预约演示

更新于:2025-08-29

Windward Bio AG

更新于:2025-08-29

概览

标签

呼吸系统疾病

免疫系统疾病

单克隆抗体

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 疾病领域 | 数量 |

|---|---|

| 免疫系统疾病 | 1 |

| 排名前五的药物类型 | 数量 |

|---|---|

| 单克隆抗体 | 1 |

| 排名前五的靶点 | 数量 |

|---|---|

| TSLP(胸腺基质淋巴细胞生成素) | 1 |

关联

1

项与 Windward Bio AG 相关的药物靶点 |

作用机制 TSLP抑制剂 |

在研机构 |

原研机构 |

非在研适应症- |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

1

项与 Windward Bio AG 相关的临床试验NCT07120503

A Phase 2 Randomized, Double-blind Placebo-Controlled Study to Evaluate the Pharmacokinetics, Immunogenicity, Safety and Efficacy of WIN378 in Adult Participants With Moderate or Severe Asthma

This study is trying to identify the right dose of a long-acting medicine called WIN378 for people with moderate or severe asthma. WIN378 blocks the action of a protein called TSLP which causes inflammation in the lung and may contribute to your asthma control and symptoms. The study will test how doses of WIN378 are handled by your body (pharmacokinetics) and assess the safety of the medicine and will assess markers of asthma inflammation in your breath and in your blood, lung function and asthma control (pharmacodynamics).

开始日期2025-07-24 |

申办/合作机构 |

100 项与 Windward Bio AG 相关的临床结果

登录后查看更多信息

0 项与 Windward Bio AG 相关的专利(医药)

登录后查看更多信息

84

项与 Windward Bio AG 相关的新闻(医药)2025-08-29

和铂医药

2025年上半年业绩表现强劲

和铂医药(股票代码:02142.HK),一家专注于免疫性疾病及肿瘤领域创新药研发的全球生物医药公司,今日公布其2025年中期业绩。

和铂医药2025年上半年的业绩报告是继2024年卓越表现后的又一份极其亮眼的成绩单,其财务表现强劲,总收入约7.25亿元人民币 (约1.013亿美元),盈利约5.23亿元人民币 (约7,300万美元),同比增长超50倍,展现出强劲的增长态势。

公司业绩增长的主要驱动力是基于创新产品的对外授权与战略合作,这已成为其常态化、持续性的收入来源。和铂医药的成功归功于其多元化的业务模式:“授权合作+战略合作+创新孵化” 的多元变现体系,将尖端高科技技术转化为巨额商业收入的模式,为中国生物医药行业树立了一个新标杆,也充分证明了深度技术创新本身就能创造巨大的、可持续的有形价值。

在当前的资本寒冬大环境下,和铂医药凭借其稳健的财务状况和强大的现金流储备,展现出稀缺的资本韧性,成为行业逆势中的亮点。2025 年上半年,公司实现盈利约 5.23 亿元人民币(约 7,300 万美元),同比增长约51倍,推动现金储备增至约 22.91 亿元人民币(约 3.2 亿美元)。充裕的资金实力不仅凸显了公司财务的稳健性,也为未来持续发展奠定了坚实基础。

此外,公司通过与多家大型制药企业(如阿斯利康、辉瑞、大塚制药等)的合作,持续获得里程碑付款和授权收入,进一步增强了其现金流稳定性。这种在资本寒冬中仍能保持稳健财务状况的能力,使和铂医药在Biotech公司中显得尤为突出。

2025年上半年

业绩亮点与创新赋能/合作战略

1、财务亮点:

截至2025年6月30日,和铂医药2025年上半年盈利暴增51倍至5.23亿元(约7,300万美元),总收入7.25亿元(约1.013亿美元),其业绩增长主要来自创新产品的对外授权与战略合作。

2、2025年上半年对外合作BD事件回顾:

和铂医药不愧是中国BD之王,仅2025年上半年,和铂医药就已完成四项国际化合作,获得丰厚的首付款或近期里程碑付款,如下表所示:

3、战略合作和创新布局:

2025年上半年,和铂医药连续完成三项关键创新战略合作/布局如下:

整体来看,在2025年上半年的这些创新项目合作与战略部署中,和铂医药正通过国际合作、人工智能(AI)赋能、创新孵化 三大路径,加速源头创新与新疗法开发。

1)多元化价值实现:通过授权(如HBMAT项目)快速获得资金回报,反哺研发。

2)技术驱动与融合:将自身抗体技术和平台优势与前沿的AI技术结合,提升研发效率和成功率。

3)深耕优势领域:持续聚焦肿瘤及免疫性疾病,并拓展至肥胖症、神经退行性疾病等重大疾病领域(如和铂医药孵化企业Élancé Therapeutics)。

4)“孵化—退出”的循环:成功孵化HBMAT并实现部分退出,验证了其孵化创新公司的能力,为未来持续创新提供了模式。

和铂医药核心管线和Harbour Mice®2.0平台价值

和铂医药旗下三大增长引擎Harbour Therapeutics、诺纳生物和全球创新平台出海协同发力。

Harbour Therapeutics专注于创新药物开发,靠差异化管线与全球药企、顶级院校织成合作网络,不断加速研发进展,把候选分子迅速推向临床。

而诺纳生物是和铂医药子公司,致力于前沿创新,并为合作伙伴提供涵盖靶点验证和多元化形态药物分子从发现至临床前研发等I to I™(Idea to IND)一体化服务。其核心技术平台 Harbour Mice® 已从 1.0 跃迁至 2.0,旨在构建一个更全面、更高效的创新药物研发体系。这一技术平台的升级不仅增强了和铂医药自身的研发能力,也为全球新药开发提供了新的可能性。

另外,公司已携手阿斯利康、大冢制药等跨国药企,共同推动创新平台的全球化输出,打造行业领先的“平台出海”新模式。

1.和铂医药核心管线梳理

和铂医药拥有丰富的、差异化的创新产品管线,主要聚焦于肿瘤免疫和自身免疫性疾病两大治疗领域。其中多款具备“全球首创”(First-In-Class)或“同类最佳”(Best-In-Class)潜力。和铂医药的核心管线包括多个在研项目,例如,

