预约演示

更新于:2025-05-07

BioPlus Co., Ltd.

更新于:2025-05-07

概览

关联

2

项与 BioPlus Co., Ltd. 相关的临床试验NCT06305520

Medical Device Pivotal Study to Evaluate the Efficacy and Safety of Injection With SkinPlus-HYAL Implant Lidocaine as Compared to RESTYLANE Lidocaine in Temporary Correction of Nasolabial Folds

Purpose : This investigation intends to demonstrate that the investigational device, SkinPlus-HYAL Implant Lidocaine, is non-inferior to the comparator device, RESTYLANE Lidocaine, in terms of temporary wrinkle reduction effect, safety, and injection site pain when applied on nasolabial folds in adults.

Design : 24-week efficacy and safety evaluation and additional 48-week long-term safety and efficacy evaluation with a multi-center, randomized, subject- & evaluator-blind, matched pairs, active controlled, none-inferiority, confirmatory design

Treatment Group: Application of the investigational medical device (SkinPlus-HYAL Implant Lidocaine) Control Group: Application of the comparator device (RESTYLANE Lidocaine)

Population: Number of subject 100

* In this investigation, the same subject receives both test and control treatments, one on each side of the nasolabial folds (matched pairs design).

Design : 24-week efficacy and safety evaluation and additional 48-week long-term safety and efficacy evaluation with a multi-center, randomized, subject- & evaluator-blind, matched pairs, active controlled, none-inferiority, confirmatory design

Treatment Group: Application of the investigational medical device (SkinPlus-HYAL Implant Lidocaine) Control Group: Application of the comparator device (RESTYLANE Lidocaine)

Population: Number of subject 100

* In this investigation, the same subject receives both test and control treatments, one on each side of the nasolabial folds (matched pairs design).

开始日期2023-03-10 |

申办/合作机构  BioPlus Co., Ltd. BioPlus Co., Ltd. [+3] |

KCT0003994

A randomized, multi center, subject/evaluator blind, active-controlled design clinical study to evaluate the adhesion prevention and safety of Interblock® versus Hibarry ® in patients after operation for disc herniation or spinal stenosis

开始日期2017-06-17 |

申办/合作机构 |

100 项与 BioPlus Co., Ltd. 相关的临床结果

登录后查看更多信息

0 项与 BioPlus Co., Ltd. 相关的专利(医药)

登录后查看更多信息

1

项与 BioPlus Co., Ltd. 相关的文献(医药)2018-06-30·Journal of Plant Biotechnology

Establishment of optimal conditions for micropropagation by node culture and multiple shoots formation from sucker explants of thornless Blackberry (Rubus fruticosus L. cv. BB21)

作者: Kim, Hyo Jin ; Oh, Seung Cheol ; Kim, Ee Youb ; Lee, Kang Seop ; Cho, Han Jig ; Park, Dae Hyun

17

项与 BioPlus Co., Ltd. 相关的新闻(医药)2025-01-13

2025年1月8日,“BiG老友记 2025 Gala Dinner”在上海外滩圆满举办。BiG部分老友们齐聚一堂,共同举杯畅谈新药出海二三事,热议CAR-T技术的前沿突破,气氛热烈而融洽。会上,进行了秘书长换届仪式,任命刘冀先生为BiG秘书长,费佳倩女士为秘书处主任。

回顾过去十年,中国Biotech迅速崛起,BiG作为连接科学与产业的桥梁,见证并推动了这一辉煌历程,也始终本着坚持“会员所有、会员自治、服务会员“(Of member, by member, for member)的治理原则持续为大家服务。

展望未来十年,BiG将继续携手科学家、企业家和投资人,共同探索从科学到产业的成熟路径,构建原创新药生态,坚持相遇、相识、相知、相助理念,scientifically driven making impact, 初心不改,助力中国Biotech在全球化进程中实现更多突破,迈向更加辉煌的下一个十年!

现场分享

开场致辞

杨颖:泉心泉意创始人/董事长、BiG常务执委

十年可以让多少事情发生,BiG当时成立起来就是一群人带着一种火花,希望有一个平台让大家在一起,让中国的声音能够在全球传播。

BiG也是属于大家的组织,非常期待所有的老友、会员们一起探讨未来十年我们能够做出什么样的新的可能,就像十年前的我们,也不曾想象中国的biotech能发展到如今的情况。未来,everything is possible!

