预约演示

更新于:2025-09-14

FutureGen Biopharmaceutical (Beijing) Co., Ltd

更新于:2025-09-14

概览

标签

肿瘤

消化系统疾病

其他疾病

单克隆抗体

双特异性抗体

ADC

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 单克隆抗体 | 3 |

| ADC | 2 |

| 三特异性抗体 | 1 |

| 双特异性抗体 | 1 |

关联

7

项与 明济生物制药(北京)有限公司 相关的药物靶点 |

作用机制 CLDN18.2抑制剂 |

在研机构 |

原研机构 |

在研适应症 |

非在研适应症- |

最高研发阶段临床3期 |

首次获批国家/地区- |

首次获批日期- |

靶点 |

作用机制 VEGI抑制剂 |

在研机构 |

原研机构 |

在研适应症 |

非在研适应症- |

最高研发阶段临床1期 |

首次获批国家/地区- |

首次获批日期- |

作用机制 CD40激动剂 [+3] |

在研机构 |

原研机构 |

非在研适应症- |

最高研发阶段临床1期 |

首次获批国家/地区- |

首次获批日期- |

5

项与 明济生物制药(北京)有限公司 相关的临床试验NCT06177041

A Phase 3, Multi-Center, Double-Blind, Randomized, Efficacy and Safety Study of M108 Monoclonal Antibody Plus CAPOX Versus Placebo Plus CAPOX as First-line Treatment for Claudin (CLDN) 18.2-Positive, HER2-Negative, PD-L1 CPS<5, Locally Advanced Unresectable or Metastatic Gastric or Gastroesophageal Junction (GEJ) Adenocarcinoma.

Gastric/GEJ adenocarcinoma, which is one of the major leading causes of cancer-related deaths worldwide, is a global challenge to human health. However, standard chemotherapy has limited efficacy in advanced gastric cancer, and there is an urgent need to explore and develop new therapeutic targets and combination therapy modalities. The main purpose of this study is to explore the efficacy of M108 monoclonal antibody plus capecitabine and oxaliplatin (CAPOX) versus placebo plus CAPOX as first-line treatment measured by progression free survival (PFS). This study will also evaluate safety, tolerability, pharmacokinetics and the immunogenicity profile of M108 monoclonal antibody, as well as its effects on quality of life.

开始日期2023-12-25 |

申办/合作机构 |

CTR20210508

M108单抗注射液在中国晚期不可切除实体瘤患者中的安全性、耐受性和药代动力学研究:一项多中心、开放、单药及联药剂量递增和单药及联药扩展的I期临床试验

评价不同给药方案下M108单抗注射液在中国晚期不可切除的实体瘤患者中的安全性、耐受性,以及药代动力学特征以及抗肿瘤效果

开始日期2021-07-01 |

申办/合作机构 |

NCT04894825

A Phase I, Multi-center, Open-label, Single-dose Escalation and Expansion, Dose Escalation and Expansion Combination With Chemotherapy Study Evaluating the Safety, Tolerability and Pharmacokinetic Profile of M108 Monoclonal Antibody in Patients With Advanced Unresectable Solid Tumors in China

M108 is a monoclonal antibody specific for gastric and gastroesophageal adenocarcinomas. The aim of this phase I study is to establish safety and Tolerability of different Dosage regimen in patients With Advanced Unresectable Solid Tumors in China.

开始日期2021-06-11 |

申办/合作机构 |

100 项与 明济生物制药(北京)有限公司 相关的临床结果

登录后查看更多信息

0 项与 明济生物制药(北京)有限公司 相关的专利(医药)

登录后查看更多信息

191

项与 明济生物制药(北京)有限公司 相关的新闻(医药)2025-09-09

点击蓝字

关注我们

本

期

看

点

CLDN18.2单抗在胃癌一线治疗中已经成为新的靶向治疗手段。后续一众CLDN18.2正在联合PD-1抑制剂和化疗的标准方案,在胃癌一线中低表达人群中进行三期布局。能否复刻DS-8201对于胃癌Her2阳性人群的扩围,继而弯道超车?安斯泰来也引进国产在研CLDN18.2 ADC产品对冲风险,但相较于信达生物的步伐,进度较缓。但毫无疑问,CLDN18.2单抗的上市,让高度异质性的胃癌精准治疗更进一步。

