预约演示

更新于:2025-05-07

Delta

更新于:2025-05-07

概览

关联

1

项与 Delta 相关的临床试验NCT01203436

Supplemental Therapeutic Oxygen for Prethreshold Retinopathy of Prematurity

The purpose of this trial was to determine the efficacy and safety of supplemental therapeutic oxygen for infants with prethreshold retinopathy of prematurity (ROP) to reduce the probability of progression to threshold ROP and the need for peripheral retinal ablation.

开始日期1994-02-01 |

申办/合作机构  Delta Delta [+3] |

100 项与 Delta 相关的临床结果

登录后查看更多信息

0 项与 Delta 相关的专利(医药)

登录后查看更多信息

29

项与 Delta 相关的新闻(医药)2025-05-01

The threat of tariffs on pharmaceuticals imported to the U.S. hasnt yet pushed drugmakers off course, with many of the largest companies indicating they expect to be able to absorb any impact in the short term.Speaking on earnings calls in recent weeks, pharma executives have, for the most part, told investors their supply chains are flexible enough to mitigate the effects of new levies for this year, at least. With a few exceptions, the large drugmakers that have reported financials for the first quarter are maintaining their sales and profit guidance for 2025.We've taken, I think, appropriate actions with inventory levels and in terms of managing our supply chain to enable us to feel comfortable we can manage it this year and in the medium term, said Novartis CEO Vas Narasimhan in the companys April 29 earnings call. His comments were largely consistent with those of his counterparts at other drugmakers.Im cautiously optimistic, said Pfizer CEO Albert Bourla on a separate April 29 call. I hope that we will weather it successfully.Pharma products were exempted from the broad tariffs President Donald Trump announced April 2. But the U.S. Department of Commerce has opened a trade investigation that analysts expect will lead to sector-specific tariffs on national security grounds. Trump has suggested the new tax could be high, floating rates between 50% and 200%. Typically, these so-called Section 232 probes take about nine months, but its thought the Trump administration will move more quickly.Executives acknowledged the uncertainty they still face, but attempted to assure analysts during earnings calls that theyve prepared for a range of scenarios. Many have already taken steps to insulate themselves, such as by moving inventory to the U.S. or by increasing U.S.-based production of key medicines.Companies are aggressively importing as much product as possible ahead of potential tariffs, wrote David Risinger, an analyst at Leerink Partners, in an April 30 note to clients. If companies have one year or more of supply already in the U.S., he added, they should be able to avoid tariffs impacting their cost of goods and profits in the near term.A few, namely Johnson & Johnson, Merck & Co. and Pfizer, have also detailed the indirect costs they expect to absorb from the general tariffs already imposed by the U.S., which will raise the expense of procuring goods like steel, laboratory supplies and chemicals. J&J expects a $400 million hit, due mainly to its medical device business, while Merck and Pfizer anticipate, respectively, expenses of $200 million and $150 million.Those general tariffs a baseline 10% duty and much higher, reciprocal rates that are temporarily paused for most countries except China have whipsawed markets and roiled the planning of companies in other sectors, like aviation, automotive and consumer goods. Firms like Walmart, Delta and GM have withdrawn their financial forecasts for the year in response.Over the longer term, drugmakers aim to reposition their manufacturing a yearslong process many have already begun.We actually had started to change and rebalance our supply chain strategy, beginning with the Tax Cut and Jobs Act, where we started moving more towards being able to have U.S. for U.S., Europe for Europe, and Asia for Asia, Merck CEO Rob Davis said on an April 24 call, referring to the 2017 U.S. tax law that lowered corporate rates.The tariff threat appears to have accelerated efforts like Mercks. Since February, big pharma firms have announced more than $170 billion in planned investment in U.S.-based manufacturing, including plans for $55 billion in spending from J&J and $50 billion from Roche.Our goal in the coming years is to have 100% of our key U.S. products fully produced end-to-end in the U.S. and we're on track to do that, said Narasimhan, of Novartis, which recently committed to $23 billion in new domestic spending.However, many large firms still have a significant manufacturing presence in countries like Ireland, Switzerland and the Netherlands, the latter of which is also a common home for companies valuable intellectual property. Tariffs on those countries could cause more significant problems for the industry.Executives are advocating for the Trump administration to lean on tax policy, rather than tariffs, to achieve its goal of reshoring drug supply chains.We support the U.S. government's goals to increase domestic investment, Lilly CEO David Ricks said Thursday. However, we don't believe tariffs are the right mechanism. Enhanced tax incentives and/or the extension of the Tax Cut and Jobs Act are better tools to achieve these goals.J&J CEO Joaquin Duato made a similar point on his companys first quarter earnings call held April 15. '

