预约演示

更新于:2025-09-21

Canadian Blood Services

更新于:2025-09-21

概览

标签

心血管疾病

血液及淋巴系统疾病

肿瘤

小分子化药

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 小分子化药 | 1 |

| 排名前五的靶点 | 数量 |

|---|---|

| Hsp27(热休克蛋白β1) | 1 |

关联

1

项与 Canadian Blood Services 相关的药物WO2024000067

专利挖掘靶点 |

作用机制- |

在研适应症 |

非在研适应症- |

最高研发阶段药物发现 |

首次获批国家/地区- |

首次获批日期- |

24

项与 Canadian Blood Services 相关的临床试验NCT04275232

The Use of Allogenic Plasma Aliquots as a Source of Plasminogen in the Treatment of Ligneous Conjunctivitis, Clinical Trial of One Case

Allogenic plasma aliquots, used as eye drops, will provide a source of plasminogen in the treatment of ligneous conjunctivitis. The investigational product will be available through written request from the Sponsor-Investigator to Canadian Blood Services, as approved by Health Canada.

开始日期2025-05-01 |

申办/合作机构 |

NCT06495294

SWiFT Canada (Study of Whole Blood in Frontline Trauma): A Pilot Randomized Controlled Trial Assessing Prehospital Whole Blood Versus Component Therapy in Traumatic Hemorrhage

Traumatic injuries affect people of all ages, races, and socioeconomic backgrounds. The Global Burden of Disease study showed that globally in 2019, there were more than 4.4 million deaths due to injury. Furthermore, unintentional injuries are the leading cause of death for people aged 5-29 years worldwide. Uncontrolled bleeding accounts for a significant proportion of these deaths, with approximately 20% occurring in the first 24 hours and 40% occurring within the first 30 days.

Blood transfusion is a life-saving treatment in the management of bleeding patients until bleeding is controlled in hospital, typically delivered through different blood components (red blood cells, plasma and platelets). These components are derived from a whole blood donation and are stored in separate bags (units). There are challenges in carrying separate blood products, such as additional weight in kit bags, and transfusing multiple blood products at the scene can delay transport to hospital.

In Ontario, Ornge Air Ambulance carries red blood cells and plasma to transfuse prehospital. However, a prehospital transfusion strategy has not been established and practice varies across the Canadian setting, and more broadly across the world.

This trial aims to investigate if carrying and transfusing two units of whole blood instead of four units (two red blood cells and two plasma) is feasible and leads to better outcomes for patients.

Blood transfusion is a life-saving treatment in the management of bleeding patients until bleeding is controlled in hospital, typically delivered through different blood components (red blood cells, plasma and platelets). These components are derived from a whole blood donation and are stored in separate bags (units). There are challenges in carrying separate blood products, such as additional weight in kit bags, and transfusing multiple blood products at the scene can delay transport to hospital.

In Ontario, Ornge Air Ambulance carries red blood cells and plasma to transfuse prehospital. However, a prehospital transfusion strategy has not been established and practice varies across the Canadian setting, and more broadly across the world.

This trial aims to investigate if carrying and transfusing two units of whole blood instead of four units (two red blood cells and two plasma) is feasible and leads to better outcomes for patients.

开始日期2024-12-16 |

申办/合作机构  Unity Health Toronto Unity Health Toronto [+7] |

NCT06462677

Surveillance of Emerging Pathogens to Ensure Blood Supply Safety

Babesia is a parasite that can be transmitted from the bite of a tick to an individual. While many some people may not have any symptoms from infection, others may experience anything from flu-like symptoms to joint pain, hemolytic anemia, or jaundice. Should an infected individual donate blood, they could pass the infection to a recipient through their blood donation. In 2018, Canadian Blood Services (CBS) screened blood donations between June and October, and Babesia was found in 0.002% - 0.0007% of donors. This prevalence is slightly less than other areas where Babesia testing is not mandated for blood donors (such as Arizona and Oklahoma), and several logs less than areas where Babesia testing is mandated for blood donations. Based on these data, a later Canadian Babesia case, and risk modelling by CBS, a risk-based decision-making (RBDM) process was initiated. The RBDM strongly emphasizes consistent monitoring and frequent testing for Babesia among Canadian blood donors. This proactive strategy is aimed at minimizing the risk of Babesia transmission through donated blood. This study will span five years and examine the prevalence of Babesia, other tick-borne diseases (such as Anaplasma and Powassan virus), and other emerging pathogens which may impact the blood supply.

开始日期2024-10-02 |

申办/合作机构 |

100 项与 Canadian Blood Services 相关的临床结果

登录后查看更多信息

0 项与 Canadian Blood Services 相关的专利(医药)

登录后查看更多信息

539

项与 Canadian Blood Services 相关的文献(医药)2024-07-01·Transfusion medicine reviews

Examining Injustices: Transfusion Medicine and Race

Review

作者: Callum, Jeannie ; Arya, Sumedha ; Haspel, Richard L ; Mahar, Alyson

Race and ethnicity are sociopolitical and not biological constructs, and assertions that these population descriptors have scientific meaning has caused significant harm. A critical assessment of the transfusion medicine literature is an important aspect of promoting race-conscious as opposed to race-based medicine. Utilizing current definitions and health equity frameworks, this review will provide a critical appraisal of transfusion medicine studies at the intersection of race and healthcare disparities, with a focus on larger methodological challenges facing the transfusion medicine community. Moving forward, risk modelling accounting for upstream factors, patient input, as well as an expert consensus on how to critically conduct and evaluate this type of literature are needed. Further, when using race and ethnicity in research contexts, investigators must be aware of existing guidelines for such reporting.

