预约演示

更新于:2025-05-07

Atai Therapeutics, Inc.

更新于:2025-05-07

概览

标签

其他疾病

神经系统疾病

心血管疾病

小分子化药

关联

3

项与 Atai Therapeutics, Inc. 相关的药物靶点- |

作用机制- |

在研机构 |

原研机构 |

非在研适应症- |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

作用机制 DAT激动剂 [+3] |

非在研适应症- |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

作用机制 5-HT receptor调节剂 [+1] |

原研机构- |

非在研适应症 |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

5

项与 Atai Therapeutics, Inc. 相关的临床试验NCT06693609

A Phase 2a, Exploratory, Randomized, Double-Blind, Placebo-Controlled Trial of the Safety, Tolerability, and Efficacy of EMP-01 in Adult Participants With Social Anxiety Disorder

This Phase 2 study (protocol number EMP-01-201) will determine the safety and tolerability of a short-term treatment with an oral dosage form of EMP-01 in adult participants with social anxiety disorder (SAD) and will assess exploratory efficacy of repeated doses of EMP-01 versus placebo.

开始日期2025-04-15 |

申办/合作机构 |

NCT06524830

A Phase 2, Multicenter, Double-blind, Randomized, Placebo-controlled Trial to Assess the Efficacy, Safety, and Tolerability of Repeated Doses of VLS-01 Buccal Film in Participants With Treatment Resistant Depression

This Phase 2 study (protocol number VLS-01-203) will determine the efficacy, safety, and tolerability of short-term treatment with a VLS-01 transmucosal buccal film (VLS-01-BU) in patients with treatment resistant Major Depressive disorder (TRD) and will characterize the onset and durability of antidepressant effects of VLS-01-BU versus placebo.

开始日期2024-12-30 |

申办/合作机构 |

ACTRN12624000025538

A Phase 1b, Single-Centre, Open-Label Dose Ranging Study of an Optimized Formulation of VLS-01 in Healthy Adult Volunteers

开始日期2024-02-01 |

申办/合作机构 |

100 项与 Atai Therapeutics, Inc. 相关的临床结果

登录后查看更多信息

0 项与 Atai Therapeutics, Inc. 相关的专利(医药)

登录后查看更多信息

3

项与 Atai Therapeutics, Inc. 相关的新闻(医药)2024-03-15

In January, the clinical-stage biopharmaceutical company atai Life Sciences (NASDAQ: ATAI), which is dedicated to revolutionizing the treatment of mental illnesses, announced a strategic investment in Beckley Psytech, a partnership that solidified atai's status as the bio-pharma company with the largest and most diversified portfolio of clinical-stage psychedelic drug candidates.

Beckley Psytech is a private clinical-stage biotechnology company focused on transforming short-acting psychedelics into highly efficacious, rapid-acting therapeutics for neuropsychiatric diseases. This strategic investment and collaboration will integrate Beckley Psytech's two clinical-stage short-acting psychedelic candidates, BPL-003 and ELE-101, into atai's mental health innovation platform, accelerating the development of these two drugs.

Per the terms of the investment, atai will hold a 35.5% stake in Beckley Psytech, which will remain an independent private company. The total investment amounts to $50 million, with $40 million directly invested in the company to fund ongoing research projects, and an additional $10 million used to purchase secondary shares from existing shareholders. atai will also have the right to appoint and hold three of the nine board seats at Beckley Psytech, and will have a time-limited right of first refusal on future company sales, asset sales or transfers of other commercial rights, as well as indefinite rights of first negotiation for BPL-003 and ELE-101.

The active ingredient of BPL-003 is a novel short-action intranasal formulation of 5-Methoxy-N,N-Dimethyltryptamine (5-MeO-DMT, also known as Mebufotenin), which is found in various plant species and is also secreted by the glands of the Colorado River toad. Structurally similar compounds, DMT and bufotenin (5-HO-DMT), are also used as psychedelics in South America.

