预约演示

更新于:2025-05-07

Vergent Bioscience, Inc.

更新于:2025-05-07

概览

标签

呼吸系统疾病

肿瘤

小分子化药

荧光染料

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 疾病领域 | 数量 |

|---|---|

| 肿瘤 | 1 |

| 排名前五的药物类型 | 数量 |

|---|---|

| 小分子化药 | 1 |

| 荧光染料 | 1 |

| 排名前五的靶点 | 数量 |

|---|---|

| cysteine protease(半胱氨酸蛋白酶) | 1 |

关联

1

项与 Vergent Bioscience, Inc. 相关的药物作用机制 cysteine protease调节剂 |

非在研适应症- |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

2

项与 Vergent Bioscience, Inc. 相关的临床试验NCT06145048

A Phase 2, Multi-center, Open-label Study to Evaluate the Safety and Efficacy of VGT-309, a Tumor-Targeted, Activatable Fluorescent Imaging Agent, in Subjects Undergoing Surgery for Cancer in the Lung

This is a Phase 2, multi-center, open-label study to evaluate the safety and efficacy of VGT-309, a tumor-targeted, activatable fluorescent imaging agent, in subjects undergoing surgery for proven or suspected cancer in the lung. Approximately 100 subjects will be enrolled to ensure at least 86 subjects are evaluable with the option to expand enrollment by protocol amendment if deemed necessary by the DSC to meet primary and/or secondary objectives.

开始日期2023-10-05 |

申办/合作机构 |

NCT05400226

A Phase 2, Open-label Study to Evaluate the Safety and Efficacy of VGT-309, a Tumor-Targeted, Activatable Fluorescent Imaging Agent, to Identify Cancer in Subjects Undergoing Lung Cancer Surgery

A Phase 2 open label study to evaluate safety and efficacy of VGT-309 to identify cancer in up to 40 subjects undergoing lung cancer surgery.

开始日期2022-05-24 |

申办/合作机构 |

100 项与 Vergent Bioscience, Inc. 相关的临床结果

登录后查看更多信息

0 项与 Vergent Bioscience, Inc. 相关的专利(医药)

登录后查看更多信息

1

项与 Vergent Bioscience, Inc. 相关的文献(医药)2020-12-01·EJNMMI Research3区 · 医学

Fluorescent image-guided surgery in breast cancer by intravenous application of a quenched fluorescence activity-based probe for cysteine cathepsins in a syngeneic mouse model

3区 · 医学

ArticleOA

作者: Schröder, Carolien P ; de Vries, Elisabeth G E ; Yim, Joshua J ; Bensen, Eric S ; Timmer-Bosscha, Hetty ; Santini, John T ; Bogyo, Matthew ; van Dam, Gooitzen M ; Qiu, Si-Qi ; Suurs, Frans V

14

项与 Vergent Bioscience, Inc. 相关的新闻(医药)2025-01-07

MINNEAPOLIS--(

BUSINESS WIRE

)--

Vergent Bioscience

, a clinical-stage biotechnology company developing tumor-targeted imaging agents, announced that the U.S. Food & Drug Administration (FDA) has granted Fast Track designation for the company’s novel, investigational tumor-targeted fluorescent imaging agent, abenacianine for injection (VGT-309), as an adjunct for the intraoperative visualization of primary lung cancer, other pulmonary lesions, cancer containing lymph nodes, and positive surgical margins in patients undergoing surgery for known or suspected cancer in the lung.

“Receiving Fast Track designation from the FDA reinforces the potential of abenacianine to address existing deficits in lung cancer surgery by helping surgeons better visualize tumors in the lung during minimally invasive surgical procedures,” said John Santini, Ph.D., president and chief executive officer at Vergent Bioscience. “We look forward to collaborating with the FDA to make abenacianine available to surgeons and their patients as quickly as possible.”

Minimally invasive surgery (MIS) and robotic-assisted surgery methods are increasingly utilized in lung cancer resection because they are associated with benefits such as shorter hospital stays, smaller incisions, less blood less, and decreased post-operative complications, including chronic pleural pain. However, these approaches often limit surgeons’ ability to distinguish tumors from normal tissue. Data to date from clinical studies have shown that abenacianine has the potential to build confidence in these procedures by helping surgeons to ensure all tumor tissue is removed.

