预约演示

更新于:2025-05-07

Olympus Biotech Corp.

子公司|Japan

子公司|Japan

更新于:2025-05-07

概览

关联

1

项与 Olympus Biotech Corp. 相关的药物靶点 |

作用机制 FGFRs刺激剂 |

最高研发阶段批准上市 |

首次获批国家/地区 日本 |

首次获批日期2001-04-04 |

7

项与 Olympus Biotech Corp. 相关的临床试验NCT01217476

A Phase III, Double-Blind, Placebo Controlled, Parallel Group, International, Multicenter Study of 12 Weeks Treatment With Trafermin 0.01% Spray in Patients With Diabetic Foot Ulcer of Neuropathic Origin

Trafermin is a recombinant human basic fibroblast growth factor (bFGF; original development code, KCB-1), which is manufactured by genetic engineering using Escherichia coli by Kaken Pharmaceutical Co., Ltd. (Tokyo, Japan). Trafermin 0.01% cutaneous spray product kit consisting of a glass bottle containing lyophilized trafermin, a glass bottle with solvent for solution and a spray part to fit the glass bottle after reconstitution of the final product.

We conduct a multinational, randomized, double-blind, placebo controlled, parallel-group, multicentre study consisting of a placebo run-in phase (2w), a treatment phase (max. 12w) and a follow-up phase (3mo+6mo). The primary objective of the study is to demonstrate a superior wound closure rate of diabetic foot ulcers (DFUs) of neuropathic origin after a maximum of 12 weeks topical daily application of trafermin 0.01% spray compared with placebo, in addition to best local care (off-loading, dressings). Approximately 210 patients will be randomized and it is planned that this study will be conducted at approximately 40 investigational sites in Europe.

We conduct a multinational, randomized, double-blind, placebo controlled, parallel-group, multicentre study consisting of a placebo run-in phase (2w), a treatment phase (max. 12w) and a follow-up phase (3mo+6mo). The primary objective of the study is to demonstrate a superior wound closure rate of diabetic foot ulcers (DFUs) of neuropathic origin after a maximum of 12 weeks topical daily application of trafermin 0.01% spray compared with placebo, in addition to best local care (off-loading, dressings). Approximately 210 patients will be randomized and it is planned that this study will be conducted at approximately 40 investigational sites in Europe.

开始日期2010-12-01 |

申办/合作机构 |

NCT01217463

A Phase III, Double-Blind, Placebo Controlled, Parallel Group, International, Multicenter Study of 12 Weeks Treatment With Trafermin 0.01% Spray in Patients With Diabetic Foot Ulcer of Neuropathic Origin

Trafermin is a recombinant human basic fibroblast growth factor (bFGF; original development code, KCB-1), which is manufactured by genetic engineering using Escherichia coli by Kaken Pharmaceutical Co., Ltd. (Tokyo, Japan). Trafermin 0.01% cutaneous spray product kit consisting of a glass bottle containing lyophilized trafermin, a glass bottle with solvent for solution and a spray part to fit the glass bottle after reconstitution of the final product.

The investigators conduct a multinational, randomized, double-blind, placebo controlled, parallel-group, multicentre study consisting of a placebo run-in phase (2w), a treatment phase (max. 12w) and a follow-up phase (3mo+6mo). The primary objective of the study is to demonstrate a superior wound closure rate of diabetic foot ulcers (DFUs) of neuropathic origin after 12 weeks topical daily application of trafermin 0.01% spray compared with placebo, in addition to best local care (off-loading, dressings). Approximately 210 patients will be randomized and it is planned that this study will be conducted at approximately 30 investigational sites in an estimated 4 countries in Europe (Czech Republic,France,Hungary,Italy,).

The investigators conduct a multinational, randomized, double-blind, placebo controlled, parallel-group, multicentre study consisting of a placebo run-in phase (2w), a treatment phase (max. 12w) and a follow-up phase (3mo+6mo). The primary objective of the study is to demonstrate a superior wound closure rate of diabetic foot ulcers (DFUs) of neuropathic origin after 12 weeks topical daily application of trafermin 0.01% spray compared with placebo, in addition to best local care (off-loading, dressings). Approximately 210 patients will be randomized and it is planned that this study will be conducted at approximately 30 investigational sites in an estimated 4 countries in Europe (Czech Republic,France,Hungary,Italy,).

开始日期2010-11-01 |

申办/合作机构 |

NCT00678353

Prospective Data Collection From the Stryker Biotech Pivotal IDE Study of OP-1 Putty in Uninstrumented Posterolateral Fusions

This study is to provide additional data to support the safety and efficacy of OP-1 Putty as a replacement for autograft in patients undergoing posterolateral spinal fusion.