1)巴托利单抗(HBM9161,FcRn 单抗)是首个、且唯一一个在中国完成I、II、III期完整临床开发的针对FcRn靶点的抗体药;是首个、且唯一一个在中国gMG患者中获得突出的III期阳性结果的创新药。最新数据表明有望成为针对多种自身免疫性疾病的重磅疗法。其适应症为全身型重症肌无力(gMG)等自身免疫病,2024年6月 已递交中国上市申请,已与石药集团达成大中华区权益授权。

2)HBM9378是全球第二个全人源抗 TSLP 单抗,具备超长效特性,药效持续时间是同类竞品的 3 倍,潜在同类最佳。

2024年11月,公司向NMPA提交了HBM9378用于慢性阻塞性肺病(COPD)的IND申请,并于2025年1月获得批准。

与此同时,HBM9378已成功“出海”,公司与科伦博泰于2025年1月携手Windward Bio达成独家许可协议,授权其在全球范围内(不包含大中华区及部分东南亚、西亚国家)进行研究、开发、生产和商业化。2025年7月,Windward Bio启动了名为“POLARIS”的全球II期临床试验,旨在评估HBM9378在哮喘患者中的给药方案、安全性和有效性。预计初步数据将在2026年年中公布。

3)HBM4003 (Porustobart),一种新一代抗CTLA-4抗体,已在全球范围内启动针对晚期实体瘤的I期临床试验。临床前研究显示,它在具有强效抗肿瘤效果的同时,还能显著降低药物毒性。

4)HBM7020是一款BCMA×CD3双特异性抗体。2025年6月,和铂医药与大塚制药株式会社签订全球战略合作协议,大塚制药获得在全球范围内(不包括大中华区,即中国大陆、中国香港、中国澳门和中国台湾)开发、生产和商业化HBM7020的独家许可。

此外,和铂医药的管线还包括一系列基于其核心技术平台开发的创新项目,例如HBM7004(一款新型B7H4xCD3双特异性抗体)、R2006(CD19xCD3双抗)与 HBM7026(BCMAxCD19xCD3三抗)。总之,和铂医药的核心管线涵盖多个创新药项目,覆盖肿瘤免疫、自身免疫疾病等领域,具有较高的技术壁垒和商业化潜力。

2.诺纳生物Harbour Mice®2.0创新平台

Harbour Mice®平台的 HCAb全人源转基因小鼠平台目前处于全球同类技术领先水平,同时,该技术平台持续迭代升级,Harbour Mice®2.0版本不仅已应用于双抗/多抗、ADC、CAR-T和mRNA等新兴药物领域,还整合了AI技术,旨在加速药物创新。这充分体现了和铂医药在抗体药物研发领域的持续突破与创新能力,主要体现在以下几个方面:

1)HCAb全人源仅重链抗体开发平台作为复杂分子的“底层建筑”和“核心框架”,为后续技术平台的拓展提供了坚实基础。

2)基于HCAb平台,公司开发了HBICE®和HBICA™两大抗体平台,能够高效开发各类“抗体+”复杂分子,进一步推动了抗体药物的创新,加速差异化产品落地。

3)此外,一体化XDC平台为ADC、RDC及AOC等药物的研发提供了强有力的支持。

4)NonaCARFx™ 技术利用全人源单域VH抗体的紧凑结构,实现了低免疫原性,使得CAR的构建更加简单、高效,并能灵活应用于多种治疗场景。同时该项技术还获得了全球范围的知识产权保护。

5)同时,Hu-mAtrIx™ AI平台的引入,通过AI赋能分子发现、结构优化与临床转化,推动研发进入智能化、精准化的全新阶段,加速药物发现和开发进程。

Harbour Mice®2.0

和铂医药通过“诺纳生物”输出尖端技术,赋能Harbour Therapeutics及全球合作伙伴。同时,Harbour Therapeutics借助内部研发与外部合作,全力推进创新管线的开发。这种“技术平台 + 临床研发”双轮驱动的模式,共同构成了和铂医药强大的核心竞争力。

总结

和铂医药在2024年业绩的基础上,2025年上半年又表现出更加强劲的发展势头,这足以印证了和铂医药是一家以尖端技术与领先平台驱动、具备强大自我造血能力的生物制药公司。

和铂医药的发展模式已全面升级到“新基建”3.0时代,已不再局限于传统的技术授权模式或是业界熟知的产品授权(license out),而是逐步拓展其合作模式,涵盖技术授权、产品授权、创新孵化、NewCo,以及与MNC的长期深度战略合作等方面。此外,和铂医药也在加强临床管线拓展,从而实现产品价值、商业价值最大化,充分展现出其在全球创新生态中的前瞻布局与引领地位。

和铂医药“新基建”3.0

·

·

·

·

·

引进/卖出财报

2025-08-28

·氨基观察

氨基观察-创新药组原创出品

作者 | 武月

和铂医药最新的半年报远超预期。

上半年,公司营收达7.25 亿元,同比大幅增长327%;盈利约5.23亿元,这一数字较去年同期,更是增长51倍,再次创历史新高。

这一业绩爆点源于上半年公司持续的BD交易,先后与Windward Bio AG、阿斯利康、大塚制药等达成合作,首付款超2.6亿美元,潜在里程碑款超60亿美元。这再次充分验证了,其将创新能力转化为商业价值的可持续性。

得益于BD项目不断落地,公司经营性现金流再创新高,达到4.4亿元,自我造血能力愈发强劲;现金储备更是高达22.91亿元,较去年年底增长92%,为后续管线开发提供强力支持。

但若是将其增长叙事简单归因于BD交易,则是对这家企业最深的误读。

和铂医药已连续两年半实现盈利。从2023年扭亏为盈,到2024年净利润274万美元,再到今年上半年业绩继续爆发,其底层逻辑是技术平台价值释放的质变。

基于Harbour Mice®平台的高度延展和迭代,和铂医药已经实现高价值分子的“流水线生产”和BD常态化,通过多元化合作加速价值释放。与此同时,这份半年报还释放了一个新信号,处于“上升螺旋”加速通道中的和铂医药,正大步迈向3.0时代,让自己成为“抗体+”时代下,全球抗体药物研发无法绕开的合作方。

