预约演示

更新于:2025-05-07

Blossomhill Therapeutics, Inc.

更新于:2025-05-07

概览

标签

肿瘤

血液及淋巴系统疾病

呼吸系统疾病

小分子化药

化学药

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 小分子化药 | 2 |

| 化学药 | 1 |

| 排名前五的靶点 | 数量 |

|---|---|

| EGFR(表皮生长因子受体erbB1) | 1 |

| CLK1 x CLK2 x CLK4 | 1 |

| KRAS(KRAS蛋白) | 1 |

关联

3

项与 Blossomhill Therapeutics, Inc. 相关的药物靶点 |

作用机制 EGFR拮抗剂 |

非在研适应症- |

最高研发阶段临床1/2期 |

首次获批国家/地区- |

首次获批日期- |

作用机制 CLK1 抑制剂 [+2] |

非在研适应症- |

最高研发阶段临床1期 |

首次获批国家/地区- |

首次获批日期- |

靶点 |

作用机制 KRAS抑制剂 |

在研适应症 |

非在研适应症- |

最高研发阶段药物发现 |

首次获批国家/地区- |

首次获批日期- |

2

项与 Blossomhill Therapeutics, Inc. 相关的临床试验NCT06706076

A Phase 1/2 Open-Label, Multicenter, First-in-Human Study of the Safety, Tolerability, Pharmacokinetics, and Antitumor Activity of BH-30643 in Adult Subjects With Locally Advanced or Metastatic NSCLC Harboring EGFR and/or HER2 Mutations (SOLARA)

BH-30643-01 is a Phase 1/2, first-in-human, open label, dose escalation and expansion study in patients with locally advanced or metastatic non-small cell lung cancer (NSCLC) with epidermal growth factor receptor (EGFR) and/or human epidermal growth factor receptor (HER2) mutations. The study drug, BH-30643 capsules, will be self-administered by mouth twice daily in 21-day cycles.

Phase 1 will determine the recommended Phase 2 dose (RP2D) and, if applicable, the maximum tolerated dose (MTD) of BH-30643.

Phase 2 will further evaluate the antitumor efficacy and safety in specified cohorts determined by EGFR/HER2 mutation subtypes and/or treatment history at the RP2D, as well as the population PK.

Phase 1 will determine the recommended Phase 2 dose (RP2D) and, if applicable, the maximum tolerated dose (MTD) of BH-30643.

Phase 2 will further evaluate the antitumor efficacy and safety in specified cohorts determined by EGFR/HER2 mutation subtypes and/or treatment history at the RP2D, as well as the population PK.

开始日期2025-01-09 |

NCT06501196

A Phase 1/1b Open-Label, Dose Escalation, First-in- Human Study to Evaluate the Safety, Tolerability, Pharmacokinetics, and Preliminary Anti-leukemic Activity of the Orally Available CDC-Like Kinase (CLK) Inhibitor, BH-30236, in Adults With Relapsed or Refractory Acute Myelogenous Leukemia (R/R AML) or Higher-Risk Myelodysplastic Syndrome (HR-MDS)

Study BH-30236-01 is a first-in-human (FIH), Phase 1/1b, open-label, dose escalation and expansion study in participants with relapsed/refractory acute myelogenous leukemia (R/R AML) or higher-risk myelodysplastic syndrome (HR-MDS).

Phase 1 (Dose Escalation) will evaluate the safety, tolerability, pharmacokinetics (PK), pharmacodynamics (PD), and preliminary efficacy of BH-30236 administered orally. Approximately 50 participants may be enrolled in Phase 1 of the study.

Phase 1b (Dose Expansion) will follow Phase 1 to further understand the relationships among dose, exposure, toxicity, tolerability, and clinical activity. Up to 24 participants may be enrolled in Phase 1b of the study.

The dose expansion part (Phase 1b) will be followed to understand the relationships among dose, exposure, toxicity, tolerability and clinical activity. Up to 24 participants may be enrolled in Phase 1b of the study.

Phase 1 (Dose Escalation) will evaluate the safety, tolerability, pharmacokinetics (PK), pharmacodynamics (PD), and preliminary efficacy of BH-30236 administered orally. Approximately 50 participants may be enrolled in Phase 1 of the study.

Phase 1b (Dose Expansion) will follow Phase 1 to further understand the relationships among dose, exposure, toxicity, tolerability, and clinical activity. Up to 24 participants may be enrolled in Phase 1b of the study.

The dose expansion part (Phase 1b) will be followed to understand the relationships among dose, exposure, toxicity, tolerability and clinical activity. Up to 24 participants may be enrolled in Phase 1b of the study.