本期内容

01

安斯泰来丨佐妥昔单抗

02

三款在研CLDN18.2单抗研究进展

03

CLDN18.2 ADC和CAR-T研究进展

04

总结与展望

【01 安斯泰来丨佐妥昔单抗】

2025年7月30日,安斯泰来公布了2025Q1财报,作为近年来重点布局的创新产品,

CLDN18.2单抗(佐妥昔单抗)的业绩表现成为业界关注的焦点:佐妥昔单抗(商品名:VYLOY)单季度销售额达到140亿日元(约合9681万美金),迅速成为公司排名第4畅销的药物。中国过去一个季度的销售额也达到了2282万美金。

获批上市

2024年12 月 31 日,NMPA 官网显示,安斯泰来申报的CLDN18.2 单抗-佐妥昔单抗在国内获批上市,适应症为联合含氟尿嘧啶类和铂类药物化疗用于 CLDN18.2 阳性、HER2阴性的局部晚期不可切除或转移性胃或胃食管交界处(GEJ)腺癌患者的一线治疗。

首张处方

2025年6月27日,广州中山大学肿瘤防治中心徐瑞华、北京大学肿瘤医院季加孚、中国药科大学附属上海高博肿瘤医院李进、北京大学国际医院梁军、四川大学华西医院毕锋、华中科技大学同济医学院附属同济医院袁响林、天津市肿瘤医院梁寒分别为患者开出威络益®(佐妥昔单抗)联合含氟尿嘧啶类和铂类药物的首张处方。由此,我国首个且目前唯一获批的靶向claudin18.2(以下简称CLDN18.2)的创新治疗方案正式进入临床实践,让高度异质性的胃癌精准治疗更进一步。

CLDN18.2阳性人群定义

但值得一提的是,佐妥昔单抗适应症的批准源自于两项关键III期研究(GLOW和SPOTLIGHT)数据。两项研究均采用免疫组化(IHC)检测筛选CLDN18.2阳性患者,定义标准为:≥75%肿瘤细胞呈中至强染色强度(IHC评分2+/3+)。

国内外其他在研抗CLDN18.2单抗的最新进展和阳性表达率要求与佐妥昔单抗的有所不同,且在联合免疫检查点抑制剂进行三期布局,有望重新定义CLDN18.2单抗的竞争格局。

02 三款在研CLDN18.2单抗研究进展

创胜集团丨Osemitamab (TST001)

2023年7月获中国CDE与韩国MFDS批准,启动TranStar 301Ⅲ期全球多中心、随机、双盲、安慰剂对照试验。联合纳武利尤单抗(Opdivo)与CAPOX方案对比纳武利尤单抗联合化疗,在HER2阴性、CLDN18.2表达的局部晚期/转移性胃或胃食管交界腺癌一线治疗中展开疗效和安全性评估。

伴随诊断:

检测方法:本地实验室开发检测(LDT)或中央病理室IHC。

阳性标准:≥1+膜染色强度,且至少10%肿瘤细胞呈现阳性(筛选出约55%患者)。

奥赛康丨ASKB589

奥赛康的CLDN18.2单抗ASKB589于2024年启动全球多中心Ⅲ期注册试验,试验方案为ASKB589+CAPOX+替雷利珠单抗 vs 替雷利珠单抗+CAPOX

阳性标准:中高表达——IHC评分2+或3+,且≥40%肿瘤细胞阳性。

明济生物丨FG-M108

正在开展Ⅲ期注册试验,评估FG-M108 + CAPOX vs CAPOX 在HER2阴性、CLDN18.2阳性、一线胃/GEJ腺癌患者中的疗效。

纳入人群:CLDN18.2阳性(≥40% 的肿瘤细胞≥2+膜染色),PD-L1 CPS<5

温馨提示:

三款在研单抗均采用IHC评估CLDN18.2表达,但纳入的CLDN18.2阳性人群相较于佐妥昔单抗的≥75%肿瘤细胞呈中至强染色强度(IHC评分2+/3+)普遍较低,有望进一步拓展人群,且在联合PD-1单抗,符合当下胃癌一线免疫联合化疗的标准。更有甚者,开始尝试CLDN18.2ADC联合PD-L1:胃癌创新试验丨Her2单抗+Her2ADC+PD-1;CLDN18.2ADC联合PD-L1

基于如此竞争白热化态势,已经有企业放弃CLDN18.2单抗,尝试CAR-T和ADC产品。

【03 CLDN18.2 ADC和CAR-T研究进展】

在Claudin18.2单抗胃癌III期研究成功利好基础上,总有企业在差异化提前布局Claudin 18.2双抗、ADC、CAR-T等创新产品。ADC和CAR-T正在成为CLDN18.2靶点赛道的热门产品。

终于来了丨科济CAR-T申报上市,实体瘤胃癌破冰在即!

