预约演示

更新于:2025-04-01

PLx Pharma, Inc.

更新于:2025-04-01

概览

标签

其他疾病

神经系统疾病

小分子化药

关联

2

项与 PLx Pharma, Inc. 相关的药物作用机制 COX-1抑制剂 [+1] |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期1965-06-25 |

靶点- |

作用机制- |

在研机构 |

原研机构 |

非在研适应症- |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

13

项与 PLx Pharma, Inc. 相关的临床试验NCT04811625

A Randomized, Open-label, 2-way Crossover Pharmacodynamic and Pharmacokinetic Study of a Novel Pharmaceutical Lipid-aspirin Complex Formulation (PL-ASA) at an 81 mg Dose

A randomized, open-label, 2-way crossover pharmacodynamic and pharmacokinetic study of a novel pharmaceutical lipid-aspirin complex formulation (PL-ASA) at an 81 mg dose

开始日期2021-04-28 |

申办/合作机构 |

NCT05055752

A Randomized, Actively-Controlled, Crossover Bioequivalence Study of a Novel Pharmaceutical Lipid-Aspirin Complex Formulation at 325 mg Dose Versus Immediate Release Aspirin in Healthy Volunteers

This trial is a randomized, actively-controlled, open-label, 2-way crossover bioequivalence study to determine PK parameters following treatment with test aspirin product (PL-ASA capsules) and reference aspirin product (IR-ASA tablets) administered at a single dose of 325 mg.

开始日期2020-05-07 |

申办/合作机构 |

NCT01590758

A Randomized, Double-Blind, Multicenter, Superiority, Placebo-Controlled Phase 3 Study of Pexiganan Cream 0.8% Applied Twice Daily for 14 Days in the Treatment of Adults With Mild Infections of Diabetic Foot Ulcers

The purpose of this study is to establish the clinical superiority and the safety of topical pexiganan cream 0.8% plus standard local wound care, as compared to placebo cream plus standard local wound care, in the treatment of mildly infected diabetic foot ulcers.

开始日期2014-06-01 |

100 项与 PLx Pharma, Inc. 相关的临床结果

登录后查看更多信息

0 项与 PLx Pharma, Inc. 相关的专利(医药)

登录后查看更多信息

5

项与 PLx Pharma, Inc. 相关的文献(医药)2022-10-01·Journal of thrombosis and thrombolysis

Pharmacokinetic and pharmacodynamic profiles of a novel phospholipid-aspirin complex liquid formulation and low dose enteric-coated aspirin: results from a prospective, randomized, crossover study

Article

作者: Angiolillo, Dominick J ; Bhatt, Deepak L ; Franchi, Francesco ; Deliargyris, Efthymios N ; Taatjes-Sommer, Heidi S ; Prats, Jayne ; Schneider, David J ; Rollini, Fabiana ; Fan, Weihong ; Been, Latonya

Abstract:

Low dose enteric-coated aspirin (EC-ASA) is routinely used for secondary cardiovascular event prevention. However, absorption of EC tablets is poor, which can result in subtherapeutic antiplatelet effects. Phospholipid-aspirin liquid filled capsules (PL-ASA) are a novel FDA-approved immediate-release formulation designed to reduce gastrointestinal (GI) injury by limiting direct contact with the stomach lining. We compared the pharmacokinetic (PK) and pharmacodynamic (PD) profiles of PL-ASA versus EC-ASA at a low dose. This randomized, open-label, crossover study assessed PK and PD following a single 81-mg dose of PL-ASA versus EC-ASA under fasting conditions in 36 volunteers without cardiovascular disease between 18 and 75 years of age. Volunteers were randomly assigned 1:1 to either PL-ASA then EC-ASA or vice versa with a minimum 14-day washout. Assessments included PK parameters for acetylsalicylic acid and salicylic acid, platelet aggregation in response to arachidonic acid (AA), and serum thromboxane B2 (TxB2) assessments over 24 h. PL-ASA was rapidly absorbed. PL-ASA reached Tmax 3 h earlier (1.01 vs. 4.00 h, p < 0.0001), with almost double the Cmax (720 vs. 368 ng/mL, p < 0.0001) and overall 44% higher exposure of acetylsalicylic acid (AUC0-t: 601 vs. 416 h*ng/mL, p = 0.0013) compared with EC-ASA. Within 1 h of dosing, PL-ASA achieved significantly lower residual platelet aggregation, which persisted for the full 24 h (median AA-LTA was 47% with PL-ASA vs. 80.5% with EC-ASA; p = 0.0022 at hour-24). Treatment with PL-ASA also resulted in significantly lower serum TxB2 concentrations at each time point compared with EC-ASA (all p-values < 0.05). PL-ASA resulted in faster and more complete aspirin absorption paralleled by more prompt and potent platelet inhibition compared with EC-ASA after a single 81 mg dose. PL-ASA represents an attractive novel aspirin formulation for the secondary prevention of cardiovascular events.Clinical Trial Registration ClinicalTrials.gov identifier: NCT04811625.