开始日期2024-06-19 |

100 项与 Blossomhill Therapeutics, Inc. 相关的临床结果

登录后查看更多信息

0 项与 Blossomhill Therapeutics, Inc. 相关的专利(医药)

登录后查看更多信息

4

项与 Blossomhill Therapeutics, Inc. 相关的文献(医药)2025-04-21·Cancer Research

Abstract 5608: Design and discovery of BH-30643: A novel, reversible, mutant-selective macrocyclic EGFR inhibitor invulnerable to common resistance mutations

作者: Ling, Nancy ; Darjania, Levan ; Li, Danan ; Rui, Eugene ; Cui, J. Jean ; Rogers, Evan ; Peng, Zhengwei ; Jiang, Ping ; Deng, Wei ; Hu, Yue ; Zhai, Dayong ; Choi, Joshua ; Sarkar, Anindya ; Wang, Zhenping

2025-04-21·Cancer Research

Abstract 5596: Novel multikinase CLK inhibitor BH-30236 targets hematological malignancies through alternative splicing regulation

作者: Wang, Eric ; Li, Danan ; Hu, Yue ; Ling, Nancy ; Jiang, Ping ; Graber, Armin ; Sims, Gregory ; Cui, Jean ; Deng, Wei ; Zhai, Dayong ; Wang, Zhenping ; Choi, Joshua

2024-11-05·Blood

BH-30236, a Novel Macrocyclic Clk Inhibitor Modulating Aberrant RNA Splicing, Demonstrates Potent Anti-Cancer Activity Against Myeloid Malignancies

作者: Deng, Wei ; Li, Danan ; Jiang, Ping ; Ling, Nancy ; Darjania, Levan ; Whitten, Jeff ; Shao, Jesse ; Montalban, Antonio ; Hu, Yue ; Rogers, Evan ; Cui, J. Jean ; Rui, Eugene ; Zhai, Dayong ; Wang, Zhenping

20

项与 Blossomhill Therapeutics, Inc. 相关的新闻(医药)2025-01-23

BH-30643 is a macrocyclic, mutant selective OMNI-EGFR™ inhibitor with sub-nanomolar potency against classical and atypical EGFR mutations that is maintained even in the presence of T790M +/- C797S resistance mutations

SAN DIEGO, CA, USA I January 22, 2025 I

BlossomHill Therapeutics, Inc.

, a privately-held, clinical-stage biotechnology company focused on the design and development of small molecule medicines for treating cancer and autoimmune diseases, today announced the first cohort of patients has been dosed in the SOLARA study (

NCT06706076

). SOLARA is a global, open label, dose escalation and expansion Phase 1/2 clinical trial assessing the safety, efficacy and tolerability of BH-30643 for locally advanced or metastatic non-small cell lung cancer (NSCLC) bearing EGFR or HER2 mutations.

“EGFR-mutant lung cancer is one of the most common genomic subtypes of lung cancer globally and has been a major target of drug development in recent years, yet an unmet medical need remains for patients,” said Dr. Geoff Oxnard, Chief Medical Officer of BlossomHill Therapeutics. “Our thesis is that the novel, macrocyclic design of BH-30643 will provide potent antitumor activity in a broader spectrum of EGFR-mutant lung cancers with reduced toxicity. Dosing the first Phase 1 patient cohort with BH-30643, our second molecule to enter the clinic, marks an important step toward our goal of providing patients with intentionally designed precision medicines.”

About the SOLARA study

The Phase 1/2 SOLARA clinical trial evaluates BH-30643, a macrocyclic, reversible, mutant-selective OMNI-EGFR™ inhibitor for patients with locally advanced or metastatic non-small cell lung cancer (NSCLC) bearing EGFR or HER2 mutations. In preclinical studies, BH-30643 demonstrated potent antitumor activity spanning classical EGFR mutations (exon 19 deletions, L858R), atypical EGFR mutations (G719X, L861Q, S768I, etc.), exon 20 insertions, and HER2 mutations. The global study consists of a dose escalation part to identify Recommended Doses for Evaluation (RDE), followed by an expansion part to further evaluate BH-30643 across a range of EGFR and HER2 mutations. Additional details on the design and discovery of BH-30643 will be reported at an upcoming medical meeting.

About Blossom Hill Therapeutics

BlossomHill Therapeutics, Inc. is a small molecule drug design and development company focused on addressing unmet medical needs in oncology and autoimmune diseases. The company is building a deep pipeline of candidates across a range of targets with the aim of making the next leap forward in treatment for patients. The company’s approach to drug design and development first considers the unmet medical need through deep knowledge of the science behind the disease, and then seeks to design a novel chemotype to provide the best chance of success. BlossomHill’s first two clinical programs are BH-30236 for the treatment of relapsed or refractory AML or HR-MDS and BH-30643 for the treatment of EGFR- or HER2-mutated NSCLC. Headquartered in San Diego, California, BlossomHill Therapeutics is supported by a strong syndicate of leading investors, including Cormorant Asset Management, OrbiMed, Vivo Capital and Colt Ventures. For more information, visit

bhtherapeutics.com

and follow us on

LinkedIn

and

X

.

