预约演示

更新于:2025-09-09

23andMe, Inc.

更新于:2025-09-09

概览

标签

肿瘤

泌尿生殖系统疾病

其他疾病

单克隆抗体

小分子化药

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 单克隆抗体 | 5 |

| 小分子化药 | 1 |

关联

6

项与 23andMe, Inc. 相关的药物靶点 |

作用机制 CD200R刺激剂 |

在研机构 |

原研机构 |

非在研适应症- |

最高研发阶段临床1/2期 |

首次获批国家/地区- |

首次获批日期- |

靶点 |

作用机制 Flt3L inhibitors |

在研机构 |

原研机构 |

在研适应症 |

非在研适应症- |

最高研发阶段临床前 |

首次获批国家/地区- |

首次获批日期- |

11

项与 23andMe, Inc. 相关的临床试验NCT06993142

Slow-SPEED: Slowing Parkinson's Early Through Exercise Dosage

The goal of this clinical trial is two-fold. First to investigate the feasibility of whether a remotely administered smartphone app can increase the volume and intensity of physical activity in daily life in individuals with a LRRK2 G2019S or GBA1 N370S genetic mutation over a long period of time (24 months). Second, to explore the preliminary efficacy of exercise on markers for prodromal Parkinson's disease progression in individuals with a LRRK2 G2019S or GBA1 N370S genetic mutation.

Participants will be tasked to achieve an incremental increase of daily steps (volume) and amount of minutes exercised at a certain heart rate (intensity) with respect to their own baseline level. Motivation with regards to physical activity will entirely be communicated through the study specific Slow Speed smartphone app. A joint primary objective consists of two components. First to determine the longitudinal effect of an exercise intervention in LRRK2 G2019S or GBA1 N370S variant carriers on a prodromal load score, comprised of digital biomarkers of prodromal symptoms. The secondary component of the primary outcome is to determine the feasibility of a remote intervention study. The secondary objective is the effect of a physical activity intervention on digital markers of physical fitness. Exploratory outcomes entail retention rate, completeness of remote digital biomarker assessments, digital prodromal motor and non-motor features of PD. Using these biomarkers, the investigators aim to develop a composite score (prodromal load score) to estimate the total prodromal load. An international exercise study with fellow researchers in the United Kingdom are currently in preparation (Slow-SPEED-UK) and active in the Netherlands (Slow-SPEED-NL). Our intention is to analyse overlapping outcomes combined where possible through a meta-analysis plan, to obtain insight on (determinants of) heterogeneity in compliance and possible efficacy across subgroups

Participants will be tasked to achieve an incremental increase of daily steps (volume) and amount of minutes exercised at a certain heart rate (intensity) with respect to their own baseline level. Motivation with regards to physical activity will entirely be communicated through the study specific Slow Speed smartphone app. A joint primary objective consists of two components. First to determine the longitudinal effect of an exercise intervention in LRRK2 G2019S or GBA1 N370S variant carriers on a prodromal load score, comprised of digital biomarkers of prodromal symptoms. The secondary component of the primary outcome is to determine the feasibility of a remote intervention study. The secondary objective is the effect of a physical activity intervention on digital markers of physical fitness. Exploratory outcomes entail retention rate, completeness of remote digital biomarker assessments, digital prodromal motor and non-motor features of PD. Using these biomarkers, the investigators aim to develop a composite score (prodromal load score) to estimate the total prodromal load. An international exercise study with fellow researchers in the United Kingdom are currently in preparation (Slow-SPEED-UK) and active in the Netherlands (Slow-SPEED-NL). Our intention is to analyse overlapping outcomes combined where possible through a meta-analysis plan, to obtain insight on (determinants of) heterogeneity in compliance and possible efficacy across subgroups

开始日期2025-07-01 |

申办/合作机构 |

NCT06290388

A Phase 1/2a, Multicenter, Open-label, Dose Escalation and Expansion Study of Intravenously Administered 23ME-01473 in Participants With Advanced Solid Malignancies

This is a first-in-human open-label study to evaluate the safety, tolerability, pharmacokinetics, pharmacodynamics, and preliminary clinical activity of 23ME-01473 given by intravenous infusion in participants with advanced solid cancers who have progressed or are intolerant of available standard therapies.

