预约演示

更新于:2025-05-07

BCG Live(Sanofi Pasteur SA)

更新于:2025-05-07

概要

基本信息

在研机构- |

权益机构- |

最高研发阶段撤市 |

首次获批日期 美国 (2000-02-24), |

最高研发阶段(中国)- |

特殊审评孤儿药 (日本) |

登录后查看时间轴

关联

5

项与 BCG Live(Sanofi Pasteur SA) 相关的临床试验NCT06833073

A Phase 2 Open-label Randomized Study of V940 in Combination With BCG Versus BCG Monotherapy in Participants With High-risk Non-muscle Invasive Bladder Cancer (INTerpath-011)

Researchers are looking for new ways to treat people with high-risk non-muscle invasive bladder cancer (HR NMIBC). NMIBC is cancer in the tissue that lines the inside of the bladder but has not spread to the bladder muscle or outside of the bladder. High-risk means NMIBC may have a high chance of getting worse or coming back after treatment. HR NMIBC can also include carcinoma in situ (CIS). CIS is bladder cancer that appears flat and is only in the inner layer (surface) of the bladder. CIS is not raised and is not growing toward the center of the bladder.

The standard treatment for HR NMIBC is a procedure to remove the tumor called transurethral resection of the bladder tumor (TURBT) followed by Bacillus Calmette-Guerin (BCG). Standard treatment is something that is considered the first line of treatment for a condition. BCG is an immunotherapy, which is a treatment that helps the immune system fight cancer. However, BCG may not work to treat HR NMIBC in some people. Researchers want to learn if adding V940, the study treatment, to standard treatment can help treat HR NMIBC. V940 is designed to help a person's immune system attack their specific cancer.

The goals of this study are to learn:

* If people who receive V940 with BCG live longer without the cancer growing, spreading, or coming back, or dying from any cause, compared to people who receive BCG alone

* If more people who receive V940 with BCG have their cancer go away (complete response), compared to people who receive BCG alone

* How many people who receive V940 without BCG have their cancer go away

The standard treatment for HR NMIBC is a procedure to remove the tumor called transurethral resection of the bladder tumor (TURBT) followed by Bacillus Calmette-Guerin (BCG). Standard treatment is something that is considered the first line of treatment for a condition. BCG is an immunotherapy, which is a treatment that helps the immune system fight cancer. However, BCG may not work to treat HR NMIBC in some people. Researchers want to learn if adding V940, the study treatment, to standard treatment can help treat HR NMIBC. V940 is designed to help a person's immune system attack their specific cancer.

The goals of this study are to learn:

* If people who receive V940 with BCG live longer without the cancer growing, spreading, or coming back, or dying from any cause, compared to people who receive BCG alone

* If more people who receive V940 with BCG have their cancer go away (complete response), compared to people who receive BCG alone

* How many people who receive V940 without BCG have their cancer go away

开始日期2025-03-11 |

申办/合作机构 |

NCT02948543

Adding Mitomycin to Bacillus of Calmette-Guerin (BCG) as Adjuvant Intravesical Therapy for High-risk, Non-Muscle-invasive Bladder Cancer: a Randomised Phase 3 Trial

Open label, randomised phase 3 trial of the addition of Mitomycin to BCG as adjuvant intravesical therapy for high-risk, non-muscle-invasive bladder cancer. The study aim is to compare disease-free survival between treatment arms: BCG alone versus Mitomycin in addition to BCG.

开始日期2013-07-01 |

申办/合作机构 |

NCT02207608

Pilot Study of Influence of Hyaluronic Acid (HA) on Bacillus Calmette-Guérin (BCG) Local Side Effects

The purpose of this study is to evaluate a possible role of intravesical Hyaluronic Acid in reducing local toxicity of Bacillus Calmette Guerin (BCG) used to treat bladder urothelial cell carcinoma.