SOURCE:

Blossom Hill Therapeutics

临床1期临床结果

2025-01-17

·深蓝观

韦晓宁 | 撰文

吴妮 | 编辑

2025年,中国创新药界开启“一天一个NewCo”的盛况。点开新闻链接,发现局中人都已不是“NewCo界”的新面孔,各方都有备而来。

1月8日,映恩生物宣布授权给Avenzo Therapeutics一个EGFR/HER3 ADC,首付款5000万美元。至此这家2022年成立的新公司一年内引进了三个中国资产,几乎可以说是ADC版本的Candid(查看报道 起底Candid:扫货中国TCE的神秘操盘手)。

1月9日,新公司Verdiva Bio Limited宣布成立,公司的主要股东及高管团队都来自Aiolos Bio,这家公司一年多前从恒瑞那里收购管线、又以40倍差价的10亿美元将自己高价卖出。这次,这个团队买下的是先为达由三个管线组成的“减肥药组合”,首付款7000万美元。

1月10日发生了两个NewCo交易:康诺亚将一个CD38单抗授权给Timberlyne Therapeutics,这是康诺亚2024年以来的第三个NewCo交易。另一个是和铂医药和科伦博泰的一个TSLP抗体,授权给Windward Bio。和铂也不是第一次做NewCo了,子公司诺纳生物还与前述NewCo Candid展开了关于TCE的合作,交易总额高达3.2亿美元。

一系列NewCo交易足以证明中国研发力量的实力。从恒瑞、先为达、康诺亚到和铂参与的NewCo,以及成立后5个TCE资产全部来自中国的candid,这些新公司都是凭借来自中国的管线作为核心资产,在海外获得多家知名基金的认可,拿下数亿美元的融资。

不过,NewCo交易之热,恐怕也有泡沫破碎的风险。目前国内的NewCo交易都集中在自免、降糖/减肥及ADC领域,引航资本团队成员盛立军称,中国重复开发管线太多,“美国买方已经开始意识到这点,开始控制风险。去年做成的NewCo有可能陷入恶性竞争”“管线的价格每半年下降一次”。

盛立军认为“做NewCo要趁早”。亦有业内人士观察,随着“扫货”进入到下一个阶段,许多交易方都已将目标瞄准临床前阶段的资产,尤其是在临床前阶段就能看到一些数据的抗体管线,“做NewCo有阶段前移的趋势”。

无需怀疑的是,随着近期JPM大会的落幕,一系列新的NewCo交易还会不断涌现。盛宴将持续多久,业界在拭目以待。

-01-

“赚了恒瑞40倍差价”的团队,再次出手中国

几个交易中,先为达的交易尤其惹人注目,原因之一是其买方团队Verdiva几乎“脱胎”于Aiolos,那个赚了恒瑞40倍差价的公司——股东Forbion、RA Capital Management也是Aiolos的股东,公司CEO Khurem Farooq、CCO Tapan Maniar、CSO Jane Hughes、CTO Ashley Taylor,都曾在Aiolos担任相同职位。

Aiolos曾从恒瑞那里买来的管线是自免领域的TSLP抗体,花了2500万美元首付款,5个月后的2024年1月转手将公司一起卖给GSK,首付款10亿美元。

在Aiolos之前,这位前MNC人士Khurem Farooq就曾主导一个NewCo被诺华收购;Aiolos被收购后,Khurem 的大名更是在中美圈内如雷贯耳,“眼光、谈判能力都比较强,基金是跟着他走的”。

据悉,先为达的交易,Khurem 团队谈了一年左右。也就是在2024年1月完成Aiolos被收购之后,Khurem 团队立即就开始了下一个收购中国管线的项目。

这一次,团队从自免转到了降糖/减肥药领域,买下了先为达的口服GLP1伊诺格鲁肽的全球权益,以及可与其联用的口服胰淀素激动剂、长效皮下胰淀素激动剂三个产品。首付款7000万美元,交易总额24亿美元,此外还有销售提成。

GLP1的小分子口服药赛道竞争正酣,尚没有产品获批上市。目前先为达的口服伊诺格鲁肽正在临床二期。据海外参与人士称,比起礼来等大公司的同类产品,目前口服伊诺格鲁肽在肝毒性、心率调整等方面都有更好的安全性数据,生物利用度高,这也是Khurem 团队是看中先为达管线的原因。

值得一提的是,恒瑞在被“赚了差价”之后,自己做的一个NewCo Hercules,主要资产也是GLP-1组合,当时给恒瑞的首付款和近期里程碑付款是1.1亿美元。组合中的三个产品,有两个已分别进入二期和三期的临床中后期阶段,比起直接license out,同样是不算高的数字。

中间要被组局者“吃一道”,所以首付款不高,这也是NewCo交易的特点了。不过,被“赚差价”没有关系,别人团队网罗基金、运作管线的能力摆在那里;要紧的是,在被“赚差价”的同时,自己能不能从中得到应有的回报,也就是有没有新公司的股权。

这也是包括先为达在内,国内所有做NewCo交易的biotech,从恒瑞那里得到的教训。

恒瑞自己也学到教训,拿下了Hercules 19.9%的股权。公开信息中,虽未披露先为达将持有Verdiva多少股权,但据上述海外参与人士,这类交易股权部分只是没有公开,“有是肯定有的”,连日来其他几个没有披露股权信息的NewCo交易也是一样。