开始日期2024-03-07 |

申办/合作机构 |

NCT06193252

Slow-SPEED-NL: Slowing Parkinson's Early Through Exercise Dosage-Netherlands

The goal of this clinical trial is to investigate the feasibility if a remotely administered smartphone app can increase the volume and intensity of physical activity in daily life in patients with isolated Rapid Eye Movement (REM) sleep behaviour disorder over a long period of time (24 months).

Participants will be tasked to achieve an incremental increase of daily steps (volume) and amount of minutes exercised at a certain heart rate (intensity) with respect to their own baseline level. Motivation with regards to physical activity will entirely be communicated through the study specific Slow Speed smartphone app. Primary outcomes will be compliance expressed as longitudinal change in digital measures of physical activity (step count) measured using a Fitbit smartwatch. Exploratory outcomes entail retention rate, completeness of remote digital biomarker assessments, digital prodromal motor and non-motor features of PD, blood biomarkers and brain imaging markers. Using these biomarkers, we aim to develop a composite score (prodromal load score) to estimate the total prodromal load. An international exercise study with fellow researchers in the United States and United Kingdom are currently in preparation (Slow-SPEED). Our intention is to analyse overlapping outcomes combined where possible through a meta-analysis plan, to obtain insight on (determinants of) heterogeneity in compliance and possible efficacy across subgroups

Participants will be tasked to achieve an incremental increase of daily steps (volume) and amount of minutes exercised at a certain heart rate (intensity) with respect to their own baseline level. Motivation with regards to physical activity will entirely be communicated through the study specific Slow Speed smartphone app. Primary outcomes will be compliance expressed as longitudinal change in digital measures of physical activity (step count) measured using a Fitbit smartwatch. Exploratory outcomes entail retention rate, completeness of remote digital biomarker assessments, digital prodromal motor and non-motor features of PD, blood biomarkers and brain imaging markers. Using these biomarkers, we aim to develop a composite score (prodromal load score) to estimate the total prodromal load. An international exercise study with fellow researchers in the United States and United Kingdom are currently in preparation (Slow-SPEED). Our intention is to analyse overlapping outcomes combined where possible through a meta-analysis plan, to obtain insight on (determinants of) heterogeneity in compliance and possible efficacy across subgroups

开始日期2024-01-15 |

申办/合作机构 |

100 项与 23andMe, Inc. 相关的临床结果

登录后查看更多信息

0 项与 23andMe, Inc. 相关的专利(医药)

登录后查看更多信息

358

项与 23andMe, Inc. 相关的新闻(医药)2025-09-06

London: The genetics testing company 23andMe asked a federal bankruptcy judge to approve a $50 million settlement to resolve claims from a 2023 data breach that exposed genetic and other personal information of about 6.4 million U.S. customers.

A preliminary settlement was filed late Thursday night in St. Louis bankruptcy court, where 23andMe filed for Chapter 11 protection from creditors in March.

Lawyers for the company said the settlement would set up a $30 million to $50 million fund and resolve a "substantial majority" of U.S. claims from the data breach, which began in April 2023 and lasted about five months.

More than 250,000 claimants, mostly in the United States, submitted proofs of claim, the lawyers said. The settlement also lets class members enroll for five years in a program known as Privacy & Medical Shield + Genetic Monitoring.

A $30 million settlement had been reached last September, before the bankruptcy, and won conditional approval from a San Francisco federal judge in December.

According to court papers, the revised settlement "closely tracks" that accord, but adds $20 million after a nonprofit controlled by founder Anne Wojcicki bought 23andMe's assets for $305 million in July, resulting in more assets.

Proceeds from the sale "remain the only source of monetary recovery" for data breach victims, a factor weighing "heavily" in favor of settlement approval, 23andMe's lawyers said.

The settlement also resolved accusations that 23andMe did not tell customers with Chinese and Ashkenazi Jewish ancestry that the hacker appeared to have targeted them, and posted their information for sale on the dark web.

The case is In re 23andMe Holding Co, U.S. Bankruptcy Court, Eastern District of Missouri, No. 25-bk-40976. (Reporting by Jonathan Stempel in New York)

并购专利侵权

2025-09-03

iStock,

juliannafunk

Some of the biggest SPACs from the industry’s pandemic-fueled heyday are no longer on the market.

2021 was a wild year for the biotech public stock market. Across the U.S. and Europe, more than 100 startups went for their initial public offerings while another large batch took a different track—merging with a special purpose acquisition company, also known as the SPAC track.

