预约演示

更新于:2025-01-23

Contract Pharmaceuticals Ltd.

更新于:2025-01-23

概览

标签

遗传病与畸形

神经系统疾病

免疫系统疾病

小分子化药

关联

1

项与 Contract Pharmaceuticals Ltd. 相关的药物2

项与 Contract Pharmaceuticals Ltd. 相关的临床试验CTR20191227

一项在1岁至不超过18岁幼年特发性关节炎(JIA)患者中评价Baricitinib的长期安全性和有效性的3期多中心研究

评估baricitinib治疗JIA或sJIA患者的长期安全性和耐受性

开始日期2020-03-20 |

申办/合作机构  Eli Lilly & Co. Eli Lilly & Co. [+2] |

CTR20191178

在2岁至18岁JIA患者中评价口服Baricitinib的随机、双盲、安慰剂对照、含停药设计的安全性和有效性研究

本研究的主要目的是评估baricitinib与安慰剂相比,治疗JIA患儿的有效性,次要目的是评估baricitinib治疗JIA患儿的有效性,baricitinib与安慰剂相比,治疗JIA患儿的有效性,评估治疗ERA或JPsA患儿的有效性,评估baricitinib对细胞及体液免疫系统的可能作用。

开始日期2019-11-30 |

申办/合作机构  Eli Lilly & Co. Eli Lilly & Co. [+2] |

100 项与 Contract Pharmaceuticals Ltd. 相关的临床结果

登录后查看更多信息

0 项与 Contract Pharmaceuticals Ltd. 相关的专利(医药)

登录后查看更多信息

1

项与 Contract Pharmaceuticals Ltd. 相关的文献(医药)2019-11-01·Environmental Science and Pollution Research

Occurrence and removal of triclosan in Canadian wastewater systems

Article

作者: Guerra, Paula ; Shah, Ariba ; Albert, Amber ; Smyth, Shirley Anne ; Teslic, Steven ; Gewurtz, Sarah B

2

项与 Contract Pharmaceuticals Ltd. 相关的新闻(医药)2024-04-09

The FDA issued separate Form 483s to India’s Jubilant Generics and Contract Pharmaceuticals Limited Canada in the wake of inspections carried out in the last five months.

India’s Jubilant Generics and Contract Pharmaceuticals Limited Canada were each hit with Form 483s by the FDA following inspections that uncovered questionable manufacturing practices.

The Jubilant Generics inspection, which took place at the company’s production facility in Bhagwanpur, India, between Jan. 25 and Feb. 2 earlier this year, cited four observations, according to a letter posted April 5 on the U.S. regulatory agency’s website.

Inspectors found the facility failed to investigate and identify the root cause of the presence of out-of-specification drugs in a batch of unspecified drugs that were later distributed in the U.S. after they were found in swab samples taken during a cleaning verification process, the FDA said.

Additionally, the site’s quality control unit was cited for not keeping proper records or following written procedures after an inspector “observed the presence of at least three uncontrolled investigation documents in a locked bin that were placed for shredding.”

The two other observations found the facility didn’t establish appropriate time limits for the completion of each production phase and failed to put control procedures in place that would validate the manufacturing processes.

Separately, the agency issued a Form 483 to Contract Pharmaceuticals Limited in the wake of an inspection between Oct. 30 and Nov. 3, 2023, of its Mississauga facility located near Toronto. The FDA cited one observation.

The company failed to “thoroughly review any unexplained discrepancy whether or not (a specific) batch has been already distributed.,” the agency said in a letter posted to its website April 3.

A third-party contract lab found brucella melitensis, a highly pathogenic microorganism, during an environmental monitoring of the production area. When notified of its presence, however, the company didn’t initiate an incident report in order to conduct a documented investigation of the finding, the agency said.

2023-05-19

DUBLIN--(

BUSINESS WIRE

)--The

"New Drug Approvals and Their Contract Manufacture - 2023 Edition"

report has been added to

ResearchAndMarkets.com's

offering.

In 2022, the FDA approved c100+ new drug applications (NDAs) and biologics license applications (BLAs). This figure represents a decrease over the 2017-21 period. Both small molecule and biologic new molecular entity (NME) approvals declined substantially, causing overall NDA approvals to drop, which meant fewer commercial-scale production contracts for the most innovative products comparative to other recent years.