Findings from a Phase 2 efficacy study (

NCT05400226

) published in

The Annals of Thoracic Surgery

demonstrated that abenacianine visualized primary and metastatic tumor tissue in the lung during surgery and was safe and well-tolerated. The primary efficacy endpoint was the proportion of patients with at least one clinically significant event (CSE), defined as locating difficult-to-find tumors, identifying positive margins, and finding previously undetected tumors that may otherwise have been missed using standard visual and palpation methods.

Of the 40 participants administered abenacianine who underwent the standard-of-care surgical resection for suspected lung cancer, 43% (n=17) had at least one CSE.

1

Vergent recently completed enrollment in the Phase 2, multicenter VISUALIZE study (

NCT06145048

), which evaluated the efficacy and safety of abenacianine in patients undergoing surgery for proven or suspected cancer in the lung. The company will begin enrollment in the Phase 3 confirmatory, multicenter VISUALIZE-2 study in 2025.

The FDA grants Fast Track designation to facilitate development and expedite the review of therapies with the potential to treat a serious condition where there is an unmet medical need. A drug that receives Fast Track designation can benefit from early and frequent communication with the agency, in addition to a rolling submission of the marketing application, with potential pathways for expedited approval that have the objective of getting important new therapies to patients more quickly.

About Vergent Bioscience, Inc.

Vergent Bioscience is a clinical-stage biotechnology company that is helping surgeons realize the full potential of minimally invasive and robotic-assisted surgery by improving the visibility of tumors. Vergent’s lead compound, abenacianine for injection, is a tumor-targeted fluorescent imaging agent designed to enable surgeons to see difficult-to-find or previously undetected tumors in real-time during surgery, so that they can ensure all tumor tissue is removed. The company is first evaluating abenacianine for cancer in the lung, with the potential to expand its application to a wide range of solid tumors. Vergent Bioscience is a privately held company based in Minneapolis, MN.

References:

Bou-Samra P., et al. Phase 2 Clinical Trial of VGT-309 for Intraoperative Molecular Imaging During Pulmonary Resection. Ann. Thorac Surg. (2024). doi:10.1016/j.athoracsur.2024.05.019

临床2期临床3期快速通道临床结果

2024-11-13

MINNEAPOLIS--(

BUSINESS WIRE

)--

Vergent Bioscience

, a clinical-stage biotechnology company developing tumor-targeted imaging agents, announced completion of patient enrollment in the company’s Phase 2, multi-center VISUALIZE trial, evaluating the efficacy and safety of abenacianine for injection (VGT-309) in patients with cancer in the lung. Abenacianine for injection is a novel, investigational tumor-targeted fluorescent imaging agent designed to improve the visibility of difficult-to-find and previously undetected tumors during minimally invasive and robotic-assisted surgical procedures.

“The VISUALIZE trial will provide additional, valuable insights illuminating the potential of our novel imaging agent to address existing deficits in tumor visualization during lung surgery,” said John Santini, Ph.D., president and chief executive officer at Vergent Bioscience. “Completing enrollment in the trial is an exciting milestone that reflects our team’s dedication, as well as the commitment of the VISUALIZE clinical investigators and study participants. We look forward to sharing the results of this study.”

Data from previous clinical studies of abenacianine for injection suggest the agent allowed surgeons to see tumor tissue during minimally invasive surgery (MIS), including robotic-assisted surgical procedures, providing “molecular sight” and potentially increasing their confidence in MIS.

For the Phase 2 VISUALIZE trial, investigators at six sites in the United States and Australia enrolled 89 patients with cancer in the lung, all of whom received 0.32mg/kg abenacianine for injection as a short infusion 12 to 36 hours prior to surgery. Following data readout from the VISUALIZE trial, Vergent intends to advance the agent into a Phase 3 study. Assuming positive Phase 3 results, the company will file a new drug application (NDA) for abenacianine for injection for cancer in the lung.

About Lung Cancer Surgery

Approximately 25% of all U.S. lung cancer patients undergo lung cancer surgery, which can be a curative treatment if lung cancer is diagnosed early, and all tumor tissue is removed.