Early studies have shown that 5-MeO-DMT has the highest binding affinity to the 5-HT1A receptor (1.9-3 nM), with a selectivity ratio of 300-1000 times higher than that of the 5-HT2A receptor. The 5-HT1A receptor is associated with the regulation of mood and the control of the autonomic nervous system. Specific stimulation of the 5-HT1A receptor can produce sympathetic inhibition, decrease blood pressure and heart rate, while stimulation of the 5-HT2A receptor can generate sympathomimetic effects such as increased heart rate, vasomotor tone, and blood pressure. The functional and experiential effects of most psychedelics on humans are primarily mediated through activation of the 5-HT2A receptor.

A single escalating dose of 5-MeO-DMT can reliably induce a "peak" experience, which is considered a core predictive marker of the therapeutic effects of psychedelics. A single exposure to 5-MeO-DMT can rapidly and sustainably alleviate symptoms of depression, anxiety, and stress. Additionally, 5-MeO-DMT can stimulate neuroendocrine functions, immunomodulation, and anti-inflammatory processes, all of which contribute to improvements in mental health. Compared to longer-acting psychedelic drugs, 5-MeO-DMT has a rapid onset and short duration of effects, which may make it more suitable for individual dose-finding strategies. Therefore, many biopharmaceutical companies show a strong interest in the development of 5-MeO-DMT formulations, with the primary clinical indication being depression.

According to the Phase 1 clinical trial data released by Beckley Psytech, BPL-003 has demonstrated good safety and tolerability profiles, along with dose-proportional PK/PD curves.

In the completed Phase I trial, the medium and high doses of BPL-003 reliably induced profound psychedelic experiences with rapid onset of psychedelic effects within minutes and dissipation of all perceptual effects within 60-90 minutes.

Beckley Psytech is conducting Phase 2a and 2b clinical studies of BPL-003 for patients with treatment-resistant depression, including cases of Treatment-Resistant Depression (TRD) and Alcohol Use Disorder (AUD), with three clinical trials underway. In addition to the Phase 2b TRD study expected to be completed in the second half of 2024, BPL-003 is also being investigated in two small-scale Phase 2a open-label studies in TRD and AUD, with data anticipated in the first half of 2024 and mid-2024, respectively.

ELE-101 is a novel intravenous formulation of psilocin (4-HO-DMT). Psilocin is the pharmacologically active metabolite of psilocybin, found in psychedelic mushrooms. Due to its structural similarity to serotonin, psilocin is capable of activating serotonin receptors (5-HT1A, 5-HT2A, and 5-HT2C) with affinity in the central nervous system. Activation of the 5-HT2A receptor by psilocin results in increased cortical activity via glutamate excitatory postsynaptic potentials, whereas activation of the 5-HT1A receptor inhibits the activity of pyramidal cells. Additionally, psilocin may produce peripheral effects involving serotonergic receptors. In humans, the psychoactive effects of psilocin, similar to those of hallucinogens, can be observed within 20-30 minutes of ingestion, including visual hallucinations, enhanced auditory perception, and incoordination. Other autonomic effects mediated by psilocin include increased heart rate, elevated blood pressure, pupil dilation, tremors, and elevated body temperature.

According to research data published by Beckley Psytech, intravenous administration of psilocin as compared to oral psilocybin has shown potential benefits in pharmacokinetic studies, such as reduced variability of the drug and a shorter half-life.

Beckley Psytech is conducting phase 1 and 2a clinical studies for ELE-101 as a treatment for severe depression. Psilocybin has demonstrated notable antidepressant effects in various clinical trials. The treatment paradigm of ELE-101 is more stable, more controllable, and shorter in duration (no more than 2 hours), hence the compound has the potential to offer the therapeutic benefits of psilocybin. Preliminary results for the ELE-101 phase 1/2a study are expected in the first half of 2024.

2021-06-18

Editor’s note: Interested in following biopharma’s fast-paced IPO market? You can bookmark our IPO Tracker here.

One of the busiest IPO weeks of the year has capped off with another four biotechs expected to make their public debuts Friday.

After Lyell, Verve and Molecular Partners all priced earlier in the week, ATAI Life Sciences, Century Therapeutics, Ambrx Biopharma and Cyteir Therapeutics each followed suit with nine-figure raises after market close Thursday. All that effort has driven the combined biotech IPO raise close to $9 billion, per the Endpoints News tally.