2020-04-01·Journal of thrombosis and thrombolysis4区 · 医学

Bioavailability of aspirin in fasted and fed states of a novel pharmaceutical lipid aspirin complex formulation

4区 · 医学

Article

作者: Deliargyris, Efthymios N ; Angiolillo, Dominick J ; Bhatt, Deepak L ; Prats, Jayne ; Fan, Weihong ; Marathi, Upendra ; Lanza, Frank

Abstract:

Dyspeptic symptoms are common with aspirin and clinicians frequently recommend that it be taken with food to reduce these side effects. However, food can interfere with absorption, especially with enteric-coated aspirin formulations. We evaluated whether food interferes with the bioavailability of a new, pharmaceutical lipid-aspirin complex (PL-ASA) liquid-filled capsule formulation. In this randomized, open label, crossover study, 20 healthy volunteers fasted for ≥ 10 h and then randomized as either “fasted”, receiving 650 mg of PL-ASA, or as “fed”, with a standard high-fat meal and 650 mg of PL-ASA 30 min later. After a washout of 7 days, participants crossed over to the other arm. The primary outcome was comparison of PK parameters of the stable aspirin metabolite salicylic acid (SA) between fasted and fed states. Mean age of participants was 36.8 years and 55% were male. The ratios for the fed to fasted states of the primary SA PK parameters of AUC0−t and AUC0−∞ were 88.7% and 88.8% respectively, with 90% confidence intervals between 80 and 125%, which is consistent with FDA bioequivalence guidance. Mean peak SA concentration was about 22% lower and occurred about 1.5 h later in the fed state. Food had a modest effect on peak SA levels and the time required to reach them after PL-ASA administration, but did not impact the extent of exposure (AUC) compared with intake in a fasted state. These data demonstrate that PL-ASA may be co-administered with food without significant impact on aspirin bioavailability.Clinical Trial Registration:http://www.clinicaltrials.gov Unique Identifier: NCT01244100

2019-12-01·International journal of cardiology2区 · 医学

Impact of diabetes mellitus on short term vascular complications after TAVR: Results from the BRAVO-3 randomized trial

2区 · 医学

Article

作者: Dangas, George D ; Cao, Davide ; Guedeney, Paul ; Stella, Pieter R ; Chandiramani, Rishi ; Violini, Roberto ; Anthopoulos, Prodromos ; Jeger, Raban ; Hengstenberg, Christian ; Mehran, Roxana ; Meneveau, Nicolas ; Ferrari, Markus ; Widder, Julian D ; Sartori, Samantha ; Dumonteil, Nicolas ; Power, David ; Tchetche, Didier ; Goel, Ridhima ; Claessen, Bimmer E ; Tron, Christophe ; Deliargyris, Efthymios N

AIMS:

The impact of diabetes mellitus (DM) on clinical outcomes after transcatheter aortic valve replacement (TAVR) remains unclear. The aim of this study was to investigate the impact of DM on short-term clinical outcomes after TAVR in a large randomized trial population.

METHODS AND RESULTS:

BRAVO-3 trial randomized 802 patients undergoing trans-femoral TAVR to procedural anticoagulation with bivalirudin or unfractionated heparin. The study population was divided according to the presence of DM, and further stratified according to the use of insulin. Net adverse cardiovascular outcomes (NACE - death, myocardial infarction (MI), stroke or major bleeding by Bleeding Academic Research Consortium (BARC) type 3b or above) was the primary outcome in-hospital and at 30-days. Of the total 802 randomized patients, 239 (30%) had DM at baseline, with 87 (36%) being treated with insulin. At 30-days, DM patients experienced numerically higher rates of net adverse cardiovascular events (16.3% vs. 14.4%, p=0.48) and acute kidney injury (19.7% vs. 15.1%, p=0.11), while non-DM (NDM) patients had numerically higher rates of cerebrovascular accidents (3.6% vs. 1.7%, p=0.22). After multivariable adjustment, DM patients had higher odds of vascular complications at 30-days (OR 1.57, p=0.03) and life-threatening bleeding both in-hospital (OR 1.50, p=0.046) and at 30-days (OR 1.50, p=0.03) with the excess overall risk primarily attributed to the higher rates observed among non-insulin dependent DM patients.

CONCLUSIONS:

Patients with DM had higher adjusted odds of vascular and bleeding complications up to 30-days post-TAVR. Overall, there was no significant association between DM and early mortality following TAVR.