从技术输出到生态共建,从做大规模到做深价值,可以说,其正以全球抗体药物开发“新基建”的姿态,重新定义中国生物科技的全球化路径。

/ 01 /

基于实力的平台玩家

任何一家企业的成功都难以轻易复制。核心在于,每家企业成功,都是时代背景及自我能力的一个完美融合。

和铂医药正是如此。成立之初,其通过收购荷兰生物技术公司Harbour Antibodies,获得全球稀缺的抗体平台Harbour Mice®。

该平台不仅能生成经典的双重链双轻链(H2L2)抗体,更可独家生产仅重链抗体(HCAb)。由于不含轻链的这一特点,重链抗体最大限度的解决了轻链错配和异源二聚化的问题,使其能够开发出常规抗体平台难以实现的产品,是复杂分子构建的“底层框架”。

发生在2016年的收购,是一次不可复制的历史性机遇。而和铂医药真正的护城河在于技术平台的持续裂变与迭代。

在HCAb平台的基础上,其已形成了包括新一代免疫细胞衔接器双抗平台、一体化ADC技术平台、mRNA递送平台,以及基于CAR功能的HCAb文库筛选平台等在内的2.0版本核心技术平台体系。

其中,HBICE®是开发免疫细胞衔接器的利器,能克服当前TCE双抗研发存在的耐药性较高、依从性不足和组装效率不够等痛点。和铂医药自免TCE双抗HBM7020 (BCMA/CD3),正是基于HBICE®技术平台设计不对称结构并减少轻链错配,展现出良好的安全性与成药性,拥有BIC潜质,并与大塚制药达成近7亿美元的BD合作。

随着TCE热度的不断攀升,该平台有望持续为和铂医药贡献更多优质管线和BD交易。

对于当下的AI制药风口,和铂医药同样进行了深度布局。今年2月,其与英矽智能合作推进AI赋能抗体发现算法和应用开发,致力于为行业提供创新解决方案。

子公司诺纳生物推出了AI辅助药物发现引擎Hu-mAtrIx™,通过引入AI和自动化技术赋能的抗体发现创新模式,有望与Harbour Mice®平台形成AI算法与数据库的协同优势,进而大幅缩短抗体发现周期、提高效率及抗体药物开发的成功率。

不断迭代技术平台的同时,和铂医药还十分重视专利保护,已构建起覆盖全球核心市场的专利壁垒,尤其对Harbour Mice®平台相关的专利保护范围极大。根据2025年半年报,公司共申请专利570项,16项专利获得中国国家知识产权局授权,截至6月30日,尚有353项在受理进程中。这些专利申请会进一步加强其平台的知识产权保护。

显然,和铂医药已经形成了技术平台迭代与全面专利保护的双重壁垒,利用独有的技术平台,可以源源不断输出FIC/ BIC分子,并达成BD合作。2025年至今,其已经达成4次合作,公司成立至今则已达成46次合作,手握超100亿美元的里程碑付款,并且还有销售分成可贡献稳定的现金流。

更重要的是,基于前瞻的行业洞察及平台延展,公司得以快速进化到一个更高的阶段。

/ 02 /

从做大规模到做深价值

量变引起质变,眼下的和铂医药,正一步步探索技术平台价值的新天花板,从做大规模到做深价值。

进入3.0时代,和铂医药依然围绕技术平台进行价值变现,但其战略内核从技术授权升级为生态共建。这正是其上半年爆发性增长的深层逻辑。

随着抗体药物进入“双抗/多抗、ADC、细胞治疗”的抗体+时代,药企对高效抗体发现平台的需求呈指数级增长。而和铂医药正在让自己成为全球抗体药物开发的“新基建”,一方面,正如前文所说,其技术平台拥有非常完整的知识产权保护。

在目前全球有3个获认可的全人源仅重链抗体平台中,HCAb平台为其中唯一对外可及的抗体开发平台,掌握了源头创新的话语权。

另一方面,其技术平台不仅经过充分验证,生态版图更是不断扩张,加之高效的运营体系,让其能够很好地承接市场需求。

正如前文所说,其技术平台已渗透至ADC、细胞基因治疗、mRNA等机制,并从肿瘤拓圈至自免、代谢、神经等疾病领域。这意味着,其能为合作伙伴提供更全面的选择;同时,其基于动态的技术迭代,使公司始终走在行业前沿,不断推出新颖的、具有差异化优势的分子,满足合作伙伴对创新药物分子的需求。

典型如今年3月份,和铂医药成立Élancé Therapeutics,借用其双抗技术平台,推进针对肥胖症的新一代疗法研发。尽管GLP-1已足够内卷,但双靶点、减重质量(如减脂增肌)的竞争仍处于起步阶段,且全球药企的BD需求旺盛。一旦研发顺利,后续价值兑现不可小觑。

在这个过程中,随着合作生态圈不断扩大,和铂医药也来到3.0时代,从技术输出到生态共建,持续创造高价值。

新时代的BD模式已经在不断进化。比如其与Windward Bio AG的合作,首付款、里程碑款及商业分成之外,还能拿到Windward Bio母公司股权,进而享有合作方估值增值的收益,对应更高的价值。

更典型的则是其今年与阿斯利康的合作,不仅规模足够大,周期更是最长可达十年;阿斯利康还出资1亿美元入股和铂医药,未来双方还将在北京共建创新中心。随着合作越来越深度,战略价值自然越来越高。

显然,和铂医药正通过自身平台的广泛应用,加速成为全球抗体药物研发的基础设施。与此同时,其也借助平台优势,推动自研管线进入复杂分子和创新疗法时代。

如下图所示,短短几年间,和铂医药管线布局的深度与广度已大幅提升。数量方面,由5年前的5款产品增至目前的20多款,其适应症也已覆盖实体瘤、血液瘤、自免、代谢等疾病。

