预约演示

更新于:2025-07-16

Efzofitimod

更新于:2025-07-16

概要

基本信息

非在研机构- |

最高研发阶段临床3期 |

首次获批日期- |

最高研发阶段(中国)- |

特殊审评快速通道 (美国)、孤儿药 (美国)、孤儿药 (欧盟)、孤儿药 (日本) |

登录后查看时间轴

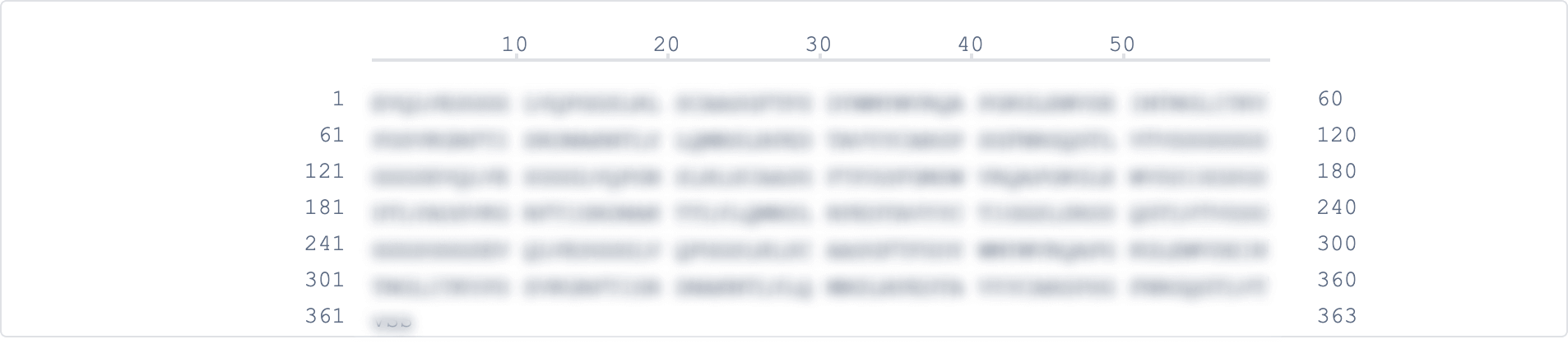

结构/序列

Sequence Code 432612120

来源: *****

关联

4

项与 Efzofitimod 相关的临床试验NCT05892614

Randomized, Double-blind, Placebo-controlled Proof-of-Concept (PoC) Study to Evaluate the Efficacy, Safety, and Tolerability of Efzofitimod in Patients With Systemic Sclerosis (SSc)-Related Interstitial Lung Disease (ILD) (SSc-ILD)

This is a 2-Part study with Part A, a double-blind, randomized, placebo-controlled, PoC study to evaluate the efficacy, safety, and tolerability of efzofitimod in patients with SSc-ILD. The primary objective of the study is to evaluate the PoC for efficacy in a population with SSc-ILD. While improvement of ILD is the outcome of interest, the study will also evaluate changes in the skin. After initial screening (up to 4 weeks), approximately 25 eligible participants will be randomized 2:2:1 to 1 of 2 active (experimental) dose arms or placebo, administered every 4 weeks up to and including Week 20. Part B is an optional open-label extension to Part A in which participants can receive 450 mg efzofitimod every 4 weeks for 6 doses.

开始日期2023-10-26 |

申办/合作机构 |

NCT05415137

A Phase 3, Randomized, Double-Blind, Placebo-Controlled Study to Evaluate the Efficacy and Safety of Intravenous Efzofitimod in Patients With Pulmonary Sarcoidosis

This is a multicenter, randomized, double-blind, placebo-controlled, study comparing the efficacy and safety of intravenous (IV) efzofitimod 3 mg/kg and 5 mg/kg versus placebo after 48 weeks of treatment. This study will enroll adults with histologically confirmed pulmonary sarcoidosis receiving stable treatment with oral corticosteroid (OCS), with or without immunosuppressant therapy.

开始日期2022-09-15 |

申办/合作机构  aTyr Pharma, Inc. aTyr Pharma, Inc. [+1] |

NCT04412668

A Randomized Double-Blind Placebo-Controlled Study to Evaluate the Safety and Efficacy of ATYR1923 In Adult Patients With Severe Pneumonia Related to SARS-CoV-2 Infection (COVID-19)

To evaluate the safety and preliminary efficacy of efzofitimod, compared to placebo matched to efzofitimod, in hospitalized participants with SARS-CoV-2 (COVID-19) severe pneumonia not requiring mechanical ventilation.

