更新于:2024-11-01

Athens Medical Center SA

更新于:2024-11-01

概览

关联

3

项与 Athens Medical Center SA 相关的临床试验Cardiovascular and Metabolic Effects of Drugs for the Treatment of Obesity

The aim of the present study is to compare the efficacy of liraglutide vs. naltrexone/bupropion on metabolic and cardiovascular risk markers, weight loss, as well as the postprandial secretion of gastrointestinal hormones involved in hunger and satiety, after a test meal. The study will include 40 patients, who will further be divided into two treatment groups (20 patients on liraglutide vs. 20 patients on naltrexone/bupropion). The patients will be examined at baseline, 3 and 6 months after the treatment initiation.

开始日期2020-09-08 |

申办/合作机构 |

Treatment of neonatal micropenis and bilateral cryptorchidism due to hypogonadotropic hypogonadism (HH) with 3-month daily subcutaneous injections of the commercially available recombinant FSH plus recombinant LH preparation (Pergoveris®)

开始日期2009-06-01 |

申办/合作机构 |

The aromatase inhibitor anastrozole combined to the LHRH analogue leuprorelin vs leuprorelin alone in ameliorating predicted adult height In girls with early or precosious puberty with a compromised growth potential

开始日期2008-01-01 |

申办/合作机构 |

100 项与 Athens Medical Center SA 相关的临床结果

登录后查看更多信息

0 项与 Athens Medical Center SA 相关的专利(医药)

登录后查看更多信息

549

项与 Athens Medical Center SA 相关的文献(医药)2024-12-01·Clinical Genitourinary Cancer

Real-World Treatment Patterns in Patients With Metastatic Castration-Resistant Prostate Cancer in Greece: The PROSPECT Study

Article

作者: Papatheodoridi, A P ; Kostouros, E ; Zolota, V ; Liontos, M ; Karalis, K ; Christodoulou, C ; Zakopoulou, R ; Tsiatas, M ; Zagouri, F ; Bournakis, E ; Emmanouil, G ; Mauri, D ; Dimitriadis, I ; Papatheodoridi, A.P. ; Tzovaras, A ; Bournakis, A ; DimitriadisI ; Bamias, A ; Vasili, E ; Kyriazoglou, A

2024-09-01·Journal of Vascular Surgery: Venous and Lymphatic Disorders

The role and principles of stenting in acute iliofemoral venous thrombosis

Review

作者: van Rijn, Marie Josee ; Avgerinos, Efthymios D ; Jalaie, Houman ; Black, Stephen

2024-09-01·European Journal of Vascular and Endovascular Surgery

Piergiorgio Settembrini (9 April 1944 – 7 April 2024)

作者: Gloviczki, Peter ; Liapis, Christos D ; Debus, E Sebastian ; Setacci, Carlo

138

项与 Athens Medical Center SA 相关的新闻(医药)2022-12-14

During an earnings call Monday, Oracle CEO Safra Catz told analysts that Cerner is performing "better than Oracle projected" five months post-acquisition.

Cerner generated $1.5 billion in revenue in the latest quarter, fueling strong growth for enterprise software giant Oracle as it topped Wall Street’s expectations for profit and revenue.

Oracle bought the health technology firm for $27 billion back in June and Cerner's strong growth helped the database technology company overcome softer demand for IT services in a challenging economy.

During an earnings call Monday, Oracle CEO Safra Catz told analysts that Cerner is performing "better than Oracle projected" five months post-acquisition.

Oracle's total quarterly revenue jumped 18% year-over-year to $12.3 billion in the period ending November 30. That's up from $10.4 billion a year ago.

"In Q2, Oracle's total revenue grew 25% in constant currency—exceeding the high end of our guidance by more than $200 million," Catz said in a statement about earnings results.

Excluding Cerner, Oracle's total revenue in the quarter grew 9% in constant currency.

