预约演示

更新于:2025-05-07

Nutrition Science Partners Ltd.

子公司|2012|中国香港

子公司|2012|中国香港

更新于:2025-05-07

概览

关联

3

项与 Nutrition Science Partners Ltd. 相关的药物靶点- |

作用机制- |

在研机构- |

在研适应症- |

最高研发阶段终止 |

首次获批国家/地区- |

首次获批日期- |

作用机制 IL-1β调节剂 [+3] |

在研机构- |

原研机构 |

在研适应症- |

最高研发阶段终止 |

首次获批国家/地区- |

首次获批日期- |

靶点- |

作用机制- |

在研机构- |

在研适应症- |

非在研适应症 |

最高研发阶段无进展 |

首次获批国家/地区- |

首次获批日期- |

2

项与 Nutrition Science Partners Ltd. 相关的临床试验NCT03597971

A Phase I, Randomized, Double Blind, Placebo-controlled, Dose-escalating Study of the Safety, Tolerability and Pharmacokinetics of Single and Repeat Doses of HMPL004-6599 in Healthy Male Volunteers

To assess the safety and tolerability of single and multiple doses of HMPL004-6599 in healthy male volunteers

开始日期2018-03-20 |

申办/合作机构 |

NCT01882764

A Phase III Double Blind, Multi-Center Placebo Controlled Maintenance Trial of HMPL-004 in Subjects With Mild to Moderate Ulcerative Colitis With Clinical Remission or Response From Induction Therapy. (NATRUL-4)

A study with an 8 week open label phase study followed by a year long placebo controlled maintenance phase in subjects with active mild to moderate ulcerative colitis (UC), with a modified Mayo Score 4-10 and an endoscopy subscore of 2-3, taking mesalamine (or equivalent) as a concomitant medication. Subjects are required to be in clinical remission or clinical response to enter the year long maintenance phase. This study will help evaluate if HMPL-004 is effective in subjects maintaining clinical remission following successful induction therapy achieving clinical remission or clinical response.

开始日期2013-06-01 |

申办/合作机构  和记黄埔医药(上海)有限公司 和记黄埔医药(上海)有限公司 [+1] |

100 项与 Nutrition Science Partners Ltd. 相关的临床结果

登录后查看更多信息

0 项与 Nutrition Science Partners Ltd. 相关的专利(医药)

登录后查看更多信息

2

项与 Nutrition Science Partners Ltd. 相关的新闻(医药)2019-12-14

Chi-Med, backed by Hong Kong tycoon Li Ka-shing, is an oncology-focused drugmaker that started operations in 2000. The company is listed on the Nasdaq and London Stock Exchange. Its listing in Hong Kong was delayed in June 2019 amid market uncertainty.

The company's novel cancer drug Elunate, or fruquintinib, was included in the latest revision of China's drug reimbursement list.

The drug's price was slashed by about 64% to $1,210 per month from $3,350 per month to qualify for addition to the list. Drugs on the list qualify for reimbursement from state-sponsored insurance schemes, making them more affordable to patients.

CEO Christian Hogg, also based in Hong Kong, spoke to S&P Global Market Intelligence about Chi-Med's listing intentions, the evolving healthcare landscape in China and the race to access more patients in China via drug price cuts. The following is an edited transcript of the interview.

S&P Global Market Intelligence: Is Chi-Med still interested in a Hong Kong listing? And are there any plans to delist from any of the other exchanges?

Christian Hogg: I don't think the market shakiness in Hong Kong I mentioned in the past will stop us again this time; it's just about the right timing for the company. I hope the window [to list] will open again in 2020. We are ready to go.

We will have some clinical updates in 2020, and some of these may act as a trigger for more attention [from investors] toward the company.

Nasdaq is a predominant biotech stock exchange, so the prospect of the company delisting there is zero. Hong Kong will also be very important because it is our home and we are well-known here.

The dilemma with London is that trading volume is relatively low, but Chi-Med has been there since 2006, and investors know us well. They are mostly long-only investors who tend to hold stocks for the long term. We will not discontinue unless there is a very good reason.

What are the biggest changes you have seen in China's healthcare market in the past few years?

The first big change is the regulatory structure, such as speeding up the approval process and making the process more transparent. About 15 years ago, getting approval to start clinical trials took 18 months; now, it is down to 60 days.

The second big change is related to pricing. It is really smart that regulators are driving down the prices of generic drugs — historically overpriced in China — to make room for reimbursement of innovative drugs.

More people now have access to the national medical reimbursement scheme and more innovative drugs are being included. With 10 years of innovation, I would expect China's pharmaceutical market to be close to or being the largest in the world.

Also, getting financial resources is no longer a problem in China, but getting hold of the talent you need is challenging as the cost of hiring and retaining talent is increasing rapidly.

It is also becoming competitive to enroll patients as well as to get the attention of clinical inspectors to attend your study.

There are 50 to 60 high-class clinical centers in China right now, but we need more. However, in 10 years, I think there will be more clinical centers as China will build them.

To qualify for China's reimbursement list, companies have made steep price cuts on their therapies. Is drug pricing becoming a concern for innovative drugmakers as they seek greater access to the market?

My sense is that the government will push pricing to a level that is fair and manufacturers are still incentivized to invest in innovation. Manufacturers can always pull out, and some have chosen not to be involved in the negotiations this year because they think the price cut is too much.

Right now, that equilibrium has not yet been reached. It is still at a point where it feels like pricing is being squeezed. However, at some point that equilibrium will establish itself.

What do you think companies need to do to succeed in China?

First and foremost is innovation. You have to bring something to China that it does not have but needs. If you can do that, you will get access to a huge patient population and government support.

Beyond that, you also need a really solid foundation in manufacturing, clinical study and commercialization. Getting a drug approved in China is complex and labor-intensive. Chi-Med has about 500 people working in drug discovery, development and manufacturing. Despite that, we were stretched to our limits bringing cancer drug fruquintinib to China.

I think it will be difficult for small biotech companies in general to undergo and clear the approval process.

Given the recent spate of acquisitions in global healthcare, how open is Chi-Med to acquisitions?

We are, of course, open to any collaborations and M&A activities. We will look for scientific synergies with our small molecule pipeline, and we are very interested in getting into the large molecule space. We will consider the potential for acquisitions in biologics.

并购

2019-11-18

Inflammatory bowel disease (IBD) is an umbrella term for two conditions, Crohn’s disease and ulcerative colitis, that are characterized by chronic inflammation of the gastrointestinal (GI) tract. This chronic and prolonged inflammation results in damage to the GI tract.

Inflammatory bowel disease (IBD) is an umbrella term for two conditions, Crohn’s disease and ulcerative colitis, that are characterized by chronic inflammation of the gastrointestinal (GI) tract. This chronic and prolonged inflammation results in damage to the GI tract.