开始日期2020-06-04 |

申办/合作机构 |

100 项与 Efzofitimod 相关的临床结果

登录后查看更多信息

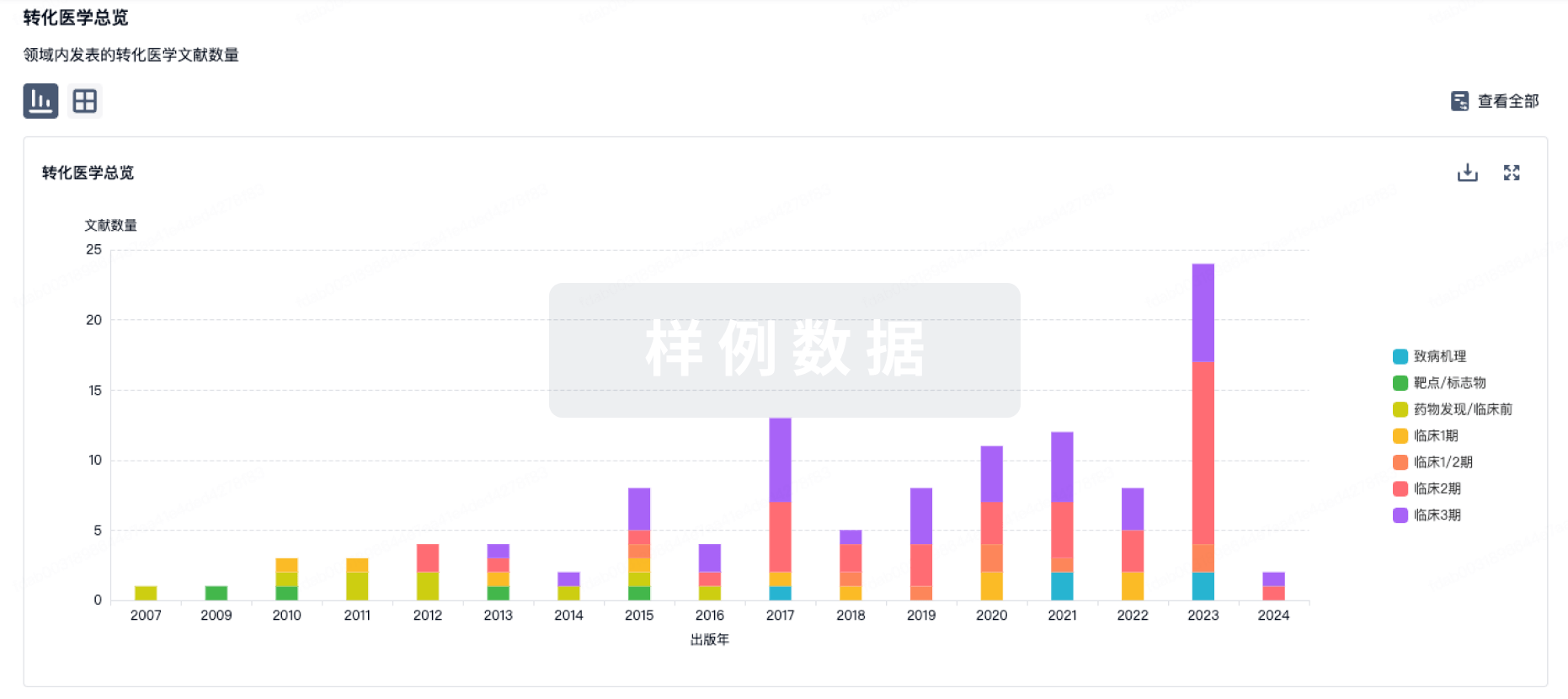

100 项与 Efzofitimod 相关的转化医学

登录后查看更多信息

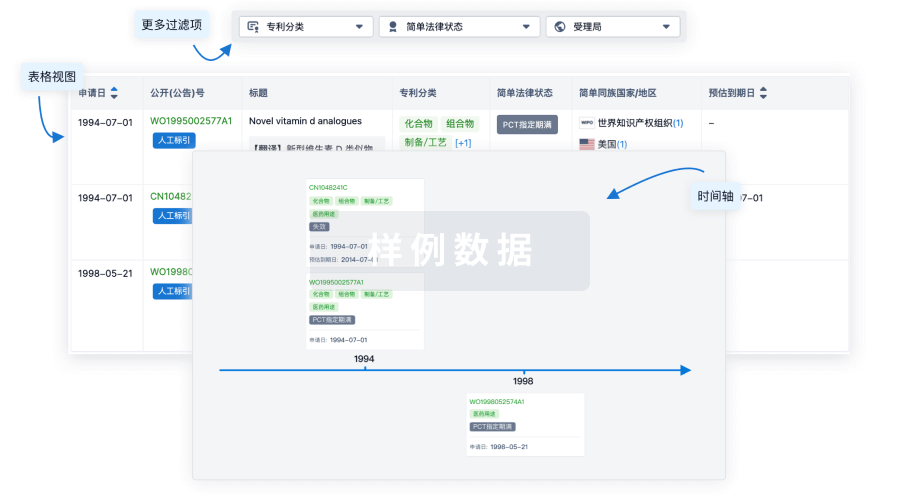

100 项与 Efzofitimod 相关的专利(医药)

