预约演示

更新于:2025-06-13

VAXON Biotech SA

更新于:2025-06-13

概览

标签

肿瘤

治疗性疫苗

生物药

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 疾病领域 | 数量 |

|---|---|

| 肿瘤 | 4 |

| 排名前五的药物类型 | 数量 |

|---|---|

| 治疗性疫苗 | 3 |

| 生物药 | 1 |

| 排名前五的靶点 | 数量 |

|---|---|

| HER2 x MAGEA1 x TERT | 1 |

| HER2 x HLA-A 24 | 1 |

关联

4

项与 VAXON Biotech SA 相关的药物作用机制 HER2拮抗剂 [+2] |

在研机构 |

原研机构 |

在研适应症 |

非在研适应症 |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

靶点- |

作用机制 免疫刺激剂 |

在研机构 |

原研机构 |

在研适应症 |

非在研适应症- |

最高研发阶段早期临床1期 |

首次获批国家/地区- |

首次获批日期- |

靶点- |

作用机制 免疫刺激剂 |

在研机构 |

原研机构 |

在研适应症 |

非在研适应症- |

最高研发阶段临床前 |

首次获批国家/地区- |

首次获批日期- |

3

项与 VAXON Biotech SA 相关的临床试验NCT02289196

A Multicenter, Open Label, Uncontrolled Phase I Trial to Compare Safety, Tolerability and Immunogenicity of Vx-006 Vaccine at 0.5mg, 1mg, 5mg and 10mg Doses in Human Leukocyte Antigen-A02 (HLA-A02) Positive Patients With Solid Tumours

Patients with histologically proven malignancy with documented disease control (objective response or stable disease) or Not Evaluable Disease (NED) expectancy > 6 months; only HLA-A*02 positive patients.

The primary objective of the trial is to compare safety and tolerability of four different doses of Vx-006. The secondary objective is to compare immunogenicity of four different doses of the Vx-006.

The primary objective of the trial is to compare safety and tolerability of four different doses of Vx-006. The secondary objective is to compare immunogenicity of four different doses of the Vx-006.

开始日期2014-03-01 |

申办/合作机构 |

NCT01935154

Phase II Study of Vx001 Vaccine in HLA-A*0201 Positive Patients With TERT Positive Stage IV or Recurrent Stage I-III NSCLC

Patients with stage IV or recurrent stage I-III NSCLC with documented disease control (objective response or stable disease) within 3 weeks after platinum based 1st line chemotherapy; only HLA-A*0201 positive patients with TERT expressing tumors will be included.

The objective of the trial is survival rate at 12 months.

The objective of the trial is survival rate at 12 months.

开始日期2012-08-01 |

申办/合作机构 |

EUCTR2006-005032-25-GR

A multi-centre phase II controlled study of Vx-001 in Non Small Cell Lung Cancer (NSCLC)

开始日期2007-05-08 |

申办/合作机构 |

100 项与 VAXON Biotech SA 相关的临床结果

登录后查看更多信息

0 项与 VAXON Biotech SA 相关的专利(医药)

登录后查看更多信息

1

项与 VAXON Biotech SA 相关的文献(医药)IDrugs : the investigational drugs journal

Development of optimized cryptic peptides for immunotherapy

作者: Menez-Jamet, Jeanne ; Kosmatopoulos, Kostas

A review.Specific immunotherapy is based on the use of tumor-specific antigens to induce an efficient antitumor immune response.Although tumors are known to be weakly immunogenic and therefore capable of escaping immune surveillance, the objective of tumor vaccination is to induce a frequent, strong and long-lasting antitumor immune response based mainly on the activation of cytotoxic T-lymphocytes.However, as widely expressed tumor antigens (universal tumor antigens) often correspond to normal proteins expressed not only by tumor cells but also by normal cells and tissues, these antigens are generally tolerated by the immune system.Thus, circumventing self tolerance to universal tumor antigens is a major goal of cancer vaccine research.Disappointing results obtained to date with most tumor vaccines has led to a shift in research toward determining ways of stimulating the immune response through the use of new adjuvants, immunostimulants and delivery vectors.However, although these aspects are clearly crucial to vaccine development, breakthroughs in the field may lie in the use of strong antigens as optimized cryptic peptides derived from universal tumor antigens, combined with a potent adjuvant.Targeting cryptic tumor peptides/antigens is an efficient way of overcoming tolerance.Indeed, the first vaccine based on an optimized cryptic peptide induced strong antitumor immunity and demonstrated promising clin. activity.