2023-07-01·Transfusion

Evaluating the inventory impact of utilizing low titer platelets in regional hospitals

Article

作者: Stepien, Jennifer ; Bodnar, Melanie ; Blake, John T ; Clarke, Gwenn

Abstract:

Background:

As a result of constrained supply, it is sometimes necessary to provide patients with ABO‐mismatched platelets. Such practices increase the risk of acute hemolytic transfusion reaction (AHTR). Providing patients with platelets suspended in O plasma having low‐titer Anti‐A and Anti‐B antibodies (LtABO) could reduce the incidence of AHTR. However, natural scarcity limits the number of such units that can be produced. In this paper we present a study to evaluate strategies for deploying LtABO at regional hospitals in Canada.

Study Design and Methods:

Regional hospitals often experience demand for platelets on an irregular basis. They are, however, required to stock some number of platelets (typically one A‐unit and one O‐unit) for emergencies; outdates are common, with discard rates sometimes >>50%. A simulation study was completed to determine the impact of replacing a (1A, 1O) inventory with 2 or 3 units of LtABO at regional hospitals.

Results:

A significant decreases in wastage and shortage can be expected by replacing a (1A, 1O) inventory policy with 2 units of LtABO. In tested cases, a 2‐unit LtABO dominated a (1A, 1O) policy, resulting in statistically fewer outdates and instances of shortage. Holding 3 units of LtABO, increases product availability, but results in an increase in outdates when compared to a (1A, 1O) policy.

Conclusion:

Providing LtABO platelets to smaller, regional hospitals will lower wastage rates and improve patient access to care, when compared to existing (1A, 1O) inventory policies.

2023-05-18·Blood

TEMRA: the CD8 subset in chronic ITP?

Communications

作者: Lazarus, Alan H ; Semple, John W

8

项与 Canadian Blood Services 相关的新闻(医药)2024-12-10

TORONTO, Dec. 10, 2024 (GLOBE NEWSWIRE) -- Brain Cancer Canada is excited to announce a $50,000 grant awarded to Dr. Shawn Beug, Scientist at the Children’s Hospital of Eastern Ontario Research Institute, and his team. The project aims to create personalized therapies for pediatric brain cancers by utilizing the body’s own immune cells to combat this disease. The project proposes the use of tumor-infiltrating lymphocytes (TILs) which involves the isolation of immune cells from the patient’s tumor, expanding these immune cells outside of the body, and re-introducing these expanded immune cells back into the patient. “Pediatric malignant brain tumours are the number one cause of cancer death in children. This group of patients is in dire need of safe and effective therapies that also allow survivors a good quality of life. Cancer immunotherapy for brain tumours, a highly innovative and forward-thinking therapeutic approach, offers a path of hope for cancers that have not historically responded well to standard chemoradiation. Our research makes use of the patient's own immune cells to fight the cancer,” highlights Dr. Beug. “In Canada, cancer immunotherapy for brain tumours is in early phases of development and requires proof-of-concept data. The support from Brain Cancer Canada fundraisers, donors, and philanthropists is critical to our effort to change outcomes for pediatric brain cancer patients and their families,” says Dr. Beug. This means that collaboration will be critical to change the landscape of treatment offered. The team will be engaging with Canadian Blood Services and the Ottawa Hospital, which has a unique facility for TIL manufacturing for early phase clinical trials, to help bring the work to fruition. This project is a partnership between the Children’s Hospital of Eastern Ontario (CHEO), The University of Ottawa, The Ottawa Hospital Research Institute, Canadian Blood Services, and Tammy Bell, a highly engaged family advisor. “Pediatric brain cancer research is some of the most underfunded. Too many parents have already lost their children to this disease for which we do not yet have effective treatments. Dr. Beug and team are at the forefront of accelerating the science that could change the treatment of these lethal brain cancers,” said Anita Angelini, Brain Cancer Canada Vice-Chair. “If we want to change outcomes for patients and families, investing in early-stage, proof-of-concept research is a must. Time is of the essence and the technologies that are available to us today, and continue to evolve, are promising. We are deeply grateful to our donors that have made investment in this research possible.” This funding will support groundbreaking studies that explore new treatment avenues, harnessing the power of the immune system to provide hope for young patients and their families facing this devastating disease. For more details about this leading-edge research initiative and other efforts by Brain Cancer Canada, please contact: sac@braincancercanada.ca Brain Cancer Canada is a national charity dedicated to supporting individuals diagnosed with malignant brain tumors. Through funding innovative research, neurosurgical technology, and advocating for increased options for treatments, Brain Cancer Canada aims to improve survival rates and the quality of life for patients, while providing essential support to their families. This funding reflects our unwavering commitment to support research in pediatric brain cancer, addressing an inequity in funding and pursuing unmet needs. Media Contact: Media@braincancercanada.ca If you wish to make a donation to Brain Cancer Canada, please visit: https://braincancercanada.ca/donate/ Contact Brain Cancer Canada by phone: 1-855-375-1381 #BrainCancerCanada #TheChildrensHospitalOfEasternOntatio #CHEO #DrBeug #DrLaCasse #TheUniversityOfOttawa #OttawaHospitalResearchInstitute #PediatricCancerResearch #PatientAdvocate

免疫疗法

2023-12-20

Availability of GLASSIA® represents significant milestone for patients with emphysema due to severe hereditary deficiency of Alpha-1 antitrypsin

TORONTO, Dec. 20, 2023 /CNW/ - Takeda Canada Inc. (Takeda) has entered into a contract with Canadian Blood Services (CBS) for GLASSIA® (alpha-1 proteinase inhibitor) resulting from CBS's request for proposal for hereditary deficiency of Alpha-1 Antitrypsin Deficiency (Alpha-1). Glassia has been approved to be listed on the CBS Plasma Protein and Related Products (PPRP) formulary with specific criteria for reimbursement. This marks Takeda's entry into the Alpha-1 community in Canada, building on the company's commitment to developing innovative treatments for rare diseases.