2024-10-16

KING OF PRUSSIA, Pa., Oct. 16, 2024 /PRNewswire/ -- Block Clinical Inc., recently had the honor of speaking at the FARA & CHOP FA Symposium. The Friedreich's Ataxia Research Alliance (FARA) and the Friedreich's Ataxia Center of Excellence at Children's Hospital of Philadelphia (CHOP) hosted the 2024 Friedreich's Ataxia Symposium on October 6–7 at the Crowne Plaza in King of Prussia, PA.

Block Clinical's Director of Client Services, Terri Nier, was invited to speak as part of a panel with industry peers from Biogen, Delta Airlines, Harkin Institute and Friedreich's Ataxia (FA) community members. Topics were focused on patient accessibility, highlighting the burdens and available solutions for this patient population including travel and high touch coordination.

As experts in this area, Block Clinical spoke about their experience delivering patient support services that include a single point of contact for patients and their caregivers, who coordinate pre-paid travel to reduce out of pocket costs and process reimbursements and stipend payments quickly and accurately. Block shared some insights into supporting patients affected with FA:

Travel is complicated and burdensome for FA Patients who may travel with wheelchairs, scooters and/or other mobility support equipment.

At the airport, this impacts wheelchair assistance, TSA screening, flight seating and layover scheduling.

Hotel accommodations require specific ADA compliance which limits the hotels to choose from. Terri was quick to point out:

"Just because a room is described as 'accessible' online does not mean that it is a mobility accessible room. Many times these rooms are designed for hearing accessibility and not mobility accessibility which may be confusing or misleading."

Ground transportation is a key component and the most frequently delivered travel service. Whether traveling for clinical trials, work, or personal trips, accessible vehicles may be required for FA patients and the quality and availability of these vehicles was discussed with the panel. Patients commented on the success and failures of "accessible" ground transportation and how often they miss the mark. Terri suggested to:

"Do your research and plan as far ahead for your trip to ensure that you have the best transportation options available to you when you are traveling. Most cities have good options but you may have to look a little harder for them before you hit the road."

Well deserved special recognition was given to Terri Nier for the work she has done to support this community. Specifically in working with FARA to organize a Thanksgiving dinner for many of the patients that were in a clinical trial over the holidays.

About Block Clinical Inc:

Block Clinical's trial logistics and payment automation platform delivers integrated services ranging from site and patient payments to high-touch patient and site convenience services that improve satisfaction, whether the trial is conducted at a research site, at a patients home, or virtually. The result is an enhanced trial experience for patients and caregivers that maximizes performance, engagement, and quality of clinical trials.

SOURCE Block Clinical Inc

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE.COM?

440k+

Newsrooms &

Influencers

9k+

Digital Media

Outlets

270k+

Journalists

Opted In

GET STARTED

临床研究

2024-10-14

Selfii, a company that provides privacy-preserving health data, announced it is partnering with secure identity company CLEAR to streamline and strengthen patient access to health records via Selfii's patient data network.

The aim of the partnership is to align healthcare organizations with 21st century Cures Act demands by allowing patients to quickly request and acquire their data without additional administrative weight.

The alliance also creates a one-stop, self-service access for patients to their entire medical records with better security and confirmation.

In addition, CLEAR will help authenticate patient-driven record inquiries within Selfii’s patient health application, making sure that individual patients can appreciate streamlined, automated patient access while healthcare organizations that are leveraging Selfii’s Cures Gateway platform, can be guaranteed that exceptional industry-leading security and identity standards have been met.

"Our alliance with CLEAR reimagines how to make health information instantly accessible and effortlessly portable, the new benchmark in simplicity for patients’ navigation of their own health," Glenn Keet, general manager of HIE at Selfii, said in a statement.

