预约演示

更新于:2025-09-09

Immunocore Ltd.

更新于:2025-09-09

概览

标签

肿瘤

皮肤和肌肉骨骼疾病

其他疾病

TCR融合蛋白

双特异性T细胞结合器

TCR-T细胞疗法

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 融合蛋白 | 3 |

| 双特异性T细胞结合器 | 2 |

| TCR融合蛋白 | 2 |

| TCR-T细胞疗法 | 2 |

| 单克隆抗体 | 1 |

关联

10

项与 Immunocore Ltd. 相关的药物作用机制 CD3调节剂 [+1] |

在研机构 |

原研机构 |

最高研发阶段批准上市 |

首次获批国家/地区 美国 |

首次获批日期2022-01-25 |

作用机制 CD3刺激剂 [+2] |

在研机构 |

原研机构 |

非在研适应症- |

最高研发阶段临床3期 |

首次获批国家/地区- |

首次获批日期- |

作用机制 CD3抑制剂 [+3] |

在研机构 |

原研机构 |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

25

项与 Immunocore Ltd. 相关的临床试验NCT06070012

Phase II Open-label, Multi-center Study of Tebentafusp in HLA-A*0201 Positive Previously Untreated Metastatic Uveal Melanoma (mUM) With Integrated Circulating Tumor DNA (ctDNA) Biomarker (TARGET-tebe)

This is a phase II open-label, single-arm, multi-center study of tebentafusp in HLA- A*0201 positive previously untreated (1L) untreated metastatic uveal melanoma (mUM) with an integrated circulating tumor DNA (ctDNA) biomarker.

开始日期2025-03-10 |

申办/合作机构 |

NCT06627244

Phase 2, Single Arm Study of Tebentafusp and Radioembolization in the Treatment of Metastatic Uveal Melanoma

The purpose of this study is to determine the effects (good and bad) that Tebentafusp in combination with Yttrium-90 (Y-90) radioembolization has on patients with metastatic uveal melanoma that has spread to the liver.

开始日期2025-02-14 |

申办/合作机构  University of Miami University of Miami [+1] |

CTIS2023-509767-25-00

- IMC-P115C-1005

开始日期2024-11-12 |

申办/合作机构 |

100 项与 Immunocore Ltd. 相关的临床结果

登录后查看更多信息

0 项与 Immunocore Ltd. 相关的专利(医药)

登录后查看更多信息

35

项与 Immunocore Ltd. 相关的文献(医药)2025-06-01·EUROPEAN JOURNAL OF MASS SPECTROMETRY

Tandem mass spectrometry fragmentation patterns of sulfo-SDA cross-linked peptides

Article

作者: Powell, Thomas ; Creese, Andrew ; Ebner, Martin

Cross-linking mass spectrometry is rapidly becoming a choice method for determining a protein's higher-order structure as well as capturing inter-protein interactions. In particular, diazirene-based photo-activatable cross-linkers, such as sulfo-SDA have been shown to be effective at generating high-density cross-linking data. Previously, we have shown that this method may be used to study binding orientation between two non-covalently linked complexes; however, several unexpected ions were noted in the MS2 spectra. In this study, the tandem mass spectrometry fragmentation patterns of sulfo-SDA-initiated cross-linked peptides under higher-energy collision induced (HCD), collision induced (CID) and electron transfer with supplementary HCD (EThcD) dissociations are discussed. The analysis revealed substantial insights into localising cross-linking sites, which is essential for accurate determination of protein higher-order structural characteristics.

2025-05-01·JOURNAL OF BIOLOGICAL CHEMISTRY

Determining T-cell receptor binding orientation and Peptide-HLA interactions using cross-linking mass spectrometry

Article

作者: Powell, Thomas ; Ebner, Martin ; Mai, Nicole ; Shaikh, Saher Afshan ; Barnbrook, Keir ; Creese, Andrew J ; Karuppiah, Vijaykumar ; Pengelly, Robert ; Sharma, Amit ; Harper, Stephen

T cell receptors (TCRs) recognize specific peptides presented by human leukocyte antigens (HLAs) on the surface of antigen-presenting cells and are involved in fighting pathogens and cancer surveillance. Canonical docking orientation of TCRs to their target peptide-HLAs (pHLAs) is essential for T cell activation, with reverse binding TCRs lacking functionality. TCR binding geometry and molecular interaction footprint with pHLAs are typically obtained by determining the crystal structure. Here, we describe the use of a cross-linking tandem mass spectrometry (XL-MS/MS) method to decipher the binding orientation of several TCRs to their target pHLAs. Cross-linking sites were localized to specific residues and their molecular interactions showed differentiation between TCRs binding in canonical or reverse orientations. Structural prediction and crystal structure determination of two TCR-pHLA complexes validated these findings. The XL-MS/MS method described herein offers a faster and simpler approach for elucidating TCR-pHLA binding orientation and interactions.

2025-04-01·Journal for ImmunoTherapy of Cancer

LILRB2 blockade facilitates macrophage repolarization and enhances T cell-mediated antitumor immunity

Article

作者: Mulgrew, Kathy ; Wilkinson, Robert W ; Dovedi, Simon J ; Rees, D Gareth ; Irving, Lorraine ; Jones, Des C ; Sandercock, Alan M ; Bowyer, Georgina ; Cobbold, Mark ; Glover, Matthew S ; Bienkowska, Kamila ; Ahuja, Shreya ; Pryts, Stacy ; Dudley, Rebecca ; Arnaldez, Fernanda ; Varkey, Reena ; Hess, Sonja ; Songvilay, Saly ; Kayserian, Andrew ; Wolny, Marcin ; Blümli, Seraina ; Chatzopoulou, Elisavet I ; Kierny, Michael ; Rajan, Saravanan

Background:

Immune checkpoint inhibitors have revolutionized the treatment of solid tumors, enhancing clinical outcomes by releasing T cells from inhibitory effects of receptors like programmed cell death protein 1 (PD-1). Despite these advancements, achieving durable antitumor responses remains challenging, often due to additional immunosuppressive mechanisms within the tumor microenvironment (TME). Tumor-associated macrophages (TAMs) contribute significantly to the immunosuppressive TME and play a pivotal role in shaping T cell-mediated antitumor responses. Leukocyte immunoglobulin-like receptor subfamily B member 2 (LILRB2), expressed on myeloid cells, including TAMs, is an inhibitory receptor, which contributes to macrophage-mediated immunosuppression. In this study, we present AZD2796, a high-affinity anti-LILRB2 antibody designed to repolarize TAMs from an immunosuppressive to a proinflammatory phenotype.

Methods:

Anti-LILRB2 antibodies were identified using single-B-cell encapsulation Immune Replica technology. The ability of AZD2796 to enhance proinflammatory responses from macrophages treated with CD40 ligand or lipopolysaccharide was assessed using a macrophage stimulation assay. A tumor cell/macrophage/T cell co-culture assay was developed to evaluate the effect of AZD2796, as a single agent and in combination with an anti-PD-1 antibody, on the cytolytic activity of antigen-specific T cells. In vivo assessments were then carried out to determine the ability of AZD2796 to alter tumor growth rate in mice humanized with CD34 hematopoietic stem cells.

Results:

In preclinical assessments, AZD2796 skewed macrophage differentiation away from an immunosuppressive phenotype and enhanced the proinflammatory function of macrophages. AZD2796 significantly increased the anti-tumor response of T cells following PD-1 checkpoint blockade, while AZD2796 monotherapy reduced tumor growth in humanized mouse models.

Conclusions:

These findings support the potential of AZD2796 as an anti-cancer therapy, with the ability to synergize with T-cell-based therapeutics.

