预约演示

更新于:2025-09-09

Dimension Therapeutics, Inc.

更新于:2025-09-09

概览

关联

1

项与 Dimension Therapeutics, Inc. 相关的临床试验EUCTR2015-001486-67-BG

A Phase I/II Open-Label Safety and Dose-Finding Study of Adeno-Associated Virus (AAV) rh10-Mediated Gene Transfer of Human Factor IX in Adults With Moderate/Severe to Severe Hemophilia B

开始日期2016-04-12 |

申办/合作机构 |

100 项与 Dimension Therapeutics, Inc. 相关的临床结果

登录后查看更多信息

0 项与 Dimension Therapeutics, Inc. 相关的专利(医药)

登录后查看更多信息

2

项与 Dimension Therapeutics, Inc. 相关的文献(医药)2016-07-01·International journal of toxicology4区 · 医学

Workshop Proceedings

4区 · 医学

Article

作者: Andrews, Laura ; King, Sruthi ; Allamneni, Krishna P. ; Parker, Suezanne ; O’Neill, Charles A. ; Wright, Teresa L.

A workshop entitled “Streamlined Development of Safety Assessment Programs Supporting Orphan/Rare Diseases—Are We There Yet?” was held at the 36th Annual Meeting of the American College of Toxicology in Summerlin, Nevada. The workshop was sponsored by Shire and Ultragenyx and was designed to present the nonclinical considerations for the development of various products for rare diseases. A panel of experts from industry and government highlighted the nonclinical considerations in developing toxicology programs supporting rare disease therapeutics, challenges in preclinical safety assessment, reviewed the current guidance, and presented the progress that has been made to date. The main learning from the workshop was that nonclinical testing of therapeutics targeting rare disease warrants special considerations, and early collaboration between sponsors and health authorities may help optimize the scope and timing of the supportive studies. Specific examples for nonclinical development programs for enzyme replacement therapy (ERT) were presented. Although the symposium focused on ERTs, the concepts are broadly applicable.

2015-11-01·Regulatory toxicology and pharmacology : RTP4区 · 医学

Proof of concept for a banding scheme to support risk assessments related to multi-product biologics manufacturing

4区 · 医学

Article

作者: Wright, Teresa L ; Blackwell, James ; Fikree, Hana ; Card, Jeffrey W ; Felice, Brian ; Haighton, Lois A

A banding scheme theory has been proposed to assess the potency/toxicity of biologics and assist with decisions regarding the introduction of new biologic products into existing manufacturing facilities. The current work was conducted to provide a practical example of how this scheme could be applied. Information was identified for representatives from the following four proposed bands: Band A (lethal toxins); Band B (toxins and apoptosis signals); Band C (cytokines and growth factors); and Band D (antibodies, antibody fragments, scaffold molecules, and insulins). The potency/toxicity of the representative substances was confirmed as follows: Band A, low nanogram quantities exert lethal effects; Band B, repeated administration of microgram quantities is tolerated in humans; Band C, endogenous substances and recombinant versions administered to patients in low (interferons), intermediate (growth factors), and high (interleukins) microgram doses, often on a chronic basis; and Band D, endogenous substances present or produced in the body in milligram quantities per day (insulin, collagen) or protein therapeutics administered in milligram quantities per dose (mAbs). This work confirms that substances in Bands A, B, C, and D represent very high, high, medium, and low concern with regard to risk of cross-contamination in manufacturing facilities, thus supporting the proposed banding scheme.