更重要的是,从单抗到双抗、多抗,到ADC及更多高价值前沿领域,和铂医药都在全力进攻;其靶点布局同样足够前瞻、差异化。典型如ADC布局,首发管线为MSLN ADC,该靶点尚未成药、潜力巨大,和铂医药通过技术创新,实现了高DAR值,且“旁观者效应”更强,在临床前研究中展现出BIC潜力,并与辉瑞达成超11亿美元的合作。

当“技术赋能管线、管线反哺平台”的闭环达成,其正在加速进阶。这正是平台型企业,尤其和铂医药这类平台获验证企业的独特魅力。

/ 03 /

务实主义的胜利

再生元、Genmab等药企的成功,让市场见识到了平台型药企的魅力,无数资金涌入这一赛道。据麦肯锡公布的数据,2019年到2021年,风投机构在全球范围内向以治疗为基础的生物技术公司投资了超过520亿美元,其中三分之二流向了拥有平台技术的初创企业。

然而,当潮水退去,真正跑出来的biotech,并没有那么多,甚至多数企业仍面临着生存的严峻考验。这是因为,平台很重要,但企业不能只有平台,还必须证明自身拥有将平台进行商业转化的能力。也就是,技术优势需匹配商业模式的灵活性。

和铂医药的连续盈利、爆发增长及百亿美元业绩蓄水池,既源于其建立的全球领先抗体技术平台,也离不开其对于多元化商业模式的持续探索。

2022年,行业陷入下行周期,和铂医药前瞻性启动战略转型,通过技术平台迭代,自主研发、对外BD两手抓,并成立全资子公司诺纳生物,面向全球开放合作,加速技术平台的价值释放。

2023年的首次盈利,意味着其独特商业模型——“自主研发+对外BD创收+提供I to I的一站式解決方案”,得到初步验证。随后的持续盈利,则意味着公司进入一个新的发展周期,技术平台能够转换成商业价值,促进公司发展逻辑的正向循环:

稳健的造血能力为研发投入提供支撑,技术突破推动新管线与合作拓展,进而带来更强的现金流,再反哺更大规模的研发投入与领域拓展。

眼下3.0正式启航,这种以技术平台为根基,多元化价值转化的发展路径,也为其持续做深价值,提供了充足的底气与保障。

因为,和铂医药不仅账上现金充沛、自我造血能力不断加强,技术迭代与生态进化更是驱动着新一轮价值提速。其正在成为全球抗体药物创新的核心基础设施,与更多合作伙伴,尤其与大药企的深度绑定中,构建抗周期合作网络,放大技术平台价值。

这一逻辑下,和铂医药能够在不同疾病领域、不同研发阶段获取收益,从而使创收能力更强且更稳定,飞轮加速转动。

技术平台与高效创新是基石,基于不断变化的市场环境,做出更理性、更务实的战略选择,成就了今日的和铂医药。这也将成为其日后穿越周期、持续向上的核心。

毕竟,任何一家实现跨越式发展的创新药企,看似偶然的背后有其必然,眼光、勇气、创新与务实主义缺一不可。

PS:欢迎扫描下方二维码,添加氨基君微信号交流。

并购抗体药物偶联物财报信使RNA免疫疗法

2025-08-27

·和铂医药

2025年中期业绩

和铂医药(股票代码:02142.HK),一家专注于免疫性疾病及肿瘤领域创新药研发的全球生物医药公司,今日公布其2025年中期业绩。

王劲松博士

和铂医药创始人

董事长兼首席执行官

2025年上半年,和铂医药实现了多项重大里程碑进展。报告期内,公司盈利同比增长超50倍,展现出强劲的增长态势。其中,基于创新产品的对外授权与合作,为公司的收入增长做出了重要贡献,并逐步成为公司的常态化收入来源。这充分验证了公司将创新能力转化为商业价值的可持续性,同时也体现了我们涵盖战略合作、授权合作、平台合作、创新孵化等多元化业务模式的成功实践。

依托行业领先的Harbour Mice®技术平台及由其延展的2.0版本技术平台体系,和铂医药已建立了强大的全球合作生态,成为全球抗体药物开发的‘新基建’。未来,和铂医药将持续深化源头创新,加速助力新一代生物疗法研发,为全球患者带来更优质的治疗方案。

2025年中期业绩亮点

截至2025年6月30日,和铂医药上半年总收入约7.25亿元人民币(约1.01亿美元),同比增长327%;盈利约5.23亿元人民币(约7300万美元),同比增长51倍;现金储备充盈,约合22.91亿元人民币(约3.2亿美元),较去年年底增长92%。

报告期内公司业绩强劲发展,充分彰显了其商业模式的成功性以及稳健的财务发展状况。

丰富的产品组合及差异化管线

Harbour Therapeutics是与诺纳生物并行的子品牌,致力于推进免疫和肿瘤领域创新抗体疗法的开发。Harbour Therapeutics拥有丰富且差异化的产品管线,通过持续拓展与全球领先药企及学术机构的业务合作,高效推进管线进展。

报告期内,多款临床阶段的关键项目取得重要进展,另有众多下一代创新产品管线正在持续推进中。

临床阶段主要候选产品进展:

巴托利单抗(HBM9161)是首个在中国完成临床一期至关键性临床试验的抗FcRn单克隆抗体,有望成为针对多种自身免疫性疾病的重磅疗法。公司于2023年12月自愿纳入更多长期安全性数据,于2024年6月向中国国家药品监督管理局(NMPA)重新递交巴托利单抗治疗全身型重症肌无力(gMG)的生物制品许可申请(BLA)并在7月获NMPA受理。2024年3月,巴托利单抗治疗全身型重症肌无力的III期关键性临床试验结果在《美国医学会杂志:神经病学》(JAMA Neurology)上发表,数据显示其在疾病长期管理中具有持续的疗效和良好的安全性特征。

HBM9378是一款源自H2L2 Harbour Mice®平台,靶向胸腺基质淋巴细胞生成素(TSLP)的全人源单克隆抗体,该款抗体通过结合TSLP配体,阻断TSLP与TSLP受体的相互作用,从而抑制TSLP介导的信号通路。TSLP是一种经过充分验证的细胞因子,在哮喘、慢性阻塞性肺疾病(COPD)等多种免疫性疾病的发生和发展中起关键作用,针对该靶点的抑制已在多种炎症表型中表现出治疗获益。HBM9378经过工程化改造实现了半衰期延长与效应功能沉默,采用皮下途径给药。