"That strong overall revenue growth was powered by our infrastructure and applications cloud businesses that grew 59% and 45% respectively, in constant currency. Fusion Cloud ERP grew 28% in constant currency, NetSuite Cloud ERP grew 29% in constant currency—each and every one of our strategic businesses delivered solid revenue growth in the quarter," Catz said.

Total cloud revenue, including Cerner, grew 48% to $3.8 billion in constant currency, Catz said. Cloud revenue was up 25% without Cerner.

Excluding Cerner, total cloud revenue, SaaS plus IaaS, was up 27% in constant currency at $3.3 billion. Total cloud services and license support revenue for the quarter, including Cerner, was $8.6 billion, up 20% in constant currency.

Oracle shares gained nearly 3% in after-hours trading after the results were announced, following a 1.8% increase to $81.29 in regular trading, Market Watch reported.

The company reported fiscal second-quarter net income of $1.74 billion, or 63 cents a share, on revenue of $12.3 billion. After adjusting for stock-based compensation and other costs, Oracle reported earnings of $1.21 a share, even with the same quarter a year ago. Analysts on average expected adjusted earnings of $1.17 a share on sales of $11.96 billion, according to FactSet.

"Since the acquisition, Cerner has contributed to Oracle's growth—and Oracle has helped Cerner improve its technology," said Oracle Chairman and CTO Larry Ellison in a statement. "But we are just beginning our mission to modernize healthcare information systems."

In the wake of the COVID pandemic, there is a worldwide sense of urgency to transform and improve national healthcare systems, Ellison noted.

"Our goals are ambitious: fully automate clinical trials to shorten the time it takes to deliver lifesaving new drugs to patients, enable doctors to easily access better information leading to better patient outcomes, and provide public health professionals with an early warning system that locates and identifies new pathogens in time to prevent the next pandemic," he said. "The scale of this opportunity is unprecedented—and so is the responsibility that goes along with it."

Oracle bought Cerner to be the company's "anchor asset" to expand into healthcare with an eye toward scaling up its cloud business in the hospital and health system market. Healthcare is a $3.8 trillion market in the U.S. alone, and the company plans to expand Cerner's business into more international markets.

Oracle is known for its massive database technology, and acquiring Cerner expands the company's reach to major health systems and presents potentially lucrative cross-selling opportunities, health tech analysts said at the time of the acquisition.

The company is seeing strong growth in its cloud applications business among healthcare and life sciences companies, Ellison told analysts during the earnings call Monday.

"We're extremely strong in healthcare; Cleveland Clinic, Mayo Clinic, Mount Sinai, Providence Saint Joseph, Adventist Health, Kaiser Permanente, National Health Service in the U.K.," he said. "There's a long list of providers, that's a partial list, are using Oracle ERP supply chain and HCM applications."

Oracle also is gaining business from healthcare payers. "As we tackle healthcare in conjunction with our Cerner acquisition, we're not just automating providers, we're also automating payers," he said, noting the company's work with UnitedHealthcare, Blue Cross Blue Shield, Humana, Highmark Health, Health Care Service Corporation, Independence Blue Cross and Bright Health.

Ellison noted Tenet Health, a 65-hospital system, went live with Oracle's HR, payroll, and recruiting cloud applications. Other "go lives" in the quarter include Cleveland Clinic, the University of Chicago Medical Center and 12 hospitals within Baptist Health Care.

He added, "We're also automating pharmaceutical companies as they do clinical trials. We're trying to automate the entire ecosystem, not just a fraction of it."

In June, after the acquisition closed, Ellison outlined a bold vision for the database giant to use the combined tech power of the two companies to make access to medical records more seamless. Oracle plans to build a national health record database that would pull data from thousands of hospital-centric EHRs, he said.

During the earnings call, Ellison expanded Oracle's ambitions in healthcare beyond hospital EHRs and outlined plans to build technology for national public health systems.