胃癌三期后,信达CLDN18.2 ADC剑指癌王,发起三期冲击

基于ADC赛道的竞争态势,2025 年 5 月 30 日,信诺维医药携手安斯泰来制药,就临床阶段的新一代靶向 CLDN18.2 抗体偶联药物 XNW27011,达成独家许可协议。依据协议,信诺维授予安斯泰来在全球(不包含中国大陆、香港、澳门以及台湾地区)对 XNW27011 独占性的开发与商业化权利。

从协议条款来看,信诺维可收获 1.3 亿美元的首笔款项,且有机会获得最高 7000 万美元的近期款项,以及最高累计 13.4 亿美元的涵盖开发、注册、商业化等环节的里程碑款项。除此之外,自 XNW27011 获批上市起,信诺维还将依据该产品净销售额获取相应的特许权使用费。

XNW27011

XNW27011乃信诺维潜心研发的新一代Claudin18.2 ADC。2024 年 6 月,其凭借治疗胃癌的潜力,荣获 FDA 颁发的快速通道资格。2025 年 5 月 16 日,CDE 官网披露,XNW27011 拟被纳入突破性治疗品种,适应症聚焦于 CLDN18.2 表达的局部晚期不可切除或转移性 HER2 阴性胃或胃食管结合部腺癌的三线及以后治疗。

2024 年的 ESMO 大会上,信诺维对外公布了 XNW27011 针对局部晚期和 / 或转移性实体瘤患者的首次人体 I 期临床研究成果。在该项研究中,XNW27011 的起始剂量为 0.6 mg/kg(每三周一次,静脉注射),运用加速剂量递增方案,后续开展 3+3 递增模式。剂量递增阶段的首要目标在于确定最大耐受剂量(MTD)。

截至 2024 年 4 月 15 日,累计入组 16 例患者,剂量跨度从 0.6 mg/kg 至 6.0 mg/kg,共分 6 个剂量组,涵盖 11 例胃癌 / 胃食管交界处腺癌、2 例卵巢癌、2 例前列腺癌以及 1 例十二指肠壶腹部周围腺癌。其中,12 例患者不同程度地表达 CLDN18.2(≥1%,IHC≥1+)。在剂量限制性内镜(DLT)治疗期间,常见不良反应(AE)依次为恶心、呕吐,其后是白细胞减少、中性粒细胞减少以及贫血。在 DLT 期间,4.8 mg/kg 剂量及以下未见 ≥3 级 TRAE。同时,未观察到 ILD 或 MMAE 相关的眼部不良反应和周围神经病变。在 6.0 mg/kg 剂量下,有 1 例患者出现 DLT。

14 例可评估疗效的患者中,ORR 达 50%(7/14),DCR 为 86%(12/14)。即便在低至 0.6 mg/kg 的剂量下,也已显现出疗效。此前接受过 PD-1 免疫疗法、伊立替康或 CLDN18.2 抗体治疗的患者,其既往治疗经历对疗效并无显著影响。

04 总结与展望

安斯泰来通过引进CLDN18.2 ADC管线加速抢占全球市场,与国内信达IBI343等ADC产品形成竞争。未来CLDN18.2赛道将聚焦疗效优化(如联合PD-1)与生产自主可控性,以突破单抗天花板并巩固市场地位。

★

临床3期抗体药物偶联物免疫疗法财报细胞疗法

2025-08-26

点击蓝字

关注我们

本

期

看

点

CLDN18.2单抗获批上市,必然带动Claudin18.2伴随诊断的同步上市。而在不同瘤种,或者及时在胃癌,不同CLDN18.2单抗临床试验所要求的阳性比例也不一样,差异何在?