Also called blank-check companies, SPACs work by raising capital via an IPO that they then let sit in trust accounts. Eventually, SPACs can leverage this funding to merge with a promising private company in a deal that not only brings the target company to the public stock market but infuses it with a hefty sum of money.

During the heyday of 2021—when the industry was flush with pandemic-driven investments—SPACs presented a

quick and comparatively easy way

to raise money and go public. SPACs typically come with lower upfront costs than traditional initial public offerings (IPOs) and allow companies to

collect even more capital

through private investment in public equity (PIPE) placements. IPOs, on the other hand, take longer to complete and are burdened by upfront underwriting and legal fees.

But the market has since

cooled and contracted

. With investors driven away by macro-level uncertainties,

dozens of companies have already closed shop

while

many more are in a precarious position

.

In this piece,

BioSpace

checks in on some standout SPACs of 2021, looking at how they’ve fared over the years, and how they’re weathering the current market turbulence.

Roivant

SPAC Date: October 2021

Value: $611 million

Roivant

debuted on Nasdaq on Oct. 1, 2021

, via a merger with Montes Archimedes Acquisition Corp. The deal gave the burgeoning biotech access to the blank-check company’s

$411 million trust fund

and $200 million in a PIPE placement.

All told, the SPAC deal put Roivant’s cash position at

around $2.5 billion

.

Roivant has used this money to step-up its subsidiary strategy—forming nimble and focused “

Vants

” dedicated to developing novel therapies. Months after completing its SPAC, for instance, the biotech

teamed up

with Pfizer and in June 2022 launched Priovant Therapeutics to advance brepocitinib, an orally available and selective TYK2 and JAK1 inhibitor for the treatment of autoimmune disorders such as systemic lupus erythematosus and dermatomyositis.

Later that year, Roivant and Pfizer

debuted another Vant

, this time to work on an anti-TL1A antibody for ulcerative colitis. The subsidiary, dubbed Telavant, was acquired by Roche in October 2023 for

$7.1 billion upfront

.

Also in 2022, Roivant

scored its first FDA approval

for Dermavant’s VTAMA cream, indicated for plaque psoriasis in adults. Two years later, in September 2024, Organon acquired Dermavant in a potential $1.2 billion agreement. That same month, Roivant

launched another subsidiary

, called Pulmovant, tasked with working on mosliciguat, an inhalable therapy for pulmonary hypertension associated with interstitial lung disease.

Since debuting, Roivant’s shares have increased 28% with a market cap of $8.36 billion.

EQRx

SPAC Date: August 2021

Value: $1.8 billion

EQRx

launched in 2020

with $200 million in series A money and a lofty goal: change the drug discovery process to develop medicines that are more affordable. In August 2021, CM Life Sciences III, Inc threw its weight behind this mission with a

hefty SPAC deal

, not only carrying EQRx to the public stock exchange but also providing a $1.8 billion cash infusion.

The problems started over a year later, in November 2022, when development plans for the PD-L1 blocker sugemalimab hit a rough patch. In talks with the FDA, EQRx was

told

that interim findings from its Phase III GEMSTONE-302 trial, conducted in China, would not be enough to support a regulatory filing for U.S. approval. The company at the time decided that there was “no commercially viable path” for sugemalimab in the U.S. EQRx was forced to abandon plans for a test in stage IV non-small cell lung cancer.

A few months later, in February 2023, in an effort to “increase . . . operational efficiencies and streamline expenses,” EQRx

downsized by 18%

, a move that the company expected to generate $18 million in annualized savings.

The company ramped up the restructuring process in May that same year with a

sweeping business reset

, laying off half its headcount and junking another cancer asset. Most notably, EQRx shifted focus to become a more cookie-cutter drug development company, “developing clinically differentiated, high-value medicines,” then-CEO Melanie Nallicheri

said in a statement

at the time.

But even this pivot failed to turn EQRx’s business around. In August 2023, EQRx

was absorbed

by Revolution Medicines and is no longer trading on Nasdaq.

23andMe

SPAC Date: June 2021

Value: $592 million

The last few months have been difficult for DNA testing company 23andMe. In March, the company filed for

Chapter 11 bankruptcy

, seeking for court supervision as it sells its business.

This is a far cry from four years earlier, when 23andMe debuted on the public stock market in a SPAC deal with VG Acquisition Corp in June 2021. The agreement

raised a gross of $592 million

for the consumer genetics company and

bumped up its value to $3.5 billion

. Shortly after landing on Nasdaq, 23andMe hit its

peak market value of approximately $6 billion

.