对话:CAR-T的未来

徐沪济 海军军医大学长征医院大内科主任兼风湿科主任/清华大学医学院教授

卢宏韬 科望医药联合创始人/CSO、BiG总干事(主持)

现场金句:

1.异体CAR-T因标准化生产、质控能力强和成本低,克服了自体CAR-T的个体差异问题,成为未来发展的重要方向。

2. 与肿瘤不同,自身免疫性疾病的负荷相对较低,因此不需要彻底‘清零’(即完全清除患者的免疫细胞)。完全清除免疫细胞容易导致免疫系统崩溃,增加感染风险,而感染往往是治疗过程中最致命的挑战。

3. CAR-T疗法在清除memory B细胞和治疗持续性上优于抗体疗法。但从临床实用性角度来看,首先,最方便可行的产品可能是T细胞衔接器(TCE),因为其简单易于推广。其次是体内CAR-T(in vivo CAR-T),再之后是异体CAR-T,最后才是自体CAR-T。

锵锵三人行: BiG友西行- 新药出海二三事

沈 宏 罗氏中国创新中心负责人

朱忠远 映恩生物创始人/CEO

杨 颖 泉心泉意创始人/董事长(主持)

现场金句:

1.Biotech的核心是biology与modality的结合,在biology相对确定的情况下,中国凭借工程化能力和敏捷研发,快速开发差异化产品,除了ADC和CAR-T,未来核药、小核酸等新modality将在代谢和自免领域大放异彩。

2.MNC是先想清楚了再做,Biotech是边做边想,在行动力中学习。

3.中国风起云涌99%都是老靶点,平衡first-in-class与best-in-class研发策略,既降低风险又保持创新,是企业实现突破与稳定发展的关键。

BiG秘书长换届仪式

见证嘉宾,左起:

杨 颖 泉心泉意创始人/董事长、BiG常务执委

史艺宾 大睿生物创始人/CEO、BiG青委

卢宏韬 科望医药联合创始人/CSO、BiG总干事

李 圆 BioPlus创始人/CEO、BiG往届秘书长

刘 冀 FIC LABS创始人、BiG现任秘书长

申华琼 纽欧申医药创始人/CEO、BiG理事

钱雪明 创胜集团创始人/CEO、BiG执委

往届秘书长离任发言

李 圆 BiG往届秘书长、BioPlus创始人/CEO

过去的几年里,BiG成为了行业里最有创新的会议组织,是希望能够打破会员间的壁垒和界线,让大家有更好的信任,携手前行。

就任期间特别感谢杨颖女士,她是我行业的领路人,见证了我的成长,以及非常感谢总干事卢宏韬博士,同时也感谢所有的理事、执委、会员们,让我们想做的很多事可以在BiG实现,我想做创新药、做临床研究也应该是没有界线的,创新的基因一脉相承。

新任秘书长上任发言

刘冀:BiG现任秘书长

过去二十年,我跟着张江一起成长,亲历了它从起步到如今的科学城,回忆起来,上市许可持有人制度的突破和上海DIA年会背后的中国加入ICH前夕等等仿如昨日,也坚信中国的生物医药行业未来会更好。作为BiG老友会员,在见证BiG的快速发展的同时,也被它全心服务会员、助力行业发展,推动科学转化的初心所打动,希望能为BiG更好的发展贡献力量。

感谢BiG各位理事、执委及广大会员的信任,愿秉持回归BiG初衷,以聚焦科学创新、聚焦会员服务、聚焦扩大影响为宗旨,为组织和BiG会员做好服务。

也希望在任期里能跟各位专家、朋友包括会员们一起为这个行业的发展做出贡献!

新任秘书处主任发言

费佳倩:BiG秘书处主任

加入 BiG,不仅仅是一份身份的转变,更是承载着厚重期望的责任担当。既是如影随形的压力,更是源源不断的动力。

在这个过程中,我们期待通过多元途径为大家赋能,也期待听到更多会员的声音,把更多创新的想法落地呈现,以更好地为大家创造发展的机遇和场域,希望未来与大家携手,继续将BiG打造成一个充满温暖与凝聚力的大家庭,让每一位会员都能在这里找到归属感与价值感。

我们深知,共建医药创新生态圈,让世界听到BiG的声音这件事情,意义非凡。为此,我定会投入 100% 的努力,全心全意为大家提供最优质的服务,不负所托,与 BiG 共同迈向下一个十年 。