开始日期2007-05-01 |

申办/合作机构 |

100 项与 Olympus Biotech Corp. 相关的临床结果

登录后查看更多信息

0 项与 Olympus Biotech Corp. 相关的专利(医药)

登录后查看更多信息

1

项与 Olympus Biotech Corp. 相关的新闻(医药)2014-08-27

Novo Nordisk A/S Prefers To Grow On Its Own, Not Buy Others: CEO

var switchTo5x=true;

stLight.options({publisher: "0341611e-38a4-415d-9e18-75e093ff27e0", doNotHash: false, doNotCopy: false, hashAddressBar: false});

August 27, 2014

By

Mark Terry

, BioSpace.com Breaking News Staff

With the stock market rife with rumors and speculation about mergers and acquisitions in the biotech space,

Novo Nordisk A/S

Chief Executive Officer Lars Sorensen

recently

said

, “We have no plans whatsoever in buying anything larger than things that we can finance through our own cash flows.”

Novo Nordisk, headquartered in Denmark, has affiliates or offices in 75 countries and employees approximately 40,700 people worldwide. The company’s product areas are diabetes care, hemostasis management, growth hormone therapy, and hormone replacement therapy. In 2013, the company announced over $83 billion in net sales and a net profit of $25.2 billion.

In related news, Novo Nordisk recently

acquired

a manufacturing plant in West Lebanon, New Hampshire from

Olympus Biotech

. The company plans to use the facility to produce active pharmaceutical ingredients for its portfolio of drugs and medications. Some of the former employees of the plant have been offered jobs. The facility was originally established in 1989, then expanded between 2003 and 2006, when it was acquired by Olympus. Olympus used the plant mostly for mammalian cell manufacturing, which they phased out earlier this year.

Novo Nordisk markets generic insulin, patented insulin and insulin delivery system products. The company is working to launch a fourth-generation insulin treatment. Earlier this summer the company

announced

promising data from a new phase 3 study on Victoza® (liraglutide), a medication used to control diabetes and blood sugar. The study compared the drug with a placebo when added to pre-existing antidiabetic treatment, insulin or a combination, and potential effects on patients with moderate renal impairment. The study found the drug was effective and did not worsen renal function in adults with type 2 diabetes and moderate renal impairment.

Sorensen indicated that the market for insulin was large enough and growing quickly enough that the company did not need to grow through acquisitions. “We can still improve the insulins, perhaps another one or two generations. I’m not going to run out of innovation.” He also points out that major M&A activity can be very disruptive and distracting.

Sorensen also

spoke out

on so-called inversion deals, where U.S. companies acquire a

smaller company

in countries with lower corporate tax rates, then relocate their domicile to the company to avoid higher U.S. taxes. “I think it’s a little bit shortsighted because I’m convinced we will see

political action

in the U.S. against this, and I think some companies are feeling a little bit more wary about it now since it’s gotten a lot of public attention.”

并购临床3期临床结果

100 项与 Olympus Biotech Corp. 相关的药物交易

登录后查看更多信息

100 项与 Olympus Biotech Corp. 相关的转化医学

登录后查看更多信息

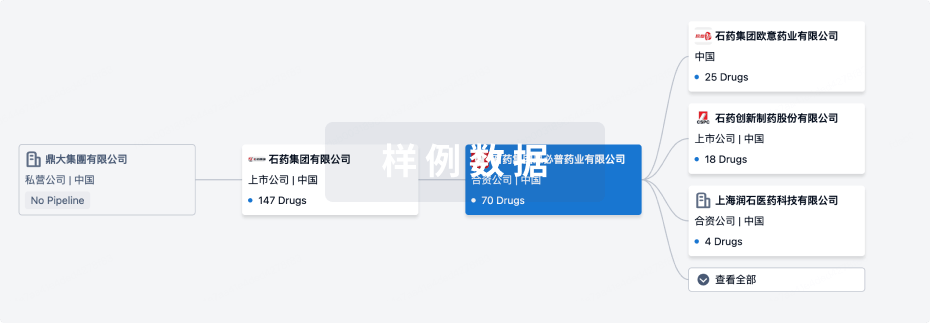

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年09月02日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