4

项与 VAXON Biotech SA 相关的新闻(医药)2021-05-07

Dublin, May 07, 2021 (GLOBE NEWSWIRE) -- The "Global Peptide Cancer Vaccine Market & Clinical Trials Insight 2026" report has been added to ResearchAndMarkets.com's offering.

As per this reports findings, it is estimated that the global peptide cancer vaccine will follow trajectory growth rates. The market will be favored by the advancement in science and arrival of novel technologies which will further enable the identification of potential targets in developing cancer vaccines.

Report Highlights:

The developments of vaccines have shown incredible impact on human health system and have resulted in significant decrease in mortality rates from several diseases. Increase in prevalence of chronic disorders including cancer has urged the development of novel targeted therapeutics for their management. In recent times, researchers have exploited the use of vaccines to generate anti-tumor response in management of cancer.

The rapid approval of Provenge for the management of pancreatic cancer and the robust response in market has surged the development of more targeted vaccines in cancer. In recent times, peptides have emerged as a potential vaccine candidate owing to their small size, simple and cost efficient production and development process.

Moreover, peptides are recognized to be highly specific and efficacious, safe and well tolerated. Given their attractive physical and chemical properties, researchers have developed several peptide based vaccines in management of wide range of cancers.

Currently, GV1001 (Riavaxtm, Tertomotide) is the only peptide based vaccine approved for the management of pancreatic cancer in Korea. GV1001 is a 16-amino-acid peptide comprising a sequence from the human enzyme telomerase reverse transcriptase (TERT). Most cancers highly express TERT, and immunization with GV1001 aims to activate the immune system to recognize and kill cancer cells. The vaccine is currently under clinical trials and applications to gain approval in other countries.

Apart from this, a cocktail of peptide based cancer vaccines are present in preclinical and clinical studies and have shown encouraging response. Most of the drugs are present in the phase I and II clinical trials which suggests that the market will be flourished with several vaccines targeting different cancers in next 4-5 years.

Moreover, in near future the market will see combination of vaccines along with other conventional drugs to improve their efficacy and specificity in targeting the complexity of cancer cells.

Keeping in mind the high adoption rates of the novel therapeutics in North America, it is expected that the region will dominate the global peptide cancer vaccine market for next few years. The high prevalence of cancer and the rising initiatives by government as well as private sectors will also propel the growth of peptide cancer vaccines in this area.

In addition to this, Europe and Asia Pacific will also emerge as a potential market wing to high untapped opportunities, low cost of raw material, growing base of companies providing outsourcing services, flourishing biotech industry, and increasing investments in the R&D sector.

The arrival of peptide based cancer vaccine has caused prompting effects on the overall cancer therapy market and has helped it to make through all the challenges that have been on the way of becoming the most dominant market in the industry.

Key Topics Covered:

1. Introduction to Peptide Cancer Vaccine

2. Need of Peptide Vaccines2.1 Why Peptides - More Desirable2.2 Peptide Vaccines V/S Traditional Vaccines

3. Classification of Peptide Vaccines3.1 On the Basis of Sources Obtained3.2 On the Basis of Length3.3 On the Basis of Epitopes

4. Mechanism of Action of Peptide Cancer Vaccines4.1 Immunological Cells Activated by Peptide Cancer Vaccines4.2 Procedure of Synthetic Peptide Vaccine Development

5. Clinical Trials Efficacy Study of Synthetic Peptide Analog Obtained From WT1 Oncoprotein against Acute Myeloid Leukemia5.1 Basic Layout of the Study5.2 Introduction to WT1 Peptide5.3 Methodologies Involved In the Clinical Study5.4 Results of the Clinical Trial Study