With the end of the second quarter rapidly approaching, the industry is well on its way to eclipsing 2020’s record IPO figures. Last year saw a $16.5 billion combined raise from 91 biotechs, according to Nasdaq, where 2021’s sum thus far comes from 53 newly public companies.

ATAI led Friday’s group, tallying a $225 million raise at $15 per share. Century also hit the $200 million mark, raising $211 million at $20 per share. Cyteir and Ambrx followed up with totals of $133 million and $126 million, respectively, each launching their stock at $18.

‘Believing in magic,’ Thiel-backed ATAI jumps to Nasdaq

Peter Thiel

Backed by billionaire Peter Thiel, ATAI has completed the next step in its journey as it continues its unique mission of wrapping several psychedelic biotechs under one corporate umbrella.

The IPO follows two nine-figure private raises, with a $125 million Series C last November and a $157 million Series D in March. CEO Florian Brand told Endpoints News at the time that their psychedelic strategy proved essential in driving that heavy investor interest, and that ostensibly continued into ATAI’s Nasdaq leap.

Having finished its IPO prep, we can now glean some more information out of ATAI’s public plans thanks to an updated S-1 filing. The biotech listed seven of their 14 portfolio companies toward which IPO funds will be directed, with Perception and Recognify leading the way. Perception had been one of ATAI’s earliest acquisitions, while Recognify joined the fold this past January.

Perception’s cash will be used to launch and complete a Phase II study for a program in treatment resistant depression, while Recognify is looking to finish a Phase IIa trial for their candidate they say can modulate the cholinergic, NMDA and GABA type B receptor systems.

The other companies specifically slated for funds are DemeRx, GABA Therapeutics, Neuronasal, Kures and Viridia. But ATAI isn’t stopping there, saving a massive amount for other players in their portfolio and setting aside $75 to $85 million for another potential acquisition.

ATAI will trade under the ticker $ATAI. Founder Christian Angermayer, who controls the largest stake in ATAI at 19.1% post-offering, tweeted his apparent pleasure at the news early Friday.

Be happy. Live your dreams. Believe in magic. 🍄😉🚀 — Christian Angermayer (@C_Angermayer) June 18, 2021

Cell therapy player Century continues its hot streak

Looking to capitalize on the momentum in another hot market — allogeneic cell therapy — CEO Lalo Flores is steering Century to Nasdaq.

Lalo Flores

The IPO continues a big year for Flores, who nailed down a $160 million raise back in March to scale their iPSC platform for CAR-T and CAR-NK efforts. Century is taking what they see as a different approach to the technology, however, opting for induced pluripotent stem cells rather than donor cells.

Century’s lead program, a CD19 CAR-NK that they hope to steer into a human trial by 2022, is expected to see a $50 million windfall from the IPO. Three other programs will get a combined $110 million in funds, Century said in its S-1 earlier this week.

The triumvirate of those preclinical programs targeting CD133 and EGFR, CD19 and CD79b, as well as another multispecific candidate. If everything goes as planned, Century will complete its slate of INDs by the end of 2024. Another $35 million is slated to boost the biotech’s manufacturing capabilities.

Century has some big players as its top investors, who will each see hefty windfalls with the IPO raise. Versant is the biotech’s biggest shareholder with a 24.7% post-offering stake, while Bayer will control 21.8% of shares once the IPO is completed. Fujifilm’s cell manufacturing subsidiary also owns 12.7% of Century.

Once it rings in the IPO on Friday, Century will trade under the ticker $IPSC.

Cyteir hits the bullseye in IPO raise

Cyteir’s public leap comes after a Series C round in February that saw the biotech pull in $80 million.

They’ve invested heavily in their lead program, an oral inhibitor of RAD51-mediated DNA repair, and the biotech is aiming to potentially complete a Phase II trial as a monotherapy with $85 million of the $133 million IPO. Targeting RAD51, the candidate hits at a critical enzyme in double-stranded DNA repair, as Cyteir researches the concept of synthetic lethality.

Markus Renschler

The biotech hopes the phenomenon can inhibit the DNA damage repair cancer cells need to survive and grow, CEO Markus Renschler told Endpoints in February.

Behind this program is another RAD51 candidate, but is still in the preclinical stage. Here, Cyteir will funnel $22 million of its IPO cash, and save the rest for other general R&D and corporate purposes.