28

项与 PLx Pharma, Inc. 相关的新闻(医药)2023-04-11

SPARTA, N.J., April 11, 2023 (GLOBE NEWSWIRE) -- PLx Pharma Inc. (NASDAQ: PLXP) (“PLx” or the “Company”), is a commercial-stage drug delivery platform technology company focused on its clinically-validated and patent-protected PLxGuard™ that has the potential to improve the absorption of many drugs currently on the market and to reduce the risk of stomach injury associated with certain drugs. The Company had previously announced that on October 3, 2022, it was notified by the Listing Qualifications Department (the “Listing Qualifications Department”) of the Nasdaq Stock Market LLC (“Nasdaq”) that the Listing Qualifications Department has determined to delist the Company’s securities from Nasdaq, citing that for a period of 30 consecutive business days, the bid price of its common stock had closed below the minimum of $1.00 per share required for continued listing on Nasdaq pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Rule”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company was provided 180 calendar days, or until April 3, 2023, to regain compliance with the minimum bid requirement. On April 4, 2023, the Company received notice from Nasdaq (the “April Notice”) indicating that the Company had not regained compliance with the Rule and is not eligible for a second 180-day period. The April Notice also stated that the Company had not yet filed its Form 10-K for the period ended December 31, 2022, meaning that the Company no longer complies with Nasdaq Listing Rule 5250(c)(1). The Company does not intend to appeal Nasdaq’s determination and, therefore, it is expected that the Company’s common stock will be delisted from the Nasdaq Stock Market on April 13, 2023. About VAZALOREVAZALORE is an FDA-approved liquid-filled aspirin capsule, available in 81 mg and 325 mg doses. VAZALORE delivers aspirin differently from plain and enteric coated aspirin products. The special complex inside the capsule is designed for targeted release of aspirin, limiting its direct contact with the stomach. VAZALORE delivers fast, reliable absorption for pain relief plus the lifesaving benefits of aspirin. To learn more about VAZALORE, please visit www.vazalore.com and follow us on Facebook. About PLx Pharma Inc.PLx Pharma Inc. is a commercial-stage drug delivery platform technology company focused on improving how and where active pharmaceutical ingredients (APIs) are absorbed in the gastrointestinal (GI) tract via its clinically validated and patent protected PLxGuard™ technology. PLx believes this platform has the potential to improve the absorption of many drugs currently on the market or in development, and to reduce the risk of stomach injury associated with certain drugs. To learn more about PLx Pharma Inc. and its pipeline, please visit www.plxpharma.com and follow us on LinkedIn and Twitter. Forward Looking Statements Any statements made in this press release relating to future financial or business performance, conditions, plans, prospects, trends, or strategies and other financial and business matters, including without limitation, the prospects for commercializing or selling any products or drug candidates, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, when or if used in this press release, the words “may,” “could,” “should,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict” and similar expressions and their variants, as they relate to PLx may identify forward-looking statements. PLx cautions that these forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Important factors that may cause actual results to differ materially from the results discussed in the forward-looking statements or historical experience include risks and uncertainties, including risks relating to PLx’s ability to successfully further commercialize its VAZALORE products; the failure by PLx to secure and maintain relationships with collaborators; risks relating to clinical trials; risks relating to the commercialization, if any, of PLx’s proposed product candidates (such as marketing, regulatory, product liability, supply, competition, and other risks); dependence on the efforts of third parties; dependence on intellectual property; developments and projections relating to our competitors or our industry; risks that PLx may lack the financial resources and access to capital to fund proposed operations; the impact of difficult macroeconomic conditions, such as inflation and reductions in consumer spending, on the demand for PLx’s products; and risks relating to PLx’s ability to identify, evaluate and complete any strategic alternative that yields value for its stockholders. Further information on the factors and risks that could affect PLx’s business, financial condition and results of operations are contained in PLx’s filings with the U.S. Securities and Exchange Commission (“SEC”), which are available at www.sec.gov. Other risks and uncertainties are more fully described in PLx’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 11, 2022, and in other filings that PLx has made or will make going forward. These forward-looking statements represent PLx’s estimate as of the date hereof only, and PLx specifically disclaims any duty or obligation to update forward-looking statements. Contact:Lisa M. WilsonFounder & President, In-Site Communications, Inc.(212) 452-2793lwilson@insitecony.com Source: PLx Pharma Inc.

2023-04-11

SPARTA, N.J., April 11, 2023 (GLOBE NEWSWIRE) -- PLx Pharma Inc. (NASDAQ: PLXP) (“PLx” or the “Company”), is a commercial-stage drug delivery platform technology company focused on its clinically-validated and patent-protected PLxGuard™ that has the potential to improve the absorption of many drugs currently on the market and to reduce the risk of stomach injury associated with certain drugs. The Company had previously announced that on October 3, 2022, it was notified by the Listing Qualifications Department (the “Listing Qualifications Department”) of the Nasdaq Stock Market LLC (“Nasdaq”) that the Listing Qualifications Department has determined to delist the Company’s securities from Nasdaq, citing that for a period of 30 consecutive business days, the bid price of its common stock had closed below the minimum of $1.00 per share required for continued listing on Nasdaq pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Rule”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company was provided 180 calendar days, or until April 3, 2023, to regain compliance with the minimum bid requirement. On April 4, 2023, the Company received notice from Nasdaq (the “April Notice”) indicating that the Company had not regained compliance with the Rule and is not eligible for a second 180-day period. The April Notice also stated that the Company had not yet filed its Form 10-K for the period ended December 31, 2022, meaning that the Company no longer complies with Nasdaq Listing Rule 5250(c)(1).

The Company does not intend to appeal Nasdaq’s determination and, therefore, it is expected that the Company’s common stock will be delisted from the Nasdaq Stock Market on April 13, 2023.

About VAZALORE

VAZALORE is an FDA-approved liquid-filled aspirin capsule, available in 81 mg and 325 mg doses. VAZALORE delivers aspirin differently from plain and enteric coated aspirin products. The special complex inside the capsule is designed for targeted release of aspirin, limiting its direct contact with the stomach. VAZALORE delivers fast, reliable absorption for pain relief plus the lifesaving benefits of aspirin. To learn more about VAZALORE, please visit and follow us on Facebook.

About PLx Pharma Inc.

PLx Pharma Inc. is a commercial-stage drug delivery platform technology company focused on improving how and where active pharmaceutical ingredients (APIs) are absorbed in the gastrointestinal (GI) tract via its clinically validated and patent protected PLxGuard™ technology. PLx believes this platform has the potential to improve the absorption of many drugs currently on the market or in development, and to reduce the risk of stomach injury associated with certain drugs. To learn more about PLx Pharma Inc. and its pipeline, please visit and follow us on LinkedIn and Twitter.