70

项与 Dimension Therapeutics, Inc. 相关的新闻(医药)2025-09-04

Premji Invest led the series D round with support from a mix of new and existing investors.\n Enveda has closed its second $150 million financing round of the year. The series D round, which moves Enveda’s total funding beyond $500 million, positions the biotech to advance a crop of programs into the clinic behind its phase 1b eczema prospect.Colorado-based Enveda is built on the idea that molecules made by living organisms are an underused source of drug candidates. There is a long history of turning natural products into drugs, but the industry has largely moved away from the model. Enveda is betting that technology for organizing, analyzing and screening molecules can revitalize natural product drug discovery while shortening the path to the clinic.VCs have bought into the idea. Enveda raised a $130 million series C round late last year, securing cash for a phase 1 trial of eczema prospect ENV-294. Sanofi added to the round in February, bringing the total size of the series C up to $150 million.Enveda’s addition of a further $150 million to its coffers equips the biotech to move multiple programs into phase 1b and phase 2 trials. The biotech is already enrolling patients in a phase 1b trial of ENV-294, a small molecule with a novel, as-yet-undisclosed mechanism of action. Enveda is pitching ENV-294 as an asset that could pair the efficacy of JAK inhibitors with the safety of drugs that hit IL-4 and IL-13. The company is developing ENV-294 in eczema, also known as atopic dermatitis, and asthma. ENV-6946 and ENV-308 are scheduled to join Enveda’s clinical roster this year. ENV-6946 is a gut-preferred inhibitor of the NLRP3/TL1A+ pathway that the company sees as a treatment for inflammatory bowel disease. ENV-308 is a first-in-class, oral small molecule for the treatment of obesity.Another two drug candidates are at the IND-enabling stage and a bunch of other programs are back at the discovery or optimization steps. As it works out where to place its R&D bets, Enveda has added a person credited with moving more than 150 drug candidates into clinical trials to its board. That person is Mikael Dolsten, M.D., Ph.D., Pfizer’s former chief scientific officer.Premji Invest led the series D round with support from a mix of new and existing investors, namely Baillie Gifford, Kinnevik, Lingotto Investment Management, Peakline Partners, FPV, Socium Ventures, Dimension, Level Ventures, Henry Kravis, IA Ventures and Lux Capital.

临床1期蛋白降解靶向嵌合体临床2期

2025-09-04

A Colorado biotech has gone from a $50,000 “pre, pre-seed” check from its founding CEO to $517 million in funding and unicorn status in five years.

Enveda hit the $1 billion valuation milestone — a relative rarity for private biotech startups compared to the tech industry — after reeling in another $150 million on Thursday. The Series D comes less than a year after the drug developer’s equally-sized

Series C

, which included an extension from Sanofi.

The biotech, which has a total of 300 employees in Boulder and CEO Viswa Colluru’s home country of India, will use the money and existing funds to get at least a dozen clinical catalysts by the time the capital is expected to dry up “well into” 2028, Colluru told

Endpoints News

.

“There was enough happening around the table that I think we could justify both additional dilution at a good price, but also show the precise chips that we would accelerate on the path to our long-term vision,” he said.

The round came together in one month, according to the CEO. That’s in stark contrast to the fundraising struggles faced by many private biotechs in recent years.

Premji Invest, which has offices in the US and India, led the Series D. Other backers include Baillie Gifford, Kinnevik, Peakline Partners, Dimension and Lux Capital.

Meanwhile, Enveda added former Pfizer chief scientist Mikael Dolsten to its board.

Enveda mines the chemistry of plants from around the world and uses machine learning tools to drive its R&D engine.

“We’re able to take the world’s most successful chemical library and put it in a manner that is programmable and searchable back into the hands of human chemists,” Colluru said. “What you can do with the world’s most diverse library, you can do one of two things: You can discover completely new biology by doing phenotypic screening, or you can make better versions of existing drugs for known targets. We do primarily the former, with a small sprinkling of the latter to balance out the portfolio.”

With that plant chemistry database, the company has been able to quickly build a sprawling pipeline of about 16 treatment candidates, many of which are oral drugs or topical medicines.

Enveda is doing work in some of the splashiest therapeutic areas, including I&I, obesity and neurological conditions. It also has ambitions in chronic pain, tissue-scarring afflictions like idiopathic pulmonary fibrosis, and MASH.

The lead program, an oral candidate dubbed ENV-294, has been through Phase 1. In the “coming months,” it will enter Phase 2a studies for atopic dermatitis and asthma, Colluru said.