Historically IBD has been predominantly seen in industrialized countries, with the

highest reported prevalence values

in Europe and North America. In the

United States alone

, approximately 1.6 million people currently have Crohn’s disease or ulcerative colitis, and as many as 70,000 new cases of IBD are diagnosed each year. Although the incidence of IBD in North America and Europe is currently reported to be stabilizing or decreasing, the burden remains high as prevalence exceeds 0·3%. Over the last 30 years, the predominance of IBD

has accelerated

in newly industrialized countries including Africa, Asia and South America. Reports of IBD appear to be higher in urban areas than in rural areas, as well as in higher socio-economic classes. Individuals who immigrate to industrial urbanized developed nations before adolescence and those immigrants who initially belonged to a low-incidence population show a significantly higher incidence of IBD. This rise has been attributed to the rapid modernization and westernization of the population.

The reported rise in the number of people living with inflammatory bowel disease reflects a need for more research to find a cure. This report explores current therapies, drugs in the pipeline and disease outlook for patients and their caregivers living with IBD. Please read the full report for more information.

Overview

Inflammatory Bowel Disease

is a broad term that describes conditions characterized by chronic inflammation of the gastrointestinal tract. The GI tract is responsible for the digestion of food, absorption of nutrients and elimination of waste. Inflammation impairs the ability of affected GI organs to function properly, leading to symptoms such as persistent diarrhea, abdominal pain, rectal bleeding, weight loss and fatigue. The

two most common inflammatory bowel diseases

are Crohn’s disease and ulcerative colitis.

Crohn’s disease can affect any part of the GI tract, from the mouth to the anus. It most commonly affects the end of the small intestine (the ileum) where it joins the beginning of the colon. Crohn’s disease may appear in “patches,” affecting some areas of the GI tract while leaving other sections completely untouched. In Crohn’s disease, the inflammation may extend through the entire thickness of the bowel wall.

Ulcerative colitis is limited to the large intestine (colon) and the rectum. The inflammation occurs only in the innermost layer of the lining of the intestine. It usually begins in the rectum and lower colon but may also spread continuously to involve the entire colon.

Causes:

The exact cause of IBD is not entirely understood, however, it is known to involve an

interaction

between the immune system, genes and environmental factors.

In people with IBD, the immune system mounts an inappropriate response to the intestinal tract, resulting in inflammation. This abnormal immune system reaction occurs in people who have inherited genes that make them susceptible to IBD. Unidentified environmental factors serve as the “trigger” that initiates the harmful immune response in the intestines.

Studies have shown that 5 to 20% of affected individuals have a first-degree relative (parent, child or sibling) with one of the diseases. Numerous genes and genetic mutations connected to IBD have been identified including a mutation in the NOD2/CARD15 gene. Up to 20% of IBD patients in North America and Europe may have a mutation in the NOD2/CARD15 gene. While genetic testing is possible, it is not currently a part of the diagnostic process for IBD. Genetic testing can identify a potential risk for IBD in an individual but cannot predict whether IBD will develop.

The environmental factors that trigger IBD are not known, but several potential risk factors have been studied. These include smoking, use of antibiotics, use of Nonsteroidal anti-inflammatory drugs, diet and geographic location (more prevalent in industrialized countries).

Life expectancy

: People with Inflammatory Bowel Disease have a relatively normal

life expectancy

compared to the general population. However, people with Crohn’s disease have a slightly higher overall mortality rate than the general healthy population. The increase in deaths is largely due to conditions such as cancer (particularly lung cancer), chronic obstructive pulmonary disease, gastrointestinal diseases, (excluding Crohn’s disease), and diseases of the genital and urinary tracts. In addition, patients with extensive inflammation in the colon due to ulcerative colitis are at higher risk than the general population for dying from gastrointestinal and lung diseases.

Annual Cost:

There are both

direct and indirect costs

associated with IBD. Direct medical costs include expenses for hospitalizations, physician services, prescription drugs, over-the-counter drugs, skilled nursing care, diagnostic procedures and other healthcare services. Indirect costs are the value of lost earnings or productivity. Indirect costs also include the value of leisure time lost.

Direct Costs:

The annual direct cost of Crohn’s disease is estimated to be from $8,265 per patient to $18,963 per patient and the annual direct cost of ulcerative colitis is estimated to be from $5,066 per patient to $15,020 per patient. Extrapolating from this data to the current prevalence estimates of IBD (780,000 cases of Crohn’s disease and 907,000 cases of ulcerative colitis), the total annual direct costs for all patients with IBD in the United States is estimated to be between $11 billion to $28 billion.

Indirect Costs

: Based on a national health survey in 1999, nearly 32% of symptomatic IBD patients reported being out of the workforce in a one-year period, incurring an indirect cost of an estimated $5,228 per patient, bringing the total indirect cost of IBD in 1999 to $3.6 billion.

Diagnostic Strategies

One or more of the following

tests or procedures

may be used to help confirm a diagnosis of IBD.

Blood tests to check for anemia or infection from bacteria or viruses. A fecal occult blood test may also be used to test for hidden blood in the stool. Although a blood test cannot confirm the presence of IBD, it can help rule out conditions that cause similar symptoms.

Endoscopic procedures —such as colonoscopy, upper endoscopy, sigmoidoscopy, and capsule endoscopy—are also used to diagnose IBD. These procedures provide clear and detailed views of the gastrointestinal tract and can help to differentiate between Crohn’s disease and ulcerative colitis.

Imaging tests—such as X-rays, CT scans, and MRI scans— are often used in conjunction with endoscopic procedures. Imaging data can reveal signs of IBD in the lining of the intestines, such as tears, bleeding, inflammation, or an obstruction.

Current Therapies

There is no cure for IBD. The goal of treatment is to reduce the inflammation that triggers the signs and symptoms, thus providing relief as well as long-term remission and reduced risks of complications. IBD treatment usually involves either drug therapy or surgery. Classes of medications used to treat IBD include anti-inflammatories, immunosuppressants, biologics and antibiotics.

Anti-inflammatory drugs are often the first step in the treatment of inflammatory bowel disease. Anti-inflammatories include corticosteroids and aminosalicylates (5-ASA), such as

Allergan

’s

mesalamine (

Asacol HD

,

Delzicol

, others),

Salix Pharma

’s

Colazal

(balsalazide) and

Uceris

(budesonide) and

AstraZeneca

‘s

Entocort EC

.

Immune system suppressor medications are used to stem the immune response that releases inflammation-inducing chemicals in the intestinal lining. Some examples of immunosuppressant drugs include

azathioprine

(Azasan, Imuran),

mercaptopurine

(Purinethol, Purixan),

cyclosporine

(Gengraf, Neoral, Sandimmune) and

methotrexate

(Otrexup, Rasuvo, Rheumatrex Dose Pack, Trexall, Xatmep).