其他

1

登录后查看更多信息

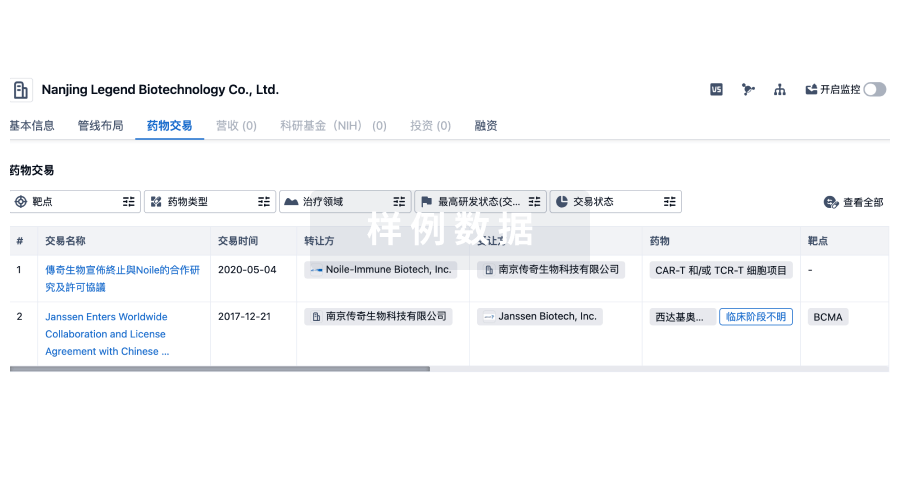

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

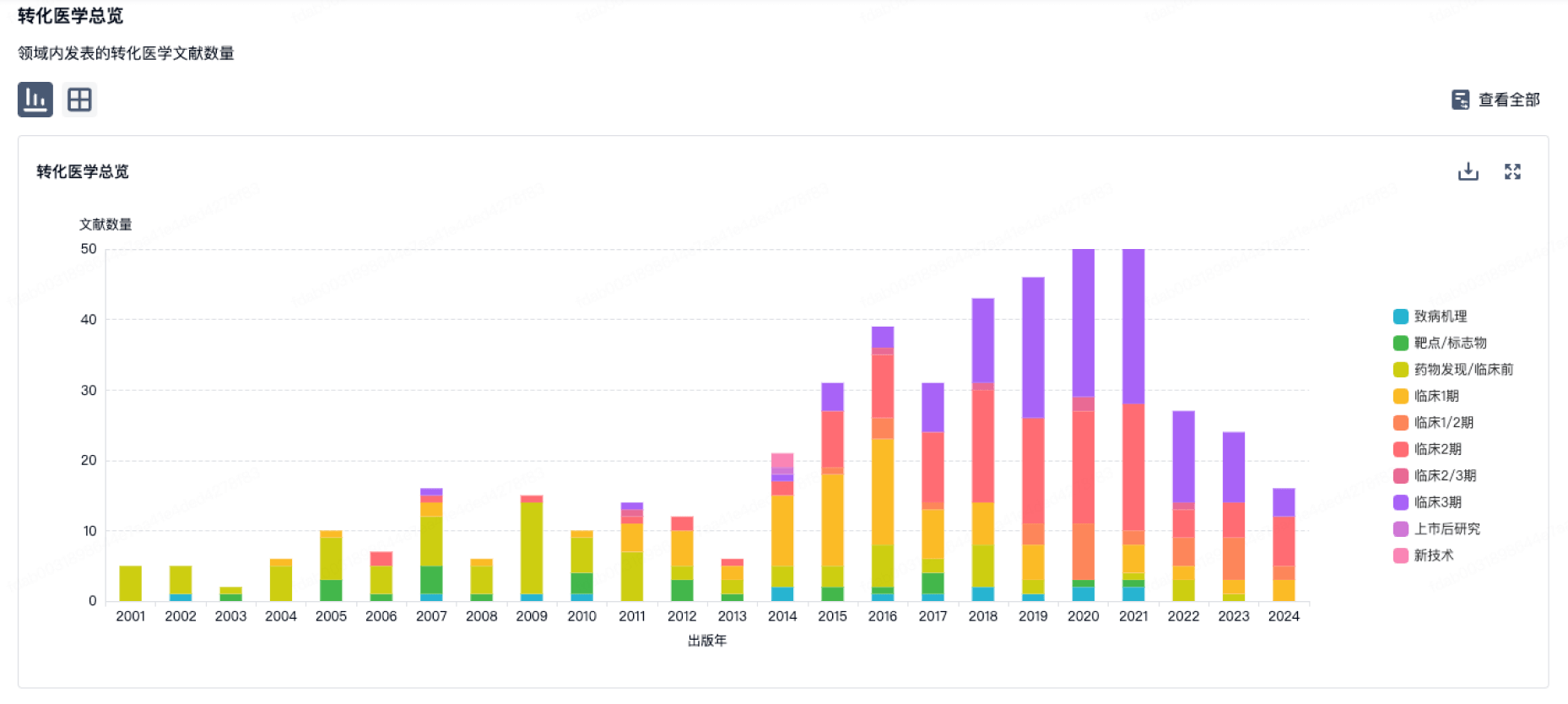

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

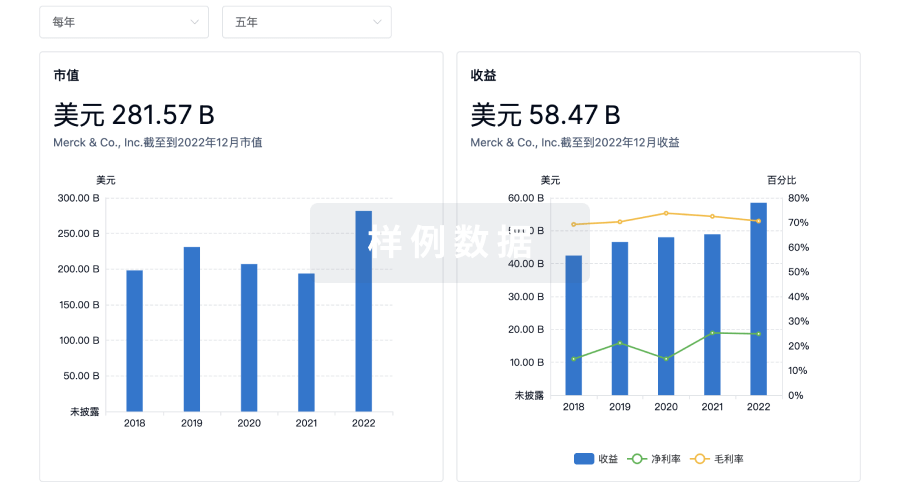