6. Wide Spectrum Action of Peptide Cancer Vaccines Against Major Cancer6.1 Colorectal Cancer6.2 Lung Cancer6.3 Pancreatic Cancer6.4 Gastric Cancer6.5 Prostate Cancer6.6 Breast Cancer

7. Global Peptide Cancer Vaccine Market Overview

8. Global Peptide Cancer Vaccine Market Trends8.1 Optimized Cryptic Peptides8.2 Therapeutic CpG Peptide-Based Cancer Vaccine8.3 Personalized Neoantigen Vaccination with Synthetic Long Peptides8.4 Recombinant Peptide Vaccine8.5 p53 Peptide-Pulsed Dendritic Cells Cancer Vaccines

9. Global Peptide Cancer Vaccine Pipeline Overview9.1 By Country9.2 By Company9.3 By Patient Segment9.4 By Phase

10. Global Peptide Cancer Vaccine Clinical Trials Insight10.1 Research10.2 Preclinical10.3 Phase-I10.4 Phase-I/II10.5 Phase-II10.6 Phase-III

11. LucaVax - First Commercially available Peptide Cancer Vaccine

12. Global Peptide Cancer Vaccine Market Dynamics12.1 Market Driving Factors12.2 Challenges Ahead For Peptide Cancer Vaccine Market Development

13. Peptide Cancer Vaccine: Promising Candidate of Cancer Immunotherapy

14. Competitive Landscape14.1 Enzo Life Science (Alexis Biotech)14.2 Antigen Express14.3 BioLife Science14.4 Immatics Biotechnologies14.5 Immune Design14.6 Imugene14.7 Immunomedics14.8 ISA Pharmaceuticals14.9 Galena Biopharma14.10 Generex Biotechnology Corporation14.11 Lytix Biopharma14.12 Merck (Merck Serono)14.13 OncoTherapy Science14.14 Oncothyreon14.15 Pfizer14.16 Phylogica14.17 Symphogen (Receptor BioLogix)14.18 Sumitomo Dainippon Pharma14.19 TapImmune14.20 Vaxon Biotech

For more information about this report visit

疫苗免疫疗法

2021-05-07

Dublin, May 07, 2021 (GLOBE NEWSWIRE) -- The "Global Peptide Cancer Vaccine Market & Clinical Trials Insight 2026" report has been added to ResearchAndMarkets.com's offering.

As per this reports findings, it is estimated that the global peptide cancer vaccine will follow trajectory growth rates. The market will be favored by the advancement in science and arrival of novel technologies which will further enable the identification of potential targets in developing cancer vaccines.

Report Highlights:

The developments of vaccines have shown incredible impact on human health system and have resulted in significant decrease in mortality rates from several diseases. Increase in prevalence of chronic disorders including cancer has urged the development of novel targeted therapeutics for their management. In recent times, researchers have exploited the use of vaccines to generate anti-tumor response in management of cancer.

The rapid approval of Provenge for the management of pancreatic cancer and the robust response in market has surged the development of more targeted vaccines in cancer. In recent times, peptides have emerged as a potential vaccine candidate owing to their small size, simple and cost efficient production and development process.

Moreover, peptides are recognized to be highly specific and efficacious, safe and well tolerated. Given their attractive physical and chemical properties, researchers have developed several peptide based vaccines in management of wide range of cancers.

Currently, GV1001 (Riavaxtm, Tertomotide) is the only peptide based vaccine approved for the management of pancreatic cancer in Korea. GV1001 is a 16-amino-acid peptide comprising a sequence from the human enzyme telomerase reverse transcriptase (TERT). Most cancers highly express TERT, and immunization with GV1001 aims to activate the immune system to recognize and kill cancer cells. The vaccine is currently under clinical trials and applications to gain approval in other countries.

Apart from this, a cocktail of peptide based cancer vaccines are present in preclinical and clinical studies and have shown encouraging response. Most of the drugs are present in the phase I and II clinical trials which suggests that the market will be flourished with several vaccines targeting different cancers in next 4-5 years.

Moreover, in near future the market will see combination of vaccines along with other conventional drugs to improve their efficacy and specificity in targeting the complexity of cancer cells.

