预约演示

更新于:2025-05-07

Nerviano Medical Sciences Group SRL

私营公司|Italy

私营公司|Italy

更新于:2025-05-07

概览

标签

肿瘤

ADC

疾病领域得分

一眼洞穿机构专注的疾病领域

暂无数据

技术平台

公司药物应用最多的技术

暂无数据

靶点

公司最常开发的靶点

暂无数据

| 疾病领域 | 数量 |

|---|---|

| 肿瘤 | 1 |

| 排名前五的药物类型 | 数量 |

|---|---|

| ADC | 1 |

| 排名前五的靶点 | 数量 |

|---|---|

| DNA x HER2 | 1 |

关联

7

项与 Nerviano Medical Sciences Group SRL 相关的药物作用机制 Aurora A抑制剂 [+3] |

在研适应症 |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

作用机制 RPS27 inhibitors [+1] |

最高研发阶段临床2期 |

首次获批国家/地区- |

首次获批日期- |

靶点 |

作用机制 PARP1抑制剂 |

最高研发阶段临床1/2期 |

首次获批国家/地区- |

首次获批日期- |

5

项与 Nerviano Medical Sciences Group SRL 相关的临床试验CTR20212544

NMS-03305293在选定晚期/转移性实体瘤成人患者中的I期剂量递增研究

主要目的: 确定选定的中国晚期/转移性实体瘤成人患者连续21天(每4周为1周期)口服单药NMS-03305293的最大耐受剂量(MTD)(如果低于美国/欧盟人群中确定的MTD)以及推荐的II期剂量(RP2D)。

次要目的: 确定NMS-03305293在中国患者中的安全性和耐受性;评价NMS-03305293在中国患者血浆和尿液中的药代动力学;记录NMS-03305293在中国患者中的任何抗肿瘤活性初步证据 。

探索性目的: 在中国患者中评价外周血中生殖系BRCA1和BRCA2突变状态,探索与临床结局的潜在相关性; 分别探索CA-125和CA 19-9变化作为抗肿瘤活性替代指标在中国卵巢癌和胰腺癌患者中的应用。

开始日期2022-01-17 |

申办/合作机构  缔脉生物医药科技(上海)有限公司 缔脉生物医药科技(上海)有限公司 [+2] |

EUCTR2021-005013-14-IT

A Phase I/II Combination Study of NMS-03592088 And Azacitidine for the Treatment of Patients With FLT3-Mutated AML with Relapsed /Refractory Disease or Who Are Unfit For Intensive Chemotherapy, or of CMML Patients. - Ph I/II Study of NMS-03592088+Aza in R/R or unfit FLT3-mut AML or CMML Pts

开始日期2022-01-11 |

EUCTR2013-000344-25-IT

Phase II study of oral PHA-848125AC in patients with malignant thymoma previously treated with multiple lines of chemotherapy

开始日期2013-04-22 |

100 项与 Nerviano Medical Sciences Group SRL 相关的临床结果

登录后查看更多信息

0 项与 Nerviano Medical Sciences Group SRL 相关的专利(医药)

登录后查看更多信息

3

项与 Nerviano Medical Sciences Group SRL 相关的新闻(医药)2024-01-02

EXTON, Pa., Jan. 2, 2024 /PRNewswire/ -- Frontage Laboratories, Inc. today announced that, through its wholly-owned subsidiary Frontage Europe S.r.l., it has completed the acquisition of the Bioanalytical and Drug Metabolism & Pharmacokinetics businesses of Accelera S.r.l (Accelera).

Accelera is a premier Contract Research Organization located in Nerviano, within the Lombardy region of Italy, part of the well-established NMS Group S.p.A. which has positioned itself as a global niche player in delivering discovery & preclinical studies and clinical bioanalysis to pharma and biotechnology companies, academic institutions, and other healthcare stakeholders.