315

项与 Immunocore Ltd. 相关的新闻(医药)2025-08-25

作者:十七

前 言

丝氨酸/苏氨酸激酶IRAK4,参与的TLR/IL-1R信号通路极其复杂,涉及众多的上游受体和下游信号分子,在免疫信号传导和炎症反应中都有作用,其研究和药物开发过程中面临诸多挑战,但同时也展现出巨大的潜力和希望。

早期的IRAK4抑制剂开发主要集中在小分子激酶抑制剂上,但这些抑制剂往往存在选择性不高、药代动力学特性不佳等问题。此外,IRAK4在免疫系统中的重要性也意味着药物开发需要在抑制炎症反应和避免过度免疫抑制之间找到平衡。过度抑制IRAK4可能导致免疫功能受损,增加感染风险,因此药物的安全性和有效性的平衡是开发过程中的关键挑战。

但随着对IRAK4信号通路的深入理解以及不同药物类型开发如小分子和PROTACs药物等,给IRAK4研发带来希望。而且IRAK4适应症逐渐拓宽,包括化脓性汗腺炎(HS)、特应性皮炎(AD)、COPD、类风湿性关节炎、系统性红斑狼疮等自身免疫性疾病以及非霍奇金淋巴瘤(NHL)、弥漫大B细胞淋巴瘤(DLBCL)等肿瘤疾病,为患者提供新的治疗选择。

01

IRAK家族和信号通路

IRAK4属于IRAK家族(白细胞介素-1受体相关激酶家族),该家族还包括IRAK1、IRAK2和IRAK3(也称IRAK-M),IRAK家族成员均含有N端的死亡结构域(DD),用于蛋白间相互作用;中心的丝氨酸/苏氨酸激酶结构域(KD),用于磷酸化下游底物,除IRAK4外,其他成员还包含C末端结构域(图1)[1]。

图1. IRAK4家族结构

IRAK4是一种丝氨酸/苏氨酸激酶,主要参与Toll样受体(TLR)和白细胞介素-1受体(IL-1R)介导的信号通路,IRAK4接收来自上游TLRs和IL-1R的信号,在免疫应答中被招募形成Myddosome复合物,激活下游的NF-κB、JNK等信号通路,调控炎症因子的表达。此外,IRAK4还参与调节NADPH氧化酶活性和p38 MAPK信号转导(图2)[2]。

图2. IRAK4介导的信号通路

IRAK4的异常激活与多种疾病相关,如类风湿关节炎(RA)、系统性红斑狼疮(SLE)、特应性皮炎(AD)、慢性阻塞性肺病(COPD)、哮喘、银屑病等炎症性疾病。IRAK4在RA的发病机制中起重要作用。在滑膜液中,单核细胞/巨噬细胞上的TLR被内源性分子激活,诱导NF-κB分泌促炎因子,进而激活成纤维细胞样滑膜细胞(FLS)中的TLR-NF-κB信号通路,导致炎症和趋化因子的表达。

而且,IRAK4在多种肿瘤中也高表达,如血液系统恶性肿瘤(如弥漫性大B细胞淋巴瘤)和实体瘤(如结肠癌、乳腺癌、肺癌等),通过调控肿瘤微环境中的炎症反应,影响肿瘤的发展(图3)。

图3. IRAK4的发病机制

目前尚无IRAK4靶向药获批上市,但临床上有很多在研的靶向IRAK4药物,包括小分子和PROTAC药物等。

02

在研的IRAK4小分子药物

IRAK4靶向药最初的药物开发类型多为小分子抑制剂,它们通过竞争性结合IRAK4的ATP结合口袋,抑制其激酶活性。辉瑞的Zimlovisertib是全球首个进入临床试验的IRAK4抑制剂,但因无法改善特应性皮炎患者皮肤微环境的炎症反应,于2022年8月终止开发,拜耳的Zabedosertib也因在特应性皮炎的Ⅱ期临床中疗效未能显著优于现有疗法,于2024年5月终止研发。此外,还有多款临床研究阶段IRAK4小分子抑制剂长期无动态或被终止(图4)。

不过,IRAK4小分子抑制剂的研发一直在进行中,如吉利德的Edecesertib、Curis的Emavusertib、朗来科技的MY004567、阿斯利康的AZD6793和AZD2962等(图4)。

图4. 在研的IRAK4小分子药物

1. Edecesertib

Edecesertib(GS-5718)是一种强效、选择性的IRAK4抑制剂,具有良好的口服生物利用度和药代动力学特性。

近期,Ammann等人在JMC杂志上报道了Edecesertib的结构与临床前数据。Edecesertib的结构如图5a所示。Edecesertib显示出对人血浆的中等结合能力(游离分数为4.4%),并且在人全血细胞实验中具有良好的活性(EC₅₀ = 124 nM)。该化合物具有良好的渗透性,在pH 2时溶解性良好,在pH 7时溶解性中等,并且在AMES实验中呈阴性。在激酶结合实验中(图5b),Edecesertib(测试浓度为1000 nM)显示出高选择性,只有七个激酶靶点(IRAK1、CDK7、CLK1、CLK2、CLK4、LRRK2、TAK1)的活性低于对照组的20%。

Edecesertib的初步毒理学研究在大鼠和食蟹猴中进行。大鼠的研究持续了14天,剂量水平为5/25/300 mg/kg/天;而食蟹猴的研究持续了7天,剂量水平为50/100/200 mg/kg/天。在这两项研究中,直到测试的最高剂量水平,均未观察到与药物相关的不良反应。令人欣慰的是,与体外hERG信号缺失一致,在食蟹猴研究中未观察到QT间期的剂量依赖性变化,这表明心血管毒性风险较低(见图5c)[3]。

图5.Edecesertib的结构与临床前数据

在类似人类狼疮的NZB/W小鼠模型中,Edecesertib显著降低了小鼠血清中TNFα和IL-12/23p40的水平,提高了小鼠存活率,并显著降低了蛋白尿水平(图6)。

图6. Edecesertib在小鼠中疗效

目前,Edecesertib正在进行针对系统性红斑狼疮(SLE)和皮肤红斑狼疮(CLE)的II期临床试验(图7)。

图7. 吉利德炎症领域管线

2. Emavusertib

Emavusertib(CA-4948)是由Aurigene Discovery原研的一款IRAK4小分子抑制剂,Curis通过与Aurigene的合作获得了Emavusertib的独家开发权。Curis目前负责Emavusertib的临床开发和商业化推进,主要用于治疗血液系统恶性肿瘤和某些实体瘤。

在一项I期临床试验(NCT03328078)中,Emavusertib单药治疗在多种非霍奇金淋巴瘤患者中显示出一定的疗效,其中28例可评估患者中有8例(29%)肿瘤负荷减少≥20%(图8)[4]。

图8. Emavusertib的临床试验结果

在一项I期临床试验(NCT04278768)中,Emavusertib单药治疗在49例患者中进行了评估,其中包括急性髓系白血病(AML)和骨髓增生异常综合征(MDS)患者。在5例可评估的携带剪接体突变的AML患者中,40%达到完全缓解(CR)或血液学完全缓解(CRh)。

在7例高危MDS患者中,57%达到骨髓CR。此外,在29例无SF3B1/U2AF1/FLT3突变的患者中,1例达到CR,2例达到PR(图9)。

图9. Emavusertib的临床试验结果

2024年美国血液学会(ASH)年会上,Winer 等人报道了Emavusertib(CA948)在复发/难治性急性髓性白血病患者中的初步安全性和疗效。

截至2024年7月10日,共有48例携带靶向突变(FLT3、U2AF1或SF3B1)且既往接受少于3线治疗的复发/难治性急性髓系白血病(R/R AML)患者接受了Emavusertib治疗。

在200 mg BID队列中,5例可评估反应的患者中有1例携带FLT3突变且既往接受过HMA、VEN和FLT3i治疗的患者达到了形态学白血病无白血病状态(MLFS)。在300 mg BID队列中,有9例患者为反应者。在17例可评估反应的携带FLT3突变的患者中,有7例产生了反应:4例完全缓解(CR),1例部分血液学恢复的完全缓解(CRh),2例MLFS,治疗持续时间范围为85天至24天。在25例可评估反应的携带SF突变的患者中,有5例产生了反应:2例CR,2例不完全和部分血液学恢复的完全缓解(CRi/CRh),1例MLFS。2例CRi和CR的患者随后接受了干细胞移植。在9例反应者中,8例在1个治疗周期后产生反应;6例既往接受过VEN治疗;8例既往接受过HMA治疗;7例产生反应的携带FLT3突变的患者中有3例既往接受过FLT3i治疗。

截至2024年7月10日,共有145例R/R AML(N=99)和高危骨髓增生异常综合征(hrMDS,N=46)患者接受了至少一次剂量的Emavusertib,剂量水平为200 mg至300 mg BID。治疗相关不良事件(TRAEs)≥3级在41例(28.3%)患者中报告,且大多数是可逆且可管理的[5]。

3. MY004567

MY004567是由上海美悦生物科技发展有限公司(朗来科技子公司)自主研发的1类新药,是一种IRAK4抑制剂,主要用于治疗自身免疫性疾病,如类风湿关节炎(RA)、银屑病和特应性皮炎等。