"With its landmark decision, Canadian Blood Services will ensure that all Canadians suffering the pulmonary consequences of this genetic disorder will have access to the protective benefits of augmentation therapy," said Dr. Ken Chapman, Director, Asthma & Airway Centre, University Health Network, Professor of Medicine, University of Toronto. "As a physician who has cared for many patients with alpha1 antitrypsin deficiency, I'm reassured that I will now have the tools to slow the progression of emphysema and prevent disability for all of my patients, not just a fortunate few".

"The availability of treatments for patients with Alpha-1 Antitrypsin Deficiency across Canada is tremendous and welcome news," said Angela Diano, Executive Director, Alpha-1 Canada. "This is a landmark moment because until now, Canadian patients have had limited options available to them, unless they lived in one of the few provinces where treatment was accessible. We look forward to working with CBS to ensure Canadian Alpha-1 patients have the information, resources, support and now treatment, they need."

GLASSIA® is a liquid medicine for infusion containing human Alpha 1-Proteinase Inhibitor (A1-PI) also known as alpha-1 antitrypsin (A1AT), which is purified from human blood. The main purpose of infusing GLASSIA® is to increase the levels of the A1AT protein in the blood. Its main function is to protect the lung tissue by limiting the action of a certain enzyme, called neutrophil elastase. Neutrophil elastase can cause damage if its action is not controlled (for example, in case you have an A1-P1 deficiency).i

"We are pleased to share this positive development to support Canadians living with Alpha-1 antitrypsin deficiency that will now have a treatment option in the form of GLASSIA®," said Rute Fernandes, President & General Manager, Takeda in Canada. "We're excited about this collaboration with CBS because of the positive impact it will have on the lives of patients living with Alpha-1 antitrypsin deficiency. At Takeda, we're proud of our commitment to developing innovative treatments for rare diseases and putting patients at the centre of everything we do."

About GLASSIA

Health Canada issued the marketing authorization (Notice of Compliance) for GLASSIA® in November 2021 for chronic augmentation and maintenance therapy in adults with clinically evident emphysema due to severe hereditary deficiency of Alpha-1 antitrypsin. GLASSIA® increases antigenic and functional (anti-neutrophil elastase capacity, ANEC) serum levels of Alpha-1 antitrypsin. GLASSIA® has shown to be equivalent in activity and similar in safety to another marketed alpha-1 antitrypsin augmentation therapy.i

For a listing of contraindications, warnings, precautions, adverse reactions, interactions, dosing, and conditions of clinical use, the Canadian product monograph should be consulted at .

About Alpha-1

Alpha-1 Antitrypsin Deficiency (AATD) is a genetic condition that affects approximately 1 in 5,000 Canadians & predisposes patients to liver disease & early onset emphysema. AATD can lead to lung disease such as chronic obstructive pulmonary disease (COPD), even in non-smokers. It increases the risk of liver cirrhosis & a skin condition called panniculitis. Low serum levels of Alpha-1 Antitrypsin indicate increased risk for developing the disease.ii

About Takeda Canada Inc.

Takeda Canada Inc. is the Canadian organization of Takeda Pharmaceutical Company Limited (TSE: 4502/NYSE: TAK), a global, values-based, R&D-driven biopharmaceutical leader headquartered in Japan, committed to discovering and delivering life-transforming treatments, guided by our commitment to patients, our people and the planet. Takeda focuses its R&D efforts on four therapeutic areas: Oncology, Rare Genetics and Hematology, Neuroscience, and Gastroenterology (GI). We also make targeted R&D investments in Plasma-Derived Therapies and Vaccines. We are focusing on developing highly innovative medicines that contribute to making a difference in people's lives by advancing the frontier of new treatment options and leveraging our enhanced collaborative R&D engine and capabilities to create a robust, modality-diverse pipeline. Our employees are committed to improving quality of life for patients and to working with our partners in health care in approximately 80 countries and regions. For more information, visit: takeda.com/en-ca

SOURCE Takeda Canada Inc.

Company Codes: NYSE:TAK, Toronto:4502

上市批准

2023-11-02

CONCORD, Calif.--(BUSINESS WIRE)-- Cerus Corporation (Nasdaq: CERS) today announced financial results for the third quarter ended September 30, 2023.

Recent highlights include:

Third quarter 2023 total revenue of $47.3 million was comprised of total product revenue of $39.8 million and government contract revenue of $7.5 million.

Completed Phase 3 ReCePI study enrollment in cardiovascular surgery patients, with top-line data readout on track for Q1 2024.

Attended first in-person AABB Annual Meeting since 2019, where presentations from transfusion medicine leaders highlighted the growing experience with the benefits of INTERCEPT-treated products, including INTERCEPT platelets and INTERCEPT Fibrinogen Complex (IFC).

Cash, cash equivalents, and short-term investments were $79.0 million at September 30, 2023.

Reaffirming commitment to achieve non-GAAP adjusted EBITDA breakeven in the fourth quarter of 2023.