现场花絮

BiG秘书长&主任简介

刘冀 BiG秘书长

2004年进入张江药谷负责招商引资、产业服务、国际合作、孵化器管理等工作。亲历并深度参与了“张江药谷”从无到有建设的全过程。负责中国首个全要素生物医药专业孵化器-张江药谷孵化器筹建、实施及首批入孵企业的引进、孵化服务,参与“十一五”国家重大新药创制专项、MAH制度试点和探索实施,招引多家TOP10 MNC和医药工业百强药企等在张江的落地与发展,孵化并服务了多家美股、港股及科创版上市企业。

2018年进入生物医药投资领域,投资和管理了十余家优质创新企业。目前任FIC LABS创始人,并发起基金专注于早期和成长期企业投资,关注全球生物医药创新。

费佳倩 BiG秘书处主任

17年进入生物医药行业,六年中积极参与产业技术的赋能,在多个技术平台,包括结构生物学、小分子高通量药物筛选、抗体筛选以及自动化生物样本库的推广中积累了丰富的专业知识和实践经验,参与并见证了多个科研院校、biotech、CRO、跨国药企的初始平台建设以及后续的发展壮大,期间也参与了生物样本库的国家级重大项目。

2023年,加入泉心泉意担任业务发展(BD)总监,根据公司战略,链接并推动产业上下游(包括政府、园区、企业、媒体等组织)的合作,探索新形势下的商业模式,以期推动实现产业上下游的合作共赢。

共建Biomedical创新生态圈!

如何加入BiG会员?

细胞疗法免疫疗法抗体药物偶联物

2024-03-19

Dive Brief:Elevance Healths pharmacy benefit manager has agreed to buy Krogers specialty pharmacy business,as PBMs continue to double down on sources of reliable revenue in a competitive pharmacy market.If the deal is finalized, Krogers specialty pharmacy will merge with CarelonRx, Elevances PBM.Kroger will retain its in-store retail pharmacies and walk-in clinics.Terms of the transaction were not disclosed. In a Monday release,Kroger said it expects the deal to close in the second half of 2024. Elevance did not respond to a request for comment by time of publication.Dive Insight:Specialty pharmacies dispense expensive prescription medicines for complex, chronic conditions. Theyre a key source of revenue for PBMs:Less than 2% of the U.S. population takes specialty drugs, according to industry estimates, but the prescriptions account for 50% of total U.S. pharmacy spend. Specialty drugs can result in profits of hundreds or even thousands of dollars per prescription.Specialty pharmacies also provide wraparound services like side-effect management and personalized care. As a result, its a difficult segment of the pharmacy supply chain for other players to disrupt, at a time when legacy PBMs are losing clients to newer businesses with more transparent business models.For example, CVS Caremark one of the largest PBMs in the U.S. lost a massive client in Blue Shield of California late last year, when the payer decided to contract with multiple vendors for pharmacy services instead.However, BSCA retained Caremarkfor its specialty business, in part due to the difficulty of switching specialty vendors.As such,Krogers specialty business could be a valuable addition for CarelonRx.Elevances PBM has hustled to build out its specialty offerings since launching in 2019 as IngenioRx: Early last year,Elevance completed its acquisition of BioPlus, one of the largest specialty pharmacy organizations in the U.S. And in March, Elevance closed its buy of Paragon Healthcare, a company that provides infusion services, including through specialty pharmacies.CarelonRx has steadily grown to account for more of Elevances topline. CarelonRx brought in $33.8 billion in revenue last year, up 19% year over year, and notched the highest operating margin of Elevances reportable segments, at 5.8%, according to a 10-K filed with the Securities and Exchange Commission earlier this yearMeanwhile,Kroger is divesting assets as it looks to get a $25 billion merger with competitor Albertsons across the finish line. The Federal Trade Commission sued to block the deal last month, citing anticompetitive concerns. '

并购

2024-01-24

Given the focus on building out its Carelon segment, Elevance now reports its performance and that of its health insurance business individually.

UPDATED: 12:50 p.m. on Jan. 24

While multiple competitors have taken a hit in the fourth quarter amid a rise in care utilization, executives at Elevance Health said what they saw in the quarter generally aligned with expectations.

Chief Financial Officer Mark Kaye said during the company's earnings call on Wednesday morning that the company's benefits expense ratio of 89.2%, landing at the midpoint of its expected range. There were some specific areas where Elevance saw heightened utilization, though, and that also tracks with reports from other payers.