Things soon went south, however, as 23andMe

struggled to cope

with rising interest rates and sales slumps. By the end of fiscal year 2022, the company hit a

$184 million net loss

, which

ballooned to $312 million in 2023

. To stanch the cash bleed, 23andMe in November 2024 put in motion a

sweeping restructuring initiative

, involving a 40% layoff and a pivot away from drug development efforts. The company at the time expected these measures to generate $35 million in savings annually.

Aside from a capital crunch, 23andMe was beset with privacy problems. In October 2023, hackers

breached

the company’s system and were able to access data of some 6.9 million people. In June this year, 23andMe and its sale were at the heart of a

Senate Oversight Committee hearing

that highlighted “serious national security” concerns over Americans’ genetic data.

That same month, the company was finally

acquired

for $305 million by the nonprofit TTAM Research Institute, owned by Anne Wojcicki, 23andMe’s former CEO. Wojcicki has pledged to comply with 23andMe’s privacy policies and has made “binding commitments” to add certain safeguards to further protect customers and their genetic data.

After being bought by TTAM, 23andMe is no longer on the public stock market.

Tango Therapeutics

SPAC Date: August 2021

Value: $342 million

Tango Therapeutics danced into the public stock market almost four years ago when it merged with BCTG Acquisition Corp. The deal gave the Massachusetts-based biotech $342 million, including $156 million from BCTG’s trust account and roughly $186 million from a PIPE placement.

At the time of its Nasdaq debut, Tango’s cash position was at $515 million.

In the years since, the biotech has worked on its pipeline of precision cancer therapies, though this effort has not been without its stumbles. In May 2024, Tango

shelved

the USP1 inhibitor TNG348, which was being testing in early-stage studies for solid tumors. The decision to scrap the asset was driven by grade 3 and 4 liver function abnormalities, which Tango detected in patients who had been on the trial for more than eight weeks.

Tango planned to assess TNG348 as a monotherapy and as part of a combination regimen with AstraZeneca and Merck’s PARP inhibitor Lynparza, though the company

never had the chance

.

A few months later, in November 2024, Tango was forced to abandon another asset, this time the PRMT5 blocker TNG908. The molecule, designed to get past the blood-brain barrier, was being trialed for glioblastoma, but a Phase I/II study showed that TNG908 “did not meet the pharmacokinetic exposure threshold for clinical efficacy,” according to a

company announcement

at the time.

Discontinuing TNG908 allowed Tango to fully resource its other PRMT5 blocker TNG462, which is now the biotech’s lead asset. The company is

developing

the asset for pancreatic and lung cancers, as well as other non-CNS malignancies. Phase I/II data are expected later this year, according to Tango’s

most recent quarterly report

, released last month, after which it expects to launch a registrational trial for pancreatic cancer next year.

Since going public, Tango’s stocks have declined 33%. The biotech has a market cap of $745.4 million.

Cerevel Therapeutics

SPAC Date: July 2020

Value: $440 million

Cerevel was a little early to the SPAC party as compared to the other entries on this list,

merging in July 2020

with blank-check firm Arya Sciences Acquisition Corp II. The SPAC at the time had $150 million in trust, which Cerevel’s backers—a high-pro including Bain Capital and Pfizer—supplemented with $320 million in a PIPE placement.

All told, Cerevel’s public stock debut a few months later was accompanied by a net cash infusion of approximately

$440 million

.

This money helped the Massachusetts biotech establish itself as a leader in the neurology space, anchored by its next-generation antipsychotic schizophrenia drug emraclidine. Phase Ib data published in December 2022 showed that the drug led to “

clinically meaningful and statistically significant improvements

” in positive and negative symptoms after six weeks of treatment, as compared with placebo.

These findings, though early, were enough to not only land emraclidine on

BioSpace

’s

watchlist for neuropsychiatric drugs

on August 2023 but also attract the attention of AbbVie. In December that year, the industry giant dropped an eye-watering

$8.7 billion

to acquire Cerevel, winning emraclidine and the biotech’s rich pipeline of other investigational neuro assets.

