预约演示

更新于:2024-11-01

Uniquity Bio

更新于:2024-11-01

概览

标签

免疫系统疾病

血液及淋巴系统疾病

消化系统疾病

小分子化药

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 小分子化药 | 1 |

| 排名前五的靶点 | 数量 |

|---|---|

| TSLP(胸腺基质淋巴细胞生成素) | 1 |

关联

1

项与 Uniquity Bio 相关的药物靶点 |

作用机制 TSLP抑制剂 |

在研机构 |

在研适应症 |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

2

项与 Uniquity Bio 相关的临床试验NCT06598462

A Phase 2, Randomized, Double-Blind, Multicenter, Placebo Controlled Study With an Open Label Extension to Investigate the Efficacy and Safety of NSI-8226 in Adults With Eosinophilic Esophagitis (ALAMERE)

Phase 2 study to evaluate the safety, tolerability, PK, immunogenicity, and pharmacodynamics of solrikitug in adult participants with Eosinophilic Esophagitis.

开始日期2024-10-31 |

申办/合作机构 |

NCT06640920

A Phase 1 Randomized, Double-Blind Study to Investigate the Safety, Tolerability, Pharmacokinetics, and Bioavailability of NSI-8226 in Healthy Participants

A Phase 1 Randomized, Double-Blind Study to Investigate the Safety, Tolerability, Pharmacokinetics, and Bioavailability of NSI-8226 in Healthy Participants.

开始日期2024-04-29 |

申办/合作机构 |

100 项与 Uniquity Bio 相关的临床结果

登录后查看更多信息

0 项与 Uniquity Bio 相关的专利(医药)

登录后查看更多信息

5

项与 Uniquity Bio 相关的新闻(医药)2024-10-11

Boston-area biotechs Upstream Bio and CAMP4 Therapeutics are headed to the Nasdaq on Friday, the latest companies to IPO in what appears to be a recovery for startups trying to raise capital on the public market.

Upstream Bio priced at $17 per share, the high end of the $15 to $17 range it

set earlier this week

. By selling 15 million shares — 2.5 million more than originally planned — it will raise

$255 million

in new cash.

CAMP4, meanwhile, priced its shares

$CAMP

at $11 apiece, $3 below the low end of the $14 to $16 range it marketed to investors. It sold 6.82 million shares versus an initial plan to offer 5 million and will raise

$75 million

.

The IPO window is “showing signs of recovery,” Oppenheimer bankers wrote in a quarterly

analysis

this week. GPCR biotech

Septerna

is also in the IPO queue, and Bain-backed obesity startup Rivus Pharmaceuticals is also considering a listing this fall,

Bloomberg

reported

this week.

For Upstream

$UPB

the offering will add to its coffers as it runs Phase 2 and later-stage trials of its TSLP receptor antagonist verekitug. The experimental treatment, licensed from Astellas, is being studied for

severe asthma

and

chronic rhinosinusitis with nasal polyps

.

Upstream hopes to enter a similar market as Amgen and AstraZeneca’s Tezspire, as well as Blackstone-backed

Uniquity Bio’s solrikitug

.

CAMP4 is working on regulatory RNA and has a

Phase 1

trial of its lead drug, a CPS1-targeting medicine for urea cycle disorders.

The IPO comes a few weeks after

CAMP4 added BioMarin

to its partnership lineup, which already includes Fulcrum Therapeutics and Eli Lilly. Earlier in its startup days, CAMP4 had pacts with Biogen and Alnylam.