Cyteir has some big backers behind the IPO, with Novo holdings topping the charts at a 13.2% stake after the offering. Janwillem Naesens’ Droia Ventures comes in second with a 9.5% stake, matching the shares owned by Venrock. And RA Capital and Celgene/Bristol Myers Squibb each own significant stakes, at 5.8% and 5.1%, respectively.

Other major stockholders include Osage University Partners II at 7.2% and Lightstone Ventures at 7.1%. Cyteir will trade under the ticker $CYT.

Second time’s the charm for re-energized Ambrx

Ambrx’s second attempt to go public has ended in success, following a 2014 effort that was withdrawn.

After selling itself to a syndicate of Chinese investors and pharma companies, Ambrx laid low until a $200 million crossover raise last November helped complete its pivot to China. They’ve lined up partnerships with Merck, Bristol Myers Squibb and Eli Lilly over the years, and signed discovery deals with BeiGene, Suzhou-based MabSpace and Shanghai-based NovoCodex, among others.

Ambrx moved its first in-house drug into the clinic, a HER2-targeting antibody-drug conjugate, and much of the IPO’s cash will focus on pushing it forward in overexpressed HER2 breast and gastric cancers, as well as other solid tumors. A prostate cancer program will also see some funds.

The Beijing investment firm HOPU stands to gain the most from this IPO, as it will own a 14.8% stake in Ambrx after the offering is finished. WuXi is also involved with 11.1% of post-offering shares. CEO Feng Tian will collect some cash as well, owning about 5.8 million shares that amount to a 2.2% stake.

Ambrx will trade under the ticker $AMAM.

抗体细胞疗法抗体药物偶联物并购

2020-08-25

ATAI Life Sciences announced on Monday that it has launched EmpathBio, a wholly-owned subsidiary focused on developing derivatives of 3,4-methylenedioxy-methamphetamine (MDMA) for the treatment of post-traumatic stress disorder.

ATAI Life Sciences

announced on Monday that it has launched EmpathBio, a wholly-owned subsidiary focused on

developing derivatives

of 3,4-methylenedioxy-methamphetamine (MDMA) for the treatment of post-traumatic stress disorder (PTSD).

“PTSD is a debilitating condition which affects millions worldwide,” said Florian Brand, CEO of ATAI Life Sciences. “Entactogen-assisted psychotherapy promises to fundamentally change how we think about this notoriously difficult to treat disorder.”

The use of MDMA for the treatment of PTSD has been researched extensively by the Multidisciplinary Association of Psychedelic Research. Published results from Phase II studies showed that 56% of subjects no longer met the criteria for PTSD two months after their final MDMA-assisted psychotherapy session. In addition, follow-ups with 91 participants 12 months later showed that 67% still did not meet PTSD criteria.

EmpathBio will look at MDMA derivatives with different pharmacological profiles than MDMA. Such changes may allow for the entactogenic effects of MDMA to be separated from some of its known adverse effects. If this approach is successful, some of the transient physiological changes caused by MDMA may be able to be avoided. In turn, the pool of PTSD patients who may be medically eligible for therapy could be expanded.

“While MDMA-assisted psychotherapy holds great promise for the treatment of PTSD, refinement of MDMA’s entactogenic pharmacology could provide for a greater therapeutic index,” said Glenn Short, CEO of EmpathBio. “We want to ensure that entactogen-assisted psychotherapy is available to all living with PTSD.”

Back in April, ATAI Life Sciences announced that it had

concluded a $24 million round

of financing, led by both new and existing investors. Jason Camm, managing director and Chief medical officer at Thiel Capital, also joined ATAI’s Board of Directors.

“ATAI’s world class team and one-of-a-kind platform are driving much needed change in mental healthcare,” said Camm. “I’m excited to be joining them in bringing novel therapeutics to the millions who’ve been failed by currently available medicines.”

ATAI Life Sciences is centered around mental health biotechnology, leveraging a tech- and data-driven platform that focuses on psychedelic compounds with non-psychedelics and artificial intelligence. Its portfolio includes several different products, including psilocybin for treatment resistant depression; ibogaine for opioid use disorder; arketamine for treatment resistant depression; and deuterated etifoxine for anxiety.