The bet seemed to pay off quickly, with a Phase III readout in April 2024 showing that its dopamine receptor partial agonist tavapadon elicited

significant motor control improvements

in patients with Parkinson’s disease. But in November last year, emraclidine returned

back-to-back Phase II failures in schizophrenia

, delivering a 12% hit to AbbVie’s shares. The pharma has since

recalibrated

its program for emraclidine and will take the molecule forward as part of an adjunct regimen.

AbbVie’s acquisition of Cerevel

closed in August 2024

, officially taking the neuro biotech off the public stock exchange just over four years since its debut.

Immatics

SPAC Date: March 2020

Value: $250 million

In two important ways, Immatics’ SPAC journey mirrors that of Cerevel’s: The cancer-focused biotech launched onto the public stock market in 2020, and it did so by merging with an Arya entity. In the case of Immatics, its SPAC was funded by the original Arya Sciences Acquisition Corp., which in

March 2020

offered its $148 million trust fund to take the biotech public.

The arrangement was completed in July that same year, with Immatics

bagging $253 million in total

, including proceeds from a PIPE financing.

In the years since its Nasdaq debut, Immatics mustered support from many other biopharma companies through partnerships.

Chief of these is Bristol Myers Squibb, which in December 2021

paid $150 million upfront

and promised up to $770 million in milestones to co-develop the T cell receptor (TCR) bispecific antibody IMA401. Some six months later, in June 2022, BMS doubled down on its commitment to Immatics by paying $60 million to

expand

their existing arrangement to go after “multiple” off-the-shelf TCR or CAR T programs. Under the expanded contract, Immatics is eligible for up to $700 million per program.

In May 2023, BMS

exercised

its first license option under the Immatics deal, gaining worldwide license to a novel TCR-T product candidate, in turn giving the biotech $15 million in exercise fees. A few months later, the pharma made a

$35 million equity investment

in Immatics.

Aside from BMS, Immatics also

struck up an R&D deal

with Moderna in September 2023, under which the companies will explore using mRNA technology for the in vivo expression of TCR bispecifics. The collaboration gave Immatics $120 million upfront plus the possibility of more than $1.7 billion in milestones.

Since its SPAC, Immatics’ shares have fallen 66%. The company has a market cap of $657 million.

并购上市批准临床3期引进/卖出临床2期

2025-08-01

Regeneron’s CEO and co-chair said he agreed with President Donald Trump’s view that European nations should pay more for new drugs.

Leonard Schleifer’s remarks on Regeneron’s second-quarter earnings call on Friday were some of the first public comments from a pharmaceutical industry executive following

Trump’s letters to drugmakers

demanding “most favored nation” pricing within 60 days.

Regeneron, and Schleifer specifically, were on the receiving end of those letters, which were posted Thursday afternoon.

“I have been, and the company has been, outspoken that we agree with the president that the Europeans are not paying their fair share of innovation, and some way that needs to change,” Schleifer said on the earnings call. “It’s complicated and it does have to be done at a trade and policy level, because it can’t be done at an individual company level. It’s very difficult.”

He added that “the solution is simply not to lower cost prices in the US without some equilibrating in Europe, because then there’ll be no innovation.”

Trump’s letters signaled the latest push to get drugmakers to bring their US prices in line with what they charge in other developed countries. But Schleifer said it raises questions over future partnerships between American and European pharmaceutical companies.

“I suspect a lot of new contracts will have to deal with the contingency of what happens if you license something to Europe,” Schleifer said.

Regeneron has multiple products approved in other countries and relies on partners to help commercialize them

.

Schleifer pointed to the company’s blockbuster eye drug Eylea as an example.

“We don’t control the pricing of Eylea outside of the United States. That’s controlled by Bayer,” he said.

Asked by an analyst if he’d been down to Trump’s Mar-a-Lago “a lot” of times to influence policy, Schleifer replied that he has “not been down there frequently.” The chief executives of Eli Lilly and Pfizer have traveled to Trump’s estate in Florida multiple times, the analyst noted.

“The president probably knows Regeneron and my first name given that it was the Regeneron cocktail for Covid that may have saved his life,” Schleifer said. “Beyond that, I don’t have any great insights to the policies.”

Elsewhere on the earnings call, Regeneron said it

received a complete response letter

for a bispecific antibody and that additional approvals of Eylea HD will likely be delayed because of an FDA inspection at a manufacturing site in Indiana.

Schleifer and chief scientific officer George Yancopoulos also repeatedly shielded questions about the amount of money that Regeneron spends on R&D, with about $5 billion anticipated to be spent this year.