临床1期IPO上市批准

2024-10-10

Dive Brief:Upstream Bio announced Thursday it priced its initial public offering, raising $255 millionto fund development of an antibody drug its testing against several respiratory diseases.The Waltham, Massachusetts-based biotechnology company sold 15 millionshares at $17apiece,exceedingthe projections it set earlier this week. Shares will begin trading on the Nasdaq stock exchange on Friday morning under the ticker symbol UPB.The offering was one of two to price on Thursday, along with a $75 million stock issuance from RNA drug developer Camp4 Therapeutics.Data compiled by BioPharma Diveshow that there have now been seven biotech IPOs since mid-September, the biggest flurry of activity since the start of the year.Dive Insight:Upstreams IPO is another indication of investor enthusiasm for immune drug research.This year, six companies focused on immunology have priced IPOs, the most of any therapeutic area outside of oncology. Thats the highest total since 2021, and even then, only seven of the record 104 companies that went public were focused on anti-inflammatory drugs, according to BioPharma Dive data.Upstream is also the latest company with a drug in advanced clinical testing to experience IPO success. A majority of the 22 IPOs in 2024 and eight of the largest 10 offerings have involved companies with drugs in Phase 2 testing or later. Theyre part of what investment bank William Blair described in a recent report as a flight to quality in the IPO markets, where investors are favoring companies with proof-of-concept data in hand and a study readout expected within the next year.Upstream already has that type of data. It also anticipates reporting Phase 2 results in a type of chronic rhinosinusitis in the second half of 2025, and following with a readout from a mid-stage study in asthma the following year, according to its IPO filing.The drug involved in those trials, verekitug, targets a protein called TSLP that drives inflammatory responses to triggers such as allergens. It was originally owned by Astellas Pharma, which advanced the drug through early-stage testing but stopped work following a strategic review. Upstream used some of a $200 million Series A round to acquire verekitug in an auction in Oct. 2021, and has made the drug its focus ever since.In pinning its future on verekitug, Upstream is working on an already-proven and increasingly popular target. Amgen and AstraZenecas Tezpire, which also aims at TSLP, was approved for asthma in 2021. Since then, startups like Uniquity Bio, Aiolos Bio and Proteologix have advanced would-be competitors. Aiolos and Proteologix have also been acquired by larger drugmakers.Upstreams drug works slightly differently than Tezpire, binding to the TSLP receptor and not a related ligand. In its IPO filing, the company claimed verekitug could be more potent and require less frequent dosing than Tezpire, which is given every four weeks. Upstream is currently testing dosing intervals of 12 and 24 weeks in its Phase 2 trials.Prior to its IPO, Upstream raised a total of about $400 million in private financing from investors such as Enavate Sciences, Venrock Capital and Bain Capital Life Sciences. OrbiMed, its largest shareholder, owns a 13% stake, according to the IPO filing.The offering comes during a particularly active week for IPOs across the economy. According to IPO research firm Renaissance Capital, ten companies were expected to price offerings by Friday. There have already been a total of 111 IPOs in the U.S. so far in 2024, up 34% from last year, the firm said. '

IPO并购上市批准临床2期

2024-09-18

Just hours after the US Federal Reserve

announced the first interest rate cut in four years

, respiratory biotech Upstream Bio revealed plans for a public listing.

The Boston-area biotech unveiled its investor prospectus on Wednesday afternoon, saying it plans to trade on the Nasdaq under the ticker

$UPB

. The biotech is developing a drug called verekitug, a TSLP receptor antagonist, for severe asthma and a form of chronic rhinosinusitis, with plans to go after the large market of chronic obstructive pulmonary disease (COPD).

After a chilly few months in the market, signs of life are emerging with biotech IPOs — and are likely to be helped by falling interest rates. Three companies

listed last week

, and this week the obesity startup BioAge said it plans to raise about $120 million in an upcoming IPO.

William Blair healthcare banker Kevin Eisele told

Endpoints News

this week that he doesn’t expect “a mad rush out of the gates before year-end, but I do think we’ll see some sustained IPO activity until the new year and likely more in 2025.”

The startup’s TSLP target has competition. Amgen and AstraZeneca sell the asthma drug Tezspire, although Upstream said its treatment candidate targets the receptor, a different method than the approved medicine. And Blackstone is betting up to $300 million on a company called Uniquity Bio, which is taking forward a former Merck atopic dermatitis asset, also targeting TSLP, that the company is repositioning for asthma and COPD.