本期内容

01

CLDN18.2伴随诊断的监管要求

02

三款在研抗CLDN18.2单抗最新进展

03

CLDN18.2会否追随Her2靶点的变迁

【01 CLDN18.2伴随诊断的监管要求】

安斯泰来Zolbetuximab国内上市

2024年12 月 31 日,NMPA 官网显示,安斯泰来申报的CLDN18.2 单抗-佐妥昔单抗在国内获批上市,适应症为联合含氟尿嘧啶类和铂类药物化疗用于 CLDN18.2 阳性、HER2阴性的局部晚期不可切除或转移性胃或胃食管交界处(GEJ)腺癌患者的一线治疗。

相应适应症的批准源自于Zolbetuximab的两项关键III期研究(GLOW和SPOTLIGHT)数据。

检测标准:

两项研究均采用免疫组化(IHC)检测筛选CLDN18.2阳性患者,定义标准为:≥75%肿瘤细胞呈中至强染色强度(IHC评分2+/3+),符合该标准的患者占比约38%。亚洲亚组分析显示更高获益趋势(如SPOTLIGHT研究中亚洲患者中位OS达23.33个月 vs 非亚洲组16.13个月),提示地域差异可能影响治疗响应。

伴随诊断试剂:

FDA批准的伴随诊断试剂为罗氏公司VENTANA CLDN18(克隆43-14A)IHC试剂盒,国内检测实验室也多采用克隆号为43-14A的抗CLDN18.2抗体进行检测。

指南推荐:

2025版CSCO胃癌诊疗指南新增FOLFOX/ XELOX联合佐妥昔单抗为Ⅰ级推荐(1A类证据),并将CLDN18.2表达检测由2024版的Ⅱ级推荐(2A类)升级为Ⅰ级推荐(1B类),强调在晚期胃/GEJ腺癌中筛选CLDN18.2阳性人群。

针对CLDN18.2免疫组织化学(IHC)检测的实际问题,2025年7月11日—中国首部《胃癌Claudin18.2临床检测专家共识(2025版)》(以下简称《共识》)近日正式发布,旨在为胃癌Claudin18.2靶点检测提供标准化、专业性、实用性的临床指导,为精准筛选胃癌靶向治疗的潜在获益人群提供技术依据。此次《共识》发布标志着我国胃癌精准诊疗和规范化发展开启了崭新的篇章。

本文比较关注的是共识提到的伴随诊断试剂及人群选择。

伴随诊断

共识意见8:不同克隆号抗体检测胃癌中CLDN18.2表达一致性的研究结果尚缺乏大样本的前瞻性研究,建议使用循证医学证据充足的IHC检测平台、抗CLDN18/CLDN18.2抗体和二抗检测试剂,确保其临床有效性(推荐级别:推荐)。

人群选择

共识意见1:CLDN18.2表达检测在局部晚期、复发或转移性胃癌患者治疗方案中起着重要作用,强烈推荐在治疗前进行CLDN18.2蛋白表达检测(推荐级别:强推荐)。

共识意见2:对于根治术后标本,推荐进行CLDN18.2蛋白表达检测(推荐级别:推荐)。

国内外其他在研抗CLDN18.2单抗的最新进展和阳性表达率要求与佐妥昔单抗的有所不同,且在联合免疫检查点抑制剂进行三期布局,有望重新定义CLDN18.2单抗的竞争格局。

02 三款在研抗CLDN18.2单抗最新进展

创胜集团丨Osemitamab (TST001)

2023年7月获中国CDE与韩国MFDS批准,启动TranStar 301Ⅲ期全球多中心、随机、双盲、安慰剂对照试验。联合纳武利尤单抗(Opdivo)与CAPOX方案对比纳武利尤单抗联合化疗,在HER2阴性、CLDN18.2表达的局部晚期/转移性胃或胃食管交界腺癌一线治疗中展开疗效和安全性评估。

伴随诊断:

检测方法:本地实验室开发检测(LDT)或中央病理室IHC。

阳性标准:≥1+膜染色强度,且至少10%肿瘤细胞呈现阳性(筛选出约55%患者)。

奥赛康丨ASKB589

奥赛康的CLDN18.2单抗ASKB589于2024年启动全球多中心Ⅲ期注册试验,试验方案为ASKB589+CAPOX+替雷利珠单抗 vs 替雷利珠单抗+CAPOX

阳性标准:中高表达——IHC评分2+或3+,且≥40%肿瘤细胞阳性。

明济生物丨FG-M108

正在开展Ⅲ期注册试验,评估FG-M108 + CAPOX vs CAPOX 在HER2阴性、CLDN18.2阳性、一线胃/GEJ腺癌患者中的疗效。

纳入人群:CLDN18.2阳性(≥40% 的肿瘤细胞≥2+膜染色),PD-L1 CPS<5

温馨提示:

三款在研单抗均采用IHC评估CLDN18.2表达,但纳入的CLDN18.2阳性人群相较于佐妥昔单抗的≥75%肿瘤细胞呈中至强染色强度(IHC评分2+/3+)普遍较低,有望进一步拓展人群,且在联合PD-1单抗,符合当下胃癌一线免疫联合化疗的标准。基于如此竞争白热化态势,已经有企业放弃CLDN18.2单抗,尝试CAR-T和ADC产品。

例如,安斯泰来已然开始BD国内在研的ADC,安斯泰来豪掷15.4亿美元获取CLDN18.2 ADC:是单抗“折戟”,还是战略前瞻?