参与人士称先为达方面对这个交易算是满意,“有机会还会继续跟Khurem 团队合作”。

Verdiva在宣布成立、买下先为达管线权益的同时,还宣布了完成A轮融资4.11亿美元,创下英国生科公司有史以来最大的A轮融资纪录。

除了Forbion、RA Capital Management,股东列表还有General Atlantic、OrbiMed、Logos Capital、Lilly Asia Ventures和LYFE Capital,都是美中的知名基金。其中,Lilly Asia Ventures和LYFE Capital也是先为达的股东,知名的国内美元基金。

当年买下恒瑞的管线的两个月后,Aiolos也曾完成了2.45亿美元的融资,创下2023年全球生科领域的第二大A轮融资纪录。

运作恒瑞管线及Aiolos的成功,无疑为Khurem 团队增添了许多拿新融资的砝码,所以这次成立新公司的同时就拿下了超4亿元融资。加上从诺和诺德挖来的CMO Mohamed Eid,Verdiva的未来及其能够给先为达带来的收益值得期待。

-02-

又一个“批量收购”中国资产的NewCo出现

另一个最近出手中国管线的“NewCo老手”是Avenzo,这已经是Avenzo第三次收购中国资产。这一次,Avenzo以5000万美元首付款买下了映恩生物一个EGFR/HER3 ADC的全球权益。该管线尚在临床前阶段,Avenzo打算今年将其推入临床一期。

Avenzo成立于2022年,CEO Athena Countouriotis 是一位女性连续创业者,公司名字Avenzo 是其两个孩子Ava和Enzo的名字组合。她此前是Turning Point Therapeutics的CEO,新公司的多数员工也来自Turning point。而Turning point成立于2013年,主要产品是第四代ALK、c-MET、ADC等,公司2019年在纳斯达克上市,2022年被BMS以41亿美元收购。

在与映恩生物合作前的一年内,Avenzo还曾连续引进两个中国的资产:2024年1月引进安锐生物的一个CDK2,以及合作另一个项目的独家选择权,首付款4000万美元;11月底引进了橙帆医药的一个Nectin4/TROP2双抗ADC,首付款及近期里程碑付款5000万美元。

引进橙帆医药管线的同时,Avenzo还同时完成了A+轮融资,历史融资共计3.86亿美元。股东包括OrbiMed、Foresite Capital、SR One、礼来亚洲基金、泰福资本、Surveyor、Sofinnova Investments、泉创资本等十多家,也都有许多知名的熟面孔。

除了乐于引进中国资产、知名连续创业者拿下明星基金融资,Avenzo和Candid的相似之处还在于,都有“初生牛犊不怕虎”之势,CEO都很敢“放话”挑战前人。

Candid CEO Ken Song曾称公司将来的TCE产品有希望超越自免领域的重磅药物、“药王”修美乐和美罗华;

Avenzo CEO Athena Countouriotis 则公开表示,在看到百利天恒与BMS交易的EGFR/HER3双抗ADC管线后,他们发现这个管线有潜在漏洞,而且是与安全性相关。基于这次与映恩合作管线的临床前数据,他们认为自己的管线可以超越百利天恒与BMS合作的产品,成为best in class。

要知道,百利天恒与BMS做的交易,首付款8亿美元,总额高达84亿美元,在当时是被称作“天价交易”,国内至今未有BD交易的首付款能够超越。

-03-

中国biotech正在成为NewCo经验者

国外有“NewCo老手”,国内的biotech们,也正在熟练地成为为这些NewCo们输出管线资源的经验者。

其中,康诺亚是一个代表,半年来完成三个NewCo交易,而且两度拿下新公司接近30%的高比例股权、董事长加入新公司董事会,拥有更大的话语权,“如果说其他公司的NewCo是BD 交易2.0,那康诺亚已经到2.5了”。

康诺亚完成第一个NewCo交易是在2024年7月,将两个双抗的全球权益授予Belenos Biosciences,首付款1500万美元。康诺亚全资附属公司一桥香港持股30.01%,陈博加入Belenos 董事会。

这是恒瑞“打响NewCo第一枪”后,国内第一个“跟上”的案例。当时,业内人对此的观感是“意外”,“康诺亚这种主做自免的小公司也能搞一票大的”。而更令人意外的是,康诺亚会在之后乘势而上,又再两度交易,成为NewCo大潮下抓住时代机遇的代表者。

2024年11月,康诺亚授予Platina Medicines Ltd 一个BCMAxCD3双抗的全球权益,首付款1600万美元,同时获得PML母公司Ouro Medicines的少数股权。

2015年1月10日,康诺亚将收取3000万美元的首付款和近期付款,并获得Timberlyne公司的25.79%股权,成为其最大股东。在达成一系列销售及开发里程碑后,康诺亚还有权收取最多3.375亿美元的额外付款,并且有权从目标公司收取销售净额的分层特许权使用费。

