预约演示

更新于:2025-05-07

PepGen Ltd.

更新于:2025-05-07

概览

关联

1

项与 PepGen Ltd. 相关的药物靶点 |

作用机制 IFNAR激动剂 [+1] |

在研机构- |

原研机构 |

在研适应症- |

最高研发阶段终止 |

首次获批国家/地区- |

首次获批日期- |

1

项与 PepGen Ltd. 相关的临床试验ACTRN12606000241538

Phase II Multi-centre, Double-Blind, Randomized, Placebo-Controlled Safety and Efficacy Study of Oral Recombinant Ovine Interferon-Tau (IFN-tau) Administered Daily in Patients with Relapsing-Remitting Multiple Sclerosis

开始日期2006-07-01 |

申办/合作机构 |

100 项与 PepGen Ltd. 相关的临床结果

登录后查看更多信息

0 项与 PepGen Ltd. 相关的专利(医药)

登录后查看更多信息

1

项与 PepGen Ltd. 相关的文献(医药)2023-12-31·Journal of Plant Interactions

Phytochemical evaluation of the fruits and green biomass of determinate-type sweet pepper (

Capsicum annuum

L. fasciculatum) grown in terrestrial bioregenerative life-support research facilities

作者: Kovács, Szilvia ; Alshaal, Tarek ; Fári, Miklós Gábor ; Domokos-Szabolcsy, Éva ; Jókai, Zsuzsa ; Csilléry, Gábor ; Koroknai, Judit ; Makleit, Péter ; Veres, Szilvia ; Matkovits, Anna ; Tóth, Csaba

63

项与 PepGen Ltd. 相关的新闻(医药)2025-02-24

A PepGen drug in development for myotonic dystrophy type 1 (DM1) has encouraging early human data that suggest it could be a better treatment than other medicines in clinical testing for this rare, inherited neuromuscular disorder that currently has no FDA-approved therapies.

PepGen said its drug candidate, PGN-EDODM1, led to a dose-dependent increase in splicing correction, which is the fixing of errors in a gene sequence. In the four evaluable patients who received a single 10 mg intravenous infusion, the higher of the two doses tested so far, the results released Monday show the average splicing correction was 29.1% measured at 28 days. Boston-based PepGen expects these results will get even better.

“Mis-splicing is the known cause of DM1, and we believe that with repeat and higher dosing, PGN-EDODM1 has the potential to produce greater splicing correction levels, which could lead to improved functional outcomes for patients,” the company said in an investor presentation.

presented by

Artificial Intelligence

What Keeps Healthcare CIOs Up at Night: Balancing Technology Investments with Consumer Expectations

When it comes to managing inbound phone calls, underperformance has devastating cost implications.

By Stephanie Baum

DM1 leads to progressive weakening of muscles. This disease stems from a mutation to the DMPK gene that results in toxic RNA. Antisense oligonucleotides (ASOs) offer one approach to treating genetic diseases. While ASOs can be used to degrade RNA that drives a disease, PepGgen is developing drugs that block it. These drugs are made with Enhanced Delivery Oligonucleotide (EDO), PepGen’s technology for engineering peptides to deliver ASO cargos to destinations in the body.

The Phase 1 single-ascending dose study is designed to enroll up to 32 adults with DM1. The study is starting with 5 mg per kilogram of patient weight and 10 mg/kg doses, escalating to 15 mg/kg and potentially 20 mg/kg if safety data support higher dosing. Patients receive muscle biopsies at baseline, day 28, and week 16. Functional outcome measures at day 28 include a 10 meter walk/run test measure and assessment of myotonia, or muscle stiffness. The company said the early results show positive early trends in these functional measures.

Leerink Partners analyst Joseph Schwartz said in a research note that the Pepgen DM1 data so far are competitive with ASO degrading therapies in development by Avidity Biosciences and Dyne Therapeutics. For context, Avidity’s del-desiran showed 3% splicing correction after a single 1 mg dose while Dyne’s DYNE-101 showed 13% splicing correction at the lowest dose measured at three months. Pepgen’s preliminary results also top the 25% splicing correction mark achieved by the Dyne therapy’s highest dose, which is the dose continuing through Phase 1/2 development.

While the early signs of efficacy are encouraging, safety was a major concern in light of the December clinical hold placed on PepGen’s plans to advance a Duchenne muscular dystrophy therapy to Phase 2 testing. Pepgen said the DM1 drug continues to show a favorable safety profile. As of a Dec. 3 data cutoff, the company said there were no adverse events related to electrolytes or renal biomarkers, which were concerns for the Duchenne study.

presented by

Health IT

Transforming Patient Care: The Role of AI-Powered Assistants

The progress in artificial intelligence (AI) is reshaping patient care, across various dimensions, from facilitating faster discharge to curating treatment plans and suggesting lifestyle changes.

By IT Medical

Schwartz said Leerink is encouraged that safety appears to be cleaner than what has been observed for PepGen’s Duchenne therapy. He added that the firm hasn’t written off the Duchenne program, which may be able to thread the needle between safety and efficacy. In its report of fourth quarter and full year 2024 financial results released Monday, PepGen said it is working with the FDA to address questions about supportive data for dosing levels in the study’s planned patient population.

More data from the Phase 1 test of the PepGen DM1 drug are coming. The company expects data from the 15 mg/kg cohort will become available in the second half of this year. Meanwhile, a separate study is underway to see whether multiple doses over longer periods of time lead to better patient outcomes. This placebo-controlled multiple-ascending Phase 2 test will evaluate the study drug in about 24 adults. The company said it expects to report results from the 5 mg 15 mg/kg cohort in the first quarter of next year.