“We continued to make progress on multiple fronts in the third quarter,” said William “Obi” Greenman, Cerus’ president and chief executive officer. “We completed patient enrollment in our U.S. Phase 3 ReCePI study and continue to plan for a top-line data readout from the study in the first quarter of next year.”

“On the top line, product revenues in the quarter returned to prior year levels, and we expect continued growth from here through the end of the year, with the near-term growth trajectory influenced by the system-wide roll-out of INTERCEPT platelets at Canadian Blood Services,” continued Greenman. “Due primarily to the timing of our recent execution of an IFC sales agreement with one of the largest U.S. producers of cryoprecipitate, we are adjusting our full-year 2023 product revenue guidance to a range of $155 million to $158 million. The growth we are expecting in the second half of this year reflects the ongoing global demand for INTERCEPT-treated blood components and the growing use of IFC by blood center and hospital customers, as evidenced at the recent AABB Annual Meeting.”

Revenue

Product revenue during the third quarter of 2023 was $39.8 million, compared to $39.6 million during the prior year period.

Third-quarter 2023 government contract revenue was $7.5 million, compared to $6.8 million during the prior year period. Reported government contract revenue in the third quarter 2023 increased versus the prior year period primarily due to funding associated with development of LyoIFC as well as research and development (R&D) activities related to the INTERCEPT Blood System for Red Blood Cells. In addition to this funding, the Company’s government contract revenue was comprised of funding associated with efforts related to the development of next-generation pathogen reduction technology to treat whole blood.

Product Gross Profit & Margin

Product gross profit for the third quarter of 2023 was $21.8 million, which is consistent with the prior year period. Product gross margin for the third quarter of 2023 was 54.9% compared to 55.4% for the third quarter of 2022. The Company continues to expect stability in gross margin percentage for the balance of the year. The Company’s margin expansion efforts are ongoing with the goal of realizing further margin expansion in the future.

Operating Expenses

Total operating expenses for the third quarter of 2023 were $34.5 million compared to $36.1 million for the same period of the prior year, reflecting a year-over-year decrease of 4%.

Selling, general, and administrative (SG&A) expenses for the third quarter of 2023 totaled $16.2 million, compared to $19.9 million for the third quarter of 2022. The year-over-year decrease in SG&A expenses for the third quarter was tied to decreased headcount and decreased non-cash stock-based compensation.

R&D expenses for the third quarter of 2023 were $16.8 million, compared to $16.2 million for the third quarter of 2022. The small year-over-year increase in R&D expenses in the third quarter was tied to the development of our next-generation illuminator and increased clinical research activities.

As previously described, the Company entered into a plan to restructure certain functions and reduce its real estate footprint during the second quarter of 2023. For the third quarter of 2023, the plan resulted in an additional $1.6 million restructuring charge. Of the $1.6 million, $1.1 million primarily relates to the write off of operating lease assets* which will be paid down over the course of the operating lease, and $0.5 million relates to non-cash charges associated with leasehold improvements which were written off. The Company excludes the restructuring charge from its non-GAAP adjusted EBITDA measure presented below.

Net Loss Attributable to Cerus Corporation

Net loss attributable to Cerus Corporation for the third quarter of 2023 was $7.3 million, or $0.04 per basic and diluted share, compared to a net loss attributable to Cerus Corporation of $8.5 million, or $0.05 per basic and diluted share, for the third quarter of 2022.

Non-GAAP Adjusted EBITDA

Non-GAAP adjusted EBITDA for the third quarter of 2023 was negative $1.0 million, compared to non-GAAP adjusted EBITDA of negative $2.7 million for the third quarter of 2022. The Company remains committed to achieving non-GAAP adjusted EBITDA breakeven during the fourth quarter of 2023. For additional information, please see definitions and the reconciliation of this non-GAAP measure to net loss attributable to Cerus Corporation accompanying this release.

Balance Sheet & Cash Use

At September 30, 2023, the Company had cash, cash equivalents and short-term investments of $79.0 million, compared to $84.5 million at June 30, 2023, and $102.2 million at December 31, 2022.

As of September 30, 2023, the Company had $60 million outstanding on its term loan and $18.8 million drawn on its revolving credit facility. The Company has access to another $15 million of term debt and $16.2 million under its revolving line of credit.

For the third quarter of 2023, net cash used in operating activities totaled $10.5 million as compared to $2.1 million during the prior year period. The increase in operating cash use was primarily related to increased inventory balances in addition to other working capital items. During the quarter the Company has initiated actions that are designed to, over time, sell down and reduce the amount of inventory on the balance sheet at September 30, 2023.

2023 Product Revenue Guidance

The Company is adjusting its previously stated product revenue guidance range. The Company expects full-year 2023 product revenue to be in the range of $155 million to $158 million. The revision is due in part to the delay in signing the now executed IFC sales agreement with one of the largest U.S. producers of cryoprecipitate.

Quarterly Conference Call

The Company will host a conference call at 4:30 P.M. EDT this afternoon, during which management will discuss the Company’s financial results and provide a general business overview and outlook. To listen to the live webcast, please visit the Investor Relations page of the Cerus website at

A replay will be available on Cerus’ website approximately three hours after the call through November 16, 2023.

*

Operating lease right-of-use assets to conform to the pure balance sheet legend.