与此同时,Timberlyne宣布达成1.8亿美元的A轮融资,Bain Capital Life Sciences、Venrock Healthcare Capital Partners和Abingworth领投,Boyu Capital、Lilly Asia Ventures、Braidwell和3H Health等跟投。

融资完成后,康诺亚将成为Timberlyne的最大股东,康诺亚董事长陈博将加入Timberlyne董事会、首席财务官张延荣将担任董事会观察员。

和康诺亚同日宣布交易的是和铂医药,其与科伦博泰的一个TSLP,全球权益授权给了Windward,首付款和近期里程碑付款4500万美元,交易总额9.7亿美元。

与此同时Windward完成2亿美元的A轮融资,OrbiMed、Novo Holdings和Blue Owl Healthcare Opportunities联合领投,多家主流美元基金参投。和铂与科伦博泰获得Windward 母公司的部分股权。

和铂早在2019年就与哈佛医学院附属波士顿儿童医院共同成立了NewCo HBM Alpha Therapeutics,聚焦在罕见病和妇科病领域,并于2023年1月完成种子轮融资。2024年12月,和铂子公司诺纳生物又与NewCo Candid展开了关于TCE的合作,交易总额高达3.2亿美元。

尽管曾亲身参与过NewCo交易,和铂医药创始人王劲松仍对媒体“时代财经”坦承,这次NewCo交易是顺势而为,并非其第一选择,“根据我们以往的经验,肯定是直接对外授权最简单”,“但是在这个过程中有国际顶级投资机构找来,再加上正在寻找资产的Windward Bio,经过多方接触,最后达成了合作”。

不过,虽然NewCo首付款较低、未来股权的退出变现还具有不确定性,但从产品未来商业价值实现的角度而言,比起向大公司直接BD,联合数家美元基金组建NewCo,或许还是一个不错的选择:NewCo管线集中效率高、管理团队操作经验丰富、背后众多基金高效推动,产品最终很可能比BD后就此埋没在MNC众多管线中,取得更好的商业化结果。

王劲松也直言,最终选择NewCo模式,是因其认为自免的适应证“需要非常专门化且更多的资源,尤其是国际市场的开发”。

对于国内biotech来说,有NewCo经验的会得到更多关注和信任,越做越顺利。NewCo的盛宴终究限于少数biotech。

-04-

NewCo主导者中闪现的华人身影

其实中国人并不是只能做NewCo的资源输出方。有勤奋与科研能力做底,在商业运作方面,华人也不是没有做NewCo的能力。

上述成功被BMS以41亿美元买下的Turning Point,其科学创始人就是华人崔景荣。她是中国科学技术大学的本科及硕士毕业生,而后赴美国俄亥俄州立大学留学。曾担任辉瑞公司的高级首席科学家和副研究员,在2024年当选美国国家工程院院士,是3款FDA上市药物和多款临床分子的主要发明人。

崔景荣为Turning Point贡献了瑞普替尼、Elzovantinib等四款候选药物。Turning Point于2019年上市后,崔景荣离开了公司。而后崔景荣与其丈夫李一山又再度创业,成立BlossomHill Therapeutics,于2024年2月完成B轮融资,历史融资达1.73亿美元。

Turning Point的成功,也有中国本土管线的加持。2022年5月,Turning Point买下了礼新医药一个ADC的全球权益,首付款2500万美元。

据观察人士,美国生科领域的主流VC/PE,大部分都已加入来中国“淘货”做NewCo的行列。而在中国,虽然不是领投方,但Lilly Asia Ventures、LYFE Capital、启明创投等在中的美元基金,都已在好几个美国基金主导的NewCo股东名单里。

跟着美国本土基金“尝到了甜头”,对中国的biotech又比美国人熟悉,在中的美元基金也开始对主导做NewCo跃跃欲试。

不过据上述观察人士,biotech们目前可能还是更偏向与美国基金主导的团队合作——大概率能拿到更高的首付款,而且有更多成熟的国际资源,产品能更好地实现商业化。

但若真如业界所料,NewCo的市场将越来越拥挤、重复性竞争越来越多的话,交易额与发展空间都要退一步的新选择出现,可能也是必然的事情。

......

欢迎添加作者交流:

韦晓宁:MoriW1995

内容合作:17610790527

抗体药物偶联物并购引进/卖出ASCO会议

2024-07-03

·药融圈

▲8月15-16日 NDC2024生物医药创新者峰会 扫码报名

注:本文不构成任何投资意见和建议,以官方/公司公告为准;本文仅作医疗健康相关药物介绍,非治疗方案推荐(若涉及),不代表平台立场。任何文章转载需得到授权。

药融云数据(www.pharnexcloud.com)监测显示:2024年2月29日,中国科大资深803应用化学校友崔景荣博士(Jean Cui)创立的新药公司BlossomHill Therapeutics,宣布完成了1亿美元的B轮融资。此轮融资由Colt Ventures领衔,Cormorant Asset Management、OrbiMed、维梧资本、Hercules BioVentures Partners、Plaisance Capital Management以及H&D Asset Management在内的新老投资者参与。Colt Ventures 合伙人 Sundeep Agrawal ,维梧资本 Timothy Stubbs 加入董事会。