As of the end of 2024, PepGen said its cash position was $120.2 million, which it estimates is sufficient to last into 2026.

Public domain image by Flickr user Berkshire Community College Bioscience Image Library

临床结果临床1期临床2期财报寡核苷酸

2025-02-23

博观而约取,我们可提供的医药领域咨询业务(可点击了解详情)

2023年12月21日,Eplontersen于获FDA批准上市,成为第一个获批上市的GalNAc偶联ASO药物。

作为ASO领军企业,经过多年的升级迭代,Ionis基于ligand-conjugated antisense(LICA)平台,已开发出多种配体用于靶向各种组织,如ASO分子与糖/多肽/抗体/Fab片段等偶联,通过ASGR/GLP1R/TfR1等细胞表面受体递送至肝/胰/肌肉等组织和器官。

递送系统是小核酸药物研究的重要课题,首款GalNAc-ASO的获批,或许ASO药物也要开始进入“递送系统”时代。回头看已上市的ASO产品,均未使用特殊的递送载体,仅仅是采用结构修饰,虽然可以一定程度上解决直接递送的问题,但给药剂量也限制了其应用方式和安全性,因此需要高效的体内递送系统。

随着人们对ASO机理的认识、以及递送方式的发展,基于作用部位、注射途径、风险收益的平衡下等诸多因素下,越来越多的经过结构修饰并携带特殊递送系统的ASO药物正在进行临床研究。本文将基于全球已上市和在研ASO管线进展,对ASO递送技术变迁进行概述,仅供参考。

1

早期:裸ASO→化学修饰→核苷类似物

ASO起源于1978年,哈佛大学科学家Zamecni等人设计合成了一条与劳斯肉瘤病毒基因互补的短RNA,并发现这条短RNA可以在体外培养的组织中抑制病毒的复制,首次提出反义核酸概念。

然而,天然存在的ASO具有较差的稳定性和非常低的特异性,并且在体内具有许多副作用。ASO起初的形式是未经过化学修饰的RNA或DNA,尽管展示了初步的效果,但也有明显缺陷,包括容易被降解、亲和力较弱、脱靶毒性、带有负电荷导致无法有效穿透细胞膜、无法与血浆蛋白结合导致肾脏清除速率较快。

为了克服上述缺陷,多种化学修饰最终被成功应用。化学修饰作为增强寡核苷酸药物递送的最有效方法之一,特别是以PMO、LNA、cEt、2' OMe/F/MOE、5'-VP/Chol、3'-PUFA等修饰方式的不断改进,优化了与RNA或蛋白亲和力以及耐酶解稳定性方面。

总体上,基于修饰技术的不断升级,在ASO药物的发展历程中,前后产生了共三代ASO药物。第一代:PS骨架全DNA结构

磷酸骨架最常用的化学修饰是硫代磷酸(PS),即将核苷酸中磷酸骨架中的一个非桥氧用硫进行替代,PS改造可以抵抗核酸酶的降解,并增强其与血浆蛋白的结合能力,降低肾脏清除速率,提高半衰期。

PS 是第一代 ASO 药物中常见的化学修饰,现在依然经常在核酸药物中使用。首款获批的ASO药物Fomivirsen 1998年上市,被FDA批准用于治疗艾滋病患者的巨细胞病毒性视网膜炎。Fomivirsen结构为21个碱基长度的硫代磷酸骨架DNA,可与CMV IE2蛋白的mRNA特异性结合。形成的DNA/RNA杂合体被RNase H识别,靶mRNA被酶降解,可以抑制IE2蛋白的翻译表达,从而抑制CMV的复制增殖。

Fomivirsen的结构第二代:gapmer设计与糖2’修饰

PS骨架修饰在高浓度时,降低了寡核苷酸与靶标的亲和力,使机体产生炎症反应,为了增强亲和力,提高抵抗核酸酶的降解能力,减少炎症反应,出现了具有糖基修饰的二代核酸药物。

第二代核酸药物以Gapmer为中间DNA,两端侧翼为RNA的序列设计。中间部分糖2’位未经修饰,从而不影响RNase H识别及对靶RNA的降解活性。两段侧翼RNA糖2’位修饰,常见的改造包括 2’-OME、2’-OMe、2’-F,这些改造可进一步增强对核酸酶的抵抗,并可以增强其与互补核苷酸链的结合能力。

碱基修饰在核酸药物开发中非常常见,比如假尿苷、2-硫代尿苷、5-甲基胞苷等。这些修饰能降低免疫系统的识别,避免被核酸酶水解。

已批准的gapmer ASO治疗药物的序列

2013年获批的Mipomersen、2018年获批的Inotersen、2019年获批的Volanesorsen、2023年获批的Tofersen均为gapmer设计,且均使用了PS、2’MOE和5-甲基胞苷的化学改造。第三代:核苷酸类似物修饰

除了对RNA进行修饰,核苷酸类似物也是增强递送的重要手段。其中,PMO(磷酸二酰胺吗啉代寡核苷酸)和PNA(肽核酸)最具代表性。由于PMO和PNA都是不带电荷的核酸分子,它们可以共价结合到带电荷的delivery-promoting moieties如细胞穿透肽 (CPP)。PMO和PNA的缺点是与血浆蛋白的相互作用很小,这意味着会通过尿液排泄迅速清除。

