预约演示

更新于:2025-05-07

NeuroCycle Therapeutics, Inc.

更新于:2025-05-07

概览

标签

其他疾病

神经系统疾病

皮肤和肌肉骨骼疾病

小分子化药

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 排名前五的药物类型 | 数量 |

|---|---|

| 小分子化药 | 4 |

| 未知 | 1 |

关联

9

项与 NeuroCycle Therapeutics, Inc. 相关的药物作用机制 GABAA receptor调节剂 |

在研适应症 |

非在研适应症- |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

作用机制 D2 receptor拮抗剂 [+1] |

非在研适应症- |

最高研发阶段临床1期 |

首次获批国家/地区- |

首次获批日期- |

作用机制 GABAA receptor调节剂 |

在研适应症 |

非在研适应症 |

最高研发阶段临床1期 |

首次获批国家/地区- |

首次获批日期- |

100 项与 NeuroCycle Therapeutics, Inc. 相关的临床结果

登录后查看更多信息

0 项与 NeuroCycle Therapeutics, Inc. 相关的专利(医药)

登录后查看更多信息

1

项与 NeuroCycle Therapeutics, Inc. 相关的文献(医药)Scientific Reports3区 · 综合性期刊

Sensory satellite glial Gq-GPCR activation alleviates inflammatory pain via peripheral adenosine 1 receptor activation

3区 · 综合性期刊

ArticleOA

作者: Xie, Alison Xiaoqiao ; McCarthy, Ken D ; Minton, Suzanne K ; Malykhina, Anna P ; Madayag, Aric

3

项与 NeuroCycle Therapeutics, Inc. 相关的新闻(医药)2021-02-02

James Sabry and Aviv Regev at Roche and Genentech have been racking up early stage partnerships, tying up with early stage biotechs developing everything from new AI engines to new ways of delivering gene therapy. Now, they’ve signed on with an older player, joining a small molecule biotech that’s already collaborated with many of the biggest names in drug development.

Genentech and X-Chem, a biotech that specializes in DNA-encoded libraries,

have signed

an agreement that will allow the big biotech to both use their technology to find new molecules and give them an exclusive license on a pre-existing program. Details for that program were undisclosed, as were upfront payment and milestones.

One of the first biotechs to specialize in massive DNA-encoded libraries — huge sets of molecules that can be rapidly screened for various properties because they’re tagged with DNA identifiers — X-Chem has racked up partnerships with over a dozen major drug developers. That includes Servier, Otsuka, Bristol Myers Squibb, Vertex, AbbVie, AstraZeneca, Alexion, Astellas, Bayer, Gilead, J&J, Pfizer, Roche, and Sanofi.

Founded a decade ago by GlaxoSmithKline’s head of discovery chemistry, Matt Clark, X-Chem was bought out last year for an undisclosed sum by the British firm GHO Capital. —

Jason Mast

Daiichi Sankyo’s prolific antibody-drug conjugate platform

has spawned

a sixth clinical candidate, with the first patient dosed in a Phase I trial targeting advanced renal cell carcinoma and ovarian cancer that progressed following standard treatment.

DS-6000 is directed against CDH6, a cadherin family protein overexpressed in several cancers.

Five-year survival rates for renal cell carcinoma and ovarian cancer, Daiichi said, remain low despite advances in targeted treatment.

There aren’t currently any marketed drugs hitting CDH6, making theirs a potential first-in-class play — right alongside the programs against known targets that AstraZeneca has bet big money to partner with Daiichi on, including HER2 and TROP2.

This new drug is the third developed in collaboration with Sarah Cannon Research Institute in Nashville, TN, Daiichi added.

— Amber Tong

Here’s an unusual way to spend cash from a collaboration announcement: handing it back to your collaborator.

A day after the biosimilar company Coherus announced

they would pay

Junshi Biosciences $150 million for the PD-1 antibody toripalimab, Junshi announced they would invest $50 million into Coherus. Although the staggered nature of the move was unusual, Junshi CEO Ning Li said it was all part of a cogent plan.

“We view our collaboration with Coherus as a strategic long-term partnership for the development and commercialization of toripalimab and promising PD-1 combination candidates,” Li said in a statement. “We wanted to invest in Coherus so we could share our future growth together and mutual success with these programs.”

The Junshi deal represented a shift for Coherus, which has focused exclusively on copycat drugs to date. Although developing a PD-1 is hardly novel — six are already approved in the US — the biotech said this would be the beginning of a push into new cancer drug R&D. —

Jason Mast

Engrail Therapeutics has only been out of stealth for 7 months but they’ve already secured a buyout,

scooping up

NeuroCycle Therapeutics and their GABA-A molecules for an undisclosed sum Tuesday morning.