1

MIS and robotic-assisted surgery methods are increasingly utilized in lung cancer resection because these approaches are associated with shorter hospital stays, smaller incisions, less blood less, and decreased post-operative complications. While these are important advantages, MIS and robotic-assisted surgery often compromise surgeons’ sight and ability to feel tissue during procedures, making it difficult for them to distinguish tumors from normal tissue and ensure all tumor tissue is removed.

About the VISUALIZE Clinical Trial

The Phase 2, multi-center, open-label VISUALIZE study (

NCT06145048

) was designed to evaluate the efficacy and safety of abenacianine for injection in patients undergoing surgery for proven or suspected cancer in the lung. Each of the 89 patients in the study received 0.32mg/kg abenacianine for injection 12 to 36 hours prior to surgery. Following an attempt to identify each tumor using standard surgical techniques, investigators used a commercially available near-infrared (NIR) endoscope to assess the presence of tumor tissue, which was then confirmed by pathology. Primary efficacy endpoints included visualization of tumors intraoperatively, surgical margin assessment, and identification of additional cancers or positive lymph nodes that may not have been seen preoperatively.

About Abenacianine for Injection (VGT-309)

Abenacianine for injection is a tumor-targeted fluorescent imaging agent designed to enable a complete solution for optimal tumor visualization during open, minimally invasive and robotic-assisted surgical procedures. Abenacianine for injection is delivered to patients via a short intravenous infusion several hours before surgery. Invented in Professor Matt Bogyo’s Lab at Stanford University School of Medicine, the molecule binds tightly (i.e., covalently) to cathepsins, a family of proteases that are overexpressed across a broad range of solid tumors. This approach, if successful, would provide distinct clinical advantages and position abenacianine for injection as an ideal tumor imaging agent. Abenacianine for injection’s imaging component is the near infrared (NIR) dye indocyanine green (ICG), which is compatible with all commercially available NIR intraoperative imaging systems that support MIS technologies and is a preferred dye to minimize confounding background autofluorescence.

About Vergent Bioscience, Inc.

Vergent Bioscience is a clinical-stage biotechnology company that is helping surgeons realize the full potential of minimally invasive and robotic-assisted surgery by improving the visibility of tumors. Vergent’s lead compound, abenacianine for injection, is a tumor-targeted fluorescent imaging agent designed to enable surgeons to see difficult-to-find or previously undetected tumors in real-time during surgery, so that they can ensure all tumor tissue is removed. The company is first evaluating abenacianine for injection for cancer in the lung, with the potential to expand its application to a wide range of solid tumors. Vergent Bioscience is a privately held company based in Minneapolis, MN.

Lu T, et al. "Trends in the incidence, treatment, and survival of patients with lung cancer in the last four decades," Cancer Manag Res. 2019 Jan 21;11:943-953.

https://pubmed-ncbi-nlm-nih-gov.libproxy1.nus.edu.sg/30718965/

临床2期临床结果临床3期

2024-11-03

Value-based care (VBC) models (which I’ve previously discussed) focus on reducing cost and improving health outcomes for defined “episodes” of care, with the expected cost of these episodes determined based on health needs and care outcomes. New care models can bring much-needed economic efficiencies without sacrificing quality, which is essential for addressing the distressing fact that the United States ranks below other developed economies in a variety of health metrics, including (but, sadly, not limited to): life expectancy at birth, all-cause mortality, premature death, maternal mortality, obstetric trauma, and chronic disease-related hospital admissions.

While VBC opens the door to new care models that can address unnecessary spending and healthcare utilization driven by prevailing fee-for-service approaches, they alone cannot solve another key driver of healthcare costs: many people are diagnosed late in their disease progression when care costs are higher. The likelihood of a positive outcome is much lower. For example, higher health service costs are associated with delayed diagnosis of functional neurological disorders, and delayed diagnosis of patients with pulmonary arterial hypertension leads to increased economic burden. Similarly, costs of cancer care increase with stage of disease at the time of diagnosis. One study found that the mean three-year cumulative out-of-pocket costs for commercially insured patients with lung cancer were nearly 60% higher when the disease was diagnosed at stage IV ($35,253) compared with stage I ($20,730) – let alone the cost of the fully burdened patient care. The same study found that cumulative costs were higher for other cancers diagnosed later.

