预约演示

更新于:2025-07-30

Nepicastat Hydrochloride

更新于:2025-07-30

概要

基本信息

在研机构- |

权益机构 |

最高研发阶段终止临床2期 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评- |

登录后查看时间轴

结构/序列

分子式C14H16ClF2N3S |

InChIKeyDIPDUAJWNBEVOY-PPHPATTJSA-N |

CAS号170151-24-3 |

关联

4

项与 Nepicastat Hydrochloride 相关的临床试验NCT01704196

Phase 2, Double-Blind, Placebo-Controlled, Parallel Group, Multi-Center Trial of Nepicastat for Cocaine Dependence

The objective of this study is to evaluate the safety and efficacy of Nepicastat in improving the number of subjects that achieve abstinence from cocaine and reducing cocaine use in subjects with cocaine dependence.

开始日期2013-04-01 |

NCT00659230

A Randomized, Placebo-Controlled Trial of the Dopamine-B-Hydroxylase (DBH) Inhibitor, Nepicastat, for the Treatment of PTSD in OIF/OEF Veterans

This study proposes a multi-site, randomized, double-blind, placebo-controlled clinical trial of the dopamine-ß-hydroxylase (DBH) inhibitor, nepicastat, for the treatment of posttraumatic stress disorder (PTSD) in outpatients who have previously served in a combat zone during Operation Iraqi Freedom and Operation Enduring Freedom (OIF/OEF)or other Southwest conditions since 19800. A DBH inhibitor's mechanism of action is to decrease neuronal noradrenaline (NA) release by inhibiting DBH conversion of dopamine (DA) to NA. Animal models of PTSD and human studies have found a substantial increase in NA activity for these animal models and for PTSD in humans. Furthermore, recent clinical studies have improved PTSD hyper-arousal symptoms by reducing the NA over-activity using agents like NA post-synaptic antagonists. Key support for the proposed study is based on a similar improvement in PTSD symptoms after treatment with the DBH inhibitor, disulfiram.

In the experience of the clinical investigators, the most common chief complaint of the OIF/OEF veterans with PTSD is hyperarousal (DSM-IV criterion D symptom cluster). These symptoms significantly interfere with social, occupational, and interpersonal function. Standard treatments with antidepressants are not fully effective in treating the symptoms of PTSD in veterans; thus, new treatments are needed. An intervention, such as nepicastat, aimed at reducing hyperarousal, as well as other PTSD symptoms, would have significant impact of restoring overall function and quality of life in OIF/OEF veterans with PTSD. Since hyperarousal symptoms responded relatively quickly to medications of this type, our study in 120 outpatient veterans with PTSD will compare nepicastat 120 mg/day vs. placebo in a 6-week double-blind, randomized clinical trial (RCT). The veterans will be followed for an additional 8 weeks after the RCT, during which, those who have a priori defined positive clinical response to the study medication, nepicastat vs. placebo, will be continued on the study medication, in order to assess further improvement and safety. Those patients who do not have a positive clinical response during the 6 week RCT will be offered the addition of the standard first-line PTSD pharmacotherapy, paroxetine, during the 8 weeks extension phase. Thus, weeks 7-14 offer an opportunity to evaluate longer-term nepicastat efficacy and to compare the treatment response of nonresponders after augmentation with paroxetine.

In the experience of the clinical investigators, the most common chief complaint of the OIF/OEF veterans with PTSD is hyperarousal (DSM-IV criterion D symptom cluster). These symptoms significantly interfere with social, occupational, and interpersonal function. Standard treatments with antidepressants are not fully effective in treating the symptoms of PTSD in veterans; thus, new treatments are needed. An intervention, such as nepicastat, aimed at reducing hyperarousal, as well as other PTSD symptoms, would have significant impact of restoring overall function and quality of life in OIF/OEF veterans with PTSD. Since hyperarousal symptoms responded relatively quickly to medications of this type, our study in 120 outpatient veterans with PTSD will compare nepicastat 120 mg/day vs. placebo in a 6-week double-blind, randomized clinical trial (RCT). The veterans will be followed for an additional 8 weeks after the RCT, during which, those who have a priori defined positive clinical response to the study medication, nepicastat vs. placebo, will be continued on the study medication, in order to assess further improvement and safety. Those patients who do not have a positive clinical response during the 6 week RCT will be offered the addition of the standard first-line PTSD pharmacotherapy, paroxetine, during the 8 weeks extension phase. Thus, weeks 7-14 offer an opportunity to evaluate longer-term nepicastat efficacy and to compare the treatment response of nonresponders after augmentation with paroxetine.

开始日期2009-07-01 |

NCT00641511

Pharmacogenetic Clinical Trial of Nepicastat for PTSD

Assess the effect of nepicastat in the treatment of in Post Traumatic Stress Disorder (PTSD) in conflict or combat zone experienced veterans, in comparison to placebo.

