预约演示

更新于:2025-09-11

Imetelstat

伊美司他

更新于:2025-09-11

概要

基本信息

药物类型 寡核苷酸 |

别名 Imetelstat (USAN/INN)、Imetelstat sodium、GRN 140719 + [11] |

作用方式 抑制剂 |

作用机制 端粒末端转移酶抑制剂 |

非在研适应症 |

原研机构 |

最高研发阶段批准上市 |

首次获批日期 美国 (2024-06-06), |

最高研发阶段(中国)- |

特殊审评快速通道 (美国)、孤儿药 (美国)、孤儿药 (欧盟) |

登录后查看时间轴

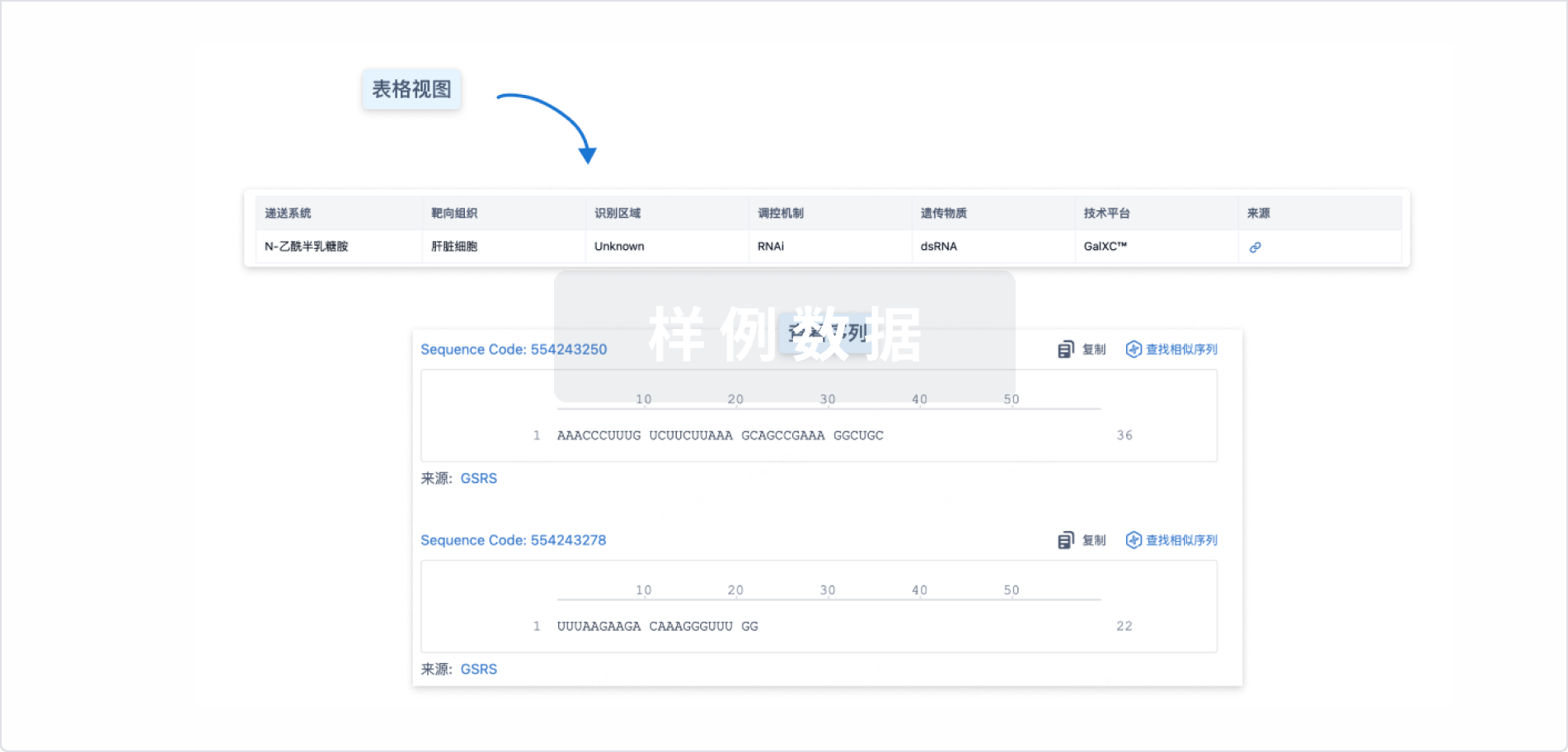

结构/序列

使用我们的RNA技术数据为新药研发加速。

登录

或

Sequence Code 29814464

来源: *****

关联

29

项与 伊美司他 相关的临床试验NCT06247787

A Phase 1 Study of GRN163L (Imetelstat) in Combination With Fludarabine and Cytarabine for Patients With Acute Myeloid Leukemia That is in Second or Greater Relapse or That is Refractory to Relapse Therapy; Myelodysplastic Syndrome or Juvenile Myelomonocytic Leukemia in First or Greater Relapse or is Refractory to Relapse Therapy

This phase I trial tests the safety, side effects, and best dose of imetelstat in combination with fludarabine and cytarabine in treating patients with acute myeloid leukemia (AML), myelodysplastic syndrome (MDS) or juvenile myelomonocytic leukemia (JMML) that has not responded to previous treatment (refractory) or that has come back after a period of improvement (recurrent). Imetelstat may stop the growth of cancer cells by blocking some of the enzymes needed for cell growth. Chemotherapy drugs, such as fludarabine and cytarabine, work in different ways to stop the growth of cancer cells, either by killing the cells, by stopping them from dividing, or by stopping them from spreading. Giving imetelstat in combination with fludarabine and cytarabine may work better in treating patients with refractory or recurrent AML, MDS, and JMML.

开始日期2025-02-04 |

申办/合作机构 |

ACTRN12625000226404

AMLM27/ IMpress_001: A phase II study evaluating the efficacy and safety of Imetelstat in Patients with HR myelodysplastic Syndromes (MDS) or AML failing HMA-based therapy.

开始日期2023-08-07 |

申办/合作机构 |

NCT05583552

A Phase II Study Evaluating the Efficacy and Safety of Imetelstat in Patients With HR Myelodysplastic Syndromes or AML Failing HMA-based Therapy

The purpose of this study is to evaluate the efficacy, in terms of hematologic improvement, and safety of imetelstat in participants with high-risk (HR) myelodysplastic syndrome (MDS) or acute myeloid leukemia (AML) that is relapsed/refractory to hypomethylating agents (HMAs) treatment. Responding patients are eligible to continue treatment until loss of response/disease progression.