MY004567目前处于临床试验阶段,其研发进展顺利,多个适应症的临床试验正在进行中,包括MY004567片在中至重度活动性类风湿关节炎患者中的药代动力学研究、评估MY004567片单、多次给药在健康成年受试者中的安全性、耐受性和药代动力学特征的I期临床试验、MY004567片治疗中至重度活动性类风湿关节炎患者的II期临床试验、MY004567片在中至重度活动性类风湿关节炎患者中的药代动力学研究等(图10)。

图10. MY004567的临床试验方案

03

在研的IRAK4的PROTAC药物

IRAK4小分子药物开发并不顺利,如上所述,多款药物被终止或无进展,因为IRAK4与MyD88、IRAK1等蛋白相互作用形成Myddosome复合体,该复合体在TLR/IL-1R介导的信号传导中起核心作用。IRAK4在该复合体中既具有激酶功能,也具有支架功能,传统小分子抑制剂仅能阻断激酶活性,无法干扰支架功能,难以全面抑制炎症信号通路,不足以产生有效的治疗效果。

因此,很多药企纷纷开发IRAK4的PTOTAC药物,如KymeraTherapeutics的KT-474和KT-485、百济神州的BGB-45035、领泰生物的LT-002等。

1. KT-474和KT-485

KT-474是由KymeraTherapeutics研发的一种靶向IRAK4的PROTAC药物,通过泛素-蛋白酶体系统特异性地降解IRAK4蛋白,同时抑制其激酶活性和骨架功能。

2020年7月,Kymera Therapeutics与赛诺菲首次达成一项多项目战略合作协议,共同开发针对IRAK4靶点的“first-in-class”蛋白降解疗法,用于治疗免疫炎症疾病。根据协议,Kymera获得了1.5亿美元的前期付款,并有资格获得超过20亿美元的潜在里程碑付款。

Kymera与赛诺菲合作的首个成果就是KT-474,已推进至II期临床阶段,用于治疗化脓性汗腺炎(HS)和特应性皮炎(AD)。在临床前研究中,KT-474显示出强大的IRAK4降解能力,能够显著抑制多种炎症细胞因子的产生。

在健康志愿者(HVs)中,KT-474显示出剂量依赖性的血浆暴露增加,稳态血浆浓度在第7天达到,第14天的暴露量比第1天增加了3-4倍。皮肤中的药物浓度显著高于血浆,且在停药2周后仍可检测到。

在化脓性汗腺炎(HS)患者中,KT-474治疗28天后,IRAK4在皮肤病变中的降解率超过50%,且与健康志愿者的水平相当,在特应性皮炎(AD)患者中,KT-474治疗28天后,IRAK4在皮肤病变中的降解率超过50%,且与健康志愿者的水平相当(图12)

图12. KT-474的临床前和临床数据

然而,赛诺菲在2025年6月决定不再推进KT-474的开发,而是优先推进下一代口服IRAK4降解剂KT-485进入临床测试。KT-485在临床前测试中展示了更高的选择性和效力,并且具有良好的安全性。Kymera Therapeutics因此获得了2000万美元的临床前开发里程碑付款,并且未来有资格基于潜在临床开发、注册和商业化里程碑获得9.75亿美元的额外付款(图13)[6,7]。

图13. 赛诺菲选择KT-485代替KT-474

2. BGB-45035

BGB-45035是百济神州基于自有CDAC平台上研发的第二款靶向降解剂,靶向IRAK4,用于治疗各类自身免疫性疾病。据报道,该药物具有潜力诱导更深、更快的IRAK4降解,并且细胞因子抑制作用更强。

2024年8月14日,据CDE官网显示,百济神州的BGB-45035片获得临床试验默示许可,适应症为中重度特应性皮炎。

2025年JPM会议上,百济神州提及BGB-45035为处于1期临床阶段的“高潜力”早期研发管线之一。百济神州认为BGB-45035将在自身免疫性疾病的治疗中发挥重要作用(图14)。

图14. 2025年JPM会议上百济神州管线

目前,BGB-45035已在一期临床试验中显示出显著的IRAK4降解特性,具有60-96小时的长半衰期。百济计划于2025年进行BGB-45035的2期临床试验,预计于2025年下半年获得组织IRAK4降解的概念验证数据(图15)。

图15. 2025年下半年BGB-45035重大进展

3. LT-002

LT-002是由领泰生物基于其现有的靶向蛋白降解(Targeted Protein Degradation, TPD)新药研发平台Nano-SPUD®筛选得到的一款靶向IRAK4的PROTAC药物,是继Kymera的KT-474之后国内首创、全球第二的IRAK4靶向蛋白降解剂,主要用于治疗自身免疫性疾病,如化脓性汗腺炎和特异性皮炎等,已在临床前动物模型中显示出优越的改善皮肤炎症症状的疗效以及良好的安全性。

2024年6月25日,领泰宣布完成LT-002的1期临床试验的首例健康志愿者给药,该项试验覆盖全部120多例健康志愿者,通过单次剂量递增(SAD)和多次剂量递增(MAD)给药,旨在评价其在健康成年人中的的安全性、耐受性和药代动力学特征。

根据目前的未揭盲数据显示,LT-002在全部健康志愿者中表现出良好的安全性和耐受性;同时,该药物在靶组织皮肤中的蓄积量较高,对于外周血单核细胞(PBMC)及皮肤中的IRAK4蛋白均具有显著的降解作用,分别能够达到99%和90%以上,并且呈现出明显的剂量依赖性;此外,LT-002还显著抑制了多个促炎细胞因子的释放,显示出其在抗炎方面的巨大潜力[8]。

2025年6月12日和7月9日,领泰相继宣布LT-002用于治疗特应性皮炎(AD)和化脓性汗腺炎(HS)的 IC 期临床试验已完成首例患者首次给药,该项目在临床开发中又一重要进展,标志着其多个适应症研究正式进入患者临床试验阶段。

小 结

IRAK4是一个药物研发热门靶点,小分子和PROTAC药物的研发层出不穷,尽管它们的开发都受到一些挫折,但新的方案和更优的药物仍在积极开发中。

欢迎大家加入BioPlus微信交流群,共同探讨。

BioPlus

微信交流群申请

入群申请联系人 :Lisa

邮箱:lisa.li@bp-bioplus.com

电话:18662346610(同微信)

入群申请,请先添加Lisa微信,并分享名片

入群画像 :Biotech/药厂研发/BD、投资机构、临床医生等

入群福利:不定时行业资料包分享

参考文献

1. Yifan Feng, Chengjuan Chen, Anqi Shao, Lei Wu, Haiyu Hu, Tiantai Zhang, Emerging interleukin-1 receptor-associated kinase 4 (IRAK4) inhibitors or degraders as therapeutic agents for autoimmune diseases and cancer, Acta Pharmaceutica Sinica B 2024;14(12):5091e5105

2. Kymera: KT-474 HS and AD Clinical Data and Oncology Pipeline Update

3. Stephen E.Ammann, et.al, Discovery of Edecesertib(GS-5718): A Potent, Selective Inhibitor of IRAK4, J.Med.Chem.2025,68,10619−10630

4. Ricardo D. Parrondo et.al, IRAK-4 inhibition: emavusertib for the treatment of lymphoid and myeloid malignancies, Front. Immunol. 14:1239082.

5. Eric S. Winer et.al, Preliminary Safety, Efcacy , and Molecular Characterization of Emavusertib (CA948) in Relapsed/Refractory Acute Myeloid Leukemia Patients, Blood 144 (2024)737-739

6. Kymera snags Gilead as new partner, while Sanofi opts for next-gen IRAK4 degrader

7. Kymera: Revolutionizing Immunology with Oral Medicines June 2025

8. 领泰生物:Last HV Out!领泰生物宣布首个管线IRAK4降解剂的I期临床试验完成全部健康志愿者给药

拓展阅读

BioPlus-海外寻找资产系列:

1.AACR复盘:9家CDH17-ADC数据对比

2.自免小众靶点APRIL,正在悄悄火起来了!

3. STEAP1,会成为ADC与TCE的下一个爆款靶点么?

BioPlus国际大会跟踪系列:

1. 2025 ASCO:ADC、双抗/多抗,有哪些看点?(附一览表)

2. 2025 AACR 双抗与ADC有哪些看点?

3. 小细胞肺癌领域,下一步将如何“破局”,ADC or TCE?

4. ELCC 讨论:NSCLC的ADCs最新进展

5. 未来ADC发展方向:新靶点,新载荷,双靶点/双表位...

6. 2025 ASCO 重点项目临床数据:有哪些精彩看点?

7. 2025 ASCO 重点项目临床数据

BioPlus靶点/管线研究系列:

1. “待爆”:CDH17 ADC项目大比拼,谁将脱颖而出?