Upstream had $235 million in cash, equivalents and short-term investments at the end of June, according to its SEC filing. It disclosed a $200 million Series B in June 2023, about 12 months after disclosing its first $200 million round.

It spent $25.7 million on R&D in the first half of this year, about double the $12.4 million it spent developing its drug in the same period last year.

Upstream’s biggest shareholder is OrbiMed, which owns about 13%. Other investors with 5% or more are: AI Upstream, Altshuler Shaham Provident Funds and Pension, Decheng Capital, TCG Crossover, HBM Healthcare, Maruho Deutschland, Enavate Sciences, Samsara BioCapital, Omega, Bain Capital Life Sciences and Venrock.

IPO

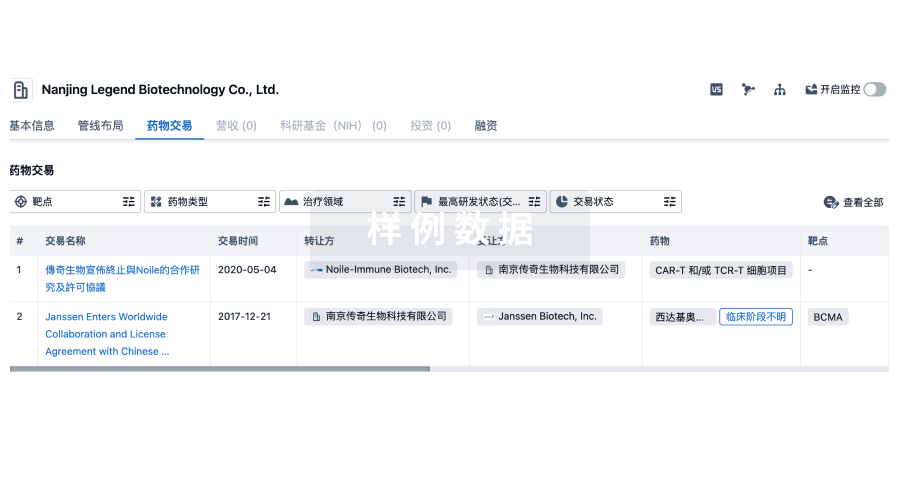

100 项与 Uniquity Bio 相关的药物交易

登录后查看更多信息

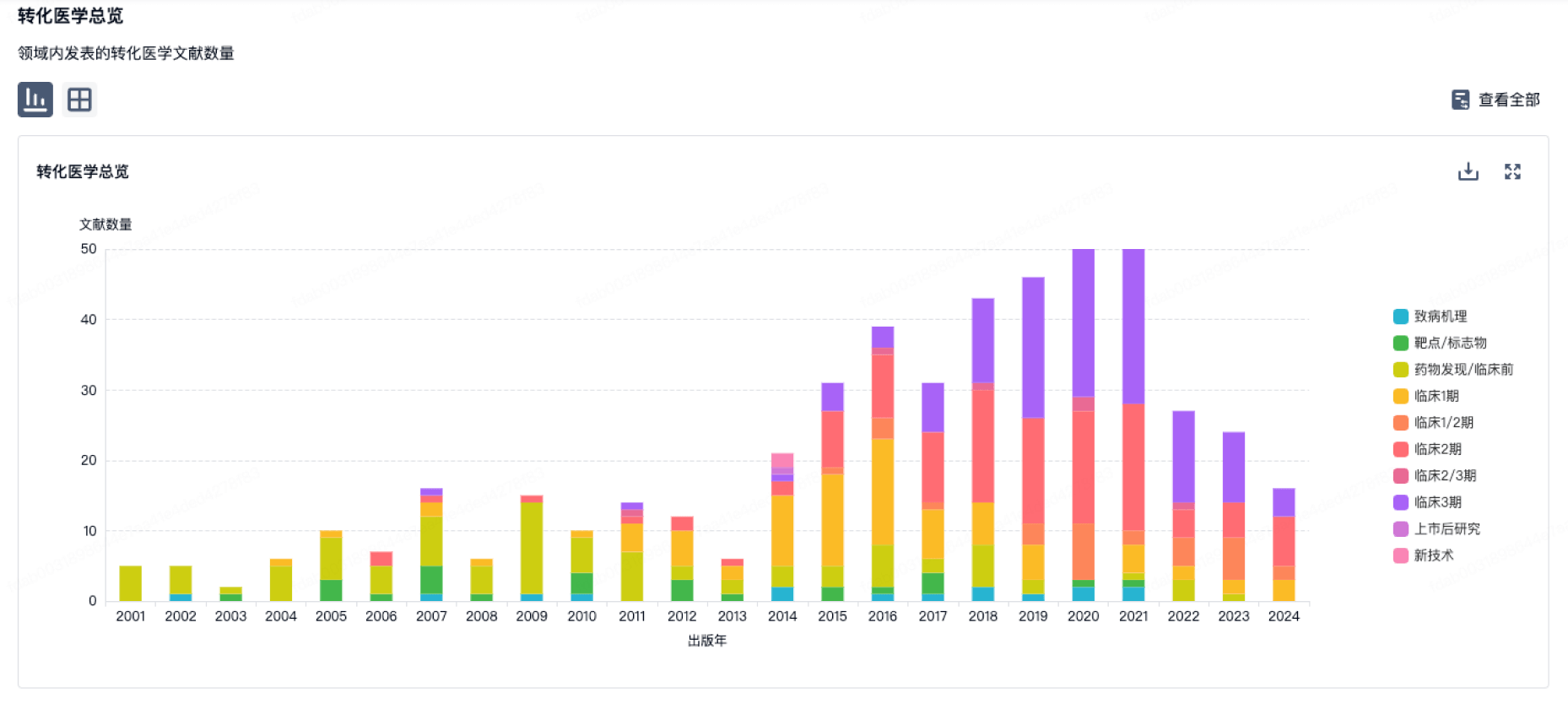

100 项与 Uniquity Bio 相关的转化医学

登录后查看更多信息

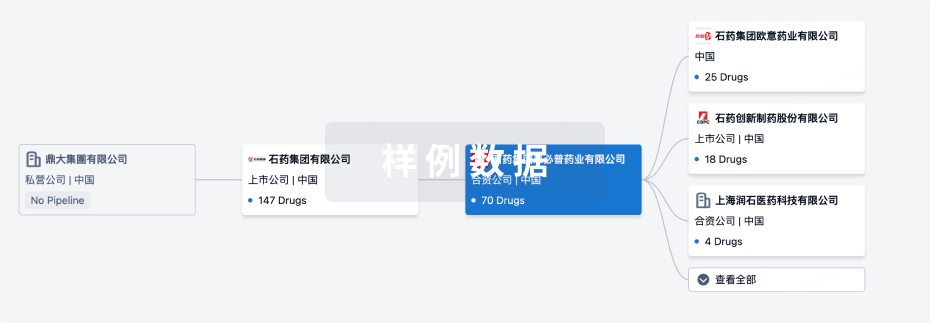

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年06月16日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床2期

1

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

Solrikitug ( TSLP ) | 嗜酸粒细胞性食管炎 更多 | 临床2期 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