这个领域内的寡核苷酸药物包括Eteplirsen(Exondys 51),Golodirsen (Vyondys 53),Vitolarsen (Viltepso),Casimersen(Amondys 45),这四种药物均用于治疗DMD,使用PMO修饰。

Eteplirsen和Golodirsen的结构

2

GalNAc-ASO递送系统:白热化地带

虽然已上市的ASO产品未使用特殊的递送载体,仅仅是采用结构修饰,但ASO作为一个由数十个核苷酸或者核苷酸类似物组成的寡聚物,仍然算是一个生物大分子,拥有生物大分子的通病——吸收困难。不管化学修饰如何,ASO的大小、亲水性和电荷对体循环、组织外渗、 细胞摄取和内体逃逸都对药物开发构成了另外的挑战。

为了克服ASO的细胞摄取与内体逃逸效率低等障碍,提升药物靶向性和生物利用度,目前借助递送系统开发ASO已成为了趋势。与siRNA一样,ASO同样可以通过共价偶联或纳米颗粒的形式形成递送系统。其中,GalNAc(N-乙酰半乳糖胺(N-acetylgalactosamine))是目前ASO应用最广泛的递送系统,Eplontersen的获批使得GalNAc成为唯一得到监管机构批准上市的生物缀合物ASO递送系统。

GalNAc是唾液酸受体(ASGPR)的靶向配体,可以与实质肝细胞表面的ASGPR特异性结合,实现细胞的快速胞吞。该技术具有高度的肝靶向特异性,给药后高效富集到肝组织,进入其他组织的量非常少。将GalNAc以三价态标记到siRNA/ASO上,形成GalNAc-siRNA/ASO,便可实现特异性高效肝脏靶向递送,在肝脏研究或肝脏疾病治疗方面具有很好的应用潜力。研究人员发现,将ASO连接GalNAc能够有效地将ASO递送至肝细胞,并使活性增强10倍。

GalNAc修饰的ASO与siRNA

ASO-GalNAc递送系统诞生于Ionis的2.0/2.5代反义寡核苷酸技术平台。N-乙酰半乳糖胺(GalNAc)部分可以连接到反义寡核苷酸(ASOs)的5′-或3′-末端,以改善对肝细胞的递送。

作为近年来炙手可热的小核酸递送技术,GalNAc技术最早出现在2014年,当年Ionis公司和Alnylam公司都发表了GalNAc技术,Ionis公司的GalNAc技术是与ASO偶联,而Alnylam公司的GalNAc技术是与siRNA偶联。2019年底,FDA批准全球首款GalNAc-siRNA偶联物Givlaari上市。

虽然首款GalNAc-ASO相比GalNAc-siRNA上市晚了四年,但目前许多其他制药公司,如Dicerna Pharmaceuticals、Silence Therapeutics、Arbutus Biopharma 和 Arrowhead Pharmaceuticals,也在开发 GalNAc 偶联产品。随着首款上市,临床进展最快的ASO-GalNAc依然来自Ionis,有三款产品进入临床3期。

部分临床在研GalNAc-ASO

Donidalorsen

Donidalorsen(IONIS-PKK-LRx)是一款潜在“best-in-class”反义寡核苷酸(ASO)疗法,旨在作为遗传性血管性水肿(HAE)的预防疗法。Donidalorsen通过2′-O-甲氧基乙基修饰,采用Ionis先进的LIgand-C结合Antisense(LICA)技术,在ASO上偶联GalNAc3分子,靶向肝脏递送donidalorsen,抑制前激肽释放酶产生,从而减少缓激肽的释放。

2024年1月,Ionis宣布其在研反义寡核苷酸(ASO)疗法donidalorsen用于治疗遗传性血管水肿(HAE)患者的3期OASIS-HAE研究获得积极结果。该疗法达主要终点,可显著降低患者HAE发作比率。基于这些数据,Ionis正准备向美国FDA递交新药申请(NDA),而拥有donidalorsen在欧洲商业化独家权利的大冢(Otsuka)亦准备向欧洲药品管理局(EMA)递交上市许可申请(MAA)。Ionis计划在年中时于医学会议上公布该试验详细结果。Olezarsen

Olezarsen(IONIS-APOCIII-LRx)是一种新型N-乙酰半乳糖胺(GalNAc)结合的反义寡核苷酸,靶向肝脏APOC III mRNA,可以选择性地抑制APOC III的合成。而抑制APOC III的合成可能是降低甘油三酯水平的有效途径。2023年9月26日,Ionis宣布其在研新药Olezarsen用于治疗家族性高乳糜微粒血症综合征(FCS)的III期Balance研究取得积极结果,达到主要疗效终点,能够显著改善患者的甘油三酯水平,同时也展现出良好的安全性和耐受性。为此,Ionis计划于2024年初向美国食品药品管理局(FDA)提交新药申请,此外还将向欧盟监管机构提交申请。pelacarsen

pelacarsen(tqj230)是其由化学修饰的反义寡核苷酸(aso)与三触角n-乙酰半乳糖胺(galnac)结合组成,通过GalNAc递送系统,进入肝细胞,与载脂蛋白(a)mRNA结合,靶向抑制载脂蛋白(a)在肝脏中的合成,从而降低血浆中的脂蛋白(a)。目前I期(NCT02414594)和II期(NCT03070782)试验已完成,可降低Lp(a)水平,且没有严重的不良反应。III期试验(NCT04023552)主要观察其对心血管疾病患者的主要心血管事件的影响,该临床试验正在进行中。Pelacarsen将有望成为首个靶向强效降低脂蛋白(a)并带来心血管获益的药物。