Keeping in mind the high adoption rates of the novel therapeutics in North America, it is expected that the region will dominate the global peptide cancer vaccine market for next few years. The high prevalence of cancer and the rising initiatives by government as well as private sectors will also propel the growth of peptide cancer vaccines in this area.

In addition to this, Europe and Asia Pacific will also emerge as a potential market wing to high untapped opportunities, low cost of raw material, growing base of companies providing outsourcing services, flourishing biotech industry, and increasing investments in the R&D sector.

The arrival of peptide based cancer vaccine has caused prompting effects on the overall cancer therapy market and has helped it to make through all the challenges that have been on the way of becoming the most dominant market in the industry.

Key Topics Covered:

1. Introduction to Peptide Cancer Vaccine

2. Need of Peptide Vaccines2.1 Why Peptides - More Desirable2.2 Peptide Vaccines V/S Traditional Vaccines

3. Classification of Peptide Vaccines3.1 On the Basis of Sources Obtained3.2 On the Basis of Length3.3 On the Basis of Epitopes

4. Mechanism of Action of Peptide Cancer Vaccines4.1 Immunological Cells Activated by Peptide Cancer Vaccines4.2 Procedure of Synthetic Peptide Vaccine Development

5. Clinical Trials Efficacy Study of Synthetic Peptide Analog Obtained From WT1 Oncoprotein against Acute Myeloid Leukemia5.1 Basic Layout of the Study5.2 Introduction to WT1 Peptide5.3 Methodologies Involved In the Clinical Study5.4 Results of the Clinical Trial Study

6. Wide Spectrum Action of Peptide Cancer Vaccines Against Major Cancer6.1 Colorectal Cancer6.2 Lung Cancer6.3 Pancreatic Cancer6.4 Gastric Cancer6.5 Prostate Cancer6.6 Breast Cancer

7. Global Peptide Cancer Vaccine Market Overview

8. Global Peptide Cancer Vaccine Market Trends8.1 Optimized Cryptic Peptides8.2 Therapeutic CpG Peptide-Based Cancer Vaccine8.3 Personalized Neoantigen Vaccination with Synthetic Long Peptides8.4 Recombinant Peptide Vaccine8.5 p53 Peptide-Pulsed Dendritic Cells Cancer Vaccines

9. Global Peptide Cancer Vaccine Pipeline Overview9.1 By Country9.2 By Company9.3 By Patient Segment9.4 By Phase

10. Global Peptide Cancer Vaccine Clinical Trials Insight10.1 Research10.2 Preclinical10.3 Phase-I10.4 Phase-I/II10.5 Phase-II10.6 Phase-III

11. LucaVax - First Commercially available Peptide Cancer Vaccine

12. Global Peptide Cancer Vaccine Market Dynamics12.1 Market Driving Factors12.2 Challenges Ahead For Peptide Cancer Vaccine Market Development

13. Peptide Cancer Vaccine: Promising Candidate of Cancer Immunotherapy

14. Competitive Landscape14.1 Enzo Life Science (Alexis Biotech)14.2 Antigen Express14.3 BioLife Science14.4 Immatics Biotechnologies14.5 Immune Design14.6 Imugene14.7 Immunomedics14.8 ISA Pharmaceuticals14.9 Galena Biopharma14.10 Generex Biotechnology Corporation14.11 Lytix Biopharma14.12 Merck (Merck Serono)14.13 OncoTherapy Science14.14 Oncothyreon14.15 Pfizer14.16 Phylogica14.17 Symphogen (Receptor BioLogix)14.18 Sumitomo Dainippon Pharma14.19 TapImmune14.20 Vaxon Biotech

For more information about this report visit

疫苗免疫疗法

2015-05-11

May 11, 2015

By

Alex Keown

, BioSpace.com Breaking News Staff

SUMMIT, N.J. --

Robert J. Hugin

, chief executive officer of

Celgene Corporation

told

Bloomberg News

licensing deals with other pharmaceutical companies are paying off with eight new compounds the company plans to put into human testing over the next year-and-a-half.

Hugin told

Bloomberg

the deal making strategy his company has become known for, is paying off.