至此,公司累计融资金额总额达1.73亿美元(A轮融资7100万美元;种子轮200万美元)。

2024年2月6日,崔景荣博士因为在SUGEN/辉瑞以及原东家TP(Turning Point Therapeutics后被BMS以41亿美元收购)抗癌新药研发领域的杰出成就而当选美国工程院院士(NAE),这是货真价实的头衔。曾经主导开发上市的产品有crizotinib (XALKORI®), lorlatinib (LOBRENA®)和 repotrectinib (AUGTYRO®)。

BlossomHill最早成立于2020年6月,重点开发的疾病领域为肿瘤与自身免疫。由崔景荣博士与医药老兵李一山(Y. Peter Li)博士共同创立。值得注意的是,这是一对新药伉俪。此前,崔景荣博士曾在SUGEN, Inc.担任项目负责人和团队领导;2003-2013年,她加入辉瑞,担任Associate Research Fellow,和Senior Principal Scientist。2013年,她加入Turning Point Therapeutics, Inc,担任Turning Point的首席科学官,2013年10月-2020年6月担任董事会成员。

药融云数据(www.pharnexcloud.com)监测显示:新公司涉及的专利与激酶和大环策略相关,涵盖的靶点有KRAS(WO2024015262A1)、EGFR、TYK2等等。

目标开发出能与阿斯利康的三代FEGFR Tagrisso竞争的候选药物;急性髓性白血病适应症的新分子;目前自身免疫候选分子也尚未公开。

参考:

NMPA/CDE;

药融云数据,www.pharnexcloud.com;

FDA/EMA/PMDA;

相关公司公开披露;

https://bhtherapeutics.com/;

https://bhtherapeutics.com/2024/02/blossomhill-therapeutics-closes-100-million-series-b-financing/;

https://www.businesswire.com/news/home/20240229403573/en;

等等。

本文仅用于向医疗卫生专业人士提供科学信息,不代表平台立场,不作任何用药推荐

[ 重磅苏州新药峰会推荐 ]

08/15AM FDA对细胞和基因治疗 (CGT) 产品的监管

09:00-09:10 致辞

09:10-09:30 新兴医疗产品的概述

09:30-10:00 FDA对CGT产品CMC方面的监管。

10:00-10:30 FDA 对 CGT 产品非临床研究的要求

10:30-11:00 CGT 产品临床试验的注意要点

11:00-12:00 小组讨论

12:00-13:30 午餐

08/15PM FDA对核酸和基因编辑产品的监管

13:30-14:00 核酸产品的 CMC 注意要点

14:00-14:30 FDA对核酸产品的非临床要求

14:30-15:00 核酸产品的临床注意要点

15:00-15:30 FDA对溶瘤病毒产品的监管

15:30-16:00 FDA 批准首个基因编辑产品 Casgevy - 案例研究

16:00-17:00 小组讨论

以上议程更新中,以会议现场为准...

门票注册通道

【关于药融圈】

药融圈PRHub旨在帮助生物医药科技型企业进行品牌推广及商务拓展服务,针对客户的真实需求制定系统化解决方案,通过“翻译-降维-场景化”将客户的品牌信息以直白易懂的方式被公众知悉,同时在流量渠道覆盖100万+垂直用户基础上实现合作目的,帮助合作伙伴完成从品牌开始到商务为终的闭环营销服务。我们已经完成了数十场线下1000人规模的生物医药研发类会议,涵盖小分子新药,大分子新药,改良型新药,BD跨境交易等多个领域,服务了百余家上市/独角兽/生物技术/制药企业。