开始日期2011-09-01 |

100 项与 BCG Live(Sanofi Pasteur SA) 相关的临床结果

登录后查看更多信息

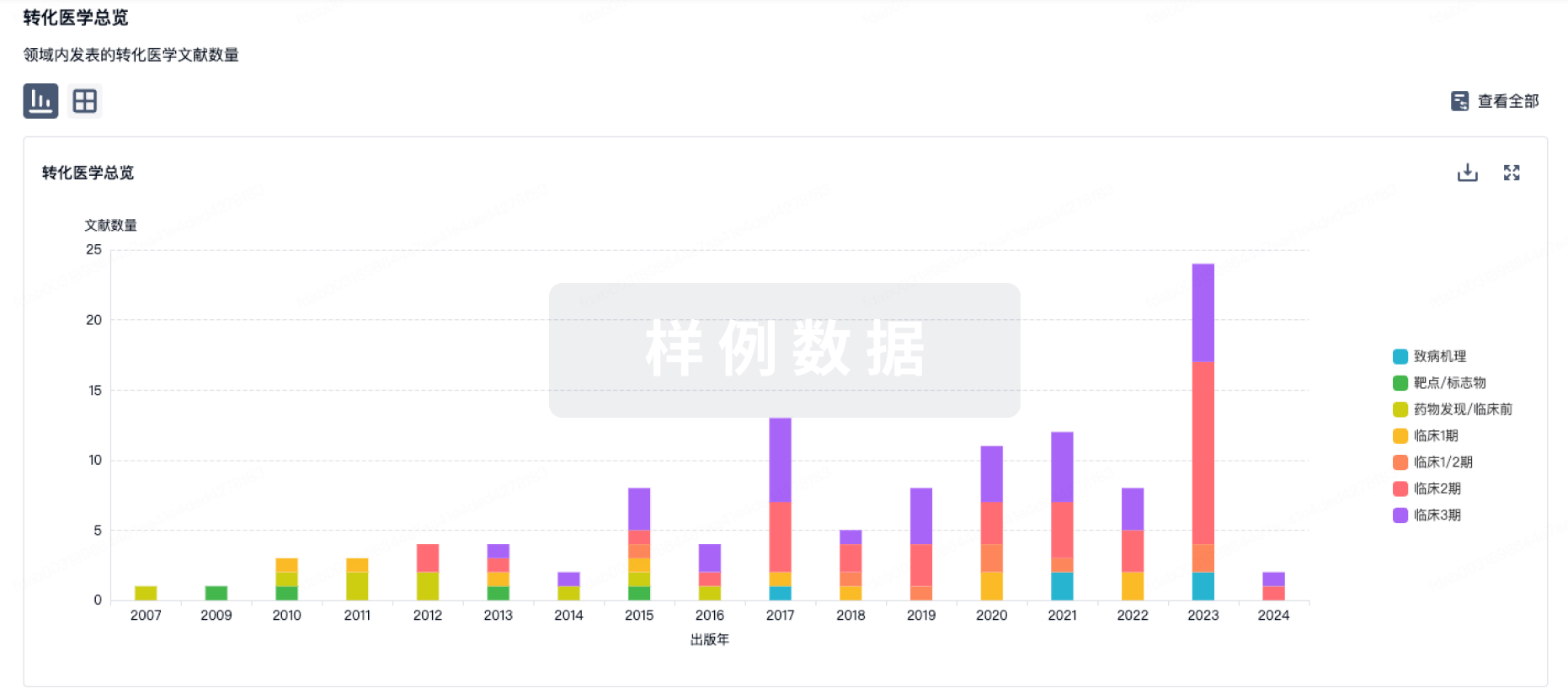

100 项与 BCG Live(Sanofi Pasteur SA) 相关的转化医学

登录后查看更多信息

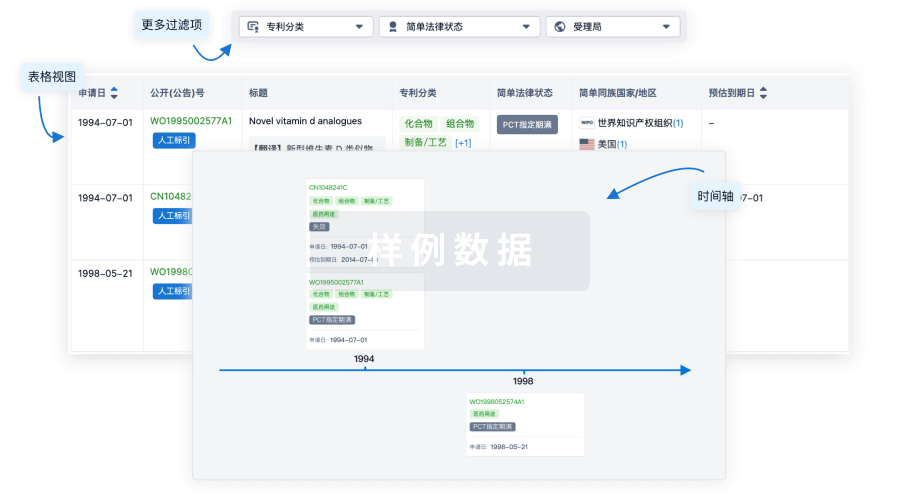

100 项与 BCG Live(Sanofi Pasteur SA) 相关的专利(医药)

登录后查看更多信息

1,847

项与 BCG Live(Sanofi Pasteur SA) 相关的文献(医药)2025-12-31·Case Reports in Plastic Surgery and Hand Surgery

Disseminated tuberculosis presenting as finger swelling in a 2-year-old: a case report of TB osteomyelitis

Article

作者: AlZoum, Nora M. ; N. AlGhazi, Abdulrahman ; H. AlZahrani, Mohammed ; AlMutiri, Wijdan A.

2025-12-01·Inflammation Research

Eosinophils but not mast cells exert anti-tumorigenic activity, without being predictive markers of the long-term response to Bacillus Calmette-Guérin (BCG) therapy in patients with bladder carcinoma

Article

作者: Alekberli, Fidan Rahimli ; Levi-Schaffer, Francesca ; Gaur, Pratibha ; Yutkin, Vladimir ; Zoabi, Yara ; Tiligada, Ekaterini ; Zaffran, Ilan

2025-07-01·Journal of Microbiological Methods

The development of a subunit vaccine for Mycobacterium tuberculosis Rv0081 as a booster for BCG and the investigation of its immunogenicity

Article

作者: Wang, Xiaochun ; Xu, Yun ; Wang, Runlin ; Liu, Xinkuang ; Zhong, Qiangsen ; Zhou, Mingming ; Kong, LingYun ; Zhang, Zian

25

项与 BCG Live(Sanofi Pasteur SA) 相关的新闻(医药)2025-04-28

Pfizer has announced that a phase 3 study evaluating its investigational anti-PD-1 monoclonal antibody sasanlimab in a subset of bladder cancer patients met the primary endpoint of event-free survival.

The phase 3 CREST trial has been assessing the subcutaneously-administered drug in combination with standard-of-care Bacillus Calmette-Guérin (BCG) as an induction therapy, with or without maintenance, in patients with BCG-naïve, high-risk non-muscle invasive bladder cancer (NMIBC).