"Today marks a very significant achievement in the 23-year history of Frontage Laboratories, as we establish a base of operations in continental Europe. Accelera has developed a tremendous reputation for high quality R&D services and we look forward to welcoming their Bioanalytical and Drug Metabolism & Pharmacokinetics teams to the Frontage family," said Dr. Abdul Mutlib, CEO of Frontage. "We envision this strategic acquisition as a first step in establishing Frontage's footprint in Europe, with the intent of adding other service areas in the continent. We believe both existing Frontage and Accelera clients stand to benefit greatly by leveraging Frontage's increasingly global platform. In addition, we are looking forward to partnering with the remaining Accelera business on exciting opportunities to service clients across our organizations."

According to Dr. Song Li, Founder and Chairman of Frontage: "It has been a long-standing goal of Frontage to expand our operations in Europe. We consider ourselves fortunate to capitalize on our outstanding relationship with the Accelera team, which has enabled us to bring our plans to fruition. We are very enthusiastic about working together as we further develop the Frontage platform in Europe, starting from a footprint in the Biopark in Nerviano Lombardy, where Accelera and Nerviano Medical Sciences Srl have already established a long-standing and efficient value chain. As always, our ongoing focus will remain on delivering the highest levels of quality, technology and expertise to our clients."

"We are thrilled to join forces with Frontage as part of this strategic acquisition that marks a significant milestone in Accelera's journey," said Luca Leone, CEO of Accelera. "Accelera has built a strong reputation for delivering high-quality R&D services through all phases of drug research and development with extensive experience in oncology. This unique occasion opens up new horizons for collaboration and growth. On one hand, we will further focus on offering top-notch In-vivo (end-to-end services) for multiple emerging modalities. At the same time, we look forward to exploring exciting opportunities to serve our clients across continents through our ongoing collaboration. This partnership reflects our commitment to advancing research and providing innovative solutions in the European market and beyond," said Luca Leone, CEO of Accelera S.r.l.

"Having Frontage as part of the growing partners operating from our Biopark is a landmark moment for us. In addition to the endless potential of the Accelera-Frontage collaboration, Nerviano Medical Sciences can leverage Frontage's world-class capabilities to drive breakthrough advancements in our drug discovery and development process. By uniting our strengths, we believe we can accelerate the pace of innovation and make a lasting difference in the field where all companies of this strong alliance operate and thrive here in Nerviano," said Hugues Dolgos, CEO of NMS Group S.p.A and Nerviano Medical Sciences Srl.

About Frontage (

)

Frontage Holdings Corp (1521.HK), together with its wholly owned subsidiary Frontage Laboratories, Inc., is a global Contract Research Organization (CRO) which provides integrated, science-driven, product development services from drug discovery to late phase clinical process to enable biopharmaceutical companies to achieve their development goals. Comprehensive services include drug metabolism and pharmacokinetics, analytical testing and formulation development, preclinical and clinical trial material manufacturing, bioanalysis, preclinical safety and toxicology assessment and early phase clinical studies. Frontage has enabled many biotechnology companies and leading pharmaceutical companies of varying sizes to advance a myriad of new molecules through development and to successfully file global regulatory submissions. For more details visit:

About NMS Group (

NMS Group is the largest oncological R&D company in Italy with more than 400 employees, of whom more than half are highly educated individuals dedicated to innovative research, development and manufacturing. The NMS kinase inhibitor discovery platform as well as the antibody-conjugating payload platform are the driving forces of the group's innovation, securing global recognition of NMS in personalized therapy. Recently entrectinib, originally discovered by NMS, which is a targeted kinase inhibitor used to treat NTRK1/2/3 and ROS1 dependent solid tumors that was licensed to Ignyta, now a member of the Roche Group, gained approvals for commercialization in all major markets. This is further evidence of the competitiveness of the drug discovery platform of NMS Group. NMS Group has three subsidiaries. NMS S.r.l. is a FIC / BIC focused drug research and development company with a robust pipeline of more than a dozen anti-cancer projects, and three of the projects are currently in early clinical development.