Forward Looking Statements

Any statements made in this press release relating to future financial or business performance, conditions, plans, prospects, trends, or strategies and other financial and business matters, including without limitation, the prospects for commercializing or selling any products or drug candidates, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, when or if used in this press release, the words “may,” “could,” “should,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict” and similar expressions and their variants, as they relate to PLx may identify forward-looking statements. PLx cautions that these forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Important factors that may cause actual results to differ materially from the results discussed in the forward-looking statements or historical experience include risks and uncertainties, including risks relating to PLx’s ability to successfully further commercialize its VAZALORE products; the failure by PLx to secure and maintain relationships with collaborators; risks relating to clinical trials; risks relating to the commercialization, if any, of PLx’s proposed product candidates (such as marketing, regulatory, product liability, supply, competition, and other risks); dependence on the efforts of third parties; dependence on intellectual property; developments and projections relating to our competitors or our industry; risks that PLx may lack the financial resources and access to capital to fund proposed operations; the impact of difficult macroeconomic conditions, such as inflation and reductions in consumer spending, on the demand for PLx’s products; and risks relating to PLx’s ability to identify, evaluate and complete any strategic alternative that yields value for its stockholders. Further information on the factors and risks that could affect PLx’s business, financial condition and results of operations are contained in PLx’s filings with the U.S. Securities and Exchange Commission (“SEC”), which are available at Other risks and uncertainties are more fully described in PLx’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 11, 2022, and in other filings that PLx has made or will make going forward. These forward-looking statements represent PLx’s estimate as of the date hereof only, and PLx specifically disclaims any duty or obligation to update forward-looking statements.

Contact:

Lisa M. Wilson

Founder & President, In-Site Communications, Inc.

(212) 452-2793

lwilson@insitecony.com

Source: PLx Pharma Inc.

2022-11-10

- Significant Reduction in Operating Expenses

- Strategic Alternatives Process Ongoing

Total Net Sales of $0.4 Million, Including $0.3 Million of Unfavorable Adjustments for Additional Trade Allowances and Incremental Sales Returns Reserves in Q3 2022

Total Operating Expenses Significantly Lower by $2.8 Million, or 22%, in Q3 2022 vs. Q3 2021; $4.4 Million or 31% Lower Sequentially vs. Q2 2022

GAAP Net Loss of ($0.30) Per Diluted Share in Q3 2022; Adjusted Non-GAAP Net Loss Per Diluted Share of ($0.37)

Cash & Cash Equivalent Balance of $25.8 Million as of September 30, 2022

SPARTA, N.J., Nov. 10, 2022 (GLOBE NEWSWIRE) -- PLx Pharma Inc. (NASDAQ: PLXP) (“PLx” or the “Company”), is a commercial-stage drug delivery platform technology company focused on its clinically-validated and patent-protected PLxGuard™ that has the potential to improve the absorption of many drugs currently on the market and to reduce the risk of stomach injury associated with certain drugs. The Company, with its lead products VAZALORE 81 mg and VAZALORE 325 mg liquid-filled aspirin capsules (referred to together as “VAZALORE®”), announced today certain financial and operational results for the three months ended September 30, 2022, and provided other business updates.

“During the first year of VAZALORE launch, we have invested in building a base of awareness among consumers and healthcare professionals,” said PLx’s President & CEO Natasha Giordano. “Since market acceptance and sales have taken longer than anticipated to develop, we have streamlined our investments, with the goal of maintaining our base consumption levels. We also recently initiated a formal process to evaluate strategic alternatives, to ensure that VAZALORE can remain available for the millions of patients who need it.”

Highlights of Third Quarter and Other Recent Events

Partnered with two large healthcare systems to incorporate VAZALORE into their “Meds to Beds” cardiovascular discharge programs. The goal is to replicate these programs in other healthcare systems nationwide.

Expanded reach efficiently to both heart health and pain relief consumer audiences with introduction of VAZALORE ads on Facebook; ads featuring professional baseball legend John Smoltz’s personal experience with VAZALORE 325 mg for fast, effective pain relief were well received and delivered high engagement levels, beating industry benchmarks by four-times.

Expanded non-personal promotional efforts to over 3,000 cardiologists and neurologists nationwide who opted-in to receive VAZALORE educational materials; materials included clinical study results for healthcare professionals and samples, education brochures and coupons for patients; program slated to run through 1Q 2023.

Executed targeted digital campaign to over 500,000 healthcare professionals (HCPs), to include cardiologists, pharmacists, and advanced practice providers; message focused on VAZALORE benefits compared with other formulations as key reason to recommend; open rates across all target audiences performed above industry benchmarks.

Distributed VAZALORE samples and patient education materials to more than 1,000 HCPs who have adopted and are actively recommending VAZALORE in their practices.

Completed final stage of broad reach consumer email campaign; communication focused on how VAZALORE is different from other aspirin formulations; engagement level exceeded benchmark.

Published (Aug. 29, 2022) online by the Journal of Thrombosis and Thrombolysis: “Pharmacokinetic and Pharmacodynamic profiles of Novel Phospholipid-Aspirin Complex Liquid Formulation and Low Dose Enteric-Coated Aspirin: Results from a Prospective, Randomized, Crossover Study.”

Third Quarter 2022 Financial Highlights

Total revenues for the third quarter of 2022 were $0.4 million and included $0.3 million of unfavorable adjustments for additional trade allowances and incremental sales returns reserves. The increased trade allowances are used to promote sell through of existing retail inventory. The increased sales returns reserve reflected excess inventory at certain retailers. Sales in the prior year period of $6.6 million benefitted from the commercial launch and initial distribution of VAZALORE to US retail channels. The VAZALORE 81 mg dose (consisting of two SKUs) represented 58% of the current period net sales versus 67% of net sales in the prior year period.