2. PD-1激动剂在自免疾病项目数据盘点:失败项目的“坑”与启示

3. 上临床就能卖?DLL3 ADC这么好卖?

4. 胰腺癌三大热门靶点:CLDN18.2、EGFR、RAS

5. TSLP/SCF双抗,下一个自免待爆靶点组合?

6. GPC3靶点临床屡败,TCE能改写格局么?

7. 亮相AACR,曾被临床终止的ADC靶点Ly6E,能否卷土重来?

8. 最高18.45亿美元!赛诺菲为何重金买了两款TL1A双抗?

9. 2025 Q1:BMS、Sanofi和Roche管线调整,哪些项目被砍?

10. 现场!2025AACR:KRAS抑制剂的百花齐放

11. IL-17小分子抑制剂,能否杀出重围?

12.全球首款:华东医药申报MUC17 ADC药物

13.荨麻疹 first-in-class双抗提交临床试验申请

14.绝非 “越低越好”:CD3 亲和力的权衡之道

15.重磅!罗氏披露BBB穿越Aβ药物最新临床数据(附详细资料)

16.阿斯利康C5纳米双抗:重症肌无力III期临床达主要终点

BioPlus技术平台深入剖析系列:

1. TCE 免疫共刺激信号之选:CD2,一颗冉冉升起的新星

2. BD爆发前夜!6家TCE Probody技术平台深度盘点

3. TCE Probody:Amgen携重磅技术“破局“,改写行业格局?

4. 有人放弃,有人前行!自免TCE全球管线大盘点

5. Immunocore将TCR疗法照进现实,向自免疾病迈进

6. B细胞清除免疫重置:SLE等疾病长效缓解终成现实!

7. 国内50家CD3平台序列来源汇总

8. CD28共刺激最终章?ZW209 DLL3/CD3/CD28 三抗剑指 Amgen

9. TCE 结构之争落幕:行业用行动给出 “标准答案”

10. CD3 VHH猴交叉:重要吗?

11.Genentech创新前沿:口服VHH抗体,靶向IL-23R

12.AbbVie专利公开:靶向PSMA/STEAP1 双抗ADC

BioPlus人物专访:

1. 专访肖亮:卖青苗不一定是坏事,这是中国Biotech长成参天大树的必经之路

2. 专访王刚,恺佧生物这些年的“出海”之旅?

3.专访熊安稳教授:NSCLC,PD-1/VEGF之后,PD-1/IL2会是下一个双抗之王么?

蛋白降解靶向嵌合体上市批准

2025-08-21

细胞免疫治疗给癌症患者带来了新的曙光,抗原特异性T细胞过继免疫治疗因其靶点明确,作用机理清楚,一直都是细胞免疫治疗发展的主流方向。CAR-T细胞治疗(Chimeric Antigen receptor-modified T cell therapy)在血液瘤领域已取得了巨大的成功,伴随着7月30日上海恒润达生的CD19 CAR-T产品上市,目前全球上市的CAR-T产品已达到13款。与此同时,CAR-T也在尝试进军实体瘤领域,为拓展适应症、扩大患者受众人群开疆拓土。TCR-T细胞治疗(T-cell Receptor engineered T cell therapy),起步虽然比CAR-T早,但发展速度比CAR-T要慢很多,直到去年8月份全球第一款产品才得以上市,且适应症较窄,受众癌症患者非常有限,拓展适应症及受众人群也是迫在眉睫的事。

TCR-T之所以发展要比CAR-T慢,主要有以下几个原因:

1. TCR-T识别的靶点是由MHC分子及所递呈的胞内抗原肽组成的MHC-抗原肽复合物(pMHC),也即TCR-T高度依赖MHC分子呈递抗原,而人类MHC基因(即HLA,人类白细胞抗原)高度多态性,不同HLA患者需要设计不同的TCR,这大大限制了其治疗的通用性,相反,CAR-T直接识别细胞表面抗原,没有这个限制;

2. 相比于CAR分子上的抗原识别区,天然的TCR其亲和力往往较低,要获得高亲和力的TCR是行业内的一个技术壁垒;

3. TCR-T因其自身的特点——识别胞内抗原、对实体肿瘤更加优异的浸润能力,赋予了TCR-T在治疗癌症时,实体瘤是其主战场,实体瘤的免疫抑制微环境是TCR-T遇到的又一个大的障碍,而CAR-T在血液瘤中这个障碍要小很多。

尽管挑战重重,TCR-T作为攻克实体瘤的利剑,科学家、临床医生和癌症患者都一直期待着它能快速的发展,早日进入大众的视野和广泛的应用,拓展适应症也是TCR-T在其发展过程中亟需解决的问题。

从TCR-T免疫细胞治疗的靶点说起

01

TCR-T识别的是由肿瘤细胞HLA分子及所递呈的胞内抗原肽组成的HLA-抗原肽复合物(pHLA),所以TCR-T的靶点要从两个方面来分析,一个是HLA分子,一个是抗原肽。通常来说,HLA和抗原肽都是一一对应的,也有一些情况,不同的相似HLA分子能结合同一个抗原肽,如泛HLA-A2亚型、泛HLA-A11亚型等,每种HLA都有很多亚型,它们之间会存在序列和结构非常接近的亚型,导致了能够结合同一个抗原肽,比如全球首款TCR-T细胞疗法TECELRA,靶向的是癌睾抗原MAGE-A4(Melanoma-associated antigen 4)的抗原肽GVYDGREHTV,其组织基因型为泛HLA-A2亚型,具体包括A*02:01、A*02:02、A*02:03、A*02:06共四个等位基因型(alleles)[1],也就是说,这里的抗原肽GVYDGREHTV,能与这四种HLA-A2亚型的分子结合,形成靶点复合物;另外一种情况是反过来,同一个HLA分子能结合相似的抗原肽,比如点突变抗原肽或者单个氨基酸的长短肽可能存在这种情况。作为治疗产品,TCR-T的安全性是第一位的,一款TCR-T通常只针对一个靶点(针对混合靶点的TCR-T实际上是多种TCR-T的混合产品),所以,一款产品的适应症往往是有限的,只有表达该抗原且HLA基因型一致的患者才能使用。在设计TCR-T时,如果靶向的抗原肽涉及到的癌症类型比较多,像PRAME、MAGE-A4这种广谱的抗原,在大部分实体瘤中都有表达,那针对该抗原的TCR-T细胞治疗产品就能覆盖很多癌种;再者,如果与该抗原肽结合的HLA分子,是人群中丰度(占比)较高的HLA分子,像中国人群中丰度较高的HLA-A的基因型HLA-A11、HLA-A24、HLA-A2,就能进一步扩大患者受众人群。所以,“广谱瘤种的抗原肽+高丰度的HLA分子亚型”组合的靶点,是TCR-T治疗时适应症及患者受众数量的决定性因素。既然如此,为何不开发更多的这种靶点类型的TCR-T?其实原因就一个:只差钱。TCR-T能靶向胞内抗原,其潜在抗原数量远远超过CAR-T的靶点,但开发一款TCR-T进入临床再到上市,其成本是昂贵的,周期是漫长的,粗略估计需要10亿人民币和10年时间;而且,在去年第一款TCR-T细胞疗法上市之前,这条路能否彻底走通在资本看来都会有一些顾虑,在此之前有多少资本敢于参与这条赛道?少数参与的资本都属于是高瞻远瞩、雄才大略了!总之一句话,只要资金充足,开发丰富的靶点、理想的靶点,在目前的技术上已是完全行得通的。我们也满怀信心,随着时间的推移,经验和数据的积累,TCR-T的开发周期会缩短、开发成本还会继续降低,后续第二款、第三款,……,第十款TCR-T产品必将陆续上市,势不可挡。届时,将会有更多的资本参与到这条赛道,TCR-T将进入飞速发展期。