“We think

the strategy

is working very well. There’s great productivity coming out of the partnerships,” Hugin said to

Bloomberg

.

In 2014

Celgene

entered into 10 deals with other companies, shelling out an average of $222 million in upfront payments to its partners.

Celgene

’s 2014 deal making was the most of any other biotech firm,

Bloomberg

said. However,

Celgene

has been striking profitable partnerships for years.

Acceleron

In 2008

Celgene

entered into a $2 billion deal with

Acceleron Pharma

to develop and market

Acceleron

‘s lead bone-forming protein,

Sotatercept

, formerly known as ACE-011. Sotatercept is an investigational protein therapeutic that increases red blood cell levels by targeting molecules in the TGF-ß superfamily for the treatment of anemia in rare blood diseases. The two companies are also collaborating on ACE-536, another blood treatment that targets sickle cell anemia. The drug is currently in late-stage trials.

Agios

In April

Celgene

entered into an $80 million agreement with

Agios Pharmaceuticals, Inc.

to develop AG-881, a small molecule that has shown in preclinical studies to fully penetrate the blood brain barrier and inhibit isocitrate dehydrogenase-1 (IDH1) and IDH2 mutant cancer models. The companies said they plan to initiate clinical development of AG-881 in the second quarter of 2015. That will make the third mutant inhibitor discovered by

Agios

to enter into clinical development. The two companies entered into a similar agreement in 2010 to develop

Agios

’ other mutant inhibitor AG-221 and AG-120. Under that deal

Agios

is eligible for up to $240 million in milestone payments.

Northern Biologics

In addition to the

Agios

deal,

Celgene

also announced in April that it struck a $30 million agreement with one-year-old Canada-based

Northern Biologics

to advance that company’s work in oncology and fibrosis therapeutics.

AstraZeneca PLC

Also in April

Celgene

entered into a

collaborative agreement

with

AstraZeneca

that will allow the U.S.-based drug firm to develop MEDI4736,

AstraZeneca

’s immunotherapy treatment for blood cancer. Under the deal,

Celgene

will be responsible for selling MEDI4736 in blood cancers and will pay

AstraZeneca

an initial royalty of 70 percent, which will decrease to approximately half of sales over a period of four years.

Nogra Pharma

Other noted deals include

Celgene

’s Crohn’s Disease drug GED-0301 (mongersen), licensed from

Nogra Pharma

for $710 million with a promise of nearly $2 billion more in milestone payments.

Celgene

plans to move GED-0301 to Phase III trial.

Quanticel Pharmaceuticals

Another April deal was the

$485 million transaction

to acquire cancer drugmaking company

Quanticel Pharmaceuticals

, following a partnership established in 2011. That alliance allowed

Quanticel

to develop its single-cell platform for analysis of tumor cellular content and apply the platform to target discovery and the development of high-quality drug candidates.

Others

Celgene

also has additional research and development deals with

NantBioscience

,

Nogra

,

OncoMed Pharmaceuticals, Inc.

,

PharmAkea Therapeutics

,

Presage

,

Quanticel, Pharmaceuticals

,

Sanford Burnham Medical Research Institute

,

Sanofi

,

Sutro Biopharma

,

Tengion Inc.

,

Triphase

,

Vaxon Biotech

and

VentiRx Pharmaceuticals, Inc.

Celgene

’s deal making strategy has been pleasing to shareholders, with stock up nearly 60 percent since last year.

Celgene

’s stock had a morning high of $114.44 this morning, up from its open of $113.83.

Celgene

is valued at $97 billion and currently has seven approved drugs on the market, including the company’s top cancer drug, Revlimid, which brought in $4.98 billion last year.

The base for Revlimid is thalidomide, a drug that garnered a bad reputation in the 1960s for causing birth defects.

Celgene

acquired the patent for thalidomide in 1992 and has transformed the drug’s reputation by adapting it for use as a therapy for the blood cancer multiple myeloma.

In addition to Revlimid,

Celgene

also markets oncology drug Abraxane, which had firs quarter sales of $223 million. The company is seeking to market Abraxane in China as a treatment for pancreatic cancer. The drug has been approved to treat pancreatic cancer in other countries, but not China,

Bloomberg

reported.