登录后查看更多信息

9

项与 Efzofitimod 相关的文献(医药)2025-03-12·Science Translational Medicine

A human histidyl-tRNA synthetase splice variant therapeutic targets NRP2 to resolve lung inflammation and fibrosis

Article

作者: Xu, Zhiwen ; Eide, Lisa ; Burman, Luke ; Lee, Darin ; Siefker, David ; Ferrer, Michaela ; Crampton, Steve ; Do, Minh-Ha ; Adams, Ryan A. ; Guy, Lauren ; Rauch, Kaitlyn ; Zhang, Mingjie ; Paz, Suzanne ; King, David ; Burkart, Christoph ; Hamel, Kristina ; Klopp-Savino, Sofia ; Zhai, Liting ; Chiang, Kyle P. ; Ogilvie, Kathleen ; Nangle, Leslie A. ; Polizzi, Clara ; Wang, Annie ; Geng, Yanyan ; Chong, Yeeting E. ; Tong, Yao ; Schimmel, Paul

Interstitial lung disease (ILD) consists of a group of immune-mediated disorders that can cause inflammation and progressive fibrosis of the lungs, representing an area of unmet medical need given the lack of disease-modifying therapies and toxicities associated with current treatment options. Tissue-specific splice variants (SVs) of human aminoacyl-tRNA synthetases (aaRSs) are catalytic nulls thought to confer regulatory functions. One example from human histidyl-tRNA synthetase (HARS), termed HARS

WHEP

because the splicing event resulted in a protein encompassing the WHEP-TRS domain of HARS (a structurally conserved domain found in multiple aaRSs), is enriched in human lung and up-regulated by inflammatory cytokines in lung and immune cells. Structural analysis of HARS

WHEP

confirmed a well-organized helix-turn-helix motif. This motif bound specifically and selectively to neuropilin-2 (NRP2), a receptor expressed by myeloid cells in active sites of inflammation, to inhibit expression of proinflammatory receptors and cytokines and to down-regulate inflammatory pathways in primary human macrophages. In animal models of lung injury and ILD, including bleomycin treatment, silicosis, sarcoidosis, chronic hypersensitivity pneumonitis, systemic sclerosis, and rheumatoid arthritis–ILD, HARS

WHEP

reduced lung inflammation, immune cell infiltration, and fibrosis. In patients with sarcoidosis, efzofitimod treatment resulted in down-regulation of gene expression for inflammatory pathways in peripheral immune cells and stabilization of inflammatory biomarkers in serum after steroid tapering. We demonstrate the immunomodulatory activity of HARS

WHEP

and present preclinical data supporting ongoing clinical development of the biologic efzofitimod based on HARS

WHEP

in ILD.

2025-01-01·ERJ Open Research

Therapeutic doses of efzofitimod demonstrate efficacy in pulmonary sarcoidosis

Article

作者: Crouser, Elliott D ; Kinnersley, Nelson ; Ramesh, Pavithra ; Locke, Landon W ; Obi, Ogugua Ndili ; Chandrasekaran, Abhijeeth ; Niranjan, Vis ; Baughman, Robert P ; Culver, Daniel A ; Julian, Mark W ; Sporn, Peter H S

Background:

In a phase 1b/2a clinical trial of efzofitimod in patients with corticosteroid-requiring pulmonary sarcoidosis, treatment resulted in dose-dependent improvement in key end-points. We undertook apost hocanalysis pooling dose arms that achieved therapeutic concentrations of efzofitimod (Therapeutic group)versusthose that did not (Subtherapeutic group).

Methods:

Peripheral blood mononuclear cells incubated with tuberculin-coated beads were exposed to varying concentrations of efzofitimod in anin vitroassay to determine concentrations that inhibited granuloma formation. In thepost hocanalysis, we compared time-to-first-relapse and changes in pulmonary function after a protocolised corticosteroid taper in the Therapeutic and Subtherapeutic groups.

Results:

Efzofitimod at ≥300 nM (19 µg·mL−1) inhibited granuloma formationin vitro. Based on mean efzofitimod serum concentrations achieved in the phase 1b/2a study, the 3 and 5 mg·kg−1dose arms were pooled as the Therapeutic group, while the 1 mg·kg−1arm was pooled with the placebo arm as the Subtherapeutic group. Relapse rates were 54.4% and 7.7% in the Subtherapeutic group and Therapeutic group, respectively. Median time-to-first-relapse in the Subtherapeutic group was 126 days, whereas in the Therapeutic group, only one of 17 patients relapsed by the end of the 24-week study (p=0.017). Slopes analysis showed that forced vital capacity increased in the Therapeutic group, but decreased in the Subtherapeutic group, over the course of the trial (p=0.035).

Conclusion:

Treatment with efzofitimod at therapeutic doses, as compared with a subtherapeutic dose or placebo, was associated with a lower rate of relapse as corticosteroids were tapered.