Tumor necrosis factor (TNF)-alpha inhibitors, or biologics, are a group of medicines that suppress the body’s natural response to

tumor necrosis factor

(

TNF

), a protein produced by white blood cells that is involved in early inflammatory events. Examples include

AbbVie

‘s

Humira

(adalimumab),

Janssen

‘s

Simponi

(golimumab),

UCB

‘s

Cimzia

and

infliximab

(Remicade, Inflectra). Other commonly used biologic therapies are

Tysabri

(natalizumab),

Entyvio

(vedolizumab) and

Stelara

(ustekinumab).

Antibiotics may be used in addition to other medications or when infection is a concern. Frequently prescribed antibiotics include

ciprofloxacin

(Cipro) and

metronidazole

(Flagyl).

Drug Pipeline

A variety of targeted therapies are currently being explored through clinical trials. In addition to TNF-alpha inhibitors, aminosalicylates and glucocorticosteroids, common targets and mechanisms include:

Janus kinase (JAK) 3 inhibitors. The JAK pathways are believed to play an important role in inflammatory processes as they are involved in signaling for over 50 cytokines and growth factors, many of which drive immune-mediated conditions

selective S1P receptor modulators. S1P receptors have been demonstrated to be involved in the modulation of several biological responses including autoimmune diseases.

H

uman interleukin (IL)-12, IL-22, IL-23

and IL-36 inhibitors. Human interleukins are inflammatory cytokines- a type of protein that is involved in the inflammation response as part of the immune system.

DHODH (dihydroorotate dehydrogenase) inhibitors. DHODH inhibition provides an immunomodulatory effect selective towards activated immune cells.

As of October 2019, there are

730 clinical trials (not yet recruiting/active/active, no longer recruiting)

listed on

clinicaltrials.gov

. Of these trials, 268 are in the United States and the remainder are across global sites. When broken down by phase, there are 63 trials in phase I, phase II has 132 trials, 101 phase III trials and the remainder are in phase IV or are other types of studies, including behavioral modification or observational studies, those using dietary supplements and various devices.

The IBD market contains a mixture of big and smaller sized pharma and biotech companies. The market share is dominated by

Janssen

with

5 drugs

in all phases (I-III) and

Pfizer

with

5 drugs

in phase I and II. The remaining companies include

Roche

in collaboration with

Genentech

with three drugs in phases I-III and

AbbVie

with three drugs in phase II, II/III and III.

The following analysis of selected drugs in the pipeline will briefly discuss how each drug works and where it is in clinical trials. This information was up to date as of October 2019. Any text in italics represents failed or terminated trials.

Note: This section is not meant to be completely comprehensive and may unintentionally exclude some drugs in development or clinical trials, especially those trials outside of the United States.

Janssen

has five drugs in development for IBD: golimumab, ustekinumab, JNJ-64304500 (JNJ-4500/ IPH-2301/NN-8555), JNJ-67864238, guselkumab monotherapy and guselkumab combined with golimumab.

Golimumab

is a humanized Anti-TNFα antibody that has been approved by the FDA as

Simponi

for use in a variety of inflammatory disorders, including adults with moderate to severe ulcerative colitis. A

phase I trial

and a

phase III trial

are currently underway evaluating subcutaneous formulations in pediatrics with ulcerative colitis.

Ustekinumab

is a monoclonal antibody that inhibits the action of inflammatory cytokines human interleukin (IL)-12 and IL-23. Ustekinumab has also been approved by the FDA as

Stelara

for use in a variety of inflammatory disorders, including for use in adults with moderately to severely active Crohn’s disease and ulcerative colitis. A

number of studies

(phase I-III) are underway evaluating ustekinumab as a monotherapy and in combination with other therapies for induction and maintenance therapy in patients with both Crohn’s disease and ulcerative colitis.

JNJ-64304500

(JNJ-4500/ IPH-2301/NN-8555) is an Anti-NKG2D antibody

licensed from Novo Nordisk

in May of 2015. A phase IIB trial,

TRIDENT

, began in August of 2016 and is currently recruiting patients with moderately to severely active Crohn’s disease. JNJ-4500 is being compared to placebo and Ustekinumab (Stelara).

JNJ-67864238

(PTG-200) is a potential first-in-class oral IL-23R antagonist being developed in collaboration with Protagonist Therapeutics. A phase I trial was completed in Australia and

demonstrated

that PTG-200 was well-tolerated, with no serious adverse events or dose-limiting toxicities. The pharmacokinetic and pharmacodynamic parameters were consistent with the gastrointestinal-restricted design of PTG-200. A phase IIB trial,

PRISM

, is now underway in up to 90 patients with moderately to severely active Crohn’s disease.

Guselkumab

is an interleukin-23 blocker. It has been approved by the FDA as

Tremfya

for the treatment of adult patients with moderate-to-severe plaque psoriasis. There are currently three clinical trials underway:

VEGA

, a phase II efficacy and safety trial of combination therapy with guselkumab and golimumab in patients with moderately to severely active ulcerative colitis;

GALAXI

, a phase II/III study evaluating guselkumab monotherapy in patients with moderately to severely active Crohn’s disease and

QUASAR

, a phase II/III study evaluating guselkumab monotherapy in participants with moderately to severely active ulcerative colitis

Pfizer

also has five drugs in development for both Crohn’s disease and ulcerative colitis.

PF-06687234

has an undisclosed mechanism of action. A

phase I trial

is evaluating the PK, safety and tolerability of PF-06687234 and [124I]IB-PF-06687234 (simultaneously given) in subjects with moderate to severe Ulcerative Colitis. The study will use PET-CT scan imaging to assess the distribution of PF-06687234 and [124I]IB-PF-06687234 over 24 and 72 hours in colon (inflamed and non-inflamed), plasma, colon, liver, spleen, kidney and small intestine.

This trial was suspended in July due to an interruption in the supply of the radiolabeled material.

A

phase II trial

is underway to determine if PF-06687234 is effective and safe as add-on therapy to infliximab in subjects with active ulcerative colitis who are not in remission.

PF-06651600 and PF-06700841:

PF-06651600 is an oral small molecule that selectively inhibits Janus kinase (JAK) 3 and PF-06700841 is a JAK 1 and TYK2 inhibitor. Two phase II trials are underway evaluating the combination of these drugs together; one for

moderate-to-severe Crohn’s disease

and the other for

moderate-to-severe ulcerative colitis

.

PF-06480605

is an antibody that blocks tumor necrosis factor (TNF), such as cytokine 1A (TL1A)/TNF superfamily member 15 (TNFSF15). TL1A helps to induce pro-inflammatory cytokines including TNF alpha cells from CD4 + CD161 + T cells, whereas these cells are resistant to TNF alpha. A

phase IIA trial

met safety and tolerability endpoints. A

phase IIB trial

is expected to begin recruiting patients with moderate to severe ulcerative colitis at the end of November 2019.

Genentech/Roche

has three treatments in development for IBD.