The other two subsidiaries are Accelera, which is a preclinical CRO company, and NerPharMa which manufactures API and drug product supporting clinical developments and commercialization.

About Accelera ( )

Accelera is a premium tier Contract Research Organization (CRO), developing and offering new technologies and integrated programs to pharmaceutical and biotechnology companies around the world to move forward their innovative drug candidates up to registration

Major services available at Accelera include:

IND/CTA enabling packages, including GLP general toxicology, safety pharmacology and genotoxicity;

Toxicology studies in rodent and non-rodent species

Preclinical development consultancy and preparation of regulatory documentation.

Accelera facilities are fully GLP and AAALAC accredited. Additional info available at: .

Media Contact:

Debra Santolini, (908) 872-8092, [email protected]

SOURCE Frontage Laboratories, Inc.

并购

2024-01-01

January 2, 2024: Frontage Laboratories, Inc. today announced that, through its wholly-owned subsidiary Frontage Europe S.r.l., it has completed the acquisition of the Bioanalytical and Drug Metabolism & Pharmacokinetics businesses of Accelera S.r.l (Accelera). Accelera is a premier Contract Research Organization located in Nerviano, within the Lombardy region of Italy, part of the well-established NMS Group S.p.A. which has positioned itself as a global niche player in delivering discovery & preclinical studies and clinical bioanalysis to pharma and biotechnology companies, academic institutions, and other healthcare stakeholders. “Today marks a very significant achievement in the 23-year history of Frontage Laboratories, as we establish a base of operations in continental Europe. Accelera has a developed a tremendous reputation for high quality R&D services and we look forward to welcoming their Bioanalytical and Drug Metabolism & Pharmacokinetics teams to the Frontage family,” said Dr. Abdul Mutlib, CEO of Frontage. “We envision this strategic acquisition as a first step in establishing Frontage’s footprint in Europe, with the intent of adding other service areas in the continent. We believe both existing Frontage and Accelera clients stand to benefit greatly by leveraging Frontage’s increasingly global platform. In addition, we are looking forward to partnering with the remaining Accelera business on exciting opportunities to service clients across our organizations.” According to Dr. Song Li, Founder and Chairman of Frontage: “It has been a long-standing goal of Frontage to expand our operations in Europe. We consider ourselves fortunate to capitalize on our outstanding relationship with the Accelera team, which has enabled us to bring our plans to fruition. We are very enthusiastic about working together as we further develop the Frontage platform in Europe, starting from a footprint in the Biopark in Nerviano Lombardy, where Accelera and Nerivano Medical Sciences Srl have already established a long-standing and efficient value chain. As always, our ongoing focus will remain on delivering the highest levels of quality, technology and expertise to our clients.” “We are thrilled to join forces with Frontage as part of this strategic acquisition that marks a significant milestone in Accelera’s journey,” said Luca Leone, CEO of Accelera. “Accelera has built a strong reputation for delivering high-quality R&D services through all phases of drug research and development with extensive experience in oncology. This unique occasion opens up new horizons for collaboration and growth. On one hand, we will further focus on offering top-notch In-vivo (end-to-end services) for multiple emerging modalities. At the same time, we look forward to exploring exciting opportunities to serve our clients across continents through our ongoing collaboration. This partnership reflects our commitment to advancing research and providing innovative solutions in the European market and beyond,” said Luca Leone, CEO of Accelera S.r.l. “Having Frontage as part of the growing partners operating from our Biopark is a landmark moment for us. In addition to the endless potential of the Accelera-Frontage collaboration, Nerviano Medical Sciences can leverage Frontage’s world-class capabilities to drive breakthrough advancements in our drug discovery and development process. By uniting our strengths, we believe we can accelerate the pace of innovation and make a lasting difference in the field where all companies of this strong alliance operate and thrive here in Nerviano,” said Hugues Dolgos, CEO of NMS Group S.p.A and Nerviano Medical Sciences Srl. PR Link:PR Frontage Europe_AEM_Accelera NMS Final from NMSGroup