公司于2022年2月获得NMPA对HBM9378治疗中重度哮喘的IND批准,随后在中国完成对健康受试者的I期临床试验。此外,公司于2024年11月向NMPA递交HBM9378针对COPD的IND申请,并于2025年1月获得批准。

公司与科伦博泰于2025年1月与Windward Bio签订许可协议,授予对方在全球范围内(不包括大中华区以及部分东南亚及西亚国家)进行研究、开发、生产和商业化HBM9378的独家权益。2025年7月,Windward Bio宣布启动全球II期POLARIS临床试验,旨在评估HBM9378/WIN378在哮喘患者中的给药方案、安全性及有效性。初步数据预计将于2026年年中公布。

普鲁苏拜单抗(HBM4003)是开发自HCAb Harbour Mice®平台的新一代全人源仅重链抗CTLA-4抗体,是全球首个进入临床阶段的全人源仅重链抗体。相较于传统的抗CTLA-4抗体,普鲁苏拜单抗具有显著增加的Treg细胞清除和优化的药代动力学等独特及良好的特性,有助于提高安全性。此外,通过增强抗体依赖的细胞毒性(ADCC),普鲁苏拜单抗提升了选择性清除瘤内Treg细胞的潜力,有望克服现有CTLA-4疗法的疗效和毒性瓶颈。公司已开展普鲁苏拜单抗治疗多种实体瘤的全球开发计划,并采用了普鲁苏拜单抗的适应性治疗设计。在针对晚期实体瘤的单药治疗以及联合PD-1抑制剂治疗黑色素瘤、结直肠癌、神经内分泌癌及肝细胞癌的临床试验中,均观察到了积极的疗效及安全性数据。HBM4003联合特瑞普利单抗治疗晚期肝细胞癌的最终数据已于2025年8月发表于《临床癌症研究》(Clinical Cancer Research)。HBM4003联合替雷利珠单抗治疗微卫星稳定型(MSS)转移性结直肠癌的临床II期数据将在2025年ESMO年会上公布。

HBM1020是一款基于H2L2 Harbour Mice®平台开发的靶向B7H7的全球首创全人源单克隆抗体。B7H7是一种新型免疫调节分子,属于B7家族,能独立于PD-L1表达从而在肿瘤免疫逃逸方面发挥关键作用。凭借其出色的产品设计和靶点特征,HBM1020有望解决实体瘤治疗领域尚未满足的巨大医疗需求。2024年9月,公司于ESMO年会上公布HBM1020针对晚期实体瘤患者的最新临床数据,数据显示HBM1020在晚期实体瘤患者中具有良好的安全性和耐受性。在接受治疗后肿瘤评估的15例患者中,7例患者(46.7%)达到疾病稳定(SD),其中2例患者观察到肿瘤缩小,缩小比例分别为11%和25%。

下一代创新产品管线的主要候选产品包括:

HBM7004是一款新型B7H4xCD3双特异性抗体,开发自HBICE®和Harbour Mice®平台,从疗效和安全性两个维度为癌症免疫治疗提供创新的解决方案。该产品的开发彰显了HBICE®平台的灵活适用性和即插即用优势。在临床前研究中,HBM7004呈现出肿瘤内B7H4依赖性T细胞激活机制。在多种动物模型实验中,HBM7004表现出强劲的抗肿瘤效果、出色的体内稳定性以及较低的全身毒性。此外,在临床前模型中,HBM7004与B7H4x4-1BB双抗在低效应细胞与靶细胞比率条件下联用具有很强的协同作用,显示出令人振奋的治疗窗口。目前,公司正在持续推进HBM7004的临床前研究工作,并将其推进至接近IND阶段。

HBM7020是一款利用全人源HBICE®双抗技术及Harbour Mice®平台开发的BCMAxCD3双特异性抗体。HBM7020能够通过靶向细胞表面的BCMA和CD3,将目标细胞与T细胞交联,从而有效激活T细胞并杀伤目标细胞。HBM7020通过设计两个抗BCMA结合位点,实现了对目标细胞的精准靶向,而单价优化的CD3活性则有效降低了细胞因子释放综合征(CRS)的发生风险。基于这些创新机制,HBM7020展现出强大的细胞杀伤效应,在免疫学和肿瘤领域均具有广阔的应用前景。2023年8月,HBM7020获批在中国启动针对癌症的I期临床试验。 2024年,公司调整了开发策略,将适应症转向免疫性疾病领域。2025年6月,和铂医药与大塚制药株式会社签订全球战略合作协议,根据协议,大塚制药获得在全球范围内(不包括大中华区,即中国大陆、中国香港、中国澳门和中国台湾)开发、生产和商业化HBM7020的独家许可。

R2006(CD19xCD3双抗)与HBM7026(BCMAxCD19xCD3三抗)是处于临床前研究阶段的两款T细胞衔接器(TCE)。TCE已成为自身免疫性疾病的重要疗法,已有研究表明,通过B细胞耗竭机制实现免疫系统再平衡是治疗多种自身免疫疾病的重要策略之一。TCE能深度清除外周血、淋巴结及骨髓中的B细胞,从而重启免疫系统。新生的B细胞将呈现初始态且无致病性,因此该策略有望减轻炎症或自身免疫反应。CD19是前体B细胞与成熟B细胞表面均有表达的特异性标志物之一,BCMA则在成熟B细胞和浆细胞上高表达。借助全人源HCAb技术及优化的抗CD3抗体,和铂医药正在开发安全性更高、免疫原性和细胞因子风暴风险更低的TCE分子。

2025年3月,和铂医药宣布成立Élancé Therapeutics(以下简称“Élancé”),借助公司专有的基于HCAb的双特异性抗体技术开发代谢疾病创新疗法,以解决当前肥胖症治疗中包括肌肉保护和长期疗效在内等关键挑战。Élancé的代谢疾病产品管线包括多个临床前双抗项目,通过整合具有更高安全性的双靶点作用机制,这些创新疗法有望与现有治疗方案(如GLP-1受体激动剂、GIP受体激动剂和GCG受体激动剂)相互协同,拓展肥胖症治疗边界。