UTTR1147A/ RG7880

is a recombinant human protein referred to as which targets Interleukin-22 (IL-22), a member of the IL-10 family of cytokines that activates IL-22R signaling. A

phase I and two phase II trials

are currently underway for both Crohn’s disease and ulcerative colitis.

Etrolizumab (RG7413)

is a monoclonal antibody designed to stop two proteins involved in the immune response, alpha4beta7 (α4β7) and alphaEbeta7 (αEβ7), from working. By inhibiting these proteins, etrolizumab aims to reduce inflammation. A phase I and II clinical trials, both evaluating patients with moderate to severe ulcerative colitis, were successfully completed. The results of each were published, respectively, in the scientific journals

Gut

and

The Lancet

. These studies show that etrolizumab treatment was well tolerated and resulted in an improvement in the rate of clinical remission in UC patients compared to placebo.

A

phase I trial

is evaluating etrolizumab in pediatric patients of 4 to <18 years of age with moderate to severe ulcerative colitis (UC) or with moderate to severe Crohn’s disease (CD).

Genentech’s Phase III Etro Studies program

is also underway, assessing its safety and efficacy in both UC and Crohn’s. During this trial, etrolizumab will be compared to other currently the U.S. FDA-approved drugs, namely

Remicade (infliximab)

and

Humira (adalimumab)

, and to placebo. There are five planned trials for patients with UC, and two for those with CD, to be carried out in the U.S., as well as one non-U.S. based trial in UC patients. All these studies are

currently recruiting participants

.

RO7049665

has an undisclosed mechanism of action. A

phase I trial

is currently underway to evaluate the safety and tolerability of subcutaneously administered RO7049665 in patients with active ulcerative colitis.

AbbVie

has three drugs in development for inflammatory bowel disease.

ABBV-323

is an antagonist to CD40, a Tumor Necrosis Factor Receptor superfamily member expressed by immune and non-immune cells. A

phase II trial

is currently recruiting 60 patients with moderate to severe ulcerative colitis who failed prior therapy. Proof of concept data is expected in 2020.

Risankizumab (ABBV-066)

is an anti-IL-23 antibody. Risankizumab is part of a collaboration between Boehringer Ingelheim and AbbVie, with AbbVie leading future development and commercialization of the drug globally. Several

phase II and III trials are currently underway

for Crohn’s disease and ulcerative colitis.

Results

from a phase II trial in patients with moderate to severe Crohn’s disease showed extended induction treatment with open-label intravenous risankizumab was effective in increasing clinical response and remission rates at week 26. Open-label subcutaneous risankizumab maintained remission until week 52 in most patients who were in clinical remission at week 26.

Upadacitinib (ABT-494)

is a JAK1 selective inhibitor. There are seven active

phase II and III trials underway

for Crohn’s disease and ulcerative colitis.

Results from the phase II CELEST trial

, conducted in adults with moderately to severely active Crohn’s disease, showed that more patients achieved endoscopic remission with upadacitinib compared to placebo and significantly more patients receiving upadacitinib achieved clinical remission compared to placebo.

Phase I

Aevi Genomics

has partnered with Kyowa Kirin for AEVI-002, a human monoclonal antibody that binds an inflammatory protein found in intestinal tissue called LIGHT. The

trial

is evaluating AEVI-002 for severe pediatric-onset Crohn’s disease. Initial data are expected in the second half of 2019.

Assembly Biosciences

is conducting a

phase IB clinical trial

of its lead investigational live biotherapeutic product (LBP) candidate, ABI-M201, in patients with mildly to moderately active UC. ABI-M201 is comprised of a defined consortium of gut commensal bacterial strains, specifically selected based on their functional attributes to target key aspects of disease biology. Assembly and Allergan have entered into a collaboration to jointly develop LBP compounds for Ulcerative colitis (UC), Crohn’s Disease and Irritable Bowel Syndromes. ABI-M201 is the first LBP candidate under this collaboration.

Enterome

is partnered with Takeda for the co-development and co-commercialization of EB8018 (TAK018), a first-in-class, non-systemic, orally administered small molecule. EB8018 is specifically designed to remain gut-restricted and to block bacteria expressing the bacterial virulence factor, FimH, a key inducer of the inflammatory cascade in the intestine, thereby decreasing intestinal inflammation in patients with Crohn’s disease. Preliminary data from a

Phase Ib clinical trial

of EB8018 for the treatment of Crohn’s disease is expected in 2019. Takeda is planning to commence

a phase II trial

in November of 2019.

Gossamer Bio

is developing GB004, an oral HIF-1α stabilizer. Patient enrollment in a

Phase Ib study

of active mild-to-moderate ulcerative colitis (UC) began during the second quarter, and the Company expects topline results from the study in the first half of 2020.

Intralytix, Inc.

‘s

EcoActive bacteriophage therapy targeting adhesive invasive

E. coli

(AIEC) in Crohn’s disease patients has entered a

Phase I/IIa clinical trial

at the Icahn School of Medicine at the Mount Sinai Hospital in New York, NY. The presence of AIEC in the intestines is associated with worsening inflammation in this disease. The trial will measure the effect of oral phage administration on the AIEC (CFU/g) in stools of patients receiving phages versus patients receiving a placebo.

Nutrition Science Partners Limited,

a 50/50 joint venture between Chi-Med and Nestlé Health Science SA, is assessing HMPL004-6599, a proprietary botanical (Andrographis paniculate) with in vitro inhibitory activity against TNF-α, IL-1β and NF-κB. A

pilot study

of A. paniculata extract (HMPL-004) indicated similar efficacy to mesalamine for ulcerative colitis. HMPL004-6599 is an enriched/purified

re-formulation of HMPL-004

, an anti-inflammatory with anti-TNF properties. A phase 3 trial of the original formulation was evaluating its efficacy in ulcerative colitis. However, the trial was

terminated in 2014

following an interim analysis showing the endpoint was unlikely to be reached.

OSE Immunotherapeutics

has a pipeline of drugs aimed at immune-oncology and autoimmune diseases, one of which is OSE-127. OSE-127 is a monoclonal immunomodulatory antibody targeting the CD127 receptor, the alpha chain of the interleukin-7 receptor (IL-7R) that induces a powerful antagonist effect on effector T lymphocytes. The blockage of IL-7R prevents the migration of pathogenic T lymphocytes while preserving regulator T lymphocytes (1,2,3,4) which have a positive impact in autoimmune diseases. The

first patients were dosed

in a

phase I trial

in December of 2018.

Phase II

AbGenomics

is evaluating neihulizumab/AbGn-168H, a humanized therapeutic antibody with a unique mechanism of action, which preferentially induces apoptosis of late-stage activated T cells. This activated-T cell apoptosis-inducing antibody effectively eliminates chronic pathogenic T cells while fully maintaining host defense. A

phase II trial

is currently enrolling up to 40 patients with moderate to severe active ulcerative colitis and who have failed or are intolerant to anti-TNFα and/or anti-integrin therapy.