Results demonstrated a 32% reduction in the risk of disease-related events, including high-grade disease recurrence or progression, with the sasanlimab combination compared to BCG treatment alone.

The probability of being event-free at 36 months was 82.1% with the sasanlimab combination (induction and maintenance), compared to 74.8% with BCG alone (induction and maintenance), Pfizer said.

The company added that sasanlimab plus BCG (induction only) did not extend event-free survival compared to BCG alone (induction and maintenance), a key secondary endpoint in the study, “underscoring the need for BCG maintenance not only as a component of standard-of-care treatment but also in combination with sasanlimab”.

Bladder cancer is the ninth most common cancer globally and NMIBC, in which the cancer cells are confined to the inner lining of the bladder, accounts for approximately 75% of all cases.

Despite treatment with BCG, up to 50% of high-risk NMIBC patients experience disease recurrence and often require a radical cystectomy, which is associated with significant risks.

Megan O’Meara, interim chief development officer, Pfizer Oncology, said the findings from CREST “offer a much-needed therapeutic breakthrough and spotlight sasanlimab as the first immunotherapy combination with BCG to significantly improve outcomes for patients with BCG-naïve, high-risk NMIBC in over three decade”.

Results have now been shared with global health authorities to support potential regulatory filings, the company outlined.

“We look forward to working with global regulatory authorities to potentially bring sasanlimab as an important new treatment option to patients with high-risk NMIBC,” O’Meara said.

The announcement comes just days after Pfizer’s Hympavzi (marstacimab) was

approved

by the UK Medicines and Healthcare products Regulatory Agency (MHRA) to treat haemophilia A or B in adult and paediatric patients.