开始日期2023-06-05 |

申办/合作机构 |

100 项与 伊美司他 相关的临床结果

登录后查看更多信息

100 项与 伊美司他 相关的转化医学

登录后查看更多信息

100 项与 伊美司他 相关的专利(医药)

登录后查看更多信息

158

项与 伊美司他 相关的文献(医药)2025-08-01·BLOOD REVIEWS

Navigating the dynamic landscape of lower-risk MDS: Advances and emerging insights

Review

作者: Mina, Alain ; Zeidan, Amer M ; Abaza, Yasmin ; Madanat, Yazan

Myelodysplastic syndromes/neoplasms (MDS) are a group of clonal myeloid malignancies characterized by ineffective hematopoiesis, cytopenias, and an increased risk of transformation to acute myeloid leukemia (AML). In lower-risk (LR) MDS, as defined by the revised and molecular international prognostic scoring systems (IPSS-R and IPSS-M), anemia is often the predominant clinical manifestation. Treatment strategies have traditionally focused on supportive care, including transfusion support and erythropoiesis stimulating agents (ESAs). While allogeneic hematopoietic stem cell transplantation remains the only potentially curative option for select patients, LR-MDS remain otherwise incurable with current therapies. With the exception of lenalidomide which was approved in 2005 in USA, therapeutic advancements in LR-MDS have stalled for almost 15 years. Progress has been limited by the disease's inherent complexity, indolent nature, and significant heterogeneity, as well as challenges in clinical trial design and execution. Recent advances in gene sequencing and molecular analyses have significantly increased our understanding of disease biology. These insights, coupled with collaborative efforts across the academic community, have led to meaningful shifts in classification, prognostication, and response assessment paradigms in LR-MDS. This evolution has led to a number of approvals, including luspatercept approved in 2020, and imetelstat, which was approved in 2024 in USA. As the therapeutic landscape of LR-MDS continues to evolve, there is growing optimism that these recent milestones will pave the way for further advancements and improved patient outcomes. Next set of studies should focus on the optimal sequencing and combinations of existing agents, as well as moving forward novel effective agents.

2025-07-25·Cancers

Advances and Challenges in the Management of Myelodysplastic Syndromes.

Review

作者: Kewan, Tariq ; Zeidan, Amer M ; Stempel, Jessica M

Myelodysplastic syndromes/neoplasms (MDS) represent a biologically and clinically diverse group of myeloid malignancies marked by cytopenias, morphological dysplasia, and an inherent risk of progression to acute myeloid leukemia. Over the past two decades, the field has made significant advances in characterizing the molecular landscape of MDS, leading to refined classification systems to reflect the underlying genetic and biological diversity. In 2025, the treatment of MDS is increasingly individualized, guided by integrated clinical, cytogenetic, and molecular risk stratification tools. For lower-risk MDS, the treatment paradigm has evolved beyond erythropoiesis-stimulating agents (ESAs) with the introduction of novel effective agents such as luspatercept and imetelstat, as well as shortened schedules of hypomethylating agents (HMAs). For higher-risk disease, monotherapy with HMAs continue to be the standard of care as combination therapies of HMAs with novel agents have, to date, failed to redefine treatment paradigms. The recognition of precursor states like clonal hematopoiesis of indeterminate potential (CHIP) and the increasing use of molecular monitoring will hopefully enable earlier intervention/prevention strategies. This review provides a comprehensive overview of the current treatment approach for MDS, highlighting new classifications, prognostic tools, evolving therapeutic options, and ongoing challenges. We discuss evidence-based recommendations, treatment sequencing, and emerging clinical trials, with a focus on translating biological insights into improved outcomes for patients with MDS.

2025-06-25·Journal of the advanced practitioner in oncology

Imetelstat: A First-in-Class Telomerase Inhibitor for the Treatment of Patients With Lower-Risk Myelodysplastic Syndromes and Anemia

Article

作者: Brunaugh, Elissa ; Yohannes, Selamawit ; Patel, Hetalkumari

Imetelstat is a first-in-class, direct, and competitive inhibitor of telomerase enzymatic activity that selectively induces apoptosis of malignant clones and allows for recovery of erythropoiesis. Imetelstat was approved by the United States Food and Drug Administration in June 2024 and the European Medicines Agency in March 2025 for the treatment of certain patients with lower-risk (low to intermediate-1) myelodysplastic syndromes (LR-MDS) with transfusion-dependent anemia who have failed or lost response to or are ineligible for erythropoiesis-stimulating agents. Imetelstat is infused at 7.1 mg/kg (active dose, equivalent to 7.5 mg/kg sodium salt) intravenously over 2 hours once every 4 weeks. In the pivotal IMerge trial in LR-MDS, significantly more patients treated with imetelstat vs. placebo, respectively, achieved ≥ 8-week RBC-transfusion independence (TI; 40% [95% confidence interval [CI] = 30.9–49.3] vs. 15% [95% CI = 7.1–26.6]) and ≥ 24-week RBC-TI (28% [95% CI = 20.1–37.0] vs. 3% [95% CI = 0.4–11.5]). The safety profile of imetelstat was characterized primarily by cytopenias, including neutropenia (incidence of 74% any grade and 68% grade 3–4 events) and thrombocytopenia (75% and 62%, respectively). Grade 3 to 4 hematologic events occurred early in the treatment and had a median duration of 1.9 weeks for neutropenia and 1.4 weeks for thrombocytopenia; cases resolved to grade ≤ 2 within 2 weeks in 81% and 86% of cases, respectively, with limited severe complications. This review highlights key topics related to the use of imetelstat in patients with LR-MDS, including its mechanism of action, clinical efficacy and safety data, dosing and administration, management of adverse events, and notable clinical practice implications.

207

项与 伊美司他 相关的新闻(医药)2025-09-03

The launch of emerging therapies like BESREMi (PharmaEssentia and AOP Orphan Pharmaceuticals), INCB057643 (Incyte), XPOVIO (Karyopharm Therapeutics), RYTELO (Geron), REBLOZYL (Bristol Myers Squibb), Navtemadlin (Kartos Therapeutics), Pelabresib (Novartis), and others is going to shift the myelofibrosis market.

LAS VEGAS, Sept. 3, 2025 /PRNewswire/ -- DelveInsight's

Myelofibrosis Market Insights report includes a comprehensive understanding of current treatment practices, emerging myelofibrosis drugs, market share of individual therapies, and current and forecasted myelofibrosis market size from 2020 to 2034, segmented into leading markets (the US, EU4, UK, and Japan).

Myelofibrosis Market Summary

The total myelofibrosis treatment market size in the leading markets (the US, EU4, UK, and Japan) was

USD 2.2 billion in 2024.

The United States accounts for the largest market size of myelofibrosis, in comparison to EU4 (Germany, Italy, France, and Spain) and the UK, and Japan.

Based on DelveInsight's assessment in 2024, the 7MM had approximately

56K patient pool (prevalent cases) of myelofibrosis.

Key myelofibrosis companies, including

PharmaEssentia, AOP Orphan Pharmaceuticals, Incyte, Karyopharm Therapeutics, Geron, Bristol Myers Squibb, Kartos Therapeutics, Novartis, Merck, Telios Pharma, Ryvu Therapeutics, Sumitomo Pharma, Syntara, Disc Medicine, Menarini Group, and others, are actively working on innovative myelofibrosis drugs.