3

下一代ASO递送系统:势如破竹

与siRNA的递送升级思路一致,虽然ASO-GalNAc递送系统应用已逐渐成熟,但靶向肝外组织和其它细胞类型,以及如何更安全、稳定、高效的实现递送,依然极具挑战,目前对递送系统的升级策略包括开发AOC、多肽偶联物、LNP、外泌体、聚合物等等,以提升药物半衰期、提升细胞摄取能力、避免脱靶效应、减少副作用。

反义寡核苷酸疗法的递送系统概述

来源:https://doi-org.libproxy1.nus.edu.sg/10.1186/s40824-022-00292-4AOC:旨在突破肝外靶向

在ADC概念的影响下,AOC已成为靶向寡核苷酸药物递送的潜在载体。具体来说,AOC是一类抗体与寡核苷酸偶联合成的新型嵌合生物分子。作为新型药物,AOC通过将单抗和寡核苷酸偶联,达到有效的靶向治疗能力,相比寡核苷酸具有精准靶向和更好的药代动力学特性。

借助AOC理念开发ASO药物,目前进展较快的公司为Dyne Therapeutics,其正在利用其专有的FORCE™平台开发AOC,可以实现向肌肉组织靶向给药、延长给药间隔时间、可重复给药、可针对疾病的遗传基础阻止或逆转疾病的发展。此外,AOC先驱Avidity也正在研究借助AOC手段将抗体和PMO偶联,AOC-1044正在被开发用于治疗DMD。

部分临床在研fab-ASO偶联物

具体来说,Dyne借助FORCE™平台设计的产品具有三个部分:

①抗原结合片段(Fabs),可与肌肉细胞(TfR1)上高表达的受体结合,从而能够靶向递送至骨骼肌、心脏肌和平滑肌。Dyne认为,与单克隆抗体(mAb)相比,Fab具有显着的肌肉输送优势,包括增强组织渗透性、增加耐受性和降低免疫系统激活风险。

②连接子(Linker),选择依据是它在放行的产品中被证明安全和有效,以及它在肌肉细胞内释放治疗药物的稳定性和能力。

③载荷(Payload),选择如ASO,PMO,siRNA或小分子等,旨在mRNA层面解决疾病的遗传问题。

FORCE™ 平台作用机制

DYNE-101由与片段抗体(Fab)偶联的反义寡核苷酸组成,Fab与肌肉上高表达的转铁蛋白受体1(TfR1)结合。它旨在实现靶向肌肉组织递送,目的是减少细胞核中的有毒DMPK RNA、释放剪接蛋白、允许正常mRNA处理和正常蛋白翻译,并有可能阻止或逆转疾病进展。DYNE-101已被欧洲药品管理局(EMA)和美国FDA授予孤儿药资格,用于治疗强直性肌营养不良1型(DM1)。

2024年1月,Dyne Therapeutics公布了其在研抗体偶联ASO药物DYNE-101在1/2期临床试验中获得积极数据。结果显示,DYNE-101在DM1患者中表现出剂量依赖性的剪接矫正、肌肉递送和DMPK敲除。多肽偶联物:提升组织/细胞靶向、细胞穿透或内涵体溶解特性

细胞穿透肽(cell-penetrating peptide, CPP)是一种有吸引力的配体来源,可赋予治疗性寡核苷酸偶联物以组织/细胞靶向、细胞穿透或内涵体溶解特性。CPP通常是一种短于30个氨基酸的肽段,自然界多种天然蛋白的结构域具有细胞穿透肽的功能。

多肽-ASO偶联物

目前已有若干个团队将CPP应用于ASO的开发。CPP与电荷中性ASO化学物质(如PMO和PNA)的直接化学偶联后,取得了相当好的引导效果,可以有效地帮助ASO进入细胞。

进展较快的多肽-ASO偶联物已进入临床2期。Sarepta Therapeutics开发的 SRP-5051是下一代肽磷酸二酯吗啉寡聚物(PPMO)化合物,由eteplirsen与专利的细胞穿透肽(CPP)偶联而成,用以针对抗肌萎缩蛋白外显子51。此外,PepGen Ltd.开发的PGN-EDO51也进入了临床2期。

部分临床在研多肽-ASO偶联物

基于强大的LICA平台,Ionis也在开发基于多肽的组织靶向递送平台,利用Bicycles大环形多肽设计LICA ASO,实现骨骼、心肌递送。

Bicycle的双环肽技术通过化学修饰,将由9-15个氨基酸构成的小分子多肽(分子量1.5-2K Da)固定在特定的构象上。它们集抗体、小分子药物及肽类的特性于一身,具有与抗体类似的亲和性和精确的靶向特异性;同时,由于它们分子量较小,使得其能够快速深入地渗透组织,从而实现从组织内部靶向病灶;其肽类的性质则提供了可调控的药物动力学半衰期和肾脏清除途径,从而避免了其他药物形式中常见的肝脏和胃肠道毒性。

脂质纳米颗粒(LNP):优化稳定性和生物分布

通过用脂质包裹药物进行递送的方式,研究已经超过40年。这种递送方式的好处,不仅增加药物的循环时间,降低其毒性,还可以通过降低药物的降解速度而增加药物的药效。如今,随着脂质纳米颗粒(lipid nanoparticles, LNP)被广泛使用至siRNA和mRNA,针对ASO的LNP递送方式也正在如火如荼研究中。