"Just as CLEAR makes travel frictionless, together we’ve transformed the often mind-numbing healthcare journey into a hassle-free experience—helping patients to navigate their digital health with unprecedented ease."

David Bardan, head of healthcare at CLEAR said that the partnership with Selfii will help to empower patients with easier, secure access to their health information.

"By pairing our expertise in secure identity verification with Selfii’s extensive provider network, this collaboration will go a long way in closing the gap in patient access and achieving an easy-to-understand, complete medical record in one place."

THE LARGER TREND

In September, CLEAR expanded to 51 TSA precheck enrollment locations throughout the U.S., including San Antonio International Airport, Buffalo Niagara International Airport, Kahului International Airport and Daniel K. Inouye International Airport.

In August, CLEAR announced the repurchase of four million shares of Class A Common stock in the third quarter of 2024 pursuant to a block share purchase agreement with Delta Air Lines. Delta still owns 4,277,958 shares of CLEAR's Class C Common stock.

Other companies involved in the privacy-preserving health data business include Datavant, which in 2023, partnered with Socially Determined to provide life sciences companies with data on social risk drivers to enhance health equity and patient outcomes.

In 2021, MindMed teamed up with Datavant to help link its clinical data with external evidence from other clinical trials and real-world data sources.

In September, True North ITG chief executive officer and cofounder Matt Murren, sat down with MobiHealthNews to discuss how the company helps health systems and venture capital firms make sure cybersecurity within their organization and among potential portfolio companies.