Kaye said that the insurer saw an uptick in orthopedic services and other care delayed during the pandemic, as well as an increase in services related to respiratory conditions late in the quarter. Given that this trend was identified earlier in the year, Elevance Health did broadly plan for the impacts as part of its estimates on cost trend.

A noted rise in vaccinations for respiratory syncytial virus also aligns with UnitedHealth Group's Q4 report.

Elevance Health beat the Street on both earnings and revenue for the fourth quarter of 2023, reporting $856 million in profit.

The company also posted $42.6 billion in revenue for Q4, according to its earnings report released Wednesday morning. That's up nearly 7% from the $39.9 billion in revenue reported for the prior year quarter.

Profit declined slightly year-over-year. In the fourth quarter of 2022, Elevance Health reported $865 million in profit, making for a 1% decrease.

The insurer's revenue and profit for the quarter both surpassed Wall Street analysts' expectations, according to Zacks Investment Research.

“We are pleased to have delivered another year of strong performance in 2023, enabled by our relentless focus on customer experience and affordability, and continued investments in growth and innovation," CEO Gail Boudreaux said in a press release. "The balance and resilience of our business coupled with the focused execution of our enterprise strategy supports our confidence in our outlook for 2024, as we continue to optimize the foundation, and scale our flywheel for sustained growth of the enterprise over the long term.”

For the full-year 2023, Elevance Health brought in $171.3 billion in revenue and $5.99 billion in profit. By comparison, the company reported $156.6 billion in revenue and $5.89 billion in profit for 2022.

Given the focus on building out its Carelon segment, Elevance now reports its performance and that of its health insurance business individually. The benefits division, which includes its Anthem Blue Cross plans as well as Wellpoint, brought in $36.5 billion in operating revenue for the fourth quarter.

Operating revenue for the full year was $148.6 billion, according to the report.

Elevance Health's membership was 47 million at the end of the year, declining by 1% or about 570,000 members. The company said this was due in part to the ongoing Medicaid redeterminations as well as declines in its employer group risk-based plans.

In Q4, the company lost 364,000 members because of the Medicaid eligibility rulings, which was partially offset by commercial segment growth.

Operating revenue at Carelon was $12.4 billion in Q4 and $48 billion for the full-year 2023. The company saw growth in membership at Carelon Rx, its pharmacy benefit management arm, and touted the acquisition of BioPlus as key drivers, according to the report.

Alongside reporting the fourth-quarter results, Elevance Health set its full-year 2024 guidance at $37.10 in earnings per share.