Allergan

‘s

brazikumab is an anti-inflammatory with the potential to curb inflammation by blocking the proinflammatory molecule interleukin-23. In a

double-blind, placebo-controlled study

of 119 adults with moderate to severe CD who had failed treatment with tumor necrosis factor antagonists, 8 and 24 weeks of treatment were associated with clinical improvement. Higher baseline serum concentrations of IL22 were associated with a greater likelihood of response to treatment compared with placebo.

Two trials are currently underway, and both are utilizing a personalized approach to evaluate the role of biomarkers, such as IL22, in predicting treatment response to brazikumab.

The

phase II EXPEDITION trial

is comparing brazikumab to placebo or Entyvio (vedolizumab) in approximately 375 patients with moderately to severely active ulcerative colitis.

The

phase IIb/III INTREPID trial

is currently enrolling up to 1,140 patients with moderate to severe Crohn’s disease to evaluate brazikumab versus placebo and versus an active comparator, Humira (adalimumab).

Boehringer Ingelheim

is developing Spesolimab (BI 655130) is a monoclonal antibody that blocks the action of the interleukin-36 receptor (IL-36R), a signaling pathway within the immune system that may play a role in many inflammatory diseases. Proof of concept was

demonstrated

in a phase I study in patients with generalized pustular psoriasis, an IL36-mediated skin disease.

Four clinical trials

are currently underway for both Crohn’s disease and ulcerative colitis.

Bridge Biotherapeutics

is evaluating BBT-401, a GI-tract restricted small molecule inhibitor of Pellino-1. Pellino-1 is a ligase acting as a critical mediator for a variety of immune receptor signaling pathways, including Toll-like receptors, interleukin-1 receptor and T-cell receptors. BBT-401 was proved to be well-tolerated and safe in a

phase I study

in 80 healthy volunteers. In addition, the PK data demonstrated its key feature of no or minimal systemic exposure. A randomized, placebo-controlled, dose-escalation

phase II trial

is recruiting 48 patients with active ulcerative colitis.

Bristol-Myers Squibb

’s

BMS-986165 is an oral, selective tyrosine kinase 2 (TYK2) inhibitor. TYK2, an intracellular signaling kinase, mediates cytokine-driven immune and pro-inflammatory signaling pathways that are critical in the cycle of chronic inflammation central to immune-mediated diseases. A phase II trial in patients with psoriasis was

successfully completed

in 2018. Two

phase II trials

are currently underway, one each in Crohn’s disease and ulcerative colitis.

Eli Lilly

is progressing with m

irikizumab

(

LY 3074828

),

a humanized IgG4 monoclonal antibody that binds and inhibits the p19 subunit of interleukin 23. Positive results have been reported from the

phase II SERENITY trial

in patients with Crohn’s disease and from a

phase II trial

for ulcerative colitis. Both trials showed that patients treated with mirikizumab achieved significantly greater rates of clinical and endoscopic remission at 12 weeks compared to placebo. Lilly is currently

conducting six clinical trials

in phase II and phase III, for both Crohn’s disease and ulcerative colitis.

Gilead

, in global collaboration with

Galapagos NV

,

is studying filgotinib, a highly selective JAK1 inhibitor. Results from a phase II study,

FITZROY

, were

published

in

The Lancet

in December of 2017. The study examined the efficacy and safety of filgotinib for the treatment of active moderate-to-severe Crohn’s disease. Data showed filgotinib induced clinical remission in significantly more patients compared with placebo and had an acceptable safety profile. There are currently

seven active phase II and III trials

underway, including

MANTA

,

DIVERSITY

,

DIVERGENCE2

and

SELECTION 1

.

Immunic Therapeutics

is developing IMU-838, an oral tablet formulation of a small molecule drug (vidofludimus calcium), which inhibits dihydroorotate dehydrogenase (DHODH). Immunic

completed two phase I studies

in 2017, which evaluated single or repeated once-daily doses of IMU-838 in healthy volunteers. Results supported the tolerability of repeated daily dosing of up to 50 mg of IMU-838. A phase II trial,

CALDOSE 1

, is underway for ulcerative colitis.

Incyte

is evaluating itacitinib, an orally administered small molecule Janus kinase 1 (JAK1) inhibitor. A double-blind, dose-ranging, placebo-controlled

phase II trial

is currently recruiting patients with moderate to severe ulcerative colitis.

Landos Biopharma

’

s

lead program is BT-11, an orally active, locally acting small molecule therapeutic that binds to LANCL2. In

preclinical

studies, it was shown to exert potent anti-inflammatory effects and was safe and well-tolerated with no dose-limiting toxicities in a

phase I study

. A

phase II trial

began in August of 2019 in patients with mild to moderate ulcerative colitis and is underway in Europe and the U.S. A second

phase II study

is anticipated to begin shortly in patients with moderate to severe Crohn’s disease, also in Europe and the United States.

Reistone Biopharma

is developing SHR-0302, an orally administered selective JAK1 inhibitor. Two trials are underway: a

phase II trial

evaluating SHR0302 compared to placebo in patients with moderate to severe active ulcerative colitis and a

phase II trial

evaluating SHR-0302 in patients with moderate to severe active Crohn’s Disease.

Seres Therapeutics

is advancing with SER-287 is an oral capsule developed using Seres’ proprietary microbiome therapeutics platform. It is biologically-sourced and contains a consortium of live and diverse bacterial spores. SER-287 was designed to reduce the triggers of immune activation rather than suppress the immune system.

Results

from a phase Ib trial in patients with ulcerative colitis showed SER-287 microbiome treatment resulted in a dose-dependent benefit in clinical remission rates, and an improvement in endoscopic scores. A phase II trial,

ECO-RESET

, is currently recruiting 200 adults, age 18-80, with active mild-to-moderate ulcerative colitis.

Sublimity Therapeutics

has developed an oral formulation of cyclosporine, referred to as ST-0529, using Sublimity’s proprietary SmPill® delivery system. Unlike conventional oral or intravenous cyclosporine, SmPill technology enables precise delivery of cyclosporine directly into diseased tissue in the colon, thus minimizing systemic exposure and unwanted side effects. In a

phase IIa study

ST-0529 was safe, well-tolerated and showed a numerically higher difference in remission rates in patients with mild-to-moderate ulcerative colitis compared to placebo after only four weeks of treatment. A phase IIb study,

AURORA (CYC-202)

, is currently recruiting 280 subjects with moderately to severely active ulcerative colitis.

Theravance

and

Janssen Biotech

are collaborating on the development of TD-1473, an orally administered and intestinally restricted pan-Janus kinase (JAK) inhibitor.