并购

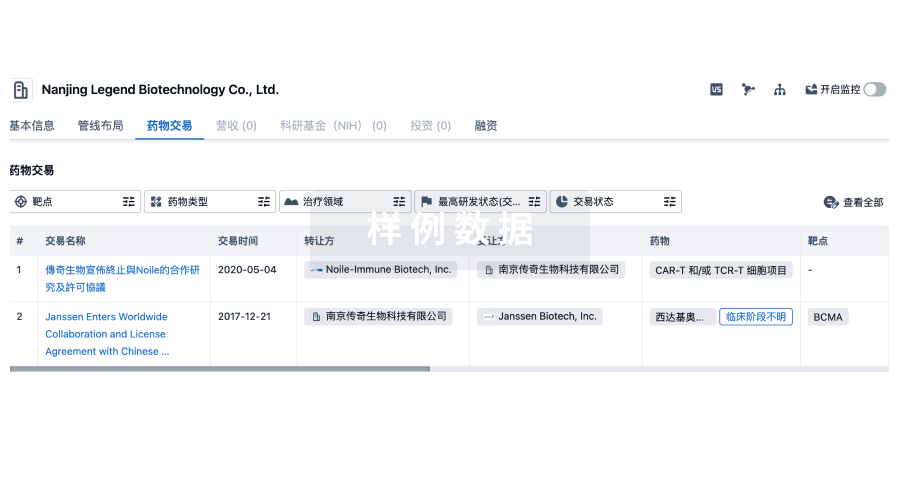

100 项与 Delta 相关的药物交易

登录后查看更多信息

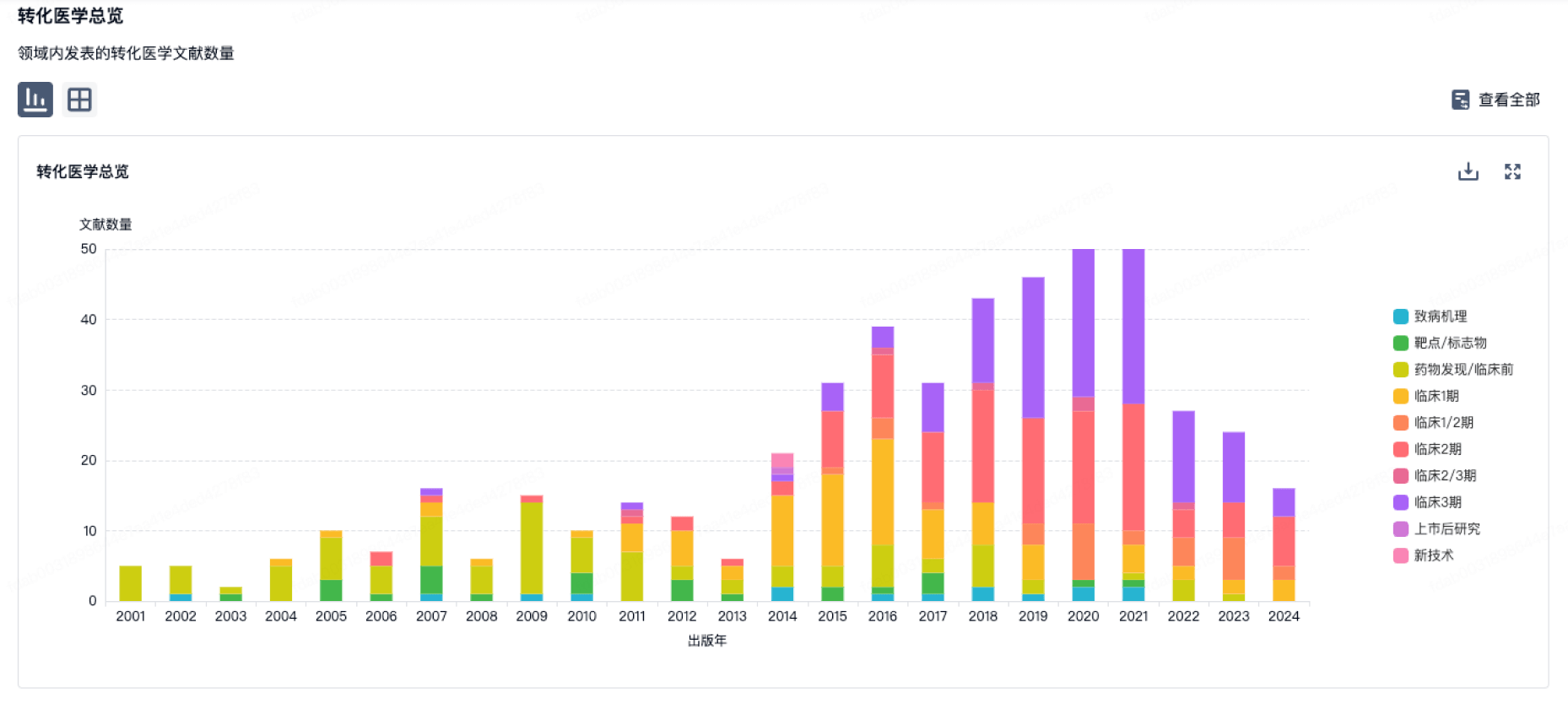

100 项与 Delta 相关的转化医学

登录后查看更多信息

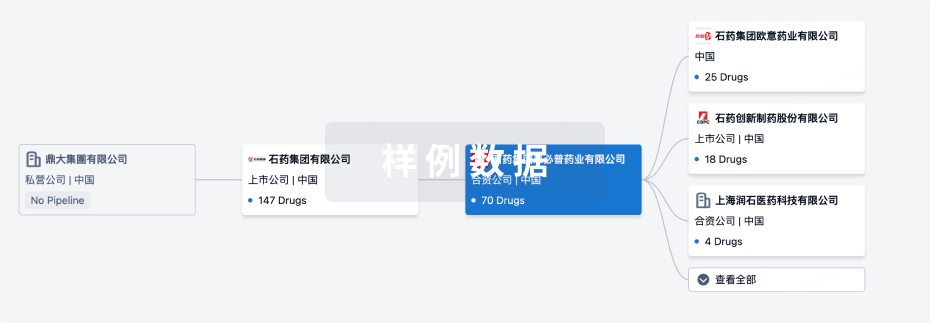

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年07月01日管线快照

无数据报导

登录后保持更新

