预约演示

更新于:2025-06-15

MyBiotics Pharma Ltd.

更新于:2025-06-15

概览

标签

其他疾病

感染

活菌制剂

生物药

CAR-T

关联

3

项与 MyBiotics Pharma Ltd. 相关的药物靶点- |

作用机制- |

在研适应症 |

非在研适应症- |

最高研发阶段临床1期 |

首次获批国家/地区- |

首次获批日期- |

靶点- |

作用机制- |

非在研适应症- |

最高研发阶段临床前 |

首次获批国家/地区- |

首次获批日期- |

靶点- |

作用机制- |

在研适应症 |

非在研适应症- |

最高研发阶段临床前 |

首次获批国家/地区- |

首次获批日期- |

100 项与 MyBiotics Pharma Ltd. 相关的临床结果

登录后查看更多信息

0 项与 MyBiotics Pharma Ltd. 相关的专利(医药)

登录后查看更多信息

3

项与 MyBiotics Pharma Ltd. 相关的新闻(医药)2023-02-27

Image Credit: Shutterstock / KingVector

In the last decade,

the idea of tapping into the gut

has attracted much interest from investors and the public, but recent years have showed that a lot more work needs to be done before such treatments enter the mainstream.

This is largely due to the FDA’s rigorous approach to the safety of

microbiome therapeutics,

which has manifested in clinical holds, resulting in delays that have dimmed the enthusiasm in the space in recent times.

Finch Therapeutics’s Phase III PRISM4 trial for recurrent

Clostridioides difficile

infection (CDI) and

MaaT Pharma’s

Phase III trial in steroid-resistant acute graft-versus-host disease were both put on hold. While the French MaaT Pharma has submitted further information to the FDA, its trial remains on hold. In January 2023, Finch announced plans to scrap the PRISM4 trial altogether.

The idea behind these treatments relies on altering the gut microbiome by designing therapeutics that contain bacteria derived from donated stool samples. In November 2022, Ferring Pharmaceuticals’s

Rebyota became the first FDA-approved microbiome-based therapeutic

to treat recurrent CDI. But the approval came through after an FDA Advisory Committee meeting.

Moreover, the Covid-19 pandemic put a spotlight on microbiome-based therapeutics due to the potential transmission risks in this class.

“This whole field has been set back a little bit by the pandemic. We lost three years,” says Dr. Susy Hota, infectious disease specialist at University Health Network, University of Toronto.

Coupled with this, the

harsh conditions of the biotech market

affected some companies. On February 16, the microbiome therapeutics-focused biotech 4D Pharma was

pulled from the London Stock Exchange

after falling into administration in June 2022. When Finch decided to end the PRISM4 program, it announced plans to reduce its workforce by 95%. Back in April 2022, the microbiome-focused biotech Kaleido Therapeutics folded due to financial and regulatory setbacks.

Although there was a lot of

hype surrounding the microbiome

about five years ago, it is a question if this is still the case, says Hota. Also, microbiome therapies need to work in other indications for continued interest. “If recurrent CDI is the main indication, it is not an extremely attractive area to a lot of people,” says Hota.

Regulatory concerns remain

Overall, microbiome research has not advanced as much as expected, which is partly due to safety issues, says Hota. Though the pandemic disrupted research in general, it was particularly difficult to conduct research that relied on stool samples, adds Hota.

Such caveats centre around the risk of infection caused by different diseases such as Covid-19 and mpox. In March 2020, the FDA shared a safety alert on the use of faecal microbiota transplants (FMTs) due to Covid-19, which added questions identifying those infected with Covid-19 to donor screening protocols.

More than two years later, the FDA

shared a similar alert

that requested additional protections on the use of FMTs due to the mpox virus.

These safety concerns froze research, says Dr. Sarah McGill, associate professor of medicine at the University of North Carolina School of Medicine, Chapel Hill. “It will take some time for research to thaw,” she adds.

McGill says she does not know of a single confirmed case of Covid-19 transmission through FMTs. The best approach here would be to screen every sample, but that raises questions on the sustainability of such protocols, Hota notes.