开始日期2008-06-01 |

申办/合作机构 |

100 项与 Nepicastat Hydrochloride 相关的临床结果

登录后查看更多信息

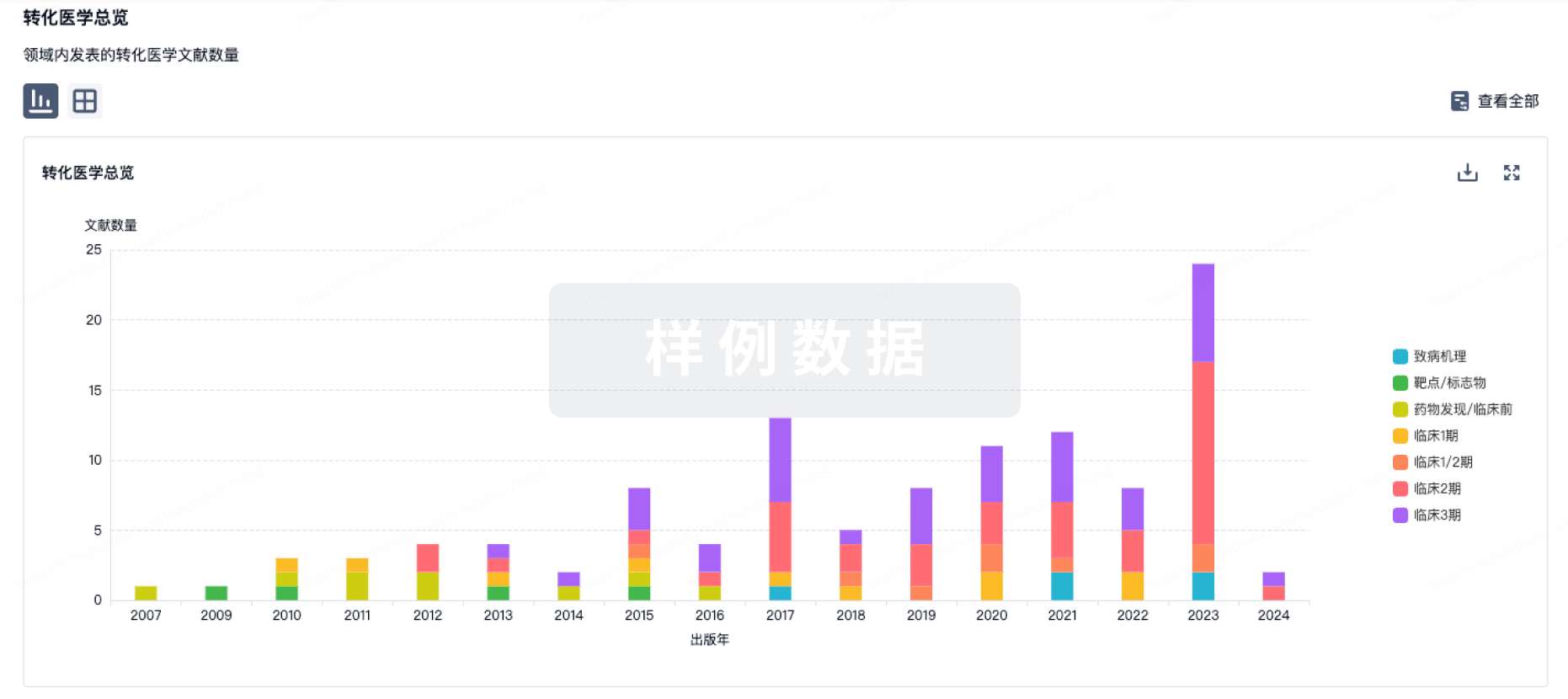

100 项与 Nepicastat Hydrochloride 相关的转化医学

登录后查看更多信息

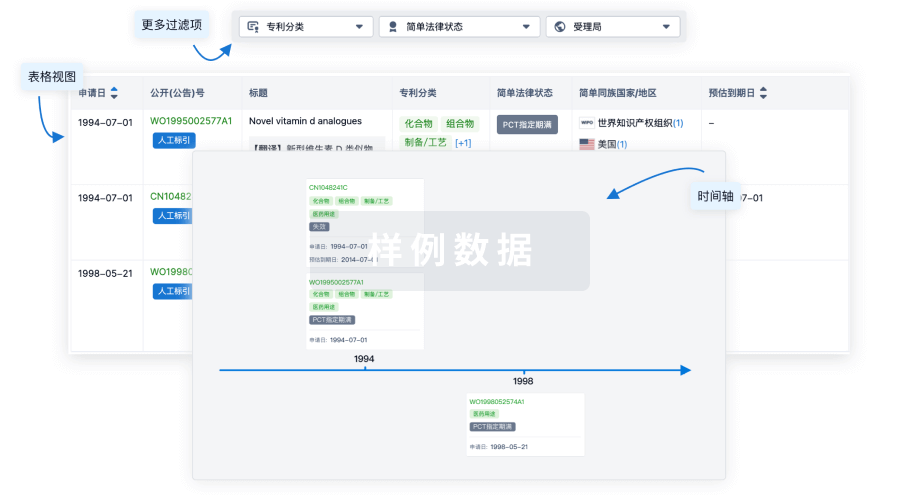

100 项与 Nepicastat Hydrochloride 相关的专利(医药)

登录后查看更多信息

45

项与 Nepicastat Hydrochloride 相关的文献(医药)2024-08-01·BEHAVIOURAL BRAIN RESEARCH

Effects of acute inhibition of dopamine β-hydroxylase on neural responses to pups in adult virgin male California mice (Peromyscus californicus)

Article

作者: Acosta, Melina C ; Hussein, Manal ; Saltzman, Wendy

The neural mechanisms underlying paternal care in biparental mammals are not well understood. The California mouse (Peromyscus californicus) is a biparental rodent in which virtually all fathers are attracted to pups, while virgin males vary widely in their behavior toward unrelated infants, ranging from attacking to avoiding to huddling and grooming pups. We previously showed that pharmacologically inhibiting the synthesis of the neurotransmitter norepinephrine (NE) with the dopamine β-hydroxylase inhibitor nepicastat reduced the propensity of virgin male and female California mice to interact with pups. The current study tested the hypothesis that nepicastat would reduce pup-induced c-Fos immunoreactivity, a cellular marker of neural activity, in the medial preoptic area (MPOA), medial amygdala (MeA), basolateral amygdala (BLA), and bed nucleus of the stria terminalis (BNST), brain regions implicated in the control of parental behavior and/or anxiety. Virgin males were injected with nepicastat (75 mg/kg, i.p.) or vehicle 2 hours prior to exposure to either an unrelated pup or novel object for 60 minutes (n = 4-6 mice per group). Immediately following the 60-minute stimulus exposure, mice were euthanized and their brains were collected for c-Fos immunohistochemistry. Nepicastat reduced c-Fos expression in the MeA and MPOA of pup-exposed virgin males compared to vehicle-injected controls. In contrast, nepicastat did not alter c-Fos expression in any of the above brain regions following exposure to a novel object. Overall, these results suggest that the noradrenergic system might influence MeA and MPOA function to promote behavioral interactions with pups in virgin males.