财报并购

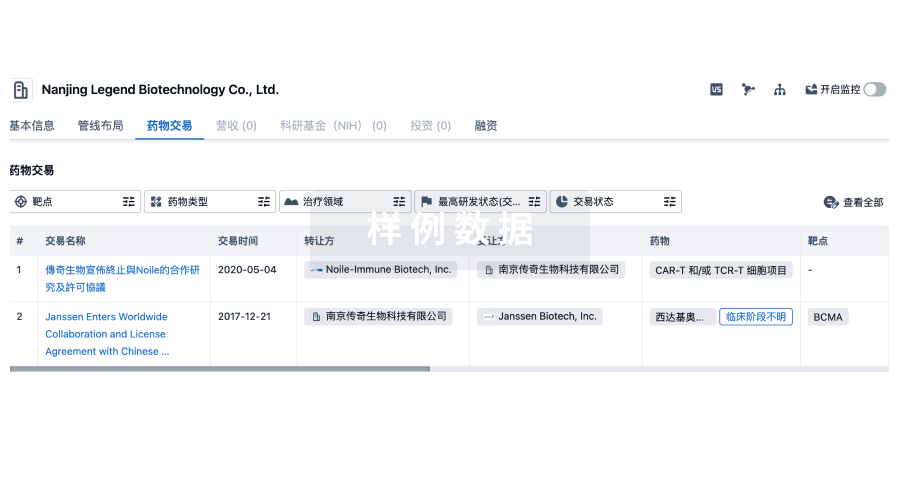

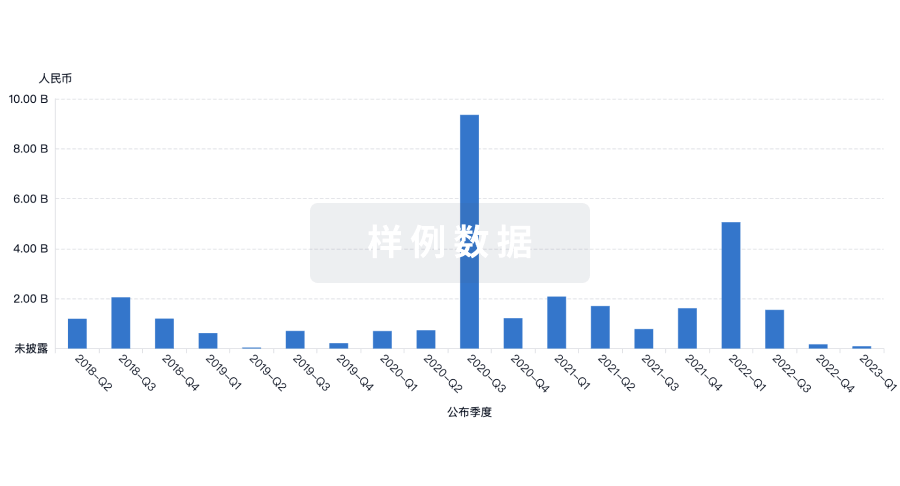

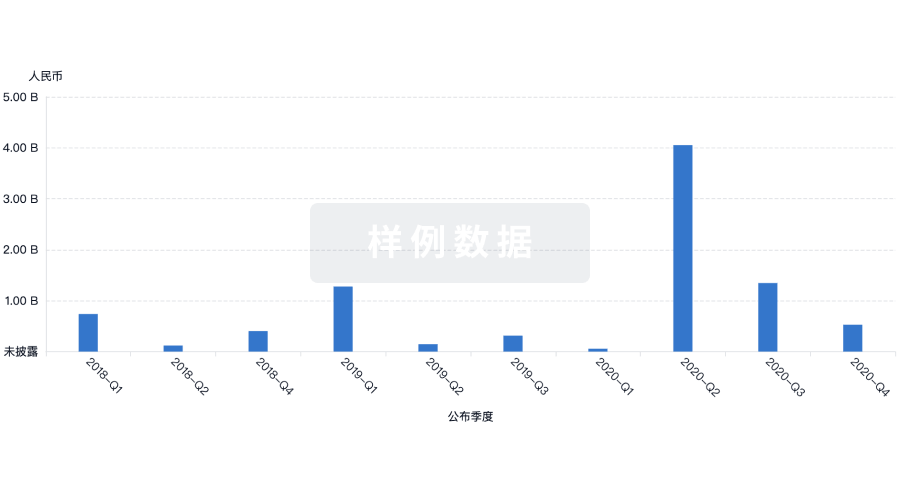

100 项与 BioPlus Co., Ltd. 相关的药物交易

登录后查看更多信息

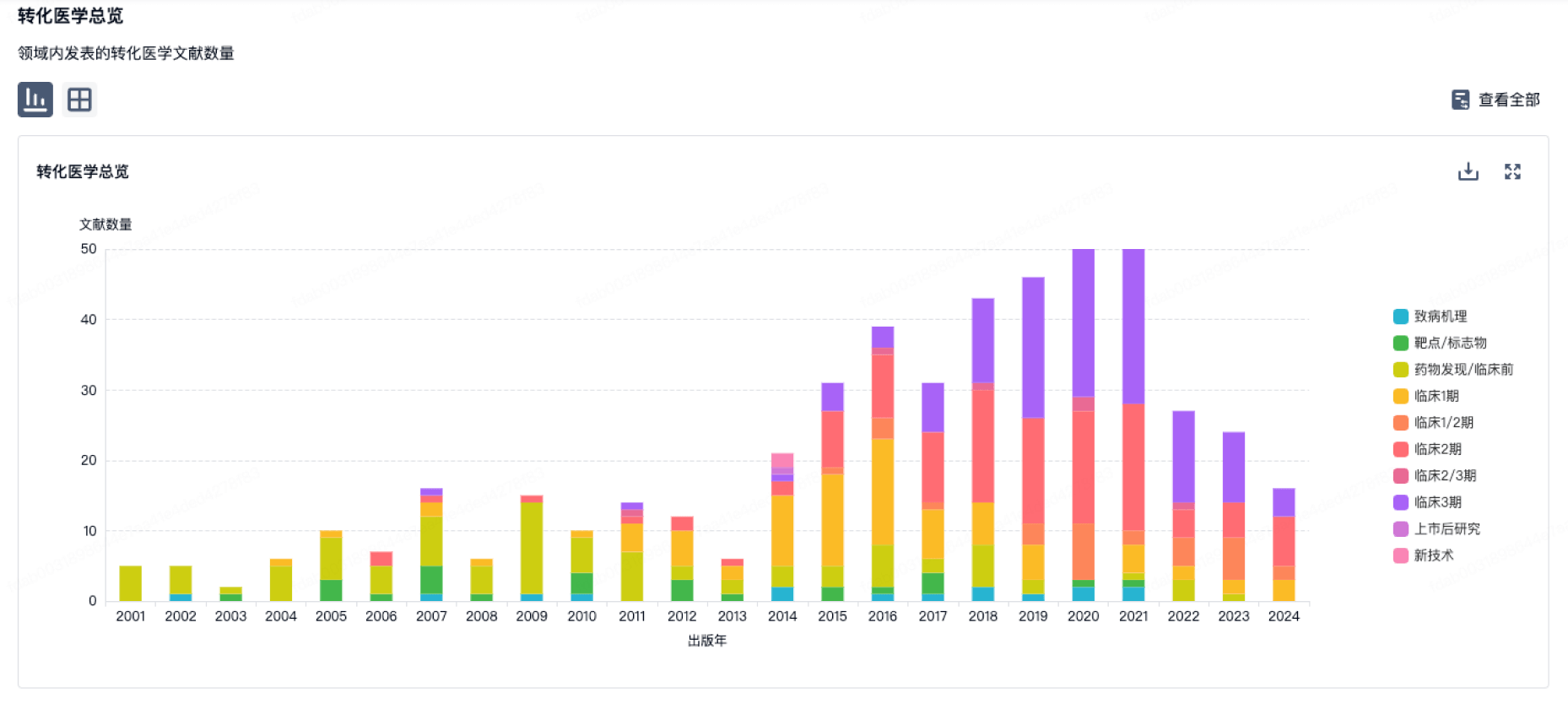

100 项与 BioPlus Co., Ltd. 相关的转化医学

登录后查看更多信息