Wild west of development

Currently, the sector is in its “wild west stage,” says Jack Gilbert, PhD, professor in paediatrics and the Scripps Institution of Oceanography, University of California San Diego. Although research here is about 20 years old, it remains new compared to other areas like genomics, says Gilbert.

To an extent,

the use of FMT in CDI

paved the way for microbiome therapies, says Dr. Neilanjan Nandi, associate professor of clinical medicine at the University of Pennsylvania, Philadelphia. While Rebyota was the first to be approved, more could be coming up soon, says Gilbert.

Rebyota is a faecal microbiota-based treatment for patients with recurrent CDI that is administered through an enema. In the Phase III PUNCH CD3 trial, Rebyota was superior to placebo in the reduction of CDI recurrence, with a 70.6% treatment success rate after eight weeks compared to 57.5% with placebo.

Seres Therapeutics’s SER-109 is under Priority Review and the FDA has set a PDUFA date of April 26, 2023, for its use as a treatment for recurrent CDI. Unlike Rebyota, SER-109 comes in capsule form and is taken over the course of three days.

Elsewhere, Vedanta Biosciences aims to bring its oral CDI treatment VE303 into a Phase III trial this year. Vedanta is a subsidiary of Puretech Health. Destiny Pharma’s CDI treatment NTCD-M3 is expected to enter a Phase III next year. Unlike Rebyota and SER-109, Vedanta’s treatment is based on clonal bacteria strains and does not use donated stool samples.

CDI should be seen as only the beginning, says Nandi, adding that

inflammatory bowel disease (IBD) is also an interesting avenue

.

However, the results here are quite mixed, say Hota and McGill. For instance, Seres’s Phase IIb study of SER-287 to treat ulcerative colitis

did not meet its primary endpoint

of clinical remission compared to placebo. Both SER-109 and SER-287 are made from a purified consortium of Firmicutes spores derived from stool samples. According to the company’s website, the biotech is undertaking research to decide on the future of the ulcerative colitis program, which also includes another candidate called SER-301.

Last year,

Takeda Pharmaceutical

ended its

deal with Finch

in August after a review of its pipeline. Previously, Takeda had licensed the two Finch treatments FIN-524 and FIN-525 for their development in IBD. Still, other companies are keen on exploring IBD further, such as the UK-based company Microbiotica. The start-up expects to start its Phase Ib in ulcerative colitis this year, and focuses on the development of orally administered live therapeutics that are derived from bacterial consortia.

The

potential use of microbiome therapeutics in cancer

comes with its own set of questions. While humans normally encounter microorganisms in their day-to-day activities, their functioning immune systems can handle those, says Hota. But since the immunity of cancer patients is suppressed by treatments like chemotherapy, the risks here are much greater, she explains.

Microbiome therapeutics here could be used as adjunct treatments, rather than primary therapies, says Dr. Louis Korman, co-director of Chevy Chase Clinical Research, Chevy Chase, Maryland. A lot of immunotherapies cause side effects in the gastrointestinal tract, says Korman. With that in mind, therapeutics could be used to reduce toxicity, he explains.

Although enthusiasm for microbiome therapeutics is broadly quite high, it is slightly waning at expert meetings, says McGill. There is some confusion from the side of the investors due to the field’s broad nature, says Gilbert. This is further emphasised by the current state of the biotech market , he adds.

But this could change with the first approvals, notes McGill. In a way, the accessibility could increase enthusiasm and interest, she adds.