常见的用于ASO的LNP载药系统

LNPs适宜的粒径(直径范围为10-500 nm)、具有生物相容性和可生物降解特性,使得LNPs-ASOs 能够逃避单核吞噬细胞系统(MPS)的摄取,从而延长了LNPs-ASOs的循环时间,使其能够通过更强的渗透性和滞留作用,被动有效地靶向细胞并释放 ASOs。它们还通过在结构相变过程中诱导 LNPs膜与靶细胞之间的脂质融合,来改善细胞对ASO的摄取,并通过促进细胞摄取后的内体逃逸来帮助ASOs向靶基因迁移。

部分临床在研LNP-ASO药物

我国领先企业也正在对传统的LNP技术进行升级,如成立于 2013 年的海昶生物研发了四价-三价脂质纳米粒(QTsome™)基因递送平台,该平台采用独特的两种阳离子脂质,可以在特定条件下电离,利用其对环境 pH 的敏感性,使药物的组织分布和给药均达到最优,稳定性也有很大程度的提高。此外,QTsome™ 还具有较高的生物安全性和较低的毒性。

QTsome™作用机制(来源:海昶生物)

基于QTsome™平台,海昶生物对治疗原发性肾癌的HC0201进行了纳米脂质体优化,形成了差异化创新的抗原发性肝癌药物HC0301,两者为同一核酸API Mychexin,但HC0301通过纳米脂质体技术,使它的稳定性和生物分布得到更佳的优化,同时对肿瘤内皮细胞和肿瘤微环境还有一些靶向的作用,通过递送系统使药物精准作用肝脏,因此用于肝癌,而未采用递送系统则是用于治疗原发性肾癌。此外,相比于HC0201,HC0301在给药剂量、给药周期上有很大的优化,提升了临床的依从性。外泌体:助力肿瘤杀伤

外泌体是内涵体来源,经由多泡体与质膜融合以后释放到细胞外的,直径介于50-150nm之间的膜性囊泡状小体。外泌体内部含有多种生物学大分子,包括蛋白质、核酸和磷脂等。外泌体可在细胞间传输各种各样的生物大分子,因此作为一种药物递送方式,具有显著的先天优势:

1)外泌体是“天然驯化”的纳米载体,本身内含多种有效成分,因此可以适用的负载药物成分类型非常丰富,包括小分子、核酸和重组蛋白等;

2)外泌体是内源性的纳米颗粒,免疫源性较低,因此安全性高;

3)外泌体可以循环至人体所有的腔室,具有比较好的组织选择性;

4)可以对外泌体进行复杂的工程化改造,通过基因或者化学等方式,对外泌体的成分以及生物学功能进行调控,从而能够更好地服务于我们的治疗目的。

Codiak BioSciences 发现了 2 种高度丰富的外泌体蛋白 PTGFRN 和 BASP1,使用这些蛋白质作为支架可将感兴趣的治疗性分子引导到外泌体的表面或内腔。其中其表面荷载 ASO 的外泌体疗法 exoASO-STAT6已进入临床一期,该产品被设计为能够选择性地递送反义寡核苷酸以破坏肿瘤相关巨噬细胞(TAM)中的STAT6信号传导,并诱导抗肿瘤免疫反应。

聚合物纳米载体:多种多样的化学和物理特性

聚合物纳米载体递送是天然高分子或合成高分子通过吸附、共价结合、交联和包埋等方式结合药物,运输到体内病变部位的一种递送方式。聚合物纳米载体的主要优点源于其多种多样的化学和物理特性,其化学组成、分子量、多分散系数等物理化学性质可以根据递送核酸类药物的种类而设计。大多数聚合物纳米载体的共同特点是结合了阳离子基团,其有助于聚合物包裹负电荷的核酸类药物,也有利于结合细胞膜上负电荷的糖蛋白。

常见的用于ASO的聚合物载药系统

聚酰胺胺(PAMAM)由于其多价结构,含有数百个伯胺末端的偶联位点,便于在酸性环境中质子化并通过质子海绵效应实现内体逃逸,因此成为目前广泛研究的ASO载体。通过PAMAM的胺基部分与细胞特异性配体连接,可以提高递送靶标的特异性。因此,以PAMAM为递送载体的肿瘤细胞基因治疗也成为治疗肿瘤的一个手段。

资料来源:

东方富海、药渡、Advances in oligonucleotide drug delivery、新药故事、伯科生物、新芽基因、Cortellis

Falzarano MS, Passarelli C, Ferlini A. Nanoparticle delivery of antisense oligonucleotides and their application in the exon skipping strategy for Duchenne muscular dystrophy. Nucleic Acid Ther. 2014; 24:87–100.

Huang, S., Hao, XY., Li, YJ.et al. Nonviral delivery systems for antisense oligonucleotide therapeutics. Biomater Res 26, 49 (2022). https://doi-org.libproxy1.nus.edu.sg/10.1186/s40824-022-00292-4

Yang L, Ma F, Liu F, Chen J, Zhao X, Xu Q. Efcient Delivery of Antisense Oligonucleotides Using Bioreducible Lipid Nanoparticles In Vitro and In Vivo. Mol Ther Nucleic Acids. 2020;19:1357–67. https://doi-org.libproxy1.nus.edu.sg/10. 1016/j.omtn.2020.01.018. 48.

Li H, Liu Y, Chen L, Liu Q, Qi S, Cheng X, Lee YB, Ahn CH, Kim DJ, Lee RJ. Folate receptor-targeted lipid-albumin nanoparticles (F-LAN) for thera‑ peutic delivery of an Akt1 antisense oligonucleotide. J Drug Target. 2018;26(5–6):466–73. https://doi-org.libproxy1.nus.edu.sg/10.1080/1061186x.2018.1433678. 49.