"What Cerner did primarily in competition with Epic is automated hospitals. And, yes, we want to automate hospitals and clinics and doctors' offices and do that. We certainly want to automate providers," he said. "But we're layering on top of that is we want to do national public health. We are doing national public health systems."

Several countries will be signing contracts with Oracle to build "national healthcare early warning systems to detect the next pathogen that turns into a pandemic," he noted.

He added, "The scale of this healthcare opportunity is unprecedented, but so are the responsibilities that go along with it. We, as humanity, have to do a better job of delivering healthcare to people than we have done historically. As far as I know, Oracle is the only company in the world that's trying to address this issue."

During an earnings call, Catz projected third-quarter revenue should increase 17% to 19% from last year, suggesting a quarterly total of roughly $12.3 billion to $12.5 billion, and guided for adjusted earnings of $1.17 a share to $1.21 a share.

并购财报

2022-12-14

Artificial Intelligence is Used at the University of Pittsburgh Medical Center to Support Pathologists Diagnosing Prostate Cancer

TEL AVIV, Israel, Dec. 14, 2022 /PRNewswire/ -- Ibex Medical Analytics (Ibex), the leader in AI-powered cancer diagnostics, today announced the live deployment by the University of Pittsburgh Medical Center (UPMC) of Galen™ Prostate, an AI-based solution that supports pathologists during cancer diagnosis, at the UPMC network.

Continue Reading

Ibex

The Galen™ suite of solutions from Ibex is used in routine clinical practice at laboratories, hospitals and health systems worldwide. Prostate biopsies at UPMC are now digitized and analyzed by Galen Prostate's AI algorithm ahead of pathologists' review, providing them with multiple diagnostic insights and decision support tools that can help improve the quality of cancer diagnosis and reduce turnaround time.

Joseph Mossel, Co-Founder and Chief Executive Officer at Ibex Medical Analytics said, "We are investing heavily to bring our AI-powered digital pathology solutions to the U.S. market and are proud to see UPMC's ongoing leadership. Pathology serves as a cornerstone to medical care, requiring the provision of accurate and timely diagnosis for every patient to better guide treatment decisions and improve survival rates. As cancer incidences continue to rise at alarming rates, with prostate cancer occurring in 12 percent of men alone, we are eager to bring Galen Prostate to additional healthcare systems and laboratories, supporting pathologists with automated decision-support tools."

UPMC previously published their pioneering work with Galen Prostate in The Lancet Digital Health, demonstrating very high accuracy rates for Galen in prostate cancer detection as well as in the detection and assessment of other clinically relevant features such as Gleason grading, perineural invasion and tumor sizing. UPMC deployed Galen 3.0, Ibex's latest software release that incorporates the very latest evolution of Ibex's AI algorithms, improved user experience and Ibex's open API (Application Programming Interface). Galen's prostate algorithm was trained on enriched data sets that included rare prostatic malignancies and can calculate a Gleason score, tumor size and percentage for each cancer slide, which may help pathologists save review time and reduce subjectivity.

"Galen Prostate serves as a "digital assistant" for our pathologists, helping automate routine processes and providing augmented insights for each biopsy," said Rajiv Dhir, MD, MBA, Medical Director of Anatomic Pathology Services at UPMC. "We look forward to expanding the deployment of this technology across our network as we adopt digital workflows that enable our pathology departments to increase efficiency, optimize workflow and ensure the highest standard of care and long-term outcomes for cancer patients."

The Galen suite of solutions is the most widely deployed AI technology in pathology, supporting pathologists worldwide with augmented diagnostic capabilities during diagnosis of breast, prostate, and gastric biopsies. Improving the diagnostic accuracy, reducing turnaround time, boosting productivity and improving user experience for pathologists, Galen has demonstrated excellent outcomes across multiple clinical studies performed in different pathology labs and diagnostic workflows1,2,3,4,5.