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

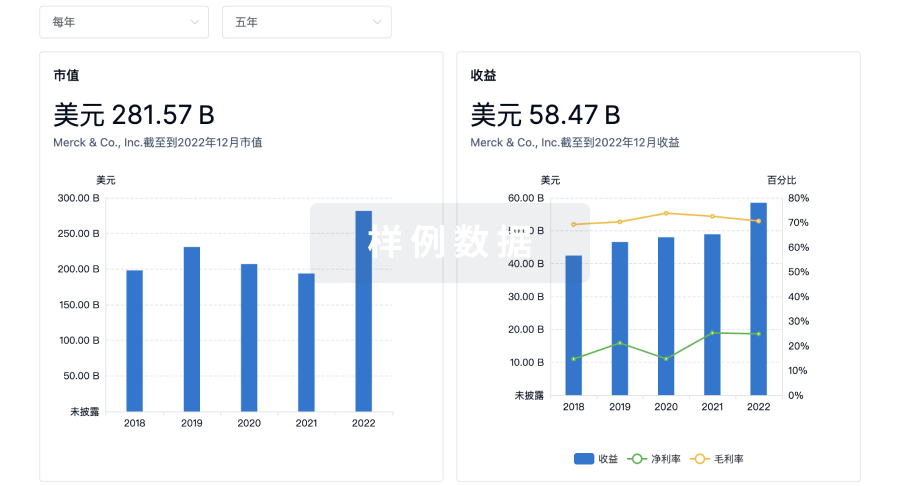

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

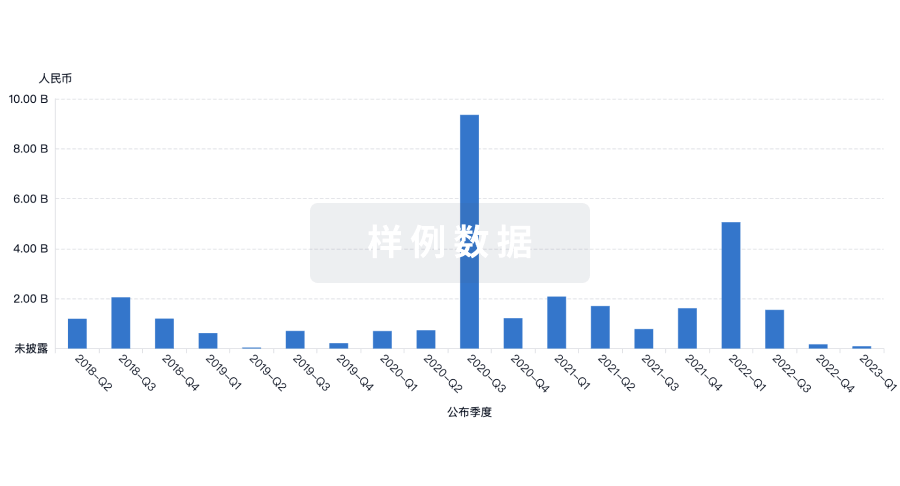

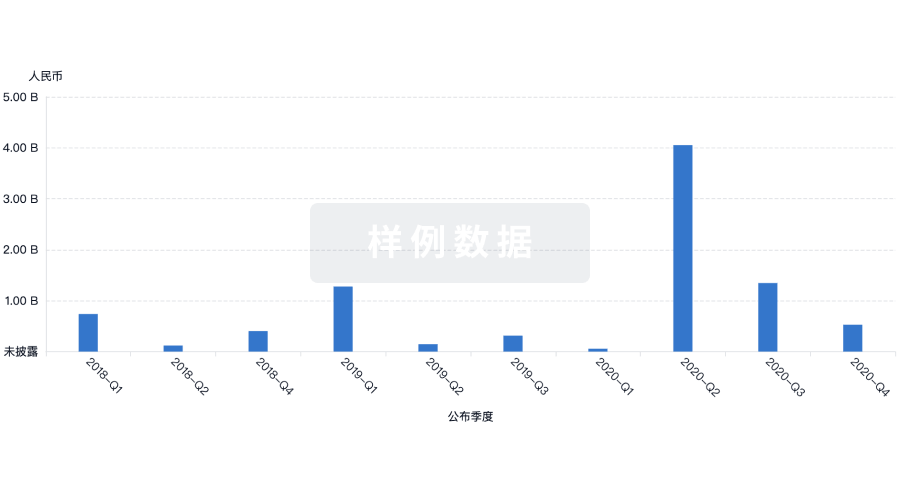

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用