所以,安斯泰来通过引进CLDN18.2 ADC管线加速抢占全球市场,与国内信达IBI343等ADC产品形成竞争。未来CLDN18.2赛道将聚焦疗效优化(如联合PD-1)与生产自主可控性,以突破单抗天花板并巩固市场地位。

03 CLDN18.2会否追随Her2靶点的变迁

联想DS-8201对于Her2靶点的重新定义,Her2已经从二分法变为四分法。

HER2表达的临床新定义:根据表达状态从两分类(HER2阴性、阳性)到四分类(HER2高表达、中表达、低表达、不表达)。高表达等同于根据ToGA研究确定的“HER2阳性”标准。

CLDN18.2靶点也会进一步进行细化,意图扩大CLDN18.2阳性人群,而伴随诊断也会迎来日渐正规且快速的发展。

★

2025-08-25

8月25日,AbbVie(NYSE:ABBV)和Gilgamesh Pharmaceuticals(“Gilgamesh”)宣布了一项最终协议,根据该协议,AbbVie将以12亿美元收购Gilgamesh的主要临床阶段候选药物GM-2505(Bretisilocin),该药物目前正在2期临床开发中,用于治疗中重度抑郁症(MDD)患者。自2023年以来,艾伯维在收购上花费了200多亿美元,因为其明星类风湿性关节炎治疗药物Humira失去了专利保护。(19.25亿美元!艾伯维引进一款CD3/CD38/BCMA三特异性抗体;21.52亿美元!艾伯维押注掩蔽型T-cell engagers;22.25亿美元!艾伯维引进一款长效减肥药,正式进军减肥领域;3.35亿美元首付款!艾伯维与ADARx合作开发下一代siRNA;14.65亿美元!艾伯维押注TCE合作,开发下一代肿瘤药;17.1亿美元!明济生物与艾伯维达成授权协议;超20亿美元!艾伯维合作开发下一代精神疾病疗法刚刚!艾伯维87亿美元收购Cerevel Therapeutics;101亿美元!艾伯维收购ImmunoGen;21亿美元!艾伯维收购Capstan Therapeutics)

迷幻药化合物,包括5-HT2A受体激动剂,因其快速、强效和持久的抗抑郁作用而被公认为治疗抑郁症等精神健康障碍的潜在方法。然而,这一类现有的替代疗法因其长期的精神活动经验而受到阻碍。

Bretisilocin是一种5-HT2A受体激动剂和5-HT释放剂,是一种新型的下一代迷幻化合物,旨在解决这类化合物中观察到的开发挑战。Bretisilocin已被证明具有较短的精神活性体验,同时保留了较长的治疗效果。

最近公布了Bretisilocin治疗重度抑郁症2a期研究的阳性顶线结果,表明与低剂量活性对照相比,抑郁症状的严重程度在临床上有显著影响,在统计学上有显著降低,如蒙哥马利-奥斯伯格抑郁量表(MADRS)总分所示。在第14天,单剂量(10mg)Bretisilocin显示出强大的抗抑郁作用,MADRS总分较基线变化-21.6分,而低剂量(1mg)活性对照组较基线变化12.1分(p=0.003)。Bretisilocin耐受良好,无严重不良事件。

AbbVie执行副总裁、研发和首席科学官Roopal Thakkar医学博士表示:“精神病学领域是医学中最具挑战性的领域之一,亟需创新的解决方案。此次收购突显了我们通过投资于新的治疗方法来扩大和加强精神科护理的承诺,这些方法有可能接触到其他治疗无效的患者。我们期待着将Bretisilocin推进到后期临床开发。”

Gilgamesh Pharmaceuticals首席执行官Jonathan Sporn医学博士表示:“AbbVie在神经科学领域的领导地位和对推进创新治疗的承诺使他们成为快速推进布瑞西洛星的理想合作伙伴,同时使Gilgamesh能够继续追求我们为复杂的心理健康和神经系统疾病开发新颖、变革性疗法的更广泛使命。”。