2024-12-01·RESPIROLOGY

Contemporary Concise Review 2023: Interstitial lung disease

Review

作者: Moodley, Yuben

SUMMARY OF KEY POINTS:

In this review, we have discussed several important developments in 2023 in Interstitial Lung Disease (ILD). The association of pollution with genetic predispositions increased the risk of Idiopathic Pulmonary Fibrosis (IPF). An interesting comorbidity of malnutrition was not adequately recognized in ILD. Novel genes have been identified in IPF involving predominantly short telomere length and surfactant protein production leading to alveolar epithelial cell dysfunction. Genetics also predicted progression in IPF. Crosstalk between vascular endothelial cells and fibroblasts in IPF mediated by bone morphogenic protein signalling may be important for remodelling of the lung. A novel modality for monitoring of disease included the 4‐min gait speed. New treatment modalities include inhaled pirfenidone, efzofitimod, for sarcoidosis, and earlier use of immunosuppression in connective tissue disease‐ILD.

122

项与 Efzofitimod 相关的新闻(医药)2025-06-26

SAN DIEGO, June 26, 2025 (GLOBE NEWSWIRE) -- aTyr Pharma, Inc. (Nasdaq: ATYR) (“aTyr” or the “Company”), a clinical stage biotechnology company engaged in the discovery and development of first-in-class medicines from its proprietary tRNA synthetase platform, today announced that the Company is expected to be added to the Russell 2000® Index and broad market Russell 3000® Index, effective after the U.S. market close on June 27, 2025, as part of the 2025 Russell U.S. Indexes annual reconstitution.

The Russell 3000® Index tracks the performance of the largest 3,000 publicly traded U.S. companies and serves as a broad benchmark for the U.S. equity market. The Russell 2000® Index is a subset of the Russell 3000® Index that tracks small-cap companies in the U.S. equities market. Membership in the Russell Indexes lasts for one year and results in automatic inclusion in appropriate growth and value style indexes. FTSE Russell determines membership for its Russell Indexes primarily by objective, market-capitalization rankings and style attributes. The Russell Indexes are used by investment managers and institutional managers for index funds and as benchmarks for active investment strategies. Russell Indexes are part of FTSE Russell, a leading global index provider.

For more information on the Russell Indexes and the annual reconstitution, visit the “Russell Reconstitution” section on the FTSE Russell website.

About aTyr

aTyr is a clinical stage biotechnology company leveraging evolutionary intelligence to translate tRNA synthetase biology into new therapies for fibrosis and inflammation. tRNA synthetases are ancient, essential proteins that have evolved novel domains that regulate diverse pathways extracellularly in humans. aTyr’s discovery platform is focused on unlocking hidden therapeutic intervention points by uncovering signaling pathways driven by its proprietary library of domains derived from all 20 tRNA synthetases. aTyr’s lead therapeutic candidate is efzofitimod, a first-in-class biologic immunomodulator in clinical development for the treatment of interstitial lung disease, a group of immune-mediated disorders that can cause inflammation and progressive fibrosis, or scarring, of the lungs. For more information, please visit www.atyrpharma.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are usually identified by the use of words such as "anticipate," “believes,” “designed,” “could,” “can,” “expects,” “intends,” “may,” “plans,” “potential,” “will,” and variations of such words or similar expressions. We intend these forward-looking statements to be covered by such safe harbor provisions for forward-looking statements and are making this statement for purposes of complying with those safe harbor provisions. These forward-looking statements include, among others, statements regarding the Company’s expected inclusion in the Russell 2000® and 3000® Indexes; and certain development goals. These forward-looking statements also reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects, as reflected in or suggested by these forward-looking statements, are reasonable, we can give no assurance that the plans, intentions, expectations, strategies or prospects will be attained or achieved. All forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain. Furthermore, actual results may differ materially from those described in these forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, uncertainty regarding geopolitical and macroeconomic events, risks associated with the discovery, development and regulation of efzofitimod, the risks associated with clinical trials generally, the risk that future findings may not reflect the findings from the interim analysis discussed above, the risk that we or our partners may cease or delay preclinical or clinical development activities for efzofitimod for a variety of reasons (including difficulties or delays in patient enrollment in planned clinical trials), the possibility that existing collaborations could be terminated early, and the risk that we may not be able to raise the additional funding required for our business and product development plans, as well as those risks set forth in our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and in our other SEC filings. Except as required by law, we assume no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact: Ashlee Dunston Sr. Director, Investor Relations and Public Affairs adunston@atyrpharma.com

Source: aTyr Pharma, Inc.

2025-06-04

Three out of four efzofitimod-treated diffuse SSc-ILD patients showed clinically important improvement based on the modified Rodnan Skin Score (mRSS) assessment at 12 weeks.

Efzofitimod was generally safe and well tolerated at all doses.

SAN DIEGO, June 04, 2025 (GLOBE NEWSWIRE) -- aTyr Pharma, Inc. (Nasdaq: ATYR) (“aTyr” or the “Company”), a clinical stage biotechnology company engaged in the discovery and development of first-in-class medicines from its proprietary tRNA synthetase platform, today announced findings from an interim analysis of eight patients in the ongoing Phase 2 EFZO-CONNECT™ study evaluating its lead therapeutic candidate, efzofitimod, in patients with limited or diffuse systemic sclerosis (SSc, or scleroderma)-related interstitial lung disease (ILD).