Cheng X, Yu D, Cheng G, Yung BC, Liu Y, Li H, Kang C, Fang X, Tian S, Zhou X. T7 Peptide-Conjugated Lipid Nanoparticles for Dual Modulation of Bcl-2 and Akt-1 in Lung and Cervical Carcinomas. Mol Pharm. 2018;15(10):4722– 32. https://doi-org.libproxy1.nus.edu.sg/10.1021/acs.molpharmaceut.8b00696. 50.

王峻峰,谭曼曼,王颖,et al.核酸类药物的修饰和递送研究进展[J].浙江大学学报:医学版, 2023, 52(4):417-428

上市批准寡核苷酸核酸药物

2024-12-16

BOSTON--(

BUSINESS WIRE

)--PepGen Inc. (Nasdaq: PEPG), a clinical-stage biotechnology company advancing the next generation of oligonucleotide therapies with the goal of transforming the treatment of severe neuromuscular and neurological diseases, today announced that the Company received a clinical hold notice from the U.S. Food and Drug Administration (FDA) regarding its Investigational New Drug (IND) application to initiate the CONNECT2-EDO51 clinical trial in patients with Duchenne muscular dystrophy (DMD). The FDA indicated they will provide an official clinical hold letter to the Company within 30 days.

CONNECT2 is PepGen’s Phase 2 multinational, double-blind placebo-controlled, multiple ascending dose, 25-week clinical trial of PGN-EDO51 in patients with DMD. The study is open in the United Kingdom.

“We intend to work closely with the FDA to address their questions on our application to initiate CONNECT2 as expeditiously as possible,” said Paul Streck, MD, MBA, Head of R&D of PepGen. “Our open-label CONNECT1-EDO51 multiple ascending dose study of PGN-EDO51 in boys and young men living with DMD continues as planned in Canada. We have completed enrollment of the 10 mg/kg dose cohort; all four patients in this cohort have received at least one dose.”

About PGN-EDO51

PGN-EDO51, PepGen's clinical candidate for the treatment of DMD, utilizes the Company's proprietary Enhanced Delivery Oligonucleotide (EDO) technology to deliver a therapeutic phosphorodiamidate morpholino oligomer (PMO) that is designed to target the root cause of this devastating disease. PGN-EDO51 is designed to skip exon 51 of the dystrophin transcript, an established therapeutic target for approximately 13% of DMD patients, thereby aiming to restore the open reading frame and enabling the production of a truncated, yet functional dystrophin protein. The FDA has granted PGN-EDO51 both Orphan Drug and Rare Pediatric Disease Designations for the treatment of patients with DMD amenable to an exon-51 skipping approach.

About PepGen

PepGen is a clinical-stage biotechnology company advancing the next-generation of oligonucleotide therapies with the goal of transforming the treatment of severe neuromuscular and neurological diseases. PepGen’s Enhanced Delivery Oligonucleotide (EDO) platform is founded on over a decade of research and development and leverages cell-penetrating peptides to improve the uptake and activity of conjugated oligonucleotide therapeutics. Using these EDO peptides, we are generating a pipeline of oligonucleotide therapeutic candidates designed to target the root cause of serious diseases.

For more information, please visit

PepGen.com

. Follow PepGen on

LinkedIn

and

X

.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These statements may be identified by words such as “aims,” “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “plans,” “possible,” “potential,” “seeks,” “will,” and variations of these words or similar expressions that are intended to identify forward-looking statements. Any such statements in this press release that are not statements of historical fact may be deemed to be forward-looking statements. These forward-looking statements include, without limitation, statements regarding the expected interactions with the FDA regarding our IND for the CONNECT2-EDO51 study of PGN-EDO51 and enrollment in the ongoing CONNECT1-EDO51 study.

Any forward-looking statements in this press release are based on current expectations, estimates and projections only as of the date of this release and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to risks related to: delays or failure to successfully initiate or complete our ongoing and planned development activities for our product candidates, including PGN-EDO51; our ability to enroll patients in our clinical trials, including CONNECT1 and CONNECT2; that our interpretation of clinical and preclinical study results may be incorrect, or that we may not observe the levels of therapeutic activity in clinical testing that we anticipate based on prior clinical or preclinical results, including for PGN-EDO51; our product candidates, including PGN-EDO51, may not be safe and effective or otherwise demonstrate safety and efficacy in our clinical trials; adverse outcomes from our regulatory interactions, including delays in regulatory review, clearance to proceed or approval by regulatory authorities with respect to our programs, including clearance to commence planned clinical studies of our product candidates, or other regulatory feedback requiring modifications to our development programs, including in each case with respect to our CONNECT1 and CONNECT2 clinical trials; changes in regulatory framework that are out of our control; unexpected increases in the expenses associated with our development activities or other events that adversely impact our financial resources and cash runway; and our dependence on third parties for some or all aspects of our product manufacturing, research and preclinical and clinical testing. Additional risks concerning PepGen’s programs and operations are described in our most recent annual report on Form 10-K and quarterly report on Form 10-Q that are filed with the SEC. PepGen explicitly disclaims any obligation to update any forward-looking statements except to the extent required by law.

This release discusses PGN-EDO51, an investigational therapy that has not been approved for use in any country and is not intended to convey conclusions about their efficacy or safety. There is no guarantee that PGN-EDO51 or any other investigational therapy will successfully complete clinical development or gain regulatory authority approval.