C,,,

,Ferring ,Rebyota,FDA-approved

,Seres,SER-109,PDUFA Date on April 26

,

,Vedanta,VE303 ,Phase III in 2023

,Destiny,NTCD-M3 ,Phase III in 2023

,Ferring

,MyBiotics,MBX-SD-202,Phase I completed in 2022

,Adiso Therapeutics,ADS024,"Enrollment of Phase Ib complete, awaiting data, potentially ready for Phase II"Company,Product,Indication,Status

AOBiome Therapeutics,B244,Pruritus,PhaseIIb complete enrollment

AOBiome Therapeutics,B244,Acne,Phase IIb completed

AOBiome Therapeutics,B244,Rosacea,Phase Iib completed

Mikrobiomik,MBK-01,Nonalcoholic steatohepatitis,Phase II not yet recruiting

Mikrobiomik,MBK-01,Klebsiella pneumoniae carpapenemase,Phase II recruiting

Microbiotica,Live Bacterial Therapeutics ,Ulcerative colitis,Phase Ib start in 2023

Microbiotica,Live Bacterial Therapeutics ,Immuno-oncology,Phase Ib start in 2023

临床2期临床3期免疫疗法临床结果微生物疗法

2021-02-17

Feb. 17, 2021 06:00 UTC

ST PREX, Switzerland & ROSEVILLE, Minn. & ROHOVOT, Israel--(BUSINESS WIRE)-- Ferring Pharmaceuticals, Rebiotix Inc., a Ferring Company, and MyBiotics Pharma Ltd. today announced a multi-year strategic collaboration to develop live microbiota-based biotherapeutics to address bacterial vaginosis, a common vaginal infection among women of reproductive age linked to increased risk of miscarriage and complications for pregnancy and fertility.1,2,3 The collaboration is an important step forward in harnessing the power of the human microbiome in this area of women’s health.

This press release features multimedia. View the full release here:

Currently bacterial vaginosis is treated with antibiotics, which can disrupt the vaginal microbiome, and it’s common for bacterial vaginosis to return following treatment.4 The aim of a microbiota-based treatment would be to reduce the need for antibiotic use and provide a long-term treatment solution.

The multi-year agreement combines MyBiotics’ unique culturing, delivery and colonisation technologies aimed at restoring microbiome equilibrium with Rebiotix’s expertise in developing clinical-stage live microbiota-based biotherapeutic products and Ferring’s therapeutic development and commercial expertise. The new agreement builds on the existing collaboration between Ferring and MyBiotics, initiated in 2017, which has already successfully piloted technologies intended to stabilise selected bacterial species critical to the health of the female reproductive tract using MyBiotics' MyCrobe technology.

“We are proud to be undertaking this collaboration, as it is a critical step forward in meeting patient needs through the potential of the microbiome,” said Ken Blount, Chief Scientific Officer, Rebiotix and Vice President of Microbiome Research, Ferring Pharmaceuticals. “This collaboration with MyBiotics not only harnesses our collective expertise in developing live microbiota-based biotherapeutic technologies, but also reaffirms Ferring’s deep commitment to building families worldwide through innovations in reproductive medicine and maternal health.”

The collaboration announced today also stands to add several firsts to Ferring’s microbiome product pipeline, including the company’s first non-donor derived formulation, and a live microbiota-based product specific to reproductive medicine.

“Today’s agreement is an important evolution of our long-standing relationship with Ferring in the field of microbiota-based therapies for the benefit of women's health, including reproduction and pregnancy,” said MyBiotics’ CEO, David Daboush. “We look forward to combining our innovative MyCrobe live bacteria culturing, delivery and colonisation technology with the world-leading development experience of Rebiotix for the benefit of women. The collaboration with Rebiotix builds on our successful collaboration with Ferring, and we are excited to build on that strong relationship targeted to bringing novel treatments to patients through our tailor-made microbiome technology platform.”

MyBiotics has developed breakthrough and robust culturing, fermentation and delivery technologies for generating a highly stable and diverse bacterial community that can be efficiently delivered to different sites across the human body for restoring microbiome equilibrium. These technologies are effective for single microbes, complex microbial consortia and whole microbiome products, and are integrated with a computational AI platform, which enables the design of unique microbial consortia and whole microbiome profiles. The technologies are highly potent and suitable for patients with microbiome-related medical conditions.

The potential of live microbiota-based biotherapeutic products is an expanding frontier. The most clinically advanced formulations, derived from the human gut microbiome, are currently being developed to address Clostridioides difficile (C.diff) infection and have opened the door to harnessing the power of the microbiome to address other unmet medical needs. As the future of microbiome-based therapeutics expands, the potential extends beyond the gut to reproductive medicine. The ability to generate standardised, stabilised, approved formulations, created to serve patient needs in reproductive medicine and maternal health, connects to the core vision of both companies.