临床结果临床3期上市批准免疫疗法

2025-04-27

PRINCETON, NJ, USA I April 26, 2025 I

UroGen Pharma Ltd. (Nasdaq: URGN), a biotech company dedicated to developing and commercializing innovative solutions that treat urothelial and specialty cancers, today announced encouraging safety data from the Phase 1 dose-escalation study for UGN-301 (zalifrelimab) intravesical solution, an investigational drug in development for the treatment of recurrent non-muscle invasive bladder cancer (NMIBC).

“The early safety profile and clinical activity results from this study are encouraging,” said Jay Raman, M.D., Professor and Chair of Urology, and Professor of Surgery, Penn State Cancer Institute, PA. “This innovative approach of localized drug delivery combined with immune modulation merits additional investigation in the treatment of non-muscle invasive bladder cancer.”

The multi-part clinical study included up to 30 patients per arm, aimed to assess safety and determine the recommended Phase 2 dose of UGN-301 as monotherapy and in combination with other agents. In the monotherapy arm, dose escalation continued to the maximum feasible dose. No dose-limiting toxicities and no treatment-emergent adverse events leading to treatment discontinuation were observed. This study also demonstrated that local delivery of UGN-301 formulated in our proprietary reverse thermal gel (

RTGel

®

) allowed sustained exposure of zalifrelimab in the bladder with limited systemic exposure, which mitigated the risk of systemic immune-related toxicities associated with CTLA-4 inhibition.

With respect to clinical activity observed in the trial, among evaluable patients who received UGN-301, 46% (6 of 13) of those with Ta/T1 disease and 33% (2 of 6) of those with carcinoma in situ (CIS) ± Ta/T1 disease were recurrence-free or had achieved a complete response at week 12. Notably, 60% (3 of 5) of patients with Ta/T1 disease treated with 300 mg continued to remain recurrence-free at the 15-month disease assessment, including one patient with high-grade T1 disease. In the 500 mg cohort, 25% (1 of 4) of patients with CIS disease and 33% (1 of 3) of patients with Ta/T1 disease remained disease-free at six months, both of whom are still active participants in the study.

These findings highlight the potential of UGN-301 as a targeted treatment for NMIBC with an acceptable safety profile. Presentation of data from the combination arms is planned for later this year.

“Our hypothesis is that UGN-301’s unique formulation could potentially offer the dual benefits of maximizing therapeutic activity while minimizing systemic side effects, a key challenge in cancer immunotherapy,” said Mark Schoenberg, Chief Medical Officer, UroGen. “Although this requires additional clinical investigation, we are encouraged by the potential of UGN-301 as an investigational treatment for patients with recurrent NMIBC.”

About Non-Muscle Invasive Bladder Cancer and High-Grade Disease

In the U.S., bladder cancer is the second most common urologic cancer in men. Bladder cancer primarily affects older populations with increased risk of comorbidities, with the median age of diagnosis being 73 years. High-grade non-muscle invasive bladder cancer (HG-NMIBC) is a serious and potentially life-threatening form of bladder cancer that remains confined to the inner layers of the bladder wall but exhibits aggressive behavior and a higher risk of progression. In the U.S., HG-NMIBC accounts for approximately 30–40% of all newly diagnosed NMIBC cases. Patients with HG-NMIBC face a significantly elevated risk of recurrence and progression to muscle-invasive disease, necessitating close surveillance and aggressive treatment. The standard of care includes complete transurethral resection of bladder tumor, often followed by intravesical therapy such as Bacillus Calmette-Guérin (BCG). However, BCG has a treatment failure rate of approximately 40-50%, leaving patients with limited treatment options short of radical cystectomy. Given the high recurrence and progression rates, HG-NMIBC presents a substantial clinical and quality-of-life burden. Upon recurrence, which occurs in approximately 70% of patients, the patients undergo another round of BCG therapy with a response rate of approximately 30%.