ABOUT CERUS

Cerus Corporation is dedicated solely to safeguarding the world’s blood supply and aims to become the preeminent global blood products company. Headquartered in Concord, California, the company develops and supplies vital technologies and pathogen-protected blood components to blood centers, hospitals, and ultimately patients who rely on safe blood. The INTERCEPT Blood System for platelets and plasma is available globally and remains the only pathogen reduction system with both CE mark and FDA approval for these two blood components. The INTERCEPT red blood cell system is under regulatory review in Europe, and in late-stage clinical development in the US. Also in the US, the INTERCEPT Blood System for Cryoprecipitation is approved for the production of Pathogen Reduced Cryoprecipitated Fibrinogen Complex (commonly referred to as INTERCEPT Fibrinogen Complex), a therapeutic product for the treatment and control of bleeding, including massive hemorrhage, associated with fibrinogen deficiency. For more information about Cerus, visit and follow us on LinkedIn.

INTERCEPT and the INTERCEPT Blood System are trademarks of Cerus Corporation.

Forward Looking Statements

Except for the historical statements contained herein, this press release contains forward-looking statements concerning Cerus’ products, prospects and expected results, including statements relating to Cerus’ updated 2023 annual product revenue guidance; Cerus achieving non-GAAP adjusted EBITDA breakeven in the fourth quarter of 2023; Cerus’ expectations for a top-line data readout from the Phase 3 ReCePI study in the first quarter of 2024; expectations for revenue growth in the second half of 2023; Cerus’ development efforts for next-generation pathogen reduction technology to treat whole blood and its next-generation illuminator; Cerus’ expectation for stability in gross margin percentage for the balance of 2023 and its goal of realizing further margin expansion in the future; Cerus’ access to another $15 million of term debt and $16.2 million under its revolving line of credit; Cerus initiating actions that are designed to, over time, sell down and lower the amount of inventory on the balance sheet at September 30, 2023; and other statements that are not historical fact. Actual results could differ materially from these forward-looking statements as a result of certain factors, including, without limitation: risks associated with the commercialization and market acceptance of, and customer demand for, the INTERCEPT Blood System, including the risks that Cerus may not (a) meet its updated 2023 annual product revenue guidance, (b) effectively continue to launch and commercialize the INTERCEPT Blood System for Cryoprecipitation, (c) grow sales globally, including in its U.S. and European markets, and/or realize expected revenue contribution resulting from its U.S. and European market agreements, (d) realize meaningful and/or increasing revenue contributions from U.S. customers in the near term or at all, particularly since Cerus cannot guarantee the volume or timing of commercial purchases, if any, that its U.S. customers may make under Cerus’ commercial agreements with these customers, (e) effectively expand its commercialization activities into additional geographies and/or (f) realize any revenue contribution from its pipeline product candidates, whether due to Cerus’ inability to obtain regulatory approval of its pipeline programs, or otherwise; risks associated with macroeconomic developments, including ongoing military conflicts in Ukraine and Israel and the COVID-19 pandemic and resulting global economic and financial disruptions, and the current and potential future negative impacts to Cerus’ business operations and financial results such as the current and potential additional disruptions to the U.S. and EMEA blood supply resulting from the evolving effects of the COVID-19 pandemic; risks associated with Cerus’ lack of longer-term commercialization experience with the INTERCEPT Blood System for Cryoprecipitation and in the United States generally, and its ability to develop and maintain an effective and qualified U.S.-based commercial organization, as well as the resulting uncertainty of its ability to achieve market acceptance of and otherwise successfully commercialize the INTERCEPT Blood System in the United States, including as a result of licensure requirements that must be satisfied by U.S. customers prior to their engaging in interstate transport of blood components processed using the INTERCEPT Blood System; risks related to the highly concentrated market for the INTERCEPT Blood System; risks related to how any future platelet additive solution (PAS) supply disruption could affect INTERCEPT’s acceptance in the marketplace; risks related to how any future PAS supply disruption might affect current commercial contracts; risks related to Cerus’ ability to demonstrate to the transfusion medicine community and other health care constituencies that pathogen reduction, including IFC for the treatment and control of bleeding, and the INTERCEPT Blood System is safe, effective and economical; risks related to the uncertain and time-consuming development and regulatory process, including the risks that (a) Cerus may be unable to comply with the FDA’s post-approval requirements for the INTERCEPT Blood System, including by successfully completing required post-approval studies, which could result in a loss of U.S. marketing approval(s) for the INTERCEPT Blood System, (b) additional manufacturing site Biologics License Applications necessary for Cerus to more broadly distribute the INTERCEPT Blood System for Cryoprecipitation may not be obtained in a timely manner or at all, (c) Cerus may be unable to complete enrollment in its RedeS study and/or report data from its ReCePI and RedeS studies in a timely manner or at all, (d) Cerus may be unsuccessful in developing next-generation technology or products, (e) Cerus may be unable to submit and complete a modular PMA submission for the INTERCEPT Red Blood Cell system in a timely manner or at all, (f) Cerus may be unable to obtain CE Mark approval, or any other regulatory approvals, of the INTERCEPT Red Blood Cell system in a timely manner or at all, and (g) Cerus may be unable to obtain the requisite regulatory approvals to advance its pipeline programs and bring them to market in a timely manner or at all; risks related to product safety, including the risk that the septic platelet transfusions may not be avoidable with the INTERCEPT Blood System; risks related to adverse market and economic conditions, including continued or more severe adverse fluctuations in foreign exchange rates and/or continued or more severe weakening in economic conditions resulting from military conflicts, the COVID-19 pandemic, rising interest rates, inflation or otherwise in the markets where Cerus currently sells and is anticipated to sell its products; Cerus’ reliance on third parties to market, sell, distribute and maintain its products; Cerus’ ability to maintain an effective, secure manufacturing supply chain, including the risks that (a) Cerus’ supply chain could be negatively impacted as a result of the evolving impact of macroeconomic developments, including the ongoing military conflicts in Ukraine and Israel, rising interest rates, inflation and the evolving effects of the COVID-19 pandemic, (b) Cerus’ manufacturers could be unable to comply with extensive FDA and foreign regulatory agency requirements, and (c) Cerus may be unable to maintain its primary kit manufacturing agreement and its other supply agreements with its third party suppliers; Cerus’ ability to identify and obtain additional partners to manufacture the INTERCEPT Blood System for Cryoprecipitation; risks associated with Cerus’ ability to access additional funds under its credit facility and to meet its debt service obligations, and its need for additional funding; the impact of legislative or regulatory healthcare reforms that may make it more difficult and costly for Cerus to produce, market and distribute its products; risks related to future opportunities and plans, including the uncertainty of Cerus’ future capital requirements and its future revenues and other financial performance and results, including with respect to expected gross margin improvement and inventory efforts, as well as other risks detailed in Cerus’ filings with the Securities and Exchange Commission, including under the heading “Risk Factors” in Cerus’ Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, filed with the SEC on August 3, 2023. Cerus disclaims any obligation or undertaking to update or revise any forward-looking statements contained in this press release.