In June 2021, the FDA granted accelerated approval of Biogen's Aduhelm for Alzheimer's disease, despite there being little to no evidence of clinical benefit and the majority of an FDA advisory panel voting against the drug's approval. This event caused controversy and added to pre-existing claims that the FDA approval process may not be as rigorous as it was in the past, the long-standing push for speed in the FDA approval process having meant a reduced level of certainty and evidence related to a drug. As a result of these issues, there may have been an increased reluctance to authorize innovative drugs for use.

COVID-19 vaccine drives have allowed economies and societies to safely reopen during the pandemic. However, new challenges such as rising inflation will bring uncertainty to the ongoing global recovery. The pharma industry faces increasing cost pressures, shrinking consumer spending power, staff shortages, and geopolitical tensions. Contract Manufacturing Organization's (CMO's) will need to find ways to remain competitive in these difficult conditions while maintaining quality and compliance. High inflation will also impact supply chains and R&D activities, and challenge their feasibility.

New Drug Approvals and Their Contract Manufacture - 2023 Edition; is the 13th edition in the series of long-running analysis of the CMO industry, using the FDA's NDA approvals as the primary indicator of performance. New Drug Approvals and their Contract Manufacture (formerly called 'CMO Scorecard') is critical for benchmarking the performance of the contract manufacturing organization (CMO) industry and the relative performance of major CMOs. This year's edition includes a discussion of Emergency Use Approvals for COVID-19 and how inflation has impacted pharma manufacturers.

Scope

This report gives important, expert insight you won't find in any other source. 11 tables and 34 figures throughout the report illustrate major points and trends.

This report is required reading for:

CMO executives who must have deep understanding of drug approvals and outsourcing to make strategic planning and investment decisions

Sourcing and procurement executives who must understand crucial components of the supply base in order to make decisions about supplier selection and management

Private equity investors that need a deeper understanding of the market to identify and value potential investment targets

Reasons to Buy

Overview of NDA drug and vaccine approvals and the levels of outsourcing associated with NDA sub segments

Detailed view of CDMO performance by number of drug and vaccine approvals

An assessment of pharmaceutical companies' propensity to outsource manufacture, by their market caps, based on the publisher's Contract Service Providers database

Outsourcing propensity for New Molecular Entities (NMEs), different dosage forms, and other drug attributes

Analysis of NME special product approvals such as those with Accelerated Approval, Orphan, Breakthrough or Fast Track designations and assessment of outsourcing

Key Topics Covered:

Executive Summary

Players

Technology Briefing

Innovative drug approvals

Dose outsourcing of drug approvals

Trends

Industry Analysis

Introduction

FDA NDA approvals overview

More biologic NME approvals than small molecule equivalents

Cell and gene therapies

First-in-class

First-time approvals

Rejected drugs

Predicted approvals for 2023

Sponsor trends

US vs. EU approval performance

FDA EUAs in 2022 for COVID-19

FDA: outsourced dose manufacture

Dosage form outsourcing

Special product categories

Accelerated approvals

Orphan drug designation

Fast track designation

Breakthrough therapy designation

Containment

Solubility enhancement

Outsourcing by company market cap

CMO performance

Dosage form

Outsourced API approvals

ANDA approvals

What it means

FDA approvals decline with a large decrease of NMEs approved

COVID-19 vaccine demand waning but there are still lucrative contracts

A few large CMOs gain majority of dose contracts

High inflation and other business conditions

Record high number of ATMP approvals in 2022

Value Chain

Companies

Appendix

Methodology

Bibliography

Primary research - key opinion leaders

Further reading

About the Authors

Contact the Publisher

Companies Mentioned

AbbVie Inc

ACS Dobfar SpA

Aenova Holding GmbH

Afton Scientific Corp

AGC Biologics Inc

Ajinomoto Bio-Pharma Services

Akorn Operating Company LLC

Alcami Corp

Alfasigma SpA

Allergopharma GmbH & Co KG

Almac Group Ltd

Alpex Pharma SA

Altasciences Co Inc

Alvogen Inc

AOP Health

ARx LLC

ASM Aerosol-Service AG

AstraZeneca Plc

Astrea SA

AtomVie Global Radiopharma Inc

Aurobindo Pharma Ltd

AustarPharma LLC

Avara Pharmaceutical Services Inc

Baccinex SA

Basic Pharma

Bausch & Lomb Pharmaceuticals Inc

Baxter Biopharma Solutions

Bayer AG

Berkshire Sterile Manufacturing LLC

BioRamo LLC

BioReliance Corp

Boehringer Ingelheim Biopharmaceuticals GmbH

Boehringer Ingelheim RCV GmbH & Co KG

Bora Pharmaceuticals Co Ltd

Bristol Myers Squibb Co

BSP Pharmaceuticals SpA

Bushu Pharmaceuticals Ltd

Cambrex Corp

Catalent Inc

Cenexi SAS

Cerovene Inc

Chia Tai Tianqing Pharmaceutical Group Co Ltd

Contract Pharmaceuticals Ltd

Corden Pharma International GmbH

CoreRx Inc

Corium Inc

Curia Global Inc

Delpharm SAS

Dexcel PT Israel Ltd

DPT Laboratories Ltd

Eisai Co Ltd

EMD Serono Inc

Emergent BioSolutions Inc

EuroAPI SAS

Eurofins Scientific SE

And Many More Companies!