About Ibex Medical Analytics

Ibex Medical Analytics (Ibex) is transforming cancer diagnostics with world-leading, clinical grade AI-powered solutions, empowering physicians to provide accurate, timely and personalized cancer diagnosis for every patient. Our Galen™ suite of solutions is the first and most widely deployed AI-technology in pathology and used as part of everyday routine, supporting pathologists and providers worldwide in improving the quality and accuracy of diagnosis, implementing comprehensive quality control, reducing turnaround times and boosting productivity with more efficient workflows. Ibex's Artificial Intelligence technology is built on Deep Learning algorithms trained by a team of pathologists, data scientists and software engineers. For additional company information, please visit and follow us on LinkedIn and Twitter.

The Galen™ suite of solutions, including Galen Prostate, is for Research Use Only (RUO) in the United States and is not cleared by the FDA. Various Galen™ solutions are CE marked and registered with the UK MHRA. For more information, including indication for use and regulatory approval in other countries, contact Ibex Medical Analytics.

Ibex

Media Contact

Nechama Feuerstein

FINN Partners

[email protected]

+1-551-444-0784

Logo -

[1] Sandbank et al., Validation and real-world clinical application of an artificial intelligence algorithm for breast cancer detection in biopsies, npj Breast Cancer, December 2022

[2] Pantanowitz et al., An artificial intelligence algorithm for prostate cancer diagnosis in whole slide images of core needle biopsies: a blinded clinical validation and deployment study, THE LANCET Digital Health Aug 2020

[3] Comperat et al., Clinical Level AI-Based Solution for Primary Diagnosis and Reporting of Prostate Biopsies in Routine Use: A Prospective Reader Study, European Congress of Pathology 2021

[4] Raoux et al., Novel AI-Based Solution for Supporting Primary Diagnosis of Prostate Cancer Increases the Accuracy and Efficiency of Reporting in Clinical Routine, USCAP 2021

[5] Sandbank et al., Validation and Clinical Deployment of an AI-Based Solution for Detection of Gastric Adenocarcinoma and Helicobacter pylori in Gastric Biopsies, USCAP 2022

SOURCE Ibex Medical Analytics

2022-12-13

Wearable fitness devices offer new insights into the relationship between physical activity and type 2 diabetes, according to a new analysis.

Wearable fitness devices offer new insights into the relationship between physical activity and type 2 diabetes, according to a new analysis of the National Institutes of Health's All of Us Research Program data published in the Endocrine Society's Journal of Clinical Endocrinology & Metabolism.

Type 2 diabetes is the most common form of the disease, affecting 90% to 95% of people with diabetes. In type 2 diabetes, the body is resistant to the action of insulin, meaning it cannot use insulin properly, so it cannot carry sugar into the cells. Type 2 diabetes most often develops in people over age 45, but more and more children, teens and young adults are being diagnosed.

"We investigated the relationship between physical activity and type 2 diabetes with an innovative approach using data from wearable devices linked to electronic health records in a real-world population," said Andrew S. Perry, M.D., of Vanderbilt University Medical Center in Nashville, Tenn. "We found that people who spent more time in any type of physical activity had a lower risk of developing type 2 diabetes. Our data shows the importance of moving your body every day to lower your risk of diabetes."

The researchers analyzed Fitbit data and type 2 diabetes rates from 5,677 participants included in the NIH's All of Us Research Program between 2010-2021. All of Us is part of an effort to advance individualized health care by enrolling one million or more participants to contribute their health data over many years. About 75% of the participants that the researchers studied were female.

They found 97 new cases of diabetes over a follow-up of 4 years in the data set. People with an average daily step count of 10,700 were 44% less likely to develop type 2 diabetes than those with 6,000 steps.

"We hope to study more diverse populations in future studies to confirm the generalizability of these findings," Perry said.