Enveda is also preparing to soon move its once-daily oral hormone mimetic for obesity and an oral NLRP3/TL1A+ pathway inhibitor for inflammatory diseases into human trials, Colluru said. Enveda anticipates each of the three drugs could hit $5 billion or more in peak annual sales, according to a presentation shared with Endpoints.

While many biopharmas are already racing to catch up to the obesity drug duopoly of Eli Lilly and Novo Nordisk, Enveda thinks it can provide a “long-term solution” to the market with a daily pill that cuts fat while preserving most muscle mass, addresses comorbidities, and has fewer side effects than the current GLP-1s, Colluru said.

Enveda won’t take all of its investigational medicines all the way to market.

“Enveda’s mission has always been to be around when our kids are talking about the medicines that they hope existed,” Colluru said. “The way to fuel that generational ambition is to have a platform that actually works and fuels a pipeline that is ambitious and multifaceted by design so that we can create the optionality where we sell an asset or two without selling the company.”

The company may consider offloading some of its drugs once it sees clinical data, Colluru said. An increasing number of biopharma companies, including Gilgamesh and Dren Bio, have also

sold off single assets

and retained the rest of their pipelines.

Enveda is also considering whether its molecules could apply commercially to sectors like animal health and agrochemicals, Colluru

told Endpoints in 2023

.

“We’re not publicly talking about some of those efforts yet, but over the next year or so, you’ll see that the potential extends beyond” therapeutics, Colluru said this week.

临床2期临床1期

2025-09-04

Against a backdrop of volatility in the US that has left many biotechs struggling to secure private funding this year, Enveda and its $150-million series D stands out — not only because the financing values the company at over $1 billion, but also because it's the Colorado-based firm's second megaround of the year. The oversubscribed round, led by Premji Invest, comes on the heels of Enveda's $150-million series C, which closed in February with a $20-million contribution from Sanofi. Bringing the biotech's total funding to $517 million, Thursday's raise also saw participation from new and existing investors including Baillie Gifford, Kinnevik, Lingotto Investment Management, Peakline Partners, FPV, Socium Ventures, Dimension, Level Ventures, Henry Kravis, IA Ventures and Lux Capital.The fresh capital will help advance Enveda's lead candidate, ENV-294, through a Phase Ib trial for atopic dermatitis, and launch a slew of additional clinical studies for its pipeline programmes across asthma, inflammatory bowel disease and obesity, among other diseases. Reading nature's blueprintSo what's inspiring investors to pour cash into Enveda — and has attracted Pfizer's former chief scientist, Mikael Dolsten, to its board? "Our foundational thesis and technology, centred on leveraging nature's chemistry for accelerated drug discovery, is proving highly fertile," Enveda founder and CEO Viswa Colluru told FirstWord. The company has built what it says is the world’s largest — and searchable — library of plant-derived molecules. Enveda first catalogued 38,000 plants linked to 12,000 human diseases and symptoms, then used that database to find more plants likely to contain therapeutically relevant molecules. By combining mass spectrometry with machine learning algorithms, it was able to catalogue all molecules in these plants."Nature is the most prolific chemist, having generated the largest and most biologically relevant chemical library known," Colluru said. "Many cornerstone medicines, from aspirin to metformin, trace their roots to this evolutionary intelligence. The challenge has always been that isolating and identifying individual natural compounds that have drug-like potential is slow, labor-intensive, and often unsuccessful."Instead of painstakingly isolating molecules one by one, Enveda's AI- and robotics-powered platform enables the rapid profiling of complex mixtures to predict their chemical structures, and then maps them to biological effects. "This allows us to access nature’s vast, untapped chemistry at unprecedented speed and scale," Colluru added.A major accelerant for Enveda is its AI platform, which he said "is a very different use of AI in drug discovery.""While most [AI] efforts focus on using biological datasets to discover new targets, our platform starts with the world’s most powerful chemical library. Once we observe interesting biological activity, we let evolution teach us the biology, just as aspirin taught us about inflammation rather than the other way around," Colluru said. "In other words, we bring together evolutionary intelligence and artificial intelligence — nature provides the blueprint, and AI gives us the tools to read it — to develop better medicines, faster."The pace of the company's R&D is certainly undeniable. Just five years after its seed financing, the company has moved its lead programme into proof-of-concept testing, when it typically takes biotechs more than seven years to bring their first new chemical entity into Phase I testing. Plus, Enveda has been working on its preclinical portfolio in parallel, which now boasts sixteen programmes, more than a dozen development candidates and four assets in IND-enabling studies.And with a fresh $150 million in-hand, Enveda is keeping its foot on the gas. "This raise allows us to double down on our progress to date over the next several years," Colluru said. "In the coming months, we anticipate significant progress with our lead asset for eczema as it advances further in clinical trials. Its novel mechanism is also being explored for other inflammatory diseases like asthma. Additionally, we expect to move two other first-in-class assets into clinical trials."