“The excitement or enthusiasm of those” Phase 3 programs and other pipeline assets, “is always being limited by people wanting to know what’s going to happen with Eylea and so forth, so I think our pipeline would be viewed very differently if it was viewed in isolation because of the incredible potential and opportunities,” Yancopoulos said.

Schleifer said the company has a broad pipeline of 45 development programs, including work across lymphoma, myeloma, complement-mediated diseases, geographic atrophy, myasthenia gravis and thrombotic diseases.

A Phase 2 trial of one of those assets, REGN7257, was discontinued in aplastic anemia. But the asset remains in Regeneron’s pipeline as the drugmaker continues to “evaluate next steps,” a spokesperson said in an emailed statement to

Endpoints News

.

Schleifer asked for more attention on the Regeneron pipeline.

“It’s hard for any one analyst, or any one analyst team, to look at 45 programs. If you’ve got 10 different companies, and the other nine have two programs each, you could consume all the time. That’s maybe why it doesn’t get as much attention as we’d like,” Schleifer said.

The Regeneron CEO also noted the company has focused historically on internal R&D given its bustling research engine. Regeneron has made relatively few acquisitions compared to its pharmaceutical peers.

“We want the best stuff for patients and so we go outside and look and look and look, and occasionally we do find stuff, and if we have to do it, we have a lot of flexibility to do it,” Schleifer said. “But to us, it’s not a lifeline like it is for so many companies.”

Regeneron bought a London ocular biotech called

Oxular

for undisclosed terms in January. It tried buying 23andMe, but was outbid

by the genetic testing company’s founder

.