Consequently, investing in new technologies that enable earlier detection, more frequent monitoring, and enhanced treatment is essential for delivering timely and effective care before people reach advanced stages of disease. Increasing access to, and decreasing the cost of routine and preventive care could also significantly improve health outcomes and the economic benefit .

Sponsored Post

The Future of Hospitals and Pharma Companies Will Depend on Strength of Healthcare Analytics Insights

PurpleLab® stands out from others in this sector by providing its data analytics services to several different groups of users across healthcare and pharma companies.

By Stephanie Baum

A novel liquid biopsy approach for early cancer detection, the FirstLook blood test developed by Delfi Diagnostics, exemplifies the value of investing in new diagnostic technologies. Only 6% of the 15 million people eligible for lung cancer screening get screened each year, even though screening has been shown to reduce lung cancer deaths and all-cause mortality by 20% and 6.7%, respectively. The machine learning-enabled “fragmentomics” technology used in the FirstLook test allows testing at lower cost and without the need for expensive laboratory equipment compared with other liquid biopsy approaches, making it more cost-effective and easier to distribute. This can reduce socioeconomic and geographic barriers to screening. Importantly, FirstLook achieves high sensitivity for early-stage lung cancer with a very low rate of false positives. This reduces the number of people that need to be screened to provide value and improves the risk/benefit ratio of lung cancer screening.

Vergent Bioscience is developing a novel visualization technology using a tumor-targeted fluorescent imaging agent that helps ensure the complete surgical removal of cancerous cells. As residual cancer cells can give rise to metastasis or disease recurrence, Vergent’s molecule, which is being evaluated in clinical trials, could be a powerful tool for providing durable outcomes after cancer surgery.

Beyond cancer, companies such as Cleerly, HeartFlow, Bodyport, Artrya, Sensydia, and Cardiosense are innovating new technologies for the improved diagnosis and/or management of patients with, or at risk for, cardiovascular disease. ChromaCode is developing breakthrough genetic and genomic analysis approaches that allow faster and more informed clinical decision-making. This technology doesn’t enable discovery of new markers, but instead reduces costs of diagnostic tests, broadening access to clinically actionable data that can enable optimal health outcomes and reduce health inequities across various disease indications. Viz.ai and Aidoc are applying cutting-edge artificial intelligence (AI) technologies to improve diagnostics, treatment, and clinical workflows.

The potential of these innovations can only be realized through the development of VBC models that incentivize their use. Toward this end, consultants, clinicians, insurance executives, and actuaries who develop these models — and the investors that provide critical funding for innovation — need to be aware of the devices, diagnostics, and therapeutics in development to (1) encourage their use early in the disease detection phase, when they can yield the greatest value and (2) have the knowledge to package these advancements effectively into a bundle of payments that facilitates their adoption and reduces clinical and financial barriers to their widespread use.

presented by

Health IT

Accelerating Claim Processing: Strategies to Shorten the Life of a Claim

These strategies and practices can significantly shorten the life cycle of claims, leading to quicker resolutions and improved financial outcomes.

By Greenway Health

These innovative diagnostics and therapeutics manufacturers must also apply VBC principles to their pricing and go-to-market approaches. Accountability for outcomes is increasingly vital to payors, so manufacturers that want adequate unit pricing and quick market entry must respond accordingly. Value-based purchasing (VBP) is taking hold for breakthrough cell and gene therapies due to the high price tags associated with these new treatments. For example, Lyfegen is a company that helps payors and drug manufacturers implement novel VBP contracts on a global basis for these types of high-priced therapies.

Diagnostics and therapeutics manufacturers must also build their real-world evidence base quickly. FDA approval isn’t enough to ensure product success if physicians, hospitals, and payors don’t see the value in prescribing, purchasing, or adequately reimbursing the product. Early-stage R&D companies ignore this drive toward value at their peril, especially as the value-based bar for market entry will only rise.