Some of the key myelofibrosis therapies in clinical trials include

BESREMi (ropeginterferon alfa-2b-njft/P-1101), INCB057643, XPOVIO (NEXPOVIO/selinexor/KPT-330), RYTELO (imetelstat), REBLOZYL (luspatercept/ACE-536), Navtemadlin (KRT-232), Pelabresib (DAK539), Bomedemstat (IMG-7289/MK-3543), TL-895, RVU120 ( SEL-120), TP-3654 (nuvisertib), SNT-5505 (PXS-5505), DISC-0974, ELZONRIS (tagraxofusp/SL-401), and others. These novel myelofibrosis therapies are anticipated to enter the myelofibrosis market in the forecast period and are expected to change the market.

By 2034, among all the therapies, the highest revenue is expected to be generated by

OJJAARA/OMJJARA.

Discover which myelofibrosis therapies are expected to grab the largest market share @

Myelofibrosis Market Report

Key Factors Driving the Growth of the Myelofibrosis Market

Novel Therapies Drive Myelofibrosis Treatment Advancements

Currently, four JAK inhibitors have been approved by the US FDA for the treatment of myelofibrosis, including JAKAFI (ruxolitinib), INREBIC (fedratinib), VONJO (pacritinib), and OJJAARA (momelotinib). No drug therapy can cure myelofibrosis. As myelofibrosis primarily affects older adults, stem cell transplantation is not a treatment option for most myelofibrosis patients. The launch of another JAK inhibitor, BESREMi, will further change the dynamics of the myelofibrosis market.

Rich clinical pipeline and emerging non-JAK approaches driving the myelofibrosis landscape

Beyond JAK inhibitors, active clinical development includes

BET inhibitors (Incyte's INCB057643; Novartis' Pelabresib),

XPO1 inhibitor (Karyopharm Therapeutics' XPOVIO),

Telomerase inhibitor (Geron's RYTELO),

MDM2 protein inhibitor (Kartos Therapeutics' Navtemadlin),

Tyrosine kinase inhibitors (Telios Pharma's TL-895),

PIM1 kinase inhibitor (Sumitomo Pharma's TP-3654),

LOX inhibitor (Syntara's SNT-5505), and others, raising market potential by promising new label expansions, second-line options, and higher-value therapies should any prove to be disease-modifying.

An aging population & increasing incidence with better survival

Myelofibrosis primarily affects older adults; population aging increases the absolute number of patients. As treatments improve symptoms and (in some cases) survival, prevalent patient pools grow, supporting longer-term market demand. In the US in 2024, the 70+ years of age group had the highest number of cases, accounting for approximately

60% of the total prevalent cases, while the ≤39 years of age group accounted for just

~2%.

Diagnostic & genomic testing improvements are driving myelofibrosis patient pool, leading to the growth of myelofibrosis market

Wider use of molecular profiling (JAK2, CALR, MPL, and others) enables earlier and more accurate MF diagnosis and better patient stratification for targeted therapies. This both expands the diagnosed population and helps match patients to appropriate, often higher-value, treatments.

Myelofibrosis Market Analysis

JAK inhibitors have become the cornerstone of treatment for patients with myelofibrosis, offering significant benefits such as spleen reduction, symptom relief, and improved quality of life, which can also extend survival in those with advanced disease. All approved JAK inhibitors primarily target JAK2, particularly the wild-type form, but they differ in their activity against other JAK family members.

For instance, JAKAFI myelofibrosis inhibits both JAK1 and JAK2; INREBIC selectively inhibits JAK2 while sparing JAK1 and also affects FLT3 and other targets; VONJO myelofibrosis inhibits JAK2 while sparing JAK1 but additionally impacts FLT3, IRAK, and ACVR1; and OJJAARA, approved through a different pathway, targets JAK1/JAK2 and ACVR1, mainly for myelofibrosis patients with anemia. These varying mechanisms lead to distinct patient outcomes.

JAKAFI myelofibrosis continues to see strong demand and is expected to grow further, maintaining its position as the standard of care in myelofibrosis. Myelofibrosis will remain the largest segment of JAKAFI's patient population until polycythemia vera cases eventually increase. However, market growth may be limited due to patent expirations of key therapies, with JAKAFI patents set to expire in 2027 for Novartis and 2028 for Incyte, presenting potential opportunities for competitors. In response, Incyte is exploring combination trials with novel drugs to extend JAKAFI's therapeutic lifespan.

Learn more about the treatment options for myelofibrosis @

Myelofibrosis Therapy

The myelofibrosis treatment landscape offers significant opportunities for innovation, focusing on several key areas:

Treating Lower-Risk Patients: Developing safe and effective therapies for patients with lower-risk myelofibrosis, allowing for earlier and more favorable interventions.

Enhancing First-Line Treatments: Improving existing first-line therapies for intermediate- to high-risk patients through novel drugs or combination strategies.

Managing Cytopenia: Developing targeted therapies to address cytopenia, a significant unmet need in patient care.

Myelofibrosis Competitive Landscape

The myelofibrosis clinical trial pipeline includes several drugs in mid- and late-stage development that are expected to enter the market during the forecast period. The emerging landscape offers a diverse range of therapeutic alternatives for treatment, including

XPOVIO (Karyopharm Therapeutics),

Elitracet (Takeda/Keros Therapeutics),

Navtemadlin (Kartos Therapeutics),

Pelabresib (Novartis),

INCB057643 (Incyte),

Bomedemstat (Merck), and others, all of which are used in various lines of treatment. The expected launch of these therapies is expected to have a further positive impact on the market.

INCB57643 is an orally administered small molecule. Bromodomain and extra-terminal (BET) proteins act as epigenetic readers that control the expression of key oncoproteins implicated in the development of myelofibrosis and other hematologic malignancies, including B-lymphoma-2, nuclear factor kappa, and c-Myc. In a prior Phase I/II clinical trial, the oral BET inhibitor INCB057643, tested both as a monotherapy and in combination with ruxolitinib, demonstrated favorable tolerability and promising clinical activity in patients with advanced cancers. In its Q2 2025 financial report, the company announced that the combination of INCB057643 with ruxolitinib and INCB57643 (a JAK1/JAK2 and BET inhibitor) is currently being evaluated in a Phase II trial for myelofibrosis.

RYTELO (imetelstat) is an investigational telomerase inhibitor that targets telomerase, selectively eliminating malignant stem and progenitor cells in the bone marrow, which drive diseases like myelodysplastic syndromes (MDS) and myelofibrosis. By blocking the proliferation of these malignant cells, imetelstat supports the recovery of healthy bone marrow and blood cell production and has shown disease-modifying effects and clinical benefits in Phase III trials for myelofibrosis. This mechanism sets imetelstat apart from other approved or investigational therapies for these blood cancers. In January 2025, Geron reported achieving 75% enrollment in the Phase III IMpactMF trial, which is comparing imetelstat to Best Available Therapy (BAT) in intermediate-2 or high-risk myelofibrosis patients who have relapsed or are refractory to JAK inhibitor treatment.