2024-07-01·CELLULAR IMMUNOLOGY

Dopamine β-hydroxylase shapes intestinal inflammation through modulating T cell activation

Article

作者: Lv, Jing ; Pan, Ke ; Li, Heng ; Chen, Alice ; Bai, Yanfeng ; Shi, Weilin ; Sun, Qiaoling

BACKGROUND:

Inflammatory bowel disease (IBD) is a chronic and relapsing disease characterized by immune-mediated dysfunction of intestinal homeostasis. Alteration of the enteric nervous system and the subsequent neuro-immune interaction are thought to contribute to the initiation and progression of IBD. However, the role of dopamine beta-hydroxylase (DBH), an enzyme converting dopamine into norepinephrine, in modulating intestinal inflammation is not well defined.

METHODS:

CD4+CD45RBhighT cell adoptive transfer, and 2,4-dinitrobenzene sulfonic acid (DNBS) or dextran sodium sulfate (DSS)-induced colitis were collectively conducted to uncover the effects of DBH inhibition by nepicastat, a DBH inhibitor, in mucosal ulceration, disease severity, and T cell function.

RESULTS:

Inhibition of DBH by nepicastat triggered therapeutic effects on T cell adoptive transfer induced chronic mouse colitis model, which was consistent with the gene expression of DBH in multiple cell populations including T cells. Furthermore, DBH inhibition dramatically ameliorated the disease activity and colon shortening in chemically induced acute and chronic IBD models, as evidenced by morphological and histological examinations. The reshaped systemic inflammatory status was largely associated with decreased pro-inflammatory mediators, such as TNF-α, IL-6 and IFN-γ in plasma and re-balanced Th1, Th17 and Tregs in mesenteric lymph nodes (MLNs) upon colitis progression. Additionally, the conversion from dopamine (DA) to norepinephrine (NE) was inhibited resulting in increase in DA level and decrease in NE level and DA/NE showed immune-modulatory effects on the activation of immune cells.

CONCLUSION:

Modulation of neurotransmitter levels via inhibition of DBH exerted protective effects on progression of murine colitis by modulating the neuro-immune axis. These findings suggested a promising new therapeutic strategy for attenuating intestinal inflammation.

2024-03-01·Ecotoxicology and environmental safety

Computational methods meet in vitro techniques: A case study on fusaric acid and its possible detoxification through cytochrome P450 enzymes

Article

作者: Galaverna, Gianni ; Dall'Asta, Chiara ; Doherty, Daniel Zocchi ; Pedroni, Lorenzo ; Dellafiora, Luca ; Bell, Stephen G

Mycotoxins are known environmental pollutants that may contaminate food and feed chains. Some mycotoxins are regulated in many countries to limit the trading of contaminated and harmful commodities. However, the so-called emerging mycotoxins are poorly understood and need to be investigated further. Fusaric acid is an emerging mycotoxin, noxious to plants and animals, but is known to be less toxic to plants when hydroxylated. The detoxification routes effective in animals have not been elucidated yet. In this context, this study integrated in silico and in vitro techniques to discover potential bioremediation routes to turn fusaric acid to its less toxic metabolites. The toxicodynamics of these forms in humans have also been addressed. An in silico screening process, followed by molecular docking and dynamics studies, identified CYP199A4 from the bacterium Rhodopseudomonas palustris HaA2 as a potential fusaric acid biotransforming enzyme. Its activity was confirmed in vitro. However, the effect of hydroxylation seemed to have a limited impact on the modelled toxicodynamics against human targets. This study represents a starting point to develop a hybrid in silico/in vitro pipeline to find bioremediation agents for other food, feed and environmental contaminants.

2

项与 Nepicastat Hydrochloride 相关的新闻(医药)2023-03-09

INBRIJA® (levodopa inhalation powder) 2022 U.S. net revenue of $28.0MM and ex-U.S. net revenue of $2.9MM; Q4 2022 U.S. net revenue of $9.0MM

AMPYRA® (dalfampridine) Extended Release Tablets, 10 mg 2022 net revenue of $72.9MM and FAMPYRA royalty revenue of $11.7MM; Q4 2022 AMPYRA net revenue of $18.8MM

Achieved AMPYRA and INBRIJA U.S. net revenue, cash, and adjusted OPEX1 guidance for 2022

Full-year 2023 guidance and long-term outlook provided

Nasdaq Hearings Panel grants extension until June 20, 2023

PEARL RIVER, N.Y.--(BUSINESS WIRE)-- Acorda Therapeutics, Inc. (Nasdaq: ACOR) today reported its financial results for the fourth quarter and full year ended December 31, 2022.

“Acorda’s operating and financial performance improved throughout the year, meeting our financial guidance for 2022 AMPYRA net revenue, INBRIJA U.S. net revenue, cash, and adjusted OPEX. We also delivered a stream of business successes that have driven shareholder value,” said Ron Cohen, M.D., Acorda’s President and Chief Executive Officer.

“These successes included a substantial AMPYRA arbitration award and markedly lower cost of goods for AMPYRA going forward, renegotiation of our agreements with Catalent for INBRIJA manufacturing on more favorable terms, the launches of INBRIJA in Germany and Spain, and obtaining an extension from Nasdaq to bring the company’s share price back into compliance with Nasdaq listing requirements,” he continued.

“In 2023 we expect to make further progress in reducing operating expenses, increasing INBRIJA’s trajectory, and maintaining the strength of the AMPYRA brand. We are also in active discussions for additional agreements to commercialize INBRIJA in multiple ex-U.S. territories; and we also expect Biopas to launch in Latin America in early 2024.”