This past July, ATAI Life Sciences announced that it had launched Viridia Life Sciences, a wholly-owned subsidiary focused on

developing novel formulations

of N,N-Dimethyltryptamine (DMT) to treat several different mental health disorders. DMT acts as a partial agonist on a variety of 5-HT receptors. Although it is commonly administered intravenously, Viridia is using ATAI Life Sciences’ drug development expertise to develop several different DMT products based on different forms of administration.

“This pragmatic approach to simplifying DMT administration and in-clinic treatment will help people access not only the neurogenic benefits of DMT, but also the personal insights that can accompany psychedelic-assisted psychotherapy,” said Short, who is also CEO of Viridia. “The impact for patients and their families may be transformative.”

Viridia’s DMT product will eventually be paired with a digital therapeutic being developed by Introspect Digital Therapeutics, an ATAI company. Clinical trials are predicted to begin early next year.

“Our goal is to ensure maximum access to innovative mental health therapies,” said Brand. “DMT represents an opportunity to reach those who might be unable or unwilling to undergo a longer psychedelic experience.”

临床2期临床结果

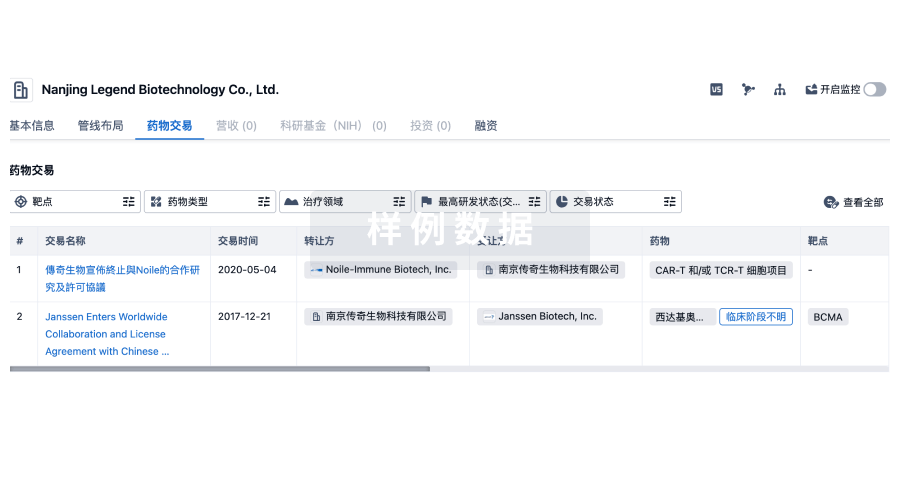

100 项与 Atai Therapeutics, Inc. 相关的药物交易

登录后查看更多信息

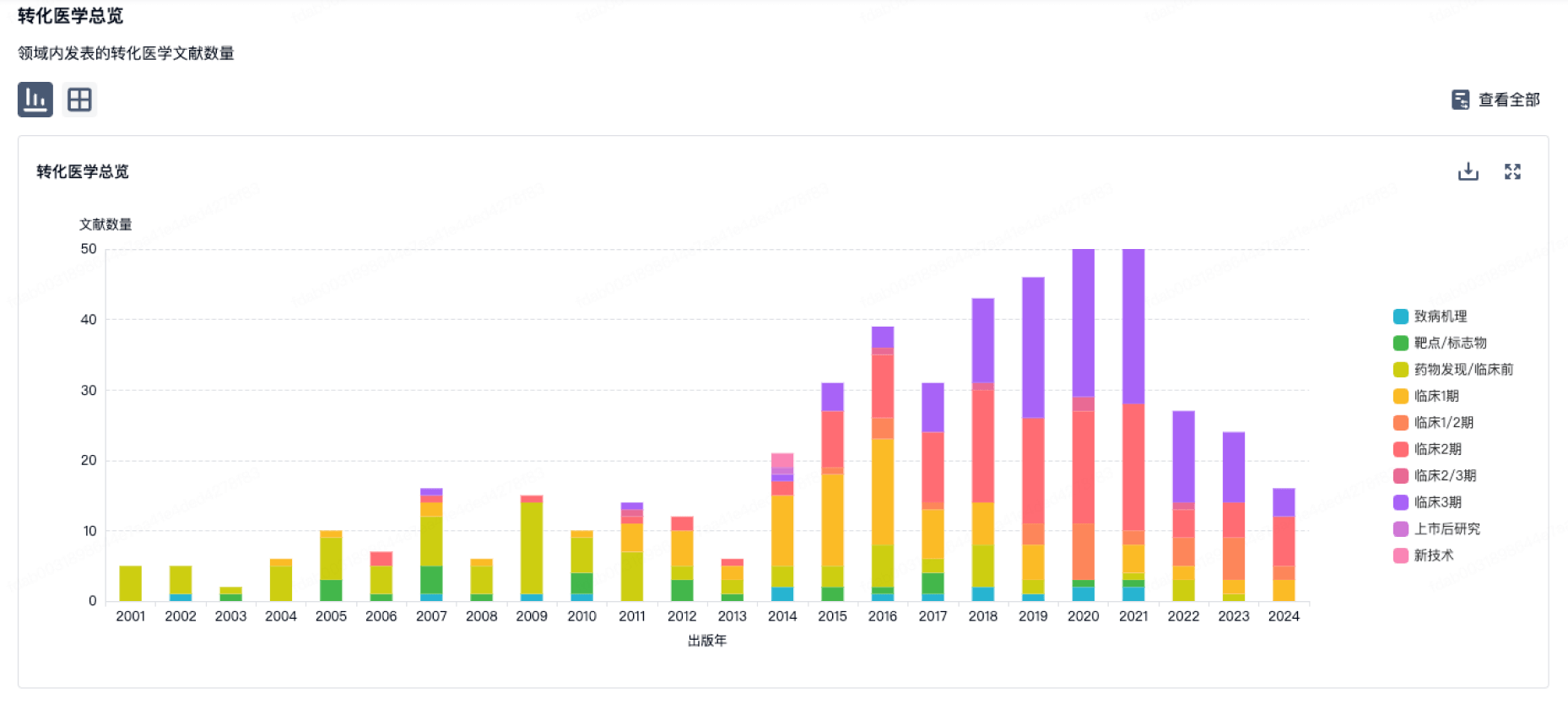

100 项与 Atai Therapeutics, Inc. 相关的转化医学

登录后查看更多信息

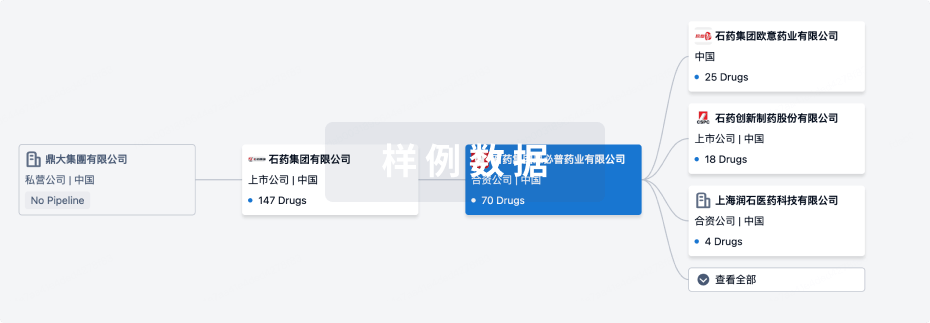

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年11月03日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床2期