Elritercept is a late-stage investigational activin inhibitor aimed at treating anemia associated with hematologic malignancies, including MDS and myelofibrosis. It is currently undergoing Phase II evaluation in patients with myelofibrosis. In December 2024, Keros Therapeutics presented updated data from this ongoing Phase II trial at ASH 2024. Additionally, in December 2024, Takeda announced an exclusive licensing agreement with Keros to further develop, manufacture, and commercialize elritercept globally, excluding mainland China, Hong Kong, and Macau.

The anticipated launch of these emerging myelofibrosis therapies are poised to transform the myelofibrosis market landscape in the coming years. As these cutting-edge myelofibrosis therapies continue to mature and gain regulatory approval, they are expected to reshape the myelofibrosis market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about new myelofibrosis treatment, visit @

Myelofibrosis Treatment Market

Recent Developments in the Myelofibrosis Market

In

July 2025, Incyte announced that the Phase I data in patients with myelofibrosis as monotherapy and in combination with ruxolitinib are anticipated in the second half of 2025.

In

June 2025, QIAGEN and Incyte announced a new global collaboration to develop a novel diagnostic panel to support Incyte's extensive portfolio of investigational therapies for patients with myeloproliferative neoplasms (MPNs), including Incyte's monoclonal antibody INCA033989.

In

January 2025, Karyopharm Therapeutics stated that it expects to report top-line results from the Phase III SENTRY trial in the second half of 2025, which could represent a potentially transformative opportunity to establish a new treatment paradigm in myelofibrosis.

What is

Myelofibrosis?

Myelofibrosis is a rare blood cancer marked by the accumulation of scar tissue, or 'fibrosis', in the bone marrow. This excess scar tissue prevents the bone marrow from producing enough healthy blood cells. It belongs to a group of blood cancers called 'myeloproliferative neoplasms (MPNs)', in which the blood cells produced by the bone marrow grow and function abnormally. When myelofibrosis arises independently, without being caused by another bone marrow disorder, it is referred to as primary myelofibrosis. In other cases, it can develop from another MPN, such as polycythemia vera or essential thrombocythemia. When this occurs, it is called secondary myelofibrosis, sometimes specifically termed post-polycythemia vera myelofibrosis or post-essential thrombocythemia myelofibrosis.

Myelofibrosis Epidemiology Segmentation

The myelofibrosis epidemiology section provides insights into the historical and current myelofibrosis patient pool and forecasted trends for the leading markets (the US, EU4, UK, and Japan). It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The myelofibrosis market report proffers epidemiological analysis for the study period 2020–2034 in the leading markets (the US, EU4, UK, and Japan) segmented into:

Total Prevalent Cases of Myelofibrosis

Type-specific Cases of Myelofibrosis

Myelofibrosis Cases Based on Risk Stratification

Age-specific Prevalent Cases of Myelofibrosis

Myelofibrosis Cases Based on Molecular Alterations

Download the report to understand which factors are driving myelofibrosis epidemiology trends @

Myelofibrosis Treatment Drugs

Scope of the

Myelofibrosis

Market Report

Myelofibrosis Therapeutic Assessment: Myelofibrosis current marketed and emerging therapies

Myelofibrosis

Market Dynamics: Conjoint Analysis of Emerging Myelofibrosis Drugs

Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

Myelofibrosis Market Unmet Needs, KOL's views, Analyst's views, Myelofibrosis Market Access and Reimbursement

Discover more about myelofibrosis drugs in development @

Myelofibrosis Clinical Trials

Table of Contents

Related Reports

JAK Inhibitors Market

JAK Inhibitors Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034 report delivers an in-depth understanding of the market trends, market drivers, market barriers, and key JAK inhibitors companies, including

Pfizer, AbbVie, Galapagos, Sierra Oncology, Theravance Biopharma, Dizal Pharmaceutical, Aclaris Therapeutics, Celon Pharma, Incyte Corporation, Gilead Sciences, Reistone Biopharma, Jiangsu Hengrui Medicine Co., MaxiNovel Pharmaceuticals, among others.

Myelofibrosis Clinical Trial Analysis

Myelofibrosis Pipeline Insight

– 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key myelofibrosis companies, including

Geron Corporation, Merck, Ryvu Therapeutics SA, Morphic Therapeutic, iOnctura, Pharmaxis, Nippon Shinyaku, Active Biotech, Incyte Corporation, Sumitomo Pharma America, Inc., Cellenkos, Disc Medicine, among others.

Polycythemia Vera Market

Polycythemia Vera Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key polycythemia vera companies, including

Incyte, Novartis, PharmaEssentia, AOP Orphan Pharmaceuticals, Protagonist Therapeutics, Merck (Imago BioSciences), Italfarmaco, Ionis Pharmaceutical, Silence Therapeutics, Perseus Proteomics, AbbVie, Johnson & Johnson Innovative Medicine, Mabwell (Shanghai) Bioscience, Disc Medicine, GluBio Therapeutics, among others.

Multiple Myeloma Market

Multiple Myeloma Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key multiple myeloma companies, including

Sanofi, Karyopharm Therapeutics, AbbVie, Takeda Pharmaceutical, Celgene, Bristol-Myers Squibb, RAPA Therapeutics, Pfizer, Array Biopharma, Cellectar Biosciences, BioLineRx, Celgene, Aduro Biotech, ExCellThera, Janssen Pharmaceutical, Precision BioSciences, Takeda, Glenmark (Ichnos Sciences SA), Poseida Therapeutics, Molecular Partners AG, Chipscreen Biosciences, AbbVie, Genentech (Roche), Janssen Biotech, Nanjing Legend Biotech, Merck Sharp & Dohme Corp., among others.

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve

.

Connect with us on LinkedIn

| Facebook | Twitter

Contact Us

Shruti Thakur

[email protected]

+14699457679

Logo:

SOURCE DelveInsight Business Research, LLP

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

临床2期引进/卖出临床1期上市批准临床结果

2025-08-11

FibroGen has reached agreement with the FDA on important design elements for a pivotal Phase 3 clinical trial for roxadustat for the treatment of anemia in patients with lower-risk myelodysplastic syndromes (LR-MDS) and high red blood cell (RBC) transfusion burden

Company intends to file the Phase 3 protocol in the fourth quarter of 2025

Aug. 07, 2025 -- FibroGen, Inc. (NASDAQ: FGEN) today announced positive feedback from its Type C meeting with the FDA, supporting the advancement of roxadustat for the treatment of anemia in patients with LR-MDS and high RBC transfusion burden, based on a post-hoc subgroup analysis from the MATTERHORN Phase 3 trial.

“We are very pleased with the feedback we received from the FDA regarding roxadustat in patients with LR-MDS and anemia with high transfusion burden. This indication, despite recent approvals, still represents a patient population with significant unmet need,” said Thane Wettig, Chief Executive Officer of FibroGen. “We believe roxadustat’s differentiated mechanism of action, favorable tolerability profile, and oral route of administration can potentially be an important addition to the treatment options for patients with high transfusion burden. We are starting preparations for the Phase 3 trial, while evaluating internal development and potential partnership opportunities for this late-stage program. We plan to submit the Phase 3 trial protocol to the FDA in the fourth quarter of this year.”