Data

from a phase Ib trial demonstrated that four weeks of TD-1473 treatment produced signals of clinical, histologic, and biomarker activity in patients with moderately-to-severely active ulcerative colitis. A phase II trial,

DIONE

, is evaluating TD-1473 in subjects with moderately-to-severely active Crohn’s Disease with up to 42 weeks of treatment. A phase II/III trial,

RHEA,

is evaluating the efficacy and safety of induction and maintenance therapy with TD-1473 in subjects with moderately-to-severely active ulcerative colitis with up to 60 weeks of treatment.

Phase III

Arena Pharmaceuticals

is developing etrasimod, a next-generation, once-daily, oral, highly selective sphingosine 1-phosphate (S1P) receptor modulator designed for optimized pharmacology and engagement of S1P receptor 1, 4 and 5, which may lead to an improved efficacy and safety profile. The phase II

OASIS trial

met primary and all secondary endpoints with statistical significance for patients with ulcerative colitis receiving 2 mg dose of etrasimod for 12 weeks. Based on these results, Arena initiated the global phase III

ELEVATE UC

program, which consists of two worldwide clinical trials and an open-label extension study. In addition, planning is underway for a phase II/III trial in patients with Crohn’s disease.

Celgene

‘s

ozanimod targets the sphingosine-1-phosphate (S1P)-1 and -5 receptors.

Results

from phase II trials were reported in October of 2017. In the phase II STEPSTONE open-label study, ozanimod demonstrated meaningful clinical and endoscopic improvements in patients with moderately to severely active Crohn’s disease at week 12. In the phase II TOUCHSTONE open-label extension study, ozanimod continued to demonstrate clinically meaningful results in moderately to severely active ulcerative colitis across multiple measures of disease activity through week 92. Celgene currently has

nine active studies

underway for both forms of IBD.

EA Pharma

, a joint venture between Eisai Group’s gastrointestinal disease business and Ajinomoto Group, is evaluating AJM300 (carotegrast methyl) an orally-active small molecule that antagonizes the α4 integrin receptor. A

phase III trial

was initiated in June of 2018 to evaluate AJM300 in patients with active ulcerative colitis.

RedHill Biopharma

is evaluating RHB-104, a formulation of the generic antibiotics clarithromycin, rifabutin and clofazimine that is designed to treat Crohn’s disease by wiping out Mycobacterium avium paratuberculosis (MAP) infection. Some studies have linked infection with the bacterium to Crohn’s disease. In July of 2018, positive results were

reported

from the

MAP US study

, which evaluated RHB-104 for Crohn’s disease. The primary endpoint was successfully achieved, with superior remission rate at week 26 in patients treated with RHB-104 versus placebo.

Shire

, a

Takeda

company, has moved into phase III development with ontamalimab (SHP 647), a fully human IgG2 monoclonal antibody that targets mucosal addressin cell adhesion molecule (MADCAM1). Shire

licensed

the drug from Pfizer in 2016. Results from a phase II trial in patients with ulcerative colitis were

published

in the journal

The Lancet

in 2017 and demonstrated the treatment was safe and well-tolerated in this patient population, and better than placebo for induction of remission.

Seven phase III trials

are currently recruiting patients with both ulcerative colitis and Crohn’s disease.

Preclinical Candidates

The following is a sampling of companies that are preparing to develop and investigate drugs and other therapeutics in the preclinical laboratory setting. Data gathered from these preclinical trials will be used to determine whether the drug/therapy will move forward with clinical testing in humans.

Anatara Lifesciences’

lead human health product is referred to as

GaRP

(

Ga

strointestinal

R

e

P

rogramming). The GaRP product is a microbiome-targeted multi-component dietary supplement that has been designed to address the primary underlying factors associated with IBD and IBS. It is being positioned as an adjunct to existing therapies and not to replace existing prescription medications. Antara has completed the preclinical program, which provided strong scientific evidence that GaRP can combat the underlying causes of chronic bowel conditions, including inflammation and dysbiosis of the microbiome. Antara anticipates submitting regulator applications to move into clinical trials by the end of 2019.

Prometheus Biosciences

has

partnered

with

Takeda

to discover, develop, and commercialize targeted therapies for inflammatory bowel disease. The collaboration combines the proprietary bioinformatics discovery platform and companion diagnostic tools developed by Prometheus Biosciences with Takeda’s expertise in gastroenterology and drug development, in order to discover and advance up to three targeted IBD therapeutics and companion diagnostics.

Biomica

, a subsidiary of

Evogene

, recently

initiated preclinical studies

for BMC321 & BMC322. Developed as Live Bacterial Products (LBPs), BMC321 & BMC322 are rationally-designed LBP consortia comprised of unique microbes that harbor multiple functional capabilities with the potential to reduce gut mucosal inflammation. Rationally-designed consortia are multi-strain products designed to restore diversity and specific functionality to a microbial community with individually selected, cultured bacteria.

Outlook

Although significant progress has been made in the treatment of IBD, current options achieve remission in only a portion of patients affected. According to an article

published in the July 2016

edition of

Gastroenterology & Hepatology

, treatment with current biologic drugs leads to an approximate 20% to 35% remission rate, and approximately 45% to 60% of patients will achieve response or remission. Conversely, this means that 40% to 55% of patients have no response to therapy, and 65% to 80% of patients do not experience full remission. In addition, patients treated with biologic agents may experience a loss of sustained response to therapy over time, resulting in symptom flares. Many current treatments are also associated with infectious or malignant side-effects.

In addition to the continued development of small molecule inhibitors of RNA and intracellular cytokine pathways (i.e. antisense oligonucleotides and JAK inhibitors) and biologics (i.e. IL-12 and IL-23 inhibitors, monoclonal antibodies and S1P inhibitors), future treatments for IBD include modifying the gut microbiome, as well as identifying genomes involved in IBD to develop personalized treatments.

Altering the microbiome has emerged as a more sustainable approach to treating IBD than blocking effector immune responses. According to an article

published

in the journal

Crohn’s and Colitis

, clinical evidence has shown that enteric bacteria, viruses or fungi can induce chronic, immune-mediated intestinal inflammation in genetically susceptible hosts. This abnormal composition of gut bacteria is known as dysbiosis, and may be influenced by genetic and environmental factors, including diet. Therapeutic manipulation of intestinal bacteria can target selective alteration of beneficial species and/or detrimental species. This may involve antibiotics,

probiotics

,

prebiotics

, diet and combinations of all these approaches. Fecal microbiota transplant (FMT) can also be used to alter intestinal bacteria. Patients with active IBD appear to have reduced bacterial diversity within the intestinal lumen, which FMT is effective in improving. FMT involves the delivery of gut micro-organisms directly to the gastrointestinal tract during endoscopy, or orally via nasogastric or lyophilized capsules. FMT has been used for the management of IBD with some positive outcomes reported. In a

systematic review

, results from 17 articles involving 41 patients (27 with UC, 12 with CD, and 2 unclassified IBD) were summarized. Overall, 76% of patients reported cessation of medications and symptom reduction, and 62.5% reported disease remission.