3

登录后查看更多信息

当前项目

| 药物(靶点) | 适应症 | 全球最高研发状态 |

|---|---|---|

伊博格碱 ( DAT x SERT x κ opioid receptor x μ opioid receptor ) | 鸦片依赖 更多 | 临床2期 |

EMP-01 | 社交恐怖症 更多 | 临床2期 |

二甲基色胺 ( 5-HT receptor ) | 难治性抑郁症 更多 | 临床2期 |

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

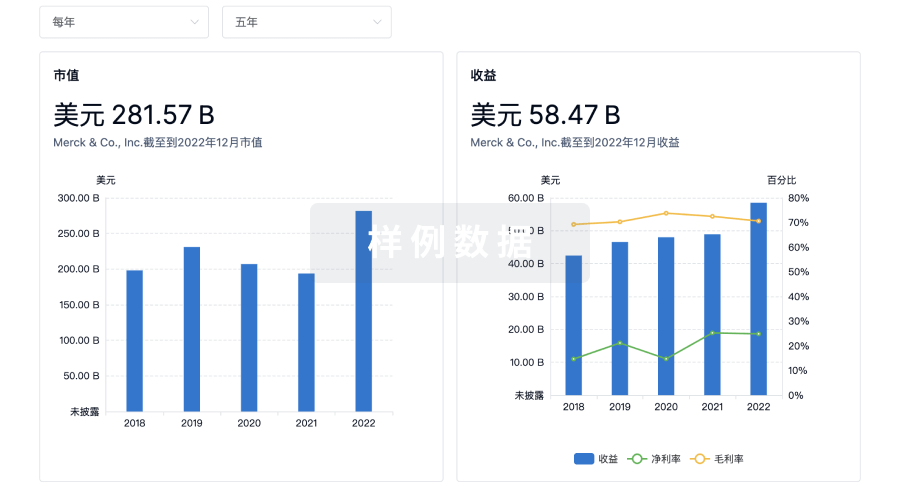

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

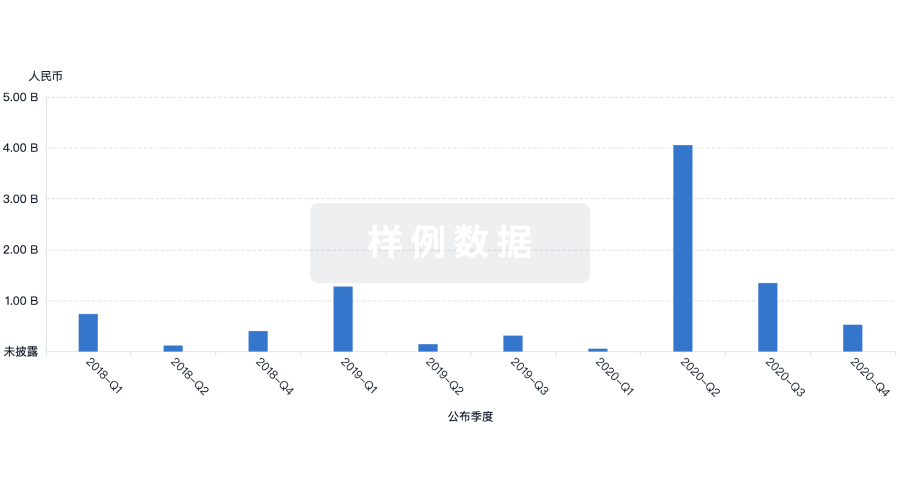

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

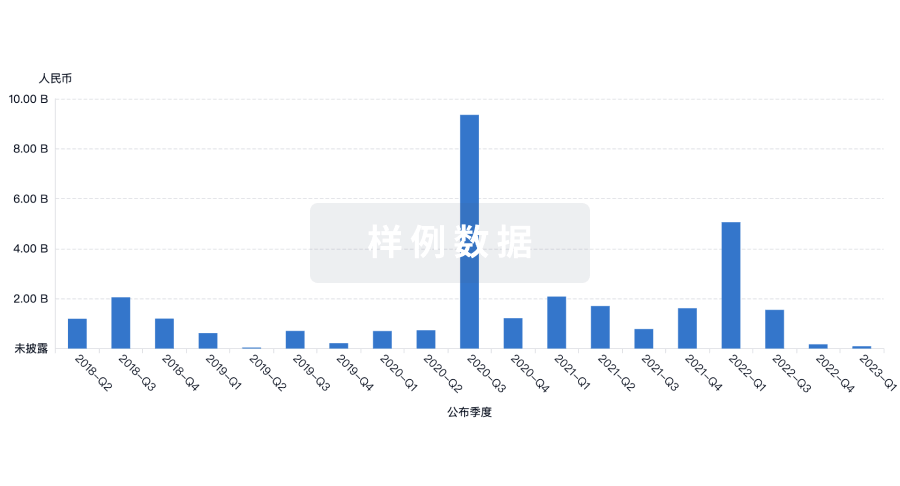

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

生物医药百科问答

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用