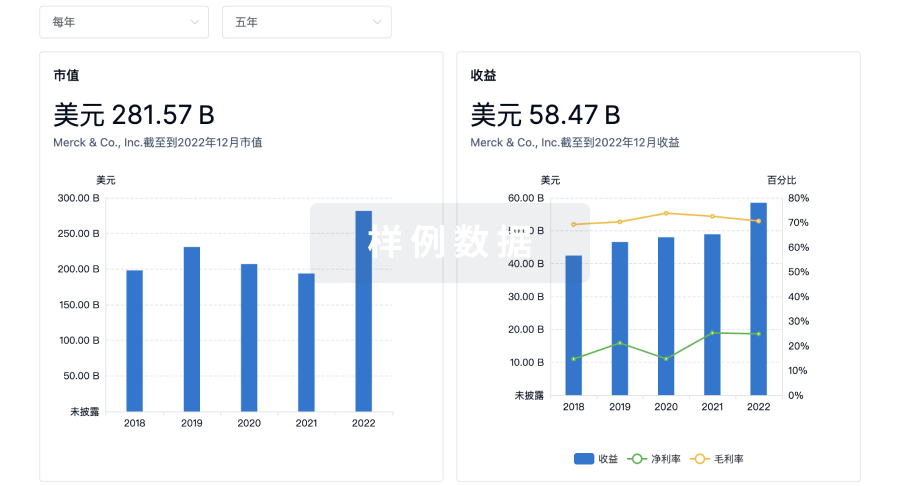

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

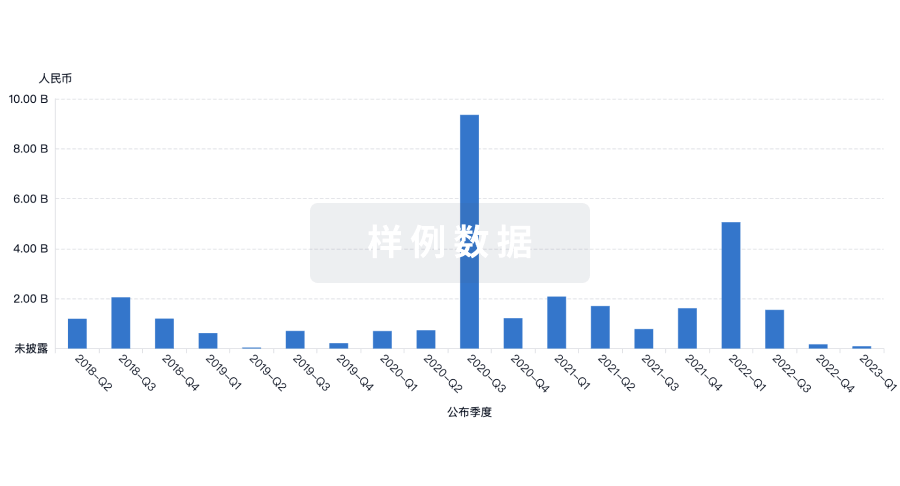

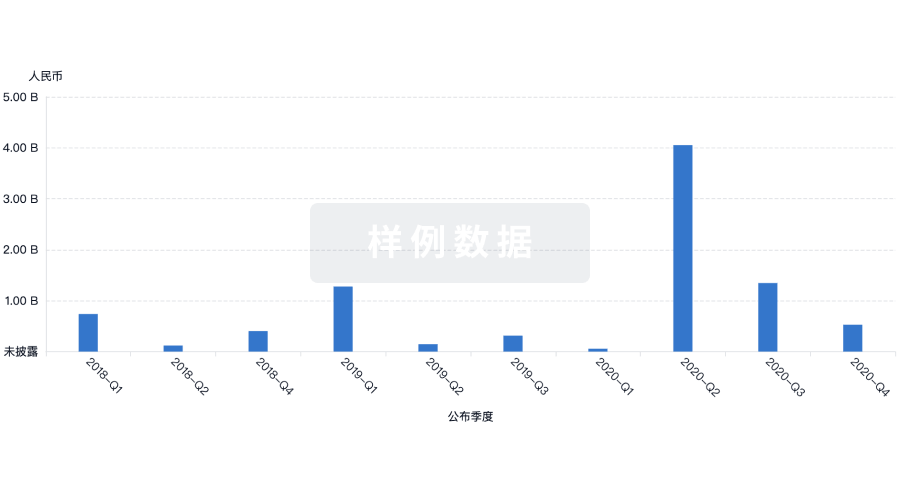

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用