并购

2022-09-26

·药明康德

Nerviano Medical Sciences(NMS)近日宣布与默沙东(MSD)在开发在研药品NMS-293上达成合作与授权协议。根据新闻稿,NMS-293是具高度选择性、可穿越脑屏障的下一代PARP1抑制剂。

多腺苷二磷酸核糖聚合酶(PARP)在细胞中的DNA修复机制中扮演关键的角色。PARP抑制剂亦已在临床上被证实,能够有效治疗带有BRCA突变蛋白、缺乏DNA同源重组修复机制的乳腺癌、卵巢癌、前列腺癌与胰腺癌。

NMS-293是一款口服的PARP1抑制剂。与第一代PARP抑制剂相比,NMS-293对PARP1更具选择性,并具有穿透血脑屏障的特性。此药物不仅具有潜力作为单药使用,并可能可以与其他造成DNA破坏累积的药物搭配,对许多不同肿瘤癌症进行组合治疗。根据公司说法,此药物对PARP1较对PARP2更具选择性的特性,可能增加此药物在病患身上的耐受性。

▲NMS研发管线(图片来源:NMS官方网站)

NMS-293目前处于早期临床开发阶段,分别检视其作为单药治疗带有BRCA突变肿瘤,以及与替莫唑胺(TMZ)组合使用治疗复发性胶质母细胞瘤(GBM)的疗效。胶质母细胞瘤是最常见的恶性脑肿瘤,也是致死率最高的癌种之一。据统计,每20名患者中只有1名能活过5年,因此复发性胶质母细胞瘤患者具有高度的医疗未竟需求。

根据现有的协议,默沙东会支付NMS最多高达6500万美元的前期款项。根据开发、监管与商业化里程碑进度与净销售额,NMS会再获得额外款项。两家公司会在NMS-293的临床开发进行合作,NMS会负责设计、发起、执行与注资药物的全球性临床试验。“根据NMS-293的独特性质,此药物具强大潜力与像是化疗、DNA修复抑制剂或抗体偶联药物(ADC)等各式DNA破坏累积药物,进行组合治疗,这在像是脑瘤治疗上,是现有PARP抑制剂无法达成的,”Nerviano Medical Sciences公司与NMS集团的首席执行官Hugues Dolgos先生说道,“NMS已经建立一项独特的专有平台,潜力开发、扩展潜在‘first-in-class’与’best-in-class’靶向药物,例如靶向PARP的NMS-293。我们相信默沙东是能够最大化我们项目价值的理想合作对象。”

参考资料:[1] Nerviano Medical Sciences S.r.l. Announces Collaboration and Option to License Agreement with Merck. Retrieved September 23, 2022 from https://www.nervianoms.com/nerviano-medical-sciences-s-r-l-announces-collaboration-and-option-to-license-agreement-with-merck/[2] Merck KGaA teams up with Italian oncology group in PARP1 development deal. Retrieved September 23, 2022 from https://endpts.com/merck-kgaa-teams-up-with-italian-oncology-group-in-parp1-development-deal/