临床2期并购

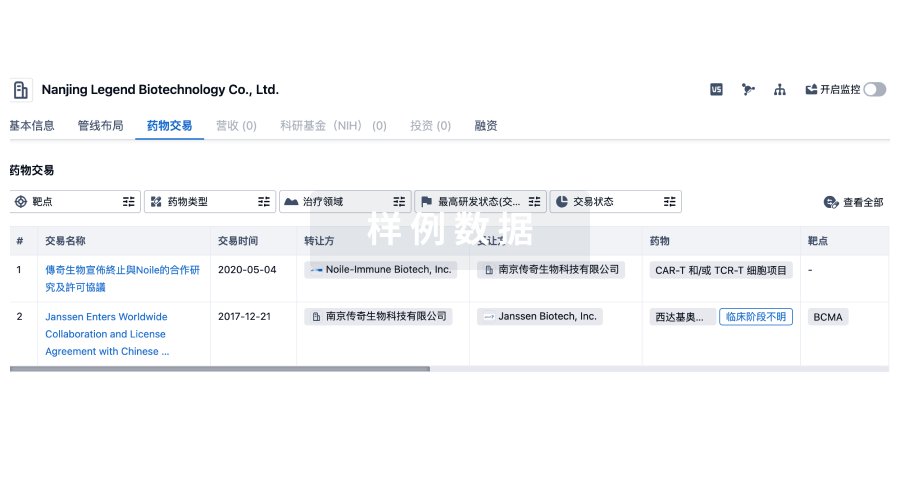

100 项与 23andMe, Inc. 相关的药物交易

登录后查看更多信息

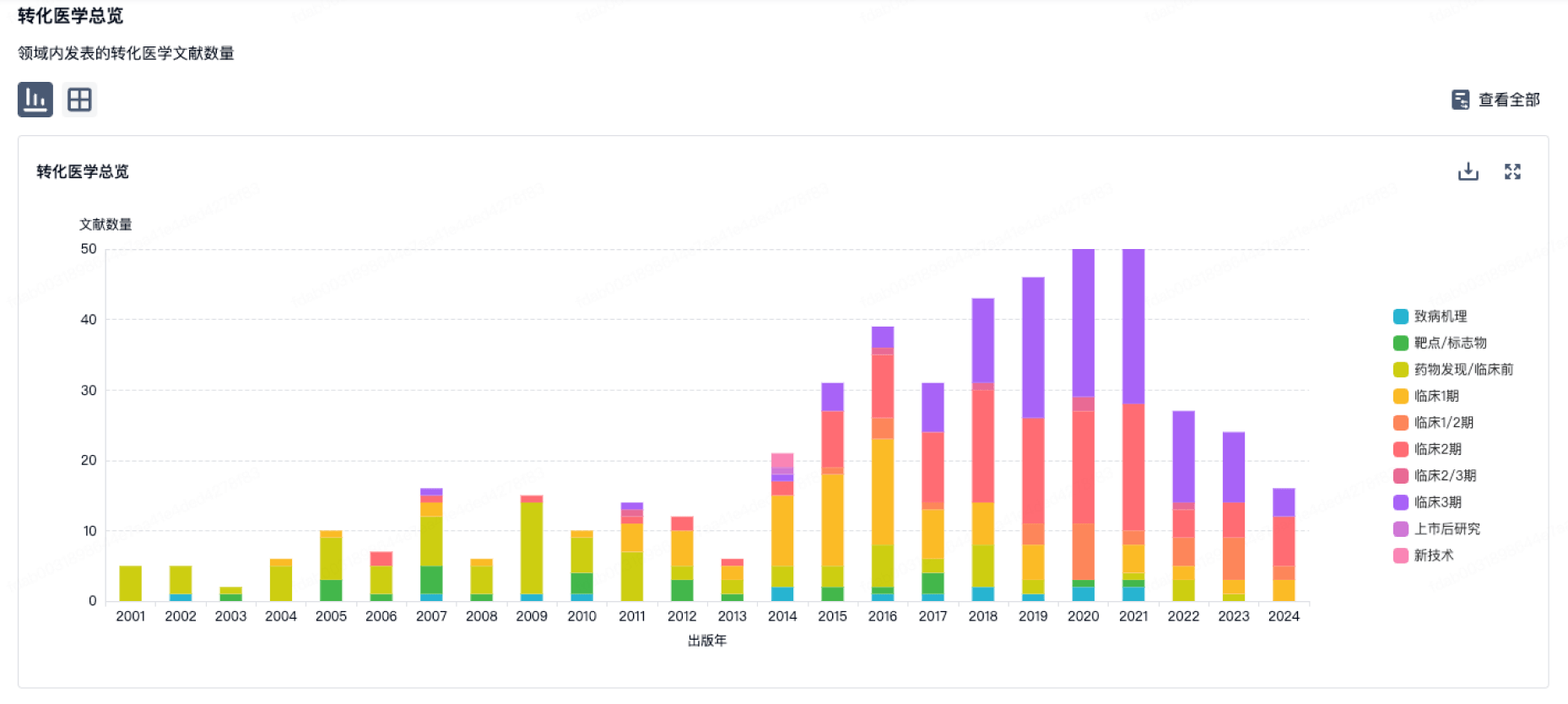

100 项与 23andMe, Inc. 相关的转化医学

登录后查看更多信息

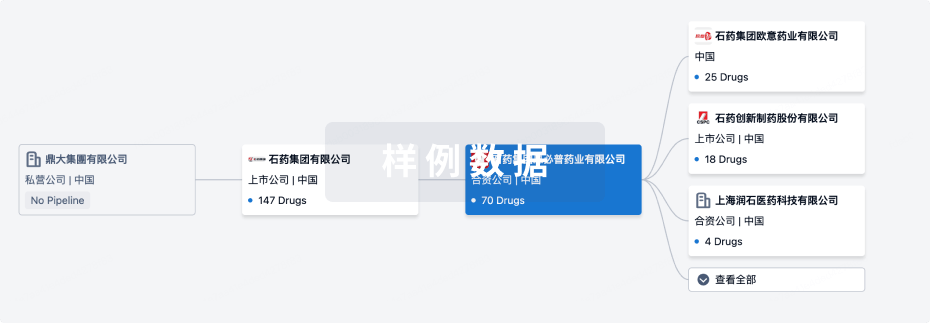

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年09月16日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

药物发现

3

1

临床前

临床1期

1

1

临床2期

其他

3

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

23ME-00610 ( CD200R ) | 晚期恶性实体瘤 更多 | 临床1/2期 |

Nelistotug ( CD96 ) | 晚期恶性实体瘤 更多 | 临床1期 |

抗FLT3L抗体(GSK) ( Flt3L ) | 自身免疫性疾病 更多 | 临床前 |

US20230220037 ( CGRP x TRPM3 )专利挖掘 | 神经系统疾病 更多 | 药物发现 |

WO2024083945 专利挖掘 | 自身免疫性疾病 更多 | 药物发现 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