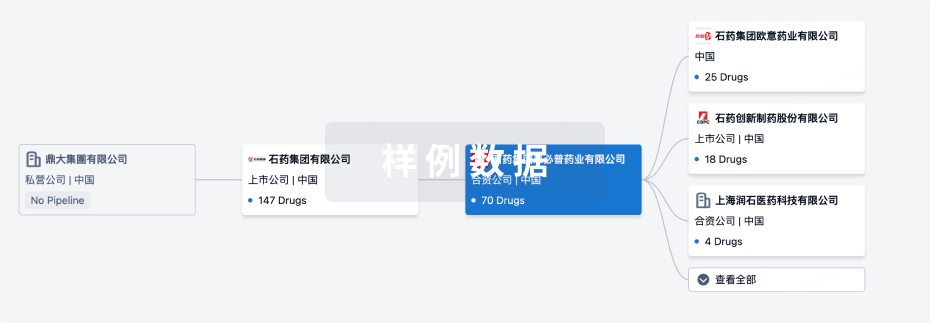

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年07月01日管线快照

无数据报导

登录后保持更新

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

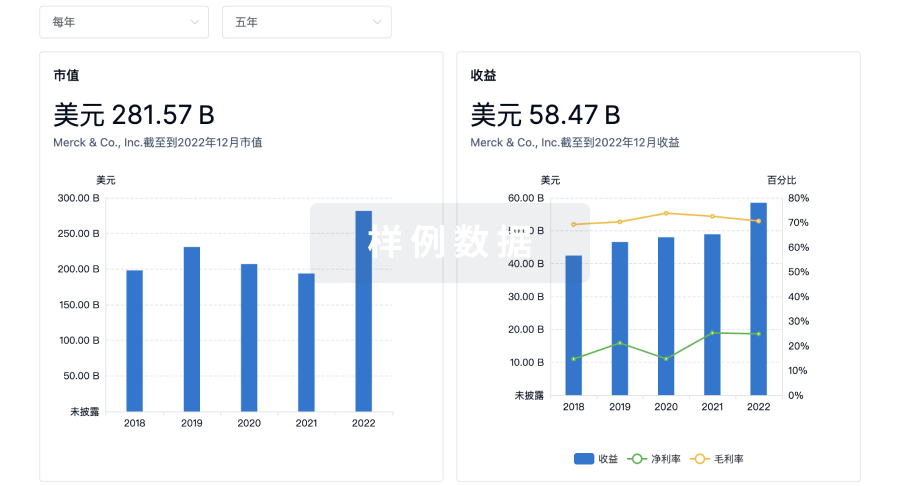

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用