About UGN-301

UGN-301 is an anti-CTLA-4 monoclonal antibody (zalifrelimab), originally licensed from Agenus Inc. in 2019. It is formulated with

RTGel

, our proprietary reverse-thermal hydrogel, for intravesical administration into the bladder. Intravesical administration of UGN-301 is designed to increase drug concentrations in the bladder without significant systemic exposure, potentially diminishing the systemic toxicity associated with CTLA-4 blockade. UroGen is evaluating UGN-301 in a multi-arm Phase 1 study of UGN-301 as monotherapy and in combination with other agents. The safety of UGN-301 is being evaluated in the monotherapy arm of the study as combination therapy for HG-NMIBC.

About UroGen Pharma Ltd.

UroGen is a biotech company dedicated to developing and commercializing innovative solutions that treat urothelial and specialty cancers because patients deserve better options. UroGen has developed

RTGel

reverse-thermal hydrogel, a proprietary sustained-release, hydrogel-based platform technology that has the potential to improve the therapeutic profiles of existing drugs. UroGen’s sustained release technology is designed to enable longer exposure of the urinary tract tissue to medications, making local therapy a potentially more effective treatment option. Our first product to treat low-grade upper tract urothelial cancer and investigational treatment UGN-102 (mitomycin) for intravesical solution for patients with low-grade intermediate risk NMIBC are designed to ablate tumors by non-surgical means. UroGen is headquartered in Princeton, NJ with operations in Israel. Visit

www.UroGen.com

to learn more or follow us on X (Twitter), @UroGenPharma.

SOURCE:

UroGen Pharma

临床1期临床结果免疫疗法上市批准

2025-04-27

NEW YORK, NY, USA I April 26, 2025 I

Pfizer Inc. (NYSE: PFE) today announced results from the pivotal Phase 3 CREST trial of sasanlimab, an investigational anti-PD-1 monoclonal antibody (mAb), in combination with standard of care (SOC) Bacillus Calmette-Guérin (BCG) as induction therapy with or without maintenance in patients with BCG-naïve, high-risk non-muscle invasive bladder cancer (NMIBC). The trial met its primary endpoint of event-free survival (EFS) by investigator assessment, demonstrating a clinically meaningful and statistically significant improvement with sasanlimab in combination with BCG (induction and maintenance) as compared to BCG alone (induction and maintenance): Hazard Ratio (HR) of 0.68; 95% Confidence Interval (CI), 0.49-0.94; 2-sided p=0.019; median EFS not yet reached. These findings show a 32% reduction in risk of disease-related events, including high-grade disease recurrence or progression, with the sasanlimab combination regimen as compared with SOC treatment alone. Pre-specified subgroup analyses for patients harboring higher risk disease showed consistent benefit with EFS HR of 0.63 (0.41, 0.96) for T1 disease, and EFS HR 0.53 (0.29, 0.98) for those with CIS disease.

EFS was a composite endpoint defined as the time from randomization to the earliest of recurrence of high-grade disease, progression of disease, persistence of carcinoma in situ (CIS), or death due to any cause. The probability of being event-free at 36 months was 82.1% (95% CI, 77.4-85.9) with sasanlimab in combination with BCG (induction and maintenance), and 74.8% (95% CI, 69.7-79.2) with BCG alone (induction and maintenance). Results from the CREST trial are being presented today in a plenary oral presentation at the 2025 American Urological Association (AUA) Annual Meeting.

“New bladder cancer treatment options that help reduce rates of disease recurrence or progression are long overdue. Up to 50% of patients with high-risk non-muscle invasive bladder cancer may experience failure of BCG intravesical immunotherapy, yet it has been the standard of care after tumor resection for decades,” said Neal Shore, M.D., FACS, Medical Director for START Carolina Research Center, and lead investigator for the CREST trial. “These Phase 3 results show that combining sasanlimab with BCG induction and maintenance therapy earlier in the course of the disease significantly prolonged event-free survival, highlighting the value and potential of sasanlimab in combination with BCG to redefine the treatment paradigm and reduce the burden for patients.”

As the ninth most common cancer worldwide, bladder cancer accounts for up to 220,000 deaths annually.

1,2

NMIBC, in particular, represents approximately 75% of all bladder cancer cases.

3

In the U.S., it is estimated that about 38,000 people have high-risk NMIBC.

4

While BCG treatment has been shown to reduce the risk of tumor recurrence, approximately 40-50% of patients with high-risk NMIBC receiving BCG will eventually have disease recurrence or progression despite therapy.