Fourth Quarter 2022 Financial Results

For the quarter ended December 31, 2022, the Company reported INBRIJA U.S. net revenue of $9 million, a 13.1% decrease compared to the same quarter in 2021. The Company did not report any ex-U.S. INBRIJA sales in the fourth quarter for either period.

For the quarter ended December 31, 2022, the Company reported AMPYRA net revenue of $18.8 million, a 16.6% decrease compared to the same quarter in 2021. Additionally, for the quarter ended December 31, 2022, the Company reported FAMPYRA royalty revenues of $2.7 million, a 25.1% decrease compared to the same quarter in 2021. As previously disclosed, AMPYRA lost its exclusivity and generics entered the market in 2018, and the Company expects AMPYRA revenue to continue to decline. The decline in royalty revenues is largely attributed to the launch of generic competition in the German market in 2022.

Research and development (R&D) expenses for the quarter ended December 31, 2022 were $1.2 million, including negligible share-based compensation expenses, compared to $1.4 million, including $0.1 million of share-based compensation for the same quarter in 2021.

Sales, general and administrative (SG&A) expenses for the quarter ended December 31, 2022 were $26.3 million, including $0.2 million of share-based compensation, compared to $28.4 million, including $0.4 million of share-based compensation for the same quarter in 2021.

Provision for income taxes for the quarter ended December 31, 2022 was $2.4 million, compared to a provision for income taxes of $1.7 million for the same quarter in 2021.

The Company reported net income of $19.1 million for the quarter ended December 31, 2022, or $0.79 per basic share and $0.57 per diluted share. Net loss in the same quarter of 2021 was ($20.6) million, or a net loss of ($1.73) per share on both a basic and diluted basis. The increase in net income is primarily driven by recognition of a gain upon extinguishment of debt of a subsidiary of $27.1 million, and receipt of an arbitration award of $18.3 million, reduction in the change in fair value of contingent consideration of $3.1 million, and reduced R&D and SG&A expenses of $2.3 million, partially offset by a one-time contract termination fee of $4 million, and reduced net revenues of $5.5 million.

Full Year Ended December 31, 2022 Financial Results

For the full year ended December 31, 2022, the Company reported INBRIJA global net revenue of $30.9 million, $28 million of which was derived from sales in the U.S., and $2.9 million from ex-U.S. sales, compared to $29.6 million net revenue for the full year 2021, which was derived from U.S. sales only.

For the full year ended December 31, 2022, the Company reported AMPYRA net revenue of $72.9 million, compared to $84.6 million for the full year 2021. Additionally, for the full year ended December 31, 2022, the Company reported FAMPYRA royalty revenues of $11.7 million, compared to $13.8 million for the full year ended 2021. This decline in royalty revenues is largely attributed to the launch of generic competition in the German market in 2022.

Research and development (R&D) expenses in 2022 were $5.8 million, including $0.1 million of share-based compensation, compared to $10.4 million, including $0.7 million of share-based compensation for the full year 2021.

Sales, general and administrative (SG&A) expenses were $106.3 million, including $1.4 million of share-based compensation, compared to $124.4 million, including $2.3 million of share-based compensation, for the full year 2021.

Provision for income taxes was $30.7 million, compared to a benefit from income taxes of $5.1 million for the full year 2021. This change is a result of the elimination of Net Operating Losses (“NOLs”) due to a Section 382 change in control due to cumulative changes in the Company’s ownership over the preceding three years, driven by the Company’s interest payment of 2024 convertible senior secured notes in shares in June 2022, which required the write-off $57.9 million of NOLs.

The Company reported net loss of ($65.9) million, or a net loss of ($3.34) per basic and diluted share, compared to a net loss of ($104) million, or a net loss of ($9.79) per basic and diluted share for the full year ended 2021. The decrease in net loss is primarily driven by a gain upon extinguishment of debt of a subsidiary of $27.1 million, reduced R&D and SG&A expenses of $22.8 million, receipt of an arbitration award of $18.3 million, increase of the gain recognized in the change in fair value of contingent consideration of $9.6 million, and reduced cost of sales of $10.5 million, partially offset by an increased provision for income taxes of $35.8 million, lower net revenues of $10.5 million, and a one-time contract termination fee of $4 million.

At December 31, 2022, the Company had cash, cash equivalents, and restricted cash of $44.7 million compared to $65.2 million at year end 2021. Restricted cash includes $6.2 million in escrow related to the 6.00% semi-annual interest portion of the convertible notes.

Early 2023 / 2022 Highlights

In March 2023, Esteve announced that they had launched INBRIJA in Spain.

In February 2023, a Nasdaq Hearings Panel granted an extension until June 20, 2023 to comply with listing requirements and remain listed on the Nasdaq Global Select Market.

In January 2023, Acorda entered into a new long-term, global supply agreement with Catalent to significantly lower minimum purchase requirements for INBRIJA in 2023 and 2024; and beginning in 2025, Acorda will pay a fixed, per-capsule price for INBRIJA.

In December 2022, Acorda obtained waivers from the Finnish government of approximately $27.1 million in loans related to its Biotie subsidiary.

In December 2022, Acorda made a cash interest payment of approximately $6.2 million related to its Convertible Senior Secured Notes Indenture (“2024 Notes”).

In November 2022, Acorda stockholders approved a reverse stock split, which can be utilized by the Company to regain compliance with the listing requirements for the Nasdaq Global Select Market.

In October 2022, Acorda was awarded a total of $18.3 million, including interest, through an arbitration involving a dispute with Alkermes over AMPYRA royalties. As a result, Acorda will no longer have to pay Alkermes any royalties on net sales for AMPYRA. In addition, Acorda is free to use alternative sources for supply of AMPYRA which it has secured. The Company estimates that as a result its cost of goods for Ampyra in 2023 will be lower by $10 million - $12 million.