Use of Non-GAAP Financial Measures

Cerus has presented in this release certain financial information in accordance with U.S. Generally Accepted Accounting Principles (GAAP) and also on a non-GAAP basis, including adjusted EBITDA. We define adjusted EBITDA as net income (loss) attributable to Cerus Corporation as reported on the consolidated statement of operations, as adjusted to exclude (i) net income (loss) attributable to noncontrolling interest, (ii) provision for (benefit from) income taxes, (iii) foreign exchange (loss)/gain, (iv) interest expense, (v) other income (expense), net (vi) depreciation and amortization, (vii) share-based compensation, (viii) goodwill and asset impairments, (ix) costs associated with our noncontrolling interest in our joint venture in China, (x) revenue and direct costs associated with our government contracts and (xi) restructuring charges. We are presenting this non-GAAP financial measure to assist investors in assessing our operating results. Management believes this non-GAAP information is useful for investors, when considered in conjunction with Cerus’ GAAP financial statements, because management uses such information internally for its operating, budgeting and financial planning purposes. Non-GAAP information is not prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of Cerus’ operating results as reported under GAAP. These non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. These non-GAAP financial measures are not necessarily comparable to similarly-titled measures presented by other companies. A reconciliation between GAAP and non-GAAP financial information is provided immediately following the financial tables. Cerus has not provided a reconciliation of its anticipated non-GAAP adjusted EBITDA breakeven in the fourth quarter of 2023 to projected fourth quarter 2023 GAAP net loss attributable to Cerus Corporation because certain items such as share-based compensation that are components of net loss attributable to Cerus Corporation cannot be reasonably projected due to the significant impact of changes in Cerus’ stock price and other factors. These components of GAAP net loss attributable to Cerus Corporation could significantly impact the reported GAAP net loss attributable to Cerus Corporation.

Supplemental Tables

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023 vs. 2022

2023 vs. 2022

Platelet Kit Growth

North America

(6

%)

(12

%)

International

(2

%)

(6

%)

Worldwide

(5

%)

(11

%)

Change in Calculated Number of Treatable Platelet Doses

North America

(6

%)

(13

%)

International

(5

%)

(9

%)

Worldwide

(6

%)

(12

%)

*

Dose treatable calculation based on the number of kits sold and the product configuration (single, double, and triple dose kits)

CERUS CORPORATION

REVENUE BY REGION

(in thousands, except percentages)

Three Months Ended

Nine Months Ended

September 30,

Change

September 30,

Change

2023

2022

$

%

2023

2022

$

%

North America

$

25,983

$

26,079

$

(96

)

0

%

$

67,077

$

73,856

$

(6,779

)

-9

%

Europe, Middle East and Africa

13,614

13,115

499

4

%

41,175

42,815

(1,640

)

-4

%

Other

175

377

(202

)

-54

%

1,347

1,343

4

0

%

Total product revenue

$

39,772

$

39,571

$

201

1

%

$

109,599

$

118,014

$

(8,415

)

-7

%

CERUS CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

(in thousands, except per share information)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Product revenue

$

39,772

$

39,571

$

109,599

$

118,014

Cost of product revenue

17,956

17,662

49,158

55,456

Gross profit on product revenue

21,816

21,909

60,441

62,558

Government contract revenue

7,479

6,772

23,856

18,980

Operating expenses:

Research and development

16,783

16,220

53,351

45,493

Selling, general and administrative

16,155

19,908

58,247

60,175

Restructuring

1,600

—

3,728

—

Total operating expenses

34,538

36,128

115,326

105,668

Loss from operations

(5,243

)

(7,447

)

(31,029

)

(24,130

)

Total non-operating expense, net

(1,965

)

(1,007

)

(4,976

)

(4,849

)

Loss before income taxes

(7,208

)

(8,454

)

(36,005

)

(28,979

)

Provision for income taxes

78

67

253

221

Net loss

(7,286

)

(8,521

)

(36,258

)

(29,200

)

Net loss attributable to noncontrolling interest

(19

)

(39

)

(97

)

(45

)

Net loss attributable to Cerus Corporation

$

(7,267

)

$

(8,482

)

$

(36,161

)

$

(29,155

)

Net loss per share attributable to Cerus Corporation:

Basic and diluted

$

(0.04

)

$

(0.05

)

$

(0.20

)

$

(0.17

)

Weighted average shares outstanding:

Basic and diluted

180,938

177,236

179,950

176,231

CERUS CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

September 30,

December 31,

2023

2022

ASSETS

(unaudited)

Current assets:

Cash and cash equivalents

$

17,389

$

35,585

Short-term investments

61,617

66,569

Accounts receivable

24,546

34,426

Inventories

42,661

29,003

Prepaid and other current assets

4,723

4,561

Total current assets

150,936

170,144

Non-current assets:

Property and equipment, net

9,252

10,969

Operating lease right-of-use assets

11,029

12,512

Goodwill

1,316

1,316

Non-current inventories

21,287

15,494

Restricted cash and other assets

12,024

7,657

Total assets

$

205,844

$

218,092

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable and accrued liabilities

$

58,139

$

58,205

Debt – current

18,779

56,159

Operating lease liabilities – current

2,268

2,105

Deferred product revenue – current

936

589

Total current liabilities

80,122

117,058

Non-current liabilities:

Debt – non-current

59,789

13,644

Operating lease liabilities – non-current

14,083

15,329

Other non-current liabilities

2,827

3,499

Total liabilities

156,821

149,530

Stockholders’ equity:

48,168

67,610

Noncontrolling interest

855

952

Total liabilities and stockholders’ equity

$

205,844

$

218,092

CERUS CORPORATION

UNAUDITED RECONCILIATION OF NON-GAAP ADJUSTED EBITDA

(in thousands)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net loss attributable to Cerus Corporation

$

(7,267

)

$

(8,482

)

$

(36,161

)

$

(29,155

)

Adjustments to net loss attributable to Cerus Corporation:

Net loss attributable to noncontrolling interest

(19

)

(39

)

(97

)

(45

)

Provision for income taxes

78

67

253

221

Total non-operating expense, net (i)

1,965

1,007

4,976

4,849

Loss from operations

(5,243

)

(7,447

)

(31,029

)

(24,130

)

Adjustments to loss from operations:

Operating depreciation and amortization

1,143

987

3,313

3,083

Government contract revenue (ii)

(7,479

)

(6,772

)

(23,856

)

(18,980

)

Direct expenses attributable to government contracts (iii)

4,991

4,734

16,800

14,010

Share-based compensation (iv)

3,979

5,768

15,368

17,201

Costs attributable to noncontrolling interest (v)

37

54

210

66

Restructuring(vi)

1,600

—

3,728

—

Non-GAAP adjusted EBITDA

$

(972

)

$

(2,676

)

$

(15,466

)

$

(8,750

)

i.

Includes interest income/expense and foreign exchange gains/losses.

ii.

Represents revenue related to the cost reimbursement provisions under our government contracts.

iii.

Represents the direct expenses attributable to work supporting government contracts, which are reimbursed and reflect under government contract revenue in the condensed consolidated statement of operations.

iv.

Represents non-cash stock-based compensation.

v.

Represents costs associated with the noncontrolling interest in Cerus Zhongbaokang (Shandong) Biomedical Co., LTD.

vi.

Represents costs associated with the Company’s restructuring plan implemented in June 2023.