并购基因疗法细胞疗法高管变更

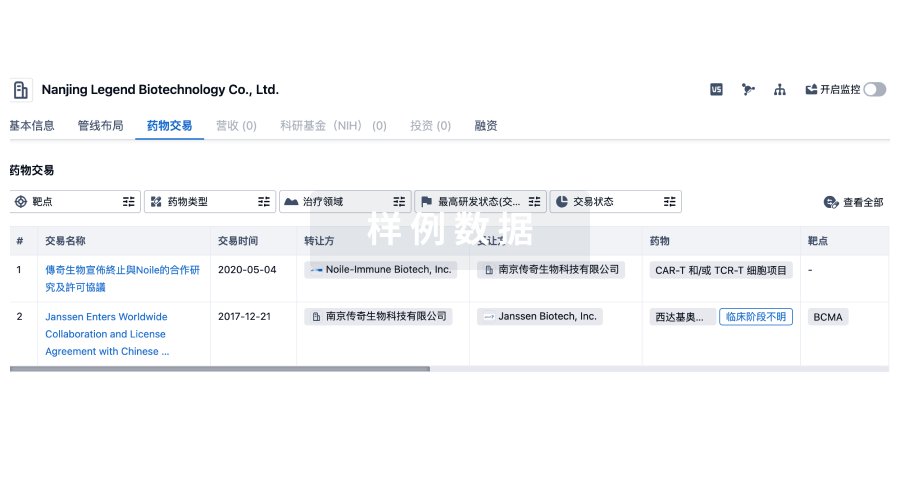

100 项与 Blossomhill Therapeutics, Inc. 相关的药物交易

登录后查看更多信息

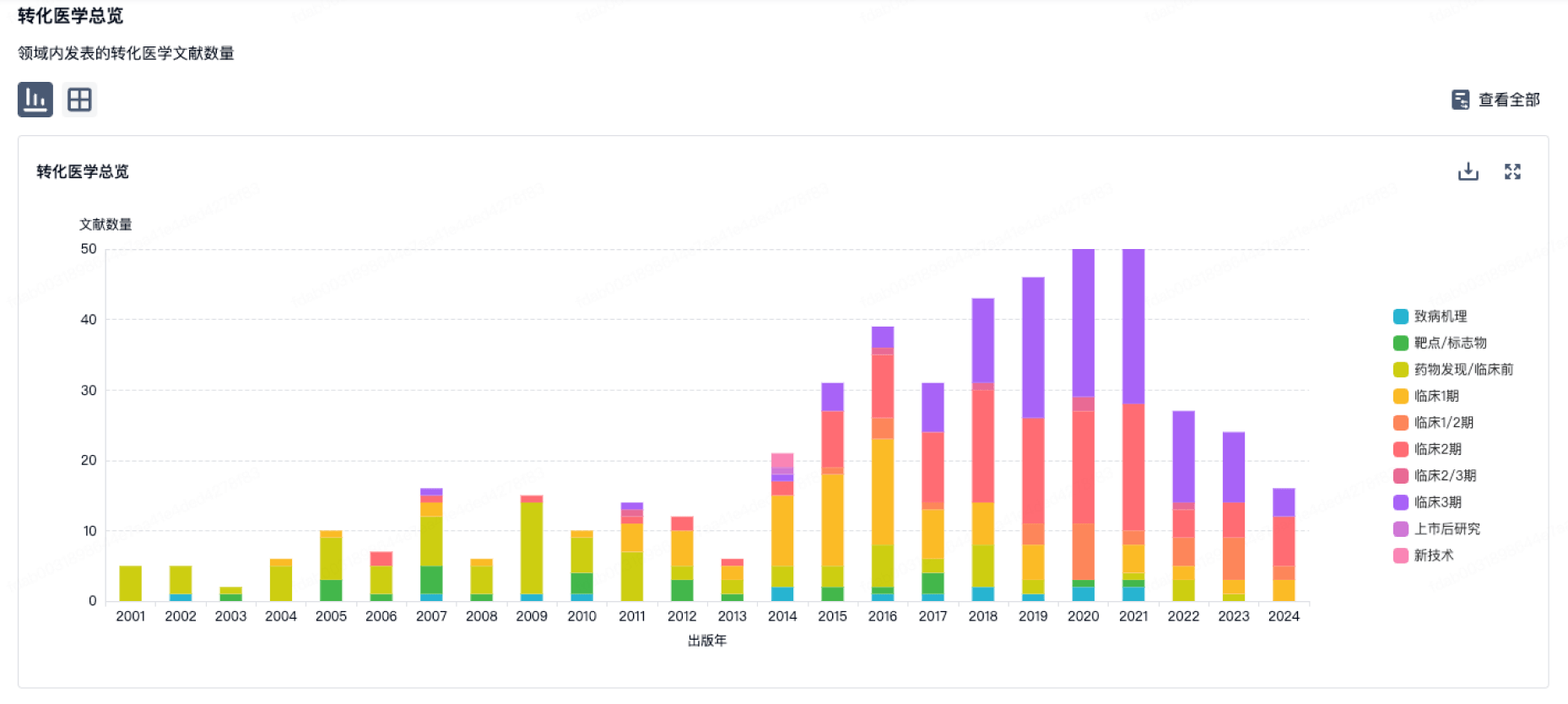

100 项与 Blossomhill Therapeutics, Inc. 相关的转化医学

登录后查看更多信息

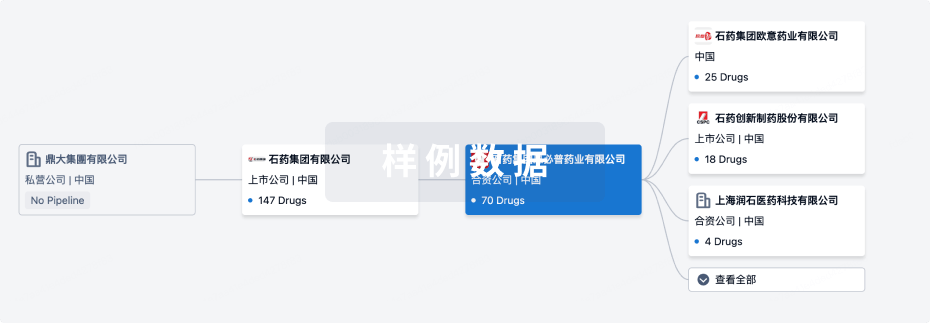

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年10月21日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