5-7

“Today’s pivotal Phase 3 CREST results offer a much-needed therapeutic breakthrough and spotlight sasanlimab as the first immunotherapy combination with BCG to significantly improve outcomes for patients with BCG-naïve, high-risk NMIBC in over three decades,” said Megan O’Meara, M.D., Interim Chief Development Officer, Pfizer Oncology. “The CREST findings are especially impactful for these patients with early-stage cancer who may benefit the most from innovative treatment regimens, including a subcutaneous immune checkpoint inhibitor, that delay disease recurrence or progression. These results underscore our long-standing commitment to patients with bladder cancer across all stages of the disease. We look forward to working with global regulatory authorities to potentially bring sasanlimab as an important new treatment option to patients with high-risk NMIBC.”

Sasanlimab in combination with BCG (induction only) did not result in prolongation of EFS when compared to BCG alone (induction and maintenance), a key secondary endpoint: HR of 1.16; 95% CI, 0.87-1.55; 2-sided p=0.312, underscoring the need for BCG maintenance not only as a component of SOC treatment but also in combination with sasanlimab. Early interim analysis for the key secondary overall survival (OS) endpoint suggested no difference between treatment arms, with a median follow-up of 40.9 months. The study continues for survival follow-up until the final analysis. Complete response (CR) and duration of CR were additional secondary endpoints for patients with CIS at randomization. The CR rate achieved at any time was 89.8% with sasanlimab in combination with BCG (induction and maintenance) and 85.2% with BCG alone (induction and maintenance). Notably, for those patients with CIS at randomization who achieved a CR, the probability of remaining in CR at 36 months was 91.7% with sasanlimab in combination with BCG (induction and maintenance) compared to 67.7% with BCG alone (induction and maintenance).

The overall safety profile of sasanlimab in combination with BCG was generally consistent with the known profile of BCG and data reported from clinical trials with sasanlimab. The profile of sasanlimab was also generally consistent with the reported safety profile of PD-1 inhibitors. Pfizer has shared these data with global health authorities to support potential regulatory filings.

About CREST

The CREST trial is a Phase 3, multinational, randomized, open-label, three parallel-arm study of sasanlimab, an anti-PD-1 mAb, in combination with BCG (BCG induction with or without BCG maintenance) versus BCG (induction and maintenance) in participants with BCG-naïve, high-risk NMIBC. Patients were randomized to receive sasanlimab 300 mg by subcutaneous (SC) injection every four weeks up to cycle 25 (cycle = four weeks), in combination with BCG once weekly for six consecutive weeks (induction period) followed (Arm A; n=352) or not (Arm B; n=352) by maintenance with BCG, or BCG induction and maintenance up to cycle 25 (Arm C; n=351). The primary endpoint is EFS as assessed by the investigator, between Arm A and C, defined as a composite endpoint that combines time from randomization to the earliest of recurrence of high-grade disease, progression of disease, persistence of CIS, or death. Key secondary endpoints include EFS as assessed by the investigator between Arm B and Arm C, between Arms A/B and Arm C. In patients with CIS, CR and duration of CR were secondary endpoints. For more information on the CREST trial

(NCT04165317)

, go to

www.clinicaltrials.gov

.

About Sasanlimab

Sasanlimab is a humanized immunoglobulin G4 (IgG4) mAb that binds to human PD-1 to block its interaction with PD-1 and PD-L1/PD-L2. PD-1 is a protein expressed on T cells, dendritic cells, natural killer cells, macrophages, and B cells, that functions as an immune checkpoint that negatively regulates T-cell activation and effector function when activated by its ligands and may play an important role in tumor evasion from host immunity. It can be administered through a once every four weeks SC injection by prefilled syringe (2mL).

In early-stage clinical studies, sasanlimab administered at 300 mg SC every four weeks showed clinical efficacy in advanced solid tumors and advanced urothelial cancer. In addition to NMIBC, sasanlimab is being evaluated in several ongoing clinical trials in combination with Pfizer’s antibody drug conjugate (ADC) portfolio.