The deal is the first public step in Engrail’s larger strategy of identifying and licensing in promising molecules for brain disorders. Founded in 2017 by GlaxoSmithKline vet Matthew Toczko and ETH Zurich scientist Jed Hubbs, NeuroCycle had been developing a small molecule drug for the seizure disorder Dravet syndrome and other diseases, and had largely relied on grant money. —

Jason Mast

合作基因疗法抗体生物类似药First in Class

2021-02-02

Feb. 2, 2021 13:00 UTC

- Advancing medicines to transform the lives of patients with life-limiting diseases of the central nervous system

- Expands GABA-A modulator pipeline with second asset

SAN DIEGO--(BUSINESS WIRE)-- Engrail Therapeutics™ (Engrail) today announced that it has acquired NeuroCycle Therapeutics, a company focused on sub-type selective GABA-A modulation. The acquisition strengthens Engrail’s presence in the GABA-A space and provides a strong platform for initiation of clinical trials with multiple assets in 2021.

“Our flexible transaction model and science-first approach allows us to acquire high-quality assets with a lower-risk path to market where significant patient need still exists,” said Vikram Sudarsan, Ph.D., CEO and president, Engrail Therapeutics. “We combine a comprehensive view of clinical development strategy, regulatory considerations and intellectual property to find differentiated assets with validated mechanisms of action. GABA-A is a well validated target and modulators of this receptor have therapeutic effect across a broad range of neurological and psychiatric conditions. We now have multiple sub-type selective GABA-A modulators with strong profiles and look forward to rapidly advancing development.”

Dr. Sudarsan continued, “We remain committed to building a leading, patient-centric neuroscience company with a growing pipeline through licensing, co-development and acquisitions. Our goal is to build a diverse pipeline of neuroscience therapeutics over the next several years, and the acquisition of NeuroCycle represents another important step on this path. We expect 2021 to be a busy year as we consider additional transactions to expand our portfolio.”

Jed Hubbs, Ph.D., CEO and president, NeuroCycle Therapeutics said, “We believe Engrail represents the ideal company to carry on the work NeuroCycle started given their focus and experience in the GABA-A space. We look forward to seeing them bring novel medicines to patients that need them.”

About Engrail Therapeutics

Founded in 2019, Engrail is forging a new direction to reduce the enormous burden of diseases that impact the nervous system. We unite biological insights with clinically meaningful solutions to build and catalyze a diversified portfolio of transformative medicines. Harnessing our rigorous scientific approach to identify the most promising therapies, we leverage our flexible transaction model to advance assets with validated mechanisms and efficiently move them through development to commercialization. Engrail is supported by a long-term capital commitment from Nan Fung Life Sciences. For more information, visit .

并购

2021-02-01

SAN DIEGO–(BUSINESS WIRE)–Engrail Therapeutics™ (Engrail) today announced that it has acquired NeuroCycle Therapeutics, a company focused on sub-type selective GABA-A modulation. The acquisition strengthens Engrail’s presence in the GABA-A space and provides a strong platform for initiation of clinical trials with multiple assets in 2021.

“We believe Engrail represents the ideal company to carry on the work NeuroCycle started given their focus and experience in the GABA-A space. We look forward to seeing them bring novel medicines to patients that need them.”

“Our flexible transaction model and science-first approach allows us to acquire high-quality assets with a lower-risk path to market where significant patient need still exists,” said Vikram Sudarsan, Ph.D., CEO and president, Engrail Therapeutics. “We combine a comprehensive view of clinical development strategy, regulatory considerations and intellectual property to find differentiated assets with validated mechanisms of action. GABA-A is a well validated target and modulators of this receptor have therapeutic effect across a broad range of neurological and psychiatric conditions. We now have multiple sub-type selective GABA-A modulators with strong profiles and look forward to rapidly advancing development.”

Dr. Sudarsan continued, “We remain committed to building a leading, patient-centric neuroscience company with a growing pipeline through licensing, co-development and acquisitions. Our goal is to build a diverse pipeline of neuroscience therapeutics over the next several years, and the acquisition of NeuroCycle represents another important step on this path. We expect 2021 to be a busy year as we consider additional transactions to expand our portfolio.”

Jed Hubbs, Ph.D., CEO and president, NeuroCycle Therapeutics said, “We believe Engrail represents the ideal company to carry on the work NeuroCycle started given their focus and experience in the GABA-A space. We look forward to seeing them bring novel medicines to patients that need them.”