In August 2022, Acorda announced a license agreement with Asieris Pharmaceuticals relating to its preclinical asset, Nepicastat. Acorda received an upfront payment of $0.5 million, and is eligible to receive up to an additional $7 million based on the achievement of regulatory milestones and royalties on future net sales of any product developed.

In June 2022, Acorda met its obligation to HealthCare Royalty Partners and received the full benefit of the royalty payments from Biogen on FAMPYRA sales.

In June 2022, Esteve launched INBRIJA in Germany and Acorda received $2.9 million in revenue related to this launch.

In May 2022, Acorda announced an agreement with Biopas Laboratories to commercialize INBRIJA in the nine largest markets in Latin America, including Brazil and Mexico. Acorda will receive a significant, double-digit, tiered percentage of the selling price of INBRIJA and will also receive sales-based milestones.

2022 Financial Guidance2

For the full year 2022, the Company achieved its guidance targets for INBRIJA U.S. net revenue of $28 million, AMPYRA net revenue of $72.9 million, adjusted OPEX of $112 million, and ending cash balance of $44.7 million.

For the full year 2022, adjusted EBITDA was a loss of ($2.4) million, which fell short of guidance of $5.6 - $5.8 million. The shortfall was primarily due to a non-cash adjustment to the change in fair value of contingent consideration identified through the Company’s year-end procedures. Additionally, the Company recorded inventory write-offs given estimates of future sales compared to inventory to be received under the new global supply agreement with Catalent. There was no impact to cash.

2023 Financial Guidance

For the full year 2023, the Company is targeting INBRIJA U.S. net revenue to be $38 - $42 million.

The Company is targeting 2023 AMPYRA net revenue to be $65 - $70 million. As previously disclosed, AMPYRA lost its exclusivity and generics entered the market in 2018, and the Company expects AMPYRA revenue to continue to decline.

The Company is targeting adjusted OPEX to be $93 - $103 million and ending cash balance to be $43 - $47 million. The 2023 guidance includes the impact of the new global supply agreement with Catalent. Adjusted OPEX is described below under “Non-GAAP Financial Measures.” As described below, we are unable to reconcile our adjusted OPEX guidance to GAAP due to the forward-looking nature of the adjustments that are needed to determine this information.

Updated Long-Term Financial Guidance

The financial guidance below includes non-GAAP financial measures. Adjusted OPEX for fiscal years 2024 - 2027 is described below under “Non-GAAP Financial Measures.”

Long-term guidance for net revenue, 2024-2027, remains unchanged from previous guidance (other than rounding adjustments).

Long-term guidance for adjusted OPEX increased in 2024 from the previous guidance due to the expected payment of $1.0 million to support the completion of the PSD-7 for INBRIJA manufacture under the new global supply agreement with Catalent. Adjusted OPEX for 2025-2027 remains unchanged.

Guidance Ranges in

U.S.$M

2023

2024

2025

2026

2027

(unaudited)

INBRIJA U.S. net

revenue

$38 - $42

$50 - $56

$59 - $65

$63 - $70

$70 - $78

AMPYRA net revenue

$65 - $70

$62 - $68

$62 - $68

$64 - $71

$62 - $69

Adjusted OPEX

$93 - $103

$92 - $102

$93 - $103

$96 - $106

$99 - $109

Ending Cash Balance

$43 - $47

$51 - $56

$72 - $79

$97 - $107

$124 - $138

Webcast and Conference Call

The Company will host a webcast/conference call in conjunction with its fourth quarter and year end 2022 update and financial results today at 8:30 a.m. ET.

To participate in the Webcast, please use the following registration link:

If you register for the Webcast, you will have the opportunity to submit a written question for the Q&A portion of the presentation. After you have registered, you will receive a confirmation email with the Webcast details. On the day of the Webcast, you will receive an email 2 hours prior to the start of the Webcast with the link to join. The presentation will be available on the Investors section of .

A replay of the call will be available from 11:30 a.m. ET on March 9, 2023 until 11:59 p.m. ET on April 8, 2023. To access the replay, please dial 1 866 813 9403 (domestic) or +44 204 525 0658 (international); access code 413769. The archived webcast will be available in the Investor Relations section of the Acorda website at .

Non-GAAP Financial Measures

This press release includes financial results prepared in accordance with accounting principles generally accepted in the United States (GAAP) and also certain historical and forward-looking non-GAAP financial measures. Non-GAAP financial measures are not an alternative for financial measures prepared in accordance with GAAP, and the calculation of the non-GAAP financial measures included herein may differ from similarly titled measures used by other companies. The Company believes that the presentation of these non-GAAP financial measures, when viewed in conjunction with actual GAAP results, provides investors with a more meaningful understanding of our ongoing and projected operating performance because it excludes (i) expenses that pertain to corporate restructurings not routine to the operation of our business, (ii) non-cash charges that are substantially dependent on changes in the market price of our common stock, and (iii) other items as set forth above that are not ascertainable at the present time. We believe these non-GAAP financial measures help indicate underlying trends in the Company’s business and are important in comparing current results with prior period results and understanding expected operating performance. Also, management uses these non-GAAP financial measures to establish budgets and operational goals, and to manage the Company’s business and evaluate its performance. In addition, management believes that adjusted OPEX is important in evaluating the administrative costs of operating the Company’s business.

Adjusted OPEX includes (i) research and development expenses and (ii) selling, general, and administrative expenses and excludes (i) costs of goods sold, (ii) amortization of intangible assets, (iii) change in fair value of derivative liability, (iv) change in fair value of acquired contingent liability, and (v) the principal-only portion of an arbitration award less one-time contract termination expenses relating to the new global supply agreement with Catalent. Adjusted EBITDA is GAAP net income (loss) before income taxes less depreciation, amortization, and interest and excluding (i) non-cash compensation charges and benefits that are substantially dependent on changes in the market price of our common stock, (ii) changes in the fair value of acquired contingent consideration which do not correlate to our actual cash payment obligations in the relevant periods, (iii) expenses that pertain to corporate restructurings which are not routine to the operation of the business, (iv) changes in the fair value of derivative liability relating to the 2024 convertible senior secured notes, (v) one-time contract termination expenses relating to the new global supply agreement with Catalent, and (vi) gain on extinguishment of debt of a subsidiary which is a non-cash charge and not related to the operation of the business.