Cost of sales for the third quarter of 2022 were $1.5 million and reflected costs related to outsourced manufacturing and packaging, shipping, quality assurance and royalties. Cost of sales also included $1.0 million of incremental costs related to expired packaging materials, higher shipping costs, and inventory obsolescence for product not expected to be sold prior to its shelf-life date, which is 12 months prior to expiry.

Total operating expenses were $9.8 million for the third quarter of 2022, a decline of approximately 22%, compared to $12.6 million in the prior year period. The significant cost savings reflected the non-recurrence of prior year costs associated with the commercial launch of VAZALORE, coupled with the Company’s disciplined spending approach, including reductions in sales and marketing expenses.

Research and development (R&D) expenses declined approximately 60% to $0.6 million in the third quarter of 2022, compared to approximately $1.6 million in the third quarter of 2021. The decrease primarily reflected the non-recurrence of prior year costs for pre-commercial manufacturing-related activities, such as validation and optimization work for VAZALORE. R&D expense in the current period included scale up manufacturing activities to increase capacity and lower cost of inventory.

Selling, marketing and administrative (SM&A) expenses of $9.1 million declined approximately 17% in the third quarter of 2022, compared to $11.0 million in the third quarter of 2021. The prior year period included higher costs associated with extensive VAZALORE launch activities, including deployment of a cardiovascular specialty field force and a national media television campaign. Sequentially, SM&A expenses declined approximately 33%, compared to the second quarter of 2022, due to lower media spending, the significant reduction in the Company’s Cardiovascular Care Specialist team and a shift to more cost efficient nonpersonal promotional activities, such as virtual and digital communications. Non-cash stock-based compensation was $1.1 million, compared to $0.7 million in the third quarter of 2021.

Other income (expense), net totaled $2.3 million of other income during the third quarter of 2022, compared to other expense of $11.8 million in the third quarter of 2021. The increase is largely attributable to the non-cash change in fair value of warrant liability, primarily due to the fluctuation of the price of the Company’s common stock.

Net loss attributable to common stockholders for the third quarter of 2022 was $8.5 million, or a loss of ($0.30) per diluted share, compared to a net loss of $21.6 million, or ($0.80) per diluted share in the prior year period.

Adjusted non-GAAP net loss per diluted share was ($0.37) in the third quarter of 2022, compared to an adjusted net loss of ($0.37) per diluted share in the third quarter of 2021.

See table for reconciliation of GAAP to adjusted non-GAAP net loss per diluted share.

Liquidity

As of September 30, 2022, the Company had $25.8 million in cash and cash equivalents, approximately $0.1 million in accounts receivable and zero debt on its balance sheet.

2022 Third Quarter Conference Call

The Company’s 2022 third quarter conference call with analysts and investors will be held today at 8:30am ET. To participate in the conference call, please click here to obtain your dial in number and PIN. A live audio webcast of the call can be accessed in the Events & Presentations section of the Company’s Investor Relations website . A replay of the audio webcast will be available under the same link immediately following the conclusion of the conference call and will be available for 30 days after the call.

About VAZALORE

VAZALORE is an FDA-approved liquid-filled aspirin capsule, available in 81 mg and 325 mg doses. VAZALORE delivers aspirin differently from plain and enteric coated aspirin products. The special complex inside the capsule is designed for targeted release of aspirin, limiting its direct contact with the stomach. VAZALORE delivers fast, reliable absorption for pain relief plus the lifesaving benefits of aspirin. To learn more about VAZALORE, please visit and follow us on Facebook.

About PLx Pharma Inc.

PLx Pharma Inc. is a commercial-stage drug delivery platform technology company focused on improving how and where active pharmaceutical ingredients (APIs) are absorbed in the gastrointestinal (GI) tract via its clinically validated and patent protected PLxGuard™ technology. PLx believes this platform has the potential to improve the absorption of many drugs currently on the market or in development, and to reduce the risk of stomach injury associated with certain drugs. To learn more about PLx Pharma Inc. and its pipeline, please visit and follow us on LinkedIn and Twitter.

Forward-Looking Statements

Any statements made in this press release relating to future financial or business performance, conditions, plans, prospects, trends, or strategies and other financial and business matters, including without limitation, the prospects for commercializing or selling any products or drug candidates, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, when or if used in this press release, the words “may,” “could,” “should,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “predict” and similar expressions and their variants, as they relate to PLx may identify forward-looking statements. PLx cautions that these forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Important factors that may cause actual results to differ materially from the results discussed in the forward-looking statements or historical experience include risks and uncertainties, including risks relating to PLx’s ability to successfully further commercialize its VAZALORE products; the failure by PLx to secure and maintain relationships with collaborators; risks relating to clinical trials; risks relating to the commercialization, if any, of PLx’s proposed product candidates (such as marketing, regulatory, product liability, supply, competition, and other risks); dependence on the efforts of third parties; dependence on intellectual property; developments and projections relating to our competitors or our industry; risks that PLx may lack the financial resources and access to capital to fund proposed operations; the impact of difficult macroeconomic conditions, such as inflation and reductions in consumer spending, on the demand for PLx’s products; and risks relating to PLx’s ability to identify, evaluate and complete any strategic alternative that yields value for its stockholders. Further information on the factors and risks that could affect PLx’s business, financial condition and results of operations are contained in PLx’s filings with the U.S. Securities and Exchange Commission (“SEC”), which are available at . Other risks and uncertainties are more fully described in PLx’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 11, 2022, and in other filings that PLx has made or will make going forward. These forward-looking statements represent PLx’s estimate as of the date hereof only, and PLx specifically disclaims any duty or obligation to update forward-looking statements.