The other authors of this study are Jeffrey Annis, Hiral Master, Aymone Kouame, Kayla Marginean, Ravi Shah and Evan Brittain of Vanderbilt University School of Medicine in Nashville, Tenn.; Matthew Nayor of Boston University School of Medicine in Boston, Mass.; Andrew Hughes and Dan M. Roden of Vanderbilt University Medical Center; Paul A. Harris of Vanderbilt University School of Medicine and Vanderbilt University Medical Center; Karthik Natarajan of Columbia University in New York, N.Y.; and Venkatesh Murthy of the University of Michigan in Ann Arbor, Mich.

The study received funding from the NIH.

100 项与 Athens Medical Center SA 相关的药物交易

登录后查看更多信息

100 项与 Athens Medical Center SA 相关的转化医学

登录后查看更多信息

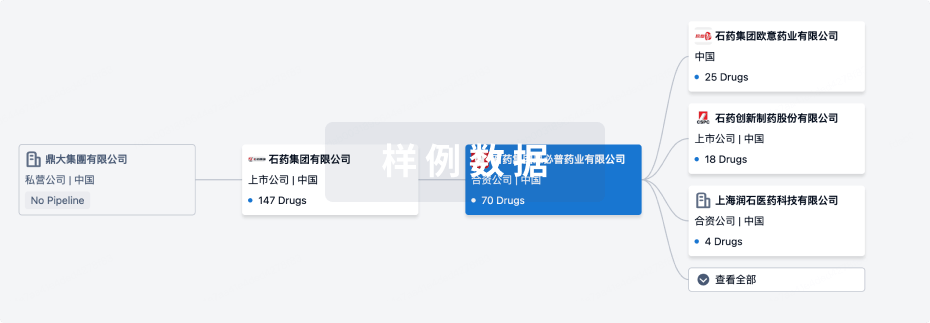

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2024年11月29日管线快照

无数据报导

登录后保持更新

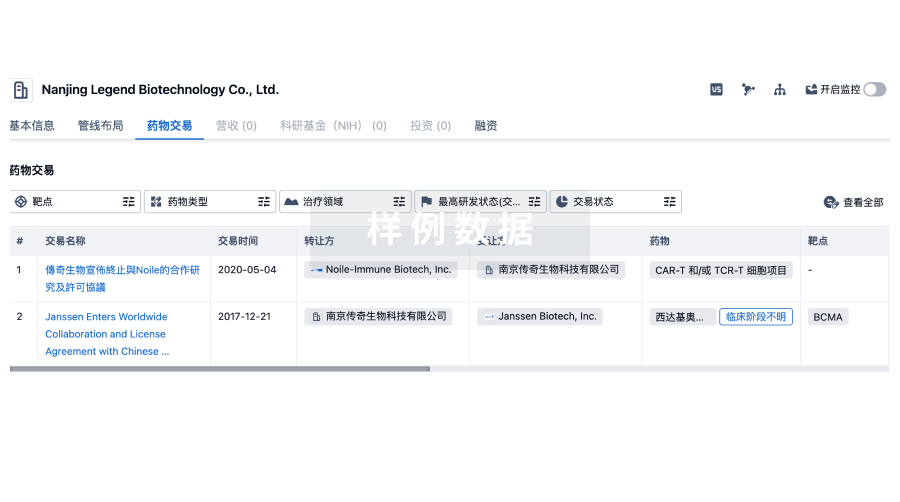

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