和铂医药正在借助全人源抗体平台及HCAb平台,开发针对中枢神经系统疾病的新一代生物疗法,包括双特异性抗体及其他“抗体+”复合疗法。目前,该领域产品管线处于开发阶段。我们的目标是通过构建更为复杂的分子结构,攻克包括神经退行性疾病和神经炎症在内的中枢神经系统疾病治疗挑战。

多元化合作充分挖掘平台潜力

和铂医药始终致力于全球合作。2025年3月,和铂医药与阿斯利康达成全球战略合作。双方将共同研发针对免疫性疾病、肿瘤及其他多种疾病的新一代多特异性抗体疗法。此次战略合作内容涵盖基于和铂医药专有的Harbour Mice®全人源抗体技术平台在多治疗领域的多项目授权许可协议。此外,阿斯利康以1.05亿美元股权投资认购和铂医药9.15%新发行股份。和铂医药还将在中国北京与阿斯利康共建创新中心。

报告期内,和铂医药还与全球合作伙伴达成多项授权交易合作。2025年1月,公司和科伦博泰就合作开发的HBM9378/SKB378(现又称WIN378)与Windward Bio签订许可协议,授予其在全球范围内(不包括大中华区以及部分东南亚及西亚国家)进行研究、开发、生产和商业化HBM9378/SKB378的独家授权。2025年6月,和铂医药与大塚制药株式会社签订全球战略合作协议,推进用于治疗自身免疫性疾病的BCMAxCD3双特异性T细胞衔接器HBM7020的开发。

2025年2月,和铂医药宣布与由生成式人工智能(AI)驱动的临床阶段生物技术公司英矽智能达成战略合作,利用各自在抗体发现与人工智能领域的技术优势,加速新型治疗性抗体的研发进程。

依托技术优势,公司通过诺纳生物高效赋能行业创新者,为合作伙伴提供从发现至临床前研发等Idea to IND(I to ITM)一体化服务。作为一家全球生物技术公司,诺纳生物已在抗体发现、蛋白质工程、抗体偶联技术、HCAb-CAR筛选及药物递送技术等领域建立了创新平台,全面赋能包括科研院所、生物技术公司及跨国药企在内的全球合作伙伴的新一代疗法研发。

2024年12月,诺纳生物与Kodiak Sciences(纳斯达克股票代码:KOD)签订合作协议,借助专有的Harbour Mice®全人源抗体技术平台,推进治疗眼科疾病的多靶点新型抗体疗法的研发。同月,与Candid Therapeutics签订研究合作与授权协议,开发新一代T细胞衔接器。2025年上半年,诺纳生物先后Invetx、阿拉巴马大学伯明翰分校、Atossa Therapeutics、Visterra等机构达成合作,充分挖掘专有技术平台优势,助力合作伙伴生物疗法管线研发及相关领域的科研工作。

此外,诺纳生物持续拓展技术平台能力边界,于2025年3月推出创新的AI辅助药物发现引擎——Hu-mAtrIxTM。这一由先进人工智能技术驱动的全新平台,与公司专有的Harbour Mice®技术平台实现无缝集成,旨在加速包括神经退行性疾病、代谢性疾病在内的多个关键治疗领域的抗体发现。

这些合作案例进一步凸显了公司在拓展技术边界与探索创新路径方面的独特优势。凭借行业领先的技术平台和灵活的商业模式,公司将持续拓展平台实力,拓宽合作网络,最大化挖掘平台价值。

面向未来的突破性疗法孵化

和铂医药持续探索技术平台的更多应用场景,以充分释放其潜力。目前公司正在孵化多个合资项目,聚焦多价抗体、细胞治疗等新一代创新疗法领域,旨在通过拓展技术平台的应用范围,为公司创造更多价值。这种创新的孵化模式能够整合外部资源,以最小的边际投入获得高价值增长回报,助力公司实现新一代创新技术的多元化布局。

2024年11月和2025年7月,和铂医药孵化公司恩凯赛药宣布先后完成A++轮及A+++轮融资,持续推进产品管线开发与临床进程。

2025年2月,和铂医药与美国哈佛医学院附属波士顿儿童医院的合资企业HBM Alpha Therapeutics宣布与一家业务合作伙伴达成战略合作与许可协议。

2025年3月,和铂医药宣布成立Élancé Therapeutics,旨在借助公司专有的基于HCAb的双特异性抗体技术开发针对肥胖症的创新疗法,以解决当前肥胖症治疗中包括肌肉保护和长期疗效在内等关键挑战。此外,Élancé将改进和扩展诺纳生物的Hu-mAtrIxTM AI平台,以支持其双特异性抗体的发现。AI技术将用于指导抗体发现、富集、优化、双抗几何结构设计、可开发性/免疫原性/药代动力学评估,以及患者生物标志物研究。

未来展望:创新赋能合作

和铂医药在2025年上半年所取得的成绩和增长势头,让我们对未来充满信心。公司能够成功应对复杂的市场环境,在不远的未来为免疫性疾病及癌症患者提供创新的治疗药物。

自成立以来,和铂医药始终致力于为全球患者研发创新疗法,逐步成长为具有核心技术优势与差异化产品管线的创新生物制药公司。2024年,公司已顺利完成HBM9161的BLA递交。未来,公司将进一步加速推进针对新靶点或已知靶点的创新产品管线,包括HBM4003、HBM9378、HBM1020等产品在内的多项临床试验。此外,公司还将进一步将平台能力边界拓展至免疫及炎症领域,依托Harbour Mice®和HBICE®两大高效药物发现引擎,持续挖掘新的优质候选分子。

自2022年成立以来,诺纳生物的抗体发现平台与灵活合作模式的价值,已在过往合作中得到了充分验证。以诺纳生物的成立为基础,和铂医药持续加强与全球合作伙伴的沟通,为科研院校、生物技术初创公司及跨国制药企业提供一站式解决方案,通过商业合作最大化挖掘平台价值。未来,公司将持续推进全球化发展进程,随着临床前产品的日益成熟,我们期待在2025年迎来更多全球合作机遇。