开发更多靶点的TCR-T细胞治疗产品

02

从上面TCR-T细胞治疗的靶点出发,不难想到,要拓展TCR-T免疫细胞治疗产品的适应症,最直接的方式就是开发更多的TCR-T细胞治疗产品,覆盖更多抗原靶点与HLA类型。不完全统计,科学家们早已发现了超过700个靶点抗原肽(数据来源于Cancer Antigenic Peptide Database,https://caped.icp.ucl.ac.be/Peptide/list),其中大部分都具备开发成为TCR-T细胞治疗产品的潜力。当开发和上市了足够多靶点的TCR-T产品后,对于癌症患者而言,只要能检测出其肿瘤中有某个或者某些抗原的表达,就能在已有的产品中找到对应抗原的TCR-T产品给予治疗,甚至是多款TCR-T联合治疗,那样治疗效果将会更好,这是非常理想的局面,也是未来TCR-T打开市场、打开治疗格局的重要路径,但要走到这一步,还需要很长一段时间和巨量的资金。表一展示了目前在Clinical Trial登记的进入确证性临床阶段的TCR-T的靶点及相关信息[2],可以看出当下的TCR-T主要集中在病毒抗原和癌睾抗原,HLA主要集中在A2亚型,不管是从抗原数量还是HLA亚型来看还存在着非常巨大的空缺有待开发。

靶点赋予

03

既然TCR-T识别肿瘤依赖于对靶点抗原的识别,那能否尝试先给肿瘤细胞打上特定抗原的标记,再使用针对该抗原的TCR-T去识别和消灭肿瘤细胞。这个话题可以从2013年讲起,日本的免疫学家Daisuke Nobuoka等人[3]当时思考一个问题:由于肿瘤细胞递呈在细胞表面的抗原非常稀少,导致细胞毒性T淋巴细胞(CTL)不能很好地识别肿瘤。他们想到两种办法:一是提高CTL的亲和力,高亲和力的CTL即使在抗原肽数量有限的情况下也能识别肿瘤细胞;二是增加肿瘤细胞表面递呈的抗原肽数量,这样即使亲和力一般的CTL也能识别肿瘤细胞。由于提高TCR亲和力的技术当时只有英国公司Immunocore、Adaptimmune和中国的香雪生命科学中心,也就是现在的香雪生命科学技术(广东)有限公司(XLifeSc,Ltd.)的前身这三家公司能进行,前两家公司是从一家公司分离开来的,所以实际上全球只有两家公司掌握这项技术,所以日本的科学家采取了第二种策略,所用的方法是直接给肿瘤注射抗原肽,结果显示,注射到瘤内的抗原肽被肿瘤细胞的HLA分子所呈递,从而增加了肿瘤细胞的免疫原性,最终增强了CTL细胞对肿瘤细胞的识别。他们通过此方法,使得过继细胞转移的小鼠模型上原本缺少特定抗原的肿瘤表达了相应的抗原,最终抑制了小鼠肿瘤的生长。该方法证明了给肿瘤细胞递送抗原肽是可行的,但对于TCR-T的广泛应用还有其不足的地方:首先,所递送的抗原肽必须和癌症患者的HLA基因型相匹配,该方法只解决了靶点中抗原肽的问题,HLA匹配问题还是没解决;其次,肿瘤细胞常常通过下调HLA的表达来逃避免疫系统的监视,即免疫逃逸现象,这个时候,即使递送了与HLA相匹配的抗原肽,因缺少呈递的“运输机”HLA分子,所以免疫细胞也识别不到抗原,肿瘤细胞得以逃脱。

那能否同时给肿瘤细胞递送HLA和抗原肽的复合物pHLA呢?答案是:可以。时间来到10年后的2023年,来自南京大学附属鼓楼医院的刘宝瑞团队,开发了一种名为“HAUL TCR-T”的技术[4],简单描述:先将HLA和抗原肽的基因用Linker连接起来并融合表达,经过纯化并折叠组装后的pHLA蛋白复合物通过使用膜融合纳米颗粒的脂质体包裹,包裹后的pHLA被直接注射给小鼠模型中的肿瘤组织,静脉注射的TCR-T细胞能有效抑制被靶点蛋白赋予的肿瘤的生长。该技术一次性解决了抗原肽和HLA的问题,应用该技术,可以将原本只靶向特定抗原、特定HLA基因型癌症患者的TCR-T产品瞬间变成了“癌种通用型”TCR-T,不再受抗原和HLA的限制,对于拓展适应症及患者受众人群,迈开了一大步。不过当下只在小鼠模型上应用成功,距离走向临床研究,还需要对“膜融合纳米颗粒包裹的pHLA”进行充分的非临床阶段安全性的评估、对人体肿瘤直接注射可行性的确认、伦理审查等关键环节。

不过,递送pHLA蛋白也有一定的局限性,对于那些肿瘤病灶不明显、肿瘤多发、或者不容易实施瘤内注射的癌症患者,要实现给每个肿瘤注射pHLA脂质纳米颗粒可行性确实不高。这个时候,能否有一种办法,可以自动导向肿瘤,并向肿瘤组织细胞递送靶点抗原的基因就显得格外先进了。你可能已经想到,没错,溶瘤病毒具备天然的导向肿瘤的能力。今年年初,广西医科大学的赵永祥教授团队在Cell期刊发文,开创性地报道了一种静脉注射溶瘤病毒疗法[5],成功实现了晚期癌症治疗的重大临床突破,引发国际学术界的高度关注。他们利用一种称为新城疫病毒(NDV)的溶瘤病毒作为载体,插入猪的基因(α1,3GR),构建出新型病毒NDV-GT。该病毒通过静脉注射后,可自动导向肿瘤组织,在感染肿瘤细胞后,可将携带的猪的基因递送给肿瘤细胞,使肿瘤细胞表面表达猪的抗原αGal,从而触发了超急性免疫排斥反应,最终引导免疫系统精准消灭肿瘤细胞。说到这,已经算接近完美了,但还有一个问题,对于癌症患者,其自身的免疫系统长期受癌症的抑制性环境压抑和“策反”,而且早期可能经历了放疗、化疗,免疫能力可能已经有些衰退,仅仅从肿瘤细胞的免疫原性出发还不足于充分地解决问题。所以,在使用溶瘤病毒递送抗原基因时,若能在T细胞方面再有所改善的话,结果可能会更好。比如,使用经过体外扩增的TCR-T细胞,因体外扩增避开了癌症患者体内的免疫抑制环境,扩增出来的细胞活性更强、更健壮。所以,将本研究中猪的基因换成TCR-T的靶点基因(HLA与抗原肽基因),再使用经体外扩增的TCR-T细胞进行治疗,一是成就了TCR-T成为癌种通用型的细胞治疗产品,二是弥补了患者体内免疫细胞活力可能不足的缺陷,完美。需要强调的是,这不是TCR-T与溶瘤病毒的简单联合治疗,这里溶瘤病毒肩负着为TCR-T免疫细胞种下靶点抗原的使命,可称之为“TCR-T-特异性溶瘤病毒联合治疗”。期待早期实现!

参考文献:

1.Wang T, Navenot JM, Rafail S, Kurtis C, Carroll M, Van Kerckhoven M, Van Rossom S, Schats K, Avraam K, Broad R et al: Identifying MAGE-A4-positive tumors for TCR T cell therapies in HLA-A *02-eligible patients. Molecular therapy Methods & clinical development 2024, 32(2):101265.

2.He W, Cui K, Farooq MA, Huang N, Zhu S, Jiang D, Zhang X, Chen J, Liu Y, Xu G: TCR-T cell therapy for solid tumors: challenges and emerging solutions. Frontiers in pharmacology 2025, 16:1493346.

3.Nobuoka D, Yoshikawa T, Takahashi M, Iwama T, Horie K, Shimomura M, Suzuki S, Sakemura N, Nakatsugawa M, Sadamori H et al: Intratumoral peptide injection enhances tumor cell antigenicity recognized by cytotoxic T lymphocytes: a potential option for improvement in antigen-specific cancer immunotherapy. Cancer immunology, immunotherapy : CII 2013, 62(4):639-652.

4.Xu R, Wang Q, Zhu J, Bei Y, Chu Y, Sun Z, Du S, Zhou S, Ding N, Meng F et al: Membrane fusogenic nanoparticle-based HLA-peptide-addressing universal T cell receptor-engineered T (HAUL TCR-T) cell therapy in solid tumor. Bioengineering & translational medicine 2023, 8(6):e10585.

5.Zhong L, Gan L, Wang B, Wu T, Yao F, Gong W, Peng H, Deng Z, Xiao G, Liu X et al: Hyperacute rejection-engineered oncolytic virus for interventional clinical trial in refractory cancer patients. Cell 2025, 188(4):1119-1136 e1123.