引进/卖出上市批准免疫疗法并购

100 项与 VAXON Biotech SA 相关的药物交易

登录后查看更多信息

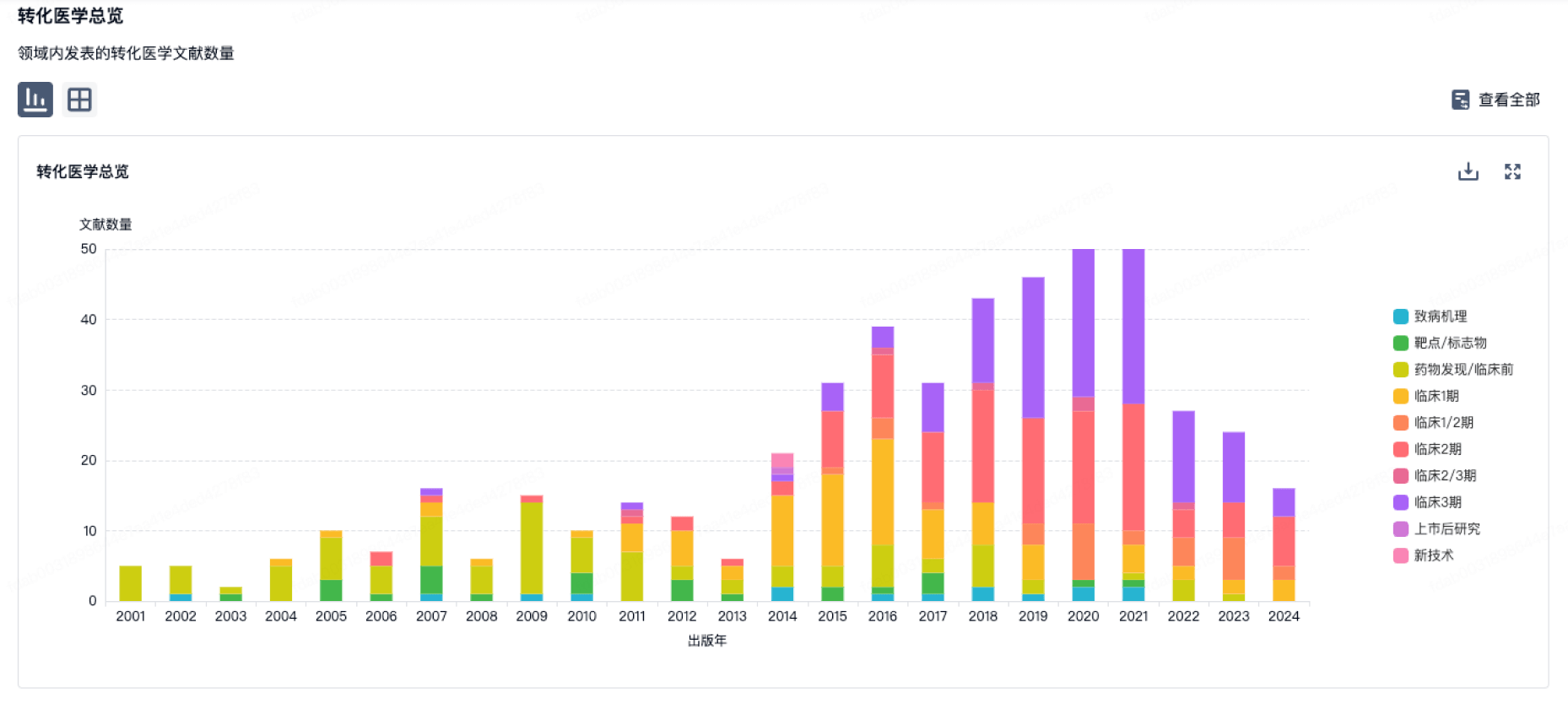

100 项与 VAXON Biotech SA 相关的转化医学

登录后查看更多信息

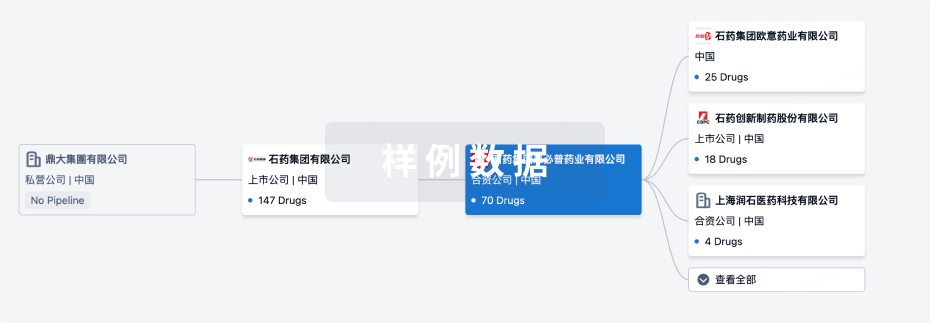

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年07月19日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