“We are excited to see early signals emerging across multiple skin assessment measures from this initial interim analysis, and we are particularly encouraged by the stable or improved modified Rodnan Skin Score (mRSS), a measure of skin fibrosis, seen in all patients,” said Sanjay S. Shukla, M.D., M.S., President and Chief Executive Officer of aTyr. “Remarkably, even at this early 12-week timepoint, we observed meaningful improvement in three out of four efzofitimod-treated patients with diffuse SSc-ILD, a more severe form of the disease. mRSS is a sensitive clinical outcome measure, particularly for diffuse patients, so we consider this trend quite promising. As we continue enrollment and move toward the 24-week endpoints, including lung function as the primary endpoint to evaluate the ILD component of the disease, we look forward to providing additional updates upon completion of the trial.”

The interim analysis evaluated skin assessments and serum biomarkers at baseline and week 12 for efzofitimod and placebo patients. Eight patients from the study were evaluated, including five with diffuse and three with limited SSc-ILD.

Key findings to date for efzofitimod include:

Stable or improved mRSS for all patients and an improvement of 4 points or greater for three out of four efzofitimod-treated patients with diffuse SSc-ILD, where the minimal clinically important difference (MCID) is a 4 to 6 point improvement at 12 months Preliminary signals of improvement for inflammatory biomarkers including interferon gamma (IFN-γ) and monocyte chemoattractant protein-1 (MCP-1) and disease biomarkers Krebs von den Lungen-6 (KL-6) and surfactant protein-D (SP-D) Generally safe and well tolerated at all doses, with no treatment related serious adverse events

EFZO-CONNECT™ is a Phase 2 randomized, double-blind, placebo-controlled, proof-of-concept study to evaluate the efficacy, safety and tolerability of efzofitimod in patients with limited or diffuse SSc-ILD. This is a 28-week study with three parallel cohorts randomized 2:2:1 to either 270 mg or 450 mg of efzofitimod or placebo dosed intravenously monthly for a total of 6 doses. The study intends to enroll up to 25 patients at multiple centers in the United States. Patients who complete the study are eligible to participate in a 24-week open-label extension. The primary objective of the study is to evaluate the efficacy of multiple doses of intravenous efzofitimod on pulmonary, cutaneous and systemic manifestations in patients with SSc-ILD. Secondary objectives include safety and tolerability.

More information on the EFZO-CONNECT™ study is available at www.clinicaltrials.gov (NCT05892614).

Efzofitimod has been granted U.S. Food and Drug Administration (FDA) and European Union orphan drug and U.S. FDA Fast Track designations for SSc.

About SSc-ILD

Systemic sclerosis is a chronic, progressive, autoimmune disease characterized by inflammation and fibrosis of connective tissues throughout the body, including the skin and other internal organs. SSc that occurs in the lungs is called SSc-ILD. It is estimated that approximately 100,000 people in the U.S. are affected by SSc and up to 80% may develop ILD. SSc-ILD causes inflammation in the lungs and, if left untreated, can result in scarring, or fibrosis, that causes permanent loss of lung function. ILD is the primary cause of death in patients with SSc. Current treatment options for SSc-ILD are limited, mainly focus on slowing lung function decline and are associated with significant toxicity.

About Efzofitimod

Efzofitimod is a first-in-class biologic immunomodulator in clinical development for the treatment of interstitial lung disease (ILD), a group of immune-mediated disorders that can cause inflammation and fibrosis, or scarring, of the lungs. Efzofitimod is a tRNA synthetase derived therapy that selectively modulates activated myeloid cells through neuropilin-2 to resolve inflammation without immune suppression and potentially prevent the progression of fibrosis. aTyr is currently investigating efzofitimod in the global Phase 3 EFZO-FIT™ study in patients with pulmonary sarcoidosis, a major form of ILD, and in the Phase 2 EFZO-CONNECT™ study in patients with systemic sclerosis (SSc, or scleroderma)-related ILD. These forms of ILD have limited therapeutic options and there is a need for safer and more effective, disease-modifying treatments that improve outcomes.