临床1期

100 项与 Dimension Therapeutics, Inc. 相关的药物交易

登录后查看更多信息

100 项与 Dimension Therapeutics, Inc. 相关的转化医学

登录后查看更多信息

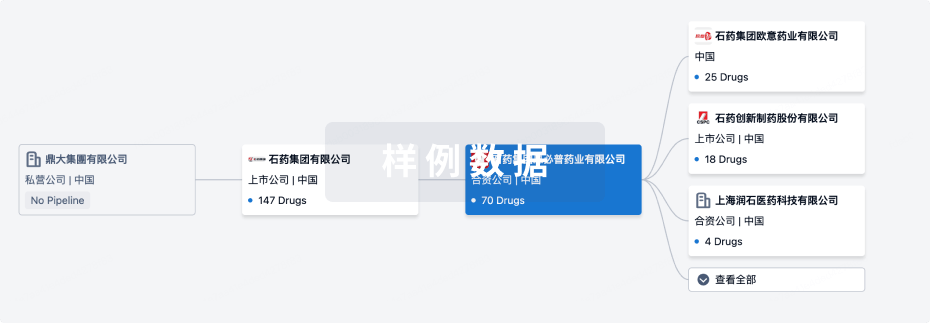

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年10月13日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

其他

2

登录后查看更多信息

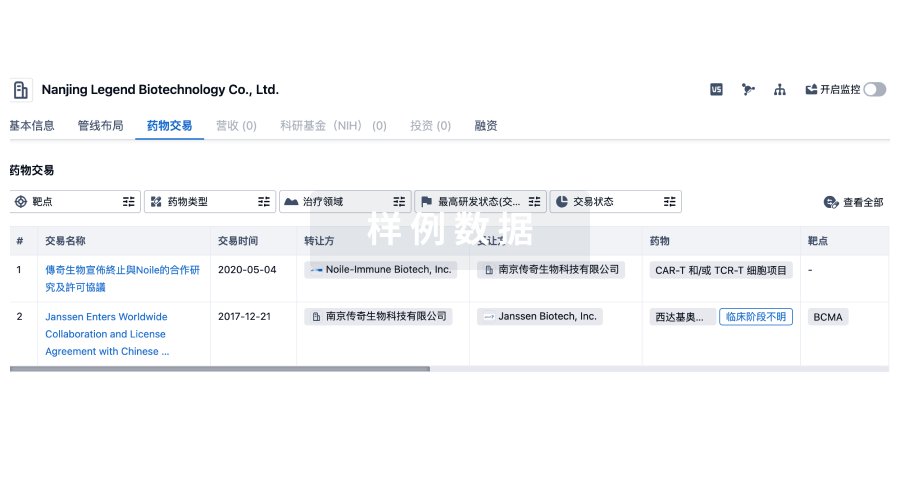

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

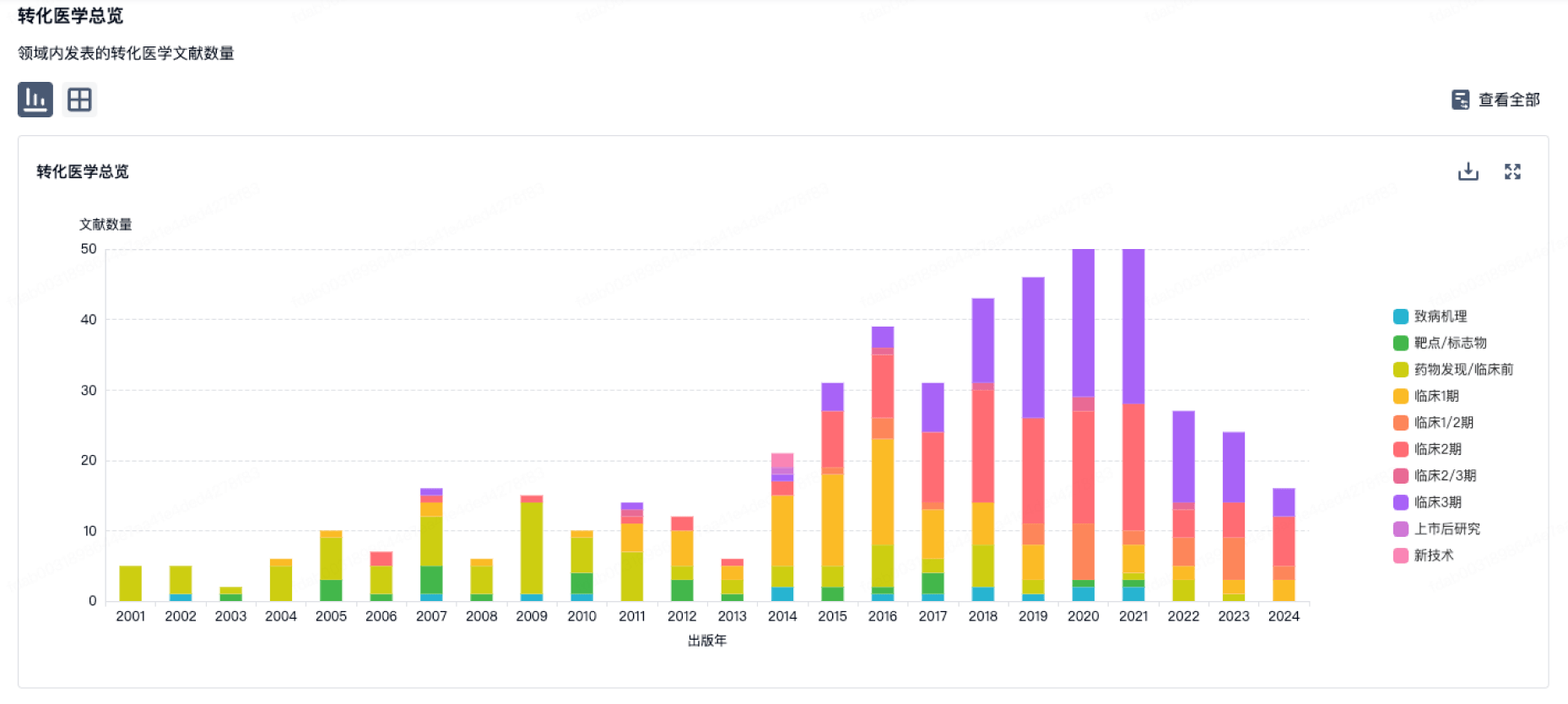

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