根据协议条款AbbVie将以高达12亿美元的价格收购Gilgamesh的Bretisilocin项目,其中包括预付款和开发里程碑。此外,作为交易的一部分,Gilgamesh将剥离一个新的实体,该实体将以Gilgamesh Pharma的名义运营,以持有其员工和其他项目,包括其口服NMDA受体拮抗剂blixeprodil(GM-1020)、心脏安全的伊波加因类似物(ibogaine analog)、M1/M4激动剂项目以及与AbbVie的现有合作。该交易受惯例成交条件的约束。

该交易建立在AbbVie和Gilgamesh在2024年的合作和许可协议的基础上,以推进下一代治疗精神疾病新药的开发。该期权许可证仍然有效,并将转让给Gilgamesh Pharma以进行分拆。

Gilgamesh是一家临床阶段公司,开发治疗精神疾病的疗法,包括抑郁症、焦虑症和创伤后应激障碍。2022年12月15日,Gilgamesh Pharmaceuticals完成3900万美元的B轮融资,正在开发一系列针对抑郁症和其他心理健康疾病的速效和持久治疗方法。融资由Prime Movers Lab领投,并获得了Alumni Ventures、Palo Santo、Negev Capital、Route 66、JLS Fund、Satori Capital和Gron Ventures的额外投资。Gilgamesh的人工智能行为和成像驱动平台正在加速和优化我们新化学实体(NCE)的开发,这些实体提供了更好的安全性、耐受性、持续时间和疗效。

关注下方公众号,带你看世界!