内容来源于网络,如有侵权,请联系删除。

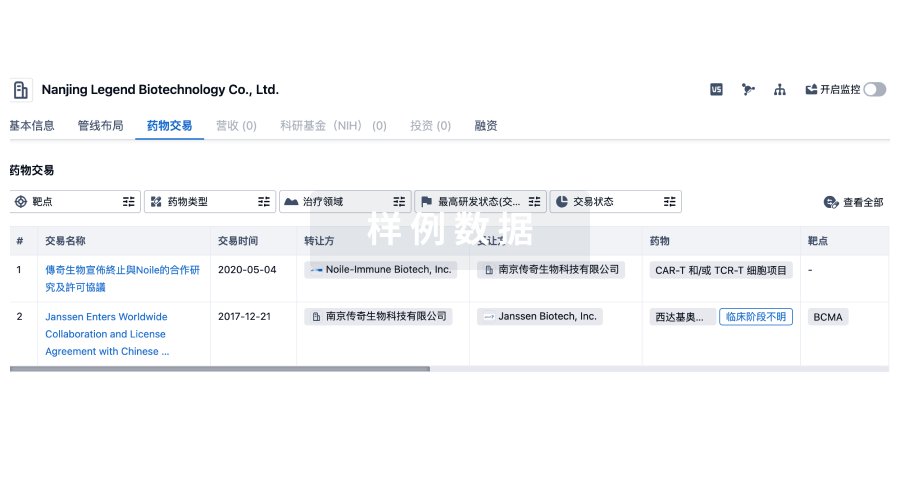

合作小分子药物

100 项与 Nerviano Medical Sciences Group SRL 相关的药物交易

登录后查看更多信息

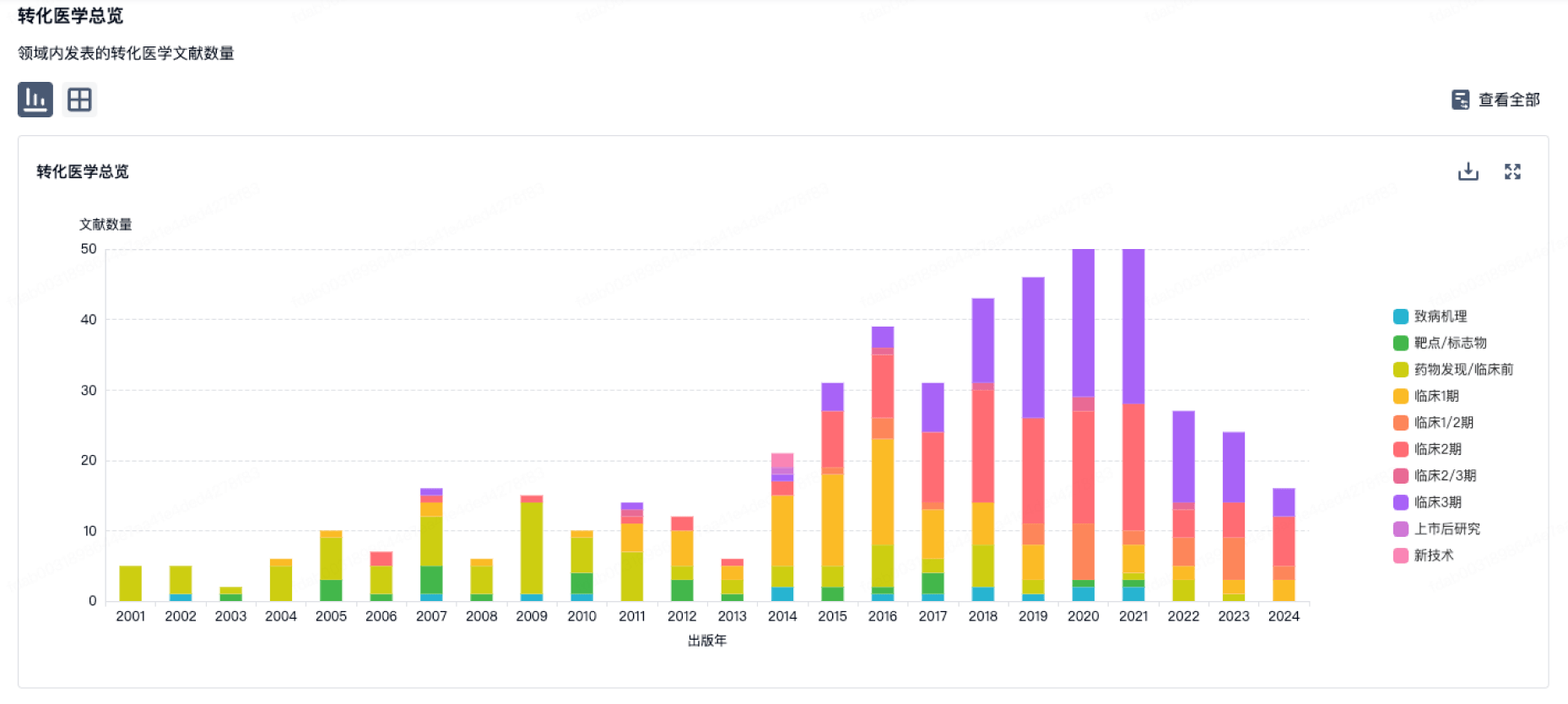

100 项与 Nerviano Medical Sciences Group SRL 相关的转化医学

登录后查看更多信息

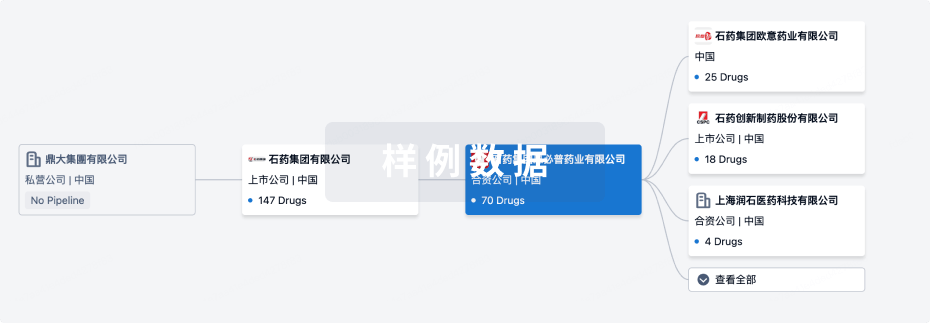

组织架构

使用我们的机构树数据加速您的研究。

登录

或

管线布局

2025年09月04日管线快照

