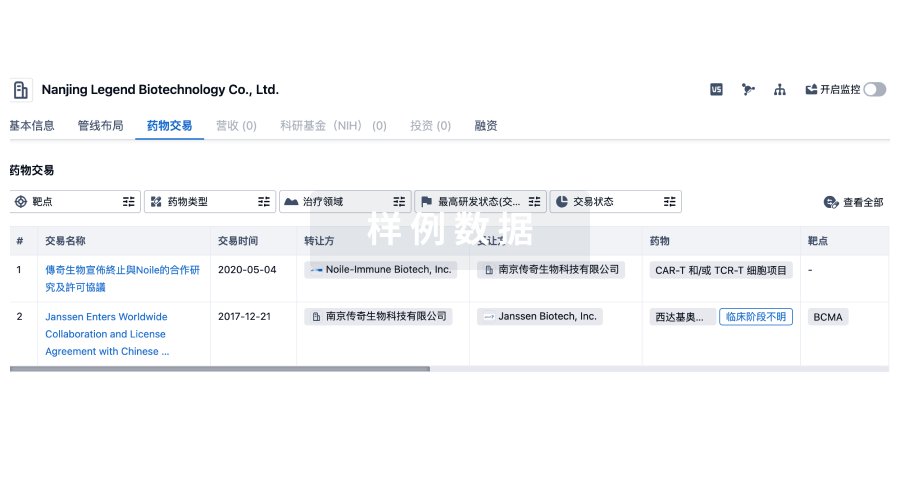

100 项与 Monte Rosa Therapeutics AG 相关的药物交易

登录后查看更多信息

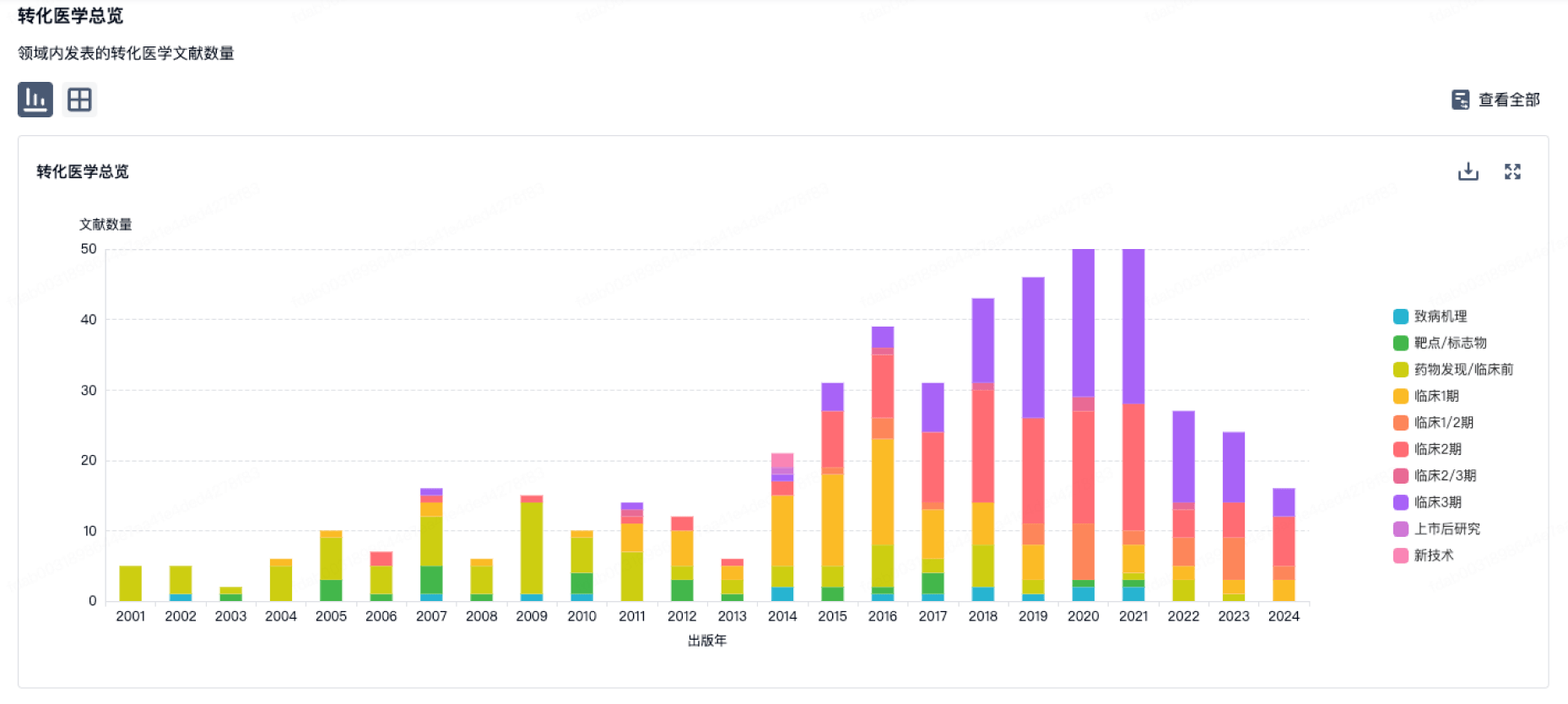

100 项与 Monte Rosa Therapeutics AG 相关的转化医学

登录后查看更多信息

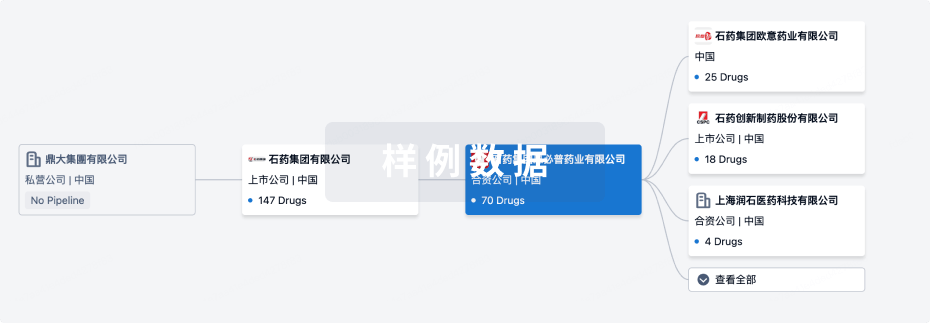