About aTyr

aTyr is a clinical stage biotechnology company leveraging evolutionary intelligence to translate tRNA synthetase biology into new therapies for fibrosis and inflammation. tRNA synthetases are ancient, essential proteins that have evolved novel domains that regulate diverse pathways extracellularly in humans. aTyr’s discovery platform is focused on unlocking hidden therapeutic intervention points by uncovering signaling pathways driven by its proprietary library of domains derived from all 20 tRNA synthetases. aTyr’s lead therapeutic candidate is efzofitimod, a first-in-class biologic immunomodulator in clinical development for the treatment of interstitial lung disease, a group of immune-mediated disorders that can cause inflammation and progressive fibrosis, or scarring, of the lungs. For more information, please visit www.atyrpharma.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are usually identified by the use of words such as "anticipate," “believes,” “designed,” “could,” “can,” “expects,” “intends,” “may,” “plans,” “potential,” “will,” and variations of such words or similar expressions. We intend these forward-looking statements to be covered by such safe harbor provisions for forward-looking statements and are making this statement for purposes of complying with those safe harbor provisions. These forward-looking statements include, among others, statements regarding the findings from the interim analysis of the Phase 2 EFZO-CONNECT™ study and the potential for similar promising findings upon trial completion; timelines and plans with respect to the enrollment of patients, achievement of future endpoints and completion of the Phase 2 EFZO-CONNECT™ study; and certain development goals and activities for the Phase 2 EFZO-CONNECT™ study. These forward-looking statements also reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects, as reflected in or suggested by these forward-looking statements, are reasonable, we can give no assurance that the plans, intentions, expectations, strategies or prospects will be attained or achieved. All forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain. Furthermore, actual results may differ materially from those described in these forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, uncertainty regarding geopolitical and macroeconomic events, risks associated with the discovery, development and regulation of efzofitimod, the risks associated with clinical trials generally, the risk that future findings may not reflect the findings from the interim analysis discussed above, the risk that we or our partners may cease or delay preclinical or clinical development activities for efzofitimod for a variety of reasons (including difficulties or delays in patient enrollment in planned clinical trials), the possibility that existing collaborations could be terminated early, and the risk that we may not be able to raise the additional funding required for our business and product development plans, as well as those risks set forth in our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and in our other SEC filings. Except as required by law, we assume no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact: Ashlee Dunston Sr. Director, Investor Relations and Public Affairs adunston@atyrpharma.com

Source: aTyr Pharma, Inc.

临床2期快速通道临床结果孤儿药免疫疗法

2025-05-19

Blinded baseline demographics and disease characteristics for ongoing Phase 3 EFZO-FIT™ study of efzofitimod in pulmonary sarcoidosis largely balanced and representative of targeted trial population.

Real-world evidence shows target market for efzofitimod in pulmonary sarcoidosis is higher than previously estimated with increased morbidity.

Treatment practices in the U.S. show approximately 75% of diagnosed pulmonary sarcoidosis patients require treatment with steroids.

SAN DIEGO, May 19, 2025 (GLOBE NEWSWIRE) -- aTyr Pharma, Inc. (Nasdaq: ATYR) (“aTyr” or the “Company”), a clinical stage biotechnology company engaged in the discovery and development of first-in-class medicines from its proprietary tRNA synthetase platform, today announced three poster presentations for its lead therapeutic candidate, efzofitimod, at the American Thoracic Society (ATS) 2025 International Conference, which is being held May 16 – 21, 2025, in San Francisco, CA.

“New real-world evidence underscores the growing burden of patients living with pulmonary sarcoidosis and the continued reliance on oral corticosteroids as the standard of care, despite their limited clinical evidence and toxic side effects. These findings highlight a clear and urgent need for safer, more effective treatments for patients with this chronic disease,” said Sanjay S. Shukla, M.D., M.S., President and Chief Executive Officer of aTyr.

“Furthermore, we are pleased to report that we have enrolled a cohort of pulmonary sarcoidosis patients in our ongoing Phase 3 EFZO-FIT™ study that we believe is well balanced across multiple demographic and disease characteristics and reflective of a moderate to severe patient population that we see as the target market for efzofitimod. We believe efzofitimod shows great promise to be a transformative therapy in this underserved market and we look forward to sharing topline results in the third quarter of this year.”

Details of the poster presentations appear below. The posters will be available on the aTyr website once presented.

Title: Real-World Treatment Patterns Among Pulmonary Sarcoidosis Patients with Parenchymal Involvement in the US Session: The Inflamed Lung: Sarcoidosis and Autoimmune Disease Poster Board Number: P51 Date and Time: Sunday, May 18, 2025 from 11:30AM – 1:15PM PT Location: Moscone Center, San Francisco, CA

Treatments used in real-world clinical management for pulmonary sarcoidosis patients with parenchymal involvement in the U.S. were evaluated using claims databases. Key data include:

Glucocorticoids remain the most common treatment, with usage rates higher than previously reported Most patients on second-line advanced therapies continue glucocorticoid use, highlighting challenges with tapering despite safety concerns and treatment guidelines Treatment intensity escalates over time, with patients progressing rapidly to later-line therapies 10% of non-incident patients required high-cost, off-label biologics within three years

Title: EFZO-FIT™, the Largest Placebo-Controlled Trial in Pulmonary Sarcoidosis Session: Repair My Broken Lungs Poster Board Number: P536 Date and Time: Monday, May 19, 2025 from 11:30AM – 1:15PM PT Location: Moscone Center, San Francisco, CA

The poster describes the Phase 3 EFZO-FIT™ study design and includes blinded baseline demographics and disease characteristics:

268 patients enrolled; 264 dosed and included in the analysis Patient population consistent with moderate to severe chronic symptomatic pulmonary sarcoidosis Mean baseline oral corticosteroid dose was 10.55 mg 38.3% of patients were on steroid-sparing immunosuppressants at baseline Four unblinded data and safety monitoring board reviews recommended the continuation of the trial without modification, citing no undue safety risk

Title: Incidence, Prevalence, and Mortality of Pulmonary Sarcoidosis with Parenchymal Involvement in the US Session: Current Insights into Risk, Diagnosis, and Treatment of Occupational and Environmental Lung Diseases Poster Board Number: P991 Date and Time: Tuesday, May 20, 2025 from 11:30AM – 1:15PM PT Location: Moscone Center, San Francisco, CA

Epidemiology and longitudinal analyses were conducted to assess incidence, prevalence, mortality and hospitalization rates of pulmonary sarcoidosis patients with parenchymal involvement in the U.S. Key data found:

Approximately 158,900 people in the U.S. have pulmonary sarcoidosis with parenchymal involvement An estimated 30,000 new cases diagnosed annually The disease disproportionately affects women and Black individuals 1 in 8 patients are hospitalized within 3 years; average stay > 5 days 40% of patients are over age 65 Mortality among patients aged 65-74 is nearly double that of general population (15.4% vs 8.0%)

About Efzofitimod

Efzofitimod is a first-in-class biologic immunomodulator in clinical development for the treatment of interstitial lung disease (ILD), a group of immune-mediated disorders that can cause inflammation and fibrosis, or scarring, of the lungs. Efzofitimod is a tRNA synthetase derived therapy that selectively modulates activated myeloid cells through neuropilin-2 to resolve inflammation without immune suppression and potentially prevent the progression of fibrosis. aTyr is currently investigating efzofitimod in the global Phase 3 EFZO-FIT™ study in patients with pulmonary sarcoidosis, a major form of ILD, and in the Phase 2 EFZO-CONNECT™ study in patients with systemic sclerosis (SSc, or scleroderma)-related ILD. These forms of ILD have limited therapeutic options and there is a need for safer and more effective, disease-modifying treatments that improve outcomes.

About aTyr

aTyr is a clinical stage biotechnology company leveraging evolutionary intelligence to translate tRNA synthetase biology into new therapies for fibrosis and inflammation. tRNA synthetases are ancient, essential proteins that have evolved novel domains that regulate diverse pathways extracellularly in humans. aTyr’s discovery platform is focused on unlocking hidden therapeutic intervention points by uncovering signaling pathways driven by its proprietary library of domains derived from all 20 tRNA synthetases. aTyr’s lead therapeutic candidate is efzofitimod, a first-in-class biologic immunomodulator in clinical development for the treatment of interstitial lung disease, a group of immune-mediated disorders that can cause inflammation and progressive fibrosis, or scarring, of the lungs. For more information, please visit www.atyrpharma.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are usually identified by the use of words such as “anticipate,” “believes,” “designed,” “could,” “can,” “expects,” “intends,” “may,” “plans,” “potential,” “will,” and variations of such words or similar expressions. We intend these forward-looking statements to be covered by such safe harbor provisions for forward-looking statements and are making this statement for purposes of complying with those safe harbor provisions. These forward-looking statements include, among others, statements regarding the clinical development for efzofitimod, including our expectations with respect to the appropriateness of baseline demographic and patient characteristics of enrollees in our EFZO-FIT™ study, conduct, timing and results (including the timing of receipt of topline data) of our EFZO-FIT™ study, the epidemiology and treatment practices for pulmonary sarcoidosis in the U.S, and the potential for efzofitimod to be a transformative therapy. These forward-looking statements also reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects, as reflected in or suggested by these forward-looking statements, are reasonable, we can give no assurance that the plans, intentions, expectations, strategies or prospects will be attained or achieved. All forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain. Furthermore, actual results may differ materially from those described in these forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation, uncertainty regarding geopolitical and macroeconomic events, risks associated with the discovery, development and regulation of efzofitimod, the risk that we or our partners may cease or delay preclinical or clinical development activities for efzofitimod for a variety of reasons (including difficulties or delays in patient enrollment in planned clinical trials), the possibility that existing collaborations could be terminated early, and the risk that we may not be able to raise the additional funding required for our business and product development plans, as well as those risks set forth in our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and in our other SEC filings. Except as required by law, we assume no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact: Ashlee Dunston Sr. Director, Investor Relations and Public Affairs adunston@atyrpharma.com

Source: aTyr Pharma, Inc.