Early diagnosis and more timely and effective intervention are essential for reducing costs and improving outcomes in our health system. The same applies to companies developing the diagnostics and therapeutics to achieve these critical goals. Considering VBC and VBP models at the earliest stages of innovation and generating the data that demonstrate the value of your product in the context of these models is vital to realizing the transformative potential of healthcare innovation.

Editor’s Note: The author has no financial relationship with any of the companies / products mentioned.

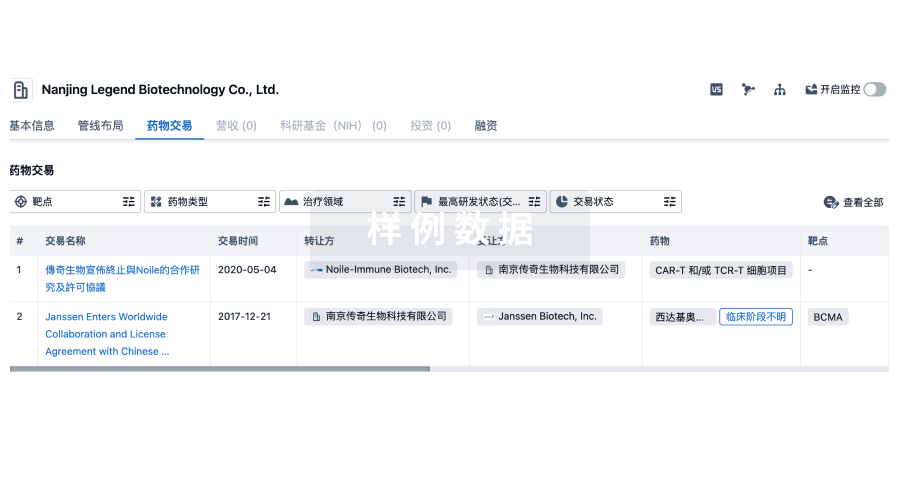

100 项与 Vergent Bioscience, Inc. 相关的药物交易

登录后查看更多信息

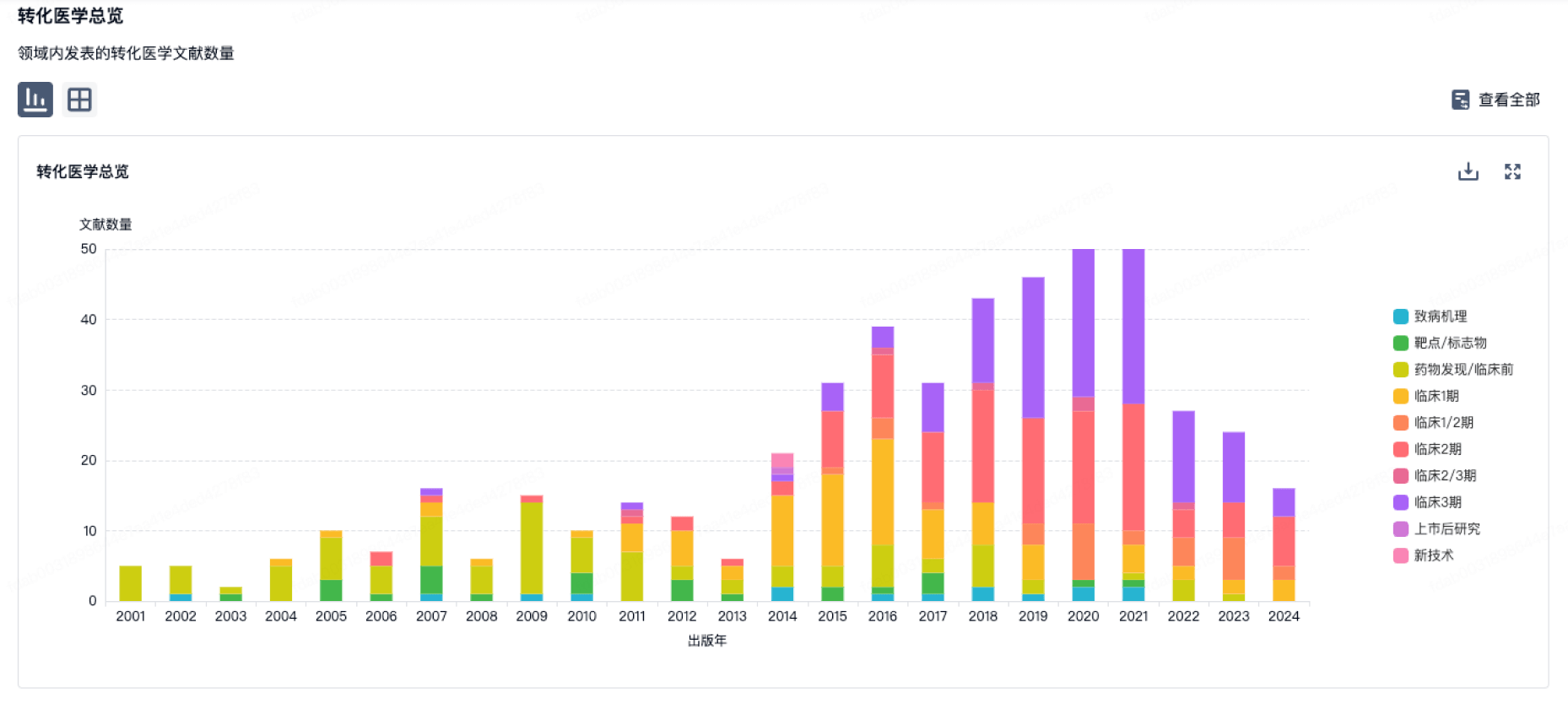

100 项与 Vergent Bioscience, Inc. 相关的转化医学

登录后查看更多信息

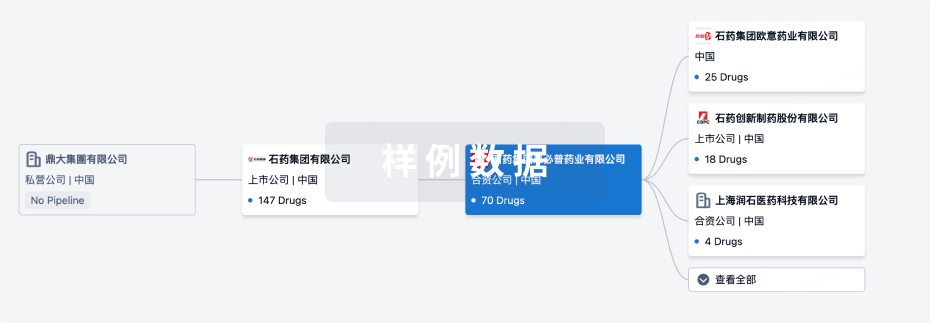

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年07月03日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床2期

1

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

VGT-309 ( cysteine protease ) | 继发性肺恶性肿瘤 更多 | 临床2期 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

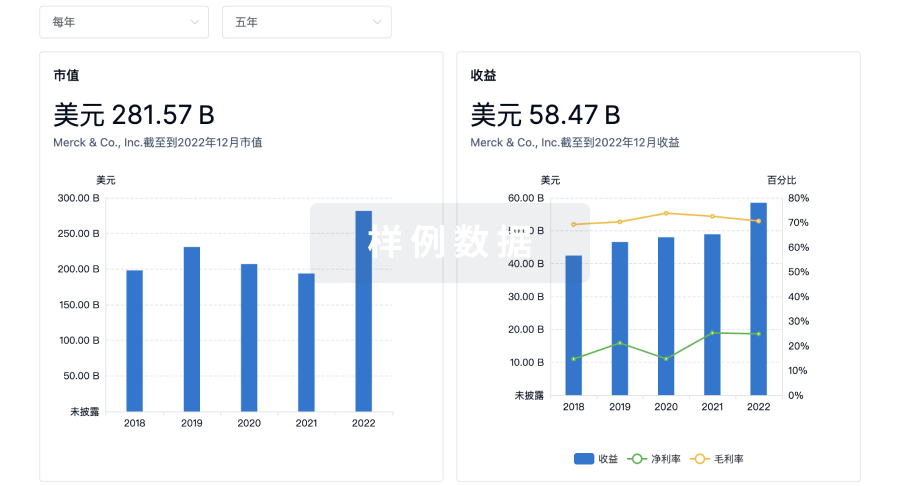

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用