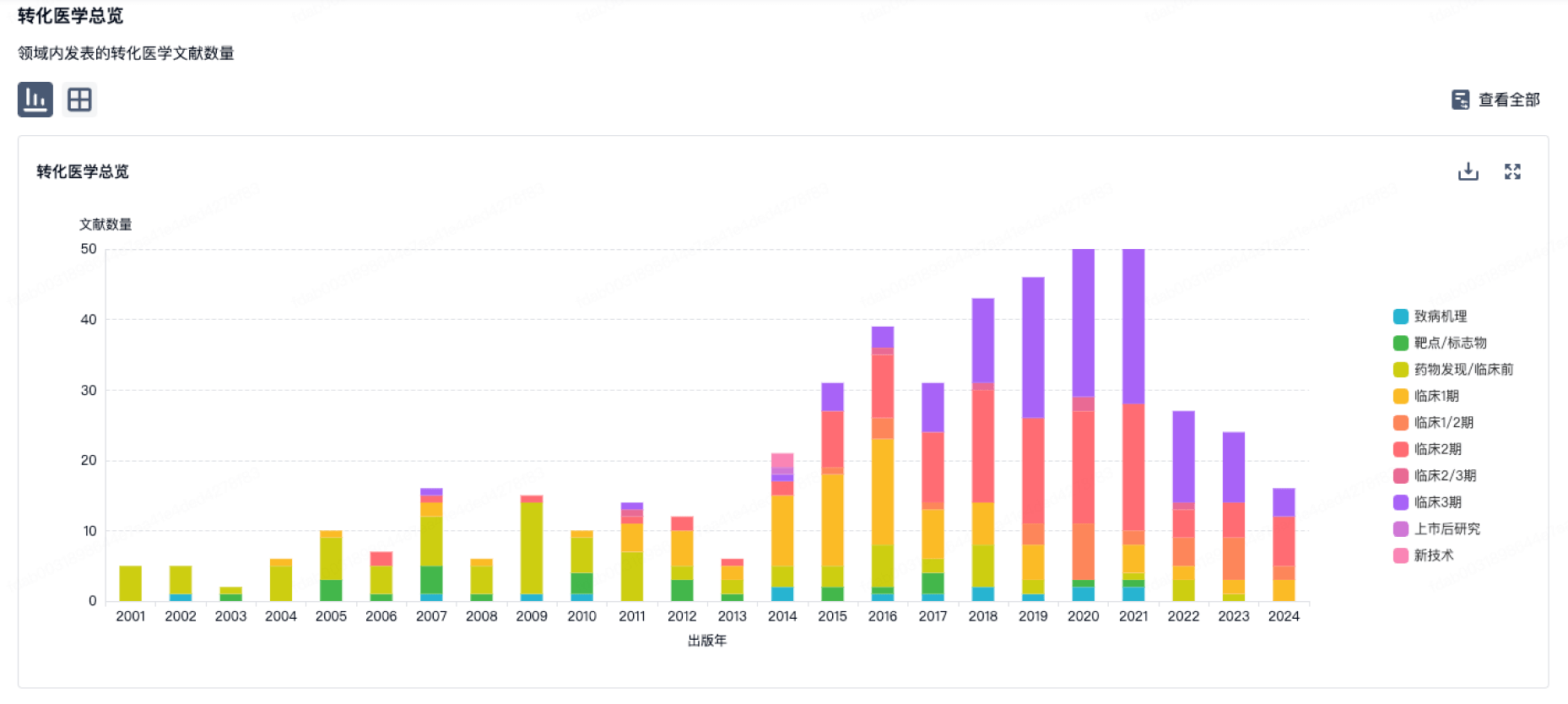

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

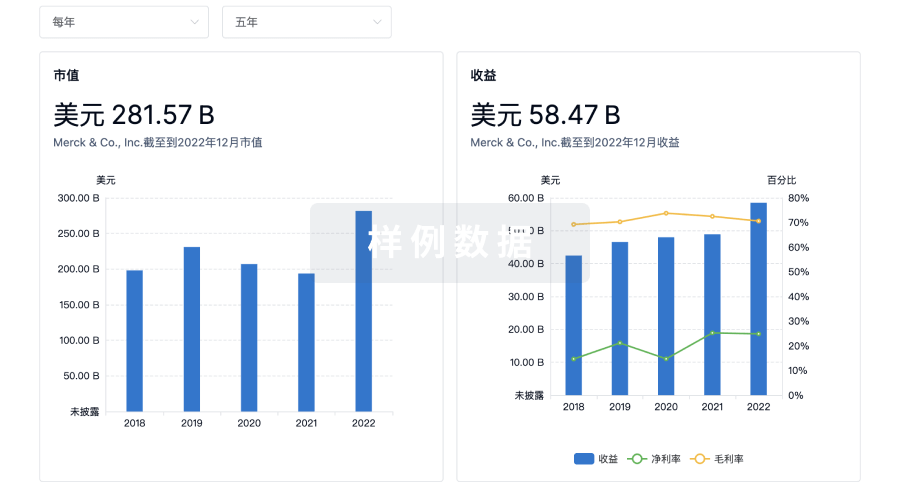

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

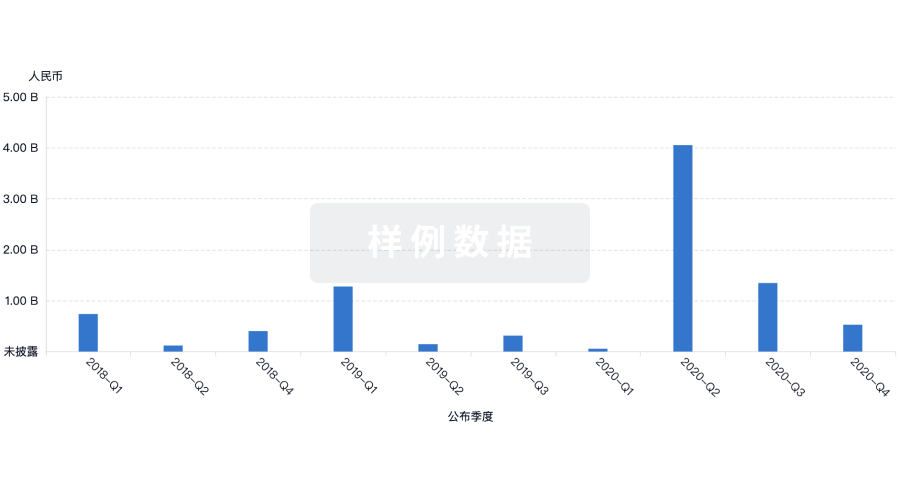

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

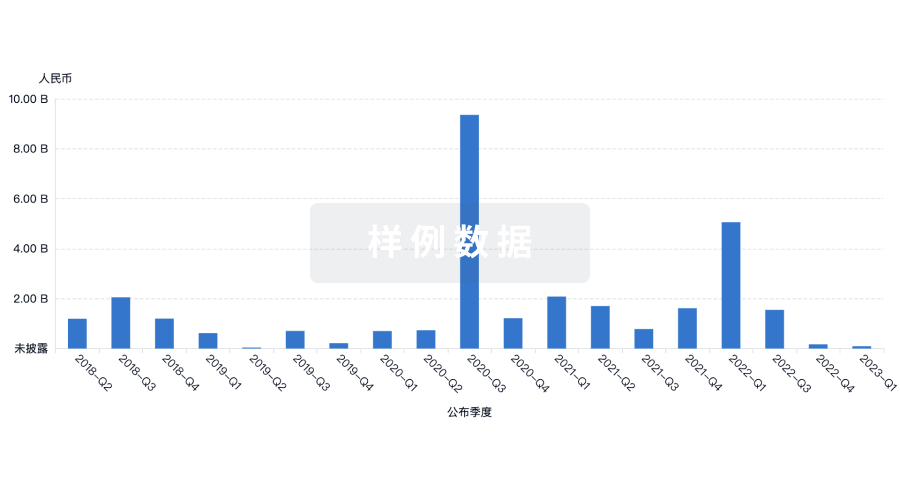

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

标准版

¥16800

元/账号/年

新药情报库 | 省钱又好用!

立即使用

来和芽仔聊天吧

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用