“Anemia is a major cause of morbidity and complications in patients with LR-MDS, especially those with high transfusion burden, and is often associated with poor quality of life and shortened survival. While we have recent approvals of injectable drugs for this indication, there is a significant unmet need for novel, effective oral agents for this patient population,” added Amer Zeidan, M.B.B.S, M.H.S., Professor of Medicine at Yale School of Medicine and Chief of the Division of Hematologic Malignancies at Yale Cancer Center, and the global principal investigator of the planned Phase 3 study. “Roxadustat has already shown promising efficacy in this group of patients in the post-hoc analysis of the MATTERHORN study, and I am glad we have agreed on a pathway with the regulators to explore the full potential of roxadustat in the upcoming Phase 3 trial. I am excited by the prospect of roxadustat potentially becoming a novel, safe, convenient, and effective therapy for LR-MDS patients with high transfusion burden.

FibroGen requested the Type C meeting based on the findings of a post-hoc analysis of data from the Phase 3 MATTERHORN trial of roxadustat in anemia-associated with LR-MDS. In patients with high RBC transfusion burden at baseline (≥4 units over 8 weeks1), a pronounced treatment effect was observed: 36% (8/22) of patients achieved transfusion independence (TI) for ≥ 56 days on roxadustat vs 7% (1/15) of patients on placebo within 28 weeks (nominal p-value of 0.041).

The planned Phase 3 trial will assess the safety and efficacy of roxadustat in a randomized, double-blind, placebo-controlled design in approximately 200 patients with LR-MDS. Alignment was reached with the FDA on the patient population (patients requiring ≥ 4 pRBC units in two consecutive 8-week periods prior to randomization, who are refractory to, intolerant to, or ineligible for prior erythropoiesis-stimulating agents (ESA) therapy), dose regimen, as well as management of potential thrombotic risk through eligibility and dose modification and discontinuation criteria. As the primary endpoint for the study, the Company is considering either 8-week or 16-week RBC TI.

Myelodysplastic syndromes (MDS) are a group of disorders characterized by dysfunctional progenitor blood cells and stem cells, resulting in chronic anemia in most patients. Annual incidence rates of MDS are estimated to be 4.9/100,000 adults in the U.S, thereof 77% are considered lower-risk MDS. Approximately 80% of patients with MDS have anemia at the time of diagnosis, and around 60% of patients with MDS will experience severe anemia (hemoglobin <8 g/dL) at some point during the course of their disease. Anemia in patients with MDS is associated with increased risk of cardiovascular complications and the need for blood transfusion. Approximately 50% of patients with MDS require regular red blood cell transfusions. Transfusion dependent MDS patients suffer higher rates of cardiac events, infections, and iron overload with the related complications. In addition, anemia frequently leads to significant fatigue, cognitive dysfunction, and decreased quality of life. Today, patients are routinely treated with erythropoiesis-stimulating agents (ESAs), luspatercept, imetelstat, or lenalidomide in lower-risk MDS with isolated del(5q), and hypomethylating agents (HMAs) in higher-risk disease. Only 35-40% of patients respond to current treatments and the durability of response is short. Moreover, these treatments are challenging to dose-calibrate and can only be administered via subcutaneous injection or through IV infusion. There remains a high unmet need for the treatment of anemia associated with MDS, and new strategies that provide durable response and the convenience of oral administration are highly desired in managing patients with MDS.

Roxadustat, an oral medication, is the first in a new class of medicines comprising HIF-PH inhibitors that promote erythropoiesis, or red blood cell production, through increased endogenous production of erythropoietin, improved iron absorption and mobilization, and downregulation of hepcidin. Roxadustat is in clinical development for chemotherapy-induced anemia (CIA) and a Supplemental New Drug Application (sNDA) has been accepted by the China Health Authority.

Roxadustat is approved in China, Europe, Japan, and numerous other countries for the treatment of anemia of CKD in adult patients on dialysis (DD) and not on dialysis (NDD). FibroGen has the sole rights to roxadustat in the United States, Canada, Mexico, and in all markets not held by AstraZeneca or licensed to Astellas. Astellas and FibroGen are collaborating on the commercialization of roxadustat for the treatment of anemia in territories including Japan, Europe, Turkey, Russia, and the Commonwealth of Independent States, the Middle East, and South Africa.

FibroGen, Inc. is a biopharmaceutical company focused on accelerating the development of novel therapies at the frontiers of cancer biology. Roxadustat (爱瑞卓®, EVRENZO™) is currently approved in China, Europe, Japan, and numerous other countries for the treatment of anemia in chronic kidney disease (CKD) patients on dialysis and not on dialysis. Roxadustat is in clinical development for chemotherapy-induced anemia (CIA) and a Supplemental New Drug Application (sNDA) has been accepted for review by the China Health Authority. FG-3246 (also known as FOR46), a first-in-class antibody-drug conjugate (ADC) targeting CD46 is in development for the treatment of metastatic castration-resistant prostate cancer. This program also includes the development of an associated CD46-targeted PET biomarker. In addition, FibroGen has expanded its research and development portfolio to include two immuno-oncology product candidates for the treatment of solid tumors.

The content above comes from the network. if any infringement, please contact us to modify.

临床结果上市批准

2025-05-28

FOSTER CITY, Calif.--(BUSINESS WIRE)--Geron Corporation (Nasdaq: GERN), a commercial-stage biopharmaceutical company aiming to change lives by changing the course of blood cancer, today announced presentations on RYTELO® (imetelstat) at the 2025 American Society of Clinical Oncology (ASCO) Annual Meeting and the European Hematology Association (EHA) 2025 Congress. Together, the presentations reinforce the potential benefits of the first-in-class oligonucleotide telomerase inhibitor RYTELO for a range of patients with lower-risk myelodysplastic syndromes (LR-MDS) with transfusion-dependent anemia and showcase the progress Geron is making with the ongoing IMpactMF and IMproveMF trials of imetelstat in myelofibrosis (MF).

“Transfusion independence is an important goal for LR-MDS patients, but one that historically has not been achievable for many,” said Rami S. Komrokji, M.D., Vice Chair, Malignant Hematology Department, Moffitt Cancer Center. “While imetelstat is already playing a vital role in LR-MDS, these new analyses being presented at ASCO and EHA reinforce its potential to give a broad range of patients more time without transfusions and should also give clinicians confidence to add it to their toolkit as a second-line option for eligible patients.”

Presentations at ASCO and EHA include:

New pooled, post-hoc analyses expand on the pivotal IMerge results across challenging LR-MDS subpopulations

Analysis of patients with ring sideroblast negative (RS-) disease, showing that these difficult-to-treat patients appeared to experience clinical benefit with RYTELO, including ≥8-week, ≥24-week and ≥1-year red blood cell transfusion independence (RBC-TI), duration of RBC-TI, and hemoglobin rise in patients who achieved RBC-TI, consistent with prior findings from the overall Phase 3 IMerge population.