About Ferring Pharmaceuticals

Ferring Pharmaceuticals is a research-driven, specialty biopharmaceutical group committed to helping people around the world build families and live better lives. Headquartered in Saint-Prex, Switzerland, Ferring is a leader in reproductive medicine and women’s health, and in specialty areas within gastroenterology and urology. Ferring has been developing treatments for mothers and babies for over 50 years and has a portfolio covering treatments from conception to birth. Founded in 1950, privately-owned Ferring now employs approximately 6,500 people worldwide, has its own operating subsidiaries in nearly 60 countries and markets its products in 110 countries.

Learn more at , or connect with us on Twitter, Facebook, Instagram, LinkedIn and YouTube.

About Rebiotix

Rebiotix Inc, a Ferring Company, is a late-stage clinical microbiome company focused on harnessing the power of the human microbiome to revolutionise the treatment of challenging diseases. Rebiotix brings a diverse pipeline of investigational drug products to Ferring’s portfolio built on its pioneering microbiota-based MRT™ drug platform. The platform consists of investigational drug technologies designed to potentially rehabilitate the human microbiome by delivering a broad consortium of live microbes into a patient’s intestinal tract. For more information on Rebiotix and its pipeline of human microbiome-directed therapies for diverse disease states, visit , or connect with us on Twitter, Facebook, LinkedIn and YouTube.

About MyBiotics

MyBiotics discovers and develops microbiome-based products aimed at restoring microbiome equilibrium for the therapeutics and food markets. MyBiotics' technologies are effective for single microbes, complex microbial consortia and whole microbiome products, and are integrated with a computational AI platform which enables the design of unique microbial consortia and whole microbiome profiles. The company's pipeline includes products targeted at infectious diseases, woman's health, gastro and oncology indications, as well as probiotics and prebiotic programs. For additional information, please visit or connect with us on LinkedIn.

References:

1 Peebles K, Velloza J, Balkus JE, McClelland RS, Barnabas RV. High Global Burden and Costs of Bacterial Vaginosis: A Systematic Review and Meta-Analysis [Internet]. Sexually transmitted diseases. U.S. National Library of Medicine; [cited 2021 Feb 2]. Available from:

2 Giakoumelou S et al. The role of infection in miscarriage. Human Reproduction Update 2016;22:116–133. doi.org/10.1093/humupd/dmv041. Last accessed February 2021

3 Bacterial vaginosis and pregnancy. March of Dimes. Available at: . Last accessed February 2021

4 Wilson J. Managing recurrent bacterial vaginosis. Sex Transm Infect 2004;80:8–11. doi:10.1136/sti.2002.002733. Last accessed February 2021

View source version on businesswire.com:

合作

2018-04-05

A Minnesota company working on a drug that could be the nation’s first pill packed with microbes has been snatched up by Swiss drug maker Ferring Pharmaceuticals.

The startup, called Rebiotix, was acquired in a deal that closed Wednesday with undisclosed terms. The company is developing a fecal microbiota transplant dubbed RBX-2660 that’s currently in Phase III trials. It’s being tested against an infection caused by C difficile, a bacteria that can induce symptoms ranging from diarrhea to life-threatening inflammation of the colon. The infection often occurs in older patients in hospitals or long-term care who happen to be taking antibiotics for a long period of time. Ironically, the standard treatment for C diff is to take the patient off the antibiotic that caused the infection… and then put them on another antibiotic.

Rebiotix’s RBX-2660 works quite differently than an antibiotic. It repopulates the gut microbiome, and the transplanted microbes then go to war with C diff, preventing it from growing and forcing it out of the gut. The treatment could be a game-changer for patients, which is why the FDA gave it fast track, breakthrough, and orphan drug designations.

Ferring says it’s not picking up Rebiotix just for one asset. It thinks the startup’s drug platform will deliver long-term gains.