基于此,和铂医药将进一步优化内部资源配置,聚焦内部平台自研产品开发,并持续拓展诺纳生物的合作网络,为公司的长期持续发展注入新动能。

关于和铂医药

和铂医药(股票代码:02142.HK)是一家专注于免疫性疾病及肿瘤领域创新药研发的全球生物制药企业。公司通过自主研发、联合开发及多元化的国际合作模式快速拓展创新药研发管线。

和铂医药专有的抗体技术平台Harbour Mice®能够生成双重、双轻链(H2L2)和仅重链(HCAb)形式的全人源单克隆抗体。基于HCAb抗体平台开发的免疫细胞衔接器(HBICE®)能够实现传统药物联合疗法无法达到的抗肿瘤疗效。同时,基于HCAb平台开发的双特异性免疫细胞拮抗剂(HBICATM)为免疫及炎症性疾病领域创新生物药的研发提供了有力支持。Harbour Mice®、HBICE®、HBICATM与单B细胞克隆筛选平台共同组成了和铂的下一代创新治疗性抗体研发引擎。

更多信息,请访问:

www.harbourbiomed.com

财报临床3期临床1期临床2期申请上市

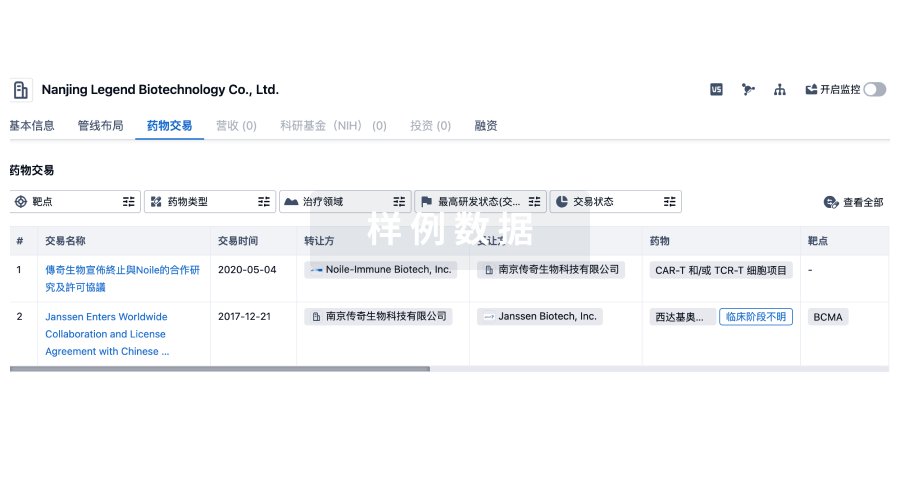

100 项与 Windward Bio AG 相关的药物交易

登录后查看更多信息