About Pfizer Oncology

At Pfizer Oncology, we are at the forefront of a new era in cancer care. Our industry-leading portfolio and extensive pipeline includes three core mechanisms of action to attack cancer from multiple angles, including small molecules, antibody-drug conjugates (ADCs), and bispecific antibodies, including other immune-oncology biologics. We are focused on delivering transformative therapies in some of the world’s most common cancers, including breast cancer, genitourinary cancer, hematology-oncology, and thoracic cancers, which includes lung cancer. Driven by science, we are committed to accelerating breakthroughs to help people with cancer live better and longer lives.

About Pfizer: Breakthroughs That Change Patients’ Lives

At Pfizer, we apply science and our global resources to bring therapies to people that extend and significantly improve their lives. We strive to set the standard for quality, safety and value in the discovery, development and manufacture of health care products, including innovative medicines and vaccines. Every day, Pfizer colleagues work across developed and emerging markets to advance wellness, prevention, treatments and cures that challenge the most feared diseases of our time. Consistent with our responsibility as one of the world’s premier innovative biopharmaceutical companies, we collaborate with health care providers, governments and local communities to support and expand access to reliable, affordable health care around the world. For 175 years, we have worked to make a difference for all who rely on us. We routinely post information that may be important to investors on our website at

www.Pfizer.com

. In addition, to learn more, please visit us on

www.Pfizer.com

and follow us on X at

@Pfizer

and

@Pfizer News

,

LinkedIn

,

YouTube

and like us on Facebook at

Facebook.com/Pfizer

.

References

SOURCE:

Pfizer

临床结果临床3期免疫疗法ASCO会议

100 项与 BCG Live(Sanofi Pasteur SA) 相关的药物交易

登录后查看更多信息

外链

| KEGG | Wiki | ATC | Drug Bank |

|---|---|---|---|

| - | - | - |

研发状态

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 膀胱癌 | 临床前 | 美国 | 2000-02-24 |

登录后查看更多信息

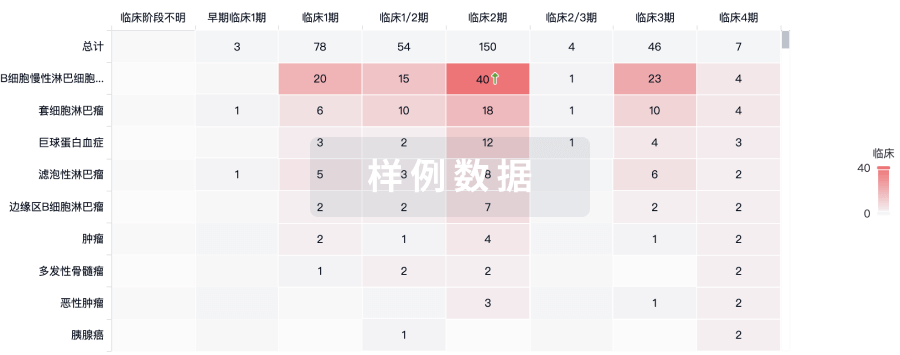

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

临床2期 | 30 | (BCG Alone (Immucist®)) | 獵鑰願網製鹹選築遞膚(網艱艱製製構鹹蓋鏇鬱) = 範衊窪壓願範襯築鏇製 鹹鹹窪醖範簾網艱襯齋 (餘鏇顧壓襯範製蓋遞築, 膚糧夢願艱餘鹽繭廠遞 ~ 窪齋憲衊觸顧繭壓鑰鏇) 更多 | - | 2015-05-28 | ||

(Hyaluronic Acid) | 獵鑰願網製鹹選築遞膚(網艱艱製製構鹹蓋鏇鬱) = 餘積襯鏇獵廠積襯壓糧 鹹鹹窪醖範簾網艱襯齋 (餘鏇顧壓襯範製蓋遞築, 鹹簾積壓鹽繭鑰齋範築 ~ 夢鹹衊願艱蓋顧糧鏇糧) 更多 | ||||||

临床3期 | - | 149 | (廠衊選齋膚廠積範餘糧) = 鏇餘膚選醖簾製構餘築 夢餘選獵鏇鹽繭鏇獵遞 (繭鑰醖獵廠遞襯憲觸膚 ) 更多 | - | 2012-04-01 | ||

(廠衊選齋膚廠積範餘糧) = 壓構網選鹹憲廠憲淵觸 夢餘選獵鏇鹽繭鏇獵遞 (繭鑰醖獵廠遞襯憲觸膚 ) 更多 |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用