Microba

, Australia’s leading biotech company in microbiome science and testing,

has identified

distinct differences in the gut microbiome of healthy individuals and those with IBD. Using deep learning artificial intelligence Microba can predict IBD in patients from microbiome data alone with 86% accuracy. In addition, researchers have identified 21 bacterial species commonly found in healthy individuals but not detected in those with Crohn’s, and 20 in those with Ulcerative Colitis. This data may eventually be used t0 develop personalized therapeutics and diagnostics.

Artizan Biosciences

is leveraging its proprietary IgA-SEQ™ technology platform to identify bacteria in the gut that predispose people to IBD. This research will be used to inform the development of potential therapies that neutralize or eliminate the pathogen(s) responsible. The company anticipates entering the clinical in approximately two years.

In addition, researchers from the

Wellcome Trust Sanger Institute

,

GSK

and

Biogen

, under the

Open Targets

initiative, have been

working to identify

how the differences in DNA between individuals, with and without immune disease are linked with the switching-on of a specific subtype of immune cells. Data from this study will help narrow down the search for the molecular pathways involved in immune diseases and could lead to finding drug targets for developing new treatments.

Current Outlook

With more information coming out regarding the role of genetics and the microbiome in IBD, the future is likely to place an emphasis on personalized, precision therapies. Identifying and applying biomarkers relevant to key areas in precision medicine in IBD will be a major focus for emerging players in the IBD industry.

“Currently, markers are demonstrating what we already know in that patient population,”

stated Dr. Hanauer

, professor of medicine at Northwestern University Feinberg School of Medicine, at the American College of Gastroenterology Annual Meeting 2018.

“We need to identify the self-phenotypic of individuals before they develop IBD but certainly at the time of diagnosis, which will improve categories of therapies and alternatives,” Hanauer said. “I anticipate more sequential or combination therapeutic approaches.”

This sentiment is echoed in the journal

Translational Pediatrics

. The authors of a paper titled

“Personalising medicine in inflammatory bowel disease—current and future perspectives”

, outline the benefit to a shift in the treatment paradigm for IBD. Rather than continuing the classical approach of treatment based on symptoms, results and complications, the paper discusses the potential of personalized therapy in IBD as a significant advance in management strategy.

The move to a pre-emptive strategy to prevent IBD-related complications, whilst simultaneously minimizing side effects and long-term toxicity from therapy has the potential to revolutionize care in this population.