药物发现

1

1

临床1期

临床2期

1

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

BH-30643 ( EGFR ) | 转移性非小细胞肺癌 更多 | 临床2期 |

BH-30236 ( CLK1 x CLK2 x CLK4 ) | 难治性急性髓细胞白血病 更多 | 临床1期 |

KRAS抑制剂(BlossomHill Therapeutics) ( KRAS ) | 肿瘤 更多 | 药物发现 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

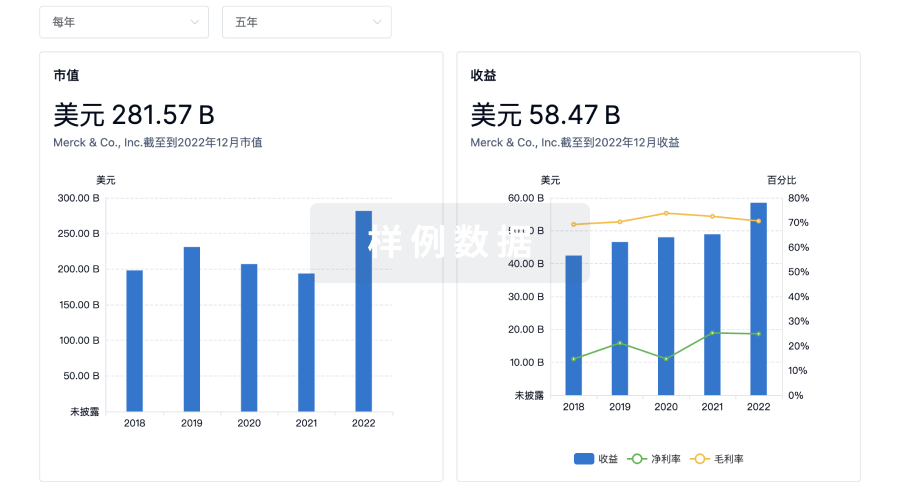

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

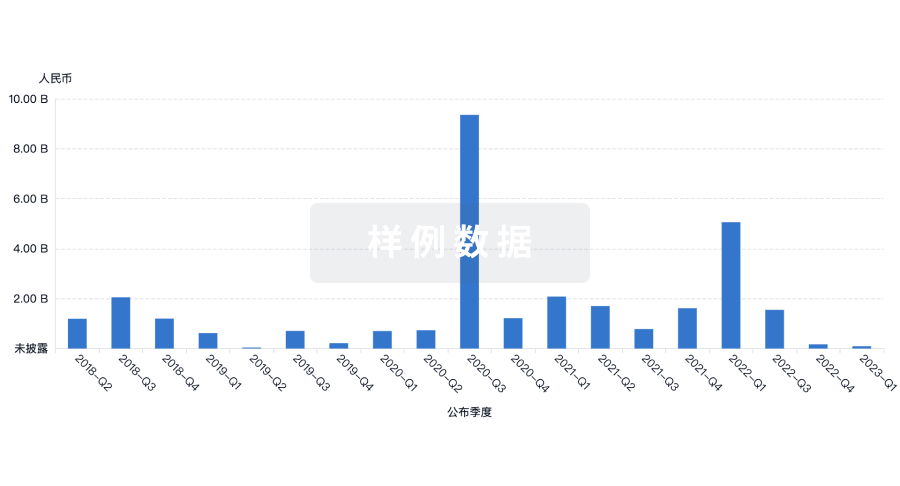

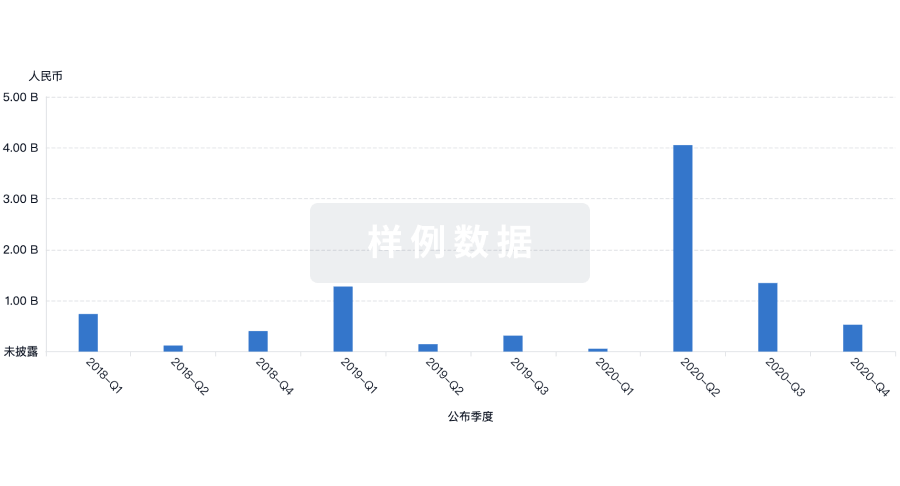

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用