“The scientific advances Rebiotix has made add significant strategic value to Ferring’s leadership in gastroenterology,” Michel Pettigrew, COO and president of the executive board at Ferring Pharmaceuticals said in a

statement

. “Therapies targeted towards the microbiome have the potential to transform healthcare. Together, we have a unique opportunity to help people living with debilitating and life-threatening conditions like Clostridium difficile infection.”

On top of its buyout of Rebiotix, Ferring has been investing in the microbiome space for years. It’s got a license agreement with MyBiotics for its women’s health therapeutics and a research deal with MetaboGen for a microbiome-based treatment for trahepatic cholestasis of pregnancy. The company also has partnerships with research organizations in microbiome arena, including with the Karolinska Institutet and Science for Life Laboratory, and the Centre for Translational Microbiome Research, among others.

Image: Clostridium difficile bacteria, 3D illustration.

SHUTTERSTOCK

合作孤儿药快速通道并购

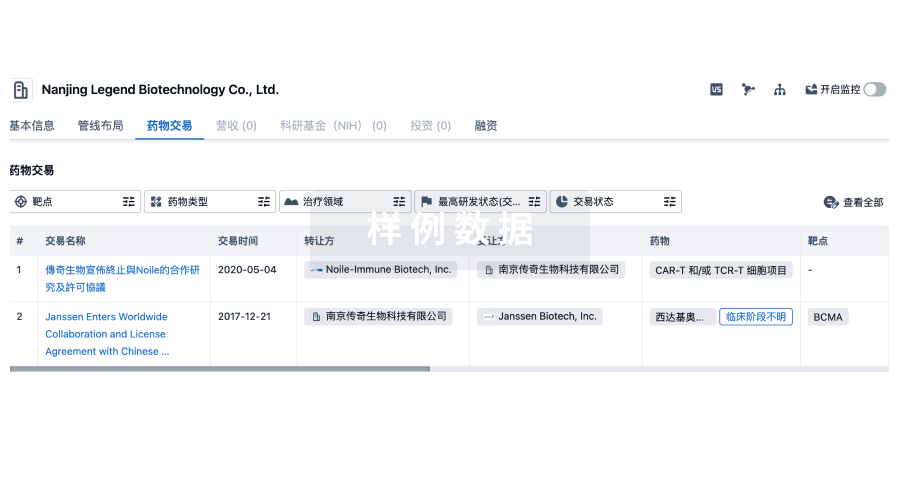

100 项与 MyBiotics Pharma Ltd. 相关的药物交易

登录后查看更多信息

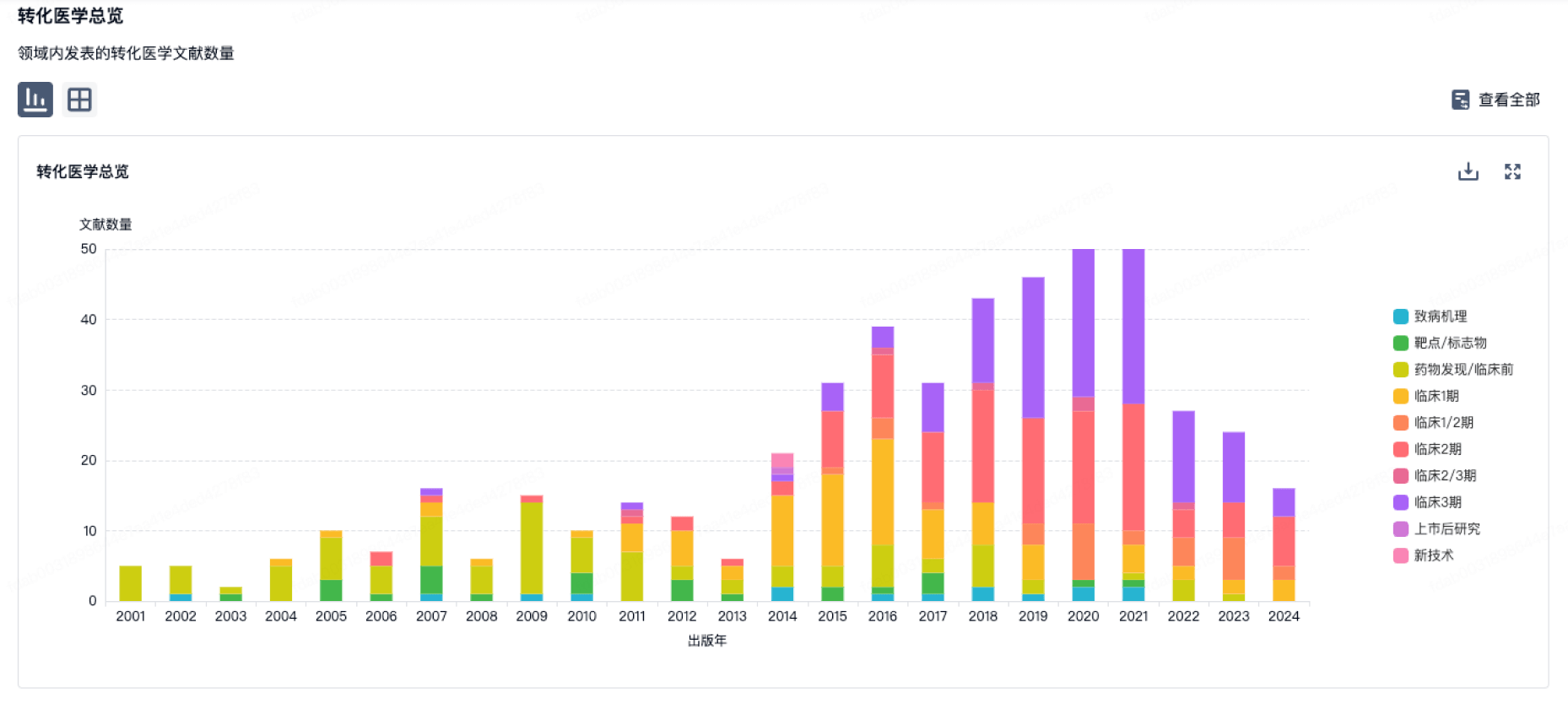

100 项与 MyBiotics Pharma Ltd. 相关的转化医学

登录后查看更多信息

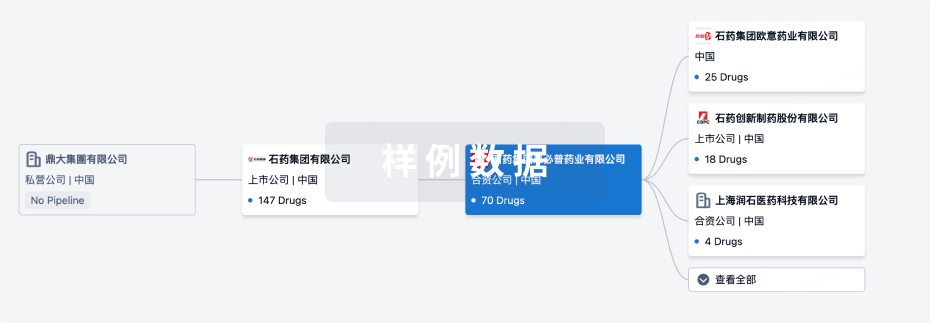

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年06月30日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床前

2

1

临床1期

其他

1

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

MBX-SD-202 | 梭菌感染 更多 | 临床1期 |

MBX-MC-101 | 阴道菌群失调 更多 | 临床前 |

MBX-SD-201 | 梭菌感染 更多 | 临床前 |

MBX-SD-103 | 细菌性阴道炎 更多 | 终止 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