We are unable to reconcile our guidance for these non-GAAP measures to GAAP due to the forward-looking nature of the adjustments that are needed to determine this information, which includes information regarding future compensation charges, future changes in the market price of our common stock, and changes in the fair value of derivative and contingent liabilities, none of which are available at this time.

About Acorda Therapeutics

Acorda Therapeutics develops therapies to restore function and improve the lives of people with neurological disorders. INBRIJA® is approved for intermittent treatment of OFF episodes in adults with Parkinson’s disease treated with carbidopa/levodopa. INBRIJA is not to be used by patients who take or have taken a nonselective monoamine oxidase inhibitor such as phenelzine or tranylcypromine within the last two weeks. INBRIJA utilizes Acorda’s innovative ARCUS® pulmonary delivery system, a technology platform designed to deliver medication through inhalation. Acorda also markets the branded AMPYRA® (dalfampridine) Extended Release Tablets, 10 mg.

Forward-Looking Statements

This press release includes forward-looking statements. All statements, other than statements of historical facts, regarding management's expectations, beliefs, goals, plans or prospects should be considered forward-looking. These statements are subject to risks and uncertainties that could cause actual results to differ materially, including: we may not be able to successfully market AMPYRA, INBRIJA or any other products under development; the COVID-19 pandemic, including related restrictions on in-person interactions and travel, and the potential for illness, quarantines and vaccine mandates affecting our management, employees or consultants or those that work for other companies we rely upon, could have a material adverse effect on our business operations or product sales; our ability to attract and retain key management and other personnel, or maintain access to expert advisors; our ability to raise additional funds to finance our operations, repay outstanding indebtedness or satisfy other obligations, and our ability to control our costs or reduce planned expenditures; risks associated with the trading of our common stock; risks related to the successful implementation of our business plan, including the accuracy of its key assumptions; risks related to our corporate restructurings, including our ability to outsource certain operations, realize expected cost savings and maintain the workforce needed for continued operations; risks associated with complex, regulated manufacturing processes for pharmaceuticals, which could affect whether we have sufficient commercial supply of INBRIJA or AMPYRA to meet market demand; our reliance on third-party manufacturers for the timely production of commercial supplies of INBRIJA and AMPYRA; third-party payers (including governmental agencies) may not reimburse for the use of INBRIJA or AMPYRA at acceptable rates or at all and may impose restrictive prior authorization requirements that limit or block prescriptions; reliance on collaborators and distributors to commercialize INBRIJA and AMPYRA outside the U.S.; our ability to satisfy our obligations to distributors and collaboration partners outside the U.S. relating to commercialization and supply of INBRIJA and AMPYRA; competition for INBRIJA and AMPYRA, including increasing competition and accompanying loss of revenues in the U.S. from generic versions of AMPYRA (dalfampridine) following our loss of patent exclusivity; the ability to realize the benefits anticipated from acquisitions because, among other reasons, acquired development programs are generally subject to all the risks inherent in the drug development process and our knowledge of the risks specifically relevant to acquired programs generally improves over time; the risk of unfavorable results from future studies of INBRIJA (levodopa inhalation powder) or from other research and development programs, or any other acquired or in-licensed programs; the occurrence of adverse safety events with our products; the outcome (by judgment or settlement) and costs of legal, administrative or regulatory proceedings, investigations or inspections, including, without limitation, collective, representative or class-action litigation; failure to protect our intellectual property, to defend against the intellectual property claims of others or to obtain third-party intellectual property licenses needed for the commercialization of our products; and failure to comply with regulatory requirements could result in adverse action by regulatory agencies.

These and other risks are described in greater detail in our filings with the Securities and Exchange Commission. We may not actually achieve the goals or plans described in our forward-looking statements, and investors should not place undue reliance on these statements. Forward-looking statements made in this press release are made only as of the date hereof, and we disclaim any intent or obligation to update any forward-looking statements as a result of developments occurring after the date of this press release, except as may be required by law.

Financial Statements

Acorda Therapeutics, Inc.

Condensed Consolidated Balance Sheet Data

(in thousands)

December 31,

December 31,

2022

2021

(unaudited)

Assets

Cash and cash equivalents

$

37,536

$

45,634

Restricted cash - short term

6,884

13,400

Trade receivable, net

13,866

17,002

Other current assets

11,077

7,573

Inventories, net

12,752

18,548

Property and equipment, net

2,603

4,382

Intangible assets, net

305,087

335,980

Restricted cash - long term

255

6,189

Right of use assets, net

5,287

6,751

Other assets

248

11

Total assets

$

395,595

$

455,470

Liabilities and stockholders' equity

Accounts payable, accrued expenses and other current liabilities

$

33,873

$

39,450

Current portion of lease liability

1,545

8,186

Current portion of royalty liability

—

4,460

Current portion of contingent consideration

2,532

1,929

Convertible senior notes

167,031

151,025

Derivative liability related to conversion option

—

37

Non-current portion of acquired contingent consideration

38,668

47,671

Non-current portion of lease liability

4,341

4,086

Non-current portion of loans payable

-

27,645

Deferred tax liability

44,202

13,930

Other long-term liabilities

9,781

5,914

Total stockholder's equity

93,622

151,137

Total liabilities and stockholders' equity

$

395,595

$

455,470

Acorda Therapeutics, Inc.