管线布局中药物为当前组织机构及其子机构作为药物机构进行统计,早期临床1期并入临床1期,临床1/2期并入临床2期,临床2/3期并入临床3期

临床前

1

6

其他

登录后查看更多信息

当前项目

登录后查看更多信息

药物交易

使用我们的药物交易数据加速您的研究。

登录

或

转化医学

使用我们的转化医学数据加速您的研究。

登录

或

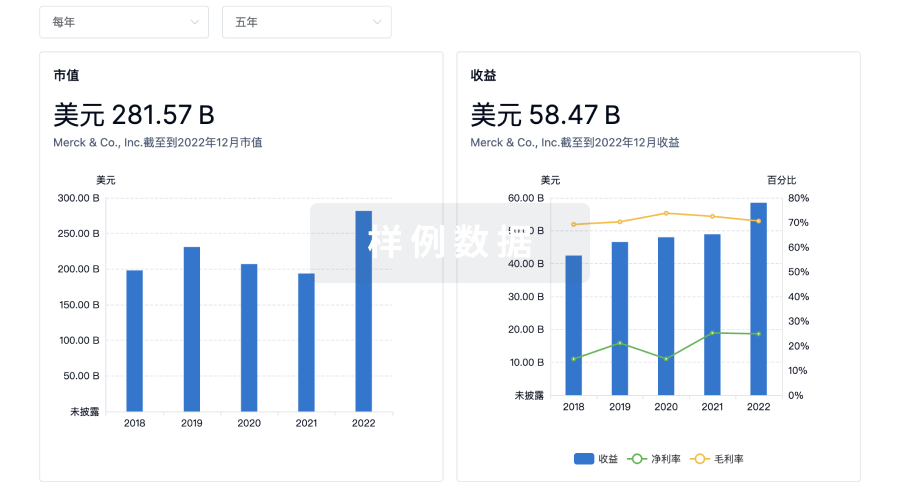

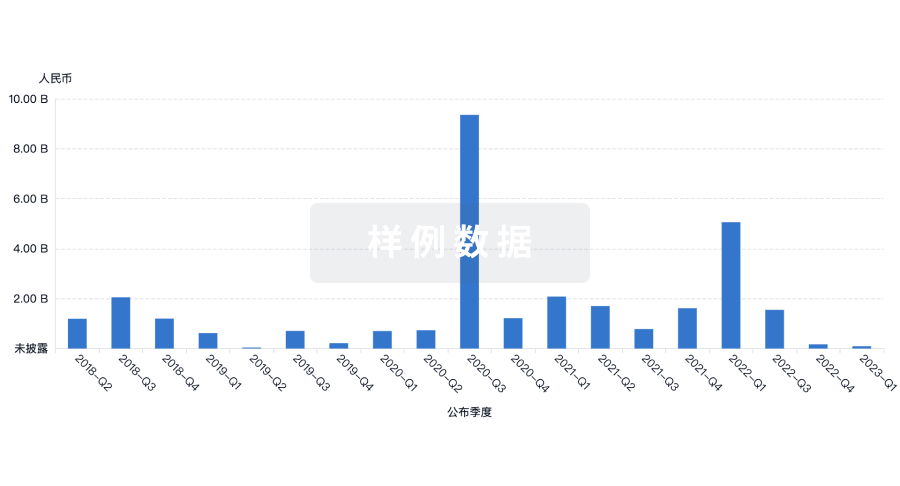

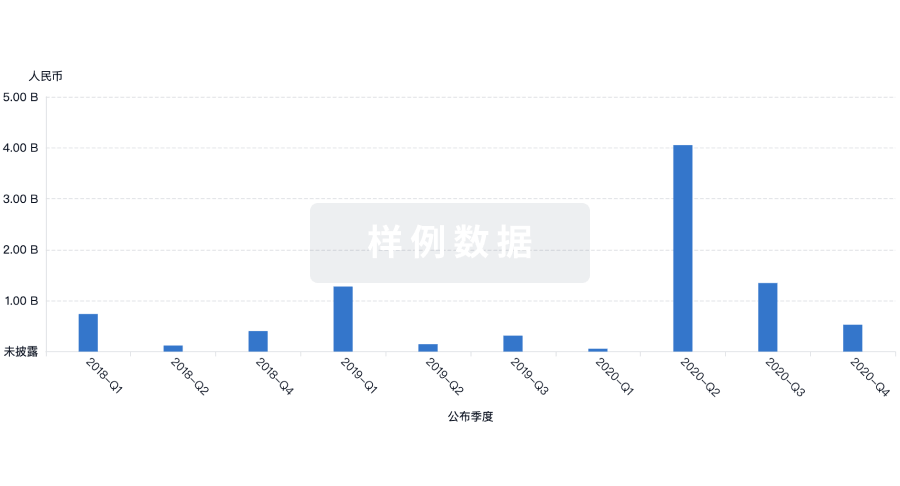

营收

使用 Synapse 探索超过 36 万个组织的财务状况。

登录

或

科研基金(NIH)

访问超过 200 万项资助和基金信息,以提升您的研究之旅。

登录

或

投资

深入了解从初创企业到成熟企业的最新公司投资动态。

登录

或

融资

发掘融资趋势以验证和推进您的投资机会。

登录

或

Eureka LS:

全新生物医药AI Agent 覆盖科研全链路,让突破性发现快人一步

立即开始免费试用!

智慧芽新药情报库是智慧芽专为生命科学人士构建的基于AI的创新药情报平台,助您全方位提升您的研发与决策效率。

立即开始数据试用!

智慧芽新药库数据也通过智慧芽数据服务平台,以API或者数据包形式对外开放,助您更加充分利用智慧芽新药情报信息。

生物序列数据库

生物药研发创新

免费使用

化学结构数据库

小分子化药研发创新

免费使用