Non-GAAP Measures

PLx’s management considers adjusted non-GAAP net loss and adjusted non-GAAP net loss per basic and diluted earnings per share to be important financial indicators of operating performance, providing investors and analysts with useful measures of operating results unaffected by the impact on the financial statements of the volatility of the change in the fair value of the warrant liability and non-cash and non-recurring dividends and beneficial conversion features on our preferred stock. Management uses adjusted non-GAAP net loss and adjusted non-GAAP net loss per share when analyzing performance. Adjusted non-GAAP net loss and adjusted non-GAAP net loss per share should be considered in addition to, but not in lieu of net loss or net loss per share reported under GAAP.

CONTACTS:

Janet M. Barth

Vice President, Investor Relations & Corporate Communications, PLx Pharma Inc.

(973) 409-6542

IR@PLxPharma.com

Lisa M. Wilson

Founder & President, In-Site Communications, Inc.

(212) 452-2793

lwilson@insitecony.com

Source: PLx Pharma Inc.

PLx Pharma Inc.

UNAUDITED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

September 30, 2022

December 31, 2021

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

25,834

$

69,392

Accounts receivable

139

634

Inventory, net

3,178

2,458

Prepaid expenses and other current assets

1,070

992

TOTAL CURRENT ASSETS

30,221

73,476

NON-CURRENT ASSETS

Property and equipment, net

768

858

Goodwill

2,061

2,061

Other assets

174

247

TOTAL ASSETS

$

33,224

$

76,642

LIABILITIES, SERIES A AND SERIES B CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY

CURRENT LIABILITIES

Accounts payable and accrued liabilities

$

5,069

$

10,600

Accrued bonuses

1,112

1,163

Other current liabilities

131

116

TOTAL CURRENT LIABILITIES

6,312

11,879

NON-CURRENT LIABILITIES

Warrant liability

536

12,818

Accrued dividends

129

129

Other liabilities

46

136

TOTAL LIABILITIES

7,023

24,962

Series A convertible preferred stock: $0.001 par value; liquidation value of $12,642,000; 45,000 shares authorized, 12,642 issued and outstanding at September 30, 2022 and December 31, 2021

13,708

13,708

Series B convertible preferred stock: $0.001 par value; liquidation value of $2,492,722; 25,000 shares authorized, 2,364 issued and outstanding at September 30, 2022 and December 31, 2021

2,306

2,306

STOCKHOLDERS' EQUITY

Preferred stock; $0.001 par value; 930,000 shares authorized; none issued and outstanding

-

-

Common stock; $0.001 par value; 100,000,000 shares authorized; 29,137,692 and 27,539,229 shares issued and outstanding at September 30, 2022 and December 31, 2021

29

28

Additional paid-in capital

189,572

183,912

Accumulated deficit

(179,414

)

(148,274

)

TOTAL STOCKHOLDERS' EQUITY

10,187

35,666

TOTAL LIABILITIES, SERIES A AND SERIES B CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY

$

33,224

$

76,642

PLx Pharma Inc.

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2022

2021

2022

2021

REVENUES:

Net sales

$

386

$

6,616

$

2,952

$

6,616

TOTAL REVENUES

386

6,616

2,952

6,616

Cost of sales

1,460

3,913

3,449

3,913

GROSS (LOSS) PROFIT

(1,074

)

2,703

(497

)

2,703

OPERATING EXPENSES:

Research and development

623

1,552

1,833

3,494

Selling, marketing and administrative

9,142

11,013

41,243

19,147

TOTAL OPERATING EXPENSES

9,765

12,565

43,076

22,641

OPERATING LOSS

(10,839

)

(9,862

)

(43,573

)

(19,938

)

OTHER INCOME (EXPENSE):

Interest income (expense), net

119

4

151

(2

)

Change in fair value of warrant liability

2,223

(11,784

)

12,282

(29,747

)

TOTAL OTHER INCOME (EXPENSE)

2,342

(11,780

)

12,433

(29,749

)

LOSS BEFORE INCOME TAXES

(8,497

)

(21,642

)

(31,140

)

(49,687

)

Income taxes

-

-

-

-

NET LOSS

(8,497

)

(21,642

)

(31,140

)

(49,687

)

Preferred dividends

-

-

-

(2,525

)

NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS

$

(8,497

)

$

(21,642

)

$

(31,140

)

$

(52,212

)

Net loss per common share - basic and diluted

$

(0.30

)

$

(0.80

)

$

(1.11

)

$

(2.34

)

Weighted average shares of common shares - basic and diluted

28,603,426

26,911,855

27,949,292

22,342,538

PLx Pharma Inc.

RECONCILIATION OF GAAP TO ADJUSTED NON-GAAP NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS AND ADJUSTED NON-GAAP EARNINGS PER SHARE

(in thousands, except share and per share data)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2022

2021

2022

2021

Net loss attributable to common stockholders - GAAP

$

(8,497

)

$

(21,642

)

$

(31,140

)

$

(52,212

)

Adjustments:

Change in fair value of warrant liability

(2,223

)

-

11,784

(12,282

)

-

29,747

Preferred dividends

-

-

-

-

-

2,525

Adjusted non-GAAP net loss attributable to common stockholders

$

(10,720

)

$

(9,858

)

$

(43,422

)

$

(19,940

)

Adjusted non-GAAP net loss per common share - basic and diluted

$

(0.37

)

$

(0.37

)

$

(1.55

)

$

(0.89

)