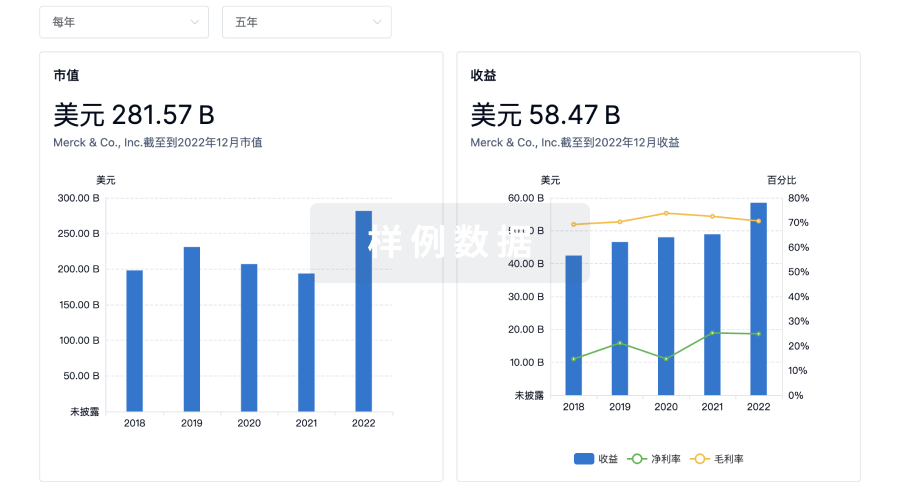

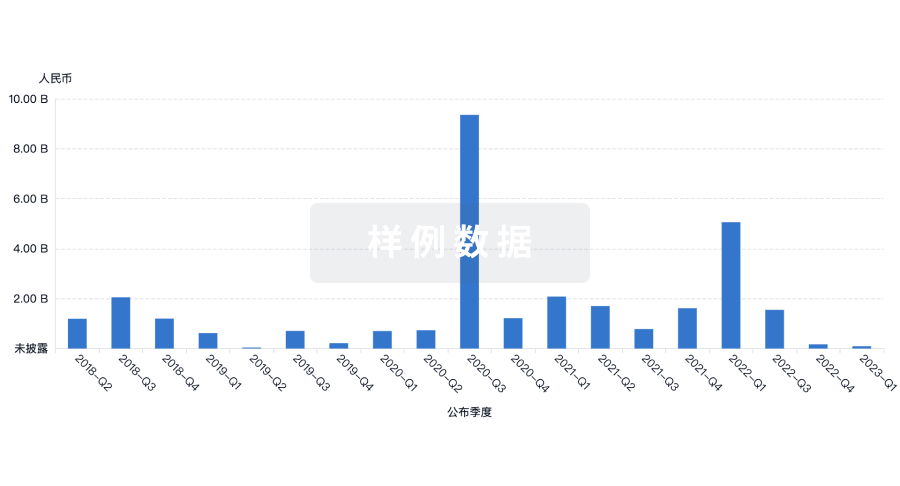

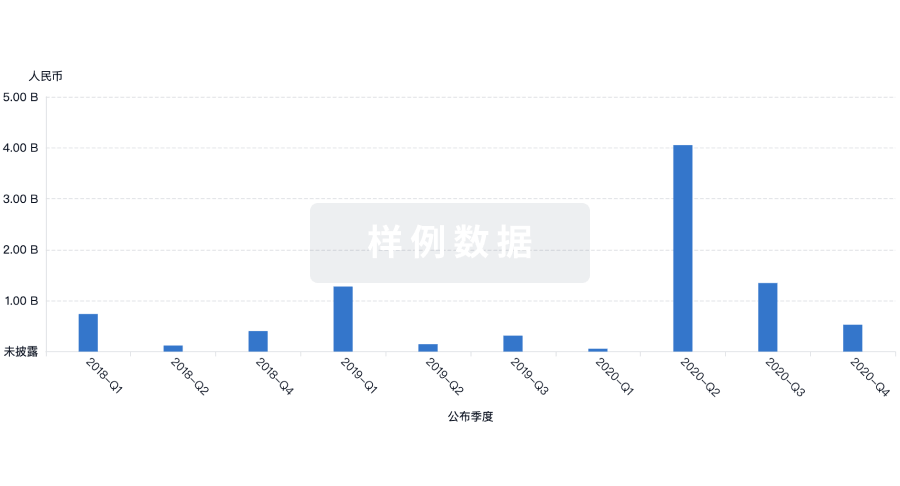

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用