【关于香雪生命科学】

香雪生命科学技术(广东)有限公司(简称“香雪生命科学”)是香雪制药控股子公司,是一家聚焦TCR领域的细胞免疫治疗产品和技术的研发企业,是国内TCR-T细胞免疫治疗的头部企业。公司以“解决人类健康难点,树立肿瘤治疗标杆”为愿景,以“聚焦TCR,赋能T细胞,攻克实体瘤”为使命。

香雪生命科学具有自主知识产权的TCR核心技术,拥有完整的TCR-T细胞治疗产品研发平台和生产制备体系,其中TCR-T细胞治疗产品研发平台包含:①抗原肽发现平台,②TCR亲和力优化平台,③TCR-T全流程开发平台;TCR-T细胞治疗产品生产制备体系包含:①自动化细胞生产平台,②质控平台。已形成TCR-T细胞产品全链条的创新产业链。

香雪生命科学TCR-T产品和储备管线布局广泛,靶点丰富涉及包括CT抗原、新生抗原和病毒抗原等几乎所有与肿瘤相关的特异性抗原,涵盖A0201、A1101及A2402等多个以中国人群居多的HLA基因型,适应症覆盖多种临床难治的实体瘤,处于国际领先水平。

目前,香雪生命科学有两个产品已在中国获得IND批件,其中第一个产品是TAEST16001,适应症为软组织肉瘤(后拓展食管癌和非小细胞肺癌),目前在中国完成I期临床试验和II期临床试验第一阶段的研究工作,纳入突破性治疗品种名单,已进入确证性临床试验阶段,有望成为中国第一个全球第二个上市的TCR-T细胞治疗产品;第二个产品是TAEST1901,适应症为原发性肝癌及其他实体瘤,正在启动I期临床试验;另有候选产品XLS-103,适应症为晚期胰腺癌、非小细胞肺癌和结直肠癌,正在进行IND申报。

细胞疗法免疫疗法

2025-08-20

作者:Lisa

前 言

IL-18在免疫领域的药物开发,在临床试验中的探索包括应性皮炎(AD)、炎症性肠病等,此前有IL-18的单抗(camoteskimab)用于特异性皮炎的研发处于II期临床,也有IL-18/IL-23双抗(GSK4528287)用于炎症性肠病处于I期研究。

在自身免疫性疾病中,如类风湿关节炎(RA)、系统性红斑狼疮(SLE)和炎症性肠病(IBD),白细胞介素-18(IL-18)在疾病进展中起着重要作用,其通过维持慢性炎症和破坏免疫稳态来推动疾病发展。在炎症性肠病中,尤其是克罗恩病,IL-18在肠道黏膜中上调,推动了由Th1细胞介导的慢性炎症。但也有越来越多的证据表明IL-18也参与了2型驱动的炎症,包括哮喘、食物过敏、嗜酸性食管炎等过敏性疾病以及血清IgE升高。

笔者整理了IL-18相关综述,包括其表达、生物学机制等内容,也盘点了IL-18在免疫领域药物的研发进展。

01

IL-18的细胞来源、调控及靶细胞

IL-18的产生与激活

在稳态条件下,IL-18主要由髓系和上皮细胞(特别是皮肤、上呼吸道和胃肠道等屏障组织)以生物活性前体(pro-IL-18)形式组成性产生。皮肤上皮细胞,尤其是基底层和基底上层角质形成细胞,含有最高水平的pro-IL-18。此外,IL-18表达在肺肺泡和脾红髓巨噬细胞、单核细胞和树突状细胞(DCs)中受多种炎症信号诱导。

图1 IL-18细胞来源、调控及靶细胞

IL-18缺乏信号肽,不易分泌,而是依赖细胞焦亡等替代释放机制。与家族成员IL-1β类似,IL-18的激活主要通过模式识别受体(PRR)激活引发的炎症小体组装和caspase-1激活。caspase-1将pro-IL-18切割为活性形式。多种炎症小体(包括NLRP1、NLRP3、NLRC4、AIM2、pyrin、NLRP6和NLRP9B)可激活caspase-1从而加工pro-IL-18。此外,caspase-1切割gasdermin D(GSDMD),产生N-GSDMD,形成膜孔选择性释放切割后的IL-18(图2a)。

与caspase-1不同,人caspase-4/5可直接被细胞内LPS激活,通过不依赖炎症小体的非经典焦亡途径切割pro-IL-18。然而,小鼠caspase-11作为caspase-4/5的类似物,不能直接加工pro-IL-18。此外,小鼠角质形成细胞缺乏关键的炎症小体成分(如NLRP1、NLRP3和AIM2),可能导致上皮来源的IL-18活性被低估。这些物种特异性差异强调了小鼠模型在研究皮肤IL-18生物学中的局限性。为更准确评估IL-18功能和治疗潜力,未来研究应纳入基于人类的平台,如器官型皮肤培养、人源化小鼠模型或离体外植体。

图2 IL-18激活与信号通路

IL-18受体及信号转导

成熟的IL-18通过与IL-18受体(IL-18R,由IL18R1和IL18RAP编码的IL-18Rα链和IL-18RAP的异源二聚体)结合发挥作用。在人类中,这两个亚基在多种淋巴细胞上组成性表达,包括NK细胞、NKT细胞、小鼠皮肤2型固有淋巴细胞(ILC2s)、CD4+和CD8+T细胞、B细胞、γδT细胞以及其他免疫细胞(如嗜碱性粒细胞、滑膜巨噬细胞、DCs、肥大细胞、中性粒细胞和嗜酸性粒细胞)。此外,非免疫细胞(如角质形成细胞、成纤维细胞和内皮细胞)也表达IL-18R。

IL-18首先以低亲和力结合IL-18Rα,随后招募IL-18RAP,形成高亲和力异源二聚体受体复合物。IL-18信号通路与IL-1β、IL-33和Toll样受体(TLR)通路有许多相似之处,起始于两个受体亚基的Toll-IL-1受体(TIR)结构域自磷酸化,随后招募MyD88和TRAM。这激活了IRAK1/4和TRAF6,导致NF-κB和AP-1转位入核调节基因表达。此外,IL-18信号还激活STAT3和MAP激酶家族成员(如ERK和JNK),参与免疫和细胞应激反应(图2b)。IL-18信号还可通过PI3K/Akt通路促进细胞存活。

IL-18结合蛋白及IL-37

IL-18半衰期较长(小鼠16小时,人类35小时),并受两种天然抑制剂严格调控:IL-18结合蛋白(IL-18BP)和IL-37(图1)。 IL-18BP作为可溶性诱饵受体,以高亲和力结合IL-18中和其活性。血清IL-18BP浓度通常比IL-18高一个数量级,确保绝大多数循环IL-18保持结合和非活性状态。IL-18BP参与负反馈循环:IL-18诱导的IFN-γ进而上调IL-18BP表达。这种调控对免疫稳态至关重要,IL-18BP缺陷小鼠或表达抗IL-18BP抑制的IL-18变体的小鼠在LPS刺激下表现出过度的IFN-γ产生。在人类中,遗传性IL-18BP缺乏可导致暴发性病毒性肝炎,凸显其在防止过度IL-18驱动炎症中的作用。

IL-37通过结合IL-18Rα和IL-1R8(SIGIRR)抑制IL-18信号传导。与IL-18BP不同,IL-37不仅中和游离IL-18,还能抑制IL-18R信号传导。 IL-37在多种细胞中表达,包括角质形成细胞和免疫细胞,通过限制IL-18活性在维持免疫稳态中发挥关键作用。

02

IL-18功能

IL-18是一种具有主要促炎活性的多效性细胞因子,但其效应因细胞环境、组织微环境和其他细胞因子的存在而异。它最著名的作用是诱导NK和Th1细胞产生IFN-γ。然而,在某些条件下,IL-18也可促进2型炎症,特别是在AD、哮喘和嗜酸性粒细胞疾病等过敏性疾病中,组织特异性效应进一步凸显了IL-18的多功能性。

在胃肠道中,IL-18支持Th1而非Th17分化,促进黏膜免疫和屏障完整性,而在皮肤中则促进Th2细胞因子,加剧过敏性炎症。在巨噬细胞中,IL-18作为促炎效应因子,而在上皮细胞中则作为组织损伤时释放的警报素。

尽管有这些不同的效应,过度的IL-18释放通常会加剧炎症。在人类中,NLRC4功能获得性突变说明了其致病潜力,导致严重的自身炎症综合征伴显著升高的游离IL-18水平。这些患者对IL-18BP治疗反应良好,凸显IL-18作为临床相关靶点的重要性。IL-18在小鼠某些背景下的调节作用与在人类疾病中的主要致病作用形成对比,强调了在解释其免疫学功能时考虑物种特异性的重要性。