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年10月13日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

药物发现

4

5

临床前

临床1期

1

1

临床2期

其他

1

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

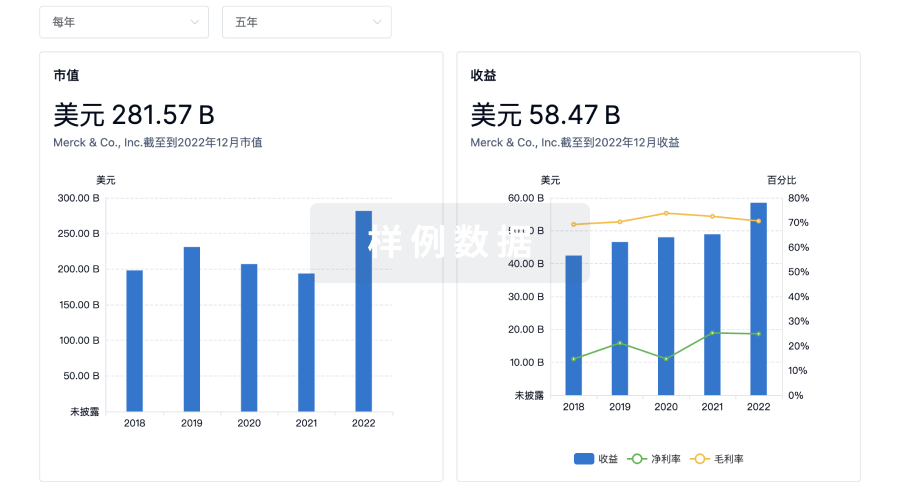

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用