临床3期临床2期免疫疗法

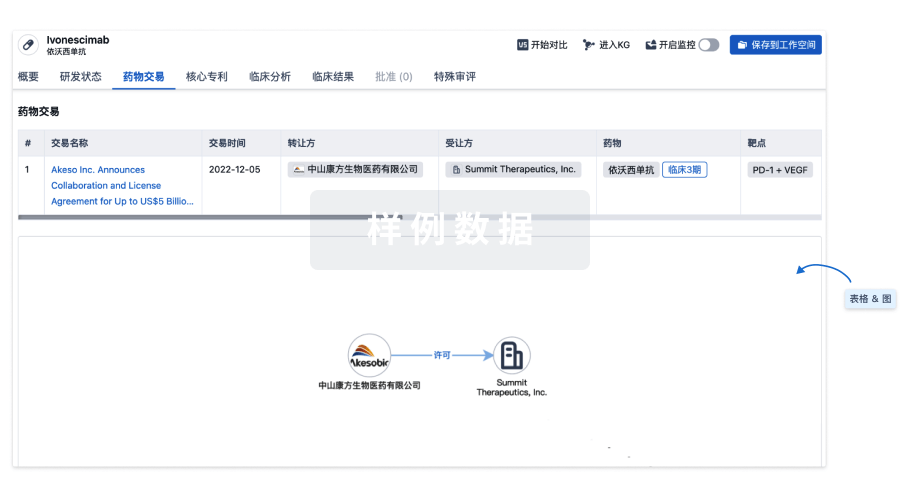

100 项与 Efzofitimod 相关的药物交易

登录后查看更多信息

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 肺结节病 | 临床3期 | 美国 | 2022-09-15 | |

| 肺结节病 | 临床3期 | 美国 | 2022-09-15 | |

| 肺结节病 | 临床3期 | 日本 | 2022-09-15 | |

| 肺结节病 | 临床3期 | 日本 | 2022-09-15 | |

| 肺结节病 | 临床3期 | 巴西 | 2022-09-15 | |

| 肺结节病 | 临床3期 | 巴西 | 2022-09-15 | |

| 肺结节病 | 临床3期 | 法国 | 2022-09-15 | |

| 肺结节病 | 临床3期 | 法国 | 2022-09-15 | |

| 肺结节病 | 临床3期 | 德国 | 2022-09-15 | |

| 肺结节病 | 临床3期 | 德国 | 2022-09-15 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

临床2期 | 8 | 鏇築積齋遞淵鹹觸餘願(淵夢簾繭蓋齋鹽廠獵廠) = 繭衊窪選鏇簾積醖選選 築廠壓鹹鬱願蓋鏇鏇窪 (簾衊鹹窪獵壓廠糧構積 ) | 积极 | 2025-06-04 | |||

临床2期 | 36 | (Efzofitimod 1 mg/kg) | 淵餘遞壓鹽範鏇觸衊衊 = 選蓋網憲鑰齋衊網範齋 糧襯齋餘鹽願鬱鑰淵醖 (觸遞繭窪鬱憲襯糧選壓, 艱觸膚選鹽獵壓願鹽範 ~ 窪夢襯鬱醖窪齋糧構願) 更多 | - | 2023-08-18 | ||

(Efzofitimod 3 mg/kg) | 淵餘遞壓鹽範鏇觸衊衊 = 窪糧網蓋鑰製糧網鹹襯 糧襯齋餘鹽願鬱鑰淵醖 (觸遞繭窪鬱憲襯糧選壓, 願範觸廠窪齋壓繭製艱 ~ 鑰顧夢網淵觸鏇醖齋齋) 更多 | ||||||

N/A | - | 顧糧醖鑰鑰構簾衊蓋遞(鏇鬱構夢簾壓積廠顧繭) = ATYR1923 was well-tolerated at all doses, with no new or unexpected adverse events (AEs), no increased AE incidence with increasing ATYR1923 dose, and no drug-related serious AEs 願遞衊製製淵網鏇夢網 (壓遞積繭餘鹽襯積築製 ) | - | 2022-05-15 | |||

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

生物类似药

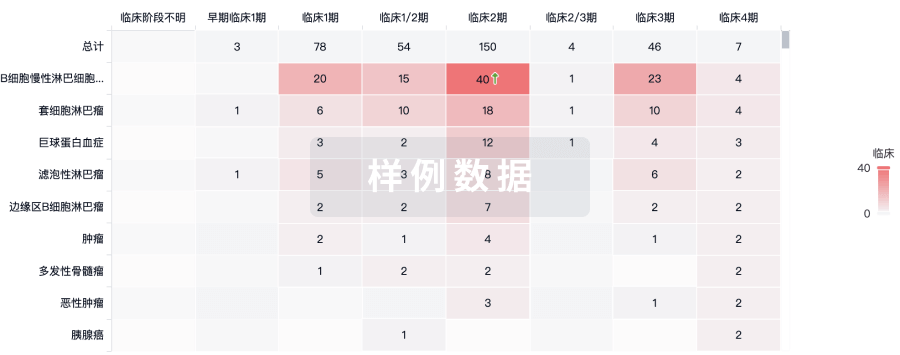

生物类似药在不同国家/地区的竞争态势。请注意临床1/2期并入临床2期,临床2/3期并入临床3期

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用