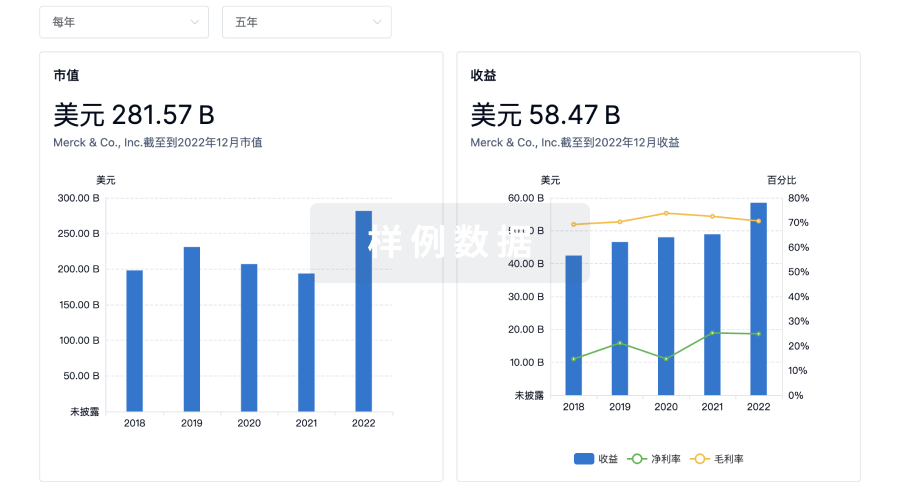

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

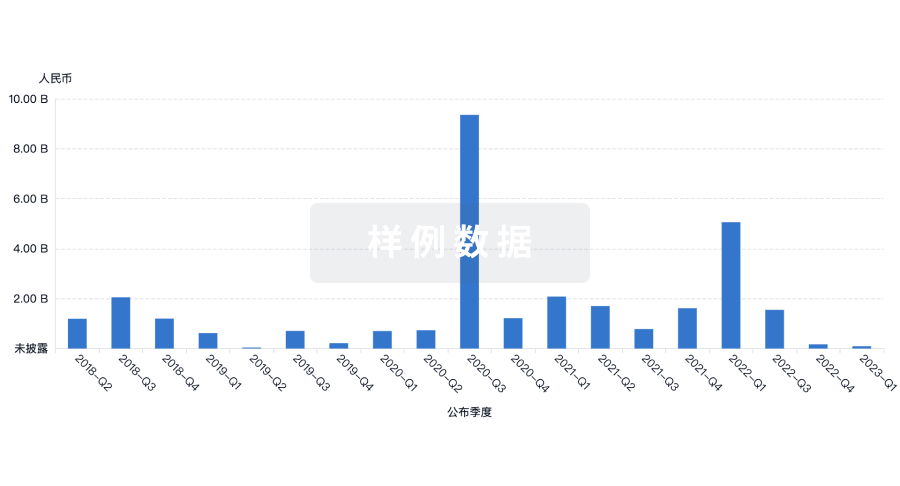

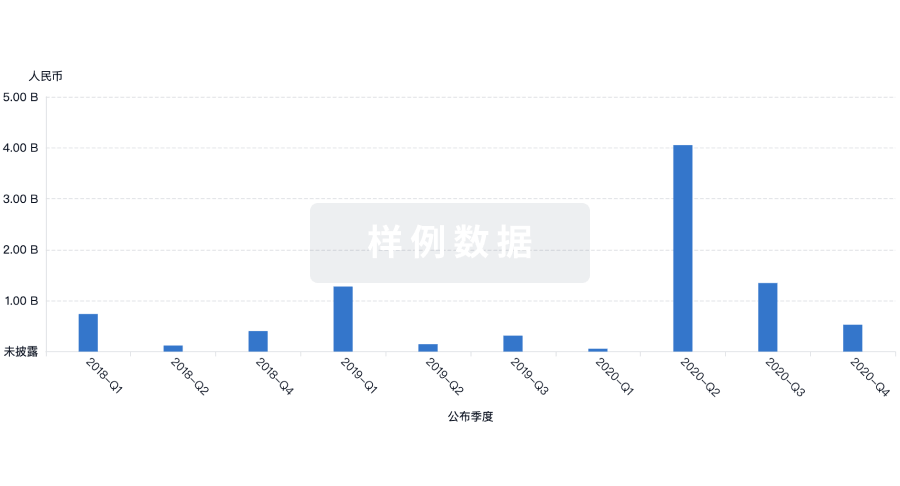

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用