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

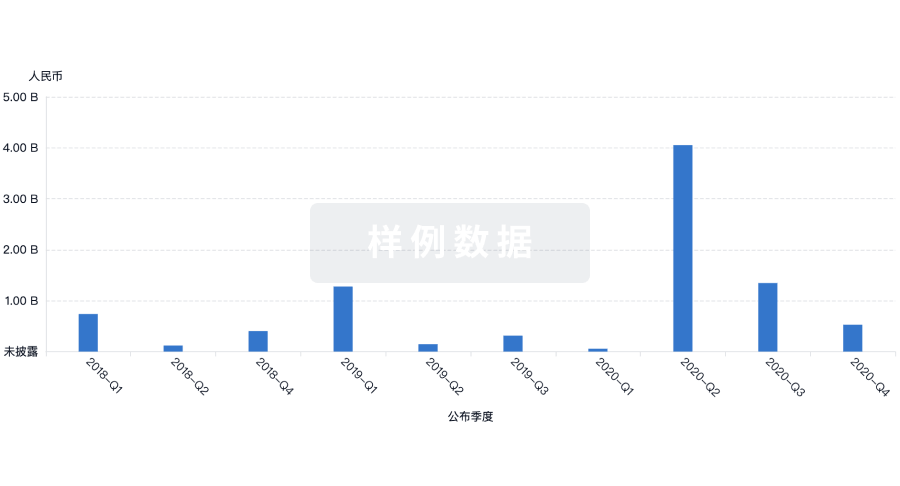

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

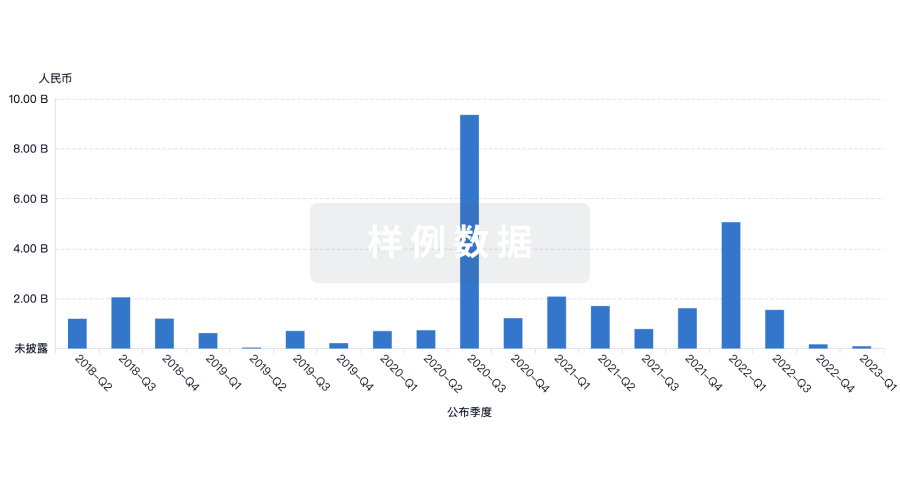

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用