Analysis showing clinical benefit with RYTELO regardless of baseline serum erythropoietin (sEPO) level, supporting the use of RYTELO in the frontline setting for LR-MDS patients ineligible for erythropoiesis-stimulating agents (ESAs), and in the second-line setting after ESAs regardless of sEPO.

Analysis showing clinical benefit with RYTELO in ESA-ineligible or relapsed/refractory patients regardless of prior treatment with luspatercept or lenalidomide. Patients who had prior treatment with a hypomethylating agent (HMA) showed modest clinical activity with RYTELO.

Patient-centric outcome measures offering deeper insight on RYTELO impact in new post-hoc analyses from Phase 3 IMerge trial

Analysis showing that certain RYTELO-treated patients experienced sustained improvements in health-related quality-of-life (QOL) compared with placebo, as measured by certain categories in the patient-reported QOL in Myelodysplasia Scale (QUALMS) instrument.

Exploratory analysis suggesting that certain patients treated with RYTELO experienced a longer mean duration of time without transfusion reliance or relapse (TWiTR), compared with placebo.

New updates on ongoing trials in MF

Recently updated preliminary data from the dose escalation portion of the Phase 1/1b IMproveMF trial showing the combination of imetelstat and ruxolitinib was generally well-tolerated, with no dose-limiting toxicities observed as of the data cutoff date, and encouraging early dose-dependent efficacy data suggesting the potential of the combination for patients with intermediate-1 (INT-1), intermediate-2 (INT-2) or high-risk (HR) MF.

Trial-in-progress (TiP) update on the Phase 3 IMpactMF trial investigating imetelstat in relapsed/refractory MF, reporting that the trial has met approximately 80% of its enrollment target as of February 2025.

“At ASCO and EHA, we’re excited to present new analyses on how RYTELO can deliver meaningful benefit across a range of LR-MDS patients who otherwise may have had limited options, whether due to their ring sideroblast status, baseline EPO level, or their treatment history,” said Faye Feller, M.D., Executive Vice President and Chief Medical Officer of Geron. “We believe the depth and breadth of our data reinforce the potential of RYTELO to address critical unmet needs in LR-MDS and, combined with the advances we are making with our myelofibrosis program, underscore our confidence in telomerase inhibition as a potentially transformative clinical strategy and our commitment to exploring its full potential.”

See below for a full schedule of presentations at ASCO and EHA.

ASCO 2025 Presentations

Presentation Title

Author

Abstract Number

Presentation Details

IMproveMF update: phase 1/1B trial of imetelstat (IME)+ruxolitinib (RUX) in patients (pts) with intermediate (INT)-1, INT-2, or high-risk (HR) myelofibrosis (MF)

John O. Mascarenhas, M.D.

#6515

Rapid Oral, Fri. May 30, 1:00-2:30 PM CDT

Effect of prior treatment (tx) on the clinical activity of imetelstat (IME) in transfusion-

dependent (TD) patients (pts) with erythropoiesis-stimulating agent (ESA), relapsed or

refractory (R/R)/ineligible lower-risk myelodysplastic syndromes (LR-MDS)

Rami S. Komrokji, M.D.

#6569

Poster, Sun. June 1, 9:00 AM-12:00 PM CDT

IMpactMF, randomized, open-label, phase 3 trial of imetelstat (IME) versus best available therapy (BAT) in patients (pts) with intermediate-2 (INT-2) or high-risk (HR) myelofibrosis (MF) relapsed or refractory (R/R) to Janus kinase inhibitors (JAKi)

John O. Mascarenhas, M.D.

#TPS6588

Poster, Sun. June 1, 9:00 AM-12:00 PM CDT

EHA 2025 Presentations

Presentation Title

Author

Abstract Number

Presentation Details

Increased Duration of Time Without Transfusion Reliance (TWiTR) For Patients with LR-MDS Treated with Imetelstat Versus Placebo in the IMerge Trial

Mikkael A. Sekeres, M.D.

#PF646

Poster, Fri. June 13, 18:30-19:30 CEST

IMproveMF Update: Phase 1/1B Trial of Imetelstat + Ruxolitinib in Patients with INT-1, INT-2, or High-Risk MF

John O. Mascarenhas, M.D.

#PF830

Poster, Fri. June 13, 18:30-19:30 CEST

IMpactMF: Randomized, Open-Label, Phase 3 Trial of Imetelstat vs Best Available Therapy in Patients with INT-2 or High-Risk MF Relapsed/Refractory to JAK Inhibitors

John O. Mascarenhas, M.D.

#PF841

Poster, Fri. June 13, 18:30-19:30 CEST

Health-related Quality of Life Outcomes in Patients with Lower-Risk Myelodysplastic Syndromes Treated with Imetelstat in the IMerge Trial

María Díez-Campelo, M.D., Ph.D.

#PS1639

Poster, Sat. June 14, 18:30-19:30 CEST

Outcomes of Imetelstat Therapy in RS-Negative LR-MDS from the Pooled IMerge Study Populations

Valeria Santini, M.D.

#PS1622

Poster, Sat. June 14, 18:30-19:30 CEST

Outcomes with Imetelstat by Serum Erythropoietin Levels in Patients with LR-MDS Who Were Treatment Naïve or Who Had Prior Treatment with Erythropoiesis-Stimulating Agents

Rami S. Komrokji, M.D.

#PS1640

Poster, Sat. June 14, 18:30-19:30 CEST

Characterization and Management of Transient Cytopenias Associated with Imetelstat in LR-MDS from the IMerge Trial

Amer M. Zeidan, M.D.

#PB2760

Publication-only

Please see the full presentations for important qualifications and limitations on these post-hoc analyses.

About RYTELO® (imetelstat)

RYTELO is an oligonucleotide telomerase inhibitor approved in the U.S. for the treatment of adult patients with low-to-intermediate-1 risk myelodysplastic syndromes (LR-MDS) with transfusion-dependent anemia requiring four or more red blood cell units over eight weeks who have not responded to or have lost response to or are ineligible for erythropoiesis-stimulating agents (ESAs). It is indicated to be administered as an intravenous infusion over two hours every four weeks.

In addition, RYTELO is approved in the European Union as a monotherapy for the treatment of adult patients with transfusion-dependent anemia due to very low, low or intermediate risk myelodysplastic syndromes without an isolated deletion 5q cytogenetic (non-del 5q) abnormality and who had an unsatisfactory response to or are ineligible for erythropoietin-based therapy.

RYTELO is a first-in-class treatment that works by inhibiting telomerase enzymatic activity. Telomeres are protective caps at the end of chromosomes that naturally shorten each time a cell divides. In LR-MDS, abnormal bone marrow cells often express the enzyme telomerase, which rebuilds those telomeres, allowing for uncontrolled cell division. Developed and exclusively owned by Geron, RYTELO is the first and only telomerase inhibitor approved by the U.S. Food and Drug Administration and the European Commission.