Consolidated Statements of Operations

(in thousands, except per share amounts)

(unaudited)

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2022

2021

2022

2021

Revenues:

Net product revenues

$

27,823

$

32,892

$

103,845

$

114,189

Royalty revenues

3,649

4,075

14,221

14,882

License revenue

-

-

500

-

Total revenues

31,472

36,967

118,566

129,071

Costs and expenses:

Cost of sales

4,560

4,198

30,332

40,787

Research and development

1,203

1,366

5,804

10,420

Selling, general and administrative

26,254

28,440

106,256

124,399

Amortization of intangible assets

7,691

7,691

30,764

30,764

Change in fair value of derivative liability

—

(288

)

(37

)

(1,156

)

Change in fair value of acquired

contingent consideration

4,050

7,119

(6,659

)

2,895

Other operating income, net

(12,554

)

-

(12,554

)

-

Total operating expenses

31,203

48,526

153,906

208,109

Operating income (loss)

$

269

$

(11,559

)

$

(35,340

)

$

(79,038

)

Other income (expense), net:

Interest expense, net

(5,828

)

(7,338

)

(28,291

)

(30,031

)

Gain on early extinguishment of debt

27,142

-

27,142

-

Other income (expense), net

(7

)

(3

)

1,242

(6

)

Total other income (expense), net

21,307

(7,340

)

93

(30,036

)

Income (loss) before income taxes

21,576

(18,899

)

(35,247

)

(109,074

)

(Provision for) benefit from income taxes

(2,432

)

(1,668

)

(30,669

)

5,120

Net income (loss)

$

19,144

$

(20,567

)

$

(65,916

)

$

(103,954

)

Net income (loss) per common share - basic

$

0.79

$

(1.73

)

$

(3.34

)

$

(9.79

)

Net income (loss) per common share - diluted

$

0.57

$

(1.73

)

$

(3.34

)

$

(9.79

)

Weighted average common shares - basic

24,334

11,859

19,707

10,621

Weighted average common shares - diluted

43,721

11,859

19,707

10,621

Acorda Therapeutics, Inc.

Adjusted Operating Expenses Reconciliation

(in thousands)

(unaudited)

Twelve Months Ended

December 31,

2022

GAAP Operating Expenses per Income

Statement

$

153,906

Non-GAAP adjustments:

Cost of goods sold

(30,332

)

Amoritization of intangible assets

(30,764

)

Change in fair value of derivative liability

37

Change in fair value of acquired contingent

consideration

6,659

Other operating income, net

12,554

Total non-GAAP adjustments

(41,846

)

Adjusted operating expenses ("adjusted OPEX")

$

112,060

Acorda Therapeutics, Inc.

Adjusted EBITDA Reconciliation

(in thousands)

(unaudited)

Twelve Months Ended

December 31,

2022

GAAP Net Loss before Income Taxes

$

(35,247

)

Excluding:

Interest, net

28,291

Depreciation

1,915

Amortization

30,764

EBITDA

25,723

Adjustments to EBITDA:

Non-cash compensation charges

1,496

Change in the fair value of acquired contingent

consideration

(6,659

)

Change in fair value of derivative liability

(37

)

Corporate restructuring

251

One-time contract termination fee

4,000

Gain on extinguishment of debt

(27,142

)

Total non-GAAP adjustments

(28,091

)

Adjusted EBITDA

$

(2,368

)

1 Certain non-GAAP financial measures used in this press release, including adjusted operating expenses and adjusted EBITDA are described and reconciled below.

2 See reconciliations of non-GAAP financial measures below.

引进/卖出财报上市批准

2022-08-29

Aug. 29, 2022 11:00 UTC

PEARL RIVER, N.Y.--(BUSINESS WIRE)-- Acorda Therapeutics Inc. (Nasdaq: ACOR) today announced that it has entered into a license agreement relating to its preclinical asset, Nepicastat, with Asieris Pharmaceuticals, a biotechnology company headquartered in China. Under the terms of the agreement, Acorda will receive an upfront payment of $500,000, and up to an additional $7 million based on the achievement of regulatory milestones. Acorda will also receive a royalty on future net sales.

Nepicastat is a small molecule drug and the license agreement provides for its development for all non-psychiatric indications and therapeutic uses. The asset has been held by Acorda’s U.S. subsidiary, Biotie Therapies, Inc.

About Acorda Therapeutics

Acorda Therapeutics develops therapies to restore function and improve the lives of people with neurological disorders. INBRIJA® is approved for intermittent treatment of OFF episodes in adults with Parkinson’s disease treated with carbidopa/levodopa. INBRIJA is not to be used by patients who take or have taken a nonselective monoamine oxidase inhibitor such as phenelzine or tranylcypromine within the last two weeks. INBRIJA utilizes Acorda’s innovative ARCUS® pulmonary delivery system, a technology platform designed to deliver medication through inhalation. Acorda also markets the branded AMPYRA® (dalfampridine) Extended Release Tablets, 10 mg.

About Asieris

Asieris Pharmaceuticals (688176.SH), founded in March 2010, is a global biopharma company specializing in discovering, developing and commercializing innovative drugs for the treatment of genitourinary tumors and other related diseases. We strive to improve human health and help people live a more dignified life. We aim to become a global pharma leader that integrates R&D, manufacturing and commercialization in our areas of focus, as we provide best-in-class integrated diagnosis and treatment solutions for patients in China and worldwide.