Weighted average shares of common shares - basic and diluted

28,603,426

26,911,855

27,949,292

22,342,538

财报合作

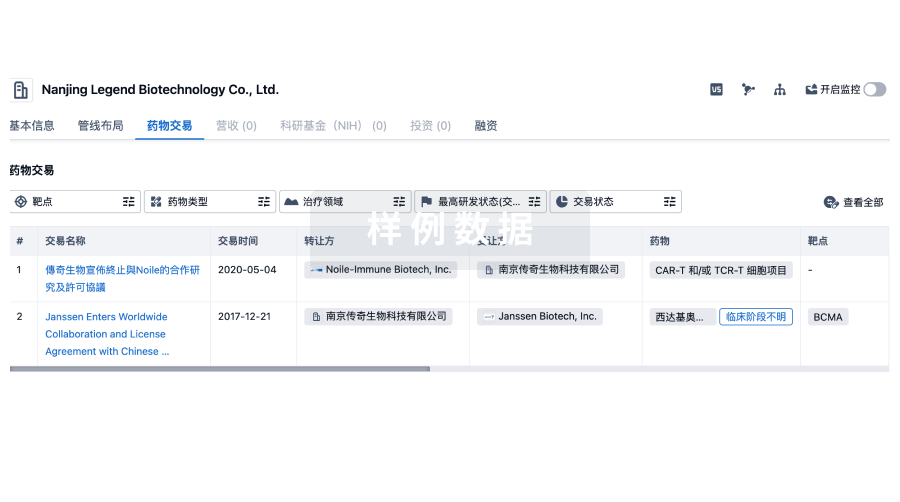

100 项与 PLx Pharma, Inc. 相关的药物交易

登录后查看更多信息

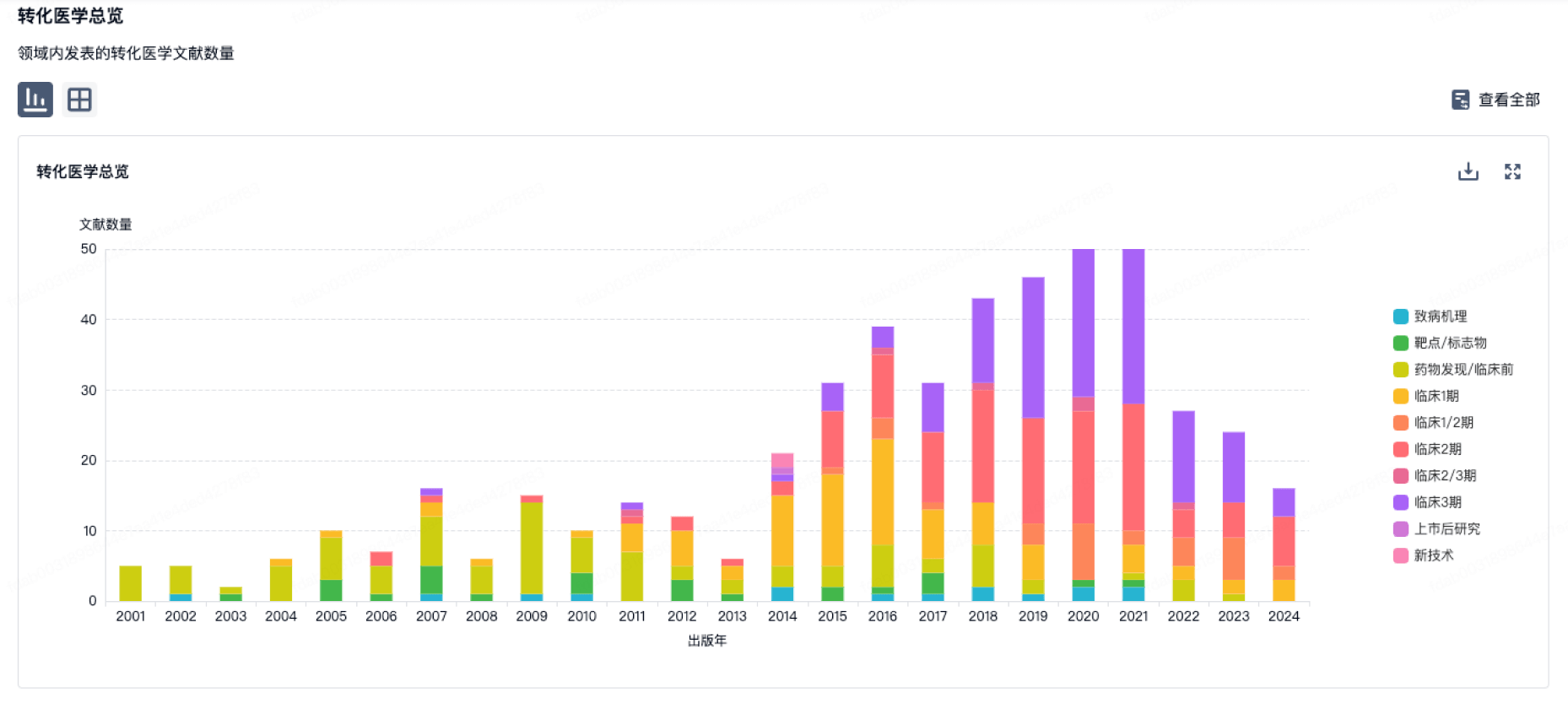

100 项与 PLx Pharma, Inc. 相关的转化医学

登录后查看更多信息

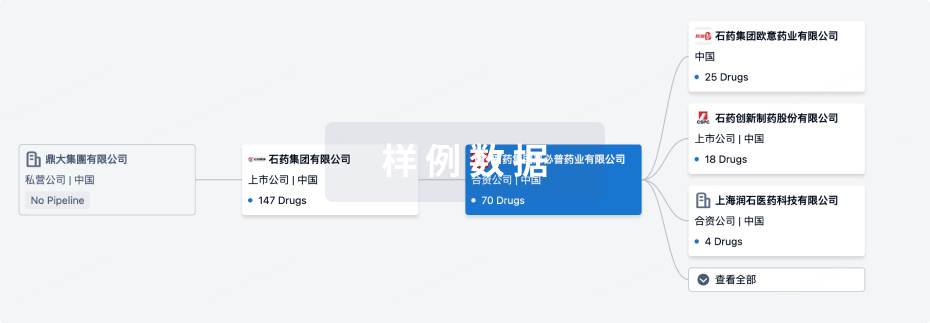

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年04月05日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床2期