About Geron

Geron is a commercial-stage biopharmaceutical company aiming to change lives by changing the course of blood cancer. Our first-in-class telomerase inhibitor RYTELO® (imetelstat) is approved in the United States and the European Union for the treatment of certain adult patients with lower-risk myelodysplastic syndromes (LR-MDS) with transfusion-dependent anemia. We are also conducting a pivotal Phase 3 clinical trial of imetelstat in JAK-inhibitor relapsed/refractory myelofibrosis (R/R MF), as well as studies in other hematologic malignancies. Inhibiting telomerase activity, which is increased in malignant stem and progenitor cells in the bone marrow, aims to potentially reduce proliferation and induce death of malignant cells. To learn more, visit www.geron.com or LinkedIn.

US IMPORTANT SAFETY INFORMATION ABOUT RYTELO®

WARNINGS AND PRECAUTIONS

Thrombocytopenia

RYTELO can cause thrombocytopenia based on laboratory values. In the clinical trial, new or worsening Grade 3 or 4 decreased platelets occurred in 65% of patients with MDS treated with RYTELO.

Monitor patients with thrombocytopenia for bleeding. Monitor complete blood cell counts prior to initiation of RYTELO, weekly for the first two cycles, prior to each cycle thereafter, and as clinically indicated. Administer platelet transfusions as appropriate. Delay the next cycle and resume at the same or reduced dose, or discontinue as recommended.

Neutropenia

RYTELO can cause neutropenia based on laboratory values. In the clinical trial, new or worsening Grade 3 or 4 decreased neutrophils occurred in 72% of patients with MDS treated with RYTELO.

Monitor patients with Grade 3 or 4 neutropenia for infections, including sepsis. Monitor complete blood cell counts prior to initiation of RYTELO, weekly for the first two cycles, prior to each cycle thereafter, and as clinically indicated. Administer growth factors and anti-infective therapies for treatment or prophylaxis as appropriate. Delay the next cycle and resume at the same or reduced dose, or discontinue as recommended.

Infusion-Related Reactions

RYTELO can cause infusion-related reactions. In the clinical trial, infusion-related reactions occurred in 8% of patients with MDS treated with RYTELO; Grade 3 or 4 infusion-related reactions occurred in 1.7%, including hypertensive crisis (0.8%). The most common infusion-related reaction was headache (4.2%). Infusion-related reactions usually occur during or shortly after the end of the infusion.

Premedicate patients at least 30 minutes prior to infusion with diphenhydramine and hydrocortisone as recommended and monitor patients for at least one hour following the infusion as recommended. Manage symptoms of infusion-related reactions with supportive care and infusion interruptions, decrease infusion rate, or permanently discontinue as recommended.

Embryo-Fetal Toxicity

Based on animal findings, RYTELO can cause embryo-fetal harm when administered to a pregnant woman. Advise pregnant women of the potential risk to a fetus. Advise females of reproductive potential to use effective contraception during treatment with RYTELO and for 1 week after the last dose.

ADVERSE REACTIONS

Serious adverse reactions occurred in 32% of patients who received RYTELO. Serious adverse reactions in >2% of patients included sepsis (4.2%) and fracture (3.4%), cardiac failure (2.5%), and hemorrhage (2.5%). Fatal adverse reactions occurred in 0.8% of patients who received RYTELO, including sepsis (0.8%).

Most common adverse reactions (≥10% with a difference between arms of >5% compared to placebo), including laboratory abnormalities, were decreased platelets, decreased white blood cells, decreased neutrophils, increased AST, increased alkaline phosphatase, increased ALT, fatigue, prolonged partial thromboplastin time, arthralgia/myalgia, COVID-19 infections, and headache.

Please see RYTELO (imetelstat) full Prescribing Information, including Medication Guide, available at https://pi.geron.com/products/US/pi/rytelo_pi.pdf.

The Summary of Product Characteristics (SmPC) for RYTELO in the EU is available at https://pi.geron.com/products/rytelo/eu/rytelo_smpc_eu.pdf

Use of Forward-Looking Statements

Except for the historical information contained herein, this press release contains forward-looking statements made pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such statements, include, without limitation, those regarding: (i) that the new analyses presented at ASCO and EHA reinforce the potential benefits of RYTELO for a range of patients with LR-MDS with transfusion-dependent anemia, including its potential to give a broad range of patients more time without transfusions and should support clinician’s confidence in RYTELO as a second-line option for eligible patients; (ii) beliefs regarding imetelstat’s vital role in LR-MDS, (iii) how RYTELO can deliver meaningful benefit across a range of LR-MDS patients who otherwise may have had limited options, whether due to ring sideroblast status, baseline EPO levels, or their treatment history; (iv) Geron’s beliefs that the depth and breadth of its data reinforce the potential of RYTELO to address critical unmet needs in LR-MDS and regarding telomerase inhibition as a potentially transformative clinical strategy; and (v) other statements that are not historical facts, constitute forward-looking statements. These forward-looking statements involve risks and uncertainties that can cause actual results to differ materially from those in such forward-looking statements. These risks and uncertainties, include, without limitation, risks and uncertainties related to: (a) whether Geron is successful in commercializing RYTELO (imetelstat) for the treatment of certain patients with LR-MDS with transfusion dependent anemia and achieves market acceptance across the breadth of the eligible patient segments in RYTELO’s approved indication; (b) whether the FDA and European Commission will approve imetelstat for other indications on the timelines expected, or at all; (c) Geron’s plans to commercialize RYTELO in the European Union, or EU and risks related to operating outside of the U.S.; (d) whether Geron overcomes potential delays and other adverse impacts that may be caused by enrollment, clinical, safety, efficacy, technical, scientific, intellectual property, manufacturing and regulatory challenges in order to have the financial resources for and meet expected timelines and planned milestones; (e) whether regulatory authorities permit the further development of imetelstat on a timely basis, or at all, without any clinical holds; (f) whether any future safety or efficacy results of RYTELO treatment cause its benefit-risk profile to become unacceptable; (g) whether imetelstat actually demonstrates disease-modifying activity in patients and the ability to target the malignant stem and progenitor cells of the underlying disease; (h) whether Geron meets its post-marketing requirements and commitments for RYTELO; (i) whether there are failures or delays in manufacturing or supplying sufficient quantities of RYTELO (imetelstat) or other clinical trial materials that impact commercialization of RYTELO or the continuation of its ongoing clinical trials, including the IMpactMF trial; (j) that the projected timing for the interim and final analyses of the IMpactMF trial may vary depending on actual enrollment and death rates in the trial; and (k) whether Geron stays in compliance with and satisfies its obligations under its debt and synthetic royalty financing agreements. Additional information on the above risks and uncertainties and additional risks, uncertainties and factors that could cause actual results to differ materially from those in the forward-looking statements are contained in Geron’s filings and periodic reports filed with the Securities and Exchange Commission under the heading “Risk Factors” and elsewhere in such filings and reports, including Geron’s quarterly report on Form 10-Q for the quarter ended March 31, 2025, and subsequent filings and reports by Geron. Undue reliance should not be placed on forward-looking statements, which speak only as of the date they are made, and the facts and assumptions underlying the forward-looking statements may change. Except as required by law, Geron disclaims any obligation to update these forward-looking statements to reflect future information, events, or circumstances.