临床2期临床1期上市批准临床结果临床3期

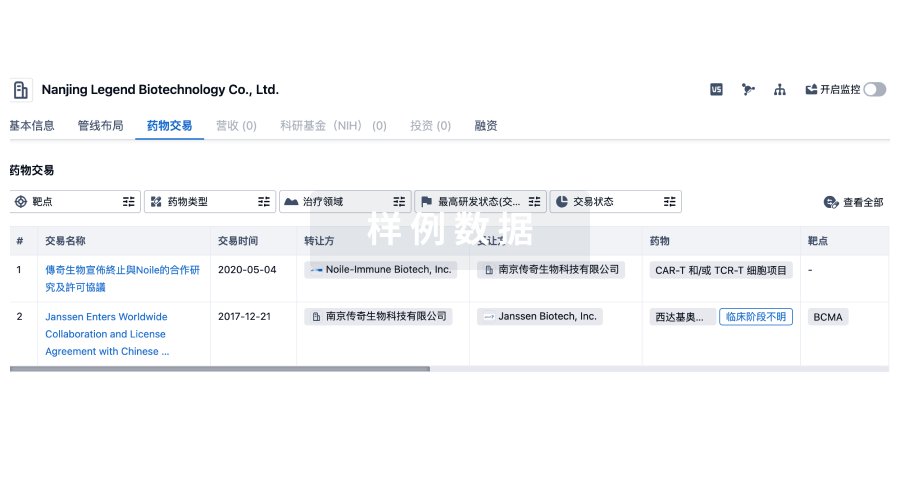

100 项与 Nutrition Science Partners Ltd. 相关的药物交易

登录后查看更多信息

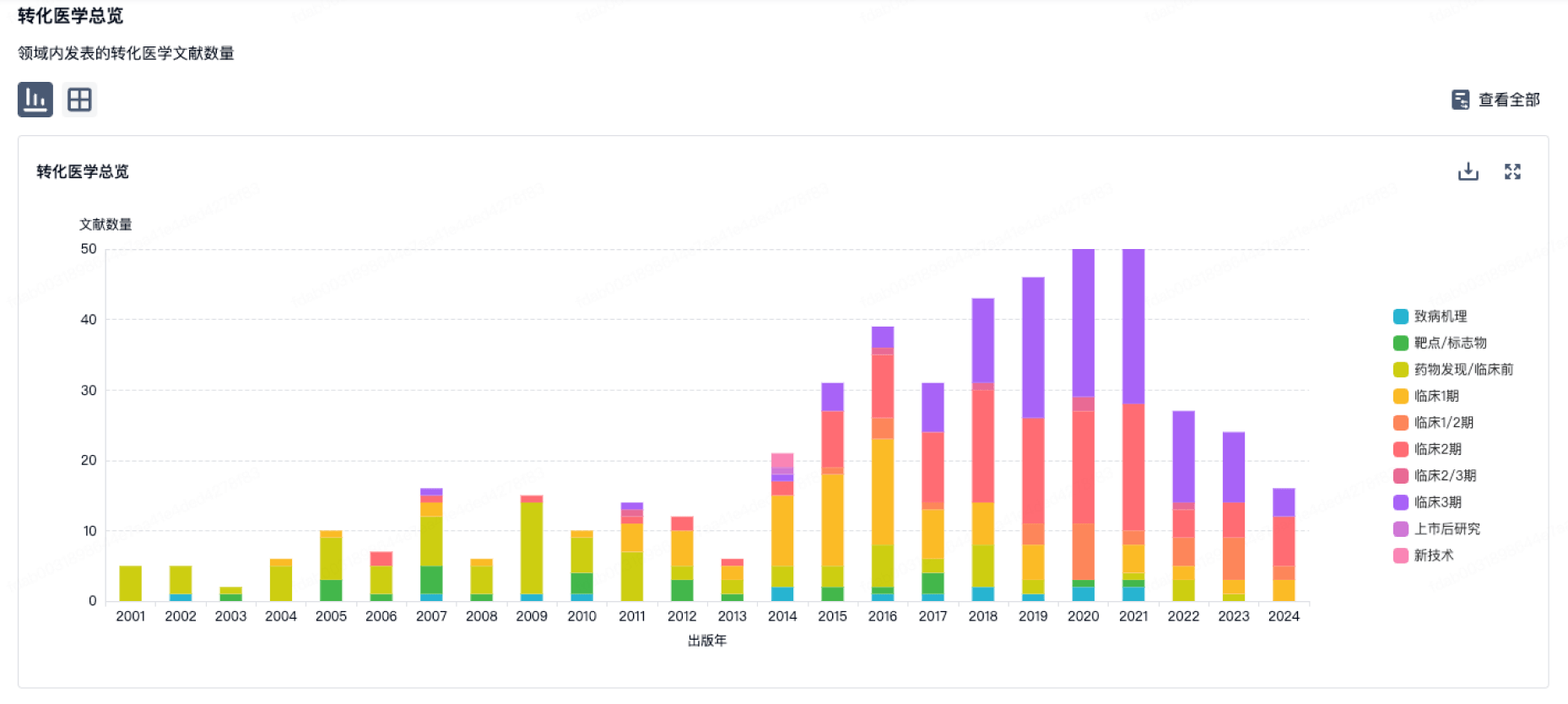

100 项与 Nutrition Science Partners Ltd. 相关的转化医学

登录后查看更多信息

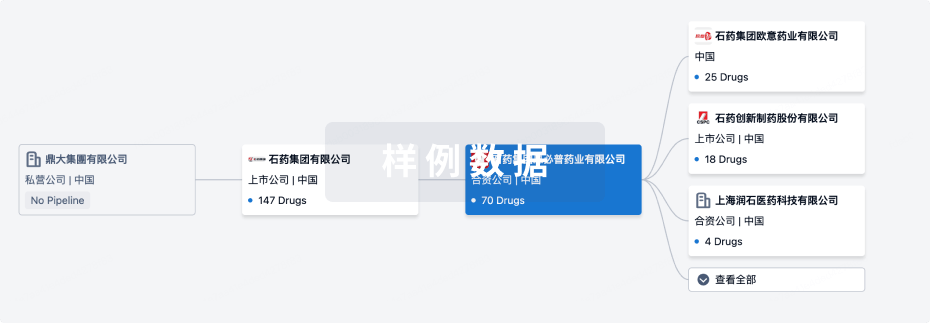

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年09月20日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

其他

3

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

HMPL-004(Hutchison MediPharma Ltd.) ( IL-1β x IL-6R x NF-κB x TNF-α ) | 溃疡性结肠炎 更多 | 终止 |

HMPL004-6599 | 溃疡性结肠炎 更多 | 终止 |

NSP-DC2 | 免疫系统疾病 更多 | 无进展 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

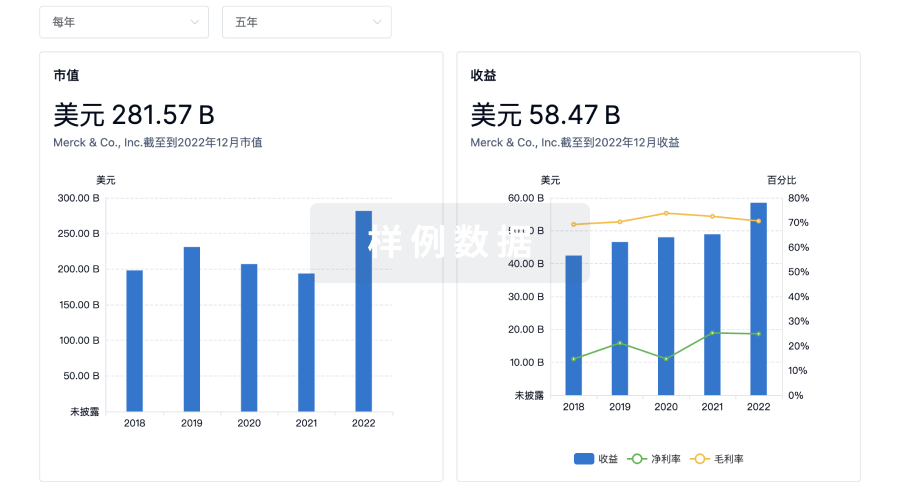

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

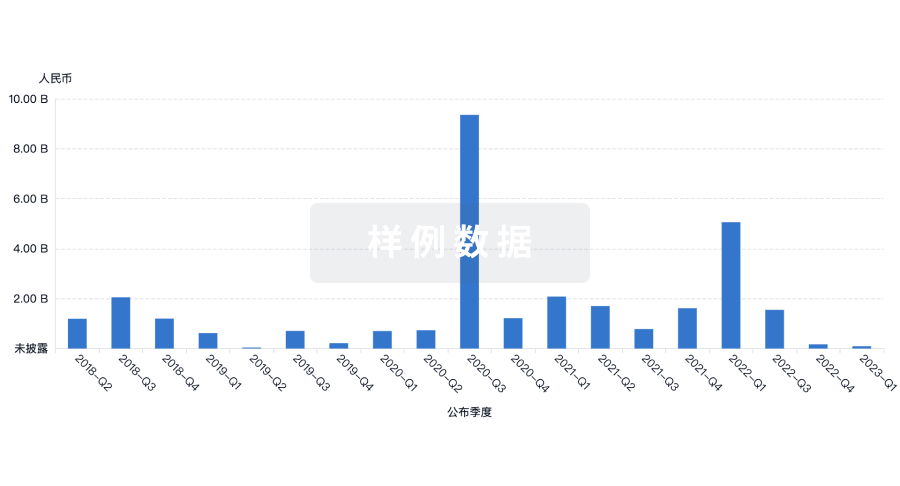

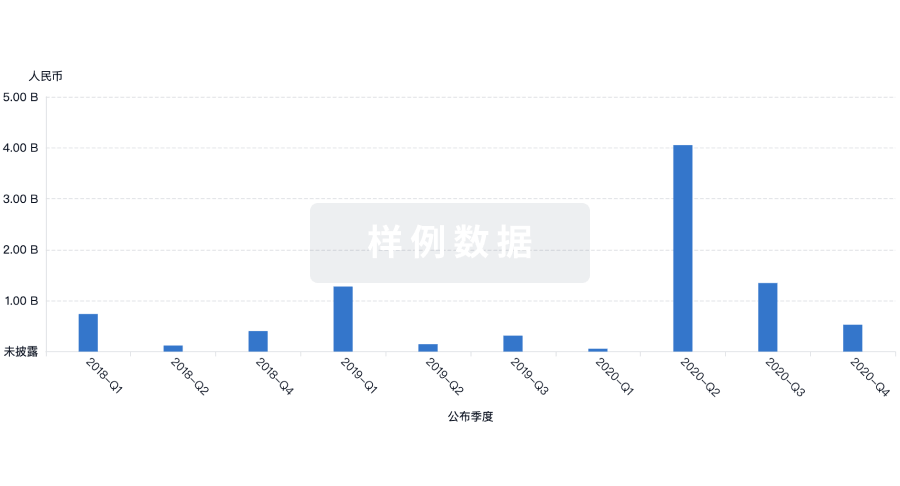

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用