1

1

批准上市

其他

3

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

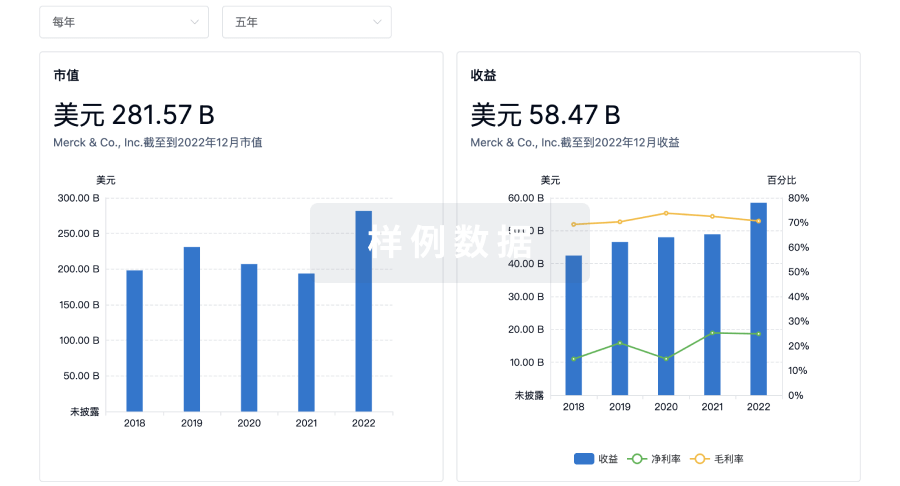

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

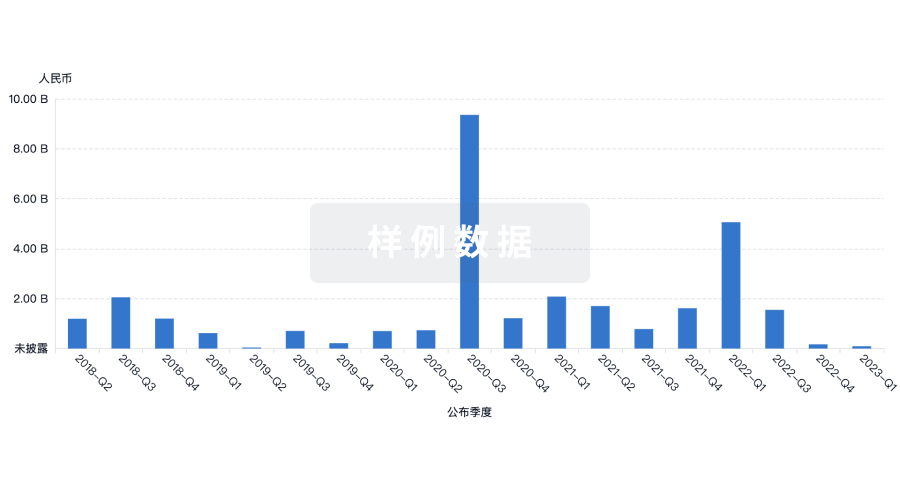

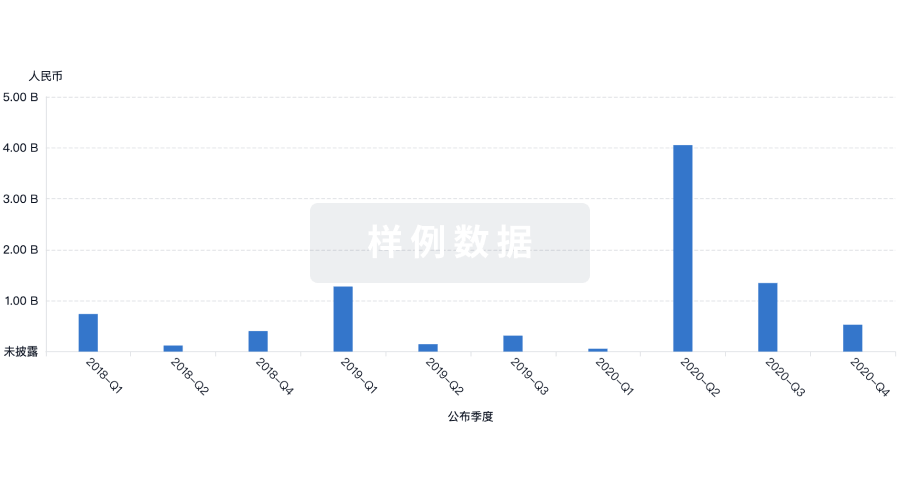

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

来和芽仔聊天吧

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用