03

IL-18对皮肤屏障功能的影响

表皮既是IL-18的来源也是其靶标,因为角质形成细胞表达IL-18及其受体。横断面患者研究显示,角质层胶带剥离或血清中较高的IL-18水平与更大的经皮水分丢失(TEWL)呈正相关,与天然保湿因子(NMF)水平呈负相关,这两个指标是表皮屏障损伤的替代标志物。

功能上,IL-18在体外下调角质形成细胞中丝聚蛋白(FLG)和兜甲蛋白(LOR)的表达,而这些蛋白的敲低进一步增加IL-18分泌。这表明IL-18破坏屏障,从而放大自身释放的恶性循环。与此机制一致,FLG突变的AD患者胶带剥离中IL-18水平略高于无此突变的患者,可能加剧屏障功能障碍和炎症(图3a)。

总之,这些发现表明IL-18不仅导致皮肤屏障损伤,还维持一个自我放大的循环,加重AD严重程度。

图3 IL-18对皮肤细胞的影响

04

IL-18在免疫领域的药物研发进展

IL-18在免疫领域的药物开发,进展最快的项目处于临床III期,如Novartis的IL-18/IL-1β双抗。从适应症来看,目前探索最多的是特应性皮炎和IBD,其中特应性皮炎的进展似乎不太顺利。

05

小 结

尽管IL-18与Th1免疫的经典关联,但它表现出依赖于环境的多功能性,能够根据局部细胞因子和组织环境促进Th1或Th2反应,也突出了IL-18在AD病理生理学中的不同和依赖于环境的作用,因此针对IL-18的治疗策略,找准最敏感的患者群体是个关键的挑战。

欢迎大家加入BioPlus微信交流群,共同探讨。

BioPlus

微信交流群申请

入群申请联系人 :Lisa

邮箱:lisa.li@bp-bioplus.com

电话:18662346610(同微信)

入群申请,请先添加Lisa微信,并分享名片

入群画像 :Biotech/药厂研发/BD、投资机构、临床医生等

入群福利:不定时行业资料包分享

参考文献:

Bähler L, Schärli S, Luther F, Bertschi NL, Skabytska Y, Roediger B, Schlapbach C, IL-18 in atopic dermatitis - A multifaceted driver of skin inflammation, The Journal of Allergy and Clinical Immunology (2025), doi: https://doi-org.libproxy1.nus.edu.sg/10.1016/j.jaci.2025.07.025.

拓展阅读

BioPlus-海外寻找资产系列:

1.AACR复盘:9家CDH17-ADC数据对比

2.自免小众靶点APRIL,正在悄悄火起来了!

3. STEAP1,会成为ADC与TCE的下一个爆款靶点么?

BioPlus国际大会跟踪系列:

1. 2025 ASCO:ADC、双抗/多抗,有哪些看点?(附一览表)

2. 2025 AACR 双抗与ADC有哪些看点?

3. 小细胞肺癌领域,下一步将如何“破局”,ADC or TCE?

4. ELCC 讨论:NSCLC的ADCs最新进展

5. 未来ADC发展方向:新靶点,新载荷,双靶点/双表位...

6. 2025 ASCO 重点项目临床数据:有哪些精彩看点?

7. 2025 ASCO 重点项目临床数据

BioPlus靶点/管线研究系列:

1. “待爆”:CDH17 ADC项目大比拼,谁将脱颖而出?

2. PD-1激动剂在自免疾病项目数据盘点:失败项目的“坑”与启示

3. 上临床就能卖?DLL3 ADC这么好卖?

4. 胰腺癌三大热门靶点:CLDN18.2、EGFR、RAS

5. TSLP/SCF双抗,下一个自免待爆靶点组合?

6. GPC3靶点临床屡败,TCE能改写格局么?

7. 亮相AACR,曾被临床终止的ADC靶点Ly6E,能否卷土重来?

8. 最高18.45亿美元!赛诺菲为何重金买了两款TL1A双抗?

9. 2025 Q1:BMS、Sanofi和Roche管线调整,哪些项目被砍?

10. 现场!2025AACR:KRAS抑制剂的百花齐放

11. IL-17小分子抑制剂,能否杀出重围?

12.全球首款:华东医药申报MUC17 ADC药物

13.荨麻疹 first-in-class双抗提交临床试验申请

14.绝非 “越低越好”:CD3 亲和力的权衡之道

15.重磅!罗氏披露BBB穿越Aβ药物最新临床数据(附详细资料)

16.阿斯利康C5纳米双抗:重症肌无力III期临床达主要终点

BioPlus技术平台深入剖析系列:

1. TCE 免疫共刺激信号之选:CD2,一颗冉冉升起的新星

2. BD爆发前夜!6家TCE Probody技术平台深度盘点

3. TCE Probody:Amgen携重磅技术“破局“,改写行业格局?

4. 有人放弃,有人前行!自免TCE全球管线大盘点

5. Immunocore将TCR疗法照进现实,向自免疾病迈进

6. B细胞清除免疫重置:SLE等疾病长效缓解终成现实!

7. 国内50家CD3平台序列来源汇总

8. CD28共刺激最终章?ZW209 DLL3/CD3/CD28 三抗剑指 Amgen

9. TCE 结构之争落幕:行业用行动给出 “标准答案”

10. CD3 VHH猴交叉:重要吗?

11.Genentech创新前沿:口服VHH抗体,靶向IL-23R

12.AbbVie专利公开:靶向PSMA/STEAP1 双抗ADC

BioPlus人物专访:

1. 专访肖亮:卖青苗不一定是坏事,这是中国Biotech长成参天大树的必经之路

2. 专访王刚,恺佧生物这些年的“出海”之旅?

3.专访熊安稳教授:NSCLC,PD-1/VEGF之后,PD-1/IL2会是下一个双抗之王么?