财报临床3期AHA会议上市批准

100 项与 Canadian Blood Services 相关的药物交易

登录后查看更多信息

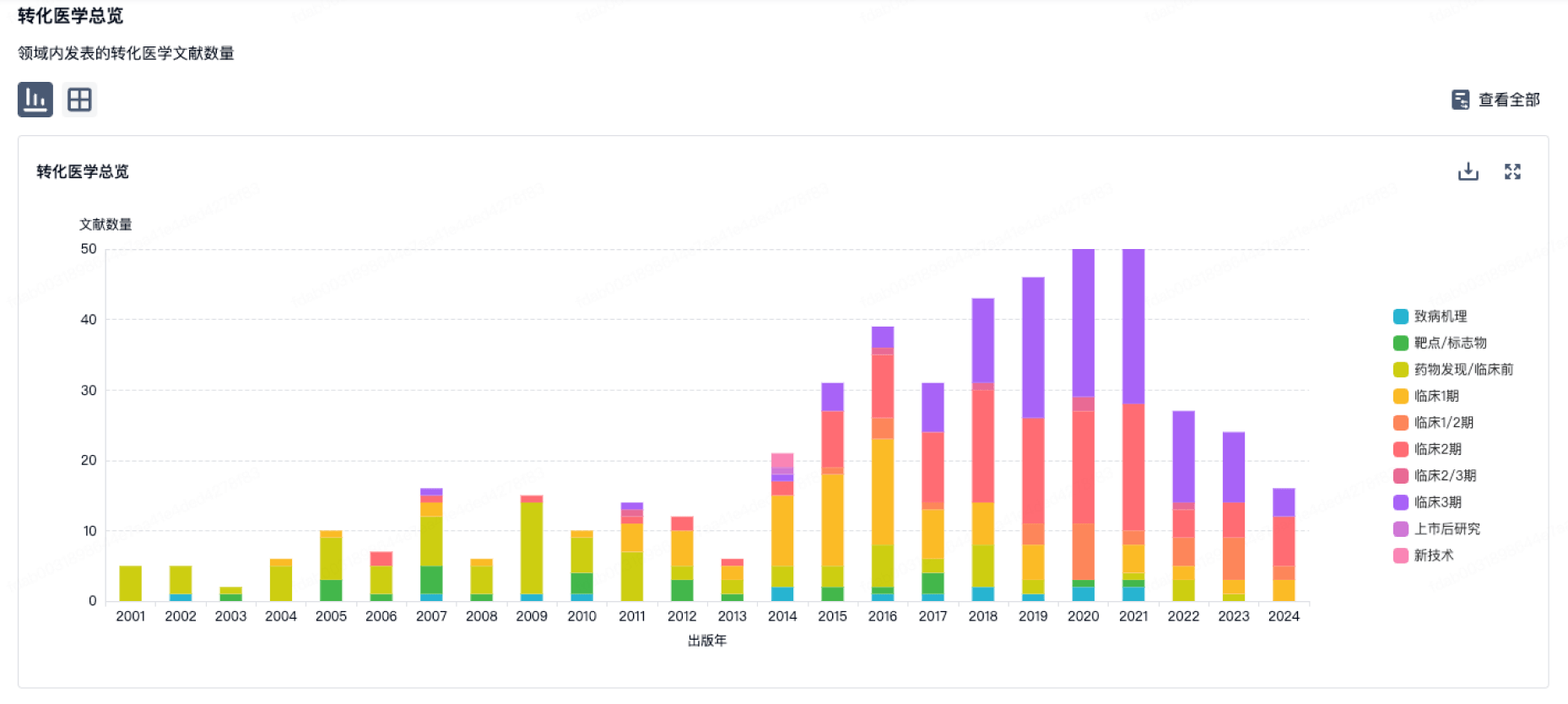

100 项与 Canadian Blood Services 相关的转化医学

登录后查看更多信息

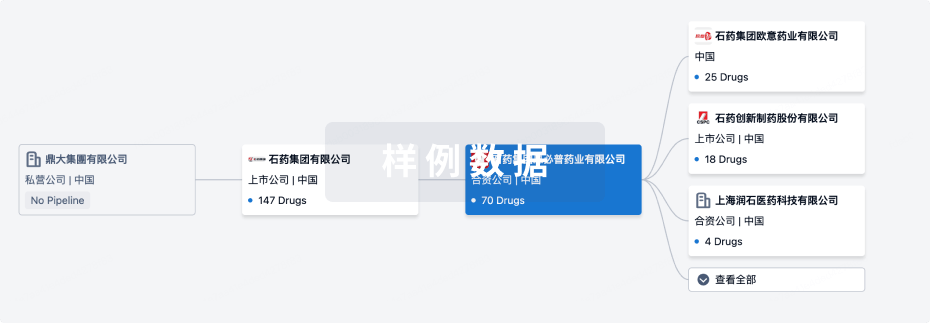

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年09月21日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

药物发现

1

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

WO2024000067 ( Hsp27 )专利挖掘 | 心血管疾病 更多 | 药物发现 |

登录后查看更多信息

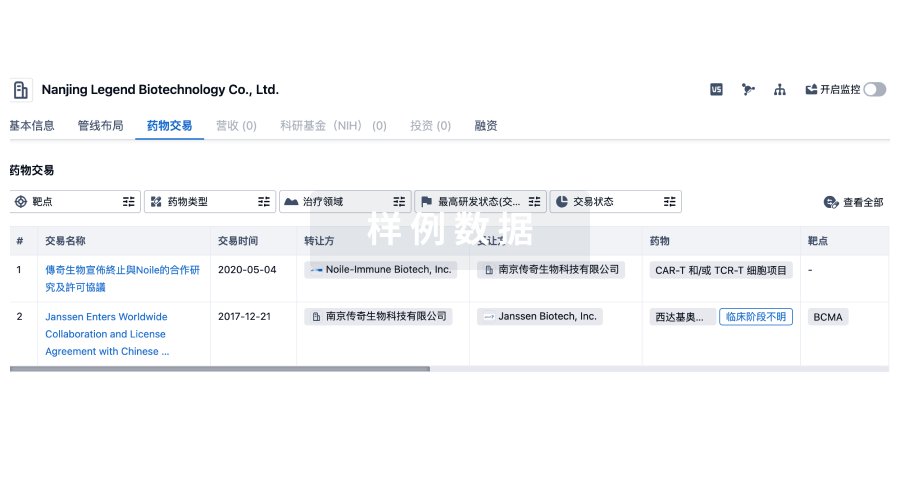

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

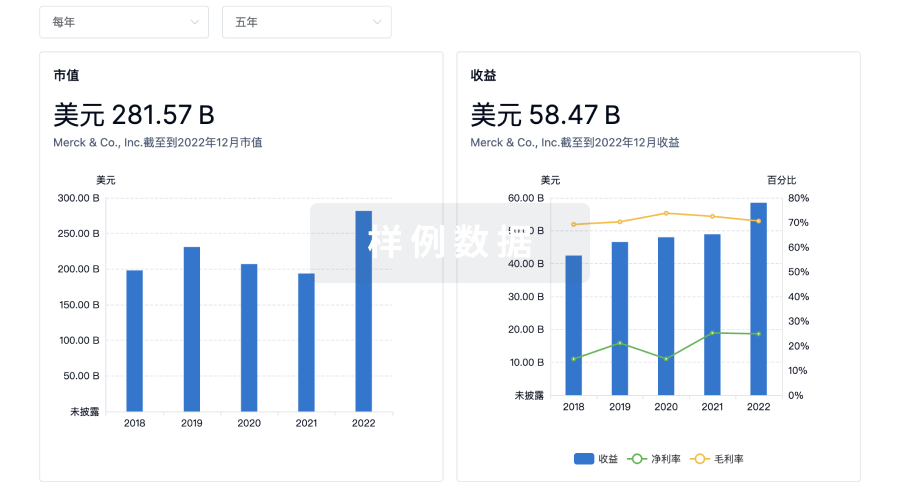

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用