临床2期并购siRNA引进/卖出临床结果

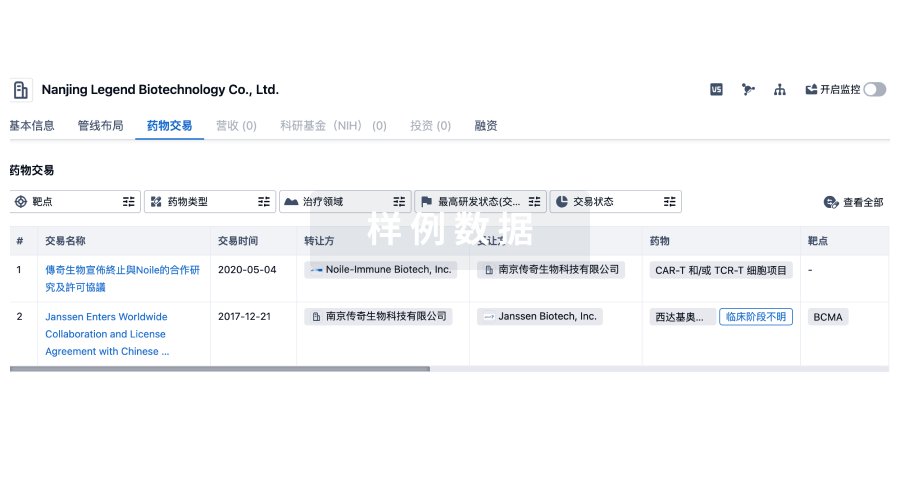

100 项与 明济生物制药(北京)有限公司 相关的药物交易

登录后查看更多信息

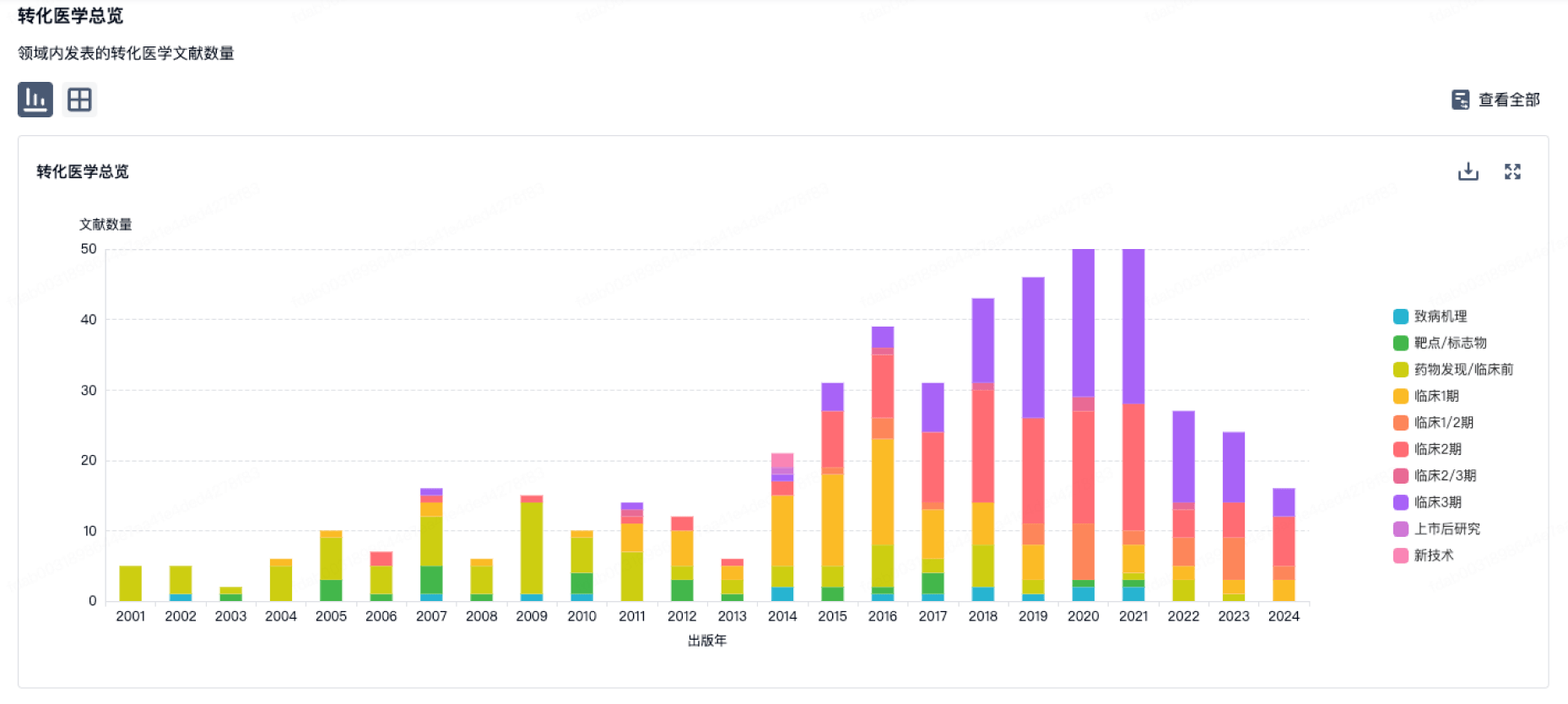

100 项与 明济生物制药(北京)有限公司 相关的转化医学

登录后查看更多信息

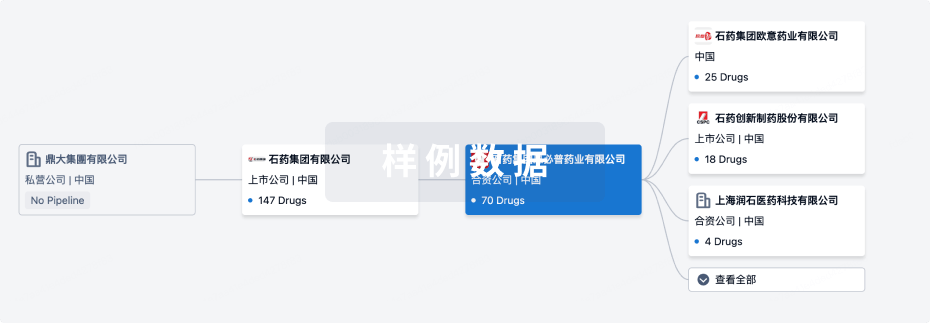

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年09月29日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

药物发现

1

4

临床前

临床1期

1

1

临床3期

其他

16

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

M108 ( CLDN18.2 ) | 晚期恶性实体瘤 更多 | 临床1期 |

B-901 ( CD40 x PDL1 ) | 晚期恶性实体瘤 更多 | 临床1期 |

FG-T903 ( CD112R x PD-1 x TIGIT ) | 实体瘤 更多 | 临床前 |

FG-M701 ( VEGI ) | 炎症性肠病 更多 | 临床前 |

FG-B902 ( CD112R x TIGIT ) | 实体瘤 更多 | 临床前 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