临床1期临床结果免疫疗法

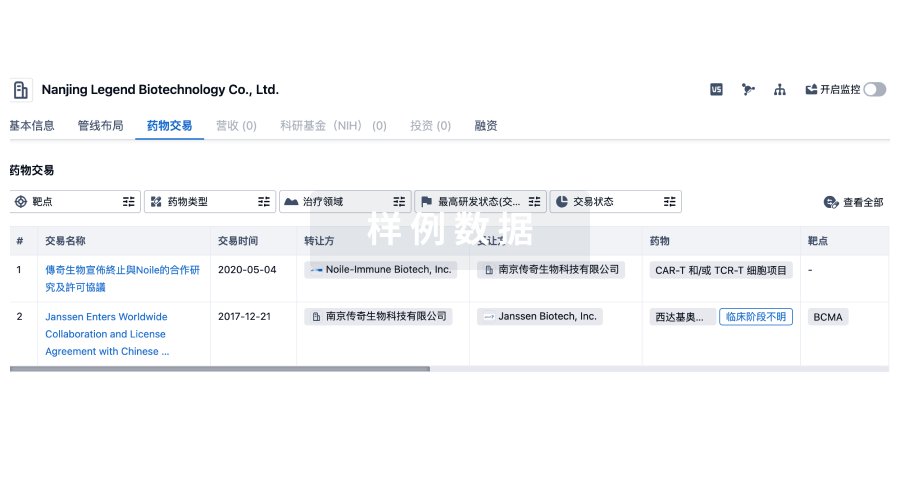

100 项与 Immunocore Ltd. 相关的药物交易

登录后查看更多信息

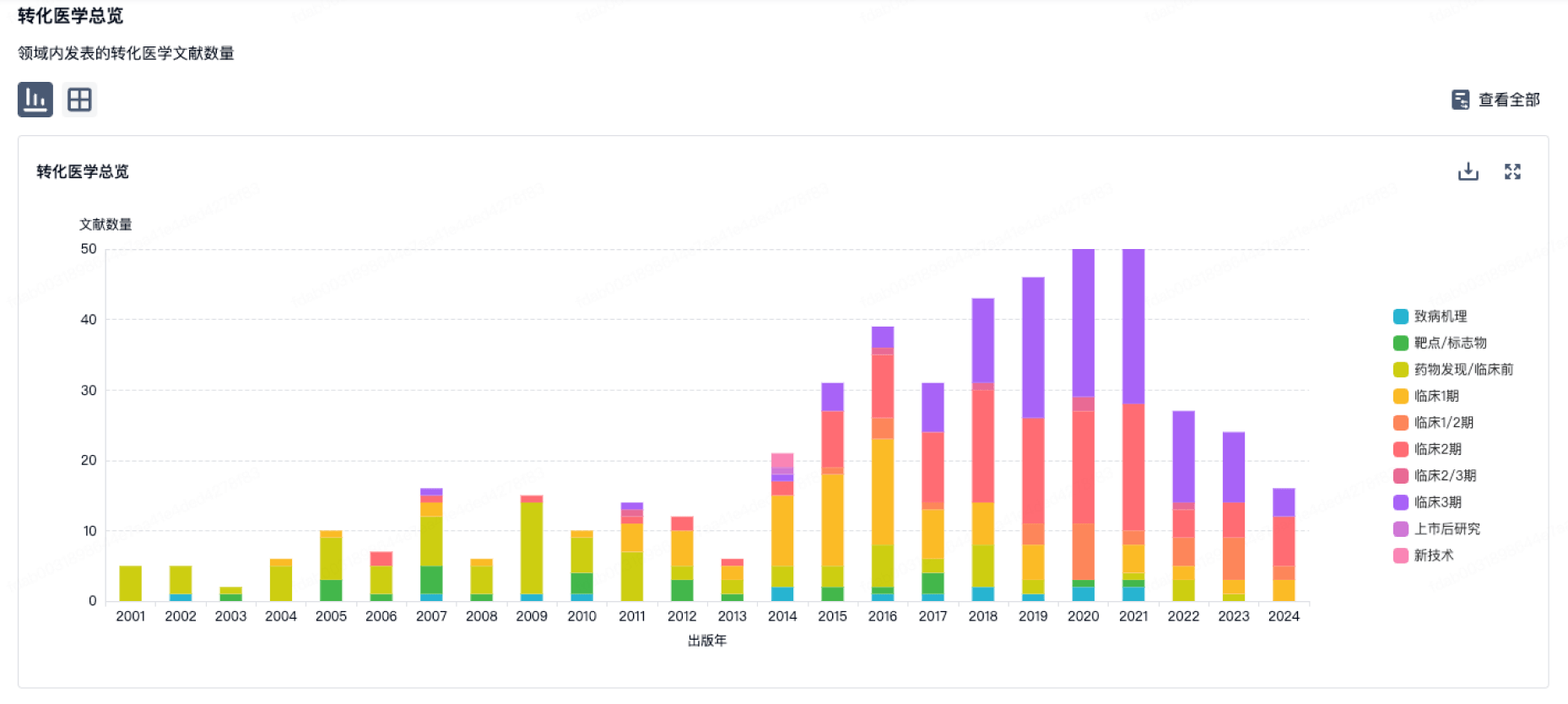

100 项与 Immunocore Ltd. 相关的转化医学

登录后查看更多信息

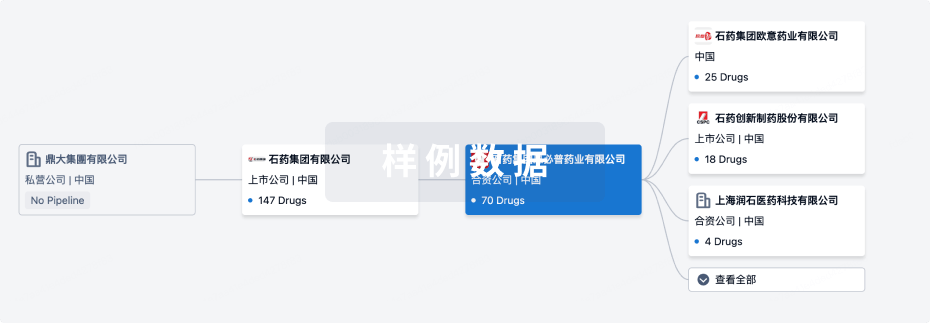

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年10月19日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床前

4

2

临床1期

临床2期

2

1

临床3期

批准上市

1

6

其他

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

Brenetafusp ( CD3 x PRAME ) | 不可切除的黑色素瘤 更多 | 临床3期 |

Tebentafusp ( CD3 x gp100 ) | 不可切除的黑色素瘤 更多 | 临床3期 |

IMC-R117C ( PIWIL1 ) | 晚期癌症 更多 | 临床1/2期 |

IMC-P115C ( CD3 x PRAME ) | 实体瘤 更多 | 临床1期 |

IMC-M113V ( HIV gag ) | HIV感染 更多 | 临床1期 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

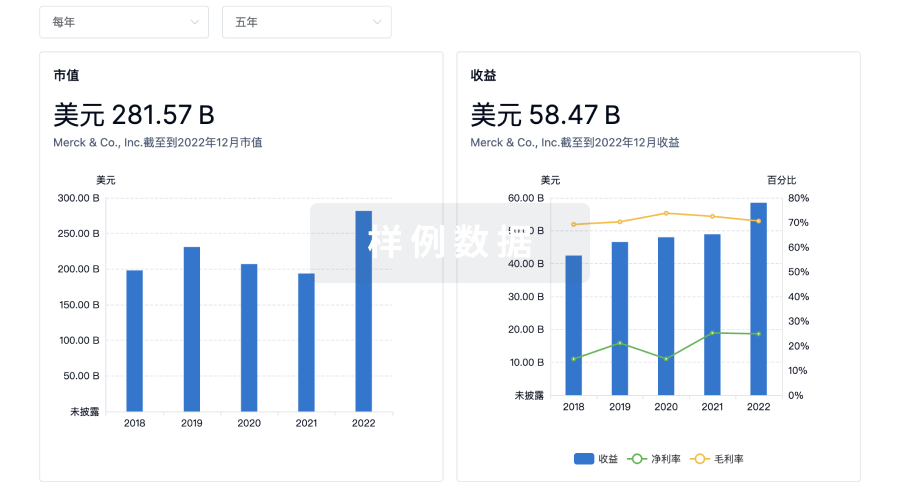

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

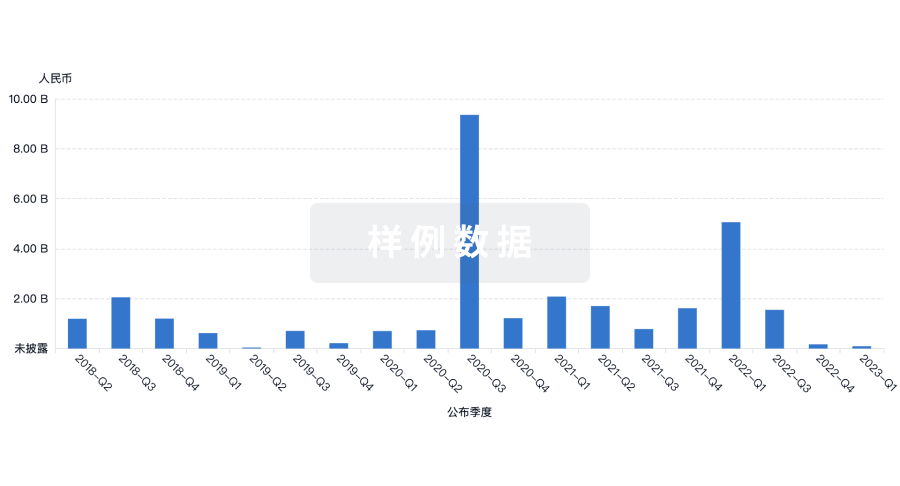

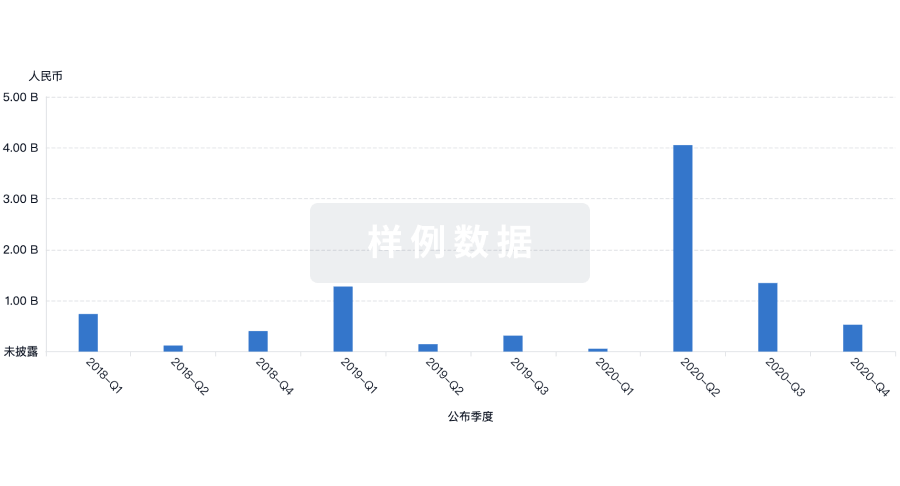

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用