For more information about this report visit

https://www.researchandmarkets.com/r/a0j1ls

Source: GlobalData

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

突破性疗法快速通道疫苗孤儿药

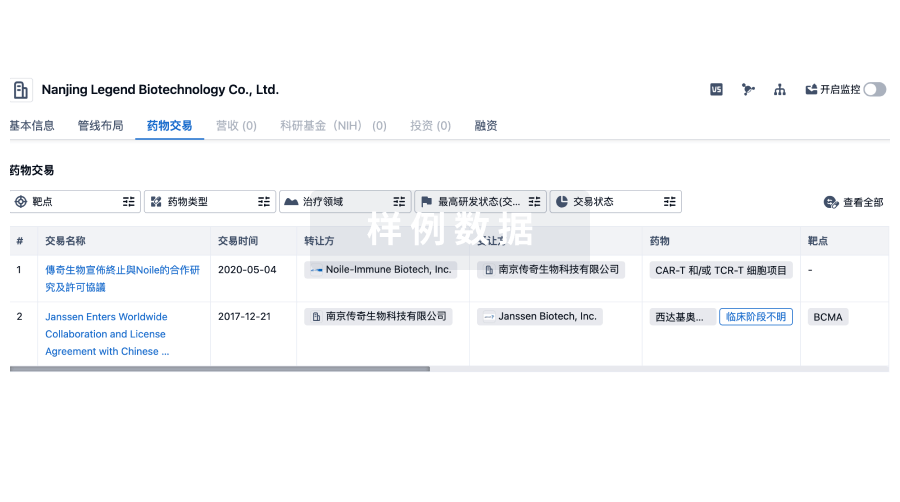

100 项与 Contract Pharmaceuticals Ltd. 相关的药物交易

登录后查看更多信息

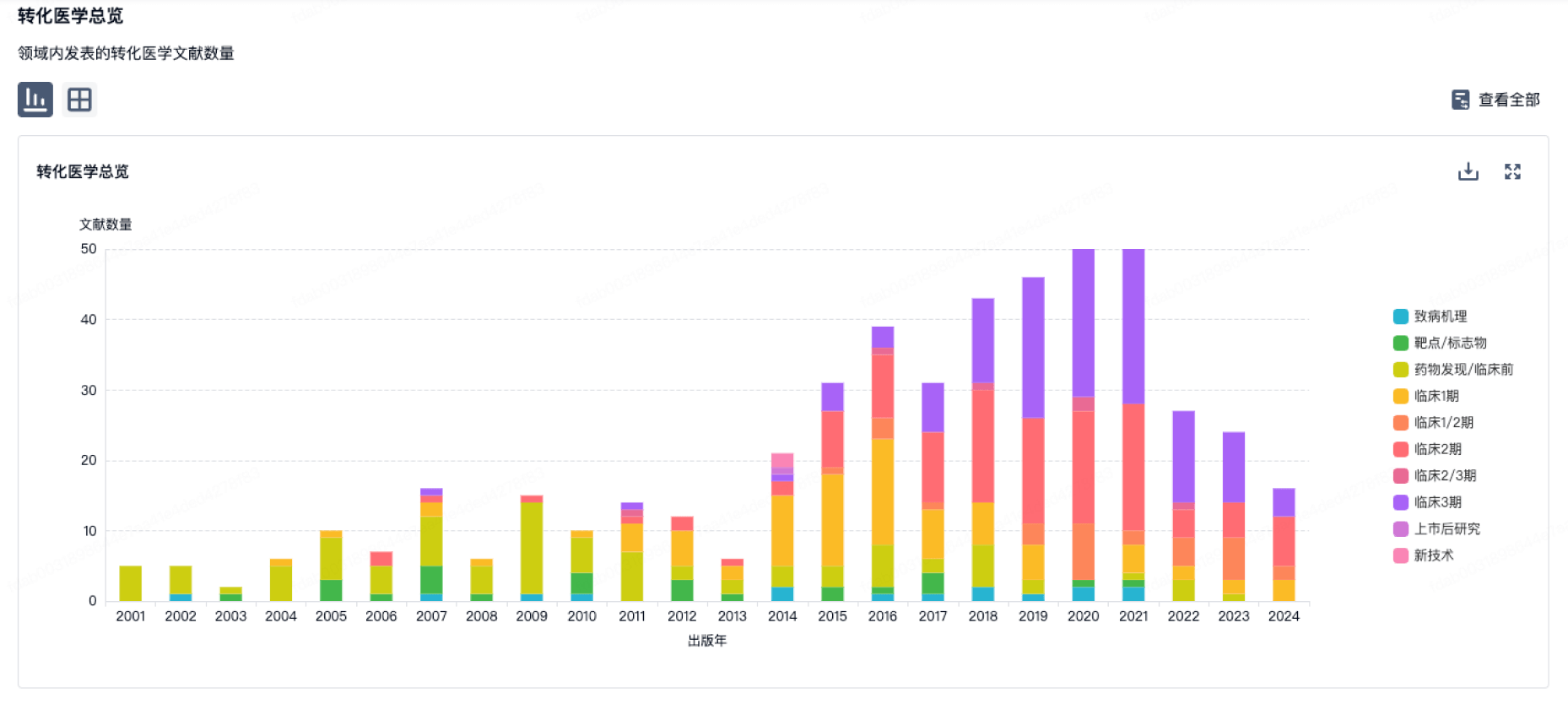

100 项与 Contract Pharmaceuticals Ltd. 相关的转化医学

登录后查看更多信息

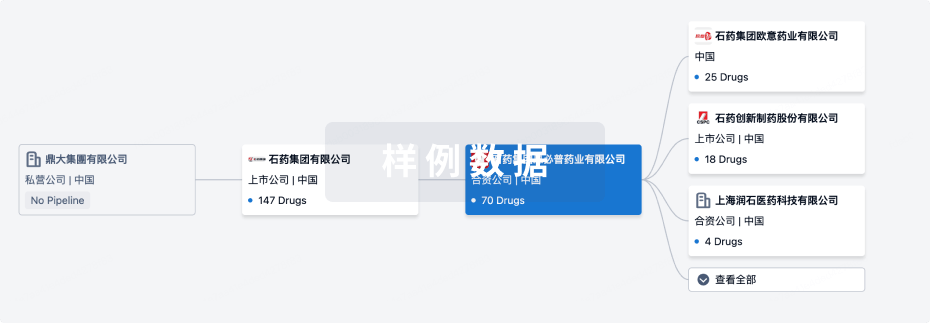

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年01月31日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床3期

1

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

巴瑞替尼 ( JAK1 x JAK2 ) | 多关节型幼年特发性关节炎 更多 | 临床3期 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