About Engrail Therapeutics

Founded in 2019, Engrail is forging a new direction to reduce the enormous burden of diseases that impact the nervous system. We unite biological insights with clinically meaningful solutions to build and catalyze a diversified portfolio of transformative medicines. Harnessing our rigorous scientific approach to identify the most promising therapies, we leverage our flexible transaction model to advance assets with validated mechanisms and efficiently move them through development to commercialization. Engrail is supported by a long-term capital commitment from Nan Fung Life Sciences. For more information, visit www.engrail.com.

并购

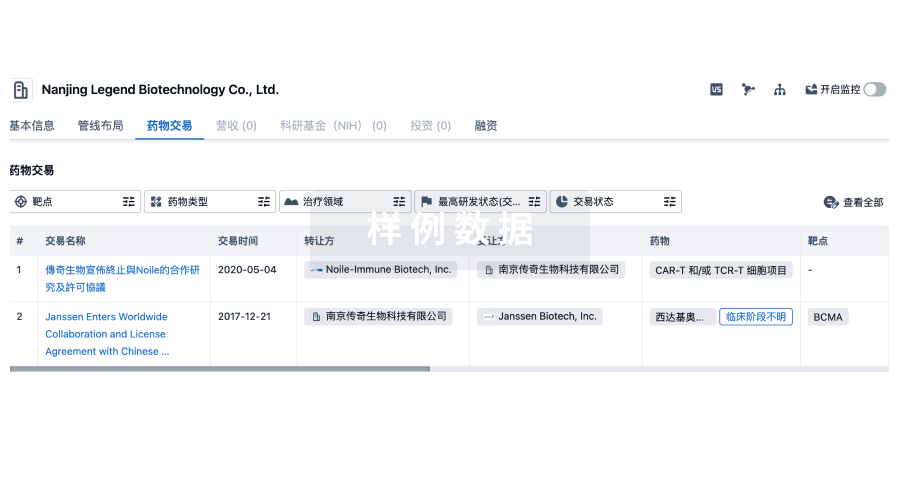

100 项与 NeuroCycle Therapeutics, Inc. 相关的药物交易