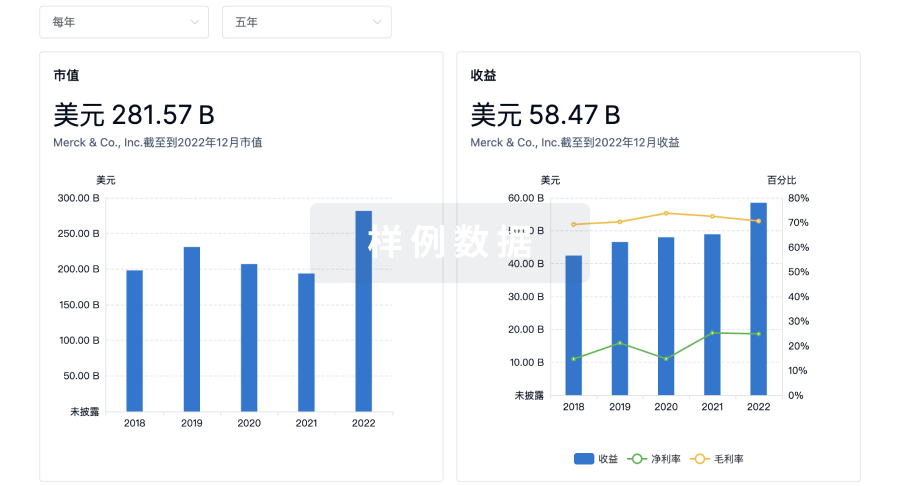

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

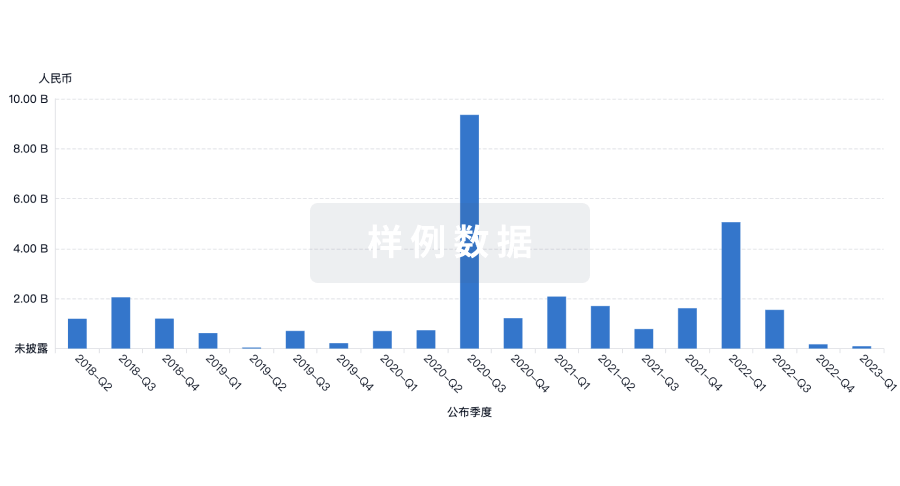

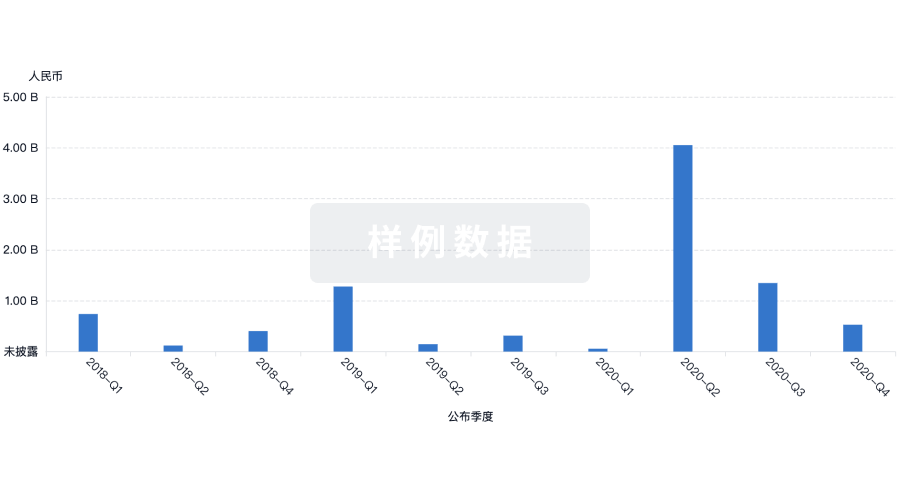

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用