孤儿药临床2期寡核苷酸临床申请

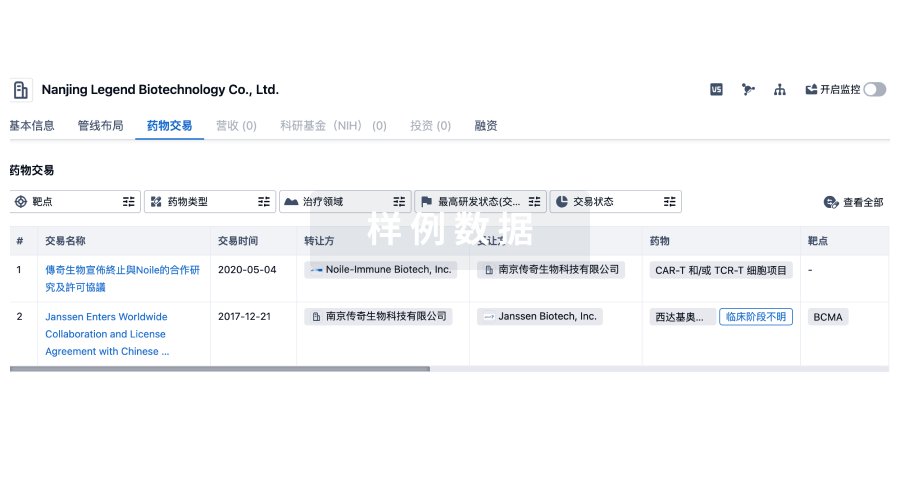

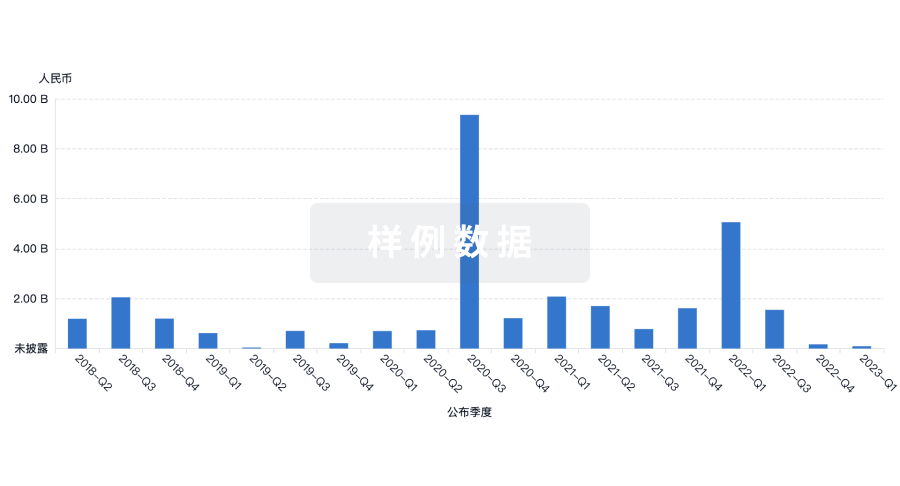

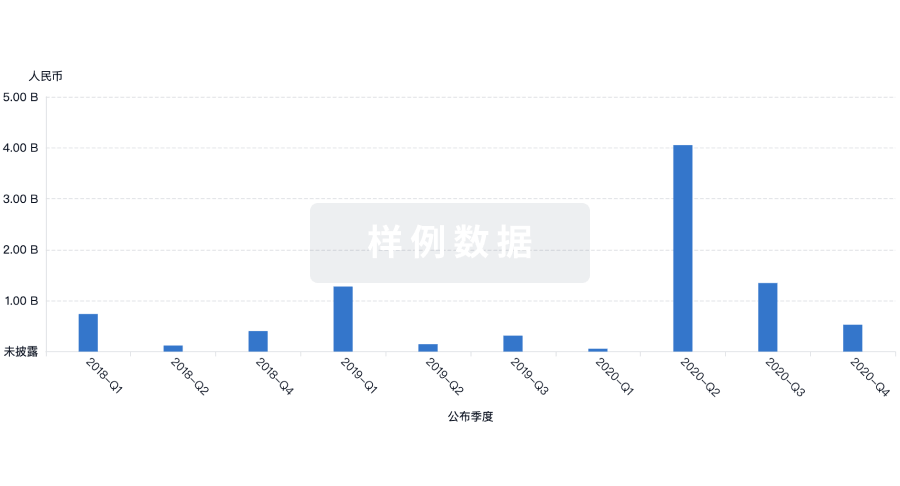

100 项与 PepGen Ltd. 相关的药物交易

登录后查看更多信息

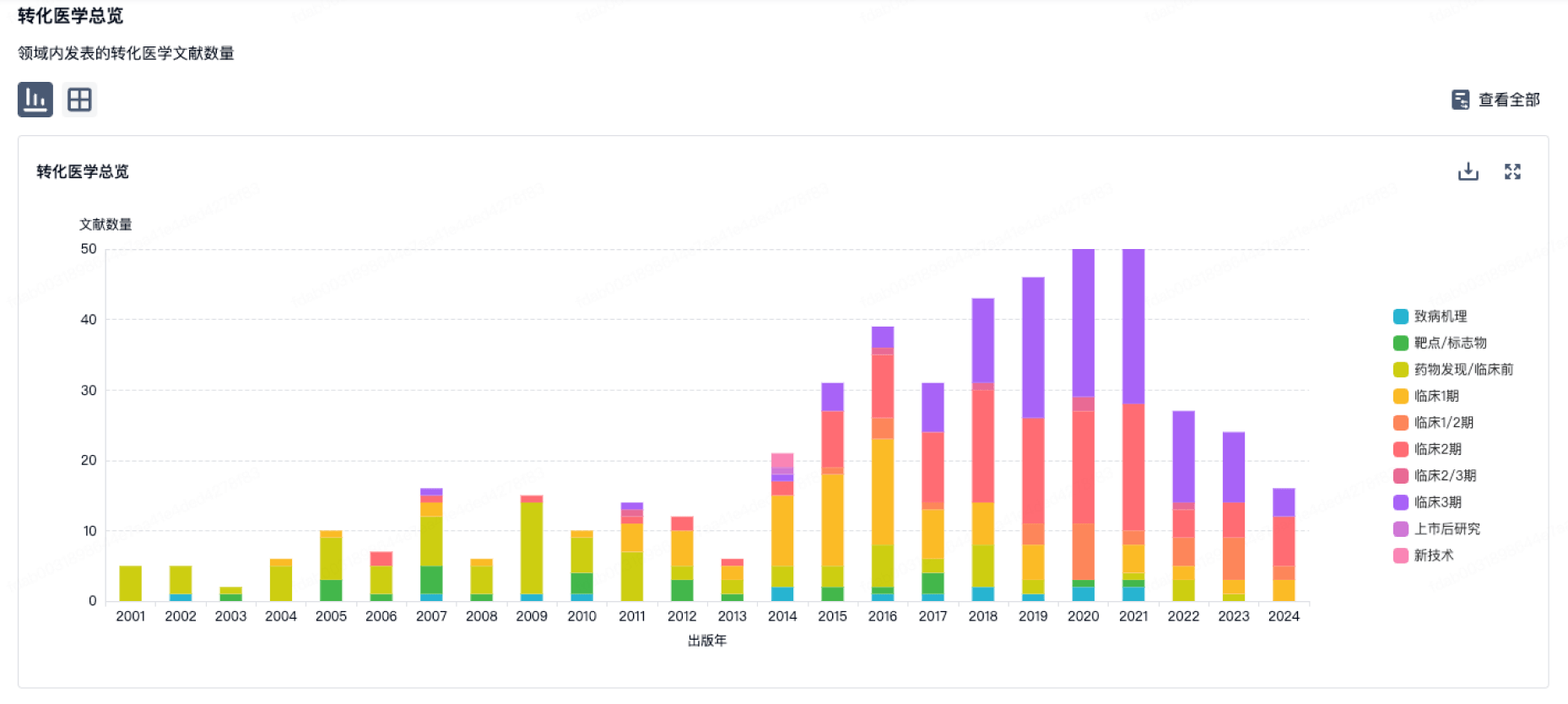

100 项与 PepGen Ltd. 相关的转化医学

登录后查看更多信息

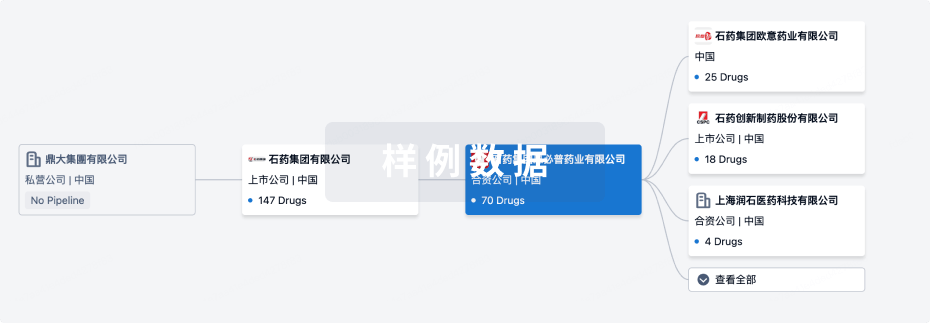