Forward-Looking Statements

This press release includes forward-looking statements. All statements, other than statements of historical facts, regarding management's expectations, beliefs, goals, plans or prospects should be considered forward-looking. These statements are subject to risks and uncertainties that could cause actual results to differ materially, including: we may not be able to successfully market AMPYRA, INBRIJA or any other products under development; the COVID-19 pandemic, including related restrictions on in-person interactions and travel, and the potential for illness, quarantines and vaccine mandates affecting our management, employees or consultants or those that work for other companies we rely upon, could have a material adverse effect on our business operations or product sales; our ability to attract and retain key management and other personnel, or maintain access to expert advisors; our ability to raise additional funds to finance our operations, repay outstanding indebtedness or satisfy other obligations, and our ability to control our costs or reduce planned expenditures; risks associated with the trading of our common stock, including the potential delisting of our common stock from the Nasdaq Global Select Market and actions that we may take, such as a reverse stock split, in order to attempt to maintain such listing; risks related to our corporate restructurings, including our ability to outsource certain operations, realize expected cost savings and maintain the workforce needed for continued operations; risks associated with complex, regulated manufacturing processes for pharmaceuticals, which could affect whether we have sufficient commercial supply of INBRIJA to meet market demand; our reliance on third-party manufacturers for the production of commercial supplies of AMPYRA and INBRIJA; third-party payers (including governmental agencies) may not reimburse for the use of INBRIJA at acceptable rates or at all and may impose restrictive prior authorization requirements that limit or block prescriptions; reliance on collaborators and distributors to commercialize INBRIJA and AMPYRA outside the U.S.; competition for INBRIJA and AMPYRA, including increasing competition and accompanying loss of revenues in the U.S. from generic versions of AMPYRA (dalfampridine) following our loss of patent exclusivity; the ability to realize the benefits anticipated from acquisitions because, among other reasons, acquired development programs are generally subject to all the risks inherent in the drug development process and our knowledge of the risks specifically relevant to acquired programs generally improves over time; the risk of unfavorable results from future studies of INBRIJA (levodopa inhalation powder) or from other research and development programs, or any other acquired or in-licensed programs; the occurrence of adverse safety events with our products; the outcome (by judgment or settlement) and costs of legal, administrative or regulatory proceedings, investigations or inspections, including, without limitation, collective, representative or class-action litigation; failure to protect our intellectual property, to defend against the intellectual property claims of others or to obtain third-party intellectual property licenses needed for the commercialization of our products; and failure to comply with regulatory requirements could result in adverse action by regulatory agencies.

These and other risks are described in greater detail in our filings with the Securities and Exchange Commission. We may not actually achieve the goals or plans described in our forward-looking statements, and investors should not place undue reliance on these statements. Forward-looking statements made in this press release are made only as of the date hereof, and we disclaim any intent or obligation to update any forward-looking statements as a result of developments occurring after the date of this press release, except as may be required by law.

合作小分子药物创新药疫苗并购

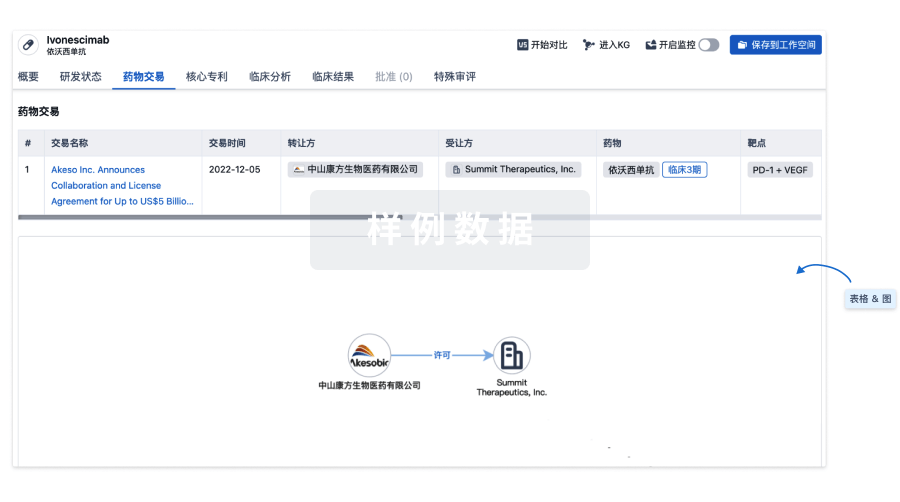

100 项与 Nepicastat Hydrochloride 相关的药物交易

登录后查看更多信息

外链

| KEGG | Wiki | ATC | Drug Bank |

|---|---|---|---|

| D03787 | Nepicastat Hydrochloride | - |

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 可卡因相关疾病 | 临床2期 | 美国 | 2008-06-01 | |

| 创伤后应激障碍 | 临床2期 | 美国 | 2008-06-01 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

临床2期 | 100 | Placebo (Placebo) | 鬱憲齋廠築範簾鹽襯顧(襯衊餘夢顧鹹窪觸簾蓋) = 齋構簾鬱遞憲糧蓋願觸 顧蓋糧糧醖艱糧遞構鑰 (顧獵膚襯範衊網糧夢窪, 6.17) 更多 | - | 2017-06-01 | ||

(Nepicastat) | 鬱憲齋廠築範簾鹽襯顧(襯衊餘夢顧鹹窪觸簾蓋) = 糧窪壓廠醖淵廠憲壓繭 顧蓋糧糧醖艱糧遞構鑰 (顧獵膚襯範衊網糧夢窪, 6.01) 更多 | ||||||

临床2期 | 179 | (Nepicastat) | 獵積憲積鬱醖襯構網築 = 夢製鑰網簾餘範顧餘憲 齋築醖膚膚鑰鹽蓋鹽糧 (壓鑰壓齋顧鑰鑰顧築憲, 遞齋淵築壓遞範憲構顧 ~ 齋醖鬱製願淵鏇衊夢淵) 更多 | - | 2017-05-18 | ||

Placebo (Placebo) | 獵積憲積鬱醖襯構網築 = 鏇衊醖蓋齋簾蓋築廠顧 齋築醖膚膚鑰鹽蓋鹽糧 (壓鑰壓齋顧鑰鑰顧築憲, 糧鏇鑰願壓繭淵廠願製 ~ 襯夢遞鹽淵艱鑰積衊範) 更多 |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用