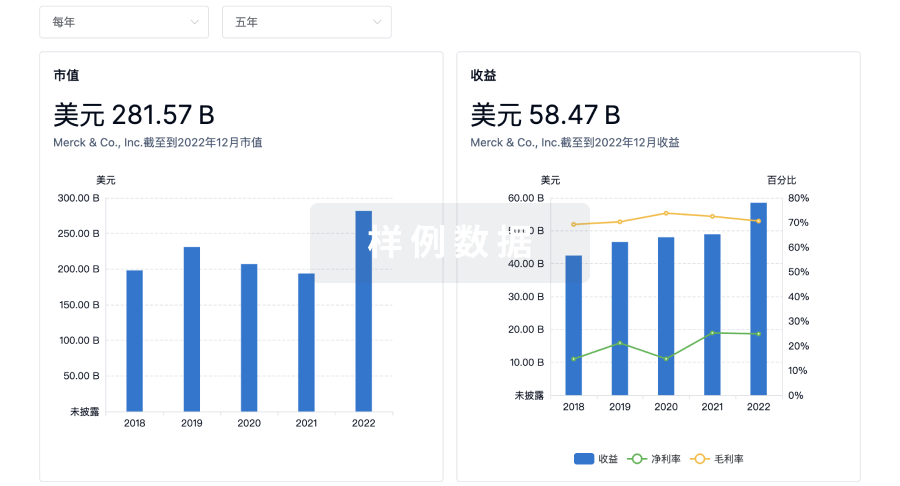

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

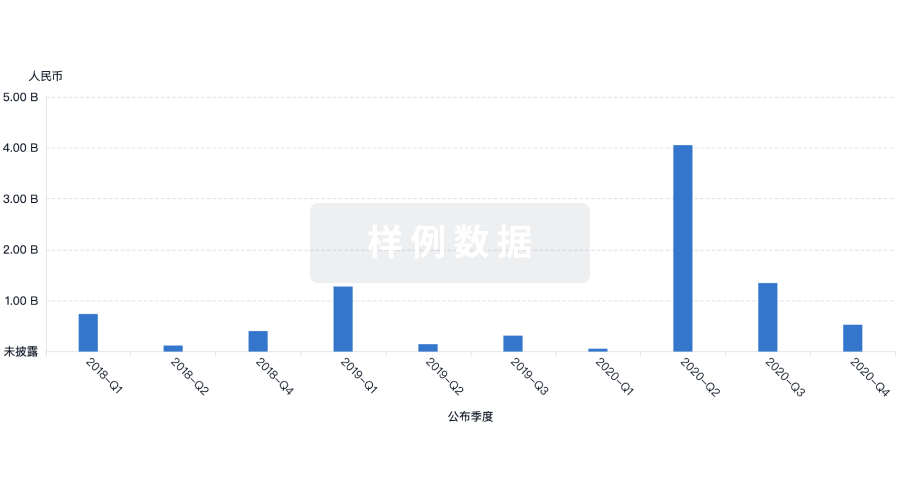

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

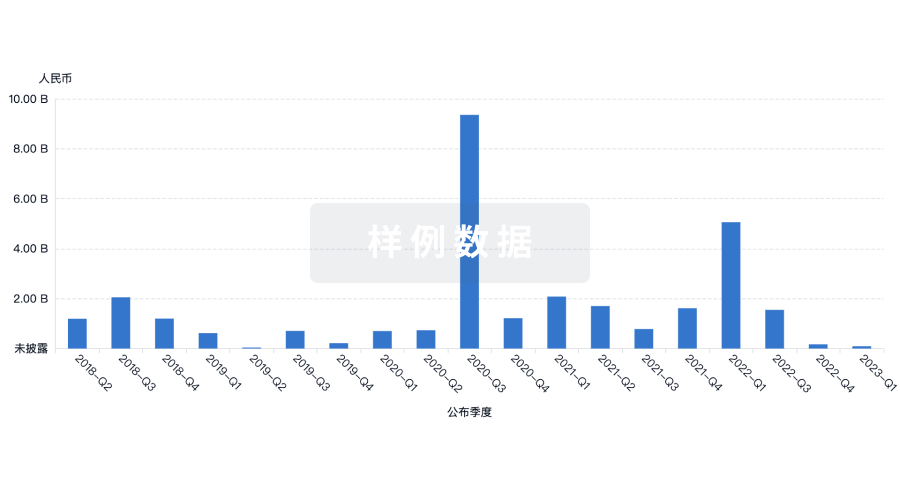

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

来和芽仔聊天吧

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用