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年10月03日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

其他

1

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

Interferon-tau(Pepgen) ( IFNAR ) | 多发性硬化症 更多 | 终止 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

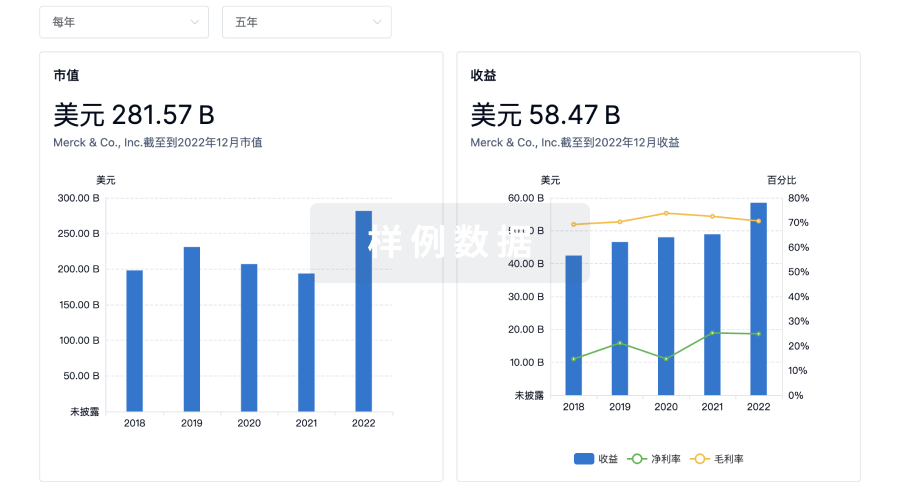

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用