登录后查看更多信息

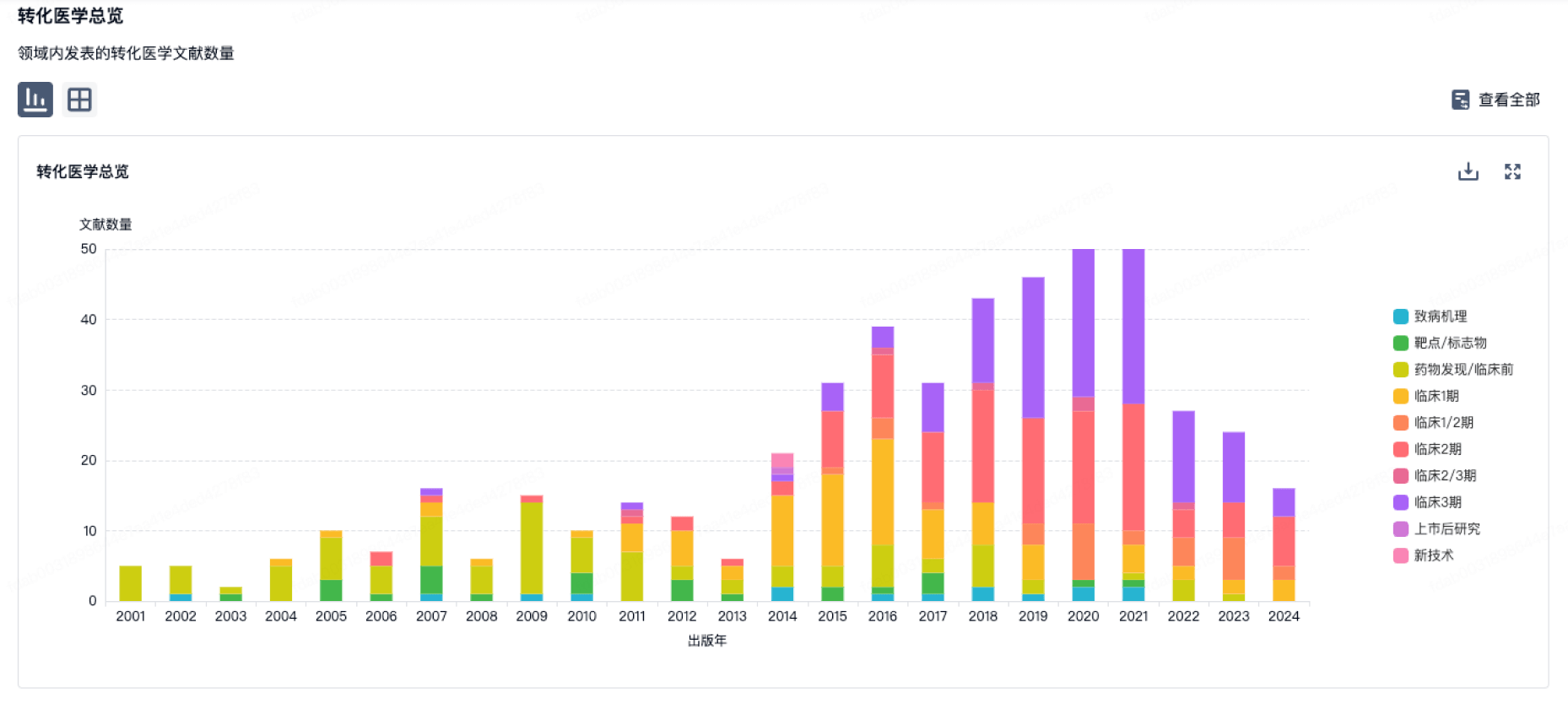

100 项与 NeuroCycle Therapeutics, Inc. 相关的转化医学

登录后查看更多信息

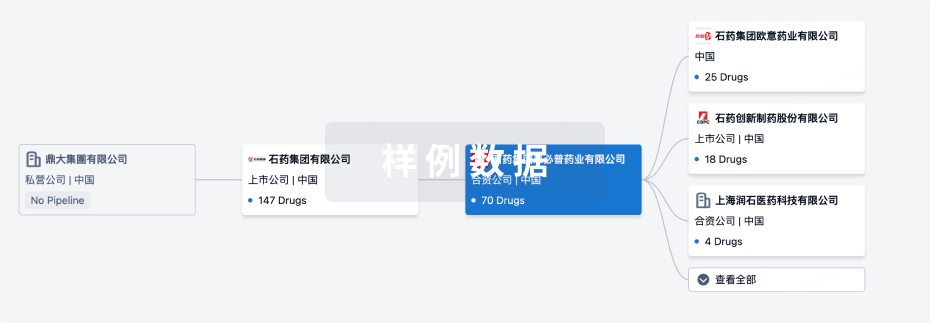

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年07月29日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床前

3

2

临床1期

其他

4

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

NCT-10004 ( GABAA receptor ) | 瘙痒 更多 | 临床1期 |

ENX-102 ( GABAA receptor ) | 广泛性焦虑障碍 更多 | 临床1期 |

Elesclomol Copper ( Cu ) | Menkes综合征 更多 | 临床前 |

ENX-105 ( 5-HT1A receptor x D2 receptor ) | 情绪障碍 更多 | 临床前 |

ENX-104 ( D2 receptor x D3 receptor ) | 重度抑郁症 更多 | 临床前 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

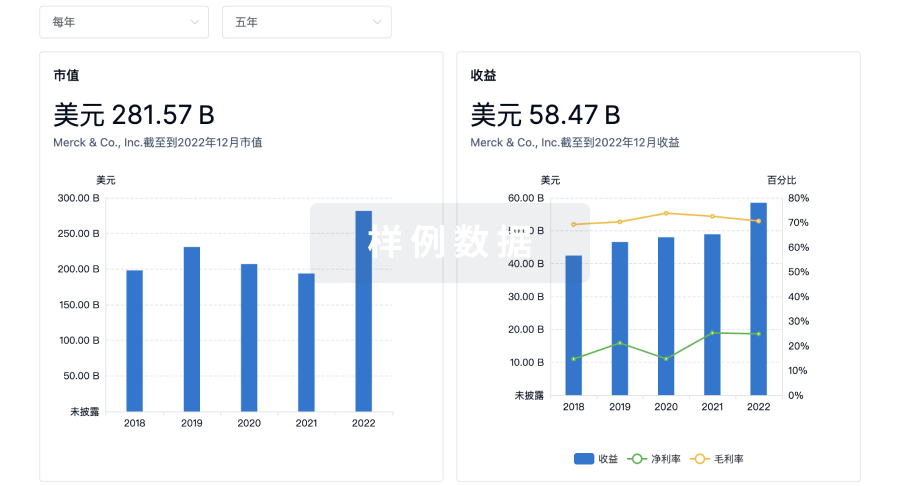

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用