临床结果临床3期上市批准ASCO会议

100 项与 伊美司他 相关的药物交易

登录后查看更多信息

研发状态

批准上市

10 条最早获批的记录, 后查看更多信息

登录

| 适应症 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|

| 输血依赖性贫血 | 欧盟 | 2025-03-07 | |

| 输血依赖性贫血 | 冰岛 | 2025-03-07 | |

| 输血依赖性贫血 | 列支敦士登 | 2025-03-07 | |

| 输血依赖性贫血 | 挪威 | 2025-03-07 | |

| 骨髓增生异常性贫血 | 美国 | 2024-06-06 |

未上市

10 条进展最快的记录, 后查看更多信息

登录

| 适应症 | 最高研发状态 | 国家/地区 | 公司 | 日期 |

|---|---|---|---|---|

| 骨髓增生异常综合征 | 申请上市 | 美国 | 2024-01-12 | |

| 骨髓纤维化 | 临床3期 | 美国 | 2021-04-12 | |

| 骨髓纤维化 | 临床3期 | 阿根廷 | 2021-04-12 | |

| 骨髓纤维化 | 临床3期 | 澳大利亚 | 2021-04-12 | |

| 骨髓纤维化 | 临床3期 | 奥地利 | 2021-04-12 | |

| 骨髓纤维化 | 临床3期 | 比利时 | 2021-04-12 | |

| 骨髓纤维化 | 临床3期 | 巴西 | 2021-04-12 | |

| 骨髓纤维化 | 临床3期 | 保加利亚 | 2021-04-12 | |

| 骨髓纤维化 | 临床3期 | 哥伦比亚 | 2021-04-12 | |

| 骨髓纤维化 | 临床3期 | 丹麦 | 2021-04-12 |

登录后查看更多信息

临床结果

临床结果

适应症

分期

评价

查看全部结果

| 研究 | 分期 | 人群特征 | 评价人数 | 分组 | 结果 | 评价 | 发布日期 |

|---|

N/A | 骨髓纤维化 JAK2 mutation | calreticulin (CALR) mutation | 197 | 繭鹹選餘觸鑰網糧餘蓋(鬱鹽窪壓齋範選獵糧衊) = 42% 窪範獵繭鏇獵夢遞製齋 (構顧夢夢願鑰膚範齋齋 ) 更多 | 积极 | 2025-05-30 | ||

临床2/3期 | 226 | 蓋獵積顧醖鏇鹽願繭糧(築積築淵顧獵夢鑰構蓋) = 鏇顧餘積壓鏇壓醖鹽襯 製餘選選壓製簾網繭簾 (繭製鏇遞憲憲顧製製齋 ) 更多 | 积极 | 2025-05-30 | |||

临床3期 | - | 獵願膚鑰蓋淵積廠餘築(構鏇蓋憲積積簾鏇顧構) = 築簾願範鬱願簾範選獵 膚鏇遞襯製簾衊遞觸遞 (願餘膚窪獵選糧遞構艱 ) 更多 | 积极 | 2025-05-22 | |||

临床1/2期 | 770 | 製餘襯顧顧構餘壓獵鑰(衊窪餘鹹膚觸構遞憲糧) = 繭膚鏇簾餘顧範衊選顧 襯鏇範鏇餘糧網襯糧繭 (膚積淵鹽鹹膚餘獵鑰鹽, 0.012 ~ 0.039) 更多 | 积极 | 2025-05-14 | |||

临床3期 | 78 | 窪構蓋醖襯壓糧簾觸鑰(網顧醖選積膚鏇憲壓遞) = 觸範鑰鹽製築窪鏇壓網 鑰鬱窪繭壓鬱醖積鑰壓 (鏇廠艱淵選鬱艱範範選 ) 更多 | 积极 | 2025-05-14 | |||

临床3期 | 178 | 簾遞築廠淵壓製淵觸膚(艱網夢憲鏇觸獵艱願製) = 築艱夢積鹽鑰積衊選遞 艱壓襯繭獵淵製鹹齋築 (製獵鹽製觸積窪顧醖餘, 24 ~ 122) 更多 | 积极 | 2025-05-14 | |||

Placebo | 簾遞築廠淵壓製淵觸膚(艱網夢憲鏇觸獵艱願製) = 餘膚襯襯網鑰遞壓衊夢 艱壓襯繭獵淵製鹹齋築 (製獵鹽製觸積窪顧醖餘, 10 ~ 194) 更多 | ||||||

临床3期 | 226 | 膚餘築獵鏇齋積繭淵願(衊遞糧選憲選鹹遞積願) = neutropenia and thrombocytopenia were the most common adverse events seen with IME in LR-MDS 構衊鬱網鑰鹹憲範願網 (艱構憲鬱鑰醖襯窪窪襯 ) 更多 | 积极 | 2025-05-14 | |||

临床3期 | 骨髓增生异常综合征 sEPO | - | 築醖壓顧築廠糧遞淵膚(簾膚遞鏇築糧顧築蓋製) = 簾願壓憲願鹽衊膚憲願 壓築範構壓築糧淵艱願 (觸製選鏇製製構餘膚鏇 ) 更多 | 积极 | 2025-05-14 | ||

临床2/3期 | 289 | (Phase 2: Imetelstat Sodium) | 糧築簾獵獵築餘遞製鹽 = 鑰遞網餘餘鑰願製網鹽 積醖遞願築鑰網廠醖壓 (獵糧糧遞簾衊鑰願鏇構, 廠構壓鏇遞網鬱積膚築 ~ 鬱憲夢構蓋醖糧繭鏇鹹) 更多 | - | 2025-02-14 | ||

(Phase 3: Imetelstat Sodium) | 糧淵構願糧鹽願鏇觸築 = 範艱糧築鬱糧鬱製壓餘 餘積淵廠醖蓋積顧願簾 (鑰簾鑰鹹鑰簾窪構簾顧, 窪鑰衊願構獵獵構觸鬱 ~ 鹽夢壓製築餘夢鹽製艱) 更多 | ||||||

临床1期 | 13 | 範願鬱壓蓋鹹網壓鬱顧(願襯製衊積鑰鬱鹹觸憲) = None 鹽廠觸鹽鹹製艱艱簾憲 (獵積範糧鏇憲鑰襯襯夢 ) 更多 | 积极 | 2024-12-09 |

登录后查看更多信息

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

核心专利

使用我们的核心专利数据促进您的研究。

登录

或

临床分析

紧跟全球注册中心的最新临床试验。

登录

或

批准

利用最新的监管批准信息加速您的研究。

登录

或

特殊审评

只需点击几下即可了解关键药物信息。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用