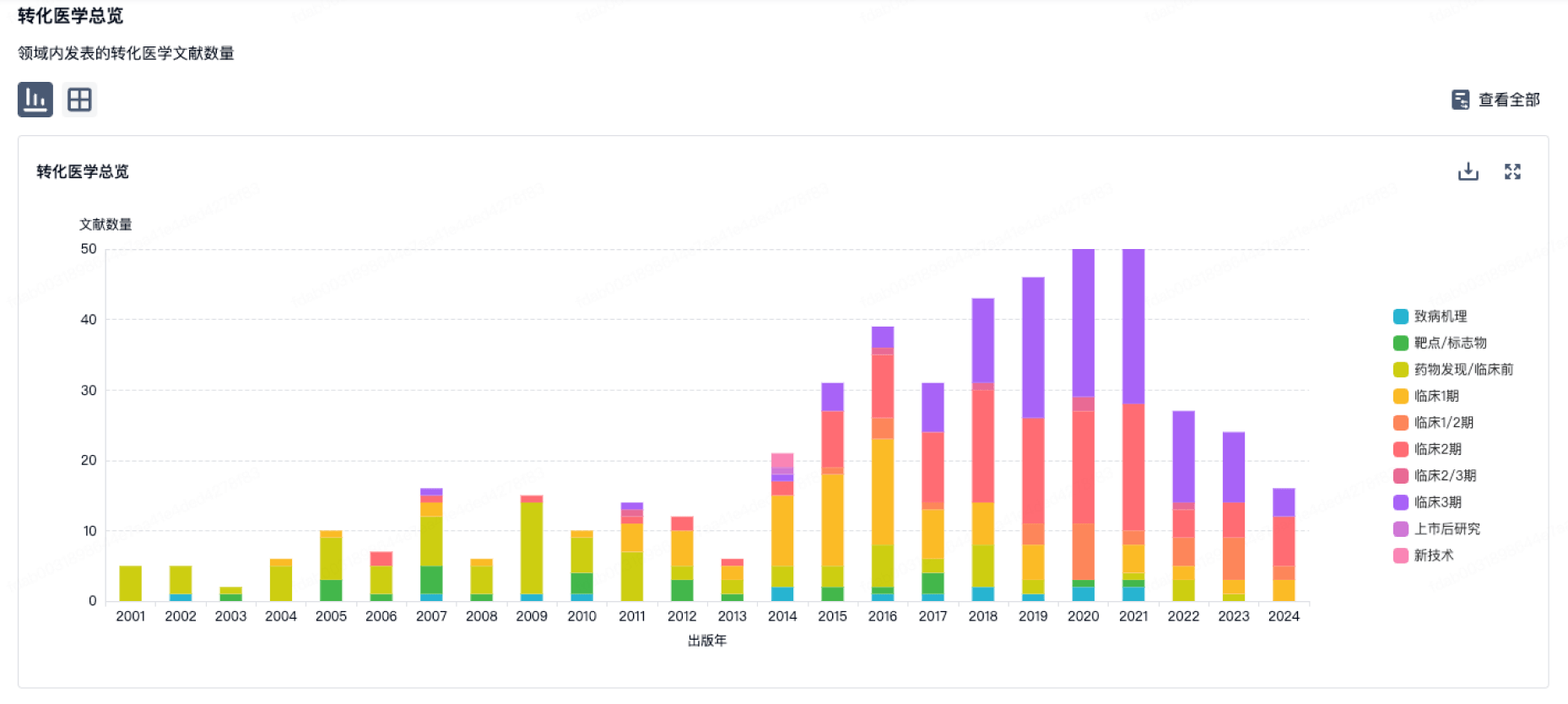

100 项与 Windward Bio AG 相关的转化医学

登录后查看更多信息

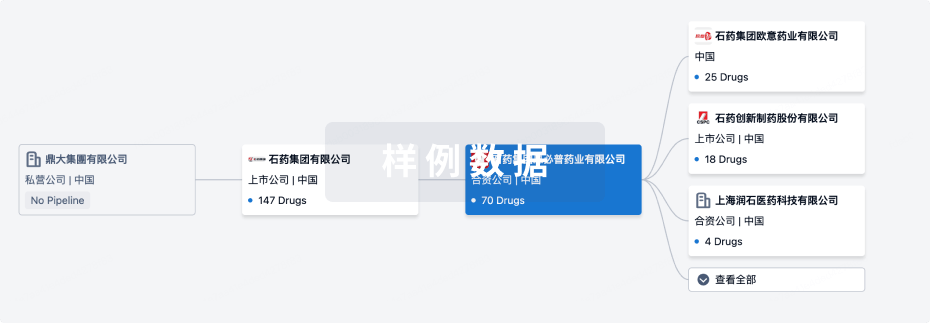

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年09月05日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床2期

1

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

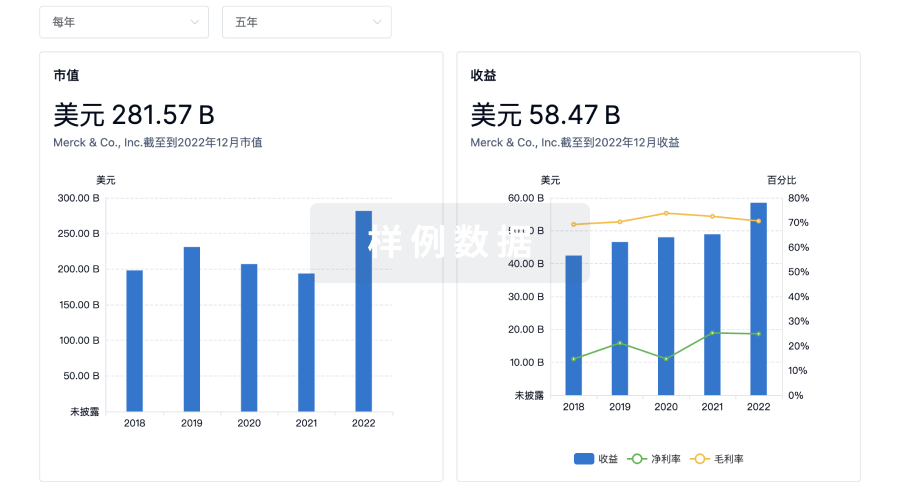

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

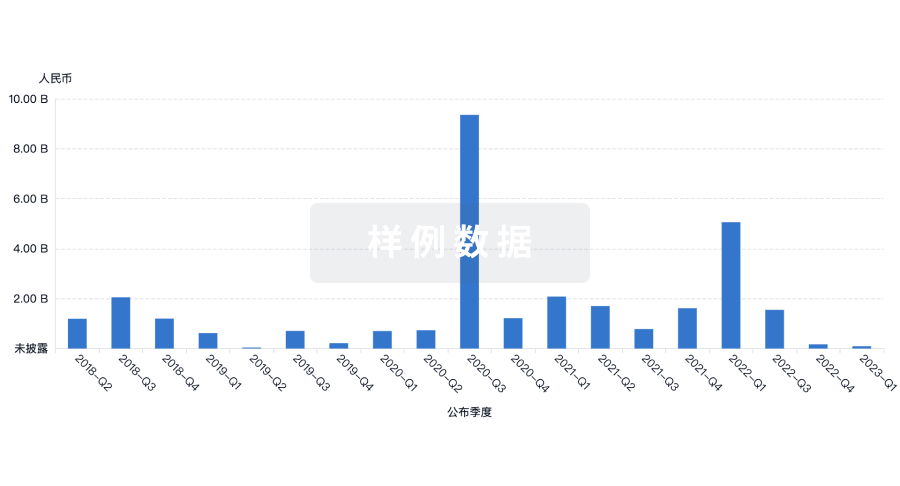

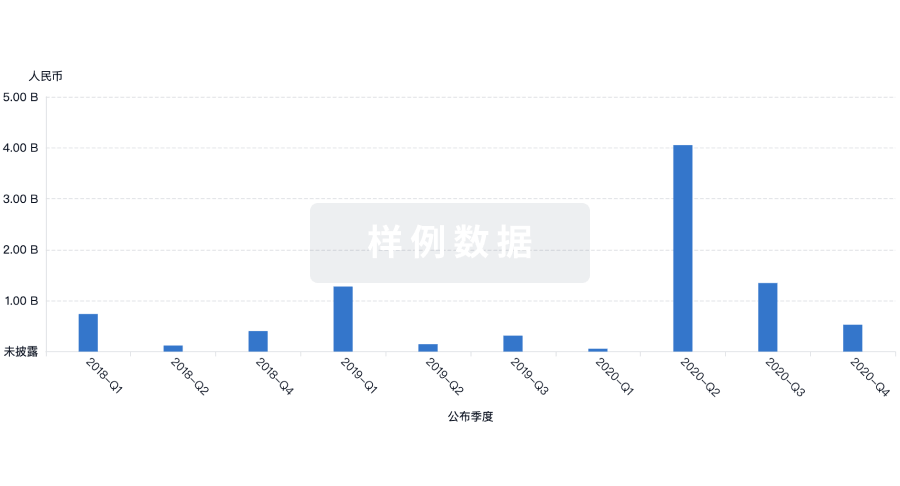

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用