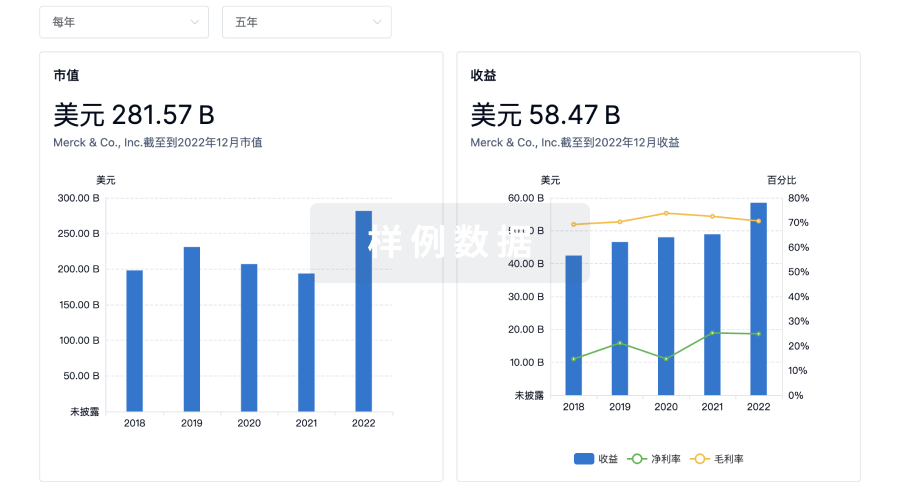

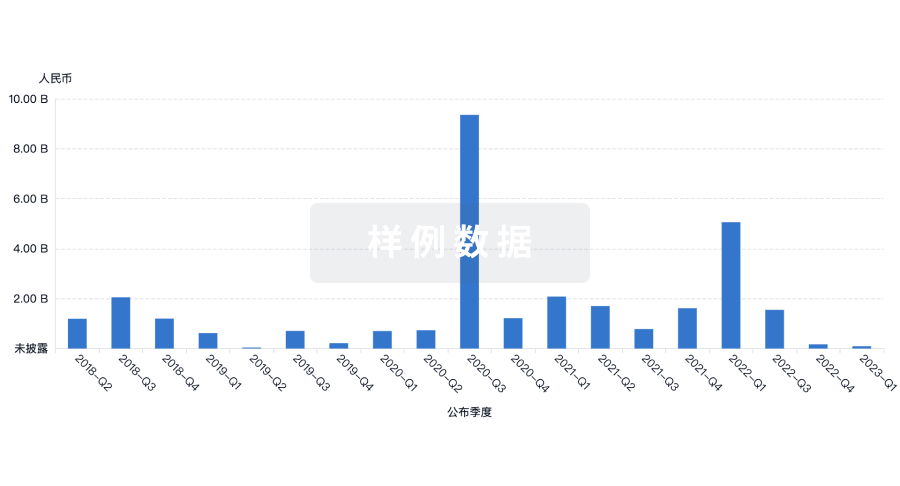

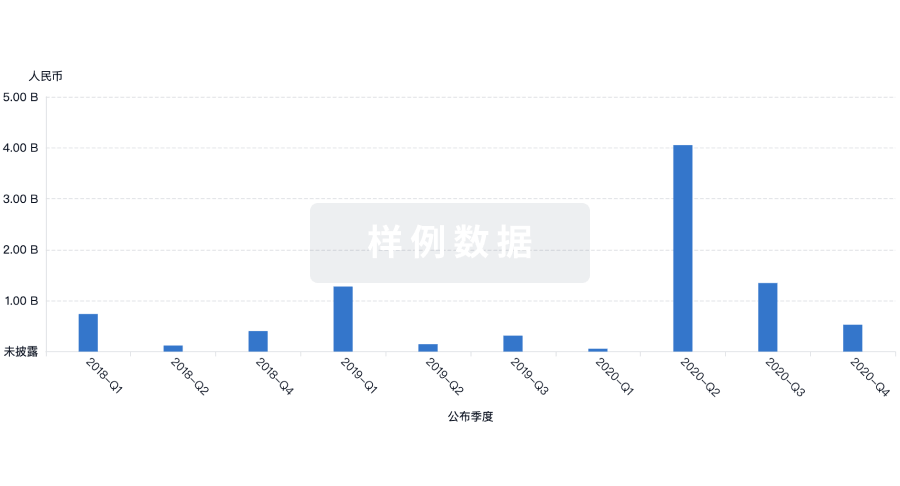

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用