药物发现

1

1

临床前

早期临床1期

1

1

临床2期

其他

3

登录后查看更多信息

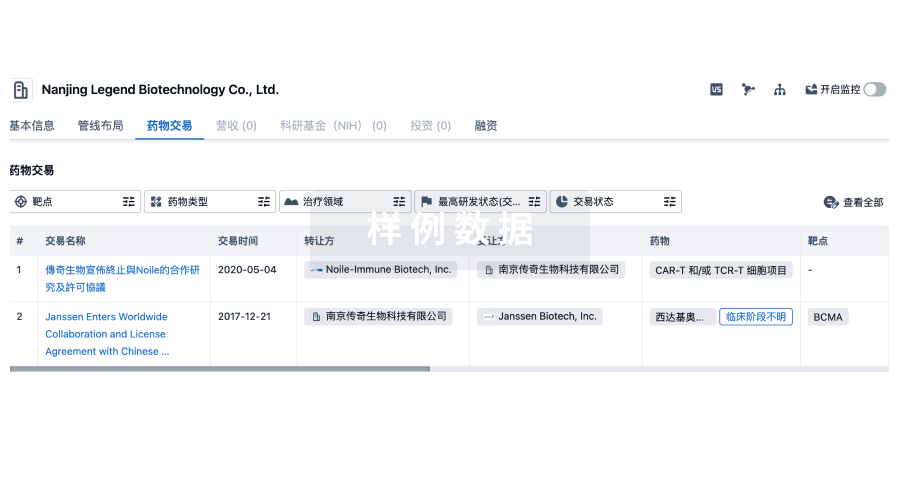

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

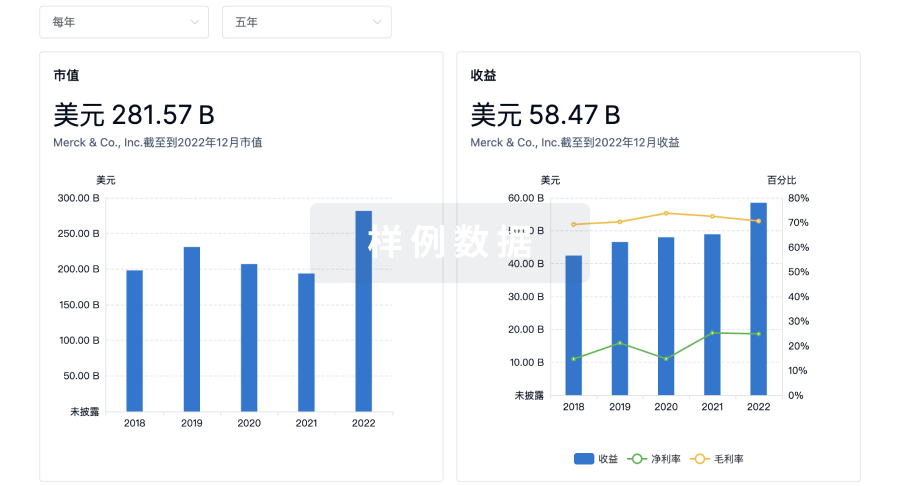

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用